49123c9ba5c40073d09c70386b0bf399.ppt

- Количество слайдов: 20

Rational Decisions in Negotiations

Rational Decisions in Negotiations

• Two parties need to reach a joint decision but have different preferences. • They negotiate. • Eventually they achieve a mutually agreeable outcome.

• Two parties need to reach a joint decision but have different preferences. • They negotiate. • Eventually they achieve a mutually agreeable outcome.

Two-party negotiations • Game Theory: given absolute rationality, it provides the most precise prescriptive advice available to the negotiator. • However: – It relies on a complete description of all options and outcomes. This may be infinitely complex. – It requires that all players consistently act rationally.

Two-party negotiations • Game Theory: given absolute rationality, it provides the most precise prescriptive advice available to the negotiator. • However: – It relies on a complete description of all options and outcomes. This may be infinitely complex. – It requires that all players consistently act rationally.

Decision-analytic approach • One must assess three key issues: • Each party’s alternative to a negotiated agreement • Each party’s set of interests • The relative importance of each party’s interests

Decision-analytic approach • One must assess three key issues: • Each party’s alternative to a negotiated agreement • Each party’s set of interests • The relative importance of each party’s interests

(1) Alternatives to a negotiated agreement • What is our best alternative to a negotiated agreement (BATNA)? • The value of a negotiator’s BATNA is the lower bound (minimum) for the outcome we require of a negotiated agreement. • We should prefer an agreement over impasse if the agreement exceeds BATNA. • We should decline any agreement below our BATNA

(1) Alternatives to a negotiated agreement • What is our best alternative to a negotiated agreement (BATNA)? • The value of a negotiator’s BATNA is the lower bound (minimum) for the outcome we require of a negotiated agreement. • We should prefer an agreement over impasse if the agreement exceeds BATNA. • We should decline any agreement below our BATNA

(2) The interests of the parties • There is a difference between the parties’ stated positions and their underlying interests. • Positions: the demands from the other side. • Interests: underlying issues that could matter. Negotiators are not always fully aware of them. • A focus on deeper interests could form more reasonable bargaining platform.

(2) The interests of the parties • There is a difference between the parties’ stated positions and their underlying interests. • Positions: the demands from the other side. • Interests: underlying issues that could matter. Negotiators are not always fully aware of them. • A focus on deeper interests could form more reasonable bargaining platform.

(3) Relative importance of each party’s interests • To be fully prepared to negotiate, we must become aware of how important each issue is to us. • The best agreements are reached by trading off relatively unimportant issues for more important ones. • One must recognize ahead of time which tradeoffs are more and less attractive.

(3) Relative importance of each party’s interests • To be fully prepared to negotiate, we must become aware of how important each issue is to us. • The best agreements are reached by trading off relatively unimportant issues for more important ones. • One must recognize ahead of time which tradeoffs are more and less attractive.

Claiming value in negotiation (Отстояване на искания) • An expert is being recruited by a company. All is agreed but the salary. • The company has offered $90, 000. The expert has counteroffered $100, 000. • Both believe they have made fair offers; both would very much like an agreement. • The expert (while not verbalizing it) would take any offer over $93, 000 rather than lose the offer. • The organization (while not verbalizing it) would be willing to pay up to $97, 000 rather than lose the candidate.

Claiming value in negotiation (Отстояване на искания) • An expert is being recruited by a company. All is agreed but the salary. • The company has offered $90, 000. The expert has counteroffered $100, 000. • Both believe they have made fair offers; both would very much like an agreement. • The expert (while not verbalizing it) would take any offer over $93, 000 rather than lose the offer. • The organization (while not verbalizing it) would be willing to pay up to $97, 000 rather than lose the candidate.

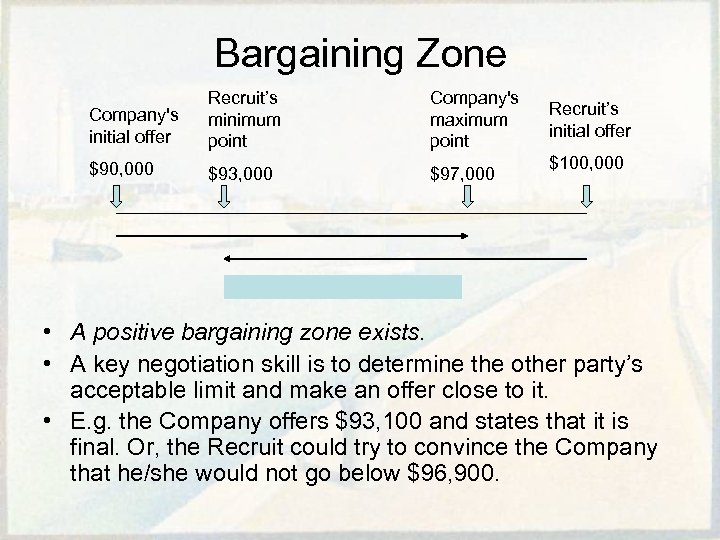

Bargaining Zone Company's initial offer Recruit’s minimum point Company's maximum point $90, 000 $93, 000 $97, 000 Recruit’s initial offer $100, 000 • A positive bargaining zone exists. • A key negotiation skill is to determine the other party’s acceptable limit and make an offer close to it. • E. g. the Company offers $93, 100 and states that it is final. Or, the Recruit could try to convince the Company that he/she would not go below $96, 900.

Bargaining Zone Company's initial offer Recruit’s minimum point Company's maximum point $90, 000 $93, 000 $97, 000 Recruit’s initial offer $100, 000 • A positive bargaining zone exists. • A key negotiation skill is to determine the other party’s acceptable limit and make an offer close to it. • E. g. the Company offers $93, 100 and states that it is final. Or, the Recruit could try to convince the Company that he/she would not go below $96, 900.

• Trades would not take place unless it were advantageous to the parties concerned. Of course, it is better to strike as good a bargain as one’s bargaining position permits. The worst outcome is when, by overreaching greed, no bargain is struck, and a trade that could have been advantageous to both parties does not come off at all. (Benjamin Franklin)

• Trades would not take place unless it were advantageous to the parties concerned. Of course, it is better to strike as good a bargain as one’s bargaining position permits. The worst outcome is when, by overreaching greed, no bargain is struck, and a trade that could have been advantageous to both parties does not come off at all. (Benjamin Franklin)

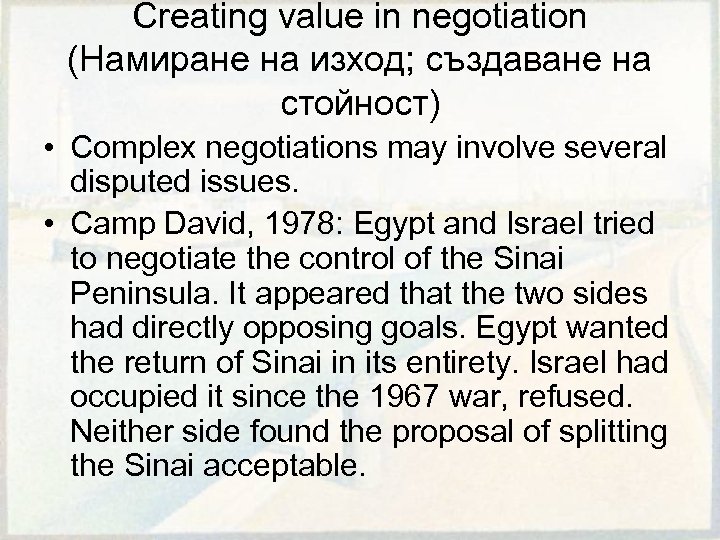

Creating value in negotiation (Намиране на изход; създаване на стойност) • Complex negotiations may involve several disputed issues. • Camp David, 1978: Egypt and Israel tried to negotiate the control of the Sinai Peninsula. It appeared that the two sides had directly opposing goals. Egypt wanted the return of Sinai in its entirety. Israel had occupied it since the 1967 war, refused. Neither side found the proposal of splitting the Sinai acceptable.

Creating value in negotiation (Намиране на изход; създаване на стойност) • Complex negotiations may involve several disputed issues. • Camp David, 1978: Egypt and Israel tried to negotiate the control of the Sinai Peninsula. It appeared that the two sides had directly opposing goals. Egypt wanted the return of Sinai in its entirety. Israel had occupied it since the 1967 war, refused. Neither side found the proposal of splitting the Sinai acceptable.

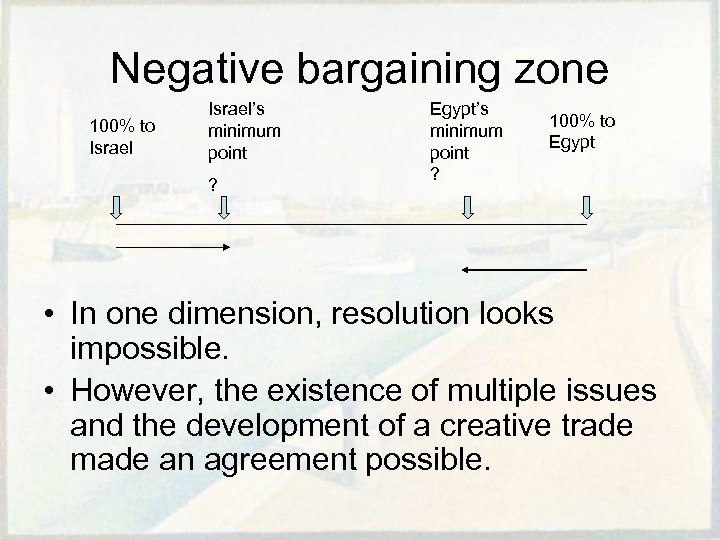

Negative bargaining zone 100% to Israel’s minimum point ? Egypt’s minimum point ? 100% to Egypt • In one dimension, resolution looks impossible. • However, the existence of multiple issues and the development of a creative trade made an agreement possible.

Negative bargaining zone 100% to Israel’s minimum point ? Egypt’s minimum point ? 100% to Egypt • In one dimension, resolution looks impossible. • However, the existence of multiple issues and the development of a creative trade made an agreement possible.

• As the negotiations proceeded, it became clear that Egypt and Israel had incompatible positions, but compatible interests. • Israel’s underlying interest was security from land or air attack. • Egypt wanted sovereignty over land, part of it for thousands of years. • There existed two issues, not one. Sovereignty and military protection were of different importance to the parties.

• As the negotiations proceeded, it became clear that Egypt and Israel had incompatible positions, but compatible interests. • Israel’s underlying interest was security from land or air attack. • Egypt wanted sovereignty over land, part of it for thousands of years. • There existed two issues, not one. Sovereignty and military protection were of different importance to the parties.

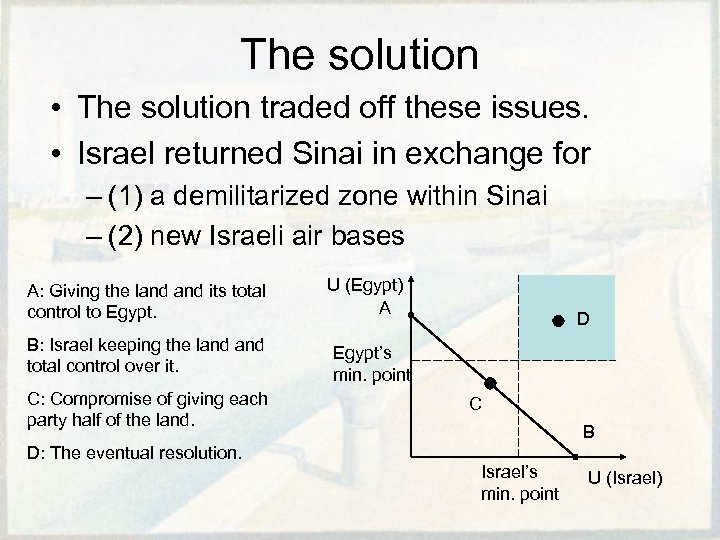

The solution • The solution traded off these issues. • Israel returned Sinai in exchange for – (1) a demilitarized zone within Sinai – (2) new Israeli air bases A: Giving the land its total control to Egypt. B: Israel keeping the land total control over it. C: Compromise of giving each party half of the land. D: The eventual resolution. U (Egypt) A D Egypt’s min. point C B Israel’s min. point U (Israel)

The solution • The solution traded off these issues. • Israel returned Sinai in exchange for – (1) a demilitarized zone within Sinai – (2) new Israeli air bases A: Giving the land its total control to Egypt. B: Israel keeping the land total control over it. C: Compromise of giving each party half of the land. D: The eventual resolution. U (Egypt) A D Egypt’s min. point C B Israel’s min. point U (Israel)

• Egypt and Israel realized the existence of a positive bargaining zone by considering each other’s interests, not just their stated positions. • Thus, it was possible to develop an agreement by trading off the issue that each country cared less about for the issue that each country cared more about.

• Egypt and Israel realized the existence of a positive bargaining zone by considering each other’s interests, not just their stated positions. • Thus, it was possible to develop an agreement by trading off the issue that each country cared less about for the issue that each country cared more about.

The case of El-Tek • El-Tek is a large conglomerate in the electrical industry with sales of over $3. 1 billion. It is a decentralized, productoriented organization, in which the various divisions operate autonomously. To preclude competition for sales to external customers, divisions are chartered to sell their products to specific customer groups outside the organization.

The case of El-Tek • El-Tek is a large conglomerate in the electrical industry with sales of over $3. 1 billion. It is a decentralized, productoriented organization, in which the various divisions operate autonomously. To preclude competition for sales to external customers, divisions are chartered to sell their products to specific customer groups outside the organization.

• Recently, the Audio Division (AD) developed a new magnetic material, called Z-25. The corporate charter prevents AD from selling it outside El-Tek. AD can sell the invention within the conglomerate, as well as use it to enhance its own products. • AD made this assessment – it can earn $5 million from Z-25 in the next two years: $1. 75 million from selling magnets internally to El-Tek; $3. 25 million from product improvements to their own (AD) components, not available to their competitors.

• Recently, the Audio Division (AD) developed a new magnetic material, called Z-25. The corporate charter prevents AD from selling it outside El-Tek. AD can sell the invention within the conglomerate, as well as use it to enhance its own products. • AD made this assessment – it can earn $5 million from Z-25 in the next two years: $1. 75 million from selling magnets internally to El-Tek; $3. 25 million from product improvements to their own (AD) components, not available to their competitors.

• The Magnetic Division (MD) in El-Tek could generate far more income for El-Tek if it sold Z-25. MD has better manufacturing capabilities and a vast outside market. • MD believes it could earn $14 million over the same two-year period from selling Z-25 magnets. • Without Z-25, MD would use their own alternative product, and expect to earn a profit of only $4 million.

• The Magnetic Division (MD) in El-Tek could generate far more income for El-Tek if it sold Z-25. MD has better manufacturing capabilities and a vast outside market. • MD believes it could earn $14 million over the same two-year period from selling Z-25 magnets. • Without Z-25, MD would use their own alternative product, and expect to earn a profit of only $4 million.

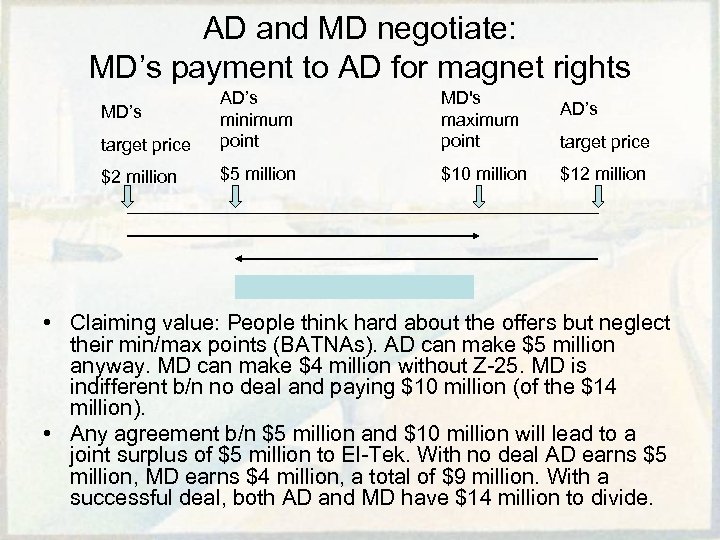

AD and MD negotiate: MD’s payment to AD for magnet rights target price AD’s minimum point MD's maximum point $2 million $5 million $10 million MD’s AD’s target price $12 million • Claiming value: People think hard about the offers but neglect their min/max points (BATNAs). AD can make $5 million anyway. MD can make $4 million without Z-25. MD is indifferent b/n no deal and paying $10 million (of the $14 million). • Any agreement b/n $5 million and $10 million will lead to a joint surplus of $5 million to El-Tek. With no deal AD earns $5 million, MD earns $4 million, a total of $9 million. With a successful deal, both AD and MD have $14 million to divide.

AD and MD negotiate: MD’s payment to AD for magnet rights target price AD’s minimum point MD's maximum point $2 million $5 million $10 million MD’s AD’s target price $12 million • Claiming value: People think hard about the offers but neglect their min/max points (BATNAs). AD can make $5 million anyway. MD can make $4 million without Z-25. MD is indifferent b/n no deal and paying $10 million (of the $14 million). • Any agreement b/n $5 million and $10 million will lead to a joint surplus of $5 million to El-Tek. With no deal AD earns $5 million, MD earns $4 million, a total of $9 million. With a successful deal, both AD and MD have $14 million to divide.