53c2be37b98e5709d0f0349b6dd58558.ppt

- Количество слайдов: 13

Proposal to Buy Activision Blizzard

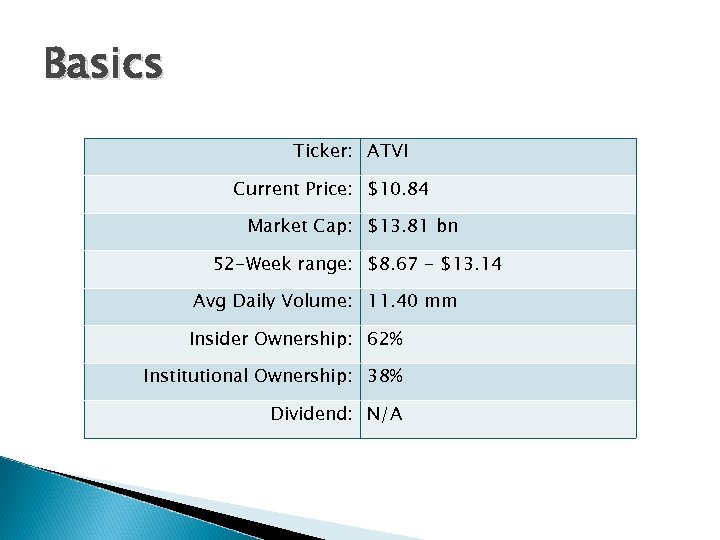

Basics Ticker: ATVI Current Price: $10. 84 Market Cap: $13. 81 bn 52 -Week range: $8. 67 - $13. 14 Avg Daily Volume: 11. 40 mm Insider Ownership: 62% Institutional Ownership: 38% Dividend: N/A

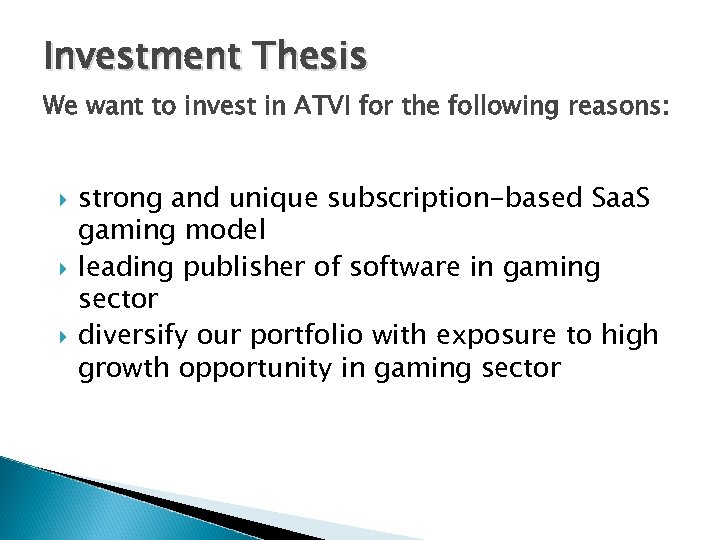

Investment Thesis We want to invest in ATVI for the following reasons: strong and unique subscription-based Saa. S gaming model leading publisher of software in gaming sector diversify our portfolio with exposure to high growth opportunity in gaming sector

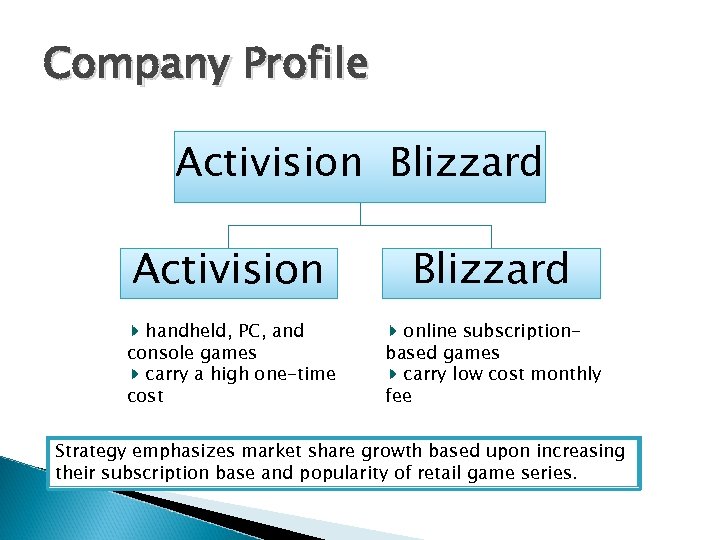

Company Profile Activision Blizzard handheld, PC, and console games carry a high one-time cost online subscriptionbased games carry low cost monthly fee Strategy emphasizes market share growth based upon increasing their subscription base and popularity of retail game series.

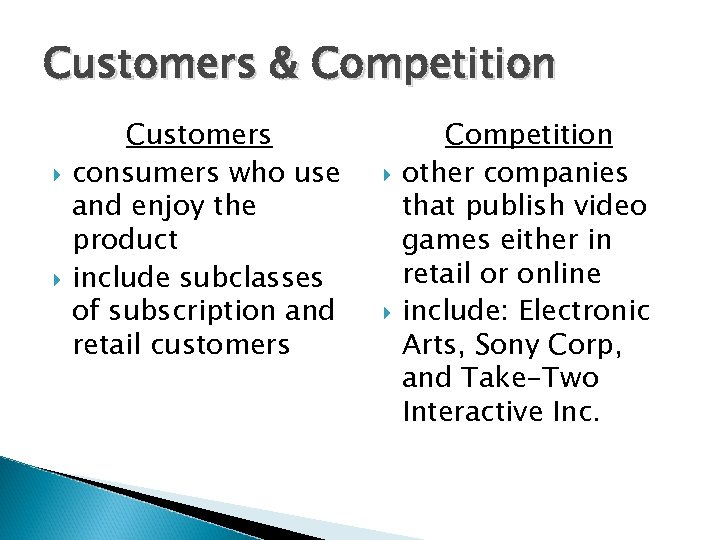

Customers & Competition Customers consumers who use and enjoy the product include subclasses of subscription and retail customers Competition other companies that publish video games either in retail or online include: Electronic Arts, Sony Corp, and Take-Two Interactive Inc.

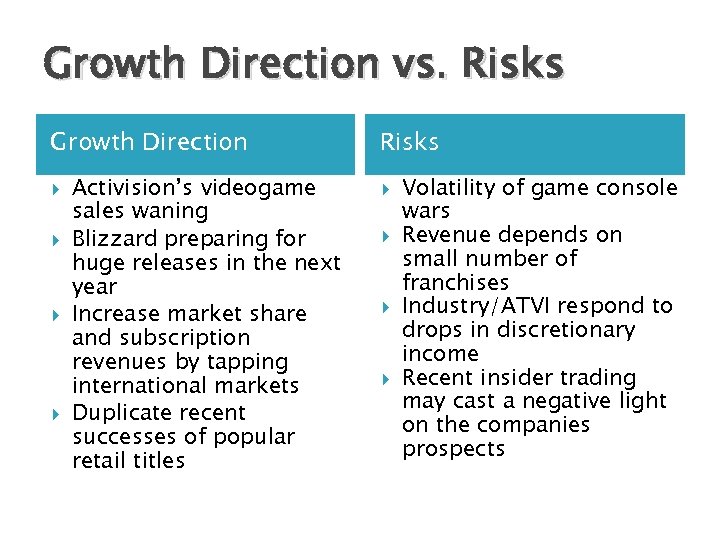

Growth Direction vs. Risks Growth Direction Activision’s videogame sales waning Blizzard preparing for huge releases in the next year Increase market share and subscription revenues by tapping international markets Duplicate recent successes of popular retail titles Risks Volatility of game console wars Revenue depends on small number of franchises Industry/ATVI respond to drops in discretionary income Recent insider trading may cast a negative light on the companies prospects

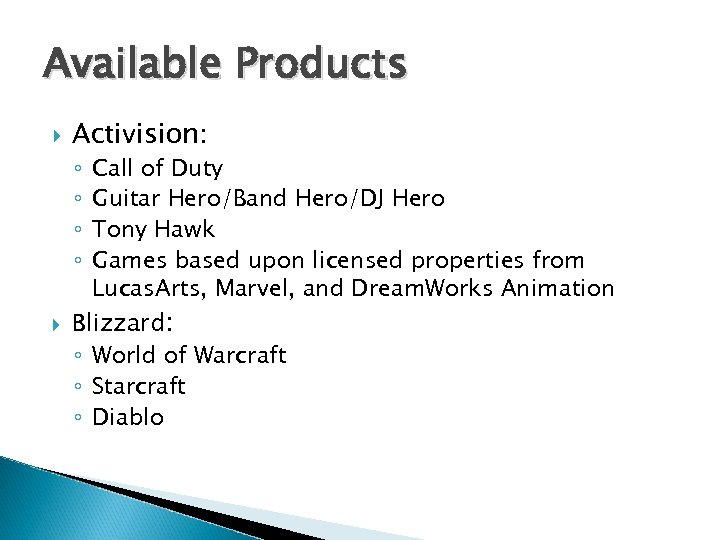

Available Products Activision: ◦ ◦ Call of Duty Guitar Hero/Band Hero/DJ Hero Tony Hawk Games based upon licensed properties from Lucas. Arts, Marvel, and Dream. Works Animation Blizzard: ◦ World of Warcraft ◦ Starcraft ◦ Diablo

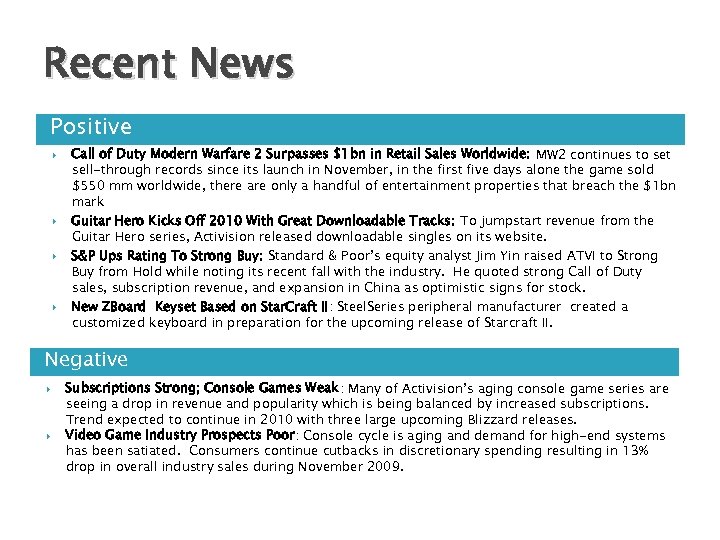

Recent News Positive Call of Duty Modern Warfare 2 Surpasses $1 bn in Retail Sales Worldwide: MW 2 continues to set sell-through records since its launch in November, in the first five days alone the game sold $550 mm worldwide, there are only a handful of entertainment properties that breach the $1 bn mark Guitar Hero Kicks Off 2010 With Great Downloadable Tracks: To jumpstart revenue from the Guitar Hero series, Activision released downloadable singles on its website. S&P Ups Rating To Strong Buy: Standard & Poor’s equity analyst Jim Yin raised ATVI to Strong Buy from Hold while noting its recent fall with the industry. He quoted strong Call of Duty sales, subscription revenue, and expansion in China as optimistic signs for stock. New ZBoard Keyset Based on Star. Craft II: Steel. Series peripheral manufacturer created a customized keyboard in preparation for the upcoming release of Starcraft II. Negative Subscriptions Strong; Console Games Weak: Many of Activision’s aging console game series are seeing a drop in revenue and popularity which is being balanced by increased subscriptions. Trend expected to continue in 2010 with three large upcoming Blizzard releases. Video Game Industry Prospects Poor: Console cycle is aging and demand for high-end systems has been satiated. Consumers continue cutbacks in discretionary spending resulting in 13% drop in overall industry sales during November 2009.

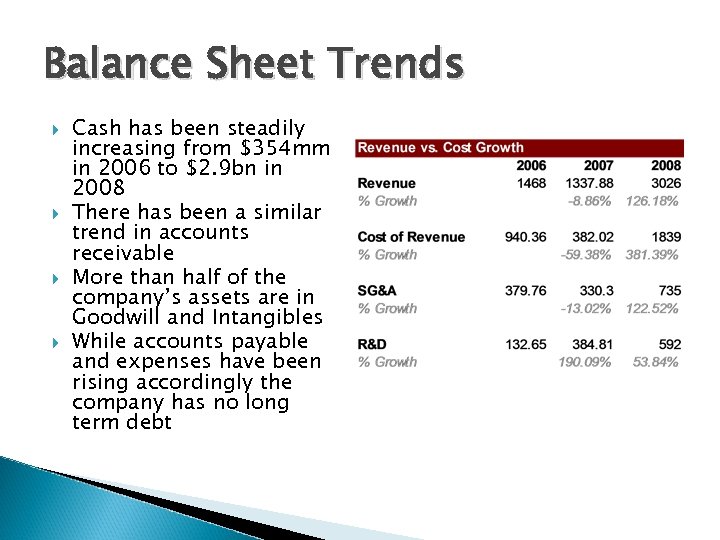

Balance Sheet Trends Cash has been steadily increasing from $354 mm in 2006 to $2. 9 bn in 2008 There has been a similar trend in accounts receivable More than half of the company’s assets are in Goodwill and Intangibles While accounts payable and expenses have been rising accordingly the company has no long term debt

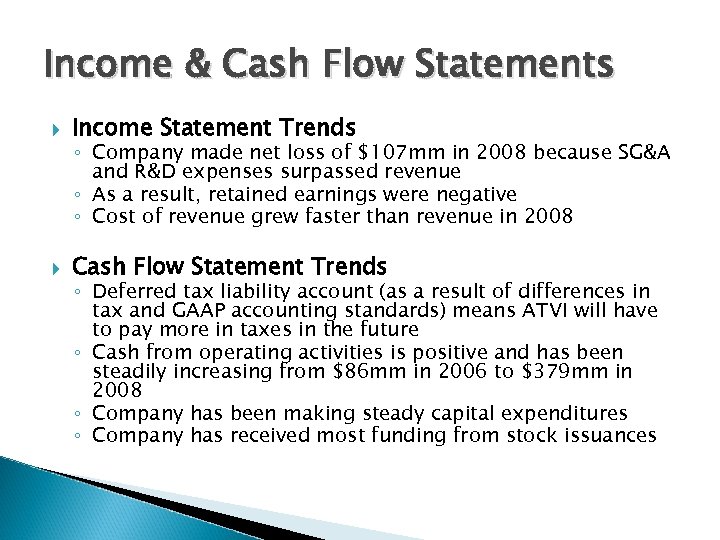

Income & Cash Flow Statements Income Statement Trends Cash Flow Statement Trends ◦ Company made net loss of $107 mm in 2008 because SG&A and R&D expenses surpassed revenue ◦ As a result, retained earnings were negative ◦ Cost of revenue grew faster than revenue in 2008 ◦ Deferred tax liability account (as a result of differences in tax and GAAP accounting standards) means ATVI will have to pay more in taxes in the future ◦ Cash from operating activities is positive and has been steadily increasing from $86 mm in 2006 to $379 mm in 2008 ◦ Company has been making steady capital expenditures ◦ Company has received most funding from stock issuances

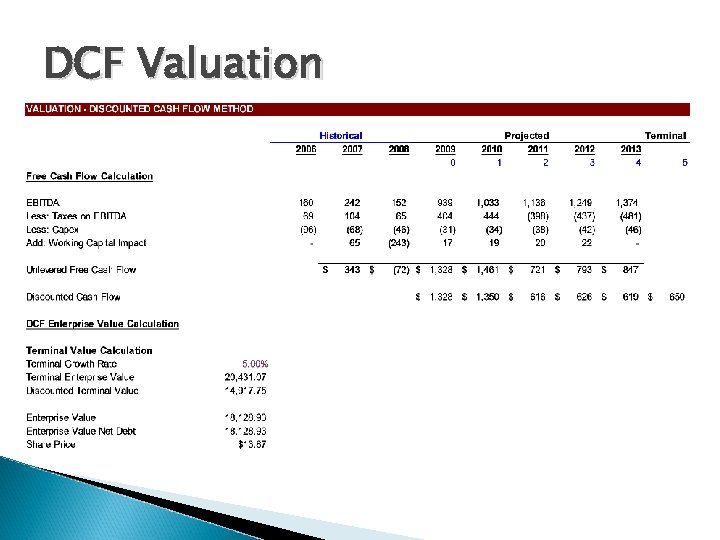

DCF Valuation

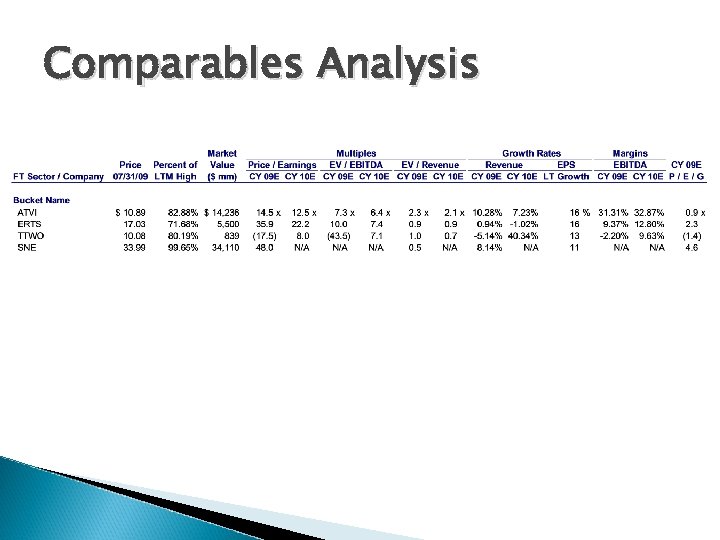

Comparables Analysis

Recommendation: Buy Entry Price Band: $5 - $7 Exit Price Band: $15 - $20 Time Horizon: 1 – 2 years Position Size: $5, 000

53c2be37b98e5709d0f0349b6dd58558.ppt