ba8a827ca3f4114060e85a15f6b7ba74.ppt

- Количество слайдов: 95

Project Profitability Assessment 1

Contents · Capital budgeting (of “environmental” projects) · Project cash flows and simple payback · The Time Value of Money (TVM) and Net Present Value (NPV) · Two small group exercises · Capital budgeting with inflation and tax · Sensitivity analysis · Key profitability indicators 2

![Capital Budgeting (of “Environmental” Projects) [15 min] 3 Capital Budgeting (of “Environmental” Projects) [15 min] 3](https://present5.com/presentation/ba8a827ca3f4114060e85a15f6b7ba74/image-3.jpg)

Capital Budgeting (of “Environmental” Projects) [15 min] 3

Capital budgeting The process by which an organization : · Decides which investment projects are needed & possible, with a special focus on projects that require significant upfront investment (i. e. , capital) · Decides how to allocate available capital between different projects · Decides if additional capital is needed 4

Capital budgeting practices · Capital budgeting practices vary widely from company to company – Larger companies tend to have more formal practices than smaller companies – Larger companies tend to make more and larger capital investments than smaller companies – Some industry sectors require more capital investment than others · Capital budgeting practices may also vary from country to country 5

Typical project types & goals (1) · Maintenance – Maintain existing equipment and operations · Improvement – Modify existing equipment, processes, and management and information systems to improve efficiency, reduce costs, increase capacity, improve product quality, etc. · Replacement – Replace outdated, worn-out, or damaged equipment or outdated/inefficient management and information systems 6

Typical project types & goals (2) · Expansion – e. g. , obtain and install new process lines, initiate new product lines · Safety – make worker safety improvements · Environmental – e. g. , reduce use of toxic materials, increase recycling, reduce waste generation, install waste treatment · Others. . . 7

The poor reputation of “environmental ” investment projects Many people in industry view “environmental” projects as increasingly necessary to stay in business, but as automatic financial losers because: – they associate “environmental projects” with pollution control systems such as wastewater treatment plants, which can be quite costly (end-of-pipe) – they are unaware of the potential financial benefits of preventive environmental management practices 8

We know better! · We have learned that some environmental projects, i. e. , Cleaner Production (CP) projects, can go hand in hand with : – Production efficiency improvements – Product quality improvements – Production expansion · So, do not place your project idea into a single narrow category — think broadly about all the possible benefits 9

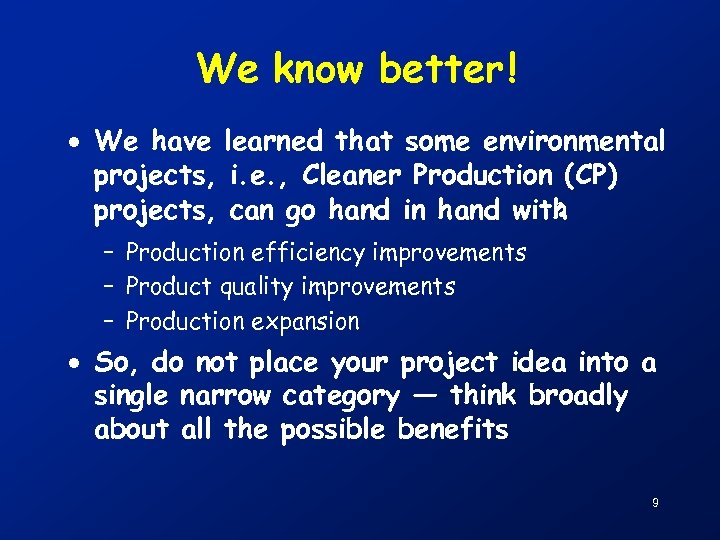

Decision-making factors Technical Regulatory Project selection Today’s focus Financial Organizational 10

![Project Cash Flows and Simple Payback [15 min] 11 Project Cash Flows and Simple Payback [15 min] 11](https://present5.com/presentation/ba8a827ca3f4114060e85a15f6b7ba74/image-11.jpg)

Project Cash Flows and Simple Payback [15 min] 11

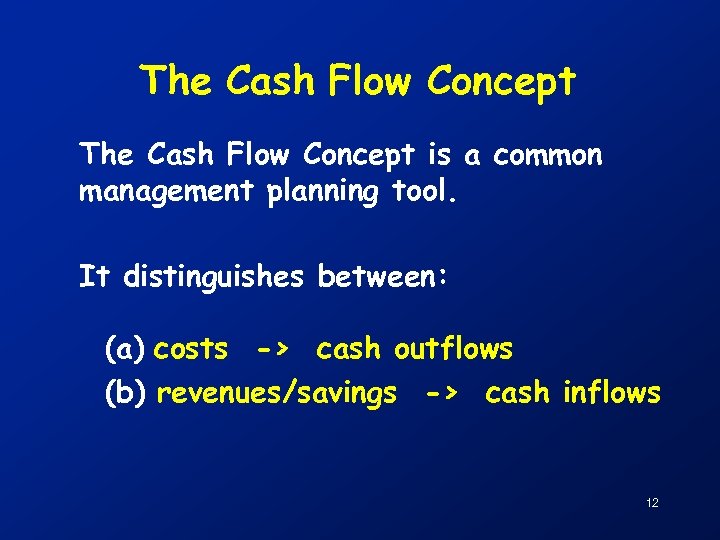

The Cash Flow Concept is a common management planning tool. It distinguishes between: (a) costs -> cash outflows (b) revenues/savings -> cash inflows 12

Cash Flow Analysis • Relies on every day life principles • Measures the difference between – What we received, and – What we paid out • Only cash receipts and cash payments are included in the analysis • Applicable also to forecast cash available 13

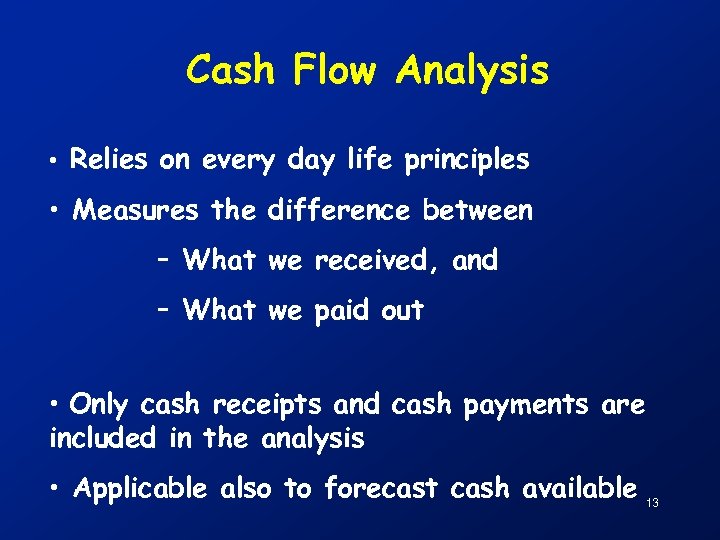

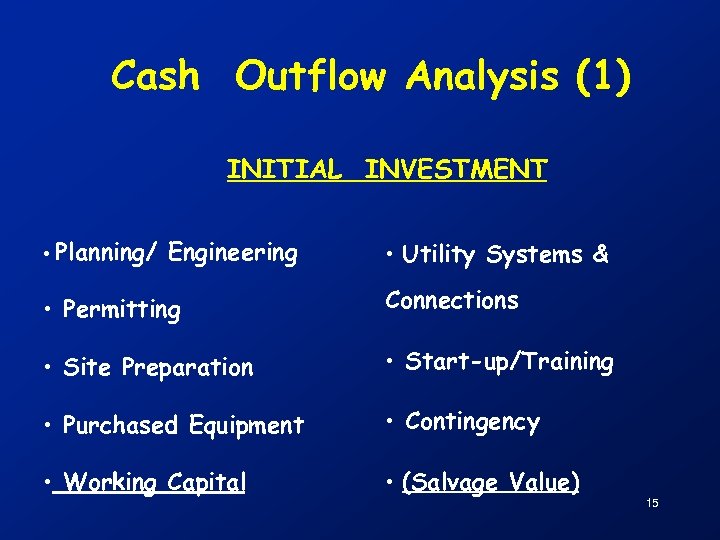

Types of Cash Flows Outflow One-time Annual Other Inflow Initial investment cost Equipment salvage value Operating costs & taxes Operating revenues & savings Working capital 14

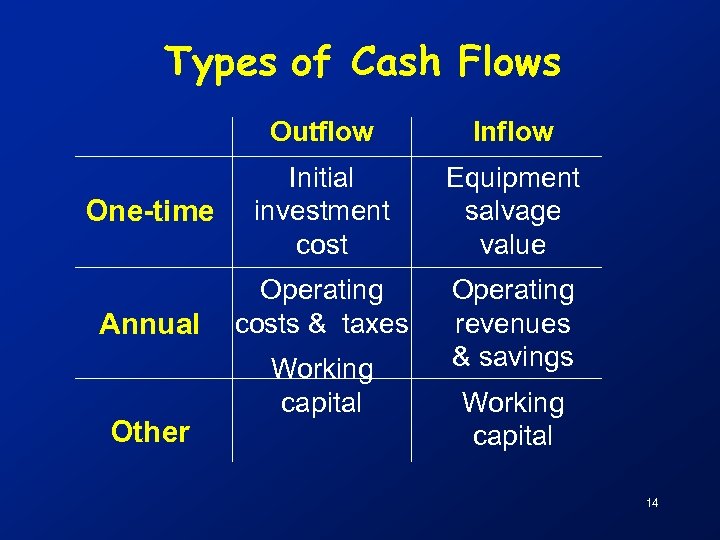

Cash Outflow Analysis (1) INITIAL INVESTMENT • Planning/ Engineering • Utility Systems & • Permitting Connections • Site Preparation • Start-up/Training • Purchased Equipment • Contingency • Working Capital • (Salvage Value) 15

Working Capital is: “the total value of goods and money necessary to maintain project operations” It includes items such as: – – Raw materials inventory Product inventory Accounts payable/receivable Cash-on-hand 16

Salvage Value is the resale value of equipment or other materials at the end of the project 17

Cash Outflow Analysis (2) • Direct costs • Input costs • Other costs • Loan repayments • Interest on loan application 18

Cash Inflow Analysis • Sales • Savings • Salvage value • Cash shortfall / surplus 19

Cash Flow Forecast/Projection (1) • We are looking at the likely future cash position. • We examine the possible effects of changes in the cash flow components. 20

Cash Flow Forecast/Projection (2) · Make assumptions about likely outcomes regarding: – Inflation – Market size – Demand for goods and services – Interest Rates 21

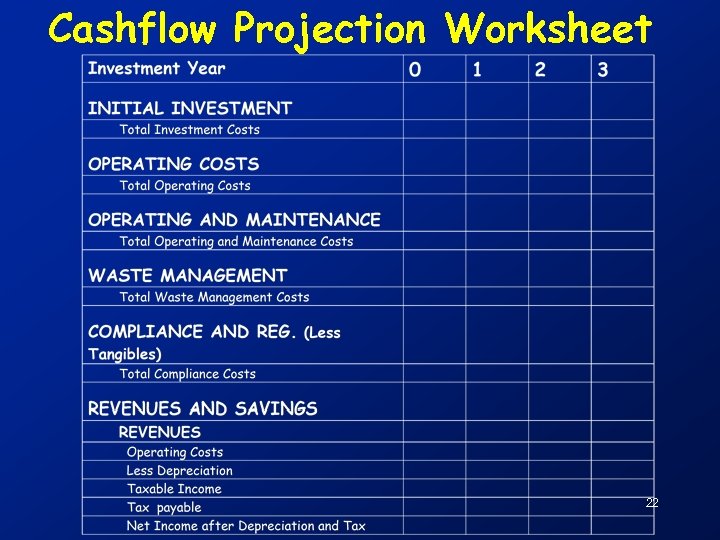

Cashflow Projection Worksheet 22

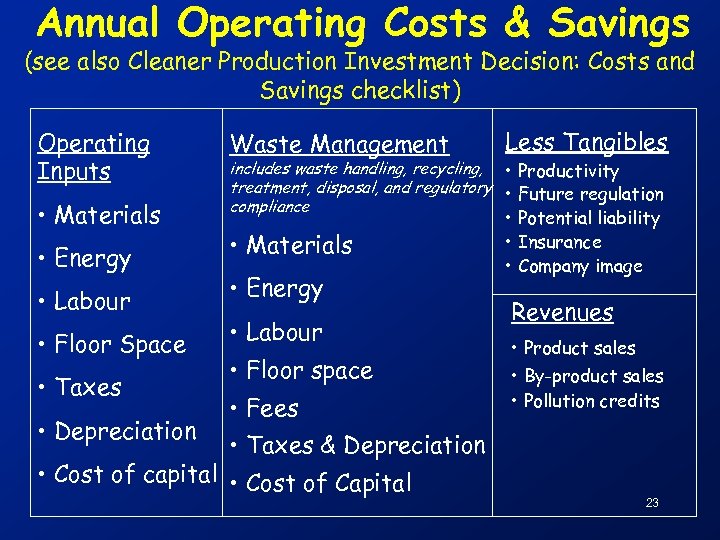

Annual Operating Costs & Savings (see also Cleaner Production Investment Decision: Costs and Savings checklist) Operating Inputs • Materials • Energy • Labour • Floor Space • Taxes • Depreciation Waste Management Less Tangibles • Materials • Potential liability • Insurance • Company image includes waste handling, recycling, • Productivity treatment, disposal, and regulatory • Future regulation compliance • Energy • Labour • Floor space • Fees Revenues • Product sales • By-product sales • Pollution credits • Taxes & Depreciation • Cost of capital • Cost of Capital 23

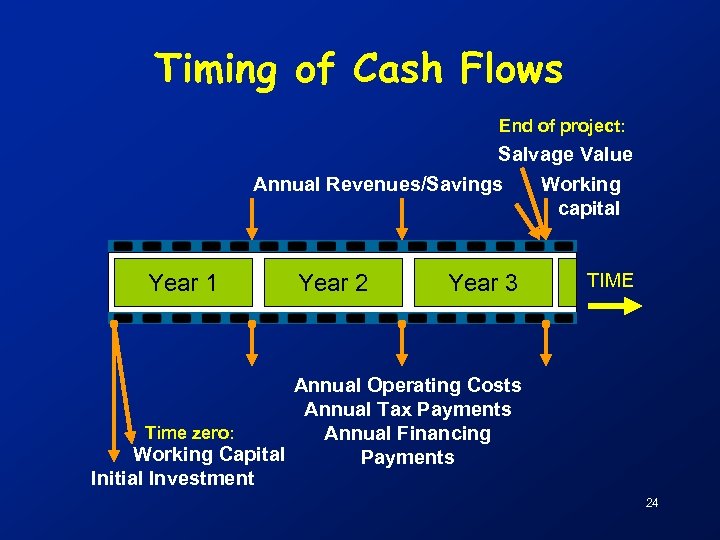

Timing of Cash Flows End of project: Salvage Value Annual Revenues/Savings Working capital Year 1 Year 2 Year 3 TIME Annual Operating Costs Annual Tax Payments Time zero: Annual Financing Working Capital Payments Initial Investment 24

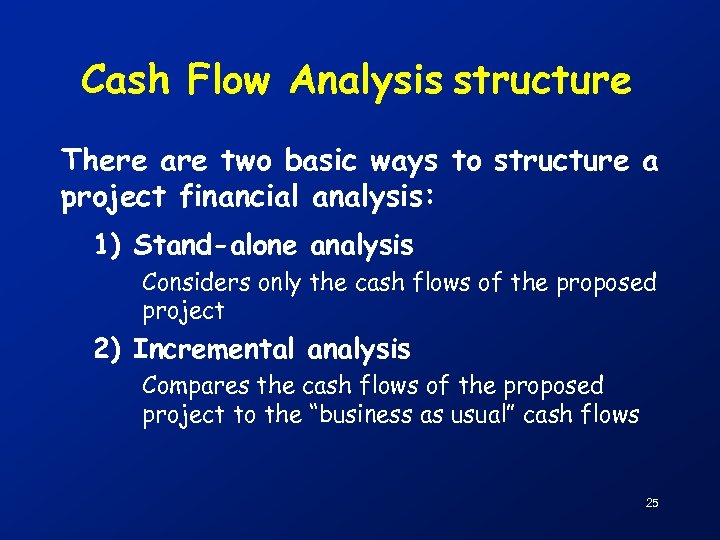

Cash Flow Analysis structure There are two basic ways to structure a project financial analysis: 1) Stand-alone analysis Considers only the cash flows of the proposed project 2) Incremental analysis Compares the cash flows of the proposed project to the “business as usual” cash flows 25

Incremental analysis for CP · For many CP projects, you will need to do an incremental analysis — compare the CP cash flows to the “business as usual” cash flows · You only need to estimate the cash flows that change when you improve the “business as usual” operations 26

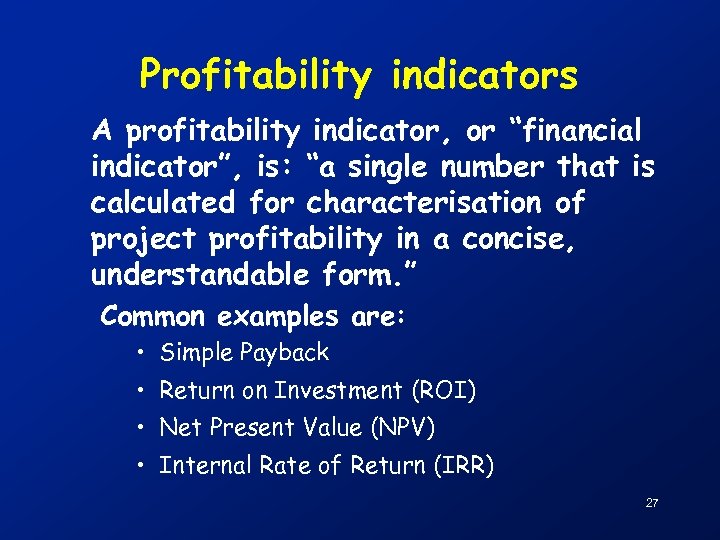

Profitability indicators A profitability indicator, or “financial indicator”, is: “a single number that is calculated for characterisation of project profitability in a concise, understandable form. ” Common examples are: • Simple Payback • Return on Investment (ROI) • Net Present Value (NPV) • Internal Rate of Return (IRR) 27

Simple payback This indicator incorporates: – the initial investment cost – the first year cash flow from the project Simple Payback = (in years) Initial Investment Year 1 Cash Flow 28

How to interpret simple payback The simple payback calculated for a project is usually compared to a company rule of thumb called a “hurdle” rate: e. g. , if the payback period is less than 3 years, then the project is viewed as profitable 29

Small Group Exercise: Profitability Assessment at the PLS Company— Part I “Cash Flows & Simple Payback” [30 min] 30

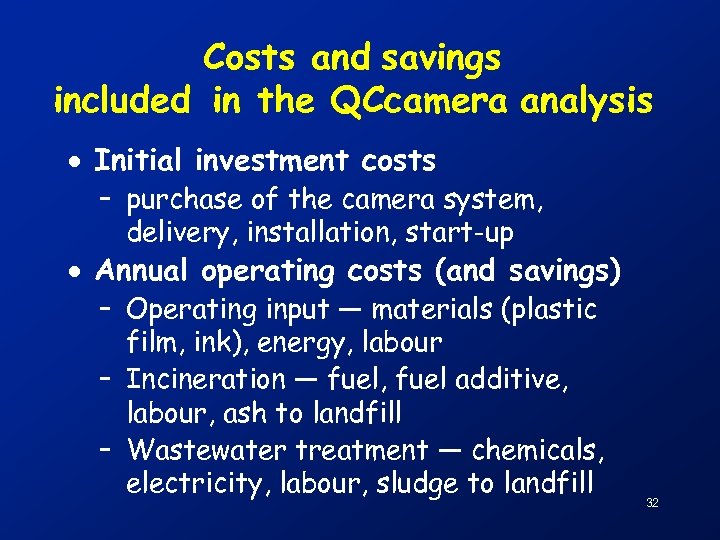

The PLS company’s QC camera project · PLS decided to purchase and install a camera system to monitor quality control (QC) of the print jobs as they actually occur · Allows the operators to detect print errors earlier and halt the operations before too much solid scrap is generated · Has reduced generation of full-run solid scrap by about 40% 31

Costs and savings included in the QCcamera analysis · Initial investment costs – purchase of the camera system, delivery, installation, start-up · Annual operating costs (and savings) – Operating input — materials (plastic film, ink), energy, labour – Incineration — fuel, fuel additive, labour, ash to landfill – Wastewater treatment — chemicals, electricity, labour, sludge to landfill 32

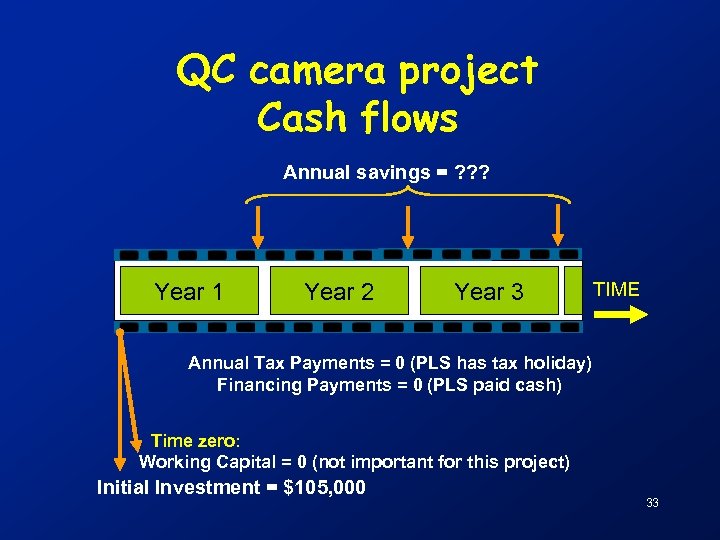

QC camera project Cash flows Annual savings = ? ? ? Year 1 Year 2 Year 3 TIME Annual Tax Payments = 0 (PLS has tax holiday) Financing Payments = 0 (PLS paid cash) Time zero: Working Capital = 0 (not important for this project) Initial Investment = $105, 000 33

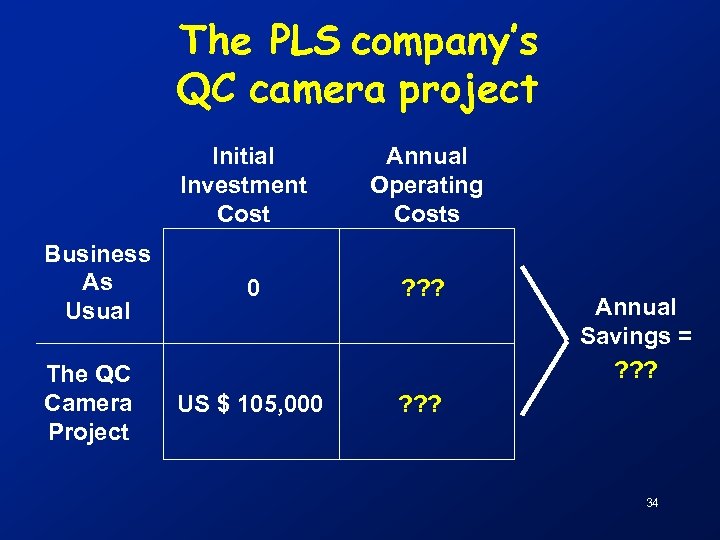

The PLS company’s QC camera project Initial Investment Cost Business As Usual The QC Camera Project Annual Operating Costs 0 ? ? ? US $ 105, 000 ? ? ? Annual Savings = ? ? ? 34

Exercise instructions Part I · Introduction (5 min. ), detailed in your handout · Question 1 (15 min. ) · Question 2 (5 min. ) · Discuss your answers with the other small groups and the instructor (5 min. ) 35

![The Time Value of Money and Net Present Value (NPV) [30 min] 36 The Time Value of Money and Net Present Value (NPV) [30 min] 36](https://present5.com/presentation/ba8a827ca3f4114060e85a15f6b7ba74/image-36.jpg)

The Time Value of Money and Net Present Value (NPV) [30 min] 36

Question: If we were giving away money, would you rather have: (A) $10, 000 today, or (B) $10, 000 3 years from now Explain your answer. . . 37

Inflation Money loses purchasing power over time as product/service prices rise, so a dollar today can buy more than a dollar next year. inflation 5% costs $1 now costs $1. 05 next year 38

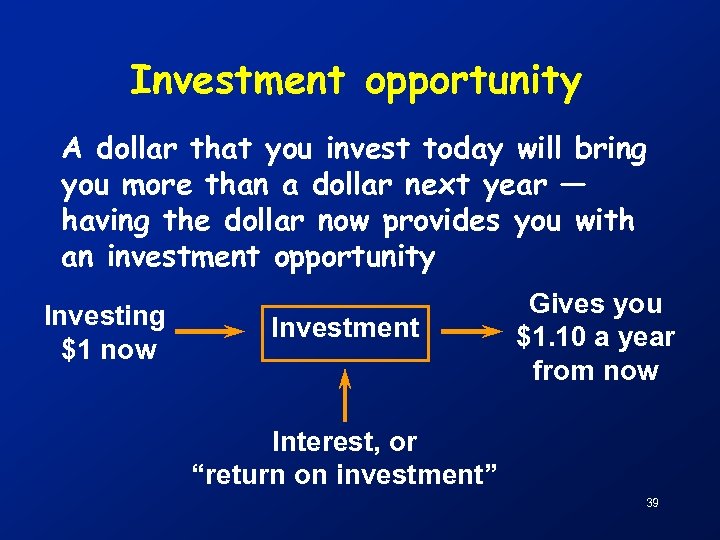

Investment opportunity A dollar that you invest today will bring you more than a dollar next year — having the dollar now provides you with an investment opportunity Investing $1 now Investment Gives you $1. 10 a year from now Interest, or “return on investment” 39

Time Value of Money (TVM) · Money now is worth more than money in the future because of: a) inflation b) investment opportunity · The exact “time value” of your money depends on the magnitude of the: a) rate of inflation and b) rate of return on investment 40

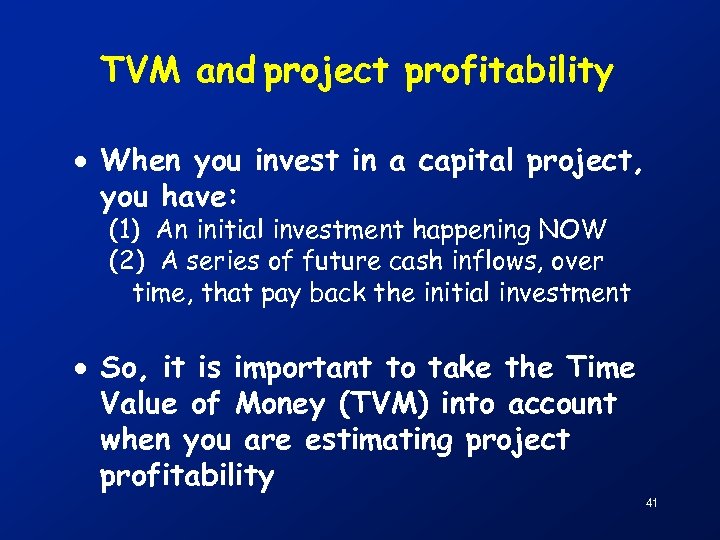

TVM and project profitability · When you invest in a capital project, you have: (1) An initial investment happening NOW (2) A series of future cash inflows, over time, that pay back the initial investment · So, it is important to take the Time Value of Money (TVM) into account when you are estimating project profitability 41

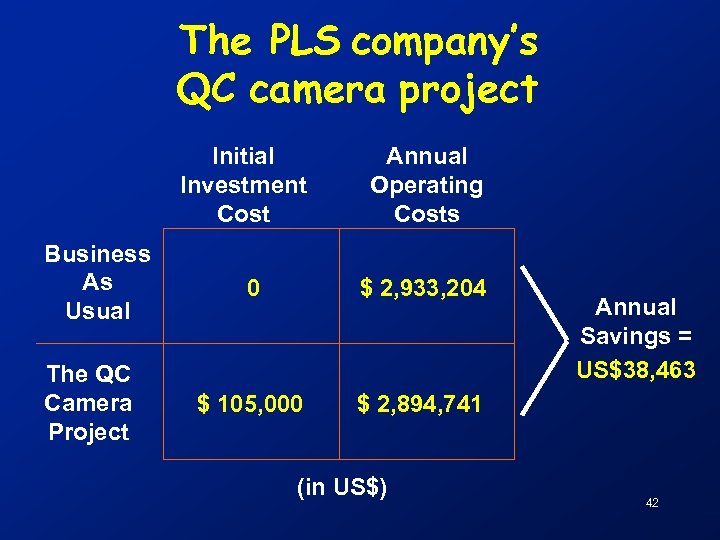

The PLS company’s QC camera project Initial Investment Cost Business As Usual The QC Camera Project Annual Operating Costs 0 $ 2, 933, 204 $ 105, 000 $ 2, 894, 741 (in US$) Annual Savings = US$38, 463 42

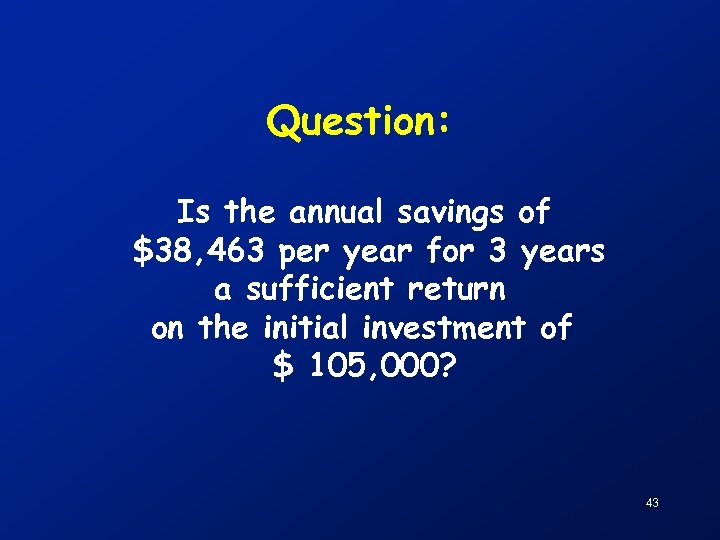

Question: Is the annual savings of $38, 463 per year for 3 years a sufficient return on the initial investment of $ 105, 000? 43

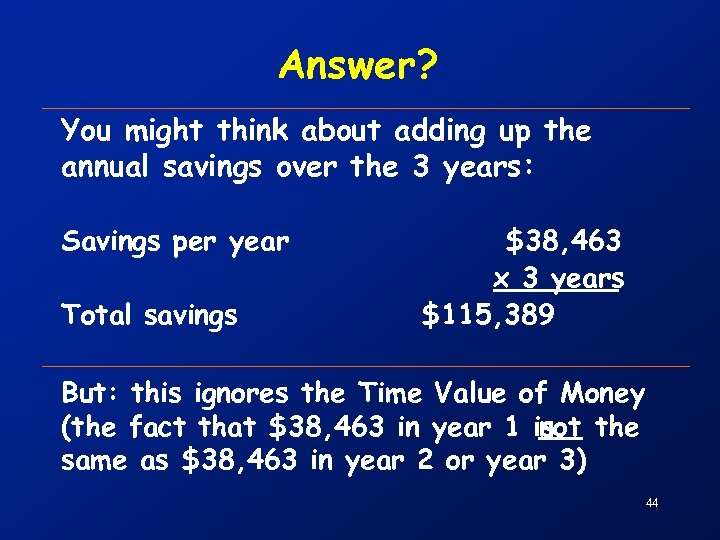

Answer? You might think about adding up the annual savings over the 3 years: Savings per year Total savings $38, 463 x 3 years $115, 389 But: this ignores the Time Value of Money (the fact that $38, 463 in year 1 is the not same as $38, 463 in year 2 or year 3) 44

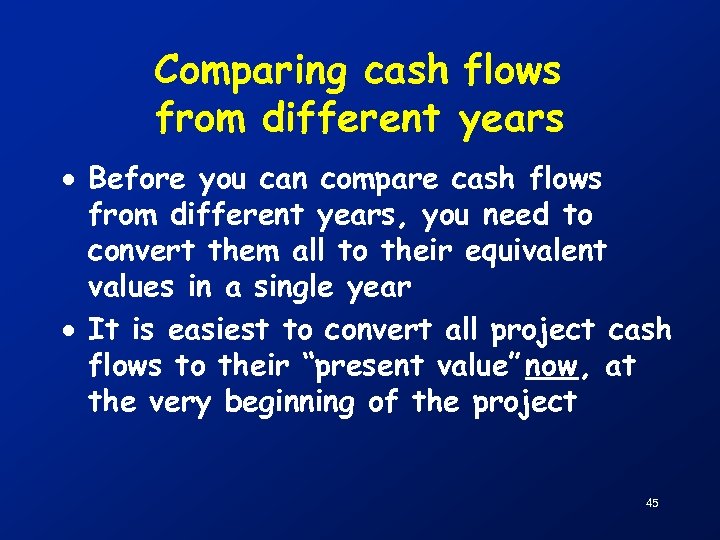

Comparing cash flows from different years · Before you can compare cash flows from different years, you need to convert them all to their equivalent values in a single year · It is easiest to convert all project cash flows to their “present value” now, at the very beginning of the project 45

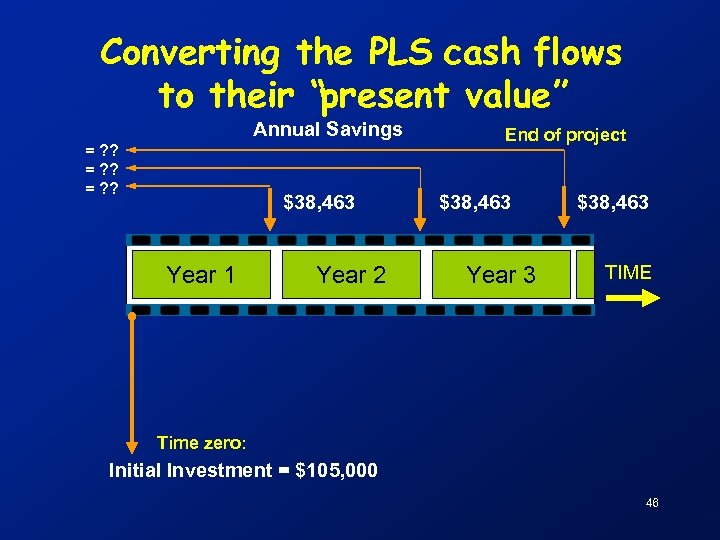

Converting the PLS cash flows to their “present value” Annual Savings = ? ? $38, 463 Year 1 Year 2 End of project $38, 463 Year 3 $38, 463 TIME Time zero: Initial Investment = $105, 000 46

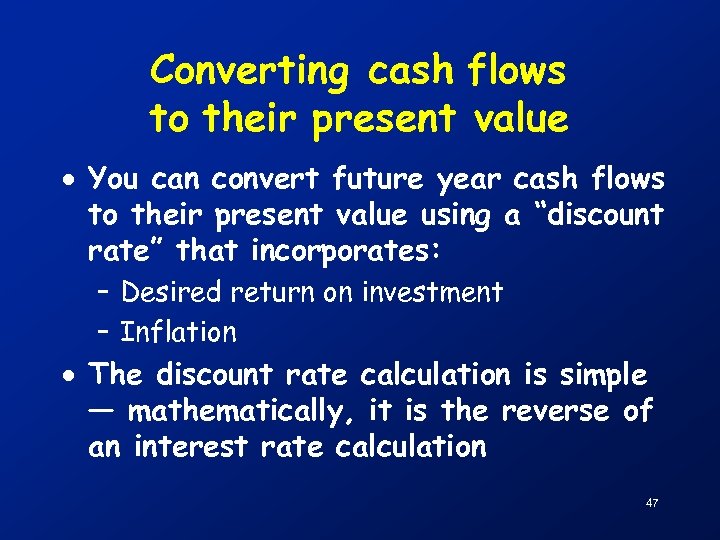

Converting cash flows to their present value · You can convert future year cash flows to their present value using a “discount rate” that incorporates: – Desired return on investment – Inflation · The discount rate calculation is simple — mathematically, it is the reverse of an interest rate calculation 47

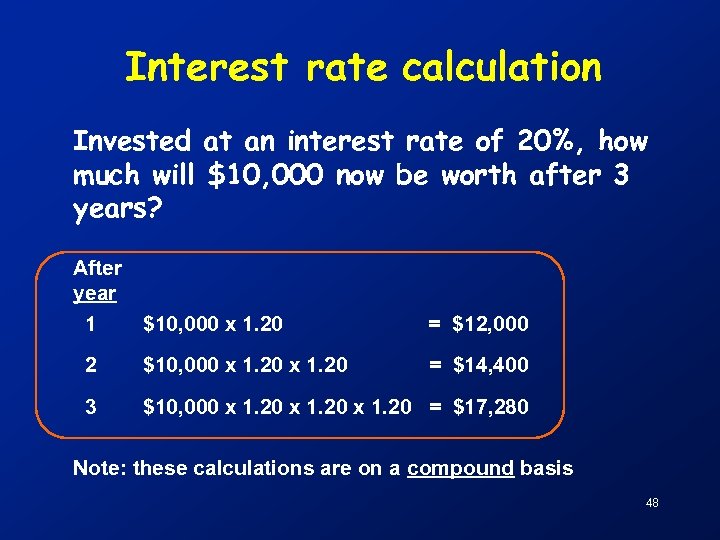

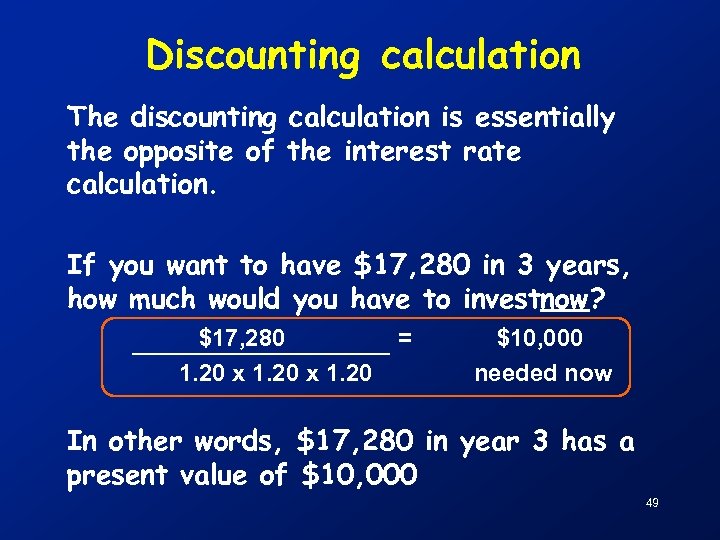

Interest rate calculation Invested at an interest rate of 20%, how much will $10, 000 now be worth after 3 years? After year 1 $10, 000 x 1. 20 = $12, 000 2 $10, 000 x 1. 20 = $14, 400 3 $10, 000 x 1. 20 = $17, 280 Note: these calculations are on a compound basis 48

Discounting calculation The discounting calculation is essentially the opposite of the interest rate calculation. If you want to have $17, 280 in 3 years, how much would you have to investnow? $17, 280 1. 20 x 1. 20 = $10, 000 needed now In other words, $17, 280 in year 3 has a present value of $10, 000 49

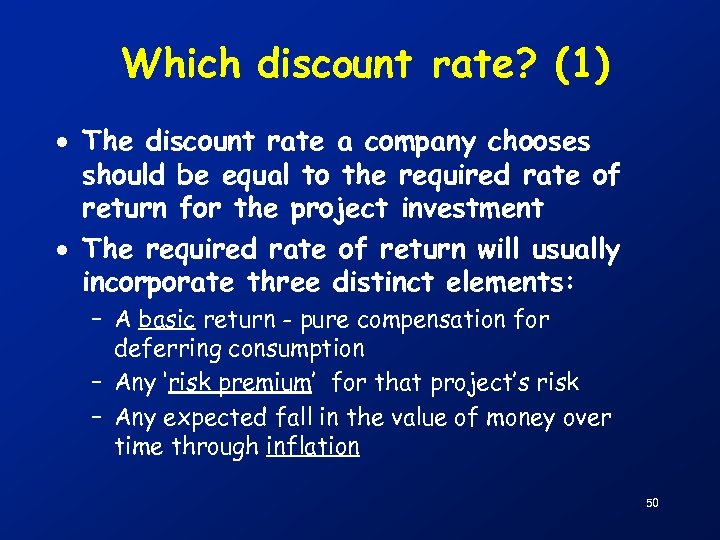

Which discount rate? (1) · The discount rate a company chooses should be equal to the required rate of return for the project investment · The required rate of return will usually incorporate three distinct elements: – A basic return - pure compensation for deferring consumption – Any ‘risk premium’ for that project’s risk – Any expected fall in the value of money over time through inflation 50

Which discount rate? (2) · At a minimum, the chosen discount rate should cover the costs of raising the investment financing from investors or lenders (i. e. the company’s“cost of capital”) · Often, rather than trying to identify the exact source of capital (and its associated cost) for each individual project, a firm will develop a single “Weighted Average Cost of Capital” (WACC) that characterises the sources and cost of capital to the company as a whole. 51

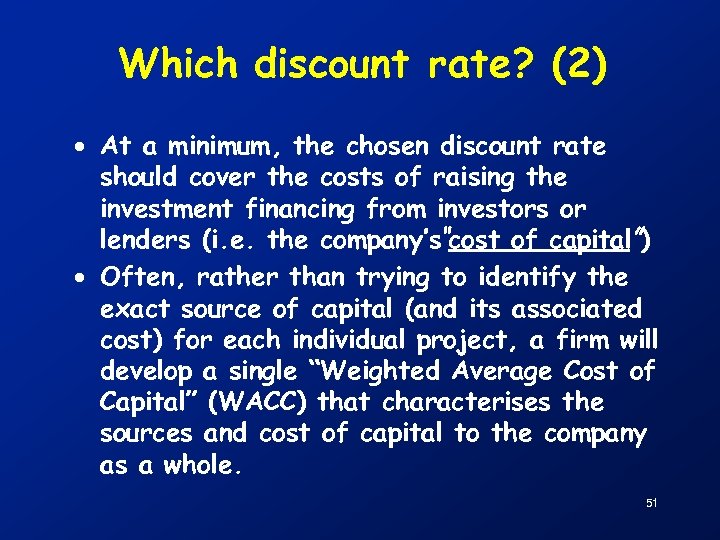

Discounting (1) The value of the cash flow in year n Present Value = Future Valuen (1 + d) n The value of the cash flow at “Time Zero, ” i. e. , at project start-up d = the discount rate n = the number of years after project start-up 52

Discounting (2) The value of the cash flow in year n Present Value = Future Valuen x (PV Factor) The value of the cash flow at “Time Zero, ” i. e. , at project start-up Present Value (PV) Factors have been calculated for various values of d (discount rate) and n (number of years) and have been tabulated for easy use. (Also called discount factors) 53

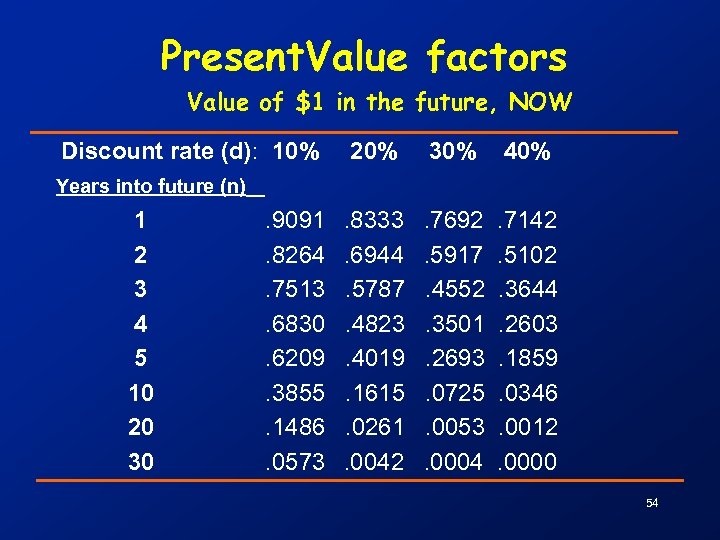

Present. Value factors Value of $1 in the future, NOW Discount rate (d): 10% 20% 30% 40% . 8333. 6944. 5787. 4823. 4019. 1615. 0261. 0042 . 7692. 5917. 4552. 3501. 2693. 0725. 0053. 0004 . 7142. 5102. 3644. 2603. 1859. 0346. 0012. 0000 Years into future (n) 1 2 3 4 5 10 20 30 . 9091. 8264. 7513. 6830. 6209. 3855. 1486. 0573 54

Net Present Value (NPV) · Net Present Value (NPV) = the sum of the present values of all of a project’s cash flows, both negative (cash outflows) and positive (cash inflows) · NPV characterises the present value of the project to the company If NPV > 0, the project is profitable If NPV < 0, the project is not 55

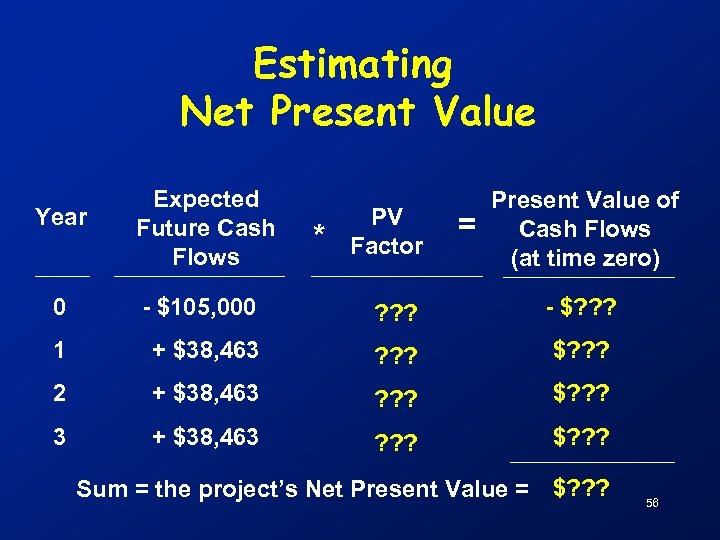

Estimating Net Present Value Year Expected Future Cash Flows 0 - $105, 000 ? ? ? - $? ? ? 1 + $38, 463 ? ? ? $? ? ? 2 + $38, 463 ? ? ? $? ? ? 3 + $38, 463 ? ? ? $? ? ? * PV Factor = Present Value of Cash Flows (at time zero) Sum = the project’s Net Present Value = $? ? ? 56

![Time for lunch ! [60 min] 57 Time for lunch ! [60 min] 57](https://present5.com/presentation/ba8a827ca3f4114060e85a15f6b7ba74/image-57.jpg)

Time for lunch ! [60 min] 57

Small Group Exercise: Profitability Assessment at the PLS Company— Part II “Net Present Value” [45 min] 58

Also — you will need the handout: “Performing Net Present Value (NPV) Calculations” Located in your handout 59

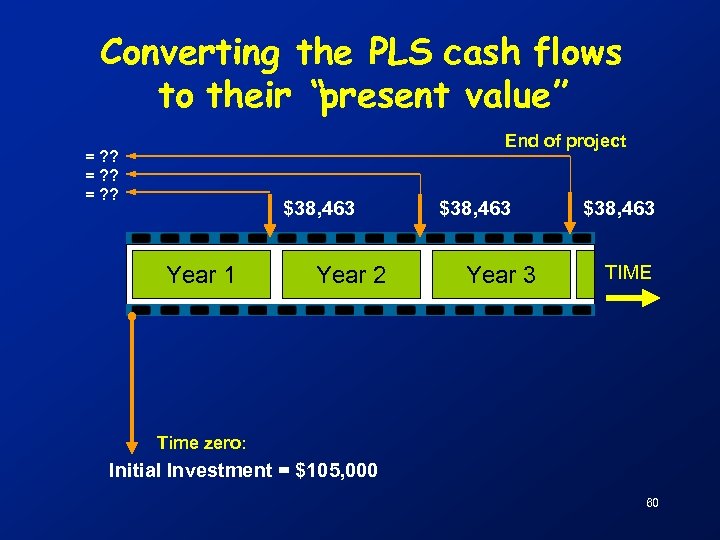

Converting the PLS cash flows to their “present value” End of project = ? ? $38, 463 Year 1 Year 2 $38, 463 Year 3 $38, 463 TIME Time zero: Initial Investment = $105, 000 60

Exercise instructions Part II · Introduction (5 min. ), detailed in your handout · Question 3 (15 min. ) · Question 4 (5 min. ) · Discuss your answers with the other small groups and the instructor (15 min. ) · Lessons learned (5 min. ) 61

![Capital Budgeting: inflation & tax [30 min] 62 Capital Budgeting: inflation & tax [30 min] 62](https://present5.com/presentation/ba8a827ca3f4114060e85a15f6b7ba74/image-62.jpg)

Capital Budgeting: inflation & tax [30 min] 62

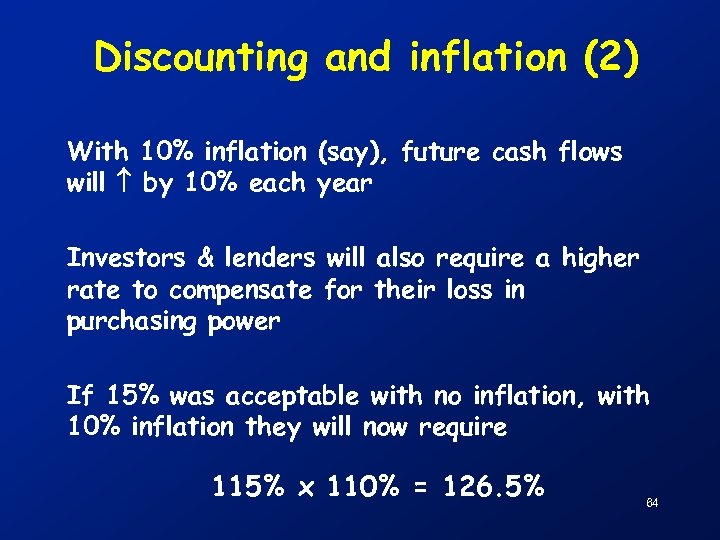

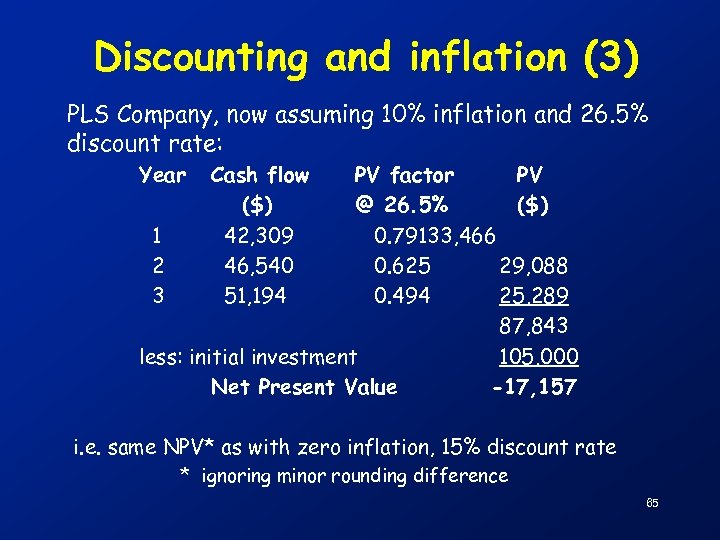

Discounting and inflation (1) · even without inflation, money has a time value due to supply/demand for money · inflation increases both: - future cash flows - interest rates (and discount rates) · these offset each other 63

Discounting and inflation (2) With 10% inflation (say), future cash flows will by 10% each year Investors & lenders will also require a higher rate to compensate for their loss in purchasing power If 15% was acceptable with no inflation, with 10% inflation they will now require 115% x 110% = 126. 5% 64

Discounting and inflation (3) PLS Company, now assuming 10% inflation and 26. 5% discount rate: Year Cash flow ($) 42, 309 46, 540 51, 194 PV factor PV @ 26. 5% ($) 1 0. 79133, 466 2 0. 625 29, 088 3 0. 494 25, 289 87, 843 less: initial investment 105, 000 Net Present Value -17, 157 i. e. same NPV* as with zero inflation, 15% discount rate * ignoring minor rounding difference 65

What is the current rate of inflation in the economy? What return on their capital will the lender really earn on their money, after allowing for the erosion of their capital over time through inflation? 66

Tax payments · Taxes can be an important project cash flow · Depending on a facility’s location, a firm may have to pay national and/or local income taxes on the revenues or savings generated by a project · Other types of taxes may also be relevant - sales taxes, pollution taxes, etc. 67

Tax deductions or credits · Tax deductions or credits can also be important · One example is the income tax deduction often given for equipment depreciation, which is the loss in value of a physical asset (e. g. , a piece of equipment) as the asset ages · Some “environmental” investments can receive special tax credits 68

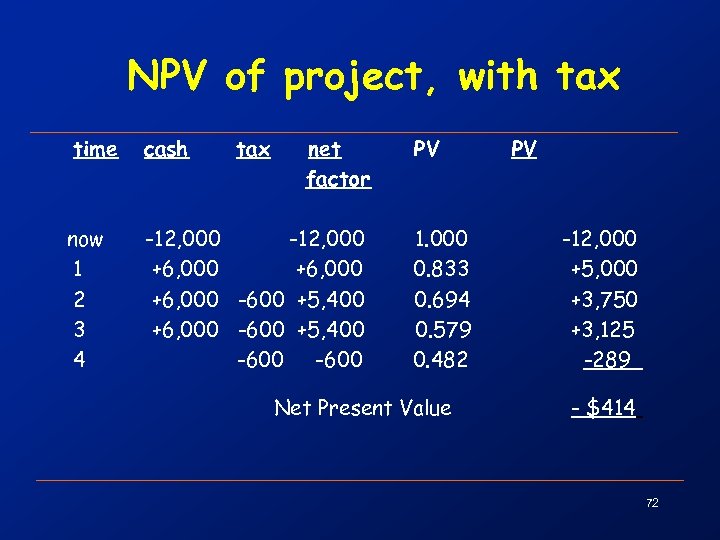

Tax and project appraisal · assume 30% rate of taxes of firms’ profits · tax is based on accounting profits, not on cashflows · accounting profits are after deducting depreciation · tax is payable 1 year after the profits have been realised 69

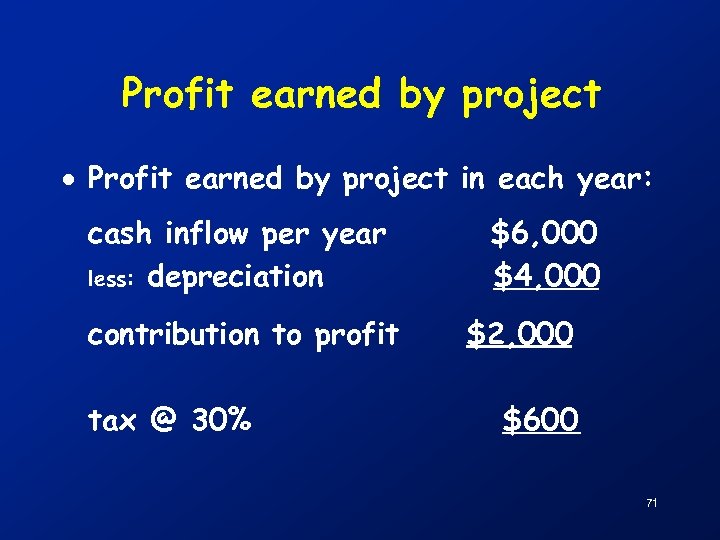

Depreciation · A project needs $12, 000 for a new machine which will last 3 years · assume the machine has no residual value after 3 years · depreciation per year: initial cost = $12, 000 = $4, 000 per year asset life 3 years 70

Profit earned by project · Profit earned by project in each year: cash inflow per year less: depreciation contribution to profit tax @ 30% $6, 000 $4, 000 $2, 000 $600 71

NPV of project, with tax time cash tax net factor now 1 2 3 4 -12, 000 +6, 000 -600 +5, 400 -600 PV 1. 000 0. 833 0. 694 0. 579 0. 482 Net Present Value PV -12, 000 +5, 000 +3, 750 +3, 125 -289 - $414 72

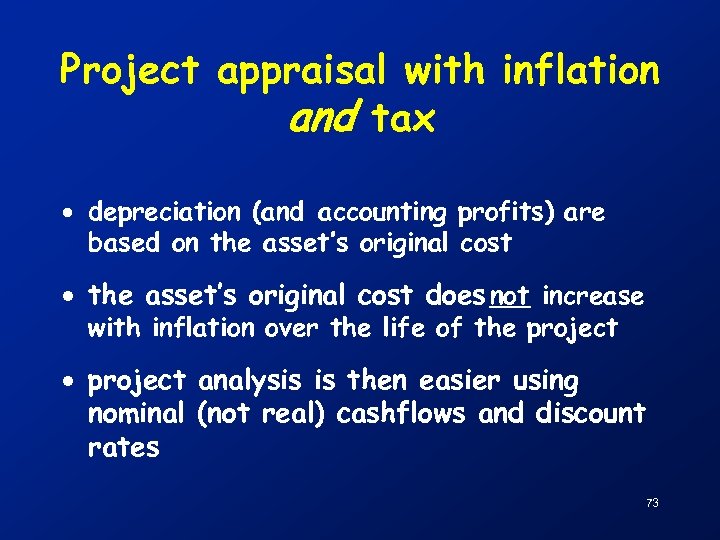

Project appraisal with inflation and tax · depreciation (and accounting profits) are based on the asset’s original cost · the asset’s original cost does not increase with inflation over the life of the project · project analysis is then easier using nominal (not real) cashflows and discount rates 73

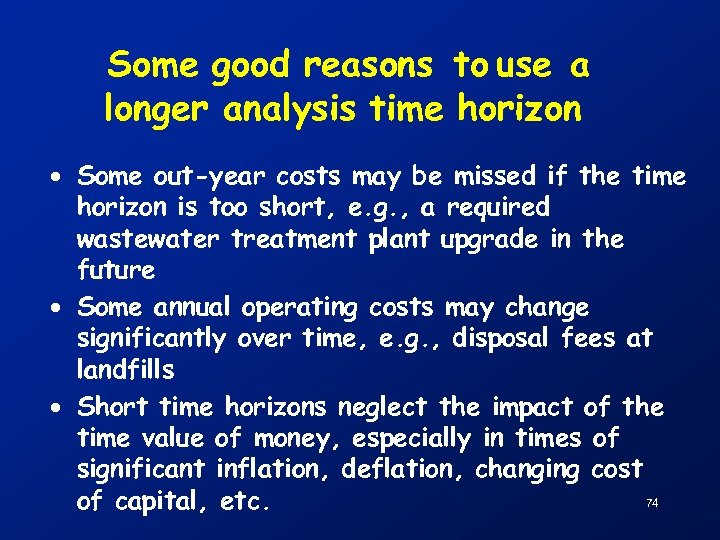

Some good reasons to use a longer analysis time horizon · Some out-year costs may be missed if the time horizon is too short, e. g. , a required wastewater treatment plant upgrade in the future · Some annual operating costs may change significantly over time, e. g. , disposal fees at landfills · Short time horizons neglect the impact of the time value of money, especially in times of significant inflation, deflation, changing cost 74 of capital, etc.

Profitability assessment tips Be sure to: – Include all relevant and significant costs/savings in the profitability analysis – Think long-term (or at least medium-term!) – Incorporate the time value of money – Use multiple profitability indicators – Perform sensitivity analyses for data estimates that are uncertain 75

![Time for a break! [15 min] 76 Time for a break! [15 min] 76](https://present5.com/presentation/ba8a827ca3f4114060e85a15f6b7ba74/image-76.jpg)

Time for a break! [15 min] 76

![Sensitivity Analysis [15 min] 77 Sensitivity Analysis [15 min] 77](https://present5.com/presentation/ba8a827ca3f4114060e85a15f6b7ba74/image-77.jpg)

Sensitivity Analysis [15 min] 77

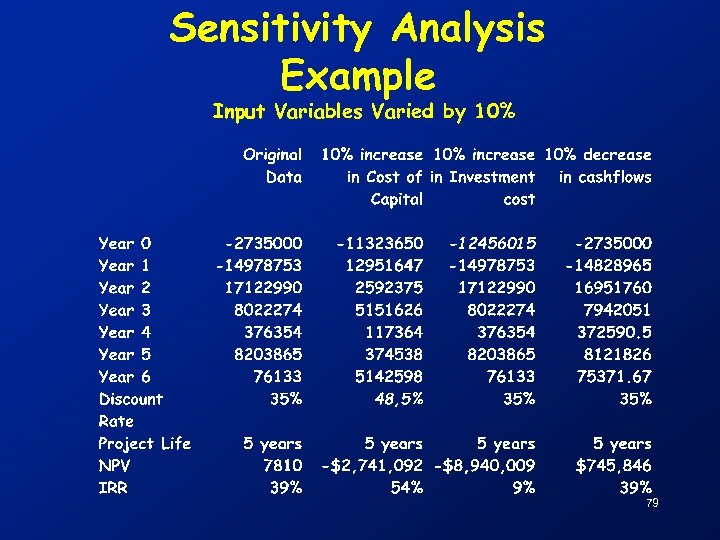

Sensitivity Analysis Introduction ·An important management tool questioning potential project benefit risks. ·Assumptions surrounding a project are computed to produce a base NPV and IRR. ·From the base case, changes in the original assumptions are made to gauge their effect on the NPV and IRR. ·Input variables varied adversely by 10% 78

Sensitivity Analysis Example Input Variables Varied by 10% 79

Sensitivity Analysis Summary · Sensitivity Analysis permits project proposals to be evaluated simply. ·The model can evaluate sensitive variables without having to input any additional data. 80

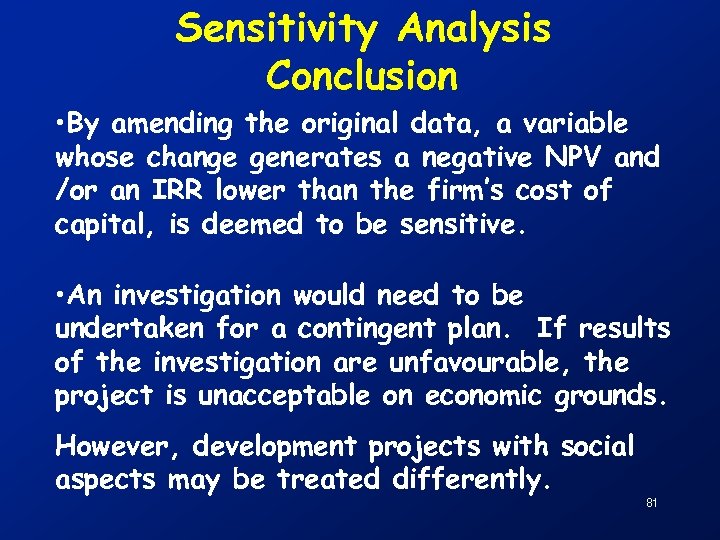

Sensitivity Analysis Conclusion • By amending the original data, a variable whose change generates a negative NPV and /or an IRR lower than the firm’s cost of capital, is deemed to be sensitive. • An investigation would need to be undertaken for a contingent plan. If results of the investigation are unfavourable, the project is unacceptable on economic grounds. However, development projects with social aspects may be treated differently. 81

![Key Profitability Indicators [15 min] 82 Key Profitability Indicators [15 min] 82](https://present5.com/presentation/ba8a827ca3f4114060e85a15f6b7ba74/image-82.jpg)

Key Profitability Indicators [15 min] 82

Profitability indicators We have seen so far: • Simple Payback • Net Present Value (NPV) But there are others, common examples are: • Return on Investment (ROI) • Internal Rate of Return (IRR) 83

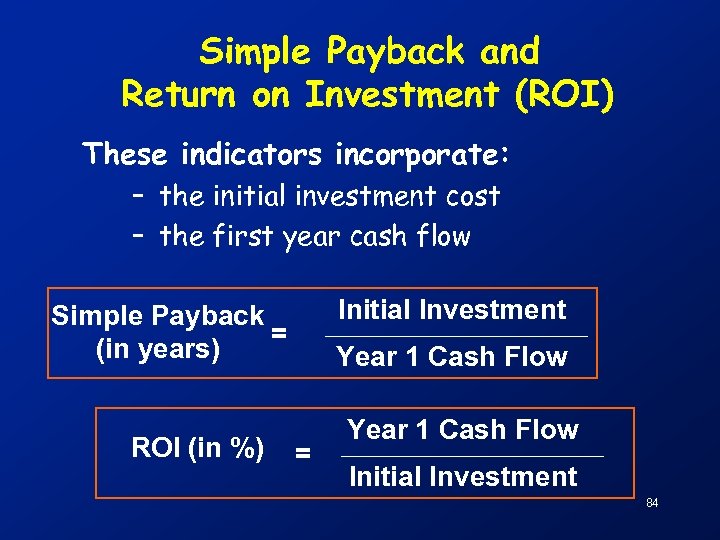

Simple Payback and Return on Investment (ROI) These indicators incorporate: – the initial investment cost – the first year cash flow Initial Investment Simple Payback = (in years) ROI (in %) Year 1 Cash Flow = Year 1 Cash Flow Initial Investment 84

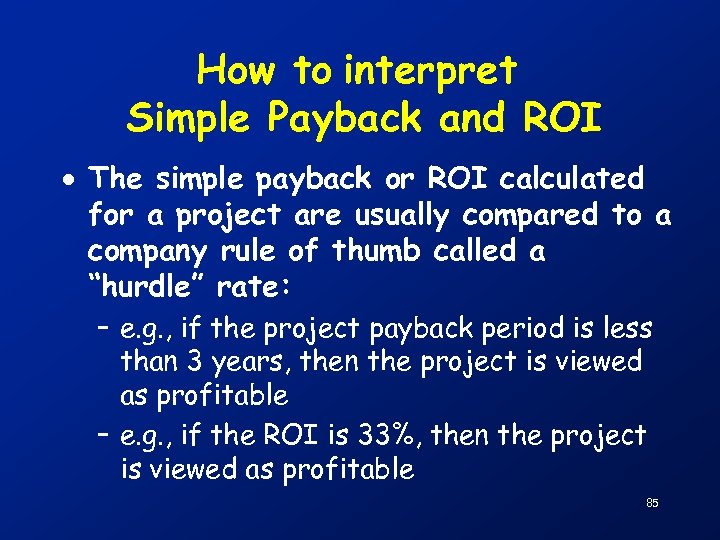

How to interpret Simple Payback and ROI · The simple payback or ROI calculated for a project are usually compared to a company rule of thumb called a “hurdle” rate: – e. g. , if the project payback period is less than 3 years, then the project is viewed as profitable – e. g. , if the ROI is 33%, then the project is viewed as profitable 85

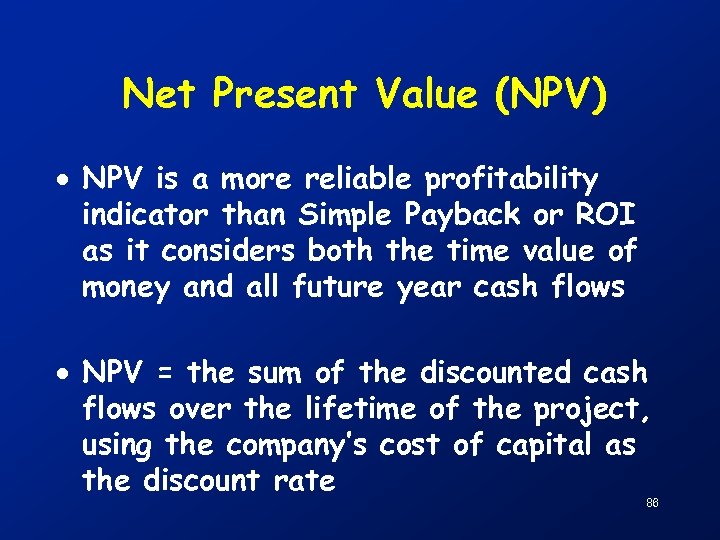

Net Present Value (NPV) · NPV is a more reliable profitability indicator than Simple Payback or ROI as it considers both the time value of money and all future year cash flows · NPV = the sum of the discounted cash flows over the lifetime of the project, using the company’s cost of capital as the discount rate 86

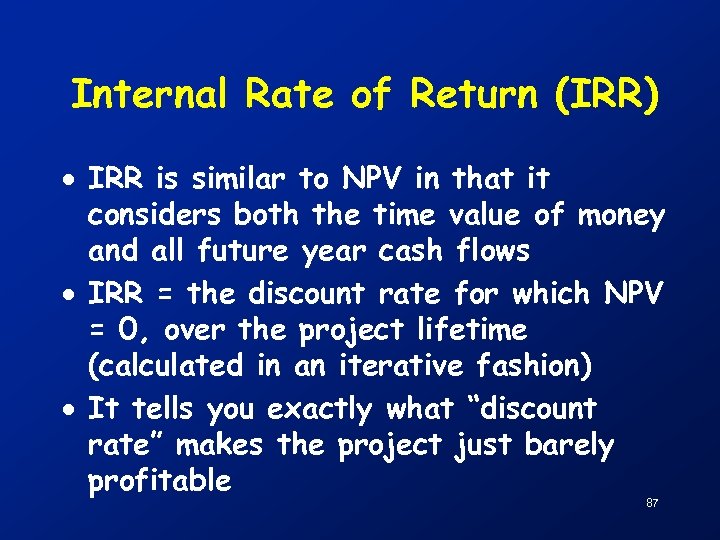

Internal Rate of Return (IRR) · IRR is similar to NPV in that it considers both the time value of money and all future year cash flows · IRR = the discount rate for which NPV = 0, over the project lifetime (calculated in an iterative fashion) · It tells you exactly what “discount rate” makes the project just barely profitable 87

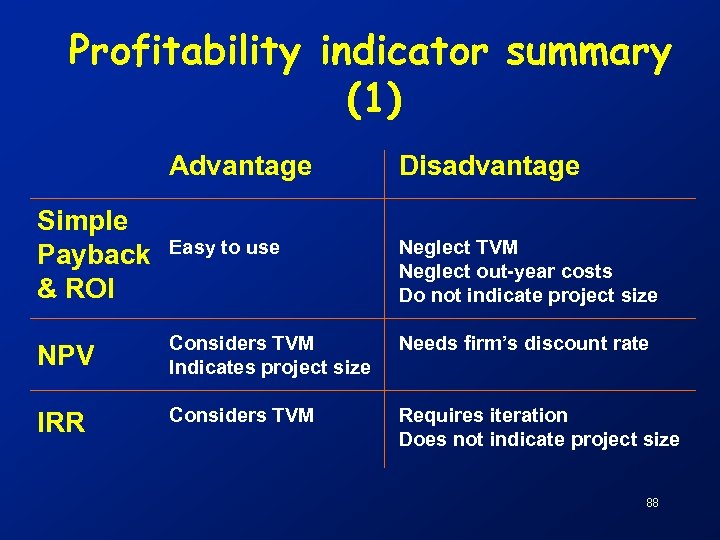

Profitability indicator summary (1) Advantage Disadvantage Simple Payback & ROI Easy to use Neglect TVM Neglect out-year costs Do not indicate project size NPV Considers TVM Indicates project size Needs firm’s discount rate IRR Considers TVM Requires iteration Does not indicate project size 88

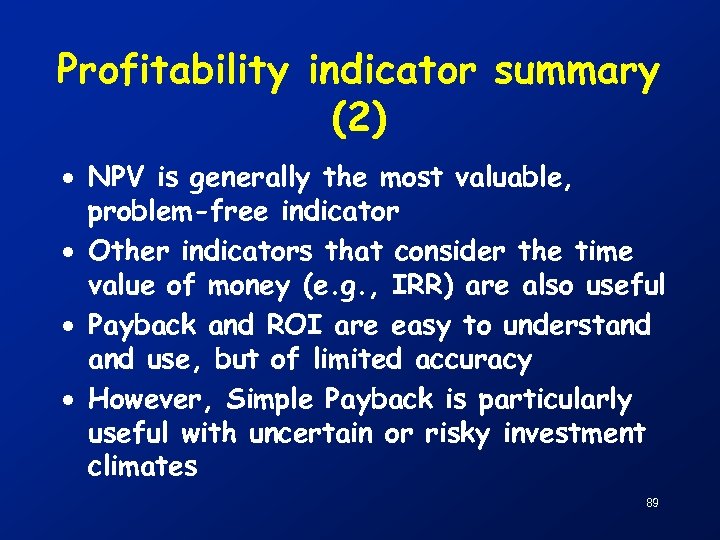

Profitability indicator summary (2) · NPV is generally the most valuable, problem-free indicator · Other indicators that consider the time value of money (e. g. , IRR) are also useful · Payback and ROI are easy to understand use, but of limited accuracy · However, Simple Payback is particularly useful with uncertain or risky investment climates 89

Interpret profitability indicators with caution. . . · We have seen that Simple Payback has some limitations as a project profitability indicator · Be aware of the advantages and limitations of the indicators you use · The best approach is to use several indicators to give a balanced view of project profitability 90

![Other Profitability Assessment Issues [15 min] 91 Other Profitability Assessment Issues [15 min] 91](https://present5.com/presentation/ba8a827ca3f4114060e85a15f6b7ba74/image-91.jpg)

Other Profitability Assessment Issues [15 min] 91

Other issues · There are other issues that impact a project’s profitability, which we do not have time to address today – Source and cost of project financing – Can you think of others? 92

Project financing · Different sources of project financing may have differing impacts on project profitability · Be sure to take financing payments such as lease payments or payments on loan principal and interest into account appropriately when estimating profitability 93

![Project Profitability Assessment Summary and Q&A [15 min] 94 Project Profitability Assessment Summary and Q&A [15 min] 94](https://present5.com/presentation/ba8a827ca3f4114060e85a15f6b7ba74/image-94.jpg)

Project Profitability Assessment Summary and Q&A [15 min] 94

Project profitability assessment · Capital budgeting (of “environmental” projects) · Project cash flows and simple payback · The Time Value of Money and Net Present Value (NPV) · Two small group exercises · Capital budgeting : inflation and tax · Sensitivity analysis · Key profitability indicators 95

ba8a827ca3f4114060e85a15f6b7ba74.ppt