98fd242437ee736fc888d9c0f9cc3291.ppt

- Количество слайдов: 48

Ratio Analysis Gabrielle Moran 11 th September 2010

l Around Christmas in 6 th Year– depending?

Why prepare accounts at all? l Ascertain profit l Measure performance l Other people

Users l l l l Shareholders/Owners Employees Suppliers Revenue Commissioners Managers Lenders Competitors

5 aspects l l l Profitability and efficiency Liquidity/Solvency Working Capital Gearing Investment

Cross Reference Grid l l Users vs Aspect Why and what looking for

Each Ratio l How to calculate (formula) l What it tells us l Expected trends/norms l Compare with/ Relate to others?

© 2008

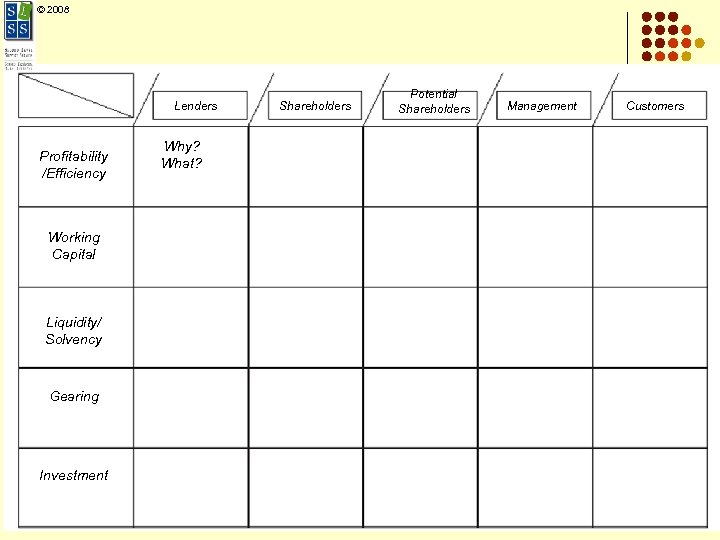

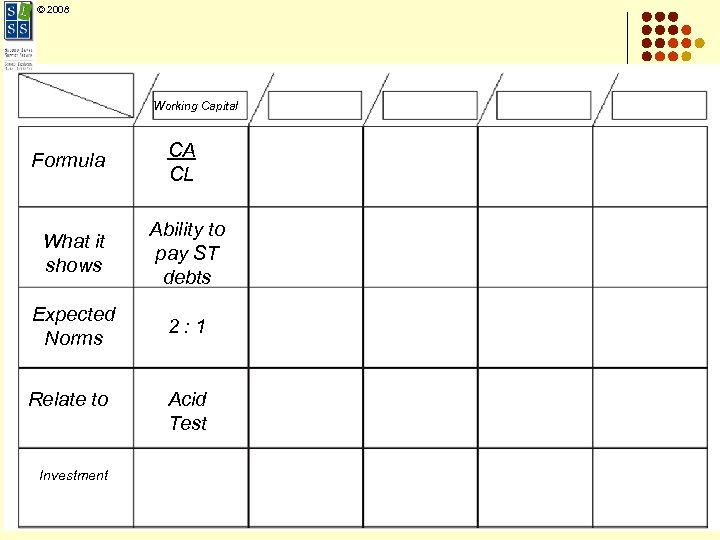

© 2008 Lenders Profitability /Efficiency Working Capital Liquidity/ Solvency Gearing Investment Why? What? Shareholders Potential Shareholders Management Customers

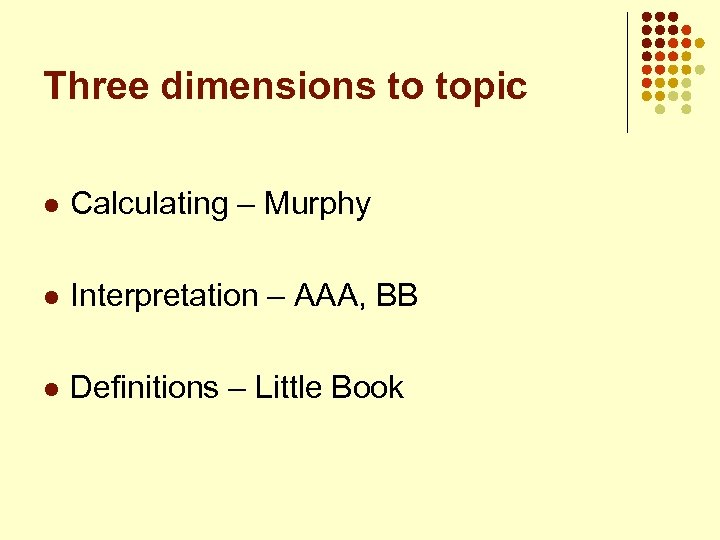

© 2008 Working Capital Formula CA CL What it shows Ability to pay ST debts Expected Norms 2: 1 Relate to Investment Acid Test

Three dimensions to topic l Calculating – Murphy l Interpretation – AAA, BB l Definitions – Little Book

General approach to part b l l l Calculate & recalculate if appropriate Figures given from previous year – Be Aware Comment on l l l Trend Norms Relation to other ratios Relation to interest rates Sector

Part C l l Don’t forget!!! Mini part B – giving advice l l opportunity to buy share To company Discuss rising liquidity ratio is a sign of prudent management Gross profit % changing explain

Methods for learning formulae q. Daily test -- immunity q. Dominos q. Follow me q. Bingo q. Little Booklet (pass definitions)

Methods for tackling part (b) q. Place mat q. Tri Pie q. Cross ref chart

Follow me ….

Who has …… Start Card Current Ratio

Current Assets Creditors Days Current Liabilities (Average period of credit received)

Trade Creditors X 12 (or 365) Credit Purchases Dividend Yield

Dividend per Share Market Price per Share X 100 Debt/Total Capital Percentage

Debt Capital Total Capital X 100 Gross Margin

Gross Profit Sales X 100 DPS Dividend per share

Total Ordinary Dividend Number of issued ordinary shares Return on Shareholders Funds

Profit (after tax and preference divs) Ordinary Shares plus reserves X 100 Debt/Equity Ratio

Debt Capital : Equity Capital Price Dividend Ratio

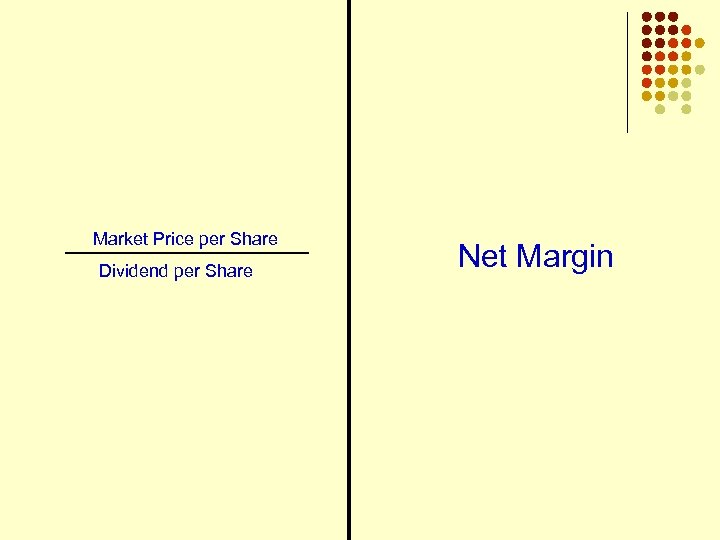

Market Price per Share Dividend per Share Net Margin

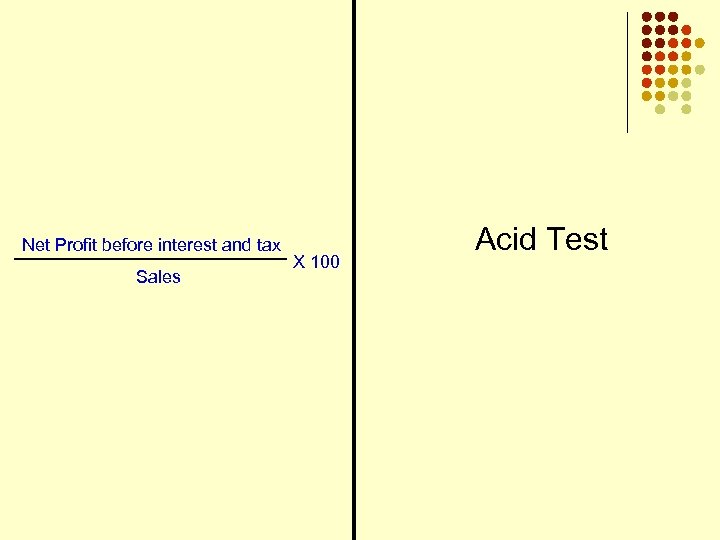

Net Profit before interest and tax Sales X 100 Acid Test

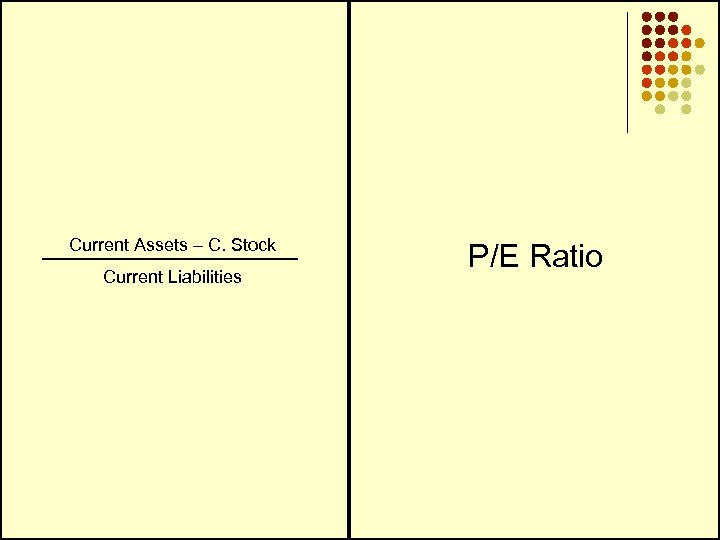

Current Assets – C. Stock Current Liabilities P/E Ratio

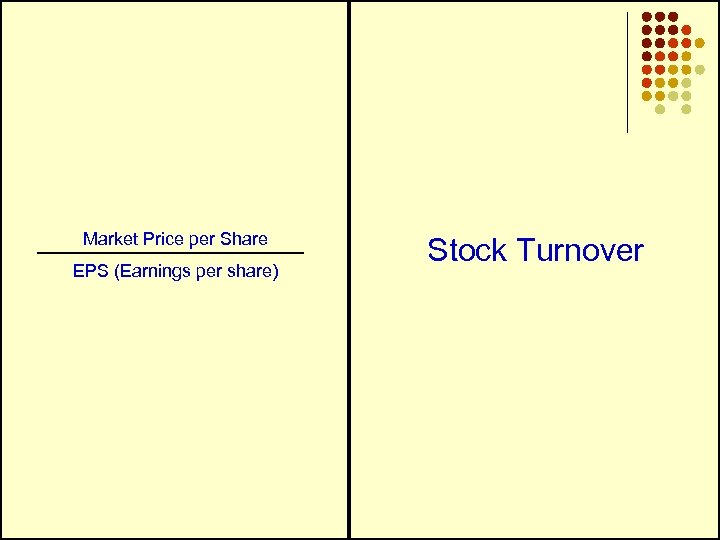

Market Price per Share EPS (Earnings per share) Stock Turnover

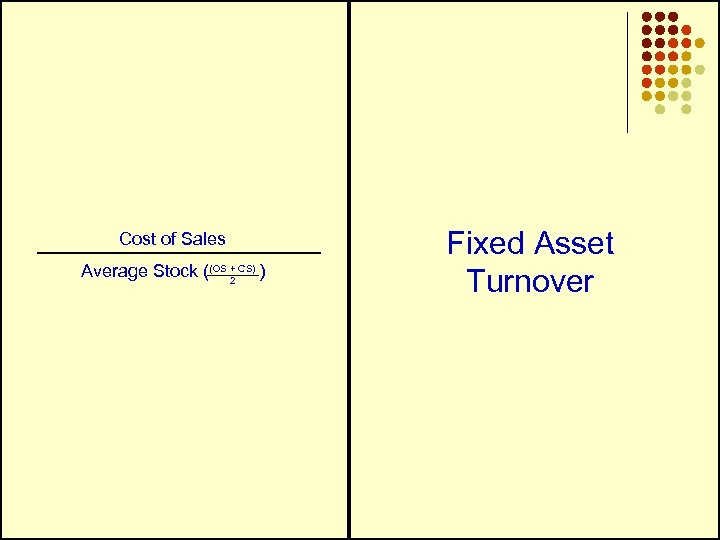

Cost of Sales + Average Stock ((OS 2 CS) ) Fixed Asset Turnover

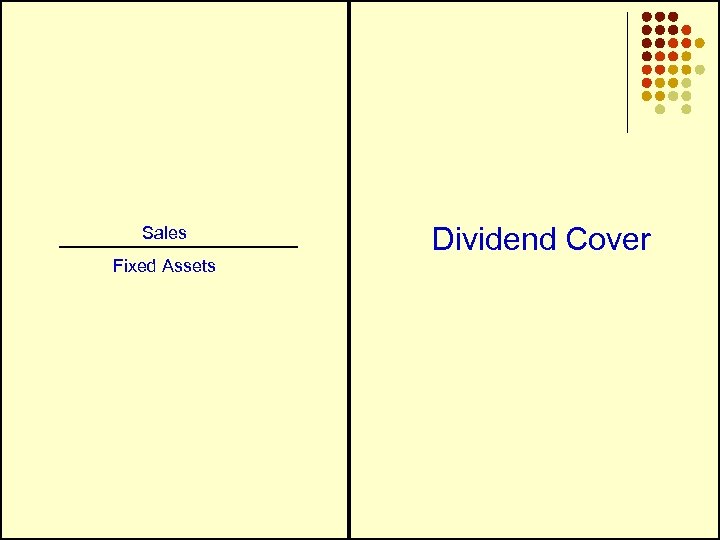

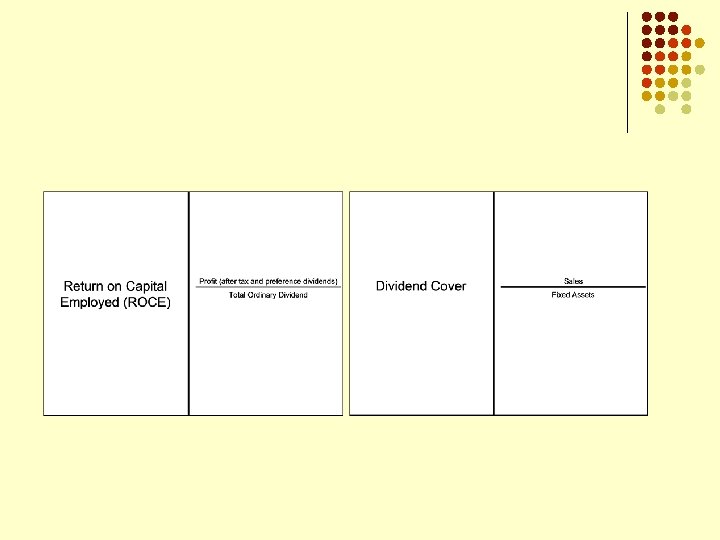

Sales Fixed Assets Dividend Cover

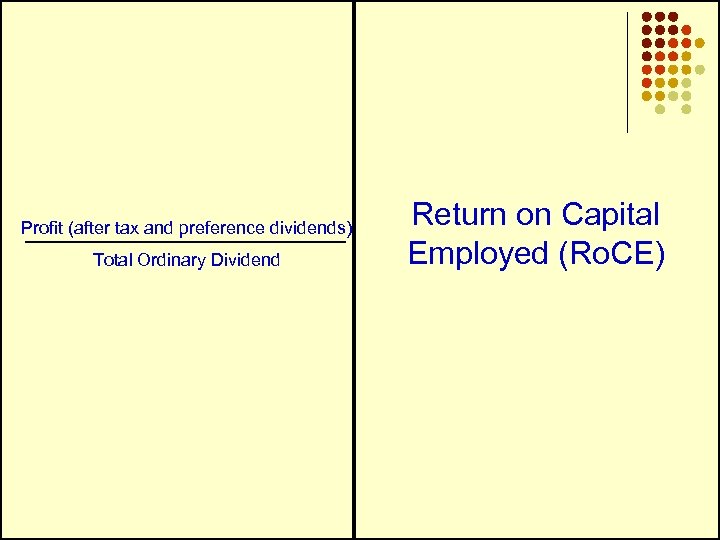

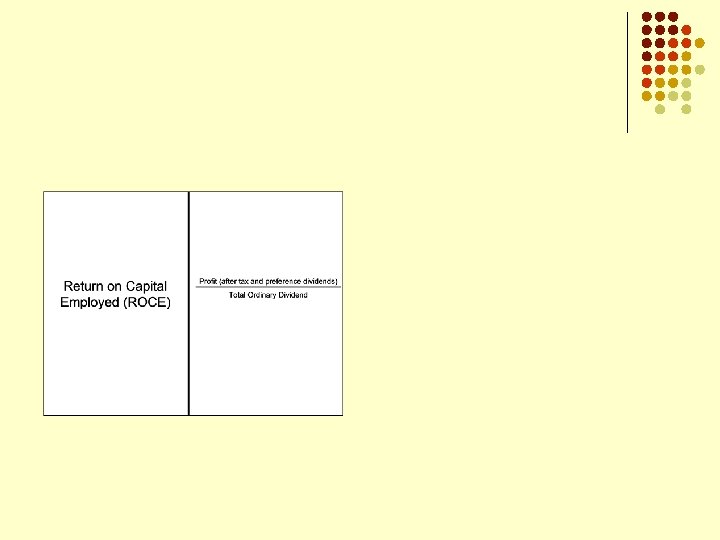

Profit (after tax and preference dividends) Total Ordinary Dividend Return on Capital Employed (Ro. CE)

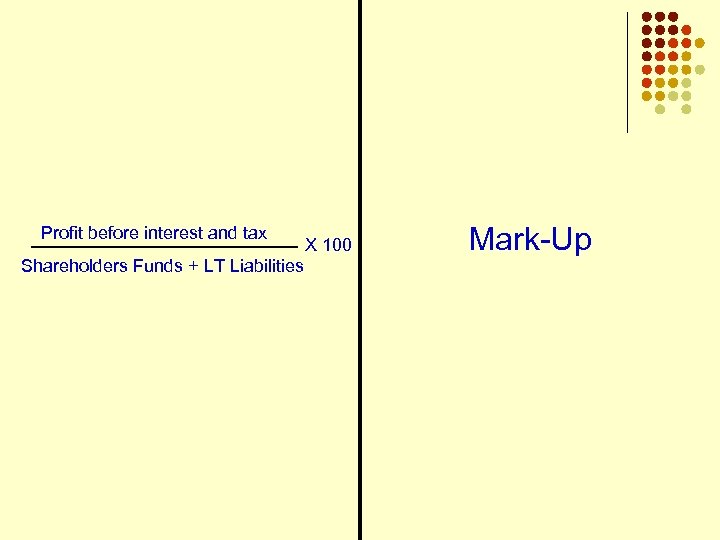

Profit before interest and tax Shareholders Funds + LT Liabilities X 100 Mark-Up

Gross Profit Cost of Sales X 100 Debtors Days (Average period of credit Allowed)

Trade Debtors X 12 (or 365) Credit Sales Interest Cover

Operating Profit Interest Charges Earnings Per Share (EPS)

I Have …… Profit (after tax and preference dividends) Number of Issued Ordinary Shares End Card

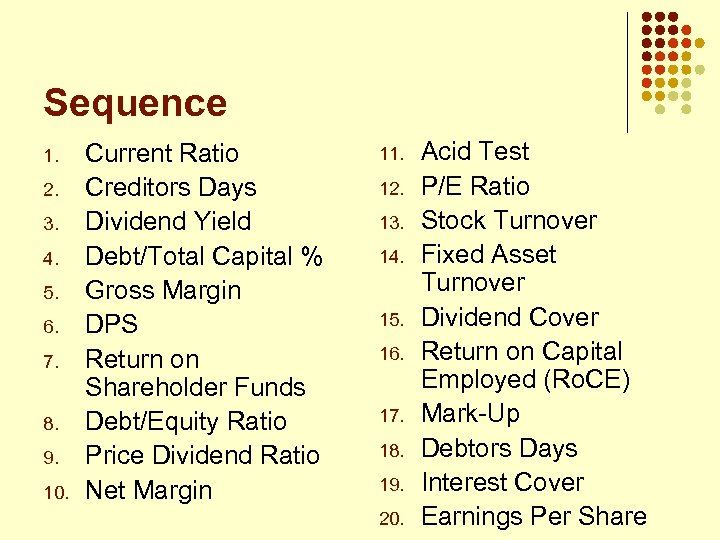

Sequence 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Current Ratio Creditors Days Dividend Yield Debt/Total Capital % Gross Margin DPS Return on Shareholder Funds Debt/Equity Ratio Price Dividend Ratio Net Margin 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. Acid Test P/E Ratio Stock Turnover Fixed Asset Turnover Dividend Cover Return on Capital Employed (Ro. CE) Mark-Up Debtors Days Interest Cover Earnings Per Share

Dominos ….

Bingo Students - Draw 3 x 3 grid q Teacher – List 15 terms on board q Students - select 9 terms and create bingo card q Teacher – read out definition of terms q Students – cross out the appropriate terms when they match the definitions q

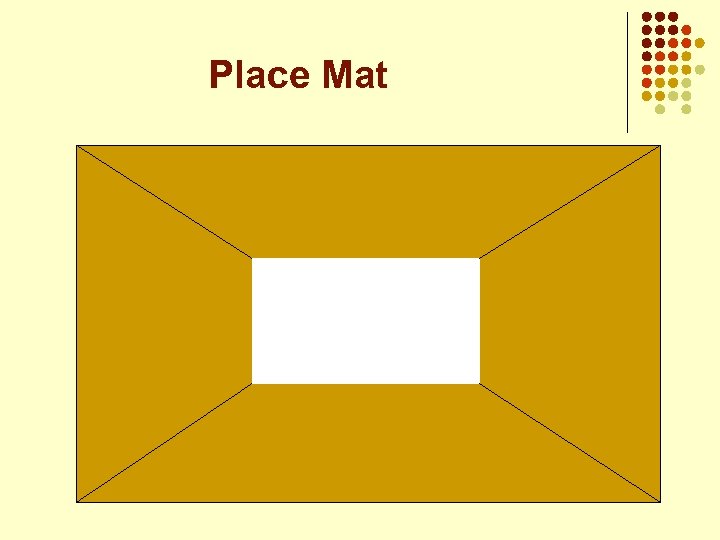

Place Mat

Place Mat • Draw the rectangle and 4 lines as shown • Each member of the group answers the question in their own section • Permission to scout • ‘No 1’ reads their list – others tick or add as appropriate

Place Mat • Permission to scout • Individually select the most important/relevant differences in your school • No 2 writes no 1’s main difference into the centre box; No 3 writes no 2’s etc. or group arrives at consensus as to the most important points •

Place Mat Agree on main points

Yes No Perhaps © 2008

98fd242437ee736fc888d9c0f9cc3291.ppt