6da36cdb93c88029fad2606cfb0ca493.ppt

- Количество слайдов: 48

Protect Yourself, Your Practice & the People who Rely on You Disability Insurance Strategies As You Start Your Career Presented by: Your Name

Protect Yourself, Your Practice & the People who Rely on You Disability Insurance Strategies As You Start Your Career Presented by: Your Name

Be realistic Be proactive Be confident

Be realistic Be proactive Be confident

What is the #1 cause of disabilities? (Since 2005) A. Accidents at home B. Musculoskeletal disorders C. Spine and nervous disorders D. Accidents at work 2011 CDA Long-Term Disability Claims Review

What is the #1 cause of disabilities? (Since 2005) A. Accidents at home B. Musculoskeletal disorders C. Spine and nervous disorders D. Accidents at work 2011 CDA Long-Term Disability Claims Review

What is the #1 cause of disabilities? (Since 2005) B. Musculoskeletal disorders 2013 CDA Long-Term Disability Claims Review

What is the #1 cause of disabilities? (Since 2005) B. Musculoskeletal disorders 2013 CDA Long-Term Disability Claims Review

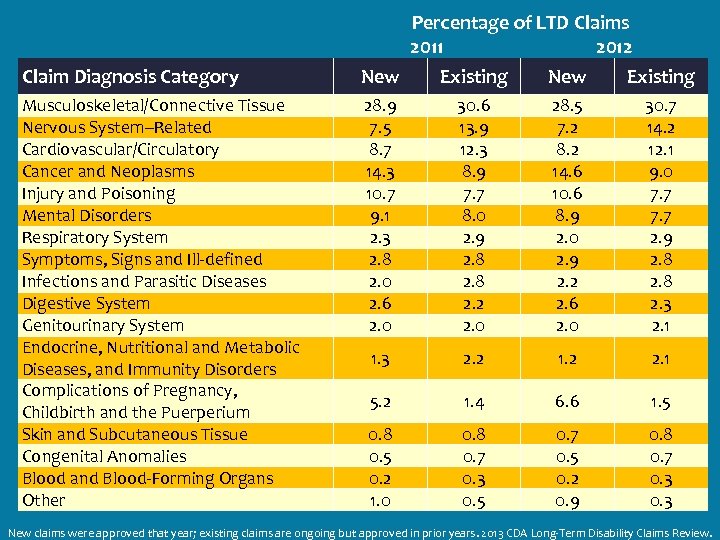

Percentage of LTD Claims 2011 2012 Claim Diagnosis Category New Existing Musculoskeletal/Connective Tissue Nervous System–Related Cardiovascular/Circulatory Cancer and Neoplasms Injury and Poisoning Mental Disorders Respiratory System Symptoms, Signs and Ill-defined Infections and Parasitic Diseases Digestive System Genitourinary System Endocrine, Nutritional and Metabolic Diseases, and Immunity Disorders Complications of Pregnancy, Childbirth and the Puerperium Skin and Subcutaneous Tissue Congenital Anomalies Blood and Blood-Forming Organs Other 28. 9 7. 5 8. 7 14. 3 10. 7 9. 1 2. 3 2. 8 2. 0 2. 6 2. 0 30. 6 13. 9 12. 3 8. 9 7. 7 8. 0 2. 9 2. 8 2. 2 2. 0 28. 5 7. 2 8. 2 14. 6 10. 6 8. 9 2. 0 2. 9 2. 2 2. 6 2. 0 30. 7 14. 2 12. 1 9. 0 7. 7 2. 9 2. 8 2. 3 2. 1 1. 3 2. 2 1. 2 2. 1 5. 2 1. 4 6. 6 1. 5 0. 8 0. 5 0. 2 1. 0 0. 8 0. 7 0. 3 0. 5 0. 7 0. 5 0. 2 0. 9 0. 8 0. 7 0. 3 New claims were approved that year; existing claims are ongoing but approved in prior years. 2013 CDA Long-Term Disability Claims Review.

Percentage of LTD Claims 2011 2012 Claim Diagnosis Category New Existing Musculoskeletal/Connective Tissue Nervous System–Related Cardiovascular/Circulatory Cancer and Neoplasms Injury and Poisoning Mental Disorders Respiratory System Symptoms, Signs and Ill-defined Infections and Parasitic Diseases Digestive System Genitourinary System Endocrine, Nutritional and Metabolic Diseases, and Immunity Disorders Complications of Pregnancy, Childbirth and the Puerperium Skin and Subcutaneous Tissue Congenital Anomalies Blood and Blood-Forming Organs Other 28. 9 7. 5 8. 7 14. 3 10. 7 9. 1 2. 3 2. 8 2. 0 2. 6 2. 0 30. 6 13. 9 12. 3 8. 9 7. 7 8. 0 2. 9 2. 8 2. 2 2. 0 28. 5 7. 2 8. 2 14. 6 10. 6 8. 9 2. 0 2. 9 2. 2 2. 6 2. 0 30. 7 14. 2 12. 1 9. 0 7. 7 2. 9 2. 8 2. 3 2. 1 1. 3 2. 2 1. 2 2. 1 5. 2 1. 4 6. 6 1. 5 0. 8 0. 5 0. 2 1. 0 0. 8 0. 7 0. 3 0. 5 0. 7 0. 5 0. 2 0. 9 0. 8 0. 7 0. 3 New claims were approved that year; existing claims are ongoing but approved in prior years. 2013 CDA Long-Term Disability Claims Review.

How many 20 -year olds are likely to suffer a disability? A. 1/4 B. 1/10 C. 1/15 U. S. Social Security Administration, Fact Sheet February 7, 2013

How many 20 -year olds are likely to suffer a disability? A. 1/4 B. 1/10 C. 1/15 U. S. Social Security Administration, Fact Sheet February 7, 2013

How many 20 -year olds are likely to suffer a disability? A. 1/4 U. S. Social Security Administration, Fact Sheet February 7, 2013

How many 20 -year olds are likely to suffer a disability? A. 1/4 U. S. Social Security Administration, Fact Sheet February 7, 2013

Working men are more likely to become disabled than working women. True False U. S. Social Security Administration, Fact Sheet February 7, 2013

Working men are more likely to become disabled than working women. True False U. S. Social Security Administration, Fact Sheet February 7, 2013

Working men are more likely to become disabled than working women. False U. S. Social Security Administration, Fact Sheet February 7, 2013

Working men are more likely to become disabled than working women. False U. S. Social Security Administration, Fact Sheet February 7, 2013

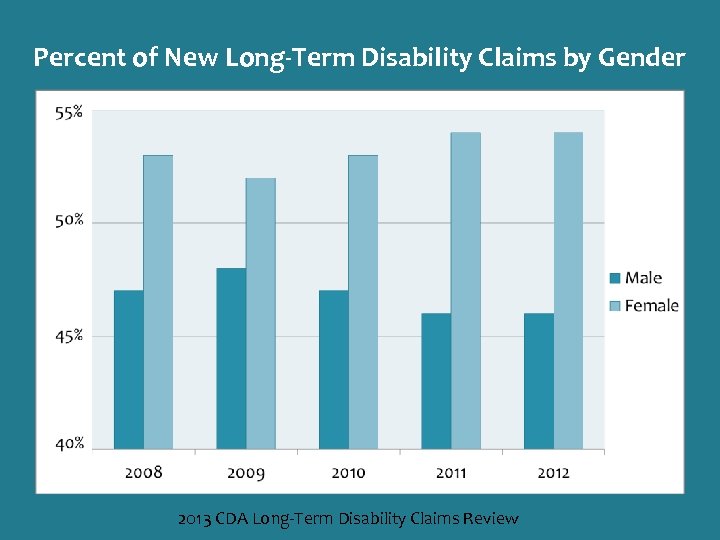

Percent of New Long-Term Disability Claims by Gender 2013 CDA Long-Term Disability Claims Review

Percent of New Long-Term Disability Claims by Gender 2013 CDA Long-Term Disability Claims Review

The average disability lasts… A. 6 months B. 1 year C. 3 years D. 10 years Gen Re, U. S. Group Disability Rate & Risk Management Survey 2012, based on claims closed in 2011 Gen Re, U. S. Individual DI Risk Management Survey 2011, based on claims closed in 2010

The average disability lasts… A. 6 months B. 1 year C. 3 years D. 10 years Gen Re, U. S. Group Disability Rate & Risk Management Survey 2012, based on claims closed in 2011 Gen Re, U. S. Individual DI Risk Management Survey 2011, based on claims closed in 2010

The average disability lasts… C. 3 years Gen Re, U. S. Group Disability Rate & Risk Management Survey 2012, based on claims closed in 2011 Gen Re, U. S. Individual DI Risk Management Survey 2011, based on claims closed in 2010

The average disability lasts… C. 3 years Gen Re, U. S. Group Disability Rate & Risk Management Survey 2012, based on claims closed in 2011 Gen Re, U. S. Individual DI Risk Management Survey 2011, based on claims closed in 2010

What was last year’s average Social Security benefit amount? A. $2, 150 B. $1, 580 C. $1, 130 D. $975 U. S. Social Security Administration

What was last year’s average Social Security benefit amount? A. $2, 150 B. $1, 580 C. $1, 130 D. $975 U. S. Social Security Administration

What was last year’s average Social Security benefit amount? C. $1, 130 U. S. Social Security Administration

What was last year’s average Social Security benefit amount? C. $1, 130 U. S. Social Security Administration

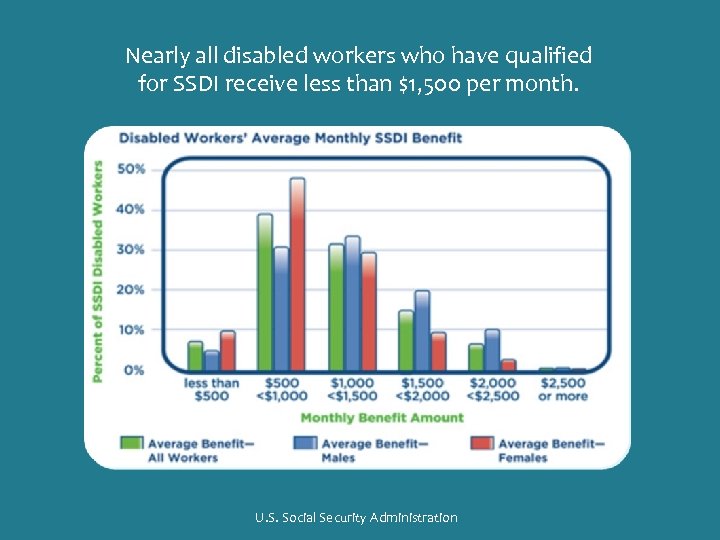

Nearly all disabled workers who have qualified for SSDI receive less than $1, 500 per month. U. S. Social Security Administration

Nearly all disabled workers who have qualified for SSDI receive less than $1, 500 per month. U. S. Social Security Administration

Be Realistic

Be Realistic

“I never thought it could happen to me. ” Met. Life Study of the Emotional and Financial Impact of Disability, March 2010

“I never thought it could happen to me. ” Met. Life Study of the Emotional and Financial Impact of Disability, March 2010

Age Potential Lifetime Income (In Millions) 30 35 40 45 50 55 60 100 k 3. 5 3 2. 5 2 1. 5 1 0. 5 Salary 150 k 200 k 250 k 5. 25 7 8. 75 4. 5 6 7. 5 3. 75 5 6. 25 3 4 5 2. 25 3 3. 75 1. 5 2 2. 5 0. 75 1 1. 25 Calculations are only based on income from the age noted until age 65. They do not include income outside this timeframe, potential salary increases, investments or taxes.

Age Potential Lifetime Income (In Millions) 30 35 40 45 50 55 60 100 k 3. 5 3 2. 5 2 1. 5 1 0. 5 Salary 150 k 200 k 250 k 5. 25 7 8. 75 4. 5 6 7. 5 3. 75 5 6. 25 3 4 5 2. 25 3 3. 75 1. 5 2 2. 5 0. 75 1 1. 25 Calculations are only based on income from the age noted until age 65. They do not include income outside this timeframe, potential salary increases, investments or taxes.

the future Salary & Incentives Advancement Savings & Interest Disability Costs

the future Salary & Incentives Advancement Savings & Interest Disability Costs

Be Proactive

Be Proactive

“Make sure you have disability insurance through your job or buy it on your own. I did and it saved my life. ” Met. Life Study of the Emotional and Financial Impact of Disability, March 2010

“Make sure you have disability insurance through your job or buy it on your own. I did and it saved my life. ” Met. Life Study of the Emotional and Financial Impact of Disability, March 2010

Joe Age: 35 Married with kids Annual pay: $275, 000 Scenario is hypothetical only and does not depict the results of any actual disability income insurance policy. The provisions in an actual policy, including benefit amount and premium, depend on the individual circumstances.

Joe Age: 35 Married with kids Annual pay: $275, 000 Scenario is hypothetical only and does not depict the results of any actual disability income insurance policy. The provisions in an actual policy, including benefit amount and premium, depend on the individual circumstances.

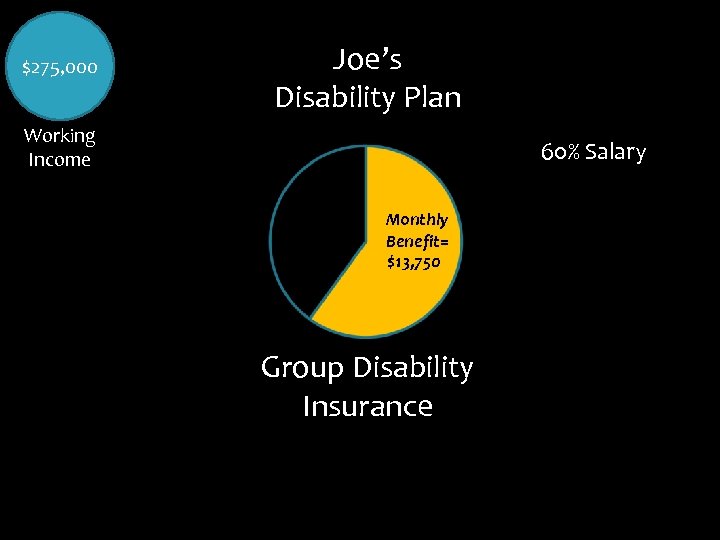

$275, 000 Joe’s Disability Plan Working Income 60% Salary Benefit= Monthly $13, 750 Benefit= $13, 750 Group Disability Insurance

$275, 000 Joe’s Disability Plan Working Income 60% Salary Benefit= Monthly $13, 750 Benefit= $13, 750 Group Disability Insurance

$275, 000 Joe’s Disability Plan Working Income 60% Salary Monthly Benefit= $12, 500 $250, 000 Covered Income Group Disability Insurance - Incentive Pay

$275, 000 Joe’s Disability Plan Working Income 60% Salary Monthly Benefit= $12, 500 $250, 000 Covered Income Group Disability Insurance - Incentive Pay

$275, 000 Joe’s Disability Plan Working Income 60% Salary Monthly Benefit= $10, 000 $250, 000 Covered Income Group Disability Insurance - Incentive Pay - Max Benefit

$275, 000 Joe’s Disability Plan Working Income 60% Salary Monthly Benefit= $10, 000 $250, 000 Covered Income Group Disability Insurance - Incentive Pay - Max Benefit

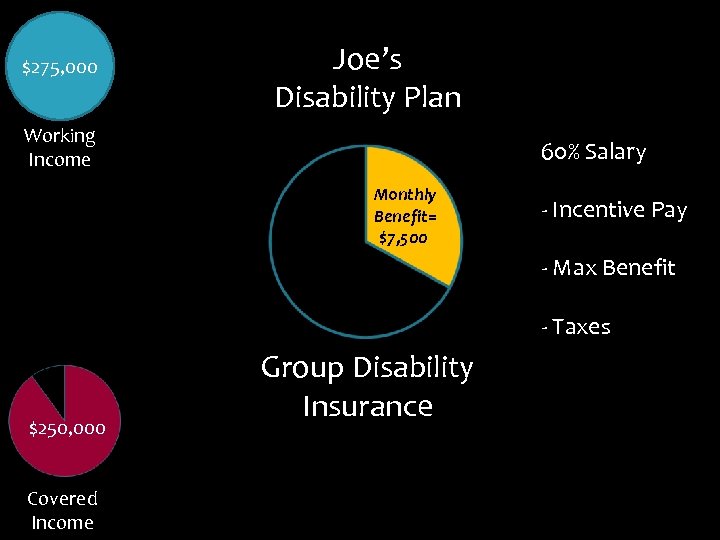

$275, 000 Joe’s Disability Plan Working Income 60% Salary Monthly Benefit= $7, 500 - Incentive Pay - Max Benefit - Taxes $250, 000 Covered Income Group Disability Insurance

$275, 000 Joe’s Disability Plan Working Income 60% Salary Monthly Benefit= $7, 500 - Incentive Pay - Max Benefit - Taxes $250, 000 Covered Income Group Disability Insurance

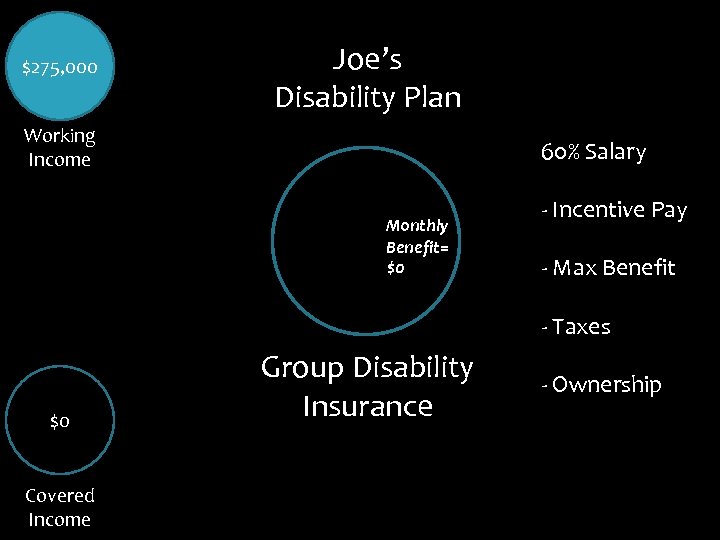

$275, 000 Joe’s Disability Plan Working Income 60% Salary Monthly Benefit= $0 - Incentive Pay - Max Benefit - Taxes $0 Covered Income Group Disability Insurance - Ownership

$275, 000 Joe’s Disability Plan Working Income 60% Salary Monthly Benefit= $0 - Incentive Pay - Max Benefit - Taxes $0 Covered Income Group Disability Insurance - Ownership

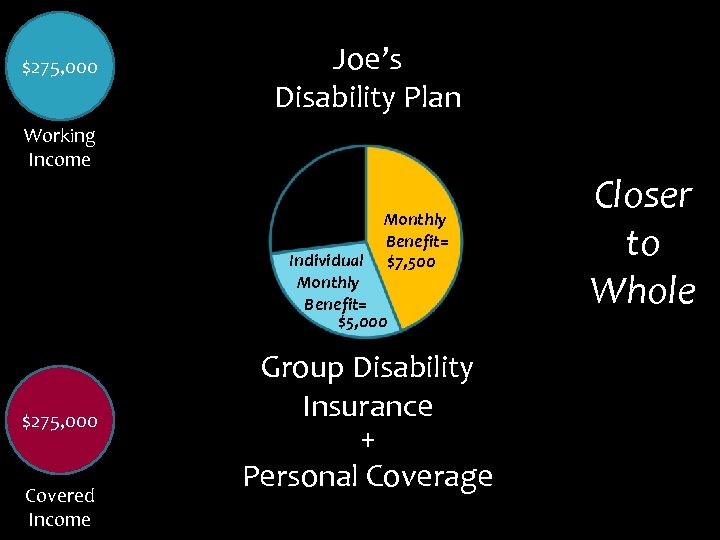

$275, 000 Joe’s Disability Plan Working Income Monthly Benefit= $7, 500 Individual Monthly Benefit= $5, 000 $275, 000 Covered Income Group Disability Insurance + Personal Coverage Closer to Whole

$275, 000 Joe’s Disability Plan Working Income Monthly Benefit= $7, 500 Individual Monthly Benefit= $5, 000 $275, 000 Covered Income Group Disability Insurance + Personal Coverage Closer to Whole

Individual Disability Insurance

Individual Disability Insurance

Meet Sarah Income: $112, 000 Noncancellable and Guaranteed Renewable Disability Insurance with a Residual Benefit Rider Monthly Benefit: $5, 000 Waiting Period: 180 days Benefit Period: To Age 65 Results may vary, based on your specific situation.

Meet Sarah Income: $112, 000 Noncancellable and Guaranteed Renewable Disability Insurance with a Residual Benefit Rider Monthly Benefit: $5, 000 Waiting Period: 180 days Benefit Period: To Age 65 Results may vary, based on your specific situation.

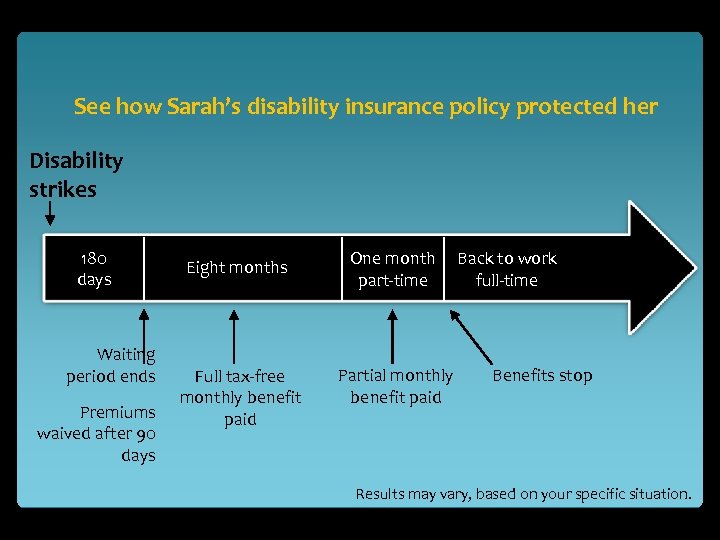

See how Sarah’s disability insurance policy protected her Disability strikes 180 days Waiting period ends Premiums waived after 90 days Eight months Full tax-free monthly benefit paid Results may vary, based on your specific situation.

See how Sarah’s disability insurance policy protected her Disability strikes 180 days Waiting period ends Premiums waived after 90 days Eight months Full tax-free monthly benefit paid Results may vary, based on your specific situation.

See how Sarah’s disability insurance policy protected her Disability strikes 180 days Waiting period ends Premiums waived after 90 days Eight months Full tax-free monthly benefit paid One month part-time Partial monthly benefit paid Back to work full-time Benefits stop Results may vary, based on your specific situation.

See how Sarah’s disability insurance policy protected her Disability strikes 180 days Waiting period ends Premiums waived after 90 days Eight months Full tax-free monthly benefit paid One month part-time Partial monthly benefit paid Back to work full-time Benefits stop Results may vary, based on your specific situation.

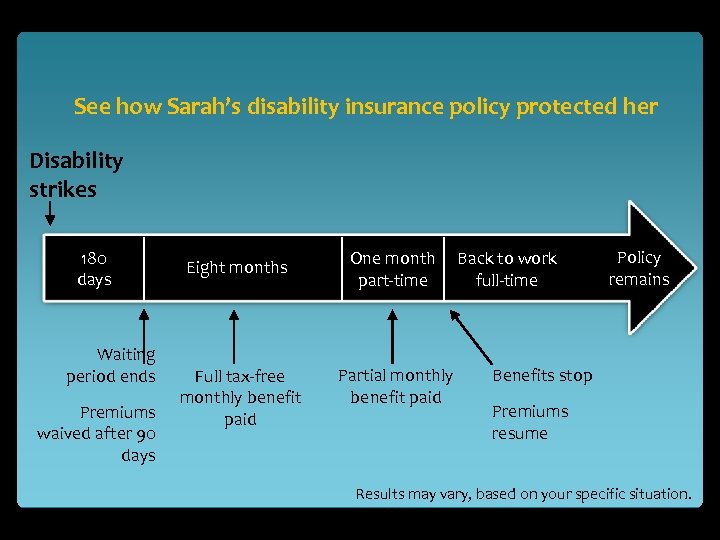

See how Sarah’s disability insurance policy protected her Disability strikes 180 days Waiting period ends Premiums waived after 90 days Eight months Full tax-free monthly benefit paid One month part-time Partial monthly benefit paid Back to work full-time Policy remains Benefits stop Premiums resume Results may vary, based on your specific situation.

See how Sarah’s disability insurance policy protected her Disability strikes 180 days Waiting period ends Premiums waived after 90 days Eight months Full tax-free monthly benefit paid One month part-time Partial monthly benefit paid Back to work full-time Policy remains Benefits stop Premiums resume Results may vary, based on your specific situation.

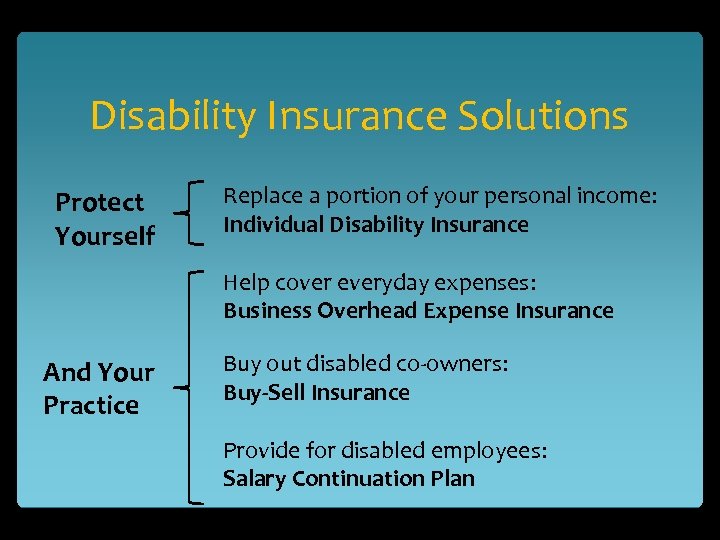

Disability Insurance Solutions Protect Yourself Replace a portion of your personal income: Individual Disability Insurance Help cover everyday expenses: Business Overhead Expense Insurance And Your Practice Buy out disabled co-owners: Buy-Sell Insurance Provide for disabled employees: Salary Continuation Plan

Disability Insurance Solutions Protect Yourself Replace a portion of your personal income: Individual Disability Insurance Help cover everyday expenses: Business Overhead Expense Insurance And Your Practice Buy out disabled co-owners: Buy-Sell Insurance Provide for disabled employees: Salary Continuation Plan

Finding the right plan for you.

Finding the right plan for you.

Be Confident

Be Confident

hat if I have W t it but I don’ need it?

hat if I have W t it but I don’ need it?

need hat if I have W t it but I don’ need it? have

need hat if I have W t it but I don’ need it? have

Today Tomorrow When you need it most “If insurance is offered be wise and take it. You never know if or when you will ever need it, but it could mean the difference between surviving through a disability financially or not!” Met. Life Study of the Emotional and Financial Impact of Disability, March 2010

Today Tomorrow When you need it most “If insurance is offered be wise and take it. You never know if or when you will ever need it, but it could mean the difference between surviving through a disability financially or not!” Met. Life Study of the Emotional and Financial Impact of Disability, March 2010

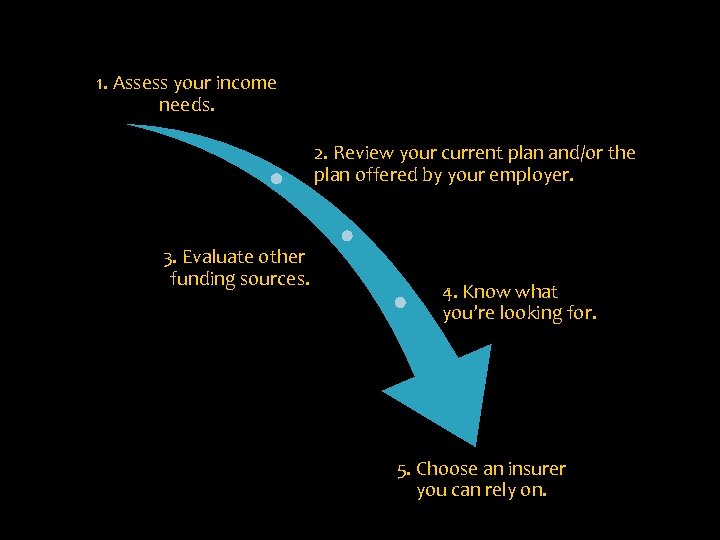

1. Assess your income needs. 2. Review your current plan and/or the plan offered by your employer. 3. Evaluate other funding sources. 4. Know what you’re looking for. 5. Choose an insurer you can rely on.

1. Assess your income needs. 2. Review your current plan and/or the plan offered by your employer. 3. Evaluate other funding sources. 4. Know what you’re looking for. 5. Choose an insurer you can rely on.

Use this and the next slide for medical/dental groups Met. Life Disability Insurance Non-cancellable and guaranteed renewable policies available Competitive rates + possible discounts High coverage limits Specialty language or a Your Occupation rider in most states Security and flexibility All from a company you know and trust Features vary by policy and state availability.

Use this and the next slide for medical/dental groups Met. Life Disability Insurance Non-cancellable and guaranteed renewable policies available Competitive rates + possible discounts High coverage limits Specialty language or a Your Occupation rider in most states Security and flexibility All from a company you know and trust Features vary by policy and state availability.

Met. Life Starting Practice Limits Occupation Monthly Benefit Limit Medical First-Year Physician Fellow; MD/DO Resident or Intern Student (3 yr+) $7, 500 $5, 000 $2, 500 Dental First-Year Dental Specialist First-Year General Dentist; Resident Senior Dental Student $6, 000 $4, 000 $2, 500

Met. Life Starting Practice Limits Occupation Monthly Benefit Limit Medical First-Year Physician Fellow; MD/DO Resident or Intern Student (3 yr+) $7, 500 $5, 000 $2, 500 Dental First-Year Dental Specialist First-Year General Dentist; Resident Senior Dental Student $6, 000 $4, 000 $2, 500

Use this and the next slide for young professionals Met. Life Disability Insurance Non-cancellable and guaranteed renewable policies available Competitive rates + possible discounts High coverage limits Customizable options Security and flexibility All from a company you know and trust Features vary by policy and state availability.

Use this and the next slide for young professionals Met. Life Disability Insurance Non-cancellable and guaranteed renewable policies available Competitive rates + possible discounts High coverage limits Customizable options Security and flexibility All from a company you know and trust Features vary by policy and state availability.

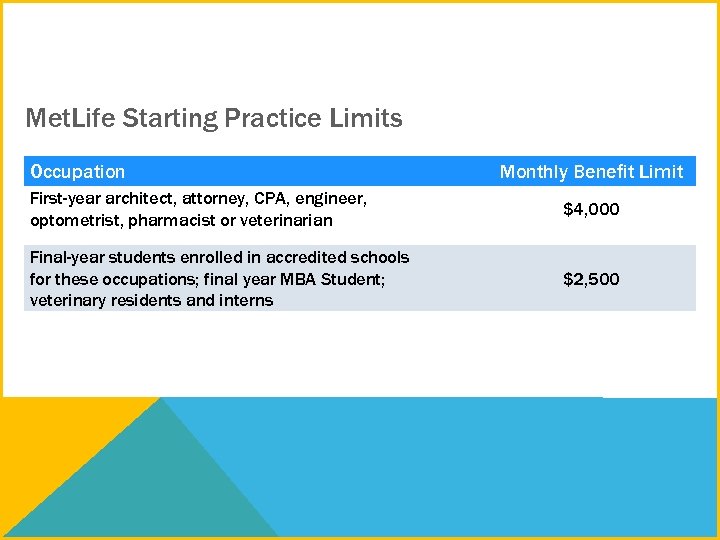

Met. Life Starting Practice Limits Occupation Monthly Benefit Limit First-year architect, attorney, CPA, engineer, optometrist, pharmacist or veterinarian $4, 000 Final-year students enrolled in accredited schools for these occupations; final year MBA Student; veterinary residents and interns $2, 500

Met. Life Starting Practice Limits Occupation Monthly Benefit Limit First-year architect, attorney, CPA, engineer, optometrist, pharmacist or veterinarian $4, 000 Final-year students enrolled in accredited schools for these occupations; final year MBA Student; veterinary residents and interns $2, 500

K N A H T ! U O Y Please fill out an evaluation form and take one of the hand-outs.

K N A H T ! U O Y Please fill out an evaluation form and take one of the hand-outs.

Like most disability income insurance policies, Met. Life’s policies contain certain exclusions, waiting periods, reductions, limitations and terms for keeping them in force. Ask your representative about costs and complete details. All policies and riders may not be available in all states, at all issue ages and to all occupational classes. Ask your representative for complete details. Eligibility is subject to underwriting approval. For policies issued in New York: These policies provide disability income insurance only. They do NOT provide basic hospital, basic medical or major medical insurance as defined by the New York State Insurance Department. The expected benefit ratio for these policies is at least 50%. This ratio is the portion of future premiums that Met. Life expects to return as benefits when averaged over all people with the applicable policy. Disability income insurance is issued by Metropolitan Life Insurance Company on IDIP 12 -01 – IDIP 12 -08, IDI 2000 -P/NC-ML, IDI 2000 -P/GR, AH 5 -88, AH 6 -90, AH 7 -96 -CA and AH 8 -96 -CA. September 2013 Met. Life Metropolitan Life Insurance Company 200 Park Avenue New York, NY 10166 CLDI 23500 L 0913341965[1015] © 2013 METLIFE, INC. PEANUTS © 2013 Peanuts Worldwide

Like most disability income insurance policies, Met. Life’s policies contain certain exclusions, waiting periods, reductions, limitations and terms for keeping them in force. Ask your representative about costs and complete details. All policies and riders may not be available in all states, at all issue ages and to all occupational classes. Ask your representative for complete details. Eligibility is subject to underwriting approval. For policies issued in New York: These policies provide disability income insurance only. They do NOT provide basic hospital, basic medical or major medical insurance as defined by the New York State Insurance Department. The expected benefit ratio for these policies is at least 50%. This ratio is the portion of future premiums that Met. Life expects to return as benefits when averaged over all people with the applicable policy. Disability income insurance is issued by Metropolitan Life Insurance Company on IDIP 12 -01 – IDIP 12 -08, IDI 2000 -P/NC-ML, IDI 2000 -P/GR, AH 5 -88, AH 6 -90, AH 7 -96 -CA and AH 8 -96 -CA. September 2013 Met. Life Metropolitan Life Insurance Company 200 Park Avenue New York, NY 10166 CLDI 23500 L 0913341965[1015] © 2013 METLIFE, INC. PEANUTS © 2013 Peanuts Worldwide