179906cca131f32732c7e5ecff56076b.ppt

- Количество слайдов: 14

Promoting work and well being: an OECD Development Centre Economic Outlook 23 June 2008 Bucharest Javier Santiso Director & Chief Development Economist, OECD Development Centre 1

DEV A platform for OECD & developing country dialogue OECD members Non-OECD members 2008 - 23 members Chile Israel South Africa Brazil India Thailand Egypt Romania Vietnam Colombia 2

BSEC-CA An OECD Development Centre Economic Outlook The OECD BSEC-CA Economic Outlook • A cross-country comparative analysis of macroeconomic and policy developments of the BSEC -CA region, involving 12 BSEC and 5 CA countries • The first such report dedicated to a cross-cutting policy issue: Work and Well-Being Further OECD work on Romania: • Reform Effort Support – Sigma – 2001 -2008 • Education Policies for Students at Risk and those with Disabilities in South Eastern Europe- EDU - 2006 • Investment Policy Review for Romania – DAF – 2005 • Enterprise Policy Performance Assessment Romania – DAF - 2005 • Reviews of National Policies for Education Romania - EDU - 2003 • Romania -- Economic Assessment – ECO - 2002 3

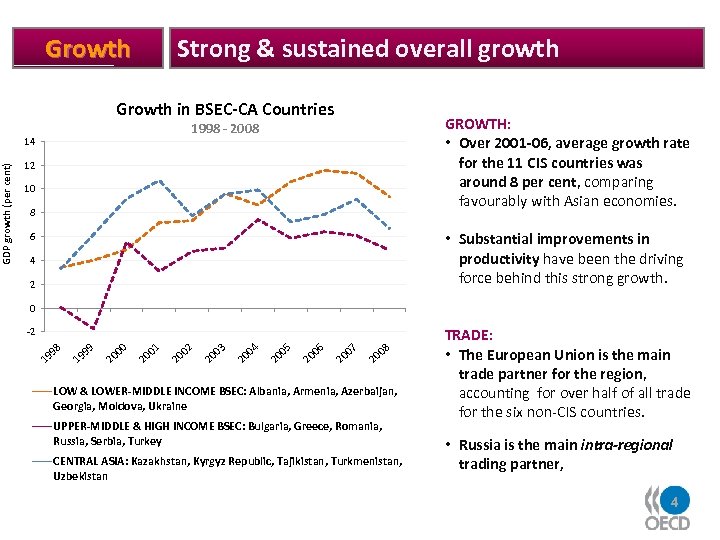

Growth in BSEC-CA Countries GROWTH: • Over 2001 -06, average growth rate for the 11 CIS countries was around 8 per cent, comparing favourably with Asian economies. 1998 - 2008 14 12 10 8 • Substantial improvements in productivity have been the driving force behind this strong growth. 6 4 2 0 08 20 07 20 06 20 05 20 04 20 03 20 02 20 01 20 00 20 99 19 98 -2 19 GDP growth (per cent) Strong & sustained overall growth Growth LOW & LOWER-MIDDLE INCOME BSEC: Albania, Armenia, Azerbaijan, Georgia, Moldova, Ukraine UPPER-MIDDLE & HIGH INCOME BSEC: Bulgaria, Greece, Romania, Russia, Serbia, Turkey CENTRAL ASIA: Kazakhstan, Kyrgyz Republic, Tajikistan, Turkmenistan, Uzbekistan TRADE: • The European Union is the main trade partner for the region, accounting for over half of all trade for the six non-CIS countries. • Russia is the main intra-regional trading partner, 4

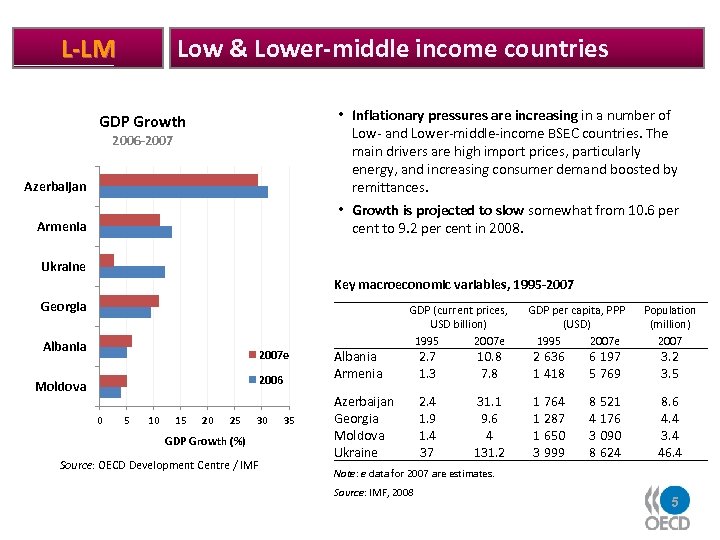

Low & Lower-middle income countries L-LM Azerbaijan • Inflationary pressures are increasing in a number of Low- and Lower-middle-income BSEC countries. The main drivers are high import prices, particularly energy, and increasing consumer demand boosted by remittances. Armenia • Growth is projected to slow somewhat from 10. 6 per cent to 9. 2 per cent in 2008. GDP Growth 2006 -2007 Ukraine Key macroeconomic variables, 1995 -2007 Georgia Albania 2007 e 2006 Moldova 0 5 10 15 20 25 30 GDP Growth (%) Source: OECD Development Centre / IMF 35 Albania Armenia GDP (current prices, USD billion) 1995 2007 e Azerbaijan Georgia Moldova Ukraine 2. 7 1. 3 10. 8 7. 8 2. 4 1. 9 1. 4 37 31. 1 9. 6 4 131. 2 GDP per capita, PPP (USD) 1995 2007 e 2 636 1 418 6 197 5 769 1 764 1 287 1 650 3 999 8 521 4 176 3 090 8 624 Population (million) 2007 3. 2 3. 5 8. 6 4. 4 3. 4 46. 4 Note: e data for 2007 are estimates. Source: IMF, 2008 5

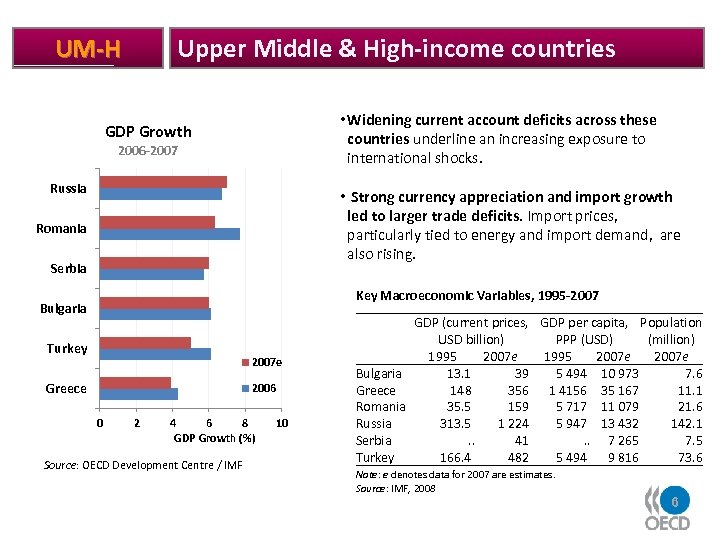

Upper Middle & High-income countries UM-H • Widening current account deficits across these countries underline an increasing exposure to international shocks. GDP Growth 2006 -2007 Russia • Strong currency appreciation and import growth led to larger trade deficits. Import prices, particularly tied to energy and import demand, are also rising. Romania Serbia Key Macroeconomic Variables, 1995 -2007 Bulgaria Turkey 2007 e Greece 2006 0 2 4 6 8 GDP Growth (%) Source: OECD Development Centre / IMF 10 GDP (current prices, GDP per capita, Population USD billion) PPP (USD) (million) 1995 2007 e Bulgaria 13. 1 39 5 494 10 973 7. 6 Greece 148 356 1 4156 35 167 11. 1 Romania 35. 5 159 5 717 11 079 21. 6 Russia 313. 5 1 224 5 947 13 432 142. 1 Serbia. . 41. . 7 265 7. 5 Turkey 166. 4 482 5 494 9 816 73. 6 Note: e denotes data for 2007 are estimates. Source: IMF, 2008 6

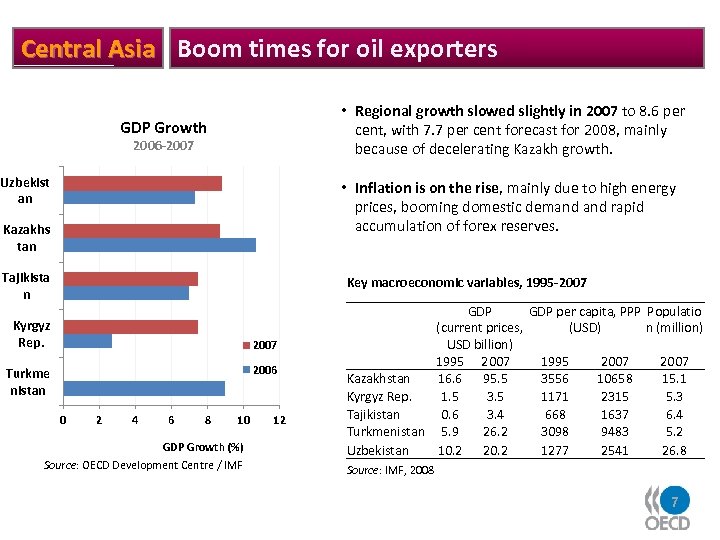

Central Asia Boom times for oil exporters • Regional growth slowed slightly in 2007 to 8. 6 per cent, with 7. 7 per cent forecast for 2008, mainly because of decelerating Kazakh growth. GDP Growth 2006 -2007 Uzbekist an • Inflation is on the rise, mainly due to high energy prices, booming domestic demand rapid accumulation of forex reserves. Kazakhs tan Tajikista n Key macroeconomic variables, 1995 -2007 Kyrgyz Rep. 2007 2006 Turkme nistan 0 2 4 6 8 10 GDP Growth (%) Source: OECD Development Centre / IMF 12 GDP per capita, PPP Populatio (current prices, (USD) n (million) USD billion) 1995 2007 Kazakhstan 16. 6 95. 5 3556 10658 15. 1 Kyrgyz Rep. 1. 5 3. 5 1171 2315 5. 3 Tajikistan 0. 6 3. 4 668 1637 6. 4 Turkmenistan 5. 9 26. 2 3098 9483 5. 2 Uzbekistan 10. 2 20. 2 1277 2541 26. 8 Source: IMF, 2008 7

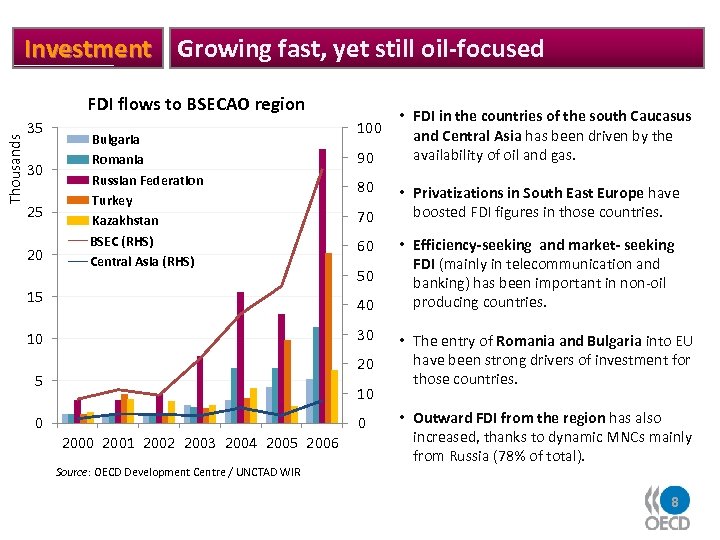

Investment Growing fast, yet still oil-focused Thousands FDI flows to BSECAO region 35 30 25 20 Bulgaria Romania Russian Federation Turkey Kazakhstan BSEC (RHS) Central Asia (RHS) 15 100 90 80 70 60 50 40 30 10 20 5 10 0 0 2001 2002 2003 2004 2005 2006 Source: OECD Development Centre / UNCTAD WIR • FDI in the countries of the south Caucasus and Central Asia has been driven by the availability of oil and gas. • Privatizations in South East Europe have boosted FDI figures in those countries. • Efficiency-seeking and market- seeking FDI (mainly in telecommunication and banking) has been important in non-oil producing countries. • The entry of Romania and Bulgaria into EU have been strong drivers of investment for those countries. • Outward FDI from the region has also increased, thanks to dynamic MNCs mainly from Russia (78% of total). 8

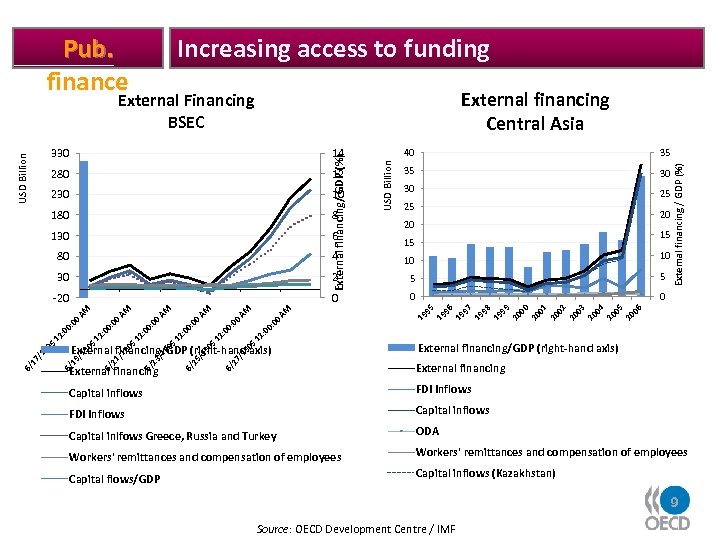

Increasing access to funding External financing Central Asia External Financing BSEC 230 10 180 8 130 6 80 4 30 -20 35 35 30 30 25 25 20 20 15 15 06 05 20 04 20 03 20 02 20 01 20 00 20 99 20 98 19 19 19 : 0 0 : 0 12 : 0 0 12 05 /1 9 27 External financing/GDP (right-hand axis) External financing 6/ 05 /1 9 25 6/ 6/ 6/ 05 23 /1 9 05 /1 9 21 19 /1 9 05 External financing/GDP (right-hand axis) External financing 97 0 96 0 95 5 AM 5 0 AM 12 : 0 0 AM 12 : 0 0 AM 0 : 0 0 12 10 2 6/ 05 /1 9 17 6/ 40 USD Billion 12 External financing/ GDP (%) 14 280 USD Billion 330 External financing / GDP (%) Pub. finance Capital inflows FDI Inflows Capital inlfows Greece, Russia and Turkey ODA Workers' remittances and compensation of employees Capital flows/GDP Capital inflows (Kazakhstan) 9 Source: OECD Development Centre / IMF

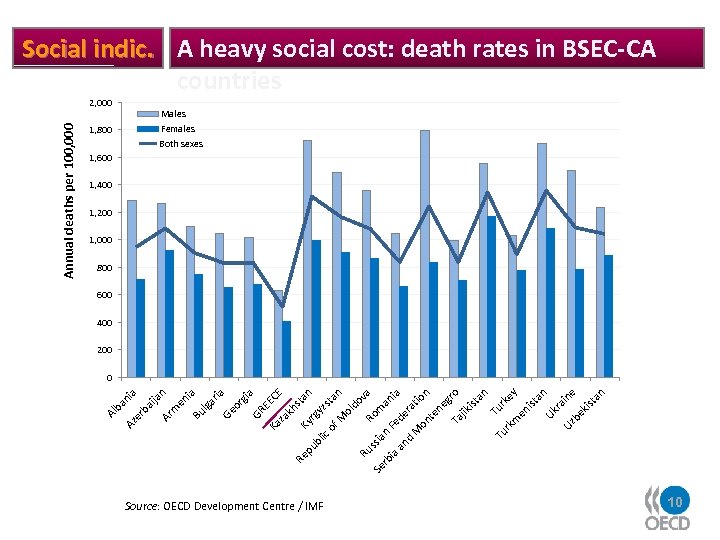

GR EE ia rg CE ak hs Re Ky tan pu rg bl ic yzs t of M an ol do v Ru Ro a ss Se m rb ian an F ia an ede ia ra d M t on ion te ne g Ta ro jik ist an Tu Tu rk rkey m en ist an Uk r Uz aine be kis ta n Ka z a ria lga Ge o Bu en i n 1, 800 m 2, 000 Ar ai ja a ba ni er b Az Al Annual deaths per 100, 000 Social indic. A heavy social cost: death rates in BSEC-CA countries Males Females Both sexes 1, 600 1, 400 1, 200 1, 000 800 600 400 200 0 Source: OECD Development Centre / IMF 10

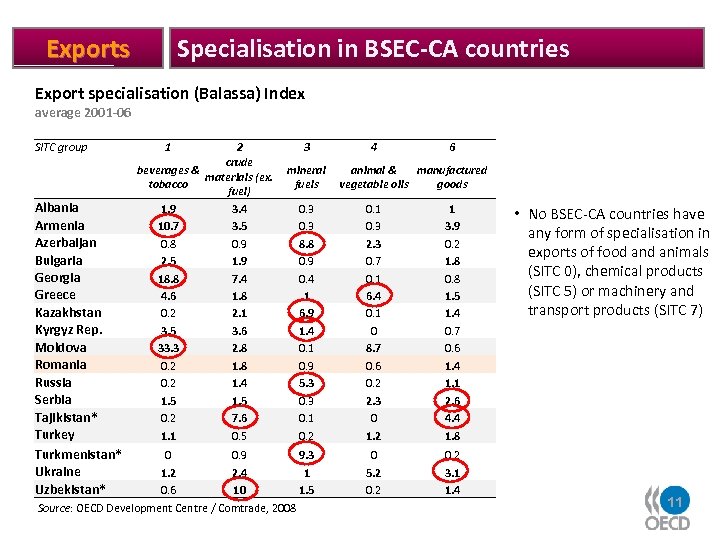

Specialisation in BSEC-CA countries Export specialisation (Balassa) Index average 2001 -06 SITC group Albania Armenia Azerbaijan Bulgaria Georgia Greece Kazakhstan Kyrgyz Rep. Moldova Romania Russia Serbia Tajikistan* Turkey Turkmenistan* Ukraine Uzbekistan* 1 2 crude beverages & materials (ex. tobacco fuel) 1. 9 3. 4 10. 7 3. 5 0. 8 0. 9 2. 5 1. 9 18. 8 7. 4 4. 6 1. 8 0. 2 2. 1 3. 5 3. 6 33. 3 2. 8 0. 2 1. 4 1. 5 0. 2 7. 6 1. 1 0. 5 3 mineral fuels 4 6 animal & manufactured vegetable oils goods 0. 3 8. 8 0. 9 0. 4 1 6. 9 1. 4 0. 1 0. 9 5. 3 0. 1 0. 2 0. 1 0. 3 2. 3 0. 7 0. 1 6. 4 0. 1 0 8. 7 0. 6 0. 2 2. 3 0 1. 2 1 3. 9 0. 2 1. 8 0. 8 1. 5 1. 4 0. 7 0. 6 1. 4 1. 1 2. 6 4. 4 1. 8 0 0. 9 9. 3 1. 2 2. 4 1 0. 6 10 1. 5 Source: OECD Development Centre / Comtrade, 2008 0 5. 2 0. 2 3. 1 1. 4 • No BSEC-CA countries have any form of specialisation in exports of food animals (SITC 0), chemical products (SITC 5) or machinery and transport products (SITC 7) 11

Focus Romania in perspective Romania • Romania was the second largest FDI recipient in both South Europe and the CIS. This is essentially the result of privatization. • Very low labour costs coupled with proximity to the EU market contribute to the strong attraction of Romania for FDI. Nevertheless, higher value-added sectors are also attracting strong investment. • Romania needs to comply with E. C rules and regulations on judicial independence, and structural transparency and accountability reforms BSEC-CA • 2006 saw a dramatic surge in FDI to the BSEC-CA reegion, raching USD 90 billion • Inflows rose in almost all countries, driven by several factors. FDI to UMH-BSEC countries more than doubled in 2006 when it reached USD 76 billion. • The principle drivers were the forthcoming accession of Bulgaria and Romania to the European Union, the continuation of the privatization process and new opportunities in extractive industries, especially in Russia. • Greece and Turkey recorded their highest-ever FDI inflows, owing to large takeover deals in the financial sector and telecommunication sector (OECD, 2007 a). 12

Outlook Looming inflation risks on the horizon • The entire BSEC-CA region faces slower growth as a result of the U. S. and Western European downturn. • Inflationary pressures are increasing with high import prices, particularly energy, and increasing consumer demand boosted by remittances. • The poor are particularly vulnerable people to the effects of higher food and energy prices. • BSEC-CA economies will continue to prosper, but challenges are rising 13

Promoting work and well being: an OECD Development Centre Economic Outlook 23 June 2008 Bucharest Javier Santiso Director & Chief Development Economist, OECD Development Centre 14

179906cca131f32732c7e5ecff56076b.ppt