66b843058128ae63dd8843d54433b7f7.ppt

- Количество слайдов: 25

Raising Proficiency Standards: Certificate In Advanced Mutual Fund Advice Presentation to Federation of Mutual Fund Dealers September 19, 2012 by Marshall Beyer Director, Regulatory Relations and Credentialing

Raising Proficiency Standards: Certificate In Advanced Mutual Fund Advice Presentation to Federation of Mutual Fund Dealers September 19, 2012 by Marshall Beyer Director, Regulatory Relations and Credentialing

Agenda § What is the Canadian Securities Institute (CSI)? § Rising Professional Standards for Advisors: An International Perspective § CSI’s Credentialing Framework § Introducing CSI’s Certificate in Advanced Mutual Funds Advice

Agenda § What is the Canadian Securities Institute (CSI)? § Rising Professional Standards for Advisors: An International Perspective § CSI’s Credentialing Framework § Introducing CSI’s Certificate in Advanced Mutual Funds Advice

Introduction to CSI § Established by Canada’s SRO’s in 1970 § Full mandate for all licensing education and testing for securities industry. Eighteen courses/exams for IIROC licensing § Full set of courses and certifications for retail banking, including mutual fund licensing and branch compliance § Offers an accredited course that leads to the LLQP § Annually serves 50, 000+ students and corporations via broad range of courses and services across all pillars § Focuses on delivering certificates and credentials to build industry professionalization § Sold by IIROC in 2006 and contracted by at thereafter.

Introduction to CSI § Established by Canada’s SRO’s in 1970 § Full mandate for all licensing education and testing for securities industry. Eighteen courses/exams for IIROC licensing § Full set of courses and certifications for retail banking, including mutual fund licensing and branch compliance § Offers an accredited course that leads to the LLQP § Annually serves 50, 000+ students and corporations via broad range of courses and services across all pillars § Focuses on delivering certificates and credentials to build industry professionalization § Sold by IIROC in 2006 and contracted by at thereafter.

CSI’s Vision To be a global leader in financial learning, credentialing and certification, helping professionals and financial services companies succeed and prosper, while contributing to the integrity of the financial markets.

CSI’s Vision To be a global leader in financial learning, credentialing and certification, helping professionals and financial services companies succeed and prosper, while contributing to the integrity of the financial markets.

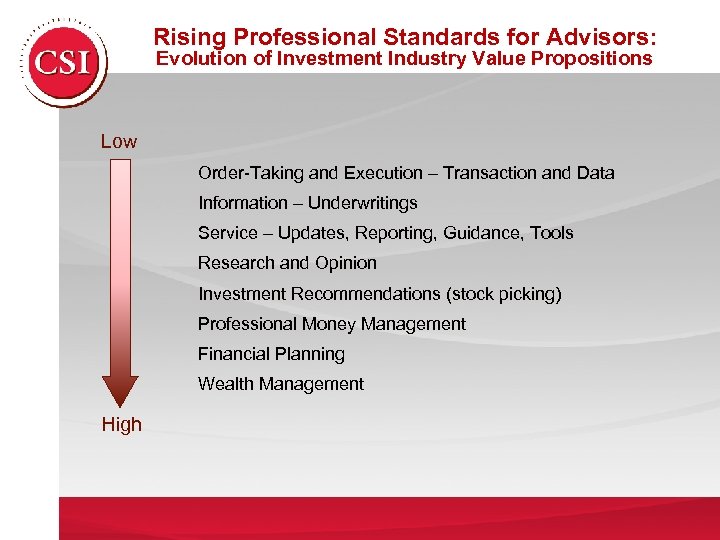

Rising Professional Standards for Advisors: Evolution of Investment Industry Value Propositions Low Order-Taking and Execution – Transaction and Data Information – Underwritings Service – Updates, Reporting, Guidance, Tools Research and Opinion Investment Recommendations (stock picking) Professional Money Management Financial Planning Wealth Management High

Rising Professional Standards for Advisors: Evolution of Investment Industry Value Propositions Low Order-Taking and Execution – Transaction and Data Information – Underwritings Service – Updates, Reporting, Guidance, Tools Research and Opinion Investment Recommendations (stock picking) Professional Money Management Financial Planning Wealth Management High

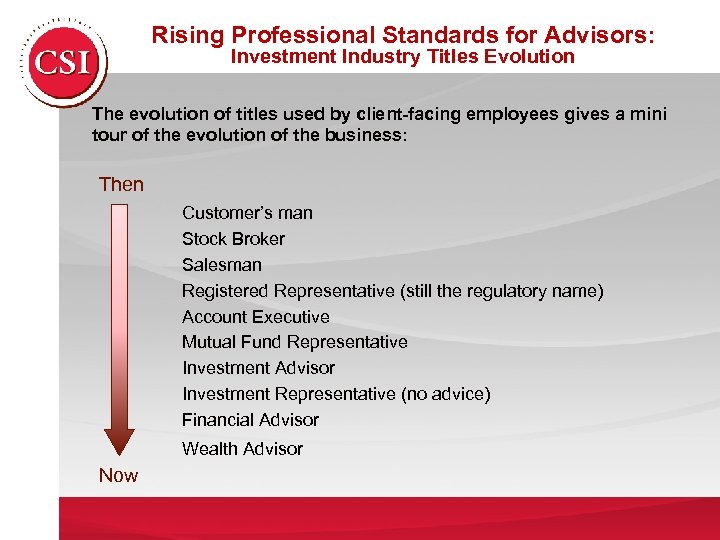

Rising Professional Standards for Advisors: Investment Industry Titles Evolution The evolution of titles used by client-facing employees gives a mini tour of the evolution of the business: Then Customer’s man Stock Broker Salesman Registered Representative (still the regulatory name) Account Executive Mutual Fund Representative Investment Advisor Investment Representative (no advice) Financial Advisor Wealth Advisor Now

Rising Professional Standards for Advisors: Investment Industry Titles Evolution The evolution of titles used by client-facing employees gives a mini tour of the evolution of the business: Then Customer’s man Stock Broker Salesman Registered Representative (still the regulatory name) Account Executive Mutual Fund Representative Investment Advisor Investment Representative (no advice) Financial Advisor Wealth Advisor Now

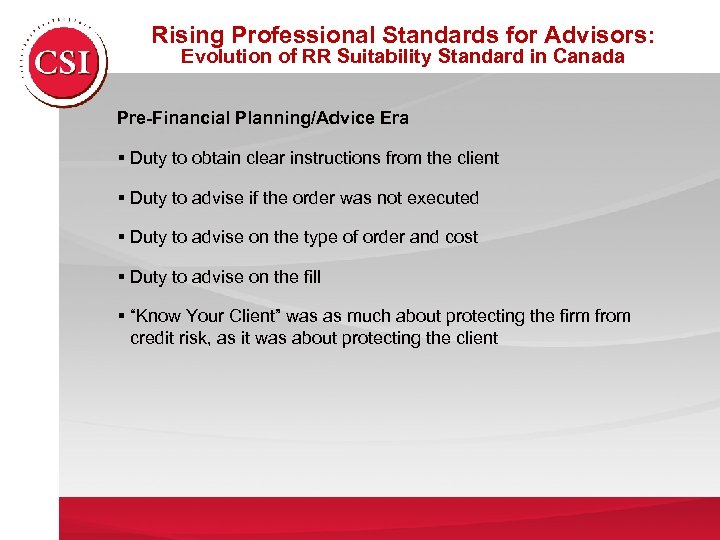

Rising Professional Standards for Advisors: Evolution of RR Suitability Standard in Canada Pre-Financial Planning/Advice Era § Duty to obtain clear instructions from the client § Duty to advise if the order was not executed § Duty to advise on the type of order and cost § Duty to advise on the fill § “Know Your Client” was as much about protecting the firm from credit risk, as it was about protecting the client

Rising Professional Standards for Advisors: Evolution of RR Suitability Standard in Canada Pre-Financial Planning/Advice Era § Duty to obtain clear instructions from the client § Duty to advise if the order was not executed § Duty to advise on the type of order and cost § Duty to advise on the fill § “Know Your Client” was as much about protecting the firm from credit risk, as it was about protecting the client

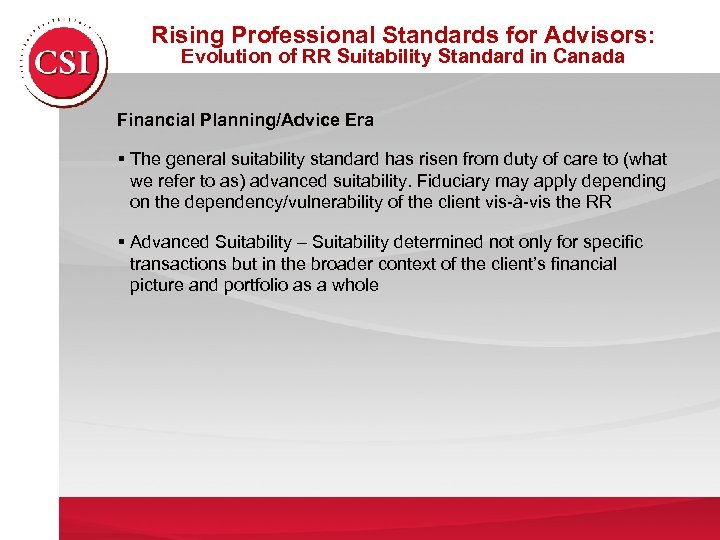

Rising Professional Standards for Advisors: Evolution of RR Suitability Standard in Canada Financial Planning/Advice Era § The general suitability standard has risen from duty of care to (what we refer to as) advanced suitability. Fiduciary may apply depending on the dependency/vulnerability of the client vis-à-vis the RR § Advanced Suitability – Suitability determined not only for specific transactions but in the broader context of the client’s financial picture and portfolio as a whole

Rising Professional Standards for Advisors: Evolution of RR Suitability Standard in Canada Financial Planning/Advice Era § The general suitability standard has risen from duty of care to (what we refer to as) advanced suitability. Fiduciary may apply depending on the dependency/vulnerability of the client vis-à-vis the RR § Advanced Suitability – Suitability determined not only for specific transactions but in the broader context of the client’s financial picture and portfolio as a whole

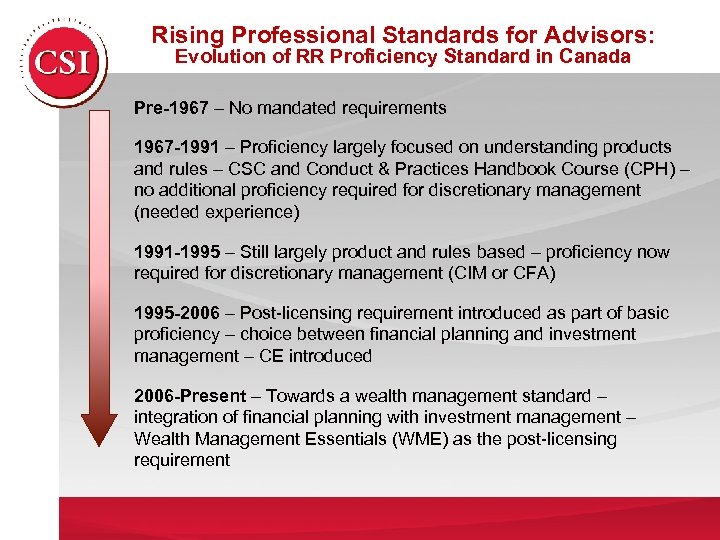

Rising Professional Standards for Advisors: Evolution of RR Proficiency Standard in Canada Pre-1967 – No mandated requirements 1967 -1991 – Proficiency largely focused on understanding products and rules – CSC and Conduct & Practices Handbook Course (CPH) – no additional proficiency required for discretionary management (needed experience) 1991 -1995 – Still largely product and rules based – proficiency now required for discretionary management (CIM or CFA) 1995 -2006 – Post-licensing requirement introduced as part of basic proficiency – choice between financial planning and investment management – CE introduced 2006 -Present – Towards a wealth management standard – integration of financial planning with investment management – Wealth Management Essentials (WME) as the post-licensing requirement

Rising Professional Standards for Advisors: Evolution of RR Proficiency Standard in Canada Pre-1967 – No mandated requirements 1967 -1991 – Proficiency largely focused on understanding products and rules – CSC and Conduct & Practices Handbook Course (CPH) – no additional proficiency required for discretionary management (needed experience) 1991 -1995 – Still largely product and rules based – proficiency now required for discretionary management (CIM or CFA) 1995 -2006 – Post-licensing requirement introduced as part of basic proficiency – choice between financial planning and investment management – CE introduced 2006 -Present – Towards a wealth management standard – integration of financial planning with investment management – Wealth Management Essentials (WME) as the post-licensing requirement

What is happening to professional standards outside of Canada?

What is happening to professional standards outside of Canada?

Rising Professional Standards for Advisors: U. S. ’s Approach § Difference between “brokers” and “advisors” § Suitability standard for brokers o Seen to be giving investment advice incidental to trading o Exception: ERISA investments – fiduciary duty § No requirement to find the best investments § Fiduciary standard for advisors o Must find the best investment o Must avoid or disclose conflicts of interest § Proficiency requirements for advisors include Series 65 (or CFP or CFA) – Being a fiduciary means more than knowing what fiduciary means – it means having the competency to do the job.

Rising Professional Standards for Advisors: U. S. ’s Approach § Difference between “brokers” and “advisors” § Suitability standard for brokers o Seen to be giving investment advice incidental to trading o Exception: ERISA investments – fiduciary duty § No requirement to find the best investments § Fiduciary standard for advisors o Must find the best investment o Must avoid or disclose conflicts of interest § Proficiency requirements for advisors include Series 65 (or CFP or CFA) – Being a fiduciary means more than knowing what fiduciary means – it means having the competency to do the job.

Rising Professional Standards for Advisors: Proposed Changes in the U. S. § Dodd Frank imposed a fiduciary duty on broker-dealers (“wirehouses”) but provision is still being debated and will not likely be determined before the U. S. election (and its fate may depend on the election results) § Regardless of whether the fiduciary standard gets imposed on brokers, there has already been significant migration by brokers to an advisory platform (or dual platform) § Issue is whether brokers should have a fiduciary standard § This would mean acting in the client’s best interests, not just considering whether the trade is suitable § Would mean higher proficiency requirements (Series 65) for brokers

Rising Professional Standards for Advisors: Proposed Changes in the U. S. § Dodd Frank imposed a fiduciary duty on broker-dealers (“wirehouses”) but provision is still being debated and will not likely be determined before the U. S. election (and its fate may depend on the election results) § Regardless of whether the fiduciary standard gets imposed on brokers, there has already been significant migration by brokers to an advisory platform (or dual platform) § Issue is whether brokers should have a fiduciary standard § This would mean acting in the client’s best interests, not just considering whether the trade is suitable § Would mean higher proficiency requirements (Series 65) for brokers

Rising Professional Standards for Advisors: U. K. ’s Approach Retail Distribution Review to be effective on January 1, 2013: § All investment advisers will be qualified to a new higher level, regarded as roughly equivalent to the first year of a degree § Ban on “conflicted” remuneration structures § Investors know up front what advice will cost and how they will pay for it 12

Rising Professional Standards for Advisors: U. K. ’s Approach Retail Distribution Review to be effective on January 1, 2013: § All investment advisers will be qualified to a new higher level, regarded as roughly equivalent to the first year of a degree § Ban on “conflicted” remuneration structures § Investors know up front what advice will cost and how they will pay for it 12

Rising Professional Standards for Advisors: Australia’s Approach § Introduction of a fiduciary standard § Considering moving to higher mandated proficiency standards (under review) § Ban on “conflicted” remuneration structures § Became effective on a voluntary basis on July 1, 2012; will become mandatory on July 1, 2013 13

Rising Professional Standards for Advisors: Australia’s Approach § Introduction of a fiduciary standard § Considering moving to higher mandated proficiency standards (under review) § Ban on “conflicted” remuneration structures § Became effective on a voluntary basis on July 1, 2012; will become mandatory on July 1, 2013 13

Rising Professional Standards for Advisors: European Union § European Securities and Market Association recently issued a consultation paper on advisory compensation practices § It is proposing similar bans on conflicted remuneration structures § Proposing harmonization of fit and proper requirements of advisory staff 14

Rising Professional Standards for Advisors: European Union § European Securities and Market Association recently issued a consultation paper on advisory compensation practices § It is proposing similar bans on conflicted remuneration structures § Proposing harmonization of fit and proper requirements of advisory staff 14

Rising Professional Standards for Advisors: Summary Regulators in the U. S. , U. K. , Australia and Canada have been responding to rising investor expectations and the shift from a transaction to an advice-based relationship. We have recently seen regulatory proposals in several jurisdictions which focus on: the training and proficiency of advisors § the advisor’s relationship with and responsibility to his/her client § compensation: getting the incentives right so the client’s and advisor’s interests are better aligned § 15

Rising Professional Standards for Advisors: Summary Regulators in the U. S. , U. K. , Australia and Canada have been responding to rising investor expectations and the shift from a transaction to an advice-based relationship. We have recently seen regulatory proposals in several jurisdictions which focus on: the training and proficiency of advisors § the advisor’s relationship with and responsibility to his/her client § compensation: getting the incentives right so the client’s and advisor’s interests are better aligned § 15

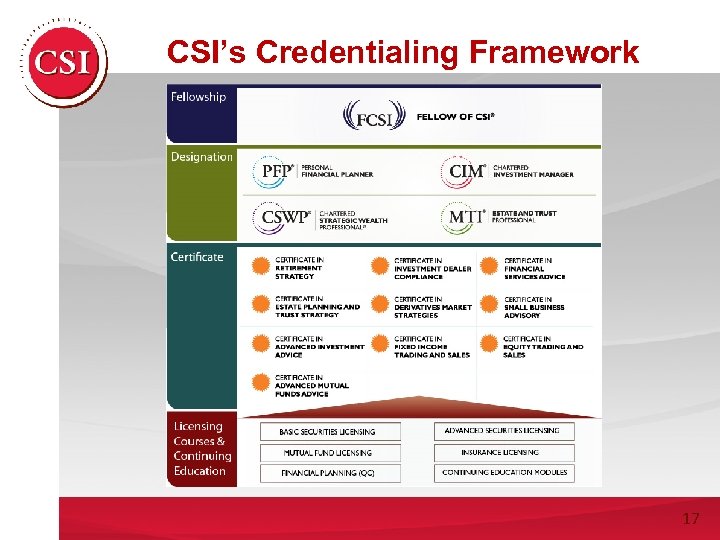

CSI’s Credentialing Framework Fellowship § Assumes an underlying profession (designation) combined with broader knowledge of the industry and includes industry contribution Designation § A focus on the assessment of professional competency and the application of those competencies, as well as awareness of the professional practice Certificate § The skill and knowledge requirements for a specialized or targeted role/ function. Usually builds upon an existing foundation role or knowledge Licensing Course The (minimum) skill and knowledge requirements for a regulated or licensed function/role. Standards are set by regulator 16

CSI’s Credentialing Framework Fellowship § Assumes an underlying profession (designation) combined with broader knowledge of the industry and includes industry contribution Designation § A focus on the assessment of professional competency and the application of those competencies, as well as awareness of the professional practice Certificate § The skill and knowledge requirements for a specialized or targeted role/ function. Usually builds upon an existing foundation role or knowledge Licensing Course The (minimum) skill and knowledge requirements for a regulated or licensed function/role. Standards are set by regulator 16

CSI’s Credentialing Framework 17

CSI’s Credentialing Framework 17

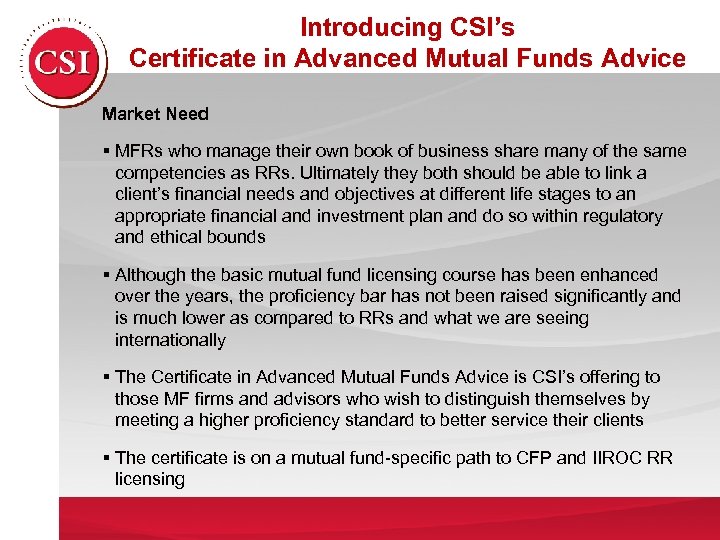

Introducing CSI’s Certificate in Advanced Mutual Funds Advice Market Need § MFRs who manage their own book of business share many of the same competencies as RRs. Ultimately they both should be able to link a client’s financial needs and objectives at different life stages to an appropriate financial and investment plan and do so within regulatory and ethical bounds § Although the basic mutual fund licensing course has been enhanced over the years, the proficiency bar has not been raised significantly and is much lower as compared to RRs and what we are seeing internationally § The Certificate in Advanced Mutual Funds Advice is CSI’s offering to those MF firms and advisors who wish to distinguish themselves by meeting a higher proficiency standard to better service their clients § The certificate is on a mutual fund-specific path to CFP and IIROC RR licensing

Introducing CSI’s Certificate in Advanced Mutual Funds Advice Market Need § MFRs who manage their own book of business share many of the same competencies as RRs. Ultimately they both should be able to link a client’s financial needs and objectives at different life stages to an appropriate financial and investment plan and do so within regulatory and ethical bounds § Although the basic mutual fund licensing course has been enhanced over the years, the proficiency bar has not been raised significantly and is much lower as compared to RRs and what we are seeing internationally § The Certificate in Advanced Mutual Funds Advice is CSI’s offering to those MF firms and advisors who wish to distinguish themselves by meeting a higher proficiency standard to better service their clients § The certificate is on a mutual fund-specific path to CFP and IIROC RR licensing

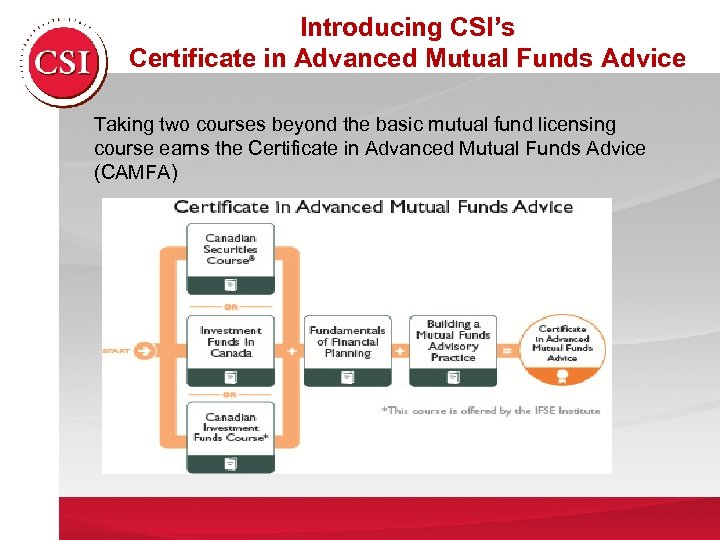

Introducing CSI’s Certificate in Advanced Mutual Funds Advice Taking two courses beyond the basic mutual fund licensing course earns the Certificate in Advanced Mutual Funds Advice (CAMFA)

Introducing CSI’s Certificate in Advanced Mutual Funds Advice Taking two courses beyond the basic mutual fund licensing course earns the Certificate in Advanced Mutual Funds Advice (CAMFA)

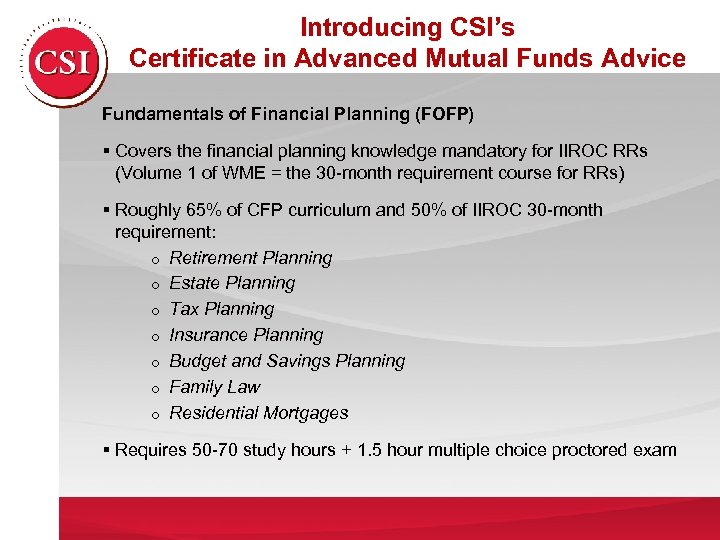

Introducing CSI’s Certificate in Advanced Mutual Funds Advice Fundamentals of Financial Planning (FOFP) § Covers the financial planning knowledge mandatory for IIROC RRs (Volume 1 of WME = the 30 -month requirement course for RRs) § Roughly 65% of CFP curriculum and 50% of IIROC 30 -month requirement: o Retirement Planning o Estate Planning o Tax Planning o Insurance Planning o Budget and Savings Planning o Family Law o Residential Mortgages § Requires 50 -70 study hours + 1. 5 hour multiple choice proctored exam

Introducing CSI’s Certificate in Advanced Mutual Funds Advice Fundamentals of Financial Planning (FOFP) § Covers the financial planning knowledge mandatory for IIROC RRs (Volume 1 of WME = the 30 -month requirement course for RRs) § Roughly 65% of CFP curriculum and 50% of IIROC 30 -month requirement: o Retirement Planning o Estate Planning o Tax Planning o Insurance Planning o Budget and Savings Planning o Family Law o Residential Mortgages § Requires 50 -70 study hours + 1. 5 hour multiple choice proctored exam

Introducing CSI’s Certificate in Advanced Mutual Funds Advice Building a Mutual Funds Advisory Practice (BMAP) § The course is split into 2 parts § Part 1 focuses on practice management: o Developing a business plan o Building a referral network o Marketing and business development o Succession planning for advisors o Know Your Client and Know Your Product o CRM o Guidelines for leverage recommendations o Incorporating your practice § The course not only teaches these concepts, but learners are required to create their own business/action plan as they work though the course

Introducing CSI’s Certificate in Advanced Mutual Funds Advice Building a Mutual Funds Advisory Practice (BMAP) § The course is split into 2 parts § Part 1 focuses on practice management: o Developing a business plan o Building a referral network o Marketing and business development o Succession planning for advisors o Know Your Client and Know Your Product o CRM o Guidelines for leverage recommendations o Incorporating your practice § The course not only teaches these concepts, but learners are required to create their own business/action plan as they work though the course

Introducing CSI’s Certificate in Advanced Mutual Funds Advice Building a Mutual Funds Advisory Practice (BMAP) § Part 2 focuses on portfolio fundamentals, accumulation and deaccumulation investment strategies and products: o o o o Asset allocation Performance measurement Advanced mutual fund analysis Hedge funds/Commodity pools How derivatives are used in managed funds Segregated funds Annuities GMWPs Requires ~50 study hours + 1. 5 hour multiple choice proctored exam

Introducing CSI’s Certificate in Advanced Mutual Funds Advice Building a Mutual Funds Advisory Practice (BMAP) § Part 2 focuses on portfolio fundamentals, accumulation and deaccumulation investment strategies and products: o o o o Asset allocation Performance measurement Advanced mutual fund analysis Hedge funds/Commodity pools How derivatives are used in managed funds Segregated funds Annuities GMWPs Requires ~50 study hours + 1. 5 hour multiple choice proctored exam

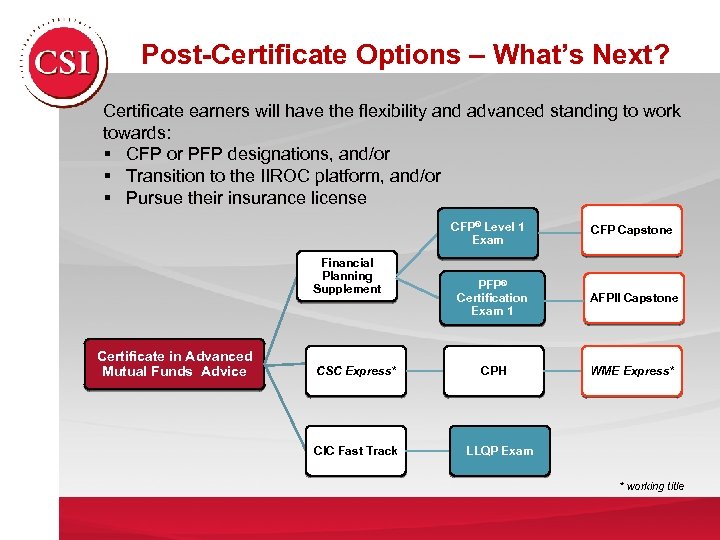

Post-Certificate Options – What’s Next? Certificate earners will have the flexibility and advanced standing to work towards: § CFP or PFP designations, and/or § Transition to the IIROC platform, and/or § Pursue their insurance license CFP® Level 1 Exam Financial Planning Supplement Certificate in Advanced Mutual Funds Advice CSC Express* CIC Fast Track CFP Capstone PFP® Certification Exam 1 AFPII Capstone CPH WME Express* LLQP Exam * working title

Post-Certificate Options – What’s Next? Certificate earners will have the flexibility and advanced standing to work towards: § CFP or PFP designations, and/or § Transition to the IIROC platform, and/or § Pursue their insurance license CFP® Level 1 Exam Financial Planning Supplement Certificate in Advanced Mutual Funds Advice CSC Express* CIC Fast Track CFP Capstone PFP® Certification Exam 1 AFPII Capstone CPH WME Express* LLQP Exam * working title

Value Proposition of CAMFA For individual advisors, sales assistants or those looking to enter the industry, CAMFA offers: § Credential that will provide increased knowledge and help build credibility with clients § A mutual fund specific path to CFP or PFP § Gradual path to IIROC licensing For dealers, CAMFA can: § Help with advisor training and succession planning

Value Proposition of CAMFA For individual advisors, sales assistants or those looking to enter the industry, CAMFA offers: § Credential that will provide increased knowledge and help build credibility with clients § A mutual fund specific path to CFP or PFP § Gradual path to IIROC licensing For dealers, CAMFA can: § Help with advisor training and succession planning