73e7dbafba148778ac935abe6a384cb6.ppt

- Количество слайдов: 66

Rachel J. Roginsky, ISHC Pinnacle Advisory Group 76 Canal Street Boston, MA 02114 Telephone: 617 -722 -9916 Fax: 617 -722 -9917 rroginsky@pinnacle-advisory. com Outlook 2004 Pinnacle Realty Investments Pinnacle Advisory Group

Rachel J. Roginsky, ISHC Pinnacle Advisory Group 76 Canal Street Boston, MA 02114 Telephone: 617 -722 -9916 Fax: 617 -722 -9917 rroginsky@pinnacle-advisory. com Outlook 2004 Pinnacle Realty Investments Pinnacle Advisory Group

National Lodging Market Top 25 Markets – 2002 Total U. S. Market Through April 2003 National Projections

National Lodging Market Top 25 Markets – 2002 Total U. S. Market Through April 2003 National Projections

National Lodging Market Top 25 Markets – 2002

National Lodging Market Top 25 Markets – 2002

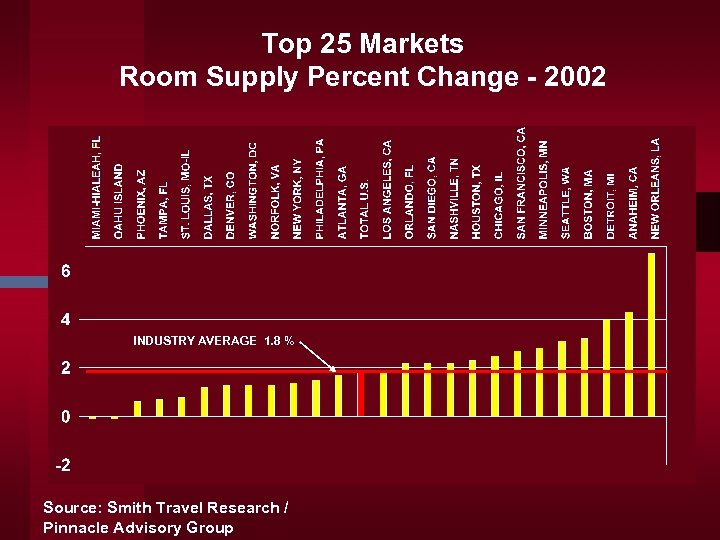

Top 25 Markets Room Supply Percent Change - 2002 INDUSTRY AVERAGE 1. 8 % Source: Smith Travel Research / Pinnacle Advisory Group

Top 25 Markets Room Supply Percent Change - 2002 INDUSTRY AVERAGE 1. 8 % Source: Smith Travel Research / Pinnacle Advisory Group

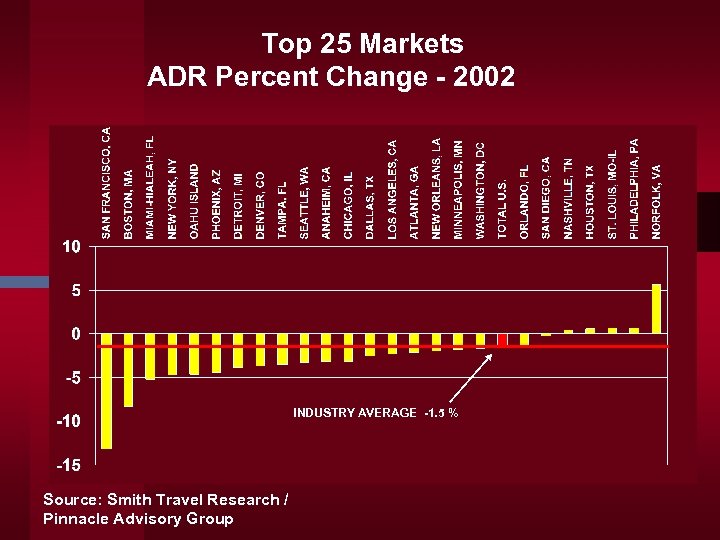

Top 25 Markets ADR Percent Change - 2002 INDUSTRY AVERAGE -1. 5 % Source: Smith Travel Research / Pinnacle Advisory Group

Top 25 Markets ADR Percent Change - 2002 INDUSTRY AVERAGE -1. 5 % Source: Smith Travel Research / Pinnacle Advisory Group

Top 25 Markets Occupancy 2002 INDUSTRY AVERAGE 59. 2 % Source: Smith Travel Research

Top 25 Markets Occupancy 2002 INDUSTRY AVERAGE 59. 2 % Source: Smith Travel Research

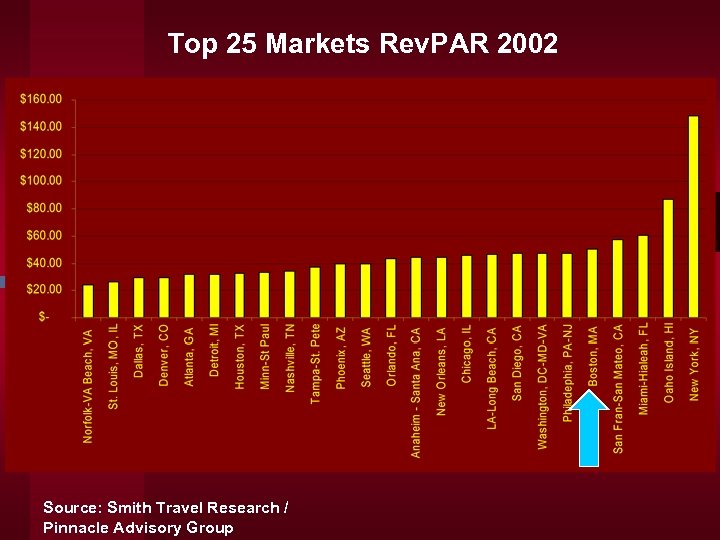

Top 25 Markets Rev. PAR 2002 Source: Smith Travel Research / Pinnacle Advisory Group

Top 25 Markets Rev. PAR 2002 Source: Smith Travel Research / Pinnacle Advisory Group

National Lodging Market Total U. S. Market Through April 2003

National Lodging Market Total U. S. Market Through April 2003

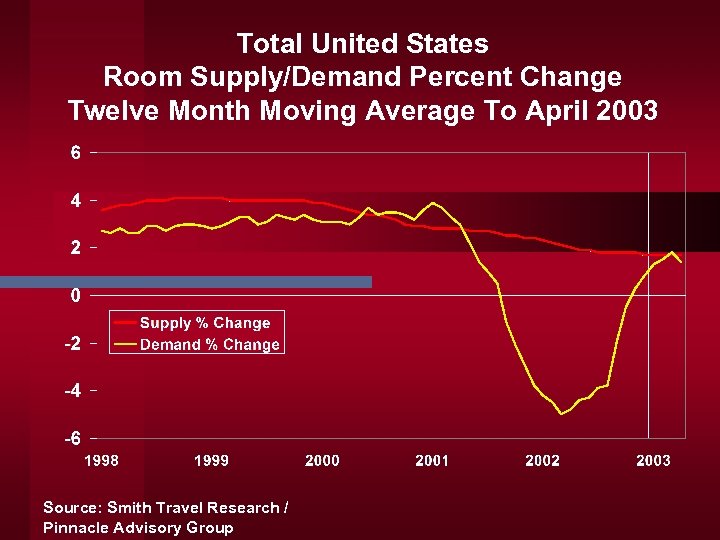

Total United States Room Supply/Demand Percent Change Twelve Month Moving Average To April 2003 Source: Smith Travel Research / Pinnacle Advisory Group

Total United States Room Supply/Demand Percent Change Twelve Month Moving Average To April 2003 Source: Smith Travel Research / Pinnacle Advisory Group

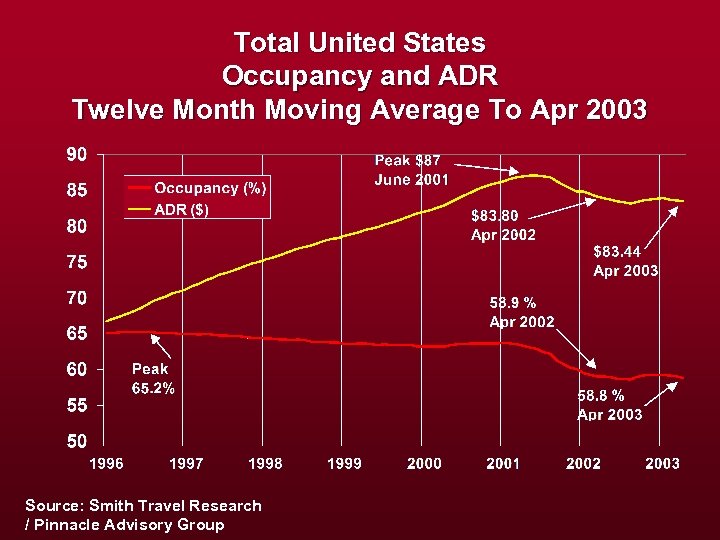

Total United States Occupancy and ADR Twelve Month Moving Average To Apr 2003 Source: Smith Travel Research / Pinnacle Advisory Group

Total United States Occupancy and ADR Twelve Month Moving Average To Apr 2003 Source: Smith Travel Research / Pinnacle Advisory Group

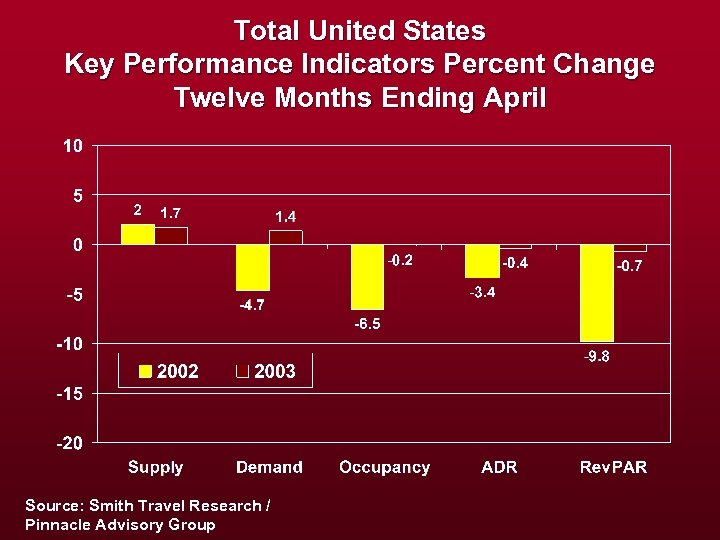

Total United States Key Performance Indicators Percent Change Twelve Months Ending April Source: Smith Travel Research / Pinnacle Advisory Group

Total United States Key Performance Indicators Percent Change Twelve Months Ending April Source: Smith Travel Research / Pinnacle Advisory Group

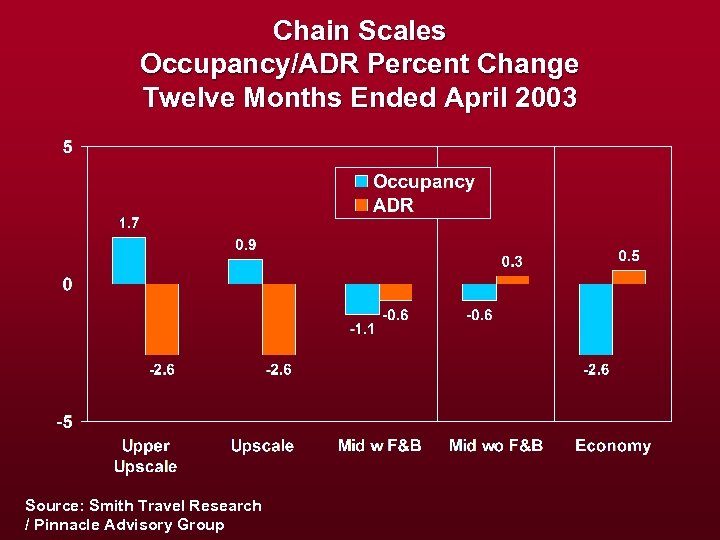

Chain Scales Occupancy/ADR Percent Change Twelve Months Ended April 2003 Source: Smith Travel Research / Pinnacle Advisory Group

Chain Scales Occupancy/ADR Percent Change Twelve Months Ended April 2003 Source: Smith Travel Research / Pinnacle Advisory Group

National Lodging Market National Projections

National Lodging Market National Projections

U. S. Lodging Outlook * Supply Growth Significantly Lower * Demand Lags, Then Recovers * Occupancy Flat * Pressure on Room Rates * Slow Rev. PAR Growth * Potential Threat – War/Terrorism

U. S. Lodging Outlook * Supply Growth Significantly Lower * Demand Lags, Then Recovers * Occupancy Flat * Pressure on Room Rates * Slow Rev. PAR Growth * Potential Threat – War/Terrorism

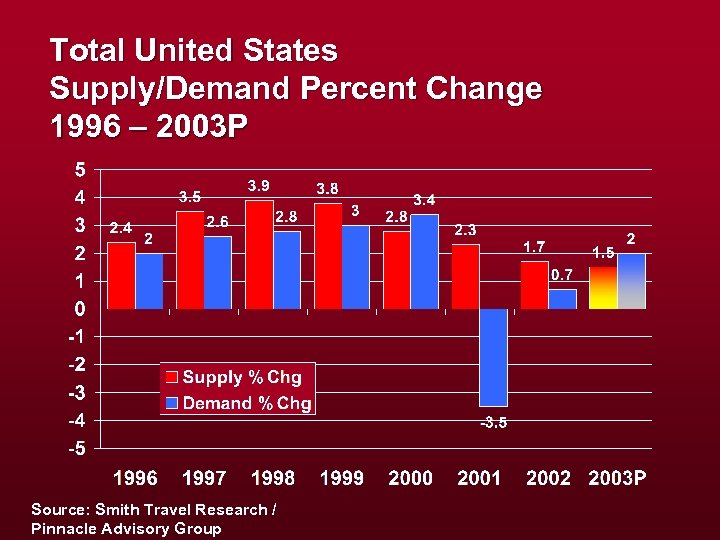

Total United States Supply/Demand Percent Change 1996 – 2003 P Source: Smith Travel Research / Pinnacle Advisory Group

Total United States Supply/Demand Percent Change 1996 – 2003 P Source: Smith Travel Research / Pinnacle Advisory Group

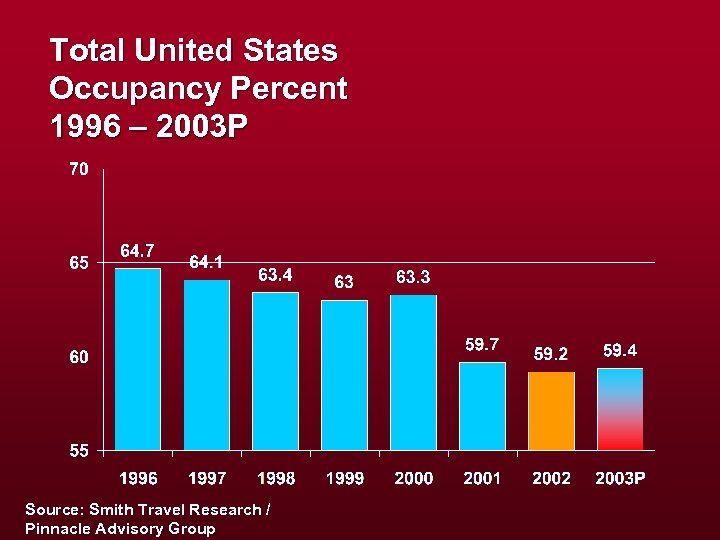

Total United States Occupancy Percent 1996 – 2003 P Source: Smith Travel Research / Pinnacle Advisory Group

Total United States Occupancy Percent 1996 – 2003 P Source: Smith Travel Research / Pinnacle Advisory Group

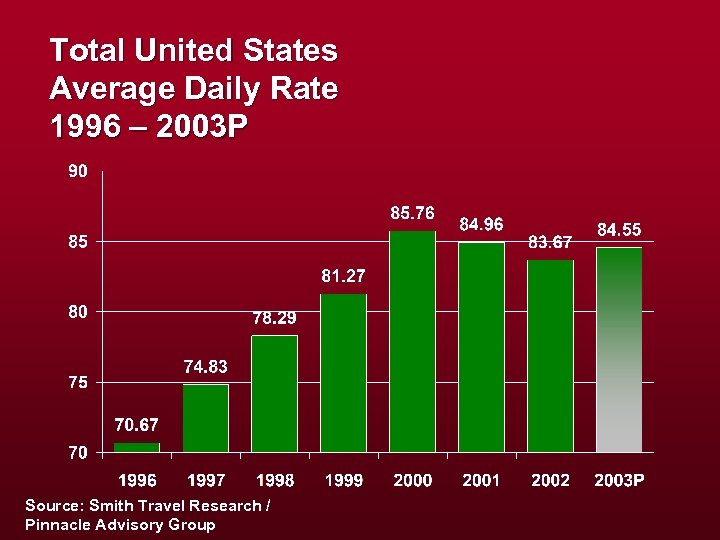

Total United States Average Daily Rate 1996 – 2003 P Source: Smith Travel Research / Pinnacle Advisory Group

Total United States Average Daily Rate 1996 – 2003 P Source: Smith Travel Research / Pinnacle Advisory Group

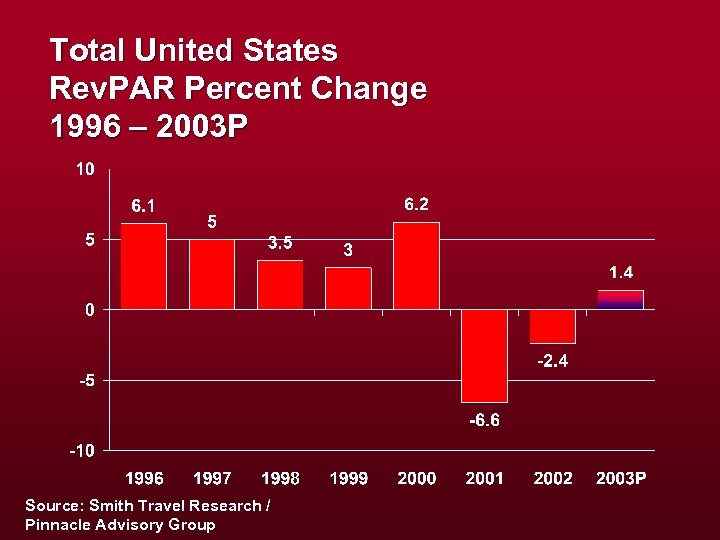

Total United States Rev. PAR Percent Change 1996 – 2003 P Source: Smith Travel Research / Pinnacle Advisory Group

Total United States Rev. PAR Percent Change 1996 – 2003 P Source: Smith Travel Research / Pinnacle Advisory Group

New England Lodging Market

New England Lodging Market

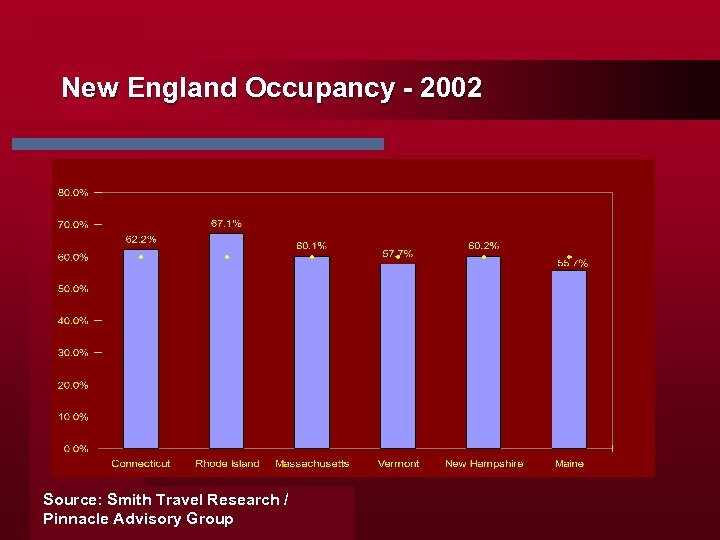

New England Occupancy - 2002 Source: Smith Travel Research / Pinnacle Advisory Group

New England Occupancy - 2002 Source: Smith Travel Research / Pinnacle Advisory Group

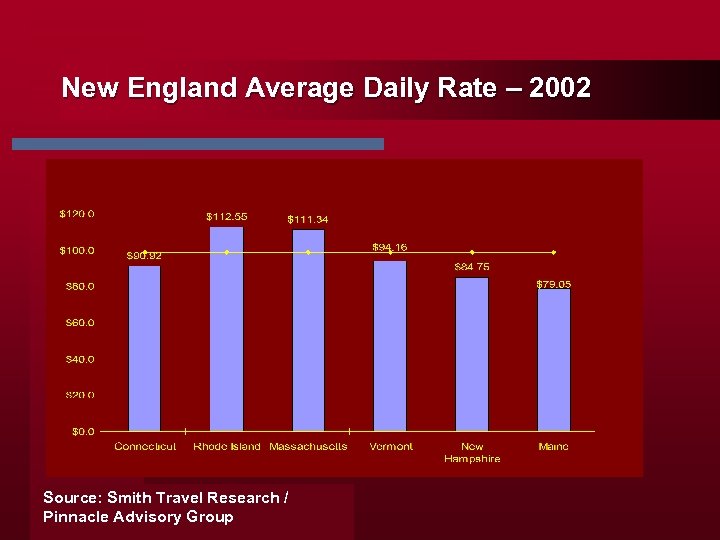

New England Average Daily Rate – 2002 Source: Smith Travel Research / Pinnacle Advisory Group

New England Average Daily Rate – 2002 Source: Smith Travel Research / Pinnacle Advisory Group

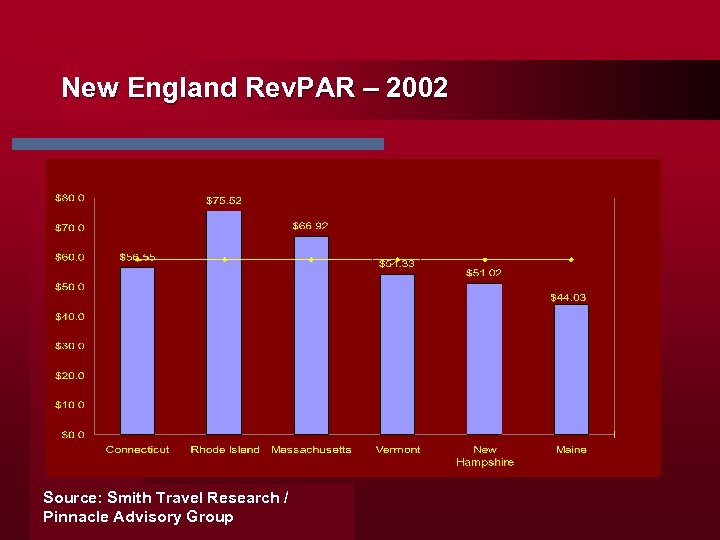

New England Rev. PAR – 2002 Source: Smith Travel Research / Pinnacle Advisory Group

New England Rev. PAR – 2002 Source: Smith Travel Research / Pinnacle Advisory Group

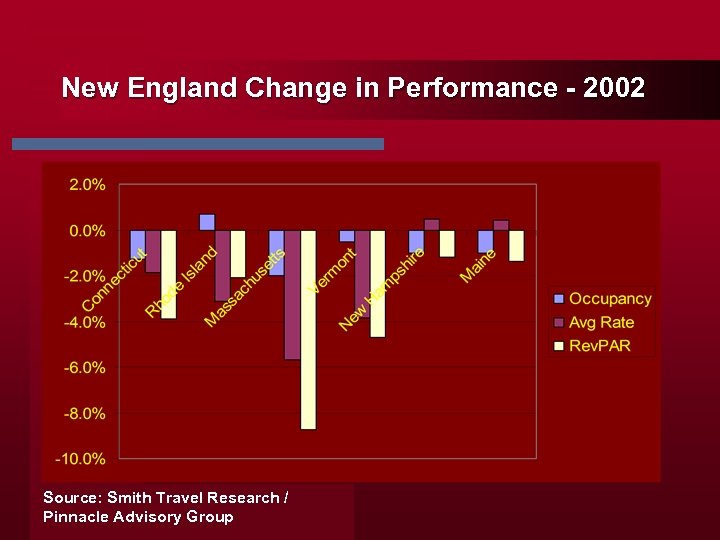

New England Change in Performance - 2002 Source: Smith Travel Research / Pinnacle Advisory Group

New England Change in Performance - 2002 Source: Smith Travel Research / Pinnacle Advisory Group

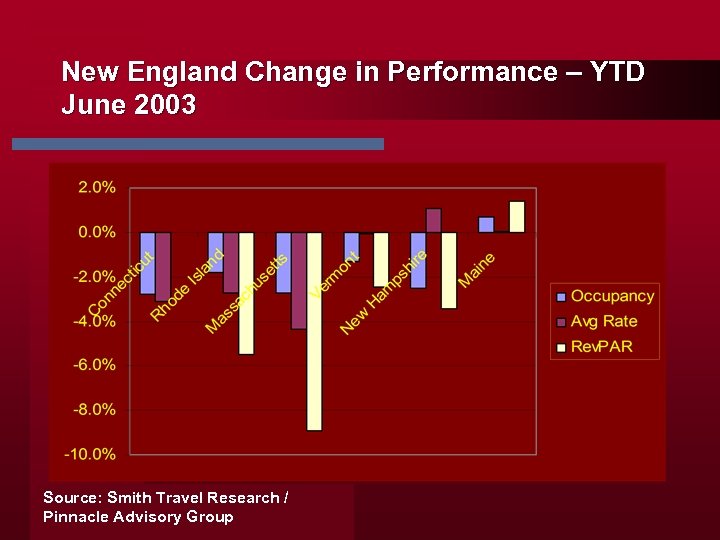

New England Change in Performance – YTD June 2003 Source: Smith Travel Research / Pinnacle Advisory Group

New England Change in Performance – YTD June 2003 Source: Smith Travel Research / Pinnacle Advisory Group

Suburban Boston Lodging Market Statistics Projections

Suburban Boston Lodging Market Statistics Projections

Suburban Boston Lodging Market Statistics

Suburban Boston Lodging Market Statistics

Suburban Boston Statistics

Suburban Boston Statistics

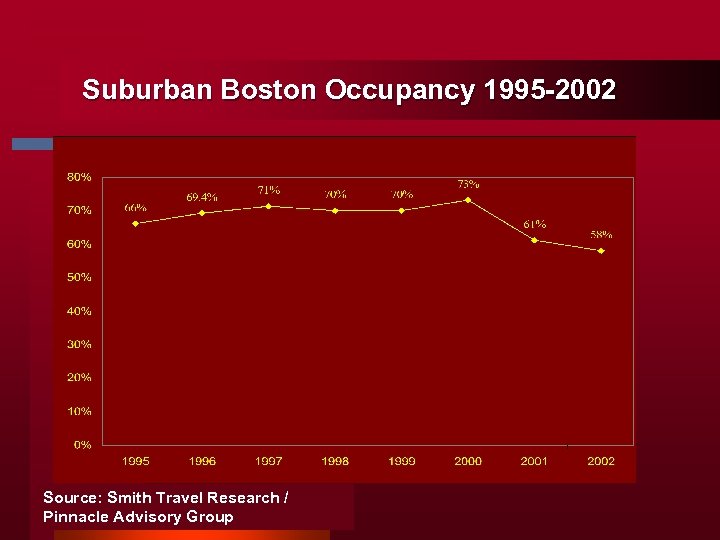

Suburban Boston Occupancy 1995 -2002 Source: Smith Travel Research / Pinnacle Advisory Group

Suburban Boston Occupancy 1995 -2002 Source: Smith Travel Research / Pinnacle Advisory Group

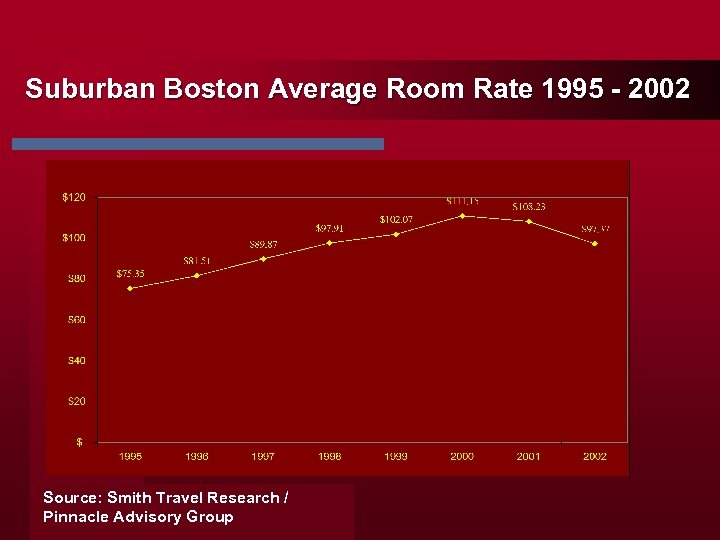

Suburban Boston Average Room Rate 1995 - 2002 Source: Smith Travel Research / Pinnacle Advisory Group

Suburban Boston Average Room Rate 1995 - 2002 Source: Smith Travel Research / Pinnacle Advisory Group

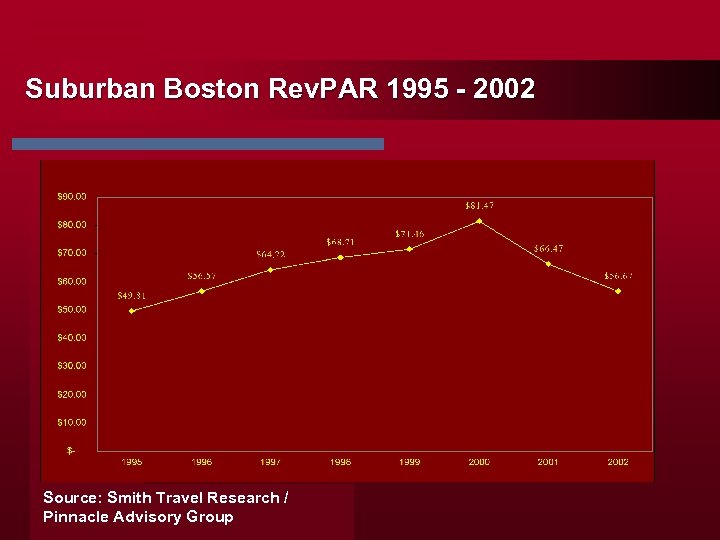

Suburban Boston Rev. PAR 1995 - 2002 Source: Smith Travel Research / Pinnacle Advisory Group

Suburban Boston Rev. PAR 1995 - 2002 Source: Smith Travel Research / Pinnacle Advisory Group

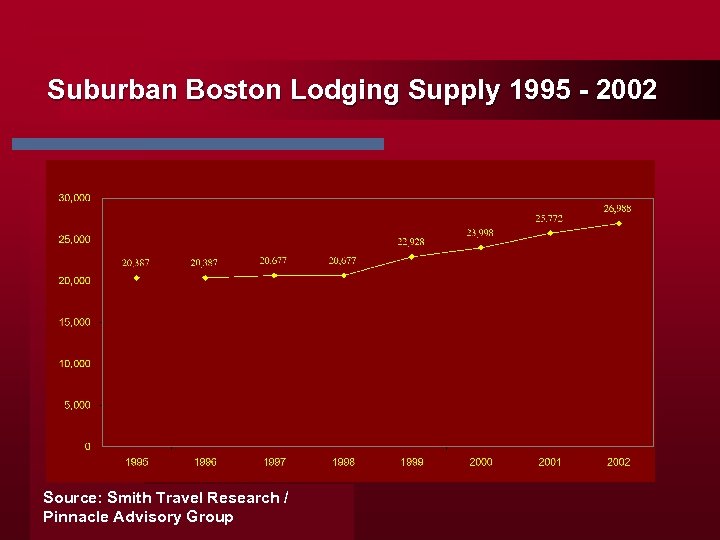

Suburban Boston Lodging Supply 1995 - 2002 Source: Smith Travel Research / Pinnacle Advisory Group

Suburban Boston Lodging Supply 1995 - 2002 Source: Smith Travel Research / Pinnacle Advisory Group

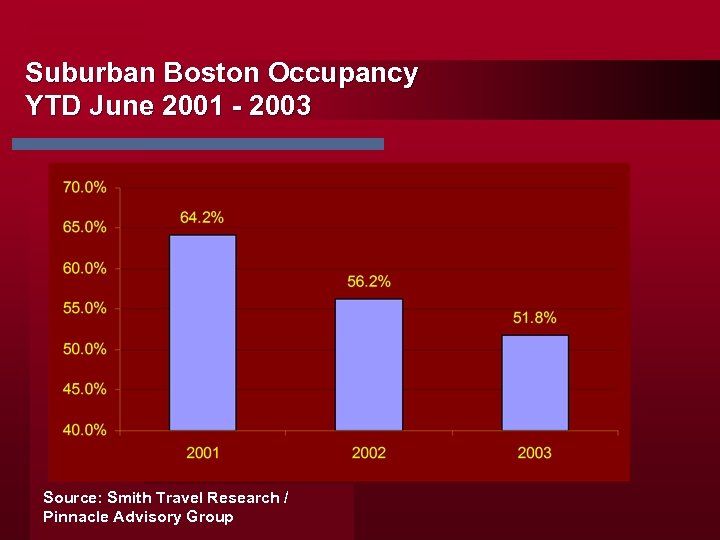

Suburban Boston Occupancy YTD June 2001 - 2003 Source: Smith Travel Research / Pinnacle Advisory Group

Suburban Boston Occupancy YTD June 2001 - 2003 Source: Smith Travel Research / Pinnacle Advisory Group

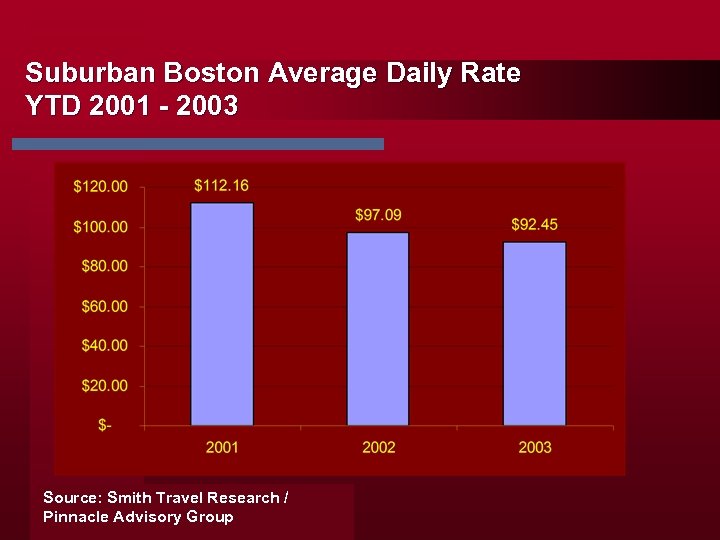

Suburban Boston Average Daily Rate YTD 2001 - 2003 Source: Smith Travel Research / Pinnacle Advisory Group

Suburban Boston Average Daily Rate YTD 2001 - 2003 Source: Smith Travel Research / Pinnacle Advisory Group

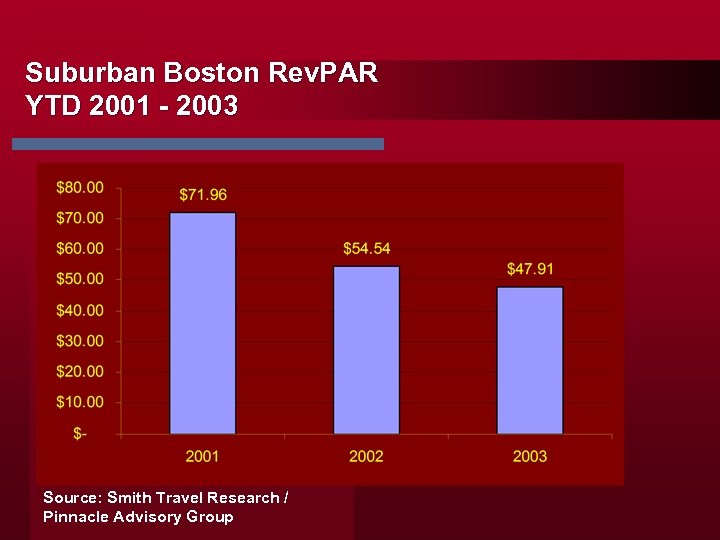

Suburban Boston Rev. PAR YTD 2001 - 2003 Source: Smith Travel Research / Pinnacle Advisory Group

Suburban Boston Rev. PAR YTD 2001 - 2003 Source: Smith Travel Research / Pinnacle Advisory Group

Suburban Boston Lodging Market Projections

Suburban Boston Lodging Market Projections

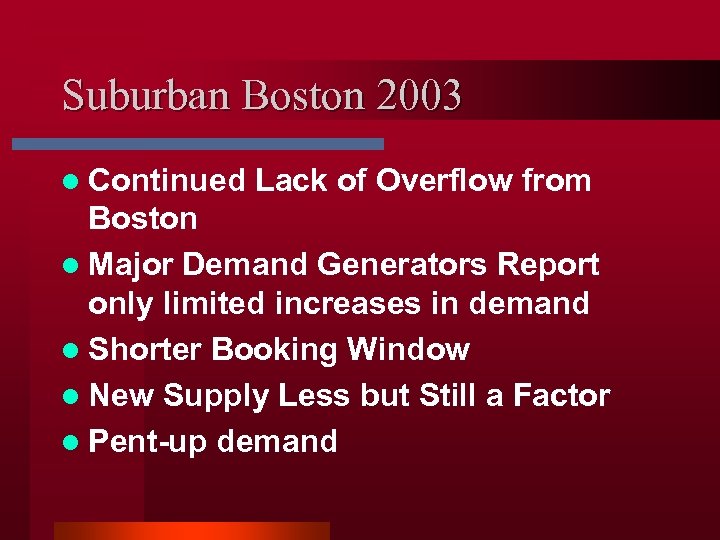

Suburban Boston 2003 l Continued Lack of Overflow from Boston l Major Demand Generators Report only limited increases in demand l Shorter Booking Window l New Supply Less but Still a Factor l Pent-up demand

Suburban Boston 2003 l Continued Lack of Overflow from Boston l Major Demand Generators Report only limited increases in demand l Shorter Booking Window l New Supply Less but Still a Factor l Pent-up demand

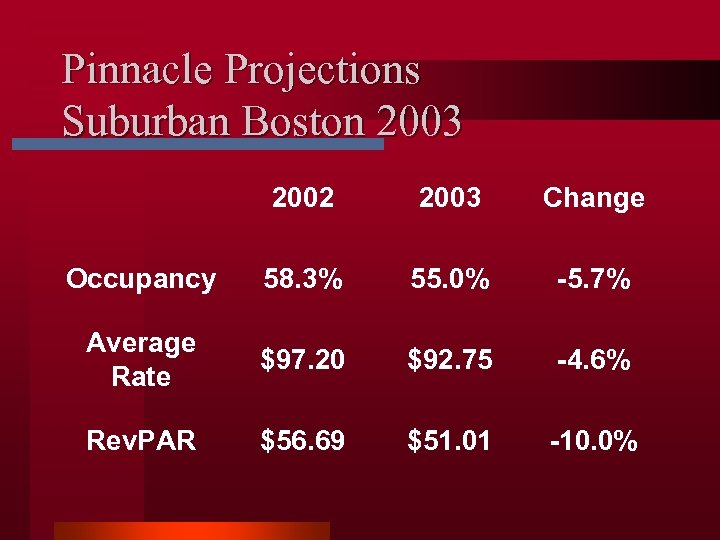

Pinnacle Projections Suburban Boston 2003 2002 2003 Change Occupancy 58. 3% 55. 0% -5. 7% Average Rate $97. 20 $92. 75 -4. 6% Rev. PAR $56. 69 $51. 01 -10. 0%

Pinnacle Projections Suburban Boston 2003 2002 2003 Change Occupancy 58. 3% 55. 0% -5. 7% Average Rate $97. 20 $92. 75 -4. 6% Rev. PAR $56. 69 $51. 01 -10. 0%

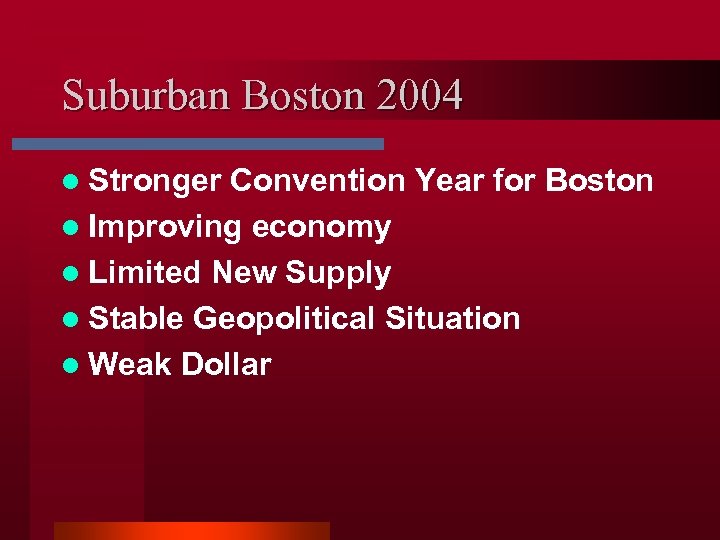

Suburban Boston 2004 l Stronger Convention Year for Boston l Improving economy l Limited New Supply l Stable Geopolitical Situation l Weak Dollar

Suburban Boston 2004 l Stronger Convention Year for Boston l Improving economy l Limited New Supply l Stable Geopolitical Situation l Weak Dollar

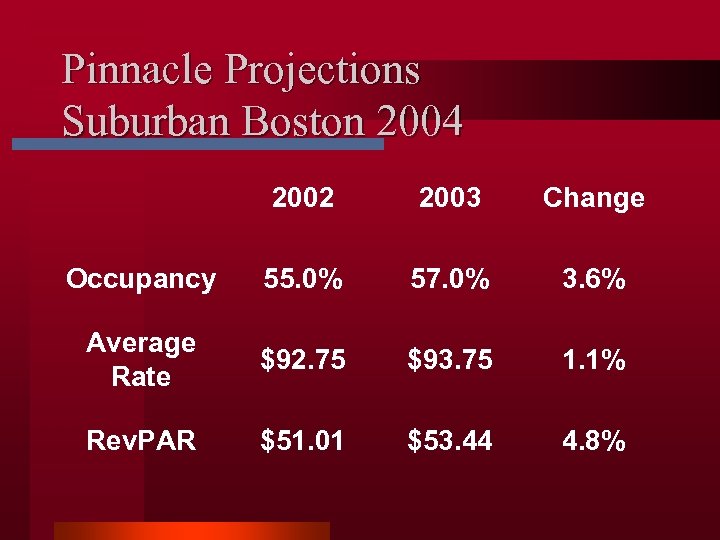

Pinnacle Projections Suburban Boston 2004 2002 2003 Change Occupancy 55. 0% 57. 0% 3. 6% Average Rate $92. 75 $93. 75 1. 1% Rev. PAR $51. 01 $53. 44 4. 8%

Pinnacle Projections Suburban Boston 2004 2002 2003 Change Occupancy 55. 0% 57. 0% 3. 6% Average Rate $92. 75 $93. 75 1. 1% Rev. PAR $51. 01 $53. 44 4. 8%

Boston / Cambridge Lodging Market Statistics New Supply Demand Trends Projections

Boston / Cambridge Lodging Market Statistics New Supply Demand Trends Projections

Boston / Cambridge Lodging Market Statistics

Boston / Cambridge Lodging Market Statistics

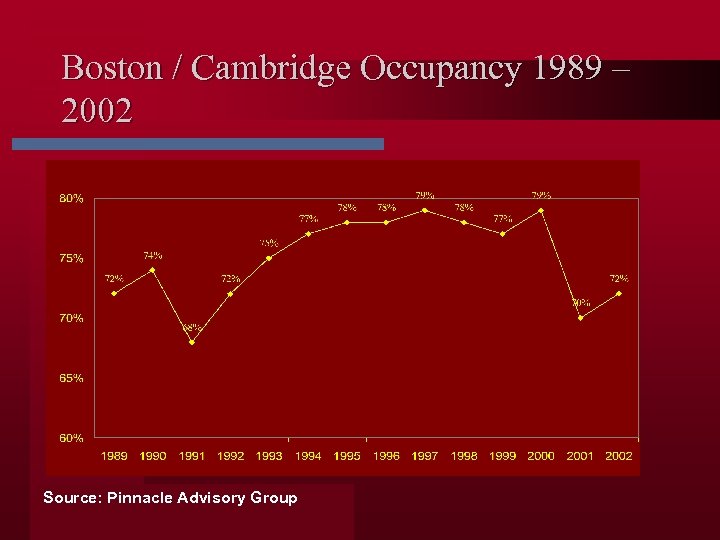

Boston / Cambridge Occupancy 1989 – 2002 Source: Pinnacle Advisory Group

Boston / Cambridge Occupancy 1989 – 2002 Source: Pinnacle Advisory Group

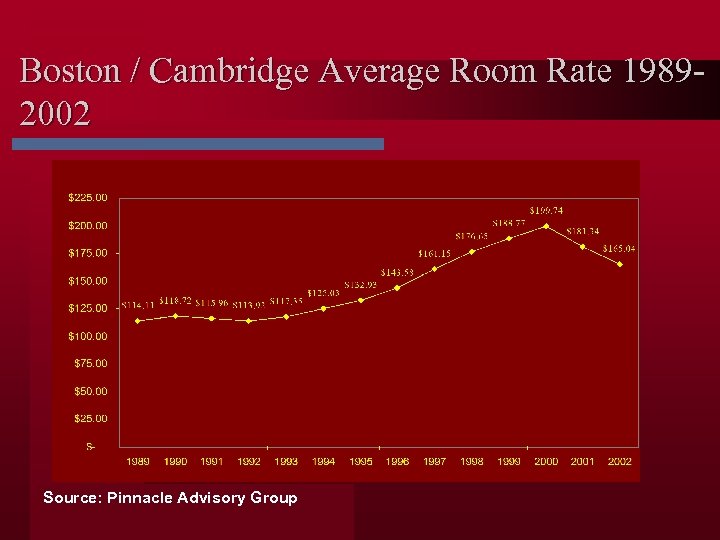

Boston / Cambridge Average Room Rate 19892002 Source: Pinnacle Advisory Group

Boston / Cambridge Average Room Rate 19892002 Source: Pinnacle Advisory Group

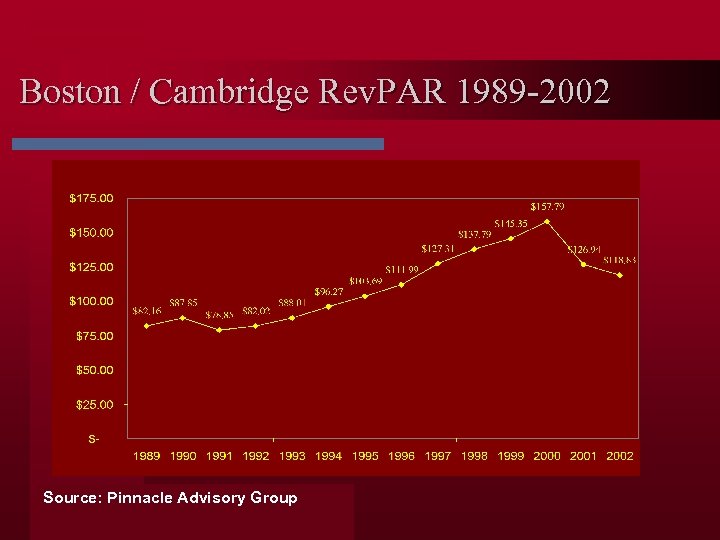

Boston / Cambridge Rev. PAR 1989 -2002 Source: Pinnacle Advisory Group

Boston / Cambridge Rev. PAR 1989 -2002 Source: Pinnacle Advisory Group

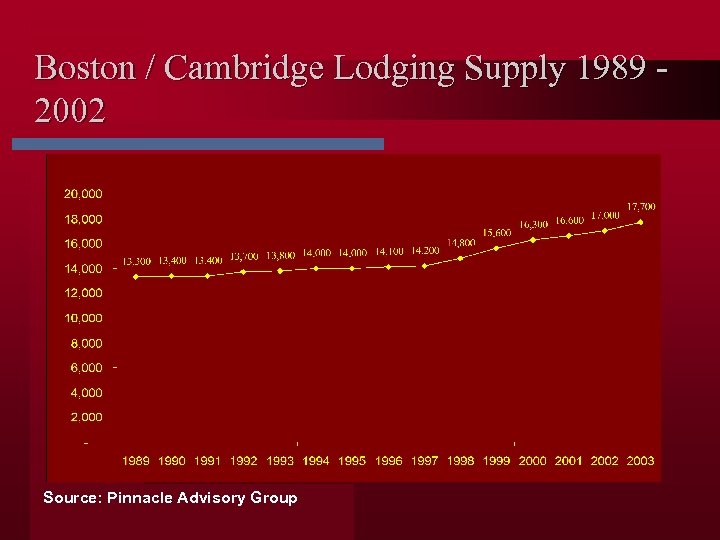

Boston / Cambridge Lodging Supply 1989 2002 Source: Pinnacle Advisory Group

Boston / Cambridge Lodging Supply 1989 2002 Source: Pinnacle Advisory Group

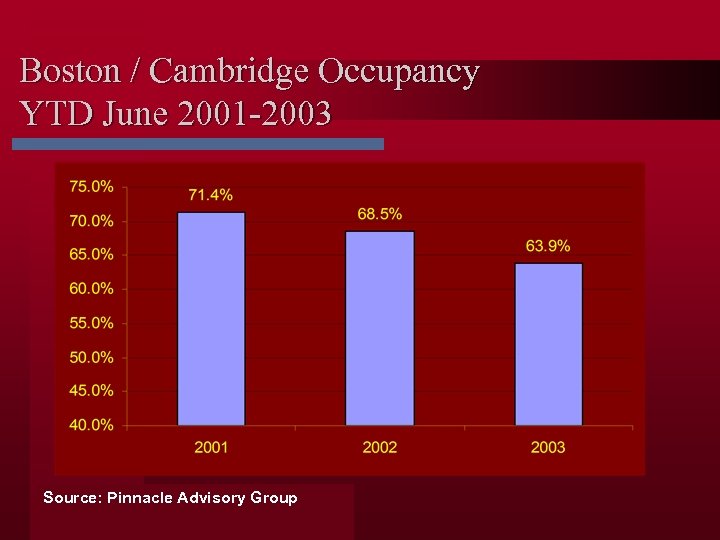

Boston / Cambridge Occupancy YTD June 2001 -2003 Source: Pinnacle Advisory Group

Boston / Cambridge Occupancy YTD June 2001 -2003 Source: Pinnacle Advisory Group

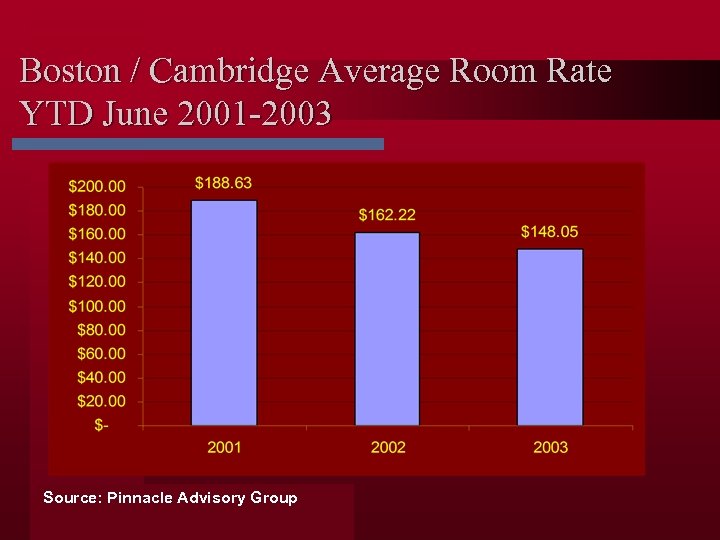

Boston / Cambridge Average Room Rate YTD June 2001 -2003 Source: Pinnacle Advisory Group

Boston / Cambridge Average Room Rate YTD June 2001 -2003 Source: Pinnacle Advisory Group

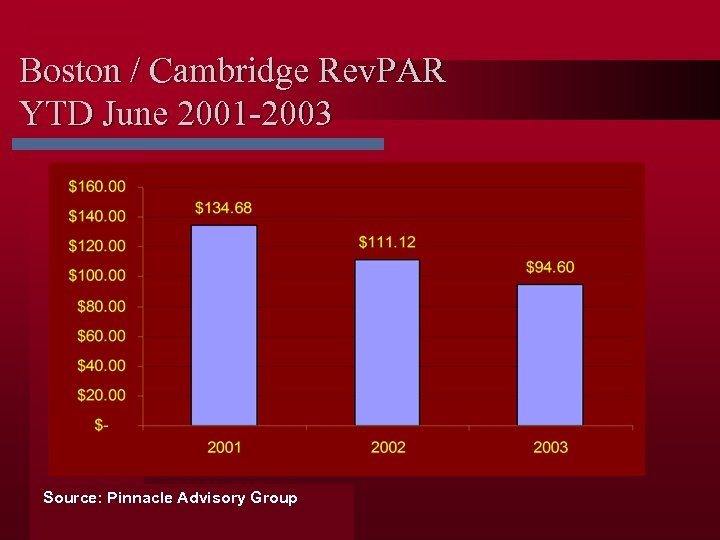

Boston / Cambridge Rev. PAR YTD June 2001 -2003 Source: Pinnacle Advisory Group

Boston / Cambridge Rev. PAR YTD June 2001 -2003 Source: Pinnacle Advisory Group

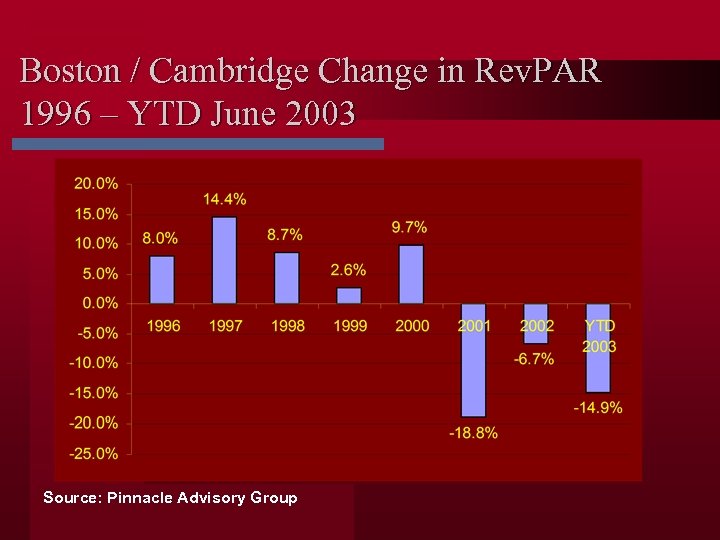

Boston / Cambridge Change in Rev. PAR 1996 – YTD June 2003 Source: Pinnacle Advisory Group

Boston / Cambridge Change in Rev. PAR 1996 – YTD June 2003 Source: Pinnacle Advisory Group

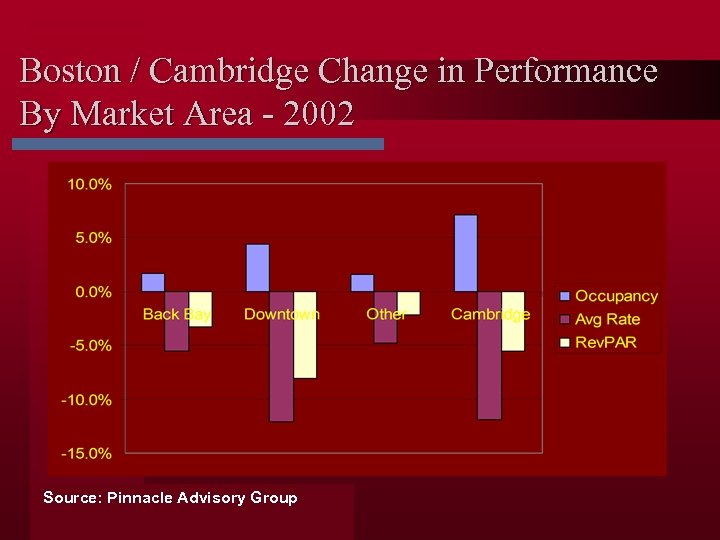

Boston / Cambridge Change in Performance By Market Area - 2002 Source: Pinnacle Advisory Group

Boston / Cambridge Change in Performance By Market Area - 2002 Source: Pinnacle Advisory Group

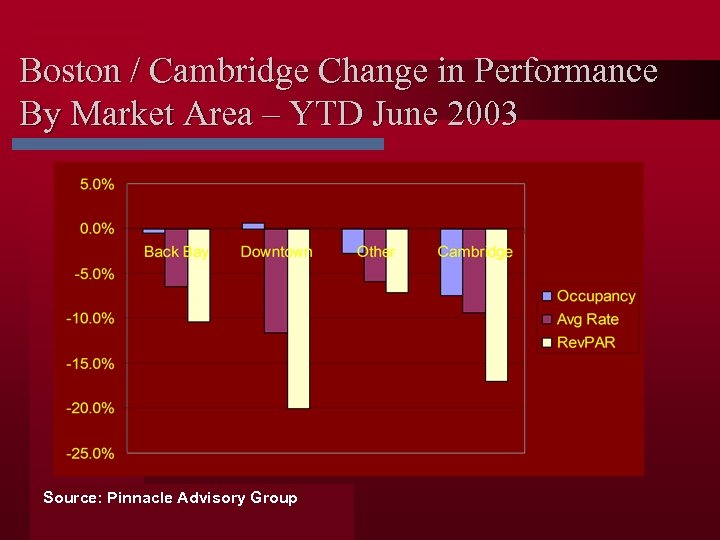

Boston / Cambridge Change in Performance By Market Area – YTD June 2003 Source: Pinnacle Advisory Group

Boston / Cambridge Change in Performance By Market Area – YTD June 2003 Source: Pinnacle Advisory Group

Boston / Cambridge Lodging Market New Supply

Boston / Cambridge Lodging Market New Supply

Boston / Cambridge New Supply 2003 • • • Embassy Suites - Airport – 273 Rooms - April Residence Inn – Charlestown – 168 Rooms – May Hotel Marlowe – E. Cambridge – 236 Rooms – May Commonwealth Hotel – Kenmore Square 149 Rooms - May Courtyard Hotel – Back Bay - 90 - Rooms September/October

Boston / Cambridge New Supply 2003 • • • Embassy Suites - Airport – 273 Rooms - April Residence Inn – Charlestown – 168 Rooms – May Hotel Marlowe – E. Cambridge – 236 Rooms – May Commonwealth Hotel – Kenmore Square 149 Rooms - May Courtyard Hotel – Back Bay - 90 - Rooms September/October

Boston / Cambridge New Supply 2004 Hotel Onyx – N. Station – 112 Rooms – Winter/Spring • Jurys Doyle – Back Bay – 220 Rooms – Spring • Clarion – N. Station – 88 Rooms – Summer • Hampton Inn and Suites – Crosstown – 175 Rooms – Summer •

Boston / Cambridge New Supply 2004 Hotel Onyx – N. Station – 112 Rooms – Winter/Spring • Jurys Doyle – Back Bay – 220 Rooms – Spring • Clarion – N. Station – 88 Rooms – Summer • Hampton Inn and Suites – Crosstown – 175 Rooms – Summer •

Boston / Cambridge Lodging Market Demand Trends

Boston / Cambridge Lodging Market Demand Trends

Boston / Cambridge Demand Trends l Declining Corporate Demand – Economy – Geopolitical Situation l Declining Group Demand – Weak Corporate Demand – Off Convention Years l Declining Airline Crew Demand – Economy – Airline Industry Woes

Boston / Cambridge Demand Trends l Declining Corporate Demand – Economy – Geopolitical Situation l Declining Group Demand – Weak Corporate Demand – Off Convention Years l Declining Airline Crew Demand – Economy – Airline Industry Woes

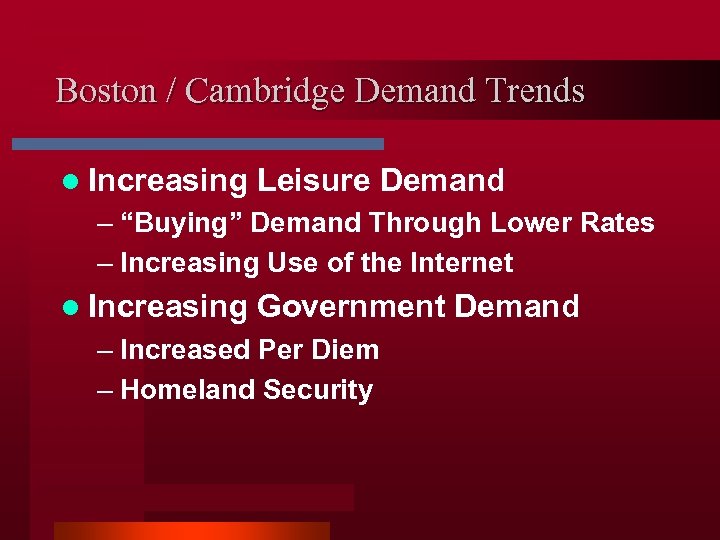

Boston / Cambridge Demand Trends l Increasing Leisure Demand – “Buying” Demand Through Lower Rates – Increasing Use of the Internet l Increasing Government Demand – Increased Per Diem – Homeland Security

Boston / Cambridge Demand Trends l Increasing Leisure Demand – “Buying” Demand Through Lower Rates – Increasing Use of the Internet l Increasing Government Demand – Increased Per Diem – Homeland Security

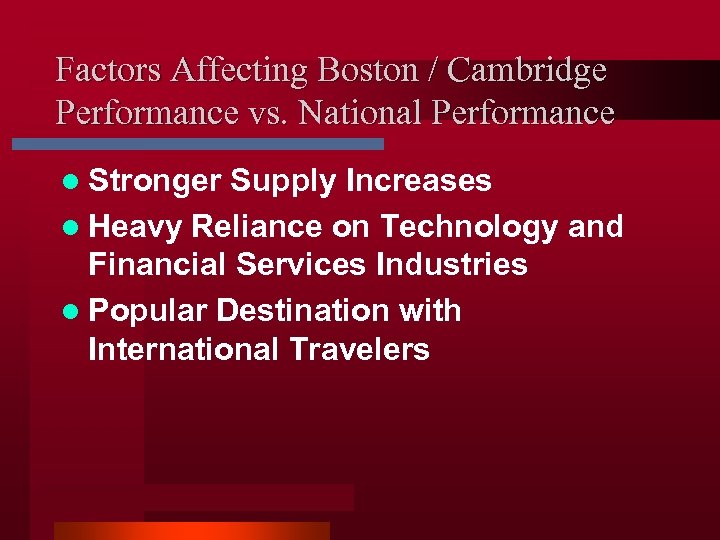

Factors Affecting Boston / Cambridge Performance vs. National Performance l Stronger Supply Increases l Heavy Reliance on Technology and Financial Services Industries l Popular Destination with International Travelers

Factors Affecting Boston / Cambridge Performance vs. National Performance l Stronger Supply Increases l Heavy Reliance on Technology and Financial Services Industries l Popular Destination with International Travelers

Boston / Cambridge Lodging Market Projections

Boston / Cambridge Lodging Market Projections

Factors Affecting Demand 2 H 2003 • • • Fewer Conventions than 2 H 2002 New Supply Shorter Booking Window Improving Economy More Stable Geopolitical Situation Weak Dollar

Factors Affecting Demand 2 H 2003 • • • Fewer Conventions than 2 H 2002 New Supply Shorter Booking Window Improving Economy More Stable Geopolitical Situation Weak Dollar

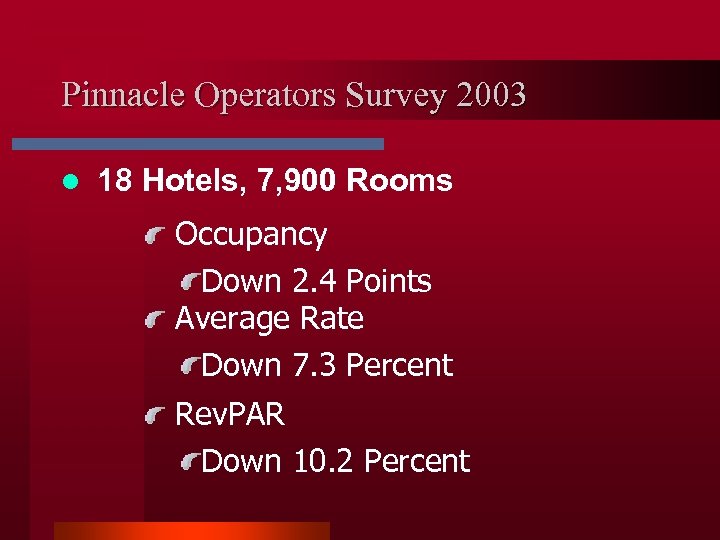

Pinnacle Operators Survey 2003 l 18 Hotels, 7, 900 Rooms Occupancy Down 2. 4 Points Average Rate Down 7. 3 Percent Rev. PAR Down 10. 2 Percent

Pinnacle Operators Survey 2003 l 18 Hotels, 7, 900 Rooms Occupancy Down 2. 4 Points Average Rate Down 7. 3 Percent Rev. PAR Down 10. 2 Percent

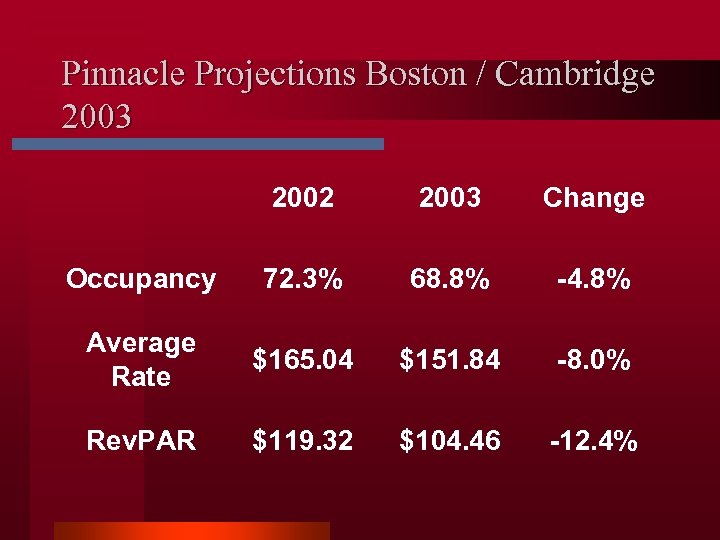

Pinnacle Projections Boston / Cambridge 2003 2002 2003 Change Occupancy 72. 3% 68. 8% -4. 8% Average Rate $165. 04 $151. 84 -8. 0% Rev. PAR $119. 32 $104. 46 -12. 4%

Pinnacle Projections Boston / Cambridge 2003 2002 2003 Change Occupancy 72. 3% 68. 8% -4. 8% Average Rate $165. 04 $151. 84 -8. 0% Rev. PAR $119. 32 $104. 46 -12. 4%

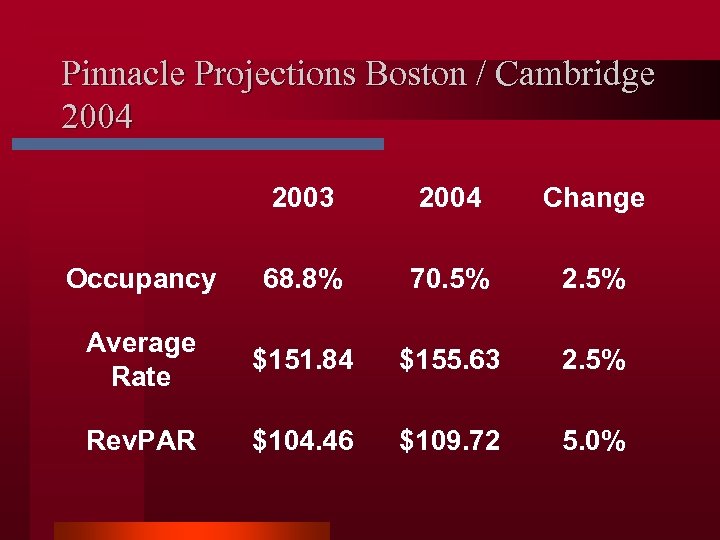

Factors Affecting Demand 2004 • • • Strong Convention Year New Supply Improving Economy More Stable Geopolitical Situation Weak Dollar MOTT Budget Reduction

Factors Affecting Demand 2004 • • • Strong Convention Year New Supply Improving Economy More Stable Geopolitical Situation Weak Dollar MOTT Budget Reduction

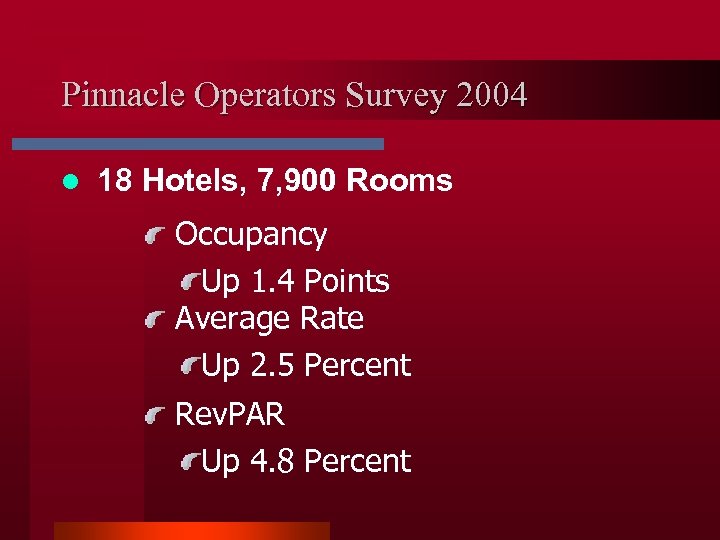

Pinnacle Operators Survey 2004 l 18 Hotels, 7, 900 Rooms Occupancy Up 1. 4 Points Average Rate Up 2. 5 Percent Rev. PAR Up 4. 8 Percent

Pinnacle Operators Survey 2004 l 18 Hotels, 7, 900 Rooms Occupancy Up 1. 4 Points Average Rate Up 2. 5 Percent Rev. PAR Up 4. 8 Percent

Pinnacle Projections Boston / Cambridge 2004 2003 2004 Change Occupancy 68. 8% 70. 5% 2. 5% Average Rate $151. 84 $155. 63 2. 5% Rev. PAR $104. 46 $109. 72 5. 0%

Pinnacle Projections Boston / Cambridge 2004 2003 2004 Change Occupancy 68. 8% 70. 5% 2. 5% Average Rate $151. 84 $155. 63 2. 5% Rev. PAR $104. 46 $109. 72 5. 0%

Rachel J. Roginsky, ISHC Pinnacle Advisory Group 76 Canal Street Boston, MA 02114 Telephone: 617 -722 -9916 Fax: 617 -722 -9917 rroginsky@pinnacle-advisory. com Outlook 2004 Pinnacle Realty Investments Pinnacle Advisory Group

Rachel J. Roginsky, ISHC Pinnacle Advisory Group 76 Canal Street Boston, MA 02114 Telephone: 617 -722 -9916 Fax: 617 -722 -9917 rroginsky@pinnacle-advisory. com Outlook 2004 Pinnacle Realty Investments Pinnacle Advisory Group