77c274af305399176bb2cbdb645b1b21.ppt

- Количество слайдов: 130

QIS Industry Workshop 3 March 2010 Katrina Squires Judy Lau Kelly Yeung Denis Gorey Guy Eastwood Anna Sofianaris Michael Booth 1

QIS Industry Workshop 3 March 2010 Katrina Squires Judy Lau Kelly Yeung Denis Gorey Guy Eastwood Anna Sofianaris Michael Booth 1

Topics for the day • Overview • Definition of capital • Leverage ratio • Liquidity • CCR and TB • Smoothing MRC • Securitisation • Operational risk • Wrap up 2

Topics for the day • Overview • Definition of capital • Leverage ratio • Liquidity • CCR and TB • Smoothing MRC • Securitisation • Operational risk • Wrap up 2

Overview • Australian participants • Activity to date • Timetable • Prioritisation of worksheets • FAQ process • Weekly progress reports 3

Overview • Australian participants • Activity to date • Timetable • Prioritisation of worksheets • FAQ process • Weekly progress reports 3

Australian participants ANZ Suncorp CBA CU Australia NAB Wide Bay WBC Heritage BS Macquarie Citibank Bank of Queensland HSBC Bendigo and Adelaide Bank 4

Australian participants ANZ Suncorp CBA CU Australia NAB Wide Bay WBC Heritage BS Macquarie Citibank Bank of Queensland HSBC Bendigo and Adelaide Bank 4

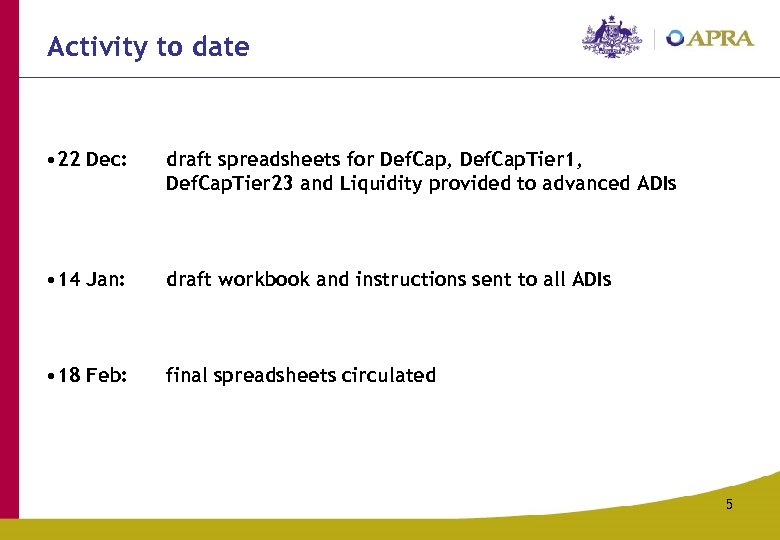

Activity to date • 22 Dec: draft spreadsheets for Def. Cap, Def. Cap. Tier 1, Def. Cap. Tier 23 and Liquidity provided to advanced ADIs • 14 Jan: draft workbook and instructions sent to all ADIs • 18 Feb: final spreadsheets circulated 5

Activity to date • 22 Dec: draft spreadsheets for Def. Cap, Def. Cap. Tier 1, Def. Cap. Tier 23 and Liquidity provided to advanced ADIs • 14 Jan: draft workbook and instructions sent to all ADIs • 18 Feb: final spreadsheets circulated 5

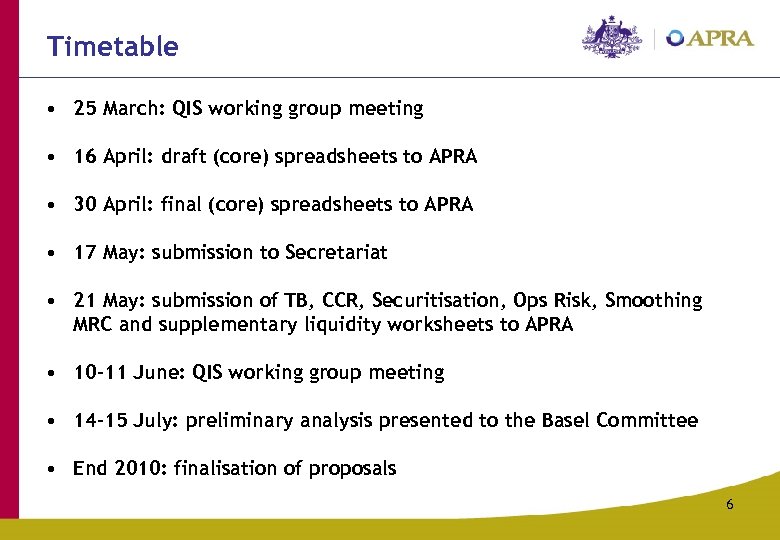

Timetable • 25 March: QIS working group meeting • 16 April: draft (core) spreadsheets to APRA • 30 April: final (core) spreadsheets to APRA • 17 May: submission to Secretariat • 21 May: submission of TB, CCR, Securitisation, Ops Risk, Smoothing MRC and supplementary liquidity worksheets to APRA • 10 -11 June: QIS working group meeting • 14 -15 July: preliminary analysis presented to the Basel Committee • End 2010: finalisation of proposals 6

Timetable • 25 March: QIS working group meeting • 16 April: draft (core) spreadsheets to APRA • 30 April: final (core) spreadsheets to APRA • 17 May: submission to Secretariat • 21 May: submission of TB, CCR, Securitisation, Ops Risk, Smoothing MRC and supplementary liquidity worksheets to APRA • 10 -11 June: QIS working group meeting • 14 -15 July: preliminary analysis presented to the Basel Committee • End 2010: finalisation of proposals 6

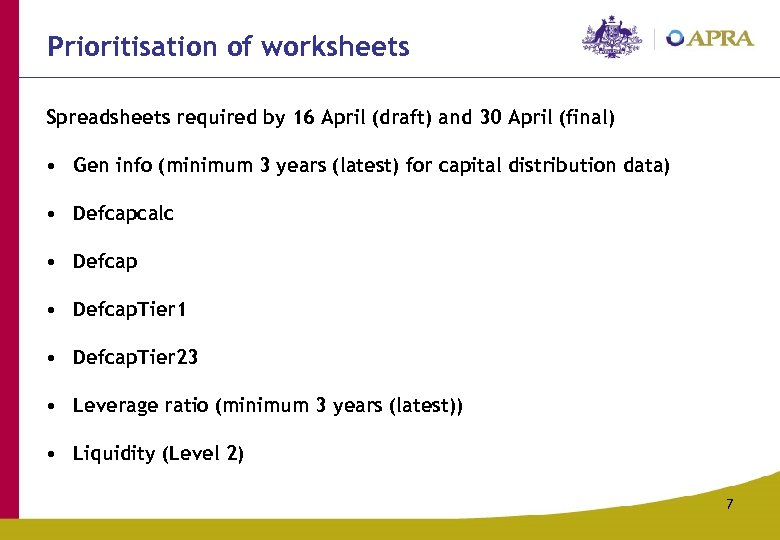

Prioritisation of worksheets Spreadsheets required by 16 April (draft) and 30 April (final) • Gen info (minimum 3 years (latest) for capital distribution data) • Defcapcalc • Defcap. Tier 1 • Defcap. Tier 23 • Leverage ratio (minimum 3 years (latest)) • Liquidity (Level 2) 7

Prioritisation of worksheets Spreadsheets required by 16 April (draft) and 30 April (final) • Gen info (minimum 3 years (latest) for capital distribution data) • Defcapcalc • Defcap. Tier 1 • Defcap. Tier 23 • Leverage ratio (minimum 3 years (latest)) • Liquidity (Level 2) 7

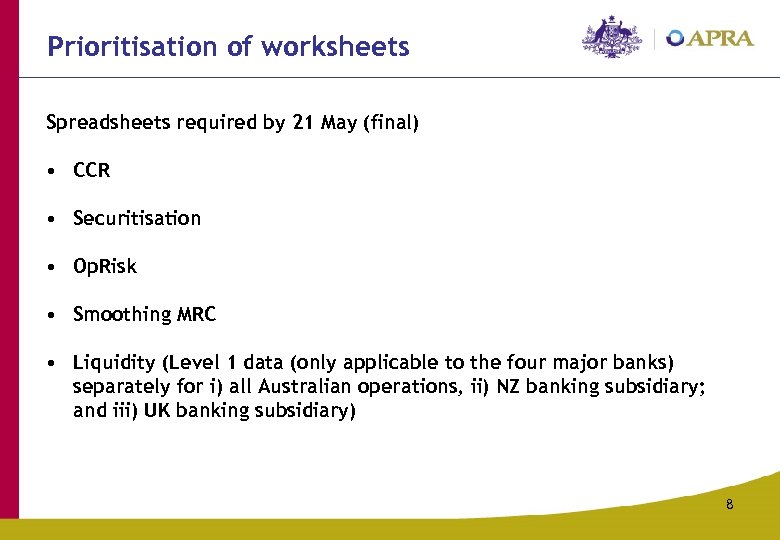

Prioritisation of worksheets Spreadsheets required by 21 May (final) • CCR • Securitisation • Op. Risk • Smoothing MRC • Liquidity (Level 1 data (only applicable to the four major banks) separately for i) all Australian operations, ii) NZ banking subsidiary; and iii) UK banking subsidiary) 8

Prioritisation of worksheets Spreadsheets required by 21 May (final) • CCR • Securitisation • Op. Risk • Smoothing MRC • Liquidity (Level 1 data (only applicable to the four major banks) separately for i) all Australian operations, ii) NZ banking subsidiary; and iii) UK banking subsidiary) 8

Prioritisation of worksheets Spreadsheets required by 21 May (final) • TB securitisation • TB correlation trading • TB securitisation LSS • TB correlation trading LSS • TB securitisation wide • TB correlation trading wide 9

Prioritisation of worksheets Spreadsheets required by 21 May (final) • TB securitisation • TB correlation trading • TB securitisation LSS • TB correlation trading LSS • TB securitisation wide • TB correlation trading wide 9

Prioritisation of worksheets N/A – no information required • CCR memo • Defcapcalc. COREP 10

Prioritisation of worksheets N/A – no information required • CCR memo • Defcapcalc. COREP 10

FAQ process • BIS FAQ (refer http: //www. bis. org/bcbs/qis/index. htm) • APRA FAQ (refer http: //www. apra. gov. au/ADI/upload/APRA-FAQ. pdf) • Bilateral responses 11

FAQ process • BIS FAQ (refer http: //www. bis. org/bcbs/qis/index. htm) • APRA FAQ (refer http: //www. apra. gov. au/ADI/upload/APRA-FAQ. pdf) • Bilateral responses 11

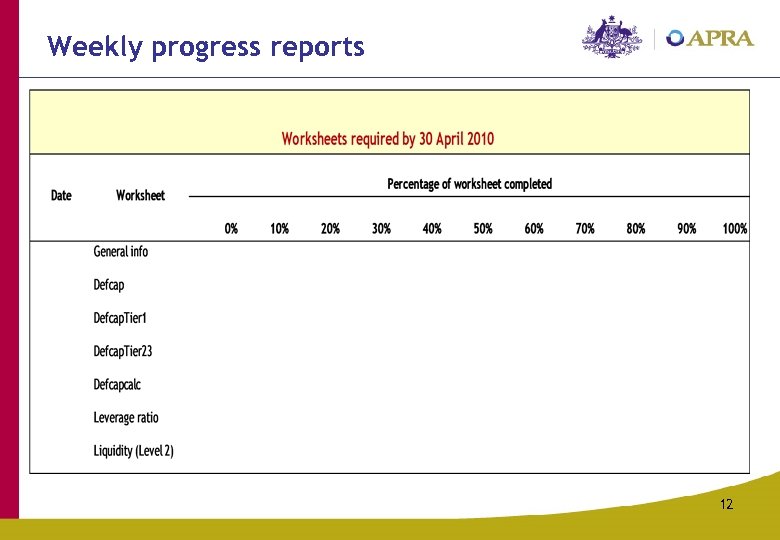

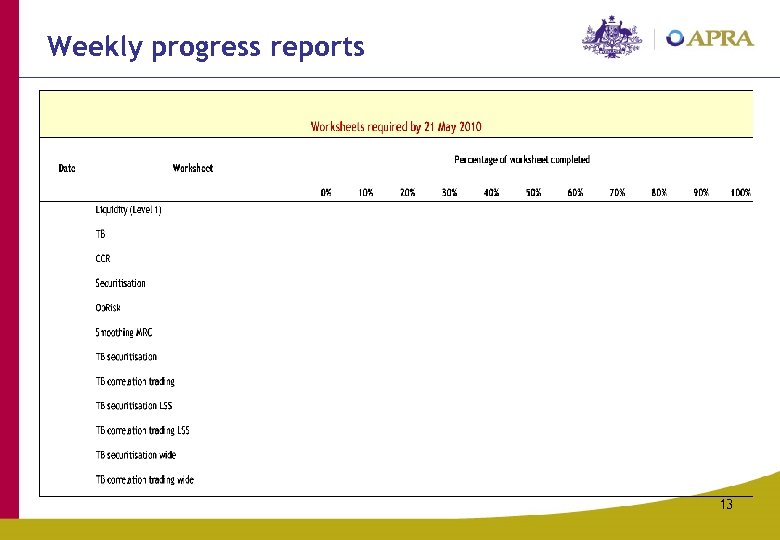

Weekly progress reports 12

Weekly progress reports 12

Weekly progress reports 13

Weekly progress reports 13

Definition of capital Judy Lau 14

Definition of capital Judy Lau 14

Background Changes to capital framework aimed at raising: • Quality • Consistency • Transparency 15

Background Changes to capital framework aimed at raising: • Quality • Consistency • Transparency 15

Quality • Stricter requirements to qualify as Tier 1 capital • Emphasis on tangible common equity • Predominant Tier 1 to comprise common shares and retained earnings • Innovative hybrids phased out • Tier 3 capital abolished 16

Quality • Stricter requirements to qualify as Tier 1 capital • Emphasis on tangible common equity • Predominant Tier 1 to comprise common shares and retained earnings • Innovative hybrids phased out • Tier 3 capital abolished 16

Consistency • Regulatory adjustments harmonised • Filters applied to predominant Tier 1 • Tier 2 capital harmonised • Explicit minimum ratios for – predominant Tier 1/risk-weighted assets – Total capital/risk-weighted assets 17

Consistency • Regulatory adjustments harmonised • Filters applied to predominant Tier 1 • Tier 2 capital harmonised • Explicit minimum ratios for – predominant Tier 1/risk-weighted assets – Total capital/risk-weighted assets 17

Tier 1 Capital Worksheet Def. Cap. Tier 1 • Column for each ‘group’ of instruments for which answers same • All sections completed for each instrument ‘group’, except where question is not applicable for Australia • All Tier 1 capital instruments accounted for in worksheet 18

Tier 1 Capital Worksheet Def. Cap. Tier 1 • Column for each ‘group’ of instruments for which answers same • All sections completed for each instrument ‘group’, except where question is not applicable for Australia • All Tier 1 capital instruments accounted for in worksheet 18

Current regulatory capital classification • Tier 1 – unlimited inclusion APRA Fundamental Tier 1 capital • Tier 1 – limited inclusion but the limit exceeding 15% APRA Non-innovative Residual Tier 1 capital • Tier 1 – inclusion limited to 15% (or less) APRA Innovative Tier 1 capital 19

Current regulatory capital classification • Tier 1 – unlimited inclusion APRA Fundamental Tier 1 capital • Tier 1 – limited inclusion but the limit exceeding 15% APRA Non-innovative Residual Tier 1 capital • Tier 1 – inclusion limited to 15% (or less) APRA Innovative Tier 1 capital 19

Common equity Only paid –up ordinary shares will qualify Questions not applicable for Australia: • Is the instrument capital under national law? (Row 18) • The paid-in amount is recognised as equity (ie not recognised as a liability) for determining balance sheet insolvency. (Q 9 under Common Equity criteria) 20

Common equity Only paid –up ordinary shares will qualify Questions not applicable for Australia: • Is the instrument capital under national law? (Row 18) • The paid-in amount is recognised as equity (ie not recognised as a liability) for determining balance sheet insolvency. (Q 9 under Common Equity criteria) 20

Tier 1 additional going concern capital • Existing instruments may not meet all criteria • Innovative instruments ineligible • No maturity date nor incentive to redeem • Call options subject to strict governance arrangements Q 10 and Q 11 relating to liabilities contributing to balance sheet insolvency not applicable in Australia 21

Tier 1 additional going concern capital • Existing instruments may not meet all criteria • Innovative instruments ineligible • No maturity date nor incentive to redeem • Call options subject to strict governance arrangements Q 10 and Q 11 relating to liabilities contributing to balance sheet insolvency not applicable in Australia 21

Tier 2 capital Worksheet Def. Cap. Tier 23 • Only one class of Tier 2 capital • Eligibility comparable to APRA Lower Tier 2 capital • No incentives to redeem Questions on lock-in features not applicable in Australia 22

Tier 2 capital Worksheet Def. Cap. Tier 23 • Only one class of Tier 2 capital • Eligibility comparable to APRA Lower Tier 2 capital • No incentives to redeem Questions on lock-in features not applicable in Australia 22

Assessing impact of capital proposal Worksheet Def. Cap • Regulatory adjustments reflect proposals in Consultative Document • Variations to the baseline proposal for a number of items • Completion on a “best-efforts” basis 23

Assessing impact of capital proposal Worksheet Def. Cap • Regulatory adjustments reflect proposals in Consultative Document • Variations to the baseline proposal for a number of items • Completion on a “best-efforts” basis 23

Change in risk-weighted assets • As a result of capital adjustments under the proposal • Assets deducted from capital excluded from RWA • Relevant where deductions not applicable in existing national rule • Since all baseline adjustments are APRA deductions, no change • Enter in ‘Other’ any current APRA deductions not required under proposal 24

Change in risk-weighted assets • As a result of capital adjustments under the proposal • Assets deducted from capital excluded from RWA • Relevant where deductions not applicable in existing national rule • Since all baseline adjustments are APRA deductions, no change • Enter in ‘Other’ any current APRA deductions not required under proposal 24

Paid in capital, reserves and AOCI Total should equal APRA Fundamental Tier 1 capital minus minority interests plus Full value of asset revaluation reserves as defined in Attachment B of APS 111 25

Paid in capital, reserves and AOCI Total should equal APRA Fundamental Tier 1 capital minus minority interests plus Full value of asset revaluation reserves as defined in Attachment B of APS 111 25

Minority interest Variations to identify: • Amounts attributable to different types of capital instruments • Total risk-weighted assets of the subsidiaries • ‘Surplus’ capital in the subsidiaries Follow instructions and complete on “best-efforts” basis 26

Minority interest Variations to identify: • Amounts attributable to different types of capital instruments • Total risk-weighted assets of the subsidiaries • ‘Surplus’ capital in the subsidiaries Follow instructions and complete on “best-efforts” basis 26

Unrealised gains and losses Variations separately identify net unrealised gains (losses): • on financial assets according to accounting classification and fair value hierarchy • on financial assets by fair value hierarchy and regulatory banking book/trading book • on property assets according to accounting treatment and regulatory banking book/trading book 27

Unrealised gains and losses Variations separately identify net unrealised gains (losses): • on financial assets according to accounting classification and fair value hierarchy • on financial assets by fair value hierarchy and regulatory banking book/trading book • on property assets according to accounting treatment and regulatory banking book/trading book 27

Goodwill and other intangibles • Associated deferred tax liabilities entered as positive numbers • Selected intangible items separately identified • Further categorisation as detailed in instructions 28

Goodwill and other intangibles • Associated deferred tax liabilities entered as positive numbers • Selected intangible items separately identified • Further categorisation as detailed in instructions 28

Deferred tax assets Netting of deferred tax assets and deferred tax liabilities per APRA rules (refer Attachment D of APS 111) Separately identify amounts whose realisation: • depends on future profitability of the bank • Do not rely on future profitability Exclude from deferred tax liabilities amounts associated with goodwill and intangibles 29

Deferred tax assets Netting of deferred tax assets and deferred tax liabilities per APRA rules (refer Attachment D of APS 111) Separately identify amounts whose realisation: • depends on future profitability of the bank • Do not rely on future profitability Exclude from deferred tax liabilities amounts associated with goodwill and intangibles 29

Investment in own shares • Not relevant to the extent holdings are derecognised under IFRS • Indirect investments have to be reported • Report obligations to purchase or provide financing 30

Investment in own shares • Not relevant to the extent holdings are derecognised under IFRS • Indirect investments have to be reported • Report obligations to purchase or provide financing 30

Investments in the capital of banking, financial and insurance entities • Investments which have not been consolidated • Distinguish holdings of common shares, other Tier 1 instruments and Tier 2 instruments • Five variations as detailed in instructions 31

Investments in the capital of banking, financial and insurance entities • Investments which have not been consolidated • Distinguish holdings of common shares, other Tier 1 instruments and Tier 2 instruments • Five variations as detailed in instructions 31

Provisions and expected losses Basel II IRB banks to provide details on • Eligible provisions • Expected losses Standardised banks to provide data on provisions eligible for inclusion in Tier 2 capital 32

Provisions and expected losses Basel II IRB banks to provide details on • Eligible provisions • Expected losses Standardised banks to provide data on provisions eligible for inclusion in Tier 2 capital 32

Cash flow hedge reserves Report total positive or (negative) value of cash flow hedge reserve with breakdown into: • Amount relating to the hedging of projected cash flows which are not recognised on balance sheet • Amount relating to the hedging of projected cash flows on assets recognised but not fair valued on balance sheet • Amount relating to the hedging of projected cash flows on liabilities recognised but not fair valued on balance sheet 33

Cash flow hedge reserves Report total positive or (negative) value of cash flow hedge reserve with breakdown into: • Amount relating to the hedging of projected cash flows which are not recognised on balance sheet • Amount relating to the hedging of projected cash flows on assets recognised but not fair valued on balance sheet • Amount relating to the hedging of projected cash flows on liabilities recognised but not fair valued on balance sheet 33

Gains and losses due to changes in own credit risk Report net gains and losses in equity due to changes in bank’s own credit worthiness Further split into: • Amount relating to liabilities fair valued under fair value option • Amount relating to liabilities fair valued due to their accounting classification 34

Gains and losses due to changes in own credit risk Report net gains and losses in equity due to changes in bank’s own credit worthiness Further split into: • Amount relating to liabilities fair valued under fair value option • Amount relating to liabilities fair valued due to their accounting classification 34

Defined benefit pension fund assets • Surplus in any ADI-sponsored defined benefit fund • Separately report any surplus amount that the ADI has demonstrated it has unrestricted and unfettered access to APRA’s satisfaction • The risk-weighted amount of the assets that the ADI has unrestricted and unfettered access • Deficits in any ADI-sponsored defined benefit fund 35

Defined benefit pension fund assets • Surplus in any ADI-sponsored defined benefit fund • Separately report any surplus amount that the ADI has demonstrated it has unrestricted and unfettered access to APRA’s satisfaction • The risk-weighted amount of the assets that the ADI has unrestricted and unfettered access • Deficits in any ADI-sponsored defined benefit fund 35

Additional deductions Separately identify the following items currently deducted 50: 50 from Tier 1 and Tier 2 capital: • • • Certain securitisation exposures Securitisation gain on sale Equity exposures under the PD/LGD approach Non-payment/delivery on non-Dv. P and non-Pv. P transactions Significant investments in commercial entities 36

Additional deductions Separately identify the following items currently deducted 50: 50 from Tier 1 and Tier 2 capital: • • • Certain securitisation exposures Securitisation gain on sale Equity exposures under the PD/LGD approach Non-payment/delivery on non-Dv. P and non-Pv. P transactions Significant investments in commercial entities 36

Country specific calculation Worksheet Def. Cap Calc ARF 110 37

Country specific calculation Worksheet Def. Cap Calc ARF 110 37

General info template Eligible Capital and Regulatory Adjustments (Current Rules) Asks for information on capital composition and regulatory deductions under current rules Amounts reported for Tier 1 capital, Tier 2 capital and total capital should match public/supervisory reports Amounts eligible to meet the predominance test should equal Fundamental Tier 1 capital 38

General info template Eligible Capital and Regulatory Adjustments (Current Rules) Asks for information on capital composition and regulatory deductions under current rules Amounts reported for Tier 1 capital, Tier 2 capital and total capital should match public/supervisory reports Amounts eligible to meet the predominance test should equal Fundamental Tier 1 capital 38

General info template Capital distribution data Relevant for consideration of capital conservation and countercyclical capital buffers Conserving capital to counter cyclicality Distribution as percentage of earnings Capital raisings 39

General info template Capital distribution data Relevant for consideration of capital conservation and countercyclical capital buffers Conserving capital to counter cyclicality Distribution as percentage of earnings Capital raisings 39

Discretionary bonus payments • Discretionary • Both in cash and/or shares • Results in reduction in Total Tier 1 capital • Net of tax (Deduct any potential purchase from Investment in Own Shares) 40

Discretionary bonus payments • Discretionary • Both in cash and/or shares • Results in reduction in Total Tier 1 capital • Net of tax (Deduct any potential purchase from Investment in Own Shares) 40

Leverage ratio Katrina Squires 41

Leverage ratio Katrina Squires 41

Leverage ratio – general principles High quality definition of (regulatory) capital Exposure measure generally based on accounting treatment/valuation (on balance sheet non-derivative items net of specific provisions and valuation adjustments) Securitisation exposures follow accounting treatment (underlying securitised portfolios included in the leverage ratio for non-derecognised (accounting) securitisations) Consistent with a non-risk based approach, no recognition of credit risk mitigants (collateral, guarantees, purchased credit protection) No recognition of netting (gets around differences between IFRS and US GAAP particularly for netting of derivatives and repos) Two options for measuring the exposure for derivatives: sum of on balance sheet positive fair values or additionally include the potential exposure using Basel II current exposure method Written credit derivatives included at notional value in the exposure measure 42

Leverage ratio – general principles High quality definition of (regulatory) capital Exposure measure generally based on accounting treatment/valuation (on balance sheet non-derivative items net of specific provisions and valuation adjustments) Securitisation exposures follow accounting treatment (underlying securitised portfolios included in the leverage ratio for non-derecognised (accounting) securitisations) Consistent with a non-risk based approach, no recognition of credit risk mitigants (collateral, guarantees, purchased credit protection) No recognition of netting (gets around differences between IFRS and US GAAP particularly for netting of derivatives and repos) Two options for measuring the exposure for derivatives: sum of on balance sheet positive fair values or additionally include the potential exposure using Basel II current exposure method Written credit derivatives included at notional value in the exposure measure 42

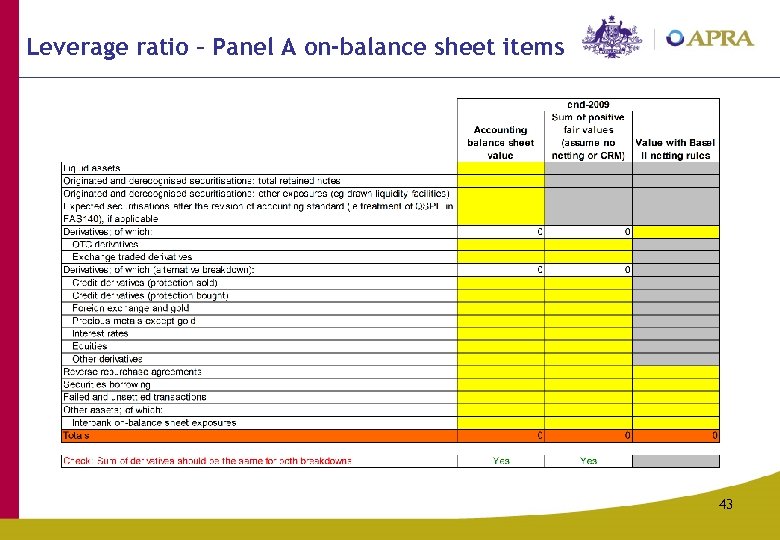

Leverage ratio – Panel A on-balance sheet items 43

Leverage ratio – Panel A on-balance sheet items 43

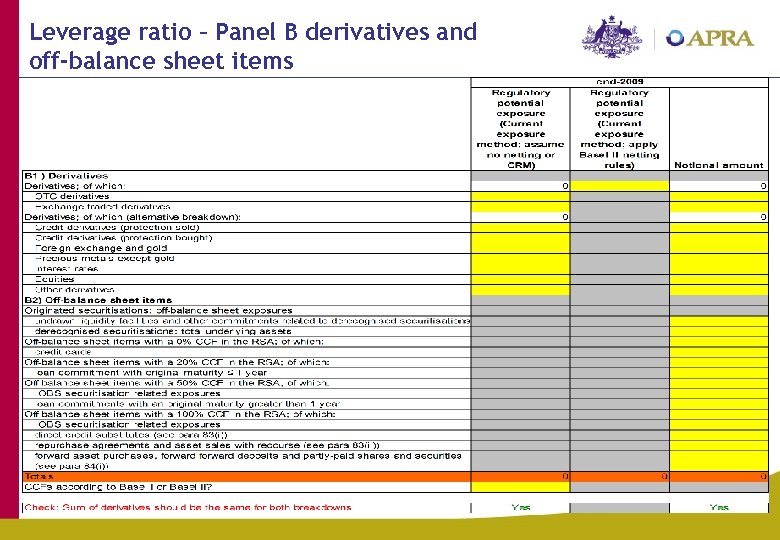

Leverage ratio – Panel B derivatives and off-balance sheet items 44

Leverage ratio – Panel B derivatives and off-balance sheet items 44

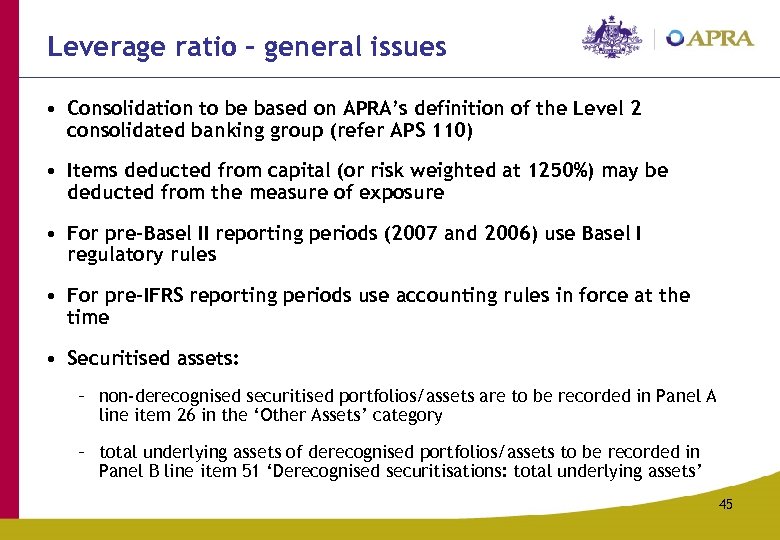

Leverage ratio – general issues • Consolidation to be based on APRA’s definition of the Level 2 consolidated banking group (refer APS 110) • Items deducted from capital (or risk weighted at 1250%) may be deducted from the measure of exposure • For pre-Basel II reporting periods (2007 and 2006) use Basel I regulatory rules • For pre-IFRS reporting periods use accounting rules in force at the time • Securitised assets: – non-derecognised securitised portfolios/assets are to be recorded in Panel A line item 26 in the ‘Other Assets’ category – total underlying assets of derecognised portfolios/assets to be recorded in Panel B line item 51 ‘Derecognised securitisations: total underlying assets’ 45

Leverage ratio – general issues • Consolidation to be based on APRA’s definition of the Level 2 consolidated banking group (refer APS 110) • Items deducted from capital (or risk weighted at 1250%) may be deducted from the measure of exposure • For pre-Basel II reporting periods (2007 and 2006) use Basel I regulatory rules • For pre-IFRS reporting periods use accounting rules in force at the time • Securitised assets: – non-derecognised securitised portfolios/assets are to be recorded in Panel A line item 26 in the ‘Other Assets’ category – total underlying assets of derecognised portfolios/assets to be recorded in Panel B line item 51 ‘Derecognised securitisations: total underlying assets’ 45

Leverage ratio – general issues • Panel A Line item 11 is not relevant for Australia, ie. ‘Expected securitisations after the revision of accounting standard (ie treatment of QSPE in FAS 140), if applicable’ • Availability of requested data: ‘best efforts’ basis 46

Leverage ratio – general issues • Panel A Line item 11 is not relevant for Australia, ie. ‘Expected securitisations after the revision of accounting standard (ie treatment of QSPE in FAS 140), if applicable’ • Availability of requested data: ‘best efforts’ basis 46

Leverage ratio – outstanding issues Calibration – how much? Pillar 1 or Pillar 2 or Pillar 3? Pillar 3 disclosures 47

Leverage ratio – outstanding issues Calibration – how much? Pillar 1 or Pillar 2 or Pillar 3? Pillar 3 disclosures 47

Liquidity Kelly Yeung 48

Liquidity Kelly Yeung 48

Presentation outline • Background of the liquidity QIS • “Walk-through” the QIS liquidity worksheet • Questions and answers 49

Presentation outline • Background of the liquidity QIS • “Walk-through” the QIS liquidity worksheet • Questions and answers 49

Background International framework for liquidity risk measurement, standards and monitoring, BCBS consultative document December 2009 • Proposing a global quantitative framework for liquidity risk supervision • Objectives - Strengthen banks’ resilience to liquidity stress - Promote stronger liquidity buffers (quantity and quality) at banks - Enhance international harmonisation of liquidity risk supervision 50

Background International framework for liquidity risk measurement, standards and monitoring, BCBS consultative document December 2009 • Proposing a global quantitative framework for liquidity risk supervision • Objectives - Strengthen banks’ resilience to liquidity stress - Promote stronger liquidity buffers (quantity and quality) at banks - Enhance international harmonisation of liquidity risk supervision 50

Background (cont’d) • Propose two global quantitative liquidity standards (regulatory metrics) - Liquidity Coverage Ratio (LCR) i) Promote short-term resiliency of banks’ liquidity risk profiles ii) Ensure banks have sufficient high quality liquid resources to survive an acute stress scenario lasting for one month - Net Stable Funding Ratio (NSFR) i) Promote banks’ resiliency over longer-term time horizons ii) Establish a minimum acceptable amount of stable funding for a bank’s assets and off-balance sheet activities over a one year horizon 51

Background (cont’d) • Propose two global quantitative liquidity standards (regulatory metrics) - Liquidity Coverage Ratio (LCR) i) Promote short-term resiliency of banks’ liquidity risk profiles ii) Ensure banks have sufficient high quality liquid resources to survive an acute stress scenario lasting for one month - Net Stable Funding Ratio (NSFR) i) Promote banks’ resiliency over longer-term time horizons ii) Establish a minimum acceptable amount of stable funding for a bank’s assets and off-balance sheet activities over a one year horizon 51

Background (cont’d) Purpose of the liquidity QIS • Gather relevant data to assess the impact of the two regulatory metrics on banks - LCR: Analyse the trade-offs between the severity of the stress scenario and the minimum levels of liquidity to be held by banks - NSFR: Analyse the impact of the minimum amount of stable funding required of banks to support relevant assets and business activities • QIS results will be used to recalibrate the parameters of the two regulatory metrics and for considering other possible options - Ensure these regulatory metrics create strong incentives for banks to maintain prudent funding liquidity profiles while minimise negative impact on the financial system and broader economy 52

Background (cont’d) Purpose of the liquidity QIS • Gather relevant data to assess the impact of the two regulatory metrics on banks - LCR: Analyse the trade-offs between the severity of the stress scenario and the minimum levels of liquidity to be held by banks - NSFR: Analyse the impact of the minimum amount of stable funding required of banks to support relevant assets and business activities • QIS results will be used to recalibrate the parameters of the two regulatory metrics and for considering other possible options - Ensure these regulatory metrics create strong incentives for banks to maintain prudent funding liquidity profiles while minimise negative impact on the financial system and broader economy 52

Background (cont’d) QIS liquidity worksheet • Capture relevant data for the LCR and NSFR measures - Data in line with the liquidity consultative document - A few areas with additional granularity for further analysis - Mainly involves reporting of outstanding balances of on- and off-balance sheet assets and liabilities 53

Background (cont’d) QIS liquidity worksheet • Capture relevant data for the LCR and NSFR measures - Data in line with the liquidity consultative document - A few areas with additional granularity for further analysis - Mainly involves reporting of outstanding balances of on- and off-balance sheet assets and liabilities 53

QIS liquidity worksheet General information • Basis of reporting: Level 2 consolidated group • Reporting period: end-Sept 2009 or end-Dec 2009 (must be consistent with other worksheets) • Reporting currency: AUD (all foreign currency amounts should be converted into AUD using the exchange rate applicable at the reporting date) 54

QIS liquidity worksheet General information • Basis of reporting: Level 2 consolidated group • Reporting period: end-Sept 2009 or end-Dec 2009 (must be consistent with other worksheets) • Reporting currency: AUD (all foreign currency amounts should be converted into AUD using the exchange rate applicable at the reporting date) 54

QIS liquidity worksheet (cont’d) General information (cont’d) • Additional data requirements for the four major banks - Provide separate equivalent data for Australia, New Zealand UK i) Australia: all ADIs and their overseas branches ii) NZ: NZ banking subsidiaries (basis of reporting in line with RBNZ’s requirements) (Note: Seek institution’s consent to share the NZ data with RBNZ) iii) UK: UK banking subsidiaries (basis of reporting in line with the FSA’s requirements) 55

QIS liquidity worksheet (cont’d) General information (cont’d) • Additional data requirements for the four major banks - Provide separate equivalent data for Australia, New Zealand UK i) Australia: all ADIs and their overseas branches ii) NZ: NZ banking subsidiaries (basis of reporting in line with RBNZ’s requirements) (Note: Seek institution’s consent to share the NZ data with RBNZ) iii) UK: UK banking subsidiaries (basis of reporting in line with the FSA’s requirements) 55

QIS liquidity worksheet (cont’d) General information (cont’d) - Solo data collected for APRA’s own analysis and will not be sent to BCBS - Required solo data to be submitted by 21 May 2010 - Submit a separate worksheet for reporting all those solo data (use separate column for reporting Australia, NZ and UK data) 56

QIS liquidity worksheet (cont’d) General information (cont’d) - Solo data collected for APRA’s own analysis and will not be sent to BCBS - Required solo data to be submitted by 21 May 2010 - Submit a separate worksheet for reporting all those solo data (use separate column for reporting Australia, NZ and UK data) 56

QIS liquidity worksheet (cont’d) General information (cont’d) - Reporting period: end-Sept 2009 or end-Dec 2009 (must be consistent with the Level 2 data) - Reporting currency: AUD (all foreign currency amounts should be converted into AUD using the exchange rate applicable at the reporting date) 57

QIS liquidity worksheet (cont’d) General information (cont’d) - Reporting period: end-Sept 2009 or end-Dec 2009 (must be consistent with the Level 2 data) - Reporting currency: AUD (all foreign currency amounts should be converted into AUD using the exchange rate applicable at the reporting date) 57

QIS liquidity worksheet (cont’d) Specific instructions • Panels A and B: capture relevant data relating to the LCR measure LCR: Stock of high quality liquid assets Net cash outflows over a 30 -day time period ≥ 100% • Panel A deals with internal estimates of liquid assets (i. e. the numerator of the LCR) • Panel B deals with net cash outflows (i. e. the denominator of the LCR) 58

QIS liquidity worksheet (cont’d) Specific instructions • Panels A and B: capture relevant data relating to the LCR measure LCR: Stock of high quality liquid assets Net cash outflows over a 30 -day time period ≥ 100% • Panel A deals with internal estimates of liquid assets (i. e. the numerator of the LCR) • Panel B deals with net cash outflows (i. e. the denominator of the LCR) 58

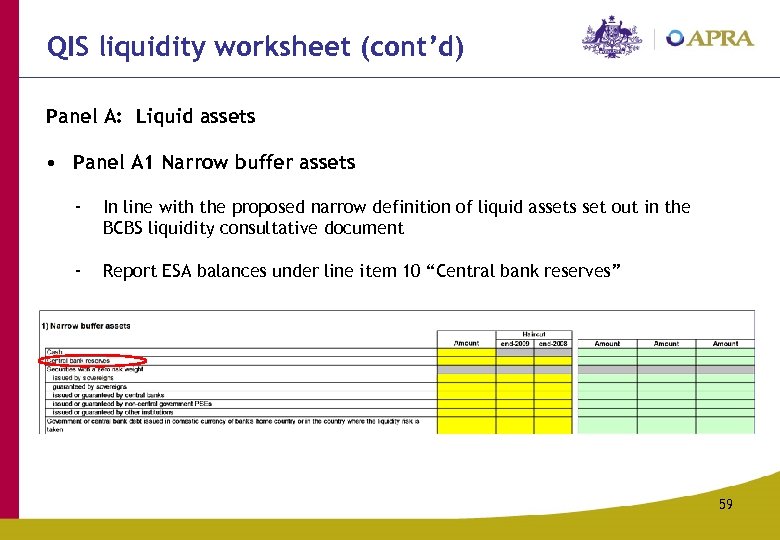

QIS liquidity worksheet (cont’d) Panel A: Liquid assets • Panel A 1 Narrow buffer assets - In line with the proposed narrow definition of liquid assets set out in the BCBS liquidity consultative document - Report ESA balances under line item 10 “Central bank reserves” 59

QIS liquidity worksheet (cont’d) Panel A: Liquid assets • Panel A 1 Narrow buffer assets - In line with the proposed narrow definition of liquid assets set out in the BCBS liquidity consultative document - Report ESA balances under line item 10 “Central bank reserves” 59

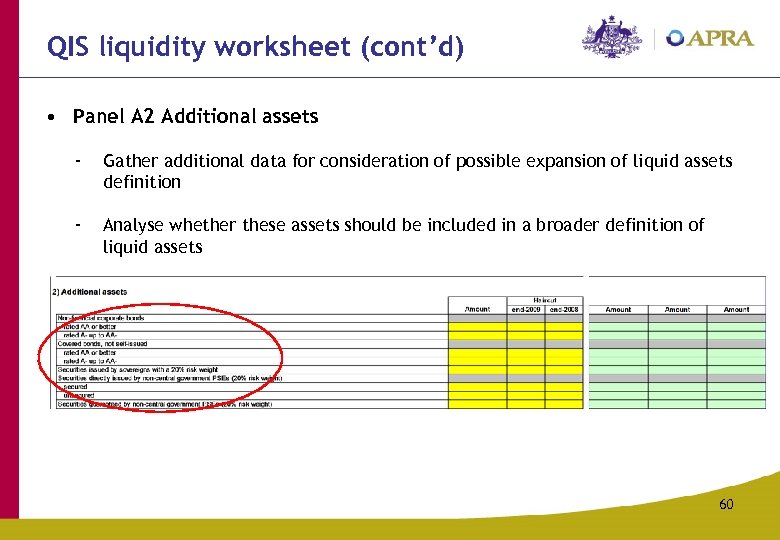

QIS liquidity worksheet (cont’d) • Panel A 2 Additional assets - Gather additional data for consideration of possible expansion of liquid assets definition - Analyse whether these assets should be included in a broader definition of liquid assets 60

QIS liquidity worksheet (cont’d) • Panel A 2 Additional assets - Gather additional data for consideration of possible expansion of liquid assets definition - Analyse whether these assets should be included in a broader definition of liquid assets 60

QIS liquidity worksheet (cont’d) • All assets reported under Panel A must be unencumbered and freely available for the next 30 days - Any of the assets listed under Panel A received by the ADI as collateral (e. g. under reverse repos) can only be included if they remain at the ADI’s disposal throughout the 30 -day time period • All assets reported under Panel A must be central bank-eligible and cannot be issued by a bank, investment firm or insurance firm • Once included in Panel A, those assets cannot be reported as cash inflows under Panel B 2 to avoid double counting • All securities should be reported at market value 61

QIS liquidity worksheet (cont’d) • All assets reported under Panel A must be unencumbered and freely available for the next 30 days - Any of the assets listed under Panel A received by the ADI as collateral (e. g. under reverse repos) can only be included if they remain at the ADI’s disposal throughout the 30 -day time period • All assets reported under Panel A must be central bank-eligible and cannot be issued by a bank, investment firm or insurance firm • Once included in Panel A, those assets cannot be reported as cash inflows under Panel B 2 to avoid double counting • All securities should be reported at market value 61

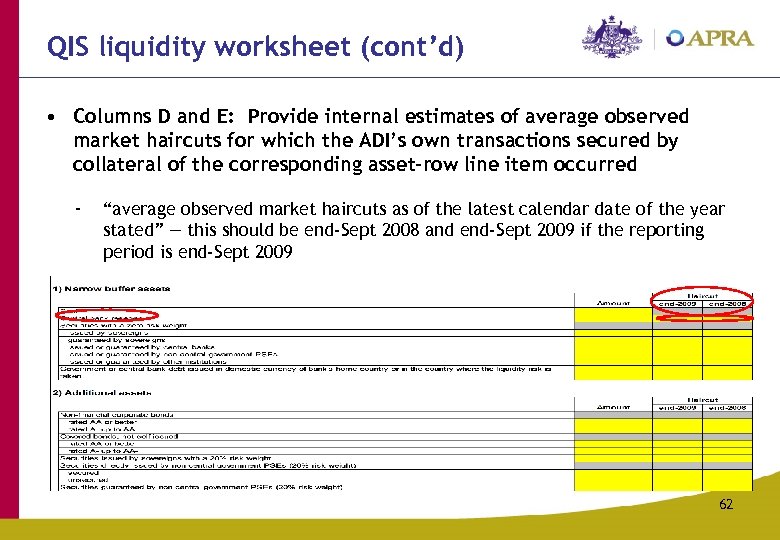

QIS liquidity worksheet (cont’d) • Columns D and E: Provide internal estimates of average observed market haircuts for which the ADI’s own transactions secured by collateral of the corresponding asset-row line item occurred - “average observed market haircuts as of the latest calendar date of the year stated” — this should be end-Sept 2008 and end-Sept 2009 if the reporting period is end-Sept 2009 62

QIS liquidity worksheet (cont’d) • Columns D and E: Provide internal estimates of average observed market haircuts for which the ADI’s own transactions secured by collateral of the corresponding asset-row line item occurred - “average observed market haircuts as of the latest calendar date of the year stated” — this should be end-Sept 2008 and end-Sept 2009 if the reporting period is end-Sept 2009 62

QIS liquidity worksheet (cont’d) • Haircut for central bank reserves: leave blank if inapplicable • Can ADIs use central bank haircuts for “narrow buffer assets”? 63

QIS liquidity worksheet (cont’d) • Haircut for central bank reserves: leave blank if inapplicable • Can ADIs use central bank haircuts for “narrow buffer assets”? 63

QIS liquidity worksheet (cont’d) Panel B: Net cash outflows Panel B 1 Cash outflows • Capture outstanding liabilities that fall due within the 30 -day window • Include term deposits where withdrawal penalty is no greater than the loss of interest 64

QIS liquidity worksheet (cont’d) Panel B: Net cash outflows Panel B 1 Cash outflows • Capture outstanding liabilities that fall due within the 30 -day window • Include term deposits where withdrawal penalty is no greater than the loss of interest 64

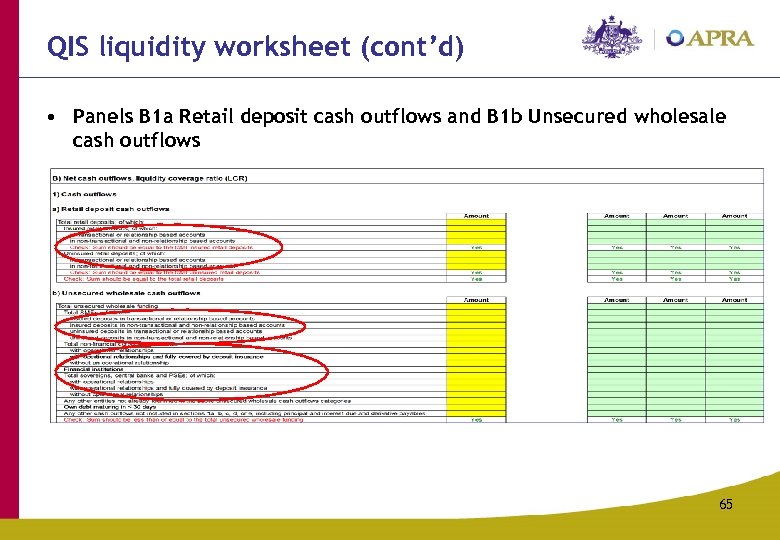

QIS liquidity worksheet (cont’d) • Panels B 1 a Retail deposit cash outflows and B 1 b Unsecured wholesale cash outflows 65

QIS liquidity worksheet (cont’d) • Panels B 1 a Retail deposit cash outflows and B 1 b Unsecured wholesale cash outflows 65

QIS liquidity worksheet (cont’d) - The QIS requires retail deposits and certain unsecured wholesale funding to be split by ‘transactional or relationship’ and ‘operational relationships’ i) The required data to be provided on a best-effort basis ii) Where data is not available, ADIs can provide estimates iii) Any assumptions used in making such estimates should be included in the qualitative document iv) The QIS instructions provide some guidance on transactional and relationship based accounts and on operational relationships 66

QIS liquidity worksheet (cont’d) - The QIS requires retail deposits and certain unsecured wholesale funding to be split by ‘transactional or relationship’ and ‘operational relationships’ i) The required data to be provided on a best-effort basis ii) Where data is not available, ADIs can provide estimates iii) Any assumptions used in making such estimates should be included in the qualitative document iv) The QIS instructions provide some guidance on transactional and relationship based accounts and on operational relationships 66

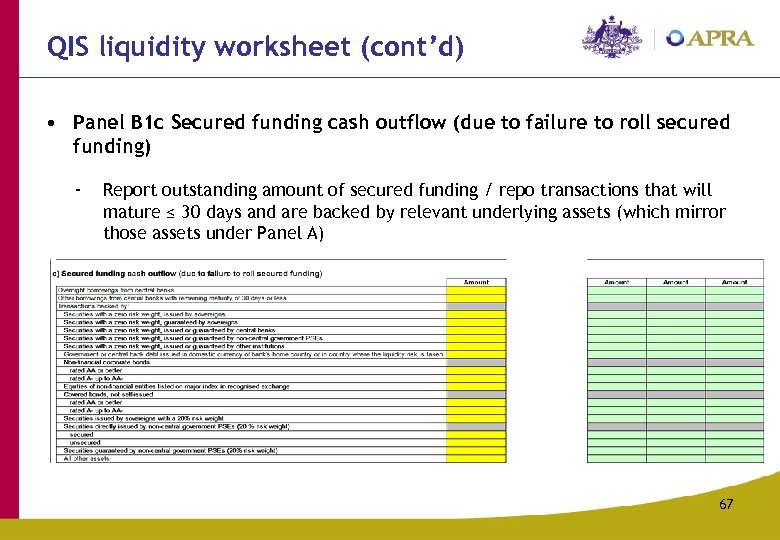

QIS liquidity worksheet (cont’d) • Panel B 1 c Secured funding cash outflow (due to failure to roll secured funding) - Report outstanding amount of secured funding / repo transactions that will mature ≤ 30 days and are backed by relevant underlying assets (which mirror those assets under Panel A) 67

QIS liquidity worksheet (cont’d) • Panel B 1 c Secured funding cash outflow (due to failure to roll secured funding) - Report outstanding amount of secured funding / repo transactions that will mature ≤ 30 days and are backed by relevant underlying assets (which mirror those assets under Panel A) 67

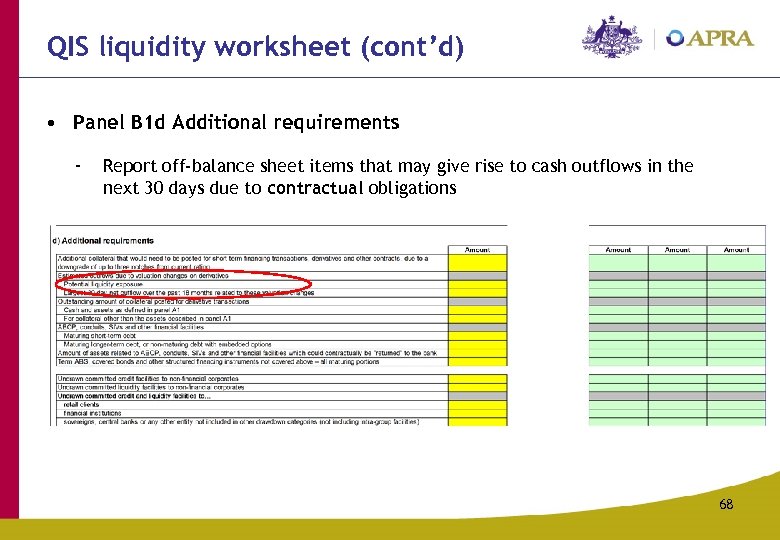

QIS liquidity worksheet (cont’d) • Panel B 1 d Additional requirements - Report off-balance sheet items that may give rise to cash outflows in the next 30 days due to contractual obligations 68

QIS liquidity worksheet (cont’d) • Panel B 1 d Additional requirements - Report off-balance sheet items that may give rise to cash outflows in the next 30 days due to contractual obligations 68

QIS liquidity worksheet (cont’d) - Estimate potential liquidity exposure (outflows) in the next 30 days due to valuation changes on derivatives (line item 96) i) The assumptions used in making such estimate should be included in the qualitative document 69

QIS liquidity worksheet (cont’d) - Estimate potential liquidity exposure (outflows) in the next 30 days due to valuation changes on derivatives (line item 96) i) The assumptions used in making such estimate should be included in the qualitative document 69

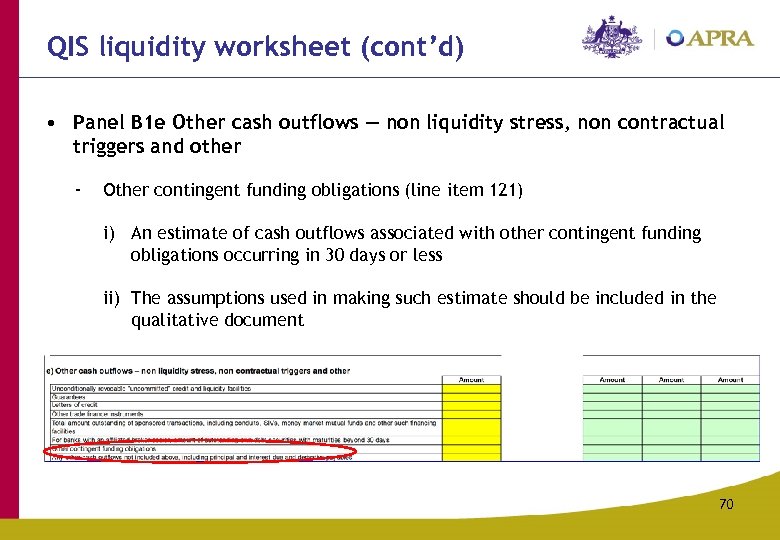

QIS liquidity worksheet (cont’d) • Panel B 1 e Other cash outflows — non liquidity stress, non contractual triggers and other - Other contingent funding obligations (line item 121) i) An estimate of cash outflows associated with other contingent funding obligations occurring in 30 days or less ii) The assumptions used in making such estimate should be included in the qualitative document 70

QIS liquidity worksheet (cont’d) • Panel B 1 e Other cash outflows — non liquidity stress, non contractual triggers and other - Other contingent funding obligations (line item 121) i) An estimate of cash outflows associated with other contingent funding obligations occurring in 30 days or less ii) The assumptions used in making such estimate should be included in the qualitative document 70

QIS liquidity worksheet (cont’d) - Any other cash outflows not included above (line item 122) i) This item may conflict with line item 66 ii) In any case, avoid double counting 71

QIS liquidity worksheet (cont’d) - Any other cash outflows not included above (line item 122) i) This item may conflict with line item 66 ii) In any case, avoid double counting 71

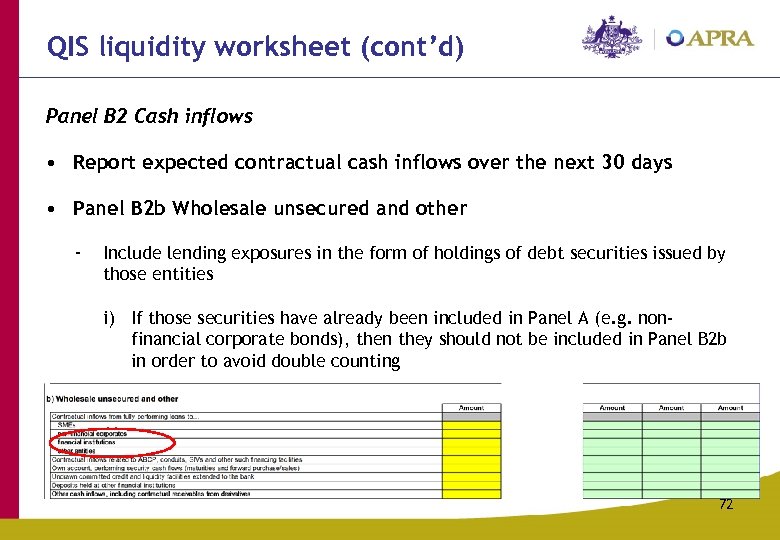

QIS liquidity worksheet (cont’d) Panel B 2 Cash inflows • Report expected contractual cash inflows over the next 30 days • Panel B 2 b Wholesale unsecured and other - Include lending exposures in the form of holdings of debt securities issued by those entities i) If those securities have already been included in Panel A (e. g. nonfinancial corporate bonds), then they should not be included in Panel B 2 b in order to avoid double counting 72

QIS liquidity worksheet (cont’d) Panel B 2 Cash inflows • Report expected contractual cash inflows over the next 30 days • Panel B 2 b Wholesale unsecured and other - Include lending exposures in the form of holdings of debt securities issued by those entities i) If those securities have already been included in Panel A (e. g. nonfinancial corporate bonds), then they should not be included in Panel B 2 b in order to avoid double counting 72

QIS liquidity worksheet (cont’d) ii) Otherwise, include contractual inflows arising from these securities (e. g. principal amount and/or interest received) in the next 30 days 73

QIS liquidity worksheet (cont’d) ii) Otherwise, include contractual inflows arising from these securities (e. g. principal amount and/or interest received) in the next 30 days 73

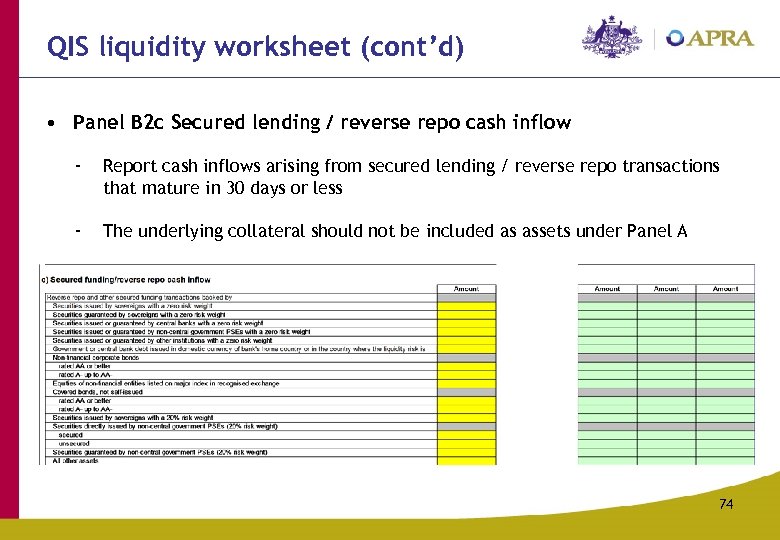

QIS liquidity worksheet (cont’d) • Panel B 2 c Secured lending / reverse repo cash inflow - Report cash inflows arising from secured lending / reverse repo transactions that mature in 30 days or less - The underlying collateral should not be included as assets under Panel A 74

QIS liquidity worksheet (cont’d) • Panel B 2 c Secured lending / reverse repo cash inflow - Report cash inflows arising from secured lending / reverse repo transactions that mature in 30 days or less - The underlying collateral should not be included as assets under Panel A 74

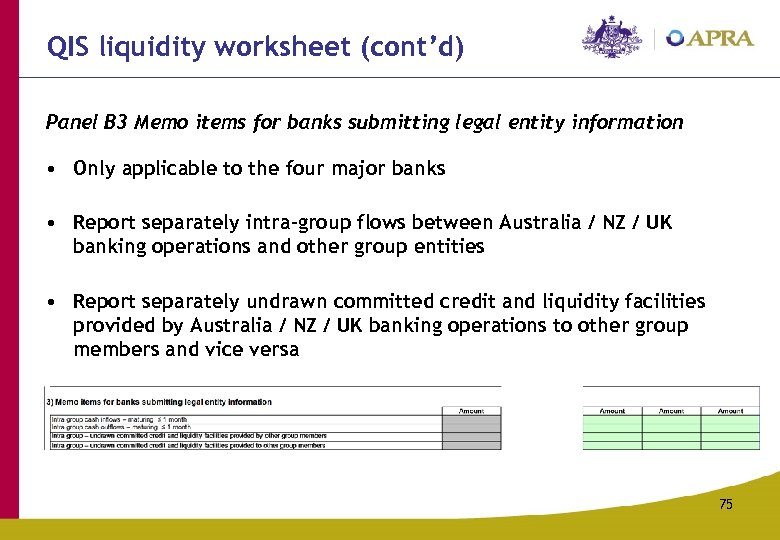

QIS liquidity worksheet (cont’d) Panel B 3 Memo items for banks submitting legal entity information • Only applicable to the four major banks • Report separately intra-group flows between Australia / NZ / UK banking operations and other group entities • Report separately undrawn committed credit and liquidity facilities provided by Australia / NZ / UK banking operations to other group members and vice versa 75

QIS liquidity worksheet (cont’d) Panel B 3 Memo items for banks submitting legal entity information • Only applicable to the four major banks • Report separately intra-group flows between Australia / NZ / UK banking operations and other group entities • Report separately undrawn committed credit and liquidity facilities provided by Australia / NZ / UK banking operations to other group members and vice versa 75

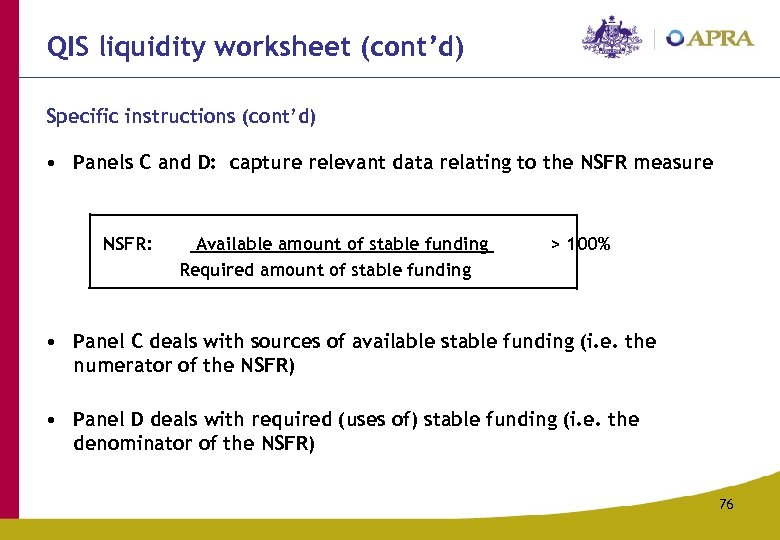

QIS liquidity worksheet (cont’d) Specific instructions (cont’d) • Panels C and D: capture relevant data relating to the NSFR measure NSFR: Available amount of stable funding Required amount of stable funding > 100% • Panel C deals with sources of available stable funding (i. e. the numerator of the NSFR) • Panel D deals with required (uses of) stable funding (i. e. the denominator of the NSFR) 76

QIS liquidity worksheet (cont’d) Specific instructions (cont’d) • Panels C and D: capture relevant data relating to the NSFR measure NSFR: Available amount of stable funding Required amount of stable funding > 100% • Panel C deals with sources of available stable funding (i. e. the numerator of the NSFR) • Panel D deals with required (uses of) stable funding (i. e. the denominator of the NSFR) 76

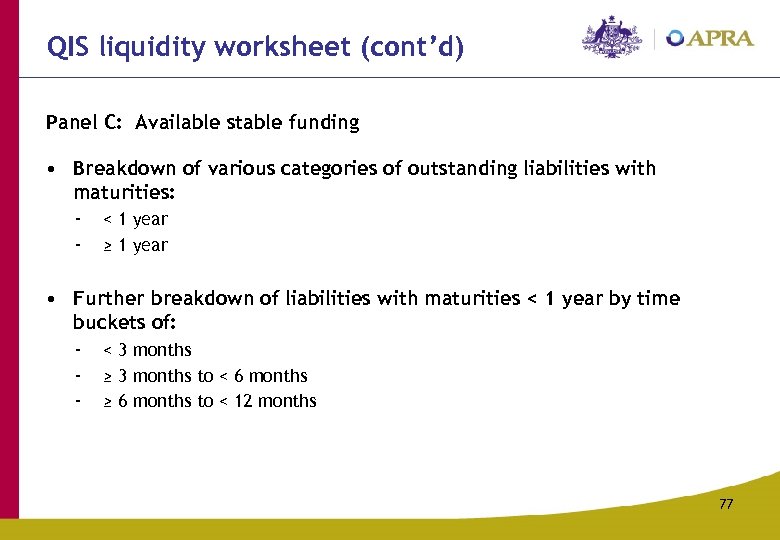

QIS liquidity worksheet (cont’d) Panel C: Available stable funding • Breakdown of various categories of outstanding liabilities with maturities: - < 1 year ≥ 1 year • Further breakdown of liabilities with maturities < 1 year by time buckets of: - < 3 months ≥ 3 months to < 6 months ≥ 6 months to < 12 months 77

QIS liquidity worksheet (cont’d) Panel C: Available stable funding • Breakdown of various categories of outstanding liabilities with maturities: - < 1 year ≥ 1 year • Further breakdown of liabilities with maturities < 1 year by time buckets of: - < 3 months ≥ 3 months to < 6 months ≥ 6 months to < 12 months 77

QIS liquidity worksheet (cont’d) Panel D: Required stable funding • Breakdown of various categories of assets (e. g. loans, securities, etc) with maturities: - < 1 year ≥ 1 year • Undrawn committed credit and liquidity facilities to fiduciaries (line items 256 and 257) - Errors in the QIS instructions (make reference to fiduciaries in both line items) - Will clarify with the BCBS QIS Working Group 78

QIS liquidity worksheet (cont’d) Panel D: Required stable funding • Breakdown of various categories of assets (e. g. loans, securities, etc) with maturities: - < 1 year ≥ 1 year • Undrawn committed credit and liquidity facilities to fiduciaries (line items 256 and 257) - Errors in the QIS instructions (make reference to fiduciaries in both line items) - Will clarify with the BCBS QIS Working Group 78

QIS liquidity worksheet (cont’d) • Other contingent funding obligations (line item 261) - An estimate - The assumptions used in making such estimate should be included in the qualitative document 79

QIS liquidity worksheet (cont’d) • Other contingent funding obligations (line item 261) - An estimate - The assumptions used in making such estimate should be included in the qualitative document 79

Counterparty credit risk and trading book Denis Gorey 80

Counterparty credit risk and trading book Denis Gorey 80

Agenda Trading Book • • General comments “TB” tab “TB Securitisation” tabs “TB Correlation” tabs Counterparty Credit Risk • General comments • “General Info” tab • “CCR” tab 81

Agenda Trading Book • • General comments “TB” tab “TB Securitisation” tabs “TB Correlation” tabs Counterparty Credit Risk • General comments • “General Info” tab • “CCR” tab 81

Agenda Trading Book • • General comments “TB” tab “TB Securitisation” tabs “TB Correlation” tabs Counterparty Credit Risk • General comments • “General Info” tab • “CCR” tab 82

Agenda Trading Book • • General comments “TB” tab “TB Securitisation” tabs “TB Correlation” tabs Counterparty Credit Risk • General comments • “General Info” tab • “CCR” tab 82

Trading Book – Market Risk rules apply to Trading Book AND FX and Commodity exposures in Banking Book – The QIS is capturing impact of changes as per draft APS 116 (December 2009) – Not all of QIS applies: • “TB” Section B and “TB Securitisation” Section 1 b apply only to ADIs who model interest rate specific risk • “TB Correlation Trading” tabs apply only to ADIs who have a correlation trading portfolio so should not apply – if you have a different view then happy to discuss – The instructions for TB are reasonably straightforward 83

Trading Book – Market Risk rules apply to Trading Book AND FX and Commodity exposures in Banking Book – The QIS is capturing impact of changes as per draft APS 116 (December 2009) – Not all of QIS applies: • “TB” Section B and “TB Securitisation” Section 1 b apply only to ADIs who model interest rate specific risk • “TB Correlation Trading” tabs apply only to ADIs who have a correlation trading portfolio so should not apply – if you have a different view then happy to discuss – The instructions for TB are reasonably straightforward 83

Trading Book • General comments • “TB” tab – Equity specific risk: Section A – Stressed Va. R: Section B • “TB Securitisation” tabs 84

Trading Book • General comments • “TB” tab – Equity specific risk: Section A – Stressed Va. R: Section B • “TB Securitisation” tabs 84

Section A: Equity specific risk • Zero unless: – You have equity exposures subject to the standard method for equity specific risk AND – Some of these are subject to a 4% charge under paragraph 36 of Attachment B to APS 116 due to their classification as being both liquid and well-diversified (as would be reported in Column 2 of ARF_116_0_3) 85

Section A: Equity specific risk • Zero unless: – You have equity exposures subject to the standard method for equity specific risk AND – Some of these are subject to a 4% charge under paragraph 36 of Attachment B to APS 116 due to their classification as being both liquid and well-diversified (as would be reported in Column 2 of ARF_116_0_3) 85

Trading Book • General comments • “TB” tab – Equity specific risk – Stressed Va. R • “TB Securitisation” tabs 86

Trading Book • General comments • “TB” tab – Equity specific risk – Stressed Va. R • “TB Securitisation” tabs 86

Section B: Stressed Va. R • Stressed Va. R contribution – Stressed Va. R observation period must be exactly one year – The draft standard says “from a continuous 12 month period of significant financial stress relevant to the ADI‟s portfolio”. I suggest for QIS purposes: any 12 month period which includes all of the last quarter of 2008 should suffice • Non-stressed Va. R observation period – Ideally ending 31 Dec 2006 – is this feasible? If not then let’s discuss (the fallback is a choice of period that doesn’t include the GFC) – No specification of length of period (but must be at least a year) – Need to supply a description of approach used in an accompanying document 87

Section B: Stressed Va. R • Stressed Va. R contribution – Stressed Va. R observation period must be exactly one year – The draft standard says “from a continuous 12 month period of significant financial stress relevant to the ADI‟s portfolio”. I suggest for QIS purposes: any 12 month period which includes all of the last quarter of 2008 should suffice • Non-stressed Va. R observation period – Ideally ending 31 Dec 2006 – is this feasible? If not then let’s discuss (the fallback is a choice of period that doesn’t include the GFC) – No specification of length of period (but must be at least a year) – Need to supply a description of approach used in an accompanying document 87

Trading Book • General comments • “TB” tab – Equity specific risk – Stressed Va. R • “TB Securitisation” tabs 88

Trading Book • General comments • “TB” tab – Equity specific risk – Stressed Va. R • “TB Securitisation” tabs 88

“TB Securitisation” tabs • Should be relatively straightforward • “Re-securitisation” as defined in the draft APS 120 • “ 10 most relevant instrument types” – classify in the same way as for the “Securitisation “ tab 89

“TB Securitisation” tabs • Should be relatively straightforward • “Re-securitisation” as defined in the draft APS 120 • “ 10 most relevant instrument types” – classify in the same way as for the “Securitisation “ tab 89

Agenda Trading Book • • General comments “TB” tab “TB Securitisation” tabs “TB Correlation” tabs Counterparty Credit Risk • General comments • “General Info” tab • “CCR” tab 90

Agenda Trading Book • • General comments “TB” tab “TB Securitisation” tabs “TB Correlation” tabs Counterparty Credit Risk • General comments • “General Info” tab • “CCR” tab 90

Counterparty Credit Risk – CCR rules calculate a loan equivalent Exposure at Default (EAD) for OTC derivatives, repos, stock lending and borrowing and other securities financing transactions (SFTs) but Section E of “CCR” tab also applies to loan activity – Under Basel framework: 3 ways of calculating EAD • • • Current exposure method (currently used) Standardised method Internal Model Method – QIS generally focuses on IMM – so much doesn’t apply • • Sections A 1, B 2, C, D, and G of “CCR” tab do not apply Focus only on sections A 2, B 1, E and F of “CCR” tab 91

Counterparty Credit Risk – CCR rules calculate a loan equivalent Exposure at Default (EAD) for OTC derivatives, repos, stock lending and borrowing and other securities financing transactions (SFTs) but Section E of “CCR” tab also applies to loan activity – Under Basel framework: 3 ways of calculating EAD • • • Current exposure method (currently used) Standardised method Internal Model Method – QIS generally focuses on IMM – so much doesn’t apply • • Sections A 1, B 2, C, D, and G of “CCR” tab do not apply Focus only on sections A 2, B 1, E and F of “CCR” tab 91

Counterparty Credit Risk • General comments • “General Info” tab – current CCR capital – should be straightforward • “CCR” tab – – CVA loss charge Asset value correlation Central counterparties Impact summary 92

Counterparty Credit Risk • General comments • “General Info” tab – current CCR capital – should be straightforward • “CCR” tab – – CVA loss charge Asset value correlation Central counterparties Impact summary 92

Counterparty Credit Risk • General comments • “General Info” tab • “CCR” tab – – CVA loss charge: Section B 1 Asset value correlation: Section E Central counterparties: Section F Impact summary: Section A 2 93

Counterparty Credit Risk • General comments • “General Info” tab • “CCR” tab – – CVA loss charge: Section B 1 Asset value correlation: Section E Central counterparties: Section F Impact summary: Section A 2 93

Section B 1: CVA charge • Bond equivalent CVA charge First step: determine EAD (as done currently, APS 112) Second step: determine Effective Maturity For each instrument in a netting set, Effective Maturity is calculated in accordance with the calculation of M in paragraphs 33 -34 or attachment B to APS 113 (either weighted by cash-flows or, more conservatively, notional maturity) except that: • To calculate the CVA capital charge, the maturity M to use in the subsequent calculations is the longest Effective Maturity (as calculated above) across all netting sets with the counterparty. • It should not be capped at five years, since CVA is the lifetime discounted expected loss of the counterparty. 94

Section B 1: CVA charge • Bond equivalent CVA charge First step: determine EAD (as done currently, APS 112) Second step: determine Effective Maturity For each instrument in a netting set, Effective Maturity is calculated in accordance with the calculation of M in paragraphs 33 -34 or attachment B to APS 113 (either weighted by cash-flows or, more conservatively, notional maturity) except that: • To calculate the CVA capital charge, the maturity M to use in the subsequent calculations is the longest Effective Maturity (as calculated above) across all netting sets with the counterparty. • It should not be capped at five years, since CVA is the lifetime discounted expected loss of the counterparty. 94

Section B 1: CVA charge • Bond equivalent CVA charge Third step: obtain a CDS spread for the counterparty • The spread used to calculate the CVA of the counterparty should be used. • If a CDS spread or bond spread is available for the counterparty use this • If no CDS or bond spread is available for the counterparty, then map the counterparty to a generic spread curve, for example by rating, industry and country. • This curve provides the spread that should be used in the calculation of the bondequivalent CVA capital charge. • If the bank has to make approximations or extrapolations for some tenors of the CDS spread curve when determining the CVA, these same extrapolated CDS spread tenors should be used in the calculation of the bond-equivalent capital charge. • For the capital charge, only one tenor is needed: the tenor corresponding to the Effective Maturity determined in Step 2. 95

Section B 1: CVA charge • Bond equivalent CVA charge Third step: obtain a CDS spread for the counterparty • The spread used to calculate the CVA of the counterparty should be used. • If a CDS spread or bond spread is available for the counterparty use this • If no CDS or bond spread is available for the counterparty, then map the counterparty to a generic spread curve, for example by rating, industry and country. • This curve provides the spread that should be used in the calculation of the bondequivalent CVA capital charge. • If the bank has to make approximations or extrapolations for some tenors of the CDS spread curve when determining the CVA, these same extrapolated CDS spread tenors should be used in the calculation of the bond-equivalent capital charge. • For the capital charge, only one tenor is needed: the tenor corresponding to the Effective Maturity determined in Step 2. 95

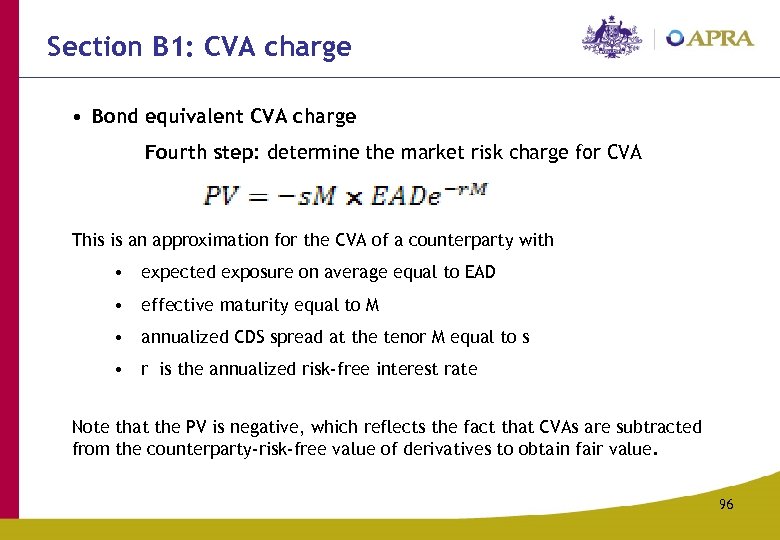

Section B 1: CVA charge • Bond equivalent CVA charge Fourth step: determine the market risk charge for CVA This is an approximation for the CVA of a counterparty with • expected exposure on average equal to EAD • effective maturity equal to M • annualized CDS spread at the tenor M equal to s • r is the annualized risk-free interest rate Note that the PV is negative, which reflects the fact that CVAs are subtracted from the counterparty-risk-free value of derivatives to obtain fair value. 96

Section B 1: CVA charge • Bond equivalent CVA charge Fourth step: determine the market risk charge for CVA This is an approximation for the CVA of a counterparty with • expected exposure on average equal to EAD • effective maturity equal to M • annualized CDS spread at the tenor M equal to s • r is the annualized risk-free interest rate Note that the PV is negative, which reflects the fact that CVAs are subtracted from the counterparty-risk-free value of derivatives to obtain fair value. 96

Section B 1: CVA charge • Bond equivalent CVA charge Fourth step (a): determine the market risk charge for CVA Calculate charge twice: • (1) once using exposure as shown on previous slide • (2) second time using EAD For both calculations: • Total market risk charge = Interest rate specific risk charge + Interest rate general market risk change (both calculated according to Attachment B to APS 116) • CVA charge = total market risk charge x 5 • RWA for CVA = CVA charge x 12. 5 (risk weight of 8% to be used) ADIs are NOT required to calculate internal model numbers (as they use SMM for interest rate specific risk), but happy to discuss this. 97

Section B 1: CVA charge • Bond equivalent CVA charge Fourth step (a): determine the market risk charge for CVA Calculate charge twice: • (1) once using exposure as shown on previous slide • (2) second time using EAD For both calculations: • Total market risk charge = Interest rate specific risk charge + Interest rate general market risk change (both calculated according to Attachment B to APS 116) • CVA charge = total market risk charge x 5 • RWA for CVA = CVA charge x 12. 5 (risk weight of 8% to be used) ADIs are NOT required to calculate internal model numbers (as they use SMM for interest rate specific risk), but happy to discuss this. 97

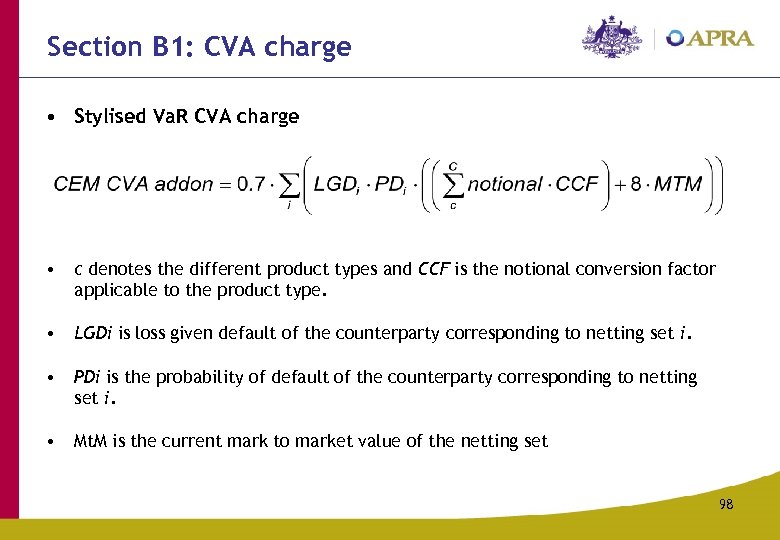

Section B 1: CVA charge • Stylised Va. R CVA charge • c denotes the different product types and CCF is the notional conversion factor applicable to the product type. • LGDi is loss given default of the counterparty corresponding to netting set i. • PDi is the probability of default of the counterparty corresponding to netting set i. • Mt. M is the current mark to market value of the netting set 98

Section B 1: CVA charge • Stylised Va. R CVA charge • c denotes the different product types and CCF is the notional conversion factor applicable to the product type. • LGDi is loss given default of the counterparty corresponding to netting set i. • PDi is the probability of default of the counterparty corresponding to netting set i. • Mt. M is the current mark to market value of the netting set 98

Section B 1: CVA charge • Rows 52 to 57: Impact of CVA on EL and EAD? Will be seeking more clarification from Basel • Rows 62 to 65: Do not complete Column I 99

Section B 1: CVA charge • Rows 52 to 57: Impact of CVA on EL and EAD? Will be seeking more clarification from Basel • Rows 62 to 65: Do not complete Column I 99

Counterparty Credit Risk • General comments • “General Info” tab • “CCR” tab – – CVA loss charge: Section B 1 Asset value correlation: Section E Central counterparties: Section F Impact summary: Section A 2 100

Counterparty Credit Risk • General comments • “General Info” tab • “CCR” tab – – CVA loss charge: Section B 1 Asset value correlation: Section E Central counterparties: Section F Impact summary: Section A 2 100

Section E: Asset Value Correlation • Apply 1. 25 x multiplier to AVC for exposures to “Financial Counterparties” (i. e. 1224% range becomes 15%-30%) • Broad definition include: • Regulated banks and non-banks (subject to a threshold, with two thresholds investigated), and • unregulated Financial Institutions and other financial intermediaries (e. g. highly levered entities) • AVC increase applies to all exposures to Financial Counterparties (e. g. loans) – not just CCR • Awaiting Basel guidance/ clarification on calculation of threshold, in particular: • Individual counterparties or consolidated group • Definition of regulated • Which unregulated entities are to be included • Definition of “highly leveraged” 101

Section E: Asset Value Correlation • Apply 1. 25 x multiplier to AVC for exposures to “Financial Counterparties” (i. e. 1224% range becomes 15%-30%) • Broad definition include: • Regulated banks and non-banks (subject to a threshold, with two thresholds investigated), and • unregulated Financial Institutions and other financial intermediaries (e. g. highly levered entities) • AVC increase applies to all exposures to Financial Counterparties (e. g. loans) – not just CCR • Awaiting Basel guidance/ clarification on calculation of threshold, in particular: • Individual counterparties or consolidated group • Definition of regulated • Which unregulated entities are to be included • Definition of “highly leveraged” 101

Counterparty Credit Risk • General comments • “General Info” tab • “CCR” tab – – CVA loss charge: Section B 1 Asset value correlation: Section E Central counterparties: Section F – should be straightforward Impact summary: Section A 2 102

Counterparty Credit Risk • General comments • “General Info” tab • “CCR” tab – – CVA loss charge: Section B 1 Asset value correlation: Section E Central counterparties: Section F – should be straightforward Impact summary: Section A 2 102

Counterparty Credit Risk • General comments • “General Info” tab • “CCR” tab – – CVA loss charge: Section B 1 Asset value correlation: Section E Central counterparties: Section F Impact summary: Section A 2 – should be straightforward 103

Counterparty Credit Risk • General comments • “General Info” tab • “CCR” tab – – CVA loss charge: Section B 1 Asset value correlation: Section E Central counterparties: Section F Impact summary: Section A 2 – should be straightforward 103

Smoothing minimum required capital (procyclicality) Guy Eastwood 104

Smoothing minimum required capital (procyclicality) Guy Eastwood 104

Smoothing MRC • Cyclicality of minimum capital requirements (MRC) is one aspect of the wider issue of procyclical behaviour within the financial system • BII Framework, as well as being more risk sensitive (particularly IRB), is also more cyclical • Cyclicality issues, in part, influenced the design of the BII Framework (eg IRB risk weighting functions, stress test requirements) • Basel Committee is now considering whether additional measures should be introduced to deal with cyclicality of MRC, eg more formal means of building up capital buffers in good times & allowing access in downturns (smoothing MRC) • Difficult issue in practice. QIS aims to help inform discussion on the need for additional measures in this area, their potential magnitude & mechanics of operation 105

Smoothing MRC • Cyclicality of minimum capital requirements (MRC) is one aspect of the wider issue of procyclical behaviour within the financial system • BII Framework, as well as being more risk sensitive (particularly IRB), is also more cyclical • Cyclicality issues, in part, influenced the design of the BII Framework (eg IRB risk weighting functions, stress test requirements) • Basel Committee is now considering whether additional measures should be introduced to deal with cyclicality of MRC, eg more formal means of building up capital buffers in good times & allowing access in downturns (smoothing MRC) • Difficult issue in practice. QIS aims to help inform discussion on the need for additional measures in this area, their potential magnitude & mechanics of operation 105

Smoothing MRC The portfolio-level PD at time t is calculated as the average of assigned grade PDs weighted by the number of counterparties in each grade. The portfolio-level PD changes over the cycle as the result of the migration of borrowers across grades and possible changes of grade PD. At any particular point in time, a scaling factor could be determined by comparing this portfolio-level PD to some PD benchmark. 106

Smoothing MRC The portfolio-level PD at time t is calculated as the average of assigned grade PDs weighted by the number of counterparties in each grade. The portfolio-level PD changes over the cycle as the result of the migration of borrowers across grades and possible changes of grade PD. At any particular point in time, a scaling factor could be determined by comparing this portfolio-level PD to some PD benchmark. 106

Smoothing MRC • The Basel Committee is interested in collecting information on two possible benchmarks: – – • Option A: the long-term average portfolio PD over a given time period (the reference period); Option B: the downturn PD, ie the highest PD over a given time period. For each IRB portfolio (or sub-portfolio), two alternative scaling factors can be calculated: – – Scaling factor A: ratio of the long-term average PD to current PD. This scaling factor can be greater or lower than 1 depending on the stage of the credit cycle. Scaling factor B: ratio of the downturn PD to current PD. This scaling factor is expected to be greater than 1 at all times but downturn periods. 107

Smoothing MRC • The Basel Committee is interested in collecting information on two possible benchmarks: – – • Option A: the long-term average portfolio PD over a given time period (the reference period); Option B: the downturn PD, ie the highest PD over a given time period. For each IRB portfolio (or sub-portfolio), two alternative scaling factors can be calculated: – – Scaling factor A: ratio of the long-term average PD to current PD. This scaling factor can be greater or lower than 1 depending on the stage of the credit cycle. Scaling factor B: ratio of the downturn PD to current PD. This scaling factor is expected to be greater than 1 at all times but downturn periods. 107

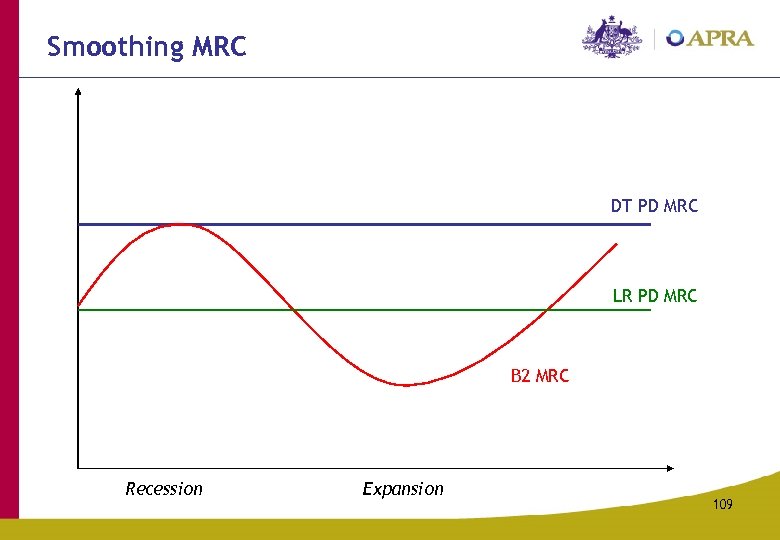

Smoothing MRC Steps: • For each rating grade, the scaling factors can used to adjust current grade PDs. • For each grade, a capital buffer can then be determined as the difference between the amount of capital computed using the current PD and the amount computed using the PD adjusted with either scaling factor A or scaling factor B. • For each portfolio, the overall buffer would the sum of grade-level buffers using one or the other scaling factor: – The buffer would increase in expansion and decrease in recession, according to the path followed by PDs: – Under Option A, the idea is that portfolio-level PDs estimated through a point-in-time rating system would be transformed into something like through-the-cycle PDs; – Under Option B, portfolio-level PDs would be transformed into recessionary PDs incorporating the impact of stressed conditions. 108

Smoothing MRC Steps: • For each rating grade, the scaling factors can used to adjust current grade PDs. • For each grade, a capital buffer can then be determined as the difference between the amount of capital computed using the current PD and the amount computed using the PD adjusted with either scaling factor A or scaling factor B. • For each portfolio, the overall buffer would the sum of grade-level buffers using one or the other scaling factor: – The buffer would increase in expansion and decrease in recession, according to the path followed by PDs: – Under Option A, the idea is that portfolio-level PDs estimated through a point-in-time rating system would be transformed into something like through-the-cycle PDs; – Under Option B, portfolio-level PDs would be transformed into recessionary PDs incorporating the impact of stressed conditions. 108

Smoothing MRC DT PD MRC LR PD MRC B 2 MRC Recession Expansion 109

Smoothing MRC DT PD MRC LR PD MRC B 2 MRC Recession Expansion 109

Smoothing MRC worksheet Main features: • Only for IRB banks • Scaling information requested only for IRB portfolio subject to a PD/LGD approach • 4 dates: 2006 -2009 time-dynamics is crucial • Best effort basis for the calculation of downturn and long-term PD but banks should be encouraged to provide estimates based on sufficiently long-time series 110

Smoothing MRC worksheet Main features: • Only for IRB banks • Scaling information requested only for IRB portfolio subject to a PD/LGD approach • 4 dates: 2006 -2009 time-dynamics is crucial • Best effort basis for the calculation of downturn and long-term PD but banks should be encouraged to provide estimates based on sufficiently long-time series 110

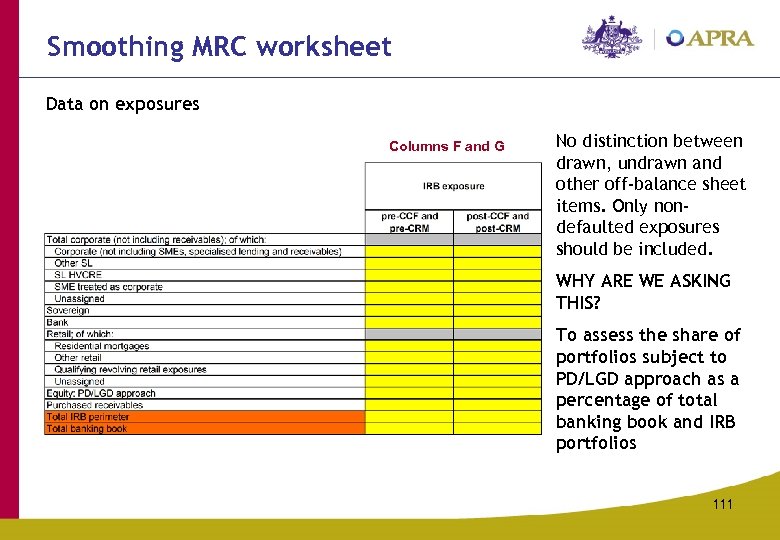

Smoothing MRC worksheet Data on exposures Columns F and G No distinction between drawn, undrawn and other off-balance sheet items. Only nondefaulted exposures should be included. WHY ARE WE ASKING THIS? To assess the share of portfolios subject to PD/LGD approach as a percentage of total banking book and IRB portfolios 111

Smoothing MRC worksheet Data on exposures Columns F and G No distinction between drawn, undrawn and other off-balance sheet items. Only nondefaulted exposures should be included. WHY ARE WE ASKING THIS? To assess the share of portfolios subject to PD/LGD approach as a percentage of total banking book and IRB portfolios 111

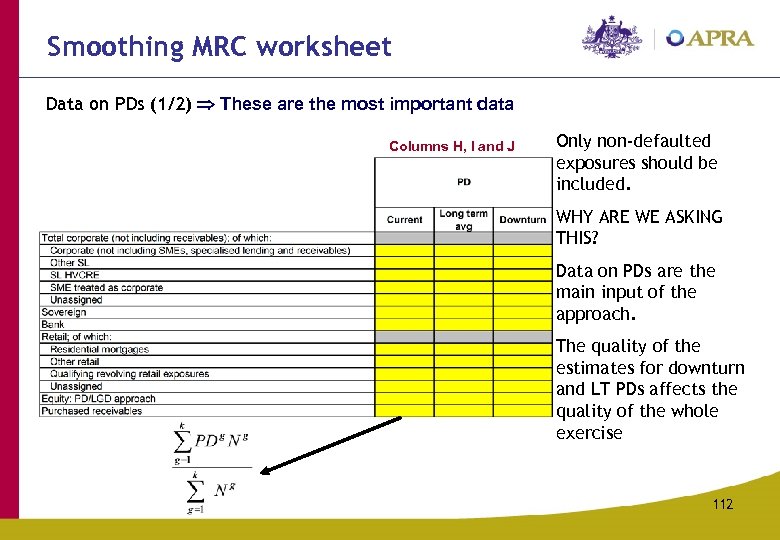

Smoothing MRC worksheet Data on PDs (1/2) These are the most important data Columns H, I and J Only non-defaulted exposures should be included. WHY ARE WE ASKING THIS? Data on PDs are the main input of the approach. The quality of the estimates for downturn and LT PDs affects the quality of the whole exercise 112

Smoothing MRC worksheet Data on PDs (1/2) These are the most important data Columns H, I and J Only non-defaulted exposures should be included. WHY ARE WE ASKING THIS? Data on PDs are the main input of the approach. The quality of the estimates for downturn and LT PDs affects the quality of the whole exercise 112

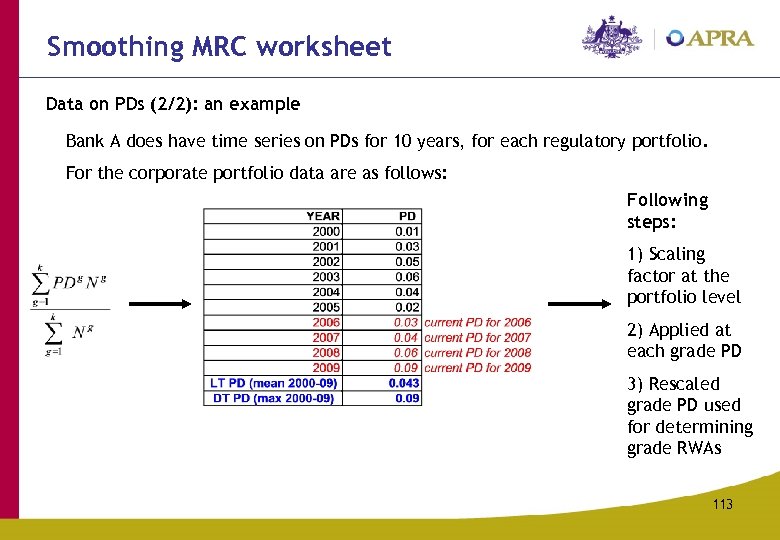

Smoothing MRC worksheet Data on PDs (2/2): an example Bank A does have time series on PDs for 10 years, for each regulatory portfolio. For the corporate portfolio data are as follows: Following steps: 1) Scaling factor at the portfolio level 2) Applied at each grade PD 3) Rescaled grade PD used for determining grade RWAs 113

Smoothing MRC worksheet Data on PDs (2/2): an example Bank A does have time series on PDs for 10 years, for each regulatory portfolio. For the corporate portfolio data are as follows: Following steps: 1) Scaling factor at the portfolio level 2) Applied at each grade PD 3) Rescaled grade PD used for determining grade RWAs 113

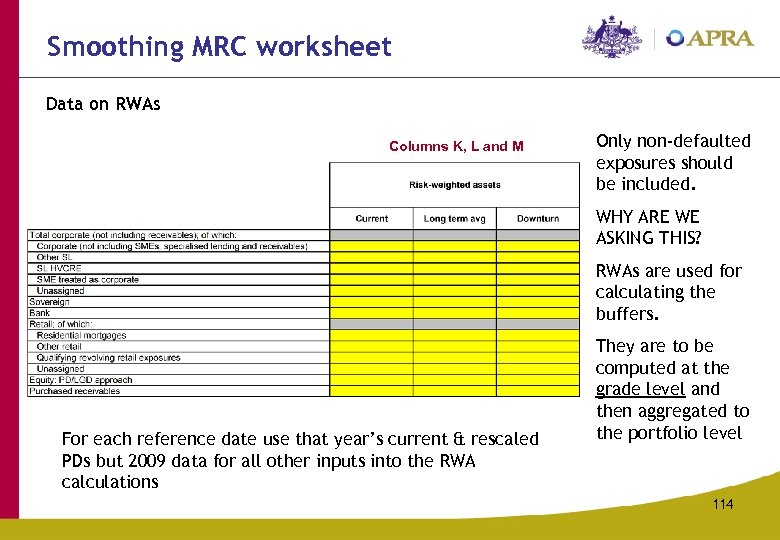

Smoothing MRC worksheet Data on RWAs Columns K, L and M Only non-defaulted exposures should be included. WHY ARE WE ASKING THIS? RWAs are used for calculating the buffers. For each reference date use that year’s current & rescaled PDs but 2009 data for all other inputs into the RWA calculations They are to be computed at the grade level and then aggregated to the portfolio level 114

Smoothing MRC worksheet Data on RWAs Columns K, L and M Only non-defaulted exposures should be included. WHY ARE WE ASKING THIS? RWAs are used for calculating the buffers. For each reference date use that year’s current & rescaled PDs but 2009 data for all other inputs into the RWA calculations They are to be computed at the grade level and then aggregated to the portfolio level 114

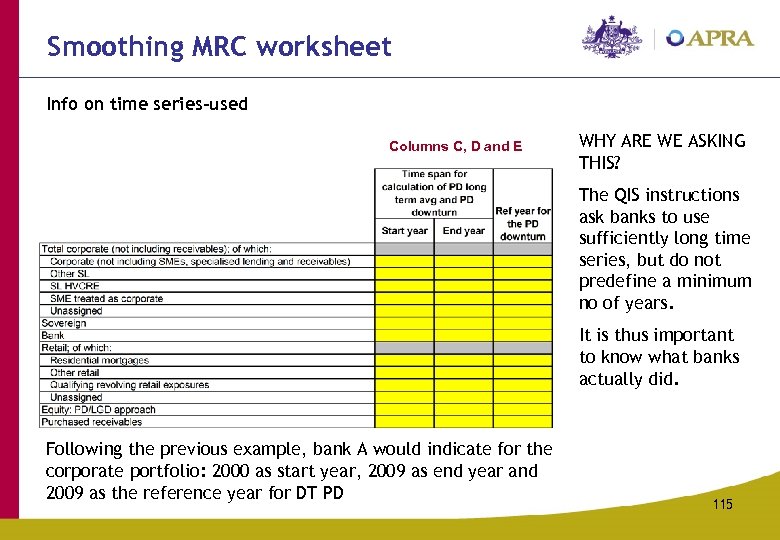

Smoothing MRC worksheet Info on time series-used Columns C, D and E WHY ARE WE ASKING THIS? The QIS instructions ask banks to use sufficiently long time series, but do not predefine a minimum no of years. It is thus important to know what banks actually did. Following the previous example, bank A would indicate for the corporate portfolio: 2000 as start year, 2009 as end year and 2009 as the reference year for DT PD 115

Smoothing MRC worksheet Info on time series-used Columns C, D and E WHY ARE WE ASKING THIS? The QIS instructions ask banks to use sufficiently long time series, but do not predefine a minimum no of years. It is thus important to know what banks actually did. Following the previous example, bank A would indicate for the corporate portfolio: 2000 as start year, 2009 as end year and 2009 as the reference year for DT PD 115

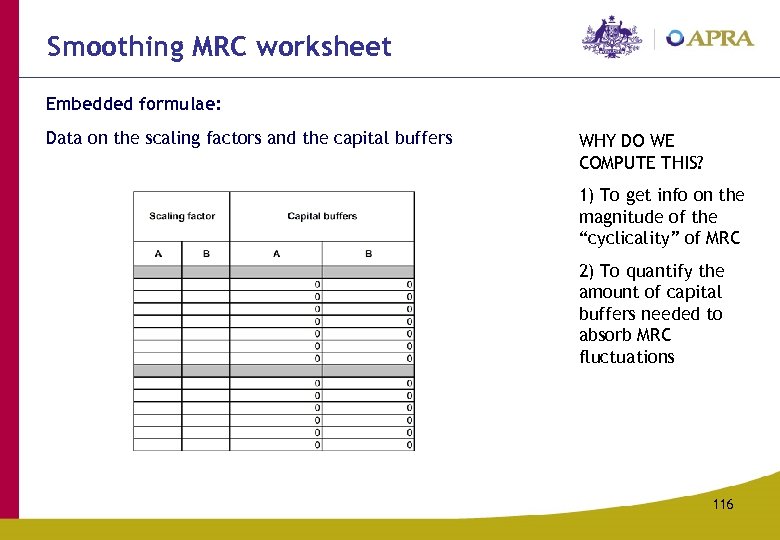

Smoothing MRC worksheet Embedded formulae: Data on the scaling factors and the capital buffers WHY DO WE COMPUTE THIS? 1) To get info on the magnitude of the “cyclicality” of MRC 2) To quantify the amount of capital buffers needed to absorb MRC fluctuations 116

Smoothing MRC worksheet Embedded formulae: Data on the scaling factors and the capital buffers WHY DO WE COMPUTE THIS? 1) To get info on the magnitude of the “cyclicality” of MRC 2) To quantify the amount of capital buffers needed to absorb MRC fluctuations 116

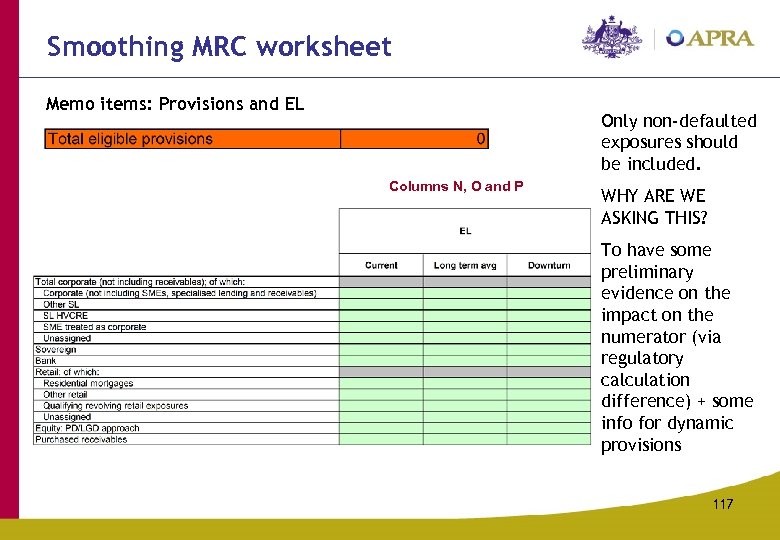

Smoothing MRC worksheet Memo items: Provisions and EL Only non-defaulted exposures should be included. Columns N, O and P WHY ARE WE ASKING THIS? To have some preliminary evidence on the impact on the numerator (via regulatory calculation difference) + some info for dynamic provisions 117

Smoothing MRC worksheet Memo items: Provisions and EL Only non-defaulted exposures should be included. Columns N, O and P WHY ARE WE ASKING THIS? To have some preliminary evidence on the impact on the numerator (via regulatory calculation difference) + some info for dynamic provisions 117

Concluding remarks • Having an annual PD series of reasonable length and quality is crucial to gain anything meaningful from this part of the QIS – this will require professional judgment in developing back estimates of PD and determining how far back to go … BUT we’re not insisting on precision here, just something reasonable to be working with – interested in hearing at an early stage how respondents might intend to do this. Is there value in us all getting together to discuss way(s) forward? • Also our thought is that use of 2009 inputs into the RWA calculations (except for PD) for all reference dates should make the data gathering/calculation burden much less. Do respondents agree? Are respondents clear on what has been asked for or are there issues/complications that we might not be seeing? Again, is there value in meeting on an industry basis to discuss? QUESTIONS/COMMENTS? 118

Concluding remarks • Having an annual PD series of reasonable length and quality is crucial to gain anything meaningful from this part of the QIS – this will require professional judgment in developing back estimates of PD and determining how far back to go … BUT we’re not insisting on precision here, just something reasonable to be working with – interested in hearing at an early stage how respondents might intend to do this. Is there value in us all getting together to discuss way(s) forward? • Also our thought is that use of 2009 inputs into the RWA calculations (except for PD) for all reference dates should make the data gathering/calculation burden much less. Do respondents agree? Are respondents clear on what has been asked for or are there issues/complications that we might not be seeing? Again, is there value in meeting on an industry basis to discuss? QUESTIONS/COMMENTS? 118

Securitisation Anna Sofianaris 119

Securitisation Anna Sofianaris 119

Securitisation • “Current” columns completed in accordance with APS 120 Securitisation (January 2008) • “New” columns completed in accordance with draft APS 120 Securitisation (December 2009) • Exposure amounts reported: - after application of credit conversion factors without recognition of any cap or provisions/value adjustments • Exclude deductions for gain-on-sale • Exclude exposures in the trading book • Exclude modifications to APS 120 reflecting additional APRA proposals (i. e. focus is on Basel II enhancements) 120

Securitisation • “Current” columns completed in accordance with APS 120 Securitisation (January 2008) • “New” columns completed in accordance with draft APS 120 Securitisation (December 2009) • Exposure amounts reported: - after application of credit conversion factors without recognition of any cap or provisions/value adjustments • Exclude deductions for gain-on-sale • Exclude exposures in the trading book • Exclude modifications to APS 120 reflecting additional APRA proposals (i. e. focus is on Basel II enhancements) 120

Securitisation – Panel A • Rows 11 and 19 irrelevant under APS 120 (current and new) • Row 15 completed in accordance with APS 120 Attachment C paragraphs 7 -9 (current and new) • Row 16 completed in accordance with APS 120 Attachment C paragraphs 10 -11 (current and new) • Row 17 completed in accordance with APS 120 Attachment C paragraphs 12 -13 (current and new) • Rows 23 and 24 are relevant as APS 120 applies cap to all ADIs under APS 120 Attachment B paragraph 23 (current) and paragraphs 26 -27 (new) 121

Securitisation – Panel A • Rows 11 and 19 irrelevant under APS 120 (current and new) • Row 15 completed in accordance with APS 120 Attachment C paragraphs 7 -9 (current and new) • Row 16 completed in accordance with APS 120 Attachment C paragraphs 10 -11 (current and new) • Row 17 completed in accordance with APS 120 Attachment C paragraphs 12 -13 (current and new) • Rows 23 and 24 are relevant as APS 120 applies cap to all ADIs under APS 120 Attachment B paragraph 23 (current) and paragraphs 26 -27 (new) 121

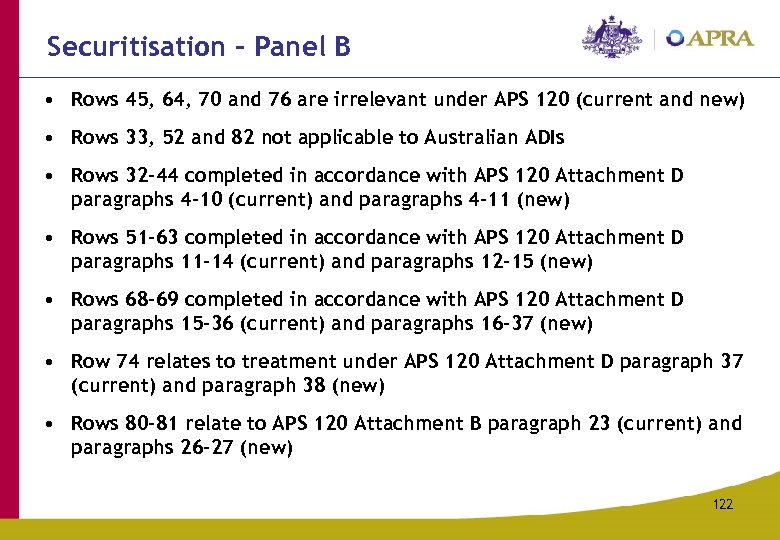

Securitisation – Panel B • Rows 45, 64, 70 and 76 are irrelevant under APS 120 (current and new) • Rows 33, 52 and 82 not applicable to Australian ADIs • Rows 32 -44 completed in accordance with APS 120 Attachment D paragraphs 4 -10 (current) and paragraphs 4 -11 (new) • Rows 51 -63 completed in accordance with APS 120 Attachment D paragraphs 11 -14 (current) and paragraphs 12 -15 (new) • Rows 68 -69 completed in accordance with APS 120 Attachment D paragraphs 15 -36 (current) and paragraphs 16 -37 (new) • Row 74 relates to treatment under APS 120 Attachment D paragraph 37 (current) and paragraph 38 (new) • Rows 80 -81 relate to APS 120 Attachment B paragraph 23 (current) and paragraphs 26 -27 (new) 122

Securitisation – Panel B • Rows 45, 64, 70 and 76 are irrelevant under APS 120 (current and new) • Rows 33, 52 and 82 not applicable to Australian ADIs • Rows 32 -44 completed in accordance with APS 120 Attachment D paragraphs 4 -10 (current) and paragraphs 4 -11 (new) • Rows 51 -63 completed in accordance with APS 120 Attachment D paragraphs 11 -14 (current) and paragraphs 12 -15 (new) • Rows 68 -69 completed in accordance with APS 120 Attachment D paragraphs 15 -36 (current) and paragraphs 16 -37 (new) • Row 74 relates to treatment under APS 120 Attachment D paragraph 37 (current) and paragraph 38 (new) • Rows 80 -81 relate to APS 120 Attachment B paragraph 23 (current) and paragraphs 26 -27 (new) 122

Operational risk Michael Booth 123

Operational risk Michael Booth 123

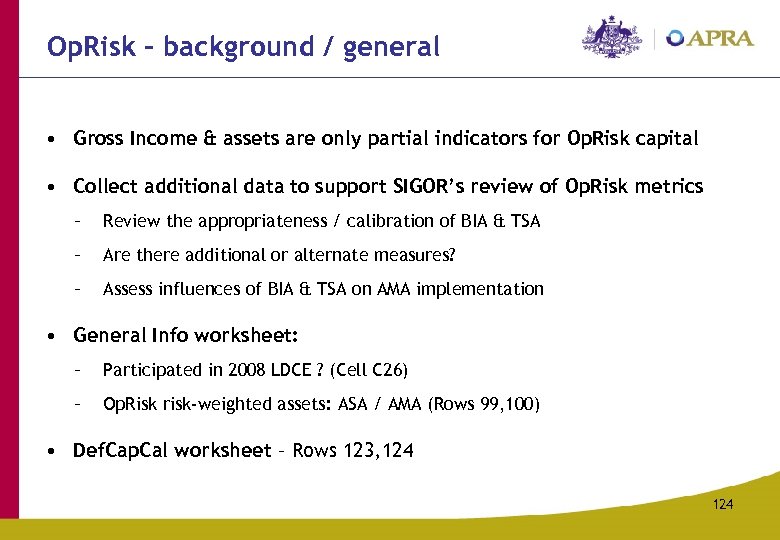

Op. Risk – background / general • Gross Income & assets are only partial indicators for Op. Risk capital • Collect additional data to support SIGOR’s review of Op. Risk metrics – Review the appropriateness / calibration of BIA & TSA – Are there additional or alternate measures? – Assess influences of BIA & TSA on AMA implementation • General Info worksheet: – Participated in 2008 LDCE ? (Cell C 26) – Op. Risk risk-weighted assets: ASA / AMA (Rows 99, 100) • Def. Cap. Cal worksheet – Rows 123, 124