5f5f49e5e6ba0b77bb88d408ee8212c2.ppt

- Количество слайдов: 15

Property Valuation Dr. Arthur C. Nelson, FAICP February 19, 2007

Overview • Market Comparison Approach • Cost Approach • Income Approach • Rules of Thumb • Ratio Analysis

Market Comparison Approach You want to buy a 20 unit apartment. How much should you pay?

Cost Approach • Cost to replace or reproduce – Variety of methods to estimate • - Depreciation – Physical deterioration – Functional obsolescence – Economic obsolescence • + Land value

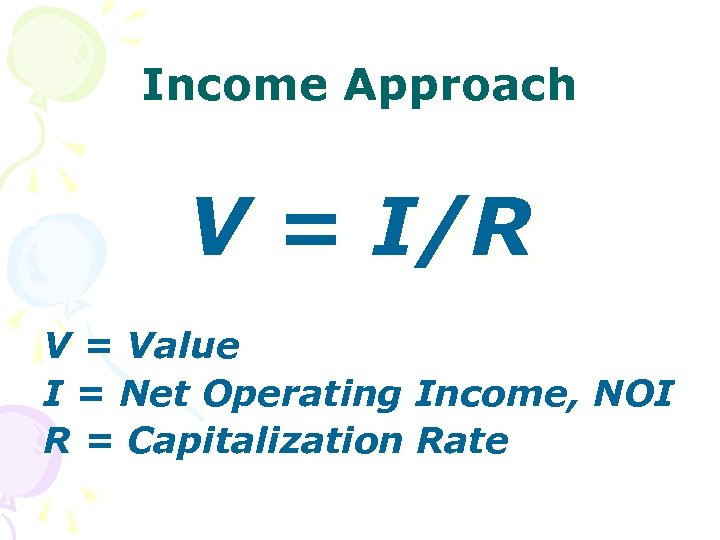

Income Approach V = I/R V = Value I = Net Operating Income, NOI R = Capitalization Rate

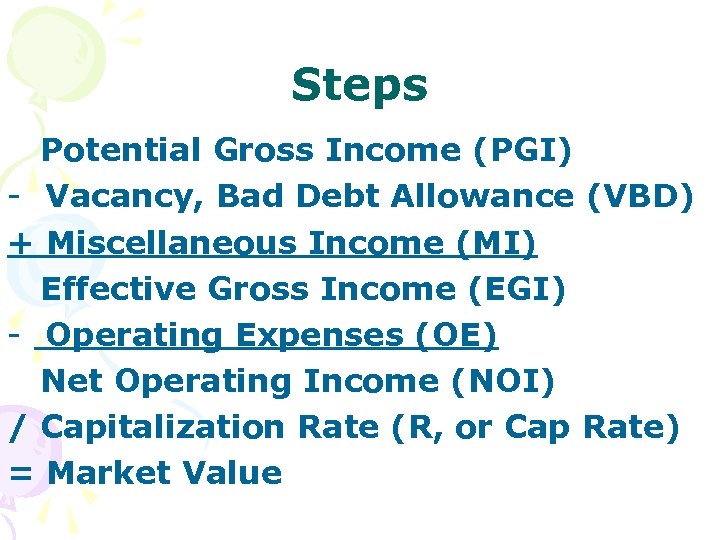

Steps Potential Gross Income (PGI) - Vacancy, Bad Debt Allowance (VBD) + Miscellaneous Income (MI) Effective Gross Income (EGI) - Operating Expenses (OE) Net Operating Income (NOI) / Capitalization Rate (R, or Cap Rate) = Market Value

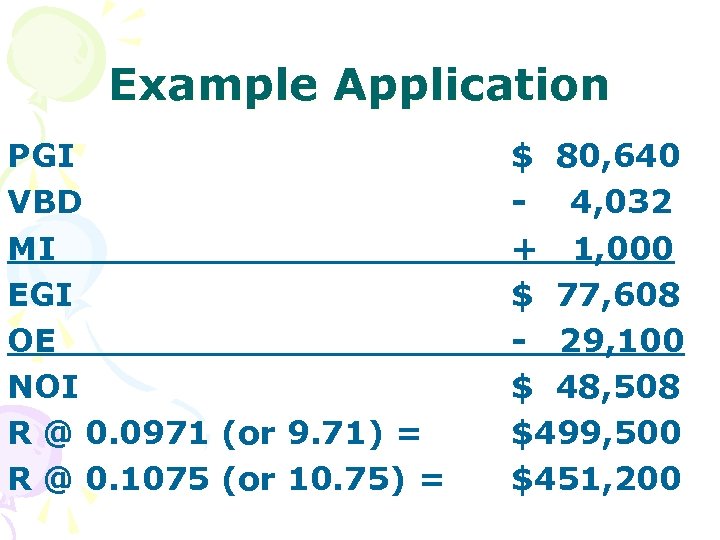

Example Application PGI VBD MI EGI OE NOI R @ 0. 0971 (or 9. 71) = R @ 0. 1075 (or 10. 75) = $ 80, 640 - 4, 032 + 1, 000 $ 77, 608 - 29, 100 $ 48, 508 $499, 500 $451, 200

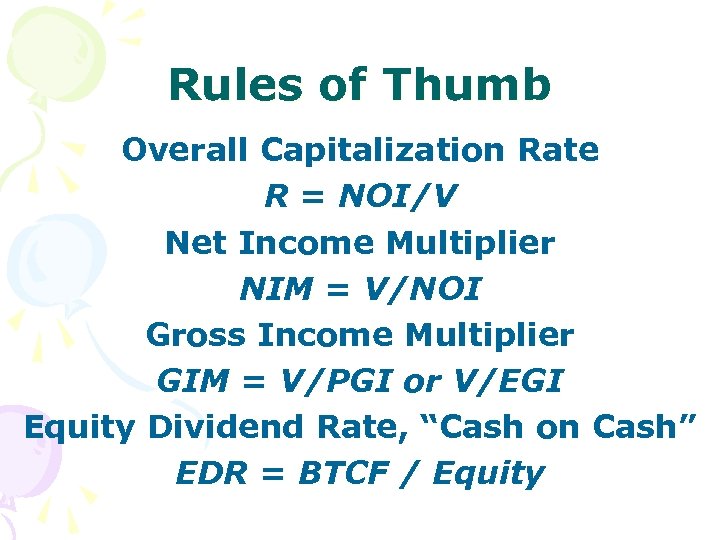

Rules of Thumb Overall Capitalization Rate R = NOI/V Net Income Multiplier NIM = V/NOI Gross Income Multiplier GIM = V/PGI or V/EGI Equity Dividend Rate, “Cash on Cash” EDR = BTCF / Equity

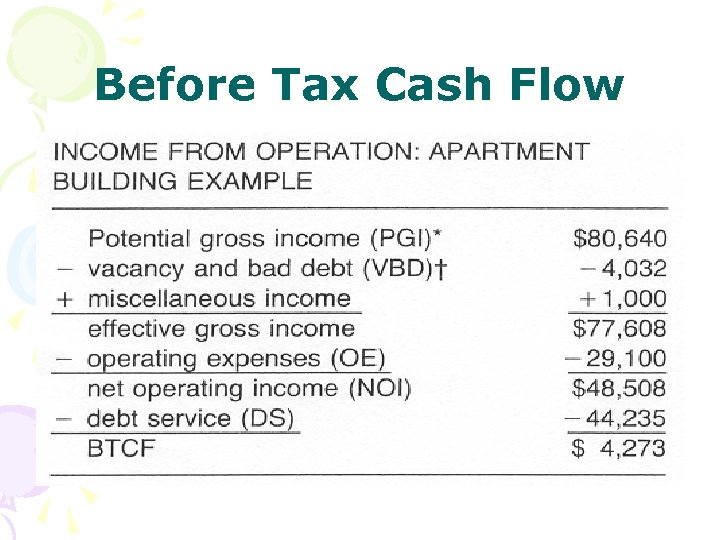

Before Tax Cash Flow

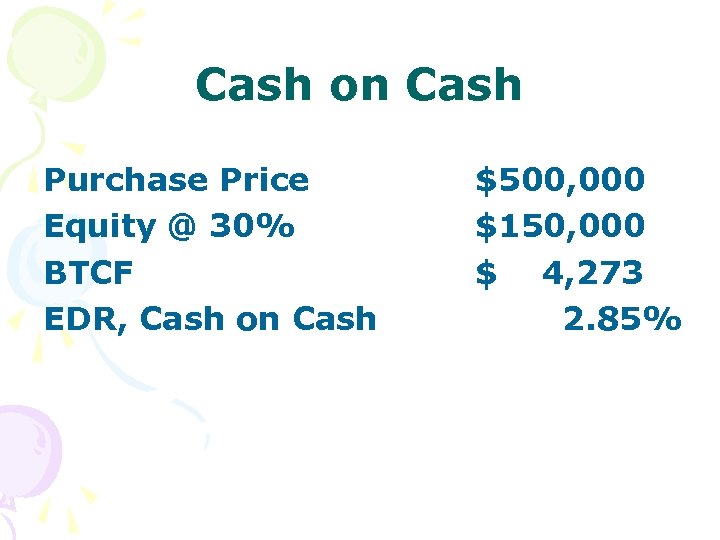

Cash on Cash Purchase Price Equity @ 30% BTCF EDR, Cash on Cash $500, 000 $150, 000 $ 4, 273 2. 85%

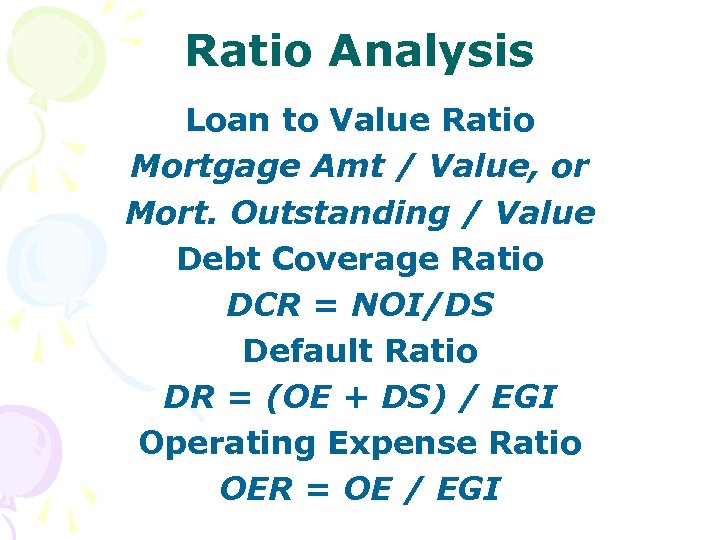

Ratio Analysis Loan to Value Ratio Mortgage Amt / Value, or Mort. Outstanding / Value Debt Coverage Ratio DCR = NOI/DS Default Ratio DR = (OE + DS) / EGI Operating Expense Ratio OER = OE / EGI

5f5f49e5e6ba0b77bb88d408ee8212c2.ppt