64aa6fa1daeb3bbc8474e2c3b759e695.ppt

- Количество слайдов: 33

Quantitative Easing Monetary Policy: Potential Risk Dr. Xiaozhou Cheng Nov. 2012 www. greenway 2 china. com 1

Quantitative Easing Monetary Policy: Potential Risk Dr. Xiaozhou Cheng Nov. 2012 www. greenway 2 china. com 1

全球中央银行量化宽松货币政 策: 制造潜在的金融危机 成小洲 博士 2012年 11月 www. greenway 2 china. com 2

全球中央银行量化宽松货币政 策: 制造潜在的金融危机 成小洲 博士 2012年 11月 www. greenway 2 china. com 2

What is the quantitative easing (QE) • • Is QE to print more currency? Answer: NO Why? Balance sheet of central bank Assets side: increase domestic securities by implementing QE • Liabilities side: increase the value of the reserve account of banks rather than the value of currency • Printing money (bank notes): increase the value of currency www. greenway 2 china. com 3

What is the quantitative easing (QE) • • Is QE to print more currency? Answer: NO Why? Balance sheet of central bank Assets side: increase domestic securities by implementing QE • Liabilities side: increase the value of the reserve account of banks rather than the value of currency • Printing money (bank notes): increase the value of currency www. greenway 2 china. com 3

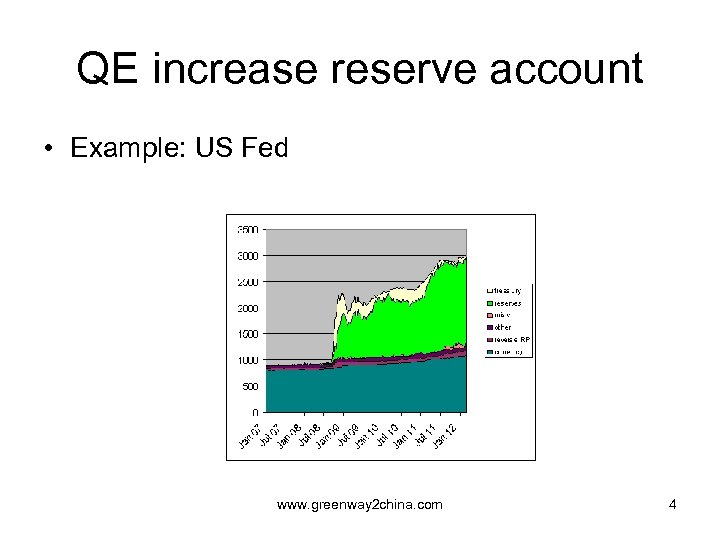

QE increase reserve account • Example: US Fed www. greenway 2 china. com 4

QE increase reserve account • Example: US Fed www. greenway 2 china. com 4

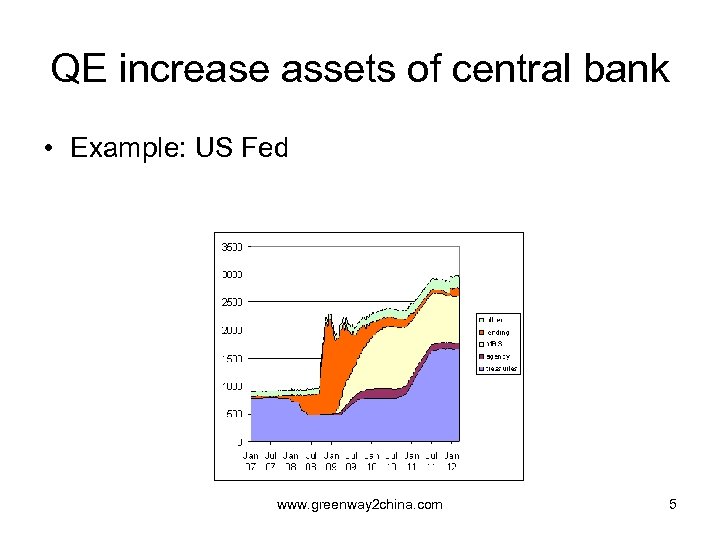

QE increase assets of central bank • Example: US Fed www. greenway 2 china. com 5

QE increase assets of central bank • Example: US Fed www. greenway 2 china. com 5

What is QE • QE monetary policy: purchase treasury bond or private securities (mortgage back securities) • QE monetary policy does not mean printing more banknotes (currency), and means to buy government bonds or private securities from investment institutes, such as pension funds, insurance company. The central bank create electronic money through purchasing these securities. These investment institutes would buy another securities using the money which has been received by selling the government bonds to the central bank. www. greenway 2 china. com 6

What is QE • QE monetary policy: purchase treasury bond or private securities (mortgage back securities) • QE monetary policy does not mean printing more banknotes (currency), and means to buy government bonds or private securities from investment institutes, such as pension funds, insurance company. The central bank create electronic money through purchasing these securities. These investment institutes would buy another securities using the money which has been received by selling the government bonds to the central bank. www. greenway 2 china. com 6

Extent of QE • US Fed: QE 1, Nov. 2008, $US 600 billion; QE 2, Nov. 2010, $US 600 billion; QE 3; Sept, 13, 2012, $US 40 billion every month until U. S. employment rate increase • Bank of England: purchased £ 200 billion gilts between March and Sept. 2009; purchased more £ 75 billion gilts in Oct. 2011; in Feb. and July, 2012, the Bank bought more £ 50 billion gilts respectively. The total assets that the bank purchased are £ 375 (during 2011 to 2012, the Bank of England increased the amounts purchased gilts) • Bank of Japan and European Central Bank also purchased the government bonds and private securities by the QE program www. greenway 2 china. com 7

Extent of QE • US Fed: QE 1, Nov. 2008, $US 600 billion; QE 2, Nov. 2010, $US 600 billion; QE 3; Sept, 13, 2012, $US 40 billion every month until U. S. employment rate increase • Bank of England: purchased £ 200 billion gilts between March and Sept. 2009; purchased more £ 75 billion gilts in Oct. 2011; in Feb. and July, 2012, the Bank bought more £ 50 billion gilts respectively. The total assets that the bank purchased are £ 375 (during 2011 to 2012, the Bank of England increased the amounts purchased gilts) • Bank of Japan and European Central Bank also purchased the government bonds and private securities by the QE program www. greenway 2 china. com 7

Intention of QE • Intention: lowers down the long term bond or securities interest rates • Intention: reduces the investment cost • Intention: stimulates the demand (investment and consumption) • Intention outcome: stimulates the economy www. greenway 2 china. com 8

Intention of QE • Intention: lowers down the long term bond or securities interest rates • Intention: reduces the investment cost • Intention: stimulates the demand (investment and consumption) • Intention outcome: stimulates the economy www. greenway 2 china. com 8

Why choose QE • Why central banks choose QE policy? • Answer: the conventional monetary policy tools have reached their limitations • Overnight interest rates have been close zero. • Central banks are impotent in using conventional monetary policy instruments • QE is extraordinary monetary policy tool www. greenway 2 china. com 9

Why choose QE • Why central banks choose QE policy? • Answer: the conventional monetary policy tools have reached their limitations • Overnight interest rates have been close zero. • Central banks are impotent in using conventional monetary policy instruments • QE is extraordinary monetary policy tool www. greenway 2 china. com 9

History of QE policy • Japan: used in its 1990 s recession • Bernanke, then a professor of Princeton University, raised the advice on QE policy to Bank of Japan • US Fed reserve implemented QE 1, QE 2 and QE 3 in recent recession • European Central Bank implemented QE in recent recession • Bank of England implemented QE in recent recession www. greenway 2 china. com 10

History of QE policy • Japan: used in its 1990 s recession • Bernanke, then a professor of Princeton University, raised the advice on QE policy to Bank of Japan • US Fed reserve implemented QE 1, QE 2 and QE 3 in recent recession • European Central Bank implemented QE in recent recession • Bank of England implemented QE in recent recession www. greenway 2 china. com 10

QE and Inflation • One of intentions of QE policy: boosting up the inflation rate (stimulate the economy) • Experiences of QE policy: with respect to either Japan in 1990 s or US, European or England, inflation rates are still low, economy still undergo the recession • Will inflation happen in the future due to QE? www. greenway 2 china. com 11

QE and Inflation • One of intentions of QE policy: boosting up the inflation rate (stimulate the economy) • Experiences of QE policy: with respect to either Japan in 1990 s or US, European or England, inflation rates are still low, economy still undergo the recession • Will inflation happen in the future due to QE? www. greenway 2 china. com 11

Why does the QE not work well • By the economics text book, the QE should stimulate the economy, why the economy still undergoes the recession? • Where has the extra money that the central bank injects through the QE gone? • Does the extra money stay within the US? Answer: NO! • Where is it? Emerging markets • Why has the extra money not stayed within US? • Explanation: By Keynesian economics, markets lost confidences on the future. It is not due to the high investment cost. www. greenway 2 china. com 12

Why does the QE not work well • By the economics text book, the QE should stimulate the economy, why the economy still undergoes the recession? • Where has the extra money that the central bank injects through the QE gone? • Does the extra money stay within the US? Answer: NO! • Where is it? Emerging markets • Why has the extra money not stayed within US? • Explanation: By Keynesian economics, markets lost confidences on the future. It is not due to the high investment cost. www. greenway 2 china. com 12

Effect of the QE • One of direct effects of QE is the assets of central banks are popped up • The advanced economy: the assets of central banks are popped up by QE through purchasing the government bonds and private securities • Emerging economy: the assets of central banks are popped up by central banks sterilization program • The extra money which the advanced economy central banks injected by QE flowed into the emerging economy. • The central banks in the emerging markets has to absorbed the inflow hot money in order to relive the pressure on appreciation of their currencies • Sterilization: the only choice for the emerging markets central banks • Consequences: the assets of central banks all over the world have increased dramatically for last four years www. greenway 2 china. com 13

Effect of the QE • One of direct effects of QE is the assets of central banks are popped up • The advanced economy: the assets of central banks are popped up by QE through purchasing the government bonds and private securities • Emerging economy: the assets of central banks are popped up by central banks sterilization program • The extra money which the advanced economy central banks injected by QE flowed into the emerging economy. • The central banks in the emerging markets has to absorbed the inflow hot money in order to relive the pressure on appreciation of their currencies • Sterilization: the only choice for the emerging markets central banks • Consequences: the assets of central banks all over the world have increased dramatically for last four years www. greenway 2 china. com 13

Scales of the assets of the main central banks • • • China (2011, the ratio : 59. 4% (GDP 47288160 million yuan, assets: 28097760 million yuan). By estimating 2012 the ratio will be more than 60% US Fed (2012 Oct Fed assets: $2. 8 trillion, the ratio: more than 20%) European (eurosystem assets: 2012 sep. € 5. 49 trillion, 2011 Dec. assets, € 4. 7 trillion the ratio: 2011 GDP € 9. 42 trillion. the ratio in 2011: 49. 89% England (the ratio: 26%) Japan (total assets: ¥ 139 trillion by the end of march 2012) India (total asset: 10. 81 trillion ruppe by the end of sept. 2012. the ratio 13. 3%) Russia (total assets 18. 56 trillion rubles by end of 2011, the ratio is 31. 16%) Brazil (total assets: 1. 58 trillion Real. the ratio: 35% by the end of 2011) The ratio of the assets of central bank to GDP is more than 30% already www. greenway 2 china. com 14

Scales of the assets of the main central banks • • • China (2011, the ratio : 59. 4% (GDP 47288160 million yuan, assets: 28097760 million yuan). By estimating 2012 the ratio will be more than 60% US Fed (2012 Oct Fed assets: $2. 8 trillion, the ratio: more than 20%) European (eurosystem assets: 2012 sep. € 5. 49 trillion, 2011 Dec. assets, € 4. 7 trillion the ratio: 2011 GDP € 9. 42 trillion. the ratio in 2011: 49. 89% England (the ratio: 26%) Japan (total assets: ¥ 139 trillion by the end of march 2012) India (total asset: 10. 81 trillion ruppe by the end of sept. 2012. the ratio 13. 3%) Russia (total assets 18. 56 trillion rubles by end of 2011, the ratio is 31. 16%) Brazil (total assets: 1. 58 trillion Real. the ratio: 35% by the end of 2011) The ratio of the assets of central bank to GDP is more than 30% already www. greenway 2 china. com 14

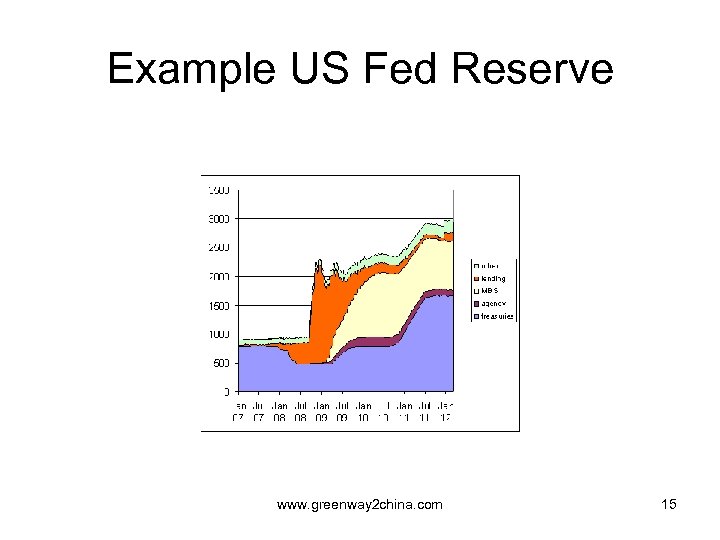

Example US Fed Reserve www. greenway 2 china. com 15

Example US Fed Reserve www. greenway 2 china. com 15

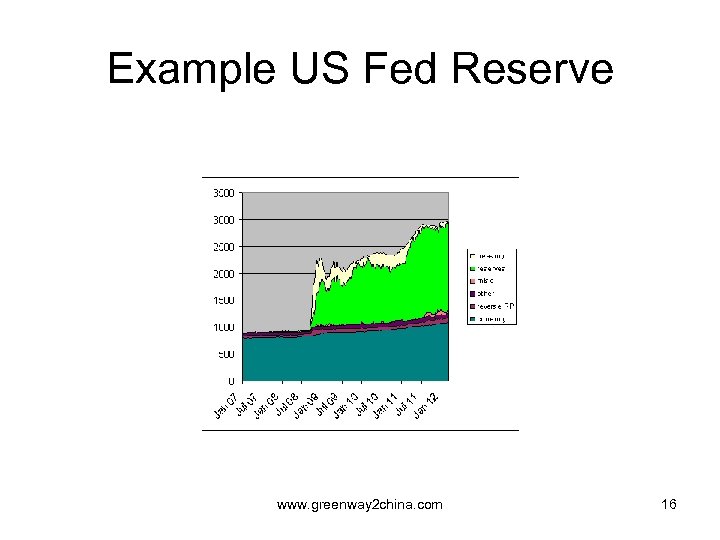

Example US Fed Reserve www. greenway 2 china. com 16

Example US Fed Reserve www. greenway 2 china. com 16

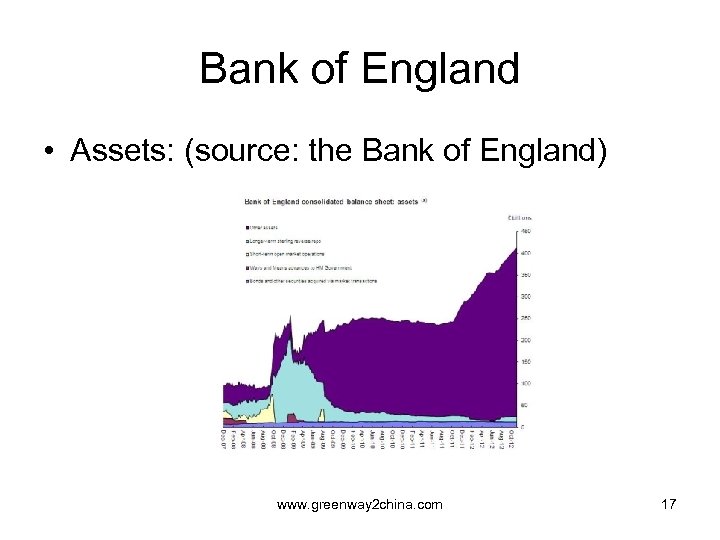

Bank of England • Assets: (source: the Bank of England) www. greenway 2 china. com 17

Bank of England • Assets: (source: the Bank of England) www. greenway 2 china. com 17

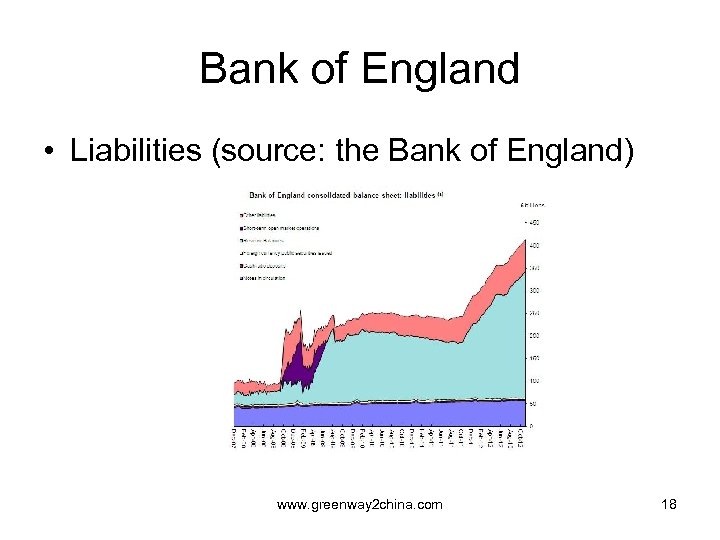

Bank of England • Liabilities (source: the Bank of England) www. greenway 2 china. com 18

Bank of England • Liabilities (source: the Bank of England) www. greenway 2 china. com 18

Hazard of large scale assets of central banks • International financial system stabilities • Financial assets bubble in the future (there is a time lag) • Changing the foreign exchange rates and the term of trade in arena of international economic system www. greenway 2 china. com 19

Hazard of large scale assets of central banks • International financial system stabilities • Financial assets bubble in the future (there is a time lag) • Changing the foreign exchange rates and the term of trade in arena of international economic system www. greenway 2 china. com 19

QE pro up the prices of food and resources • High prices of the food and resources impeded recovering the markets confidences www. greenway 2 china. com 20

QE pro up the prices of food and resources • High prices of the food and resources impeded recovering the markets confidences www. greenway 2 china. com 20

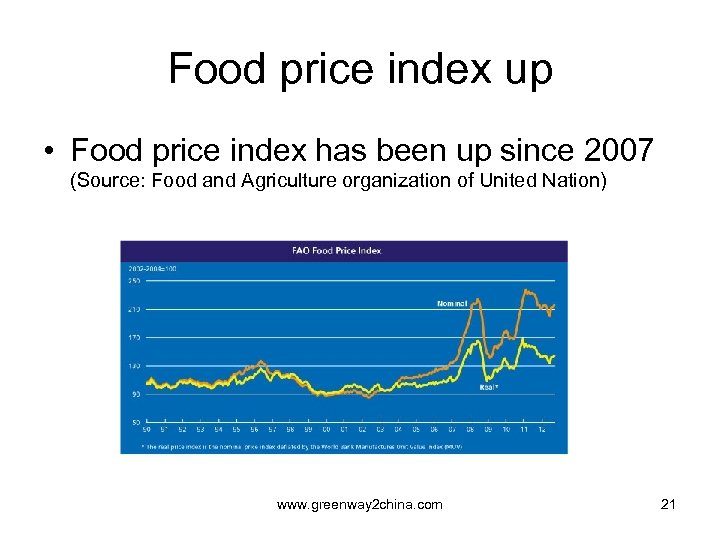

Food price index up • Food price index has been up since 2007 (Source: Food and Agriculture organization of United Nation) www. greenway 2 china. com 21

Food price index up • Food price index has been up since 2007 (Source: Food and Agriculture organization of United Nation) www. greenway 2 china. com 21

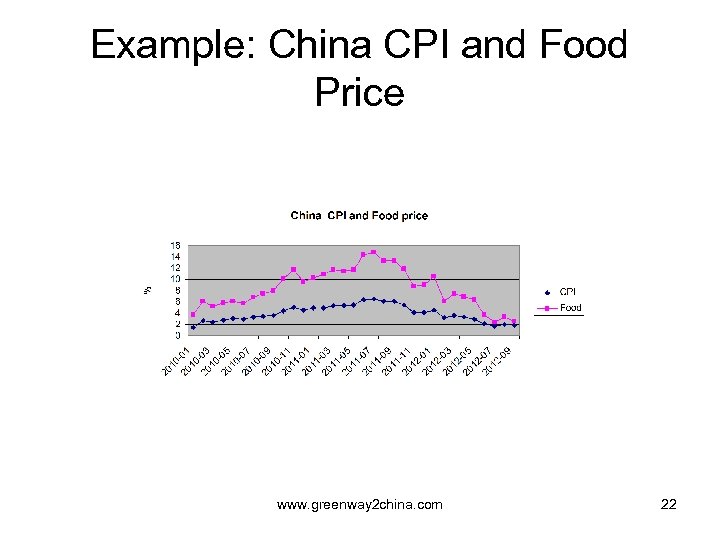

Example: China CPI and Food Price www. greenway 2 china. com 22

Example: China CPI and Food Price www. greenway 2 china. com 22

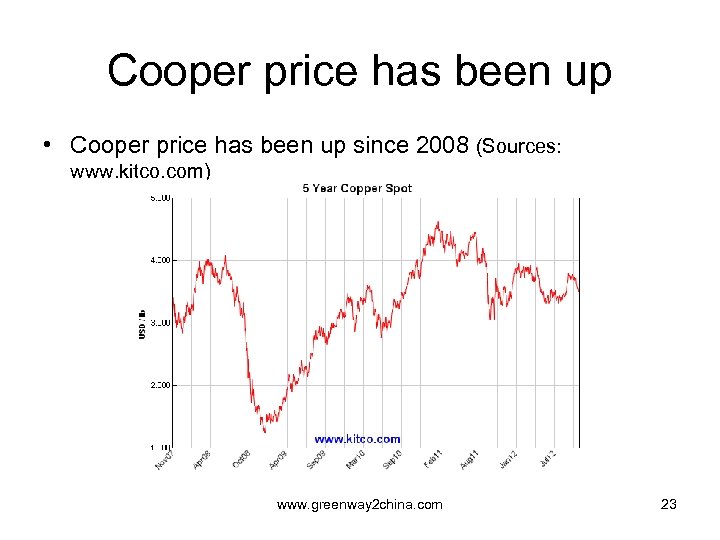

Cooper price has been up • Cooper price has been up since 2008 (Sources: www. kitco. com) www. greenway 2 china. com 23

Cooper price has been up • Cooper price has been up since 2008 (Sources: www. kitco. com) www. greenway 2 china. com 23

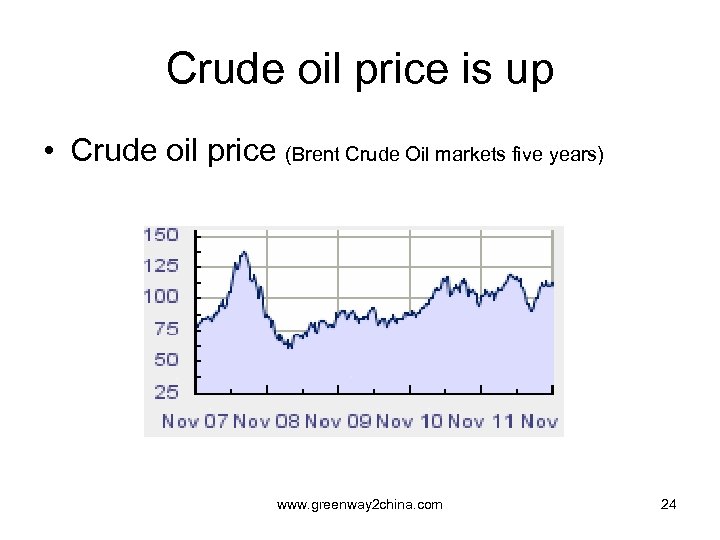

Crude oil price is up • Crude oil price (Brent Crude Oil markets five years) www. greenway 2 china. com 24

Crude oil price is up • Crude oil price (Brent Crude Oil markets five years) www. greenway 2 china. com 24

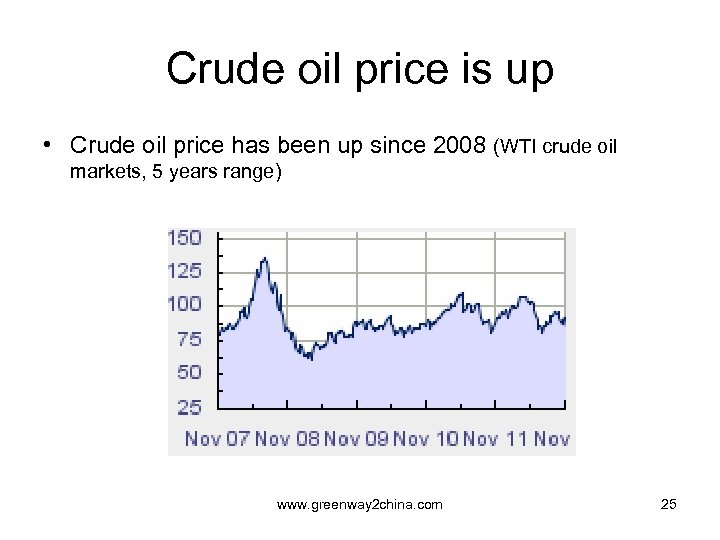

Crude oil price is up • Crude oil price has been up since 2008 (WTI crude oil markets, 5 years range) www. greenway 2 china. com 25

Crude oil price is up • Crude oil price has been up since 2008 (WTI crude oil markets, 5 years range) www. greenway 2 china. com 25

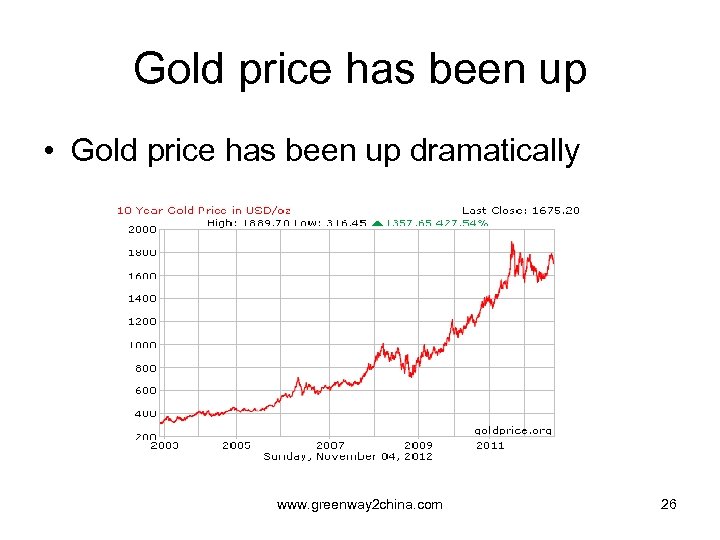

Gold price has been up • Gold price has been up dramatically www. greenway 2 china. com 26

Gold price has been up • Gold price has been up dramatically www. greenway 2 china. com 26

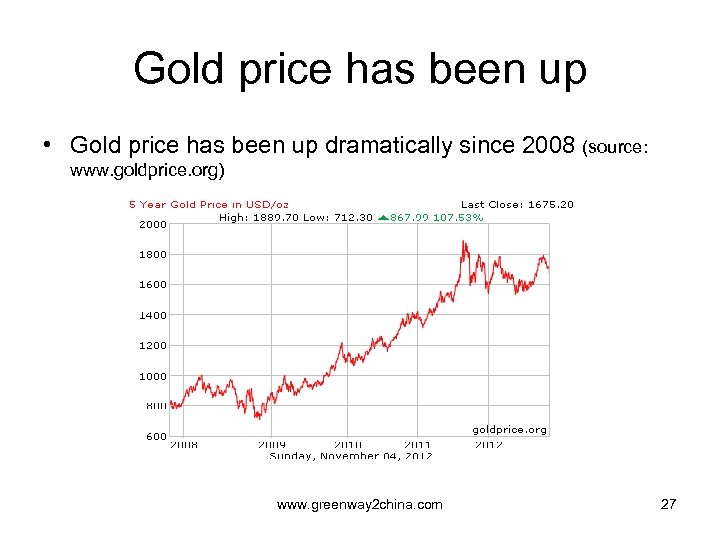

Gold price has been up • Gold price has been up dramatically since 2008 (source: www. goldprice. org) www. greenway 2 china. com 27

Gold price has been up • Gold price has been up dramatically since 2008 (source: www. goldprice. org) www. greenway 2 china. com 27

Gold price has been up • The extent of gold price move by US dollar • 2009 up 23. 4%; 2010, up 27. 1%, 2011, up 10. 1%, 2012 (to Oct. ), up 6. 9% www. greenway 2 china. com 28

Gold price has been up • The extent of gold price move by US dollar • 2009 up 23. 4%; 2010, up 27. 1%, 2011, up 10. 1%, 2012 (to Oct. ), up 6. 9% www. greenway 2 china. com 28

Impact on foreign exchange rate • Emerging markets currency facing pressure on appreciation against US dollar, Euro and British Pound. For example, China renminbi, • Resource-rich country currency facing pressure on appreciation against US dollar, Euro, and British Pound. For example, Canadian dollar, Australian Dollar • Japan Yen, Switzerland franc and Hong Kong dollar are also facing appreciation pressure www. greenway 2 china. com 29

Impact on foreign exchange rate • Emerging markets currency facing pressure on appreciation against US dollar, Euro and British Pound. For example, China renminbi, • Resource-rich country currency facing pressure on appreciation against US dollar, Euro, and British Pound. For example, Canadian dollar, Australian Dollar • Japan Yen, Switzerland franc and Hong Kong dollar are also facing appreciation pressure www. greenway 2 china. com 29

Impact on China economy • Impeded China economy recovering from the latest world economic recession • China has implemented export-oriented economic development strategy for last three decades; the high growth rate of economy in China has been dependent on this strategy and fast growing world demand. • China economy has already slowed down since 2009 because of the slowing down demand of the western world. • Appreciating Chinese currency, renminbi, reduces the competitive of Chinese goods in the world markets www. greenway 2 china. com 30

Impact on China economy • Impeded China economy recovering from the latest world economic recession • China has implemented export-oriented economic development strategy for last three decades; the high growth rate of economy in China has been dependent on this strategy and fast growing world demand. • China economy has already slowed down since 2009 because of the slowing down demand of the western world. • Appreciating Chinese currency, renminbi, reduces the competitive of Chinese goods in the world markets www. greenway 2 china. com 30

Impact on Canadian economy • Canadian, although live a resource-rich country, has not get benefits from the high price of the resources. • Canadian has to pay more money to gas and food, since the prices of oil and food in the international markets have been hiking up. Consumers are losing confidence due to high living cost • The exchange rate of Canadian dollar against US dollar has been up for last ten years because of Canada is a resource-rich country • High Canadian dollar worse the term of trade of Canada www. greenway 2 china. com 31

Impact on Canadian economy • Canadian, although live a resource-rich country, has not get benefits from the high price of the resources. • Canadian has to pay more money to gas and food, since the prices of oil and food in the international markets have been hiking up. Consumers are losing confidence due to high living cost • The exchange rate of Canadian dollar against US dollar has been up for last ten years because of Canada is a resource-rich country • High Canadian dollar worse the term of trade of Canada www. greenway 2 china. com 31

Impacts on Japan, Switzerland Hong Kong • The terms of trade of these countries are worse off since the values of their currencies against US dollar is up • The central banks or monetary authority in the country and region have to sterilize the inflowing capital and keep their own currency value stable. • These economic entities are facing high pressure on inflation www. greenway 2 china. com 32

Impacts on Japan, Switzerland Hong Kong • The terms of trade of these countries are worse off since the values of their currencies against US dollar is up • The central banks or monetary authority in the country and region have to sterilize the inflowing capital and keep their own currency value stable. • These economic entities are facing high pressure on inflation www. greenway 2 china. com 32

QE monetary policy hurdles the world economy from fast recovering • High food prices and high gas prices degrades the consumer confidences on the future • Appreciated currencies of emerging markets and declining demand of the western markets impeded recovering economy of emerging markets • High values of Japanese Yen and Canadian dollar hurdled the economic recovering from this five-year recession www. greenway 2 china. com 33

QE monetary policy hurdles the world economy from fast recovering • High food prices and high gas prices degrades the consumer confidences on the future • Appreciated currencies of emerging markets and declining demand of the western markets impeded recovering economy of emerging markets • High values of Japanese Yen and Canadian dollar hurdled the economic recovering from this five-year recession www. greenway 2 china. com 33