9bd96f0f59fca04ddea8c7655e1b0a69.ppt

- Количество слайдов: 64

PROJECT BLACK SEA TRADENET DOING BUSINESS WITH ROMANIA RODICA BELTEU – CONSTANTA CHAMBER OF COMMERCE, INDUSTRY, SHIPPING AND AGRICULTURE WORKSHOP DOBRICH, BULGARIA, 13 -14 MARCH 2012

COUNTRY PROFILE Official name: ROMANIA Flag and coat of arms: Legal system: Romania is a parliamentary republic, the current Constitution was adopted in 1991 and subsequently amended in 2003. The Parliament represents the legislative power in the state. It is a bicameral 471 -seat Parliament composed of the Senate (137 seats) and the Chamber of Deputies (334 seats). The Government, led by a prime-minister appointed by the president of the country, is the executive power. Geographical location: Romania is located in the geographical center of Europe (southeastern of Central Europe), on the Black Sea coast. It lies on north of the Balkanic peninsula, inside and outside the Carpathian arch, on the lower Danube (1075 km) and by the Black Sea. It lies between latitudes 43° and 49° N, and longitudes 20° and 30° E. Easterly, Romania is oriented towards the sea, while westerly, towards the continent. Frontiers: The length of Romania’s frontiers is of 3150 km, of which 1085. 5 km are terrestrial frontiers, and 2064. 5 km water frontiers. Romania shares a border with Hungary and Serbia to the west, Ukraine and Moldova to the northeast and east, and Bulgaria to the south. Area: With a surface area of 238, 391 km², Romania is the largest country in southeastern Europe and the twelfth -largest in Europe. An area of 23 700 km² of Black Sea platform should be added to this area. Water represents 3% of Romania’s area.

COUNTRY PROFILE Relief: Romania’s relief is composed of three main levels, namely the high level of the Carpathian Mountains, the middle level of the Sub-Carpathians, hills and plateaus, and the lowlands of plains, meadows and Danube Delta. These major relief forms are disposed in balanced concentric areas: 31% mountains, 36% hills and 33% lowlands. Waters : The running waters are radial, most of them springing in the Carpathian Mountains. Danube is their main collector and it runs the southern part of Romania on a 1075 m length. Danube flows into Black Sea and forms Danube Delta, the second largest and best preserved delta in Europe, and also a biosphere reserve and a biodiversity World Heritage Site. The main rivers are Mures - 761 km, Prut – 742 km, Olt - 615 km, and Siret – 559 km. Of great economic importance, Black Sea – Danube Canal is a 64. 2 km manmade canal linking Black Sea (Constanta) and Danube (Cernavoda), reducing the navigation way between Constanta Port and Cernavoda with 400 km. Lakes are mainly natural, spread on all major relief forms, from glacial lakes in the upper relief level, to river-maritime lakes. The largest natural lakes in Romania are Razelm – Sinoe maritime lagoons (41, 500 ha), Lakes Oltina and Tasaul, Lakes Brates and Dranov of over (2, 000. 00 ha). Manmade lakes are also numerous and many of them are artificial dam lakes, such as Lake Portile de Fier on Danube – 70, 000 ha. Climate: Due to its position between open sea and in the edge of the European continent, Romania has a climate that is transitional between temperate and continental, with four distinct seasons. The average annual temperature is 11 °C in the south and 8 °C in the north. Precipitation is average with over 750 mm per year only on the highest western mountains—much of it falling as snow, which allows for an extensive skiing industry. In the south-central parts of the country the level of precipitation drops to around 600 mm, while in the Danube Delta, rainfall levels are very low, and average only around 370 mm.

COUNTRY PROFILE Natural resources: Romania enjoys important natural resources ranging from oil and natural gas, coal – mainly coal, brown coal, and lignite, large resources of salt, metal and non-metal minerals, gold, silver and primary aluminium (bauxite), wood and timber, important arable areas. Over 2, 000 mineral springs for consumption and health treatment are also considered an important natural resource. Renewable sources for energy are also important, the wind potential of sea coastal territories being considered to be one of the highest in Europe, while the water energy is important on numerous rivers. Oficial language: Romanian is the official language of Romania. Time zone: Eastern European Time (UTC+02), Eastern European Summer Time (UTC+03) Religion: 86. 7% of the inhabitants are Orthodox Christian, followed by other Christian churches: Roman Catholic, Protestant, Pentecostal. Muslim church represents 0. 3% of the total population. Currency: Romanian currency is „leu” – „lei” in plural, wiht „ban” as subdivision. 1 leu = 100 bani. Transactions are made with coins (1, 5 and 50 bani), and notes (1, 5, 10, 50, 100, 200 and 500 lei). Official ISO 4217 short name is „ROL”. The national currency course is established daily on the inter-bank market, the refewrence currency being euro. The average exchange rate in 2010 was of 4, 2099 lei for 1 euro. Measuring system : The standard metric system has been adopted into 1884. Excepting for remote rural areas, no traditional metric system is in use in Romania.

COUNTRY PROFILE Administrative organisation : Romania is organised into several types of units that correspond to the European classification systems – Nomenclature of territorial units for statistics (NUTS) and the system meeting the demand at local level - Local Administrative Units (LAU), as per 2010, January the 1 st. Thus, Romania is organised into 42 counties, including Bucharest, the capital town. They have legal identity and correspond to NUTS 3 level. Counties have in average between 300, 000 and over 700, 000 inhabitants. At local level, the organisation is based on towns and municipalities (municipii) – 320 units of LAU 2 level, and communes and villages – 2861 communes encompassing 12, 956 villages of LAU 2 level. Towns varies between 5, 000 and over 1, 000 inhabitants, most of them having 20, 000 – 50, 000 inhabitants, while communes varies between 1, 000 and over 10, 000 inhabitants, most of them 2, 000 – 5, 000 inhabitants. For development purpose, Romania has defined 8 development regions encompassing 2 – 8 counties (NUTS 2 level) and macroregions encompassing 2 development regions each (NUTS 1 level). They do not have legal identity. There are no autonomous regions in Romania. National holiday and other legal holidays: 1 st of December – the national holiday of Romania, celebrating the union of Transilvania and Banat historical regions (west of Romania) with the existing Romania, and thus, the unification of all Romanian into one modern state (1918). One day-off is related to the national day. Six other national holidays are declared by law, with one or two day-offs. Romania is a member of numerous international organizations, of which : United Nations (UN), since 1955 North Atlantic Treaty Organisation (NATO), since 2004 Council of Europe, since 1993 European Union (EU), since 2007 World Bank, since 1972

COUNTRY PROFILE In terms of economy, Romania is a member of: European Bank for Reconstruction and Development (EBRD) European Investment Bank (EIB) Food and Agriculture Organization (FAO) International Chamber of Commerce (ICC) International Bank for Reconstruction and Development (IBRD) International Monetary Fund (IMF) United Nations Conference on Trade and Development (UNCTAD) World Tourism Organization (UNWTO) World Trade Organization (WTO) World Customs Organization (WCO) In terms of security and cooperation, Romania is a member of: Organization for Security and Cooperation in Europe (OSCE) International Criminal Court (ICCt) International Criminal Police Organization (Interpol) International Red Cross and Red Crescent Movement (ICRM) United Nations High Commissioner for Refugees (UNHCR) World Health Organization (WHO) In terms of regional affairs and policy, Romania is a member of: Black Sea Economic Cooperation Zone (BSEC), since 1992 Southeast European Cooperative Initiative (SECI) Central European Initiative (CEI) Euro-Atlantic Partnership Council (EAPC) Group of 9 (G 9)

COUNTRY PROFILE History and civilisation Romanian civilization is one of the oldest civilizations in Europe, as human fossils of about 42, 000 years old were discovered in the country. The oldest written record of people living in the geographical area of the present-day Romania is highlighted in Herodotus's book, where he mentioned about the Getae tribes. The Dacians were a part of Thracians, the inhabitants of the area between Northern Carpathian chain and the Balkan mountains. In the 1 st century BC, the Roman Empire expanded its border and the Dacian kingdom became a Roman province. During the 3 rd century, the Roman troops and administrative body left Roman Dacia in the face of possible attacks by the Carpian and Goth tribes. After the retreat of the Romans, Dacia was invaded repeatedly by numerous migratory tribes. In the middle ages, the Romanians mainly inhabited Wallachia, Moldavia and Transylvania. During the 10 th and 11 th centuries, Transylvania became an autonomous part of the Hungarian kingdom. Wallachia and Moldavia came under the control of Ottoman Empire. Important figures in the middle age were Michael, the Brave, whose main intention was to unite the lands inhabited by the Romanians and create a single country, and Stephen, the Great, who ruled the Moldavia region between 1457 -1504, and was a great military leader. In the eighteenth century, the Ottoman Empire witnessed a gradual decline and lost its former power and glory. The rise of the Russian and Austrian empires affected the political scenario of Romania, and Transylvania was captured by the Austrians, while later on, Bukovina, a part of Moldavia, and Bassarabia also came under the rule of Austria. The desire of the Romanians to form an independent nation gave birth to many revolutions in the three principalities. In 1848, revolution for complete independence took place in the regions of Wallachia, Moldavia and Transylvania. On January 24, 1859, Wallachia and Moldavia were united under the rule of Alexandru Ioan Cuza. In 1866, Alexandru Cuza was removed from the throne, and Prince Karl of Hohenzollern (Prince Carol of Romania) was appointed in his place. In 1877, during Russian-Turkish war, the Romanian principalities rendered their support to Russia, and fought against the Turks. After the war, Romania declared independence from the Ottoman Empire and got recognition as an independent state with the Treaty of Berlin in 1878. But, in return, Romania had to give up a large portion of Bessarabia to Russia.

COUNTRY PROFILE History and civilisation (continuation) Romania during World War I: in 1916, Romania entered World War I as an ally of France, Russia and United Kingdom, on the condition that after the war it would regain its authority over Transylvania. In May 1918, Romania discontinued the war, and signed a treaty with Germany and again joined the war in October, 1918. By then, the Austrian and Russian empires had collapsed; and hence, Bassarabia, Bukovina and Transylvania united with the Romanian kingdom, that led to the formation of Greater Romania during World War II: Romania joined the world war as an ally of Germany, and played an important role in the war as a source of oil for Germany. During the war, it lost many regions under the pressure of Germany and the Soviet Union. The country lost southern Dobruja to Bulgaria, northern Transylvania to Hungary, Bessarabia and northern Bukovina to the Soviet Union. In 1947, Romania came under the direct control of Soviet Union, and as a result communism was established in Romania. The Russians controlled Romania till 1958. The communist regime changed its policy, and in the 1960 s, in the first years of Nicolae Ceausescu’s rule, the country - the Socialist Republic of Romania - was recognised for its pro-western views and good relations, while challenging the authority of the Soviet Union. Between 1977 and 1981, Romania's economic condition started to deteriorate and its foreign debt increased to a large extent. In order to repay such a huge amount of debt, Nicolae Ceausescu introduced many policies, which further worsened the condition of the people and the economy. As a result, Romanian revolution took place in 1989, which brought an end to the communist regime. Romanians have succeeded in restoring democracy, stability, peace and order in the country. Now a days Romania is rapidly integrating with Western Europe, becoming a member state of the European Union in 2007. Romania is a pluralistic, multi-party state and a parliamentary republic.

COUNTRY PROFILE Socio-economic profile Population and structure of population Romania had 21, 431, 298 inhabitants by 2010, July the 1 st. Like other countries in the region, the population is expected to gradually decline as a result of sub-replacement fertility rates. The average of the Romanians was of 39. 7 years in 2010. Roughly half of the population is living in towns, 11. 8 mil. persons, while 51. 3% of the population are women, and 48. 7% men. Romanians make up 89. 5% of the population. The largest ethnic minorities are the Hungarians (6. 6% of the population) and Gypsies (2. 46% of the population). Economic profile Before the global economic recession, Romania enjoyed almost a decade of steady economic growth, thanks to a strong demand in EU markets. Domestic consumption and investments have fuelled strong GDP growth, but have also led to a widening account deficit. From the 2008 great economic expansion, when a credit-fuelled consumption made Romania the EU’s fastest-growing economy, the country plunged into recession in 2009 when the GDP fell by more than 7%. This prompted the Government to seek multilateral support, including from the IMF, the European Commission and the World Bank Group. The international community agreed to support the reforms with a package totalling EUR 19. 95 billion over the period 2009 -2010. Austerity measures were implemented through 2010, yet the GDP contracted by another 1. 9% in the same year. Nevertheless, the country’s fiscal performance to date sends encouraging signals with respect to resumed growth in 2011. Analysts forecast a growth in GDP of 1. 5% in 2011, followed by a growth of 4. 4% in 2012.

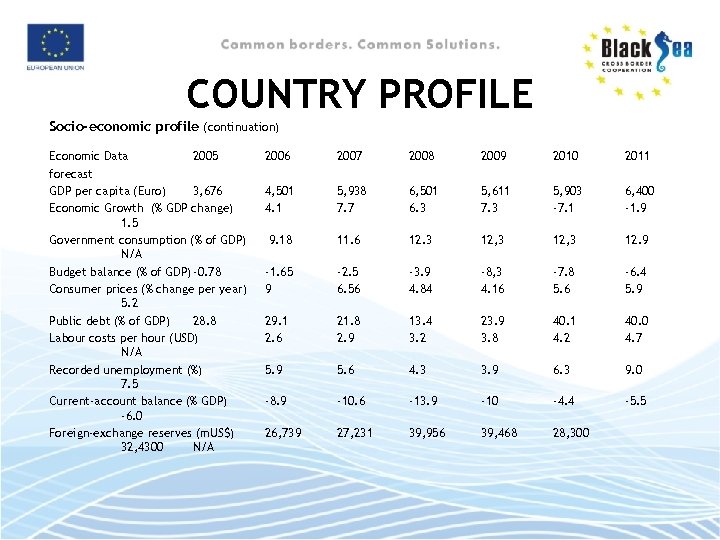

COUNTRY PROFILE Socio-economic profile (continuation) Economic Data 2005 forecast GDP per capita (Euro) 3, 676 Economic Growth (% GDP change) 1. 5 Government consumption (% of GDP) N/A Budget balance (% of GDP) -0. 78 Consumer prices (% change per year) 5. 2 Public debt (% of GDP) 28. 8 Labour costs per hour (USD) N/A Recorded unemployment (%) 7. 5 Current-account balance (% GDP) -6. 0 Foreign-exchange reserves (m. US$) 32, 4300 N/A 2006 2007 2008 2009 2010 2011 4, 501 4. 1 5, 938 7. 7 6, 501 6. 3 5, 611 7. 3 5, 903 -7. 1 6, 400 -1. 9 9. 18 11. 6 12. 3 12, 3 12. 9 -1. 65 9 -2. 5 6. 56 -3. 9 4. 84 -8, 3 4. 16 -7. 8 5. 6 -6. 4 5. 9 29. 1 2. 6 21. 8 2. 9 13. 4 3. 2 23. 9 3. 8 40. 1 4. 2 40. 0 4. 7 5. 9 5. 6 4. 3 3. 9 6. 3 9. 0 -8. 9 -10. 6 -13. 9 -10 -4. 4 -5. 5 26, 739 27, 231 39, 956 39, 468 28, 300

COUNTRY PROFILE Socio-economic profile (continuation) Inflation: The inflation rate rose to 8 percent in December 2010, more than double the 3. 4 percent forecast. IMF predicts that inflation will average 5. 2% in 2011. Budget Deficit: The administration plans to narrow the budget deficit to 4. 4% GDP, in 2011, compared to the 7. 8% in 2010, in line with its international borrowing agreements. In December 2010, Romania's parliament approved an austere budget for 2011 that will allow for these budgetary cuts. Structural Reform: The authorities are making progress on reforms of the labor market and of the social benefits system, which will improve its targeting and help mitigate the impact of the austerity package, approved in July 2010. Unemployment: As key reforms in public sector are advancing and a unified wage law for the public sector was approved, the unemployment rate has begun to stabilize. At the same time, the creation of new jobs in the private sector is more difficult. Unemployment will be around 7% in 2011 (i. e. , the lowest in the region in all three years), according to the IMF’s forecast. Exports: With consumer confidence and economic sentiment gradually improving and export-oriented industry continuing to grow, recent indicators suggest growth will turn positive early in 2011.

COUNTRY PROFILE Romania, part of the Black Sea community On 25 June 1992, the Heads of State and Government of eleven countries: Albania, Armenia, Azerbaijan, Bulgaria, Georgia, Greece, Moldova, Romania, Russia, Turkey and Ukraine signed in Istanbul the Summit Declaration and the Bosphorus Statement giving birth to the Black Sea Economic Cooperation (BSEC). It came into existence as a unique and promising model of multilateral political and economic initiative aimed at fostering interaction and harmony among the Member States, as well as to ensure peace, stability and prosperity encouraging friendly and good-neighbourly relations in the Black Sea region. The BSEC Headquarters - the Permanent International Secretariat of the Organization of the Black Sea Economic Cooperation - was established in March 1994 in Istanbul. BSEC covers a geography encompassing the territories of the Black Sea littoral States, the Balkans and the Caucasus with an area of nearly 20 million square kilometres, located on two continents. BSEC represents a region of some 350 million people with a foreign trade capacity of over USD 300 billion annually. After the Persian Gulf region, it is the second-largest source of oil and natural gas along with its rich proven reserves of minerals and metals. Also, it is becoming Europe's major transport and energy transfer corridor. With this aim, Romania develops its activities on two main directions , first, an active participation in actions of international cooperation aimed at fighting terrorism and cross-border organized crime, and second, developing regional relations and cooperation for building up stability and resolving crises. The main objectives of Romania in the Black Sea region, which were announced in a national strategy (2006), aim at creating and strengthening a stable, democratic, prosperous area in the Eastern neighbourhood, but also at opening the Black Sea wider region to the European and Euro-Atlantic values and processes.

COUNTRY PROFILE Romania, part of the Black Sea community (continuation) The Black Sea Synergy emerged as a new proposal for an EU policy particularly designed for the region. It was initiated in 2007, during the German presidency of the EU, following the actions of Romania, Bulgaria, Greece, and with the support of other member states and the input of the European Commission. It was officially launched on 14 February 2008, in Kiev. The main objective of the Black Sea Synergy is to build up cooperation in the Black Sea region. It offers the guidelines for the implementation of concrete and pragmatic projects of cooperation between wider Black Sea region states and the EU, in areas such as: democracy, human rights, good governance, border management, protracted conflicts, energy, transports, environment, maritime policy, fishing, migration, education, research and development. Building upon a rich experience of joining forces with the civil society from the Black Sea region (during 20062007), Romania initiated the Black Sea NGO Forum in fruitful partnership with the Federation of Nongovernmental Organizations in Romania (FOND) and the Black Sea Trust. Romania underlines the importance of moving on to a straightforward, concrete delineation and complementarities between the principles of implementation of the Black Sea Synergy and the multilateral dimension of the Eastern Partnership, as stated in various political declarations of the EU. These two European initiatives are now in the phase of implementation of the projects and the recommendations proposed in the networks established under their aegis, both at regional and macro-regional levels.

INSTITUTIONAL FRAMEWORK Public institutions - The Romanian Public Administration is structured on two main levels: the central public administration and the local public administration. Central institutions: Besides the Presidency, the central public administration consists in the Government of Romania that forms one half of the country's executive branch, the other half being the President. The Government is headed by the Prime-Minister, and consists of Ministries, various subordinated institutions and agencies, and 42 Prefectures. The Prime Minister leads the Government and coordinates the activity of its members, in compliance with their respective legal duties. Fifteen ministries form currently the Romania Government: • Ministry of Administration and Interior, http: //www. mira. gov. ro • Ministry of Agriculture and Rural Development, http: //www. madr. ro • Ministry of Communication and Information Society, http: //www. mcsi. ro • Ministry of Culture and National Cultural Heritage, http: //www. cultura. ro • Ministry of Economy, Trade and the Business Environment, http: //www. minind. ro • Ministry of Education, Research, Youth and Sports, http: //www. edu. ro • Ministry of Environment and Forests, http: //www. mmediu. ro • Ministry of European Affairs (recently created) • Ministry of Foreign Affairs, http: //www. mae. ro • Ministry of Health, http: //www. ms. gov. ro • Ministry of Justice, http: //www. just. ro • Ministry of Labor, Family and Social Protection, http: //www. mmuncii. ro • Ministry of National Defence, http: //www. mapn. gov. ro • Ministry of Public Finance, http: //www. mfinante. gov. ro • Ministry of Regional Development and Tourism, http: //www. mdrt. ro • Ministry of Transportation and Infrastructure, http: //www. mt. ro

INSTITUTIONAL FRAMEWORK Each ministry includes various entities under ministries’ subordination, coordination or their authority, such as national agencies, authorities, inspections, national companies, management authorities for operational programmes and national funding schemes, etc. All of them have very technical orientation, usually being of a great specialisation and playing regulatory and supervision roles in narrow sectors. International business relations and foreign investments are supported by several central administration agencies and authorities, as follows: • Romanian Centre for Trade and Foreign Investment, http: //www. romtradeinvest. ro • National Trade Register Office, http: //www. onrc. ro • Customs National Authority, http: //www. customs. ro • Romanian Police, http: //www. politiaromana. ro • Romanian Office for Immigrations, http: //ori. mai. gov. ro • State Office for Inventions and Trademarks, http: //www. osim. ro • Competition Council, http: //www. competition. ro • National Institute of Statistics, http: //www. insse. ro • National Authority for Consumer Protection, http: //www. anpc. ro • National Customs Authority, http: //www. customs. ro • National authorities for road, water, air, and railway transportation. The Government and a large number of ministries have decentralised and de-concentrated representatives, namely prefectures and directorate, in each of the 42 counties. Also, various national agencies and authorities have created local services, either in partnership with relevant entities, such as chambers of commerce and industries and business associations. The National Trade Register Office and Customs National Authority have local active services in each county.

INSTITUTIONAL FRAMEWORK Local administration - consists in local councils, mayoralties, and county councils (http: //www. administratie. ro). According to the law 70/1992, local and county councils are elected on the basis of the list system through direct suffrage, while mayors are elected on the basis of uninominal system in two rounds. Bucharest municipality is organized in 6 administrative-territorial subdivisions called sectors. Currently, there are 320 towns and 2860 communes in Romania, each of them with their own local council and mayor; also there are 41 counties and county councils. Through their activity, companies and foreign investors come in contact with services provided by municipalities – the working unit of each mayor, and by county councils. Private institutions and organisations: Private institutions and organisations relevant for companies and foreign investors are mainly dealing with supporting starting up and developing a company, interests representation at local and national level, as well as specialist services requiring a strong public involvement. Thus, the Romanian chamber system is one of the most important support organisations for businesses. One local chamber of commerce and industry is located in each county, while the national chamber is located in Bucharest and has both a representation and mainstreaming role: Chamber of Commerce and Industry of Romania, http: //. www. ccir. ro All economic sectors are organised into sectorial and sub-sectorial business organisations, united at national level into federations or national associations. Besides them, at local level, there are numerous smaller business associations, more or less active or involved in relevant actions. The most important and visible national business association are as follows: • National Association of Romanian Exporters and Importers (ANEIR) http: //www. aneir-cpce. ro • The Romanian Association of Building Contractors www. araco. org • Automotive Manufacturers and Importers Association www. apia. ro • National Association of Software Industry & Services

INSTITUTIONAL FRAMEWORK • • • Exchanges: National Union of Road Hauliers from Romania www. untrr. ro National Federation for Light Industry www. fepaius. ro Romanian Association for Quality www. quality. ro Romanian Banking Associations www. arb. ro Romanian Union of Cosmetics and Detergents Manufacturers www@rucodem. ro CECAR The Body of Expert and Licensed Accountants of Romania www. cecar. ro o Romanian Commodity Exchange http: //www. brm. ro o Romanian Stock Exchange http: //www. bvb. ro Black Sea specific institutions and organisations: Organization of the Black Sea Economic Cooperation came into existence as a model of multilateral political and economic initiative aimed at fostering interaction and harmony among the Member States, as well as to ensure peace, stability and prosperity encouraging friendly and good relations in the Black Sea region. http: //www. bsec-organization. org Black Sea Trade and Development Bank is an international financial institution that supports economic development and regional cooperation by providing trade and project financing, guarantees, and equity for development projects supporting both public and private enterprises in its member countries. http: //www. ¬bstdb. ¬com International Black Sea Club is an international non-governmental organisation uniting 24 cities on the Black Sea and in its vicinity. http: //www. i-bsc. org The Commission on the Protection of the Black Sea Against Pollution (the Black Sea Commission or BSC) is the intergovernmental body established in implementation of the Convention on the Protection of the Black Sea Against Pollution (Bucharest Convention), its Protocols and the Strategic Action Plan for the Environmental Protection and Rehabilitation of the Black Sea. http: //www. blacksea-commission. org

INSTITUTIONAL FRAMEWORK Black Sea Forum for Partnership and Dialogue (BSF) is a Romanian initiative aiming at supporting cooperation and partnership in the Black Sea area. Members: Armenia, Azerbaijan, Georgia, Moldova, Romania, Ukraine, and observers Bulgaria and Turkey http: //www. blackseaforum. org International Centre for Black Sea Studies (ICBSS) is a think-tank based in Athens, Greece, committed to promoting multilateral cooperation between the countries of the Black Sea region and with their international partners http: //www. icbss. org GUAM Organization for Democracy and Economic Development is a regional organization of four post-Soviet states: Georgia, Ukraine, Azerbaijan, Moldova, and Turkey and Latvia as observers http: //www. mfa. gov. md/guam-en/ The Community of Democratic Choice is an intergovernmental organization of nine states of Northern and Eastern Europe from the region between the Baltic, Black Sea and Caspian Sea ("The three Seas"). Its main task is to promote democracy, human rights and the rule of law in that region. Black Sea Trust for Regional Cooperation promotes regional cooperation and good governance in the Wider Black Sea region http: //www. gmfus. org/blacksea Black Sea Regional Energy Center (BSREC) acts as a focal point for energy related activities, aimed at developing the co-operation between the Black Sea region countries and the EU in the energy field. Apart from its international activities, the BSREC is actively involved in the Bulgarian energy issues, acting as a Bulgarian energy society http: //www. bsrec. bg

LEGAL FRAMEWORK FOR DOING BUSSINESS Legal base to register a business in Romania: A local business presence is essential to success in the Romanian market. This may take a variety of forms, joint ventures or companies registered in Romania, local agents or distributors that can contribute significantly by bringing knowledge of the market, industry experience, access to key contacts, and other resources. Limited liability companies are the most popular businesses in Romania because of their simple administrative requirements, greater flexibility compared to other types of companies, and low capital requirement. However, joint stock companies remain an attractive option for investors which plan to list their companies on the stock exchange. Legal base to register a company - There are no specific investment approvals required for setting up a business in Romania. The procedure requires fulfilling certain legal formalities such as registering with the Romanian Trade Registry and the Fiscal Administration. The general legal framework for registering a company initiated by a foreign entity refers to both the company itself, as well as to the registration process, as follows: • Law No. 31/1990 concerning commercial companies, republished; • Law No. 105/1992 on the Regulation of the Private International Law Relationship; • Decree – Law No. 122/1990 on the authorization and operation in Romania of the Representative Offices of foreign companies and corporation; • Law No. 85/2006 regarding bankruptcy procedure; • Law No. 26/1990 on the Register of Commerce, republished; • Law No. 359/2004, on the simplification of formalities regarding the registration in the trade register of natural persons, family associations and legal persons, their fiscal registration and authorization for functioning; • Government Decision No. 913/2004 on the approval of taxes and tariffs related to the operations performed by Trade Register Offices by Courts.

LEGAL FRAMEWORK FOR DOING BUSSINESS Institutions to be approached: Several institutions may be relevant for starting a business in Romania, finding a partner and registering the company. Searching and finding a business partner can be facilitated by the system of the Romanian Chamber of Commerce and Industry (http: //www. ccir. ro), by bilateral chambers of commerce and industry, Romanian Trade Promotion Center and Foreign Investment (http: //www. romtradeinvest. ro), the European network of Enterprise Europe Network in Romania (http: //www. erbsn. ro), or diplomatic representatives of in Romania (ministry of Foreign Affairs: http: //www. mae. ro). Business associations are also capable of recommending and facilitating business contacts. Bilateral chambers of commerce and industry: • Romanian – Armenian Chamber of Commerce and Industry ccibra 2004@yahoo. com • Bulgarian – Romanian Chamber of Commerce and Industry http: //www. brcci. eu • Representative of the Hellenic – Romanian Chamber of Commerce and Industry hell-rom@clicknet. ro • Romanian – Republic of Moldova Chamber of Commerce and Industry, http: //www. camera-de-comertromania-moldova. go. ro • Romanian – Turkey Chamber of Commerce and Industry http: //www. ccirt. ro • Bilateral Chambers Union http: //www. bilateralchambers. ro Preparation of documents, along with legal assistance and counselling, is provided by private consultancies and public institutions, such as the local Trade Register Offices and chambers of commerce and industry. Registration is ensured solely by the Trade Register offices, located in each county, in the main town (capital of the county). Depending on the type of activity, on its degree of regulation, various additional permits and proofs may be required by the Trade Register.

LEGAL FRAMEWORK FOR DOING BUSSINESS Forms of business cooperation and ventures : The establishment, functioning, dissolution, merge, division and liquidation of the commercial companies are regulated by Company Law No. 31/1990, republished. In order to develop trading activities, legal and natural persons may associate and establish commercial companies. Commercial companies with the head office in Romania are legal Romanian persons. The commercial companies regulated by the Romania legislation may be established in one of the following forms : general partnership; limited partnership; joint stock company; limited partnership by shares; limited liability company. General Partnerships (Societate in nume colectiv – SNC) - A general partnership can involve two or more partners. The partnership relationship is based upon a contract and any person who is capable of entering a binding contract may enter a partnership. Following this agreement, the parties must register their partnership with the National Trade Register Office. In a general partnership, partners are jointly liable for the debts and obligations of the partnership and each partner can be personally liable for the overall debts and liabilities, which are not satisfied by assets of the partnership. The capital of the partnership is formed of the partners’ contributions. These contributions can include cash, real estate, equipment, or other property. Contributions become assets of the partnership and comprise its registered capital. Romanian laws do not set maximum or minimum limits on capital, nor does they indicate how much must be in cash or assets.

LEGAL FRAMEWORK FOR DOING BUSSINESS Limited Partnerships (Societate in comandita simpla, S. C. S. ): A limited partnership consists of one or more general partners who manage the business of a partnership and one or more limited partners who contribute capital (money or other property) to a partnership but do not participate in its management. Generally, limited partners are not liable for the debts and obligations of the partnership beyond their contributions, to the registered capital. The liability of the general partner is the same as the liability of partners in a general partnership. For an investor, therefore, being a limited partner is similar to have an investment in a corporation. Limited partners share the profits or other compensation by way of income in proportion to their partnership contributions. However, no such income or other distribution can be made if it would reduce the assets of the limited partnership to an amount insufficient to discharge its liabilities to persons who are not partners. Company Law No. 31/1990 generally sets out the rights, powers and obligations of limited partners. Limited Liability Companies (Societate cu raspundere limitata, S. R. L. ): A limited liability company is a company formed by a limited number of partners (no more than 50). It is based on the constitutive documents. The registered capital of a limited liability company cannot be less than 200 RON (Romanian currency). The registered share capital of a limited liability company is normally divided into social parts/shares with a registered value of not less than 10 RON. Shares cannot be freely traded, making limited liability companies similar to what are known as private companies in other legal systems. Shares of these companies cannot be pledged as collateral for loans. Decisions are made by majority vote in the General Meeting of the Shareholders (1 share = 1 vote). Decisions involving changes in the constitutive documents must be agreed by all shareholders if these documents do not state otherwise. One or more Directors/Managers are appointed in the constitutive documents or by the General Meeting and are put in charge of the management of the company. Limited liability companies may also be formed by a sole associate.

LEGAL FRAMEWORK FOR DOING BUSSINESS Joint Stock Companies (Societate pe Actiuni, S. A. ): A joint stock company is a limited liability corporation with registered capital of a minimum of 25. 000 euro, equivalent RON and with at least five shareholders. When an SA is established, at least 30% of the share capital, or 100% in respect of contributions in kind, must be immediately contributed upon formation of the company and all registered share capital must be fully paid up within twelve months of formation. Shares could be nominative shares or bearer shares and can be freely traded or pledged. A joint stock company may be set up privately or by public subscription. When a joint stock company is established by public subscription, a notarized prospectus must be drawn-up and filled with the Trade Register in the district where the head office of the company will be located. Decisions are made by a majority vote in the General Meeting of the Shareholders (each share represents one vote). General Meetings can be ordinary meeting, called at least once a year or extraordinary, called when needed to make decisions involving changes in the Memorandum of Association. Meetings require a quorum of ¾ of the shareholders and a simple majority vote of the quorum is required to approve changes in the Memorandum of Association. The management of a joint-stock company is assumed by a Council of Administration (Board of Directors), although it is possible to have only one Administrator. Limited Joint Stock Companies (Societate in Comandita pe Actiuni): A limited joint stock company is a rare form of limited partnership. It has characteristics of both a joint stock company and a limited partnership. At the same as in a limited partnership there are general and limited partners. Similarly to a joint stock company, the registered capital of the limited joint stock company is represented by shares. Similarly to a partnership, the general partners may be liable for the debts and obligations of the company beyond amounts they have contributed. The limited partners, not active in the management of the company, have their liability limited to their share stake. A limited joint stock corporation is normally recognized by use of the words SCA in its name (Societate in Comandita pe Actiuni).

LEGAL FRAMEWORK FOR DOING BUSSINESS Branches, Subsidiaries and Agencies of Foreign Companies - A foreign company can do business in Romania through a subsidiary, agency or a branch. While a subsidiary has a legal personality and is considered a Romanian entity, the branch is just an extension of the parent company and therefore has no legal personality and no independence. Agencies are established and operate in accordance with the provisions of Decree Law No. 122/1990, are authorized by Ministry of Foreign Affairs and undertakes on behalf of the parent companies only transactions and activities which are consistent to its authorized object. Law No. 105/1992 on the Regulation of the Private International Law Relationship adopts the accepted international practice by which a branch is governed by the national law of its parents company. Legally, the branch has no separate status from the foreign company itself. It is merely carrying on business in Romania. The foreign company will be liable to the employees and creditors of the branch for the actions of, and debts contracted by, its managers and agents on behalf of the branch. On the contrary, according to the Law No. 31/1990, a Romanian subsidiary of a foreign company is a Romanian legal person and, consequently, it is subject to Romanian laws. It is liable, on its own behalf, for the actions assumed. Subsidiaries and branches can carry out only the activities to which the parent company is authorized. In practice, subsidiaries are commissioned following the same steps as the registration of companies, i. e. notarizing the statutes, and registering the subsidiary with the National Trade Register Office. Requirements for registering a company General partnerships and limited liability partnerships are set up through a contract of company. Joint-stock company, limited partnerships with shares or limited liability company are set through a contract of company and a statute, which might be concluded as a sole document called Articles of Incorporation.

LEGAL FRAMEWORK FOR DOING BUSSINESS Requirements for registering a company (continuation) The Articles of Incorporation shall be signed by all associates or in case of public subscription, by the founders and will be concluded in authentic form. The signatories of the articles of incorporation are considered founders. In general, and depending on the type of company, the incorporation articles should contain: • first and last name, place and date of birth, domicile and citizenship for the associates, natural persons; name, head office and nationality of the associates, legal persons; • the type, name, headquarters and, if any, the company logo; • the object of the company, specifying the main domain of activity; • the subscribed and paid in registered capital, the shareholders contribution in cash or in kind, the value of the contribution in kind and its valuation method as well as the date of the full payment of the subscribed share capital; the number and nominal value of shares as well as the number of shares subscribed to each associate for his/her contribution; • the shareholders in charge with the representation and administration of the company or the nonshareholder administrators individuals or legal persons, and their powers which are to be exercised jointly or separately; • the share of profits and loses for each shareholder; • the secondary offices (branches, agencies, representative offices or other such entities with no legal personality) whether or not are established as the same time with the company, or the conditions of their subsequent establishment if such establishment is taken into account; • duration of the company; • the rules for distribution of dividends and sharing losses; • secondary offices; • rules for dissolution and liquidation.

LEGAL FRAMEWORK FOR DOING BUSSINESS Registration of Commercial Companies: Checking the availability and booking the company’s name is the first step to registering a company. Within 15 days from the date of authentication of the Articles of Incorporation, the founders or the administrators of the company or an attorney-in-fact of theirs will request the incorporation of the company in the Commercial Register in the area where the head office of the company will be located. The incorporation application shall be accompanied by the following documents for limited liability companies: request for registration; • proof for company’s name availability; • if the company is created by a single shareholder, the proof he/she has registered no other company he/she is a single shareholder; • the Articles of the Incorporation of the company; • the proof for the headquarters’ availability – rental, ownership or other forms. In case the headquarters have an initial residential use, the approval for changing its destination; • the proof of the transfer of the money according to the Articles of Incorporation; • the documents concerning the ownership over the distribution in kind; • the documents attesting the operations concluded in the company’s account and approved by the partners; • the declarations on oath of the founders, administrators and auditors showing that they fulfil the conditions stipulated by the Law No. 31/1990, republished; • the founders, administrators and/or auditors’ identity documents; • signature samples for company’s representatives; • judicial records for company’s representatives. Foreign persons/bodies should submit a declaration on oath that he/she/the company has no debts against the Romanian state;

LEGAL FRAMEWORK FOR DOING BUSSINESS • • • the declarations on oath on the fact that the legal conditions for functioning are known and complied for sanitary, veterinary and food safety frame, public health, environment and occupational health and safety (standardized statements) if the founders are companies, their registration documents, decision to create the new company, delegacy for the person representing the company and having the right to sign the documents for the new company, credit worthiness foreign companies issued by a bank/chamber of commerce in the country of origin, depending on the company’s main activity to be declared with the Trade Register, additional documents and approvals may be required. Additional documents may be required for other types of companies. The registration taxes depend on document’s complexity and volume. Additionally, extra costs will be charged if the Trade Register provides the legal assistance for preparing the documents. A minimum of 800 -1000 euro may be taken into account for a limited liability company. The judiciary, through a delegated judge, exercises the control over the legality of the documents and of the deeds which, according to the law, are going to be registered with the trade register, including the request for registration of the companies. In cases where the legal requirements are fulfilled, the delegated judge shall authorize, by way of decision, the setting up of the company and will order its incorporation with the trade register. The registration period provided by the law for registering companies is 3 days from the day the request has been submitted. In the same period the trade register office issues the registration certificate containing the unique registration code. In general terms, the preparation and registration of a company takes 14 days in average.

LEGAL FRAMEWORK FOR DOING BUSSINESS The World Bank Group assesses regulations affecting domestic firms through its annual Doing Business in a More Transparent World Report. Doing Business 2012 shows the following results: Romania ranks 72 among 183 countries assessed in what concerns the ease of doing business, while starting a company procedures rank 63, dealing with construction permit ranks 123, getting electricity rank 165, yet protecting investors ranks 46. Operation of a company requires permits and approvals, depending on its declared activity: • General permits for all types of activities include an operational authorisation and daily schedule approval issued by the local municipalities. • Specialised permits are imposed by regulatory frameworks specific for such domains as environment, public health, sanitary – veterinary and food safety, fire fight, transportation, use of certain equipments and installations, quality in tourism services. The more complex the activity is, more regulations apply and, thus, more complex starting the operation of a company is. Most of the mentioned specialised regulations are to be taken in consideration when building a new construction or modernising/extending an existing one, and equipping it, as they refer to technical solutions and/or requirements. In order to fulfil all these regulations, it is strongly recommended to search for qualified counselling and assistance, legal, technical and architectural services should be enough. Operation of Commercial Companies - The assets representing contribution in kind to the company become its property when the company is incorporated at the Trade Register. Interest is not paid for the contribution of the associates. The benefit quota, which will be paid to each associate, represents the dividend. Dividends will be paid proportional with their participation to the paid social capital. Dividends will be distributed only from real benefits, in the contrary they will be given back. The returning of the dividends is prescribed in a period of 3 years from the date they were distributed. If a reduction of the social capital is noticed, it has to be completed or reduced prior to distributing any benefit.

LEGAL FRAMEWORK FOR DOING BUSSINESS Administrators may perform all necessary activities in order to fulfil the activity of the company, besides the restrictions stipulated by the articles of incorporation. They are obliged to attend the company’s meetings, administration councils, and other similar bodies. Administrators that have the right to represent the company cannot transmit it only if they were enabled expressly to do so. Administrators are jointly liable to the company for: • the existence of the payments made by the associates; • the legality of the paid dividends; • the existence of the registers requested by the law and their correct keeping; • the fulfilment of the general assembly’s decisions; • the strict fulfilment of the dispositions of the law and Articles of Incorporation. The right to sue the administrators may also be exercised by the creditors but only upon the bankruptcy of the company. Any document, letter or publication issued by the company must indicate the name, legal form, and head office, recording number in the Trade Register and the fiscal code. Legal requirements for buildings When building any construction in Romania, a legal building permit is required, proving that the new building or the extension/modernisation of an existing one meet the legal framework for construction activity, meet the legislation in such domains as the environment, do not disturb underground networks, or have included solutions for them, include solutions for power feeding, water and sewage, etc. Depending on the land/building location, special attention is given to environmental solutions, if the land/building is in a reserve, or next to water that is a source for drinking water, conservation solutions if the land/building is located on or next to archaeological vestiges, and other less frequent cases.

LEGAL FRAMEWORK FOR DOING BUSSINESS The building permit is issued by the local municipality, or, for certain rural cases, by the county council. Documentation for this permit includes the following documents: - Application, to be filled in by the applicant and his/her architecture and engineering contractor - Urban permit that is the first construction-related document the applicant must obtain prior to starting all architectural and engineering plans. The local municipalities issue urban permits informing the applicant what are the conditions under which a construction may be developed (e. g. height of the building, permits and approvals addressing other domains, such as environment, telecommunications, water and sewage, electric power, built heritage). The urban permit should be accompanied by all permits and approvals that were required. - Architectural documentation, including written presentation and blueprints. Two types of buildings are identified by the Romania legislation : 1. Permanent buildings, such as residential or business buildings, logistical projects, roads, utilities, bridges, etc. Building permits for permanent buildings are obtained if the real estate (land or building) is the applicant’s property or concession. 2. Temporary building, such as kiosks, display panels, etc. Building permits may be obtained even if the real estate is under lease.

LEGAL FRAMEWORK FOR DOING BUSSINESS Lifecycle of a company: exit through bankruptcy, insolvency, transfer of business Dissolution - The company shall be dissolved through: • the expiration of the period set for the duration of the company; • the impossibility of achieving the object of the activity or its achievement; • the notification of the nullity of the company; • the decision of the General Meeting of the Shareholders; • a court order at the request of any associate, based on founded reasons; • the bankruptcy of the company. If the dissolution of the company is based on the decision of the associates, they can change this decision with the requested majority for the modification of the Articles of Incorporation as long as no asset was distributed. The dissolution of the commercial company has to be recorded at the Trade Register and published in the Official Journal of Romania. The effect of the dissolution of the company is the beginning of the liquidation procedure. The dissolution takes place without liquidation in the case of merger or total division of the company or in other cases stipulated by the law. From the moment of the dissolution, administrators cannot undertake new operations. Merger and Division of Commercial Companies - The merger represents the absorption of a company by another company or by merging of two or more companies to form a new company. The division represents the division of the entire patrimony of a company, which ceased to exist, between two or more existing companies or which are thus set up. Merger and division are decided by each company, under the terms stipulated for the modification of the Articles of Incorporation.

LEGAL FRAMEWORK FOR DOING BUSSINESS Liquidation of Commercial Companies - The liquidation of the company must be finished within maximum 3 months from the date of dissolution. For founded reasons, the court may extend this period with maximum 2 years. After completing the liquidation, the liquidators have to ask the deletion of the company from the Trade Register. The Trade Register could make the deletion also automatically. The liquidation does not operate a release for the associates and does not impede the commencement of the bankruptcy proceedings of the company. The bankruptcy procedure - Romanian bankruptcy legislation provides creditors the ability to force insolvent companies into either reorganization or liquidation. If a company is able to overcome its inability to pay its debts by reorganization, it may not have to go into liquidation. Nevertheless, if the reorganization is not successful, the judge will order the start of liquidation procedures. This procedure has been reformed by a law passed in December 2009, which provides for a debt settlement mechanism- Company Voluntary Agreementswhich may be used to establish debt servicing schedules without resorting to bankruptcy. The bankruptcy procedures: • The general procedure – represents the procedure mode scheduled by law, according to a debtor which fulfils the condition of the law is submitted after an observation period to the judiciary reorganization and bankruptcy procedure, successive or separately. • The simplified procedure - represents the procedure mode scheduled by law, according to the debtor is submitted directly to the bankruptcy procedure either at the beginning of the insolvency procedure either after an observation period of maximum 60 days (this is the time interval to analyse all the specific elements). The parts in a procedure are creditors – civil or legal person, debtors - civil or legal person whose patrimony is submitted to insolvency, legal courts, the bankruptcy judge, and administrator and liquidator.

INVESTING IN ROMANIA General consideration and framework - Romania actively seeks direct foreign investment, while its marketplace offers 21. 5 million consumers, a well-educated workforce, a strategic geographical location, and abundant natural resources. To date, favoured areas foreign investment include IT and telecommunications, energy, services, manufacturing, and consumer products. Relevant institutions for facilitating foreign investment initiatives include: Romanian Centre for Trade and Foreign Investment, http: //www. romtradeinvest. ro; National Trade Register Office, http: //www. onrc. ro; National Association of Romanian Exporters and Importers (ANEIR), http: //www. aneir-cpce. ro; Foreign Investors Council, http: //www. fic. ro The general environment for investing in Romania also includes access to a large variety of infrastructure and utilities. Thus, dense and partially modernised road and railway networks cover all country, and excepting for remote mountainous areas or Danube Delta, there is no inhabited locality without at least one reasonable access way. The public road network consists in 73, 435 km , excluding streets in localities, of which 25% km have been modernised. Out of the total, the national roads represent 20%, while the local and county roads are the rest. The local roads are in the poorest condition. Highways are very limited, 113 km. The railway system is of 10, 981 km length. The water transport is divided into maritime and inland ways, serviced by 35 ports , of which 3 Black Sea ports, including Port of Constanta operates the largest capacity in the Black Sea Basin (over 100 mil. Tons capacity annually), followed by ports of Mangalia and Midia. Danube River is services by 6 maritime-river ports, and 26 river ports. Inland water ways cover 1. 779 km of which 1. 075 km on the international navigable Danube, 524 on navigable Danube channels and 91 km on canals (Danube-Black Sea and Poarta Alba–Navodari). A special case is Danube Delta which localities are accessed solely by water, and each of the village or town has its own harbour.

INVESTING IN ROMANIA Air transport is serviced by 17 airports, of which international airports in 4 towns. Three Trans-European Corridors cross Romania: corridor IV (Berlin/Nurenberg-Praga-Budapest-Arad-Bucharest. Constanta-Istanbul-Thessaloniki), VII (Danube, including Sulina Channel and Danube-Black Sea Canal) and IX (Helsinki-St. Petersburg-Moscw-Pskov-Kiev-Ljubasevka-Chisinau-Bucharest-Dimitrovgrad-Alexandroupolis). Romanian communication market is operated by state and private operators. Currently , the major communication service providers are offering combined services for fixed and mobile telephone, fixed and mobile internet connection, and cable TV services. Over 70 fixed telephone service providers are active in the country, 6 mobile telephone services providers, 973 internet active providers, and 479 cable TV providers. Endusers of communication means: 3. 89 million subscribers of fixed telephone services, 24. 6 mil. active users of mobile telephone services (subscribers and pre-paid SIM cards), 3. 0 mil. fixed broadband internet access connections and 6. 07 mil. active mobile internet connections, and 5. 74 mil. subscribers to paid audio-visual programme retransmission services. Postal services are offered by the national postal company “Posta Romana SA”, as well as by private courier companies operating at national level. Incentives The National Agency for Fiscal Administration (NAFA) is the specialized institution of the Ministry of Public Finance which is designed to provide the resources for public expenditure and administration of the state. NAFA also coordinates the Financial Guard, the National Customs Authority, county and Bucharest public finance directorates. Taxation in Romania is governed by the Tax Code, its last review being conducted in August 2011.

INVESTING IN ROMANIA Incentives Fiscal policy in Romania is marked by government commitments to the implementation of the Stand-By Agreement with the IMF. In this context, tax incentives remain low in number and scope. Thus, the Tax Code provides some facilities in 2011, such as: • non-taxation of dividends received by a Romanian legal person, parent company from its subsidiary located in a Member State; • exemption from income tax under certain conditions; • deductions for research and development expenses; • tax-exempt dividends received by permanent establishments in Romania of foreign legal persons from other Member States, parent companies, which are distributed by their subsidiaries located in Member States; • Tax Credit; • taxable income when calculating income tax; • tax-exempt VAT in Romania's point of view of acquisitions of goods whose total value during the calendar year does not exceed $ 10, 000; • special scheme for VAT exemption for small enterprises; • VAT exemptions for operations inside the country; • VAT exemptions for imported goods and acquisitions; • Exemptions of VAT for exports or other similar operations for intra-Community supplies and intra-and international transport; • special VAT scheme for travel agencies; • special VAT scheme for second-hand goods, works of art, collectors' items and antiques; • Measures to simplify the application of reverse charge.

INVESTING IN ROMANIA Incentives Additionally, tax and customs privileges are available in six free zones in Romania, located in Constanta South Basarabi, Braila, Galati, Sulina, Giurgiu and the Court - Arad. Activities that may take place in the free zones can be made by individuals and legal entities, Romanian or foreign, based on licenses issued by the administration of free zones. Also, the network of industrial and technological parks in Romania can provide facilities including tax hosted companies in the context of aid schemes for regional development and access to utilities and infrastructure in specific conditions. Competition policy In line with art. 135, par 1 of the Constitution, the Romanian economy is a market economy, based on free initiative and competition. According to these provisions all development policies should promote competition in the context of a sustainable development. Legislative Framework and Provisions - Romania’s competition regulations are well harmonized with similar EU rules, Government Emergency Ordinance 117/2006, with subsequent changes and additions, transposes most of the provisions and notification procedures set forth by EC Regulations 659/1999 and 794/2004. As a result, granted state aid shall be notified to and authorized by the relevant department of the European Commission (EC), and the Romanian Competition Council acts only as a liaising authority between state aid providers, beneficiaries, and EC. The Romanian Competition Council remains responsible for monitoring the competitive behaviour of businesses on the Romanian market, collusions between competitors in the Romanian market, and the growth of market structures (mergers and acquisitions). Collusive arrangements and anti-competitive agreements between competitors are strictly forbidden, but mergers and acquisitions are permitted provided these do not hinder free competition in the market.

INVESTING IN ROMANIA The EC Regulation 139/2004 on mergers control is applicable in Romania and sets forth the procedure for notifying to the European Commission economic concentrations bearing a “community dimension”. An economic concentration bears a “community dimension” if: (a) the combined aggregate worldwide turnover of all the undertakings concerned is over EUR 5, 000 m; and (b) the aggregate Community-wide turnover of each of at least two of the undertakings concerned is over EUR 250 m. Approval of the Competition Council is required in case of economic concentrations that exceed the following: i. EUR 10 m in RON equivalent of aggregate turnover of the entities involved, and ii. EUR 4 m in RON equivalent of individual turnovers generated in Romania by at least two of the entities involved. State Aid • • • The established priorities are to be supported through state aid measures compatible with the Romanian and EC legislation, respectively measure which can be framed under the following state aid definitions: Regional aid: creation of a new enterprise, extension of an existing one, diversification of production, introduction of new products/services, fundamentally changing the overall production process within an existing enterprise, etc. Aid for SMEs: partial coverage of the operating costs during the first years of existence, specialised consultancy services for business development offered at preferential tariffs, risk capital, etc. Aid for research and development: investments in instruments, equipments, land, buildings, employment of specialised personnel, covering costs related to consultancy services in the field of R&D, etc. Aid for environmental protection: investments in improving the environmental protection standards; preventing and restoring the damages caused to the environment or to the natural resources; energy saving; producing energy from renewable sources; sustaining the production of energy in combined heat and power installations etc.

INVESTING IN ROMANIA State Aid • • Employment aid: investments required for adapting the employer’s premises in order to make possible the recruitment of disabled persons, partial coverage of costs related to the employment of new persons; partial or total exemption from the payment of certain taxes and social contributions related to the disabled persons, newly employed. Training aid: general training providing qualifications which are largely transferable to other firms or activities. Aid for rescue and restructuring firms in difficulty: when justified by arguments of social or regional policy or by the need to take into consideration the positive role of SMEs or, exceptionally, when there is an interest to maintain certain undertakings on a given market structure so to avoid a monopoly or a narrow oligopoly. Aid in the form of risk capital: this type of aid aims at correcting some failures of the financial markets as concerns their capacity to provide the required capital, especially for start-ups and undertakings operating in the field of high technologies. Aid for compensating net losses generated by the provision of services of general economic interest: ensures the provision of quality essential services, in sufficient quantities and at reasonable prices, for all citizens, irrespective of their geographic positioning. Aid under the “de minimis” threshold: the amounts granted cannot exceed the EUR 200, 000 ceiling over a 3 year period, or 100, 000 for transport field, and cannot be used for subsidising the export. Sectorial aid: in sectors considered to be sensitive, such as: coal industry, steel sector, synthetic fibres industry, motor vehicles and shipbuilding industries, agriculture and fishery, air and maritime transport sectors. Currently, The National Network for State Aid created animated by the National Competition Council, offers support and additional information on state aid schemes and ad-hoc state aid.

INVESTING IN ROMANIA Human ressources - Romania has traditionally offered a large, skilled labour force at comparatively low wage rates in most sectors, although the labour pool has tightened in highly skilled professions, despite growing unemployment overall. The university system is generally regarded as good, particularly in technical fields. The quality of work of Romanian craftsmen, engineers, and software designers is well regarded by foreign managers. With appropriate on-the-job training, local labour performs well with new technologies and more exacting quality requirements. However, labour shortages have appeared in certain sectors, resulting in strong upward pressure on wages in recent years. Outward labour migration and the number of students graduating without the practical skills needed for the modern workplace are considered the main causes for this trend. Labour Code has been revised in the beginning of 2011 (Law 40/2011), balancing employees’ right with employers’, and allowing employers to dismiss as well as hiring easier. Unemployment officially stood at 4. 93% in the end of October 2011, representing 444, 000 persons, in a slow increase after a steady drop between January – July 2011 and even compared to 2010. Since 1989, labour-management relations have changed dramatically. Trade unions, much better organized than employers' associations, are vocal defenders of their rights and benefits. The national minimum wage was set at RON 670 per month (about EUR 160) on January 1, 2011, after extensive negotiations between unions, employers’ associations, and the Government. Current law makes it very costly to engage non-EU citizen staff in Romania. Work permits are issued for a maximum of one year (except for seasonal work), for a fee of 200 euro (payable in the RON equivalent of that day’s exchange rate). These permits are automatically renewable with a valid individual work contract. There are 41 Romanian Immigration Authority offices – one in each county – to issue work permits foreign citizens. Citizens of other EU countries can work in Romania without work permits if their own country does not impose restrictions on Romanian citizens. In 2011, Romania issued 5, 500 work permits, 2, 500 fewer than the previous year.

INVESTING IN ROMANIA Land building property rights - The Romanian Constitution, adopted in December 1991 and revised in 2003, guarantees the right to ownership of private property. Mineral and airspace rights, and similar rights, are excluded from private ownership. Under the revised Constitution, foreign citizens can gain land ownership through inheritance. Citizens of EU member states can own land in Romania, subject to reciprocity in their home country. Companies owning foreign capital may acquire land or property needed to fulfil or develop company goals. If the company is dissolved or liquidated, the land must be sold within one year of closure, and may only be sold to a buyer(s) with the legal right to purchase such assets. For a period of seven years after Romania's accession to the EU, foreign investors may not purchase agricultural land, forests, or forestry land (except for farmers acting as commercial entities). Investors can purchase shares in agricultural companies that lease land in the public domain from the State Land Agency. Intellectual and industrial property rights - Romania is signatory to international conventions in the intellectual property field, mainly the Paris Convention, the Berne Convention and TRIPS Agreement. Its domestic legislation for all intellectual property objects is fully harmonized with the Community regulations and the international treaties and conventions. Industrial property - The State Office for Inventions and Trademarks - OSIM (http: //www. osim. ro) is the national administration in charge of granting protection for inventions, trademarks, geographical indications, industrial designs and others, in the territory of Romania, under the law and the provisions of international conventions and treaties to which the Romanian State is party.

INVESTING IN ROMANIA An invention may be protected in Romania by the grant of a patent by OSIM, according to the national legislation, or by the grant of a European patent with effect in Romania, according to the European Patent Convention. The legislation regarding the patents consists of the Patent Law no. 64/1991 amended si republished on the basis of Law. no 203/2002 and the Regulations Implementing Law no. 64/ 1991. Copyright - For Romania, Law no. 8 / 1996 is the first truly completely modern copyright and related rights law, compatible with all the Conventions and all the Treaties to which Romania had accessed and to the first five European Directives which were into force at the moment of the promulgation of the Romanian law. The Copyright Office of Romania (COR) – http: //www. orda. ro is the unique specialized national authority for settlement, administration of national registers, supervising, authorizing, arbitration and technical and scientifically expertise in the domain of copyright and related rights. According to the Romanian law there are five National Registers: The National Register for Phonograms, The National Register for Computer Programs, The National Register for Videograms, The National Register for Private Copy, The National Register for Multipliers / Reproductions, The National Register for Works. Counterfeit - While problems persist in protecting IPR from counterfeit products, OSIM, law enforcement, and private groups have increased their efforts to combat counterfeiting while informing the business community of how best to protect and enforce IPR protections. Protection of Intellectual Property Rights during Customs Procedures - Intellectual property rights holders may apply to the Customs Authority requesting action against goods infringing their rights. Goods infringing an intellectual property right may not be imported, exported, or re-exported and may be placed under a suspension. Such merchandise may be destroyed or, subject to the consent of the right-holder, they may be given to nonprofit organizations, depending on the nature of goods.

INVESTING IN ROMANIA Public procurement - The regulatory framework of public procurement in Romania, harmonized with the European legislation is marked by frequent and extensive changes. Primary legislation in public procurement is Emergency Ordinance 34/2004, subsequently modified and supplemented. The legislation applies equally to all contracting authorities, and other categories of beneficiaries, which are imposed in the context of the use of public funds. For public contracts with values below the European thresholds, relevant national legislation recommended by the Treaty principles, namely non-discrimination, mutual recognition, transparency, equal treatment and proportionality. Currently, public procurement procedures are as follows: • Open tender is a procedure in which any company has the right to submit an offer; • Restricted tender is a procedure in which any company can apply as a candidate, but only those selected will be invited to submit tenders; • Competitive dialogue is a procedure in which any company is entitled to apply as a candidate, the contracting authority will organize a dialogue with the candidates selected to identify the most appropriate solutions. Solutions based on the selected candidates will submit offers; • Negotiation is a procedure in which the contracting authority is launching consultations with selected candidates and negotiate contract terms with one or more candidates; • Request for offers is a procedure whereby the contracting authority request bids from several operators; • Competition solution is a special procedure used to purchase a plan or project, and selection is assigned to a panel of judges. The ceiling the public procurement legislation does not apply in Romania is EUR 15, 000 (September 2011).

INVESTING IN ROMANIA Public procurement All operators interested in participating in public procurement procedures carried out electronically must register in Electronic Procurement System (SEAP). Also, this system is a source of information on procedures launched by contracting authorities or other entities as well as the registration of potential bidders. National Authority for Public Procurement Regulation (ANRMAP) – http: //www. anrmap. ro is the regulatory and supervisory entity of this domain, and the National Council for Solving Complaints (NCCC) – http: //www. cnsc. ro is the administrative body competent to resolve jurisdictional appeals related to public procurement procedures. Ministry of Finance is responsible for checking all procedural aspects related to public procurement process, the Unit for Coordination and Verification of Public Procurement. Statistics and trends Foreign direct investments attracted by Romania during 2004 -2010 (Million Euro) : Year 2004 2005 2006 2007 2008 2009 FDI value 5183 5213 9056 7250 9496 3490 2010 2696 Foreign direct investments stock by economic activity attracted in 2009 by Romania, according to the statistical classification of economic activities NACE Code rev. 2), were distributed to manufacturing (31. 1% of the total), out of which the largest recipients were: • Oil processing, chemicals, rubber and plastic products (6. 3%) • Metallurgy (5. 2%) • Transport means and equipment (4. 7%) • Food, beverage 2 and tobacco (4. 1%) • Cement, glassware and ceramics (3. 3%)

INVESTING IN ROMANIA Statistics and trends Despite their large potential, certain sectors such as textiles, apparel, and footwear and leather products, still hold a rather small share of the total FDI, 1. 6% respectively. Other activities that have attracted important FDI are: financial intermediation and insurance, which include banks, non-banks and insurance companies and accounts for 19. 0% of the total FDI stock, constructions and real estate (12. 9%), trade (12. 3%), IT and communications (6. 5%). At territorial level, Bucharest – Ilfov region attracted the most of the FDI – 63. 4%, followed by Centre Region 7. 4%, South Region – 7. 2%, West Region – 6. 2%, and South-East Region – 5. 9%. Top five countries that invested in Romania were The Netherlands – 21. 8% of the total FDI stock by the end of 2009, Austria – 18. 8%, Germany – 13. 4%, France – 8. 5%, and Greece 6. 6%. The list of top countries includes Turkey, in the fifteenth position, with 1. 1% of the total FDI stock. Foreign direct investments attracted by Romania in 2011 (Million Euro): Month Jan Feb Mar Apr May Sep Oct Nov Dec Stock 240 296 379 443 799 Monthly flow 240 56 83 64 356 Jun Jul Aug 1018 1105 1126 219 87 21 Source: National Bank of Romania, Balance of Payments

EXPORT AND IMPORT ACTIVITIES Movement of goods and services, regulatory frame Beginning with July 1, 2009 customs or other authorities designated by the member states have provided businesses with a unique registration and identification number (the EORI number) to be used for all customs activities they undertake within the European Union. If a business (or “economic operator”) is not established within the EU customs territory and does not have an EORI number, it will have to be registered by the designated authority of the member state where it conducts one of the following activities for the first time : • Submits, within the Community territory, a short customs declaration, other than: - A customs declaration done in accordance with Articles 225 - 238 from the Community Customs Regulation (Commission Regulation no. 2454/93) - A customs declaration solicited within the temporary admission regime. • Submits, within the Community territory, a short statement of entry or exit. • Manages a warehouse for temporary deposit based on Article 185, 1 st paragraph, from the Community Customs Regulation. • Submits an authorization request based on the Articles 324 a or 372 from the Community Customs Regulation. • Requests an economic operator certificate, authorized according to Article 14 a from the Community Customs Regulation. The Customs Authority is the Romanian authority in charge of regulating and supervising this domain http: //www. customs. ro.