dda1d4bfe272fa1bb24b973238ed8d96.ppt

- Количество слайдов: 34

Q 2 2007 TELUS investor conference call August 3, 2007

Q 2 2007 TELUS investor conference call August 3, 2007

TELUS forward looking statements This session and answers to questions contain forward-looking statements that require assumptions about expected future events including 2007 guidance, competition, financing, financial and operating results, and regulation that are subject to inherent risks and uncertainties. There is significant risk that predictions and other forward looking statements will not prove to be accurate so do not place undue reliance on them. Factors that could cause actual results to differ materially include but are not limited to: competition; capital expenditure levels (including possible spectrum purchases); financing and debt requirements (including share repurchases, debt redemptions and refinancing plans); tax matters (including acceleration or deferral of payment of significant cash taxes); regulatory developments (including local forbearance, local number portability, the timing, rules, process and cost of future spectrum auctions, and possible changes to foreign ownership restrictions); process risks (including conversion of legacy systems and billing system integrations); and other risk factors discussed herein and listed from time to time in TELUS’ reports. There are many factors that could cause actual results to differ materially. For a full listing and description of the potential risk factors and assumptions, please refer to the TELUS 2006 annual report and updates in the 2007 quarterly reports (see Section 10 Risks and Risk Management in Management’s discussion and analysis), and other filings with securities commissions in Canada (sedar. com) and the United States (sec. gov). All dollars referenced are in C$ unless otherwise specified. 2

TELUS forward looking statements This session and answers to questions contain forward-looking statements that require assumptions about expected future events including 2007 guidance, competition, financing, financial and operating results, and regulation that are subject to inherent risks and uncertainties. There is significant risk that predictions and other forward looking statements will not prove to be accurate so do not place undue reliance on them. Factors that could cause actual results to differ materially include but are not limited to: competition; capital expenditure levels (including possible spectrum purchases); financing and debt requirements (including share repurchases, debt redemptions and refinancing plans); tax matters (including acceleration or deferral of payment of significant cash taxes); regulatory developments (including local forbearance, local number portability, the timing, rules, process and cost of future spectrum auctions, and possible changes to foreign ownership restrictions); process risks (including conversion of legacy systems and billing system integrations); and other risk factors discussed herein and listed from time to time in TELUS’ reports. There are many factors that could cause actual results to differ materially. For a full listing and description of the potential risk factors and assumptions, please refer to the TELUS 2006 annual report and updates in the 2007 quarterly reports (see Section 10 Risks and Risk Management in Management’s discussion and analysis), and other filings with securities commissions in Canada (sedar. com) and the United States (sec. gov). All dollars referenced are in C$ unless otherwise specified. 2

Q 2 2007 TELUS investor conference call Darren Entwistle member of the TELUS team August 3, 2007

Q 2 2007 TELUS investor conference call Darren Entwistle member of the TELUS team August 3, 2007

Decision on BCE acquisition § TELUS pursued discussions on benefits of acquisition to June 26 § Potential for TELUS to pursue offer on investment grade model § Completed assessment of this opportunity considering § Disadvantageous auction process § Substantive price offered by private equity consortium § Deteriorating debt market conditions § Positive benefits of not bidding § Timeline and uncertain outcome of competition approval § Risk to TELUS shareholders § TELUS does not intend to submit a competing offer Stand-alone TELUS can continue to create future value 4

Decision on BCE acquisition § TELUS pursued discussions on benefits of acquisition to June 26 § Potential for TELUS to pursue offer on investment grade model § Completed assessment of this opportunity considering § Disadvantageous auction process § Substantive price offered by private equity consortium § Deteriorating debt market conditions § Positive benefits of not bidding § Timeline and uncertain outcome of competition approval § Risk to TELUS shareholders § TELUS does not intend to submit a competing offer Stand-alone TELUS can continue to create future value 4

Wireline highlights – Q 2 2007 § Resilient wireline revenue as per operating strategy § Data growth continues to be strong at 8% § Moderate NAL loss at 3% § Converted Alberta consumers to new customer care platform § Critical billing function performed well § Initial difficulties reduced capability for new orders § Additional resources impacted EBITDA by $29 million § Backlogs and call centre operations returning to normal Committed to consolidated care platform and its benefits 5

Wireline highlights – Q 2 2007 § Resilient wireline revenue as per operating strategy § Data growth continues to be strong at 8% § Moderate NAL loss at 3% § Converted Alberta consumers to new customer care platform § Critical billing function performed well § Initial difficulties reduced capability for new orders § Additional resources impacted EBITDA by $29 million § Backlogs and call centre operations returning to normal Committed to consolidated care platform and its benefits 5

Wireline highlights – Q 2 2007 § Major $200 million contract with Department of National Defence § Local forbearance in key markets beginning § Fort Mc. Murray residential service deregulated July 25 th § Large urban markets waiting for deregulation decisions § Vancouver, Victoria, Calgary, Edmonton, and Rimouski Continued resiliency in wireline New regulatory framework based on market forces 6

Wireline highlights – Q 2 2007 § Major $200 million contract with Department of National Defence § Local forbearance in key markets beginning § Fort Mc. Murray residential service deregulated July 25 th § Large urban markets waiting for deregulation decisions § Vancouver, Victoria, Calgary, Edmonton, and Rimouski Continued resiliency in wireline New regulatory framework based on market forces 6

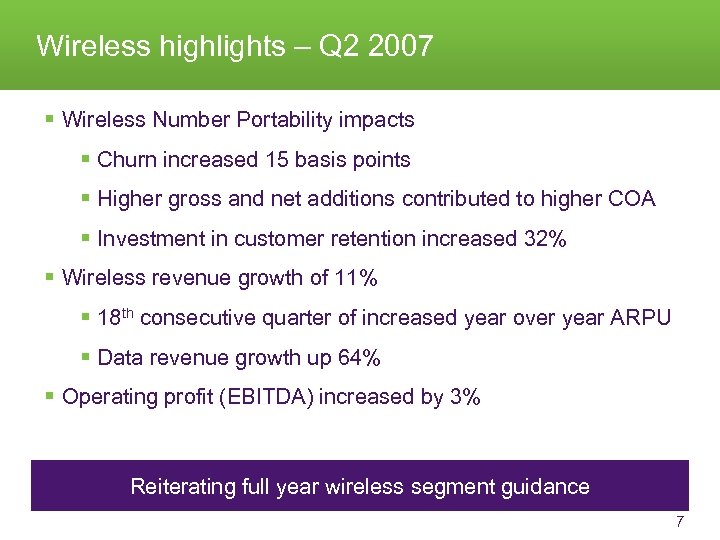

Wireless highlights – Q 2 2007 § Wireless Number Portability impacts § Churn increased 15 basis points § Higher gross and net additions contributed to higher COA § Investment in customer retention increased 32% § Wireless revenue growth of 11% § 18 th consecutive quarter of increased year over year ARPU § Data revenue growth up 64% § Operating profit (EBITDA) increased by 3% Continued resiliency in wireline Reiterating full year wireless segment guidance 7

Wireless highlights – Q 2 2007 § Wireless Number Portability impacts § Churn increased 15 basis points § Higher gross and net additions contributed to higher COA § Investment in customer retention increased 32% § Wireless revenue growth of 11% § 18 th consecutive quarter of increased year over year ARPU § Data revenue growth up 64% § Operating profit (EBITDA) increased by 3% Continued resiliency in wireline Reiterating full year wireless segment guidance 7

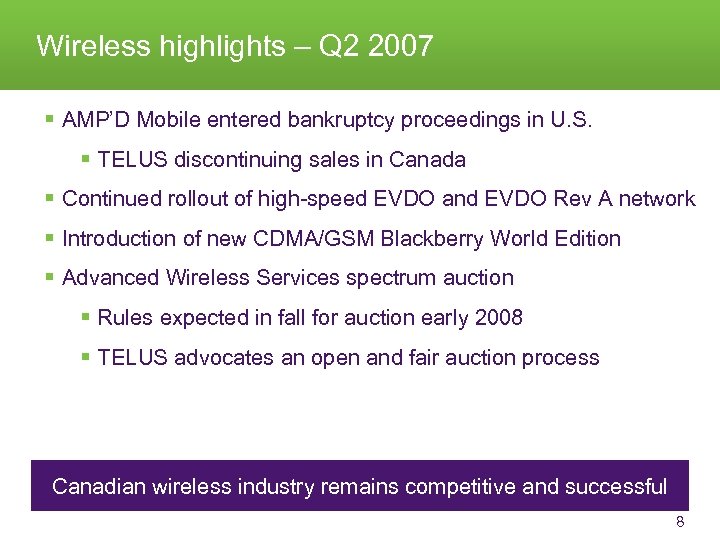

Wireless highlights – Q 2 2007 § AMP’D Mobile entered bankruptcy proceedings in U. S. § TELUS discontinuing sales in Canada § Continued rollout of high-speed EVDO and EVDO Rev A network § Introduction of new CDMA/GSM Blackberry World Edition § Advanced Wireless Services spectrum auction § Rules expected in fall for auction early 2008 § TELUS advocates an open and fair auction process Continued resiliency in wireline Canadian wireless industry remains competitive and successful 8

Wireless highlights – Q 2 2007 § AMP’D Mobile entered bankruptcy proceedings in U. S. § TELUS discontinuing sales in Canada § Continued rollout of high-speed EVDO and EVDO Rev A network § Introduction of new CDMA/GSM Blackberry World Edition § Advanced Wireless Services spectrum auction § Rules expected in fall for auction early 2008 § TELUS advocates an open and fair auction process Continued resiliency in wireline Canadian wireless industry remains competitive and successful 8

Consolidated highlights – Q 2 2007 § Committed to improving performance in coming quarters § Second quarter impacted by special events § Committed to original consolidated guidance for 2007 § Balancing interests of debt and equity holders § Refinanced $1. 5 billion 7. 5% notes at lower interest cost § Repurchased $170 million of shares in quarter § Repurchased 45. 6 million shares for $2. 1 billion since 2004 § Quarterly per share dividend 37. 5 cents, up 36% Strongly positioned to advance growth strategy 9

Consolidated highlights – Q 2 2007 § Committed to improving performance in coming quarters § Second quarter impacted by special events § Committed to original consolidated guidance for 2007 § Balancing interests of debt and equity holders § Refinanced $1. 5 billion 7. 5% notes at lower interest cost § Repurchased $170 million of shares in quarter § Repurchased 45. 6 million shares for $2. 1 billion since 2004 § Quarterly per share dividend 37. 5 cents, up 36% Strongly positioned to advance growth strategy 9

Q 2 2007 TELUS investor conference call Robert Mc. Farlane EVP & Chief Financial Officer August 3, 2007

Q 2 2007 TELUS investor conference call Robert Mc. Farlane EVP & Chief Financial Officer August 3, 2007

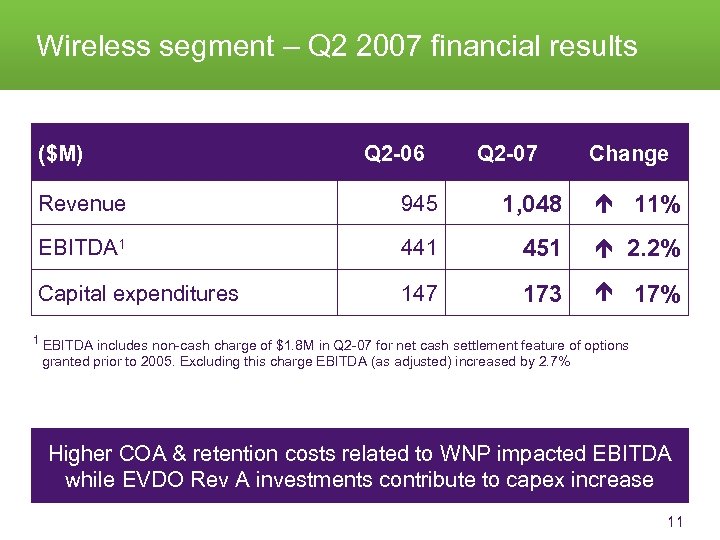

Wireless segment – Q 2 2007 financial results ($M) Q 2 -06 Q 2 -07 Change Revenue 945 1, 048 11% EBITDA 1 441 451 2. 2% Capital expenditures 147 173 17% 1 EBITDA includes non-cash charge of $1. 8 M in Q 2 -07 for net cash settlement feature of options granted prior to 2005. Excluding this charge EBITDA (as adjusted) increased by 2. 7% Higher COA & retention costs related to WNP impacted EBITDA while EVDO Rev A investments contribute to capex increase 11

Wireless segment – Q 2 2007 financial results ($M) Q 2 -06 Q 2 -07 Change Revenue 945 1, 048 11% EBITDA 1 441 451 2. 2% Capital expenditures 147 173 17% 1 EBITDA includes non-cash charge of $1. 8 M in Q 2 -07 for net cash settlement feature of options granted prior to 2005. Excluding this charge EBITDA (as adjusted) increased by 2. 7% Higher COA & retention costs related to WNP impacted EBITDA while EVDO Rev A investments contribute to capex increase 11

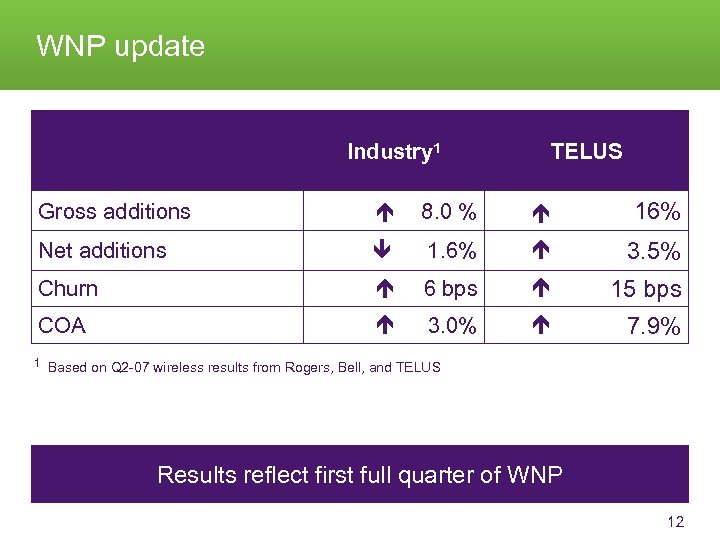

WNP update Industry 1 TELUS Gross additions 8. 0 % 16% Net additions 1. 6% 3. 5% Churn 6 bps 15 bps COA 3. 0% 7. 9% 1 Based on Q 2 -07 wireless results from Rogers, Bell, and TELUS Results reflect first full quarter of WNP 12

WNP update Industry 1 TELUS Gross additions 8. 0 % 16% Net additions 1. 6% 3. 5% Churn 6 bps 15 bps COA 3. 0% 7. 9% 1 Based on Q 2 -07 wireless results from Rogers, Bell, and TELUS Results reflect first full quarter of WNP 12

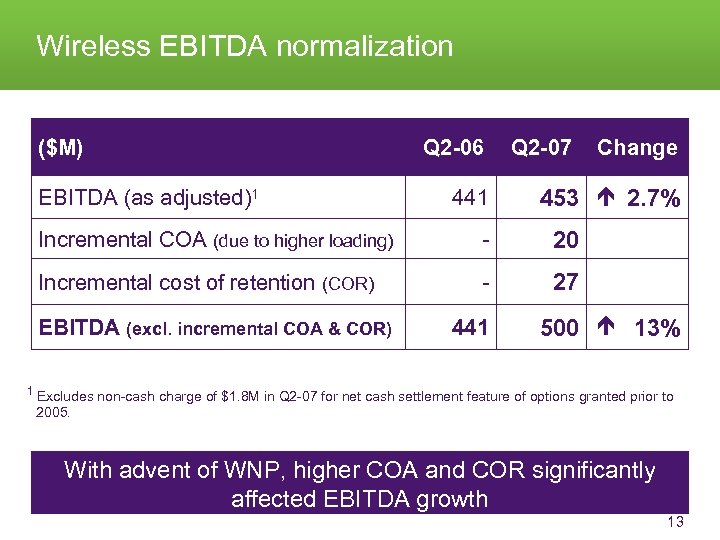

Wireless EBITDA normalization ($M) EBITDA (as adjusted)1 Q 2 -06 441 Q 2 -07 Change 453 2. 7% Incremental COA (due to higher loading) - 20 Incremental cost of retention (COR) - 27 EBITDA (excl. incremental COA & COR) 441 500 13% 1 Excludes non-cash charge of $1. 8 M in Q 2 -07 for net cash settlement feature of options granted prior to 2005. With advent of WNP, higher COA and COR significantly affected EBITDA growth 13

Wireless EBITDA normalization ($M) EBITDA (as adjusted)1 Q 2 -06 441 Q 2 -07 Change 453 2. 7% Incremental COA (due to higher loading) - 20 Incremental cost of retention (COR) - 27 EBITDA (excl. incremental COA & COR) 441 500 13% 1 Excludes non-cash charge of $1. 8 M in Q 2 -07 for net cash settlement feature of options granted prior to 2005. With advent of WNP, higher COA and COR significantly affected EBITDA growth 13

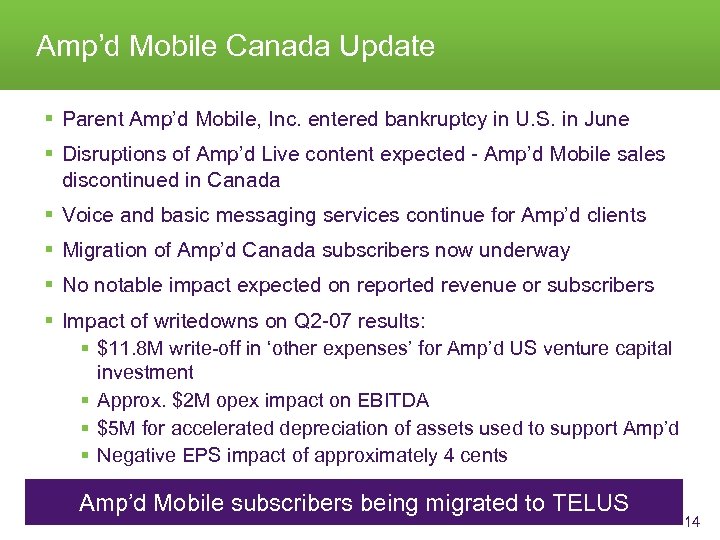

Amp’d Mobile Canada Update § Parent Amp’d Mobile, Inc. entered bankruptcy in U. S. in June § Disruptions of Amp’d Live content expected - Amp’d Mobile sales discontinued in Canada § Voice and basic messaging services continue for Amp’d clients § Migration of Amp’d Canada subscribers now underway § No notable impact expected on reported revenue or subscribers § Impact of writedowns on Q 2 -07 results: § $11. 8 M write-off in ‘other expenses’ for Amp’d US venture capital investment § Approx. $2 M opex impact on EBITDA § $5 M for accelerated depreciation of assets used to support Amp’d § Negative EPS impact of approximately 4 cents Amp’d Mobile subscribers being migrated to TELUS 14

Amp’d Mobile Canada Update § Parent Amp’d Mobile, Inc. entered bankruptcy in U. S. in June § Disruptions of Amp’d Live content expected - Amp’d Mobile sales discontinued in Canada § Voice and basic messaging services continue for Amp’d clients § Migration of Amp’d Canada subscribers now underway § No notable impact expected on reported revenue or subscribers § Impact of writedowns on Q 2 -07 results: § $11. 8 M write-off in ‘other expenses’ for Amp’d US venture capital investment § Approx. $2 M opex impact on EBITDA § $5 M for accelerated depreciation of assets used to support Amp’d § Negative EPS impact of approximately 4 cents Amp’d Mobile subscribers being migrated to TELUS 14

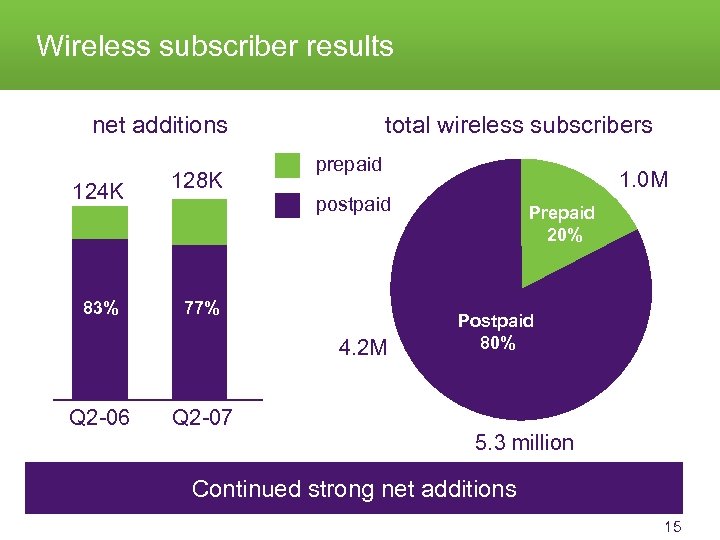

Wireless subscriber results net additions 124 K 83% 128 K total wireless subscribers prepaid postpaid 77% 4. 2 M Q 2 -06 1. 0 M Q 2 -07 Prepaid 20% Postpaid 80% 5. 3 million Continued strong net additions 15

Wireless subscriber results net additions 124 K 83% 128 K total wireless subscribers prepaid postpaid 77% 4. 2 M Q 2 -06 1. 0 M Q 2 -07 Prepaid 20% Postpaid 80% 5. 3 million Continued strong net additions 15

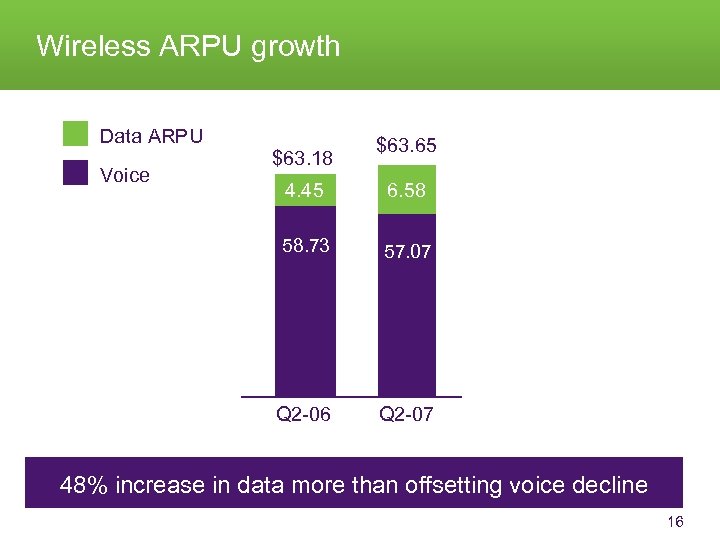

Wireless ARPU growth Data ARPU Voice $63. 18 $63. 65 4. 45 6. 58 58. 73 57. 07 Q 2 -06 Q 2 -07 48% increase in data more than offsetting voice decline 16

Wireless ARPU growth Data ARPU Voice $63. 18 $63. 65 4. 45 6. 58 58. 73 57. 07 Q 2 -06 Q 2 -07 48% increase in data more than offsetting voice decline 16

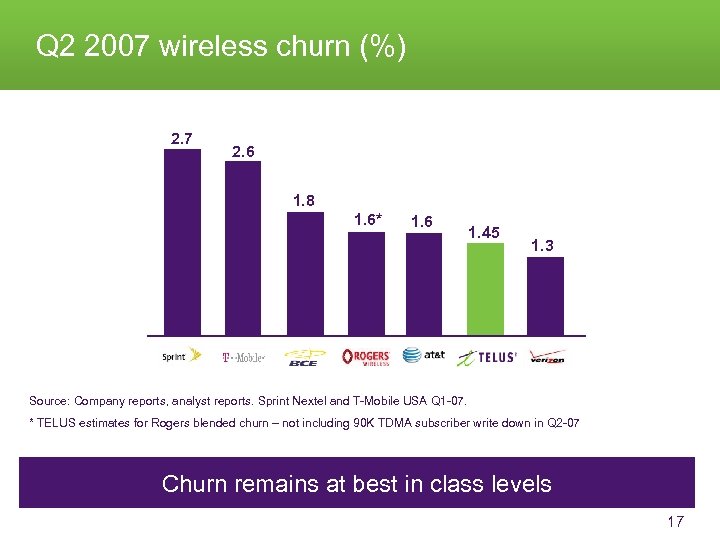

Q 2 2007 wireless churn (%) 2. 7 2. 6 1. 8 1. 6* 1. 6 1. 45 1. 3 Source: Company reports, analyst reports. Sprint Nextel and T-Mobile USA Q 1 -07. * TELUS estimates for Rogers blended churn – not including 90 K TDMA subscriber write down in Q 2 -07 Churn remains at best in class levels 17

Q 2 2007 wireless churn (%) 2. 7 2. 6 1. 8 1. 6* 1. 6 1. 45 1. 3 Source: Company reports, analyst reports. Sprint Nextel and T-Mobile USA Q 1 -07. * TELUS estimates for Rogers blended churn – not including 90 K TDMA subscriber write down in Q 2 -07 Churn remains at best in class levels 17

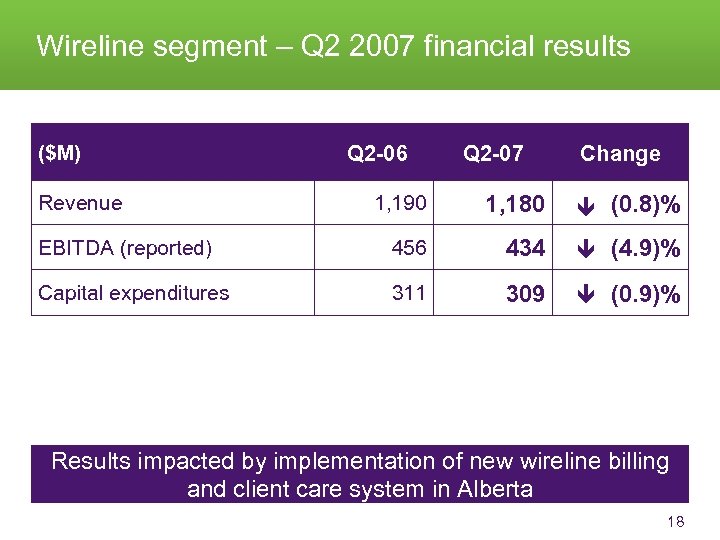

Wireline segment – Q 2 2007 financial results 1, 190 1, 180 EBITDA (reported) 456 434 Capital expenditures 311 309 Revenue Change (0. 8)% (4. 9)% Q 2 -07 Q 2 -06 ($M) (0. 9)% Results impacted by implementation of new wireline billing and client care system in Alberta 18

Wireline segment – Q 2 2007 financial results 1, 190 1, 180 EBITDA (reported) 456 434 Capital expenditures 311 309 Revenue Change (0. 8)% (4. 9)% Q 2 -07 Q 2 -06 ($M) (0. 9)% Results impacted by implementation of new wireline billing and client care system in Alberta 18

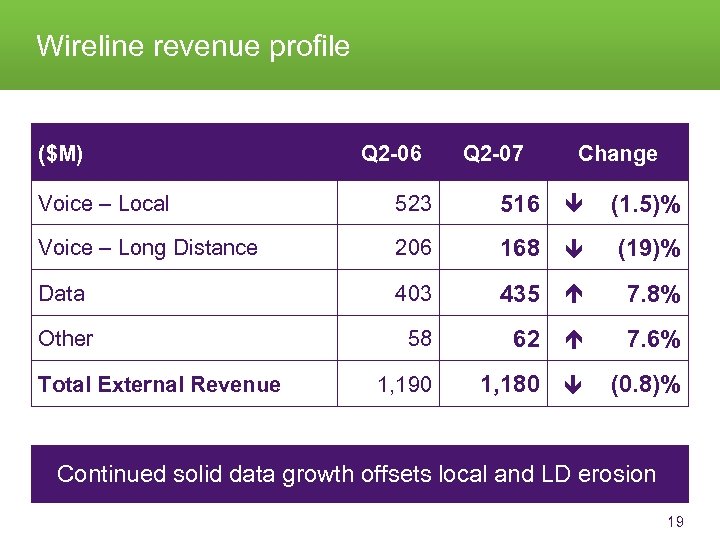

Wireline revenue profile ($M) Q 2 -06 Q 2 -07 Change Voice – Local 523 516 (1. 5)% Voice – Long Distance 206 168 (19)% Data 403 435 7. 8% Other 58 62 7. 6% 1, 190 1, 180 (0. 8)% Total External Revenue Continued solid data growth offsets local and LD erosion 19

Wireline revenue profile ($M) Q 2 -06 Q 2 -07 Change Voice – Local 523 516 (1. 5)% Voice – Long Distance 206 168 (19)% Data 403 435 7. 8% Other 58 62 7. 6% 1, 190 1, 180 (0. 8)% Total External Revenue Continued solid data growth offsets local and LD erosion 19

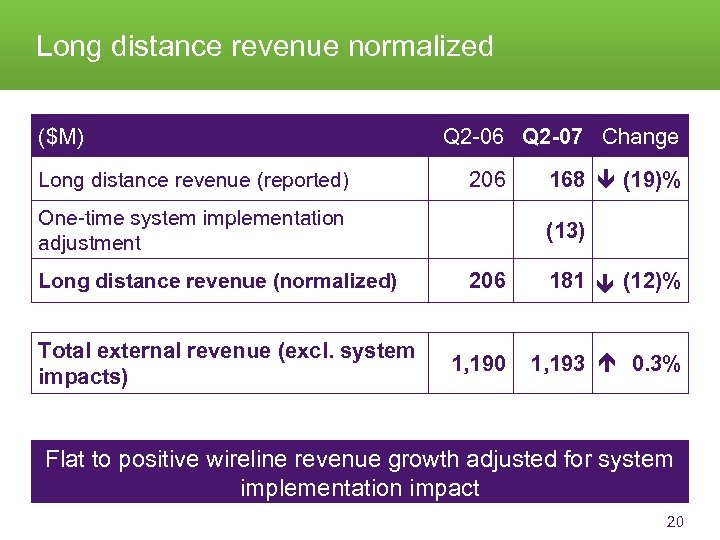

Long distance revenue normalized 206 One-time system implementation adjustment Long distance revenue (normalized) Total external revenue (excl. system impacts) 168 (19)% Long distance revenue (reported) Q 2 -06 Q 2 -07 Change ($M) (12)% (13) 206 1, 190 181 1, 193 0. 3% Flat to positive wireline revenue growth adjusted for system implementation impact 20

Long distance revenue normalized 206 One-time system implementation adjustment Long distance revenue (normalized) Total external revenue (excl. system impacts) 168 (19)% Long distance revenue (reported) Q 2 -06 Q 2 -07 Change ($M) (12)% (13) 206 1, 190 181 1, 193 0. 3% Flat to positive wireline revenue growth adjusted for system implementation impact 20

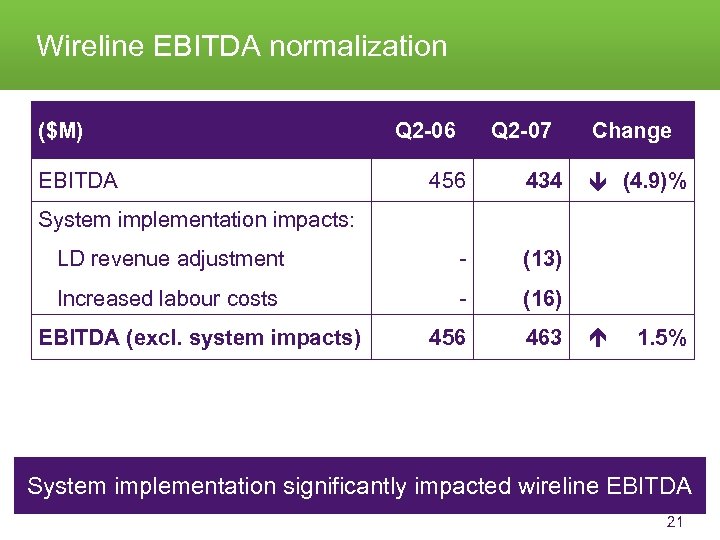

Wireline EBITDA normalization EBITDA Q 2 -06 Q 2 -07 456 434 LD revenue adjustment - (13) Increased labour costs - (16) 456 463 Change ($M) (4. 9)% 1. 5% System implementation impacts: EBITDA (excl. system impacts) System implementation significantly impacted wireline EBITDA 21

Wireline EBITDA normalization EBITDA Q 2 -06 Q 2 -07 456 434 LD revenue adjustment - (13) Increased labour costs - (16) 456 463 Change ($M) (4. 9)% 1. 5% System implementation impacts: EBITDA (excl. system impacts) System implementation significantly impacted wireline EBITDA 21

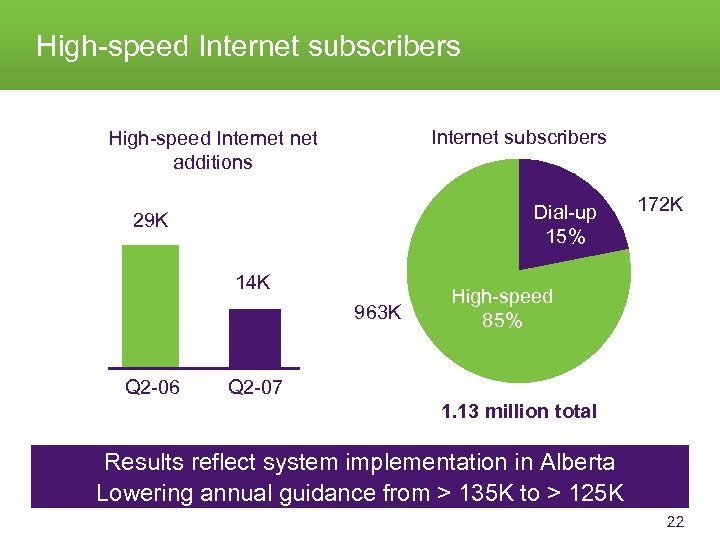

High-speed Internet subscribers High-speed Internet additions Dial-up 15% 29 K 14 K 963 K Q 2 -06 172 K High-speed 85% Q 2 -07 1. 13 million total Results reflect system implementation in Alberta Lowering annual guidance from > 135 K to > 125 K 22

High-speed Internet subscribers High-speed Internet additions Dial-up 15% 29 K 14 K 963 K Q 2 -06 172 K High-speed 85% Q 2 -07 1. 13 million total Results reflect system implementation in Alberta Lowering annual guidance from > 135 K to > 125 K 22

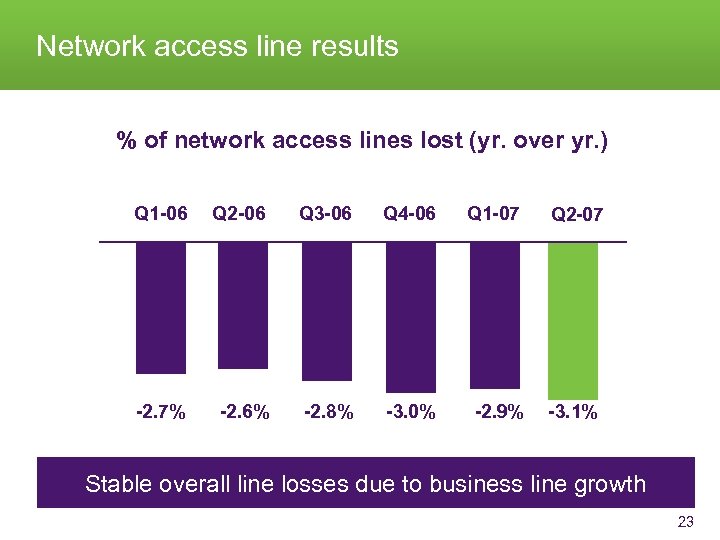

Network access line results % of network access lines lost (yr. over yr. ) Q 1 -06 Q 2 -06 Q 3 -06 Q 4 -06 Q 1 -07 Q 2 -07 -2. 7% -2. 6% -2. 8% -3. 0% -2. 9% -3. 1% Stable overall line losses due to business line growth 23

Network access line results % of network access lines lost (yr. over yr. ) Q 1 -06 Q 2 -06 Q 3 -06 Q 4 -06 Q 1 -07 Q 2 -07 -2. 7% -2. 6% -2. 8% -3. 0% -2. 9% -3. 1% Stable overall line losses due to business line growth 23

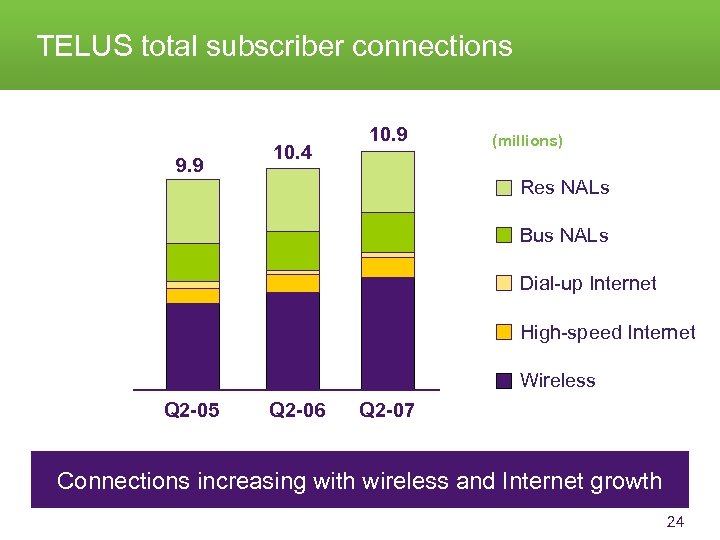

TELUS total subscriber connections 9. 9 10. 4 10. 9 (millions) Res NALs Bus NALs Dial-up Internet High-speed Internet Wireless Q 2 -05 Q 2 -06 Q 2 -07 Connections increasing with wireless and Internet growth 24

TELUS total subscriber connections 9. 9 10. 4 10. 9 (millions) Res NALs Bus NALs Dial-up Internet High-speed Internet Wireless Q 2 -05 Q 2 -06 Q 2 -07 Connections increasing with wireless and Internet growth 24

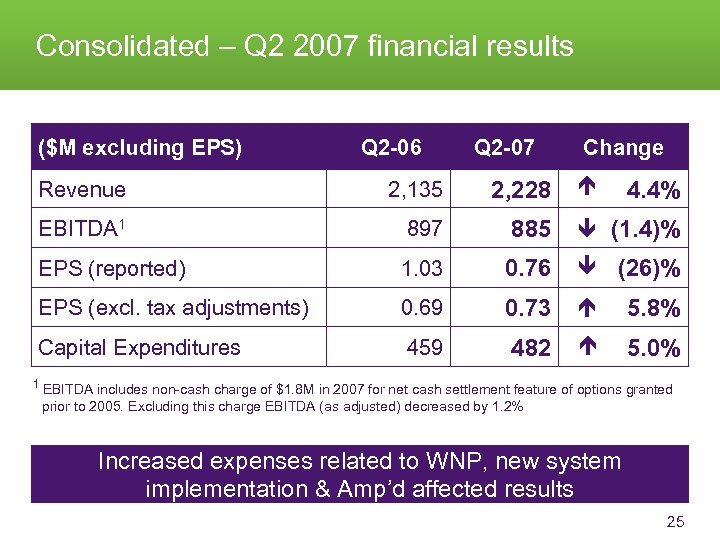

Consolidated – Q 2 2007 financial results Q 2 -07 Change 4. 4% (1. 4)% Q 2 -06 ($M excluding EPS) (26)% 5. 8% Revenue 2, 135 2, 228 EBITDA 1 897 885 EPS (reported) 1. 03 0. 76 EPS (excl. tax adjustments) 0. 69 0. 73 Capital Expenditures 459 482 5. 0% 1 EBITDA includes non-cash charge of $1. 8 M in 2007 for net cash settlement feature of options granted prior to 2005. Excluding this charge EBITDA (as adjusted) decreased by 1. 2% Increased expenses related to WNP, new system implementation & Amp’d affected results 25

Consolidated – Q 2 2007 financial results Q 2 -07 Change 4. 4% (1. 4)% Q 2 -06 ($M excluding EPS) (26)% 5. 8% Revenue 2, 135 2, 228 EBITDA 1 897 885 EPS (reported) 1. 03 0. 76 EPS (excl. tax adjustments) 0. 69 0. 73 Capital Expenditures 459 482 5. 0% 1 EBITDA includes non-cash charge of $1. 8 M in 2007 for net cash settlement feature of options granted prior to 2005. Excluding this charge EBITDA (as adjusted) decreased by 1. 2% Increased expenses related to WNP, new system implementation & Amp’d affected results 25

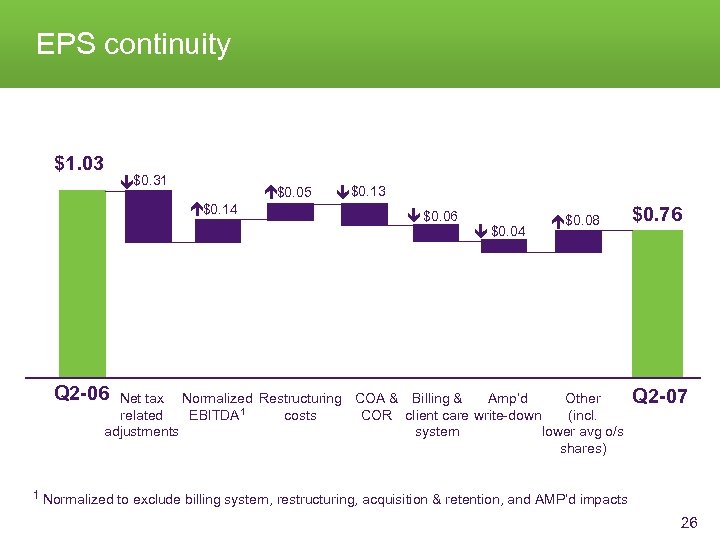

EPS continuity $0. 13 $0. 06 $0. 14 $0. 05 $0. 31 $1. 03 $0. 04 $0. 08 Q 2 -06 Net tax Normalized Restructuring COA & Billing & Amp’d Other 1 related EBITDA costs COR client care write-down (incl. adjustments system lower avg o/s shares) $0. 76 Q 2 -07 1 Normalized to exclude billing system, restructuring, acquisition & retention, and AMP’d impacts 26

EPS continuity $0. 13 $0. 06 $0. 14 $0. 05 $0. 31 $1. 03 $0. 04 $0. 08 Q 2 -06 Net tax Normalized Restructuring COA & Billing & Amp’d Other 1 related EBITDA costs COR client care write-down (incl. adjustments system lower avg o/s shares) $0. 76 Q 2 -07 1 Normalized to exclude billing system, restructuring, acquisition & retention, and AMP’d impacts 26

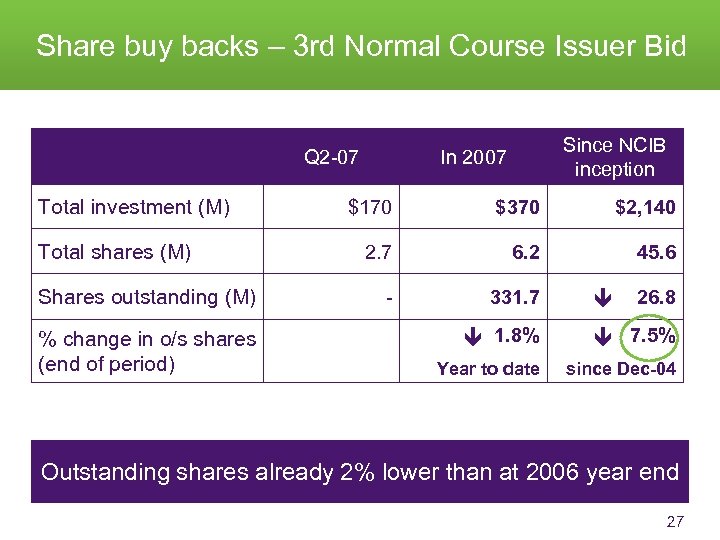

Share buy backs – 3 rd Normal Course Issuer Bid Q 2 -07 % change in o/s shares (end of period) $2, 140 2. 7 6. 2 45. 6 - 331. 7 26. 8 7. 5% Shares outstanding (M) $370 Total shares (M) $170 Total investment (M) Since NCIB inception In 2007 1. 8% Year to date since Dec-04 Outstanding shares already 2% lower than at 2006 year end 27

Share buy backs – 3 rd Normal Course Issuer Bid Q 2 -07 % change in o/s shares (end of period) $2, 140 2. 7 6. 2 45. 6 - 331. 7 26. 8 7. 5% Shares outstanding (M) $370 Total shares (M) $170 Total investment (M) Since NCIB inception In 2007 1. 8% Year to date since Dec-04 Outstanding shares already 2% lower than at 2006 year end 27

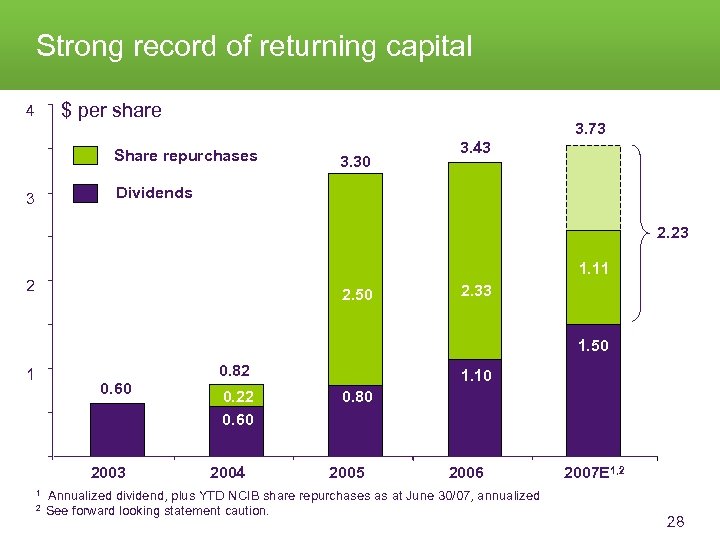

Strong record of returning capital 4 $ per share 3. 73 Share repurchases 3 3. 30 3. 43 Dividends 2. 23 1. 11 2 2. 50 2. 33 1. 50 1 0. 60 2003 0. 82 0. 22 0. 60 2004 1. 10 0. 80 2005 2006 2007 E 1, 2 1 Annualized dividend, plus YTD NCIB share repurchases as at June 30/07, annualized 2 See forward looking statement caution. 28

Strong record of returning capital 4 $ per share 3. 73 Share repurchases 3 3. 30 3. 43 Dividends 2. 23 1. 11 2 2. 50 2. 33 1. 50 1 0. 60 2003 0. 82 0. 22 0. 60 2004 1. 10 0. 80 2005 2006 2007 E 1, 2 1 Annualized dividend, plus YTD NCIB share repurchases as at June 30/07, annualized 2 See forward looking statement caution. 28

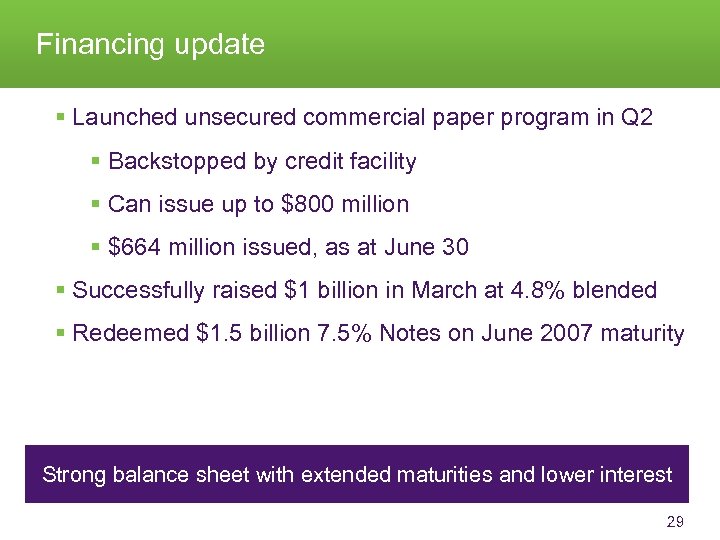

Financing update § Launched unsecured commercial paper program in Q 2 § Backstopped by credit facility § Can issue up to $800 million § $664 million issued, as at June 30 § Successfully raised $1 billion in March at 4. 8% blended § Redeemed $1. 5 billion 7. 5% Notes on June 2007 maturity Strong balance sheet with extended maturities and lower interest 29

Financing update § Launched unsecured commercial paper program in Q 2 § Backstopped by credit facility § Can issue up to $800 million § $664 million issued, as at June 30 § Successfully raised $1 billion in March at 4. 8% blended § Redeemed $1. 5 billion 7. 5% Notes on June 2007 maturity Strong balance sheet with extended maturities and lower interest 29

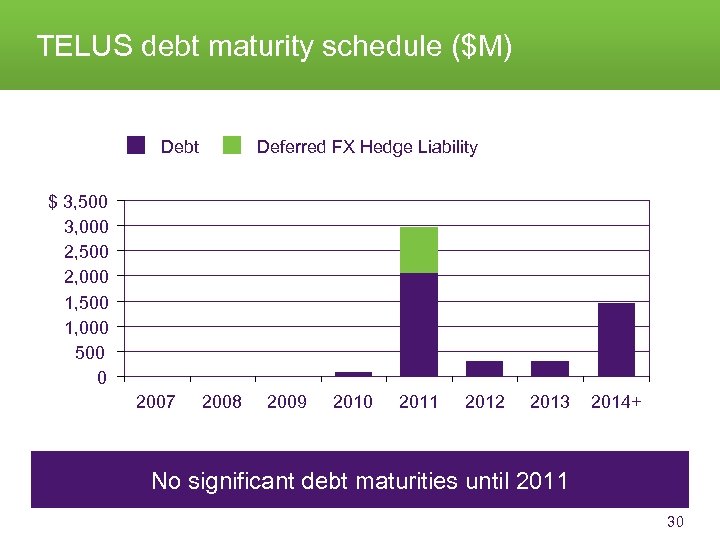

TELUS debt maturity schedule ($M) Debt Deferred FX Hedge Liability $ 3, 500 3, 000 2, 500 2, 000 1, 500 1, 000 500 0 2007 2008 2009 2010 2011 2012 2013 2014+ No significant debt maturities until 2011 30

TELUS debt maturity schedule ($M) Debt Deferred FX Hedge Liability $ 3, 500 3, 000 2, 500 2, 000 1, 500 1, 000 500 0 2007 2008 2009 2010 2011 2012 2013 2014+ No significant debt maturities until 2011 30

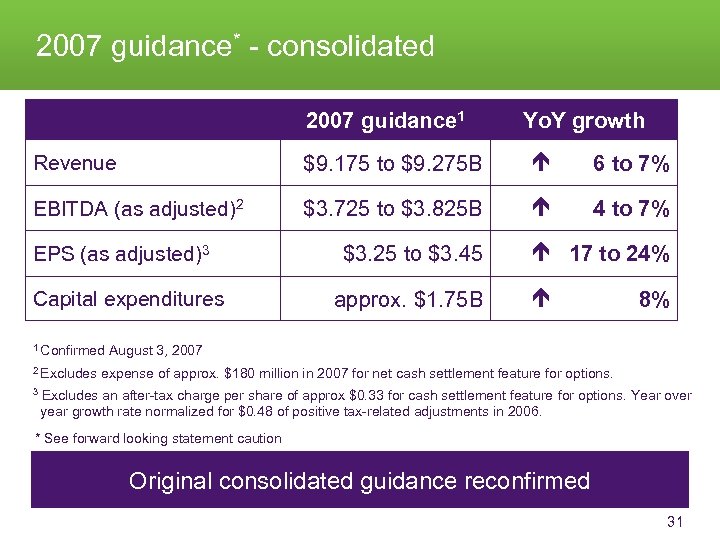

2007 guidance* - consolidated 2007 guidance 1 Yo. Y growth Revenue $9. 175 to $9. 275 B 6 to 7% EBITDA (as adjusted)2 $3. 725 to $3. 825 B 4 to 7% EPS (as adjusted)3 Capital expenditures $3. 25 to $3. 45 approx. $1. 75 B 17 to 24% 8% 1 Confirmed August 3, 2007 2 Excludes expense of approx. $180 million in 2007 for net cash settlement feature for options. 3 Excludes an after-tax charge per share of approx $0. 33 for cash settlement feature for options. Year over year growth rate normalized for $0. 48 of positive tax-related adjustments in 2006. * See forward looking statement caution Original consolidated guidance reconfirmed 31

2007 guidance* - consolidated 2007 guidance 1 Yo. Y growth Revenue $9. 175 to $9. 275 B 6 to 7% EBITDA (as adjusted)2 $3. 725 to $3. 825 B 4 to 7% EPS (as adjusted)3 Capital expenditures $3. 25 to $3. 45 approx. $1. 75 B 17 to 24% 8% 1 Confirmed August 3, 2007 2 Excludes expense of approx. $180 million in 2007 for net cash settlement feature for options. 3 Excludes an after-tax charge per share of approx $0. 33 for cash settlement feature for options. Year over year growth rate normalized for $0. 48 of positive tax-related adjustments in 2006. * See forward looking statement caution Original consolidated guidance reconfirmed 31

Questions? investor relations 1 -800 -667 -4871 telus. com ir@telus. com

Questions? investor relations 1 -800 -667 -4871 telus. com ir@telus. com

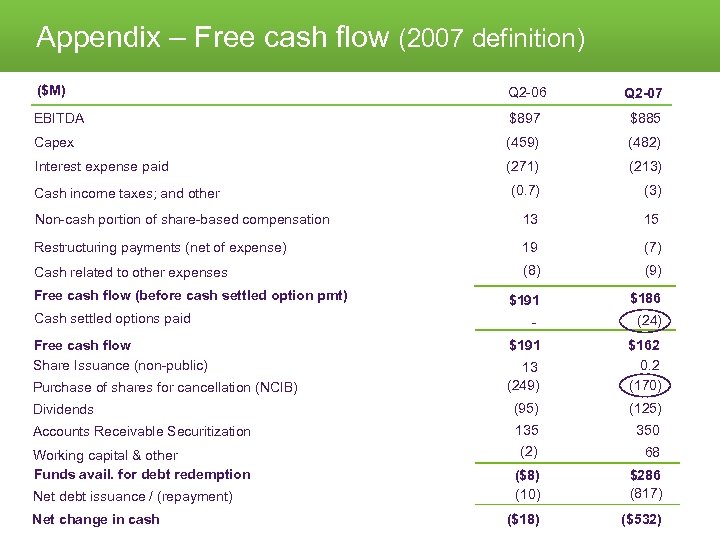

Appendix – Free cash flow (2007 definition) ($M) Q 2 -06 Q 2 -07 EBITDA $897 $885 Capex (459) (482) Interest expense paid (271) (213) (0. 7) (3) Non-cash portion of share-based compensation 13 15 Restructuring payments (net of expense) 19 (7) Cash related to other expenses (8) (9) $191 $186 - (24) $191 13 (249) $162 0. 2 (170) Dividends (95) (125) Accounts Receivable Securitization 135 (2) 350 ($8) (10) $286 (817) ($18) ($532) Cash income taxes; and other Free cash flow (before cash settled option pmt) Cash settled options paid Free cash flow Share Issuance (non-public) Purchase of shares for cancellation (NCIB) Working capital & other Funds avail. for debt redemption Net debt issuance / (repayment) Net change in cash 68

Appendix – Free cash flow (2007 definition) ($M) Q 2 -06 Q 2 -07 EBITDA $897 $885 Capex (459) (482) Interest expense paid (271) (213) (0. 7) (3) Non-cash portion of share-based compensation 13 15 Restructuring payments (net of expense) 19 (7) Cash related to other expenses (8) (9) $191 $186 - (24) $191 13 (249) $162 0. 2 (170) Dividends (95) (125) Accounts Receivable Securitization 135 (2) 350 ($8) (10) $286 (817) ($18) ($532) Cash income taxes; and other Free cash flow (before cash settled option pmt) Cash settled options paid Free cash flow Share Issuance (non-public) Purchase of shares for cancellation (NCIB) Working capital & other Funds avail. for debt redemption Net debt issuance / (repayment) Net change in cash 68

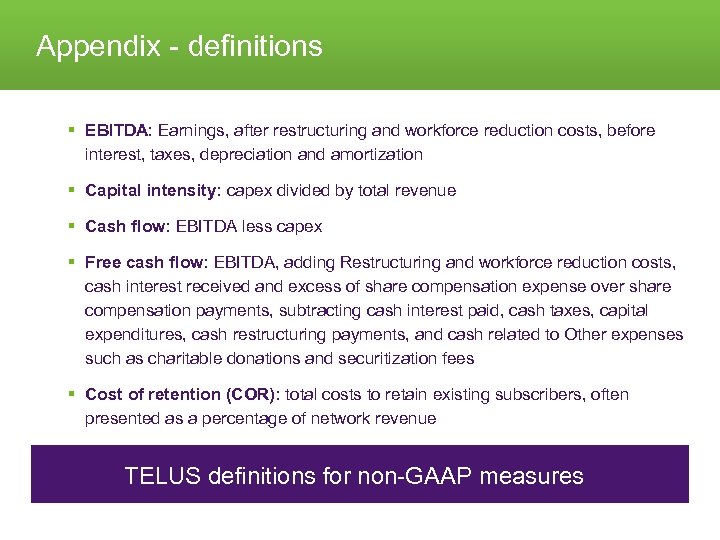

Appendix - definitions § EBITDA: Earnings, after restructuring and workforce reduction costs, before interest, taxes, depreciation and amortization § Capital intensity: capex divided by total revenue § Cash flow: EBITDA less capex § Free cash flow: EBITDA, adding Restructuring and workforce reduction costs, cash interest received and excess of share compensation expense over share compensation payments, subtracting cash interest paid, cash taxes, capital expenditures, cash restructuring payments, and cash related to Other expenses such as charitable donations and securitization fees § Cost of retention (COR): total costs to retain existing subscribers, often presented as a percentage of network revenue TELUS definitions for non-GAAP measures

Appendix - definitions § EBITDA: Earnings, after restructuring and workforce reduction costs, before interest, taxes, depreciation and amortization § Capital intensity: capex divided by total revenue § Cash flow: EBITDA less capex § Free cash flow: EBITDA, adding Restructuring and workforce reduction costs, cash interest received and excess of share compensation expense over share compensation payments, subtracting cash interest paid, cash taxes, capital expenditures, cash restructuring payments, and cash related to Other expenses such as charitable donations and securitization fees § Cost of retention (COR): total costs to retain existing subscribers, often presented as a percentage of network revenue TELUS definitions for non-GAAP measures