56210ab9582ebc86e4e1b95d2069a832.ppt

- Количество слайдов: 44

Quick Quiz • Illustrate the movement from shortrun loss to long run normal profit under perfect competition

Quick Quiz • Illustrate the movement from shortrun loss to long run normal profit under perfect competition

GUESS WHO?

GUESS WHO?

Monopoly

Monopoly

Monopoly Pure Monopoly- only one firm in the industry Working Monopoly- 25% + market share A monopolist has the power to determine either: The price at which they sells his product; The quantity they wishes to sell The monopolist cannot determine both as they cannot determine Demand What determines monopoly power? • the availability of close substitutes from rival industries • ability to maintain barriers to entry

Monopoly Pure Monopoly- only one firm in the industry Working Monopoly- 25% + market share A monopolist has the power to determine either: The price at which they sells his product; The quantity they wishes to sell The monopolist cannot determine both as they cannot determine Demand What determines monopoly power? • the availability of close substitutes from rival industries • ability to maintain barriers to entry

Key Features of Monopoly • There is one firm, which is also the industry • It produces a unique good/ service • There are complete barriers to entry and exit from the industry. • Customers have only 1 firm to buy from, as there are no direct substitutes- Limited Choice • The Firm is a ‘Price Maker’ • The Firm has the ability to earn abnormal profits in the long run • Low levels of economic efficiency- productive and allocative efficiency not achieved

Key Features of Monopoly • There is one firm, which is also the industry • It produces a unique good/ service • There are complete barriers to entry and exit from the industry. • Customers have only 1 firm to buy from, as there are no direct substitutes- Limited Choice • The Firm is a ‘Price Maker’ • The Firm has the ability to earn abnormal profits in the long run • Low levels of economic efficiency- productive and allocative efficiency not achieved

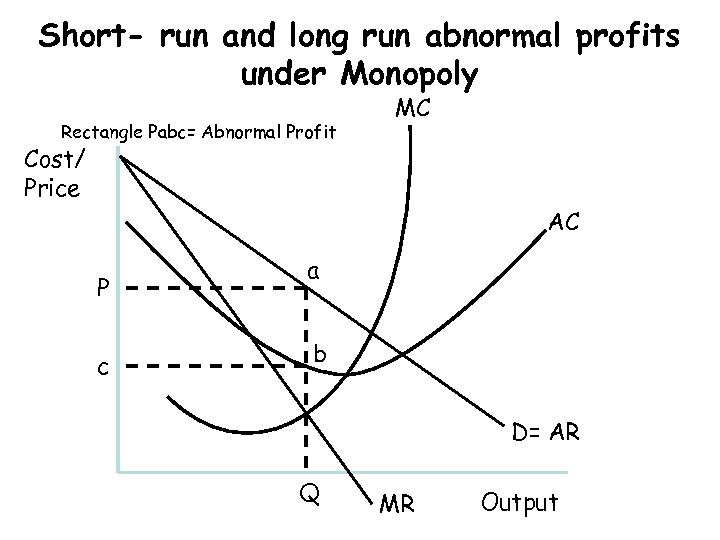

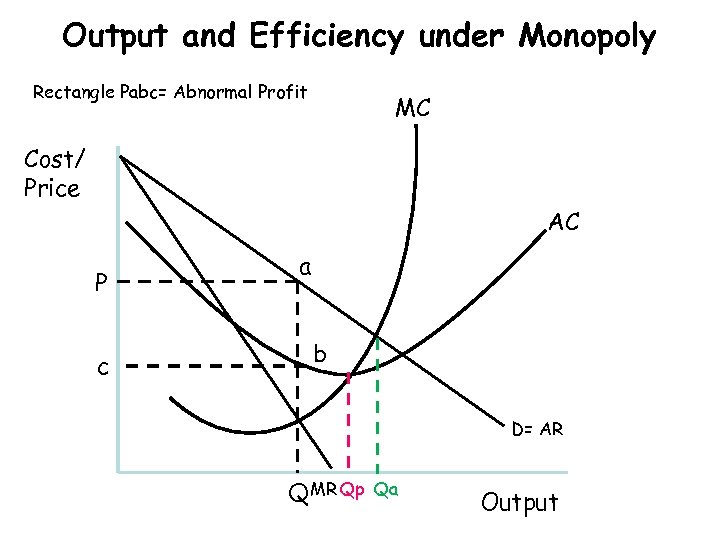

Short- run and long run abnormal profits under Monopoly Rectangle Pabc= Abnormal Profit MC Cost/ Price AC P c a b D= AR Q MR Output

Short- run and long run abnormal profits under Monopoly Rectangle Pabc= Abnormal Profit MC Cost/ Price AC P c a b D= AR Q MR Output

Long run equilibrium The monopolist can maintain abnormal profits in the long run if : There are barriers to entry and exit. These may be - artificial (e. g. patent, brand loyalty) or - natural (e. g. economies of scale)

Long run equilibrium The monopolist can maintain abnormal profits in the long run if : There are barriers to entry and exit. These may be - artificial (e. g. patent, brand loyalty) or - natural (e. g. economies of scale)

Barriers To Entry §Economies of scale and High sunk costs §A clearly differentiated product with brand loyalty §Brand proliferation: In many industries multi-product firms engaging in brand proliferation can give a false appearance of competition to the consumer. This is common in markets such as detergents, confectionery and household goods – it is non-price competition. §Legal/ regulatory barriers eg Patents are legal property rights to prevent the entry of rivals. They are generally valid for 17 -20 years and give the owner an exclusive right to prevent others from using patented products, inventions, or processes. The owners of patents can sell licences to other businesses/. Statutory monopolies- those granted legal protection from competition eg Post Office in UK. In the past companies such as the Hudson’s Bay Company and the East India Company were granted the sole right to trade in certain areas. Many public utility companies providing water, gas and electricity have been granted local monopoly powers, but are subject to some regulation.

Barriers To Entry §Economies of scale and High sunk costs §A clearly differentiated product with brand loyalty §Brand proliferation: In many industries multi-product firms engaging in brand proliferation can give a false appearance of competition to the consumer. This is common in markets such as detergents, confectionery and household goods – it is non-price competition. §Legal/ regulatory barriers eg Patents are legal property rights to prevent the entry of rivals. They are generally valid for 17 -20 years and give the owner an exclusive right to prevent others from using patented products, inventions, or processes. The owners of patents can sell licences to other businesses/. Statutory monopolies- those granted legal protection from competition eg Post Office in UK. In the past companies such as the Hudson’s Bay Company and the East India Company were granted the sole right to trade in certain areas. Many public utility companies providing water, gas and electricity have been granted local monopoly powers, but are subject to some regulation.

§ Ownership/control of key factors of production. Until recently, De. Beers controlled the world’s supply of uncut diamonds, and there was no way that new firms could enter the market because of the agreements that De. Beers had with mining companies and governments in those parts of the world where diamonds are mined. The monopoly has lasted for many years, and is only now starting to break down § Other barriers- aggressive trading tactics- eg. Limit pricing (predatory pricing), the threat of aggressive merger and takeover, ownership/control of retail outlets and intimidation.

§ Ownership/control of key factors of production. Until recently, De. Beers controlled the world’s supply of uncut diamonds, and there was no way that new firms could enter the market because of the agreements that De. Beers had with mining companies and governments in those parts of the world where diamonds are mined. The monopoly has lasted for many years, and is only now starting to break down § Other barriers- aggressive trading tactics- eg. Limit pricing (predatory pricing), the threat of aggressive merger and takeover, ownership/control of retail outlets and intimidation.

Monopoly Cont. Tues 6 th March

Monopoly Cont. Tues 6 th March

Efficiency and Monopoly • • Recall output levels for Productive Efficiency? Allocative Efficiency? Draw the monopoly diagram and label 3 output levels

Efficiency and Monopoly • • Recall output levels for Productive Efficiency? Allocative Efficiency? Draw the monopoly diagram and label 3 output levels

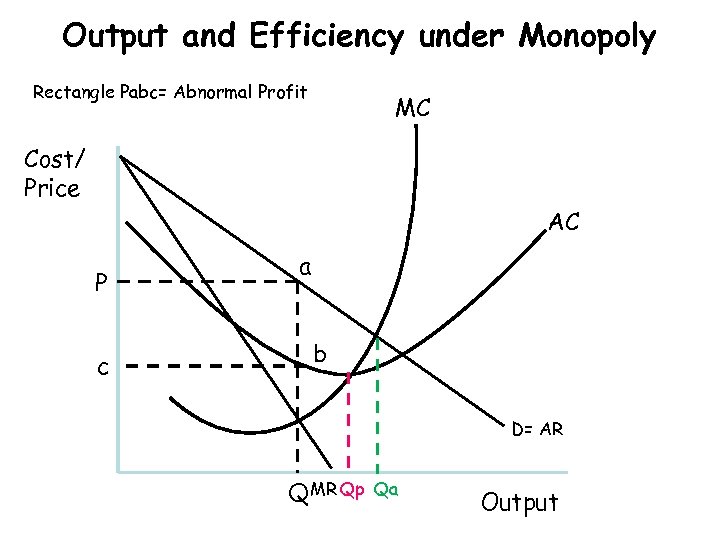

Output and Efficiency under Monopoly Rectangle Pabc= Abnormal Profit MC Cost/ Price AC P c a b D= AR Q MR Qp Qa Output

Output and Efficiency under Monopoly Rectangle Pabc= Abnormal Profit MC Cost/ Price AC P c a b D= AR Q MR Qp Qa Output

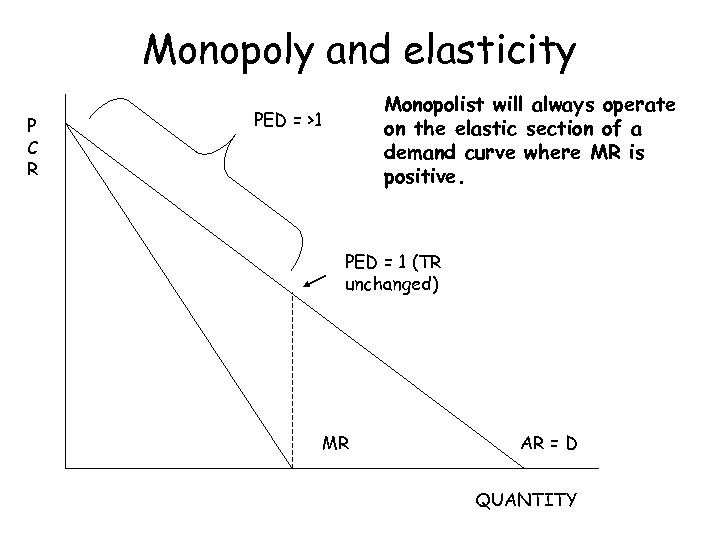

Monopoly and elasticity P C R Monopolist will always operate on the elastic section of a demand curve where MR is positive. PED = >1 PED = 1 (TR unchanged) MR AR = D QUANTITY

Monopoly and elasticity P C R Monopolist will always operate on the elastic section of a demand curve where MR is positive. PED = >1 PED = 1 (TR unchanged) MR AR = D QUANTITY

Comparing PC and Monopoly Efficiency

Comparing PC and Monopoly Efficiency

Allocative efficiency P = MC i. e the price a consumer is prepared to pay = cost to society of producing an additional unit, assuming no external costs Under PC, P = MC Under monopoly, P > MC

Allocative efficiency P = MC i. e the price a consumer is prepared to pay = cost to society of producing an additional unit, assuming no external costs Under PC, P = MC Under monopoly, P > MC

Productive Efficiency Firms are productively efficient if they are producing at the lowest point on their lowest possible AC (ATC) curve. Looking at the l/r AC curve firms are producing at their MES Under PC firm is operating at min ATC Under monopoly, firm operating at > min ATC

Productive Efficiency Firms are productively efficient if they are producing at the lowest point on their lowest possible AC (ATC) curve. Looking at the l/r AC curve firms are producing at their MES Under PC firm is operating at min ATC Under monopoly, firm operating at > min ATC

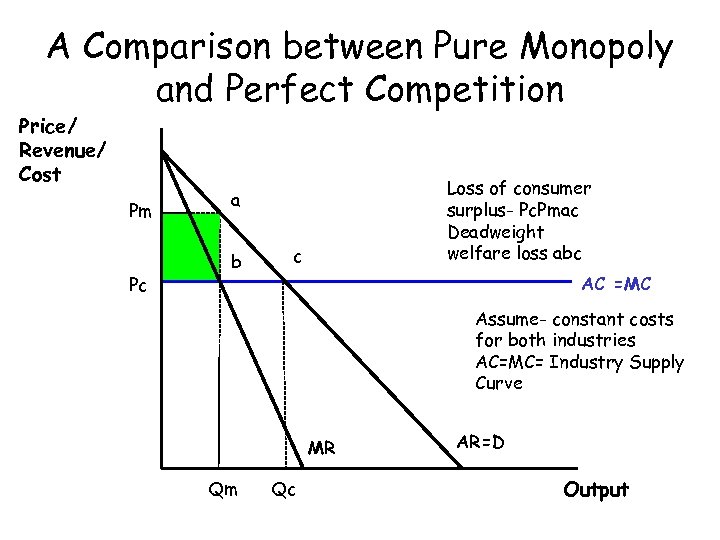

A Comparison between Pure Monopoly and Perfect Competition Price/ Revenue/ Cost Pm Pc Loss of consumer surplus- Pc. Pmac Deadweight welfare loss abc a b c AC =MC Assume- constant costs for both industries AC=MC= Industry Supply Curve MR Qm Qc AR=D Output

A Comparison between Pure Monopoly and Perfect Competition Price/ Revenue/ Cost Pm Pc Loss of consumer surplus- Pc. Pmac Deadweight welfare loss abc a b c AC =MC Assume- constant costs for both industries AC=MC= Industry Supply Curve MR Qm Qc AR=D Output

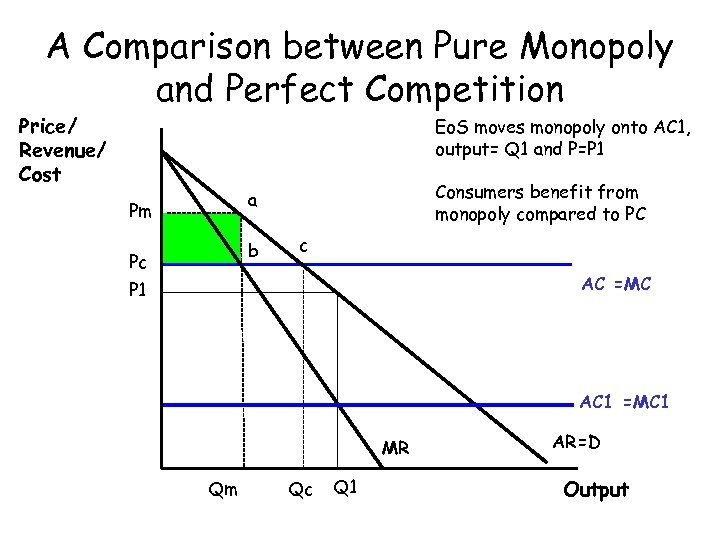

A Comparison between Pure Monopoly and Perfect Competition Price/ Revenue/ Cost Eo. S moves monopoly onto AC 1, output= Q 1 and P=P 1 Consumers benefit from monopoly compared to PC a Pm b Pc c AC =MC P 1 AC 1 =MC 1 MR Qm Qc Q 1 AR=D Output

A Comparison between Pure Monopoly and Perfect Competition Price/ Revenue/ Cost Eo. S moves monopoly onto AC 1, output= Q 1 and P=P 1 Consumers benefit from monopoly compared to PC a Pm b Pc c AC =MC P 1 AC 1 =MC 1 MR Qm Qc Q 1 AR=D Output

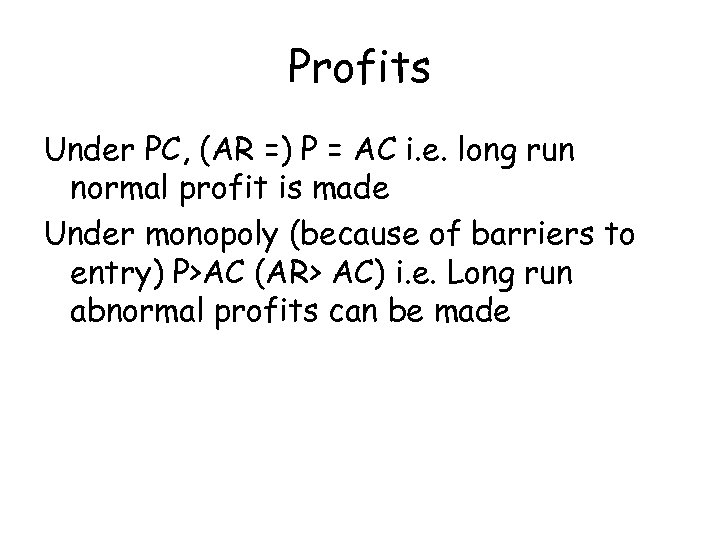

Profits Under PC, (AR =) P = AC i. e. long run normal profit is made Under monopoly (because of barriers to entry) P>AC (AR> AC) i. e. Long run abnormal profits can be made

Profits Under PC, (AR =) P = AC i. e. long run normal profit is made Under monopoly (because of barriers to entry) P>AC (AR> AC) i. e. Long run abnormal profits can be made

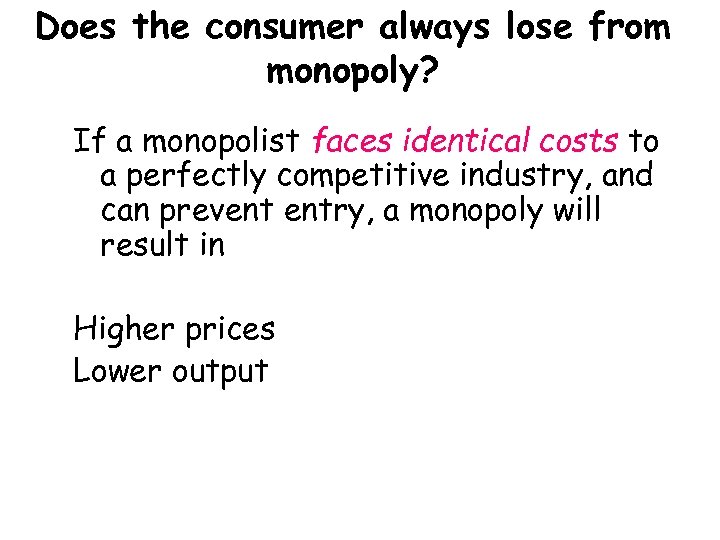

Does the consumer always lose from monopoly? If a monopolist faces identical costs to a perfectly competitive industry, and can prevent entry, a monopoly will result in Higher prices Lower output

Does the consumer always lose from monopoly? If a monopolist faces identical costs to a perfectly competitive industry, and can prevent entry, a monopoly will result in Higher prices Lower output

‘Advantages’ of monopoly Supernormal profits provide an incentive and a source of funds for process and product innovation: • New technologies that may reduce costs i. e. LRAC under monopoly < LRAC under perfect competition. • New products increase consumer choice • E of S can lead to greater output and lower prices than under PC

‘Advantages’ of monopoly Supernormal profits provide an incentive and a source of funds for process and product innovation: • New technologies that may reduce costs i. e. LRAC under monopoly < LRAC under perfect competition. • New products increase consumer choice • E of S can lead to greater output and lower prices than under PC

Natural Monopoly • A natural monopoly is characterised by increasing returns to scale at all levels of output. Thus the LRACs continue to fall as output expands. • Due to high sunk costs and economies of scale it is not efficient to have more than one firm providing goods or services in this market. • Some examples of industries that are close to being natural monopolies are BT, Royal Mail, Camelot and the National Grid.

Natural Monopoly • A natural monopoly is characterised by increasing returns to scale at all levels of output. Thus the LRACs continue to fall as output expands. • Due to high sunk costs and economies of scale it is not efficient to have more than one firm providing goods or services in this market. • Some examples of industries that are close to being natural monopolies are BT, Royal Mail, Camelot and the National Grid.

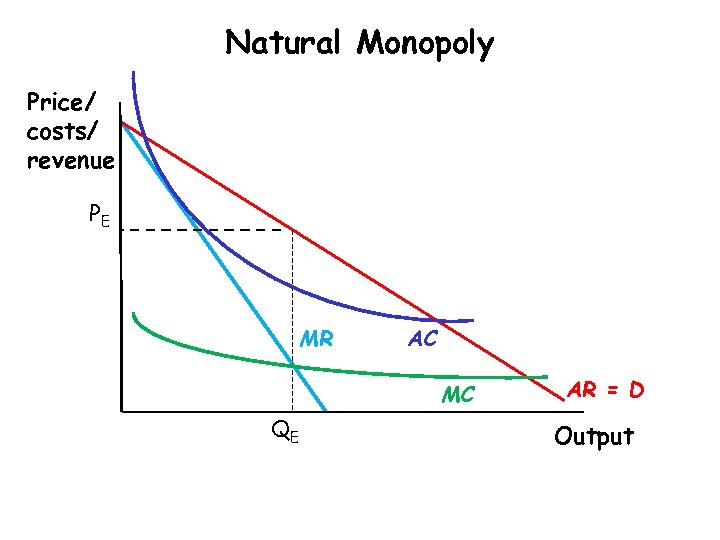

Natural Monopoly Price/ costs/ revenue PE MR AC MC QE AR = D Output

Natural Monopoly Price/ costs/ revenue PE MR AC MC QE AR = D Output

Monopoly and Efficiency • Using the article ‘Monopoly’ ET Jan 2005 • Add to your notes on the advantages and disadvantages on monopoly. • Ensure you have explained the concepts of static and dynamic efficiency

Monopoly and Efficiency • Using the article ‘Monopoly’ ET Jan 2005 • Add to your notes on the advantages and disadvantages on monopoly. • Ensure you have explained the concepts of static and dynamic efficiency

Output and Efficiency under Monopoly Rectangle Pabc= Abnormal Profit MC Cost/ Price AC P c a b D= AR Q MR Qp Qa Output

Output and Efficiency under Monopoly Rectangle Pabc= Abnormal Profit MC Cost/ Price AC P c a b D= AR Q MR Qp Qa Output

Price Discrimination

Price Discrimination

Examples of Price Discrimination?

Examples of Price Discrimination?

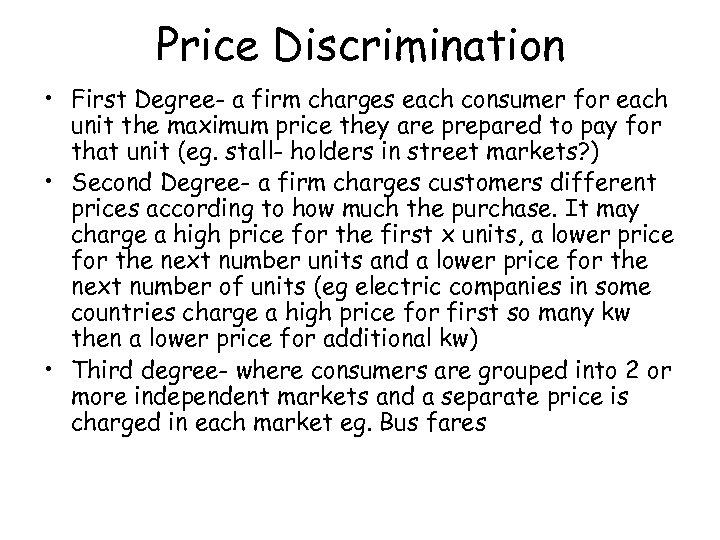

Price Discrimination • First Degree- a firm charges each consumer for each unit the maximum price they are prepared to pay for that unit (eg. stall- holders in street markets? ) • Second Degree- a firm charges customers different prices according to how much the purchase. It may charge a high price for the first x units, a lower price for the next number units and a lower price for the next number of units (eg electric companies in some countries charge a high price for first so many kw then a lower price for additional kw) • Third degree- where consumers are grouped into 2 or more independent markets and a separate price is charged in each market eg. Bus fares

Price Discrimination • First Degree- a firm charges each consumer for each unit the maximum price they are prepared to pay for that unit (eg. stall- holders in street markets? ) • Second Degree- a firm charges customers different prices according to how much the purchase. It may charge a high price for the first x units, a lower price for the next number units and a lower price for the next number of units (eg electric companies in some countries charge a high price for first so many kw then a lower price for additional kw) • Third degree- where consumers are grouped into 2 or more independent markets and a separate price is charged in each market eg. Bus fares

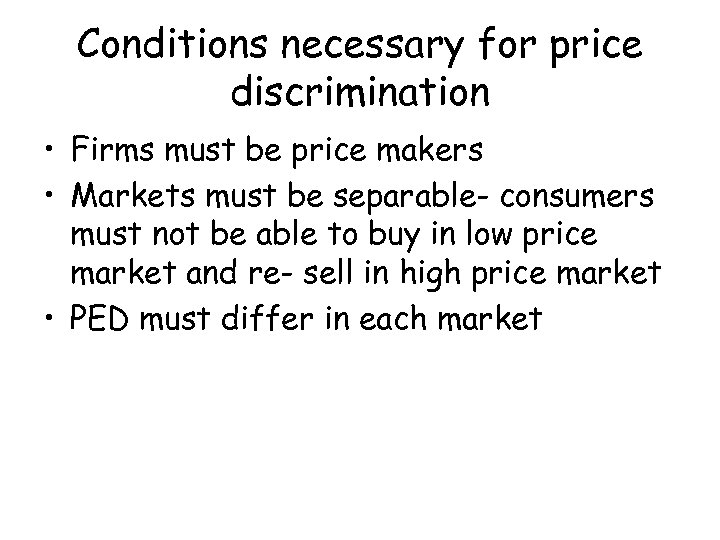

Conditions necessary for price discrimination • Firms must be price makers • Markets must be separable- consumers must not be able to buy in low price market and re- sell in high price market • PED must differ in each market

Conditions necessary for price discrimination • Firms must be price makers • Markets must be separable- consumers must not be able to buy in low price market and re- sell in high price market • PED must differ in each market

Diagram for Price discrimination

Diagram for Price discrimination

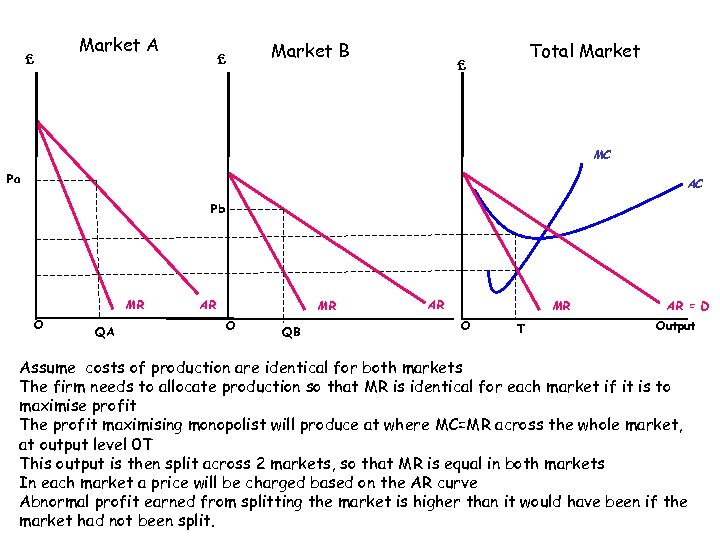

£ Market A £ Market B Total Market £ MC Pa AC Pb MR O QA AR MR O QB AR MR O T AR = D Output Assume costs of production are identical for both markets The firm needs to allocate production so that MR is identical for each market if it is to maximise profit The profit maximising monopolist will produce at where MC=MR across the whole market, at output level 0 T This output is then split across 2 markets, so that MR is equal in both markets In each market a price will be charged based on the AR curve Abnormal profit earned from splitting the market is higher than it would have been if the market had not been split.

£ Market A £ Market B Total Market £ MC Pa AC Pb MR O QA AR MR O QB AR MR O T AR = D Output Assume costs of production are identical for both markets The firm needs to allocate production so that MR is identical for each market if it is to maximise profit The profit maximising monopolist will produce at where MC=MR across the whole market, at output level 0 T This output is then split across 2 markets, so that MR is equal in both markets In each market a price will be charged based on the AR curve Abnormal profit earned from splitting the market is higher than it would have been if the market had not been split.

Handout • Who Gains from Price Discrimination? • ET Sept 2005

Handout • Who Gains from Price Discrimination? • ET Sept 2005

Price Discrimination and the Public Interest • Price discrimination is likely to increase output and make the product available to more people. • Distribution- those paying the higher price may feel it is unfair, those paying the lower price will have a higher consumer surplus than the otherwise would have had, they are able to consumer more and some may be able to obtain a good or service that they could otherwise not afford.

Price Discrimination and the Public Interest • Price discrimination is likely to increase output and make the product available to more people. • Distribution- those paying the higher price may feel it is unfair, those paying the lower price will have a higher consumer surplus than the otherwise would have had, they are able to consumer more and some may be able to obtain a good or service that they could otherwise not afford.

• Competition- A firm may use price discrimination to drive competitors out of business- predatory pricing (pricing below AC), eg. Cross- subsidising bus routes. On the other hand, a firm may use profits from high priced market to break into new markets and withstand a possible price war, thus competition is increased. • Profits- higher profits and prices could be seen as an undesirable re-distribution of income in society, however, higher profits could be reinvested= innovation or lower cost in future (maybe leading to lower prices? )

• Competition- A firm may use price discrimination to drive competitors out of business- predatory pricing (pricing below AC), eg. Cross- subsidising bus routes. On the other hand, a firm may use profits from high priced market to break into new markets and withstand a possible price war, thus competition is increased. • Profits- higher profits and prices could be seen as an undesirable re-distribution of income in society, however, higher profits could be reinvested= innovation or lower cost in future (maybe leading to lower prices? )

handout • P 209 • Price discrimination in the cinema

handout • P 209 • Price discrimination in the cinema

Alternative Objectives of the Firm • Profit Maximisation • Optimum Output (productively efficient level of output due to Govt intervention? ) • Socially Optimum output (allocatively efficient due to Govt intervention? ) • Normal Profit (Gov intervention? ) • Predatory Pricing Output (above normal profit below profit max • Sales Revenue Maximisation (when is sales revenue (total revenue maximised? ) • Sales Maximisation • Profit Satisficing

Alternative Objectives of the Firm • Profit Maximisation • Optimum Output (productively efficient level of output due to Govt intervention? ) • Socially Optimum output (allocatively efficient due to Govt intervention? ) • Normal Profit (Gov intervention? ) • Predatory Pricing Output (above normal profit below profit max • Sales Revenue Maximisation (when is sales revenue (total revenue maximised? ) • Sales Maximisation • Profit Satisficing

Sales Revenue Maximisation • High sales revenue – increase market share, easier to borrow money, increased market power • Output should be where MR=0, where TR will be at a peak • Output likely to be greater than Profit Max point • Extra sales after the unit where MR=0 contribute nothing to TR, therefore it is the sales revenue maximisation output

Sales Revenue Maximisation • High sales revenue – increase market share, easier to borrow money, increased market power • Output should be where MR=0, where TR will be at a peak • Output likely to be greater than Profit Max point • Extra sales after the unit where MR=0 contribute nothing to TR, therefore it is the sales revenue maximisation output

Sales Maximisation • Maximises volume of sales rather than revenue • Unlikely to increase output beyond a point where TC=TR (don’t want to make a loss) • Growth of the firm • May be the objective for managers (pay rise and other benefits) • Could conflict with shareholder objectives – want larger dividends, managers want to reinvest profits into the firm • Long run- both parties may be happy if sales maximisation policies have increased market share and raised long-run profits

Sales Maximisation • Maximises volume of sales rather than revenue • Unlikely to increase output beyond a point where TC=TR (don’t want to make a loss) • Growth of the firm • May be the objective for managers (pay rise and other benefits) • Could conflict with shareholder objectives – want larger dividends, managers want to reinvest profits into the firm • Long run- both parties may be happy if sales maximisation policies have increased market share and raised long-run profits

Profit Satisficing • Managers aim for a level of profit that will keep shareholders happy • Managers may be unwilling to accept extra responsibility and pressure for more competitive policies • May also wish to satisfy other stakeholders

Profit Satisficing • Managers aim for a level of profit that will keep shareholders happy • Managers may be unwilling to accept extra responsibility and pressure for more competitive policies • May also wish to satisfy other stakeholders

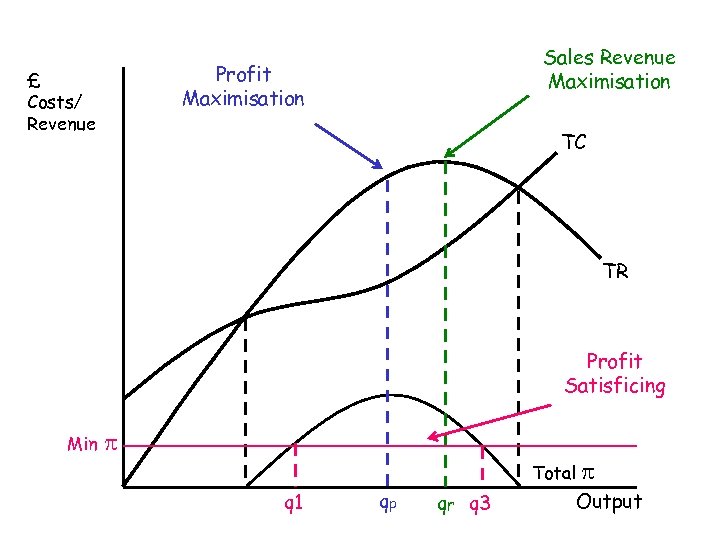

Sales Revenue Maximisation Profit Maximisation £ Costs/ Revenue TC TR Profit Satisficing Min p Total q 1 qp qr q 3 p Output

Sales Revenue Maximisation Profit Maximisation £ Costs/ Revenue TC TR Profit Satisficing Min p Total q 1 qp qr q 3 p Output

• Handout-Profit maximisation • Question

• Handout-Profit maximisation • Question

Contestable Markets : a market is perfectly contestable if 1. the cost of entry and exit by potential rivals are zero 2. entry can be made very rapidly A market is less contestable if there are: Economies of Scale if market demand is =/> MES, then the firm is likely to be a natural monopoly Sunk Costs: a firm’s investment e. g. specific capital, cannot be employed in alternative uses

Contestable Markets : a market is perfectly contestable if 1. the cost of entry and exit by potential rivals are zero 2. entry can be made very rapidly A market is less contestable if there are: Economies of Scale if market demand is =/> MES, then the firm is likely to be a natural monopoly Sunk Costs: a firm’s investment e. g. specific capital, cannot be employed in alternative uses

PC and Contestable Markets • ET Nov 2005 • Q 4

PC and Contestable Markets • ET Nov 2005 • Q 4