11cf8762f4f203a5e56eb4f8486193f7.ppt

- Количество слайдов: 142

Quick Tour Country Profiles Business, Insurance and Lloyd’s info on Lloyd’s International Office Network summarised on three slides for all territories Click HERE for Tutorial Click HERE to launch dashboard > www. lloyds. com/QUICKTOUR > filip. wuebbeler@lloyds. com FOR BROKERS & MANAGING AGENTS Recent Updates: July 2010 § Update of all Lloyd’s figures § New Business Environment sections

North America Latin America Europe IMEA Asia Pacific Offices 2 Europe Latin America Click Box to navigate North America India, Middle East and Africa QUICK TOUR (Country Profiles) China Japan Asia Pacific © Lloyd’s

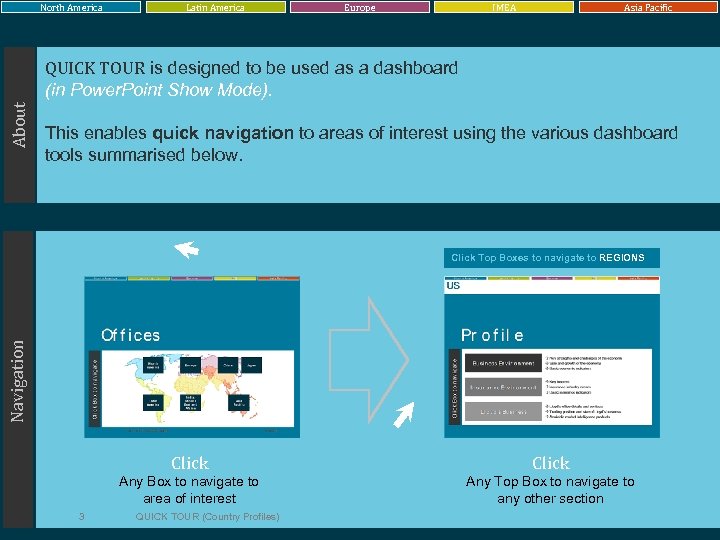

North America Latin America Europe IMEA Asia Pacific About QUICK TOUR is designed to be used as a dashboard (in Power. Point Show Mode). This enables quick navigation to areas of interest using the various dashboard tools summarised below. Navigation Click Top Boxes to navigate to REGIONS Click Any Box to navigate to area of interest 3 Click Any Top Box to navigate to any other section QUICK TOUR (Country Profiles) © Lloyd’s

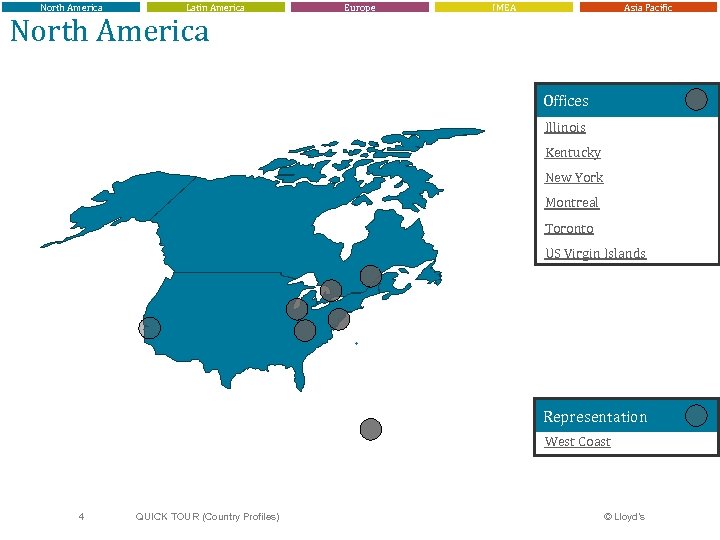

North America Latin America North America Europe IMEA Asia Pacific Offices Illinois Kentucky New York Montreal Toronto US Virgin Islands Representation West Coast 4 QUICK TOUR (Country Profiles) © Lloyd’s

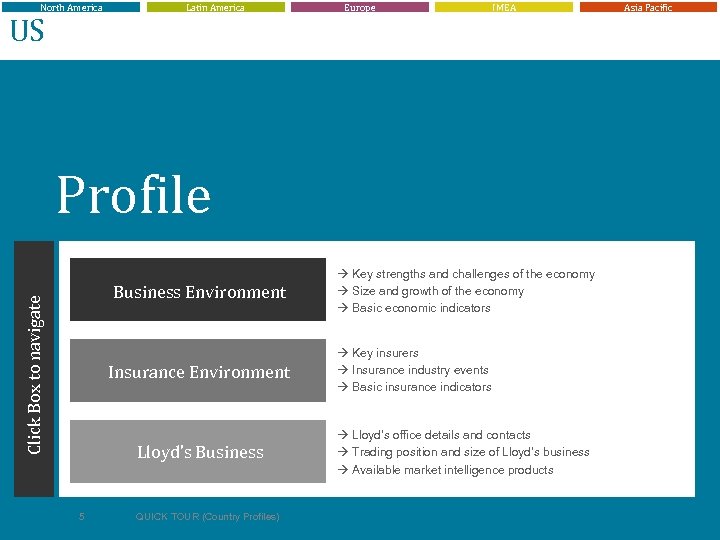

North America US Latin America Europe IMEA Asia Pacific Profile Click Box to navigate Business Environment Insurance Environment Lloyd’s Business 5 QUICK TOUR (Country Profiles) à Key strengths and challenges of the economy à Size and growth of the economy à Basic economic indicators à Key insurers à Insurance industry events à Basic insurance indicators à Lloyd’s office details and contacts à Trading position and size of Lloyd’s business à Available market intelligence products © Lloyd’s

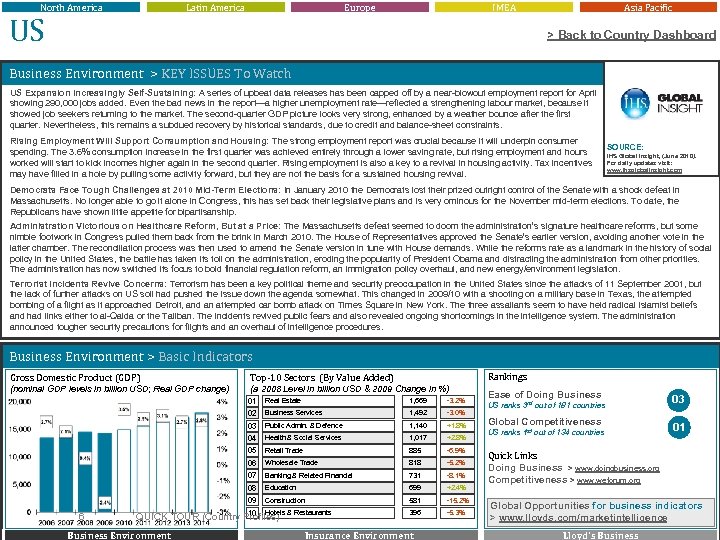

North America Latin America US Europe IMEA Asia Pacific > Back to Country Dashboard Business Environment > KEY ISSUES To Watch US Expansion Increasingly Self-Sustaining: A series of upbeat data releases has been capped off by a near-blowout employment report for April showing 290, 000 jobs added. Even the bad news in the report—a higher unemployment rate—reflected a strengthening labour market, because it showed job seekers returning to the market. The second-quarter GDP picture looks very strong, enhanced by a weather bounce after the first quarter. Nevertheless, this remains a subdued recovery by historical standards, due to credit and balance-sheet constraints. Rising Employment Will Support Consumption and Housing: The strong employment report was crucial because it will underpin consumer spending. The 3. 6% consumption increase in the first quarter was achieved entirely through a lower saving rate, but rising employment and hours worked will start to kick incomes higher again in the second quarter. Rising employment is also a key to a revival in housing activity. Tax incentives may have filled in a hole by pulling some activity forward, but they are not the basis for a sustained housing revival. SOURCE: IHS Global Insight, (June 2010). For daily updates visit: www. ihsglobalinsight. com Democrats Face Tough Challenges at 2010 Mid-Term Elections: In January 2010 the Democrats lost their prized outright control of the Senate with a shock defeat in Massachusetts. No longer able to go it alone in Congress, this has set back their legislative plans and is very ominous for the November mid-term elections. To date, the Republicans have shown little appetite for bipartisanship. Administration Victorious on Healthcare Reform, But at a Price: The Massachusetts defeat seemed to doom the administration’s signature healthcare reforms, but some nimble footwork in Congress pulled them back from the brink in March 2010. The House of Representatives approved the Senate’s earlier version, avoiding another vote in the latter chamber. The reconciliation process was then used to amend the Senate version in tune with House demands. While the reforms rate as a landmark in the history of social policy in the United States, the battle has taken its toll on the administration, eroding the popularity of President Obama and distracting the administration from other priorities. The administration has now switched its focus to bold financial regulation reform, an immigration policy overhaul, and new energy/environment legislation. Terrorist Incidents Revive Concerns: Terrorism has been a key political theme and security preoccupation in the United States since the attacks of 11 September 2001, but the lack of further attacks on US soil had pushed the issue down the agenda somewhat. This changed in 2009/10 with a shooting on a military base in Texas, the attempted bombing of a flight as it approached Detroit, and an attempted car bomb attack on Times Square in New York. The three assailants seem to have held radical Islamist beliefs and had links either to al-Qaida or the Taliban. The incidents revived public fears and also revealed ongoing shortcomings in the intelligence system. The administration announced tougher security precautions for flights and an overhaul of intelligence procedures. Business Environment > Basic Indicators Gross Domestic Product (GDP) (nominal GDP levels in billion USD; Real GDP change) Rankings Top-10 Sectors (By Value Added) (a 2008 Level in billion USD & 2009 Change in %) 01 1, 669 -3. 2% 02 Business Services 1, 492 -3. 0% 03 Public Admin. & Defence 1, 140 +1. 8% 04 Health & Social Services 1, 017 +2. 8% 05 Retail Trade 885 -6. 9% 06 Wholesale Trade 818 -5. 2% 07 Banking & Related Financial 731 -8. 1% 08 Education 699 +2. 4% 09 6 Real Estate Construction 581 -15. 2% 10 Hotels & Restaurants 396 -5. 3% QUICK TOUR (Country Profiles) Business Environment Insurance Environment Ease of Doing Business US ranks 3 rd out of 181 countries Global Competitiveness US ranks 1 st out of 134 countries 03 01 Quick Links Doing Business > www. doingbusiness. org Competitiveness > www. weforum. org Global Opportunities for business indicators © Lloyd’s > www. lloyds. com/marketintelligence Lloyd’s Business

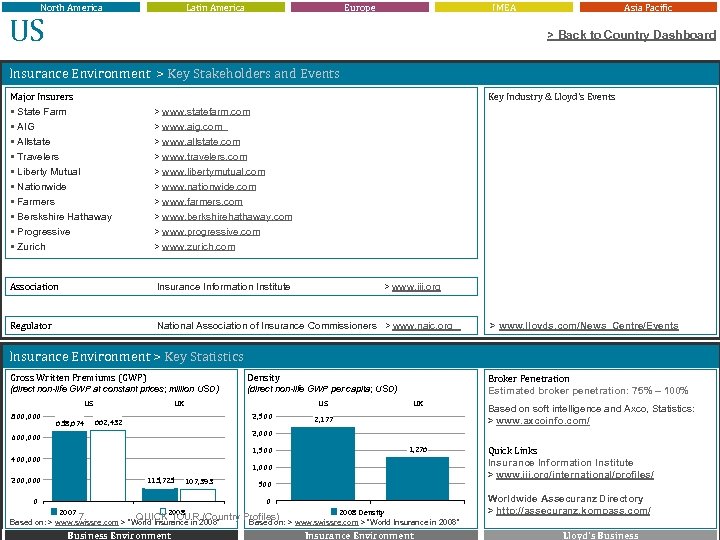

North America Latin America US Europe IMEA Asia Pacific > Back to Country Dashboard Insurance Environment > Key Stakeholders and Events Major Insurers § State Farm Key Industry & Lloyd’s Events > www. statefarm. com § AIG § Allstate § Travelers § Liberty Mutual § Nationwide § Farmers § Berskshire Hathaway § Progressive § Zurich > www. aig. com > www. allstate. com > www. travelers. com > www. libertymutual. com > www. nationwide. com > www. farmers. com Association Insurance Information Institute Regulator National Association of Insurance Commissioners > www. naic. org > www. berkshirehathaway. com > www. progressive. com > www. zurich. com > www. iii. org > www. lloyds. com/News_Centre/Events Insurance Environment > Key Statistics Gross Written Premiums (GWP) Density (direct non-life GWP at constant prices; million USD) (direct non-life GWP per capita; USD) US 800, 000 658, 674 UK US 2, 500 662, 432 UK 2, 177 Based on soft intelligence and Axco, Statistics: > www. axcoinfo. com/ 2, 000 600, 000 1, 500 400, 000 200, 000 Broker Penetration Estimated broker penetration: 75% – 100% 1, 276 1, 000 115, 725 107, 393 500 0 0 2007 2008 7 QUICK TOUR (Country Based on: > www. swissre. com > “World Insurance in 2008” Business Environment 2008 Density Profiles) > www. swissre. com > “World Insurance in 2008” Based on: Insurance Environment Quick Links Insurance Information Institute > www. iii. org/international/profiles/ Worldwide Assecuranz Directory > http: //assecuranz. kompass. com/ © Lloyd’s Business

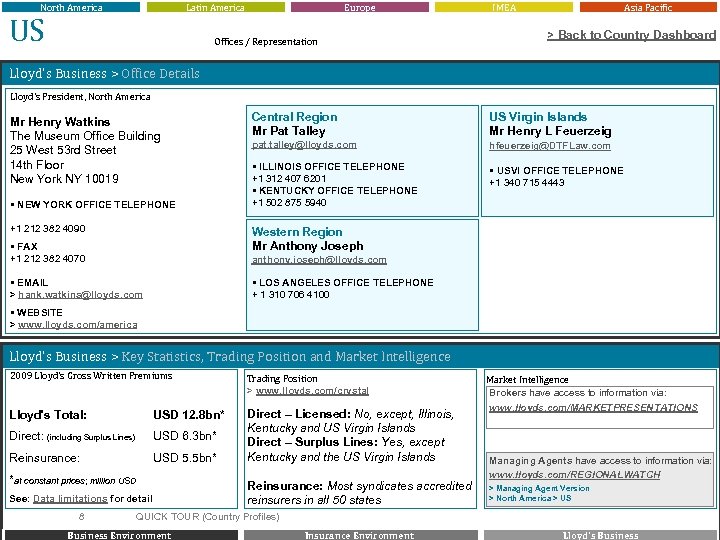

North America Latin America US Europe Offices / Representation IMEA Asia Pacific > Back to Country Dashboard Lloyd’s Business > Office Details Lloyd’s President, North America Mr Henry Watkins The Museum Office Building 25 West 53 rd Street 14 th Floor New York NY 10019 § NEW YORK OFFICE TELEPHONE +1 212 382 4090 Central Region Mr Pat Talley US Virgin Islands Mr Henry L Feuerzeig pat. talley@lloyds. com hfeuerzeig@DTFLaw. com § ILLINOIS OFFICE TELEPHONE +1 312 407 6201 § KENTUCKY OFFICE TELEPHONE +1 502 875 5940 § USVI OFFICE TELEPHONE +1 340 715 4443 Western Region Mr Anthony Joseph § FAX +1 212 382 4070 anthony. joseph@lloyds. com § LOS ANGELES OFFICE TELEPHONE + 1 310 706 4100 § EMAIL > hank. watkins@lloyds. com § WEBSITE > www. lloyds. com/america Lloyd’s Business > Key Statistics, Trading Position and Market Intelligence 2009 Lloyd’s Gross Written Premiums Trading Position > www. lloyds. com/crystal Lloyd's Total: USD 12. 8 bn* Direct: (including Surplus Lines) USD 6. 3 bn* Reinsurance: USD 5. 5 bn* Direct – Licensed: No, except, Illinois, Kentucky and US Virgin Islands Direct – Surplus Lines: Yes, except Kentucky and the US Virgin Islands *at constant prices; million USD See: Data limitations for detail 8 Reinsurance: Most syndicates accredited reinsurers in all 50 states QUICK TOUR (Country Profiles) Business Environment Market Intelligence Brokers have access to information via: www. lloyds. com/MARKETPRESENTATIONS Managing Agents have access to information via: www. lloyds. com/REGIONALWATCH > Managing Agent Version > North America > US © Lloyd’s Insurance Environment Lloyd’s Business

North America Canada Latin America Europe IMEA Asia Pacific Profile Click Box to navigate Business Environment Insurance Environment Lloyd’s Business 9 QUICK TOUR (Country Profiles) à Key strengths and challenges of the economy à Size and growth of the economy à Basic economic indicators à Key insurers à Insurance industry events à Basic insurance indicators à Lloyd’s office details and contacts à Trading position and size of Lloyd’s business à Available market intelligence products © Lloyd’s

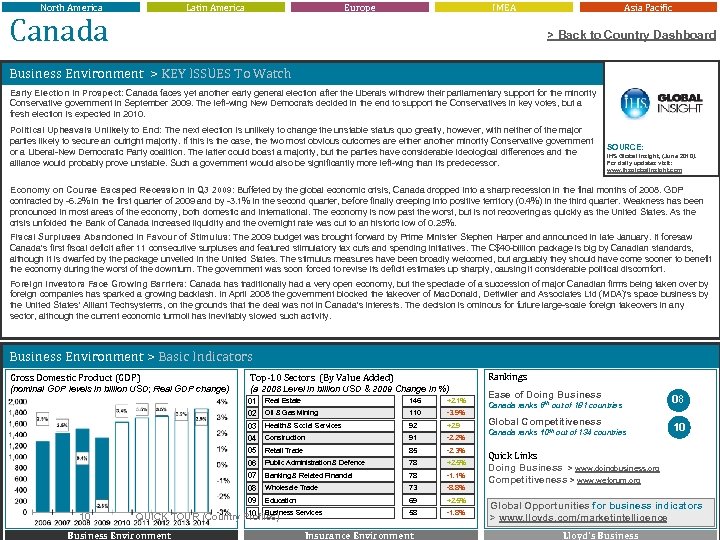

North America Latin America Canada Europe IMEA Asia Pacific > Back to Country Dashboard Business Environment > KEY ISSUES To Watch Early Election in Prospect: Canada faces yet another early general election after the Liberals withdrew their parliamentary support for the minority Conservative government in September 2009. The left-wing New Democrats decided in the end to support the Conservatives in key votes, but a fresh election is expected in 2010. Political Upheavals Unlikely to End: The next election is unlikely to change the unstable status quo greatly, however, with neither of the major parties likely to secure an outright majority. If this is the case, the two most obvious outcomes are either another minority Conservative government or a Liberal-New Democratic Party coalition. The latter could boast a majority, but the parties have considerable ideological differences and the alliance would probably prove unstable. Such a government would also be significantly more left-wing than its predecessor. SOURCE: IHS Global Insight, (June 2010). For daily updates visit: www. ihsglobalinsight. com Economy on Course Escaped Recession in Q 3 2009: Buffeted by the global economic crisis, Canada dropped into a sharp recession in the final months of 2008. GDP contracted by -6. 2% in the first quarter of 2009 and by -3. 1% in the second quarter, before finally creeping into positive territory (0. 4%) in the third quarter. Weakness has been pronounced in most areas of the economy, both domestic and international. The economy is now past the worst, but is not recovering as quickly as the United States. As the crisis unfolded the Bank of Canada increased liquidity and the overnight rate was cut to an historic low of 0. 25%. Fiscal Surpluses Abandoned in Favour of Stimulus: The 2009 budget was brought forward by Prime Minister Stephen Harper and announced in late January. It foresaw Canada's first fiscal deficit after 11 consecutive surpluses and featured stimulatory tax cuts and spending initiatives. The C$40 -billion package is big by Canadian standards, although it is dwarfed by the package unveiled in the United States. The stimulus measures have been broadly welcomed, but arguably they should have come sooner to benefit the economy during the worst of the downturn. The government was soon forced to revise its deficit estimates up sharply, causing it considerable political discomfort. Foreign Investors Face Growing Barriers: Canada has traditionally had a very open economy, but the spectacle of a succession of major Canadian firms being taken over by foreign companies has sparked a growing backlash. In April 2008 the government blocked the takeover of Mac. Donald, Dettwiler and Associates Ltd (MDA)'s space business by the United States' Alliant Techsystems, on the grounds that the deal was not in Canada's interests. The decision is ominous for future large-scale foreign takeovers in any sector, although the current economic turmoil has inevitably slowed such activity. Business Environment > Basic Indicators Gross Domestic Product (GDP) (nominal GDP levels in billion USD; Real GDP change) Rankings Top-10 Sectors (By Value Added) (a 2008 Level in billion USD & 2009 Change in %) 01 146 +2. 1% 02 Oil & Gas Mining 110 -3. 9% 03 Health & Social Services 92 +2. 9 04 Construction 91 -2. 2% 05 Retail Trade 85 -2. 3% 06 Public Administration & Defence 78 +2. 5% 07 Banking & Related Financial 78 -1. 1% 08 Wholesale Trade 73 -8. 8% 09 10 Real Estate Education 69 +2. 5% 10 Business Services 58 -1. 8% QUICK TOUR (Country Profiles) Business Environment Insurance Environment Ease of Doing Business Canada ranks 8 th out of 181 countries Global Competitiveness Canada ranks 10 th out of 134 countries 08 10 Quick Links Doing Business > www. doingbusiness. org Competitiveness > www. weforum. org Global Opportunities for business indicators © Lloyd’s > www. lloyds. com/marketintelligence Lloyd’s Business

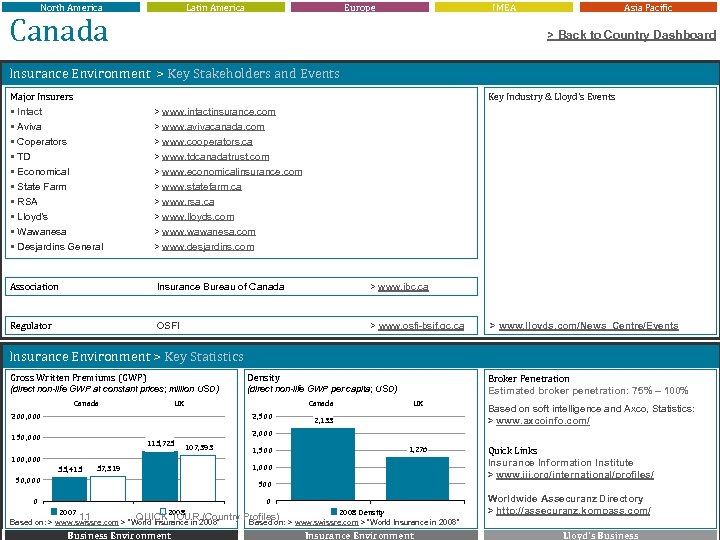

North America Latin America Canada Europe IMEA Asia Pacific > Back to Country Dashboard Insurance Environment > Key Stakeholders and Events Major Insurers § Intact Key Industry & Lloyd’s Events > www. intactinsurance. com § Aviva § Coperators § TD § Economical § State Farm § RSA § Lloyd’s § Wawanesa § Desjardins General > www. avivacanada. com > www. cooperators. ca > www. tdcanadatrust. com > www. economicalinsurance. com > www. statefarm. ca > www. rsa. ca Association Insurance Bureau of Canada > www. ibc. ca Regulator OSFI > www. osfi-bsif. gc. ca > www. lloyds. com > www. wawanesa. com > www. desjardins. com > www. lloyds. com/News_Centre/Events Insurance Environment > Key Statistics Gross Written Premiums (GWP) Density (direct non-life GWP at constant prices; million USD) (direct non-life GWP per capita; USD) Canada UK Canada 200, 000 2, 500 Broker Penetration Estimated broker penetration: 75% – 100% UK 2, 133 Based on soft intelligence and Axco, Statistics: > www. axcoinfo. com/ 2, 000 150, 000 115, 725 107, 393 100, 000 55, 415 57, 319 50, 000 1, 500 1, 276 1, 000 500 0 0 2007 2008 11 QUICK TOUR (Country Based on: > www. swissre. com > “World Insurance in 2008” Business Environment 2008 Density Profiles) > www. swissre. com > “World Insurance in 2008” Based on: Insurance Environment Quick Links Insurance Information Institute > www. iii. org/international/profiles/ Worldwide Assecuranz Directory > http: //assecuranz. kompass. com/ © Lloyd’s Business

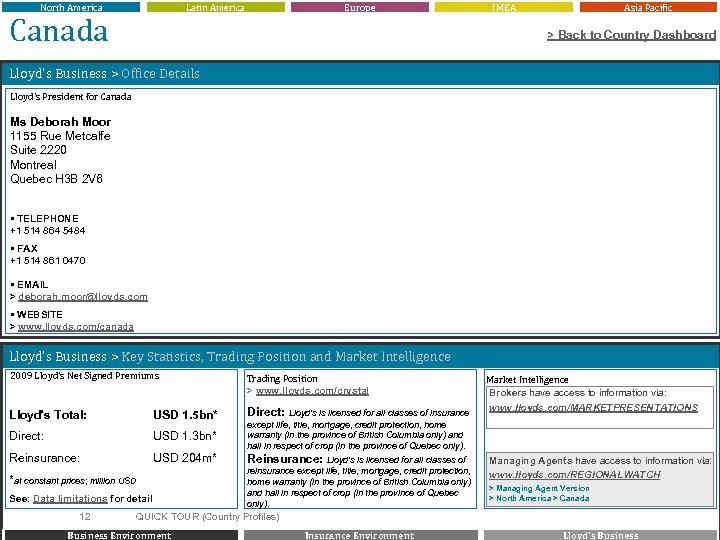

North America Latin America Canada Europe IMEA Asia Pacific > Back to Country Dashboard Lloyd’s Business > Office Details Lloyd’s President for Canada Ms Deborah Moor 1155 Rue Metcalfe Suite 2220 Montreal Quebec H 3 B 2 V 6 § TELEPHONE +1 514 864 5484 § FAX +1 514 861 0470 § EMAIL > deborah. moor@lloyds. com § WEBSITE > www. lloyds. com/canada Lloyd’s Business > Key Statistics, Trading Position and Market Intelligence 2009 Lloyd’s Net Signed Premiums Trading Position > www. lloyds. com/crystal Lloyd's Total: USD 1. 5 bn* Direct: Lloyd's is licensed for all classes of insurance Direct: USD 1. 3 bn* except life, title, mortgage, credit protection, home warranty (in the province of British Columbia only) and hail in respect of crop (in the province of Quebec only). Reinsurance: USD 204 m* Reinsurance: Lloyd's is licensed for all classes of *at constant prices; million USD See: Data limitations for detail 12 reinsurance except life, title, mortgage, credit protection, home warranty (in the province of British Columbia only) and hail in respect of crop (in the province of Quebec only). QUICK TOUR (Country Profiles) Business Environment Market Intelligence Brokers have access to information via: www. lloyds. com/MARKETPRESENTATIONS Managing Agents have access to information via: www. lloyds. com/REGIONALWATCH > Managing Agent Version > North America > Canada © Lloyd’s Insurance Environment Lloyd’s Business

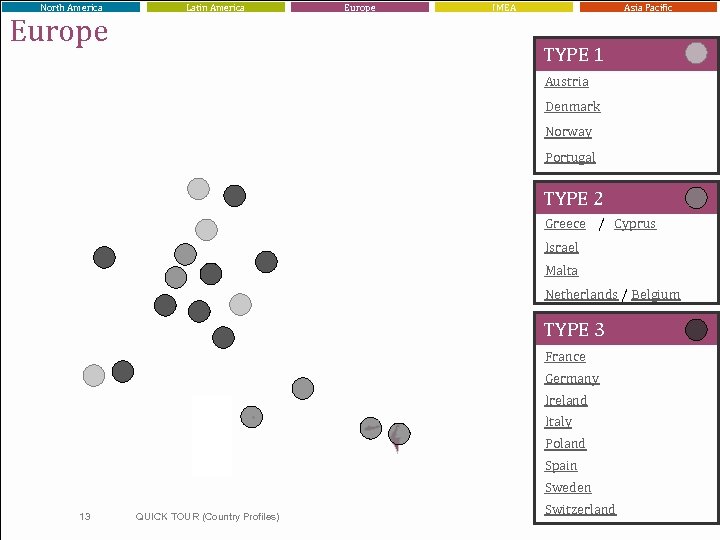

North America Europe Latin America Europe IMEA Asia Pacific TYPE 1 Austria Denmark Norway Portugal TYPE 2 Greece / Cyprus Israel Malta Netherlands / Belgium TYPE 3 France Germany Ireland Italy Poland Spain Sweden 13 QUICK TOUR (Country Profiles) Switzerland. Lloyd’s ©

North America Latin America Austria – TYPE 1 Office Europe IMEA Asia Pacific Profile Click Box to navigate Business Environment Insurance Environment Lloyd’s Business 14 QUICK TOUR (Country Profiles) à Key strengths and challenges of the economy à Size and growth of the economy à Basic economic indicators à Key insurers à Insurance industry events à Basic insurance indicators à Lloyd’s office details and contacts à Trading position and size of Lloyd’s business à Available market intelligence products © Lloyd’s

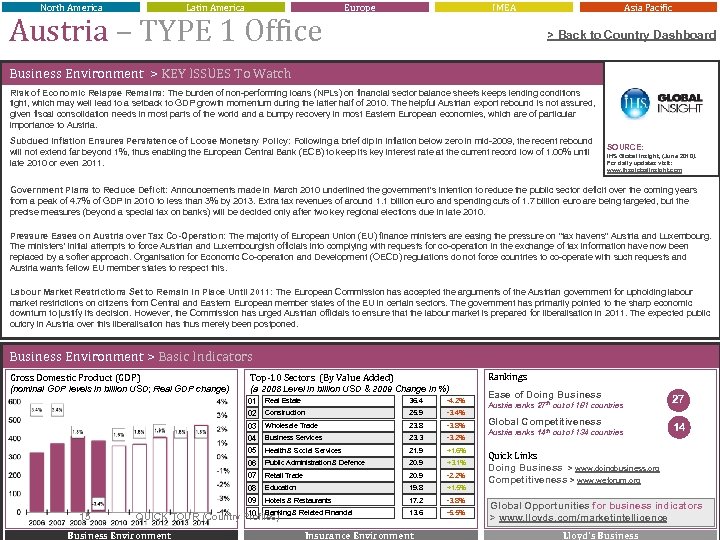

North America Latin America Austria – TYPE 1 Office Europe IMEA Asia Pacific > Back to Country Dashboard Business Environment > KEY ISSUES To Watch Risk of Economic Relapse Remains: The burden of non-performing loans (NPLs) on financial sector balance sheets keeps lending conditions tight, which may well lead to a setback to GDP growth momentum during the latter half of 2010. The helpful Austrian export rebound is not assured, given fiscal consolidation needs in most parts of the world and a bumpy recovery in most Eastern European economies, which are of particular importance to Austria. Subdued Inflation Ensures Persistence of Loose Monetary Policy: Following a brief dip in inflation below zero in mid-2009, the recent rebound will not extend far beyond 1%, thus enabling the European Central Bank (ECB) to keep its key interest rate at the current record low of 1. 00% until late 2010 or even 2011. SOURCE: IHS Global Insight, (June 2010). For daily updates visit: www. ihsglobalinsight. com Government Plans to Reduce Deficit: Announcements made in March 2010 underlined the government's intention to reduce the public sector deficit over the coming years from a peak of 4. 7% of GDP in 2010 to less than 3% by 2013. Extra tax revenues of around 1. 1 billion euro and spending cuts of 1. 7 billion euro are being targeted, but the precise measures (beyond a special tax on banks) will be decided only after two key regional elections due in late 2010. Pressure Eases on Austria over Tax Co-Operation: The majority of European Union (EU) finance ministers are easing the pressure on "tax havens" Austria and Luxembourg. The ministers' initial attempts to force Austrian and Luxembourgish officials into complying with requests for co-operation in the exchange of tax information have now been replaced by a softer approach. Organisation for Economic Co-operation and Development (OECD) regulations do not force countries to co-operate with such requests and Austria wants fellow EU member states to respect this. Labour Market Restrictions Set to Remain in Place Until 2011: The European Commission has accepted the arguments of the Austrian government for upholding labour market restrictions on citizens from Central and Eastern European member states of the EU in certain sectors. The government has primarily pointed to the sharp economic downturn to justify its decision. However, the Commission has urged Austrian officials to ensure that the labour market is prepared for liberalisation in 2011. The expected public outcry in Austria over this liberalisation has thus merely been postponed. Business Environment > Basic Indicators Gross Domestic Product (GDP) (nominal GDP levels in billion USD; Real GDP change) Rankings Top-10 Sectors (By Value Added) (a 2008 Level in billion USD & 2009 Change in %) 01 36. 4 -4. 2% 02 Construction 25. 9 -3. 4% 03 Wholesale Trade 23. 8 -3. 8% 04 Business Services 23. 3 -3. 2% 05 Health & Social Services 21. 9 +1. 6% 06 Public Administration & Defence 20. 9 +3. 1% 07 Retail Trade 20. 9 -2. 2% 08 Education 19. 8 +1. 5% 09 15 Real Estate Hotels & Restaurants 17. 2 -3. 8% 10 Banking & Related Financial 13. 6 -5. 5% QUICK TOUR (Country Profiles) Business Environment Insurance Environment Ease of Doing Business Austria ranks 27 th out of 181 countries Global Competitiveness Austria ranks 14 th out of 134 countries 27 14 Quick Links Doing Business > www. doingbusiness. org Competitiveness > www. weforum. org Global Opportunities for business indicators © Lloyd’s > www. lloyds. com/marketintelligence Lloyd’s Business

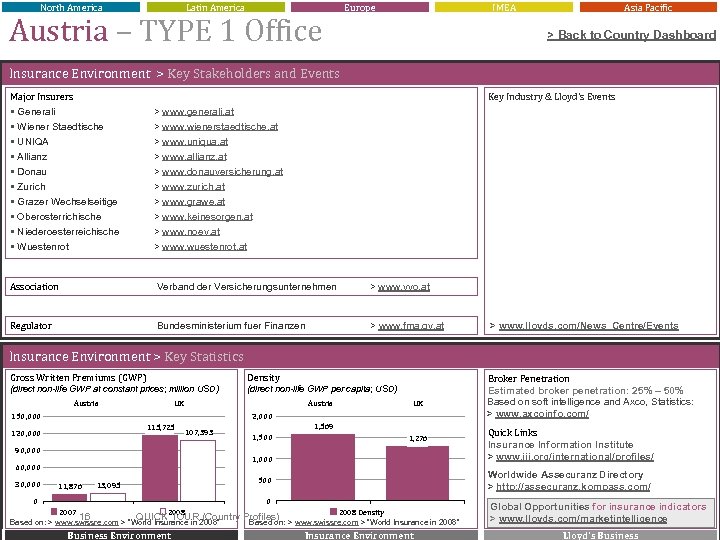

North America Latin America Europe Austria – TYPE 1 Office IMEA Asia Pacific > Back to Country Dashboard Insurance Environment > Key Stakeholders and Events Major Insurers § Generali Key Industry & Lloyd’s Events > www. generali. at § Wiener Staedtische § UNIQA § Allianz § Donau § Zurich § Grazer Wechselseitige § Oberosterrichische § Niederoesterreichische § Wuestenrot > www. wienerstaedtische. at > www. uniqua. at > www. allianz. at > www. donauversicherung. at > www. zurich. at > www. grawe. at Association Verband der Versicherungsunternehmen > www. vvo. at Regulator Bundesministerium fuer Finanzen > www. fma. gv. at > www. keinesorgen. at > www. noev. at > www. wuestenrot. at > www. lloyds. com/News_Centre/Events Insurance Environment > Key Statistics Gross Written Premiums (GWP) Density (direct non-life GWP at constant prices; million USD) (direct non-life GWP per capita; USD) Austria UK Austria 150, 000 115, 725 120, 000 107, 393 90, 000 1, 569 1, 500 1, 276 1, 000 60, 000 30, 000 UK 2, 000 11, 876 13, 095 2007 2008 16 QUICK TOUR (Country Based on: > www. swissre. com > “World Insurance in 2008” Business Environment Quick Links Insurance Information Institute > www. iii. org/international/profiles/ Worldwide Assecuranz Directory > http: //assecuranz. kompass. com/ 500 0 0 Broker Penetration Estimated broker penetration: 25% – 50% Based on soft intelligence and Axco, Statistics: > www. axcoinfo. com/ 2008 Density Global Opportunities for insurance indicators © Lloyd’s > www. lloyds. com/marketintelligence Insurance Environment Lloyd’s Business Profiles) > www. swissre. com > “World Insurance in 2008” Based on:

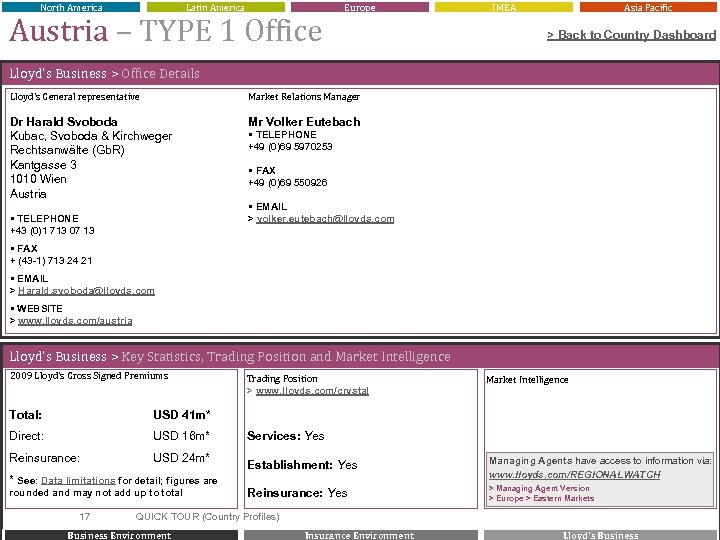

North America Latin America Austria – TYPE 1 Office Europe IMEA Asia Pacific > Back to Country Dashboard Lloyd’s Business > Office Details Lloyd’s General representative Market Relations Manager Dr Harald Svoboda Kubac, Svoboda & Kirchweger Rechtsanwälte (Gb. R) Kantgasse 3 1010 Wien Austria Mr Volker Eutebach § TELEPHONE +49 (0)69 5970253 § FAX +49 (0)69 550926 § EMAIL > volker. eutebach@lloyds. com § TELEPHONE +43 (0)1 713 07 13 § FAX + (43 -1) 713 24 21 § EMAIL > Harald. svoboda@lloyds. com § WEBSITE > www. lloyds. com/austria Lloyd’s Business > Key Statistics, Trading Position and Market Intelligence 2009 Lloyd’s Gross Signed Premiums Total: USD 16 m* Reinsurance: USD 24 m* Market Intelligence USD 41 m* Direct: Trading Position > www. lloyds. com/crystal Services: Yes Establishment: Yes Managing Agents have access to information via: www. lloyds. com/REGIONALWATCH Reinsurance: Yes > Managing Agent Version > Europe > Eastern Markets * See: Data limitations for detail; figures are rounded and may not add up to total 17 QUICK TOUR (Country Profiles) Business Environment © Lloyd’s Insurance Environment Lloyd’s Business

North America Latin America Belgium – TYPE 2 Office Europe IMEA Asia Pacific Profile Click Box to navigate Business Environment Insurance Environment Lloyd’s Business 18 QUICK TOUR (Country Profiles) à Key strengths and challenges of the economy à Size and growth of the economy à Basic economic indicators à Key insurers à Insurance industry events à Basic insurance indicators à Lloyd’s office details and contacts à Trading position and size of Lloyd’s business à Available market intelligence products © Lloyd’s

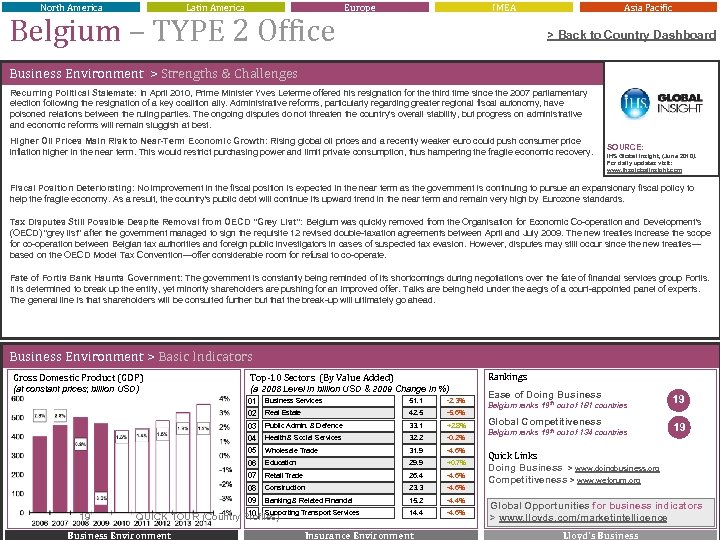

North America Latin America Belgium – TYPE 2 Office Europe IMEA Asia Pacific > Back to Country Dashboard Business Environment > Strengths & Challenges Recurring Political Stalemate: In April 2010, Prime Minister Yves Leterme offered his resignation for the third time since the 2007 parliamentary election following the resignation of a key coalition ally. Administrative reforms, particularly regarding greater regional fiscal autonomy, have poisoned relations between the ruling parties. The ongoing disputes do not threaten the country's overall stability, but progress on administrative and economic reforms will remain sluggish at best. Higher Oil Prices Main Risk to Near-Term Economic Growth: Rising global oil prices and a recently weaker euro could push consumer price inflation higher in the near term. This would restrict purchasing power and limit private consumption, thus hampering the fragile economic recovery. SOURCE: IHS Global Insight, (June 2010). For daily updates visit: www. ihsglobalinsight. com Fiscal Position Deteriorating: No improvement in the fiscal position is expected in the near term as the government is continuing to pursue an expansionary fiscal policy to help the fragile economy. As a result, the country's public debt will continue its upward trend in the near term and remain very high by Eurozone standards. Tax Disputes Still Possible Despite Removal from OECD "Grey List": Belgium was quickly removed from the Organisation for Economic Co-operation and Development's (OECD) "grey list" after the government managed to sign the requisite 12 revised double-taxation agreements between April and July 2009. The new treaties increase the scope for co-operation between Belgian tax authorities and foreign public investigators in cases of suspected tax evasion. However, disputes may still occur since the new treaties— based on the OECD Model Tax Convention—offer considerable room for refusal to co-operate. Fate of Fortis Bank Haunts Government: The government is constantly being reminded of its shortcomings during negotiations over the fate of financial services group Fortis. It is determined to break up the entity, yet minority shareholders are pushing for an improved offer. Talks are being held under the aegis of a court-appointed panel of experts. The general line is that shareholders will be consulted further but that the break-up will ultimately go ahead. Business Environment > Basic Indicators Gross Domestic Product (GDP) (at constant prices; billion USD) Rankings Top-10 Sectors (By Value Added) (a 2008 Level in billion USD & 2009 Change in %) 01 51. 1 -2. 3% 02 Real Estate 42. 5 -5. 6% 03 Public Admin. & Defence 33. 1 +2. 8% 04 Health & Social Services 32. 2 -0. 2% 05 Wholesale Trade 31. 9 -4. 6% 06 Education 29. 9 +0. 7% 07 Retail Trade 26. 4 -4. 6% 08 Construction 23. 3 -4. 6% 09 19 Business Services Banking & Related Financial 15. 2 -4. 4% 10 Supporting Transport Services 14. 4 -4. 6% QUICK TOUR (Country Profiles) Business Environment Insurance Environment Ease of Doing Business Belgium ranks 19 th out of 181 countries Global Competitiveness Belgium ranks 19 th out of 134 countries 19 19 Quick Links Doing Business > www. doingbusiness. org Competitiveness > www. weforum. org Global Opportunities for business indicators © Lloyd’s > www. lloyds. com/marketintelligence Lloyd’s Business

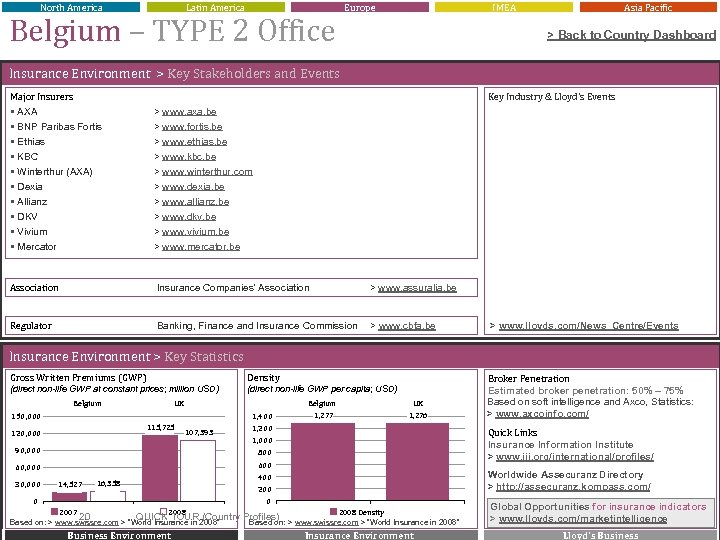

North America Latin America Europe Belgium – TYPE 2 Office IMEA Asia Pacific > Back to Country Dashboard Insurance Environment > Key Stakeholders and Events Major Insurers § AXA Key Industry & Lloyd’s Events > www. axa. be § BNP Paribas Fortis § Ethias § KBC § Winterthur (AXA) § Dexia § Allianz § DKV § Vivium § Mercator > www. fortis. be > www. ethias. be > www. kbc. be > www. winterthur. com > www. dexia. be > www. allianz. be Association Insurance Companies' Association > www. assuralia. be Regulator Banking, Finance and Insurance Commission > www. cbfa. be > www. dkv. be > www. vivium. be > www. mercator. be > www. lloyds. com/News_Centre/Events Insurance Environment > Key Statistics Gross Written Premiums (GWP) Density (direct non-life GWP at constant prices; million USD) (direct non-life GWP per capita; USD) Belgium UK Belgium 150, 000 1, 400 115, 725 120, 000 107, 393 UK 1, 277 1, 276 1, 200 Quick Links Insurance Information Institute > www. iii. org/international/profiles/ 1, 000 90, 000 800 60, 000 600 30, 000 14, 527 16, 358 Worldwide Assecuranz Directory > http: //assecuranz. kompass. com/ 400 200 0 0 2007 2008 20 QUICK TOUR (Country Based on: > www. swissre. com > “World Insurance in 2008” Business Environment Broker Penetration Estimated broker penetration: 50% – 75% Based on soft intelligence and Axco, Statistics: > www. axcoinfo. com/ 2008 Density Global Opportunities for insurance indicators © Lloyd’s > www. lloyds. com/marketintelligence Insurance Environment Lloyd’s Business Profiles) > www. swissre. com > “World Insurance in 2008” Based on:

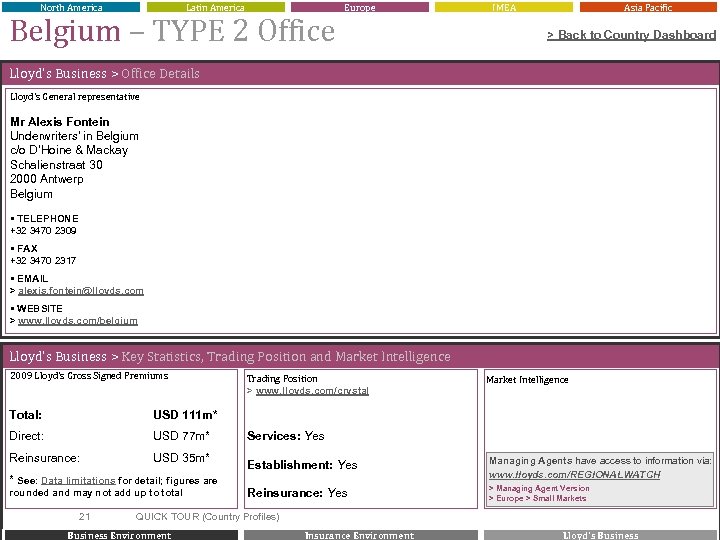

North America Latin America Belgium – TYPE 2 Office Europe IMEA Asia Pacific > Back to Country Dashboard Lloyd’s Business > Office Details Lloyd’s General representative Mr Alexis Fontein Underwriters' in Belgium c/o D’Hoine & Mackay Schalienstraat 30 2000 Antwerp Belgium § TELEPHONE +32 3470 2309 § FAX +32 3470 2317 § EMAIL > alexis. fontein@lloyds. com § WEBSITE > www. lloyds. com/belgium Lloyd’s Business > Key Statistics, Trading Position and Market Intelligence 2009 Lloyd’s Gross Signed Premiums Total: USD 77 m* Reinsurance: USD 35 m* Market Intelligence USD 111 m* Direct: Trading Position > www. lloyds. com/crystal Services: Yes Establishment: Yes Managing Agents have access to information via: www. lloyds. com/REGIONALWATCH Reinsurance: Yes > Managing Agent Version > Europe > Small Markets * See: Data limitations for detail; figures are rounded and may not add up to total 21 QUICK TOUR (Country Profiles) Business Environment © Lloyd’s Insurance Environment Lloyd’s Business

North America Latin America Cyprus – TYPE 2 Office Europe IMEA Asia Pacific Profile Click Box to navigate Business Environment Insurance Environment Lloyd’s Business 22 QUICK TOUR (Country Profiles) à Key strengths and challenges of the economy à Size and growth of the economy à Basic economic indicators à Key insurers à Insurance industry events à Basic insurance indicators à Lloyd’s office details and contacts à Trading position and size of Lloyd’s business à Available market intelligence products © Lloyd’s

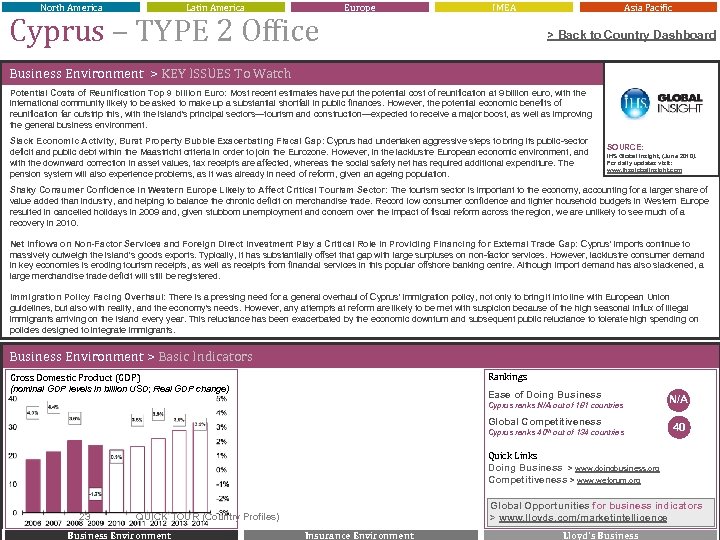

North America Latin America Cyprus – TYPE 2 Office Europe IMEA Asia Pacific > Back to Country Dashboard Business Environment > KEY ISSUES To Watch Potential Costs of Reunification Top 9 billion Euro: Most recent estimates have put the potential cost of reunification at 9 billion euro, with the international community likely to be asked to make up a substantial shortfall in public finances. However, the potential economic benefits of reunification far outstrip this, with the island's principal sectors—tourism and construction—expected to receive a major boost, as well as improving the general business environment. Slack Economic Activity, Burst Property Bubble Exacerbating Fiscal Gap: Cyprus had undertaken aggressive steps to bring its public-sector deficit and public debt within the Maastricht criteria in order to join the Eurozone. However, in the lacklustre European economic environment, and with the downward correction in asset values, tax receipts are affected, whereas the social safety net has required additional expenditure. The pension system will also experience problems, as it was already in need of reform, given an ageing population. SOURCE: IHS Global Insight, (June 2010). For daily updates visit: www. ihsglobalinsight. com Shaky Consumer Confidence in Western Europe Likely to Affect Critical Tourism Sector: The tourism sector is important to the economy, accounting for a larger share of value added than industry, and helping to balance the chronic deficit on merchandise trade. Record low consumer confidence and tighter household budgets in Western Europe resulted in cancelled holidays in 2009 and, given stubborn unemployment and concern over the impact of fiscal reform across the region, we are unlikely to see much of a recovery in 2010. Net Inflows on Non-Factor Services and Foreign Direct Investment Play a Critical Role in Providing Financing for External Trade Gap: Cyprus' imports continue to massively outweigh the island's goods exports. Typically, it has substantially offset that gap with large surpluses on non-factor services. However, lacklustre consumer demand in key economies is eroding tourism receipts, as well as receipts from financial services in this popular offshore banking centre. Although import demand has also slackened, a large merchandise trade deficit will still be registered. Immigration Policy Facing Overhaul: There is a pressing need for a general overhaul of Cyprus' immigration policy, not only to bring it into line with European Union guidelines, but also with reality, and the economy's needs. However, any attempts at reform are likely to be met with suspicion because of the high seasonal influx of illegal immigrants arriving on the island every year. This reluctance has been exacerbated by the economic downturn and subsequent public reluctance to tolerate high spending on policies designed to integrate immigrants. Business Environment > Basic Indicators Rankings Gross Domestic Product (GDP) (nominal GDP levels in billion USD; Real GDP change) Ease of Doing Business Cyprus ranks N/A out of 181 countries Global Competitiveness Cyprus ranks 40 th out of 134 countries N/A 40 Quick Links Doing Business > www. doingbusiness. org Competitiveness > www. weforum. org 23 Global Opportunities for business indicators © Lloyd’s > www. lloyds. com/marketintelligence QUICK TOUR (Country Profiles) Business Environment Insurance Environment Lloyd’s Business

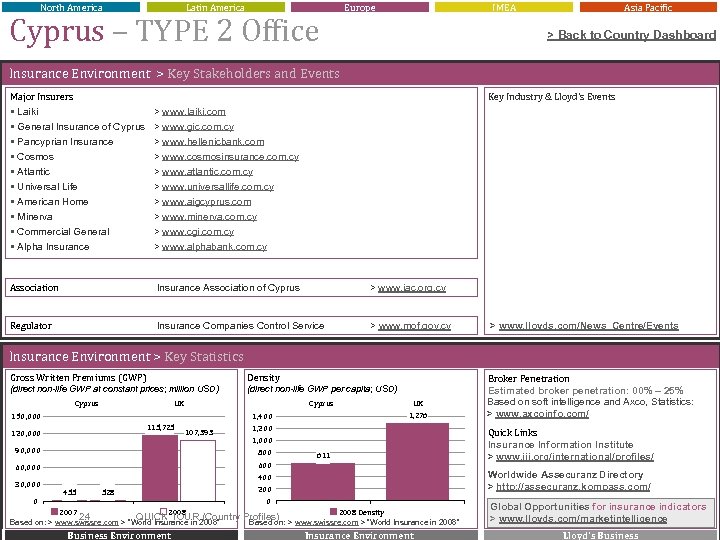

North America Latin America Europe Cyprus – TYPE 2 Office IMEA Asia Pacific > Back to Country Dashboard Insurance Environment > Key Stakeholders and Events Major Insurers § Laiki Key Industry & Lloyd’s Events > www. laiki. com § General Insurance of Cyprus § Pancyprian Insurance § Cosmos § Atlantic § Universal Life § American Home § Minerva § Commercial General § Alpha Insurance > www. gic. com. cy > www. hellenicbank. com > www. cosmosinsurance. com. cy > www. atlantic. com. cy > www. universallife. com. cy > www. aigcyprus. com Association Insurance Association of Cyprus > www. iac. org. cy Regulator Insurance Companies Control Service > www. mof. gov. cy > www. minerva. com. cy > www. cgi. com. cy > www. alphabank. com. cy > www. lloyds. com/News_Centre/Events Insurance Environment > Key Statistics Gross Written Premiums (GWP) Density (direct non-life GWP at constant prices; million USD) (direct non-life GWP per capita; USD) Cyprus UK Cyprus 150, 000 115, 725 120, 000 107, 393 1, 200 800 60, 000 600 0 Quick Links Insurance Information Institute > www. iii. org/international/profiles/ 1, 000 90, 000 30, 000 UK 1, 276 1, 400 611 Worldwide Assecuranz Directory > http: //assecuranz. kompass. com/ 400 455 528 2007 2008 24 QUICK TOUR (Country Based on: > www. swissre. com > “World Insurance in 2008” Business Environment Broker Penetration Estimated broker penetration: 00% – 25% Based on soft intelligence and Axco, Statistics: > www. axcoinfo. com/ 200 0 2008 Density Global Opportunities for insurance indicators © Lloyd’s > www. lloyds. com/marketintelligence Insurance Environment Lloyd’s Business Profiles) > www. swissre. com > “World Insurance in 2008” Based on:

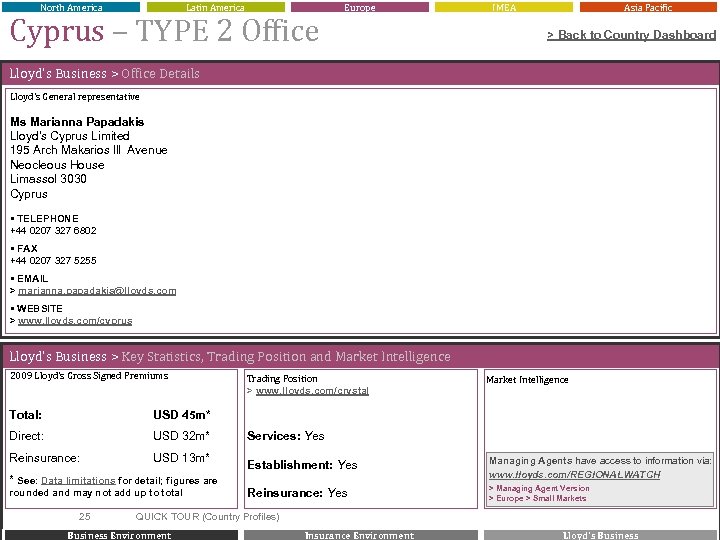

North America Latin America Cyprus – TYPE 2 Office Europe IMEA Asia Pacific > Back to Country Dashboard Lloyd’s Business > Office Details Lloyd’s General representative Ms Marianna Papadakis Lloyd's Cyprus Limited 195 Arch Makarios lll Avenue Neocleous House Limassol 3030 Cyprus § TELEPHONE +44 0207 327 6802 § FAX +44 0207 327 5255 § EMAIL > marianna. papadakis@lloyds. com § WEBSITE > www. lloyds. com/cyprus Lloyd’s Business > Key Statistics, Trading Position and Market Intelligence 2009 Lloyd’s Gross Signed Premiums Total: USD 32 m* Reinsurance: USD 13 m* Market Intelligence USD 45 m* Direct: Trading Position > www. lloyds. com/crystal Services: Yes Establishment: Yes Managing Agents have access to information via: www. lloyds. com/REGIONALWATCH Reinsurance: Yes > Managing Agent Version > Europe > Small Markets * See: Data limitations for detail; figures are rounded and may not add up to total 25 QUICK TOUR (Country Profiles) Business Environment © Lloyd’s Insurance Environment Lloyd’s Business

North America Latin America Europe Denmark – Type 1 Office IMEA Asia Pacific Profile Click Box to navigate Business Environment Insurance Environment Lloyd’s Business 26 QUICK TOUR (Country Profiles) à Key strengths and challenges of the economy à Size and growth of the economy à Basic economic indicators à Key insurers à Insurance industry events à Basic insurance indicators à Lloyd’s office details and contacts à Trading position and size of Lloyd’s business à Available market intelligence products © Lloyd’s

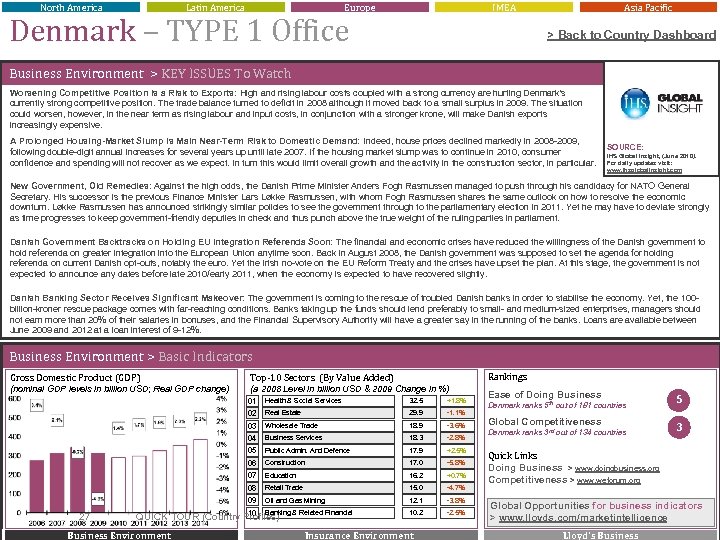

North America Latin America Europe IMEA Denmark – TYPE 1 Office Asia Pacific > Back to Country Dashboard Business Environment > KEY ISSUES To Watch Worsening Competitive Position is a Risk to Exports: High and rising labour costs coupled with a strong currency are hurting Denmark's currently strong competitive position. The trade balance turned to deficit in 2008 although it moved back to a small surplus in 2009. The situation could worsen, however, in the near term as rising labour and input costs, in conjunction with a stronger krone, will make Danish exports increasingly expensive. A Prolonged Housing-Market Slump is Main Near-Term Risk to Domestic Demand: Indeed, house prices declined markedly in 2008 -2009, following double-digit annual increases for several years up until late 2007. If the housing market slump was to continue in 2010, consumer confidence and spending will not recover as we expect. In turn this would limit overall growth and the activity in the construction sector, in particular. SOURCE: IHS Global Insight, (June 2010). For daily updates visit: www. ihsglobalinsight. com New Government, Old Remedies: Against the high odds, the Danish Prime Minister Anders Fogh Rasmussen managed to push through his candidacy for NATO General Secretary. His successor is the previous Finance Minister Lars Løkke Rasmussen, with whom Fogh Rasmussen shares the same outlook on how to resolve the economic downturn. Løkke Rasmussen has announced strikingly similar policies to see the government through to the parliamentary election in 2011. Yet he may have to deviate strongly as time progresses to keep government-friendly deputies in check and thus punch above the true weight of the ruling parties in parliament. Danish Government Backtracks on Holding EU Integration Referenda Soon: The financial and economic crises have reduced the willingness of the Danish government to hold referenda on greater integration into the European Union anytime soon. Back in August 2008, the Danish government was supposed to set the agenda for holding referenda on current Danish opt-outs, notably the euro. Yet the Irish no-vote on the EU Reform Treaty and the crises have upset the plan. At this stage, the government is not expected to announce any dates before late 2010/early 2011, when the economy is expected to have recovered slightly. Danish Banking Sector Receives Significant Makeover: The government is coming to the rescue of troubled Danish banks in order to stabilise the economy. Yet, the 100 billion-kroner rescue package comes with far-reaching conditions. Banks taking up the funds should lend preferably to small- and medium-sized enterprises, managers should not earn more than 20% of their salaries in bonuses, and the Financial Supervisory Authority will have a greater say in the running of the banks. Loans are available between June 2009 and 2012 at a loan interest of 9 -12%. Business Environment > Basic Indicators Gross Domestic Product (GDP) (nominal GDP levels in billion USD; Real GDP change) Rankings Top-10 Sectors (By Value Added) (a 2008 Level in billion USD & 2009 Change in %) 01 32. 5 +1. 8% 02 Real Estate 29. 9 -1. 1% 03 Wholesale Trade 18. 9 -3. 6% 04 Business Services 18. 3 -2. 8% 05 Public Admin. And Defence 17. 9 +2. 5% 06 Construction 17. 0 -5. 8% 07 Education 16. 2 +0. 7% 08 Retail Trade 15. 0 -4. 7% 09 27 Health & Social Services Oil and Gas Mining 12. 1 -3. 8% 10 Banking & Related Financial 10. 2 -2. 5% QUICK TOUR (Country Profiles) Business Environment Insurance Environment Ease of Doing Business Denmark ranks 5 th out of 181 countries Global Competitiveness Denmark ranks 3 rd out of 134 countries 5 3 Quick Links Doing Business > www. doingbusiness. org Competitiveness > www. weforum. org Global Opportunities for business indicators © Lloyd’s > www. lloyds. com/marketintelligence Lloyd’s Business

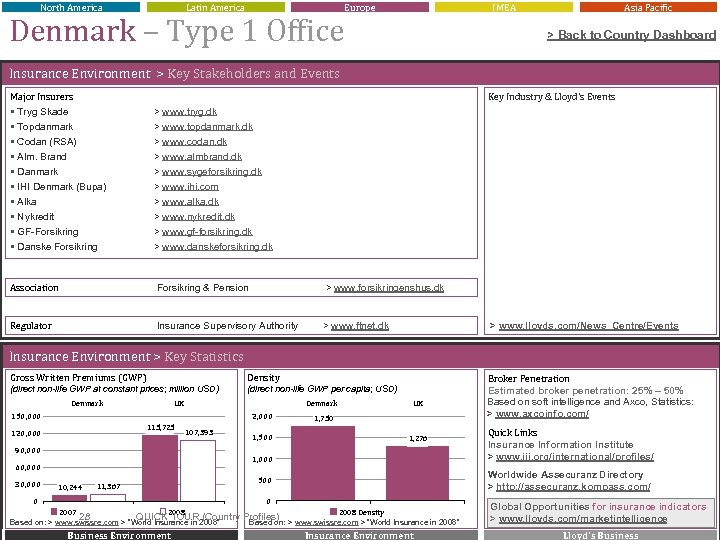

North America Latin America Europe IMEA Denmark – Type 1 Office Asia Pacific > Back to Country Dashboard Insurance Environment > Key Stakeholders and Events Major Insurers § Tryg Skade Key Industry & Lloyd’s Events > www. tryg. dk § Topdanmark § Codan (RSA) § Alm. Brand § Danmark § IHI Denmark (Bupa) § Alka § Nykredit § GF-Forsikring § Danske Forsikring > www. topdanmark. dk > www. codan. dk > www. almbrand. dk > www. sygeforsikring. dk > www. ihi. com > www. alka. dk Association Forsikring & Pension > www. forsikringenshus. dk Regulator Insurance Supervisory Authority > www. ftnet. dk > www. nykredit. dk > www. gf-forsikring. dk > www. danskeforsikring. dk > www. lloyds. com/News_Centre/Events Insurance Environment > Key Statistics Gross Written Premiums (GWP) Density (direct non-life GWP at constant prices; million USD) (direct non-life GWP per capita; USD) Denmark UK Denmark 150, 000 2, 000 115, 725 120, 000 107, 393 90, 000 1, 750 1, 500 1, 276 1, 000 60, 000 30, 000 UK 10, 244 11, 367 2008 28 QUICK TOUR (Country Based on: > www. swissre. com > “World Insurance in 2008” Business Environment Quick Links Insurance Information Institute > www. iii. org/international/profiles/ Worldwide Assecuranz Directory > http: //assecuranz. kompass. com/ 500 0 0 Broker Penetration Estimated broker penetration: 25% – 50% Based on soft intelligence and Axco, Statistics: > www. axcoinfo. com/ 2008 Density Global Opportunities for insurance indicators © Lloyd’s > www. lloyds. com/marketintelligence Insurance Environment Lloyd’s Business Profiles) > www. swissre. com > “World Insurance in 2008” Based on:

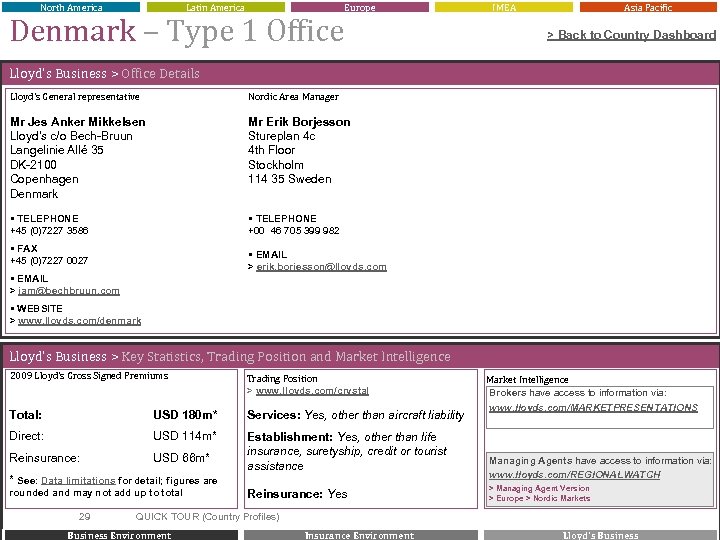

North America Latin America Europe Denmark – Type 1 Office IMEA Asia Pacific > Back to Country Dashboard Lloyd’s Business > Office Details Lloyd’s General representative Nordic Area Manager Mr Jes Anker Mikkelsen Lloyd’s c/o Bech-Bruun Langelinie Allé 35 DK-2100 Copenhagen Denmark Mr Erik Borjesson Stureplan 4 c 4 th Floor Stockholm 114 35 Sweden § TELEPHONE +45 (0)7227 3586 § TELEPHONE +00 46 705 399 982 § FAX +45 (0)7227 0027 § EMAIL > erik. borjesson@lloyds. com § EMAIL > jam@bechbruun. com § WEBSITE > www. lloyds. com/denmark Lloyd’s Business > Key Statistics, Trading Position and Market Intelligence 2009 Lloyd’s Gross Signed Premiums Trading Position > www. lloyds. com/crystal Total: USD 180 m* Services: Yes, other than aircraft liability Direct: USD 114 m* Reinsurance: USD 66 m* Establishment: Yes, other than life insurance, suretyship, credit or tourist assistance * See: Data limitations for detail; figures are rounded and may not add up to total 29 Reinsurance: Yes QUICK TOUR (Country Profiles) Business Environment Market Intelligence Brokers have access to information via: www. lloyds. com/MARKETPRESENTATIONS Managing Agents have access to information via: www. lloyds. com/REGIONALWATCH > Managing Agent Version > Europe > Nordic Markets © Lloyd’s Insurance Environment Lloyd’s Business

North America Latin America France – Type 3 Office Europe IMEA Asia Pacific Profile Click Box to navigate Business Environment Insurance Environment Lloyd’s Business 30 QUICK TOUR (Country Profiles) à Key strengths and challenges of the economy à Size and growth of the economy à Basic economic indicators à Key insurers à Insurance industry events à Basic insurance indicators à Lloyd’s office details and contacts à Trading position and size of Lloyd’s business à Available market intelligence products © Lloyd’s

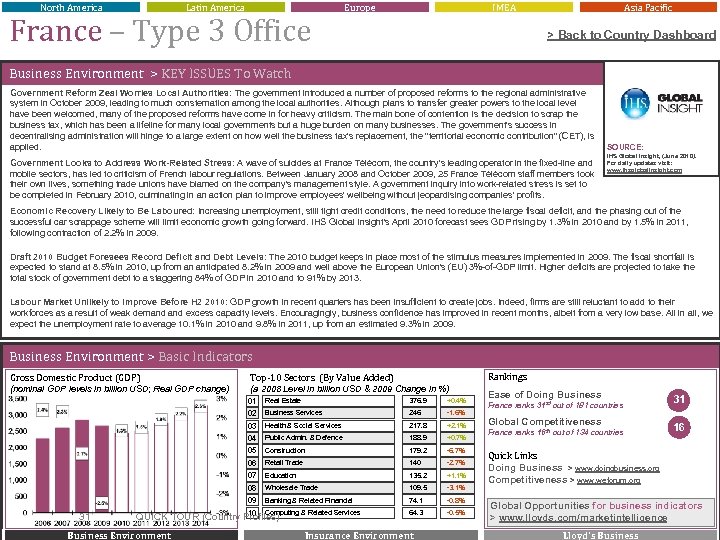

North America Latin America France – Type 3 Office Europe IMEA Asia Pacific > Back to Country Dashboard Business Environment > KEY ISSUES To Watch Government Reform Zeal Worries Local Authorities: The government introduced a number of proposed reforms to the regional administrative system in October 2009, leading to much consternation among the local authorities. Although plans to transfer greater powers to the local level have been welcomed, many of the proposed reforms have come in for heavy criticism. The main bone of contention is the decision to scrap the business tax, which has been a lifeline for many local governments but a huge burden on many businesses. The government's success in decentralising administration will hinge to a large extent on how well the business tax's replacement, the "territorial economic contribution" (CET), is applied. Government Looks to Address Work-Related Stress: A wave of suicides at France Télécom, the country's leading operator in the fixed-line and mobile sectors, has led to criticism of French labour regulations. Between January 2008 and October 2009, 25 France Télécom staff members took their own lives, something trade unions have blamed on the company's management style. A government inquiry into work-related stress is set to be completed in February 2010, culminating in an action plan to improve employees' wellbeing without jeopardising companies' profits. SOURCE: IHS Global Insight, (June 2010). For daily updates visit: www. ihsglobalinsight. com Economic Recovery Likely to Be Laboured: Increasing unemployment, still tight credit conditions, the need to reduce the large fiscal deficit, and the phasing out of the successful car scrappage scheme will limit economic growth going forward. IHS Global Insight's April 2010 forecast sees GDP rising by 1. 3% in 2010 and by 1. 5% in 2011, following contraction of 2. 2% in 2009. Draft 2010 Budget Foresees Record Deficit and Debt Levels: The 2010 budget keeps in place most of the stimulus measures implemented in 2009. The fiscal shortfall is expected to stand at 8. 5% in 2010, up from an anticipated 8. 2% in 2009 and well above the European Union's (EU) 3%-of-GDP limit. Higher deficits are projected to take the total stock of government debt to a staggering 84% of GDP in 2010 and to 91% by 2013. Labour Market Unlikely to Improve Before H 2 2010: GDP growth in recent quarters has been insufficient to create jobs. Indeed, firms are still reluctant to add to their workforces as a result of weak demand excess capacity levels. Encouragingly, business confidence has improved in recent months, albeit from a very low base. All in all, we expect the unemployment rate to average 10. 1% in 2010 and 9. 8% in 2011, up from an estimated 9. 3% in 2009. Business Environment > Basic Indicators Gross Domestic Product (GDP) (nominal GDP levels in billion USD; Real GDP change) Rankings Top-10 Sectors (By Value Added) (a 2008 Level in billion USD & 2009 Change in %) 01 376. 9 +0. 4% 02 Business Services 246 -1. 6% 03 Health & Social Services 217. 8 +2. 1% 04 Public Admin. & Defence 188. 9 +0. 7% 05 Construction 179. 2 -6. 7% 06 Retail Trade 140 -2. 7% 07 Education 135. 2 +1. 1% 08 Wholesale Trade 109. 5 -3. 1% 09 31 Real Estate Banking & Related Financial 74. 1 -0. 8% 10 Computing & Related Services 64. 3 -0. 5% QUICK TOUR (Country Profiles) Business Environment Insurance Environment Ease of Doing Business France ranks 31 st out of 181 countries Global Competitiveness France ranks 16 th out of 134 countries 31 16 Quick Links Doing Business > www. doingbusiness. org Competitiveness > www. weforum. org Global Opportunities for business indicators © Lloyd’s > www. lloyds. com/marketintelligence Lloyd’s Business

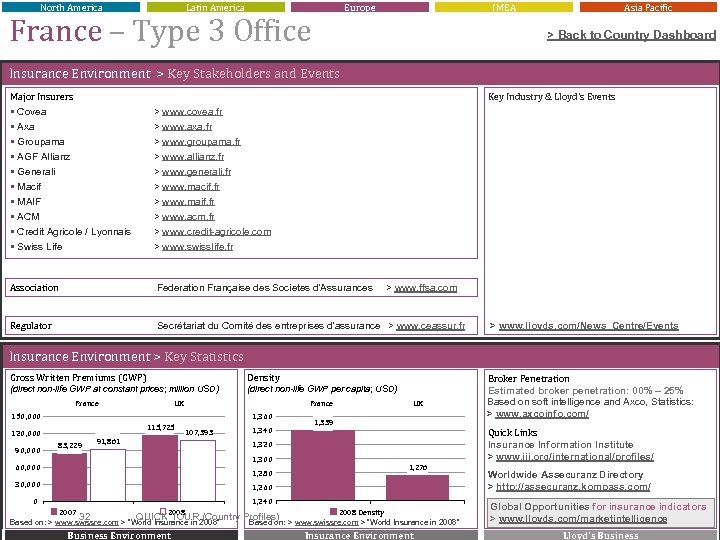

North America Latin America Europe France – Type 3 Office IMEA Asia Pacific > Back to Country Dashboard Insurance Environment > Key Stakeholders and Events Major Insurers § Covea Key Industry & Lloyd’s Events > www. covea. fr § Axa § Groupama § AGF Allianz § Generali § Macif § MAIF § ACM § Credit Agricole / Lyonnais § Swiss Life > www. axa. fr > www. groupama. fr > www. allianz. fr > www. generali. fr > www. macif. fr > www. maif. fr Association Federation Française des Societes d'Assurances Regulator Secrétariat du Comité des entreprises d'assurance > www. ceassur. fr > www. acm. fr > www. credit-agricole. com > www. swisslife. fr > www. ffsa. com > www. lloyds. com/News_Centre/Events Insurance Environment > Key Statistics Gross Written Premiums (GWP) Density (direct non-life GWP at constant prices; million USD) (direct non-life GWP per capita; USD) France UK France 150, 000 1, 360 115, 725 120, 000 90, 000 83, 229 91, 861 107, 393 1, 340 UK 1, 339 Quick Links Insurance Information Institute > www. iii. org/international/profiles/ 1, 320 1, 300 60, 000 1, 276 1, 280 30, 000 1, 260 1, 240 0 2007 2008 32 QUICK TOUR (Country Based on: > www. swissre. com > “World Insurance in 2008” Business Environment Broker Penetration Estimated broker penetration: 00% – 25% Based on soft intelligence and Axco, Statistics: > www. axcoinfo. com/ Worldwide Assecuranz Directory > http: //assecuranz. kompass. com/ 2008 Density Global Opportunities for insurance indicators © Lloyd’s > www. lloyds. com/marketintelligence Insurance Environment Lloyd’s Business Profiles) > www. swissre. com > “World Insurance in 2008” Based on:

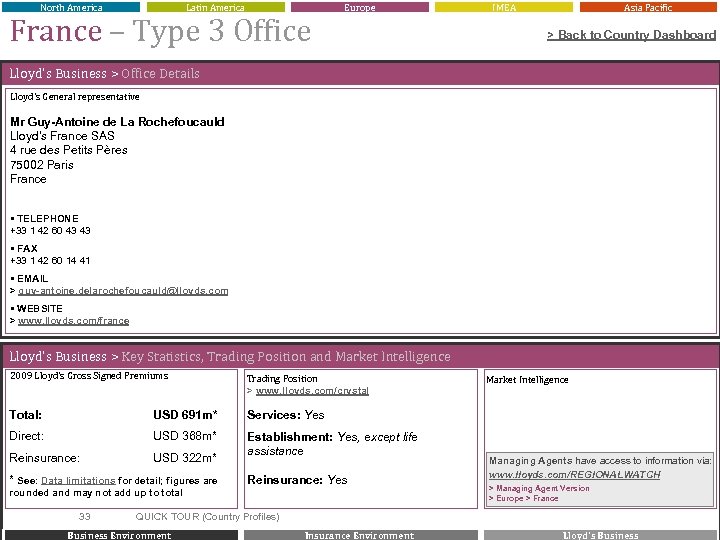

North America Latin America France – Type 3 Office Europe IMEA Asia Pacific > Back to Country Dashboard Lloyd’s Business > Office Details Lloyd’s General representative Mr Guy-Antoine de La Rochefoucauld Lloyd's France SAS 4 rue des Petits Pères 75002 Paris France § TELEPHONE +33 1 42 60 43 43 § FAX +33 1 42 60 14 41 § EMAIL > guy-antoine. delarochefoucauld@lloyds. com § WEBSITE > www. lloyds. com/france Lloyd’s Business > Key Statistics, Trading Position and Market Intelligence 2009 Lloyd’s Gross Signed Premiums Trading Position > www. lloyds. com/crystal Total: USD 691 m* Services: Yes Direct: USD 368 m* Reinsurance: USD 322 m* Establishment: Yes, except life assistance * See: Data limitations for detail; figures are Reinsurance: Yes rounded and may not add up to total 33 QUICK TOUR (Country Profiles) Business Environment Market Intelligence Managing Agents have access to information via: www. lloyds. com/REGIONALWATCH > Managing Agent Version > Europe > France © Lloyd’s Insurance Environment Lloyd’s Business

North America Latin America Europe Germany – TYPE 3 Office IMEA Asia Pacific Profile Click Box to navigate Business Environment Insurance Environment Lloyd’s Business 34 QUICK TOUR (Country Profiles) à Key strengths and challenges of the economy à Size and growth of the economy à Basic economic indicators à Key insurers à Insurance industry events à Basic insurance indicators à Lloyd’s office details and contacts à Trading position and size of Lloyd’s business à Available market intelligence products © Lloyd’s

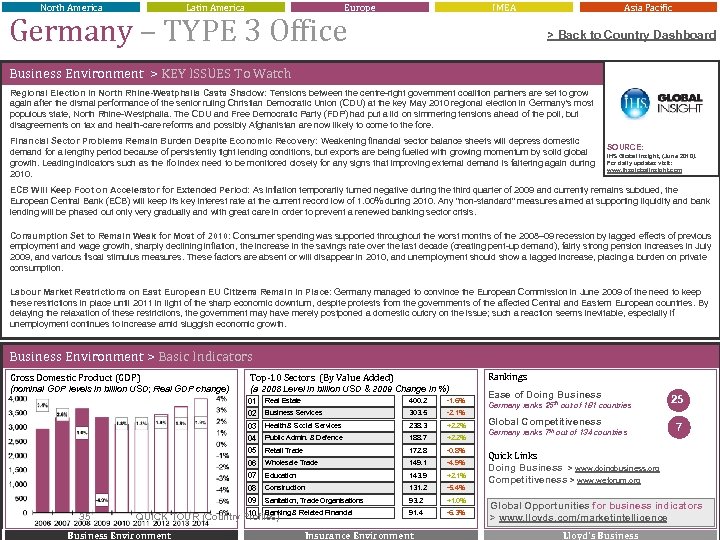

North America Latin America Europe IMEA Germany – TYPE 3 Office Asia Pacific > Back to Country Dashboard Business Environment > KEY ISSUES To Watch Regional Election in North Rhine-Westphalia Casts Shadow: Tensions between the centre-right government coalition partners are set to grow again after the dismal performance of the senior ruling Christian Democratic Union (CDU) at the key May 2010 regional election in Germany's most populous state, North Rhine-Westphalia. The CDU and Free Democratic Party (FDP) had put a lid on simmering tensions ahead of the poll, but disagreements on tax and health-care reforms and possibly Afghanistan are now likely to come to the fore. Financial Sector Problems Remain Burden Despite Economic Recovery: Weakening financial sector balance sheets will depress domestic demand for a lengthy period because of persistently tight lending conditions, but exports are being fuelled with growing momentum by solid global growth. Leading indicators such as the Ifo index need to be monitored closely for any signs that improving external demand is faltering again during 2010. SOURCE: IHS Global Insight, (June 2010). For daily updates visit: www. ihsglobalinsight. com ECB Will Keep Foot on Accelerator for Extended Period: As inflation temporarily turned negative during the third quarter of 2009 and currently remains subdued, the European Central Bank (ECB) will keep its key interest rate at the current record low of 1. 00% during 2010. Any "non-standard" measures aimed at supporting liquidity and bank lending will be phased out only very gradually and with great care in order to prevent a renewed banking sector crisis. Consumption Set to Remain Weak for Most of 2010: Consumer spending was supported throughout the worst months of the 2008– 09 recession by lagged effects of previous employment and wage growth, sharply declining inflation, the increase in the savings rate over the last decade (creating pent-up demand), fairly strong pension increases in July 2009, and various fiscal stimulus measures. These factors are absent or will disappear in 2010, and unemployment should show a lagged increase, placing a burden on private consumption. Labour Market Restrictions on East European EU Citizens Remain in Place: Germany managed to convince the European Commission in June 2009 of the need to keep these restrictions in place until 2011 in light of the sharp economic downturn, despite protests from the governments of the affected Central and Eastern European countries. By delaying the relaxation of these restrictions, the government may have merely postponed a domestic outcry on the issue; such a reaction seems inevitable, especially if unemployment continues to increase amid sluggish economic growth. Business Environment > Basic Indicators Gross Domestic Product (GDP) (nominal GDP levels in billion USD; Real GDP change) Rankings Top-10 Sectors (By Value Added) (a 2008 Level in billion USD & 2009 Change in %) 01 400. 2 -1. 6% 02 Business Services 303. 5 -2. 1% 03 Health & Social Services 238. 3 +2. 2% 04 Public Admin. & Defence 188. 7 +2. 2% 05 Retail Trade 172. 8 -0. 8% 06 Wholesale Trade 149. 1 -4. 9% 07 Education 143. 9 +2. 1% 08 Construction 131. 2 -5. 4% 09 35 Real Estate Sanitation, Trade Organisations 93. 2 +1. 0% 10 Banking & Related Financial 91. 4 -6. 3% QUICK TOUR (Country Profiles) Business Environment Insurance Environment Ease of Doing Business Germany ranks 25 th out of 181 countries Global Competitiveness Germany ranks 7 th out of 134 countries 25 7 Quick Links Doing Business > www. doingbusiness. org Competitiveness > www. weforum. org Global Opportunities for business indicators © Lloyd’s > www. lloyds. com/marketintelligence Lloyd’s Business

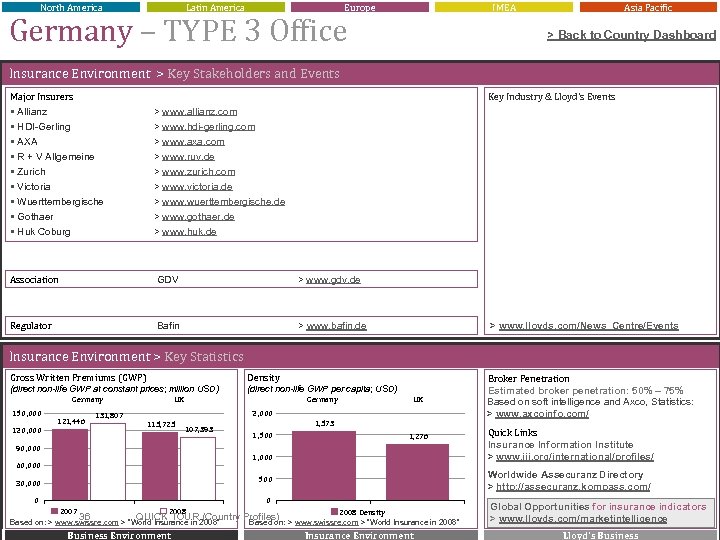

North America Latin America Europe IMEA Germany – TYPE 3 Office Asia Pacific > Back to Country Dashboard Insurance Environment > Key Stakeholders and Events Major Insurers § Allianz Key Industry & Lloyd’s Events > www. allianz. com § HDI-Gerling § AXA § R + V Allgemeine § Zurich § Victoria § Wuerttembergische § Gothaer § Huk Coburg > www. hdi-gerling. com > www. axa. com > www. ruv. de > www. zurich. com > www. victoria. de > www. wuerttembergische. de Association GDV > www. gdv. de Regulator Bafin > www. bafin. de > www. gothaer. de > www. huk. de > www. lloyds. com/News_Centre/Events Insurance Environment > Key Statistics Gross Written Premiums (GWP) Density (direct non-life GWP at constant prices; million USD) (direct non-life GWP per capita; USD) Germany 150, 000 121, 446 131, 807 UK Germany UK 2, 000 115, 725 107, 393 90, 000 1, 573 1, 500 1, 276 1, 000 60, 000 0 0 2007 2008 36 QUICK TOUR (Country Based on: > www. swissre. com > “World Insurance in 2008” Business Environment Quick Links Insurance Information Institute > www. iii. org/international/profiles/ Worldwide Assecuranz Directory > http: //assecuranz. kompass. com/ 500 30, 000 Broker Penetration Estimated broker penetration: 50% – 75% Based on soft intelligence and Axco, Statistics: > www. axcoinfo. com/ 2008 Density Profiles) > www. swissre. com > “World Insurance in 2008” Based on: Insurance Environment Global Opportunities for insurance indicators © Lloyd’s > www. lloyds. com/marketintelligence Lloyd’s Business

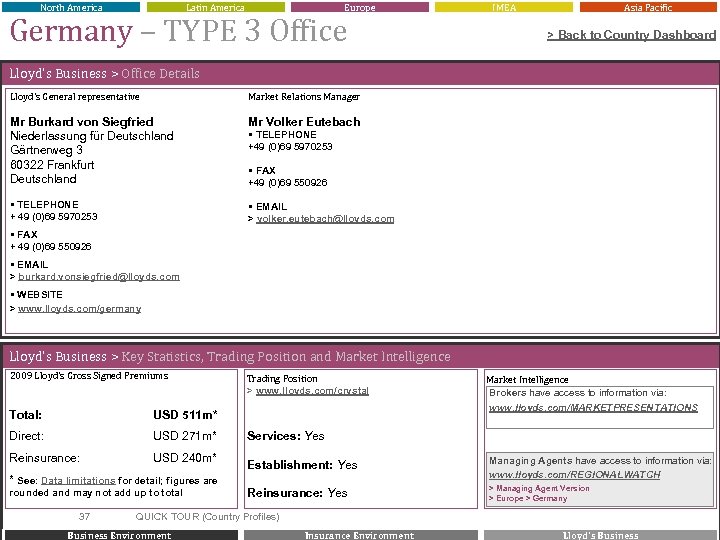

North America Latin America Europe Germany – TYPE 3 Office IMEA Asia Pacific > Back to Country Dashboard Lloyd’s Business > Office Details Lloyd’s General representative Market Relations Manager Mr Burkard von Siegfried Niederlassung für Deutschland Gärtnerweg 3 60322 Frankfurt Deutschland Mr Volker Eutebach § TELEPHONE + 49 (0)69 5970253 § EMAIL > volker. eutebach@lloyds. com § TELEPHONE +49 (0)69 5970253 § FAX +49 (0)69 550926 § FAX + 49 (0)69 550926 § EMAIL > burkard. vonsiegfried@lloyds. com § WEBSITE > www. lloyds. com/germany Lloyd’s Business > Key Statistics, Trading Position and Market Intelligence 2009 Lloyd’s Gross Signed Premiums Total: USD 511 m* Direct: USD 271 m* Reinsurance: USD 240 m* Trading Position > www. lloyds. com/crystal Services: Yes Establishment: Yes Managing Agents have access to information via: www. lloyds. com/REGIONALWATCH Reinsurance: Yes > Managing Agent Version > Europe > Germany * See: Data limitations for detail; figures are rounded and may not add up to total 37 QUICK TOUR (Country Profiles) Business Environment Market Intelligence Brokers have access to information via: www. lloyds. com/MARKETPRESENTATIONS © Lloyd’s Insurance Environment Lloyd’s Business

North America Latin America Greece – Type 2 Office Europe IMEA Asia Pacific Profile Click Box to navigate Business Environment Insurance Environment Lloyd’s Business 38 QUICK TOUR (Country Profiles) à Key strengths and challenges of the economy à Size and growth of the economy à Basic economic indicators à Key insurers à Insurance industry events à Basic insurance indicators à Lloyd’s office details and contacts à Trading position and size of Lloyd’s business à Available market intelligence products © Lloyd’s

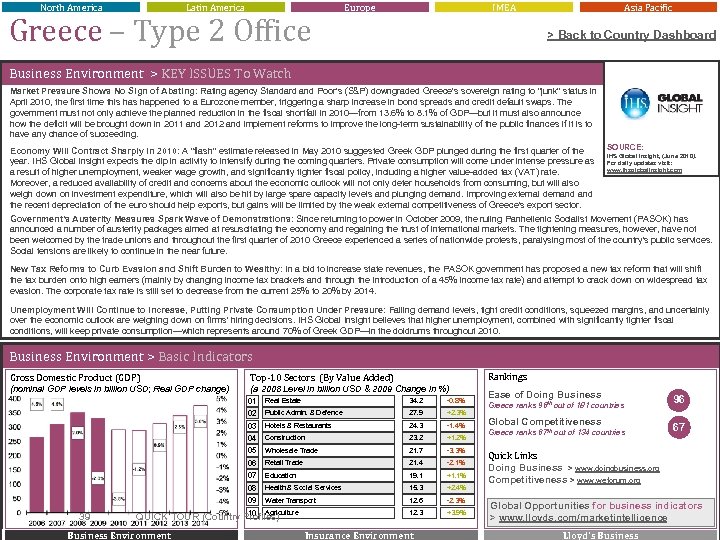

North America Latin America Greece – Type 2 Office Europe IMEA Asia Pacific > Back to Country Dashboard Business Environment > KEY ISSUES To Watch Market Pressure Shows No Sign of Abating: Rating agency Standard and Poor's (S&P) downgraded Greece's sovereign rating to "junk" status in April 2010, the first time this happened to a Eurozone member, triggering a sharp increase in bond spreads and credit default swaps. The government must not only achieve the planned reduction in the fiscal shortfall in 2010—from 13. 6% to 8. 1% of GDP—but it must also announce how the deficit will be brought down in 2011 and 2012 and implement reforms to improve the long-term sustainability of the public finances if it is to have any chance of succeeding. Economy Will Contract Sharply in 2010: A "flash" estimate released in May 2010 suggested Greek GDP plunged during the first quarter of the year. IHS Global Insight expects the dip in activity to intensify during the coming quarters. Private consumption will come under intense pressure as a result of higher unemployment, weaker wage growth, and significantly tighter fiscal policy, including a higher value-added tax (VAT) rate. Moreover, a reduced availability of credit and concerns about the economic outlook will not only deter households from consuming, but will also weigh down on investment expenditure, which will also be hit by large spare capacity levels and plunging demand. Improving external demand the recent depreciation of the euro should help exports, but gains will be limited by the weak external competitiveness of Greece's export sector. SOURCE: IHS Global Insight, (June 2010). For daily updates visit: www. ihsglobalinsight. com Government's Austerity Measures Spark Wave of Demonstrations: Since returning to power in October 2009, the ruling Panhellenic Socialist Movement (PASOK) has announced a number of austerity packages aimed at resuscitating the economy and regaining the trust of international markets. The tightening measures, however, have not been welcomed by the trade unions and throughout the first quarter of 2010 Greece experienced a series of nationwide protests, paralysing most of the country's public services. Social tensions are likely to continue in the near future. New Tax Reforms to Curb Evasion and Shift Burden to Wealthy: In a bid to increase state revenues, the PASOK government has proposed a new tax reform that will shift the tax burden onto high earners (mainly by changing income tax brackets and through the introduction of a 45% income tax rate) and attempt to crack down on widespread tax evasion. The corporate tax rate is still set to decrease from the current 25% to 20% by 2014. Unemployment Will Continue to Increase, Putting Private Consumption Under Pressure: Falling demand levels, tight credit conditions, squeezed margins, and uncertainly over the economic outlook are weighing down on firms' hiring decisions. IHS Global Insight believes that higher unemployment, combined with significantly tighter fiscal conditions, will keep private consumption—which represents around 70% of Greek GDP—in the doldrums throughout 2010. Business Environment > Basic Indicators Gross Domestic Product (GDP) (nominal GDP levels in billion USD; Real GDP change) Rankings Top-10 Sectors (By Value Added) (a 2008 Level in billion USD & 2009 Change in %) 01 34. 2 -0. 8% 02 Public Admin. & Defence 27. 9 +2. 3% 03 Hotels & Restaurants 24. 3 -1. 4% 04 Construction 23. 2 +1. 2% 05 Wholesale Trade 21. 7 -3. 3% 06 Retail Trade 21. 4 -2. 1% 07 Education 19. 1 +1. 1% 08 Health & Social Services 15. 3 +2. 4% 09 39 Real Estate Water Transport 12. 6 -2. 3% 10 Agriculture 12. 3 +3. 9% QUICK TOUR (Country Profiles) Business Environment Insurance Environment Ease of Doing Business Greece ranks 96 th out of 181 countries Global Competitiveness Greece ranks 67 th out of 134 countries 96 67 Quick Links Doing Business > www. doingbusiness. org Competitiveness > www. weforum. org Global Opportunities for business indicators © Lloyd’s > www. lloyds. com/marketintelligence Lloyd’s Business

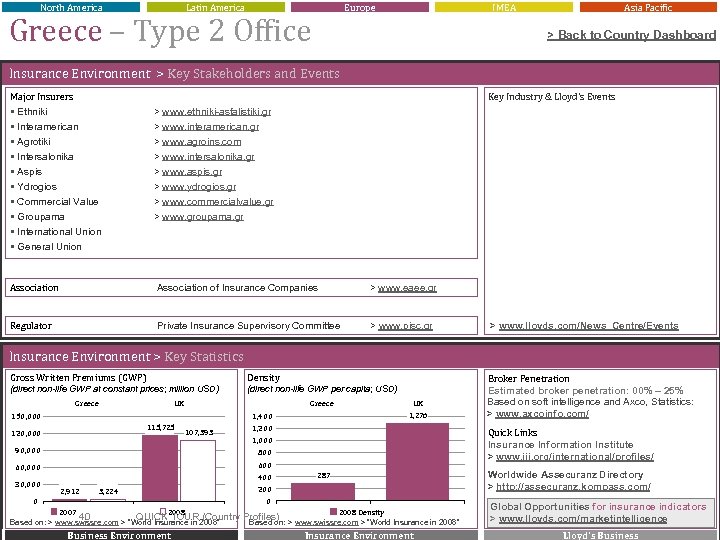

North America Latin America Europe Greece – Type 2 Office IMEA Asia Pacific > Back to Country Dashboard Insurance Environment > Key Stakeholders and Events Major Insurers § Ethniki Key Industry & Lloyd’s Events > www. ethniki-asfalistiki. gr § Interamerican § Agrotiki § Intersalonika § Aspis § Ydrogios § Commercial Value § Groupama § International Union § General Union > www. interamerican. gr > www. agroins. com > www. intersalonika. gr > www. aspis. gr > www. ydrogios. gr > www. commercialvalue. gr Association of Insurance Companies > www. eaee. gr Regulator Private Insurance Supervisory Committee > www. pisc. gr > www. groupama. gr > www. lloyds. com/News_Centre/Events Insurance Environment > Key Statistics Gross Written Premiums (GWP) Density (direct non-life GWP at constant prices; million USD) (direct non-life GWP per capita; USD) Greece UK Greece 150, 000 UK 1, 276 1, 400 115, 725 120, 000 107, 393 1, 200 Quick Links Insurance Information Institute > www. iii. org/international/profiles/ 1, 000 90, 000 800 60, 000 600 30, 000 400 2, 912 3, 224 Worldwide Assecuranz Directory > http: //assecuranz. kompass. com/ 287 200 0 0 2007 2008 40 QUICK TOUR (Country Based on: > www. swissre. com > “World Insurance in 2008” Business Environment Broker Penetration Estimated broker penetration: 00% – 25% Based on soft intelligence and Axco, Statistics: > www. axcoinfo. com/ 2008 Density Global Opportunities for insurance indicators © Lloyd’s > www. lloyds. com/marketintelligence Insurance Environment Lloyd’s Business Profiles) > www. swissre. com > “World Insurance in 2008” Based on:

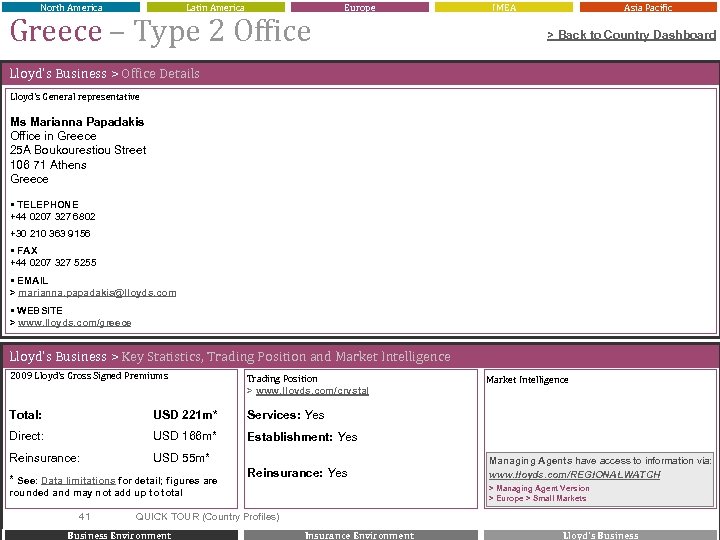

North America Latin America Greece – Type 2 Office Europe IMEA Asia Pacific > Back to Country Dashboard Lloyd’s Business > Office Details Lloyd’s General representative Ms Marianna Papadakis Office in Greece 25 A Boukourestiou Street 106 71 Athens Greece § TELEPHONE +44 0207 327 6802 +30 210 363 9156 § FAX +44 0207 327 5255 § EMAIL > marianna. papadakis@lloyds. com § WEBSITE > www. lloyds. com/greece Lloyd’s Business > Key Statistics, Trading Position and Market Intelligence 2009 Lloyd’s Gross Signed Premiums Trading Position > www. lloyds. com/crystal Total: USD 221 m* Services: Yes Direct: USD 166 m* Establishment: Yes Reinsurance: USD 55 m* * See: Data limitations for detail; figures are Reinsurance: Yes QUICK TOUR (Country Profiles) Business Environment Managing Agents have access to information via: www. lloyds. com/REGIONALWATCH > Managing Agent Version > Europe > Small Markets rounded and may not add up to total 41 Market Intelligence © Lloyd’s Insurance Environment Lloyd’s Business

North America Latin America Ireland – Type 3 Office Europe IMEA Asia Pacific Profile Click Box to navigate Business Environment Insurance Environment Lloyd’s Business 42 QUICK TOUR (Country Profiles) à Key strengths and challenges of the economy à Size and growth of the economy à Basic economic indicators à Key insurers à Insurance industry events à Basic insurance indicators à Lloyd’s office details and contacts à Trading position and size of Lloyd’s business à Available market intelligence products © Lloyd’s

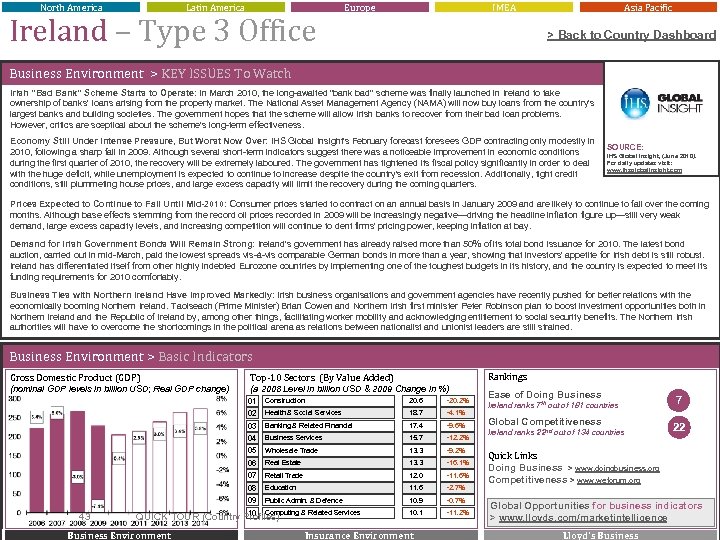

North America Latin America Ireland – Type 3 Office Europe IMEA Asia Pacific > Back to Country Dashboard Business Environment > KEY ISSUES To Watch Irish "Bad Bank" Scheme Starts to Operate: In March 2010, the long-awaited "bank bad" scheme was finally launched in Ireland to take ownership of banks' loans arising from the property market. The National Asset Management Agency (NAMA) will now buy loans from the country's largest banks and building societies. The government hopes that the scheme will allow Irish banks to recover from their bad loan problems. However, critics are sceptical about the scheme's long-term effectiveness. Economy Still Under Intense Pressure, But Worst Now Over: IHS Global Insight's February forecast foresees GDP contracting only modestly in 2010, following a sharp fall in 2009. Although several short-term indicators suggest there was a noticeable improvement in economic conditions during the first quarter of 2010, the recovery will be extremely laboured. The government has tightened its fiscal policy significantly in order to deal with the huge deficit, while unemployment is expected to continue to increase despite the country's exit from recession. Additionally, tight credit conditions, still plummeting house prices, and large excess capacity will limit the recovery during the coming quarters. SOURCE: IHS Global Insight, (June 2010). For daily updates visit: www. ihsglobalinsight. com Prices Expected to Continue to Fall Until Mid-2010: Consumer prices started to contract on an annual basis in January 2009 and are likely to continue to fall over the coming months. Although base effects stemming from the record oil prices recorded in 2009 will be increasingly negative—driving the headline inflation figure up—still very weak demand, large excess capacity levels, and increasing competition will continue to dent firms' pricing power, keeping inflation at bay. Demand for Irish Government Bonds Will Remain Strong: Ireland's government has already raised more than 50% of its total bond issuance for 2010. The latest bond auction, carried out in mid-March, paid the lowest spreads vis-à-vis comparable German bonds in more than a year, showing that investors' appetite for Irish debt is still robust. Ireland has differentiated itself from other highly indebted Eurozone countries by implementing one of the toughest budgets in its history, and the country is expected to meet its funding requirements for 2010 comfortably. Business Ties with Northern Ireland Have Improved Markedly: Irish business organisations and government agencies have recently pushed for better relations with the economically booming Northern Ireland. Taoiseach (Prime Minister) Brian Cowen and Northern Irish first minister Peter Robinson plan to boost investment opportunities both in Northern Ireland the Republic of Ireland by, among other things, facilitating worker mobility and acknowledging entitlement to social security benefits. The Northern Irish authorities will have to overcome the shortcomings in the political arena as relations between nationalist and unionist leaders are still strained. Business Environment > Basic Indicators Gross Domestic Product (GDP) (nominal GDP levels in billion USD; Real GDP change) Rankings Top-10 Sectors (By Value Added) (a 2008 Level in billion USD & 2009 Change in %) 01 20. 6 -20. 2% 02 Health & Social Services 18. 7 -4. 1% 03 Banking & Related Financial 17. 4 -9. 6% 04 Business Services 15. 7 -12. 2% 05 Wholesale Trade 13. 3 -9. 2% 06 Real Estate 13. 3 -16. 1% 07 Retail Trade 12. 0 -11. 6% 08 Education 11. 6 -2. 7% 09 43 Construction Public Admin. & Defence 10. 9 -0. 7% 10 Computing & Related Services 10. 1 -11. 2% QUICK TOUR (Country Profiles) Business Environment Insurance Environment Ease of Doing Business Ireland ranks 7 th out of 181 countries Global Competitiveness Ireland ranks 22 nd out of 134 countries 7 22 Quick Links Doing Business > www. doingbusiness. org Competitiveness > www. weforum. org Global Opportunities for business indicators © Lloyd’s > www. lloyds. com/marketintelligence Lloyd’s Business

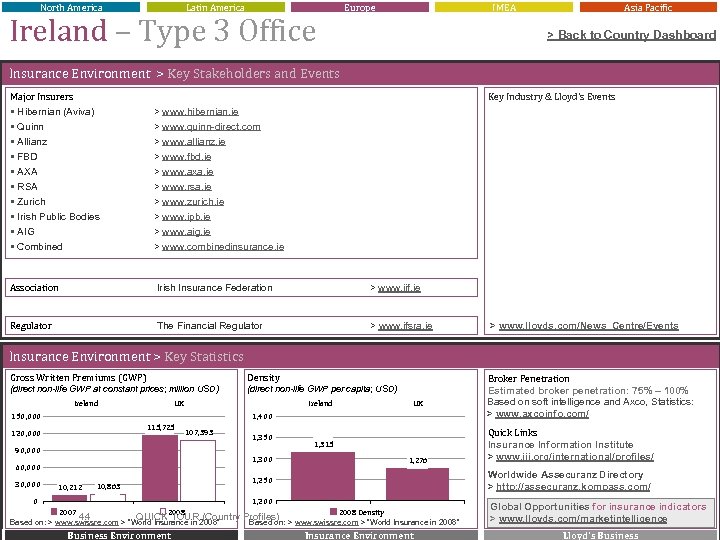

North America Latin America Europe Ireland – Type 3 Office IMEA Asia Pacific > Back to Country Dashboard Insurance Environment > Key Stakeholders and Events Major Insurers § Hibernian (Aviva) Key Industry & Lloyd’s Events > www. hibernian. ie § Quinn § Allianz § FBD § AXA § RSA § Zurich § Irish Public Bodies § AIG § Combined > www. quinn-direct. com > www. allianz. ie > www. fbd. ie > www. axa. ie > www. rsa. ie > www. zurich. ie Association Irish Insurance Federation > www. iif. ie Regulator The Financial Regulator > www. ifsra. ie > www. ipb. ie > www. aig. ie > www. combinedinsurance. ie > www. lloyds. com/News_Centre/Events Insurance Environment > Key Statistics Gross Written Premiums (GWP) Density (direct non-life GWP at constant prices; million USD) (direct non-life GWP per capita; USD) Ireland UK Ireland 150, 000 115, 725 120, 000 107, 393 90, 000 1, 350 1, 315 1, 300 60, 000 30, 000 UK 1, 400 10, 212 10, 863 1, 276 2007 2008 44 QUICK TOUR (Country Based on: > www. swissre. com > “World Insurance in 2008” Business Environment Quick Links Insurance Information Institute > www. iii. org/international/profiles/ Worldwide Assecuranz Directory > http: //assecuranz. kompass. com/ 1, 250 1, 200 0 Broker Penetration Estimated broker penetration: 75% – 100% Based on soft intelligence and Axco, Statistics: > www. axcoinfo. com/ 2008 Density Global Opportunities for insurance indicators © Lloyd’s > www. lloyds. com/marketintelligence Insurance Environment Lloyd’s Business Profiles) > www. swissre. com > “World Insurance in 2008” Based on:

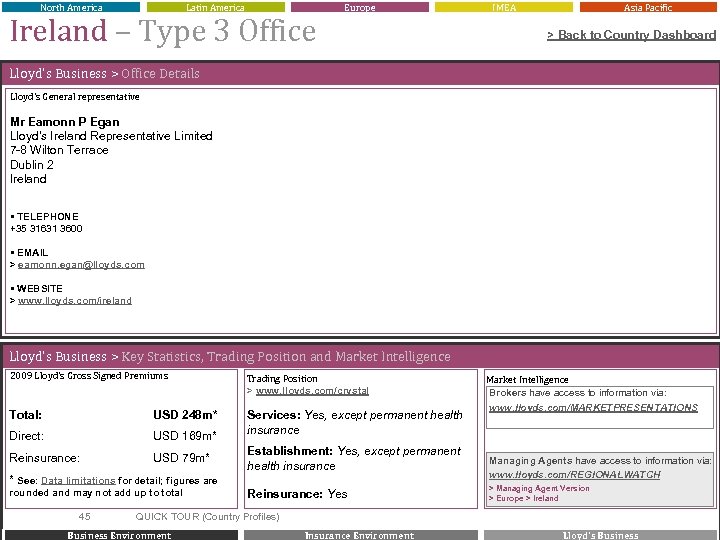

North America Latin America Ireland – Type 3 Office Europe IMEA Asia Pacific > Back to Country Dashboard Lloyd’s Business > Office Details Lloyd’s General representative Mr Eamonn P Egan Lloyd’s Ireland Representative Limited 7 -8 Wilton Terrace Dublin 2 Ireland § TELEPHONE +35 31631 3600 § EMAIL > eamonn. egan@lloyds. com § WEBSITE > www. lloyds. com/ireland Lloyd’s Business > Key Statistics, Trading Position and Market Intelligence 2009 Lloyd’s Gross Signed Premiums Trading Position > www. lloyds. com/crystal Total: USD 248 m* Direct: USD 169 m* Services: Yes, except permanent health insurance Reinsurance: USD 79 m* Establishment: Yes, except permanent health insurance * See: Data limitations for detail; figures are rounded and may not add up to total 45 Reinsurance: Yes QUICK TOUR (Country Profiles) Business Environment Market Intelligence Brokers have access to information via: www. lloyds. com/MARKETPRESENTATIONS Managing Agents have access to information via: www. lloyds. com/REGIONALWATCH > Managing Agent Version > Europe > Ireland © Lloyd’s Insurance Environment Lloyd’s Business

North America Latin America Israel – Type 2 Office Europe IMEA Asia Pacific Profile Click Box to navigate Business Environment Insurance Environment Lloyd’s Business 46 QUICK TOUR (Country Profiles) à Key strengths and challenges of the economy à Size and growth of the economy à Basic economic indicators à Key insurers à Insurance industry events à Basic insurance indicators à Lloyd’s office details and contacts à Trading position and size of Lloyd’s business à Available market intelligence products © Lloyd’s

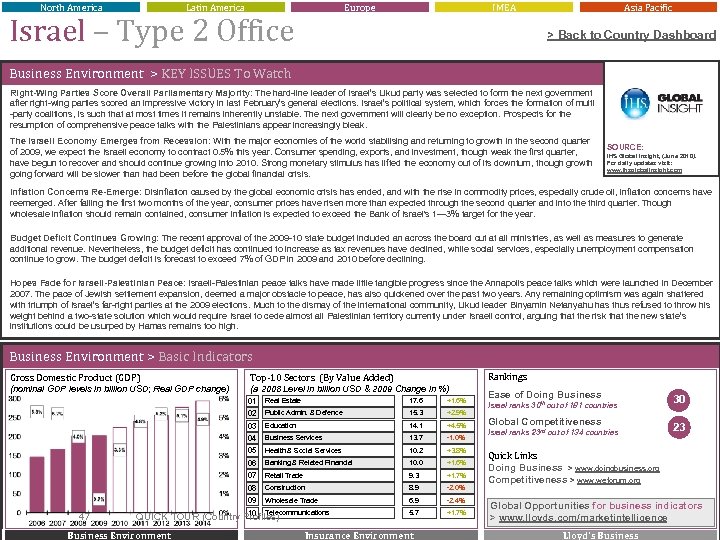

North America Latin America Europe Israel – Type 2 Office IMEA Asia Pacific > Back to Country Dashboard Business Environment > KEY ISSUES To Watch Right-Wing Parties Score Overall Parliamentary Majority: The hard-line leader of Israel’s Likud party was selected to form the next government after right-wing parties scored an impressive victory in last February’s general elections. Israel’s political system, which forces the formation of multi -party coalitions, is such that at most times it remains inherently unstable. The next government will clearly be no exception. Prospects for the resumption of comprehensive peace talks with the Palestinians appear increasingly bleak. The Israeli Economy Emerges from Recession: With the major economies of the world stabilising and returning to growth in the second quarter of 2009, we expect the Israeli economy to contract 0. 5% this year. Consumer spending, exports, and investment, though weak the first quarter, have begun to recover and should continue growing into 2010. Strong monetary stimulus has lifted the economy out of its downturn, though growth going forward will be slower than had been before the global financial crisis. SOURCE: IHS Global Insight, (June 2010). For daily updates visit: www. ihsglobalinsight. com Inflation Concerns Re-Emerge: Disinflation caused by the global economic crisis has ended, and with the rise in commodity prices, especially crude oil, inflation concerns have reemerged. After falling the first two months of the year, consumer prices have risen more than expected through the second quarter and into the third quarter. Though wholesale inflation should remain contained, consumer inflation is expected to exceed the Bank of Israel's 1— 3% target for the year. Budget Deficit Continues Growing: The recent approval of the 2009 -10 state budget included an across the board cut at all ministries, as well as measures to generate additional revenue. Nevertheless, the budget deficit has continued to increase as tax revenues have declined, while social services, especially unemployment compensation continue to grow. The budget deficit is forecast to exceed 7% of GDP in 2009 and 2010 before declining. Hopes Fade for Israeli-Palestinian Peace: Israeli-Palestinian peace talks have made little tangible progress since the Annapolis peace talks which were launched in December 2007. The pace of Jewish settlement expansion, deemed a major obstacle to peace, has also quickened over the past two years. Any remaining optimism was again shattered with triumph of Israel’s far-right parties at the 2009 elections. Much to the dismay of the international community, Likud leader Binyamin Netanyahu has thus refused to throw his weight behind a two-state solution which would require Israel to cede almost all Palestinian territory currently under Israeli control, arguing that the risk that the new state’s institutions could be usurped by Hamas remains too high. Business Environment > Basic Indicators Gross Domestic Product (GDP) (nominal GDP levels in billion USD; Real GDP change) Rankings Top-10 Sectors (By Value Added) (a 2008 Level in billion USD & 2009 Change in %) 01 17. 6 +1. 6% 02 Public Admin. & Defence 15. 3 +2. 9% 03 Education 14. 1 +4. 5% 04 Business Services 13. 7 -1. 0% 05 Health & Social Services 10. 2 +3. 8% 06 Banking & Related Financial 10. 0 +1. 6% 07 Retail Trade 9. 3 +1. 7% 08 Construction 8. 9 -2. 0% 09 47 Real Estate Wholesale Trade 6. 9 -2. 4% 10 Telecommunications 5. 7 +1. 7% QUICK TOUR (Country Profiles) Business Environment Insurance Environment Ease of Doing Business Israel ranks 30 th out of 181 countries Global Competitiveness Israel ranks 23 rd out of 134 countries 30 23 Quick Links Doing Business > www. doingbusiness. org Competitiveness > www. weforum. org Global Opportunities for business indicators © Lloyd’s > www. lloyds. com/marketintelligence Lloyd’s Business

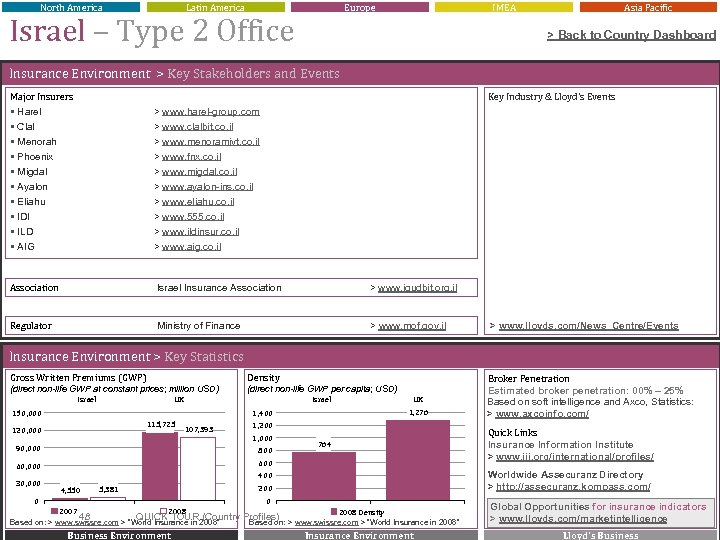

North America Latin America Europe Israel – Type 2 Office IMEA Asia Pacific > Back to Country Dashboard Insurance Environment > Key Stakeholders and Events Major Insurers § Harel Key Industry & Lloyd’s Events > www. harel-group. com § Clal § Menorah § Phoenix § Migdal § Ayalon § Eliahu § IDI § ILD § AIG > www. clalbit. co. il > www. menoramivt. co. il > www. fnx. co. il > www. migdal. co. il > www. ayalon-ins. co. il > www. eliahu. co. il Association Israel Insurance Association > www. igudbit. org. il Regulator Ministry of Finance > www. mof. gov. il > www. 555. co. il > www. ildinsur. co. il > www. aig. co. il > www. lloyds. com/News_Centre/Events Insurance Environment > Key Statistics Gross Written Premiums (GWP) Density (direct non-life GWP at constant prices; million USD) (direct non-life GWP per capita; USD) Israel UK Israel 150, 000 UK 1, 276 1, 400 115, 725 120, 000 107, 393 1, 200 1, 000 90, 000 800 60, 000 Quick Links Insurance Information Institute > www. iii. org/international/profiles/ 764 600 30, 000 Worldwide Assecuranz Directory > http: //assecuranz. kompass. com/ 400 4, 550 5, 381 200 0 0 2007 2008 48 QUICK TOUR (Country Based on: > www. swissre. com > “World Insurance in 2008” Business Environment Broker Penetration Estimated broker penetration: 00% – 25% Based on soft intelligence and Axco, Statistics: > www. axcoinfo. com/ 2008 Density Profiles) > www. swissre. com > “World Insurance in 2008” Based on: Insurance Environment Global Opportunities for insurance indicators © Lloyd’s > www. lloyds. com/marketintelligence Lloyd’s Business

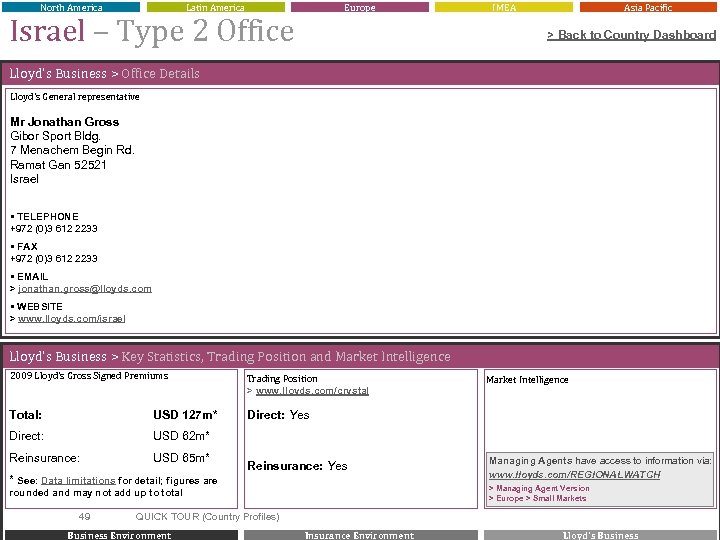

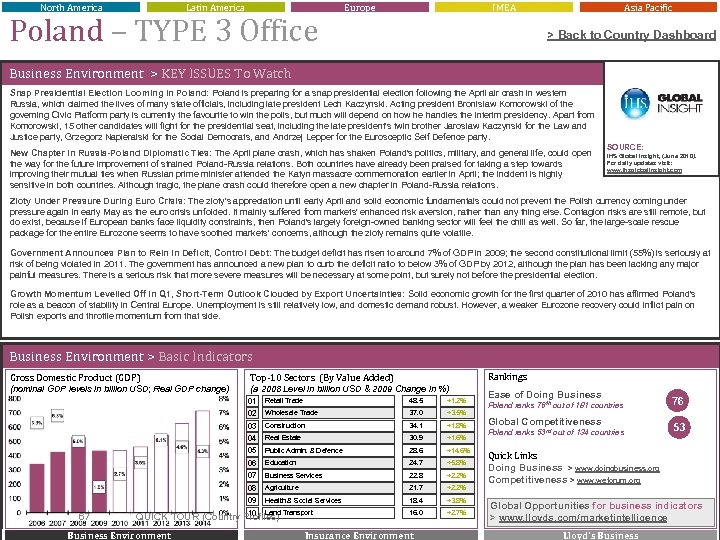

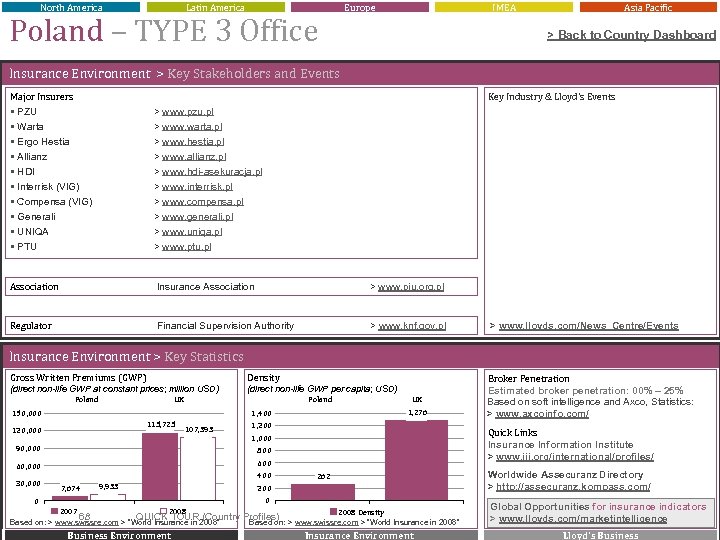

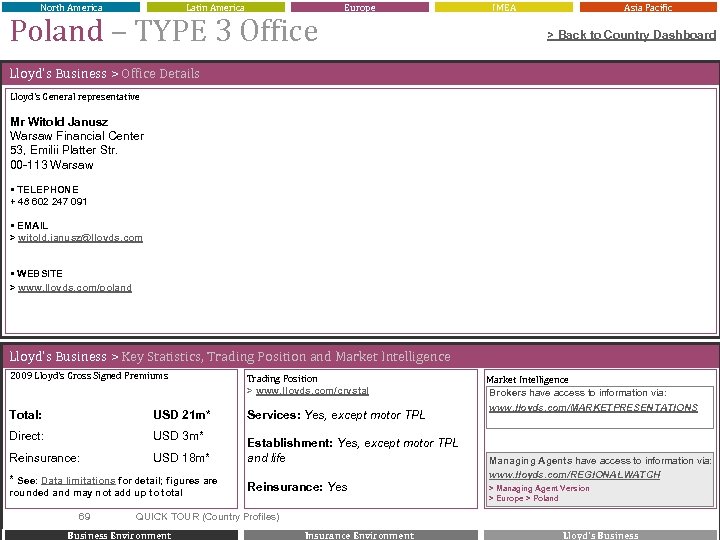

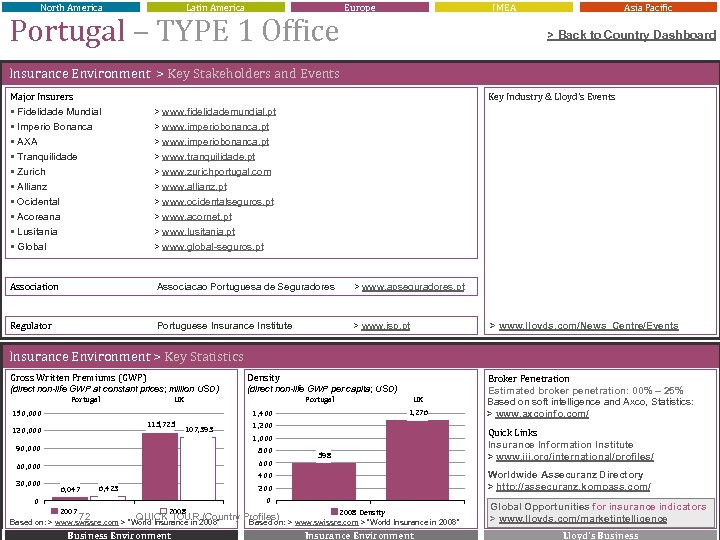

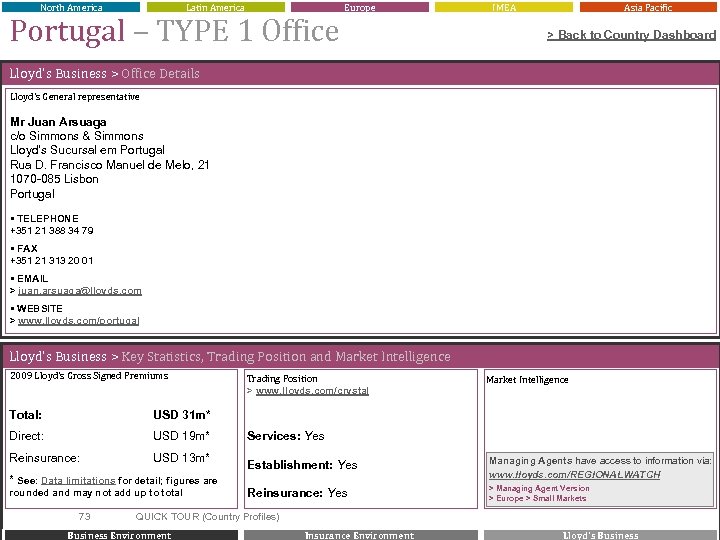

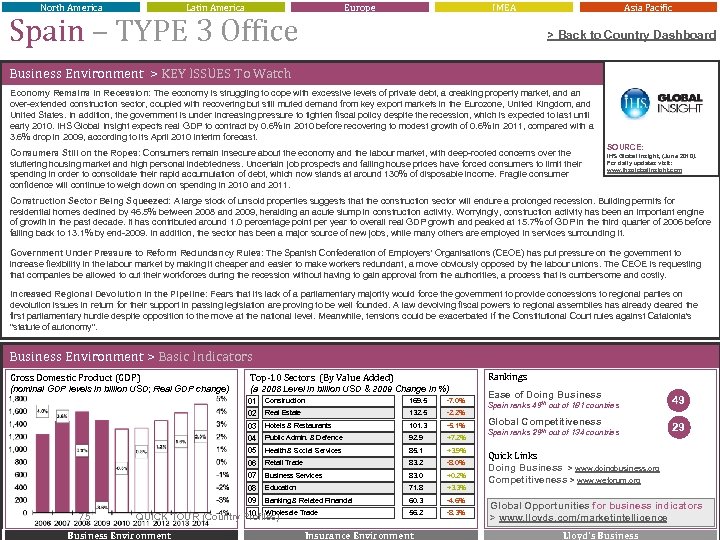

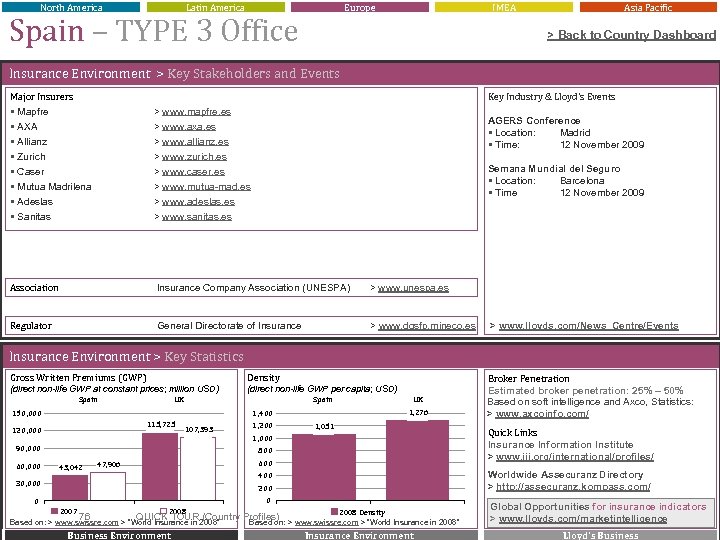

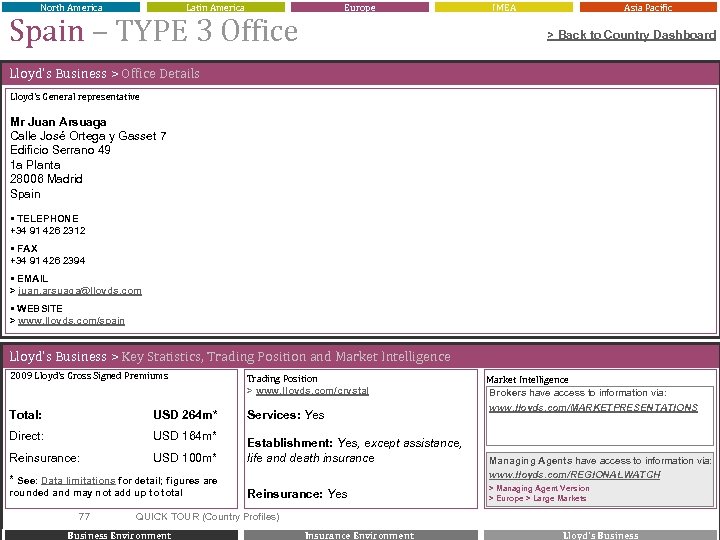

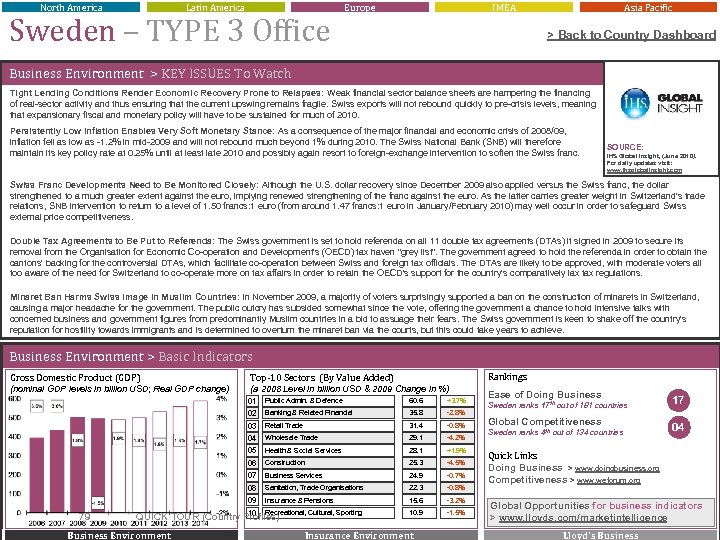

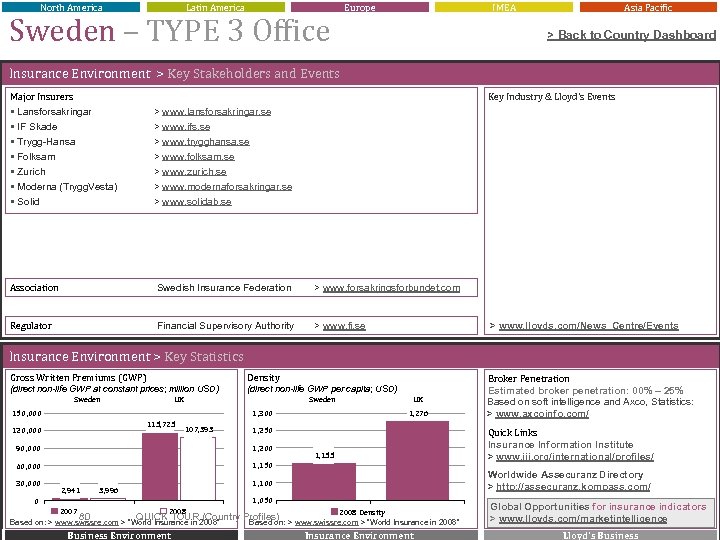

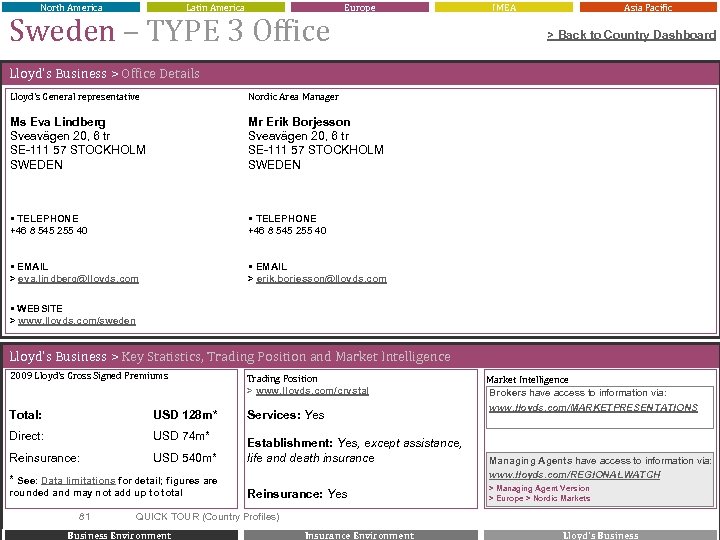

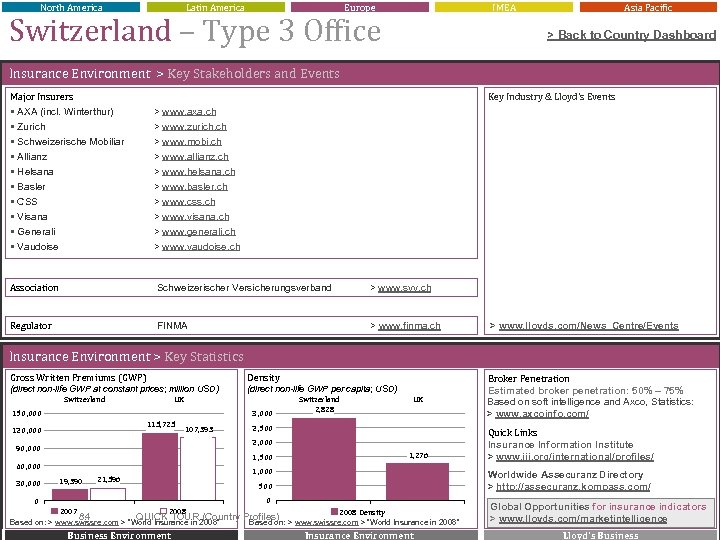

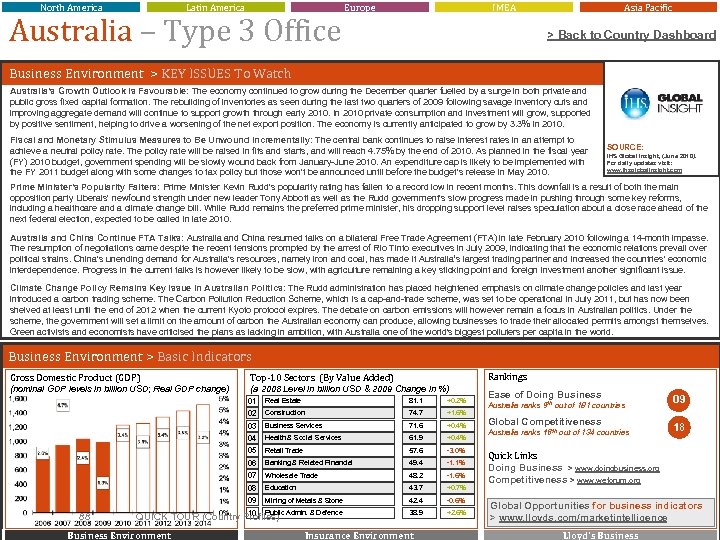

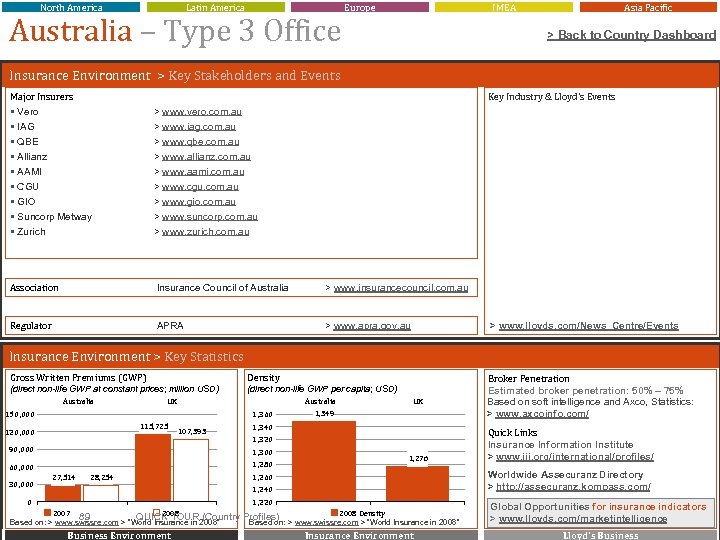

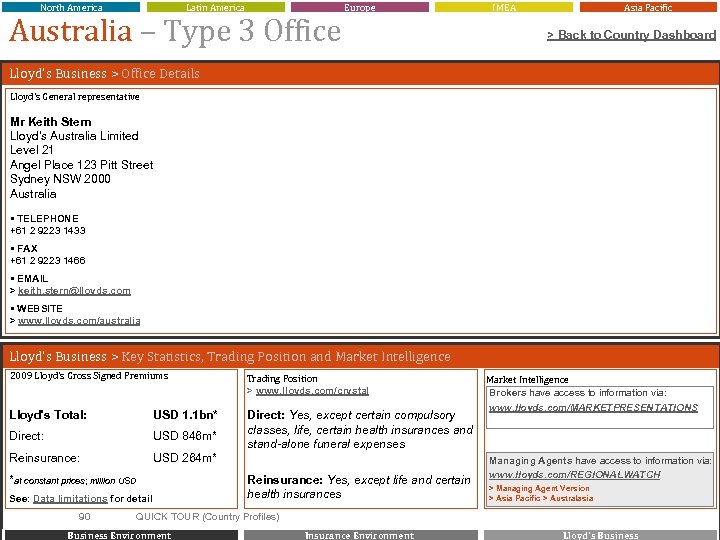

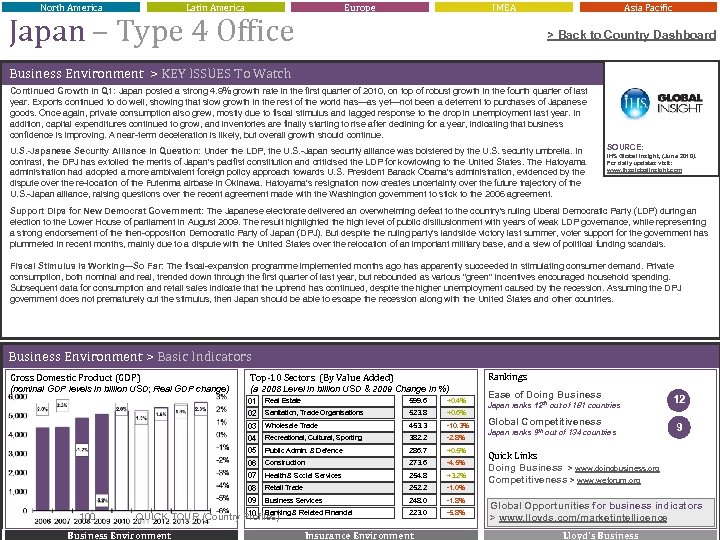

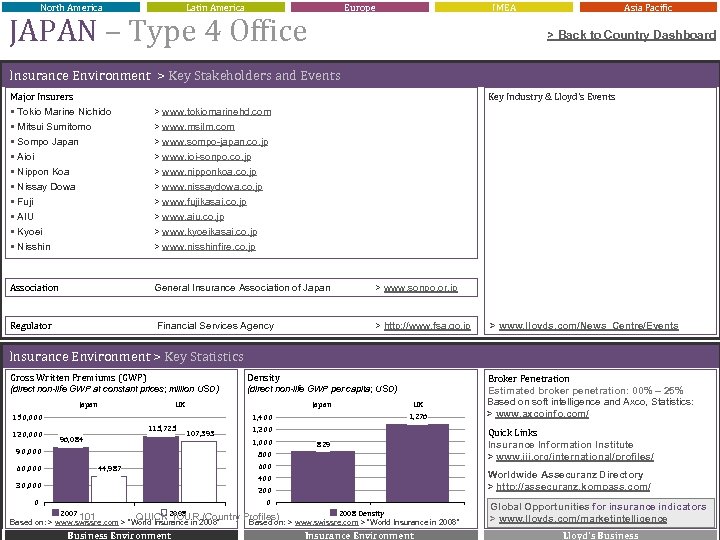

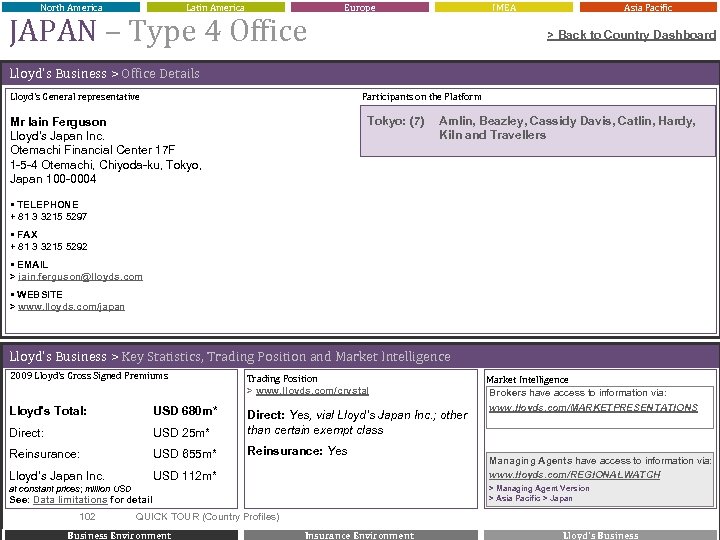

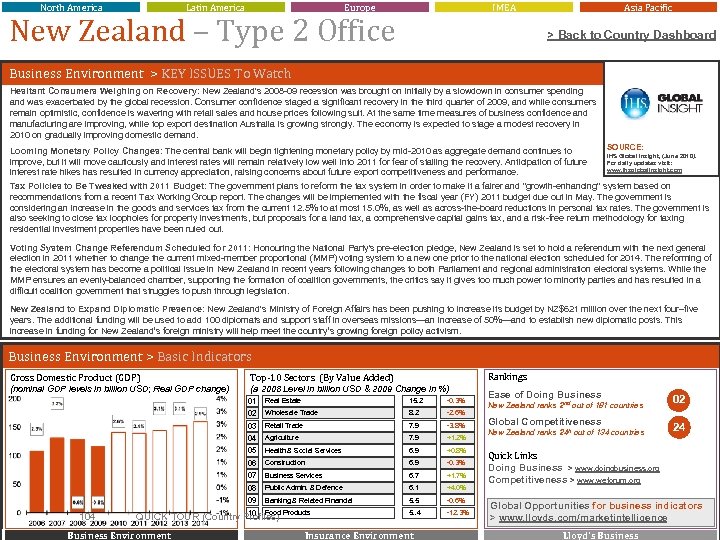

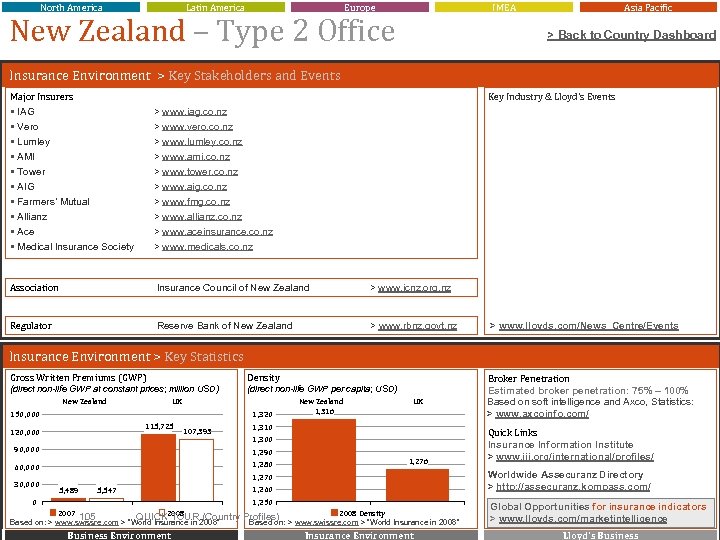

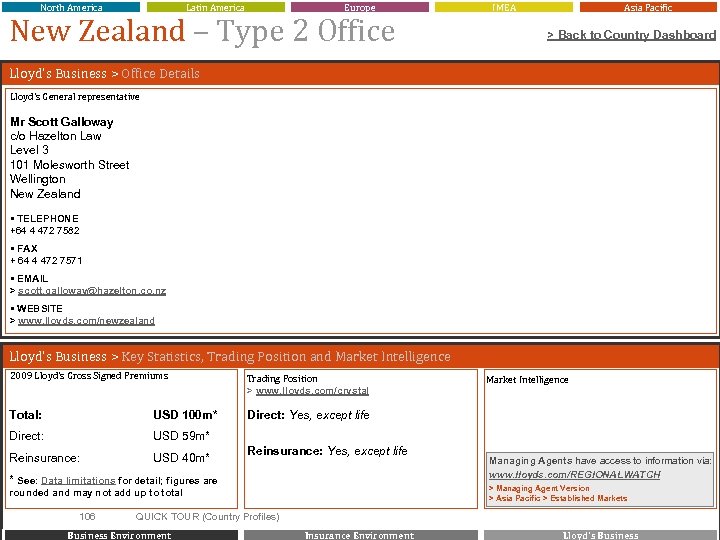

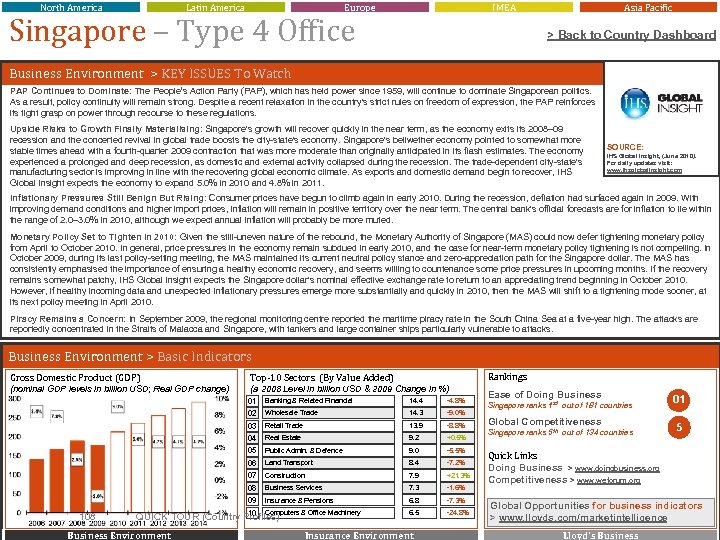

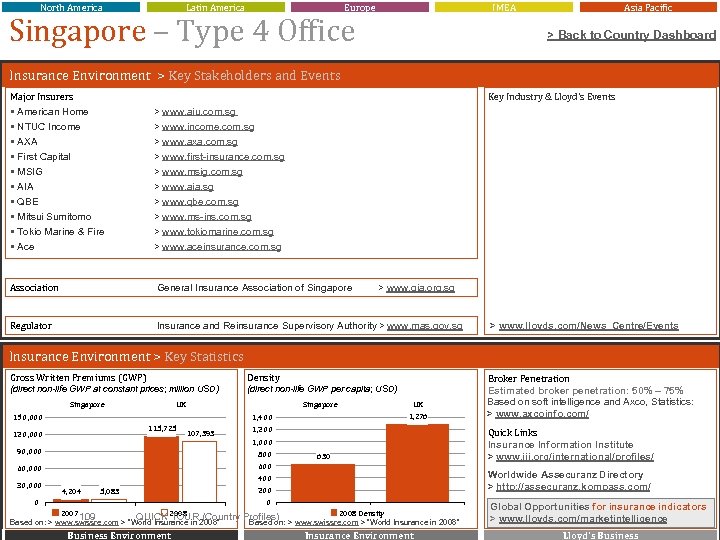

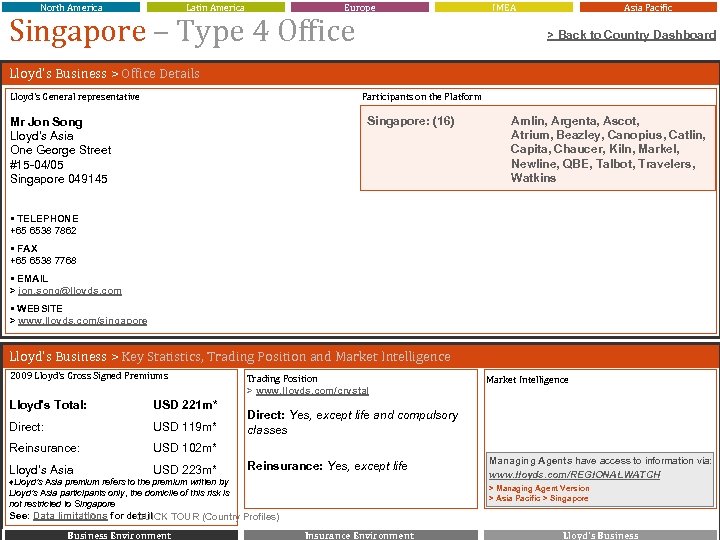

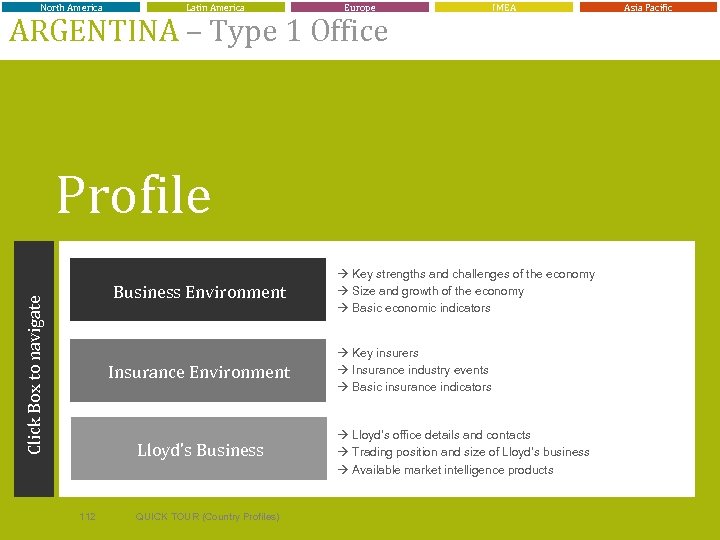

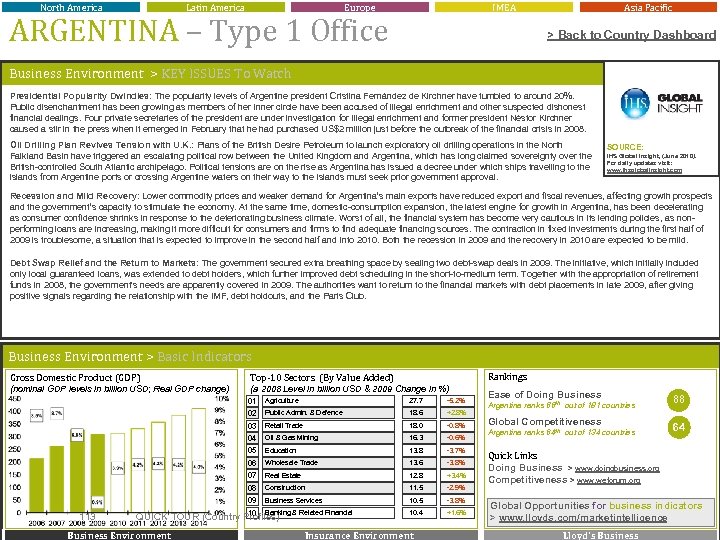

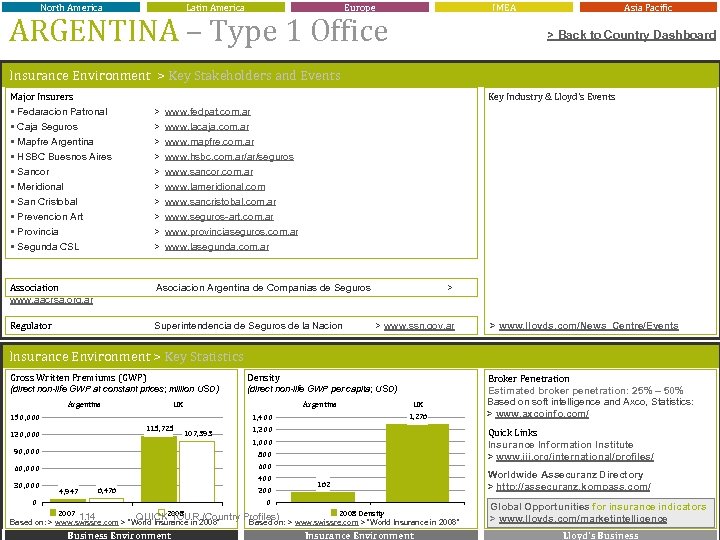

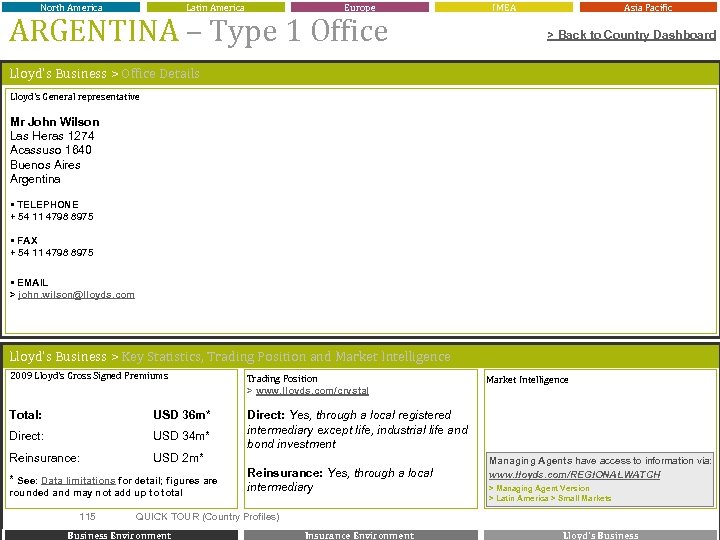

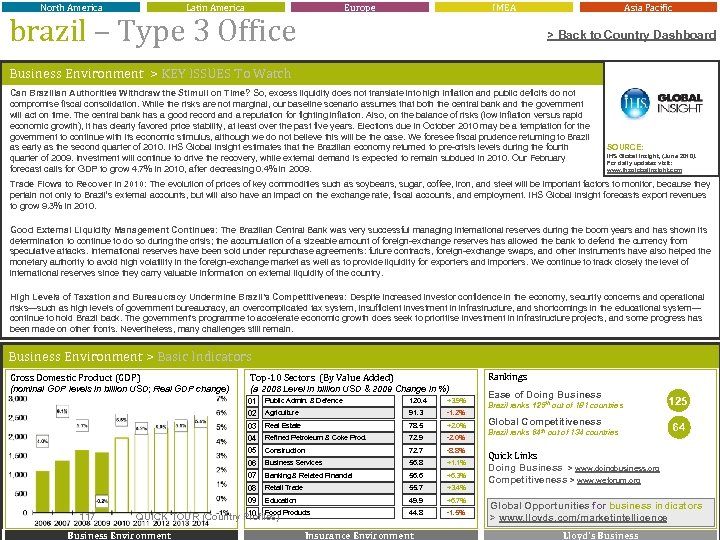

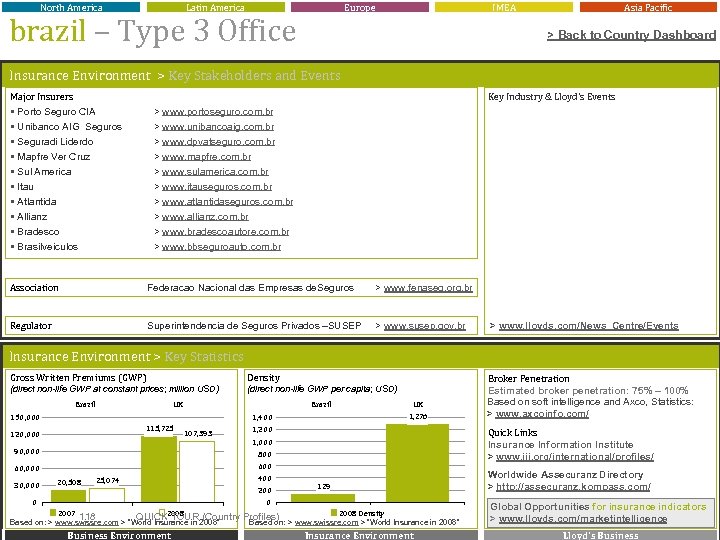

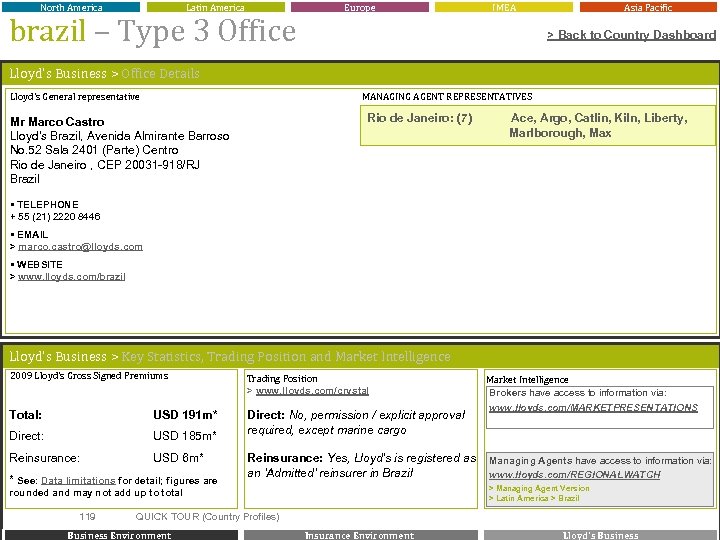

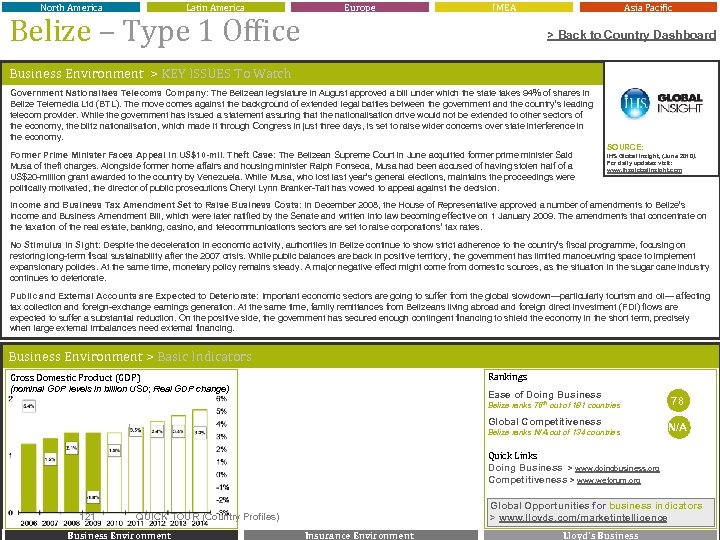

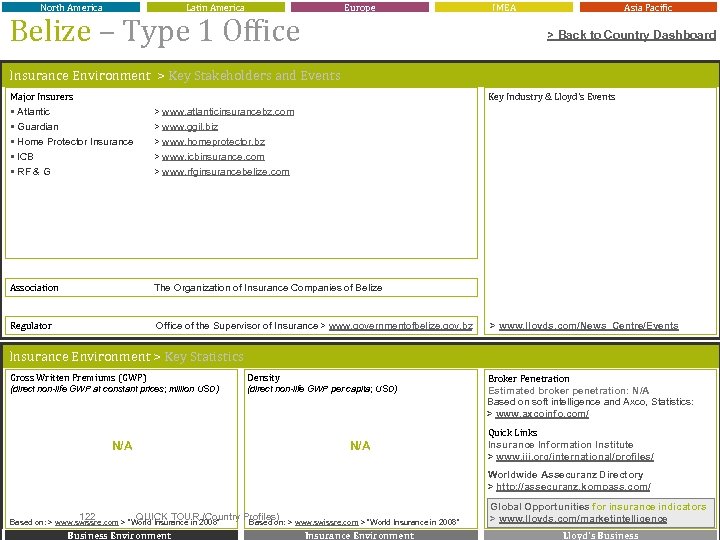

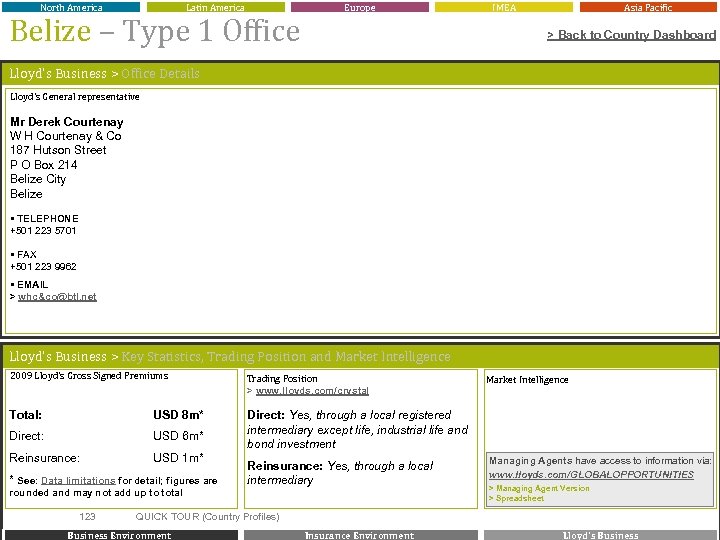

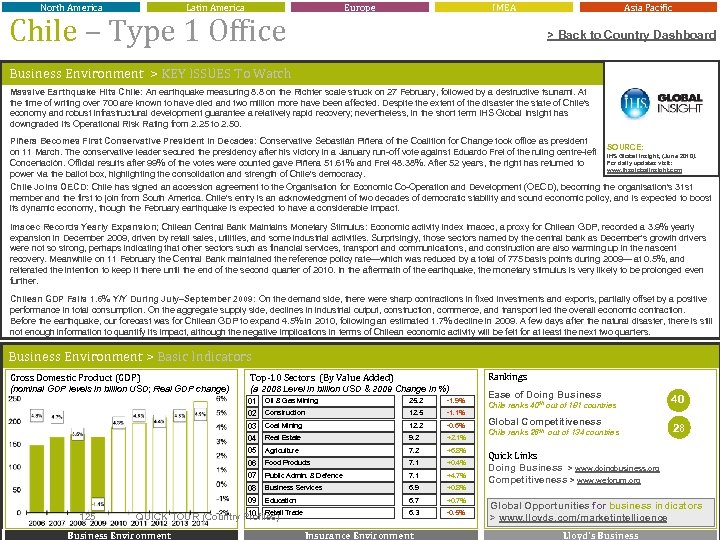

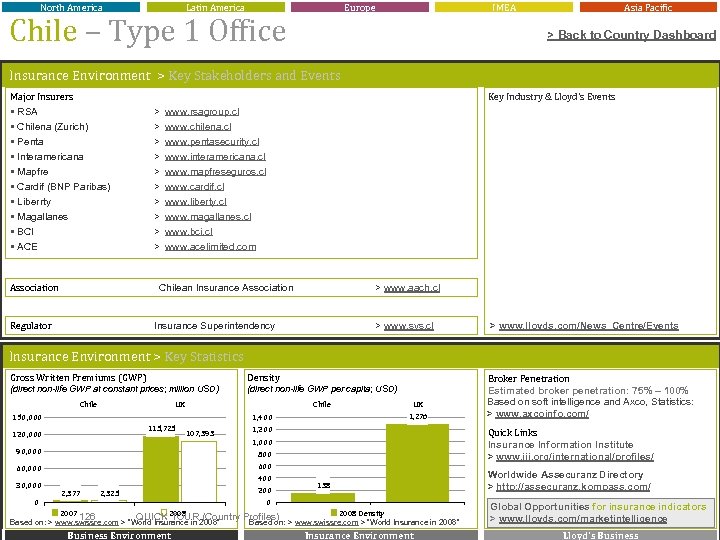

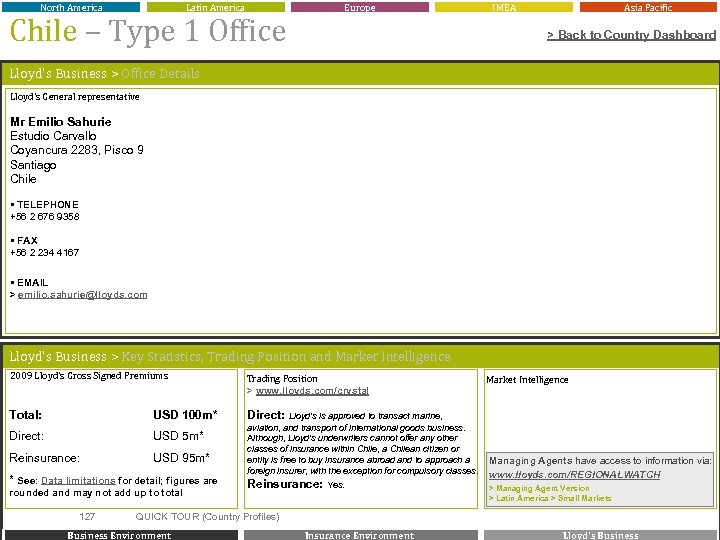

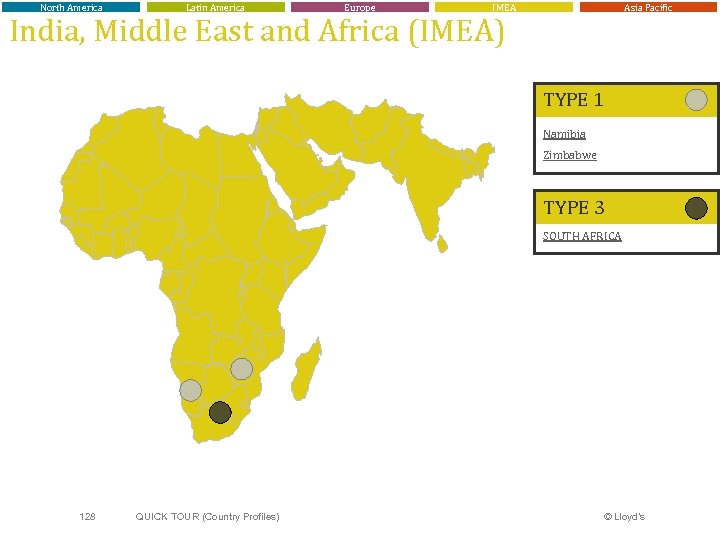

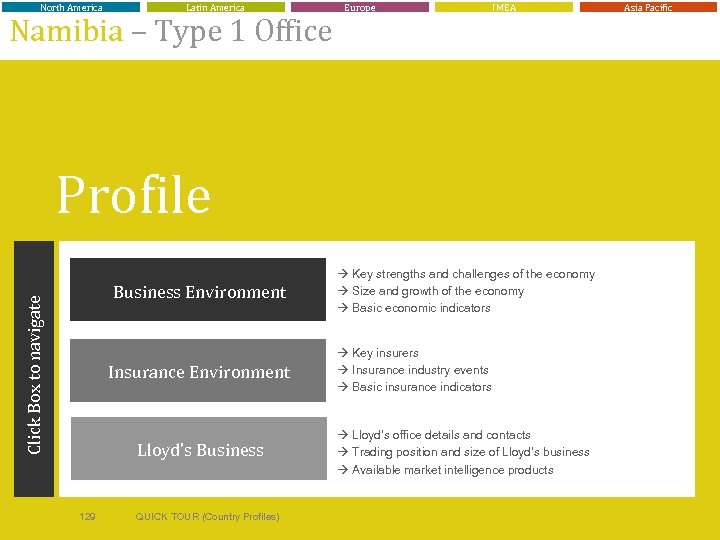

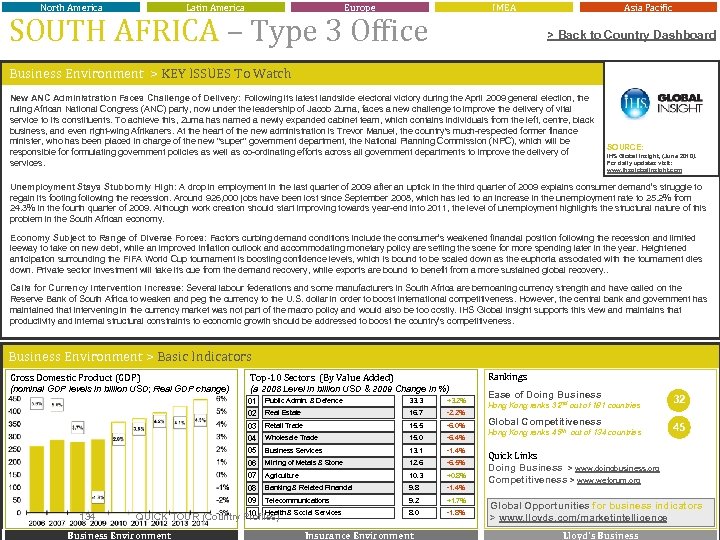

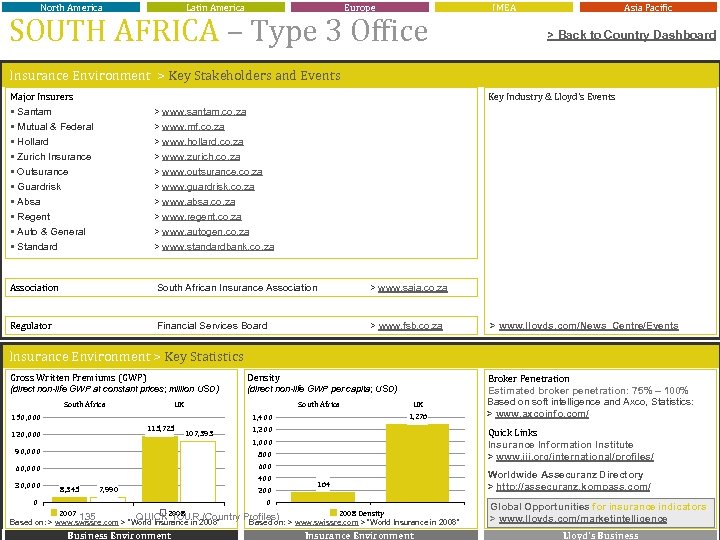

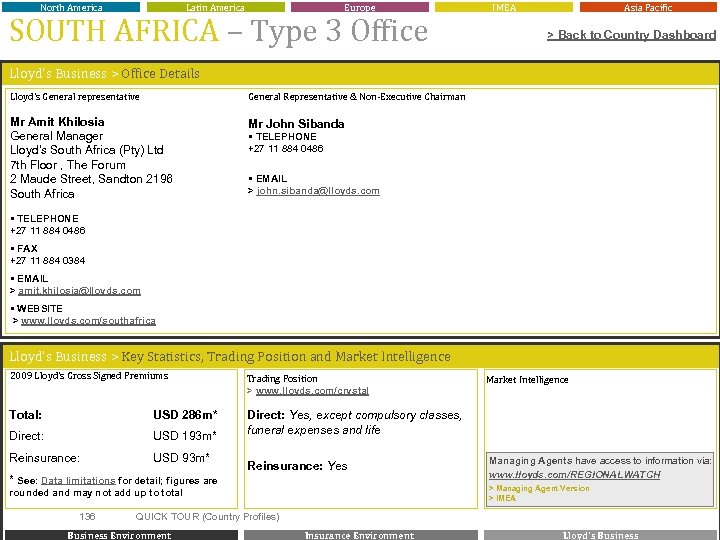

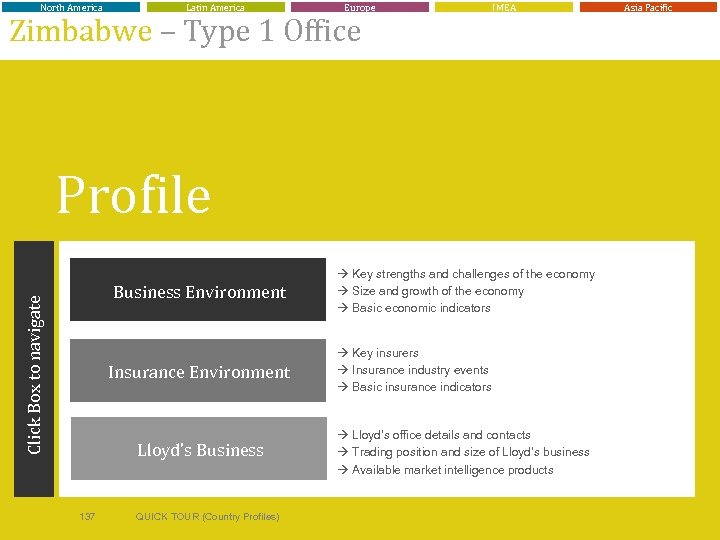

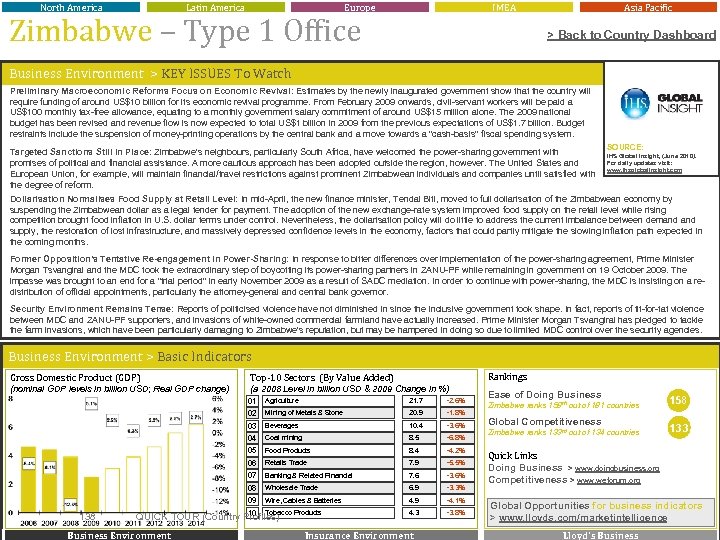

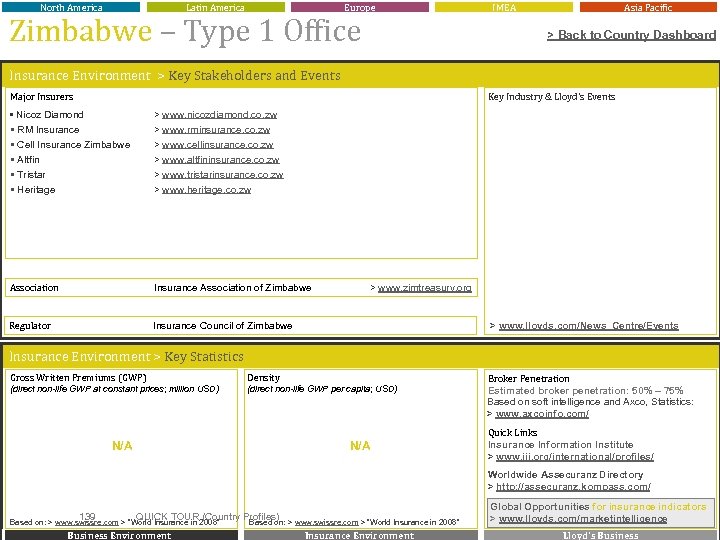

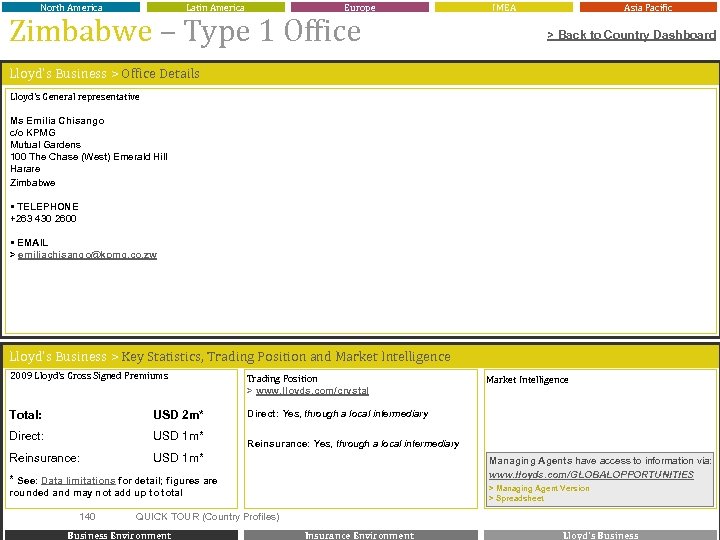

North America Latin America Europe Israel – Type 2 Office IMEA Asia Pacific > Back to Country Dashboard Lloyd’s Business > Office Details Lloyd’s General representative Mr Jonathan Gross Gibor Sport Bldg. 7 Menachem Begin Rd. Ramat Gan 52521 Israel § TELEPHONE +972 (0)3 612 2233 § FAX +972 (0)3 612 2233 § EMAIL > jonathan. gross@lloyds. com § WEBSITE > www. lloyds. com/israel Lloyd’s Business > Key Statistics, Trading Position and Market Intelligence 2009 Lloyd’s Gross Signed Premiums Trading Position > www. lloyds. com/crystal Total: USD 127 m* Direct: Yes Direct: USD 62 m* Reinsurance: USD 65 m* Reinsurance: Yes * See: Data limitations for detail; figures are QUICK TOUR (Country Profiles) Business Environment Managing Agents have access to information via: www. lloyds. com/REGIONALWATCH > Managing Agent Version > Europe > Small Markets rounded and may not add up to total 49 Market Intelligence © Lloyd’s Insurance Environment Lloyd’s Business