1b465268cc0a147c1803f77ec6816706.ppt

- Количество слайдов: 21

Qualification Criteria and Levels of Preferences in WTO Goods Agreements Technical Workshop on International Merchandise Trade Statistics: Focusing on goods traded under the preferential trade agreements 26 February to 2 March 2018 Pacific Islands Forum Secretariat, Suva 1

Qualification Criteria and Levels of Preferences in WTO Goods Agreements Technical Workshop on International Merchandise Trade Statistics: Focusing on goods traded under the preferential trade agreements 26 February to 2 March 2018 Pacific Islands Forum Secretariat, Suva 1

Contents § Setting the Context: Tariffs, Statistics and Trade § WTO Multilateral Trading Rules § Structure of WTO Agreements § Framework and Basic Principles § Market Access Negotiations in WTO: Ao. A & NAMA § Market Access Conditions § Tariffs, Other Distinctions & Binding Coverage § FIC-WTO Members: Market Access Commitments § Non-Preferential Rules of Origin: WTO ROO Agreement § Next Steps for the Pacific 2

Contents § Setting the Context: Tariffs, Statistics and Trade § WTO Multilateral Trading Rules § Structure of WTO Agreements § Framework and Basic Principles § Market Access Negotiations in WTO: Ao. A & NAMA § Market Access Conditions § Tariffs, Other Distinctions & Binding Coverage § FIC-WTO Members: Market Access Commitments § Non-Preferential Rules of Origin: WTO ROO Agreement § Next Steps for the Pacific 2

Links between Tariffs, Statistics and Trade Tariffs play two important roles for Governments: § Revenue policy – to generate revenue for public services § Trade Policy - an instrument of trade policy (eg. to protect domestic production/industry from foreign competition) Trade Statistics – rely on reliable sources § important for trade policy development and trade negotiations § Goods – rely on Customs data § Services – rely on Central banks etc Trade Agreements – regional (RTAs) or multilateral (WTO) § aim to liberalise trade i. e to lower or eliminate trade barriers § trade barriers can be tariffs or non-tariffs (quarantine procedures) 3

Links between Tariffs, Statistics and Trade Tariffs play two important roles for Governments: § Revenue policy – to generate revenue for public services § Trade Policy - an instrument of trade policy (eg. to protect domestic production/industry from foreign competition) Trade Statistics – rely on reliable sources § important for trade policy development and trade negotiations § Goods – rely on Customs data § Services – rely on Central banks etc Trade Agreements – regional (RTAs) or multilateral (WTO) § aim to liberalise trade i. e to lower or eliminate trade barriers § trade barriers can be tariffs or non-tariffs (quarantine procedures) 3

WTO - Multilateral Trading Rules § WTO represents a set of multilaterally agreed rules for the conduct of world trade in: § Goods – agricultural and non-agricultural (industrial) and products § Trade in Services § Trade-related Intellectual Property Rights § WTO is also a forum for negotiation of global trade rules and launched in trade rounds – currently Doha Round § Negotiations to accord Special & Differential Treatment (SDT) for developing countries and LDCs § WTO has 164 members including (eight) 8 Pacific WTO members (Australia, Fiji, New Zealand, PNG, Samoa, Solomon Is, Tonga, Vanuatu) 4

WTO - Multilateral Trading Rules § WTO represents a set of multilaterally agreed rules for the conduct of world trade in: § Goods – agricultural and non-agricultural (industrial) and products § Trade in Services § Trade-related Intellectual Property Rights § WTO is also a forum for negotiation of global trade rules and launched in trade rounds – currently Doha Round § Negotiations to accord Special & Differential Treatment (SDT) for developing countries and LDCs § WTO has 164 members including (eight) 8 Pacific WTO members (Australia, Fiji, New Zealand, PNG, Samoa, Solomon Is, Tonga, Vanuatu) 4

WTO Basic Principles: • Non- Discrimination: • MFN-Clause (Most-Favoured-Nation): GATT. I and GATS. II Countries cannot (normally) discriminate between their trading partners. E. g. apply the same tariff to all trading partners (between foreign suppliers) • National Treatment: GATT Art. III Once goods have cleared customs, imported goods must be treated equally to domestically-produced goods (between domestic and foreign supplier) • Predictability – Members concessions are legally bound in Schedules to the Agreements - GATT II and GATS XVI. • Transparency – Members are required to notify any measures that affect Concessions GATT X, GATS III 5

WTO Basic Principles: • Non- Discrimination: • MFN-Clause (Most-Favoured-Nation): GATT. I and GATS. II Countries cannot (normally) discriminate between their trading partners. E. g. apply the same tariff to all trading partners (between foreign suppliers) • National Treatment: GATT Art. III Once goods have cleared customs, imported goods must be treated equally to domestically-produced goods (between domestic and foreign supplier) • Predictability – Members concessions are legally bound in Schedules to the Agreements - GATT II and GATS XVI. • Transparency – Members are required to notify any measures that affect Concessions GATT X, GATS III 5

WTO Basic Principles: Exceptions • Economic Integration – FTAs, RTAs (GATT. XXIV, GATS V) – Members may discriminate if joining FTAs but this should meet three criteria: • substantially all trade criteria i. e cover a substantial proportion of trade (eg EPA required 80% of tariff lines) and; • Should not create trade diversion • Transition period should be more than 10 years only in exceptional circumstances Note: WTO is not an FTA/RTA i. e does not require Members to reduce tariffs to zero over a given time. • Modification of Schedules – Article XVIII • To promote infant industry and industrialisation • To address Balance of Payment reasons But these are subject to consultations and compensation eg to raise a tariff on one sensitive product, you have to offer a tariff concession in a product of interest to a Member/Members that are major suppliers • Safeguards (Agreement on Safeguards) • Members may take emergency measures (including raising tariffs) to address sudden import surges that cause or threaten to cause injury to domestic industry • But will need to prove causal link between imports and domestic injury (eg loss of market share) 6

WTO Basic Principles: Exceptions • Economic Integration – FTAs, RTAs (GATT. XXIV, GATS V) – Members may discriminate if joining FTAs but this should meet three criteria: • substantially all trade criteria i. e cover a substantial proportion of trade (eg EPA required 80% of tariff lines) and; • Should not create trade diversion • Transition period should be more than 10 years only in exceptional circumstances Note: WTO is not an FTA/RTA i. e does not require Members to reduce tariffs to zero over a given time. • Modification of Schedules – Article XVIII • To promote infant industry and industrialisation • To address Balance of Payment reasons But these are subject to consultations and compensation eg to raise a tariff on one sensitive product, you have to offer a tariff concession in a product of interest to a Member/Members that are major suppliers • Safeguards (Agreement on Safeguards) • Members may take emergency measures (including raising tariffs) to address sudden import surges that cause or threaten to cause injury to domestic industry • But will need to prove causal link between imports and domestic injury (eg loss of market share) 6

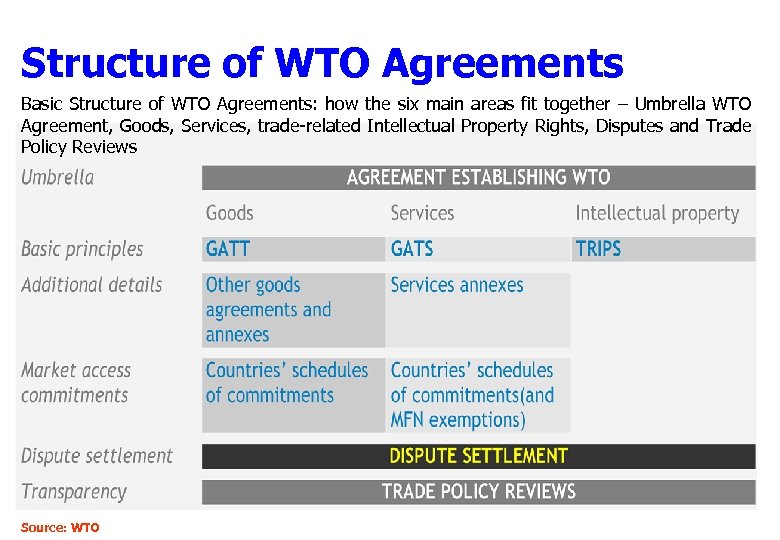

Structure of WTO Agreements Basic Structure of WTO Agreements: how the six main areas fit together – Umbrella WTO Agreement, Goods, Services, trade-related Intellectual Property Rights, Disputes and Trade Policy Reviews Source: WTO

Structure of WTO Agreements Basic Structure of WTO Agreements: how the six main areas fit together – Umbrella WTO Agreement, Goods, Services, trade-related Intellectual Property Rights, Disputes and Trade Policy Reviews Source: WTO

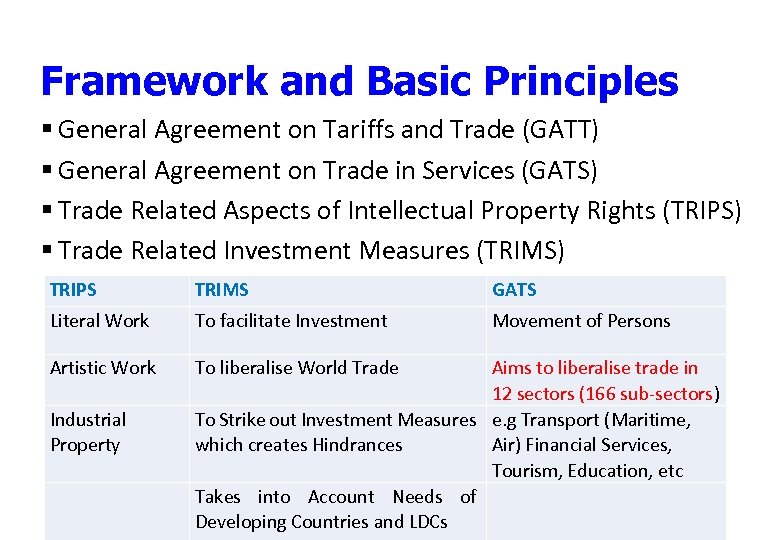

Framework and Basic Principles § General Agreement on Tariffs and Trade (GATT) § General Agreement on Trade in Services (GATS) § Trade Related Aspects of Intellectual Property Rights (TRIPS) § Trade Related Investment Measures (TRIMS) TRIPS TRIMS GATS Literal Work To facilitate Investment Movement of Persons Artistic Work To liberalise World Trade Industrial Property Aims to liberalise trade in 12 sectors (166 sub-sectors) To Strike out Investment Measures e. g Transport (Maritime, which creates Hindrances Air) Financial Services, Tourism, Education, etc Takes into Account Needs of 8 Developing Countries and LDCs

Framework and Basic Principles § General Agreement on Tariffs and Trade (GATT) § General Agreement on Trade in Services (GATS) § Trade Related Aspects of Intellectual Property Rights (TRIPS) § Trade Related Investment Measures (TRIMS) TRIPS TRIMS GATS Literal Work To facilitate Investment Movement of Persons Artistic Work To liberalise World Trade Industrial Property Aims to liberalise trade in 12 sectors (166 sub-sectors) To Strike out Investment Measures e. g Transport (Maritime, which creates Hindrances Air) Financial Services, Tourism, Education, etc Takes into Account Needs of 8 Developing Countries and LDCs

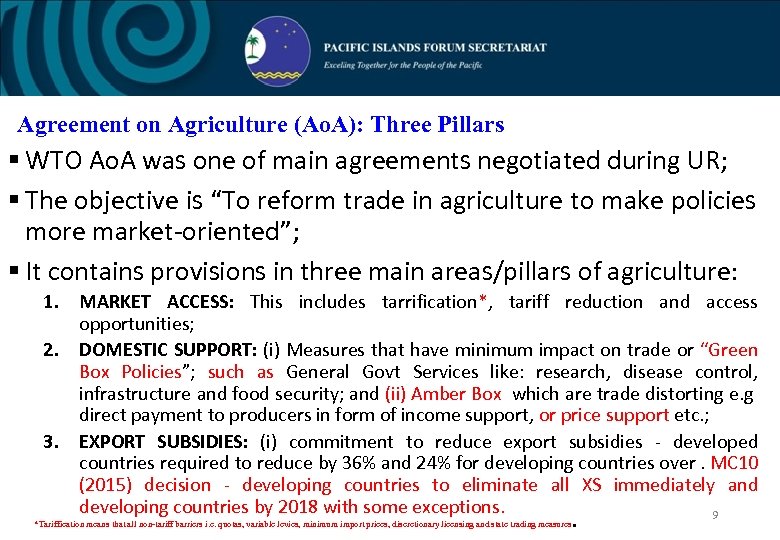

Agreement on Agriculture (Ao. A): Three Pillars § WTO Ao. A was one of main agreements negotiated during UR; § The objective is “To reform trade in agriculture to make policies more market-oriented”; § It contains provisions in three main areas/pillars of agriculture: 1. MARKET ACCESS: This includes tarrification*, tariff reduction and access opportunities; 2. DOMESTIC SUPPORT: (i) Measures that have minimum impact on trade or “Green Box Policies”; such as General Govt Services like: research, disease control, infrastructure and food security; and (ii) Amber Box which are trade distorting e. g direct payment to producers in form of income support, or price support etc. ; 3. EXPORT SUBSIDIES: (i) commitment to reduce export subsidies - developed countries required to reduce by 36% and 24% for developing countries over. MC 10 (2015) decision - developing countries to eliminate all XS immediately and developing countries by 2018 with some exceptions. 9 *Tariffication means that all non-tariff barriers i. e. quotas, variable levies, minimum import prices, discretionary licensing and state trading measures .

Agreement on Agriculture (Ao. A): Three Pillars § WTO Ao. A was one of main agreements negotiated during UR; § The objective is “To reform trade in agriculture to make policies more market-oriented”; § It contains provisions in three main areas/pillars of agriculture: 1. MARKET ACCESS: This includes tarrification*, tariff reduction and access opportunities; 2. DOMESTIC SUPPORT: (i) Measures that have minimum impact on trade or “Green Box Policies”; such as General Govt Services like: research, disease control, infrastructure and food security; and (ii) Amber Box which are trade distorting e. g direct payment to producers in form of income support, or price support etc. ; 3. EXPORT SUBSIDIES: (i) commitment to reduce export subsidies - developed countries required to reduce by 36% and 24% for developing countries over. MC 10 (2015) decision - developing countries to eliminate all XS immediately and developing countries by 2018 with some exceptions. 9 *Tariffication means that all non-tariff barriers i. e. quotas, variable levies, minimum import prices, discretionary licensing and state trading measures .

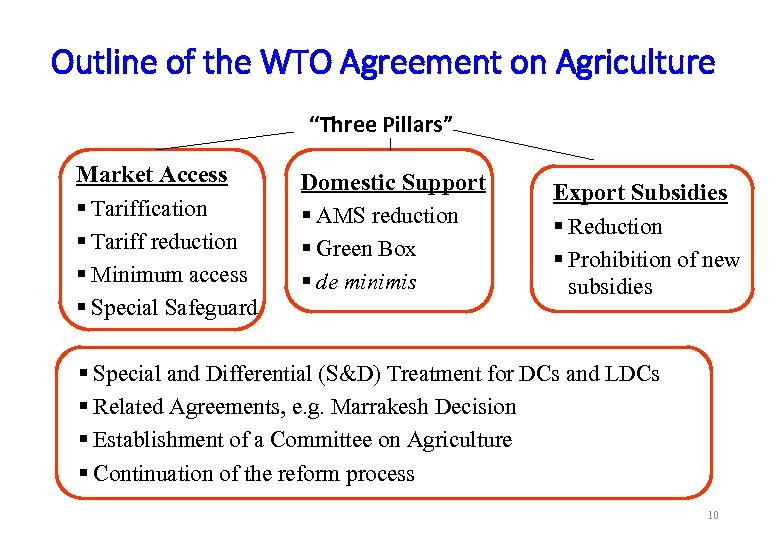

Outline of the WTO Agreement on Agriculture “Three Pillars” Market Access § Tariffication § Tariff reduction § Minimum access § Special Safeguard Domestic Support § AMS reduction § Green Box § de minimis Export Subsidies § Reduction § Prohibition of new subsidies § Special and Differential (S&D) Treatment for DCs and LDCs § Related Agreements, e. g. Marrakesh Decision § Establishment of a Committee on Agriculture § Continuation of the reform process 10

Outline of the WTO Agreement on Agriculture “Three Pillars” Market Access § Tariffication § Tariff reduction § Minimum access § Special Safeguard Domestic Support § AMS reduction § Green Box § de minimis Export Subsidies § Reduction § Prohibition of new subsidies § Special and Differential (S&D) Treatment for DCs and LDCs § Related Agreements, e. g. Marrakesh Decision § Establishment of a Committee on Agriculture § Continuation of the reform process 10

Market Access Conditions § Market access conditions are the tariff and non-tariff measures (NTMs), set by countries for the entry of specific goods into their markets. § In the WTO, tariff commitments for goods (industrial and agricultural) are agreed upon and set out in each member's schedules of concessions on goods. The schedules represent commitments not to apply tariffs above the listed rates — these rates are “bound”. Non-tariff measures are dealt with under specific WTO agreement. § In an FTA, preferential market access is given to members of the FTA. It can be thought of as a discrimination across trading partners by providing some countries with a lower tariff. 11

Market Access Conditions § Market access conditions are the tariff and non-tariff measures (NTMs), set by countries for the entry of specific goods into their markets. § In the WTO, tariff commitments for goods (industrial and agricultural) are agreed upon and set out in each member's schedules of concessions on goods. The schedules represent commitments not to apply tariffs above the listed rates — these rates are “bound”. Non-tariff measures are dealt with under specific WTO agreement. § In an FTA, preferential market access is given to members of the FTA. It can be thought of as a discrimination across trading partners by providing some countries with a lower tariff. 11

Tariffs § Tariffs are taxes on imports or exports of goods, levied at the border § A tariff raises the price of the imported (exported) product above its price on the world (domestic) market 2 types: 1. Ad valorem. Expressed as a percentage of the value of the imported (exported) good (usually as a percentage of the CIF value) 2. Specific. Stated as a fixed currency amount per unit of the good q Example: Australia’s 2005 schedule includes a tariff of $1. 22/kg on certain types of cheeses and the United States charges $0. 68 per live goat q Combinations of ad valorem and specific tariffs q Mixed tariffs are expressed as either a specific or an ad valorem rate, depending on which generates the most (or sometimes least) revenue –For example, Indian duties on certain rayon fabrics are either 15 percent ad valorem or Rs. 87 per square meter, whichever is higher q Compound tariffs include both ad valorem and a specific component –For example, Pakistan charges Rs. 0. 88 per liter of some petroleum products plus 25 percent ad valorem q Trade economists typically argue that these non ad valorem tariffs are less transparent and more distorting, i. e. that they drive a bigger wedge between domestic and international prices. q In addition, their economic impact changes as world prices change 12

Tariffs § Tariffs are taxes on imports or exports of goods, levied at the border § A tariff raises the price of the imported (exported) product above its price on the world (domestic) market 2 types: 1. Ad valorem. Expressed as a percentage of the value of the imported (exported) good (usually as a percentage of the CIF value) 2. Specific. Stated as a fixed currency amount per unit of the good q Example: Australia’s 2005 schedule includes a tariff of $1. 22/kg on certain types of cheeses and the United States charges $0. 68 per live goat q Combinations of ad valorem and specific tariffs q Mixed tariffs are expressed as either a specific or an ad valorem rate, depending on which generates the most (or sometimes least) revenue –For example, Indian duties on certain rayon fabrics are either 15 percent ad valorem or Rs. 87 per square meter, whichever is higher q Compound tariffs include both ad valorem and a specific component –For example, Pakistan charges Rs. 0. 88 per liter of some petroleum products plus 25 percent ad valorem q Trade economists typically argue that these non ad valorem tariffs are less transparent and more distorting, i. e. that they drive a bigger wedge between domestic and international prices. q In addition, their economic impact changes as world prices change 12

Other Distinctions 1. Most Favored Nation (MFN) tariff rates vs. Preferential Tariff Rates § MFN tariffs are the ones that WTO Members commit to accord to imports from all other WTO Members with which they have not signed a preferential agreement § Preferential tariffs are the ones accorded to imports from preferential partners in FTAs, customs unions or other preferential trade agreements, and are more likely than others to be at zero 2. Bound vs. Applied Tariff Rates § Bound MFN tariff levels, which are listed in a country's tariff schedule, indicate the upper limit at which the government is committed to set its applied MFN tariff § For a given tariff line, the bound tariff must thus be higher or equal to the applied MFN tariff § For developed countries, bound tariffs are typically identical or very close to applied tariffs. For developing countries, however, there is often "water" in the tariff (spread between bound applied rate, “binding overhang”) 13

Other Distinctions 1. Most Favored Nation (MFN) tariff rates vs. Preferential Tariff Rates § MFN tariffs are the ones that WTO Members commit to accord to imports from all other WTO Members with which they have not signed a preferential agreement § Preferential tariffs are the ones accorded to imports from preferential partners in FTAs, customs unions or other preferential trade agreements, and are more likely than others to be at zero 2. Bound vs. Applied Tariff Rates § Bound MFN tariff levels, which are listed in a country's tariff schedule, indicate the upper limit at which the government is committed to set its applied MFN tariff § For a given tariff line, the bound tariff must thus be higher or equal to the applied MFN tariff § For developed countries, bound tariffs are typically identical or very close to applied tariffs. For developing countries, however, there is often "water" in the tariff (spread between bound applied rate, “binding overhang”) 13

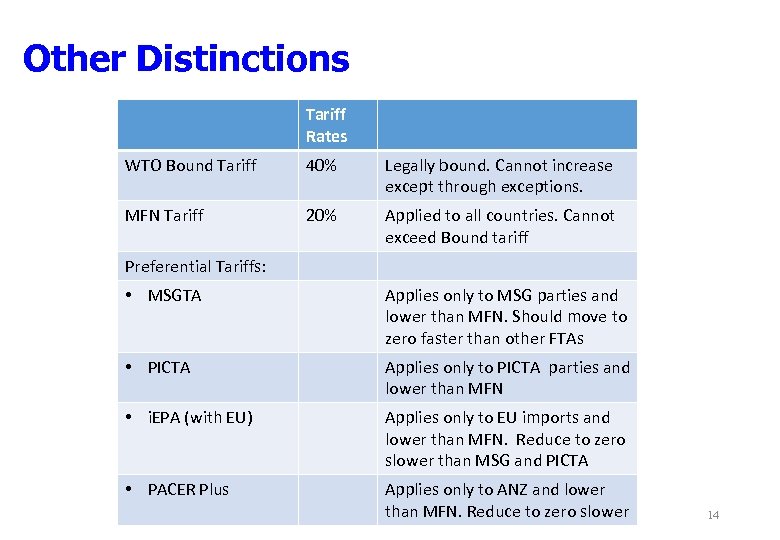

Other Distinctions Tariff Rates WTO Bound Tariff 40% Legally bound. Cannot increase except through exceptions. MFN Tariff 20% Applied to all countries. Cannot exceed Bound tariff Preferential Tariffs: • MSGTA Applies only to MSG parties and lower than MFN. Should move to zero faster than other FTAs • PICTA Applies only to PICTA parties and lower than MFN • i. EPA (with EU) Applies only to EU imports and lower than MFN. Reduce to zero slower than MSG and PICTA • PACER Plus Applies only to ANZ and lower than MFN. Reduce to zero slower 14

Other Distinctions Tariff Rates WTO Bound Tariff 40% Legally bound. Cannot increase except through exceptions. MFN Tariff 20% Applied to all countries. Cannot exceed Bound tariff Preferential Tariffs: • MSGTA Applies only to MSG parties and lower than MFN. Should move to zero faster than other FTAs • PICTA Applies only to PICTA parties and lower than MFN • i. EPA (with EU) Applies only to EU imports and lower than MFN. Reduce to zero slower than MSG and PICTA • PACER Plus Applies only to ANZ and lower than MFN. Reduce to zero slower 14

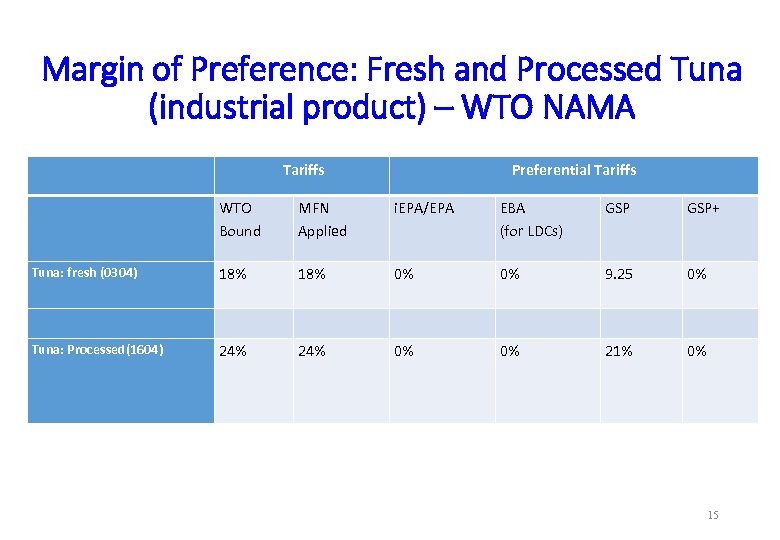

Margin of Preference: Fresh and Processed Tuna (industrial product) – WTO NAMA Tariffs Preferential Tariffs WTO Bound MFN Applied i. EPA/EPA EBA (for LDCs) GSP+ Tuna: fresh (0304) 18% 0% 0% 9. 25 0% Tuna: Processed(1604) 24% 0% 0% 21% 0% 15

Margin of Preference: Fresh and Processed Tuna (industrial product) – WTO NAMA Tariffs Preferential Tariffs WTO Bound MFN Applied i. EPA/EPA EBA (for LDCs) GSP+ Tuna: fresh (0304) 18% 0% 0% 9. 25 0% Tuna: Processed(1604) 24% 0% 0% 21% 0% 15

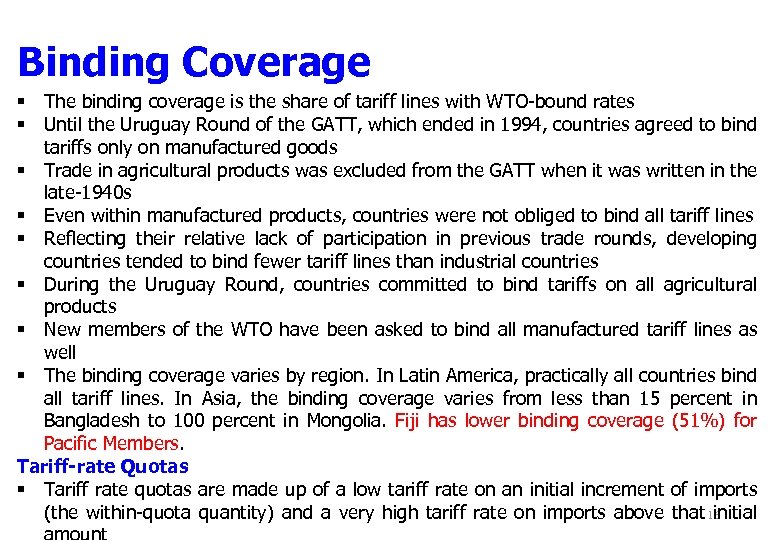

Binding Coverage § The binding coverage is the share of tariff lines with WTO-bound rates § Until the Uruguay Round of the GATT, which ended in 1994, countries agreed to bind tariffs only on manufactured goods § Trade in agricultural products was excluded from the GATT when it was written in the late-1940 s § Even within manufactured products, countries were not obliged to bind all tariff lines § Reflecting their relative lack of participation in previous trade rounds, developing countries tended to bind fewer tariff lines than industrial countries § During the Uruguay Round, countries committed to bind tariffs on all agricultural products § New members of the WTO have been asked to bind all manufactured tariff lines as well § The binding coverage varies by region. In Latin America, practically all countries bind all tariff lines. In Asia, the binding coverage varies from less than 15 percent in Bangladesh to 100 percent in Mongolia. Fiji has lower binding coverage (51%) for Pacific Members. Tariff-rate Quotas § Tariff rate quotas are made up of a low tariff rate on an initial increment of imports (the within-quota quantity) and a very high tariff rate on imports above that 16 initial

Binding Coverage § The binding coverage is the share of tariff lines with WTO-bound rates § Until the Uruguay Round of the GATT, which ended in 1994, countries agreed to bind tariffs only on manufactured goods § Trade in agricultural products was excluded from the GATT when it was written in the late-1940 s § Even within manufactured products, countries were not obliged to bind all tariff lines § Reflecting their relative lack of participation in previous trade rounds, developing countries tended to bind fewer tariff lines than industrial countries § During the Uruguay Round, countries committed to bind tariffs on all agricultural products § New members of the WTO have been asked to bind all manufactured tariff lines as well § The binding coverage varies by region. In Latin America, practically all countries bind all tariff lines. In Asia, the binding coverage varies from less than 15 percent in Bangladesh to 100 percent in Mongolia. Fiji has lower binding coverage (51%) for Pacific Members. Tariff-rate Quotas § Tariff rate quotas are made up of a low tariff rate on an initial increment of imports (the within-quota quantity) and a very high tariff rate on imports above that 16 initial

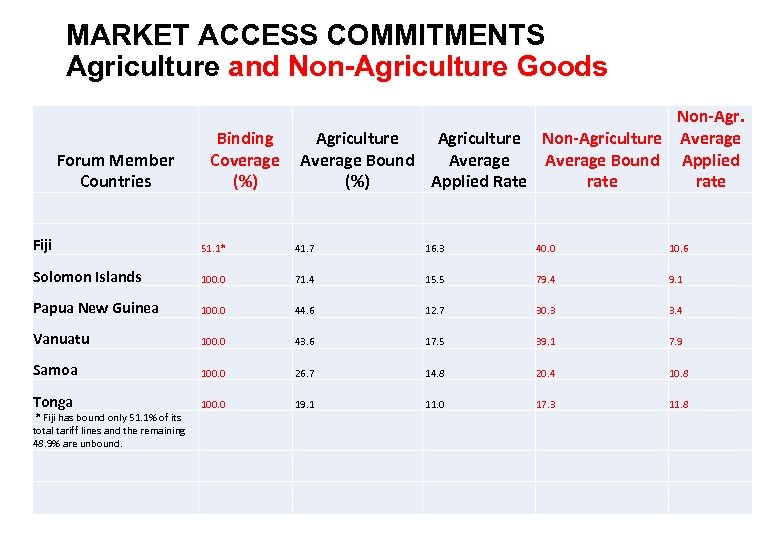

MARKET ACCESS COMMITMENTS Agriculture and Non-Agriculture Goods Non-Agr. Agriculture Non-Agriculture Average Bound Applied (%) Applied Rate rate Binding Coverage (%) Forum Member Countries Fiji 51. 1* 41. 7 16. 3 40. 0 10. 6 Solomon Islands 100. 0 71. 4 15. 5 79. 4 9. 1 Papua New Guinea 100. 0 44. 6 12. 7 30. 3 3. 4 Vanuatu 100. 0 43. 6 17. 5 39. 1 7. 9 Samoa 100. 0 26. 7 14. 8 20. 4 10. 8 Tonga 100. 0 19. 1 11. 0 17. 3 11. 8 * Fiji has bound only 51. 1% of its total tariff lines and the remaining 48. 9% are unbound. 17

MARKET ACCESS COMMITMENTS Agriculture and Non-Agriculture Goods Non-Agr. Agriculture Non-Agriculture Average Bound Applied (%) Applied Rate rate Binding Coverage (%) Forum Member Countries Fiji 51. 1* 41. 7 16. 3 40. 0 10. 6 Solomon Islands 100. 0 71. 4 15. 5 79. 4 9. 1 Papua New Guinea 100. 0 44. 6 12. 7 30. 3 3. 4 Vanuatu 100. 0 43. 6 17. 5 39. 1 7. 9 Samoa 100. 0 26. 7 14. 8 20. 4 10. 8 Tonga 100. 0 19. 1 11. 0 17. 3 11. 8 * Fiji has bound only 51. 1% of its total tariff lines and the remaining 48. 9% are unbound. 17

Market Access Negotiations in WTO: Agriculture and Non. Agriculture § Current trade round, Doha Round was launched in Doha in 2001 and amongst others, required market access negotiations in: § Agriculture - focused on tariff reduction formula, increase binding coverage and conversion of specific duties to ad valorem duties § NAMA (Non-Agriculture) goods - focused on tariff reduction formula, including formulas to reduce tariff peaks, high tariffs, tariff escalation (tariff rates increase with level of processing) and increase binding coverage § Since 2001 Members had intensive negotiations on tariff reduction formulas in both NAMA and Agriculture which include options such as: § Average reductions, cuts to the average, Swiss formula (cuts higher tariffs more) § In 2008 negotiations on tariff modalities collapsed and since then interest in market access negotiations leading up to MC 9, MC 10 and MC 11 (2017)has significantly dropped § Therefore – the current Market Access commitments of the Pacific Members will remain at existing levels until new tariff reduction formulas are agreed. 18 § Any new formula agreed will apply on the bound rates

Market Access Negotiations in WTO: Agriculture and Non. Agriculture § Current trade round, Doha Round was launched in Doha in 2001 and amongst others, required market access negotiations in: § Agriculture - focused on tariff reduction formula, increase binding coverage and conversion of specific duties to ad valorem duties § NAMA (Non-Agriculture) goods - focused on tariff reduction formula, including formulas to reduce tariff peaks, high tariffs, tariff escalation (tariff rates increase with level of processing) and increase binding coverage § Since 2001 Members had intensive negotiations on tariff reduction formulas in both NAMA and Agriculture which include options such as: § Average reductions, cuts to the average, Swiss formula (cuts higher tariffs more) § In 2008 negotiations on tariff modalities collapsed and since then interest in market access negotiations leading up to MC 9, MC 10 and MC 11 (2017)has significantly dropped § Therefore – the current Market Access commitments of the Pacific Members will remain at existing levels until new tariff reduction formulas are agreed. 18 § Any new formula agreed will apply on the bound rates

Non-Preferential Rules of Origin: WTO Agreement on ROO § Distinguish non-preferential origin of product if countries wish to apply WTO rules on antidumping duties, countervailing measures, safeguard measures or origin labeling. § Otherwise, non-preferential origin is only important for the collection of trade statistics. The WTO Agreement on Rules of Origin: § The WTO Members, desiring to ensure that rules of origin do not in themselves create unnecessary obstacles to trade, agreed to establish the Agreement on Rules of Origin as part of the Marrakech Agreement establishing the WTO in 1995. § Until the finalization of the Harmonization of the Rules of Origin, all WTO Members apply own nonpreferential ROO. The complexities of national rules lead to complications and increased costs both for customs administrations and for the business community. • Prior to WTO Agreement on Rules of Origin, Annex D of the Kyoto Convention (now Specific Annex K of the Revised Kyoto Convention) of the Customs Co-operation Council (now WCO) was the only existing international convention mentioning the rules of origin. • Objectives and Principles [to insert] • Scope of Application (MFN, Anti-Dumping and Countervailing Duties, Safeguards, Origin Marking Requirements etc. ) 19 • Etc.

Non-Preferential Rules of Origin: WTO Agreement on ROO § Distinguish non-preferential origin of product if countries wish to apply WTO rules on antidumping duties, countervailing measures, safeguard measures or origin labeling. § Otherwise, non-preferential origin is only important for the collection of trade statistics. The WTO Agreement on Rules of Origin: § The WTO Members, desiring to ensure that rules of origin do not in themselves create unnecessary obstacles to trade, agreed to establish the Agreement on Rules of Origin as part of the Marrakech Agreement establishing the WTO in 1995. § Until the finalization of the Harmonization of the Rules of Origin, all WTO Members apply own nonpreferential ROO. The complexities of national rules lead to complications and increased costs both for customs administrations and for the business community. • Prior to WTO Agreement on Rules of Origin, Annex D of the Kyoto Convention (now Specific Annex K of the Revised Kyoto Convention) of the Customs Co-operation Council (now WCO) was the only existing international convention mentioning the rules of origin. • Objectives and Principles [to insert] • Scope of Application (MFN, Anti-Dumping and Countervailing Duties, Safeguards, Origin Marking Requirements etc. ) 19 • Etc.

WTO Negotiations Future Outlook : Prepare for E-Commerce q Doha Round is in crisis – single undertaking was abandoned after 2008 and incremental approach to securing outcomes was adopted. Market access is of low priority. q At MC 11 in 2017 – the only substantive outcomes were mandates to : q continue negotiation on fisheries subsidies and conclude an agreement by 2019 (MC 12) q continue the Work Program on E-commerce in the WTO, (to clarify definitions, define scope etc) and to extend the moratorium of not charging customs duties on EC transmissions for another 2 years. q E-commerce – new form of trade defined in WTO as follows: 'electronic commerce' is understood to mean the production, distribution, marketing, sale or delivery of goods and services by electronic means" q E-commerce is much more complex than traditional trade and cuts across goods, services and TRIPs. q Some WTO members interested to launch negotiations on EC and Pacific must prepare 20

WTO Negotiations Future Outlook : Prepare for E-Commerce q Doha Round is in crisis – single undertaking was abandoned after 2008 and incremental approach to securing outcomes was adopted. Market access is of low priority. q At MC 11 in 2017 – the only substantive outcomes were mandates to : q continue negotiation on fisheries subsidies and conclude an agreement by 2019 (MC 12) q continue the Work Program on E-commerce in the WTO, (to clarify definitions, define scope etc) and to extend the moratorium of not charging customs duties on EC transmissions for another 2 years. q E-commerce – new form of trade defined in WTO as follows: 'electronic commerce' is understood to mean the production, distribution, marketing, sale or delivery of goods and services by electronic means" q E-commerce is much more complex than traditional trade and cuts across goods, services and TRIPs. q Some WTO members interested to launch negotiations on EC and Pacific must prepare 20

Next Steps for Pacific Countries q Doha Round crisis provides opportunity for Pacific countries to: q assess the impact of WTO and international trade treaties on revenue and exports q define trade interests to be pursued in the WTO and in other RTAs q define market access (tariff) positions should WTO market access negotiations restart q Trade Statistics would be key to the above analysis/positions and technical assistance/capacity building should be secured to: q Strengthen customs trade data capture/classification – q Build capacity for services data indicators, collection and compilation q WTO Regional Workshop on Services Data planned for early 2019 q Build capacity for collecting data on E-commerce trade q Customs Departments/Central banks – will also need to: q monitor the level of trade taking place through E-commerce; and q decide how to apply customs duties on e-transmitted goods and services once the moratorium is lifted 21

Next Steps for Pacific Countries q Doha Round crisis provides opportunity for Pacific countries to: q assess the impact of WTO and international trade treaties on revenue and exports q define trade interests to be pursued in the WTO and in other RTAs q define market access (tariff) positions should WTO market access negotiations restart q Trade Statistics would be key to the above analysis/positions and technical assistance/capacity building should be secured to: q Strengthen customs trade data capture/classification – q Build capacity for services data indicators, collection and compilation q WTO Regional Workshop on Services Data planned for early 2019 q Build capacity for collecting data on E-commerce trade q Customs Departments/Central banks – will also need to: q monitor the level of trade taking place through E-commerce; and q decide how to apply customs duties on e-transmitted goods and services once the moratorium is lifted 21