a8162c86268aef638738c8d7c0efaecf.ppt

- Количество слайдов: 18

PUT-OPTIONS ON BANKDEPOSITS: AN EFFICIENT DEPOSIT-INSURANCE SCHEME FOR GUATEMALA Juan Carlos Castañeda F. Óscar Leonel Herrera V. 1

CONTENTS 1 SUMMARY 2 INTRODUCTION 3 NATURE OF THE PROPOSED DEPOSIT-INSURANCE SCHEME 4 PUT OPTIONS’ CHARACTERISTICS 5 SCHEME’S OPERATING FEATURES 6 THE FIRST ISSUE OF PUT-OPTIONS ON BANK-DEPOSITS 7 CONCLUSION 2

1. SUMMARY A particular deposit-insurance scheme is proposed: put- options of bank-deposits, issued by the central bank. Purposes: Ü Prevent the occurrence of contagion-driven bank runs. Ü Generate incentives that tend to eliminate the “moral hazard” problem usually found in typical deposit-insurance schemes. The Put options on bank-deposits would… ÜBe freely negotiable at both the primary and secondary markets. ÜHave bank-specific prices: the price of a particular bank’s put-option would tend to reflect the amount of risk taken by that bank. 3

2. INTRODUCTION Contagion: Ü Due to informational asymmetries, the failure of one bank can endanger the stability of other banks whose fundamentals are sound and, eventually, the stability of the whole banking sector. ÜTheoretically: rationalized by self-fulfilling prophecies (multiple equilibria). ÜEmpirically: documented by Freixas, Parigi & Rochet (2000); Kanas (2003); Saunders and Wilson (1996); Temzelides (1997). Ü A typical deposit-insurance scheme can avoid contagion, but it has high social costs. The costs of a deposit-insurance scheme: Ü 4

Ü Creation of a new financial asset: a put option on bank-deposits. Ü Analogous to an insurance policy, but easily negotiable in the secondary market. 5

Classic Precedent in the Literature Ü Merton, Robert C. (1977). “An Analytic Derivation of the Cost of Deposit Insurance and Loan Guarantees - An application of modern option pricing theory”. Journal of Banking and Finance, 1, p. 3 -11. Ü The analogy between deposit-insurance and a put-option is shown Ü The Government is the issuer of the put-option. Ü The banker is the “holder”. Ü The face value of the bank’s liabilities is the “striking price”. 6

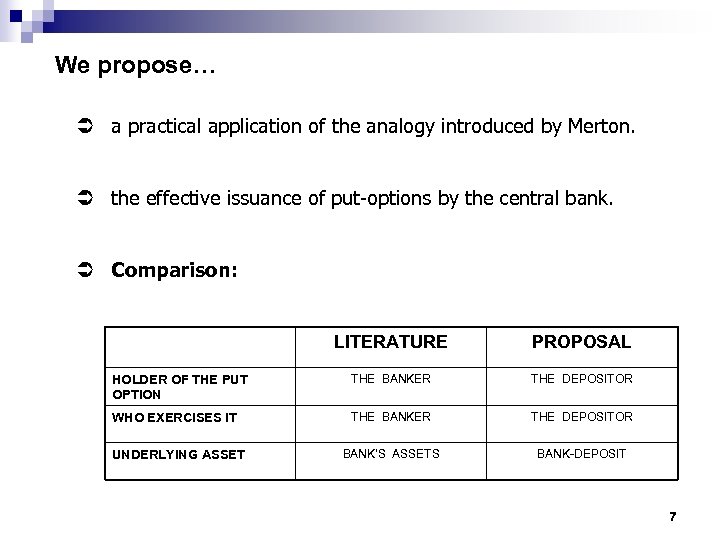

We propose… Ü a practical application of the analogy introduced by Merton. Ü the effective issuance of put-options by the central bank. Ü Comparison: LITERATURE PROPOSAL HOLDER OF THE PUT OPTION THE BANKER THE DEPOSITOR WHO EXERCISES IT THE BANKER THE DEPOSITOR BANK’S ASSETS BANK-DEPOSIT UNDERLYING ASSET 7

Why the difference? Ü A deep secondary market is required. Ü Such a market is conceivable only if there is a large number of put-option holders. Ü If the bankers were the put-option holders, the market for these assets would be very shallow. Ü If the depositors were the put-option holders, the market would be deeper and more competitive. 8

Core of the proposal: Ü The central bank would issue put-options on bank-deposits. Ü Each put-option would be backed by the central bank’s promise to buy, to the option’s holder, and at face value, the holder’s deposits in some specific bank, up to some specific amount, in case that bank’s license were canceled. Ü The funds raised by the central bank by selling the put-options would be analogous to the funds raised by insurance companies as “premiums”. Depositors would pay higher prices for insuring their deposits in riskier banks. Ü Ü The depositor would pay a higher price - for the corresponding put option - when hedging the deposits of a high-risk bank, compared to the deposit-hedging of a low risk bank. 9

Advantages: Ü Avoidance of contagion-driven bank runs: instead of running , depositors would buy deposit-insurance. Ü The running “moral hazard” problem would be substantially reduced: each bank would internalize the effects of increasing the risk of its assets: Bank X’s risk Bank X’s PO price Bank X’s financial cost Ü The adverse selection problem would be solved: a low risk bank, paying low interest rates, would be competitive because the corresponding PO’s price would also be low. Ü Economic agents with inside-information would have incentives to trade on POs: Hence, they would reveal valuable information, through the POs prices, for both the financial markets and the Superintendency of Banks, regarding the financial soundness of each bank. 10

4. MAIN CHARACTERISTICS OF THE 5. PUT OPTIONS Ü Issuer: the central bank (no need to create a previous fund) Ü Underlying asset: bank deposits. Ü Notional value: face value of the insured bank deposits. Ü Holder: anyone, including insiders and non-depositors. Ü Exerciser: the legitimate holder of both the put option and the bank deposit. Ü Striking Price: face value of the underlying asset Ü Term: between ten and twenty years. 11

5. OPERATING CHARACTERISTICS Ü The central bank would sell the put-options in monthly, uniform-price auctions. Ü The notional value of a bank’s put-options would be a function of that bank’s outstanding deposits. Ü If one bank’s outstanding deposits diminished, the central bank would buy (rather than sell) put-options corresponding to that commercial bank, in a uniform-price auction. 12

6. THE FIRST ISSUE Ü The notional value of the first issue of POs would be equal to the total amount of bank deposits up to some specific date. Ü The Government would buy the entire issue to the central bank and would endow each depositor with put-options whose notional value would equal the face value of that depositor’s deposits. Ü The central bank of Guatemala would not legally allowed to directly endow the depositors with putoptions. 13

Purpose: Ü As the price of the put-option corresponding to each bank were revealed, there would be no “runs” on the riskier banks (“flight to quality”), since all deposits would be already insured. Ü The market for put-options would be deep right from its inception. Ü The subsequent issues would be sold at public auctions. Hence, the subsidy to the depositors would be bounded by the value of the first issue of put-options. 14

Pricing the First Issue of Put-Options: Ü The first issue of put-options would not be priced by the market (no auction). Ü How would the Government-Central Bank transaction be priced? Ü Two possible approaches: Ü Use Merton (1977) formula: Silvana Zimeri (2002) does this for the Guatemalan banks. Ü Use put-call parity condition: Castañeda, Herrera & Alvarado (2005) do this for the Guatemalan banks. 15

Problem (for both methodologies): Ü The analysis is strictly valid for European options only. Ü The POs proposed here would resemble American options rather than European ones. 16

7. CONCLUSION We propose a particular deposit insurance scheme: putoptions on bank-deposits, issued by the central bank. The purpose of this proposal is to minimize the probability of occurrence of bank runs and, at the same time, to provide the right incentives for both bankers and depositors regarding their risk-taking behavior. 17

Thank you for your attention. 18

a8162c86268aef638738c8d7c0efaecf.ppt