f1942fb3efa328a29ddd62b330e8b49e.ppt

- Количество слайдов: 25

Public Budget Presentation June 3 , 2002 Lewis Plauny Budget 2002 -2003 Montrose Area

Presentation Agenda n Current “Draft Budget” key numbers n Explain Budgetary Reserve & Fund Balance n Major Revenue & Expenditure Increases n Our Continuing Budget Improvement Plan n Insights on Grants & Budget Problems n Standard & Poors Review n Answer questions & ask for decisions Budget 2002 -2003 Montrose Area

Budget Draft Status n 2001 -2002 Budget n 2002 -2003 Budget approx. $19, 500, 000 n Increase Budget 2002 -2003 of $ 1, 500, 000 Montrose Area $18, 000 or 8. 3%

Review of “Budget Draft” content n 155 Page Board Document Itemizes all anticipated expenses and revenues n Current Expenses are $ 18, 221, 995 n Current Revenues are $ 18, 171, 324 n Difference is $ -50, 671 n Difference in millage equivalent is. 28 mill – 1. 0 mill = 2. 6 % tax increase –. 5 mill = 1. 3 % tax increase 3/17/2018

How We Calculate “Millage Equivalent” In 2001 -2002 the District collected $ 6, 901, 236. 09 in current real estate taxes. n This was 90. 4% of the levied taxes. n Amount collected divided by 37. 5 mills levied equals 184, 032. 96 dollars collected for each mill levied. n 3/17/2018

Why We Should “Think” “Millage Equivalent” Proactive - To be “fiscally responsible” local Boards should fund “Current Revenues”=“Current Expenditures” and “Think of all newly created budget costs in terms of millage increases” n Reactive - The State & Federal govts are always one to three years behind (if) they fund school needs n 3/17/2018

Millage Impacts n Average 2001 -2002 Real Estate Parcel is assessed at 27, 340 (after Clean & Green) n One mill is $ 26. 62 increase on the average parcel. 3/17/2018

Budgetary Reserve for 2002 -2003 n A Budgetary Reserve is a “non-itemized placeholder amount” that is used to anticipate unforeseeable expenses during the budget year that “must” be recorded in the General Fund. – Example: a “special needs” student enrolls during the year and the district must pay his/her tuition Budgetary Reserve is approx. $ 198, 000 n $ 198, 000 is approx. 1% of a $ 19, 500, 000 n 3/17/2018

Beginning Fund Balance for 2002 -2003 n n n 2001 -2002’s budget total is $ 18, 000 The District budgets to a 7 ½ % fund balance 7 ½ % of $ 18, 000 is $ 1, 350, 000 Tentative Budget is approx. $ 19, 500, 000 7 ½ % of $ 19, 500, 00 is $ 1, 462, 500 3/17/2018

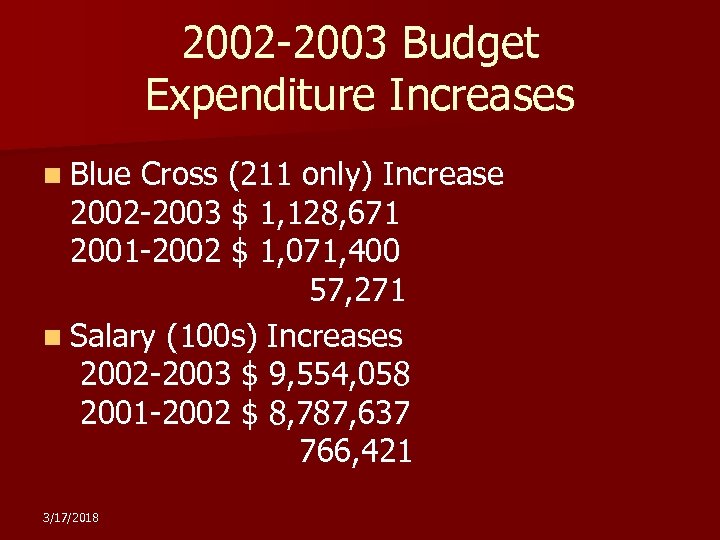

2002 -2003 Budget Expenditure Increases n Blue Cross (211 only) Increase 2002 -2003 $ 1, 128, 671 2001 -2002 $ 1, 071, 400 57, 271 n Salary (100 s) Increases 2002 -2003 $ 9, 554, 058 2001 -2002 $ 8, 787, 637 766, 421 3/17/2018

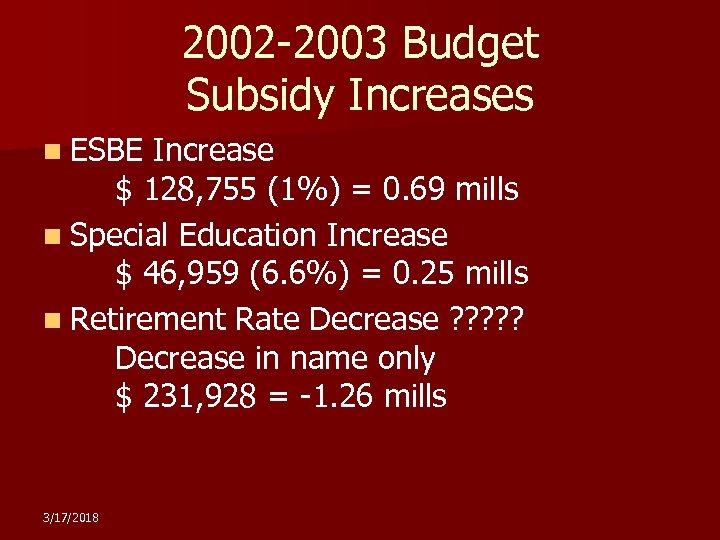

2002 -2003 Budget Subsidy Increases n ESBE Increase $ 128, 755 (1%) = 0. 69 mills n Special Education Increase $ 46, 959 (6. 6%) = 0. 25 mills n Retirement Rate Decrease ? ? ? Decrease in name only $ 231, 928 = -1. 26 mills 3/17/2018

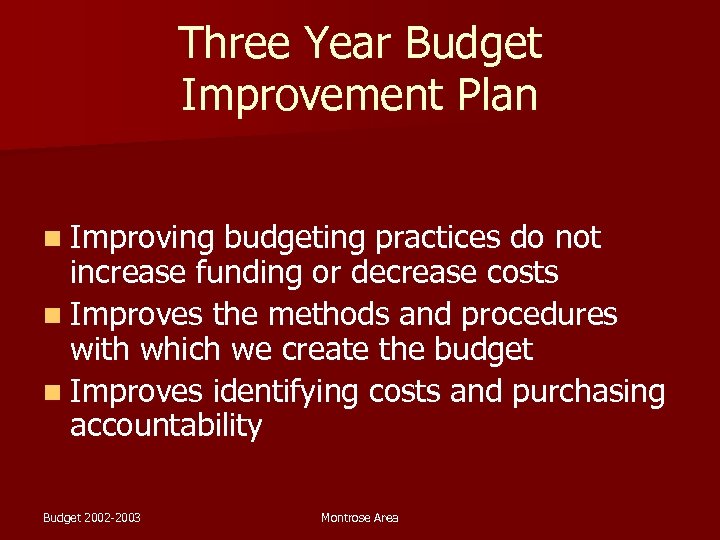

Three Year Budget Improvement Plan n Improving budgeting practices do not increase funding or decrease costs n Improves the methods and procedures with which we create the budget n Improves identifying costs and purchasing accountability Budget 2002 -2003 Montrose Area

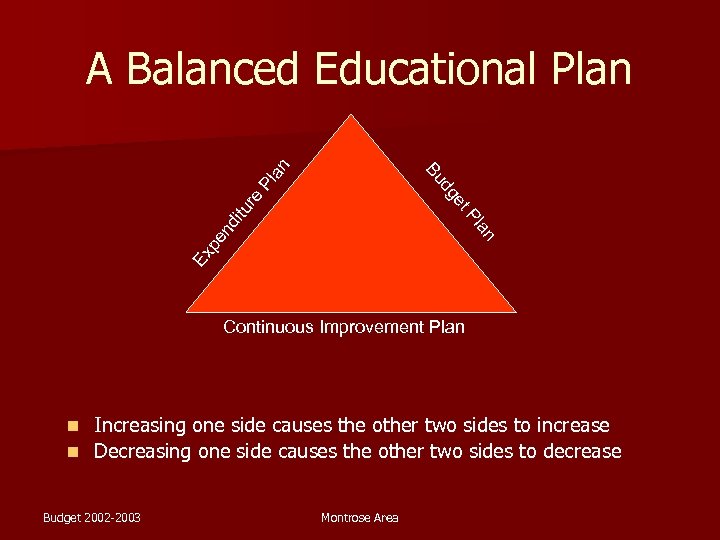

Ex pe nd an Pl itu et re dg Pl Bu an A Balanced Educational Plan Continuous Improvement Plan Increasing one side causes the other two sides to increase n Decreasing one side causes the other two sides to decrease n Budget 2002 -2003 Montrose Area

Electronic Equipment Depreciation Philosophy n. A recommended “Sustainability Guideline” – If you can not afford to “replace” it, you can not afford to “maintain” it – If you can not afford to “maintain” it, you can not afford to “buy” it – If you can not afford to “train staff to use it properly”, you can not afford to “buy” it Budget 2002 -2003 Montrose Area

Grant Insights n Funding allocations are determined primarily by the availability of funds at higher levels of government n Funding for all grants will change and the funding changes will not always be positive n Higher government levels do not have “downward” accountability Budget 2002 -2003 Montrose Area

Entitlement Type Grants n Expect continuing State & Federal support – Example: Title 1 for poor & needy families n Grant amounts controlled by State & Federal funding allocations – Funding will increase or decrease – “Allowable uses” will change n May be “carefully” used for continuing salaries and benefits Budget 2002 -2003 Montrose Area

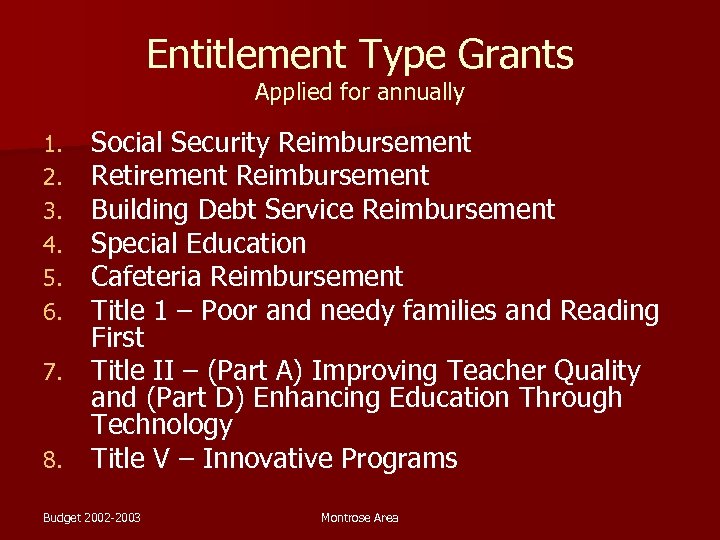

Entitlement Type Grants Applied for annually Social Security Reimbursement Retirement Reimbursement Building Debt Service Reimbursement Special Education Cafeteria Reimbursement Title 1 – Poor and needy families and Reading First 7. Title II – (Part A) Improving Teacher Quality and (Part D) Enhancing Education Through Technology 8. Title V – Innovative Programs 1. 2. 3. 4. 5. 6. Budget 2002 -2003 Montrose Area

Competitive Type Grants “Sunset” type legislation n Politically motivated (can occur midyear) n Used to “start” but not “continue” support of Federal and State education initiatives n Be thankful for them but, – Only spend after you have received funds – Use grant funds for non-recurring expenses – Consider carefully future program maintenance costs Budget 2002 -2003 Montrose Area

Standard & Poors Review n Local-Source Revenue Per Student (Definition) – Includes revenue for instruction, support services, and other operating purposes obtained from local sources including real estate property and other district-levied taxes, investment earnings, and tuition. Revenue is divided by total enrollment to determine perstudent basis. Budget 2002 -2003 Montrose Area

Standard & Poors Review MASD Key Factors n “Well below-average operations and maintenance expenditures per student” n “Exceptionally above-average transportation expenditures per student” n “Well below-average local-source revenue per student” Budget 2002 -2003 Montrose Area

Standard & Poors Quotes n “On a per-student basis, the district’s operations and maintenance expenditures of $460 are exceptionally below the state average of $658, and lower than the peer group average. Statewide, only 6. 0% of Pennsylvania’s school districts report lower per-student operations and maintenance expenditures. Spending on operations and maintenance represents 6. 8% of the district’s operating expenditures, compared with the state average of 9. 0%. During the period examined, the district’s per-student operations and maintenance expenditures have decreased by 7. 2%. This is counter to the state trend, which has increased, and counter to the peer trend, which has remained relatively unchanged over the same time period. ” Budget 2002 -2003 Montrose Area

Standard & Poors Quotes n “Transportation expenditures of $814 per student are exceptionally above the state average of $414, and higher than the peer group average. Statewide, only 1. 2% of Pennsylvania’s school districts spend more per student than the district. Spending on transportation represents 12. 1% of the district’s operating expenditures, compared with the state average of 5. 7%. During the period examined, the district’s per-student transportation expenditures have increased by 17. 4%. This is greater than the state and peer increases over the same time period. ” Budget 2002 -2003 Montrose Area

“Postponing” Capital Expenditures n Postponing “real” and “needed” costs is not “budget cutting”. n The “need” does not “go away”. n Not budgeting a “need” results in “hidden deficit budgeting”. n The negative impact is even worse in future budgets. 3/17/2018

“Inherent Structural Budget Deficiencies” “built-in” budget problems Employee Contracts, Benefits & Services Cost Increases n Proportionally Reduced State & Federal Funding n – Decrease in State subsidies from 52% to 3 x% n “Hidden” problems – “Work loads shifted” from Federal and State staff to Local education staff – Unfunded State & Federal Mandates“ shift tax burden” from Federal & State tax levies to Local tax levies“ Budget 2002 -2003 Montrose Area

What we need to do n Decide on any final budget changes n Decide on a total final budget amount n Decide the millage rate for next year n Approve both items at Friday’s meeting 3/17/2018

f1942fb3efa328a29ddd62b330e8b49e.ppt