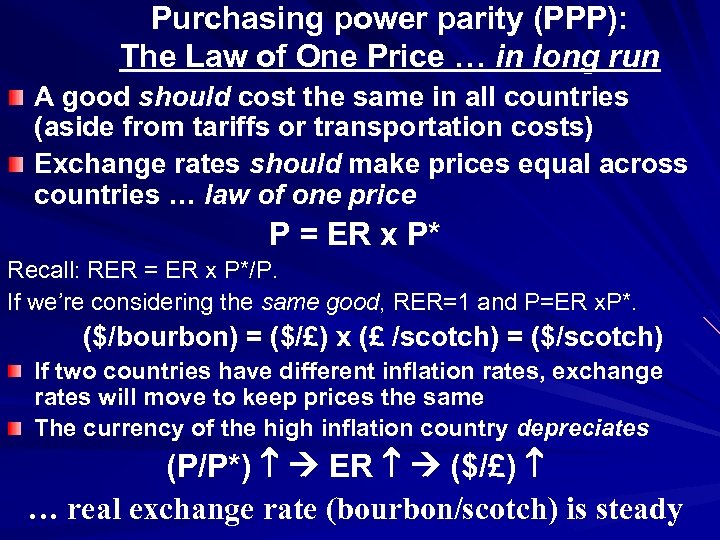

Purchasing power parity (PPP): The Law of One Price … in long run A good should cost the same in all countries (aside from tariffs or transportation costs) Exchange rates should make prices equal across countries … law of one price P = ER x P* Recall: RER = ER x P*/P. If we’re considering the same good, RER=1 and P=ER x. P*. ($/bourbon) = ($/£) x (£ /scotch) = ($/scotch) If two countries have different inflation rates, exchange rates will move to keep prices the same The currency of the high inflation country depreciates (P/P*) ER ($/£) … real exchange rate (bourbon/scotch) is steady

Purchasing power parity (PPP): The Law of One Price … in long run A good should cost the same in all countries (aside from tariffs or transportation costs) Exchange rates should make prices equal across countries … law of one price P = ER x P* Recall: RER = ER x P*/P. If we’re considering the same good, RER=1 and P=ER x. P*. ($/bourbon) = ($/£) x (£ /scotch) = ($/scotch) If two countries have different inflation rates, exchange rates will move to keep prices the same The currency of the high inflation country depreciates (P/P*) ER ($/£) … real exchange rate (bourbon/scotch) is steady

Parities you have known Uncovered interest rate parity: Ee = E (1+i)/(1+i*) Δ Ee/E = i – i* – A higher interest rate compensates for expected depreciation – If exchange rate truly fixed, i = i* Monetary Discipline Purchasing Power Parity: E = (RER) P/P* Δ Ee/E = π – π* – High inflation Currency depreciation – If exchange rate fixed, π – π* Price Discipline Wage Discipline

Parities you have known Uncovered interest rate parity: Ee = E (1+i)/(1+i*) Δ Ee/E = i – i* – A higher interest rate compensates for expected depreciation – If exchange rate truly fixed, i = i* Monetary Discipline Purchasing Power Parity: E = (RER) P/P* Δ Ee/E = π – π* – High inflation Currency depreciation – If exchange rate fixed, π – π* Price Discipline Wage Discipline

Something’s gotta give: Suppose demand for your country’s exports falls Floating rate system – Excess supply of your currency on foreign exchange market – Your currency depreciates – Your exports become more attractive – Your export industries aren’t hurt as badly as they would otherwise be – Your country’s terms of trade worsen Fixed rate system – Excess supply of your currency on foreign exchange market – Your currency can’t depreciate Your prices fall Your wages fall Your interest rate rises Your income falls – Demand for your currency increases – Your payments balance

Something’s gotta give: Suppose demand for your country’s exports falls Floating rate system – Excess supply of your currency on foreign exchange market – Your currency depreciates – Your exports become more attractive – Your export industries aren’t hurt as badly as they would otherwise be – Your country’s terms of trade worsen Fixed rate system – Excess supply of your currency on foreign exchange market – Your currency can’t depreciate Your prices fall Your wages fall Your interest rate rises Your income falls – Demand for your currency increases – Your payments balance

Gold Standard: The Mother of Fixed Rate Systems Money was either gold coin, currency backed by gold issued by central bank, or bank deposits backed by currency Each currency’s value was fixed in terms of gold, e. g. , 1 oz. of gold = $22 = £ 4. 27 $4. 86/ £ Gold could flow freely internationally – You could redeem your $ for gold, ship the gold to England (or France or wherever), and buy the local currency with the gold

Gold Standard: The Mother of Fixed Rate Systems Money was either gold coin, currency backed by gold issued by central bank, or bank deposits backed by currency Each currency’s value was fixed in terms of gold, e. g. , 1 oz. of gold = $22 = £ 4. 27 $4. 86/ £ Gold could flow freely internationally – You could redeem your $ for gold, ship the gold to England (or France or wherever), and buy the local currency with the gold

Gold Standard: Automatic Adjustment Mechanisms Humian Mechanism P … D$ … Bo. P Deficit … Gold Outflow … M … P Interest Rate Mechanism P … D$ … Bo. P Deficit Threatens … “Bank Rate” … Capital In Income Mechanism P … D$ … Bo. P Deficit Threatens … “Bank Rate” … I GDP Im Stabilizing Speculation: “Gold Points”

Gold Standard: Automatic Adjustment Mechanisms Humian Mechanism P … D$ … Bo. P Deficit … Gold Outflow … M … P Interest Rate Mechanism P … D$ … Bo. P Deficit Threatens … “Bank Rate” … Capital In Income Mechanism P … D$ … Bo. P Deficit Threatens … “Bank Rate” … I GDP Im Stabilizing Speculation: “Gold Points”

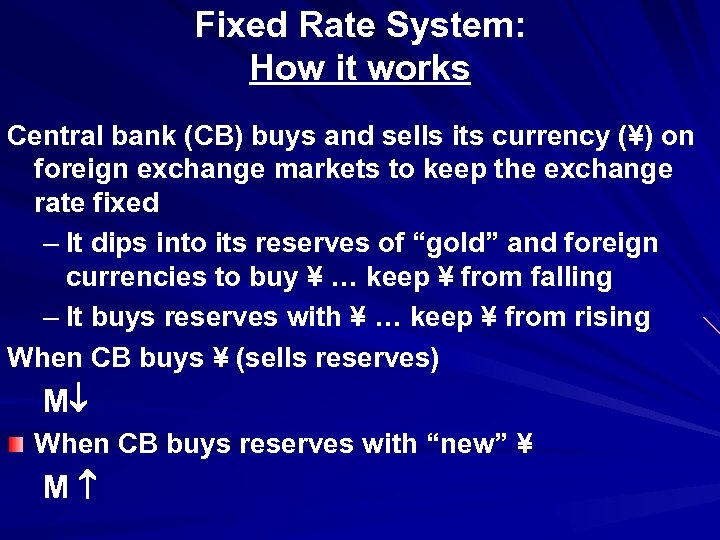

Fixed Rate System: How it works Central bank (CB) buys and sells its currency (¥) on foreign exchange markets to keep the exchange rate fixed – It dips into its reserves of “gold” and foreign currencies to buy ¥ … keep ¥ from falling – It buys reserves with ¥ … keep ¥ from rising When CB buys ¥ (sells reserves) M When CB buys reserves with “new” ¥ M

Fixed Rate System: How it works Central bank (CB) buys and sells its currency (¥) on foreign exchange markets to keep the exchange rate fixed – It dips into its reserves of “gold” and foreign currencies to buy ¥ … keep ¥ from falling – It buys reserves with ¥ … keep ¥ from rising When CB buys ¥ (sells reserves) M When CB buys reserves with “new” ¥ M

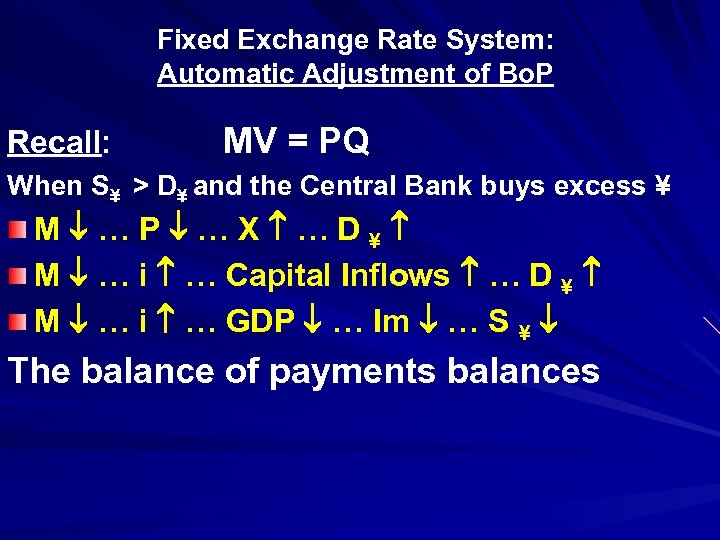

Fixed Exchange Rate System: Automatic Adjustment of Bo. P Recall: MV = PQ When S¥ > D¥ and the Central Bank buys excess ¥ M …P …X …D¥ M … i … Capital Inflows … D ¥ M … i … GDP … Im … S ¥ The balance of payments balances

Fixed Exchange Rate System: Automatic Adjustment of Bo. P Recall: MV = PQ When S¥ > D¥ and the Central Bank buys excess ¥ M …P …X …D¥ M … i … Capital Inflows … D ¥ M … i … GDP … Im … S ¥ The balance of payments balances

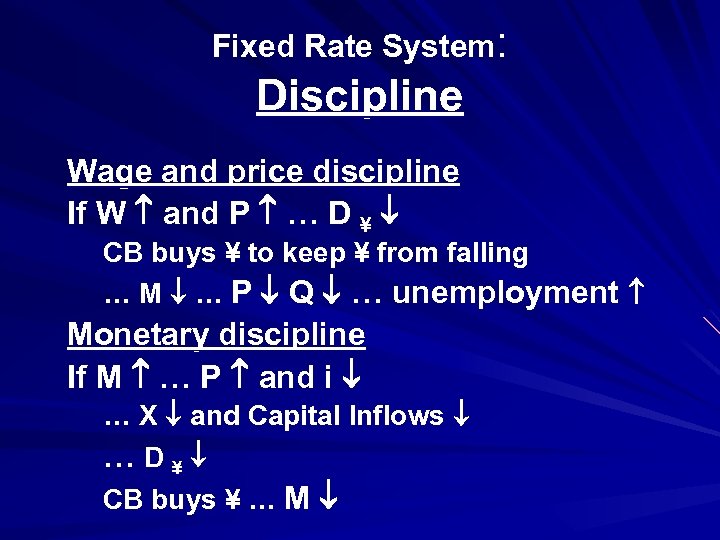

Fixed Rate System: Discipline Wage and price discipline If W and P … D ¥ CB buys ¥ to keep ¥ from falling … M … P Q … unemployment Monetary discipline If M … P and i … X and Capital Inflows …D¥ CB buys ¥ … M

Fixed Rate System: Discipline Wage and price discipline If W and P … D ¥ CB buys ¥ to keep ¥ from falling … M … P Q … unemployment Monetary discipline If M … P and i … X and Capital Inflows …D¥ CB buys ¥ … M