624c4ccd5c23e89fdb612b59cbcbb604.ppt

- Количество слайдов: 28

Ratio Analysis and Valuation n Valuation theory n n n ROE disaggregation into RNOA and financial returns n n n Discounted free cash flows Residual income ROE - Identifying and Computing Operating Working Capital and Operating Assets exercise ROE Disaggregation (P&G) exercise Pfizer (PFE) valuation exercise Margin and Turnover EVA © 2005 by Robert F. Halsey, all rights reserved

Ratio Analysis and Valuation n Valuation theory n n n ROE disaggregation into RNOA and financial returns n n n Discounted free cash flows Residual income ROE - Identifying and Computing Operating Working Capital and Operating Assets exercise ROE Disaggregation (P&G) exercise Pfizer (PFE) valuation exercise Margin and Turnover EVA © 2005 by Robert F. Halsey, all rights reserved

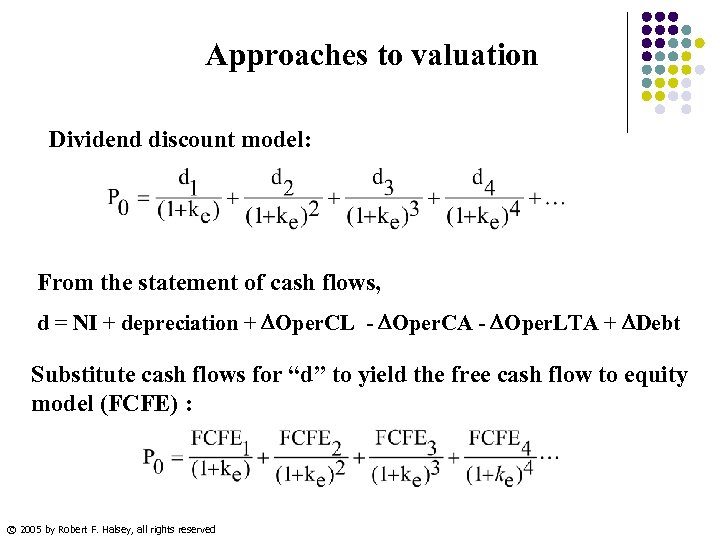

Approaches to valuation Dividend discount model: From the statement of cash flows, d = NI + depreciation + Oper. CL - Oper. CA - Oper. LTA + Debt Substitute cash flows for “d” to yield the free cash flow to equity model (FCFE) : © 2005 by Robert F. Halsey, all rights reserved

Approaches to valuation Dividend discount model: From the statement of cash flows, d = NI + depreciation + Oper. CL - Oper. CA - Oper. LTA + Debt Substitute cash flows for “d” to yield the free cash flow to equity model (FCFE) : © 2005 by Robert F. Halsey, all rights reserved

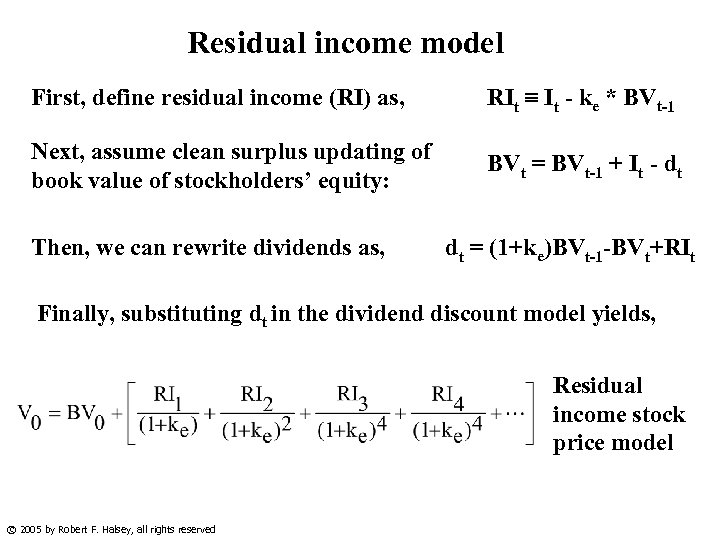

Residual income model First, define residual income (RI) as, RIt It - ke * BVt-1 Next, assume clean surplus updating of book value of stockholders’ equity: BVt = BVt-1 + It - dt Then, we can rewrite dividends as, dt = (1+ke)BVt-1 -BVt+RIt Finally, substituting dt in the dividend discount model yields, Residual income stock price model © 2005 by Robert F. Halsey, all rights reserved

Residual income model First, define residual income (RI) as, RIt It - ke * BVt-1 Next, assume clean surplus updating of book value of stockholders’ equity: BVt = BVt-1 + It - dt Then, we can rewrite dividends as, dt = (1+ke)BVt-1 -BVt+RIt Finally, substituting dt in the dividend discount model yields, Residual income stock price model © 2005 by Robert F. Halsey, all rights reserved

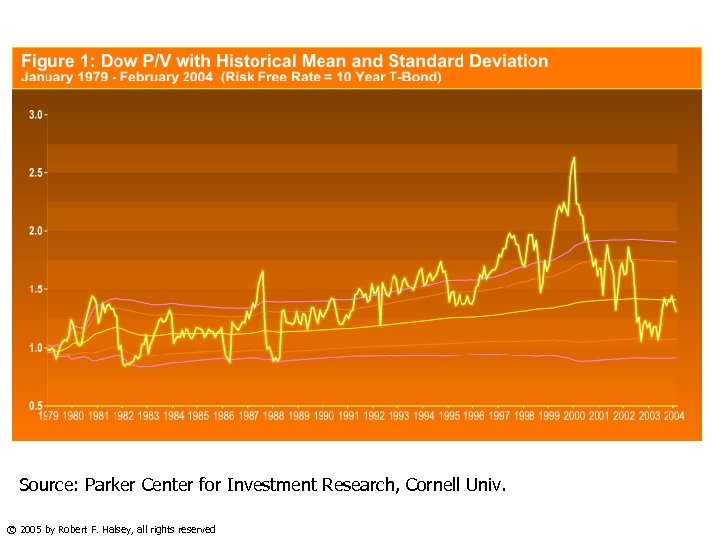

Source: Parker Center for Investment Research, Cornell Univ. © 2005 by Robert F. Halsey, all rights reserved

Source: Parker Center for Investment Research, Cornell Univ. © 2005 by Robert F. Halsey, all rights reserved

FCF and RI models n n The FCF and RI models are theoretically equivalent since both are derived from the dividend discount model. They will, therefore, yield the same valuation in a steady state (constant RNOA) FCF defines value in terms of cash flows. RI defines value in terms of accrual accounting (earnings and book values) © 2005 by Robert F. Halsey, all rights reserved

FCF and RI models n n The FCF and RI models are theoretically equivalent since both are derived from the dividend discount model. They will, therefore, yield the same valuation in a steady state (constant RNOA) FCF defines value in terms of cash flows. RI defines value in terms of accrual accounting (earnings and book values) © 2005 by Robert F. Halsey, all rights reserved

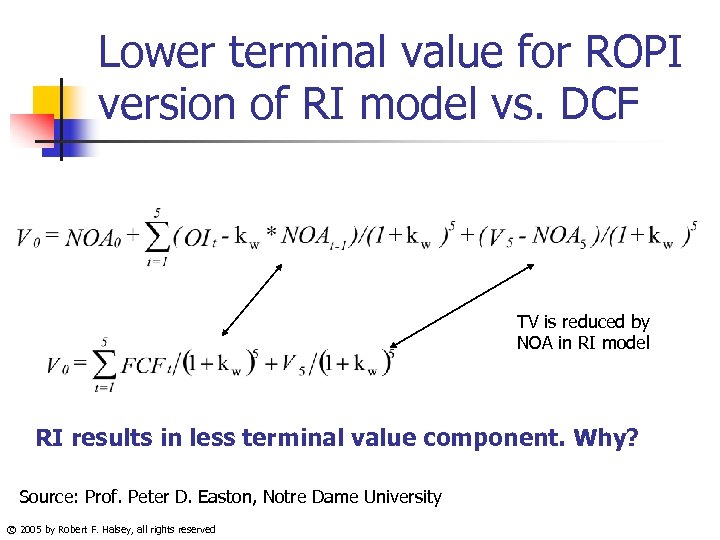

Lower terminal value for ROPI version of RI model vs. DCF TV is reduced by NOA in RI model RI results in less terminal value component. Why? Source: Prof. Peter D. Easton, Notre Dame University © 2005 by Robert F. Halsey, all rights reserved

Lower terminal value for ROPI version of RI model vs. DCF TV is reduced by NOA in RI model RI results in less terminal value component. Why? Source: Prof. Peter D. Easton, Notre Dame University © 2005 by Robert F. Halsey, all rights reserved

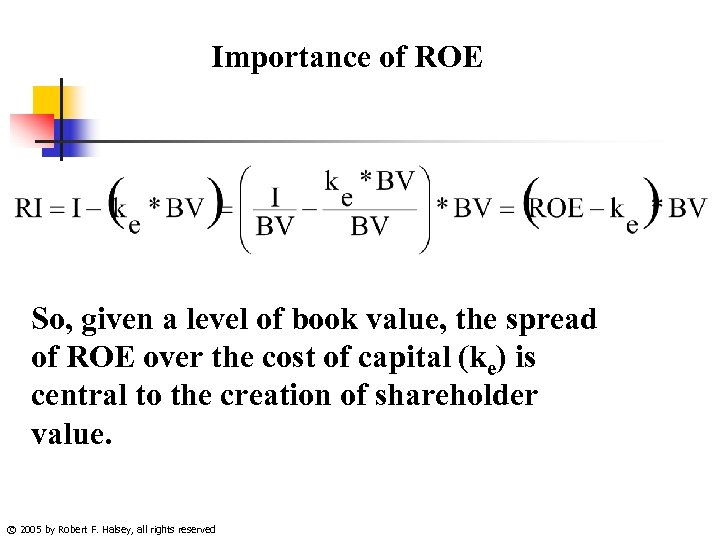

Importance of ROE So, given a level of book value, the spread of ROE over the cost of capital (ke) is central to the creation of shareholder value. © 2005 by Robert F. Halsey, all rights reserved

Importance of ROE So, given a level of book value, the spread of ROE over the cost of capital (ke) is central to the creation of shareholder value. © 2005 by Robert F. Halsey, all rights reserved

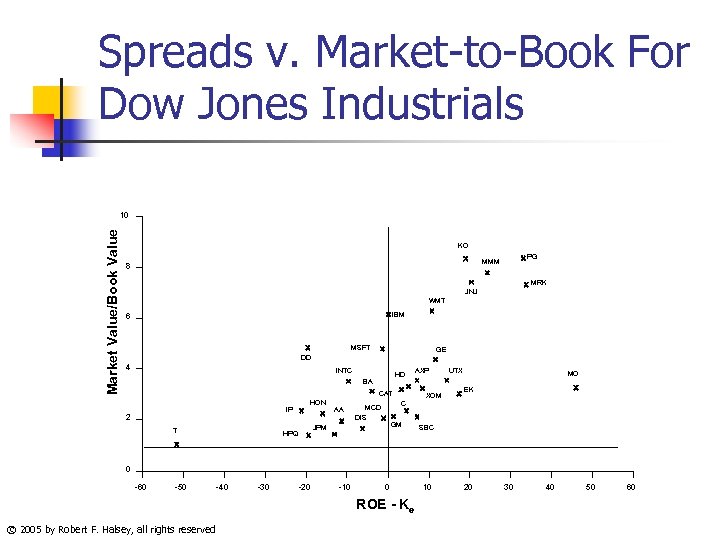

Spreads v. Market-to-Book For Dow Jones Industrials Market Value/Book Value 10 KO PG MMM 8 MRK JNJ WMT IBM 6 MSFT GE DD 4 INTC HD BA CAT IP 2 HON AA C MCD DIS T GM JPM HPQ AXP XOM UTX MO EK SBC 0 -60 -50 -40 -30 -20 -10 0 ROE - Ke © 2005 by Robert F. Halsey, all rights reserved 10 20 30 40 50 60

Spreads v. Market-to-Book For Dow Jones Industrials Market Value/Book Value 10 KO PG MMM 8 MRK JNJ WMT IBM 6 MSFT GE DD 4 INTC HD BA CAT IP 2 HON AA C MCD DIS T GM JPM HPQ AXP XOM UTX MO EK SBC 0 -60 -50 -40 -30 -20 -10 0 ROE - Ke © 2005 by Robert F. Halsey, all rights reserved 10 20 30 40 50 60

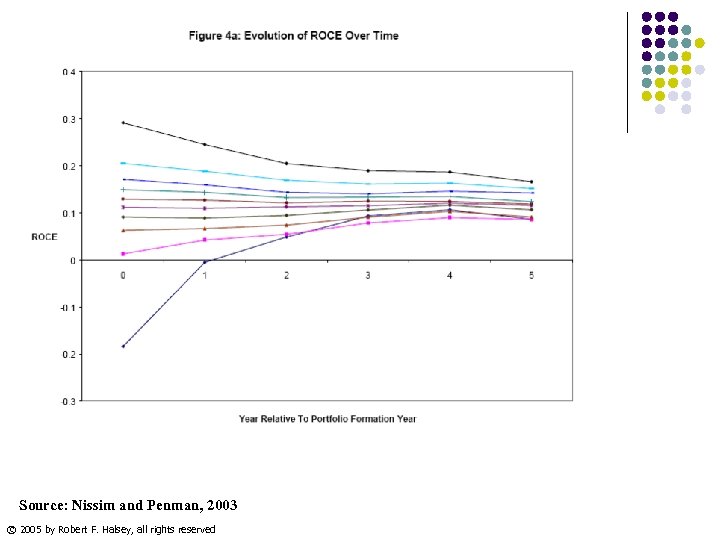

Source: Nissim and Penman, 2003 © 2005 by Robert F. Halsey, all rights reserved

Source: Nissim and Penman, 2003 © 2005 by Robert F. Halsey, all rights reserved

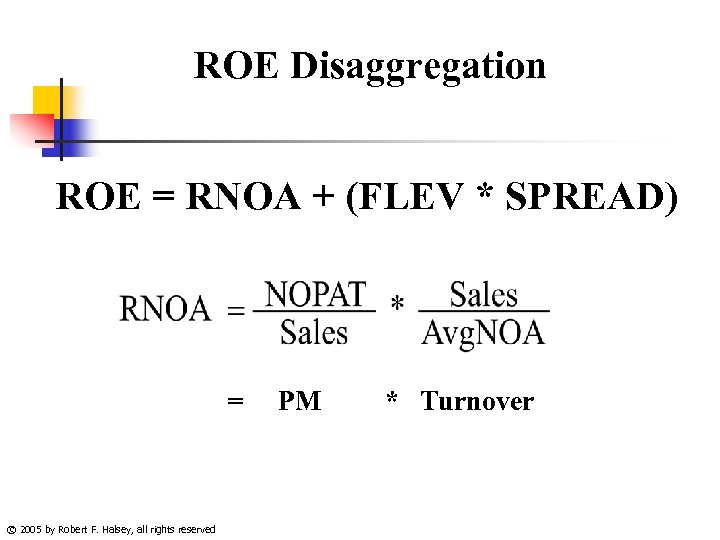

ROE Disaggregation ROE = RNOA + (FLEV * SPREAD) = © 2005 by Robert F. Halsey, all rights reserved PM * Turnover

ROE Disaggregation ROE = RNOA + (FLEV * SPREAD) = © 2005 by Robert F. Halsey, all rights reserved PM * Turnover

Exercises ROE - Identifying and Computing Operating Working Capital and Operating Assets exercise ROE Disaggregation (P&G) exercise Pfizer (PFE) valuation exercise © 2005 by Robert F. Halsey, all rights reserved

Exercises ROE - Identifying and Computing Operating Working Capital and Operating Assets exercise ROE Disaggregation (P&G) exercise Pfizer (PFE) valuation exercise © 2005 by Robert F. Halsey, all rights reserved

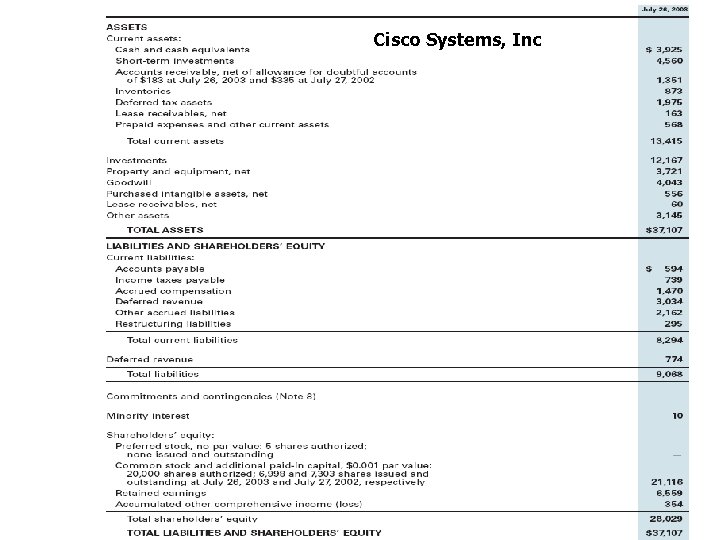

Cisco Systems, Inc

Cisco Systems, Inc

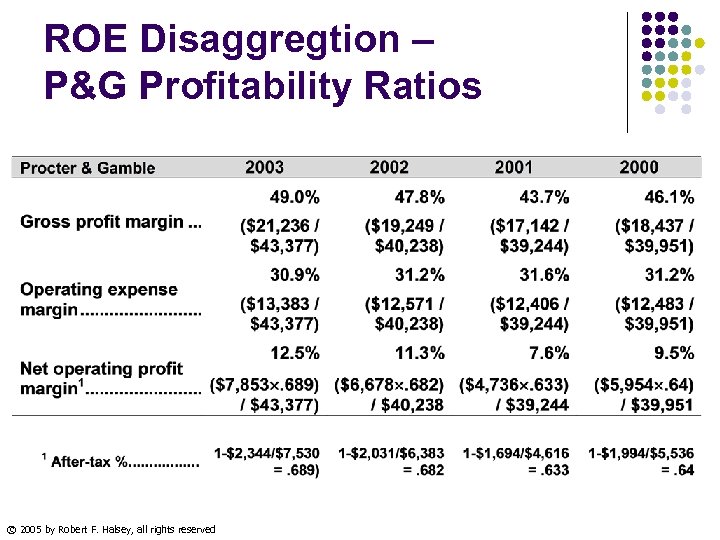

ROE Disaggregtion – P&G Profitability Ratios © 2005 by Robert F. Halsey, all rights reserved

ROE Disaggregtion – P&G Profitability Ratios © 2005 by Robert F. Halsey, all rights reserved

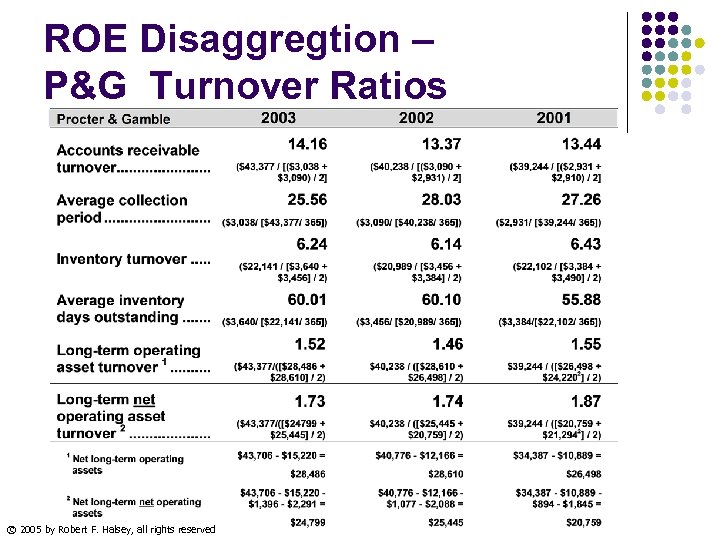

ROE Disaggregtion – P&G Turnover Ratios © 2005 by Robert F. Halsey, all rights reserved

ROE Disaggregtion – P&G Turnover Ratios © 2005 by Robert F. Halsey, all rights reserved

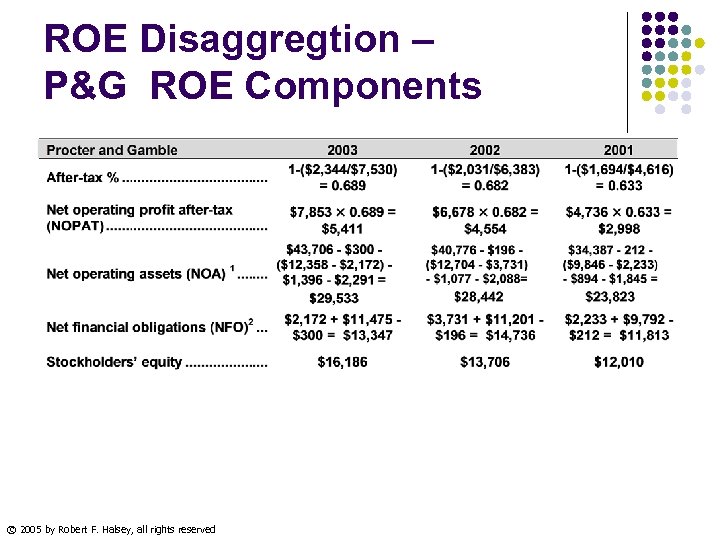

ROE Disaggregtion – P&G ROE Components © 2005 by Robert F. Halsey, all rights reserved

ROE Disaggregtion – P&G ROE Components © 2005 by Robert F. Halsey, all rights reserved

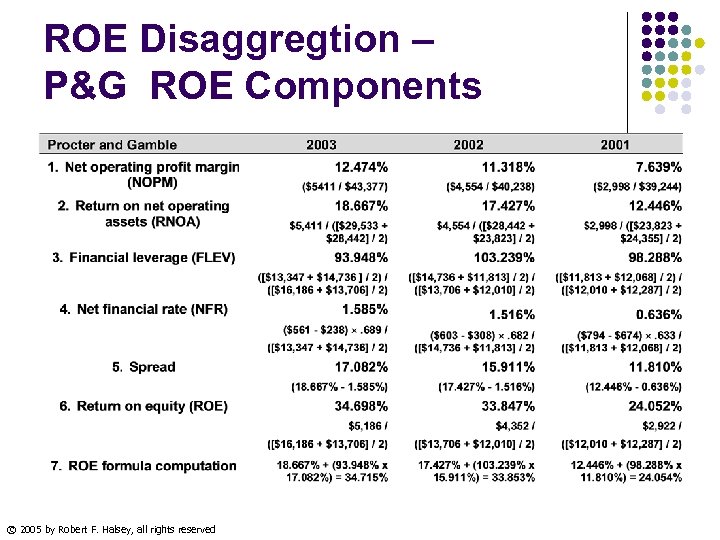

ROE Disaggregtion – P&G ROE Components © 2005 by Robert F. Halsey, all rights reserved

ROE Disaggregtion – P&G ROE Components © 2005 by Robert F. Halsey, all rights reserved

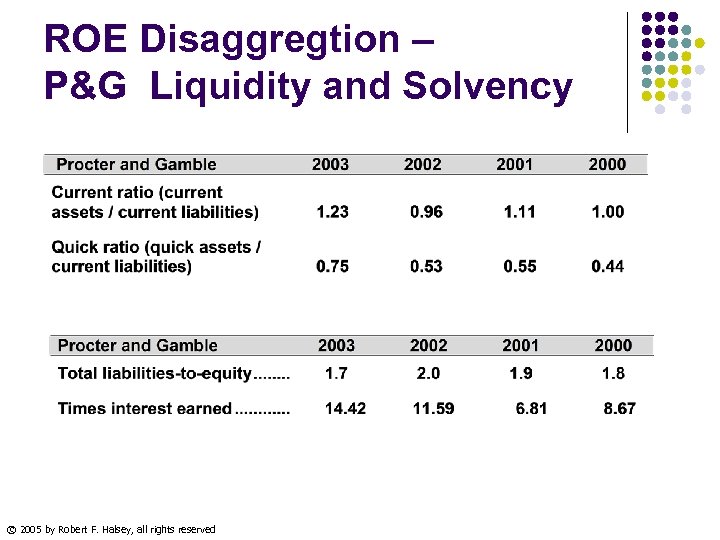

ROE Disaggregtion – P&G Liquidity and Solvency © 2005 by Robert F. Halsey, all rights reserved

ROE Disaggregtion – P&G Liquidity and Solvency © 2005 by Robert F. Halsey, all rights reserved

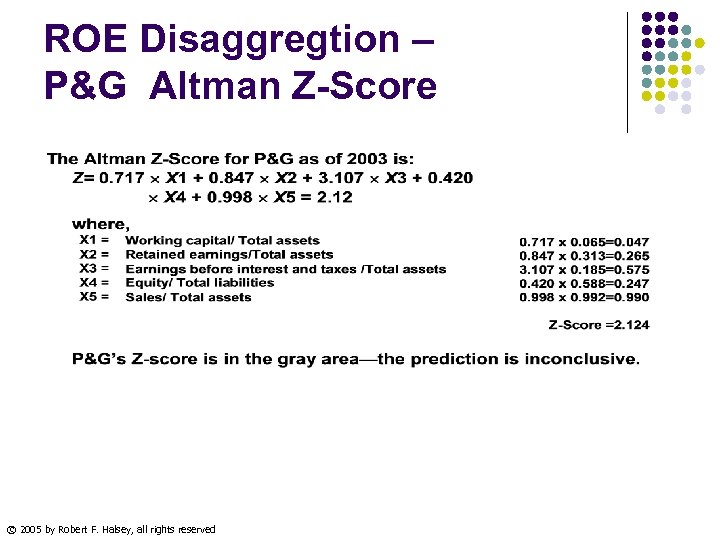

ROE Disaggregtion – P&G Altman Z-Score © 2005 by Robert F. Halsey, all rights reserved

ROE Disaggregtion – P&G Altman Z-Score © 2005 by Robert F. Halsey, all rights reserved

PG 5 -Year Stock Price Trend © 2005 by Robert F. Halsey, all rights reserved

PG 5 -Year Stock Price Trend © 2005 by Robert F. Halsey, all rights reserved

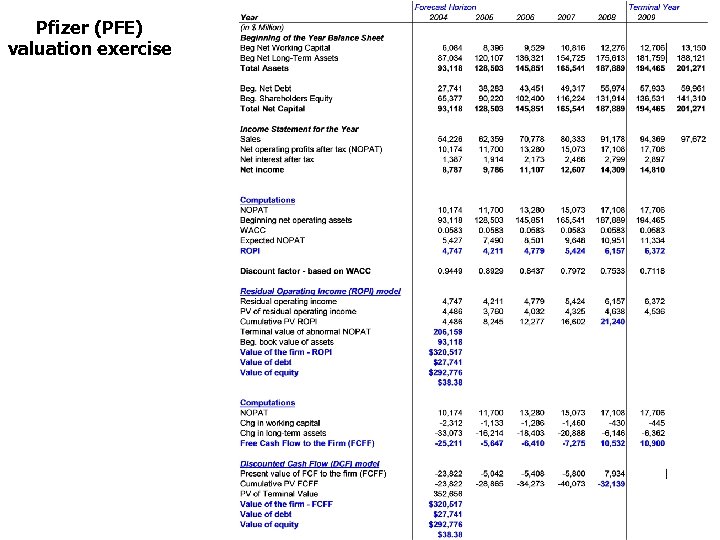

Pfizer (PFE) valuation exercise

Pfizer (PFE) valuation exercise

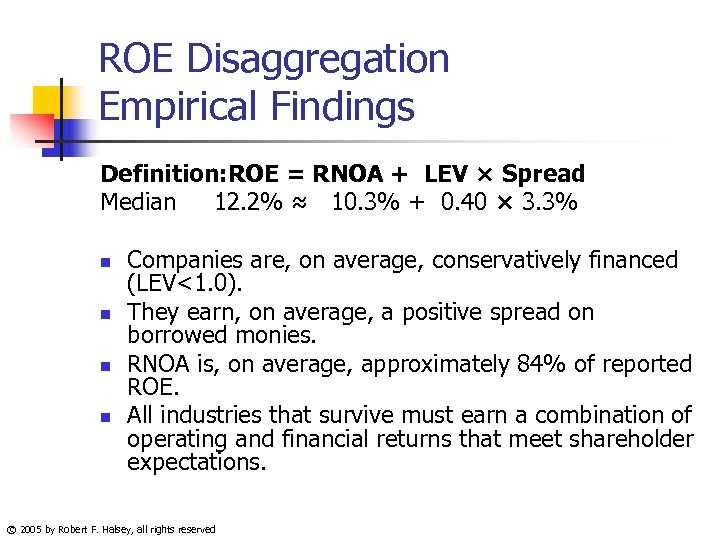

ROE Disaggregation Empirical Findings Definition: ROE = RNOA + LEV × Spread Median 12. 2% ≈ 10. 3% + 0. 40 × 3. 3% n n Companies are, on average, conservatively financed (LEV<1. 0). They earn, on average, a positive spread on borrowed monies. RNOA is, on average, approximately 84% of reported ROE. All industries that survive must earn a combination of operating and financial returns that meet shareholder expectations. © 2005 by Robert F. Halsey, all rights reserved

ROE Disaggregation Empirical Findings Definition: ROE = RNOA + LEV × Spread Median 12. 2% ≈ 10. 3% + 0. 40 × 3. 3% n n Companies are, on average, conservatively financed (LEV<1. 0). They earn, on average, a positive spread on borrowed monies. RNOA is, on average, approximately 84% of reported ROE. All industries that survive must earn a combination of operating and financial returns that meet shareholder expectations. © 2005 by Robert F. Halsey, all rights reserved

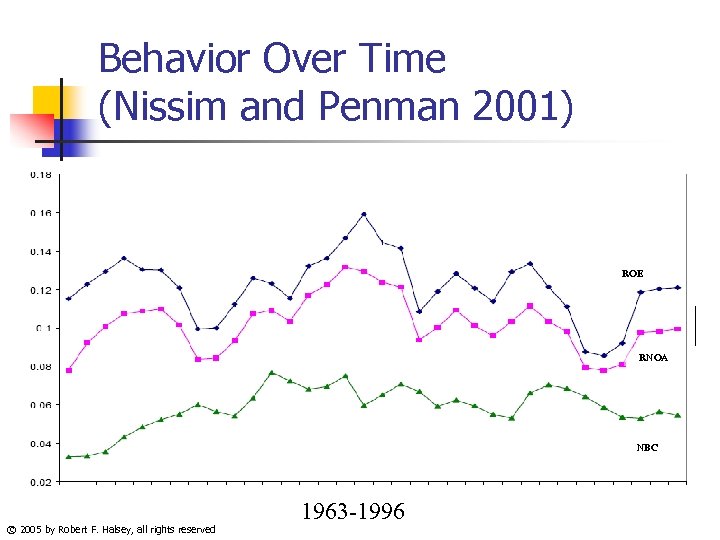

Behavior Over Time (Nissim and Penman 2001) ROE RNOA NBC © 2005 by Robert F. Halsey, all rights reserved 1963 -1996

Behavior Over Time (Nissim and Penman 2001) ROE RNOA NBC © 2005 by Robert F. Halsey, all rights reserved 1963 -1996

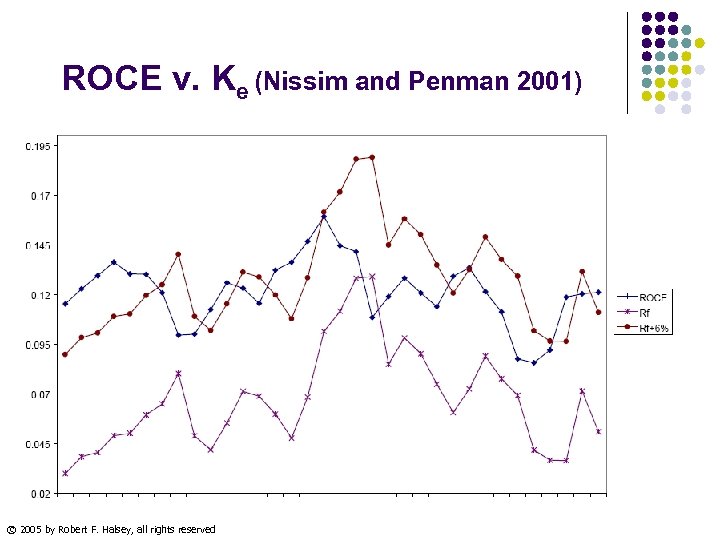

ROCE v. Ke (Nissim and Penman 2001) © 2005 by Robert F. Halsey, all rights reserved

ROCE v. Ke (Nissim and Penman 2001) © 2005 by Robert F. Halsey, all rights reserved

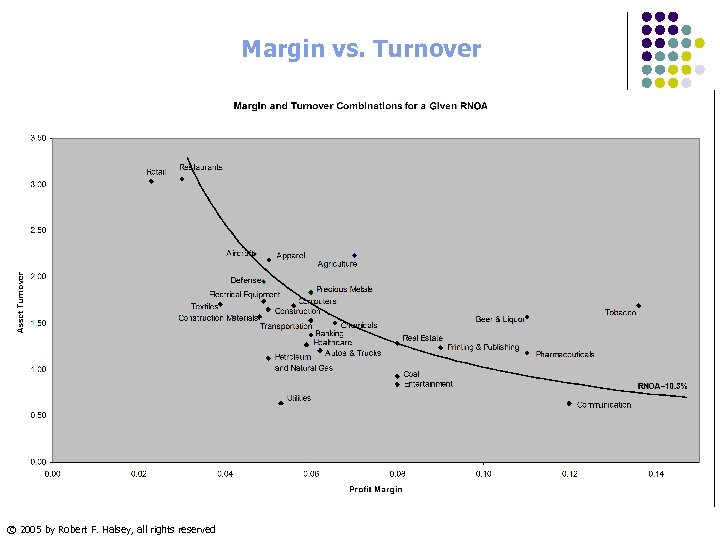

Margin vs. Turnover © 2005 by Robert F. Halsey, all rights reserved

Margin vs. Turnover © 2005 by Robert F. Halsey, all rights reserved

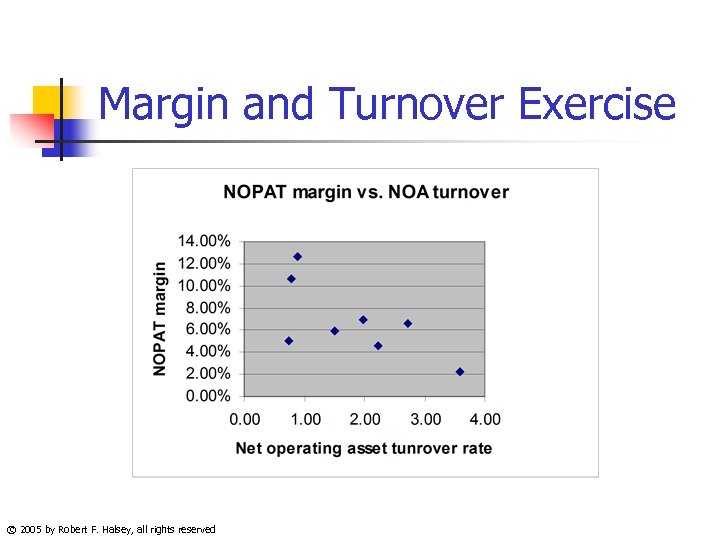

Margin and Turnover Exercise © 2005 by Robert F. Halsey, all rights reserved

Margin and Turnover Exercise © 2005 by Robert F. Halsey, all rights reserved

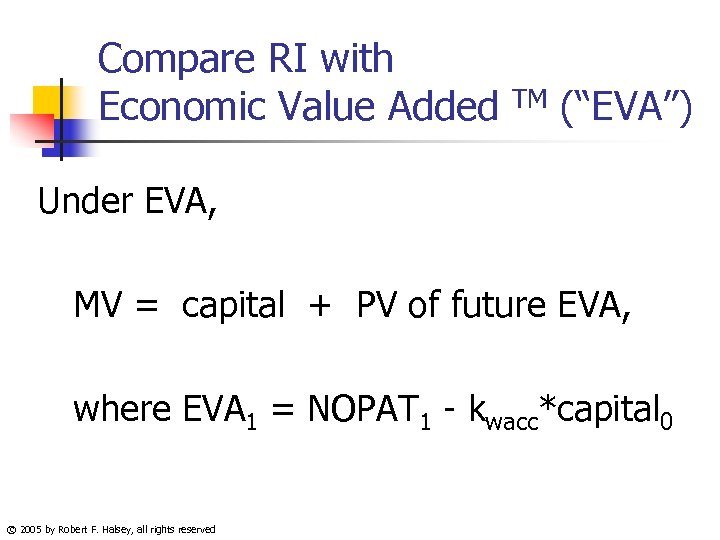

Compare RI with Economic Value Added TM (“EVA”) Under EVA, MV = capital + PV of future EVA, where EVA 1 = NOPAT 1 - kwacc*capital 0 © 2005 by Robert F. Halsey, all rights reserved

Compare RI with Economic Value Added TM (“EVA”) Under EVA, MV = capital + PV of future EVA, where EVA 1 = NOPAT 1 - kwacc*capital 0 © 2005 by Robert F. Halsey, all rights reserved

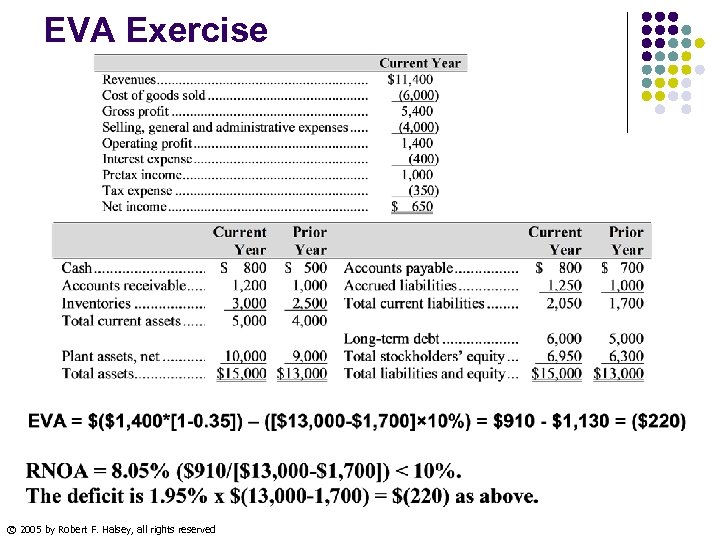

EVA Exercise © 2005 by Robert F. Halsey, all rights reserved

EVA Exercise © 2005 by Robert F. Halsey, all rights reserved

EVA Exercise – Areas for Improvement © 2005 by Robert F. Halsey, all rights reserved

EVA Exercise – Areas for Improvement © 2005 by Robert F. Halsey, all rights reserved