30bebb9d3a0f221850b41cdef7d33cb7.ppt

- Количество слайдов: 57

Public Power Corporation SA PPC’s Strategic Priorities November 21, 2007

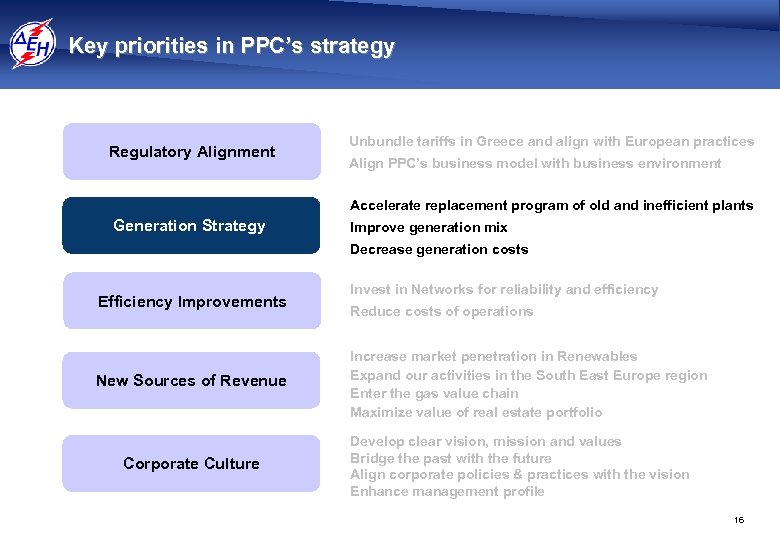

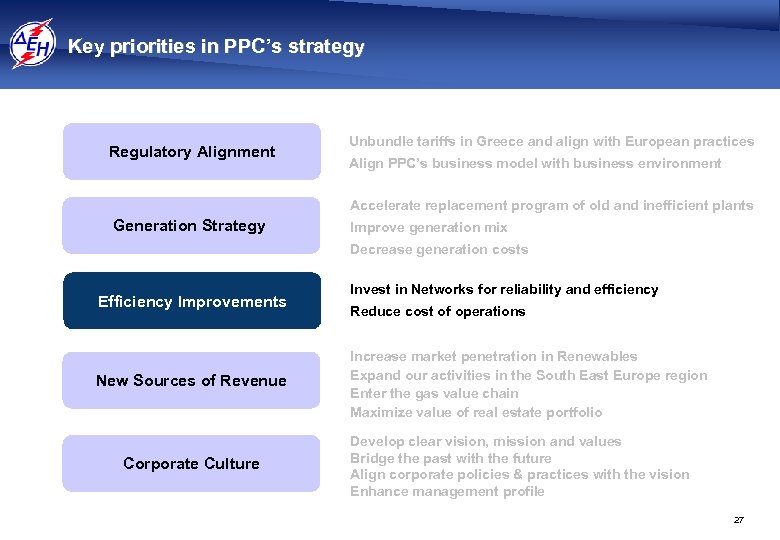

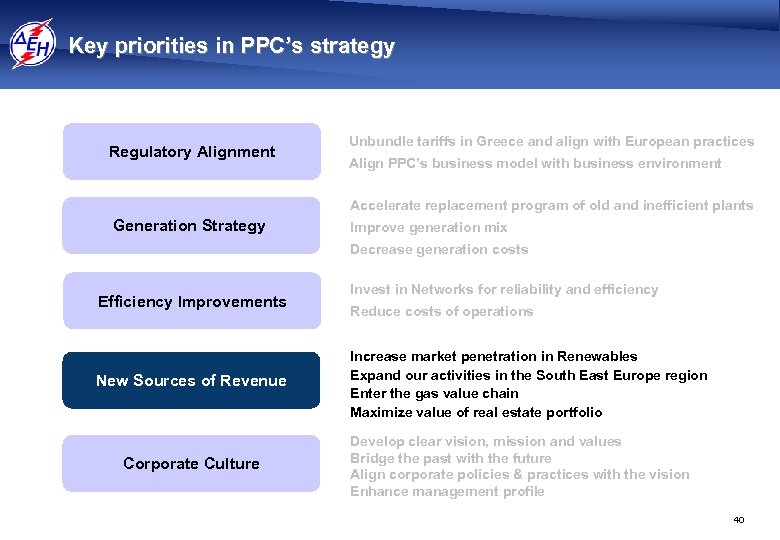

There are five key priorities in PPC’s strategy Regulatory Alignment Generation Strategy Efficiency Improvements New Sources of Revenue Corporate Culture 1

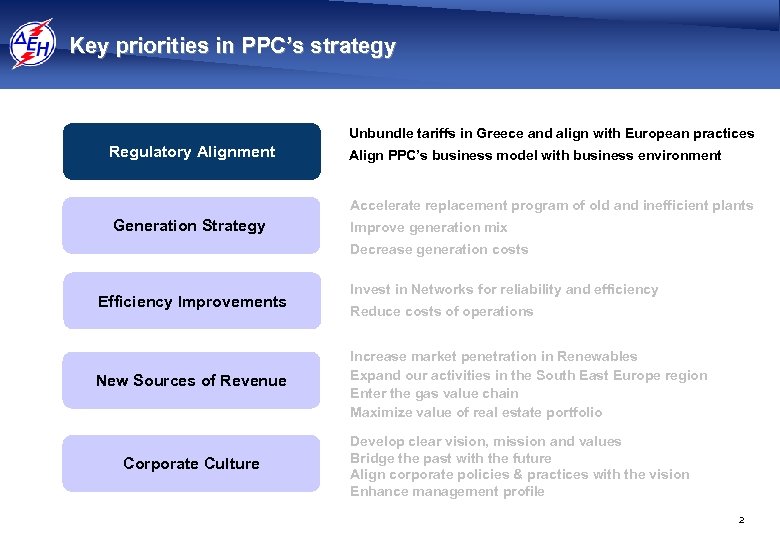

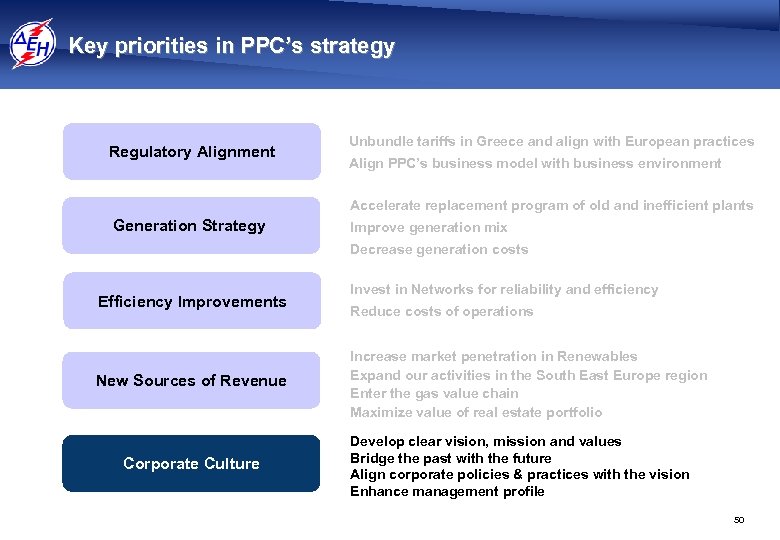

Key priorities in PPC’s strategy 4 Unbundle tariffs in Greece and align with European practices Regulatory Alignment 4 Align PPC’s business model with business environment 4 Accelerate replacement program of old and inefficient plants Generation Strategy 4 Improve generation mix 4 Decrease generation costs Efficiency Improvements New Sources of Revenue Corporate Culture 4 Invest in Networks for reliability and efficiency 4 Reduce costs of operations 4 Increase market penetration in Renewables 4 Expand our activities in the South East Europe region 4 Enter the gas value chain 4 Maximize value of real estate portfolio 4 Develop clear vision, mission and values 4 Bridge the past with the future 4 Align corporate policies & practices with the vision 4 Enhance management profile 2

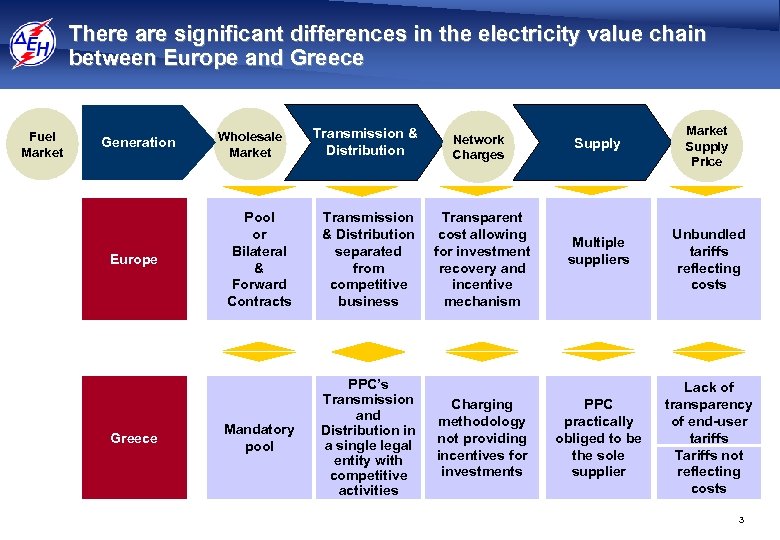

There are significant differences in the electricity value chain between Europe and Greece Fuel Market Generation Europe Greece Transmission & Distribution Network Charges Pool or Bilateral & Forward Contracts Transmission & Distribution separated from competitive business Transparent cost allowing for investment recovery and incentive mechanism Mandatory pool PPC’s Transmission and Distribution in a single legal entity with competitive activities Wholesale Market Charging methodology not providing incentives for investments Supply Multiple suppliers PPC practically obliged to be the sole supplier Market Supply Price Unbundled tariffs reflecting costs Lack of transparency of end-user tariffs Tariffs not reflecting costs 3

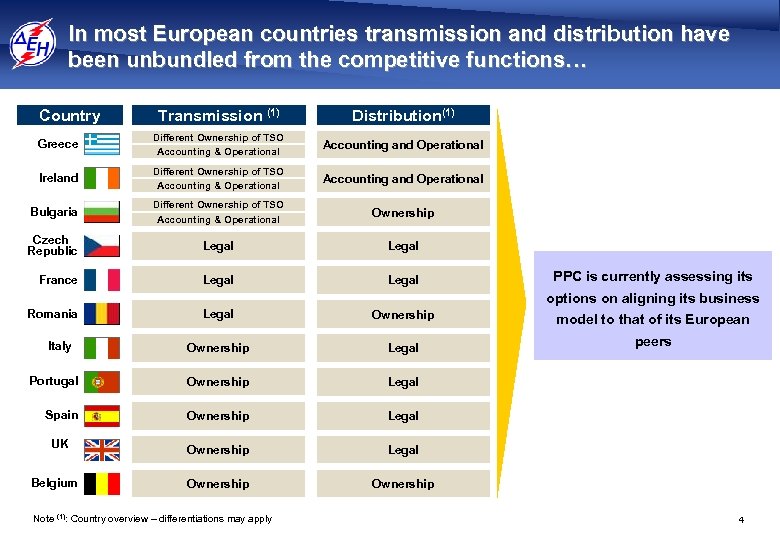

In most European countries transmission and distribution have been unbundled from the competitive functions… Country Transmission (1) Distribution(1) Greece Different Ownership of TSO Accounting & Operational Accounting and Operational Ireland Different Ownership of TSO Accounting & Operational Accounting and Operational Bulgaria Different Ownership of TSO Accounting & Operational Ownership Czech Republic Legal France Legal PPC is currently assessing its options on aligning its business Romania Legal Ownership Legal Portugal Ownership Legal Spain Ownership Legal Ownership Italy UK Belgium Note (1): Country overview – differentiations may apply model to that of its European peers 4

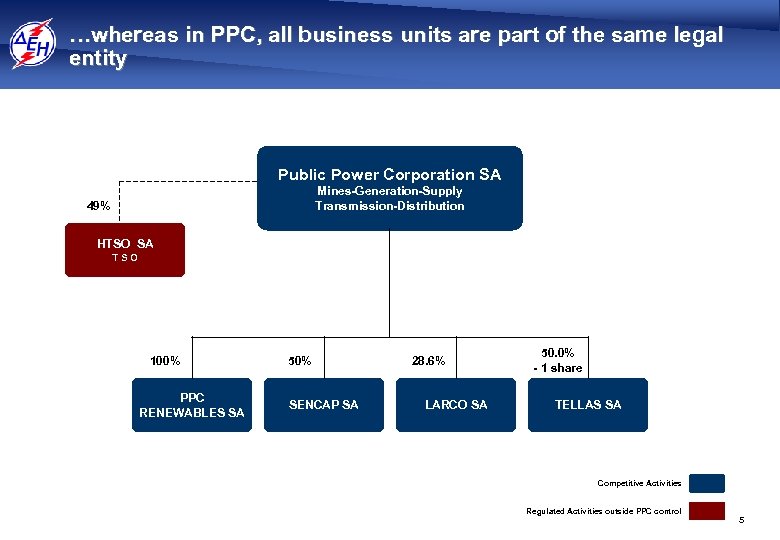

…whereas in PPC, all business units are part of the same legal entity Public Power Corporation SA Mines-Generation-Supply Transmission-Distribution 49% HTSO SA TSO 100% PPC RENEWABLES SA 50% SENCAP SA 28. 6% LARCO SA 50. 0% - 1 share TELLAS SA Competitive Activities Regulated Activities outside PPC control 5

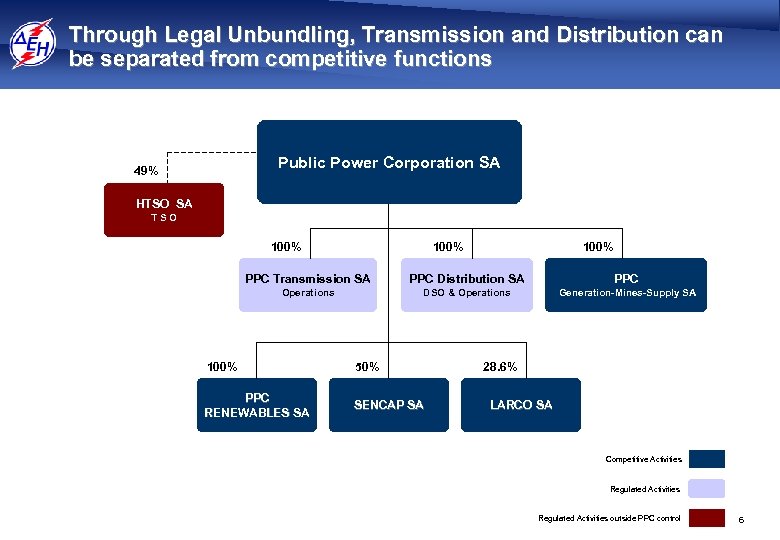

Through Legal Unbundling, Transmission and Distribution can be separated from competitive functions Public Power Corporation SA 49% HTSO SA TSO 100% PPC Transmission SA PPC Distribution SA PPC Operations DSO & Operations Generation-Mines-Supply SA 100% 50% PPC RENEWABLES SA SENCAP SA 28. 6% LARCO SA Competitive Activities Regulated Activities outside PPC control 6

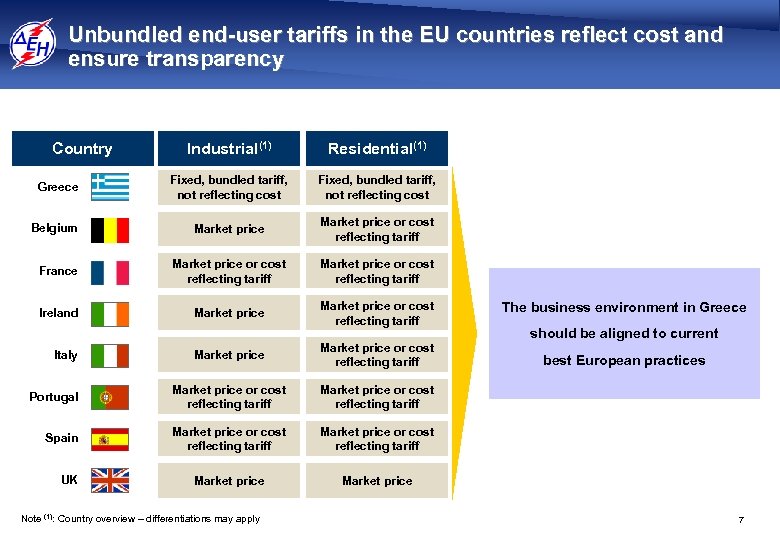

Unbundled end-user tariffs in the EU countries reflect cost and ensure transparency Country Industrial(1) Residential(1) Greece Fixed, bundled tariff, not reflecting cost Belgium Market price or cost reflecting tariff France Market price or cost reflecting tariff Ireland Market price or cost reflecting tariff Portugal Market price or cost reflecting tariff Market price should be aligned to current Market price or cost reflecting tariff Spain The business environment in Greece Market price Italy UK Note (1): Country overview – differentiations may apply best European practices 7

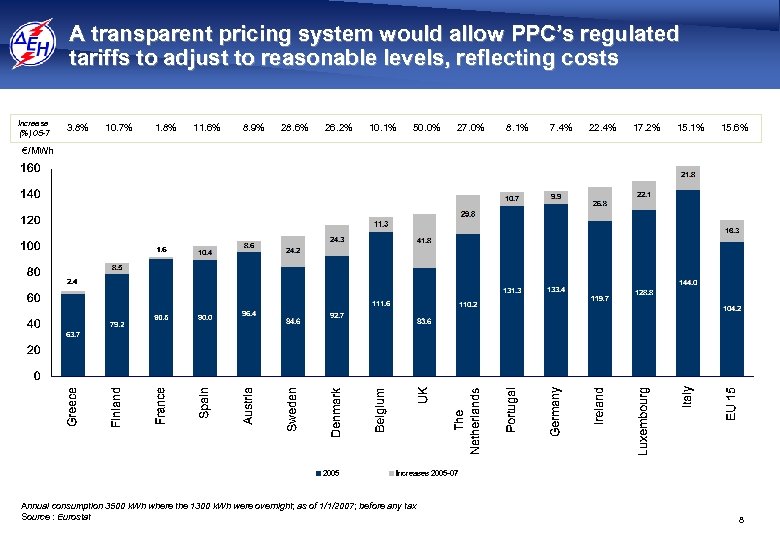

A transparent pricing system would allow PPC’s regulated tariffs to adjust to reasonable levels, reflecting costs Increase (%) 05 -7 3. 8% 10. 7% 1. 8% 11. 6% 8. 9% 28. 6% 26. 2% 10. 1% 50. 0% 27. 0% 8. 1% 7. 4% 22. 4% 17. 2% 15. 1% 15. 6% €/ΜWh Annual consumption 3500 k. Wh where the 1300 k. Wh were overnight; as of 1/1/2007; before any tax Source : Eurostat 8

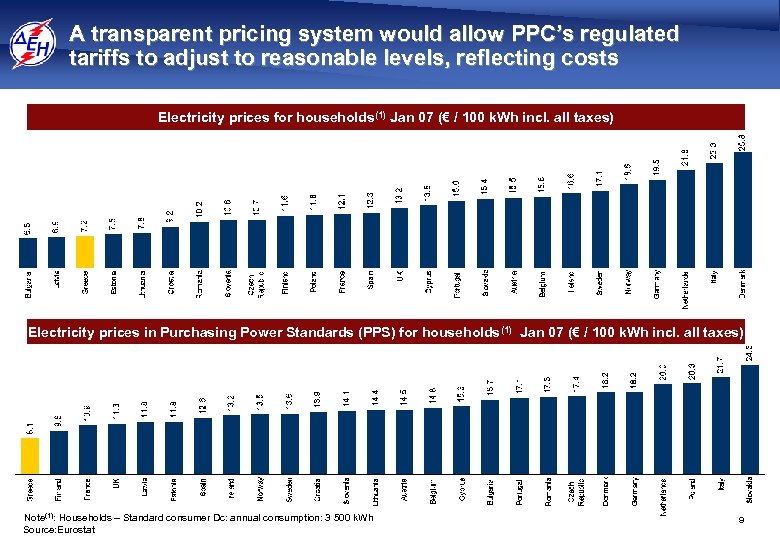

A transparent pricing system would allow PPC’s regulated tariffs to adjust to reasonable levels, reflecting costs Electricity prices for households(1) Jan 07 (€ / 100 k. Wh incl. all taxes) Electricity prices in Purchasing Power Standards (PPS) for households (1) Jan 07 (€ / 100 k. Wh incl. all taxes) Note(1): Households – Standard consumer Dc: annual consumption: 3 500 k. Wh Source: Eurostat 9

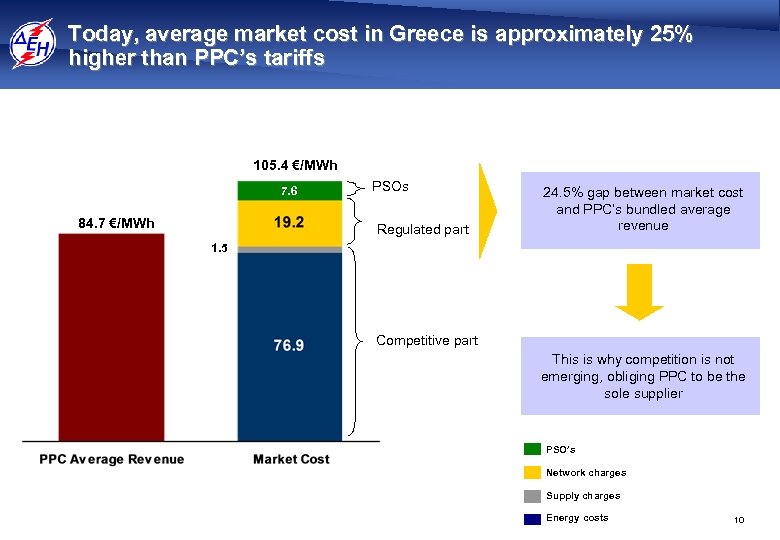

Today, average market cost in Greece is approximately 25% higher than PPC’s tariffs 105. 4 €/MWh 7. 6 84. 7 €/MWh PSOs Regulated part 24. 5% gap between market cost and PPC’s bundled average revenue 1. 5 Competitive part This is why competition is not emerging, obliging PPC to be the sole supplier PSO’s Network charges Supply charges Energy costs 10

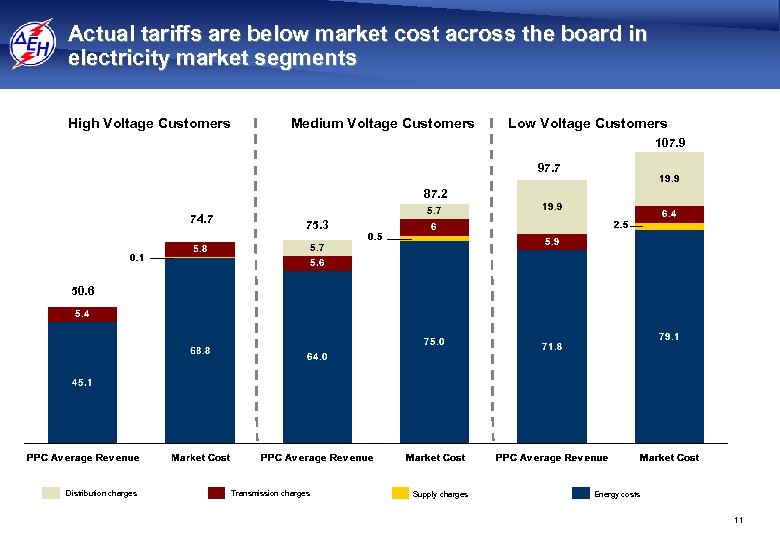

Actual tariffs are below market cost across the board in electricity market segments High Voltage Customers Medium Voltage Customers Low Voltage Customers 107. 9 97. 7 87. 2 74. 7 75. 3 50. 6 Distribution charges Transmission charges Supply charges Energy costs 11

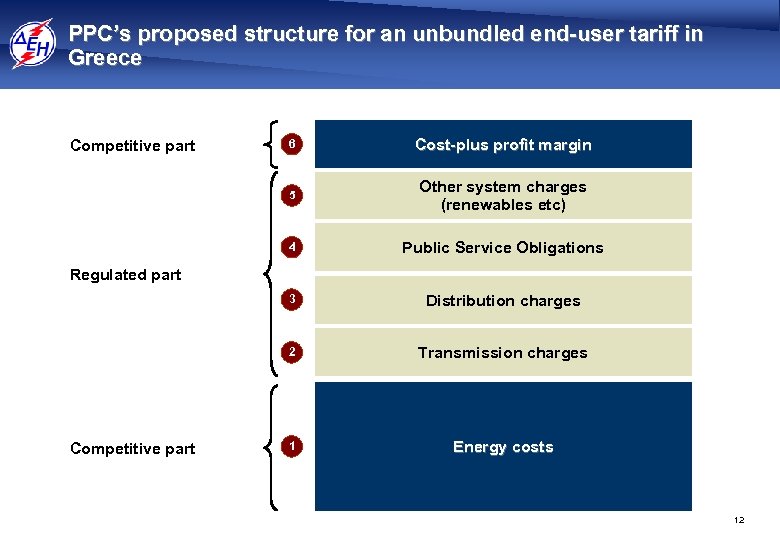

PPC’s proposed structure for an unbundled end-user tariff in Greece 6 Cost-plus profit margin 5 Other system charges (renewables etc) 4 Public Service Obligations 3 Distribution charges 2 Competitive part Transmission charges 1 Energy costs Regulated part Competitive part 12

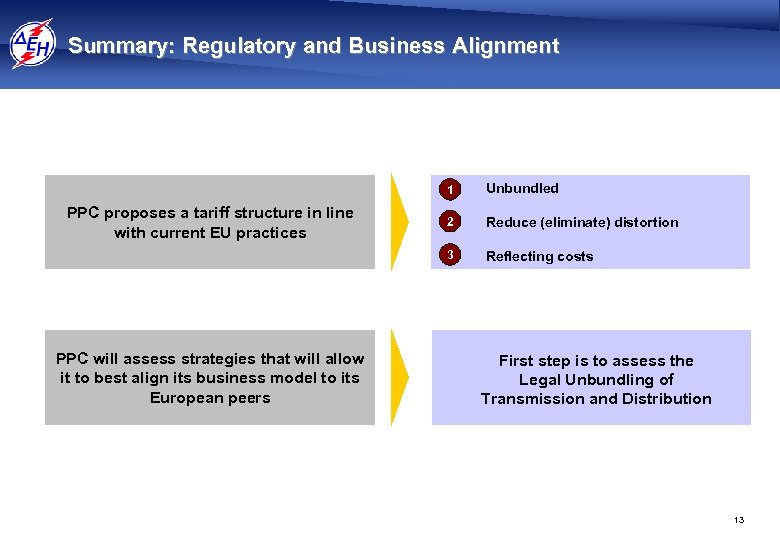

Summary: Regulatory and Business Alignment 1 PPC will assess strategies that will allow it to best align its business model to its European peers 2 Reduce (eliminate) distortion 3 PPC proposes a tariff structure in line with current EU practices Unbundled Reflecting costs First step is to assess the Legal Unbundling of Transmission and Distribution 13

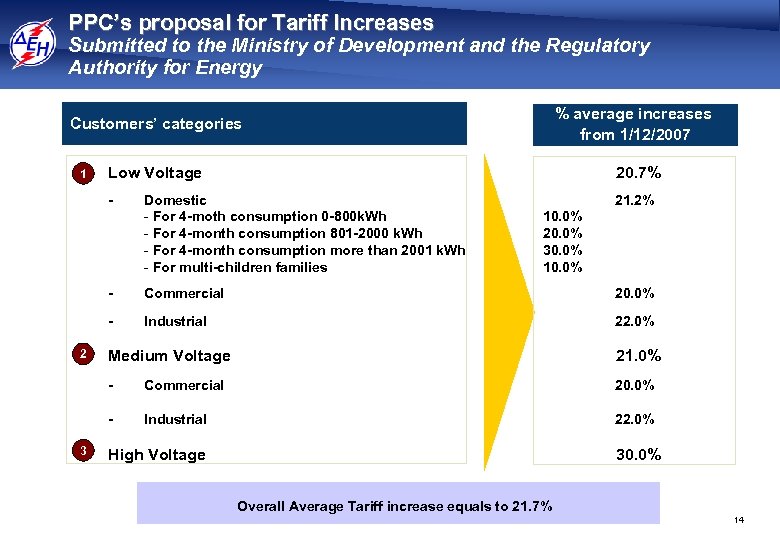

PPC’s proposal for Tariff Increases Submitted to the Ministry of Development and the Regulatory Authority for Energy % average increases from 1/12/2007 Customers’ categories Low Voltage 20. 7% - 1 21. 2% Domestic - For 4 -moth consumption 0 -800 k. Wh - For 4 -month consumption 801 -2000 k. Wh - For 4 -month consumption more than 2001 k. Wh - For multi-children families 10. 0% 20. 0% 30. 0% 10. 0% - Commercial 20. 0% - Industrial 22. 0% 21. 0% Commercial 20. 0% 3 Medium Voltage - 2 Industrial 22. 0% High Voltage 30. 0% Overall Average Tariff increase equals to 21. 7% 14

PPC has also proposed The introduction of an appropriate Fuel Clause to reflect International Fuel Prices Volatility in Electricity Prices 15

Key priorities in PPC’s strategy Regulatory Alignment 4 Unbundle tariffs in Greece and align with European practices 4 Align PPC’s business model with business environment 4 Accelerate replacement program of old and inefficient plants Generation Strategy 4 Improve generation mix 4 Decrease generation costs Efficiency Improvements New Sources of Revenue Corporate Culture 4 Invest in Networks for reliability and efficiency 4 Reduce costs of operations 4 Increase market penetration in Renewables 4 Expand our activities in the South East Europe region 4 Enter the gas value chain 4 Maximize value of real estate portfolio 4 Develop clear vision, mission and values 4 Bridge the past with the future 4 Align corporate policies & practices with the vision 4 Enhance management profile 16

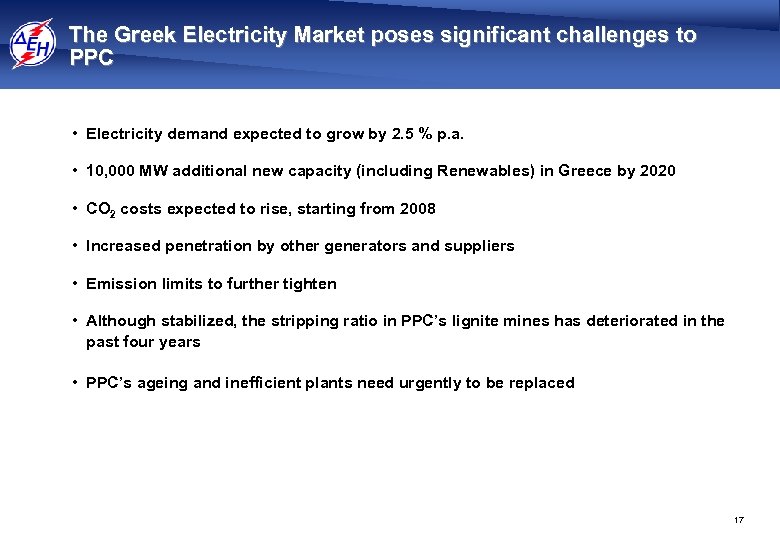

The Greek Electricity Market poses significant challenges to PPC • Electricity demand expected to grow by 2. 5 % p. a. • 10, 000 MW additional new capacity (including Renewables) in Greece by 2020 • CO 2 costs expected to rise, starting from 2008 • Increased penetration by other generators and suppliers • Emission limits to further tighten • Although stabilized, the stripping ratio in PPC’s lignite mines has deteriorated in the past four years • PPC’s ageing and inefficient plants need urgently to be replaced 17

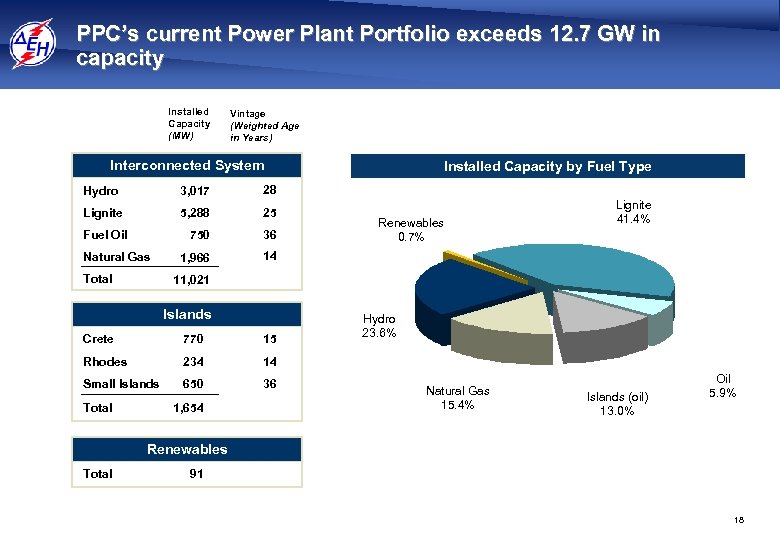

PPC’s current Power Plant Portfolio exceeds 12. 7 GW in capacity Installed Capacity (MW) Vintage (Weighted Age in Years) Interconnected System Hydro 3, 017 28 Lignite 5, 288 25 750 36 1, 966 Installed Capacity by Fuel Type 14 Fuel Oil Natural Gas Total Renewables 0. 7% Lignite 41. 4% 11, 021 Islands Crete 770 15 Rhodes 234 14 Small Islands 650 36 Hydro 23. 6% Total 1, 654 Natural Gas 15. 4% Islands (oil) 13. 0% Oil 5. 9% Renewables Total 91 18

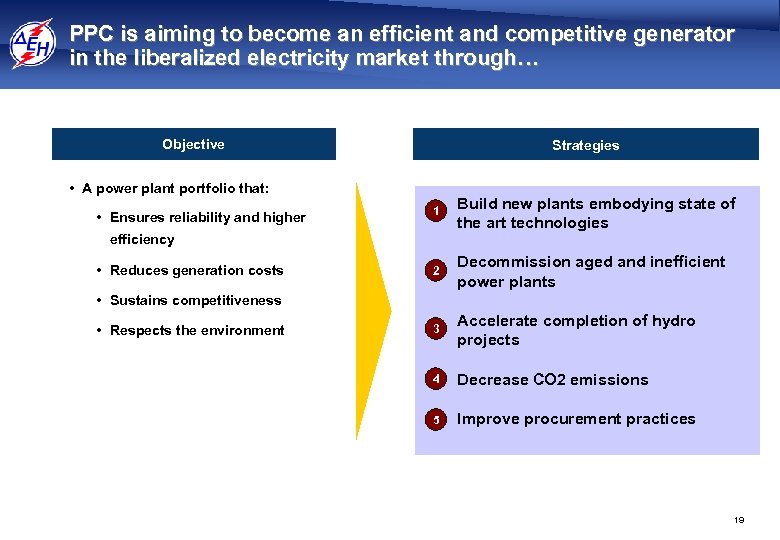

PPC is aiming to become an efficient and competitive generator in the liberalized electricity market through… Objective Strategies • A power plant portfolio that: • Ensures reliability and higher 1 Build new plants embodying state of the art technologies 2 Decommission aged and inefficient power plants 3 Accelerate completion of hydro projects 4 Decrease CO 2 emissions 5 Improve procurement practices efficiency • Reduces generation costs • Sustains competitiveness • Respects the environment 19

…decommissioning old and inefficient plants Old and inefficient plants Power Station Fuel Capacity (MW) Commissioning year Ptolemais I, III Lignite 320 1959 -65 Ptolemais IV Lignite 300 1973 LIPTOL I, II Lignite 43 1959 -65 Megalopolis I, II Lignite 250 1970 Lavrio III Natural gas 180 1980 Aghios Georgios VIII Natural gas 160 1968 Aghios Georgios IX Natural gas 200 1971 Lavrio I, II HFO 450 1972 -73 Aliveri III, IV HFO 300 1968 -69 Cyclades Islands Diesel and HFO 200 various 20

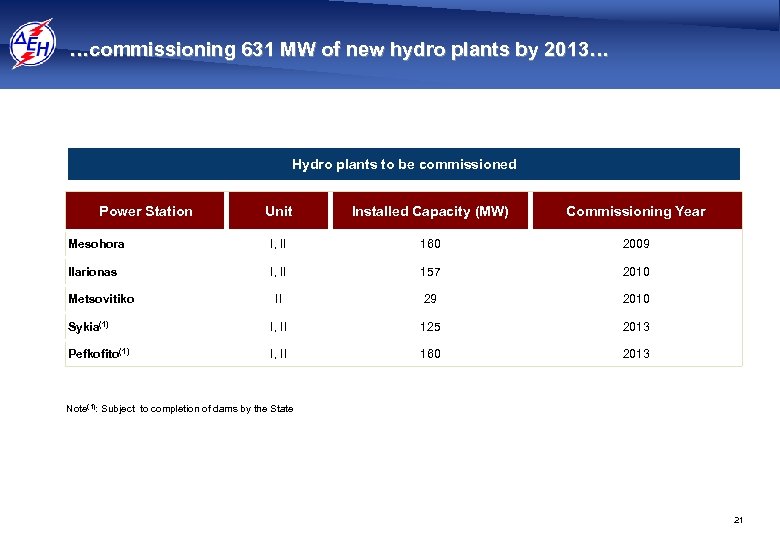

…commissioning 631 MW of new hydro plants by 2013… Hydro plants to be commissioned Power Station Unit Installed Capacity (MW) Commissioning Year Mesohora I, II 160 2009 Ilarionas I, II 157 2010 II 29 2010 Sykia(1) I, ΙΙ 125 2013 Pefkofito(1) I, ΙΙ 160 2013 Metsovitiko Note(1): Subject to completion of dams by the State 21

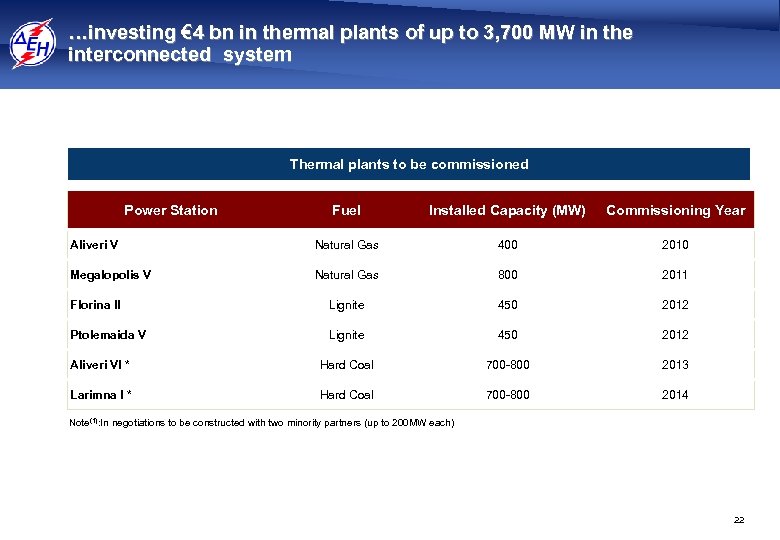

…investing € 4 bn in thermal plants of up to 3, 700 MW in the interconnected system Thermal plants to be commissioned Power Station Fuel Installed Capacity (MW) Commissioning Year Aliveri V Natural Gas 400 2010 Megalopolis V Natural Gas 800 2011 Florina II Lignite 450 2012 Ptolemaida V Lignite 450 2012 Aliveri VI * Hard Coal 700 -800 2013 Larimna I * Hard Coal 700 -800 2014 Note(1): In negotiations to be constructed with two minority partners (up to 200 MW each) 22

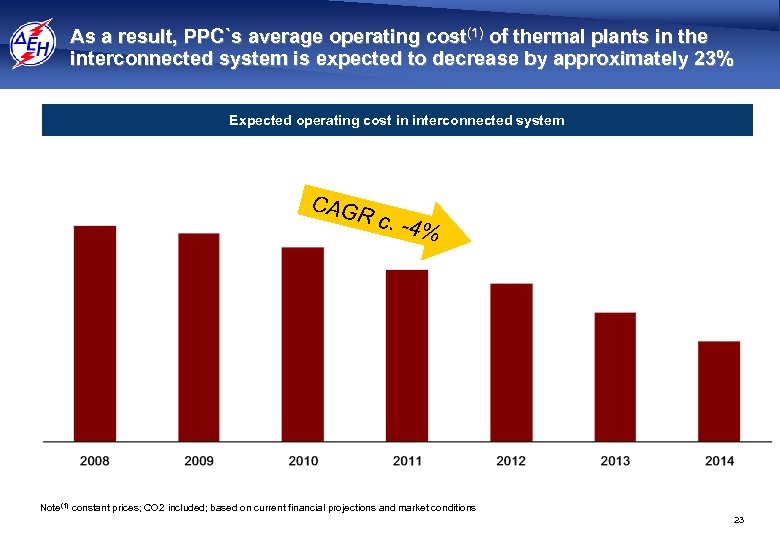

As a result, PPC`s average operating cost(1) of thermal plants in the interconnected system is expected to decrease by approximately 23% Expected operating cost in interconnected system CAG R c. - 4% Note(1) constant prices; CO 2 included; based on current financial projections and market conditions 23

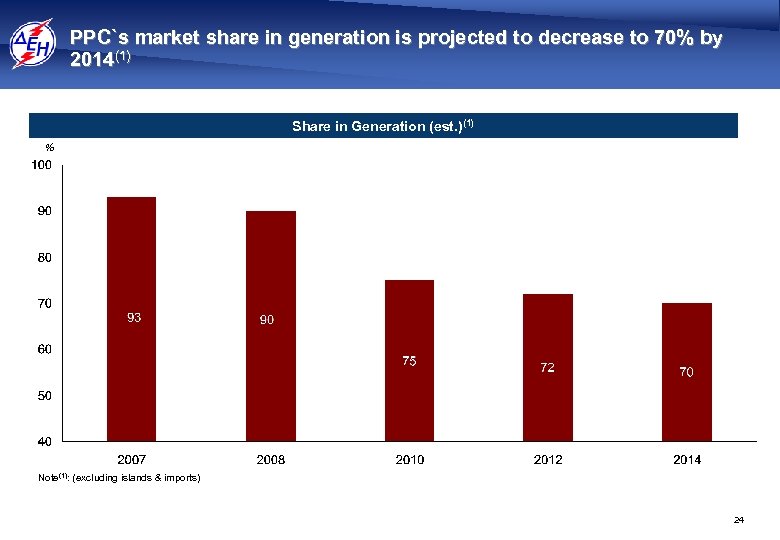

PPC`s market share in generation is projected to decrease to 70% by 2014(1) Share in Generation (est. )(1) % Note(1): (excluding islands & imports) 24

Generation costs in the islands are expected to drop significantly via investments of € 1. 3 bn • Shift from oil-fired to gas-fired generation in Crete after 2012 to decrease operating costs over 35% (over € 150 m p. a. in today’s prices) • 120 MW oil-fired generation plant in Rhodes by 2011 • 120 MW oil-fired generation plant in Lesvos by 2012 • Cyclades connection with mainland grid by 2012 • A total of 180 MW units to be installed in various small islands • Total generation investments in islands € 1. 3 bn 25

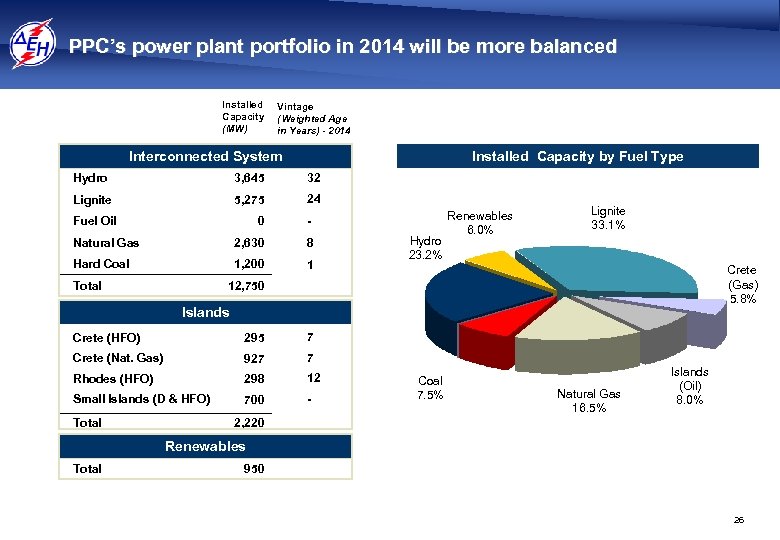

PPC’s power plant portfolio in 2014 will be more balanced Installed Capacity (MW) Vintage (Weighted Age in Years) - 2014 Installed Capacity by Fuel Type Interconnected System Hydro 3, 645 32 Lignite 5, 275 24 Fuel Oil 0 - Natural Gas 2, 630 8 Hard Coal 1, 200 1 Total Hydro 23. 2% Renewables 6. 0% Lignite 33. 1% Crete (Gas) 5. 8% 12, 750 Islands Crete (HFO) 295 7 Crete (Nat. Gas) 927 7 Rhodes (HFO) 298 12 Small Islands (D & HFO) 700 - Total Coal 7. 5% Natural Gas 16. 5% Islands (Oil) 8. 0% 2, 220 Renewables Total 950 26

Key priorities in PPC’s strategy Regulatory Alignment 4 Unbundle tariffs in Greece and align with European practices 4 Align PPC’s business model with business environment 4 Accelerate replacement program of old and inefficient plants Generation Strategy 4 Improve generation mix 4 Decrease generation costs Efficiency Improvements New Sources of Revenue Corporate Culture 4 Invest in Networks for reliability and efficiency 4 Reduce cost of operations 4 Increase market penetration in Renewables 4 Expand our activities in the South East Europe region 4 Enter the gas value chain 4 Maximize value of real estate portfolio 4 Develop clear vision, mission and values 4 Bridge the past with the future 4 Align corporate policies & practices with the vision 4 Enhance management profile 27

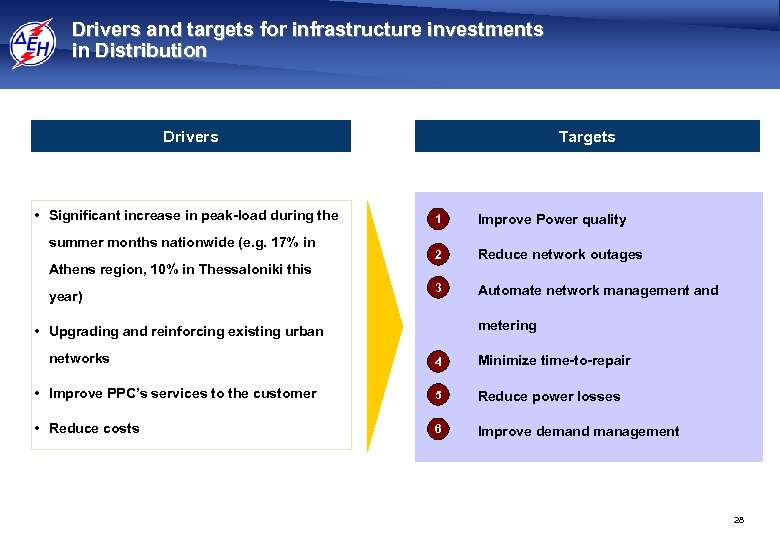

Drivers and targets for infrastructure investments in Distribution Drivers • Significant increase in peak-load during the summer months nationwide (e. g. 17% in Athens region, 10% in Thessaloniki this year) Targets 1 Improve Power quality 2 Reduce network outages 3 Automate network management and metering • Upgrading and reinforcing existing urban networks 4 Minimize time-to-repair • Improve PPC’s services to the customer 5 Reduce power losses • Reduce costs 6 Improve demand management 28

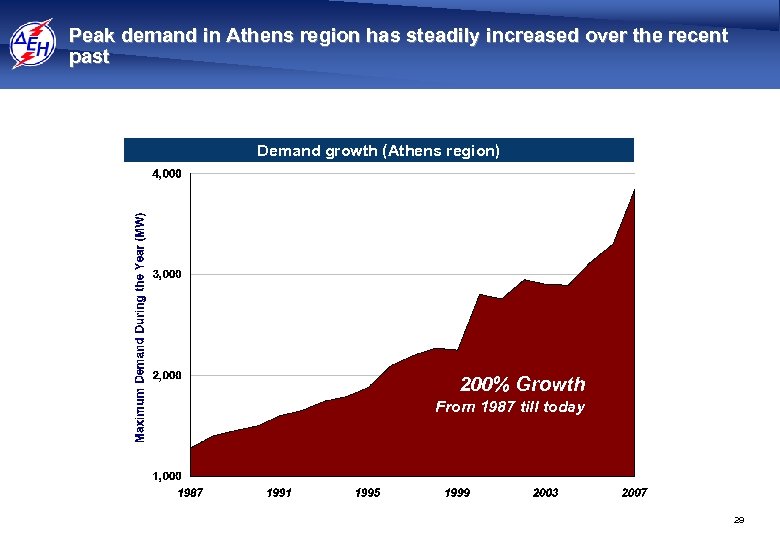

Peak demand in Athens region has steadily increased over the recent past Demand growth (Athens region) 200% Growth From 1987 till today 29

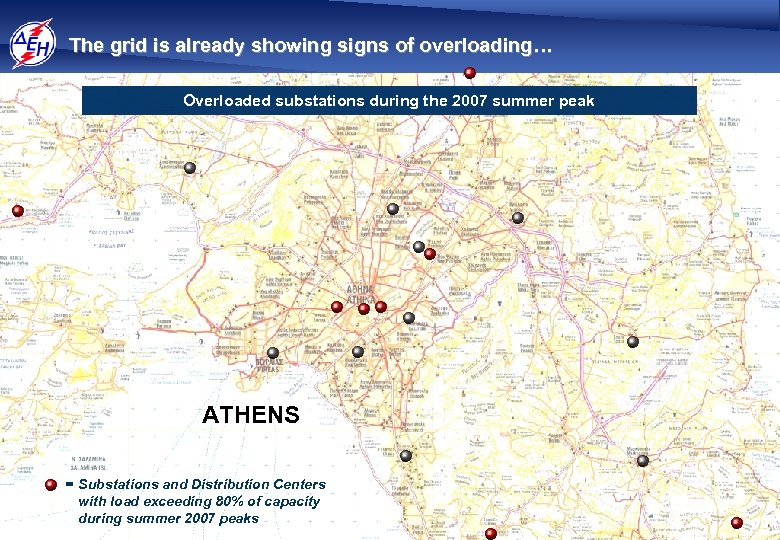

The grid is already showing signs of overloading… Overloaded substations during the 2007 summer peak ATHENS = Substations and Distribution Centers with load exceeding 80% of capacity during summer 2007 peaks 30

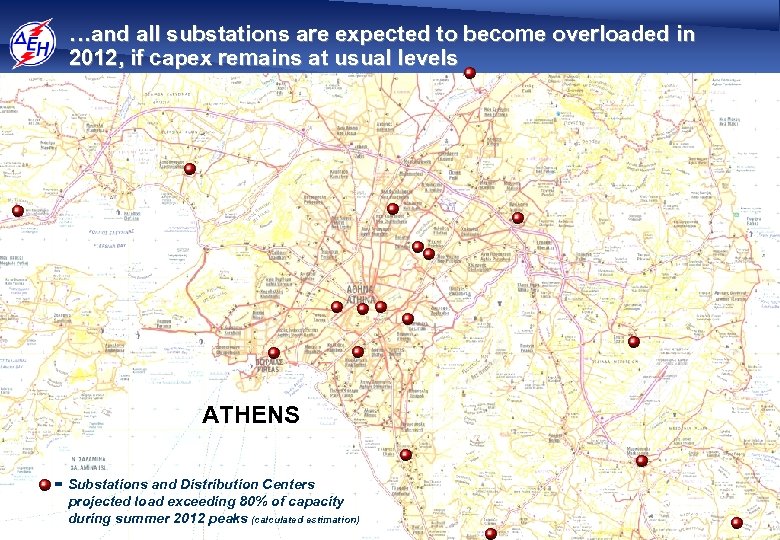

…and all substations are expected to become overloaded in 2012, if capex remains at usual levels ATHENS = Substations and Distribution Centers projected load exceeding 80% of capacity during summer 2012 peaks (calculated estimation) 31

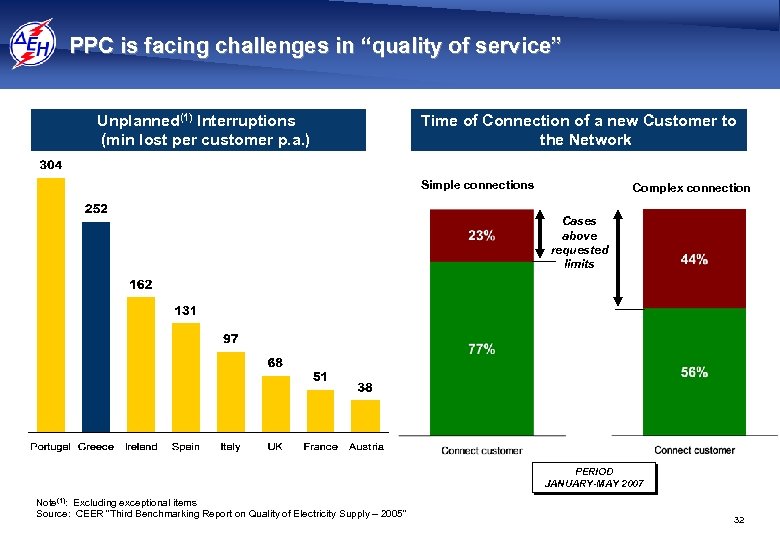

PPC is facing challenges in “quality of service” Unplanned(1) Interruptions (min lost per customer p. a. ) Time of Connection of a new Customer to the Network Simple connections Complex connection Cases above requested limits PERIOD JANUARY-MAY 2007 Note(1): Excluding exceptional items Source: CEER “Third Benchmarking Report on Quality of Electricity Supply – 2005” 32

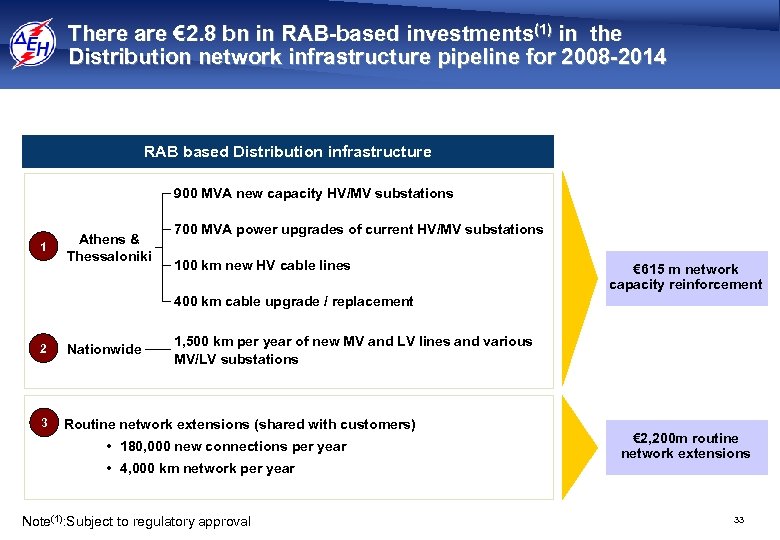

There are € 2. 8 bn in RAB-based investments(1) in the Distribution network infrastructure pipeline for 2008 -2014 RAB based Distribution infrastructure 900 MVA new capacity HV/MV substations 1 Athens & Thessaloniki 700 MVA power upgrades of current HV/MV substations 100 km new HV cable lines € 615 m network capacity reinforcement 400 km cable upgrade / replacement 1, 500 km per year of new MV and LV lines and various MV/LV substations 2 Nationwide 3 Routine network extensions (shared with customers) • 180, 000 new connections per year • 4, 000 km network per year Note(1): Subject to regulatory approval € 2, 200 m routine network extensions 33

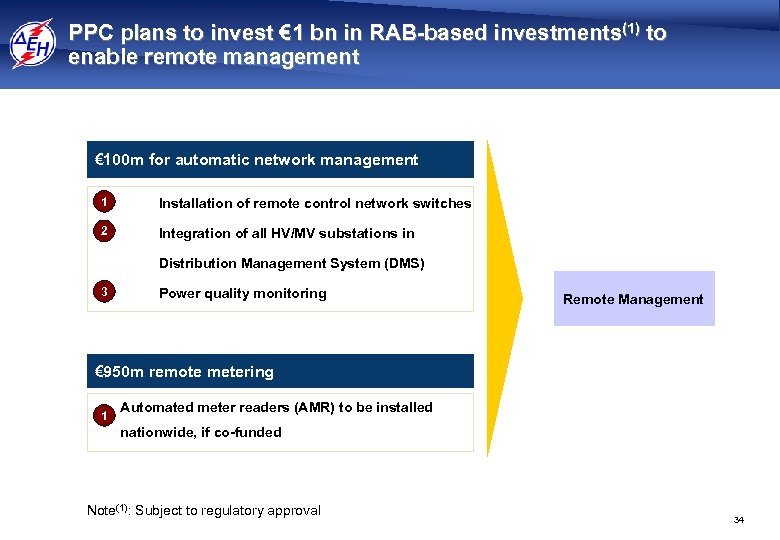

PPC plans to invest € 1 bn in RAB-based investments(1) to enable remote management € 100 m for automatic network management 1 Installation of remote control network switches 2 Integration of all HV/MV substations in Distribution Management System (DMS) 3 Power quality monitoring Remote Management € 950 m remote metering 1 Automated meter readers (AMR) to be installed nationwide, if co-funded Note(1): Subject to regulatory approval 34

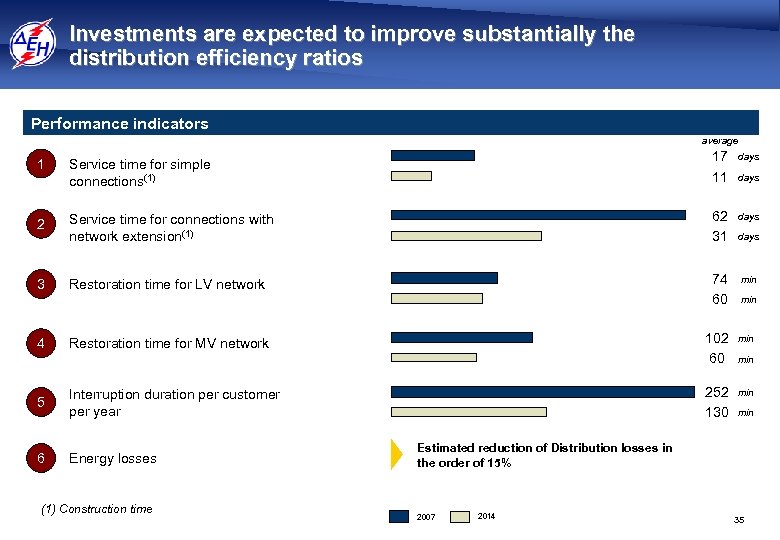

Investments are expected to improve substantially the distribution efficiency ratios Performance indicators average Service time for simple connections(1) 17 11 days 2 Service time for connections with network extension(1) 62 31 days 3 Restoration time for LV network 74 60 min 102 60 min 252 130 min 1 4 Restoration time for MV network 5 Interruption duration per customer per year 6 Energy losses (1) Construction time days min min Estimated reduction of Distribution losses in the order of 15% 2007 2014 35

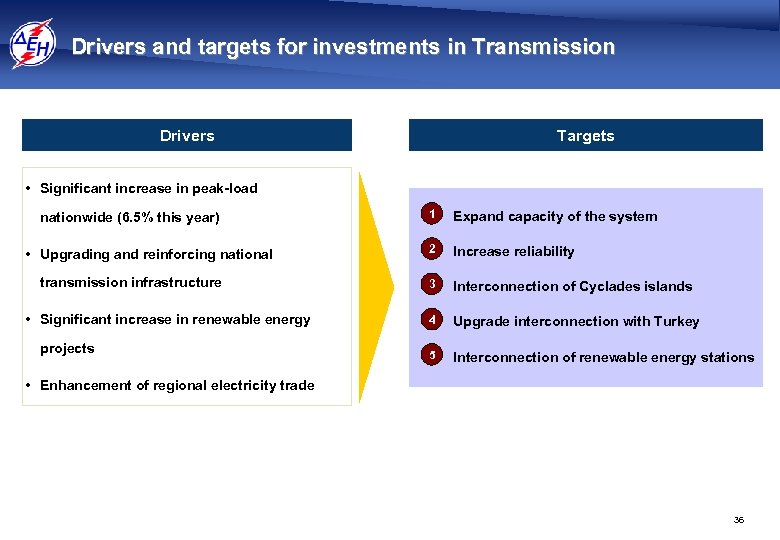

Drivers and targets for investments in Transmission Drivers Targets • Significant increase in peak-load nationwide (6. 5% this year) • Upgrading and reinforcing national transmission infrastructure • Significant increase in renewable energy projects 1 Expand capacity of the system 2 Increase reliability 3 Interconnection of Cyclades islands 4 Upgrade interconnection with Turkey 5 Interconnection of renewable energy stations • Enhancement of regional electricity trade 36

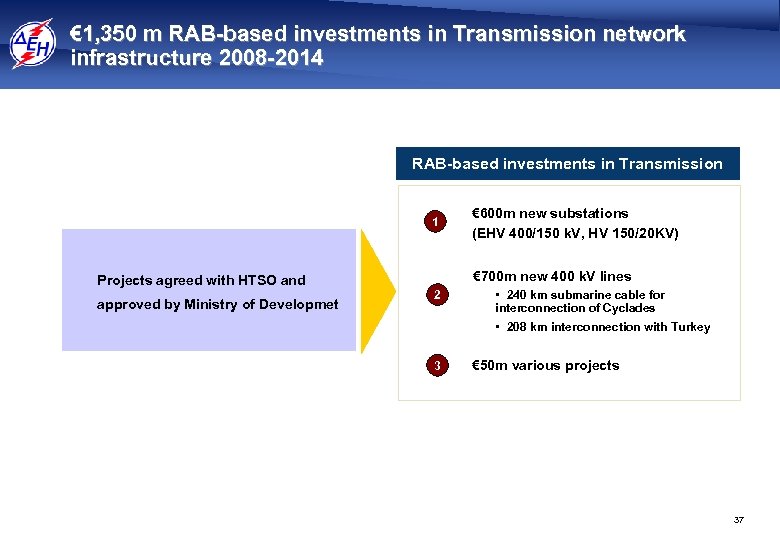

€ 1, 350 m RAB-based investments in Transmission network infrastructure 2008 -2014 RAB-based investments in Transmission 1 Projects agreed with HTSO and approved by Ministry of Developmet € 600 m new substations (EHV 400/150 k. V, HV 150/20 KV) € 700 m new 400 k. V lines 2 3 • 240 km submarine cable for interconnection of Cyclades • 208 km interconnection with Turkey € 50 m various projects 37

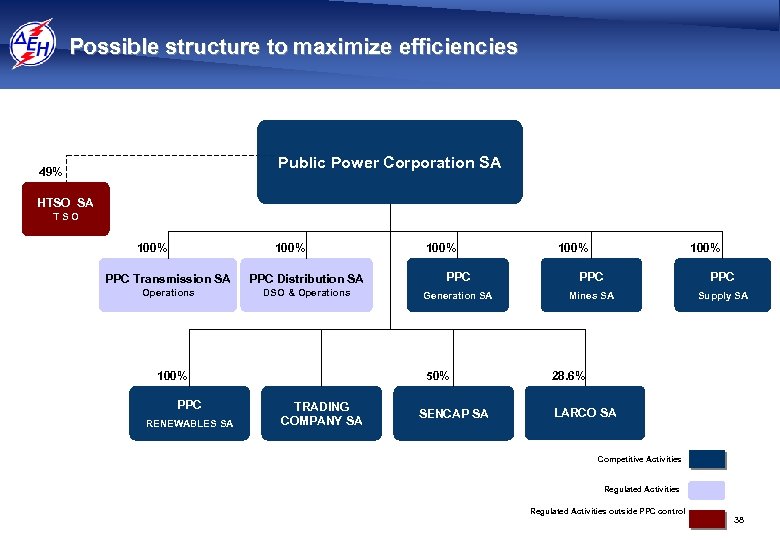

Possible structure to maximize efficiencies Public Power Corporation SA 49% HTSO SA TSO 100% 100% PPC Transmission SA PPC Distribution SA PPC PPC Operations DSO & Operations Generation SA Mines SA Supply SA 100% PPC RENEWABLES SA 50% TRADING COMPANY SA SENCAP SA 28. 6% LARCO SA Competitive Activities Regulated Activities outside PPC control 38

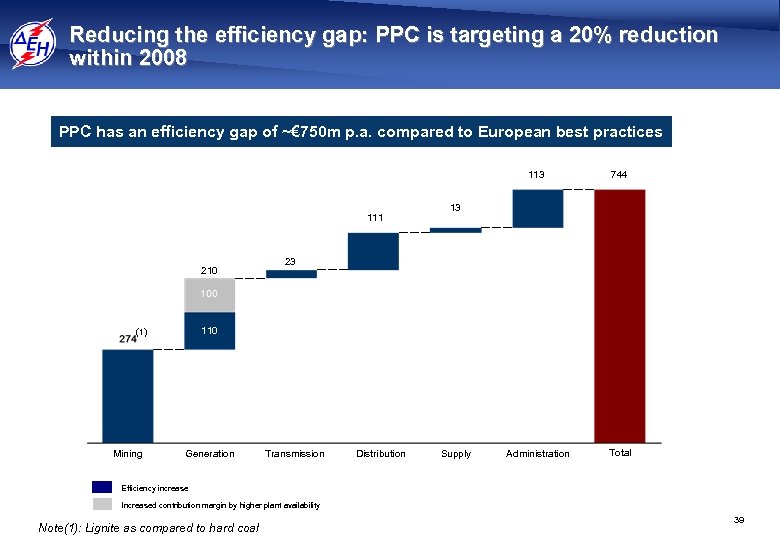

Reducing the efficiency gap: PPC is targeting a 20% reduction within 2008 PPC has an efficiency gap of ~€ 750 m p. a. compared to European best practices 113 111 210 Administration Total 13 23 110 (1) Mining 744 Generation Transmission Distribution Supply Efficiency increase Increased contribution margin by higher plant availability Note(1): Lignite as compared to hard coal 39

Key priorities in PPC’s strategy Regulatory Alignment 4 Unbundle tariffs in Greece and align with European practices 4 Align PPC’s business model with business environment 4 Accelerate replacement program of old and inefficient plants Generation Strategy 4 Improve generation mix 4 Decrease generation costs Efficiency Improvements New Sources of Revenue Corporate Culture 4 Invest in Networks for reliability and efficiency 4 Reduce costs of operations 4 Increase market penetration in Renewables 4 Expand our activities in the South East Europe region 4 Enter the gas value chain 4 Maximize value of real estate portfolio 4 Develop clear vision, mission and values 4 Bridge the past with the future 4 Align corporate policies & practices with the vision 4 Enhance management profile 40

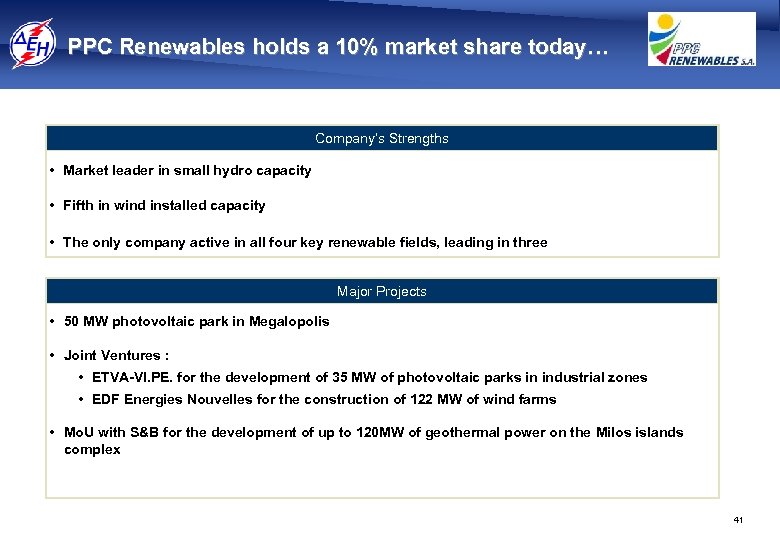

PPC Renewables holds a 10% market share today… Company’s Strengths • Market leader in small hydro capacity • Fifth in wind installed capacity • The only company active in all four key renewable fields, leading in three Major Projects • 50 MW photovoltaic park in Megalopolis • Joint Ventures : • ETVA-VI. PE. for the development of 35 MW of photovoltaic parks in industrial zones • EDF Energies Nouvelles for the construction of 122 MW of wind farms • Mo. U with S&B for the development of up to 120 MW of geothermal power on the Milos islands complex 41

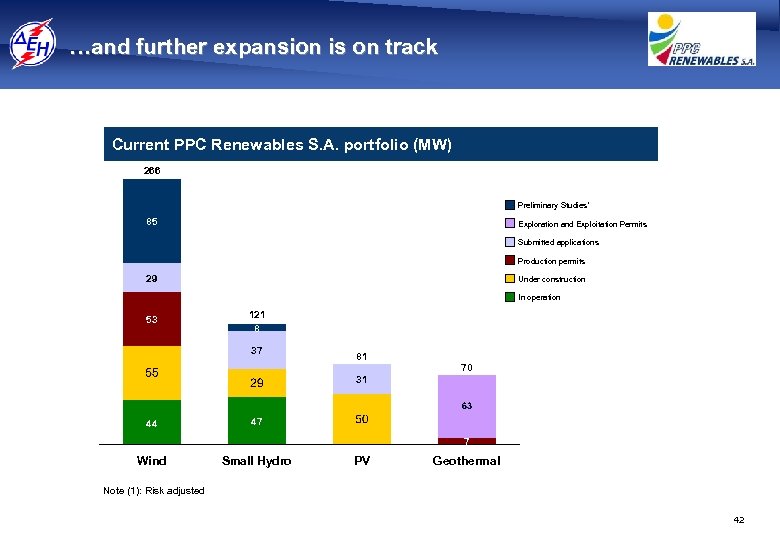

…and further expansion is on track Current PPC Renewables S. A. portfolio (MW) 266 Preliminary Studies* 85 Exploration and Exploitation Permits Submitted applications Production permits 29 Under construction In operation 53 121 8 37 81 70 31 44 47 7 Wind Small Hydro PV Geothermal Note (1): Risk adjusted 42

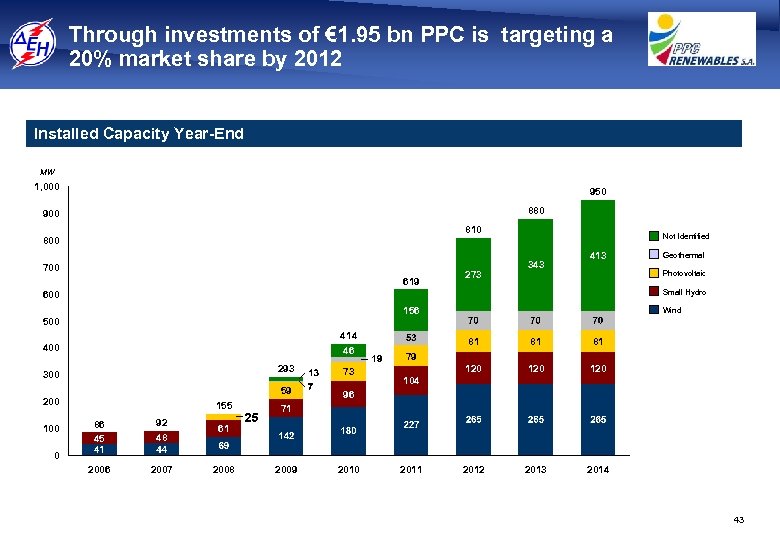

Through investments of € 1. 95 bn PPC is targeting a 20% market share by 2012 Installed Capacity Year-End MW 1, 000 950 880 900 810 Not Identified 800 700 619 273 343 413 Geothermal Photovoltaic Small Hydro 600 156 Wind 500 414 46 400 293 200 155 86 45 92 48 2007 2008 81 81 120 120 2012 2013 2014 96 104 71 61 2006 73 59 300 81 79 0 2009 2010 2011 43

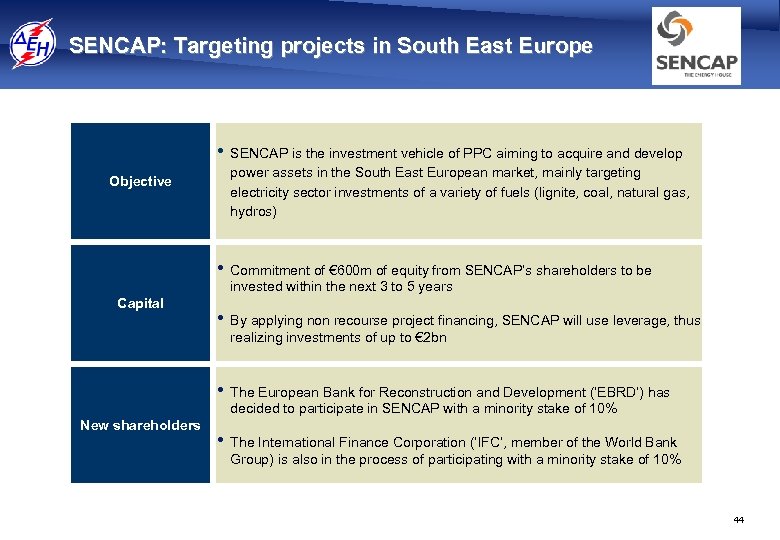

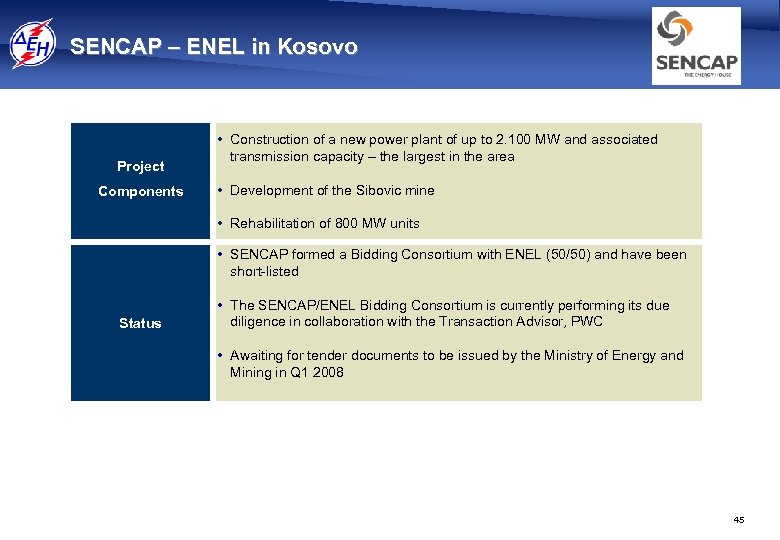

SENCAP: Targeting projects in South East Europe • SENCAP is the investment vehicle of PPC aiming to acquire and develop Objective power assets in the South East European market, mainly targeting electricity sector investments of a variety of fuels (lignite, coal, natural gas, hydros) • Commitment of € 600 m of equity from SENCAP’s shareholders to be invested within the next 3 to 5 years Capital • By applying non recourse project financing, SENCAP will use leverage, thus realizing investments of up to € 2 bn • The European Bank for Reconstruction and Development (‘EBRD’) has decided to participate in SENCAP with a minority stake of 10% New shareholders • The International Finance Corporation (‘IFC’, member of the World Bank Group) is also in the process of participating with a minority stake of 10% 44

SENCAP – ENEL in Kosovo Project Components • Construction of a new power plant of up to 2. 100 MW and associated transmission capacity – the largest in the area • Development of the Sibovic mine • Rehabilitation of 800 MW units • SENCAP formed a Bidding Consortium with ENEL (50/50) and have been short-listed Status • The SENCAP/ENEL Bidding Consortium is currently performing its due diligence in collaboration with the Transaction Advisor, PWC • Awaiting for tender documents to be issued by the Ministry of Energy and Mining in Q 1 2008 45

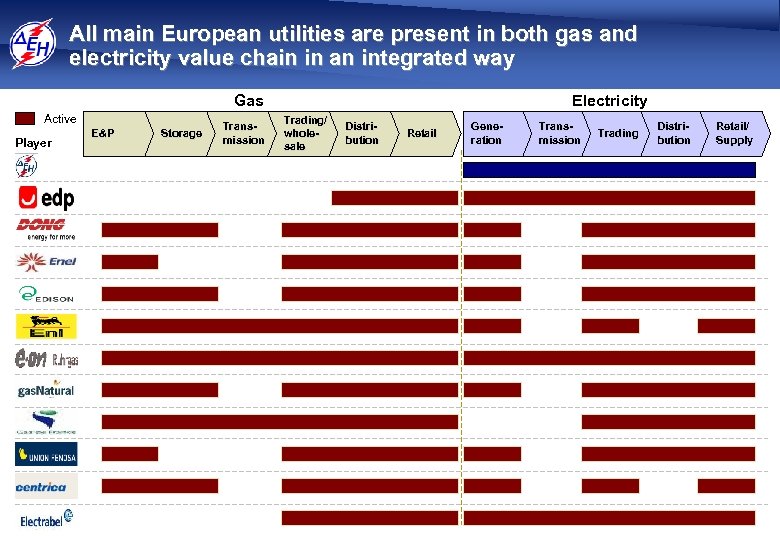

All main European utilities are present in both gas and electricity value chain in an integrated way Gas Active Player E&P Storage Transmission Electricity Trading/ wholesale Distribution Retail Generation Transmission Trading Distribution Retail/ Supply 46

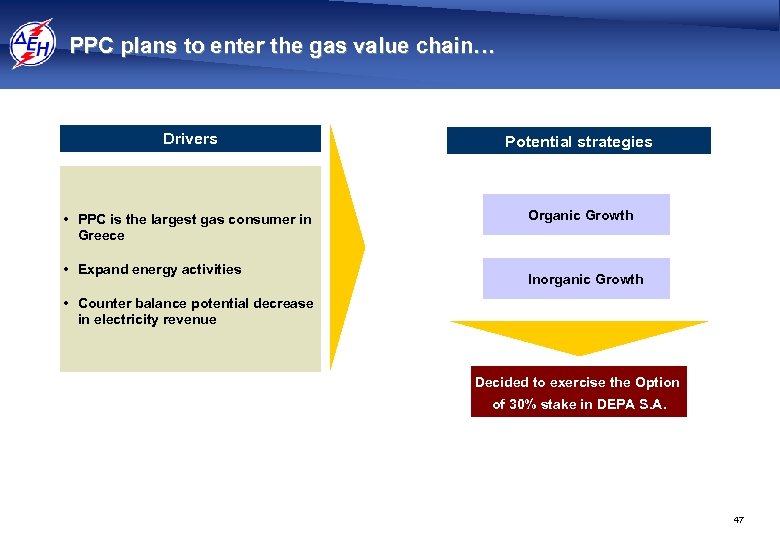

PPC plans to enter the gas value chain… Drivers Potential strategies • PPC is the largest gas consumer in Greece Organic Growth • Expand energy activities Inorganic Growth • Counter balance potential decrease in electricity revenue Decided to exercise the Option of 30% stake in DEPA S. A. 47

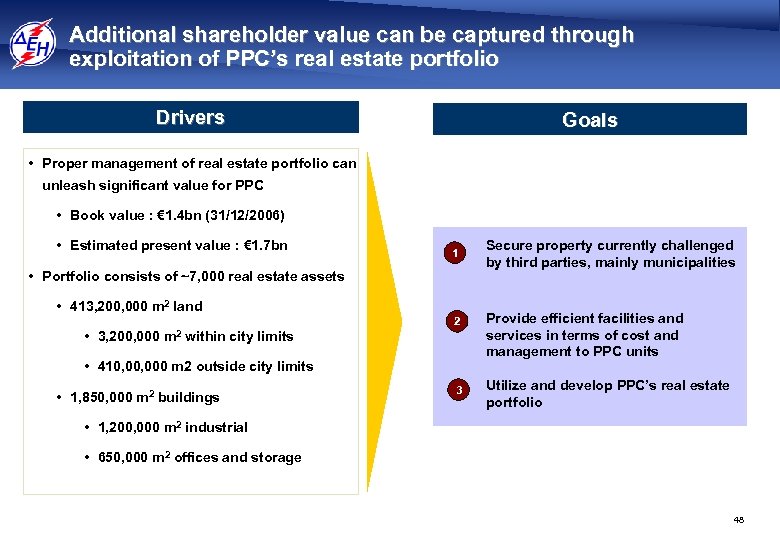

Additional shareholder value can be captured through exploitation of PPC’s real estate portfolio Drivers Goals • Proper management of real estate portfolio can unleash significant value for PPC • Book value : € 1. 4 bn (31/12/2006) • Estimated present value : € 1. 7 bn 1 • Portfolio consists of ~7, 000 real estate assets • 413, 200, 000 m 2 land 2 • 3, 200, 000 m 2 within city limits • 410, 000 m 2 outside city limits • 1, 850, 000 m 2 buildings 3 Secure property currently challenged by third parties, mainly municipalities Provide efficient facilities and services in terms of cost and management to PPC units Utilize and develop PPC’s real estate portfolio • 1, 200, 000 m 2 industrial • 650, 000 m 2 offices and storage 48

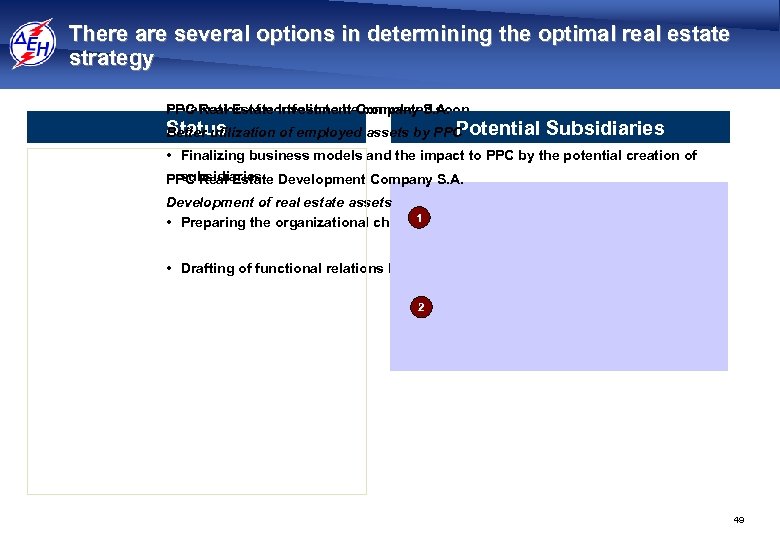

There are several options in determining the optimal real estate strategy • Valuation of portfolio to be. Company S. A. PPC Real Estate Investment completed soon Status Potential Better utilization of employed assets by PPC Subsidiaries • Finalizing business models and the impact to PPC by the potential creation of subsidiaries PPC Real Estate Development Company S. A. Development of real estate assets • Preparing the organizational charts 1 and estimating the OPEX needed • Drafting of functional relations between PPC and potential subsidiaries 2 49

Key priorities in PPC’s strategy Regulatory Alignment 4 Unbundle tariffs in Greece and align with European practices 4 Align PPC’s business model with business environment 4 Accelerate replacement program of old and inefficient plants Generation Strategy 4 Improve generation mix 4 Decrease generation costs Efficiency Improvements New Sources of Revenue Corporate Culture 4 Invest in Networks for reliability and efficiency 4 Reduce costs of operations 4 Increase market penetration in Renewables 4 Expand our activities in the South East Europe region 4 Enter the gas value chain 4 Maximize value of real estate portfolio 4 Develop clear vision, mission and values 4 Bridge the past with the future 4 Align corporate policies & practices with the vision 4 Enhance management profile 50

Satisfy the expectations of all stakeholders in a balanced way Shareholders State, Municipalities & Local communities Partners: Suppliers, Contractors Authorities & Institutions Management Customers Non Governmental Organizations Competitors Employees 51

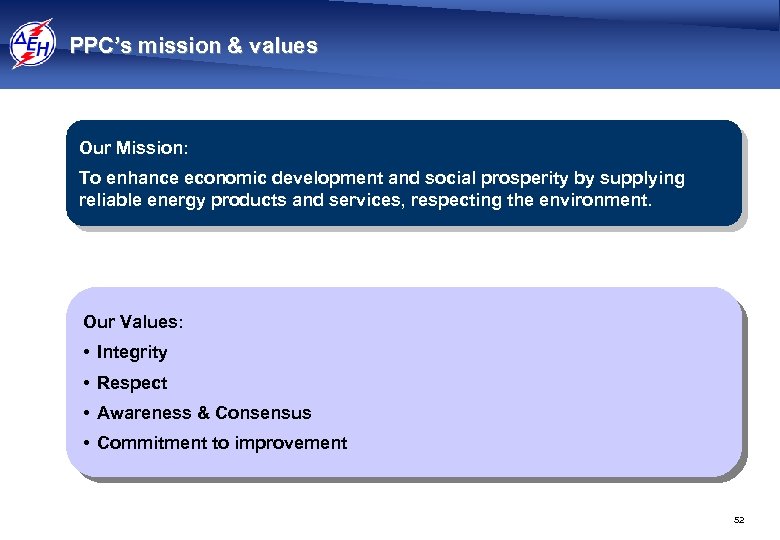

PPC’s mission & values Our Mission: To enhance economic development and social prosperity by supplying reliable energy products and services, respecting the environment. Our Values: • Integrity • Respect • Awareness & Consensus • Commitment to improvement 52

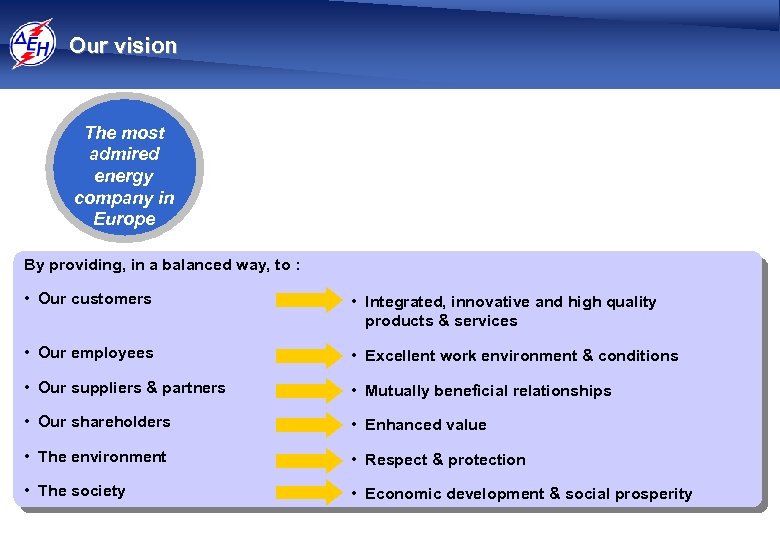

Our vision The most admired energy company in Europe By providing, in a balanced way, to : • Our customers • Integrated, innovative and high quality products & services • Our employees • Excellent work environment & conditions • Our suppliers & partners • Mutually beneficial relationships • Our shareholders • Enhanced value • The environment • Respect & protection • The society • Economic development & social prosperity

Corporate Culture: the main pillar of our strategy implementation Elements of current state: • Strong company history • Technical competency & know-how • Operational decision-making at the top • Management and employee roles not distinct Already in transition to …

Corporate Culture: the main pillar of our strategy implementation Align corporate policies & practices with the vision: • Build on employee loyalty • Develop flexible management and organization systems and processes • Enhance management profile & create momentum by: • Instilling sense of urgency and proactivity • Establishing open communication • Mobilizing informed decision making • Motivating personnel at all levels • Empowering managers towards a competitive status • Develop best practice work ethics

Thank you for your attention

30bebb9d3a0f221850b41cdef7d33cb7.ppt