f660afb89cdd86a7b887e15ac24ad3fa.ppt

- Количество слайдов: 27

Qatar Development Bank A supporting arm to the private sector Nov 2014

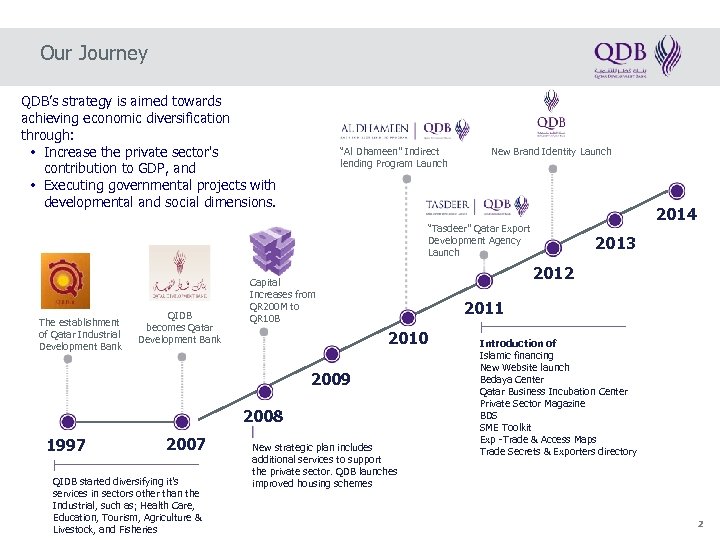

Our Journey QDB’s strategy is aimed towards achieving economic diversification through: • Increase the private sector's contribution to GDP, and • Executing governmental projects with developmental and social dimensions. “Al Dhameen” Indirect lending Program Launch New Brand Identity Launch 2014 “Tasdeer” Qatar Export Development Agency Launch The establishment of Qatar Industrial Development Bank QIDB becomes Qatar Development Bank 2012 Capital Increases from QR 200 M to QR 10 B 2011 2010 2009 2008 1997 2007 QIDB started diversifying it’s services in sectors other than the Industrial, such as; Health Care, Education, Tourism, Agriculture & Livestock, and Fisheries 2013 New strategic plan includes additional services to support the private sector. QDB launches improved housing schemes Introduction of Islamic financing New Website launch Bedaya Center Qatar Business Incubation Center Private Sector Magazine BDS SME Toolkit Exp -Trade & Access Maps Trade Secrets & Exporters directory 2

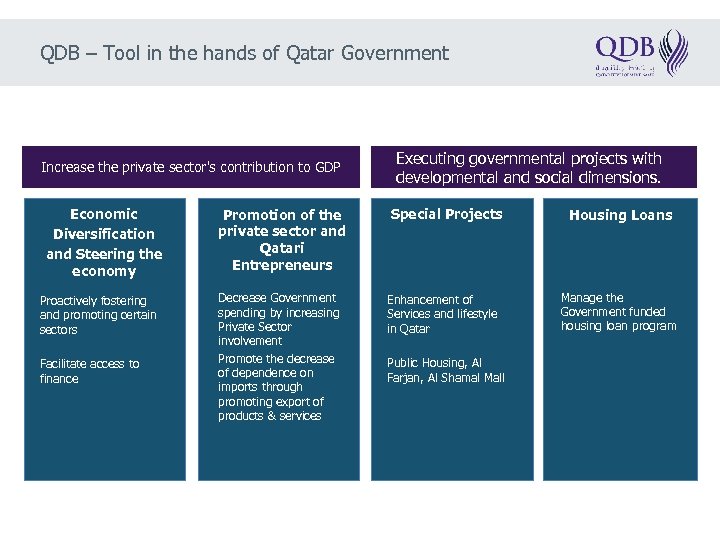

QDB – Tool in the hands of Qatar Government Increase the private sector's contribution to GDP Economic Diversification and Steering the economy Proactively fostering and promoting certain sectors Facilitate access to finance Promotion of the private sector and Qatari Entrepreneurs Decrease Government spending by increasing Private Sector involvement Promote the decrease of dependence on imports through promoting export of products & services Executing governmental projects with developmental and social dimensions. Special Projects Enhancement of Services and lifestyle in Qatar Public Housing, Al Farjan, Al Shamal Mall Housing Loans Manage the Government funded housing loan program

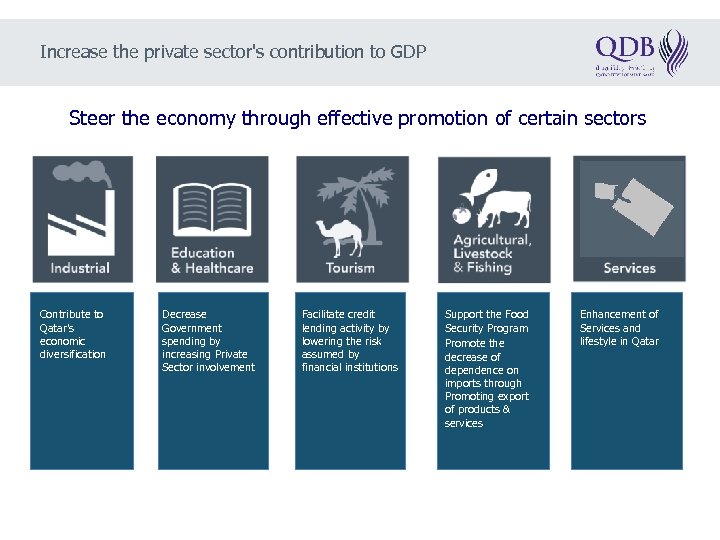

Increase the private sector's contribution to GDP Steer the economy through effective promotion of certain sectors Contribute to Qatar’s economic diversification Decrease Government spending by increasing Private Sector involvement Facilitate credit lending activity by lowering the risk assumed by financial institutions Support the Food Security Program Promote the decrease of dependence on imports through Promoting export of products & services Enhancement of Services and lifestyle in Qatar

Increase the private sector's contribution to GDP (as of October 2014) DIRECT LENDING AL DHAMEEN Competitive Finance for large loans SME’s indirect landing program Long-term Business & Project financing – of businesses in strategic sectors covering construction, plant, equipment & working capital. Guarantees business owners facilities up to 85% of the finance value not exceeding QR 15 M. Financing from a partner bank, through issuance of guarantees in favor of the bank. TASDEER ADVISORY Qatar Export Development Agency Business Support Services Export Agency offering financial solutions, credit insurances and advisory services for exporters. Promote, support & develop business export capabilities. Provide entrepreneurs with business knowhow, business education, skills and resources to enhance competitive edge in the local and international markets. QR 3. 1 BN QR 345 MN QR 385 MN outstanding loans in guarantees for over in guarantees Export promotion & over 314 customers (including fisheries and agriculture) 110 SMEs 15 Partner banks advice to over 200 potential exporters Pre and post start up advice to over 300 private sector clients 33, 000 SME Toolkit visitors BUSINESS PROMOTION Participate in identification, dissemination, support and promotion of new business opportunities to the private sector 100 new business opportunities for Rail 25 tourism business opportunities 1500 youth enrolled in entrepreneur programs

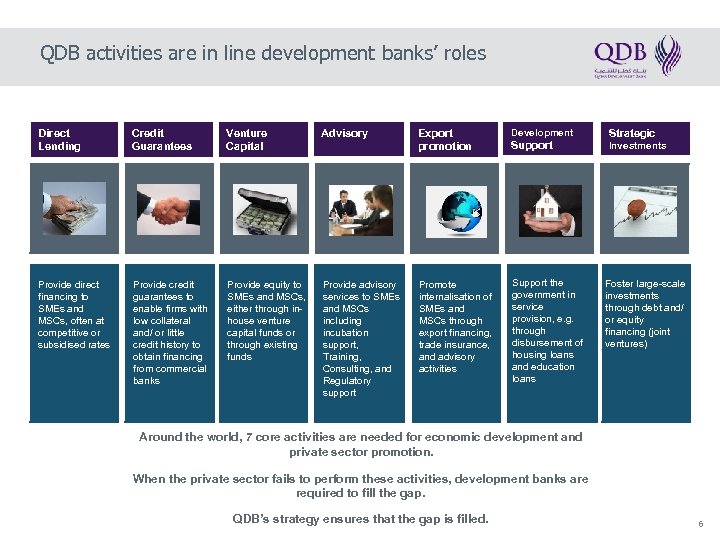

QDB activities are in line development banks’ roles Direct Lending Credit Guarantees Venture Capital Advisory Provide direct financing to SMEs and MSCs, often at competitive or subsidised rates Provide credit guarantees to enable firms with low collateral and/ or little credit history to obtain financing from commercial banks Provide equity to SMEs and MSCs, either through inhouse venture capital funds or through existing funds Provide advisory services to SMEs and MSCs including incubation support, Training, Consulting, and Regulatory support Export promotion Development Promote internalisation of SMEs and MSCs through export financing, trade insurance, and advisory activities Support the government in service provision, e. g. through disbursement of housing loans and education loans Support Strategic Investments Foster large-scale investments through debt and/ or equity financing (joint ventures) Around the world, 7 core activities are needed for economic development and private sector promotion. When the private sector fails to perform these activities, development banks are required to fill the gap. QDB’s strategy ensures that the gap is filled. 6

Supporting the Private Sector Get initial support, skills development, training, occupational and advisory services and referrals to partners Work with partners: through referring potential clients to well-equipped and experienced partners (like EQ) to help them with their business plans, feasibility studies & capacity building support. SME Toolkit Qatar: “One-stop shop” online resource centre –developed in association with IFC (International Finance Corporation) Bedaya Centre for Entrepreneurship & Career Development: QDB & Silatech joint initiative Private Sector magazine: QDB initiative with CPI Get financial support with a very competitive interest rates and terms, and extended repayment periods through Al Dhameen & Direct Finance Also advisory services and connection to right institutions Get support to export while being protected from the risks involved in foreign trade, through innovative cover facilities. A leading business incubation center with the goal of developing the next 100 Million QAR companies in Qatar. The center can incubate up to 150 businesses every 3 years. QAR 7

Key Achievements of Qatar Development Bank 2013 2012 2011 2010 • Al-Dhameen launched • 23% increased Financing YOY • Established the Engineering Projects Department (EDP) • Reduced gross NPL from 17. 45% to 12. 47% • Islamic Finance introduced Al-Dhameen Islamic Finance • Launched Tasdeer – Qatar Export Development Agency • Established Bedaya Center for Career Development and Entrepreneurship with Silatech • Launched Private Sector Magazine • Housing Loans TAT from 2 weeks to 4 days. • Al Dhameen program doubled its performance • Reduced gross NPL to below 9% • Launched Qatar’s SME Toolkit an online resource provides valuable advice and business tips, empowering small businesses in Qatar. • Bedaya: over 150 1 -to-1 counseling sessions, 1500 youth enrolled in programs & workshops. • Launch of SME Clinic over 60 companies assisted and evaluated for growth opportunities, diagnostic for nonperformance etc. • Reduce gross NPL to below 7. 5% • 50, 000 SME toolkit visitors • 52% underperforming SMEs have shown improved performance after being referred to advisory • 6. 5% increase in Net Profit over the budgeted estimate • Q-Rail Collaboration +100 business opportunities for private sector identified & launched • QTA Collaboration +25 business opportunities identified • Launch incubator: QIBC Planned • + 25 market studies developed for 8 manufacturing sectors

Al Dhameen

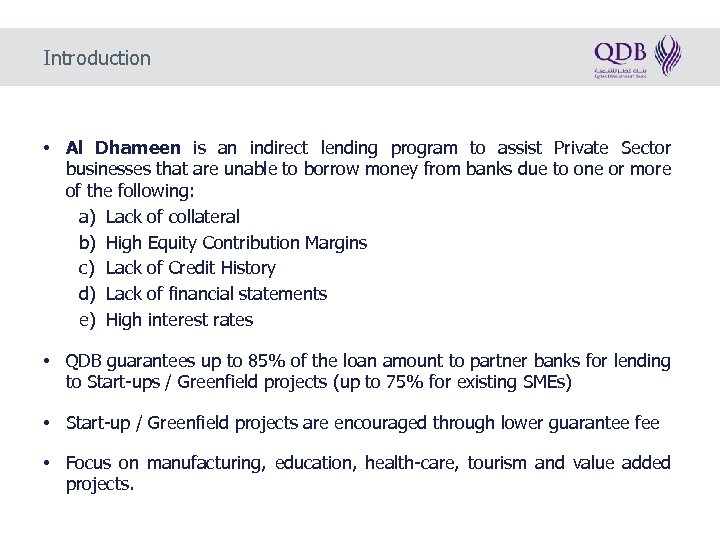

Introduction • Al Dhameen is an indirect lending program to assist Private Sector businesses that are unable to borrow money from banks due to one or more of the following: a) Lack of collateral b) High Equity Contribution Margins c) Lack of Credit History d) Lack of financial statements e) High interest rates • QDB guarantees up to 85% of the loan amount to partner banks for lending to Start-ups / Greenfield projects (up to 75% for existing SMEs) • Start-up / Greenfield projects are encouraged through lower guarantee fee • Focus on manufacturing, education, health-care, tourism and value added projects.

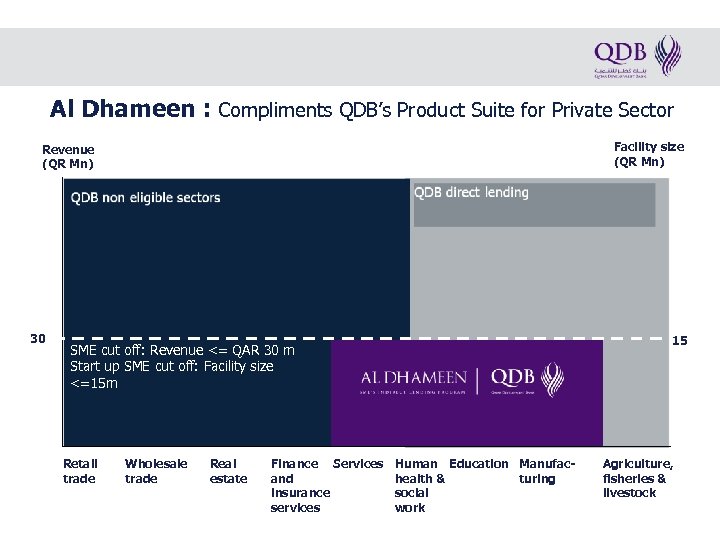

Al Dhameen : Compliments QDB’s Product Suite for Private Sector Facility size (QR Mn) Revenue (QR Mn) 30 15 SME cut off: Revenue <= QAR 30 m Start up SME cut off: Facility size <=15 m Retail trade Wholesale trade Real estate Finance Services and insurance services Human Education Manufachealth & turing social work Agriculture, fisheries & livestock

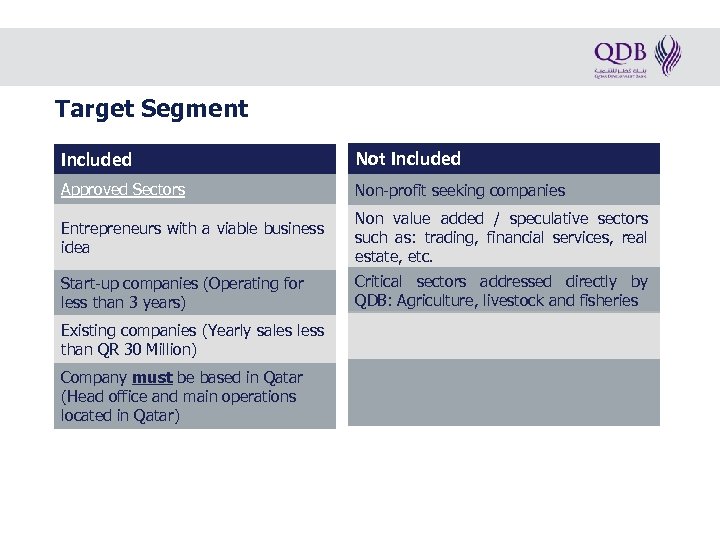

Target Segment Included Not Included Approved Sectors Non-profit seeking companies Entrepreneurs with a viable business idea Non value added / speculative sectors such as: trading, financial services, real estate, etc. Start-up companies (Operating for less than 3 years) Critical sectors addressed directly by QDB: Agriculture, livestock and fisheries Existing companies (Yearly sales less than QR 30 Million) Company must be based in Qatar (Head office and main operations located in Qatar)

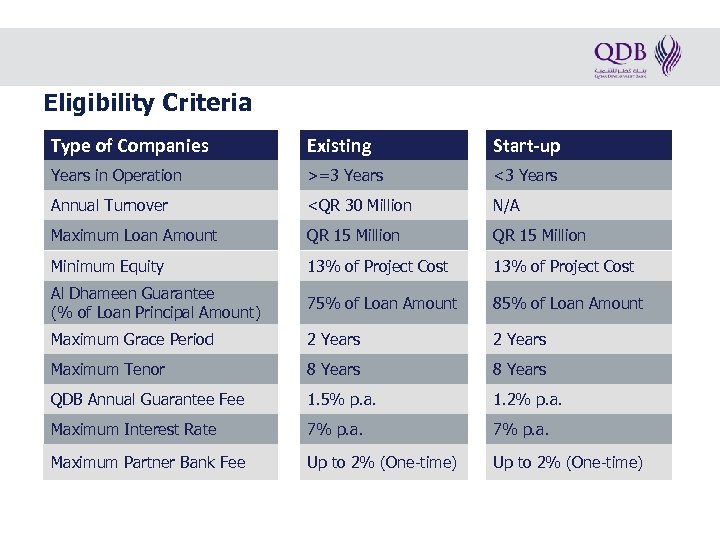

Eligibility Criteria Type of Companies Existing Start-up Years in Operation >=3 Years <3 Years Annual Turnover <QR 30 Million N/A Maximum Loan Amount QR 15 Million Minimum Equity 13% of Project Cost Al Dhameen Guarantee (% of Loan Principal Amount) 75% of Loan Amount 85% of Loan Amount Maximum Grace Period 2 Years Maximum Tenor 8 Years QDB Annual Guarantee Fee 1. 5% p. a. 1. 2% p. a. Maximum Interest Rate 7% p. a. Maximum Partner Bank Fee Up to 2% (One-time)

How the Program Works: Stage 1 : Pre-screening Stage 2 : Guarantee Approval Stage 3 : Disbursement

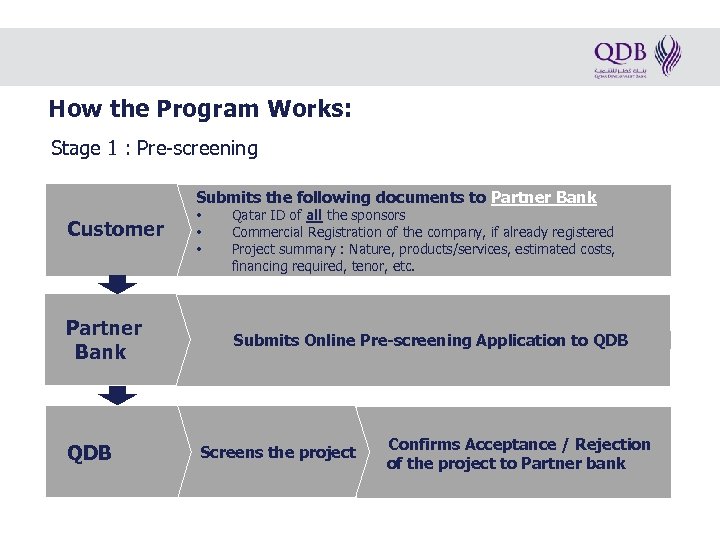

How the Program Works: Stage 1 : Pre-screening Submits the following documents to Partner Bank Customer Partner Bank QDB • • • Qatar ID of all the sponsors Commercial Registration of the company, if already registered Project summary : Nature, products/services, estimated costs, financing required, tenor, etc. Submits Online Pre-screening Application to QDB Screens the project Confirms Acceptance / Rejection of the project to Partner bank

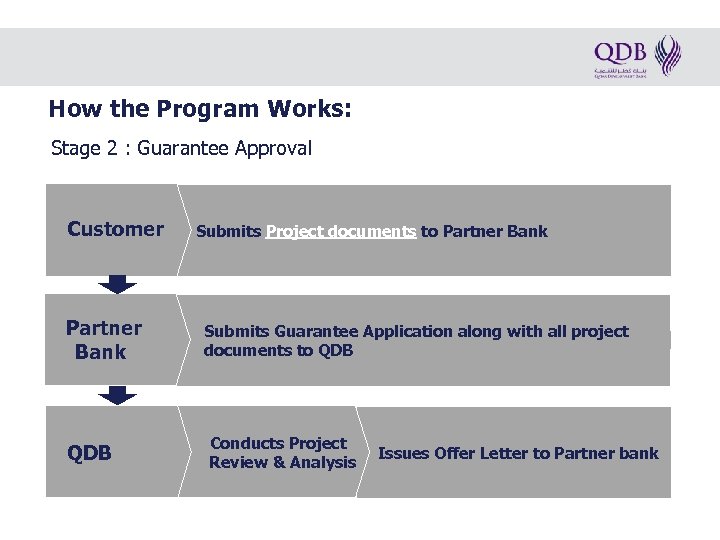

How the Program Works: Stage 2 : Guarantee Approval Customer Partner Bank QDB Submits Project documents to Partner Bank Submits Guarantee Application along with all project documents to QDB Conducts Project Review & Analysis Issues Offer Letter to Partner bank

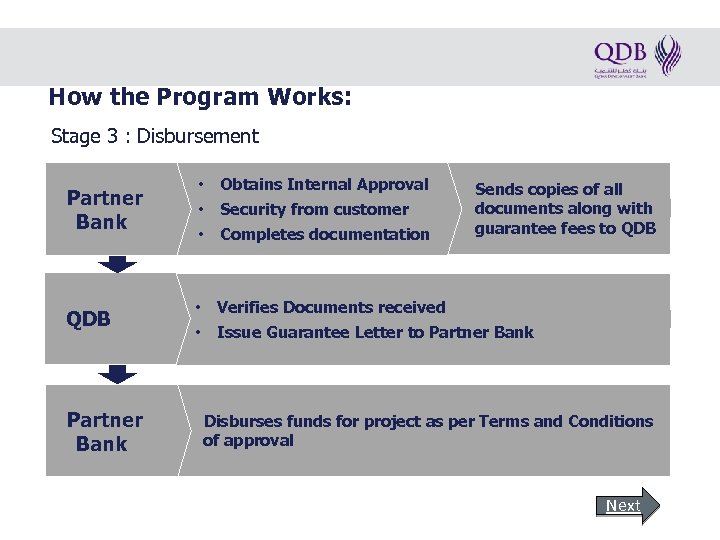

How the Program Works: Stage 3 : Disbursement Partner Bank QDB Partner Bank • Obtains Internal Approval • Security from customer • Completes documentation • Verifies Documents received • Issue Guarantee Letter to Partner Bank Sends copies of all documents along with guarantee fees to QDB Disburses funds for project as per Terms and Conditions of approval Next

Approved sectors: 1. Manufacturing 2. Services, including: a)Healthcare b)Education c) Tourism d)Value adding services Back

List of Partner Banks: Islamic Conventional Back

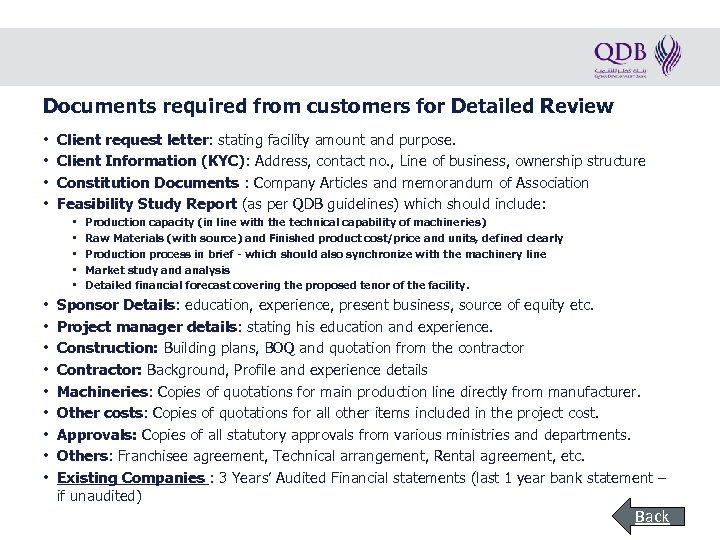

Documents required from customers for Detailed Review • • Client request letter: stating facility amount and purpose. Client Information (KYC): Address, contact no. , Line of business, ownership structure Constitution Documents : Company Articles and memorandum of Association Feasibility Study Report (as per QDB guidelines) which should include: • • • • Production capacity (in line with the technical capability of machineries) Raw Materials (with source) and Finished product cost/price and units, defined clearly Production process in brief - which should also synchronize with the machinery line Market study and analysis Detailed financial forecast covering the proposed tenor of the facility. Sponsor Details: education, experience, present business, source of equity etc. Project manager details: stating his education and experience. Construction: Building plans, BOQ and quotation from the contractor Contractor: Background, Profile and experience details Machineries: Copies of quotations for main production line directly from manufacturer. Other costs: Copies of quotations for all other items included in the project cost. Approvals: Copies of all statutory approvals from various ministries and departments. Others: Franchisee agreement, Technical arrangement, Rental agreement, etc. Existing Companies : 3 Years’ Audited Financial statements (last 1 year bank statement – if unaudited) Back

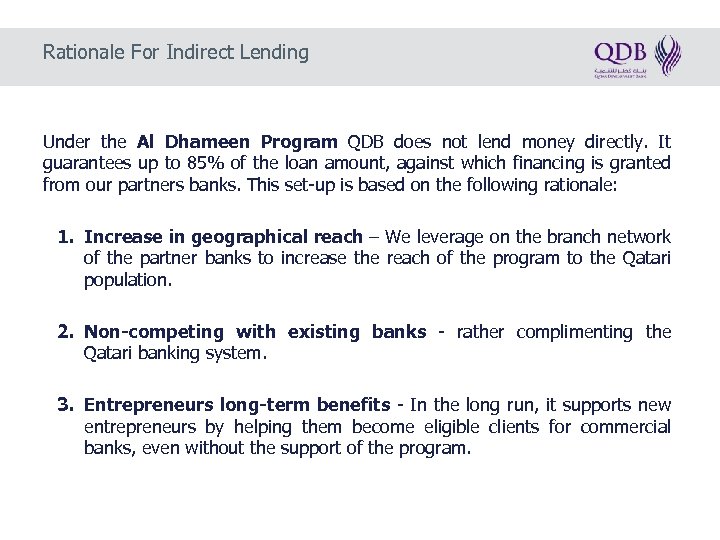

Rationale For Indirect Lending Under the Al Dhameen Program QDB does not lend money directly. It guarantees up to 85% of the loan amount, against which financing is granted from our partners banks. This set-up is based on the following rationale: 1. Increase in geographical reach – We leverage on the branch network of the partner banks to increase the reach of the program to the Qatari population. 2. Non-competing with existing banks - rather complimenting the Qatari banking system. 3. Entrepreneurs long-term benefits - In the long run, it supports new entrepreneurs by helping them become eligible clients for commercial banks, even without the support of the program.

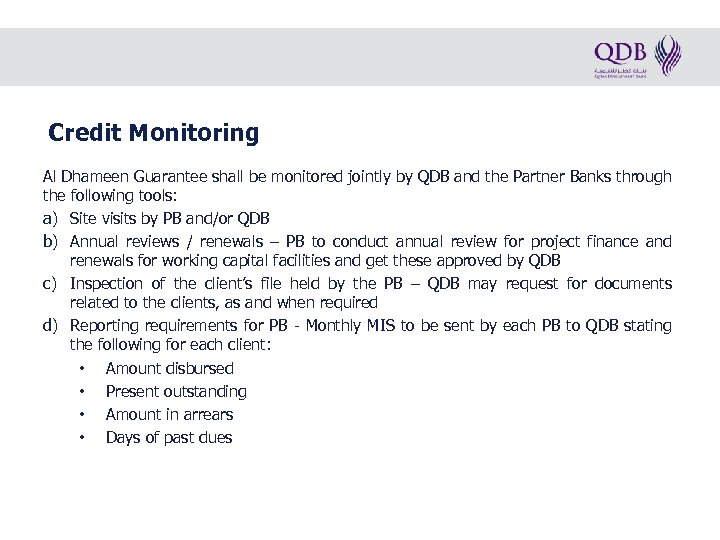

Credit Monitoring Al Dhameen Guarantee shall be monitored jointly by QDB and the Partner Banks through the following tools: a) Site visits by PB and/or QDB b) Annual reviews / renewals – PB to conduct annual review for project finance and renewals for working capital facilities and get these approved by QDB c) Inspection of the client’s file held by the PB – QDB may request for documents related to the clients, as and when required d) Reporting requirements for PB - Monthly MIS to be sent by each PB to QDB stating the following for each client: • Amount disbursed • Present outstanding • Amount in arrears • Days of past dues

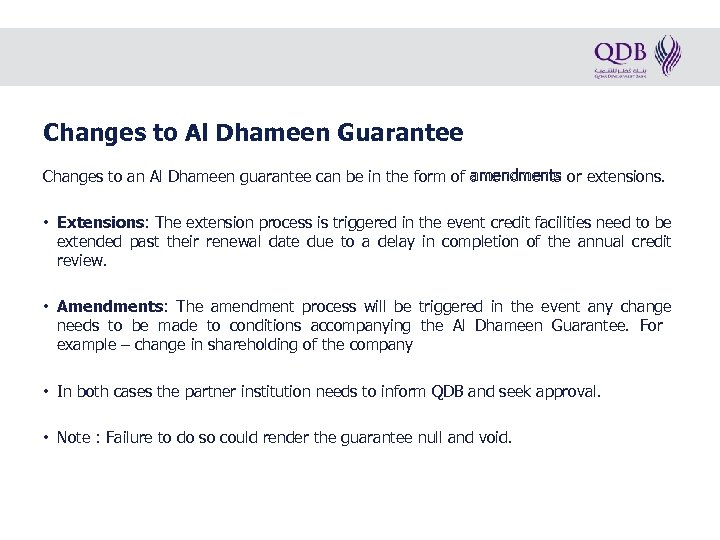

Changes to Al Dhameen Guarantee Changes to an Al Dhameen guarantee can be in the form of amendments or extensions. • Extensions: The extension process is triggered in the event credit facilities need to be extended past their renewal date due to a delay in completion of the annual credit review. • Amendments: The amendment process will be triggered in the event any change needs to be made to conditions accompanying the Al Dhameen Guarantee. For example – change in shareholding of the company • In both cases the partner institution needs to inform QDB and seek approval. • Note : Failure to do so could render the guarantee null and void.

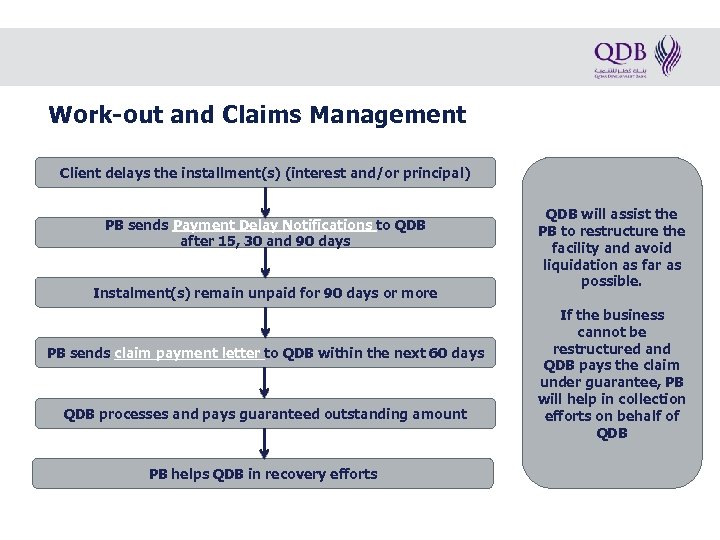

Work-out and Claims Management Client delays the installment(s) (interest and/or principal) PB sends Payment Delay Notifications to QDB after 15, 30 and 90 days Instalment(s) remain unpaid for 90 days or more PB sends claim payment letter to QDB within the next 60 days QDB processes and pays guaranteed outstanding amount PB helps QDB in recovery efforts QDB will assist the PB to restructure the facility and avoid liquidation as far as possible. If the business cannot be restructured and QDB pays the claim under guarantee, PB will help in collection efforts on behalf of QDB

Claim Refusal QDB can refuse paying a claim if one or more of the following conditions are not met: • Personal guarantees and personal checks from the clients are not in place • Appropriate securities not perfected on behalf of QDB • Insurance not in place or renewed (in case lack thereof materially resulted in default) • Amendments made to facility agreement contrary to the facility authorization / guarantee approval without QDB’s consent • Disbursements in violation / contrary to the approved conditions

Program Monitoring Quarterly Al Dhameen Feedback Sessions - To ascertain the program’s effectiveness through one or more of the following: 1. Explore ways to improve the program 2. Introduce new products 3. Address any ongoing concerns Furthermore QDB reviews the Al Dhameen program internally on a regular basis in order to maintain the program’s effectiveness. End

Thank You

f660afb89cdd86a7b887e15ac24ad3fa.ppt