27f2b415e665e5a4f752e74f942ea9d5.ppt

- Количество слайдов: 64

PUBLIC FINANCE MANAGEMENT ACT NOLS DU PLESSIS PFMA IMPLEMENTATION UNIT NATIONAL TREASURY

CONTENTS z. Introduction & Background z. Overview of the Public Finance Management Act z. Overview of the Treasury Regulations z. Accountability & Responsibility under the Act z. Implementation of the PFMA z. Performance Management

Introduction and Background Public Finance Management Act and Treasury Regulations

Why a new approach? z. RDP: maximise service delivery z. Limited resources vs. 'Unlimited' demands z. Satisfy constitutional obligations z. Transparency and accountability (s 216)

Budget Reforms Since 1994 z Budget decentralisation z Shift to multi-year budgeting z In-year management - early warning z Less focus on inputs z International classifications

Where We Starting From? z. Financial administration : rule-bound z. AO passive z. Focus on inputs z. Need to transform the public services z. Fiscal constraints vs. Service backlogs In summary, Need to improve value for money

Components to Change Financial management Financial Administration Line managers Technical Procedures Transactional Accounting

The Solution z Modernising financial management z. Enabling managers to manage - better information z. Make managers accountable z Clearer definition of roles z. Minister/MEC responsible for outcomes z. DG /HOD responsible for output z Greater transparency & accountability z Better information & reporting; improved management Result Improved value for money & service delivery

How Will Things Change – Practicalities z Budgeting by outputs z. From an "input" to "output" budget x(Legislature will always 'vote' on cash) z. Formats changes to 'standard form' z Introduce service standards & costing systems z Greater responsibilities over transfers z. Interdepartmental charges (eg public works) z. Role of programme managers emphasised

Clarity of Roles: Minister & DG z‘Executive authority’(Minister/ MEC) z. Policy matters z. Outcomes z. Presentation & approval of Departmental budget & report

Clarity of Roles: Minister & DG (Continue) z. Accounting officer (DG/ HOD/ board) z. Outputs & implementation z. Accountable to parliament for financial management z. Implementation of departmental budget

What Are the Act’s Benefits? z. Greater flexibility, within framework z. Basis for assessing achievements z. Linkages between planning & budget z. Focus on outputs & responsibilities z. Better accountability z. Clarity of role of accounting officer A basis for Better use of resources & improved delivery of services

Desired Outcomes : Long Term z Sound financial management systems and processes z Transparent budgeting process z Effective management of revenue, expenditure, assets and liabilities z Unqualified consolidated financial statements, prepared on the accrual basis z Accountability of public entities & external agencies

Overview of the Act

What Does the PFMA Do? z. Repeals or overrides 10 exchequer acts z. Establishes national treasury z. Provides frameworks in place of procedures z. Oversight over public entities z. Accounting Standards Board z. Treasury regulations

The New Act : Modalities z. Coverage z. National departments & constitutional institutions z. Provinces & provincial departments z‘Public entities’ z. Excludes university z. Excludes local govt: similar bill to follow z. Phased implementation z. Mostly 1 April 2000 z. Planning for future ‘qualitative’ changes

National & Provincial Treasuries z Broad national powers to monitor and enforce z Frameworks z. Cash management, banking and investment z. Procurement z Leadership in financial management: z. Design, guidance, support z Consolidation of financial statements z Importance of provincial treasuries

Budgets z. Outputs and measurable objectives z. Voting by main division z. Monthly reports z. Publication of information z. Virement & adjustments budgets z. Approving unauthorised expenditure z. Unfunded mandates

Executive Authorities z. Statutory responsibilities z. Consider monthly reports z. Reporting to cabinet/ executive council z. Tabling of annual report & audit opinion z. Oversight over public entities z. Written explanations of failure to table z. Directives with financial implications

Role of Accounting Officer z. All departments and constitutional institutions z. Performance contracts z. Duties z. Maintaining efficient, effective & transparent systems of financial management z. Enforcing discipline z. Delegations z. CFO and others

Public Entities z Schedule 2 entities z. Report directly to parliament via minister z. Managerial autonomy z. Provide info on budget and corporate plan z. Borrowing powers - annual limits z. Schedule 3 entities z. Govt. Business enterprises may have autonomy z. Non-business entities treated as departments

Loans and Guarantees z. Restricted authority to borrow or ‘guarantee’ - Minister of Finance, MEC of finance, accounting authority (for public entity) z. Foreign liabilities and borrowing illegal z. State not bound by individual ‘organs’

General Treasury Matters z. Norms and standards z. Treasury regulations z. Financial misconduct z. Disciplinary procedures & criminal sanctions z. Accounting Standards Board z. GRAP

OVERVIEW OF THE TREASURY REGULATIONS

New Treasury Regulations Less restrictive than previous Treasury Instructions and Financial Regulations Focus on principle rather than detail More autonomy to accounting officers in financial decision making Enable accounting officers to manage better

Management arrangements Chief Financial Officer Must appoint a CFO no later than 1 April 2001 CFO is directly accountable to the AO Audit Committees Constituted so as to ensure independence Report to the Accounting Officer May communicate any concerns to Executive Authority and/or the Auditor-General Internal Controls and Internal Audit May be contracted to external body Treasuries may establish shared Internal Audit units Independent with no limitation on accessing information

Financial misconduct Investigation of alleged financial misconduct AO must ensure that disciplinary proceedings are carried out to investigate alleged financial misconduct Investigation must be conducted within a reasonable period If an AO is alleged to have committed financial misconduct the treasury must ensure appropriate disciplinary proceedings Criminal Proceedings AO must advise Treasury and AG of any charges laid for criminal financial misconduct Treasury may direct an institution to lay charges of criminal financial misconduct Reporting AO must advise Treasury and AG of any disciplinary proceedings instituted AO must report to Treasury and the Auditor-General of outcome Advise Treasury of any changes to its systems of financial and risk management

Strategic planning Strategic Plan 3 Year rolling plan consistent with MTEF Programme objectives and outcomes identified by Minister Key performance measures and indicators Include requirements of Public Service Regulations Form the basis for annual reports First date of submission is 30 June 2001

Strategic planning Evaluation of Performance Establish procedures for quarterly reporting Quarterly reporting to Executive Authority Must form the basis for report of the institution in the annual report

Budgeting and related matters Comply with annual circular issued by Treasury AO must ensure that budget submissions of constitutional institutions & public entities receiving transfers via departments are included Estimates of expenditure and revenue must conform to formats prescribed by National Treasury Virement * * * Max 8% of savings Personnel expenditure and transfer payments Allocations earmarked not to be used for other purposes Unspent funds may be rolled over subject to certain limitations and conditions Additional funds through an Adjustment Estimate

Revenue management AO must manage revenue efficiently and effectively Implementing appropriate processes for * * Identification Collections Safeguarding Recording Must review fees and charges annually Information of tariff policy must be disclosed in Annual Report

Expenditure management AO must ensure that internal procedures and control measures are in place for payment approval Official may not spend or commit to spend except with express approval of a properly delegated officer Payments due to creditors must be settled within 30 days No contract can be cancelled or amended to the detriment of the State without prior Treasury approval

Expenditure management AO making or receiving grants to or from other spheres of governments must comply with reporting requirements of the division of Revenue Act AO must ensure that institutions receiving grants submits with its certificate of compliance (sec 38(I)(j)) the most recent audited statements and any annual report before any funds are transferred Approving transfer payments includes, ensuring that: * beneficiary complied with conditions attached to previous year's assistance * continued financial aid are still necessary * agreed objectives were attained * transfer payment expense provide reasonable value for money

Unauthorized expenditure Overspending of a Vote or Main Division Expenditure not in accordance with purpose of Vote or Main Division Must be reported to Treasury on discovery Recover expenditure if not authorised by Legislature Amounts must be disclosed in annual financial statements

Irregular expenditure Not in accordance with PFMA or Procurement Legislation or Regulations Must be reported to Treasury or Procurement Authority on discovery Treasury or Procurement Authority may condone If not condoned losses must be recovered Amounts must be disclosed in annual financial statements

Fruitless and wasteful expenditure Expenditure in vain that could have been prevented Must be reported to relevant Treasury Expenditure must be recovered Must be disclosed in annual financial statements

Asset management AO must ensure that proper control systems exists Preventative mechanisms are in place to eliminate theft, losses, wastage and misuse Stock levels are at an optimum and economical level Sale of immovable property must be at market value Letting of immovable State property must be at marketrelated tariffs and reviewed annually by AO

Management of debtors AO must take effective and appropriate steps to collect money due to the Institution Debts owing to the State may at discretion of AO be recovered in installments Interest must be charged on all debts to the State Debt may only be written off after reasonable steps have been taken to recover All debts written off must be disclosed as a note in Annual Financial Statements

Management of losses and claims Complexities are taken out of the prescripts AO can deal with losses without referral to Treasury Losses or damages for which an official is liable must be recovered Debts arising from losses and claims must be dealt with in terms of chapter on Management of Debtors

Loans, guarantees and other commitments The executive authority of a provincial department may not issue a guarantee, security of indemnity except with written approval of MEC for Finance AO must ensure that no official borrow money on behalf of the department Should the AO be responsible for transgressions with regard to borrowings the treasury must initiate misconduct proceedings

Banking, cash management and investment Framework issued by National Treasury in terms of the PFMA Framework deals with a whole host of issues * * * Deposits into revenue funds Withdrawals from and investment of funds Surrender of surplus funds AO must establish processes for efficient and effective cash management CFO must monitor cash management on a regular basis and report monthly to the AO Treasury must report monthly to Minister on its Revenue Fund

Public private partnerships Private party perform departmental function on behalf of department AO must do a feasibility study Obtain National Treasury approval AO is responsible for ensuring that a PPP agreement is properly enforced

Financial reports AO must submit to Treasury a break-down of expenditure and revenue by end of February for the following year Institutions may not draw funds in excess of amounts approved by Treasury Institutions must submit to Treasury and Minister within 15 days of end of month * * * Actual revenue and expenditure Projections for remainder of year Reasons for any deviation and steps to remain within budget AO effecting transfer payments must submit quarterly reports to Treasury outlining, per organisation, funds transferred

Annual financial statements Departments in accordance with GRAP * For 2000/01 still on a cash basis Unaudited financial statements must be submitted to Treasury 2 months after year end Financial statements must be submitted to Treasury and Minister not later than 5 months after year end Minister must table financial statements in legislature within 1 month after receipt

Annual Reports Report is on activities of department and must comply with requirements of PFMA Comply with requirements prescribed in PSR Include information about the institution's efficiency, effectiveness in delivering programs and achieving its objectives (1 April 2002) Report on the use of foreign aid assistance Information on transfer payments per organisation including compliance with sec 38(1)(j)) of the Act Minister must table in legislature 1 month after receipt

Other issues covered in Treasury Regulations Money and property held in trust Trading entities Commission and Committees Gifts, donations and sponsorships Payments, refunds and remissions as an act of grace or favour Public entities

Accountability & Responsibility Under the Act

Accountability & Responsibility Under the Act z. Accountability relationships z. Elements of accountability z. Accountability instruments z. Political & statutory accountability z. How will accountability change? z. Support mechanisms for the AO z. Empowering managers

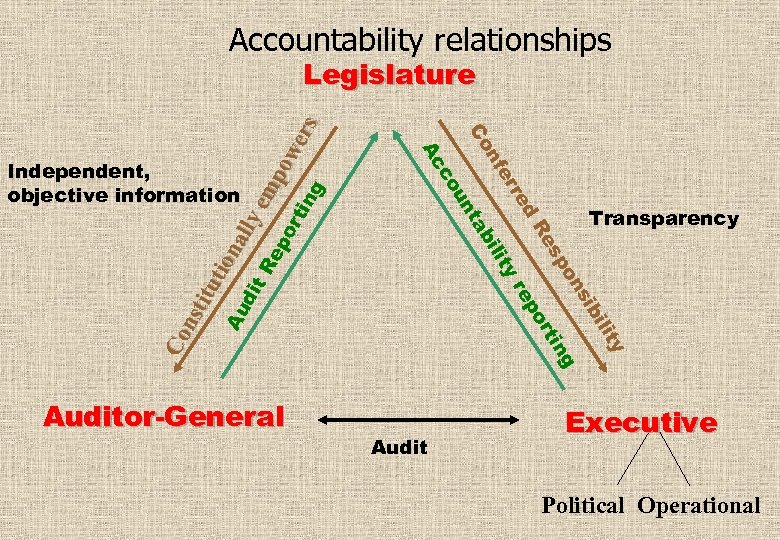

Accountability relationships Auditor-General y lit bi si on ng sp rti Re po d re re y er lit nf bi Co ta un co Independent, objective information Ac Co nst itu tio na Au lly di t. R em ep po or we tin rs g Legislature Transparency Audit Executive Political Operational

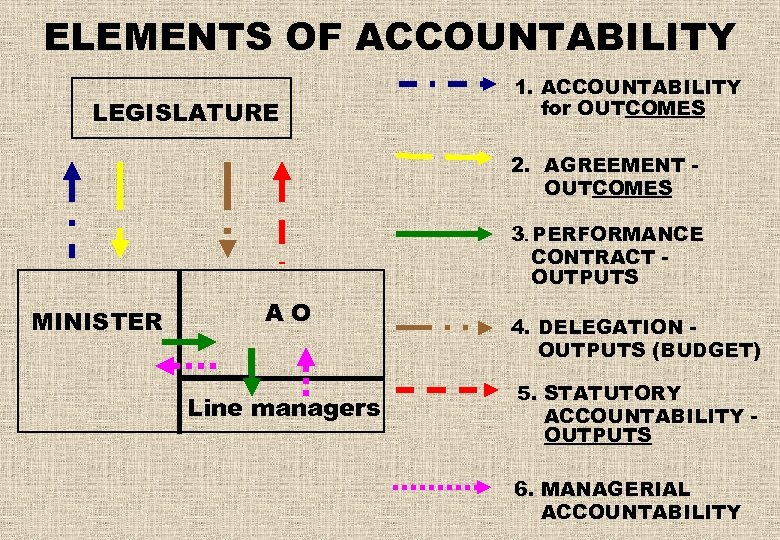

ELEMENTS OF ACCOUNTABILITY LEGISLATURE 1. ACCOUNTABILITY for OUTCOMES 2. AGREEMENT OUTCOMES 3. PERFORMANCE CONTRACT OUTPUTS MINISTER AO Line managers 4. DELEGATION OUTPUTS (BUDGET) 5. STATUTORY ACCOUNTABILITY OUTPUTS 6. MANAGERIAL ACCOUNTABILITY

Accountability Instruments z. The legislature, as representatives of the people and custodian of their resources z. Portfolio committees - role in planning, budgeting & monitoring z. Standing committee on public accounts proxy for parliament z. Auditor-General - parliament’s independent and objective assurance provider

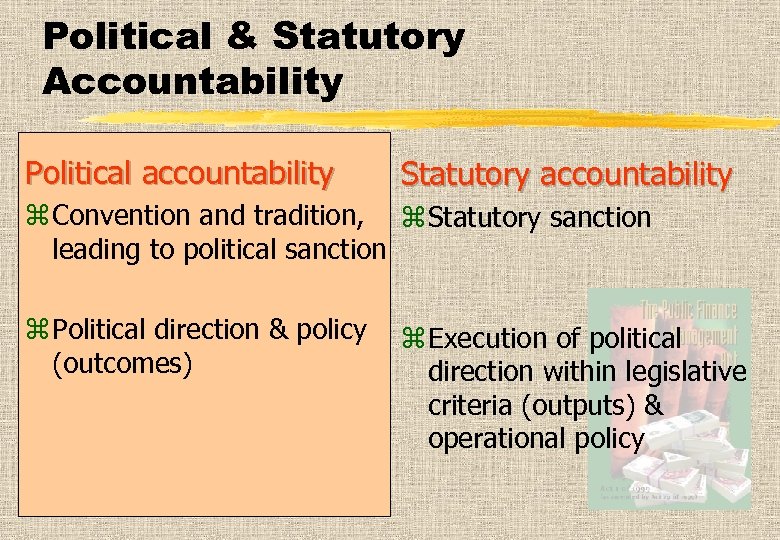

Political & Statutory Accountability Political accountability Statutory accountability z Convention and tradition, z Statutory sanction leading to political sanction z Political direction & policy (outcomes) z Execution of political direction within legislative criteria (outputs) & operational policy

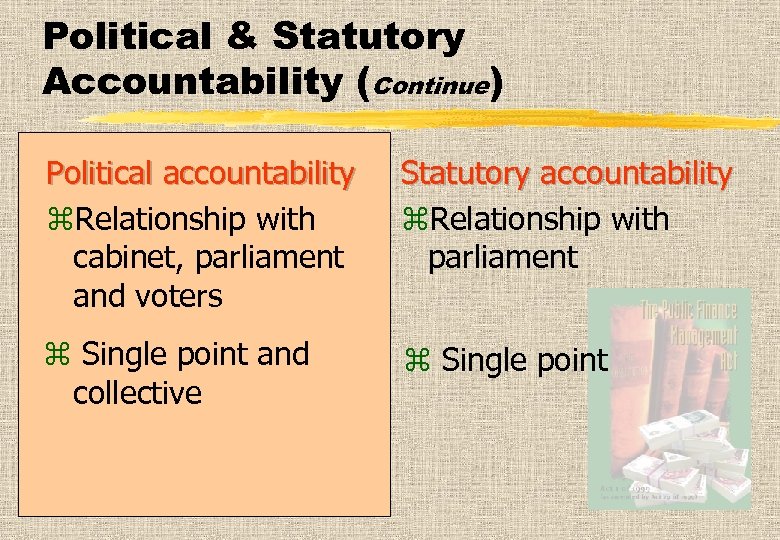

Political & Statutory Accountability (Continue) Political accountability z. Relationship with cabinet, parliament and voters Statutory accountability z. Relationship with parliament z Single point and collective z Single point

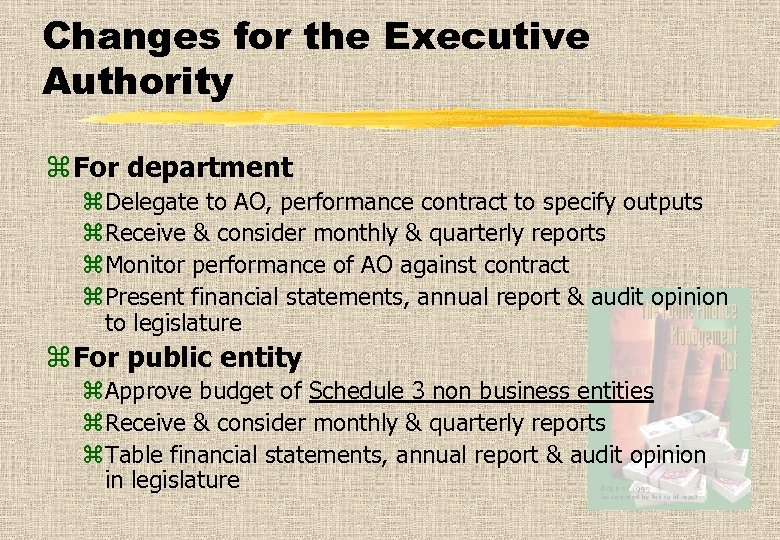

Changes for the Executive Authority z For department z. Delegate to AO, performance contract to specify outputs z. Receive & consider monthly & quarterly reports z. Monitor performance of AO against contract z. Present financial statements, annual report & audit opinion to legislature z For public entity z. Approve budget of Schedule 3 non business entities z. Receive & consider monthly & quarterly reports z. Table financial statements, annual report & audit opinion in legislature

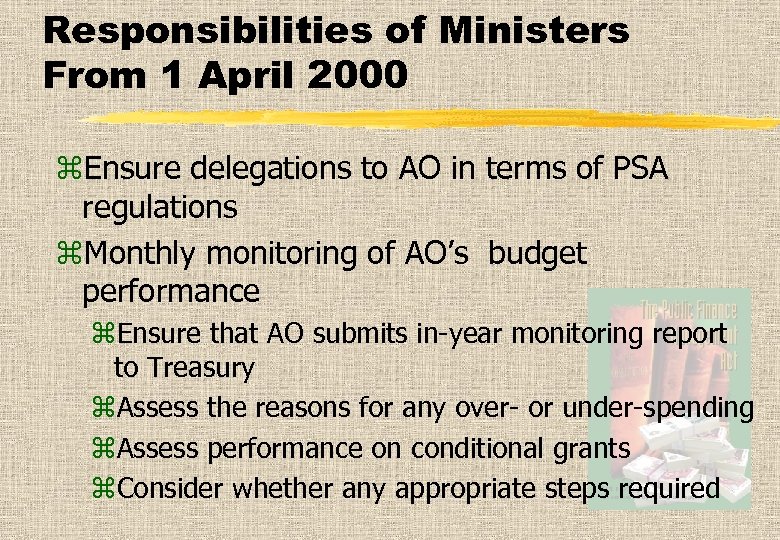

Responsibilities of Ministers From 1 April 2000 z. Ensure delegations to AO in terms of PSA regulations z. Monthly monitoring of AO’s budget performance z. Ensure that AO submits in-year monitoring report to Treasury z. Assess the reasons for any over- or under-spending z. Assess performance on conditional grants z. Consider whether any appropriate steps required

Responsibilities of Ministers From 1 April 2000 (Continue) z. Ensure AO ready to submit completed financial statements to Auditor-General by 31 May 2001 z. Ensure AO submits annual report by 31 August 2001 for Minister to table

Responsibilities of Ministers From 1 April 2000 (Continue) z. Ensure AO enforces disciplinary measures z. Ensure in-year oversight over public entities z. Ensure that the accounting authority of a public entity (board) exercises its fiduciary responsibilities z. Ensure receipts of corporate plans and budget from public entities

What Will Change for the AO? z Accountability becomes explicit z Procedural controls replaced by frameworks z Accountable for outputs, not only inputs z Planning responsibilities linked to budget z Specific assignment of AO responsibilities z CFO with greater competence z Specific statutory timeframes & sanctions z Obligatory transparency – not left to AG to discover ‘sins’

Obligations on Accounting Officers From 1 April 2000 z. Monthly in-year reporting z. Use monthly information to manage department z. To Minister by main division, with appropriate steps to address any problems identified z. To treasury for reporting to Cabinet z. To treasury for monthly publication z. Submission of financial statements to Auditor -General by 31 May 2001 z. Submission of annual report and financial statements to Minister by 31 Aug 2001

Obligations on Accounting Officers From 1 April 2000 (Continue) z. Expenditure in line with the purpose voted z. Appropriate steps to prevent unauthorised expenditure z. Internal control system, internal audit & audit committees functioning during 2000/1 z. Enforce disciplinary measures z. Obligations over transfers z. Conditional grants - monthly reporting requirements in terms of Div of Revenue Act z. Other transfers - certificate on internal controls

What Do the Changes Mean? Business not as usual

Support for the Accounting Officer z. Competent line and financial managers z. Mechanisms to ensure proper assessments of risk and focus management attention on high risk areas z. Appropriately qualified CFO, with necessary infrastructure, to provide expert assistance z. Clearly defined responsibilities for all officials z. Internal audit and audit committee

Empowering Responsible Managers Systems and procedures must be: z. Effective, efficient, economic and transparent z. Prevent unauthorised, irregular, fruitless and wasteful expenditure as well as fraud z. Be well documented, z. Regularly evaluated, z. Made available to all

Empowering Responsible Managers User friendly rules required to impose effective sanctions, if needed Let managers manage But hold them accountable

27f2b415e665e5a4f752e74f942ea9d5.ppt