9d0f6d6c599d409bf4fe0db148678eb2.ppt

- Количество слайдов: 27

PROSPECTUS Deptt. of Commerce Government College, Dera Bassi

DEFINITION Section 2(70) of the Act defines a prospectus as “any document described or issued as a prospectus and includes a red herring prospectus referred to sec. 32 or shelf prospectus referred to in section 31 or any notice, circular, advertisement or other document inviting deposits from the public or inviting offers from the pubic for the subscription or purchase of any shares in, or debentures of a body corporate. ” The definition of prospectus now specifically provides that “Red Herring or Shelf Prospectus” will also be treated as prospectus. The scope of definition has been broadened to include securities instead of only shares or debentures.

In other words, a prospectus means any invitation issued to the public inviting it to deposit money with the company or to take shares or debentures of the company. Such invitation may be in the form of a document or a notice, circulation, advertisement etc. (a) (b) (c) (d) Any document to be called a prospectus must have the following ingredients: There must be an invitation offering to the public; The invitation must be made by or on behalf of the company or in relation to an intended company ; The invitation must be to subscribe or purchase; The invitation must relate to shares or debentures.

DEEMED PROSPECTUS Requirement of prospectus are very rigorous under the companies Act. In order to avoid the issued of prospectus, one practice was to issue shares to another person. Such another person (often called Issue House), would then make further offer of sale of these shares to public by advertisement etc. This was one of the ways to avoid rigours of prospectus. Section 25 of the companies Act lays down that any document by witch the offer or sale of securities to the public is made shall for all purposes be treated as prospectus.

A company is deemed (presumed) to have allotted or agreed to allot shares or debentures to issue House for further sale if (a) such issue House makes offer for sale of debentures or shares within 6 months after the shares/debentures were allotted to them or agreed to be allotted to them or (b) On the date of offer of issue House, whole consideration in respect of shares or debentures was not received by the company. In short, the ‘offer of sale’ by issue house will not be considered as ‘prospectus’ only when (a) company receives full consideration in respect of shares/debentures and (b) The ‘offer for sale’ Is made at least 6 months after the shares were allotted to it. [section 25(2)].

SHELF PROSPECTUS(SEC. 31) Sometimes, securities are issued in stages spread over a period of time, particularly in respect of infrastructure projects where issue size is large as huge funds have to be collected. In such case, filling of prospectus each time will be very expensive. So a provision of ‘shelf prospectus’ has been made vide section 31 of the companies Act, 2013. The advantage is that at each stage of offer of securities during validity of shelf prospectus, filling of prospectus is not required.

The term ‘shelf prospectus’ means a prospectus in respect of which the securities or class of securities included therein are issued for subscription in one or more issues over a certain period without the issue of a further prospectus. The company shall also file information memorandum on new charges created, if any change in financial position with the registrar of companies prior to the issue of a second or subsequent offer under shelf prospectus. [sec. 31(2)]

ABRIDGED PROSPECTUS 1. 2. Section 33 of the companies Act provides that every form of application issued for the purchase of any securities of a company shall be accompanied by an abridged prospectus. According to the companies Act, “abridged prospectus” means a memorandum containing such salient features of a prospectus as may be specified by the securities and Exchange Board by making regulations in this behalf. Variation in term of contract or objects in prospectus. Public offer of securities to be in dematerialized form.

Advertisement Of Prospectus Section 30 of the companies Act provides that where an advertisement of any prospectus of a company is published, it shall specify the contents of memorandum as regards to the objects, the liability of members and the amount of share capital, the names of the signatories and the number of shares subscribed by them and also its capital structure. Offer to the public. A document will be treated as a prospectus only when it invites offers from the public.

WHEN PROSPECTUS IS NOT REQUIRED TO BE ISSUED (SEC. 26) The issue of a prospectus by a company is not necessary in the following case. (1)When an offer is made in connection with a bonafide invitation to a person to enter into a underwriting agreement with respect to shares or debentures. (2)When the shares or debentures are not offered to the public. (3)Where the offer is made only to exiting members or debentures holder of the company with or without a right to renounce. e. g. when shares are placed privately to less than 50 persons.

(4)Where the shares or debentures offered are in all respects uniform with shares or debentures previously issued and dealt in or quoted on a recognised stock exchange. (5)Where invitation to the public for subscription to the shares or debentures of a company is made in the form of newspaper advertisement. (sec. 30). (6) A private company is not required to issue prospectus. [sec. 2(35)]

LEGAL REQUIREMENTS IN RELATION TO A PROSPECTUS 1. Dating of prospectus (sec 26) A prospectus issued by a company must be dated. Section 26 further provides that the date on the prospectus shall, unless contrary is provide, be taken as the date of the publication of the prospectus. This ensures a prime facie evidence of the date of its publication. However, this evidence may be rebutted by a contrary evidence.

2. Registration of prospectus (sec. 27(7)) A. B. C. D. E. F. G. H. I. Nature. Time limit. Signatures. Date of issue of prospectus. Contents. Enclosures. Registration. Penalty for non-registration of prospectus. Opening of subscription list.

When Registrar can refuse registration(sec. 26) A. B. C. The registrar can refuse to register a prospectus if: It is not dated; It does not comply with the requirements of as to the matter and repots to be set out in it; It contains statements or repot of experts engaged or interested in the formation or promotion or management of the company.

CONTENTS OF PROSPECTUS A prospectus is the most important document since the intending investors base their decisions on the facts and figures furnished in the prospectus. It is the window through which a prospective investor can look into the soundness of a company’s venture. In order to protect the interests of the investing public against the frauds of the promoters, the companies Act requires every company issuing a prospectus to observe a large number of regulation. Failure to observe them is made punishable with fine or imprisonment or both. Hence, utmost care should be taken in drafting a prospectus.

(A)MATTER IN PROSPECTUS n n n n Names and address. Dates of the opening and closing. A statement. Detail about underwriting. Consent of the directors. The authority for the issue. Procedure and time.

n n n n Capital structure. Main objects and present business. Particulars. Minimum subscription. Detail of directors. disclosures

(B)REPORTS IN PROSPECTUS The prospectus must set out the following reports for the purposes of the financial information namely: n Reports by the auditors. n Reports relating to profits and losses. n Reports made by the auditors upon the profits and loses of the business.

(C) DECLARATION The prospectus shall make a declaration about the compliance of the provisions of this Act and a statement to the effect that nothing in the prospectus in contrary to the provisions of this Act, the securities Contracts (Regulation) Act, 1956 (42 of 1956) and the Securities and Exchange Board of India Act, 1992 (15 of 1992) and the rules and regulation made there under. The prospectus shall also state such other matters and set out such other reports, as may be prescribed.

BOOK BUILDING Book Building is defined to mean a process by which demand for the securities proposed to be issued by a body corporate is elicited and built-up and the price for such securities is assessed for the determination of the quantum of such securities to be issued by mean of a notice, circular, advertisement, document or information memorandum or other document. thus, in case of a public issue through the process of book-building, though the total size of the issue is known, the number of shares is not known. It is because the price at which shares will be allotted is not known, it’s determined through the process of book-building only.

LIABILITY FOR MIS-STATEMENTS IN PROSPECTUS Golden rule as to the framing of prospectus. A prospectus constitutes the basis of the contract between the company and the person who purchase securities. The persons who are behind the company have all the knowledge or means of knowledge as to the present position and future prospects of the enterprise and the investing public has none. It is but fair that the former should not only disclosed all the matters within their knowledge relating to the enterprise, which might affect the investing mind but should state them accurately, correctly and unambiguously. A prospectus must, therefore, tell the truth the whole truth and nothing but truth. Also it must not conceal any fact which ought to be disclosed.

What is an untrue statement? It is necessary to find out as to what constitutes an untrue statement. Whether a statement is untrue or not is to be judged by the context in which it appears and the totality of impression it would create. A statement may be false, not only because of what it states but also because of what it conceals or omits. If taking the whole prospectus together, there was really a misrepresentation of fact, the contract may be set aside, though each statement by itself is literally true. This leading case on this point is Greenwood v. leather shod wheel Co. (1900)

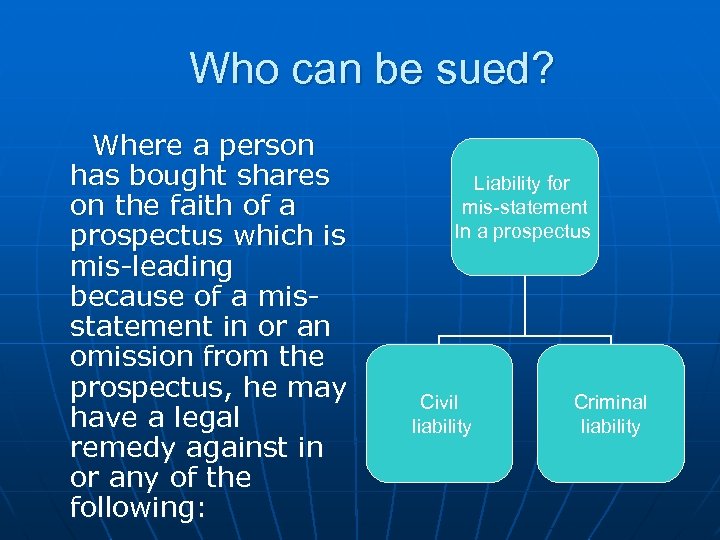

Who can be sued? Where a person has bought shares on the faith of a prospectus which is mis-leading because of a misstatement in or an omission from the prospectus, he may have a legal remedy against in or any of the following: Liability for mis-statement In a prospectus Civil liability Criminal liability

![Civil liability [sec. 35(1)] A person has subscribed for securities of a company action Civil liability [sec. 35(1)] A person has subscribed for securities of a company action](https://present5.com/presentation/9d0f6d6c599d409bf4fe0db148678eb2/image-24.jpg)

Civil liability [sec. 35(1)] A person has subscribed for securities of a company action on any statement included or the inclusion or omission of any matter, in the prospectus which is misleading and has sustained any loss or damage as a consequence thereof, the company and every person who(a) Is a director of the company at the time of the issue of the prospectus; (b) Has authorized himself to be name and is named in the prospectus as a director of the company, or has agreed to become such director, either, immediately or after an interval of time; (c) Is a promoter of the company; n

(d) Has authorized the issue of the prospectus; and (e) Is an expert referred to in sec. 26(5). shall, be liable to pay compensation to every person who has sustained such loss or damage. Thus a person who has subscribed for securities on the faith of the misleading prospectus has remedies against(a) The company and (b) the directors, promoters, experts and every person who authorized the issue of prospectus. Remedies against the company. A person who has been induced to subscribe for shares may (1) rescind the contract to take the securities ; (2)claim damages.

Criminal Liability Sec. 34 of the Companies Act, 2013 provides for criminal liability for misstatement in prospectus. It provides that where a prospectus, issued, circulated or distributed under this Chapter, includes any statement which is unture or misleading in form or context in which it is included or where any inclusion or omission of any matter is likely to mislead, every person who authorizes the issue of such prospectus shall be liable under sec. 447. In addition to penal provisions for untrue statement in prospectus , now in case of prospectus containing statement which are misleading in form or context or where any inclusion or omission of any matter is likely to mislead, the persons who have authorised the issue of the said prospectus shall also be criminally liable.

![Issue and allotment of shares in fictitious names[sec. 38] Benami shareholding and shareholding in Issue and allotment of shares in fictitious names[sec. 38] Benami shareholding and shareholding in](https://present5.com/presentation/9d0f6d6c599d409bf4fe0db148678eb2/image-27.jpg)

Issue and allotment of shares in fictitious names[sec. 38] Benami shareholding and shareholding in the name of fictitious or non existing persons are common. The object is avoid tax. Section 38 makes it an offence to make application for shares in the name of, or to induce the allotment or transfer of shares to fictitious persons. The punishment in such cases is imposed u/s 447 (improvement for 6 months which may extend to 10 years or five equivalent to three times the amount of fraud)

9d0f6d6c599d409bf4fe0db148678eb2.ppt