30587813b1f925a2e333a0b2463cfb8a.ppt

- Количество слайдов: 48

PSAB Reporting Model

Objectives of the Presentation 1. Review the objectives of the old financial statements. 2. Review the objectives of the new financial statements with the recording of tangible capital assets. 3. Help you understand the differences between the old & new F/S.

PSAB Reporting Model ■ The Public Sector Accounting Board (PSAB) of the Canadian Institute of Chartered Accountants (CICA) issues standards with respect to accounting and financial reporting for the public sector. ■ Years ago there was little or no standards for government financial reporting and governments all did it a differently.

PSAB Reporting Model ■ PSAB established to set standards for governments based on the financial reporting information required for public sector. ■ Standards are established after extensive research and consensus from all levels of government and other stakeholders by way of exposure drafts being issued together with meetings throughout the country.

PSAB Reporting Model ■ Municipal Act 185(1) – Must prepare F/S’s for municipal governments recommended by CICA ■ 185(2)- F/S’s must include ■ Debt limit of the municipality ■ Amount of debt of the municipality

PSAB Reporting Model ■ Please note that Saskatchewan municipalities have been reporting in accordance with PSAB standards since 2002

PSAB Reporting Model (Old) ■ Conceptual model of old financial statements has been Revenue Less: Expenditures Equals: Excess of Revenues over Expenditures (Change in Net Fin. Assets)

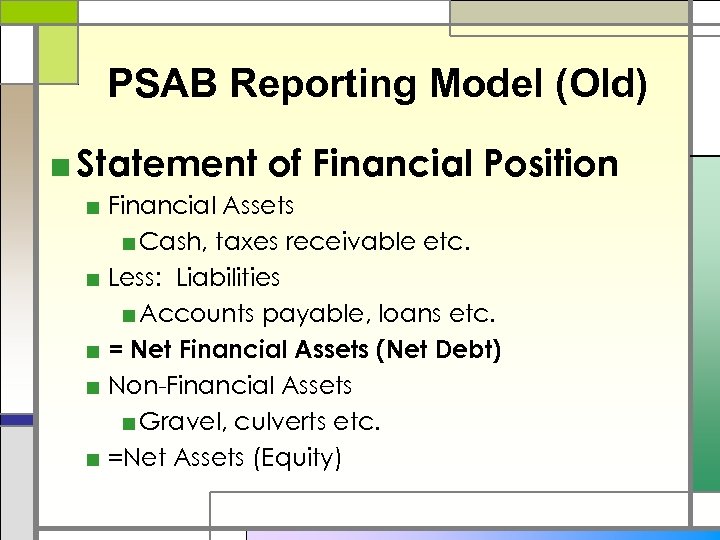

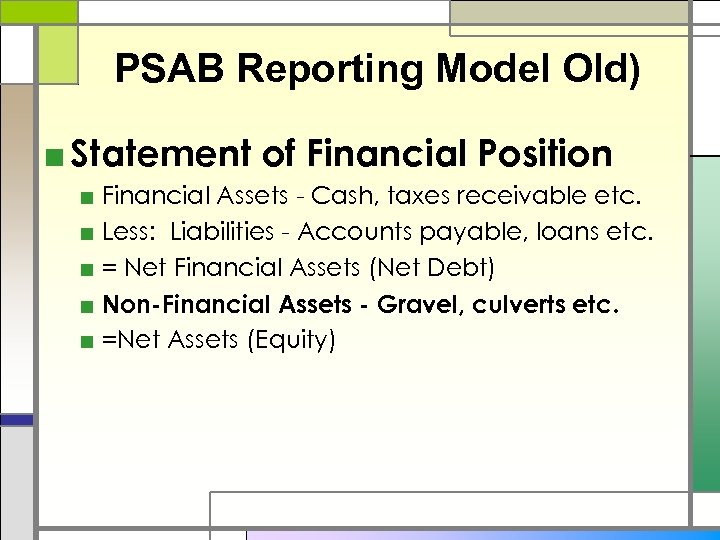

PSAB Reporting Model (Old) ■ Statement of Financial Position ■ Financial Assets ■ Cash, taxes receivable etc. ■ Less: Liabilities ■ Accounts payable, loans etc. ■ = Net Financial Assets (Net Debt) ■ Non-Financial Assets ■ Gravel, culverts etc. ■ =Net Assets (Equity)

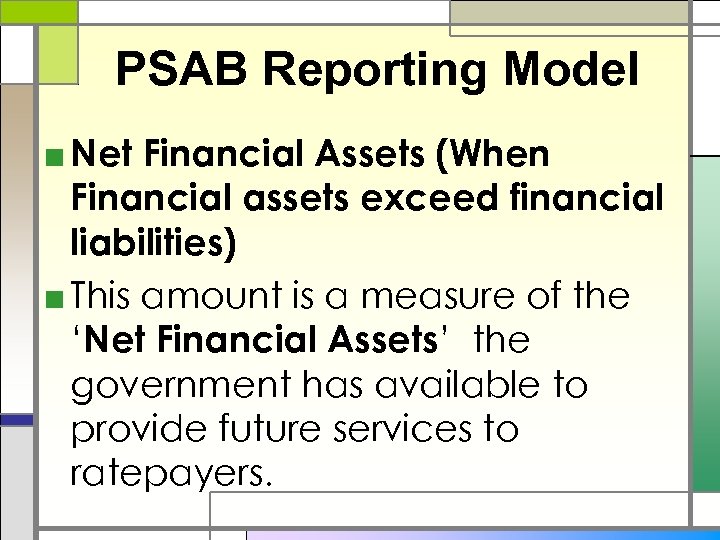

PSAB Reporting Model ■ Net Financial Assets (When Financial assets exceed financial liabilities) ■ This amount is a measure of the ‘Net Financial Assets’ the government has available to provide future services to ratepayers.

PSAB Reporting Model ■ Net Debt (When financial liabilities exceed financial assets) ■ Amount is a measure of the future revenues required to pay for past transactions.

PSAB Reporting Model Old) ■ Statement of Financial Position ■ Financial Assets - Cash, taxes receivable etc. ■ Less: Liabilities - Accounts payable, loans etc. ■ = Net Financial Assets (Net Debt) ■ Non-Financial Assets - Gravel, culverts etc. ■ =Net Assets (Equity)

PSAB Reporting Model ■ Non-Financial Assets – gravel, culverts, rat poison etc. ■ These are normally consumed In the normal course of operations ■ Are not for sale in the normal course of operations

PSAB Reporting Model ■ Statement of Financial Position ■ Financial Assets - Cash, taxes receivable etc. ■ Less: Liabilities - Accounts payable, loans etc. ■ = Net Financial Assets (Net Debt) ■ Non-Financial Assets - Gravel, culverts etc. ■ =Net Assets (Equity)

PSAB Reporting Model(Old) ■ Net Assets (Equity) ■ Net economic resources available to the municipality to provide future services.

PSAB Reporting Model ■ Statement of Financial Position ■ Financial Assets - Cash, taxes receivable etc. ■ Less: Liabilities - Accounts payable, loans etc. ■ = Net Financial Assets (Net Debt) ■ Non-Financial Assets - Gravel, culverts etc. ■ =Net Assets (Equity) But what’s missing?

PSAB Reporting Model ■ Tangible Capital Assets ■ Graders ■ Tractors ■ Buildings ■ Roads ■ Bridges

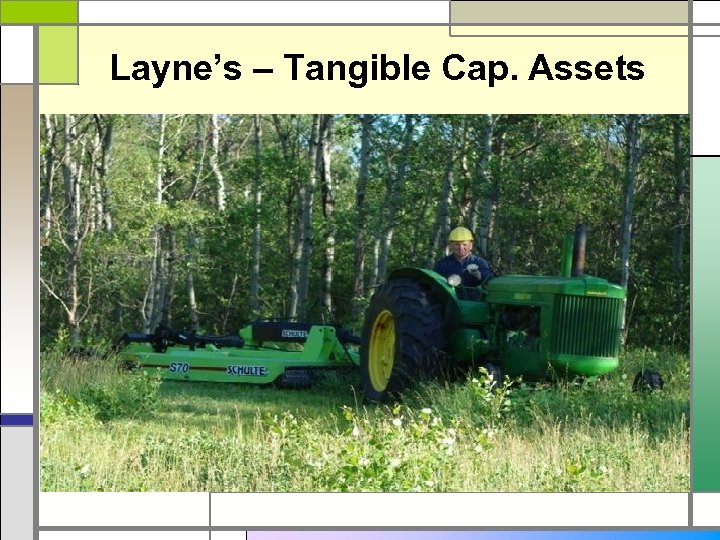

Layne’s – Tangible Cap. Assets

Layne’s – Tangible Cap. Assets

PSAB Reporting Model ■ Tangible Capital Assets ■ Are used continually in the supply of goods or services to ratepayers. ■ Have useful lives over one year ■ Are not for sale in the ordinary course of business.

PSAB Reporting Model ■ Note - A tangible Capital Asset Is Not? ■ Water ■ Rat Poison ■ Gravel

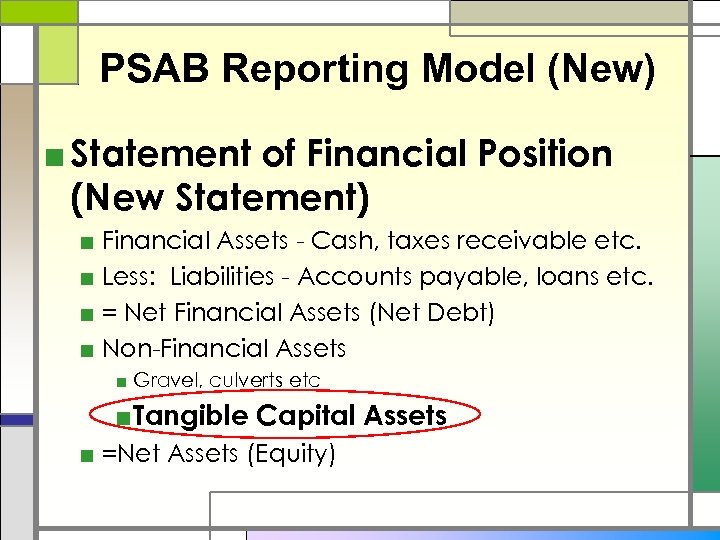

PSAB Reporting Model (New) ■ Statement of Financial Position (New Statement) ■ Financial Assets - Cash, taxes receivable etc. ■ Less: Liabilities - Accounts payable, loans etc. ■ = Net Financial Assets (Net Debt) ■ Non-Financial Assets ■ Gravel, culverts etc ■Tangible Capital Assets ■ =Net Assets (Equity)

PSAB Reporting Model ■ New Financial Statement – uses accounting principles applied by businesses and farms for (almost) ever. ■ Consider that a farmer would always include in his/her ownership equity assets such as equipment, buildings etc.

PSAB Reporting Model (New) ■ Conceptual model of (New) Income Statements is now: Revenue Less: Expenses Equals: Excess of Revenues over Expenses

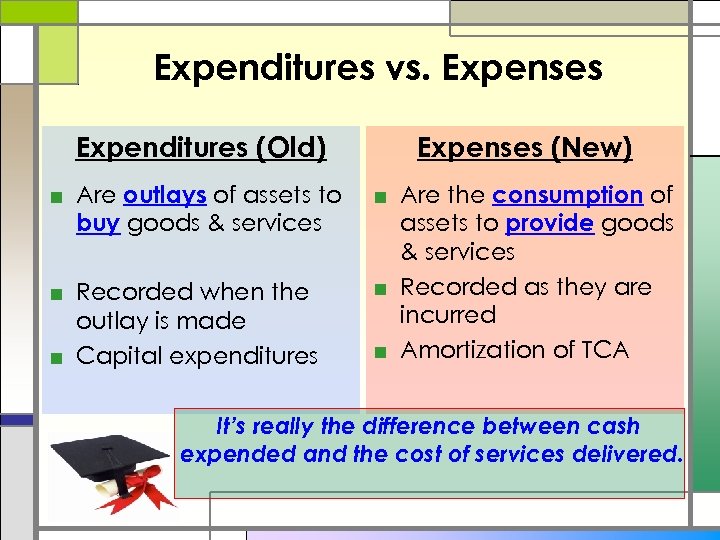

Expenditures vs. Expenses Expenditures (Old) Expenses (New) ■ Are outlays of assets to buy goods & services ■ Are the consumption of assets to provide goods & services ■ Recorded as they are incurred ■ Amortization of TCA ■ Recorded when the outlay is made ■ Capital expenditures It’s really the difference between cash expended and the cost of services delivered.

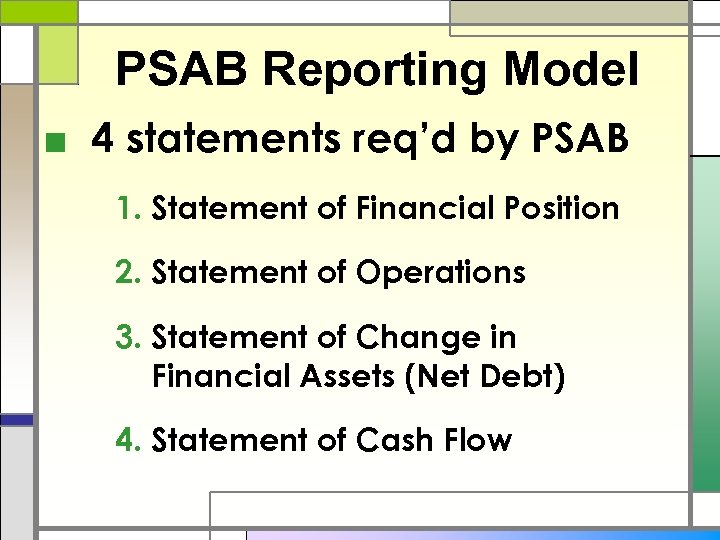

PSAB Reporting Model ■ 4 statements req’d by PSAB 1. Statement of Financial Position 2. Statement of Operations 3. Statement of Change in Financial Assets (Net Debt) 4. Statement of Cash Flow

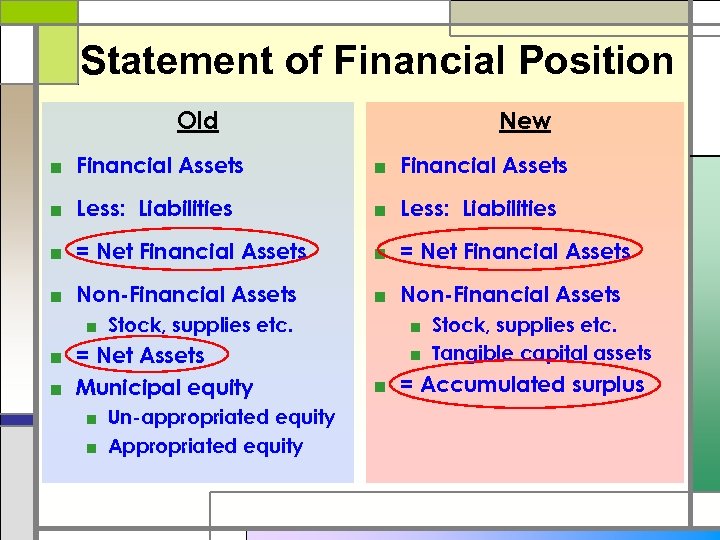

Statement of Financial Position Old New ■ Financial Assets ■ Less: Liabilities ■ = Net Financial Assets ■ Non-Financial Assets ■ Stock, supplies etc. ■ = Net Assets ■ Municipal equity ■ Un-appropriated equity ■ Appropriated equity ■ Stock, supplies etc. ■ Tangible capital assets ■ = Accumulated surplus

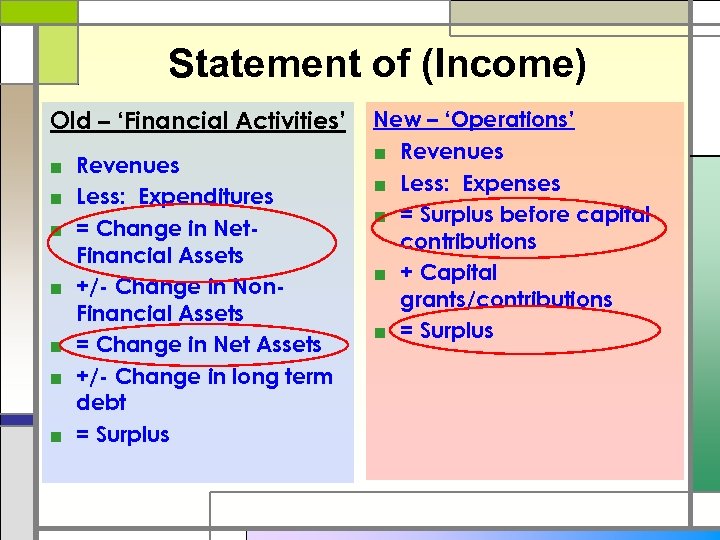

Statement of (Income) Old – ‘Financial Activities’ ■ Revenues ■ Less: Expenditures ■ = Change in Net. Financial Assets ■ +/- Change in Non. Financial Assets ■ = Change in Net Assets ■ +/- Change in long term debt ■ = Surplus New – ‘Operations’ ■ Revenues ■ Less: Expenses ■ = Surplus before capital contributions ■ + Capital grants/contributions ■ = Surplus

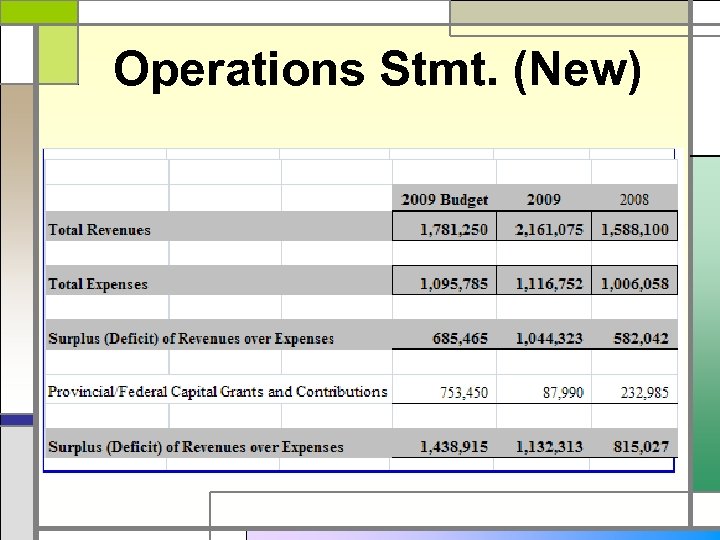

Operations Stmt. (New)

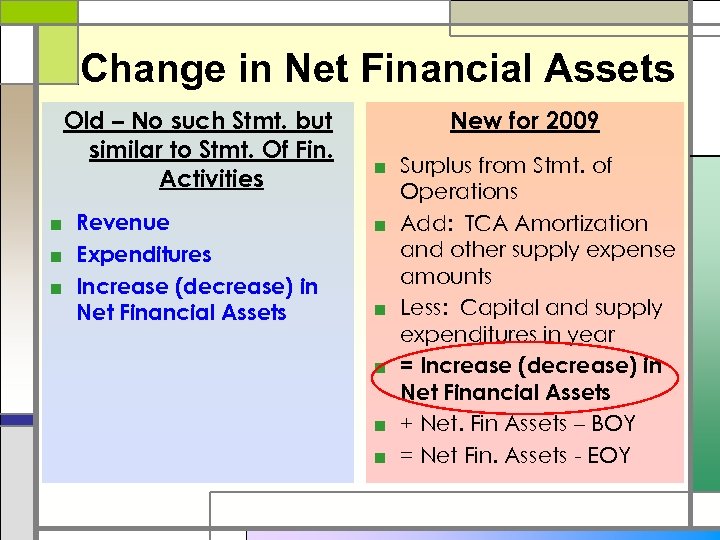

Change in Net Financial Assets Old – No such Stmt. but similar to Stmt. Of Fin. Activities ■ Revenue ■ Expenditures ■ Increase (decrease) in Net Financial Assets New for 2009 ■ Surplus from Stmt. of Operations ■ Add: TCA Amortization and other supply expense amounts ■ Less: Capital and supply expenditures in year ■ = Increase (decrease) in Net Financial Assets ■ + Net. Fin Assets – BOY ■ = Net Fin. Assets - EOY

Change in Fin. Assets

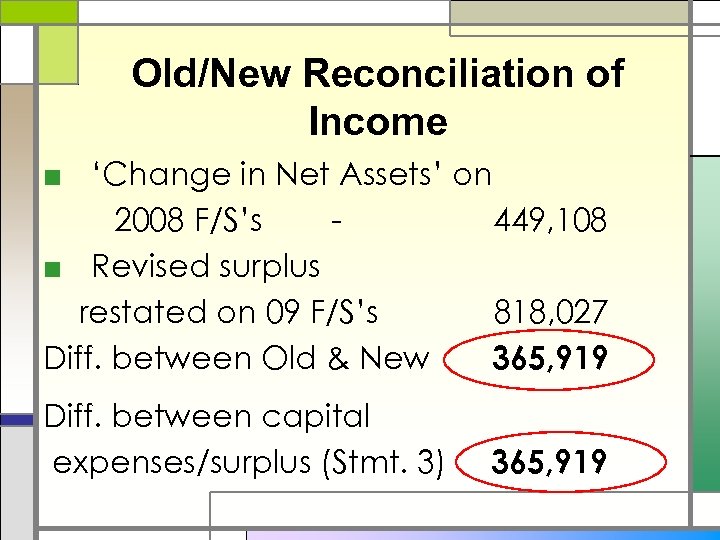

Old/New Reconciliation of Income ■ ‘Change in Net Assets’ on 2008 F/S’s 449, 108 ■ Revised surplus restated on 09 F/S’s 818, 027 Diff. between Old & New 365, 919 Diff. between capital expenses/surplus (Stmt. 3) 365, 919

Net Fin. Assets/Net Debt PSAB Reporting model places equal emphasis on the annual surplus/deficit & the overall financial health of the muni. A government’s net financial assets (debt) is a key indicator of a Govt’s overall financial health

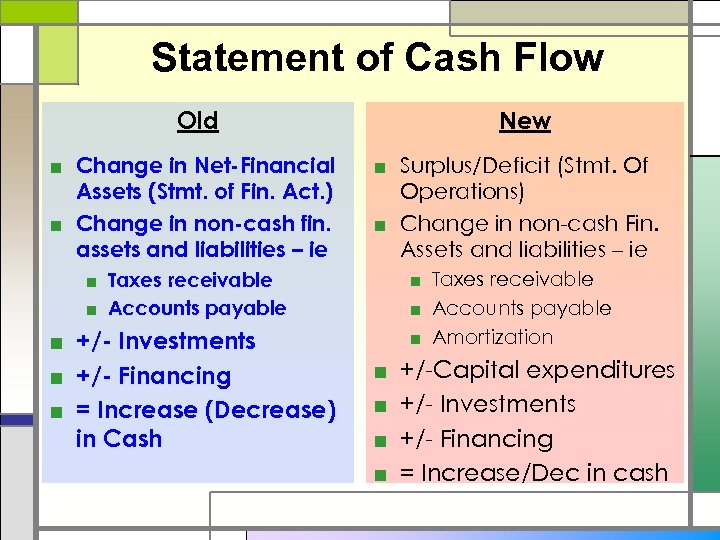

Statement of Cash Flow Old ■ Change in Net-Financial Assets (Stmt. of Fin. Act. ) ■ Change in non-cash fin. assets and liabilities – ie New ■ Surplus/Deficit (Stmt. Of Operations) ■ Change in non-cash Fin. Assets and liabilities – ie ■ Taxes receivable ■ Accounts payable ■ Amortization ■ Taxes receivable ■ Accounts payable ■ +/- Investments ■ +/- Financing ■ = Increase (Decrease) in Cash ■ ■ +/-Capital expenditures +/- Investments +/- Financing = Increase/Dec in cash

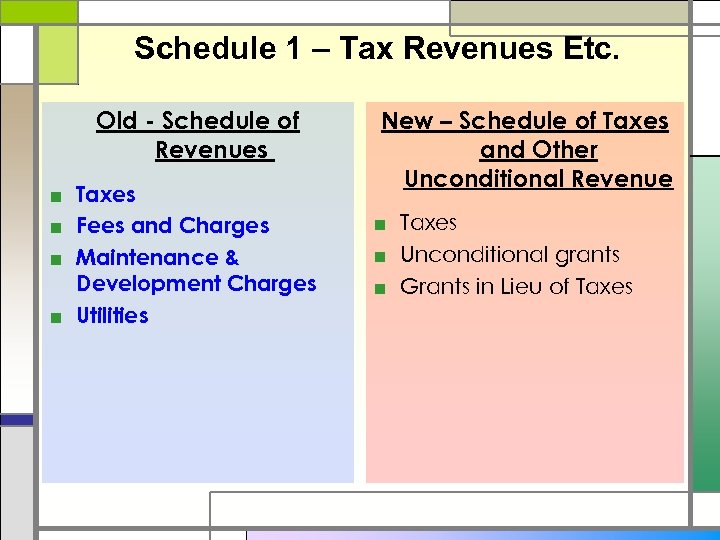

Schedule 1 – Tax Revenues Etc. Old - Schedule of Revenues ■ Taxes ■ Fees and Charges ■ Maintenance & Development Charges ■ Utilities New – Schedule of Taxes and Other Unconditional Revenue ■ Taxes ■ Unconditional grants ■ Grants in Lieu of Taxes

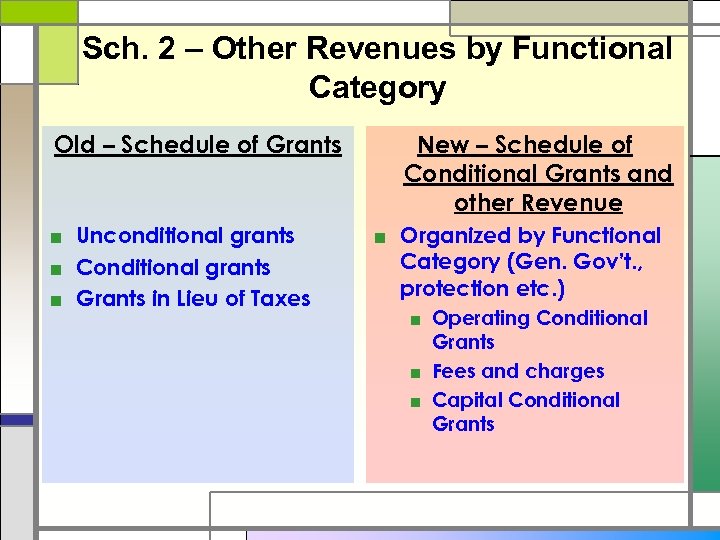

Sch. 2 – Other Revenues by Functional Category Old – Schedule of Grants ■ Unconditional grants ■ Conditional grants ■ Grants in Lieu of Taxes New – Schedule of Conditional Grants and other Revenue ■ Organized by Functional Category (Gen. Gov’t. , protection etc. ) ■ Operating Conditional Grants ■ Fees and charges ■ Capital Conditional Grants

New Sch. 2 – Other Revenues by Functional Category

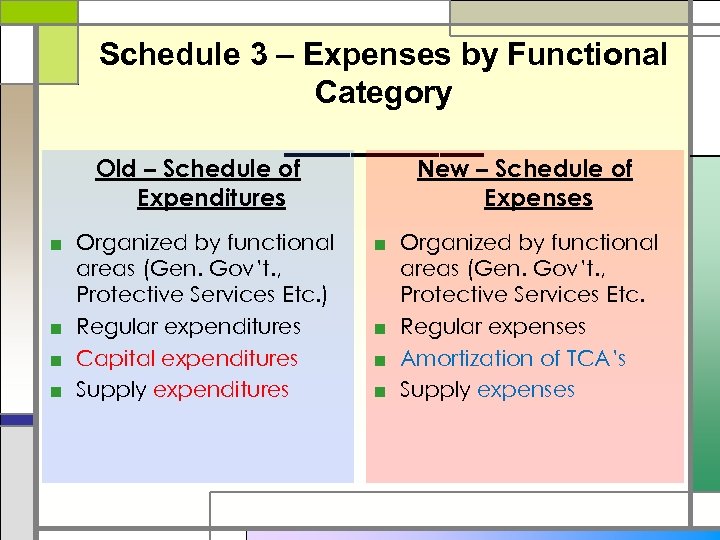

Schedule 3 – Expenses by Functional Category _____ Old – Schedule of Expenditures ■ Organized by functional areas (Gen. Gov’t. , Protective Services Etc. ) ■ Regular expenditures ■ Capital expenditures ■ Supply expenditures New – Schedule of Expenses ■ Organized by functional areas (Gen. Gov’t. , Protective Services Etc. ■ Regular expenses ■ Amortization of TCA’s ■ Supply expenses

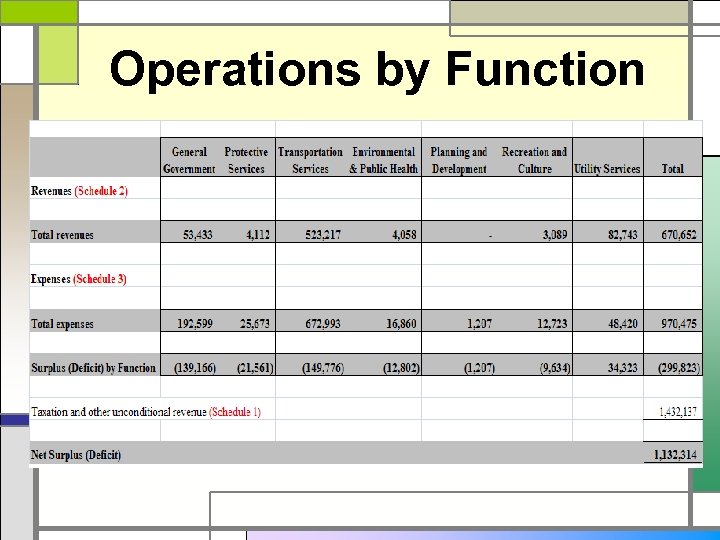

Schedules 4 & 5 – Revenues & Expenses grouped by Function ■ Revenues (by function) - xxx, xxx ■ Expenses (by function) - yyy, yyy ■ Surplus(Deficit) –Function - zzz, zzz ■ Tax & other revenues - aaa, aaa ■ Surplus (Deficit) - bbb, bbb

Operations by Function

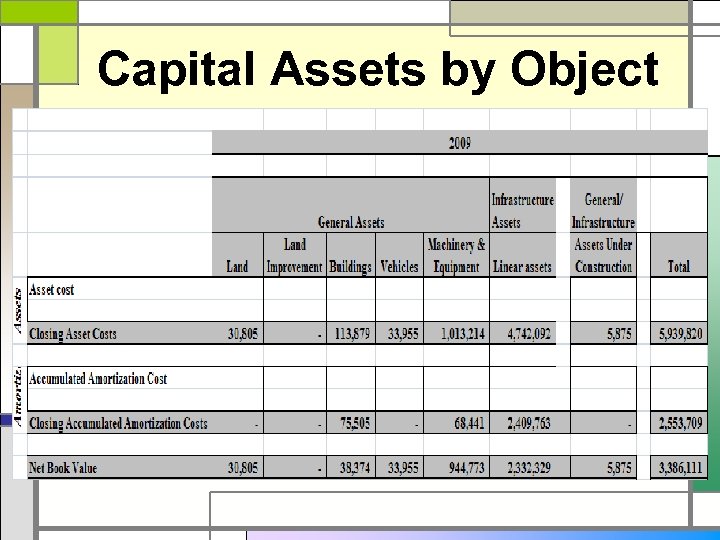

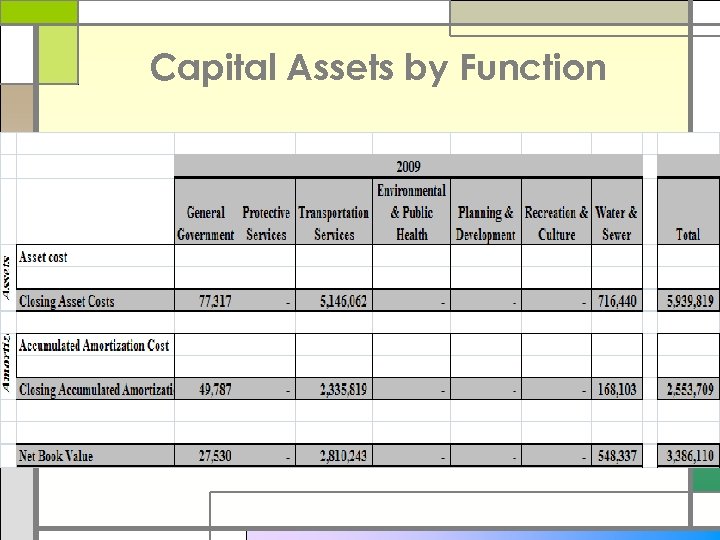

Schedules 6 & 7 – Tangible Capital Assets by Object & Function ■ Schedule 6 – TCA’s organized by: ■ Land, Buildings, Equipment, Infrastructure Etc. ■ Schedule 7 – TCA’s organized by: ■ Gen. Gov’t, Protective services, Transportation

Capital Assets by Object

Capital Assets by Function

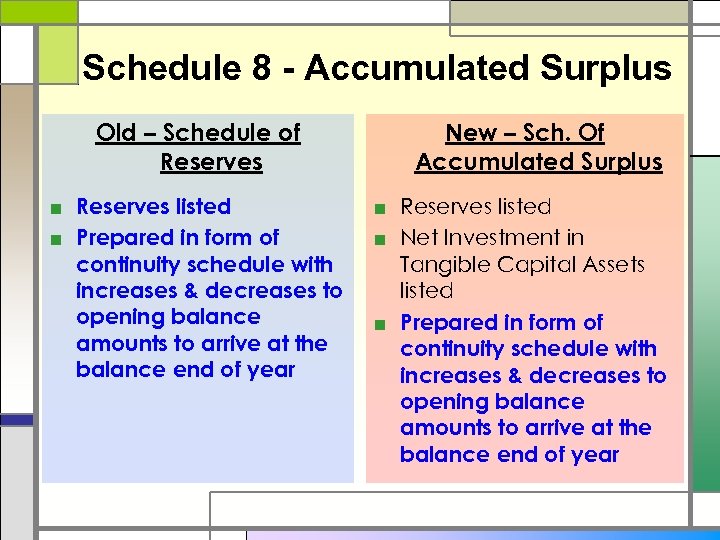

Schedule 8 - Accumulated Surplus Old – Schedule of Reserves ■ Reserves listed ■ Prepared in form of continuity schedule with increases & decreases to opening balance amounts to arrive at the balance end of year New – Sch. Of Accumulated Surplus ■ Reserves listed ■ Net Investment in Tangible Capital Assets listed ■ Prepared in form of continuity schedule with increases & decreases to opening balance amounts to arrive at the balance end of year

Management Responsibility. Report Old ■ No such report New ■ PS Recommendation – 1200. 005 ■ The Fin. Stmts. of a Gov’t. should be clearly identified and should include or be accompanied by an acknowledgement of the government’s responsibility for their preparation.

Initial Recording More work for Administrators and Auditors in this year of change. Work process for both Administrators and Auditors should be normal in future years.

Auditor’s Report – Clear Opinion ■ Same as last year. ■ Last paragraph indicates Fin. Stmts. present fairly in accordance with generally accepted accounting principles (GAAP).

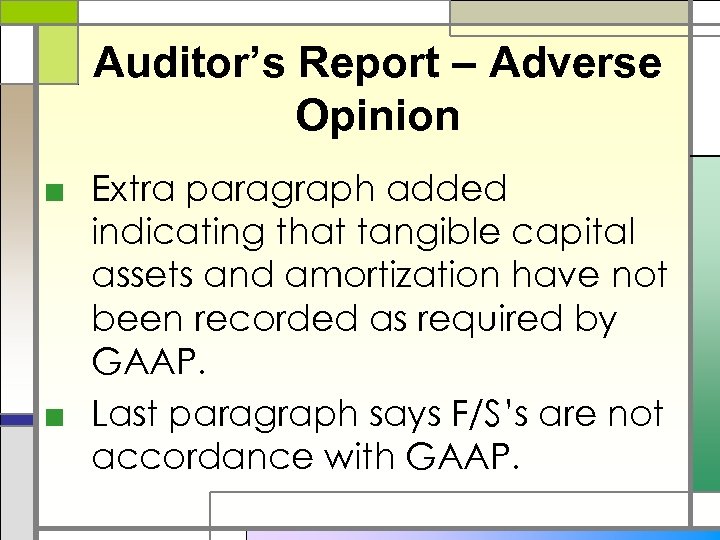

Auditor’s Report – Adverse Opinion ■ Extra paragraph added indicating that tangible capital assets and amortization have not been recorded as required by GAAP. ■ Last paragraph says F/S’s are not accordance with GAAP.

That’s All Folks Questions

30587813b1f925a2e333a0b2463cfb8a.ppt