bc5ff53a46bdcab77fd0335e2c6b032a.ppt

- Количество слайдов: 58

Quantitative Investing Ibbotson Asset Allocation Conference Robert Litterman March, 2008

Clearly Articulated Investment Beliefs Should Drive Investment Strategy Our Investment Beliefs (an example) 1) There is only one basic source of long run wealth creation, the growth of the economy. 2) In equilibrium the investment portfolios of all individuals should reflect that source of wealth. The portfolios would all have weights proportional to market capitalizations which would reflect the economy’s expected future productive capacity. 3) The world is clearly (given, among other indications, the diversity of portfolios) not in equilibrium. 4) The market as a whole has shown itself to be subject to extended periods of overreaction. Nonetheless, capital markets are competitive, and though not entirely efficient, are becoming more efficient over time.

Clearly Articulated Investment Beliefs Should Drive Investment Strategy (continued) Our Investment Beliefs (an example) 5) Deviations from equilibrium provide opportunities for some disciplined investors with superior skills and information and typically a longer than average investment horizon to outperform the market return on a risk adjusted basis. 6 ) The key to superior investment performance is superior fundamental research through which we can identify disequilibrium phenomena. 7) Systematically capturing returns from such phenomena requires rigorous objective research, state of art risk measurement and portfolio construction, efficient trading, and patience.

Risk Is a Scarce Resource Risk provides the energy that creates returns However, risk also creates the opportunity for losses Losses should be limited in a bad scenario Thus, risk appetite is limited

How much pain is too much? Imagine a very bad economic scenario: · Equity markets decline globally by 50% · This decline reflects extensive defaults and depressed economic activity for several years In this environment long term investors should be increasing their allocation to equity. Will the investor be able to? How much can an individual afford to lose? (10%, 20%, …? ) The answer to this question is the most important determinant of long term asset allocation.

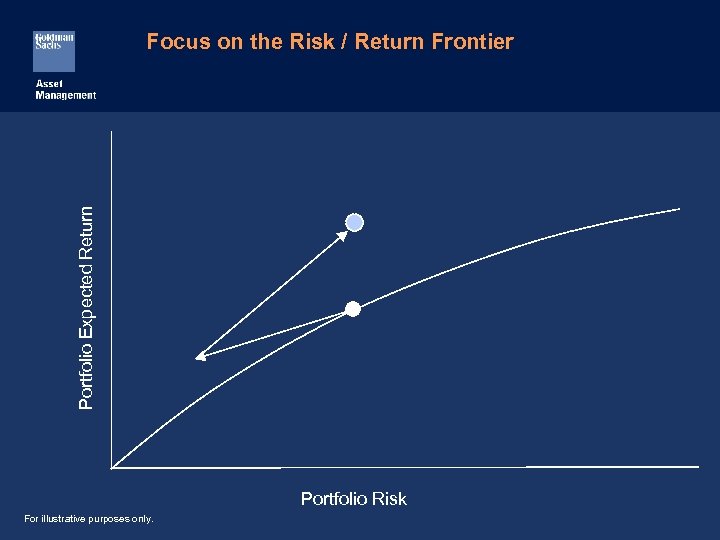

An Optimal Portfolio Maximizes return for a given level of risk For illustrative purposes only.

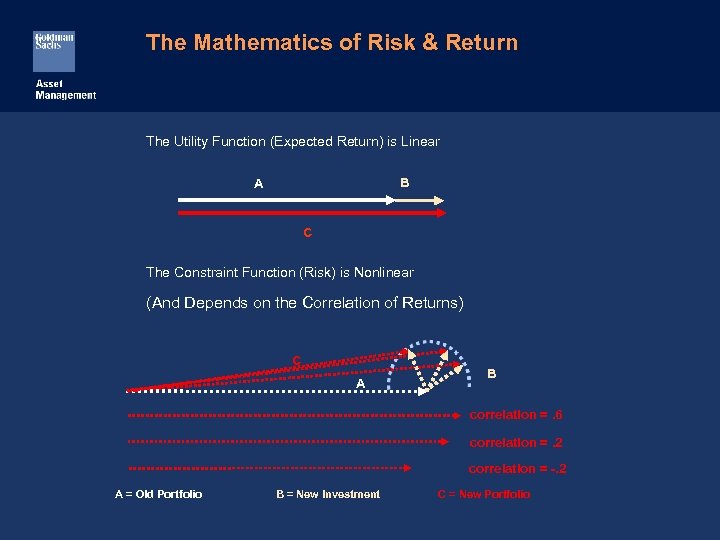

The Mathematics of Risk & Return The Utility Function (Expected Return) is Linear B A C The Constraint Function (Risk) is Nonlinear (And Depends on the Correlation of Returns) C A B correlation =. 6 correlation =. 2 correlation = -. 2 A = Old Portfolio B = New Investment C = New Portfolio

Different Levels of Portfolio Aggregation Can Highlight Different Dimensions of Risk In understanding the sources of risk and return at times it may be useful to focus on: · Each cash flow · Individual securities However, the most important determinants are: · Asset class allocations · Factors driving overall valuations ¾ In particular, beta, the exposure to global market returns

When Is a Portfolio Optimal? A portfolio is optimal when, at the margin the following ratio is identical for each asset or other investment activity: Change in Expected Excess Return Change in Portfolio Risk

Why Should This Be True? If not, the fund can be improved: · Take funds from the lowest (per unit of contribution to portfolio risk) returning activity · Move funds into a higher returning activity · Adjust cash to keep portfolio risk constant

Portfolio Expected Return Focus on the Risk / Return Frontier Portfolio Risk For illustrative purposes only.

The Bottom Line Ultimately there is a risk budget Every decision depends on: · Expected excess return · And the marginal impact on portfolio risk Efficient allocations require this ratio to be the same at every margin

Quantitative Models Measure Marginal Contribution to Risk The marginal contribution to risk of each asset · Depends on: ¾ The covariance of that asset with every other asset ¾ The amounts invested in each asset · Can be calculated given: ¾ Portfolio holdings ¾ Volatilities and correlations

The Marginal Risk Contribution Determines “Implied Views” If a portfolio is optimal, the implied expected excess returns must be proportional to the marginal contribution to portfolio risk We refer to these expected excess returns for which the portfolio is optimal as the “implied views” of the portfolio We call this a “risk based” approach to asset allocation because risk is measurable and risk measurement implies a set of views for which any portfolio is optimal. Are those implied views reasonable?

Implied Views Guide Behavior If these “implied views” conform with current expectations · Portfolio structure is appropriate Otherwise · Adjustments should be made to increase expected portfolio return ¾ Consider increasing investments in assets with expected returns above the implied views; decreasing those below

Equilibrium Theory provides a neutral starting point for Expected Returns

Modern Investment Management An Equilibrium Approach A book by Bob Litterman and 22 Goldman Sachs Asset Management investment professionals A re-examination of investment strategy with a focus on alpha vs. beta · Institutional investors are adjusting to an environment of low interest rates and reduced expected returns from equities. · What does the equilibrium theory suggest?

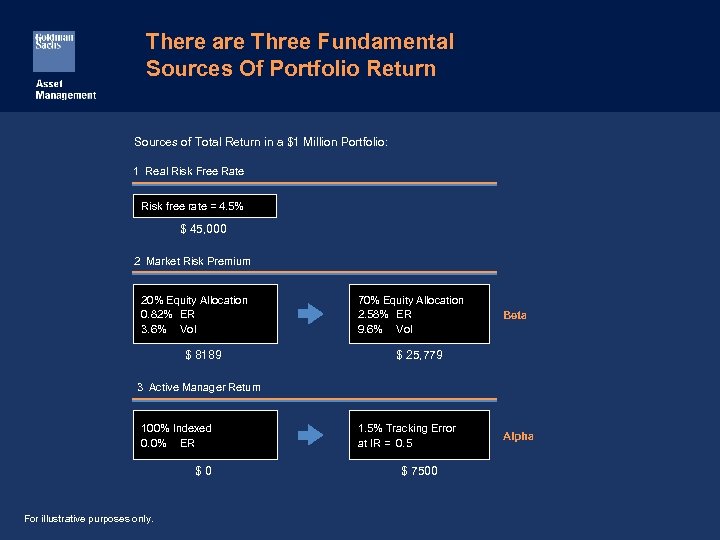

There are Three Fundamental Sources Of Portfolio Return Sources of Total Return in a $1 Million Portfolio: 1 Real Risk Free Rate Risk free rate = 4. 5% $ 45, 000 2 Market Risk Premium 20% Equity Allocation 0. 82% ER 3. 6% Vol $ 8189 70% Equity Allocation 2. 58% ER 9. 6% Vol Beta $ 25, 779 3 Active Manager Return 100% Indexed 0. 0% ER $ 0 For illustrative purposes only. 1. 5% Tracking Error at IR = 0. 5 $ 7500 Alpha

And Three Sources of Portfolio Risk Interest rate risk, usually from liabilities: · Uncompensated risk · Can be hedged via derivatives or bonds Market risk: · Basically available for free (no fees) · Has relatively low expected return per unit of risk Active risk: · Uncorrelated risk implies low impact on portfolio risk · Skill-based · Opportunities require deviations from equilibrium · Active management fees

Which Risks Should Be Compensated? An answer was provided by the capital asset pricing model: an equilibrium model When all investors maximize expected return subject to a risk constraint and markets are efficient Expected excess return (the equilibrium risk premium) is proportional to the beta of an asset Why? · Beta measures the marginal impact of increasing asset weight on the risk of the market portfolio

Why Focus on Equilibrium? The world is not “in equilibrium” The academic theory is nonetheless relevant for investors Deviations from equilibrium provide opportunities But investors taking advantage of these opportunities push the capital markets back toward equilibrium and greater efficiency So the equilibrium framework helps investors to identify opportunities…it provides the hurdle rate, the required expected return for taking additional risk

Equilibrium Expected Excess Returns There are several versions of Global CAPM Equilibrium We focus on a particularly simple one: Fischer Black’s “Universal Hedging” · An assumption on risk aversion determines: ¾ A constant degree of currency hedging ¾ A risk premium or excess return on all assets · Fischer’s model is calibrated to long run market returns

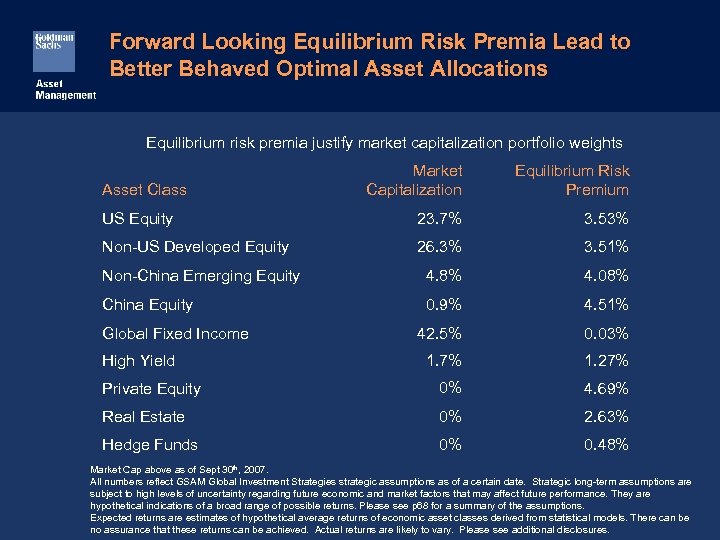

Forward Looking Equilibrium Risk Premia Lead to Better Behaved Optimal Asset Allocations Equilibrium risk premia justify market capitalization portfolio weights Market Capitalization Equilibrium Risk Premium US Equity 23. 7% 3. 53% Non-US Developed Equity 26. 3% 3. 51% Non-China Emerging Equity 4. 8% 4. 08% China Equity 0. 9% 4. 51% 42. 5% 0. 03% 1. 7% 1. 27% Private Equity 0% 4. 69% Real Estate 0% 2. 63% Hedge Funds 0% 0. 48% Asset Class Global Fixed Income High Yield Market Cap above as of Sept 30 th, 2007. All numbers reflect GSAM Global Investment Strategies strategic assumptions as of a certain date. Strategic long-term assumptions are subject to high levels of uncertainty regarding future economic and market factors that may affect future performance. They are hypothetical indications of a broad range of possible returns. Please see p 68 for a summary of the assumptions. Expected returns are estimates of hypothetical average returns of economic asset classes derived from statistical models. There can be no assurance that these returns can be achieved. Actual returns are likely to vary. Please see additional disclosures.

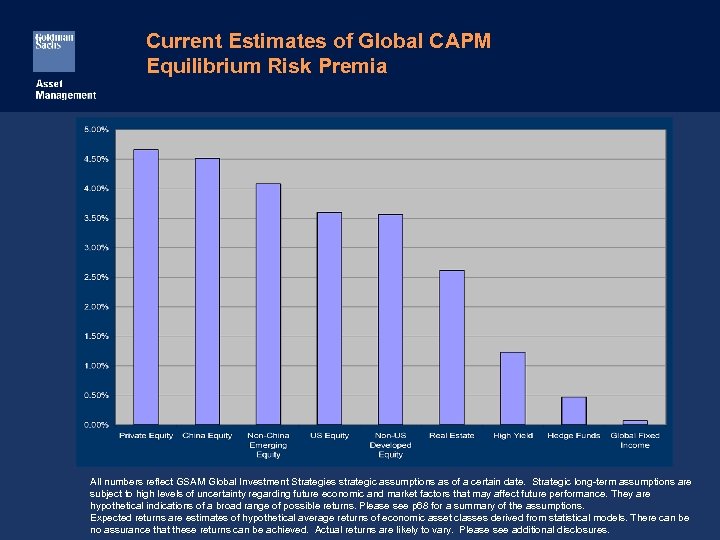

Current Estimates of Global CAPM Equilibrium Risk Premia All numbers reflect GSAM Global Investment Strategies strategic assumptions as of a certain date. Strategic long-term assumptions are subject to high levels of uncertainty regarding future economic and market factors that may affect future performance. They are hypothetical indications of a broad range of possible returns. Please see p 68 for a summary of the assumptions. Expected returns are estimates of hypothetical average returns of economic asset classes derived from statistical models. There can be no assurance that these returns can be achieved. Actual returns are likely to vary. Please see additional disclosures.

Strategic Asset Allocation provides a long term neutral anchor fund investment policy

Steps toward a Strategic Asset Allocation Specify the liability structure or fund objective: e. g. maximize real wealth creation Determine a risk tolerance Start with global equilibrium risk premia Tilt in the direction of long-term views Optimize

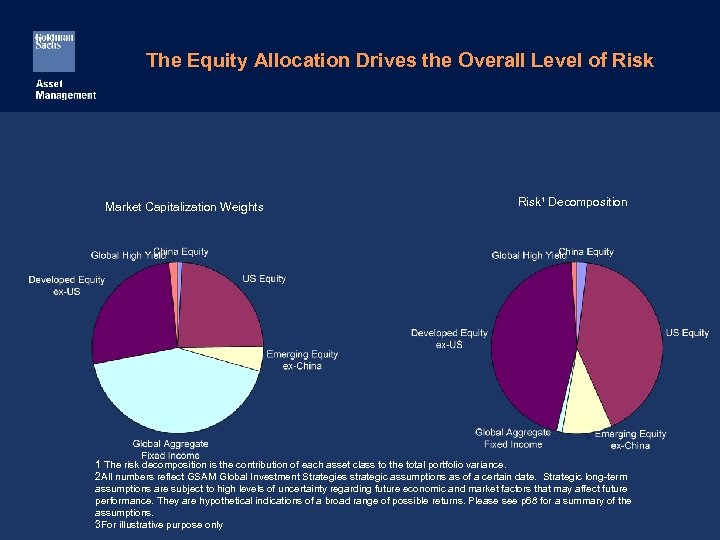

The Equity Allocation Drives the Overall Level of Risk Market Capitalization Weights Risk¹ Decomposition 1 The risk decomposition is the contribution of each asset class to the total portfolio variance. 2 All numbers reflect GSAM Global Investment Strategies strategic assumptions as of a certain date. Strategic long-term assumptions are subject to high levels of uncertainty regarding future economic and market factors that may affect future performance. They are hypothetical indications of a broad range of possible returns. Please see p 68 for a summary of the assumptions. 3 For illustrative purpose only

Black-Litterman Model combines Market Equilibrium with Investor Views

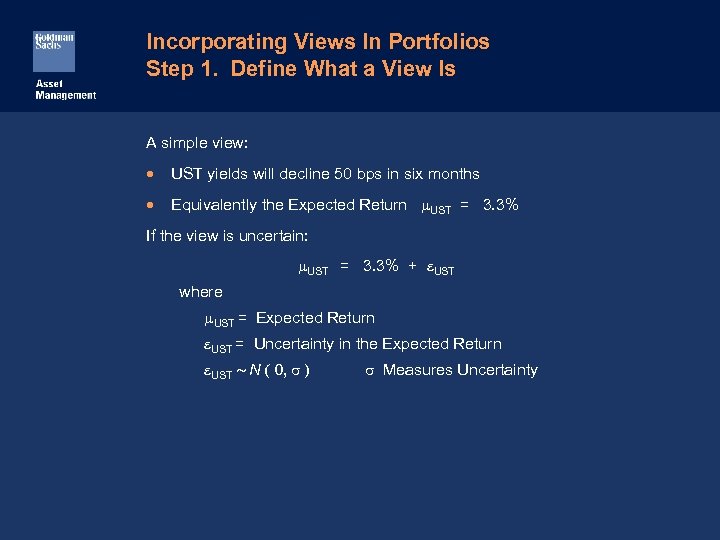

Incorporating Views In Portfolios Step 1. Define What a View Is A simple view: · UST yields will decline 50 bps in six months · Equivalently the Expected Return m. UST = 3. 3% If the view is uncertain: m. UST = 3. 3% + e. UST where m. UST = Expected Return e. UST = Uncertainty in the Expected Return e. UST ~ N ( 0, s ) s Measures Uncertainty

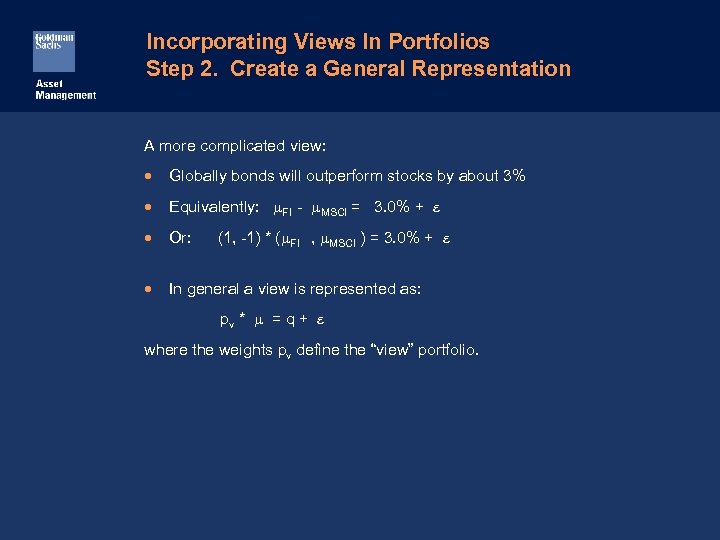

Incorporating Views In Portfolios Step 2. Create a General Representation A more complicated view: · Globally bonds will outperform stocks by about 3% · Equivalently: m. FI - m. MSCI = 3. 0% + e · Or: (1, -1) * (m. FI , m. MSCI ) = 3. 0% + e · In general a view is represented as: pv * m = q + e where the weights pv define the “view” portfolio.

Views Can Reflect Long-Run or Short-Run Opportunities In forming a Strategic Benchmark, views should reflect long-term deviations from equilibrium Examples: · Emerging markets will outperform developed markets · Infrastructure returns will exceed their beta · Excess returns to commodities will be positive

Tactical Views In forming a Tactical Asset Allocation, views should reflect shortterm deviations from equilibrium Examples: · Global stock markets will outperform global bond markets by only 2 percent this year (a relatively bearish view on stocks) · Real estate will underperform US equities by 5 percent this year · Chinese equities will outperform other emerging markets by 5 percent this year

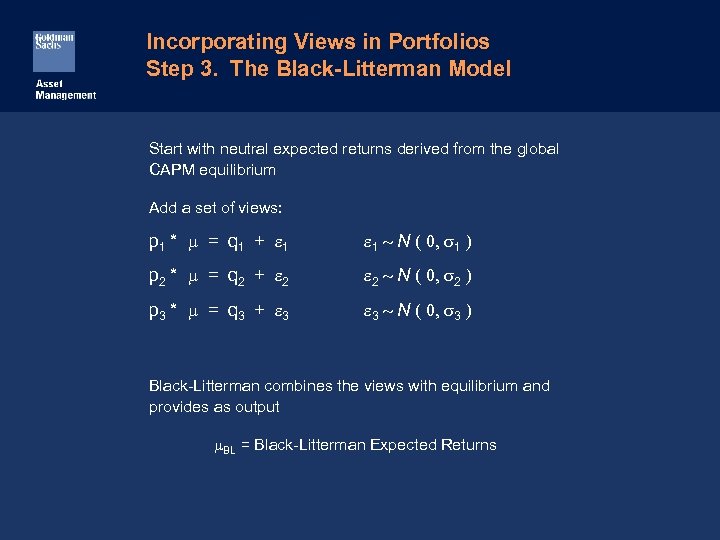

Incorporating Views in Portfolios Step 3. The Black-Litterman Model Start with neutral expected returns derived from the global CAPM equilibrium Add a set of views: p 1 * m = q 1 + e 1 ~ N ( 0, s 1 ) p 2 * m = q 2 + e 2 ~ N ( 0, s 2 ) p 3 * m = q 3 + e 3 ~ N ( 0, s 3 ) Black-Litterman combines the views with equilibrium and provides as output m. BL = Black-Litterman Expected Returns

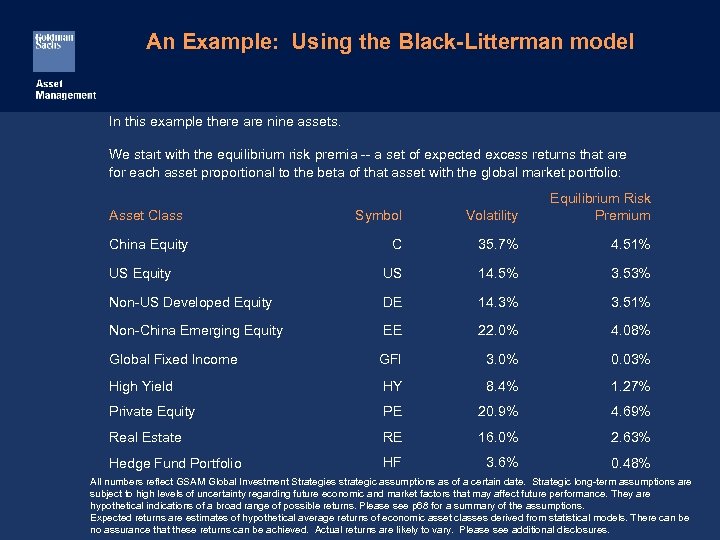

An Example: Using the Black-Litterman model In this example there are nine assets. We start with the equilibrium risk premia -- a set of expected excess returns that are for each asset proportional to the beta of that asset with the global market portfolio: Symbol Volatility Equilibrium Risk Premium C 35. 7% 4. 51% US Equity US 14. 5% 3. 53% Non-US Developed Equity DE 14. 3% 3. 51% Non-China Emerging Equity EE 22. 0% 4. 08% Global Fixed Income GFI 3. 0% 0. 03% High Yield HY 8. 4% 1. 27% Private Equity PE 20. 9% 4. 69% Real Estate RE 16. 0% 2. 63% Hedge Fund Portfolio HF 3. 6% 0. 48% Asset Class China Equity All numbers reflect GSAM Global Investment Strategies strategic assumptions as of a certain date. Strategic long-term assumptions are subject to high levels of uncertainty regarding future economic and market factors that may affect future performance. They are hypothetical indications of a broad range of possible returns. Please see p 68 for a summary of the assumptions. Expected returns are estimates of hypothetical average returns of economic asset classes derived from statistical models. There can be no assurance that these returns can be achieved. Actual returns are likely to vary. Please see additional disclosures.

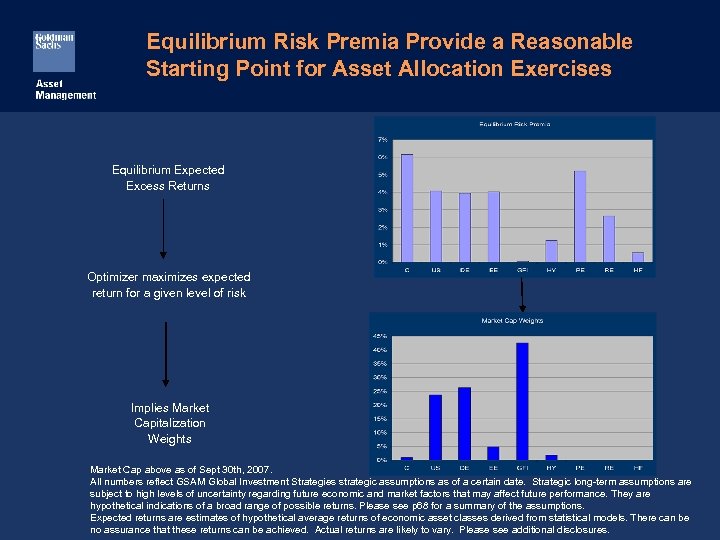

Equilibrium Risk Premia Provide a Reasonable Starting Point for Asset Allocation Exercises Equilibrium Expected Excess Returns Optimizer maximizes expected return for a given level of risk Implies Market Capitalization Weights Market Cap above as of Sept 30 th, 2007. All numbers reflect GSAM Global Investment Strategies strategic assumptions as of a certain date. Strategic long-term assumptions are subject to high levels of uncertainty regarding future economic and market factors that may affect future performance. They are hypothetical indications of a broad range of possible returns. Please see p 68 for a summary of the assumptions. Expected returns are estimates of hypothetical average returns of economic asset classes derived from statistical models. There can be no assurance that these returns can be achieved. Actual returns are likely to vary. Please see additional disclosures.

Suppose you have the view described below. How would you adjust your expected returns? 1. Global stock markets will outperform global bond markets by only 2 percent this year One approach is to make adjustments directly to the expected excess returns that drive an asset allocation exercise. Another approach is to use the Black-Litterman Global Asset Allocation Model.

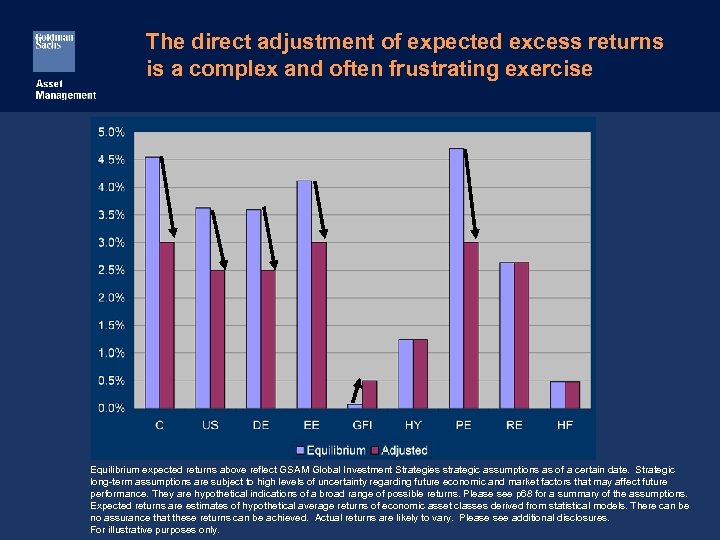

The direct adjustment of expected excess returns is a complex and often frustrating exercise Equilibrium expected returns above reflect GSAM Global Investment Strategies strategic assumptions as of a certain date. Strategic long-term assumptions are subject to high levels of uncertainty regarding future economic and market factors that may affect future performance. They are hypothetical indications of a broad range of possible returns. Please see p 68 for a summary of the assumptions. Expected returns are estimates of hypothetical average returns of economic asset classes derived from statistical models. There can be no assurance that these returns can be achieved. Actual returns are likely to vary. Please see additional disclosures. For illustrative purposes only.

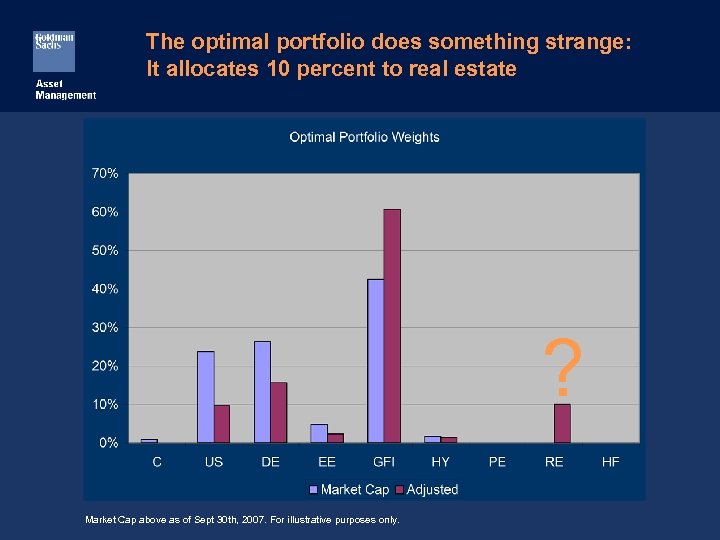

The optimal portfolio does something strange: It allocates 10 percent to real estate ? Market Cap above as of Sept 30 th, 2007. For illustrative purposes only.

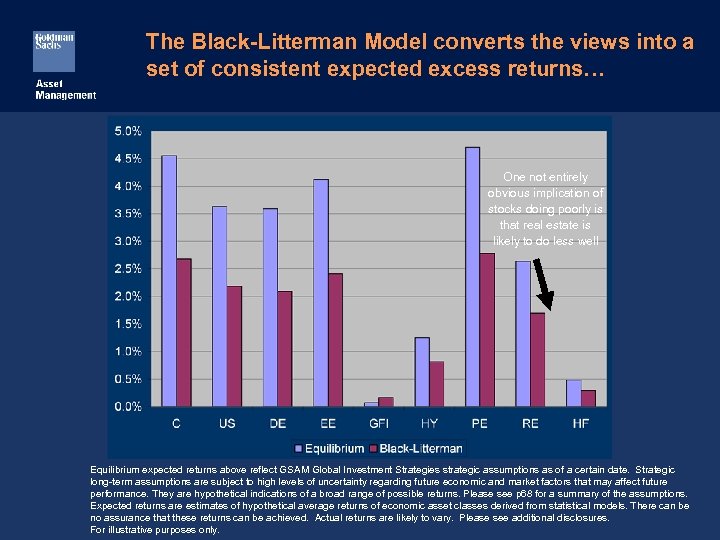

The Black-Litterman Model converts the views into a set of consistent expected excess returns… One not entirely obvious implication of stocks doing poorly is that real estate is likely to do less well Equilibrium expected returns above reflect GSAM Global Investment Strategies strategic assumptions as of a certain date. Strategic long-term assumptions are subject to high levels of uncertainty regarding future economic and market factors that may affect future performance. They are hypothetical indications of a broad range of possible returns. Please see p 68 for a summary of the assumptions. Expected returns are estimates of hypothetical average returns of economic asset classes derived from statistical models. There can be no assurance that these returns can be achieved. Actual returns are likely to vary. Please see additional disclosures. For illustrative purposes only.

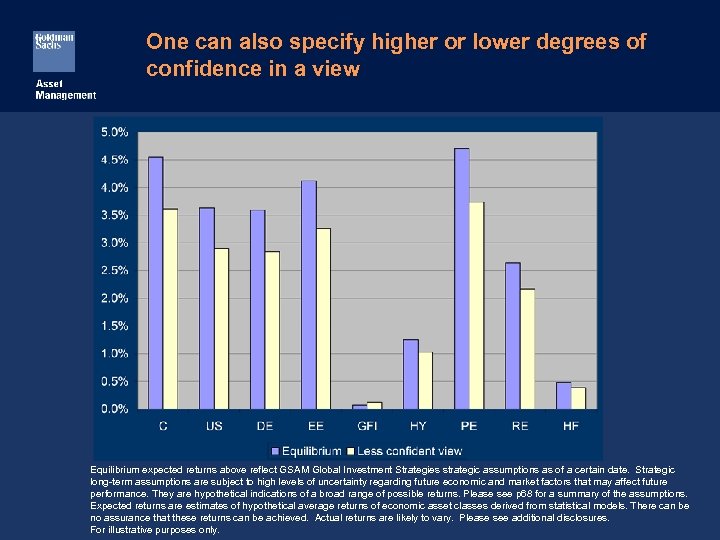

One can also specify higher or lower degrees of confidence in a view Equilibrium expected returns above reflect GSAM Global Investment Strategies strategic assumptions as of a certain date. Strategic long-term assumptions are subject to high levels of uncertainty regarding future economic and market factors that may affect future performance. They are hypothetical indications of a broad range of possible returns. Please see p 68 for a summary of the assumptions. Expected returns are estimates of hypothetical average returns of economic asset classes derived from statistical models. There can be no assurance that these returns can be achieved. Actual returns are likely to vary. Please see additional disclosures. For illustrative purposes only.

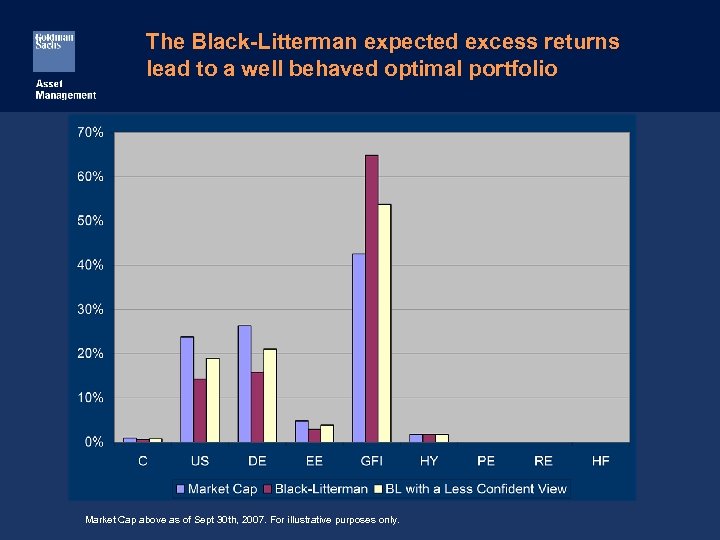

The Black-Litterman expected excess returns lead to a well behaved optimal portfolio Market Cap above as of Sept 30 th, 2007. For illustrative purposes only.

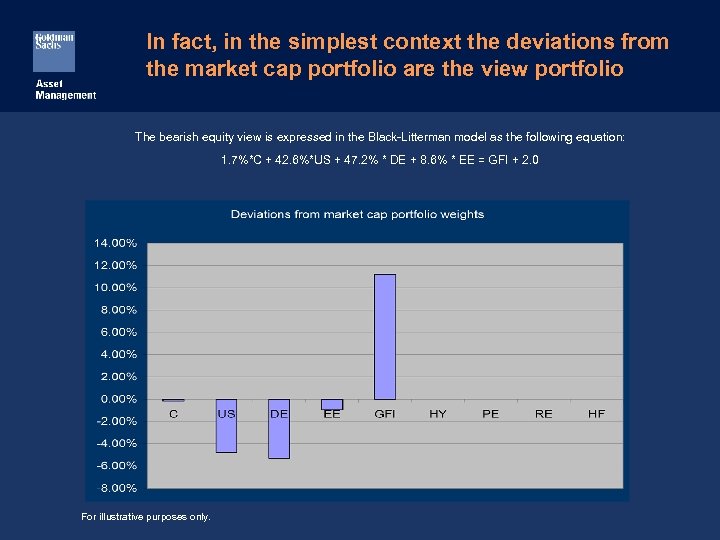

In fact, in the simplest context the deviations from the market cap portfolio are the view portfolio The bearish equity view is expressed in the Black-Litterman model as the following equation: 1. 7%*C + 42. 6%*US + 47. 2% * DE + 8. 6% * EE = GFI + 2. 0 For illustrative purposes only.

More generally, the Black-Litterman model allocates risk to a combination of view portfolios In the absence of: · A benchmark · Constraints · Transactions costs The optimal portfolio is a linear combination of the market and the view portfolios PBL = l 0 x M + l 1 x p 1 + l 2 x p 2 + l 3 x p 3

Where is the Value Added? In this simplest context the optimal portfolio is intuitive and obvious: · Tilt away from the market portfolio · Tilt toward an optimal combination of the view portfolios which we call the OTP, or “Optimal Tilt Portfolio” · Black-Litterman determines these optimal weights · The value added also shows up in more complex environments ¾ When transactions costs matter ¾ Or when there are constraints

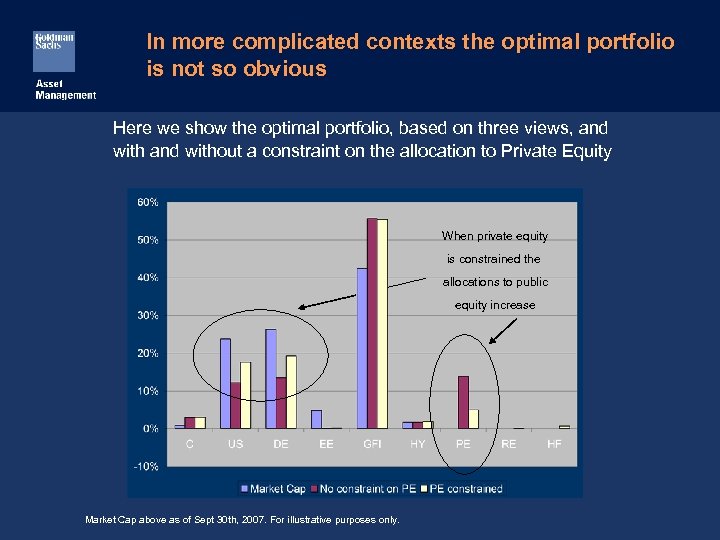

In more complicated contexts the optimal portfolio is not so obvious Here we show the optimal portfolio, based on three views, and without a constraint on the allocation to Private Equity When private equity is constrained the allocations to public equity increase Market Cap above as of Sept 30 th, 2007. For illustrative purposes only.

The Role of Active Management

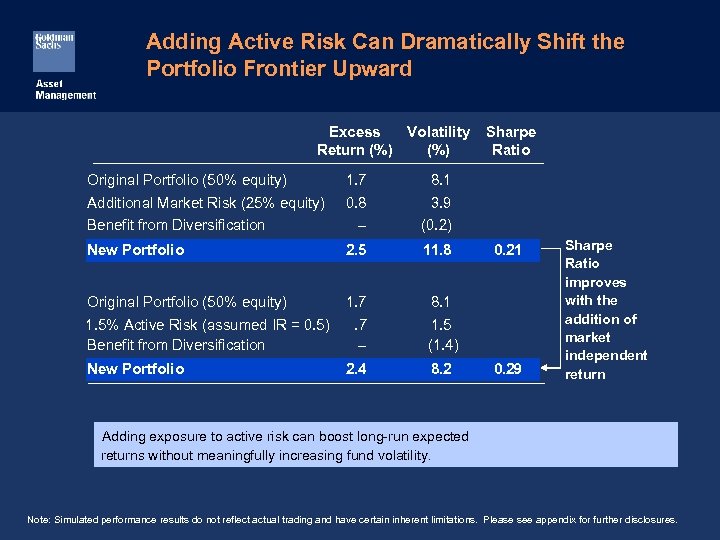

Adding Active Risk Can Dramatically Shift the Portfolio Frontier Upward Volatility Excess (%) Return (%) Original Portfolio (50% equity) 1. 7 8. 1 Additional Market Risk (25% equity) Benefit from Diversification 0. 8 – 3. 9 (0. 2) New Portfolio 2. 5 11. 8 Original Portfolio (50% equity) 1. 7 8. 1 . 7 – 1. 5 (1. 4) 2. 4 8. 2 Sharpe Ratio 1. 5% Active Risk (assumed IR = 0. 5) Benefit from Diversification New Portfolio 0. 21 0. 29 Sharpe Ratio improves with the addition of market independent return Adding exposure to active risk can boost long-run expected returns without meaningfully increasing fund volatility. Note: Simulated performance results do not reflect actual trading and have certain inherent limitations. Please see appendix for further disclosures.

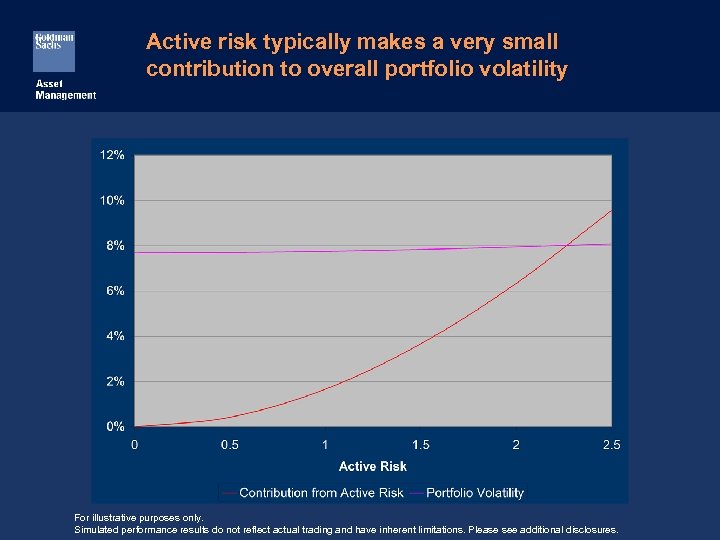

Active risk typically makes a very small contribution to overall portfolio volatility For illustrative purposes only. Simulated performance results do not reflect actual trading and have inherent limitations. Please see additional disclosures.

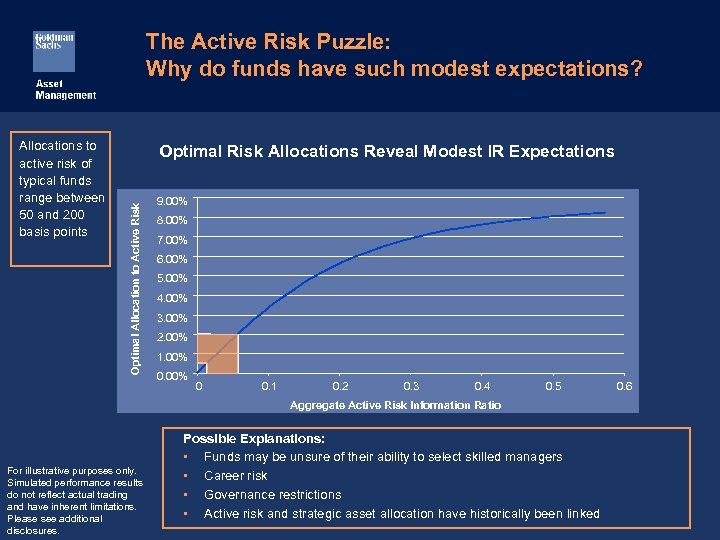

The Active Risk Puzzle: Why do funds have such modest expectations? Optimal Risk Allocations Reveal Modest IR Expectations Optimal Allocation to Active Risk Allocations to active risk of typical funds range between 50 and 200 basis points Volatility = 9. 0% 9. 00% 8. 00% 7. 00% Volatility = 6. 0% 6. 00% 5. 00% 4. 00% 3. 00% 2. 00% 1. 00% 0 0. 1 Source: Goldman Sachs Asset Management. 0. 2 0. 3 0. 4 0. 5 Aggregate Active Risk Information Ratio For illustrative purposes only. Simulated performance results do not reflect actual trading and have inherent limitations. Please see additional disclosures. Possible Explanations: • Funds may be unsure of their ability to select skilled managers • Career risk • Governance restrictions • Active risk and strategic asset allocation have historically been linked 0. 6

Alternative investments encompass a diverse range of strategies and are a good source of active risk Private Equity Real Estate Hedge Funds Commodities Overlays such as GTAA (Global Tactical Asset Allocation) and Active Currency Management

What Makes Alternative Investments Attractive? Attributes of Alternative Investments include: · Historically attractive absolute returns versus traditional asset classes · Lower correlations that can provide protection in bear markets · Therefore may provide excess returns above the equilibrium hurdle rate

Appendix

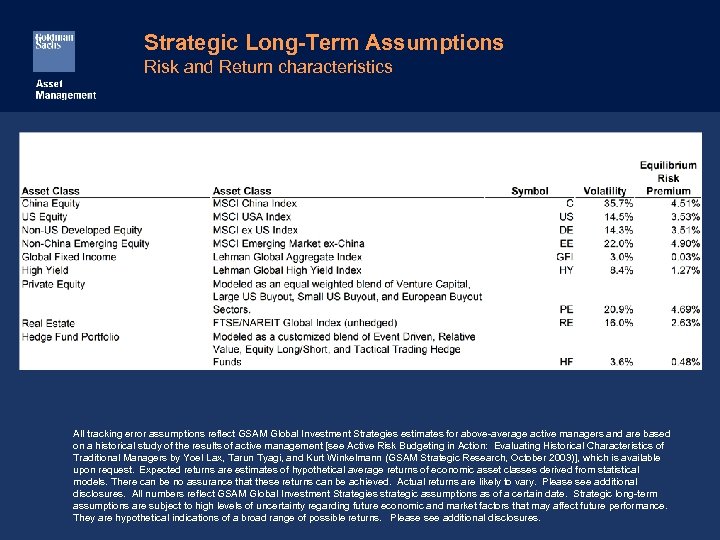

Strategic Long-Term Assumptions Risk and Return characteristics All tracking error assumptions reflect GSAM Global Investment Strategies estimates for above-average active managers and are based on a historical study of the results of active management [see Active Risk Budgeting in Action: Evaluating Historical Characteristics of Traditional Managers by Yoel Lax, Tarun Tyagi, and Kurt Winkelmann (GSAM Strategic Research, October 2003)], which is available upon request. Expected returns are estimates of hypothetical average returns of economic asset classes derived from statistical models. There can be no assurance that these returns can be achieved. Actual returns are likely to vary. Please see additional disclosures. All numbers reflect GSAM Global Investment Strategies strategic assumptions as of a certain date. Strategic long-term assumptions are subject to high levels of uncertainty regarding future economic and market factors that may affect future performance. They are hypothetical indications of a broad range of possible returns. Please see additional disclosures.

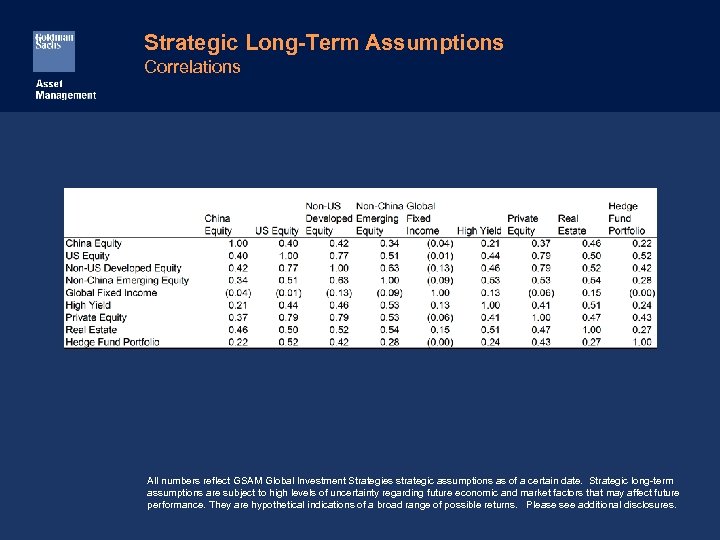

Strategic Long-Term Assumptions Correlations All numbers reflect GSAM Global Investment Strategies strategic assumptions as of a certain date. Strategic long-term assumptions are subject to high levels of uncertainty regarding future economic and market factors that may affect future performance. They are hypothetical indications of a broad range of possible returns. Please see additional disclosures.

Appendix The currency market affords investors a substantial degree of leverage. This leverage presents the potential for substantial profits but also entails a high degree of risk including the risk that losses may be similarly substantial. Such transactions are considered suitable only for investors who are experienced in transactions of that kind. Currency fluctuations will also affect the value of an investment. Emerging markets securities may be less liquid and more volatile and are subject to a number of additional risks, including but not limited to currency fluctuations and political instability. High-yield, lower-rated securities involve greater price volatility and present greater credit risks than higher-rated fixed income securities. An investment in real estate securities is subject to greater price volatility and the special risks associated with direct ownership of real estate. The portfolio risk management process includes an effort to monitor and manage risk, but does not imply low risk. Indices are unmanaged. The figures for the index reflect the reinvestment of dividends but do not reflect the deduction of any fees or expenses which would reduce returns. Investors cannot invest directly in indices. References to indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only and do not imply that the portfolio will achieve similar results. The index composition may not reflect the manner in which a portfolio is constructed. While an adviser seeks to design a portfolio which reflects appropriate risk and return features, portfolio characteristics may deviate from those of the benchmark.

Appendix There may be conflicts of interest relating to the Alternative Investment and its service providers, including Goldman Sachs and its affiliates, who are engaged in businesses and have interests other than that of managing, distributing and otherwise providing services to the Alternative Investment. These activities and interests include potential multiple advisory, transactional and financial and other interests in securities and instruments that may be purchased or sold by the Alternative Investment, or in other investment vehicles that may purchase or sell such securities and instruments. These are considerations of which investors in the Alternative Investment should be aware. Additional information relating to these conflicts is set forth in the offering materials for the Alternative Investment. Past performance is not indicative of future results, which may vary. The value of investments and the income derived from investments can go down as well as up. Future returns are not guaranteed, and a loss of principal may occur. Effect of Fees The following table provides a simplified example of the effect of management fees on portfolio returns. Assume a portfolio has a steady investment return, gross of fees, of 0. 5% per month and total management fees of 0. 05% per month of the market value of the portfolio on the last day of the month. Management fees are deducted from the market value of the portfolio on that day. There are no cash flows during the period. The table shows that, assuming all other factors remain constant, the difference increases due to the compounding effect over time. Of course, the magnitude of the difference between gross-of-fee and net-of-fee returns will depend on a variety of factors, and this example is purposely simplified. Period 1 year 2 years 10 years Gross Return 6. 17% 12. 72 81. 94 Net Return 5. 54% 11. 38 71. 39 Differential 0. 63% 1. 34 10. 55

Appendix Alternative Investments such as hedge funds are subject to less regulation than other types of pooled investment vehicles such as mutual funds, may make speculative investments, may be illiquid and can involve a significant use of leverage, making them substantially riskier than the other investments. An Alternative Investment Fund may incur high fees and expenses which would offset trading profits. Alternative Investment Funds are not required to provide periodic pricing or valuation information to investors. The Manager of an Alternative Investment Fund has total investment discretion over the investments of the Fund and the use of a single advisor applying generally similar trading programs could mean a lack of diversification, and consequentially, higher risk. Investors may have limited rights with respect to their investments, including limited voting rights and participation in the management of the Fund. Alternative Investments by their nature, involve a substantial degree of risk, including the risk of total loss of an investor's capital. Fund performance can be volatile. There may be conflicts of interest between the Alternative Investment Fund and other service providers, including the investment manager and sponsor of the Alternative Investment. Similarly, interests in an Alternative Investment are highly illiquid and generally are not transferable without the consent of the sponsor, and applicable securities and tax laws will limit transfers. Strategic Long Term Assumptions The data regarding strategic assumptions has been generated by GSAM for informational purposes. As such data is estimated and based on a number of assumptions; it is subject to significant revision and may change materially with changes in the underlying assumptions. GSAM has no obligation to provide updates or changes. The strategic longterm assumptions shown are largely based on proprietary models and do not provide any assurance as to future returns. They are not representative of how we will manage any portfolios or allocate funds to the asset classes.

Appendix These examples are for illustrative purposes only and are not actual results. If any assumptions used do not prove to be true, results may vary substantially. This material is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. Simulated Performance Simulated performance is hypothetical and may not take into account material economic and market factors that would impact the adviser’s decision-making. Simulated results are achieved by retroactively applying a model with the benefit of hindsight. The results reflect the reinvestment of dividends and other earnings, but do not reflect fees, transaction costs, and other expenses, which would reduce returns. Actual results will vary. Views and opinions expressed are for informational purposes only and do not constitute a recommendation by GSAM to buy, sell, or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change, they should not be construed as investment advice. Opinions expressed are current opinions as of the date appearing in this material only. No part of this material may, without GSAM’s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient. Copyright © 2007, Goldman, Sachs & Co. All rights reserved.

bc5ff53a46bdcab77fd0335e2c6b032a.ppt