76bf08c3213820630811ab74450c5aef.ppt

- Количество слайдов: 21

Rates of return and alternative measures of capital input Nicholas OULTON London School of Economics and Ana RINCON-AZNAR National Institute of Economic and Social Research August 2010 Presented at The First World KLEMS Conference, Harvard University, Boston, August 19 -20, 2010 This research was made possible by financial support under the 6 th Framework Programme of the European Commission to the “EU KLEMS Project on Productivity in the European Union”. The views expressed are our own.

Rates of return and alternative measures of capital input Nicholas OULTON London School of Economics and Ana RINCON-AZNAR National Institute of Economic and Social Research August 2010 Presented at The First World KLEMS Conference, Harvard University, Boston, August 19 -20, 2010 This research was made possible by financial support under the 6 th Framework Programme of the European Commission to the “EU KLEMS Project on Productivity in the European Union”. The views expressed are our own.

Outline • Aims of the study: 1. Estimate average rate of return in 11 branches and 14 countries: can observed patterns be explained by economic factors? 2. Measure capital’s contribution by three methods: • Ex-post • Ex-ante • Hybrid (Oulton, 2007) 2

Outline • Aims of the study: 1. Estimate average rate of return in 11 branches and 14 countries: can observed patterns be explained by economic factors? 2. Measure capital’s contribution by three methods: • Ex-post • Ex-ante • Hybrid (Oulton, 2007) 2

The spirit of the new SNA Issues raised here are relevant given the new System of National Accounts 2008: • Capital stocks, capital services and capital consumption should all be estimated in an internally consistent way. All underlying data should be consistent (see OECD manuals). • and Capital Compensation should include a breakdown into the returns to different assets (Schreyer et al. 2005; EC 2009, chapter 20). 3

The spirit of the new SNA Issues raised here are relevant given the new System of National Accounts 2008: • Capital stocks, capital services and capital consumption should all be estimated in an internally consistent way. All underlying data should be consistent (see OECD manuals). • and Capital Compensation should include a breakdown into the returns to different assets (Schreyer et al. 2005; EC 2009, chapter 20). 3

Ex post versus ex ante: previous literature Hall and Jorgenson (1967) Berndt and Fuss (1986) Jorgenson, Gollop and Fraumeni (1987) Jorgenson (1989) Berndt (1990) OECD Capital Manuals (2001, 2009) Oulton (2007) 4

Ex post versus ex ante: previous literature Hall and Jorgenson (1967) Berndt and Fuss (1986) Jorgenson, Gollop and Fraumeni (1987) Jorgenson (1989) Berndt (1990) OECD Capital Manuals (2001, 2009) Oulton (2007) 4

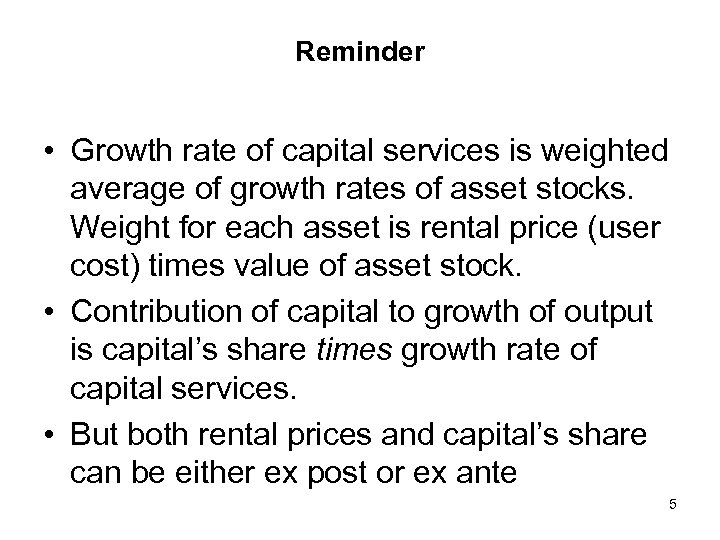

Reminder • Growth rate of capital services is weighted average of growth rates of asset stocks. Weight for each asset is rental price (user cost) times value of asset stock. • Contribution of capital to growth of output is capital’s share times growth rate of capital services. • But both rental prices and capital’s share can be either ex post or ex ante 5

Reminder • Growth rate of capital services is weighted average of growth rates of asset stocks. Weight for each asset is rental price (user cost) times value of asset stock. • Contribution of capital to growth of output is capital’s share times growth rate of capital services. • But both rental prices and capital’s share can be either ex post or ex ante 5

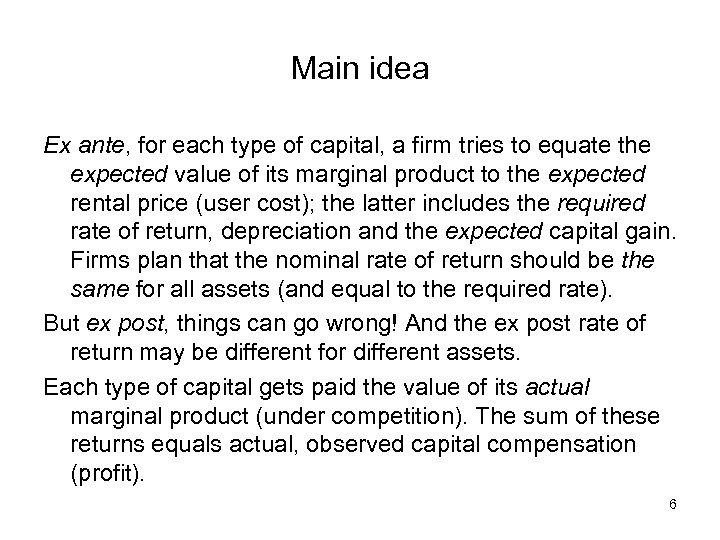

Main idea Ex ante, for each type of capital, a firm tries to equate the expected value of its marginal product to the expected rental price (user cost); the latter includes the required rate of return, depreciation and the expected capital gain. Firms plan that the nominal rate of return should be the same for all assets (and equal to the required rate). But ex post, things can go wrong! And the ex post rate of return may be different for different assets. Each type of capital gets paid the value of its actual marginal product (under competition). The sum of these returns equals actual, observed capital compensation (profit). 6

Main idea Ex ante, for each type of capital, a firm tries to equate the expected value of its marginal product to the expected rental price (user cost); the latter includes the required rate of return, depreciation and the expected capital gain. Firms plan that the nominal rate of return should be the same for all assets (and equal to the required rate). But ex post, things can go wrong! And the ex post rate of return may be different for different assets. Each type of capital gets paid the value of its actual marginal product (under competition). The sum of these returns equals actual, observed capital compensation (profit). 6

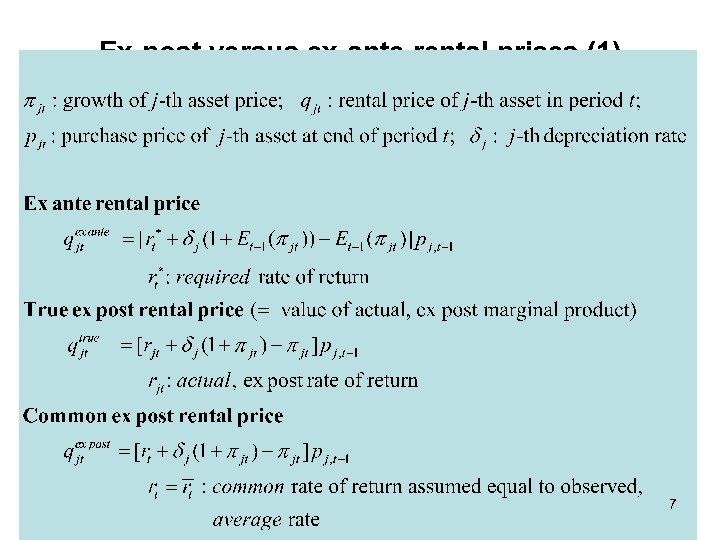

Ex-post versus ex-ante rental prices (1) 7

Ex-post versus ex-ante rental prices (1) 7

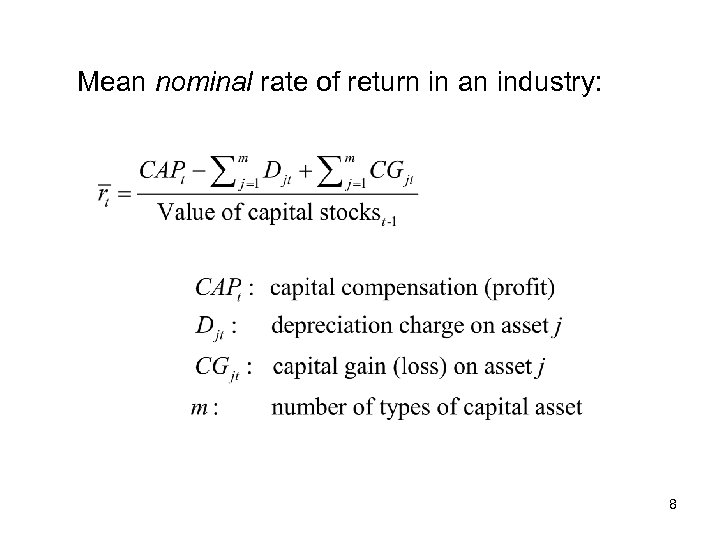

Mean nominal rate of return in an industry: 8

Mean nominal rate of return in an industry: 8

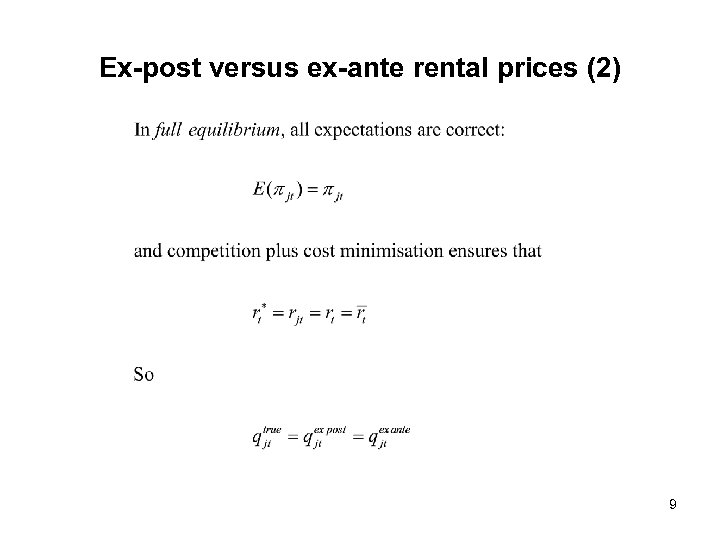

Ex-post versus ex-ante rental prices (2) 9

Ex-post versus ex-ante rental prices (2) 9

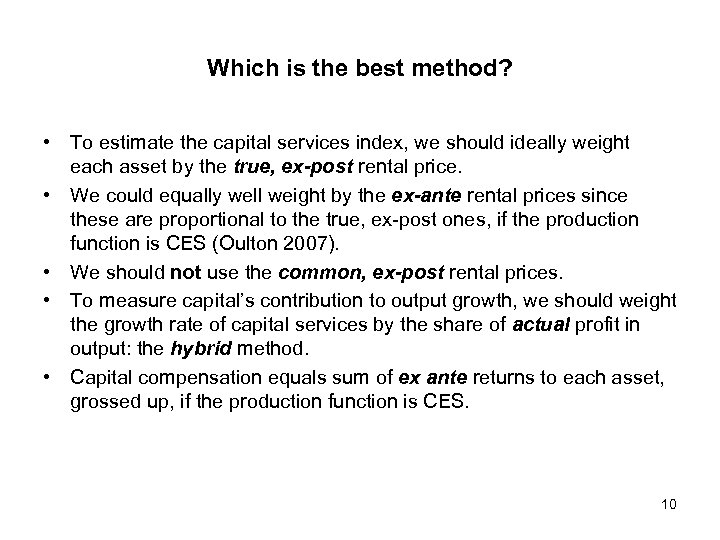

Which is the best method? • To estimate the capital services index, we should ideally weight each asset by the true, ex-post rental price. • We could equally well weight by the ex-ante rental prices since these are proportional to the true, ex-post ones, if the production function is CES (Oulton 2007). • We should not use the common, ex-post rental prices. • To measure capital’s contribution to output growth, we should weight the growth rate of capital services by the share of actual profit in output: the hybrid method. • Capital compensation equals sum of ex ante returns to each asset, grossed up, if the production function is CES. 10

Which is the best method? • To estimate the capital services index, we should ideally weight each asset by the true, ex-post rental price. • We could equally well weight by the ex-ante rental prices since these are proportional to the true, ex-post ones, if the production function is CES (Oulton 2007). • We should not use the common, ex-post rental prices. • To measure capital’s contribution to output growth, we should weight the growth rate of capital services by the share of actual profit in output: the hybrid method. • Capital compensation equals sum of ex ante returns to each asset, grossed up, if the production function is CES. 10

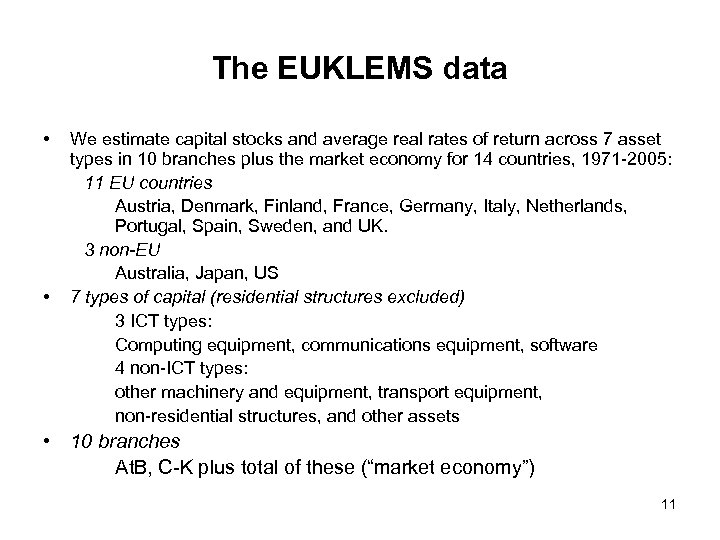

The EUKLEMS data • • We estimate capital stocks and average real rates of return across 7 asset types in 10 branches plus the market economy for 14 countries, 1971 -2005: 11 EU countries Austria, Denmark, Finland, France, Germany, Italy, Netherlands, Portugal, Spain, Sweden, and UK. 3 non-EU Australia, Japan, US 7 types of capital (residential structures excluded) 3 ICT types: Computing equipment, communications equipment, software 4 non-ICT types: other machinery and equipment, transport equipment, non-residential structures, and other assets • 10 branches At. B, C-K plus total of these (“market economy”) 11

The EUKLEMS data • • We estimate capital stocks and average real rates of return across 7 asset types in 10 branches plus the market economy for 14 countries, 1971 -2005: 11 EU countries Austria, Denmark, Finland, France, Germany, Italy, Netherlands, Portugal, Spain, Sweden, and UK. 3 non-EU Australia, Japan, US 7 types of capital (residential structures excluded) 3 ICT types: Computing equipment, communications equipment, software 4 non-ICT types: other machinery and equipment, transport equipment, non-residential structures, and other assets • 10 branches At. B, C-K plus total of these (“market economy”) 11

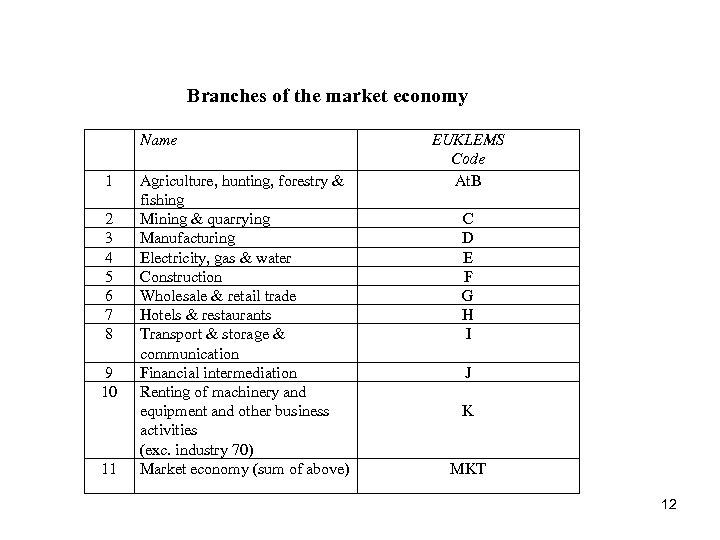

Branches of the market economy Name 1 2 3 4 5 6 7 8 9 10 11 Agriculture, hunting, forestry & fishing Mining & quarrying Manufacturing Electricity, gas & water Construction Wholesale & retail trade Hotels & restaurants Transport & storage & communication Financial intermediation Renting of machinery and equipment and other business activities (exc. industry 70) Market economy (sum of above) EUKLEMS Code At. B C D E F G H I J K MKT 12

Branches of the market economy Name 1 2 3 4 5 6 7 8 9 10 11 Agriculture, hunting, forestry & fishing Mining & quarrying Manufacturing Electricity, gas & water Construction Wholesale & retail trade Hotels & restaurants Transport & storage & communication Financial intermediation Renting of machinery and equipment and other business activities (exc. industry 70) Market economy (sum of above) EUKLEMS Code At. B C D E F G H I J K MKT 12

Ex-post method: number of negative rental prices • 746 out of 27, 930 rental prices are negative: 2. 7% • Over half of these (414) are for “Other construction” • 248 are in Transport and storage, 226 in Financial intermediation • 180 are in Finland NOTE: negative rental prices make no sense economically. So to implement the common ex post method they have to be smoothed away. 13

Ex-post method: number of negative rental prices • 746 out of 27, 930 rental prices are negative: 2. 7% • Over half of these (414) are for “Other construction” • 248 are in Transport and storage, 226 in Financial intermediation • 180 are in Finland NOTE: negative rental prices make no sense economically. So to implement the common ex post method they have to be smoothed away. 13

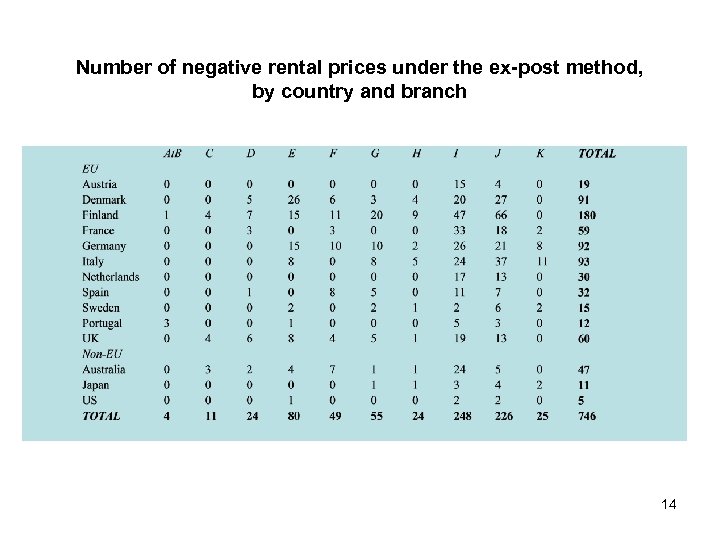

Number of negative rental prices under the ex-post method, by country and branch 14

Number of negative rental prices under the ex-post method, by country and branch 14

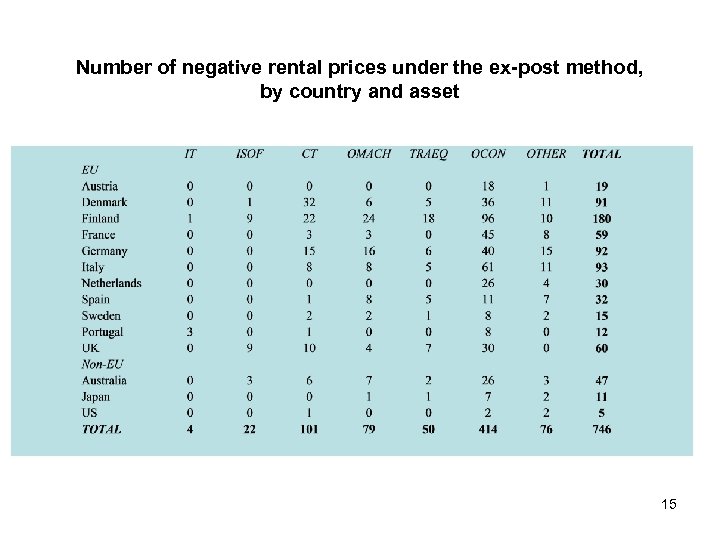

Number of negative rental prices under the ex-post method, by country and asset 15

Number of negative rental prices under the ex-post method, by country and asset 15

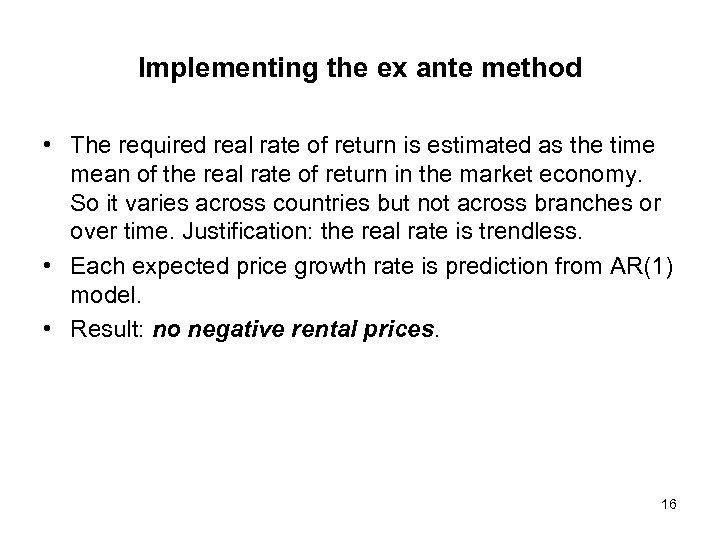

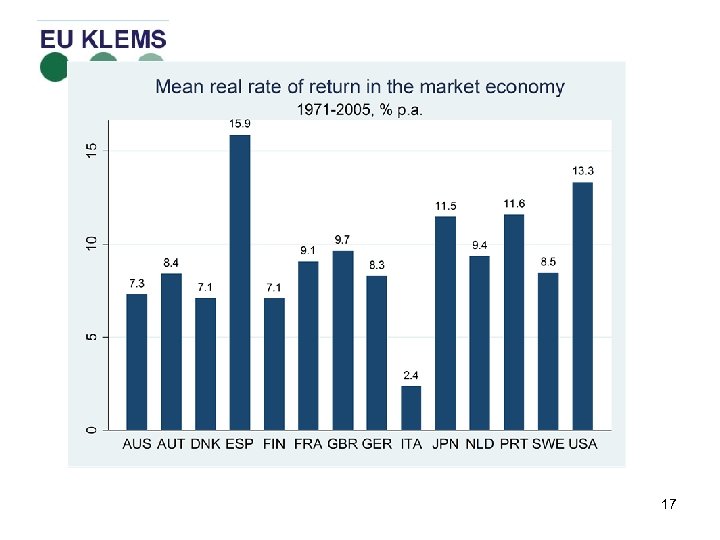

Implementing the ex ante method • The required real rate of return is estimated as the time mean of the real rate of return in the market economy. So it varies across countries but not across branches or over time. Justification: the real rate is trendless. • Each expected price growth rate is prediction from AR(1) model. • Result: no negative rental prices. 16

Implementing the ex ante method • The required real rate of return is estimated as the time mean of the real rate of return in the market economy. So it varies across countries but not across branches or over time. Justification: the real rate is trendless. • Each expected price growth rate is prediction from AR(1) model. • Result: no negative rental prices. 16

17

17

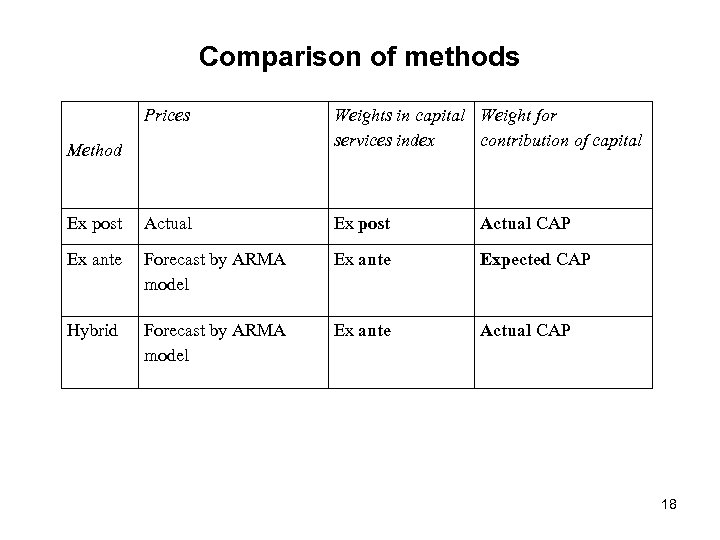

Comparison of methods Prices Weights in capital Weight for services index contribution of capital Ex post Actual CAP Ex ante Forecast by ARMA model Ex ante Expected CAP Hybrid Forecast by ARMA model Ex ante Actual CAP Method 18

Comparison of methods Prices Weights in capital Weight for services index contribution of capital Ex post Actual CAP Ex ante Forecast by ARMA model Ex ante Expected CAP Hybrid Forecast by ARMA model Ex ante Actual CAP Method 18

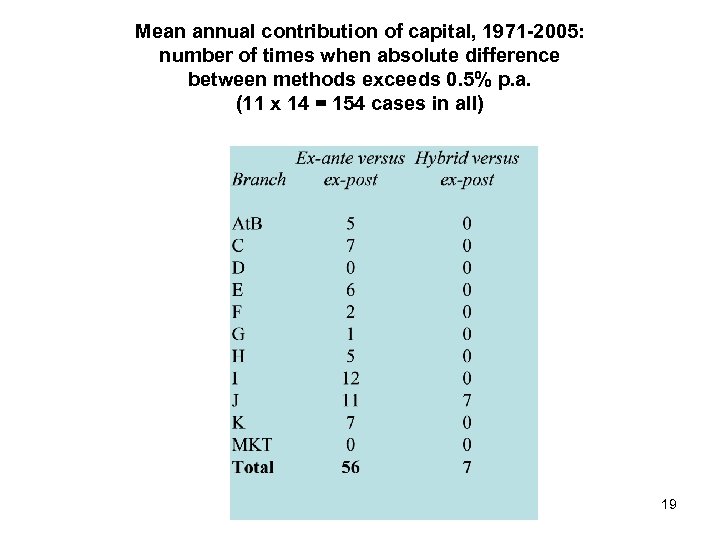

Mean annual contribution of capital, 1971 -2005: number of times when absolute difference between methods exceeds 0. 5% p. a. (11 x 14 = 154 cases in all) 19

Mean annual contribution of capital, 1971 -2005: number of times when absolute difference between methods exceeds 0. 5% p. a. (11 x 14 = 154 cases in all) 19

Conclusions • The three methods produce very similar results at the market economy level. • But there are marked differences between the ex -ante and the ex-post methods at the branch level. • The hybrid and the ex-post method are quite similar at the branch level. • The hybrid method gives a theoretical justification for smoothing away the negative rental prices generated by the ex-post method. 20

Conclusions • The three methods produce very similar results at the market economy level. • But there are marked differences between the ex -ante and the ex-post methods at the branch level. • The hybrid and the ex-post method are quite similar at the branch level. • The hybrid method gives a theoretical justification for smoothing away the negative rental prices generated by the ex-post method. 20

THE END

THE END