issuance.ppt

- Количество слайдов: 22

RAISING CAPITAL

RAISING CAPITAL

Venture Capital • Considerations in Structuring the Deal – Agreeing on the relevant numbers – Management’s incentives (minimize principal/agent problem) – VC wants to monitor (serve on Board) – Funds dispersed in stages

Venture Capital • Considerations in Structuring the Deal – Agreeing on the relevant numbers – Management’s incentives (minimize principal/agent problem) – VC wants to monitor (serve on Board) – Funds dispersed in stages

Venture Capital (background) • Tremendous growth in venture capital financing in late 1990 s (is still a nontrivial source of funds) • VC funds raise money from investors, then distribute that money to young companies • Venture capital provided by investors such as, for example, pension funds, endowments, very wealth individuals (angels), and corporations

Venture Capital (background) • Tremendous growth in venture capital financing in late 1990 s (is still a nontrivial source of funds) • VC funds raise money from investors, then distribute that money to young companies • Venture capital provided by investors such as, for example, pension funds, endowments, very wealth individuals (angels), and corporations

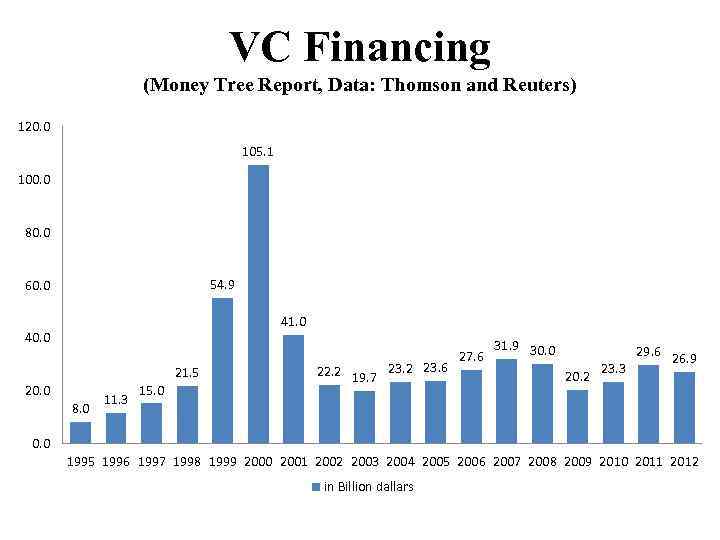

VC Financing (Money Tree Report, Data: Thomson and Reuters) 120. 0 105. 1 100. 0 80. 0 54. 9 60. 0 41. 0 40. 0 20. 0 8. 0 11. 3 15. 0 21. 5 22. 2 19. 7 23. 2 23. 6 27. 6 31. 9 30. 0 20. 2 23. 3 29. 6 26. 9 0. 0 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 in Billion dallars

VC Financing (Money Tree Report, Data: Thomson and Reuters) 120. 0 105. 1 100. 0 80. 0 54. 9 60. 0 41. 0 40. 0 20. 0 8. 0 11. 3 15. 0 21. 5 22. 2 19. 7 23. 2 23. 6 27. 6 31. 9 30. 0 20. 2 23. 3 29. 6 26. 9 0. 0 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 in Billion dallars

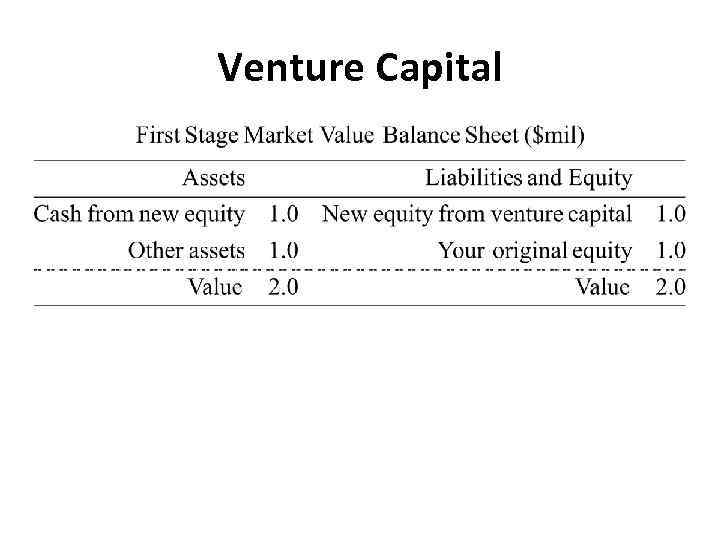

Venture Capital

Venture Capital

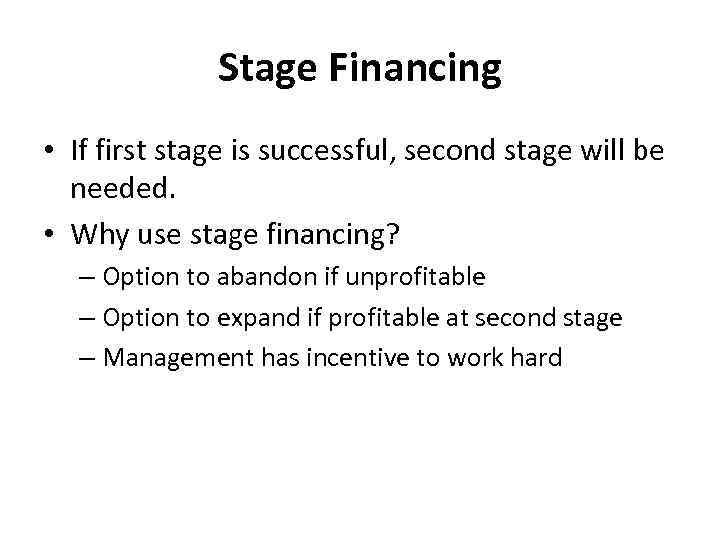

Stage Financing • If first stage is successful, second stage will be needed. • Why use stage financing? – Option to abandon if unprofitable – Option to expand if profitable at second stage – Management has incentive to work hard

Stage Financing • If first stage is successful, second stage will be needed. • Why use stage financing? – Option to abandon if unprofitable – Option to expand if profitable at second stage – Management has incentive to work hard

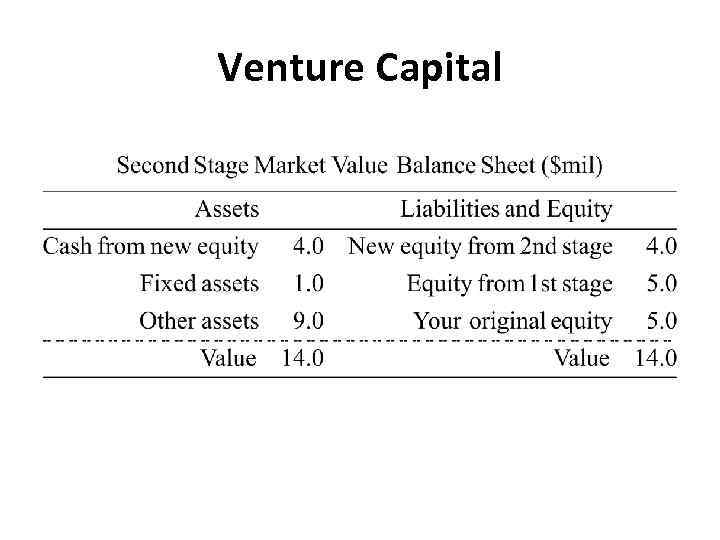

Venture Capital

Venture Capital

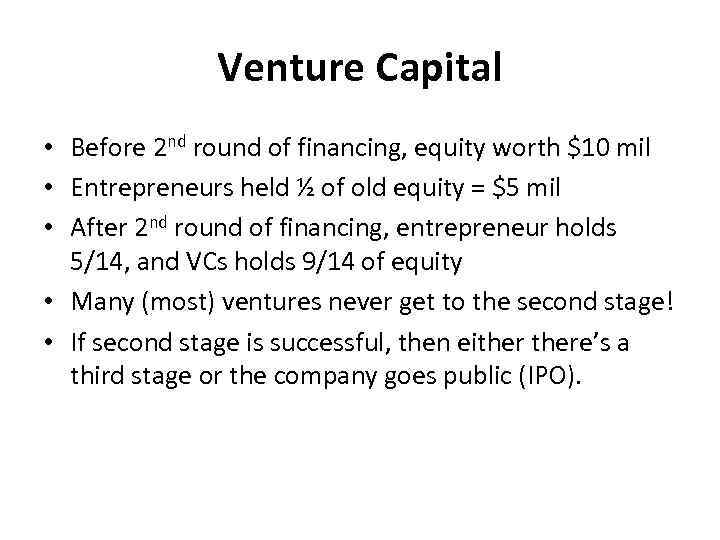

Venture Capital • Before 2 nd round of financing, equity worth $10 mil • Entrepreneurs held ½ of old equity = $5 mil • After 2 nd round of financing, entrepreneur holds 5/14, and VCs holds 9/14 of equity • Many (most) ventures never get to the second stage! • If second stage is successful, then eithere’s a third stage or the company goes public (IPO).

Venture Capital • Before 2 nd round of financing, equity worth $10 mil • Entrepreneurs held ½ of old equity = $5 mil • After 2 nd round of financing, entrepreneur holds 5/14, and VCs holds 9/14 of equity • Many (most) ventures never get to the second stage! • If second stage is successful, then eithere’s a third stage or the company goes public (IPO).

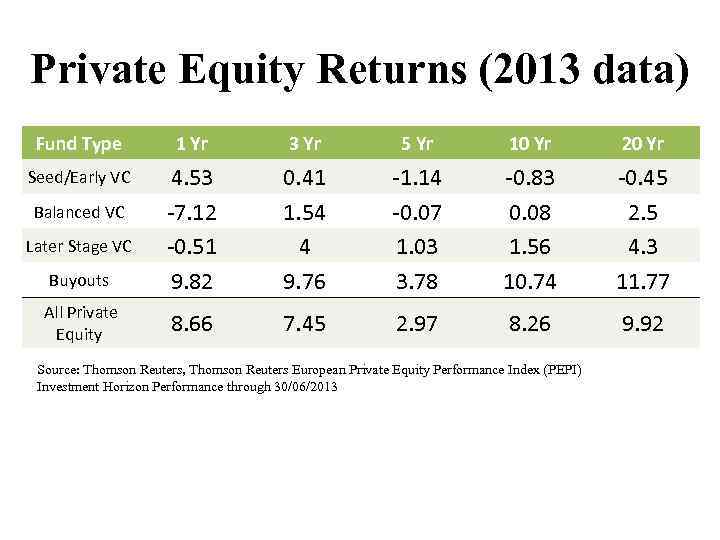

Private Equity Returns (2013 data) Fund Type 1 Yr 3 Yr 5 Yr 10 Yr 20 Yr Seed/Early VC Buyouts 4. 53 -7. 12 -0. 51 9. 82 0. 41 1. 54 4 9. 76 -1. 14 -0. 07 1. 03 3. 78 -0. 83 0. 08 1. 56 10. 74 -0. 45 2. 5 4. 3 11. 77 All Private Equity 8. 66 7. 45 2. 97 8. 26 9. 92 Balanced VC Later Stage VC Source: Thomson Reuters, Thomson Reuters European Private Equity Performance Index (PEPI) Investment Horizon Performance through 30/06/2013

Private Equity Returns (2013 data) Fund Type 1 Yr 3 Yr 5 Yr 10 Yr 20 Yr Seed/Early VC Buyouts 4. 53 -7. 12 -0. 51 9. 82 0. 41 1. 54 4 9. 76 -1. 14 -0. 07 1. 03 3. 78 -0. 83 0. 08 1. 56 10. 74 -0. 45 2. 5 4. 3 11. 77 All Private Equity 8. 66 7. 45 2. 97 8. 26 9. 92 Balanced VC Later Stage VC Source: Thomson Reuters, Thomson Reuters European Private Equity Performance Index (PEPI) Investment Horizon Performance through 30/06/2013

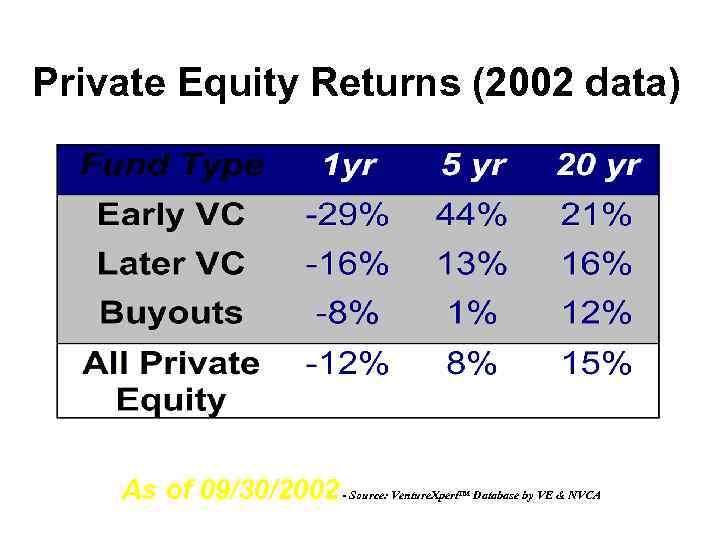

Private Equity Returns (2002 data) As of 09/30/2002 - Source: Venture. Xpert™ Database by VE & NVCA

Private Equity Returns (2002 data) As of 09/30/2002 - Source: Venture. Xpert™ Database by VE & NVCA

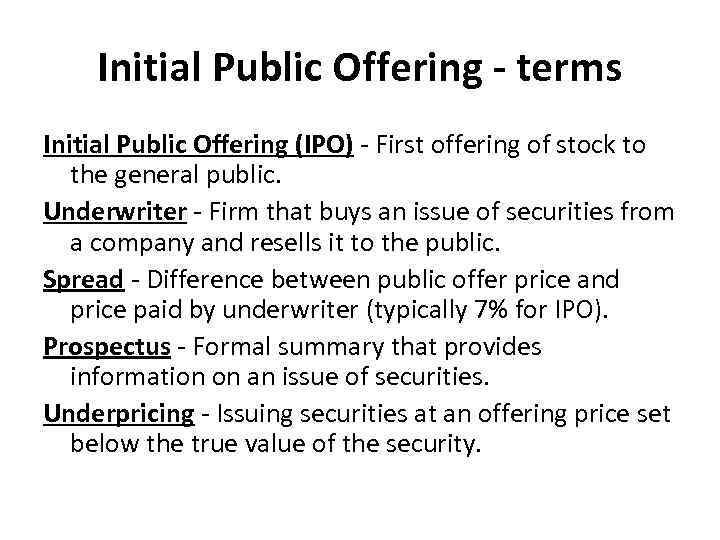

Initial Public Offering - terms Initial Public Offering (IPO) - First offering of stock to the general public. Underwriter - Firm that buys an issue of securities from a company and resells it to the public. Spread - Difference between public offer price and price paid by underwriter (typically 7% for IPO). Prospectus - Formal summary that provides information on an issue of securities. Underpricing - Issuing securities at an offering price set below the true value of the security.

Initial Public Offering - terms Initial Public Offering (IPO) - First offering of stock to the general public. Underwriter - Firm that buys an issue of securities from a company and resells it to the public. Spread - Difference between public offer price and price paid by underwriter (typically 7% for IPO). Prospectus - Formal summary that provides information on an issue of securities. Underpricing - Issuing securities at an offering price set below the true value of the security.

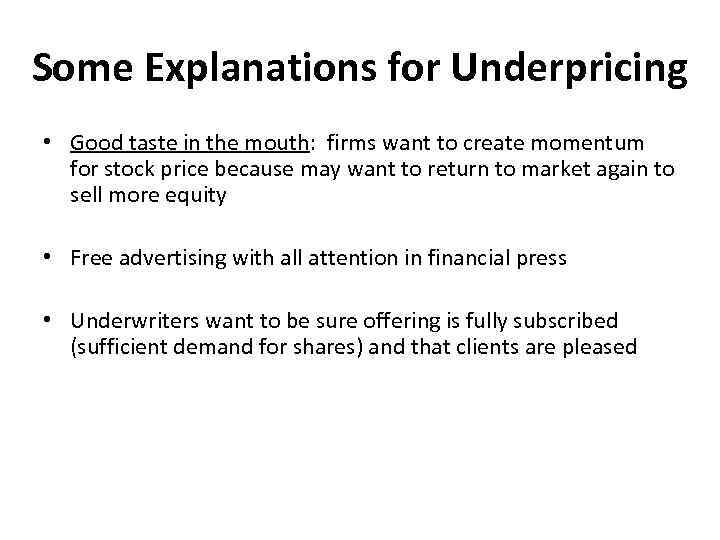

Some Explanations for Underpricing • Good taste in the mouth: firms want to create momentum for stock price because may want to return to market again to sell more equity • Free advertising with all attention in financial press • Underwriters want to be sure offering is fully subscribed (sufficient demand for shares) and that clients are pleased

Some Explanations for Underpricing • Good taste in the mouth: firms want to create momentum for stock price because may want to return to market again to sell more equity • Free advertising with all attention in financial press • Underwriters want to be sure offering is fully subscribed (sufficient demand for shares) and that clients are pleased

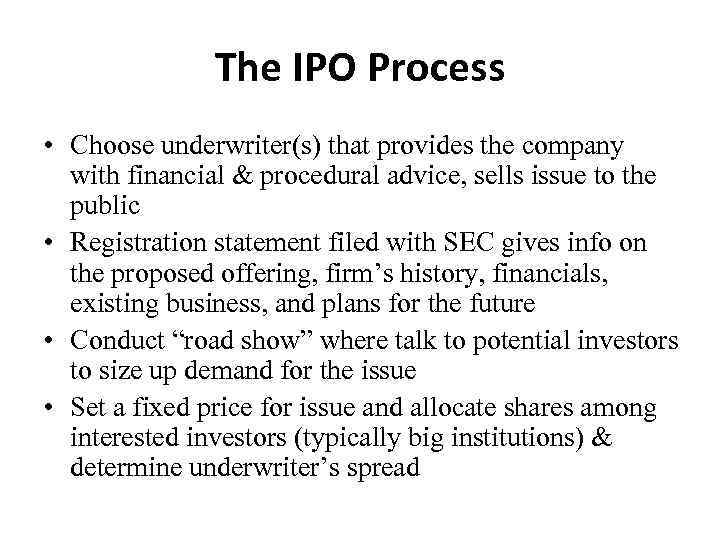

The IPO Process • Choose underwriter(s) that provides the company with financial & procedural advice, sells issue to the public • Registration statement filed with SEC gives info on the proposed offering, firm’s history, financials, existing business, and plans for the future • Conduct “road show” where talk to potential investors to size up demand for the issue • Set a fixed price for issue and allocate shares among interested investors (typically big institutions) & determine underwriter’s spread

The IPO Process • Choose underwriter(s) that provides the company with financial & procedural advice, sells issue to the public • Registration statement filed with SEC gives info on the proposed offering, firm’s history, financials, existing business, and plans for the future • Conduct “road show” where talk to potential investors to size up demand for the issue • Set a fixed price for issue and allocate shares among interested investors (typically big institutions) & determine underwriter’s spread

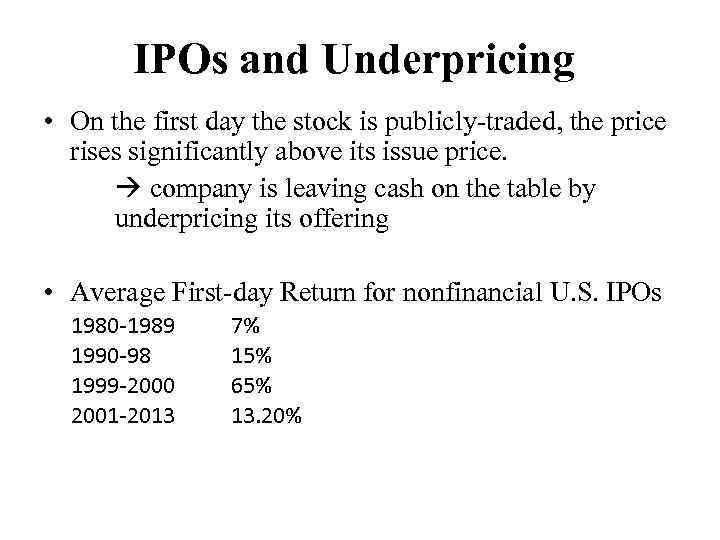

IPOs and Underpricing • On the first day the stock is publicly-traded, the price rises significantly above its issue price. company is leaving cash on the table by underpricing its offering • Average First-day Return for nonfinancial U. S. IPOs 1980 -1989 1990 -98 1999 -2000 2001 -2013 7% 15% 65% 13. 20%

IPOs and Underpricing • On the first day the stock is publicly-traded, the price rises significantly above its issue price. company is leaving cash on the table by underpricing its offering • Average First-day Return for nonfinancial U. S. IPOs 1980 -1989 1990 -98 1999 -2000 2001 -2013 7% 15% 65% 13. 20%

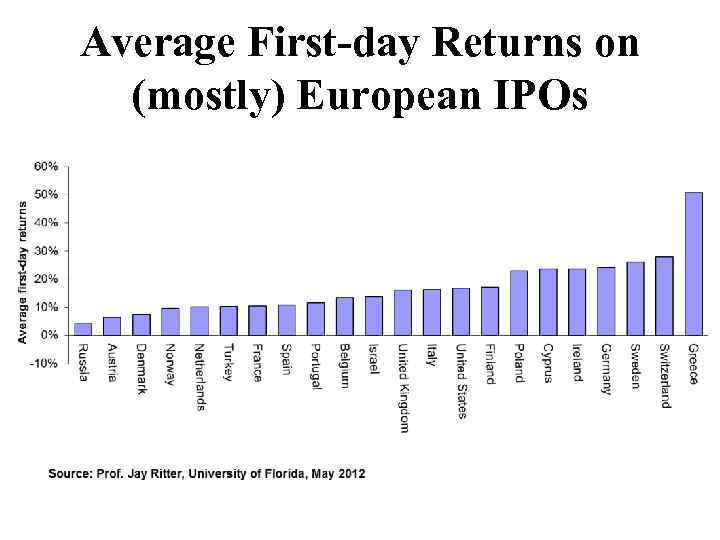

Average First-day Returns on (mostly) European IPOs

Average First-day Returns on (mostly) European IPOs

Average First-day Returns on Non-European IPOs

Average First-day Returns on Non-European IPOs

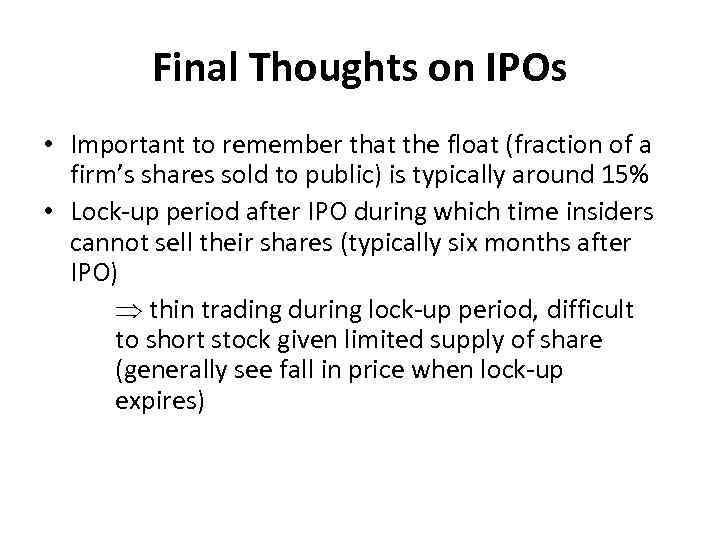

Final Thoughts on IPOs • Important to remember that the float (fraction of a firm’s shares sold to public) is typically around 15% • Lock-up period after IPO during which time insiders cannot sell their shares (typically six months after IPO) Þ thin trading during lock-up period, difficult to short stock given limited supply of share (generally see fall in price when lock-up expires)

Final Thoughts on IPOs • Important to remember that the float (fraction of a firm’s shares sold to public) is typically around 15% • Lock-up period after IPO during which time insiders cannot sell their shares (typically six months after IPO) Þ thin trading during lock-up period, difficult to short stock given limited supply of share (generally see fall in price when lock-up expires)

General Cash Offers - terms Seasoned Offering - Sale of securities by a firm that is already publicly traded. Private Placement - Sale of securities to a limited number of investors without a public offering.

General Cash Offers - terms Seasoned Offering - Sale of securities by a firm that is already publicly traded. Private Placement - Sale of securities to a limited number of investors without a public offering.

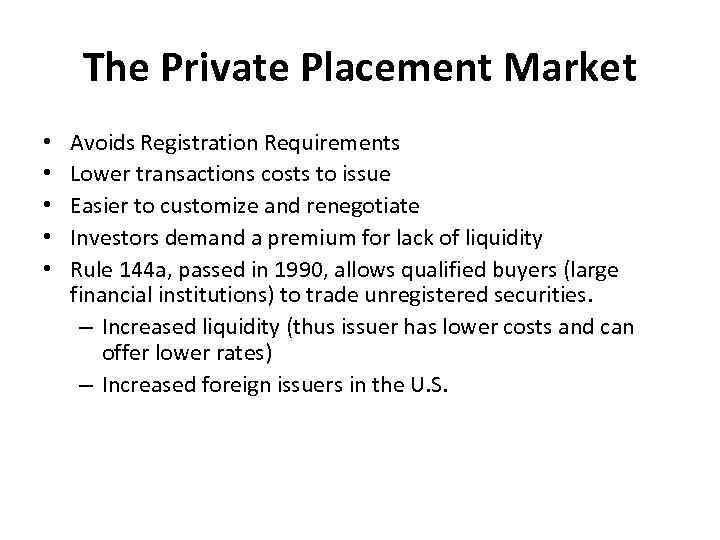

The Private Placement Market • • • Avoids Registration Requirements Lower transactions costs to issue Easier to customize and renegotiate Investors demand a premium for lack of liquidity Rule 144 a, passed in 1990, allows qualified buyers (large financial institutions) to trade unregistered securities. – Increased liquidity (thus issuer has lower costs and can offer lower rates) – Increased foreign issuers in the U. S.

The Private Placement Market • • • Avoids Registration Requirements Lower transactions costs to issue Easier to customize and renegotiate Investors demand a premium for lack of liquidity Rule 144 a, passed in 1990, allows qualified buyers (large financial institutions) to trade unregistered securities. – Increased liquidity (thus issuer has lower costs and can offer lower rates) – Increased foreign issuers in the U. S.

Rights Issue - Issue of securities offered only to current stockholders. • Usually think of rights offer in context of takeover deterrent (i. e. , poison pill) • Also can be way to raise capital without having to go to external sources (SEO or bond offering) • Example of latter motivation is HSBC (one of largest banks and financial service organizations in the world) raised $18 B in spring 2009 via a rights offer to shore up balance sheet

Rights Issue - Issue of securities offered only to current stockholders. • Usually think of rights offer in context of takeover deterrent (i. e. , poison pill) • Also can be way to raise capital without having to go to external sources (SEO or bond offering) • Example of latter motivation is HSBC (one of largest banks and financial service organizations in the world) raised $18 B in spring 2009 via a rights offer to shore up balance sheet