ad6012397b5dc91d747ca026d532b2e7.ppt

- Количество слайдов: 55

Provisions Applicable to Micro, Small and Medium Enterprises By, CA. Abhay Vasant Arolkar +91 9820999231 abhay@avarolkar. com/arolkarca@gmail. com

Micro, Small and Medium Sector n Comprises q q q n 50% of India’s total manufactured exports 45% of India’s industrial employment 95% of all industrial units in India Obstacles q q Access to finance/markets Mistreatment by larger procurement companies Difficult bureaucratic procedures Lack of management skills abhay@avarolkar. com arolkarca@gmail. com 2

Micro, Small and Medium Sector n Manufacturing q q q n Services q q q n Registered – 10, 35, 102 units Unregistered – 64, 18, 294 units Total – 74, 53, 396 units Registered – 5, 17, 390 units Unregistered – 1, 81, 30, 011 units Total – 1, 86, 47, 401 units Total q q Registered – 15, 52, 492 units Unregistered – 2, 45, 48, 305 units 3

Micro, Small and Medium Sector n State-wise registrations upto March 31, 2010 q q q q q Uttar Pradesh : 61, 564 Gujarat : 55, 015 West Bengal : 48, 244 Karnataka : 44, 031 Maharashtra : 40, 190 Tamil Nadu : 36, 133 Rajasthan : 35, 368 Other States : 85, 364 Total : 405, 909 units. 4

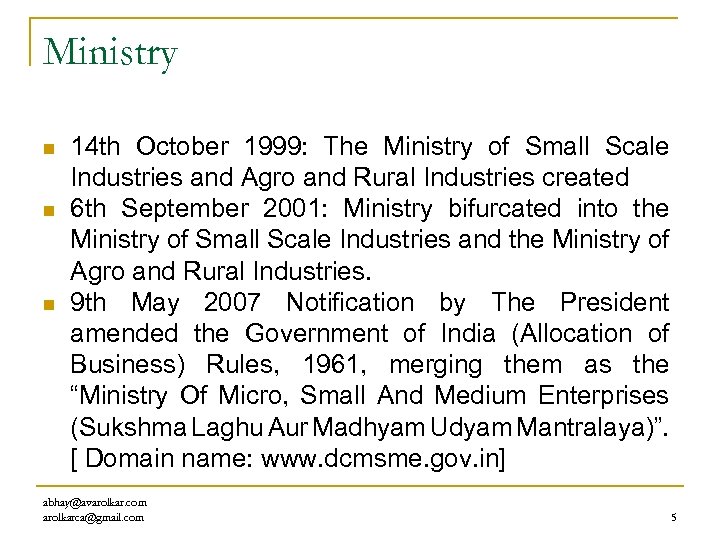

Ministry n n n 14 th October 1999: The Ministry of Small Scale Industries and Agro and Rural Industries created 6 th September 2001: Ministry bifurcated into the Ministry of Small Scale Industries and the Ministry of Agro and Rural Industries. 9 th May 2007 Notification by The President amended the Government of India (Allocation of Business) Rules, 1961, merging them as the “Ministry Of Micro, Small And Medium Enterprises (Sukshma Laghu Aur Madhyam Udyam Mantralaya)”. [ Domain name: www. dcmsme. gov. in] abhay@avarolkar. com arolkarca@gmail. com 5

Objective n To provide for facilitating the promotion and development and enhancing the competitiveness of micro, small and medium enterprises and for matters connected therewith or incidental thereto abhay@avarolkar. com arolkarca@gmail. com 6

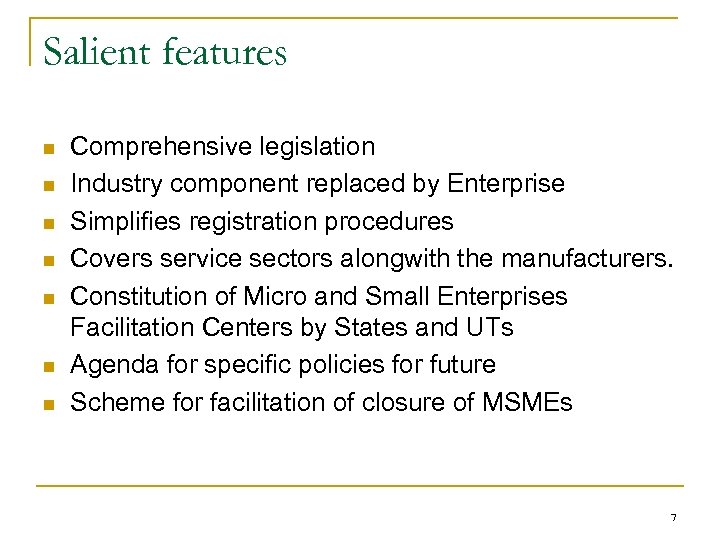

Salient features n n n n Comprehensive legislation Industry component replaced by Enterprise Simplifies registration procedures Covers service sectors alongwith the manufacturers. Constitution of Micro and Small Enterprises Facilitation Centers by States and UTs Agenda for specific policies for future Scheme for facilitation of closure of MSMEs 7

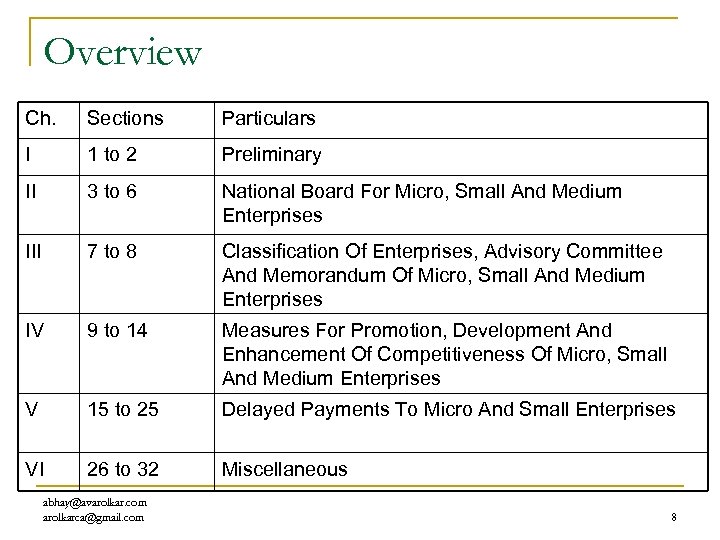

Overview Ch. Sections Particulars I 1 to 2 Preliminary II 3 to 6 National Board For Micro, Small And Medium Enterprises III 7 to 8 Classification Of Enterprises, Advisory Committee And Memorandum Of Micro, Small And Medium Enterprises IV 9 to 14 Measures For Promotion, Development And Enhancement Of Competitiveness Of Micro, Small And Medium Enterprises V 15 to 25 Delayed Payments To Micro And Small Enterprises VI 26 to 32 Miscellaneous abhay@avarolkar. com arolkarca@gmail. com 8

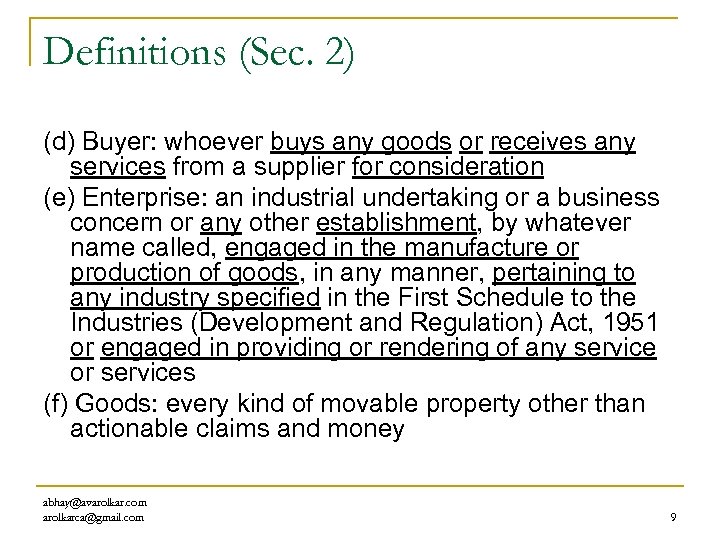

Definitions (Sec. 2) (d) Buyer: whoever buys any goods or receives any services from a supplier for consideration (e) Enterprise: an industrial undertaking or a business concern or any other establishment, by whatever name called, engaged in the manufacture or production of goods, in any manner, pertaining to any industry specified in the First Schedule to the Industries (Development and Regulation) Act, 1951 or engaged in providing or rendering of any service or services (f) Goods: every kind of movable property other than actionable claims and money abhay@avarolkar. com arolkarca@gmail. com 9

Medium enterprise 2(g) n “medium enterprise” means an enterprise classified as such under sub-clause (iii) of clause (a) or sub-clause (iii) of clause (b) of sub-section(1) of section 7 abhay@avarolkar. com arolkarca@gmail. com 10

Micro enterprise 2(h) n “micro enterprise” means an enterprise classified as such under sub-clause (i) of clause (a) or sub-clause (i) of clause (b) of sub-section (1) of section 7 abhay@avarolkar. com arolkarca@gmail. com 11

Small enterprise 2(m) n “small enterprise” means an enterprise classified as such under sub-clause (ii) of clause (a) or sub-clause (ii) of clause (b) of sub-section (1) of section 7 abhay@avarolkar. com arolkarca@gmail. com 12

Supplier 2(n) A micro or small enterprise, which has filed a memorandum with the authority referred to in clause (a) of sub-section (1) of section 8, and includes, – (i) the National Small Industries Corporation, being a company, registered under the Companies Act, 1956 (ii) the Small Industries Development Corporation of a State or a Union territory, by whatever name called, being a company registered under the Companies Act, 1956; (iii) any company, cooperative society, trust or a body, by whatever name called, registered or constituted under any law for the time being in force and engaged in selling goods produced by micro or small enterprises and rendering services which are provided by such enterprises abhay@avarolkar. com arolkarca@gmail. com 13

National Board For Micro, Small and Medium Enterprises Ch II n n n Established under Section 3 by Central Government For playing pro-active role in facilitating and coordinating the inter institutional linkages among the organizations of Central/State Governments for the growth and development of MSMEs First met on 20. 6. 2007 under the Chairmanship of Shri Mahabir Prasad, Union Minister for MSMEs abhay@avarolkar. com arolkarca@gmail. com 14

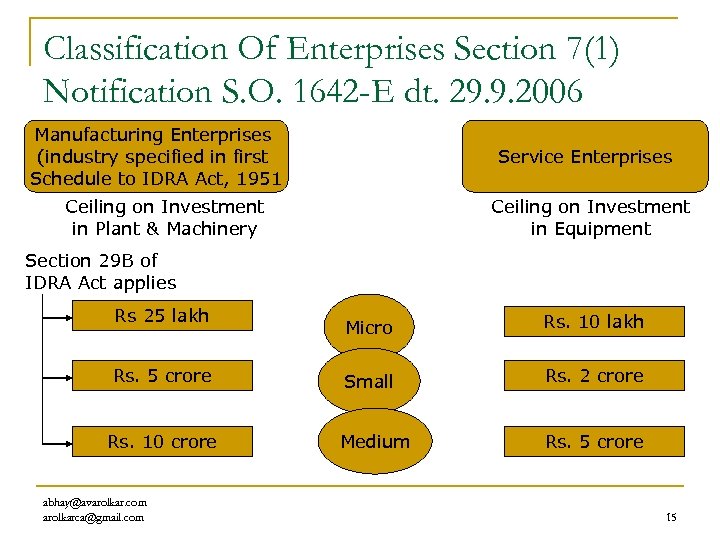

Classification Of Enterprises Section 7(1) Notification S. O. 1642 -E dt. 29. 9. 2006 Manufacturing Enterprises (industry specified in first Schedule to IDRA Act, 1951 Service Enterprises Ceiling on Investment in Plant & Machinery Ceiling on Investment in Equipment Section 29 B of IDRA Act applies Rs 25 lakh Rs. 5 crore Rs. 10 crore abhay@avarolkar. com arolkarca@gmail. com Micro Rs. 10 lakh Small Rs. 2 crore Medium Rs. 5 crore 15

Investment in plant & machinery … n n n Original cost excluding Land building and furniture, fittings and such items, specifically excluded in calculating the investment in plant and machinery, the cost of pollution control, research and development, industrial safety devices and such other items as may be specified, by notification, shall be excluded. Guidelines for calculation : Notification S. O. 1722 -E dated 5. 10. 2006 abhay@avarolkar. com arolkarca@gmail. com 16

CALCULATION OF INVESTMENT FOR PLANT & MACHINERY n n In calculating the value of plant and machinery for the purpose of calculating investment limit, the original price thereof, irrespective of whether the plant and machinery are new or second hand shall be taken into account. In case the enterprise is unable to assess the original investment criteria, a certificate with regard to investment in plant, machinery, equipment etc. would be obtained from a Chartered Accountant. The investment in establishing wind mill/s to generate electricity for captive consumption or partly for captive consumption and remaining power to sell to Electricity Boards/others are to be included in the investment in plant and machinery. 17

Section 29 B n Section 29 B of the IDRA Act 1951 empowers the Central Government to exempt any industrial undertaking or class of industrial undertakings from any of the provisions of that Act, having regard to the smallness of the number of workers employed or to the amount invested in any industrial undertaking or to the desirability of encouraging small undertakings generally or to the stage of development of any scheduled industry abhay@avarolkar. com arolkarca@gmail. com 18

Advisory Committee Section 7(2) to 7(8) n n n Notification No S. O. 1622 -E dt. 27. 09. 2006 Constituted for two years from the date of the notification 13 members including one Chairperson (Secretary to the Government of India, Ministry of Small Scale Industries and Ministry of Agro and Rural Industries) To meet ordinarily, at least once in 3 months Can invite other persons to meetings abhay@avarolkar. com arolkarca@gmail. com 19

Functions – Advisory Committee n n n Recommend the Central Government prior to classifying any class or classes of enterprises Examine the matters referred to it by the Board under section 5 and furnish its recommendations Render advice where called for to q q The Central Government on any of the matters specified in section 9, 10, 11, 12 or 14 of Chapter IV. The State Government on any of the matters specified in the rules made under section 30 abhay@avarolkar. com arolkarca@gmail. com 20

Considerations – Advisory Committee 7(8) (a) (b) (c) (d) (e) the level of employment the level of investments in plant and machinery or equipment the need of higher investment in plant and machinery or equipment for technological upgradation, employment generation and enhanced competitiveness the possibility of promoting and diffusing entrepreneurship in micro, small or medium enterprises the international standards for classification of small and medium enterprises abhay@avarolkar. com arolkarca@gmail. com 21

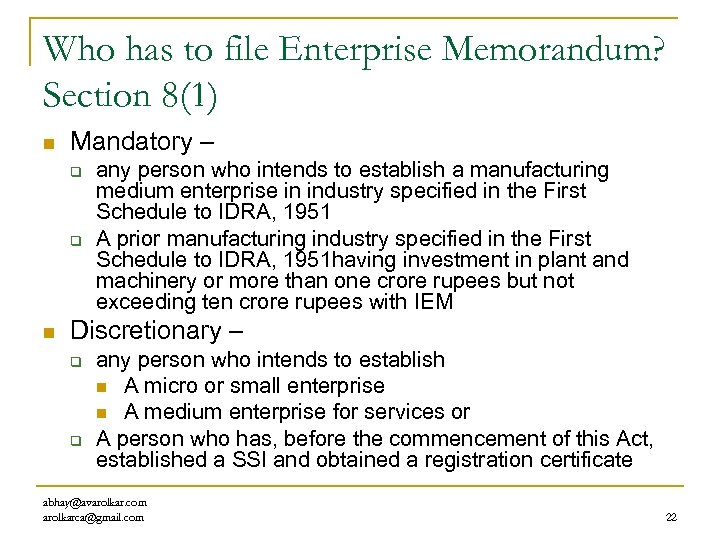

Who has to file Enterprise Memorandum? Section 8(1) n Mandatory – q q n any person who intends to establish a manufacturing medium enterprise in industry specified in the First Schedule to IDRA, 1951 A prior manufacturing industry specified in the First Schedule to IDRA, 1951 having investment in plant and machinery or more than one crore rupees but not exceeding ten crore rupees with IEM Discretionary – q q any person who intends to establish n A micro or small enterprise n A medium enterprise for services or A person who has, before the commencement of this Act, established a SSI and obtained a registration certificate abhay@avarolkar. com arolkarca@gmail. com 22

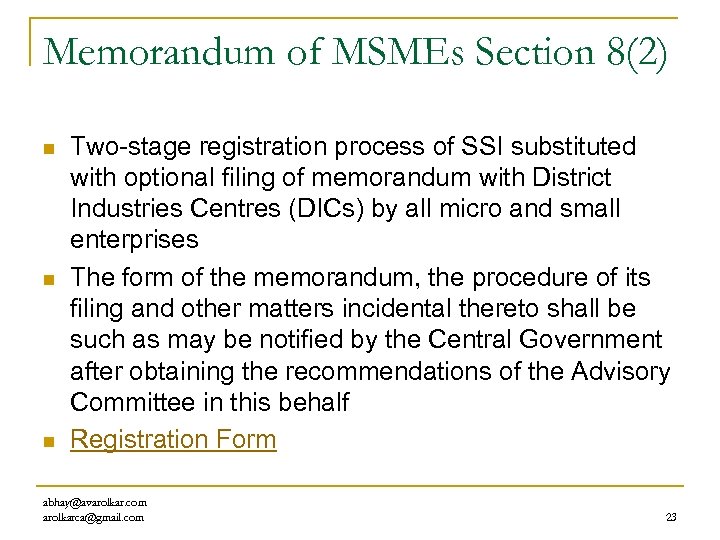

Memorandum of MSMEs Section 8(2) n n n Two-stage registration process of SSI substituted with optional filing of memorandum with District Industries Centres (DICs) by all micro and small enterprises The form of the memorandum, the procedure of its filing and other matters incidental thereto shall be such as may be notified by the Central Government after obtaining the recommendations of the Advisory Committee in this behalf Registration Form abhay@avarolkar. com arolkarca@gmail. com 23

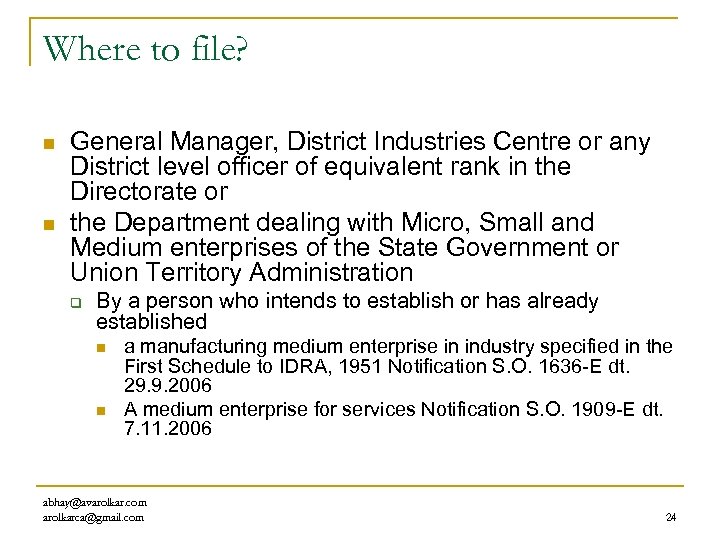

Where to file? n n General Manager, District Industries Centre or any District level officer of equivalent rank in the Directorate or the Department dealing with Micro, Small and Medium enterprises of the State Government or Union Territory Administration q By a person who intends to establish or has already established n n a manufacturing medium enterprise in industry specified in the First Schedule to IDRA, 1951 Notification S. O. 1636 -E dt. 29. 9. 2006 A medium enterprise for services Notification S. O. 1909 -E dt. 7. 11. 2006 abhay@avarolkar. com arolkarca@gmail. com 24

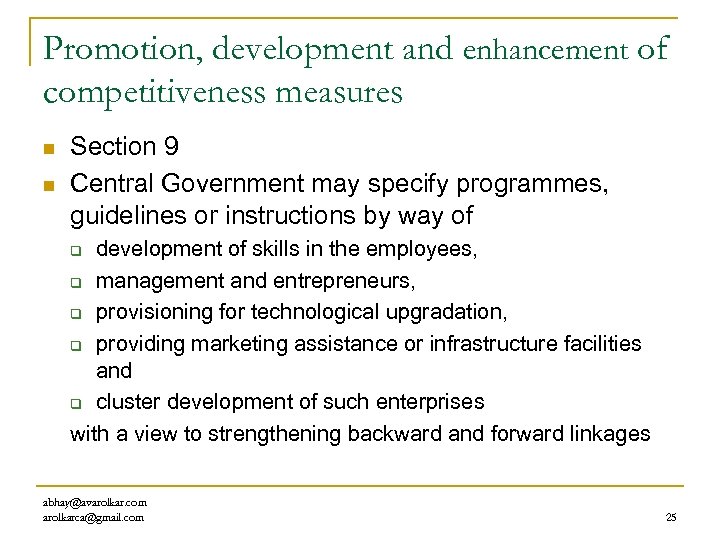

Promotion, development and enhancement of competitiveness measures n n Section 9 Central Government may specify programmes, guidelines or instructions by way of development of skills in the employees, q management and entrepreneurs, q provisioning for technological upgradation, q providing marketing assistance or infrastructure facilities and q cluster development of such enterprises with a view to strengthening backward and forward linkages q abhay@avarolkar. com arolkarca@gmail. com 25

Credit facilities Section 10 n Progressive policies and practices to be issued in the guidelines or instructions issued by the Reserve Bank, from time to time, to q q q n ensure timely and smooth flow of credit minimise the incidence of sickness enhance the competitiveness RBI Notifications: q q q Apr 04, 2007 : Credit flow to Micro, Small and Medium Enterprises Sector Apr 18, 2007 : Credit flow to Micro, Small and Medium Enterprises Sector-UCBs Guidelines On Lending To Priority Sector – Revised dt. April 30, 2007 abhay@avarolkar. com arolkarca@gmail. com 26

Other measures by Central Government n n notify preference policies in respect of procurement of goods and services, produced and provided by micro and small enterprises, by its Ministries or departments, or its aided institutions and public sector enterprises S 11 Constitution of Funds S 12 Credit of grants to the Funds S 13 Administration and utilisation of Funds S 14 abhay@avarolkar. com arolkarca@gmail. com 27

Delayed Payments to Micro and Small Enterprises Ch. V n more effective mechanisms for mitigating the problems of delayed payments to micro and small enterprises abhay@avarolkar. com arolkarca@gmail. com 28

Payments by buyer to supplier n n Payment to be made on or before the date agreed upon or appointed day The period agreed upon between the supplier and the buyer in writing shall not exceed forty-five days from the day of acceptance or the day of deemed acceptance. abhay@avarolkar. com arolkarca@gmail. com 29

Appointed day S 2(b) n the day following immediately after the expiry of 15 days from the day of acceptance or the day of deemed acceptance of any goods or any services by a buyer from a supplier abhay@avarolkar. com arolkarca@gmail. com 30

Day of acceptance (a) (b) where no objection is made in writing by the buyer regarding acceptance of goods or services within fifteen days from the day of the delivery of goods or the rendering of services, the day of the actual delivery of goods or the rendering of services where any objection is made in writing by the buyer regarding acceptance of goods or services within fifteen days from the day of the delivery of goods or the rendering of services, the day on which such objection is removed by the supplier; abhay@avarolkar. com arolkarca@gmail. com 31

Delayed Payments to Micro and Small Enterprises – Problem 1 n n No objection in writing from buyer No credit period Date of Order : October 3, 2010 Date of Supply : November 3, 2010 32

Delayed Payments to Micro and Small Enterprises – Problem 2 n n No objection in writing from buyer Credit period : 60 days Date of Order : October 3, 2010 Date of Supply : November 3, 2010 33

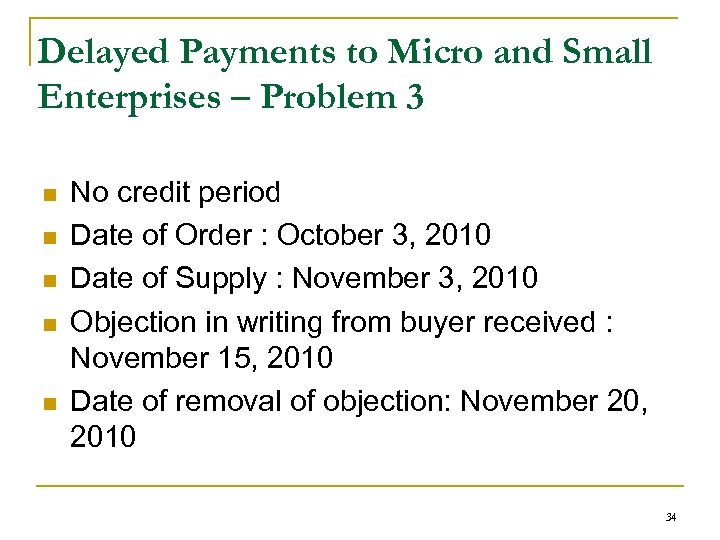

Delayed Payments to Micro and Small Enterprises – Problem 3 n n n No credit period Date of Order : October 3, 2010 Date of Supply : November 3, 2010 Objection in writing from buyer received : November 15, 2010 Date of removal of objection: November 20, 2010 34

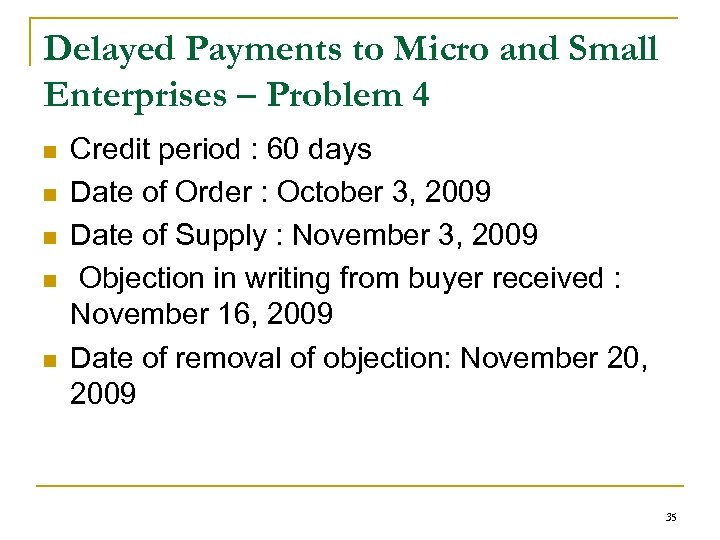

Delayed Payments to Micro and Small Enterprises – Problem 4 n n n Credit period : 60 days Date of Order : October 3, 2009 Date of Supply : November 3, 2009 Objection in writing from buyer received : November 16, 2009 Date of removal of objection: November 20, 2009 35

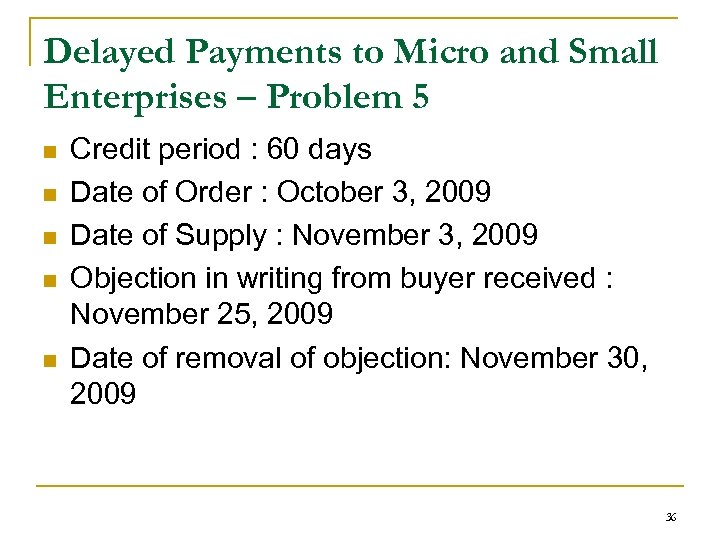

Delayed Payments to Micro and Small Enterprises – Problem 5 n n n Credit period : 60 days Date of Order : October 3, 2009 Date of Supply : November 3, 2009 Objection in writing from buyer received : November 25, 2009 Date of removal of objection: November 30, 2009 36

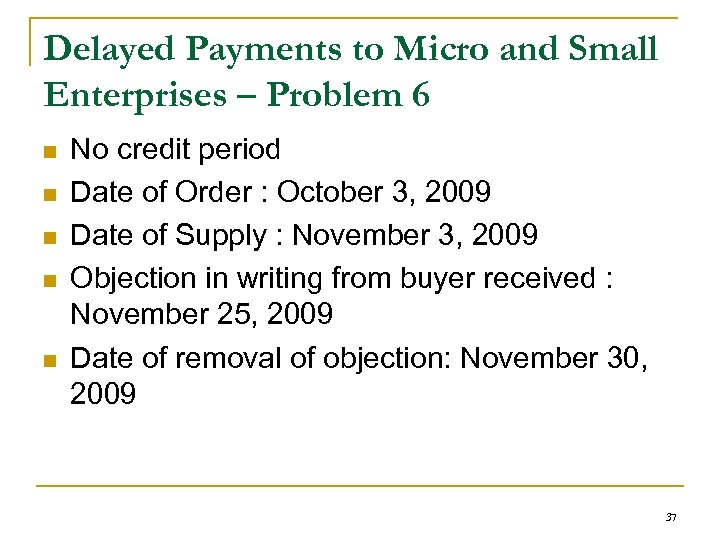

Delayed Payments to Micro and Small Enterprises – Problem 6 n n n No credit period Date of Order : October 3, 2009 Date of Supply : November 3, 2009 Objection in writing from buyer received : November 25, 2009 Date of removal of objection: November 30, 2009 37

Interest S 16, 17 n When applicable? q n Buyer fails to pay as per S. 15 Liability q q compound interest with monthly rests to the supplier on that amount from the appointed day or, as the case may be, from the date immediately following the date agreed upon, at three times of the bank rate notified by the Reserve Bank notwithstanding anything contained in any agreement between the buyer and the supplier or in any law for the time being in force. abhay@avarolkar. com arolkarca@gmail. com 38

Micro and Small Enterprises Facilitation Council Sections 20 & 21 n n n To be established by State Governments Not less than 3 and not more than 5 members (including chairperson) The composition of the Micro and Small Enterprise Facilitation Council, the manner of filling vacancies of its members and the procedure to be followed in the discharge of their functions by the members to be prescribed by State Governments abhay@avarolkar. com arolkarca@gmail. com 39

Reference to Micro and Small Enterprises Facilitation Council S 18 n Who may refer? q n For what amount? q n n any party to a dispute Amount due plus interest Notwithstanding anything contained in any other law for the time being in force What will the Council do? q q itself conduct conciliation in the matter or Refer to any institution or centre providing alternate dispute resolution services for conducting conciliation (provisions of sections 65 to 81 of the Arbitration and Conciliation Act, 1996 to apply as if the conciliation was initiated under Part III of that Act). abhay@avarolkar. com arolkarca@gmail. com 40

Failure of conciliation 18(3) n Where the conciliation stands terminated on failure, the Council shall q q itself take up the dispute for arbitration or refer it to any institution or centre providing alternate dispute resolution services arbitration (provisions of the Arbitration and Conciliation Act, 1996, to apply as if the arbitration was in pursuance of an arbitration agreement referred to in section 7(1) of that Act) abhay@avarolkar. com arolkarca@gmail. com 41

Arbitrator/conciliator n Jurisdiction of such Arbitrator/conciliator: q n dispute between the supplier located within its jurisdiction and a buyer located anywhere in India. Time limit for decision of reference: q 90 days from the date of reference abhay@avarolkar. com arolkarca@gmail. com 42

Application for setting aside decree, award or other order S. 19 n n n Application to a Court Appellant (not being a supplier) has to deposit 75% of the amount in terms of the decree, award or, other order in the manner directed by such court The court may order that such percentage of the amount deposited shall be paid to the supplier, as it considers reasonable under the circumstances of the case subject to such conditions as it deems necessary to impose abhay@avarolkar. com arolkarca@gmail. com 43

Details to be specified in annual accounts if required by law to be audited S 22 (i) (iii) (iv) (v) The principal and the interest due (separately) remaining unpaid as at the end of each accounting year; Interest paid by the buyer u/s 18, along with the payment made beyond the appointed day during each accounting year Interest due and payable for the period of delay in making payment (which have been paid but beyond the appointed day during the year) but without adding the interest specified under this Act the amount of interest accrued and remaining unpaid at the end of each accounting year; and the amount of further interest remaining due and payable even in the succeeding years, until such date when the interest dues as above are actually paid to the small enterprise, for the purpose of disallowance as a deductible expenditure under section 23. abhay@avarolkar. com arolkarca@gmail. com 44

Disclosure requirements n Under Companies Act, 1956 q Schedule VI “The following shall be disclosed under notes to the accounts: n The principal amount and the interest due thereon n The amount of interest paid by the buyer in terms of section 16 along with the amount of the payment made to the supplier beyond the appointed day n The amount of interest due and payable for the period of delay in making payment (which have been paid but beyond the appointed day during the year) but without adding the interest specified under the Micro, Small and Medium Enterprises Development Act, 2006; abhay@avarolkar. com arolkarca@gmail. com 45

Disclosure requirements n The amount of interest accrued and remaining unpaid at the end of each accounting year; and n The amount of further interest remaining due and payable even in the succeeding years, until such date when the interest dues as above are actually paid to the small enterprise, for the purpose of disallowance as a deductible expenditure under section 23 of the Micro, Small and Medium Enterprises Development Act, 2006. Relating to “Liabilities”, under the heading “current liabilities and provisions n Total outstanding dues of micro enterprises and small enterprises; and n Total outstanding dues of creditors other than micro enterprises and small enterprises. abhay@avarolkar. com arolkarca@gmail. com 46

Disclosure requirements n Under Income Tax Act, 1961 q Tax Audit Report Vide the Income-tax (Tenth Amendment) Rules, 2009 Income Form 3 CD has been amended by insertion of a new entry no. 17 A which reads as follows: n "17 A. Amount of interest inadmissible under section 23 of the Micro, Small and Medium Enterprises Development Act, 2006. ". abhay@avarolkar. com arolkarca@gmail. com 47

Interest not to be allowed as deduction from income. S 23 n n the amount of interest payable or paid by any buyer, under or in accordance with the provisions of this Act, shall not, for the purposes of computation of income under the Income-tax Act, 1961, be allowed as deduction. sections 15 to 23 shall have overriding effect abhay@avarolkar. com arolkarca@gmail. com 48

Scheme for closure of business S. 25 n n n For a micro, small or medium enterprise, not being a company registered under the Companies Act, 1956 Scheme to be notified by the Central Government within one year from the date of commencement of this Act To facilitate closure of business abhay@avarolkar. com arolkarca@gmail. com 49

Policy for Closure of business n To ensure q q q To ensure that inefficient investment is directed to more efficient businesses Prevent mismanagement and irresponsible practices Set priorities on closure amongst n n Owners Employees Other Stakeholders No policy notified till date 50

Penalties n n n Whoever intentionally contravenes or attempts to contravene or abets the contravention of any of the provisions contained in subsection (1) of section 8 or sub-section (2) of section 26 shall be punishable q in the case of the first conviction, with fine which may extend to rupees one thousand; and q in the case of any second or subsequent conviction, with fine which shall not be less than rupees one thousand but may extend to rupees ten thousand Where a buyer contravenes the provisions of section 22, he shall be punishable with a fine which shall not be less than rupees ten thousand No court inferior to that of a Metropolitan Magistrate or a Magistrate of the first class shall try any offence punishable under this Act abhay@avarolkar. com arolkarca@gmail. com 51

Areas that need government intervention n n Tiny, small and medium enterprises should have their own separate priority packages of financing lest the tiniest are not elbowed out by the biggest Create separate capital markets for these sectors. Encourage better labour practices Promote woman entrepreneurship 52

Websites n n http: //msme. nic. in/ Ministry of Micro, Small and Medium Enterprises http: //dcmsme. gov. in/ Development Commissioner, MSME http: //www. fisme. org. in/index. htm Federation of Indian Micro, Small and Medium Enterprises http: //www. rbi. org. in Reserve Bank of India abhay@avarolkar. com arolkarca@gmail. com 53

Opportunities for CAs under the Act n n n Registration for clients under the Act Registration for self under the Act Knowledge of the Act essential for compliance: q q n n n Disclosure requirements Calculation of interest for delayed payments Could be an attorney for the client in case of disputes under settlement before the Facilitation Council As and when the scheme for closure is declared, he would be able to play a part for smooth closure Consultation for various schemes and facilities available to MSMEs 54

QUESTIONS/ SUGGESTIONS/ COMMENTS… THANK YOU abhay@avarolkar. com arolkarca@gmail. com 55

ad6012397b5dc91d747ca026d532b2e7.ppt