bbbae484127c390b51f8068167232283.ppt

- Количество слайдов: 16

R&D Tax Credits’ Challenges Jacek Warda Mutual Learning Exercise – ERAC Workshop Directorate General for Research and Innovation Brussels June 30, 2015 1 JPW Innovation Assocaites Inc.

R&D Tax Credits’ Challenges Jacek Warda Mutual Learning Exercise – ERAC Workshop Directorate General for Research and Innovation Brussels June 30, 2015 1 JPW Innovation Assocaites Inc.

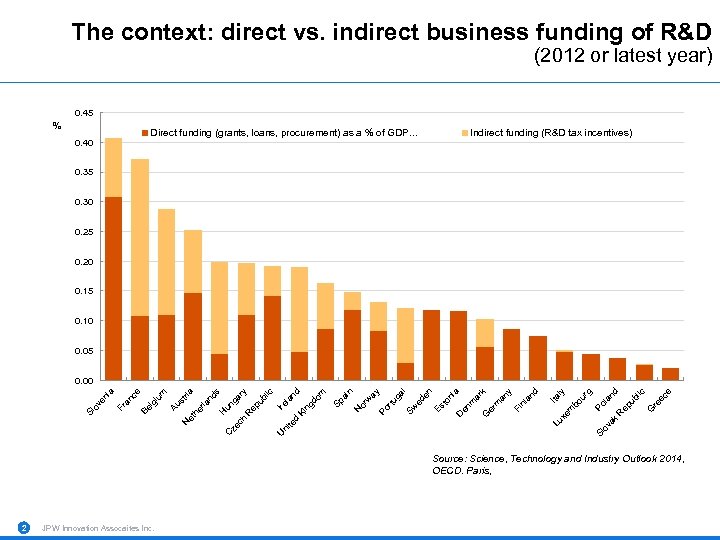

The context: direct vs. indirect business funding of R&D (2012 or latest year) 0. 45 % Direct funding (grants, loans, procurement) as a % of GDP. . . 0. 40 Indirect funding (R&D tax incentives) 0. 35 0. 30 0. 25 0. 20 0. 15 0. 10 0. 05 e ec Sl o va k G re R ep ub lic la nd Po ur g ly Lu xe m bo Ita an d Fi nl an y ar k er m G en m to ni a n Es l ed e ga Sw tu ay Po r or w ai n N D d te ni Sp ng do m la nd Ki ic ub l Ire U C ze ch R ep ga ry s un H he rla nd ria st N et Au um gi ce Be l an Fr Sl o ve ni a 0. 00 Source: Science, Technology and Industry Outlook 2014, OECD. Paris, 2 JPW Innovation Assocaites Inc.

The context: direct vs. indirect business funding of R&D (2012 or latest year) 0. 45 % Direct funding (grants, loans, procurement) as a % of GDP. . . 0. 40 Indirect funding (R&D tax incentives) 0. 35 0. 30 0. 25 0. 20 0. 15 0. 10 0. 05 e ec Sl o va k G re R ep ub lic la nd Po ur g ly Lu xe m bo Ita an d Fi nl an y ar k er m G en m to ni a n Es l ed e ga Sw tu ay Po r or w ai n N D d te ni Sp ng do m la nd Ki ic ub l Ire U C ze ch R ep ga ry s un H he rla nd ria st N et Au um gi ce Be l an Fr Sl o ve ni a 0. 00 Source: Science, Technology and Industry Outlook 2014, OECD. Paris, 2 JPW Innovation Assocaites Inc.

Why this instrument? § Widely used in the European Union (and overseas) § Rich accumulated experience § Good uptake, generally § Asymmetric learning process § incumbents vs. beginners 3 JPW Innovation Assocaites Inc.

Why this instrument? § Widely used in the European Union (and overseas) § Rich accumulated experience § Good uptake, generally § Asymmetric learning process § incumbents vs. beginners 3 JPW Innovation Assocaites Inc.

Discussion § Identification of policy challenges § How MS have overcome challenges § Challenges that could benefit from a potential MLE project § Are there groups of countries interested in potential MLE projects § How to take the process to next stage 4 JPW Innovation Assocaites Inc.

Discussion § Identification of policy challenges § How MS have overcome challenges § Challenges that could benefit from a potential MLE project § Are there groups of countries interested in potential MLE projects § How to take the process to next stage 4 JPW Innovation Assocaites Inc.

Challenges for design Definition 1 § What is R&D? § Frascati definition – scientific advance, systematic investigation and uncertainty of outcome § Broader definitions § Impacts: uptake, supporting documentation. easiness of filling the claim § Tendency to expand towards innovation expenses beyond R&D § France : Innovation Tax Credit within the research tax credit, starting in 2013 § Other examples? 5 JPW Innovation Assocaites Inc.

Challenges for design Definition 1 § What is R&D? § Frascati definition – scientific advance, systematic investigation and uncertainty of outcome § Broader definitions § Impacts: uptake, supporting documentation. easiness of filling the claim § Tendency to expand towards innovation expenses beyond R&D § France : Innovation Tax Credit within the research tax credit, starting in 2013 § Other examples? 5 JPW Innovation Assocaites Inc.

Challenges for design Definition 2 § What expenses? § Expense base can vary § All (capital and current) or some items (e. g. labour) only § Impact on generosity § Reflects the definition adopted 6 JPW Innovation Assocaites Inc.

Challenges for design Definition 2 § What expenses? § Expense base can vary § All (capital and current) or some items (e. g. labour) only § Impact on generosity § Reflects the definition adopted 6 JPW Innovation Assocaites Inc.

Challenges for design Mechanism 1 § What taxes? § Corporate income tax credit § Generally more complex in design and implementation § Payroll tax-based credits § § 7 Anti-cyclic Less costly to manage Instant refund Smaller base - less generous so rates typically are high JPW Innovation Assocaites Inc.

Challenges for design Mechanism 1 § What taxes? § Corporate income tax credit § Generally more complex in design and implementation § Payroll tax-based credits § § 7 Anti-cyclic Less costly to manage Instant refund Smaller base - less generous so rates typically are high JPW Innovation Assocaites Inc.

Challenges for design Mechanism 2 § What base: volume or incremental? § Volume – broad scope, favours catching up on innovation, risk of deadweight losses § Incremental – targeted at R&D-growing companies, prone to strategizing by firms, may have complex formula § What instrument? § Tax credit – deduction from tax payable § Independent of taxable profits § Super-allowance – deduction from taxable profits § Need to adjust the rate of super-allowance with changes to corporate income tax (i. e. , to keep benefit constant) § Related instruments like reduced rates for social contributions. France Jeune entreprise innovante / JEI 8 JPW Innovation Assocaites Inc.

Challenges for design Mechanism 2 § What base: volume or incremental? § Volume – broad scope, favours catching up on innovation, risk of deadweight losses § Incremental – targeted at R&D-growing companies, prone to strategizing by firms, may have complex formula § What instrument? § Tax credit – deduction from tax payable § Independent of taxable profits § Super-allowance – deduction from taxable profits § Need to adjust the rate of super-allowance with changes to corporate income tax (i. e. , to keep benefit constant) § Related instruments like reduced rates for social contributions. France Jeune entreprise innovante / JEI 8 JPW Innovation Assocaites Inc.

Challenges for design Policy issues 1 § What to target? § Size (SMEs) § Financial constraints for SMEs (market failure) § Danger of subsidizing not growing incumbent firms, particularly if incentives vary with thresholds § Knowledge spillovers hard to justify § Age § Specific to young innovative companies (YIC) § Parameters to define: eligible age, length of enhanced support § Public-private collaboration § Profit-neutral as no market rivalry with science organizations § Help leverage knowledge and resources § Other areas (technology, market, legal status etc. ) 9 JPW Innovation Assocaites Inc.

Challenges for design Policy issues 1 § What to target? § Size (SMEs) § Financial constraints for SMEs (market failure) § Danger of subsidizing not growing incumbent firms, particularly if incentives vary with thresholds § Knowledge spillovers hard to justify § Age § Specific to young innovative companies (YIC) § Parameters to define: eligible age, length of enhanced support § Public-private collaboration § Profit-neutral as no market rivalry with science organizations § Help leverage knowledge and resources § Other areas (technology, market, legal status etc. ) 9 JPW Innovation Assocaites Inc.

Challenges for design Policy issues 2 § What rates? § High tax credit rates don’t mean high generosity § Base and mechanism are important § Caps as ‘taming’ and targeting instrument § What about unused credits? § § 10 Inability to fully use credits reduces their value Cash refunds – for corporate-income tax credits Automatic refunds for payroll-based tax credits Otherwise carry-forwards from one-year to infinite JPW Innovation Assocaites Inc.

Challenges for design Policy issues 2 § What rates? § High tax credit rates don’t mean high generosity § Base and mechanism are important § Caps as ‘taming’ and targeting instrument § What about unused credits? § § 10 Inability to fully use credits reduces their value Cash refunds – for corporate-income tax credits Automatic refunds for payroll-based tax credits Otherwise carry-forwards from one-year to infinite JPW Innovation Assocaites Inc.

Challenges for implementation 1 § Stability § Permanent = predictable, good for R&D planning § Temporary (periodically renewed) § Experimental – one-time only pending assessment § Monitoring: hands-on or hands-off § Both come at a cost § Hands-on – high burden of administration; requires client oriented programs to ease the initial burden; costly § Hands-off – works more as an incentive; less costly to business and government; may involve a free-riding cost (fiscal accountability issue) 11 JPW Innovation Assocaites Inc.

Challenges for implementation 1 § Stability § Permanent = predictable, good for R&D planning § Temporary (periodically renewed) § Experimental – one-time only pending assessment § Monitoring: hands-on or hands-off § Both come at a cost § Hands-on – high burden of administration; requires client oriented programs to ease the initial burden; costly § Hands-off – works more as an incentive; less costly to business and government; may involve a free-riding cost (fiscal accountability issue) 11 JPW Innovation Assocaites Inc.

Challenges for implementation 2 § Promotion, outreach to business community § New credit instruments require working with business to provide advertising and initial assistance § Critical for business buy-in and uptake § Governance § Country dependent § Need to process claims on (a) scientific/technical merit and than (b) financial/fiscal soundness § Models include tax agency (does both a and b) or mix of science-based agency (doing a) and tax agency (doing b) § France: cooperation between the ministry of finance and the ministry for research § Models where science-based organization does scientific eligibility are preferred 12 JPW Innovation Assocaites Inc.

Challenges for implementation 2 § Promotion, outreach to business community § New credit instruments require working with business to provide advertising and initial assistance § Critical for business buy-in and uptake § Governance § Country dependent § Need to process claims on (a) scientific/technical merit and than (b) financial/fiscal soundness § Models include tax agency (does both a and b) or mix of science-based agency (doing a) and tax agency (doing b) § France: cooperation between the ministry of finance and the ministry for research § Models where science-based organization does scientific eligibility are preferred 12 JPW Innovation Assocaites Inc.

Challenges for evaluation § Planning for evaluation § Proactive vs. reactive § Data collection § Anticipate what data you will need to collect § Timely and cost-effective evaluation § Meta-analysis § Benefit-cost analysis § Expert knowledge and independence § Governance and publication 13 JPW Innovation Assocaites Inc.

Challenges for evaluation § Planning for evaluation § Proactive vs. reactive § Data collection § Anticipate what data you will need to collect § Timely and cost-effective evaluation § Meta-analysis § Benefit-cost analysis § Expert knowledge and independence § Governance and publication 13 JPW Innovation Assocaites Inc.

Questions § In designing, implementing and/or evaluating your policy instrument, what was some of the most pressing challenges you were faced with, and how did you overcome them? § What are the persistent challenges that you continue to face? § Which other countries may face similar challenges? 14 JPW Innovation Assocaites Inc.

Questions § In designing, implementing and/or evaluating your policy instrument, what was some of the most pressing challenges you were faced with, and how did you overcome them? § What are the persistent challenges that you continue to face? § Which other countries may face similar challenges? 14 JPW Innovation Assocaites Inc.

Questions: challenges in France § Challenges in implementation: § organisation of control. Interested to know about other countries with respect to a priori or a posteriori controls and whethere are specialized fiscal teams. § Role of intermediaries/fiscal consultancies in the process § Challenges in impact evaluation: § policy mix and interactions with other instruments § Meta-analysis § Impact on R&D and impact on innovation (patents…) § Back to design § What can we say about the combination of fiscal incentives on input (R&D) and output (patents)? In other words, tax credit and patent box ? 15 JPW Innovation Assocaites Inc.

Questions: challenges in France § Challenges in implementation: § organisation of control. Interested to know about other countries with respect to a priori or a posteriori controls and whethere are specialized fiscal teams. § Role of intermediaries/fiscal consultancies in the process § Challenges in impact evaluation: § policy mix and interactions with other instruments § Meta-analysis § Impact on R&D and impact on innovation (patents…) § Back to design § What can we say about the combination of fiscal incentives on input (R&D) and output (patents)? In other words, tax credit and patent box ? 15 JPW Innovation Assocaites Inc.

Suggestions from France on impact evaluation Discussions/workshops based on « A study on R&D tax incentives » Taxation papers, European Commission 2014 1. Scoring method 2. Consideration of different fiscal instruments together 3. Meta analysis of tax credits 16 JPW Innovation Assocaites Inc.

Suggestions from France on impact evaluation Discussions/workshops based on « A study on R&D tax incentives » Taxation papers, European Commission 2014 1. Scoring method 2. Consideration of different fiscal instruments together 3. Meta analysis of tax credits 16 JPW Innovation Assocaites Inc.