c1fff0effa669f6a29bce07aa0509d39.ppt

- Количество слайдов: 52

Project BLACK SEA TRADENET (B. S. T. ) ARMENIA CONSTANTA, ROMANIA, 30 -31 May, 2012 Constanta Chamber of Commerce, Industry, Shipping and Agriculture

STRUCTURE OF PRESENTATION 1. Country Profile (ARMENIA) 2. Legal Framework for Operating Business In Armenia 3. Investing in Armenia 4. Export and Import Activities in Armenia 5. Sources of Financing Business Activities in Armenia 6. Entrepreneurial Culture 7. Local Resources For Cross Border Cooperation

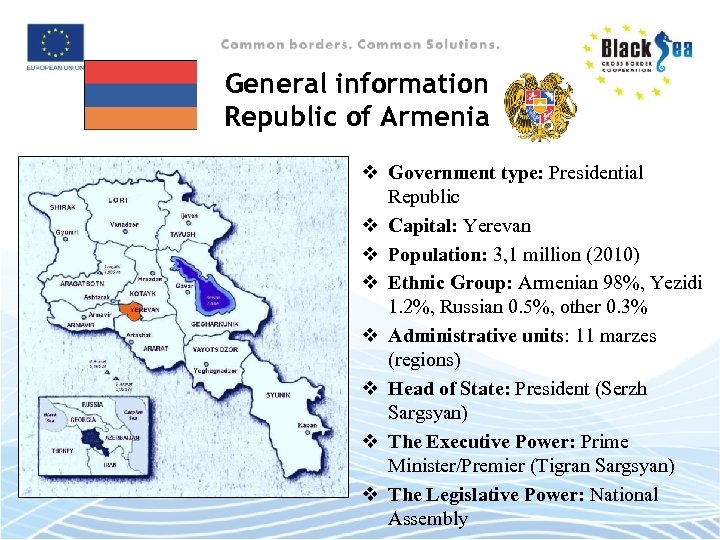

General information Republic of Armenia v Government type: Presidential Republic v Capital: Yerevan v Population: 3, 1 million (2010) v Ethnic Group: Armenian 98%, Yezidi 1. 2%, Russian 0. 5%, other 0. 3% v Administrative units: 11 marzes (regions) v Head of State: President (Serzh Sargsyan) v The Executive Power: Prime Minister/Premier (Tigran Sargsyan) v The Legislative Power: National Assembly

INSTITUTIONAL FRAMEWORK Local Administration v The territory of the Republic of Armenia is divided into 10 marzes (administrative units) and the capital of the country – Yerevan.

History and Civilization v. Human beings have inhabited the Armenian Plateau and Caucasus Region since over 100, 000 years ago. Little is known of them, however, drawings in caves and on rocks attest to their existence. Additionally, the Bible records that Noah's Ark came to rest on Historic Armenia's Mt. Ararat, and there are many references of his descent from the mountain after the Great Flood v. The invention of the Armenian alphabet in 405 AD by Mesrob Mashtots paved the way for the first Golden Age of Armenia, and over the subsequent centuries, Armenian writers, philosophers, mathematicians, and scientists, have achieved world acclaim due in large part to St. Mesrob Mashtots' seminal work. His contribution to Armenian culture was immense because it further distinguished the Armenians from neighboring peoples thereby making the process of assimilation difficult. Armenia throughout the centuries has been persecuted and harassed by neighboring countries and empires, but through all the turbulence and foreign domination, however, Armenians created a rich and a colorful culture, their own alphabet and a socioeconomic structure that has allowed them to preserve their distinct way of life.

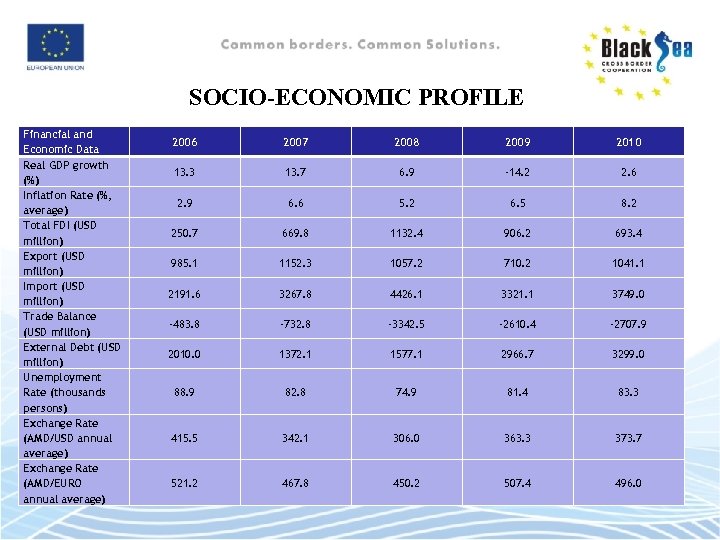

SOCIO-ECONOMIC PROFILE Financial and Economic Data Real GDP growth (%) Inflation Rate (%, average) Total FDI (USD million) Export (USD million) Import (USD million) Trade Balance (USD million) External Debt (USD million) Unemployment Rate (thousands persons) Exchange Rate (AMD/USD annual average) Exchange Rate (AMD/EURO annual average) 2006 2007 2008 2009 2010 13. 3 13. 7 6. 9 -14. 2 2. 6 2. 9 6. 6 5. 2 6. 5 8. 2 250. 7 669. 8 1132. 4 906. 2 693. 4 985. 1 1152. 3 1057. 2 710. 2 1041. 1 2191. 6 3267. 8 4426. 1 3321. 1 3749. 0 -483. 8 -732. 8 -3342. 5 -2610. 4 -2707. 9 2010. 0 1372. 1 1577. 1 2966. 7 3299. 0 88. 9 82. 8 74. 9 81. 4 83. 3 415. 5 342. 1 306. 0 363. 3 373. 7 521. 2 467. 8 450. 2 507. 4 496. 0

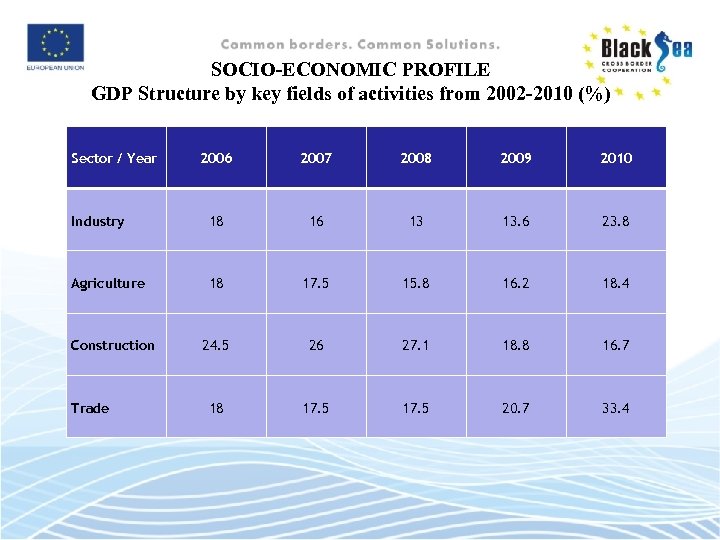

SOCIO-ECONOMIC PROFILE GDP Structure by key fields of activities from 2002 -2010 (%) Sector / Year 2006 2007 2008 2009 2010 Industry 18 16 13 13. 6 23. 8 Agriculture 18 17. 5 15. 8 16. 2 18. 4 24. 5 26 27. 1 18. 8 16. 7 18 17. 5 20. 7 33. 4 Construction Trade

SOCIO-ECONOMIC PROFILE Industries v Diamond-processing, metal-cutting machine tools, forging-pressing machines, electric motors, tyres, knitwear, hosiery, shoes, silk fabric, chemicals, trucks, instruments, microelectronics, jewellery manufacturing, software development, food processing, brandy. Export Commodities v Diamonds, mineral products, foodstuffs, energy. Import Commodities v Natural gas, petroleum, tobacco products, foodstuffs. Main import partners v Russia, China, Ukraine, Turkey, Germany, US, Iran. Main export partners v Russia, Germany, Netherlands, Belgium, Georgia, Bulgaria, USA.

INSTITUTIONAL FRAMEWORK Public and private institutions and organizations v v v Business Support Council of the RA Small and Medium Entrepreneurship (SME) Development Council Armenian Development Agency (ADA) Fund “SME Development National Center of Armenia” (SME DNC of Armenia) Enterprise Europe Network The National Competitiveness Foundation of Armenia Enterprise Incubator Foundation (EIF) Union of Manufacturers and Businessmen (Employers) of Armenia UMB(E)A Republican Union of Employers of Armenia Chamber of Commerce and Industry of RA (Arm. CCI) The Union of banks of Armenia

Public and private institutions and organizations

Armenia, part of the Black Sea community: role in the Black Sea basin, current position and activities

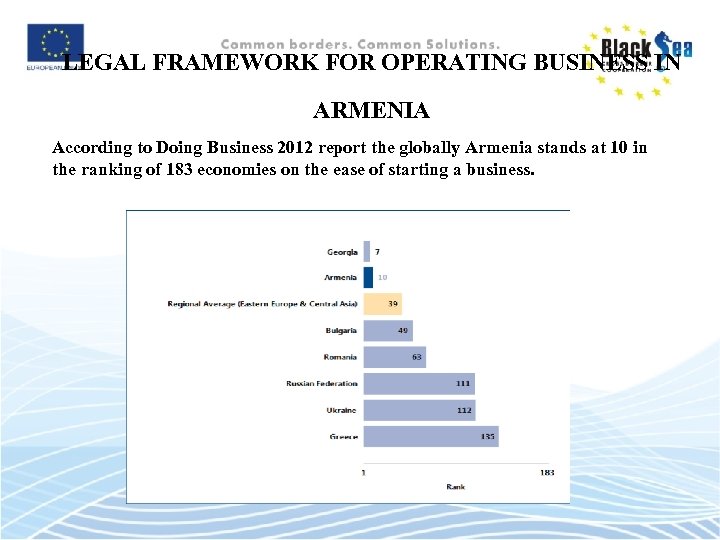

LEGAL FRAMEWORK FOR OPERATING BUSINESS IN ARMENIA According to Doing Business 2012 report the globally Armenia stands at 10 in the ranking of 183 economies on the ease of starting a business.

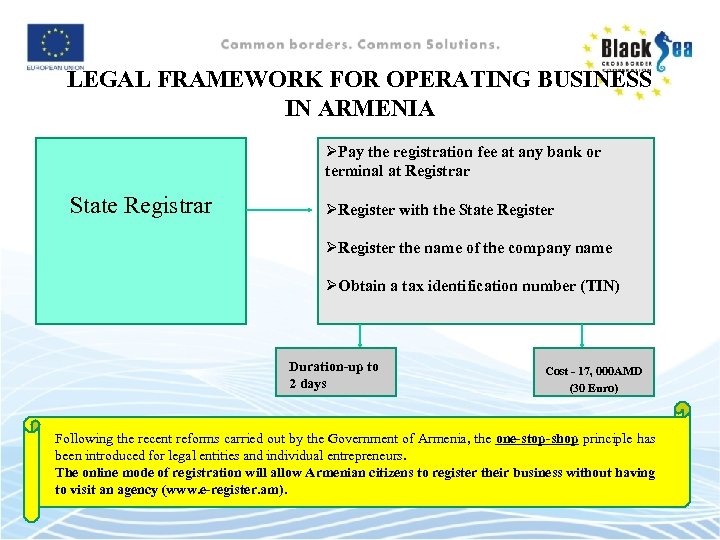

LEGAL FRAMEWORK FOR OPERATING BUSINESS IN ARMENIA ØPay the registration fee at any bank or terminal at Registrar State Registrar ØRegister with the State Register ØRegister the name of the company name ØObtain a tax identification number (TIN) Duration-up to 2 days Cost - 17, 000 AMD (30 Euro) Following the recent reforms carried out by the Government of Armenia, the one-stop-shop principle has been introduced for legal entities and individual entrepreneurs. The online mode of registration will allow Armenian citizens to register their business without having to visit an agency (www. e-register. am).

Forms of business cooperation and ventures recognized by the law (Types of enterprises) v v Individual Entrepreneurs Business partnerships Limited liability companies Supplementary liability companies v Joint-stock companies v Cooperatives v Representative offices and branches of legal entities Armenian legislation provides the same legal guarantees and protections to foreign and local businesses. Foreign investors have the right to create any form of enterprise.

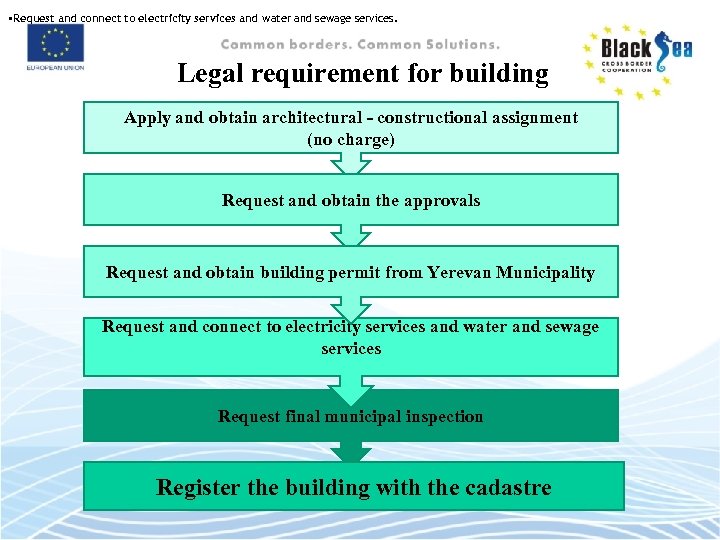

• Request and connect to electricity services and water and sewage services. Legal requirement for building Apply and obtain architectural - constructional assignment (no charge) Request and obtain the approvals Request and obtain building permit from Yerevan Municipality Request and connect to electricity services and water and sewage services Request final municipal inspection Register the building with the cadastre

Lifecycle of a company: exit through bankruptcy, transfer of business, etc. A legal entity shall be deemed as closed down on the date of state registration of its closedown. State registration is required also in case of reorganization (merger, unification, split, separation) and transformation of Legal Entities, which is regulated by the Civil Code of the RA (adopted on July 28, 1998) and Law on State Registration of Legal Entities (adopted on 3 April, 2001).

INVESTING IN ARMENIA Incentives v v v v v Attractive legislation regulating the investment, Investment guarantees*, Policy pursuing by the Government on attraction of FDI, Stable economic growth, Easy entry to the markets of CIS and the Middle East, Well-educated and skilled labor force, Unlimited recruitment of labor, Profit tax exemption for companies involved in agri-business, Permission of foreign 100% property, Stable banking system and monetary unit, Competitive price of energy resources, WTO membership since 2003, Liberal trade regime, absence of quote and import licenses, Absence of export duty and VAT return for exported commodities and services, Free exchange of foreign rate, Free repatriation of profit, Worldwide Diaspora, Political and economic stability.

INVESTING IN ARMENIA Types of foreign investments v Establishment of a fully foreign-owned company (including representations, affiliates and branches), or the purchase of an existing company. v Establishment of a new joint venture company with the participation of Armenian companies or citizens, or the purchase of the portion of the shares in an existing company. v Purchase of different types of securities. v Procurement of permit to use the land, or a concession agreement for the use of Armenian natural resources with participation of Armenian companies or citizens. v Procurement of other property rights. v Other forms of investments.

INVESTING IN ARMENIA Competition Policy Basic principles in the field of improvement of competitive environment and protection of market of the Republic of Armenia are: v v ensuring the fair trade and free market, application of non discriminated and transparent legislation, ensuring the application of WTO rules and principles, promotion of reforms in the related field.

INVESTING IN ARMENIA Human resources (work force) population (68 % of the population ranges from 15 to 59 years old), among which the level of education is more than satisfactory. As of 2010, the unemployment rate in Armenia made 7% according to the country's National Statistical Service data, which is representing 83. 3 thousands officially registered unemployed persons. Armenia ranks 86 th in the UN Human Development Index out of 187 states (2011).

According to the Article 28 of the Constitution every citizen has the right of property and succession. The foreign citizens (physical persons) as INVESTING IN ARMENIA Land buildings property rights According to the Article 28 of the Constitution every citizen has the right of property and succession. The foreign citizens (physical persons) as well as the persons without the right of citizenship do not enjoy the right of land property, except for the cases provided by law. If these citizens own any property under ownership right, then they can enjoy only the right to land plot usage, but never an ownership right. Disqualification of the property right may be realized only juridical, only in cases provided by the law. The disqualification for the needs of the society and the state may be realized only in exceptional cases, basing on the law, along with preliminary reimbursement.

Intellectual property rights (IPR) As a member of the World Intellectual Property Organization (WIPO), Armenia has signed a number of international agreements on intellectual property rights. However, there are several key documents which weren’t signed by Armenia, such as follows: the Patent Law Treaty, the Singapore Treaty on the Law on Trademarks, the Trademark Law Treaty, or the International Convention for the Protection of New Varieties of Plants. The authorities noted, however, that recent amendments to Armenia's Law on Trademark and the new Law on Patents have prepared the way for it to join these treaties in the near future. Armenia is a member of the Eurasian Patent Office. Armenia has notified the Agency of Intellectual Property (Agency) as the contact point under Article 69 of the Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS Agreement). The Agency was established as separate division acting within the Ministry of Economy, in 2002, following the merger of the Patent Office and the National Agency of Copyright. The Agency is responsible for policy formulation and implementation in industrial property and copyright, including processing applications for patent protection, and trade mark and design registration. It has a cooperation agreement with the European Patent Office (EPO) http: //www. aipa. am

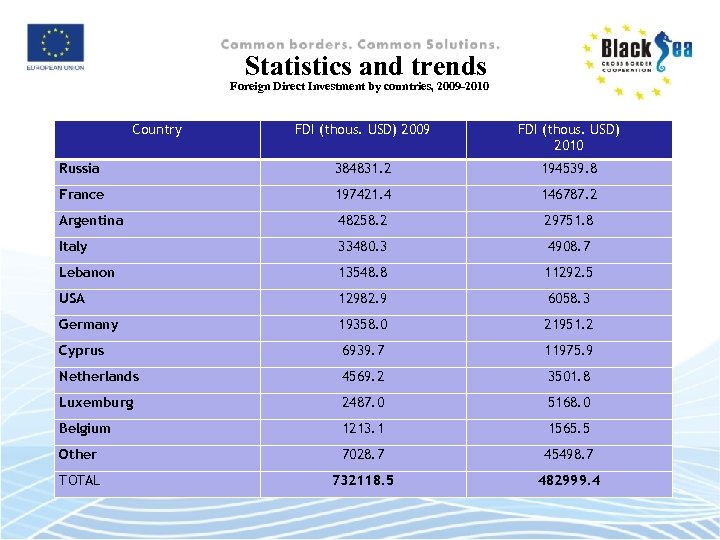

Statistics and trends Foreign Direct Investment by countries, 2009 -2010 Country FDI (thous. USD) 2009 FDI (thous. USD) 2010 Russia 384831. 2 194539. 8 France 197421. 4 146787. 2 Argentina 48258. 2 29751. 8 Italy 33480. 3 4908. 7 Lebanon 13548. 8 11292. 5 USA 12982. 9 6058. 3 Germany 19358. 0 21951. 2 Cyprus 6939. 7 11975. 9 Netherlands 4569. 2 3501. 8 Luxemburg 2487. 0 5168. 0 Belgium 1213. 1 1565. 5 Other 7028. 7 45498. 7 TOTAL 732118. 5 482999. 4

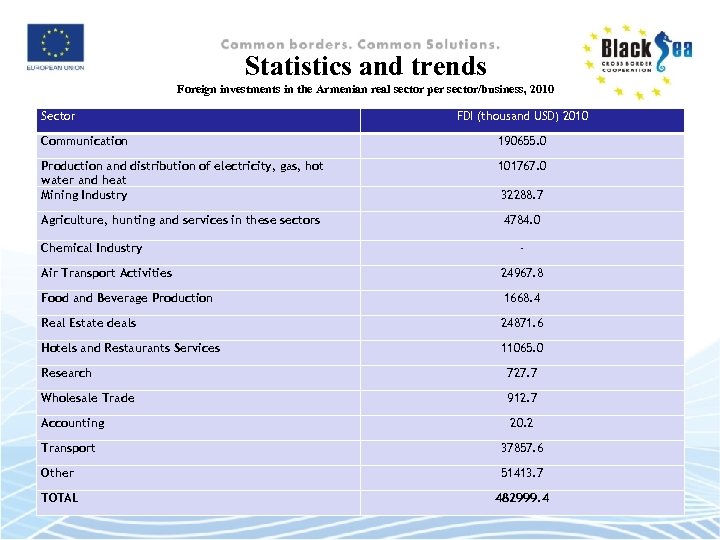

Statistics and trends Foreign investments in the Armenian real sector per sector/business, 2010 Sector FDI (thousand USD) 2010 Communication 190655. 0 Production and distribution of electricity, gas, hot water and heat Mining Industry 101767. 0 Agriculture, hunting and services in these sectors 4784. 0 Chemical Industry 32288. 7 - Air Transport Activities 24967. 8 Food and Beverage Production 1668. 4 Real Estate deals 24871. 6 Hotels and Restaurants Services 11065. 0 Research 727. 7 Wholesale Trade 912. 7 Accounting 20. 2 Transport 37857. 6 Other 51413. 7 TOTAL 482999. 4

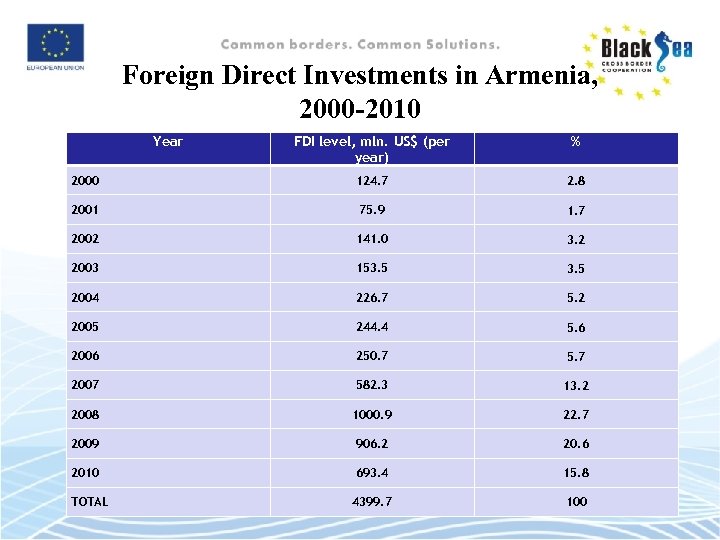

Foreign Direct Investments in Armenia, 2000 -2010 Year FDI level, mln. US$ (per year) % 2000 124. 7 2. 8 2001 75. 9 1. 7 2002 141. 0 3. 2 2003 153. 5 2004 226. 7 5. 2 2005 244. 4 5. 6 2006 250. 7 5. 7 2007 582. 3 13. 2 2008 1000. 9 22. 7 2009 906. 2 20. 6 2010 693. 4 15. 8 TOTAL 4399. 7 100

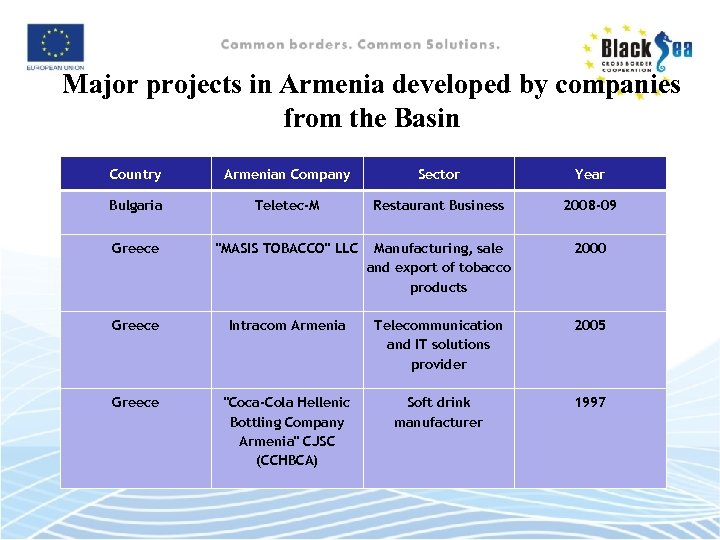

Major projects in Armenia developed by companies from the Basin Country Armenian Company Sector Year Bulgaria Teletec-M Restaurant Business 2008 -09 Greece "MASIS TOBACCO" LLC Manufacturing, sale and export of tobacco products 2000 Greece Intracom Armenia Telecommunication and IT solutions provider 2005 Greece "Coca-Cola Hellenic Bottling Company Armenia" CJSC (CCHBCA) Soft drink manufacturer 1997

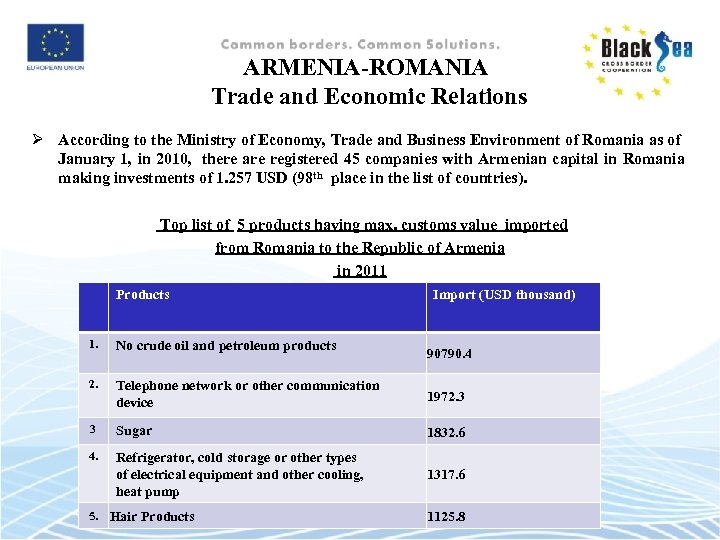

ARMENIA-ROMANIA Trade and Economic Relations Ø According to the Ministry of Economy, Trade and Business Environment of Romania as of January 1, in 2010, there are registered 45 companies with Armenian capital in Romania making investments of 1. 257 USD (98 th place in the list of countries). Top list of 5 products having max. customs value imported from Romania to the Republic of Armenia in 2011 Products Import (USD thousand) 1. No crude oil and petroleum products 2. Telephone network or other communication device 1972. 3 3 Sugar 1832. 6 4. Refrigerator, cold storage or other types of electrical equipment and other cooling, heat pump 1317. 6 5. Hair Products 90790. 4 1125. 8

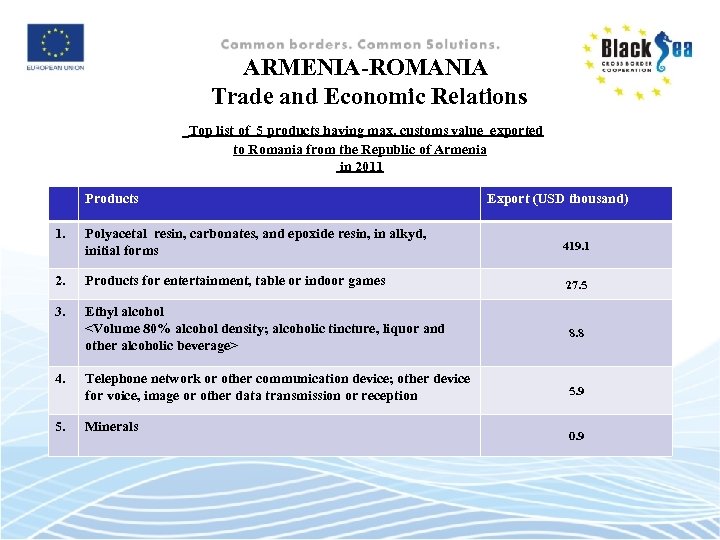

ARMENIA-ROMANIA Trade and Economic Relations Top list of 5 products having max. customs value exported to Romania from the Republic of Armenia in 2011 Products Export (USD thousand) 1. Polyacetal resin, carbonates, and epoxide resin, in alkyd, initial forms 419. 1 2. Products for entertainment, table or indoor games 27. 5 3. Ethyl alcohol <Volume 80% alcohol density; alcoholic tincture, liquor and other alcoholic beverage> 8. 8 4. Telephone network or other communication device; other device for voice, image or other data transmission or reception 5. 9 5. Minerals 0. 9

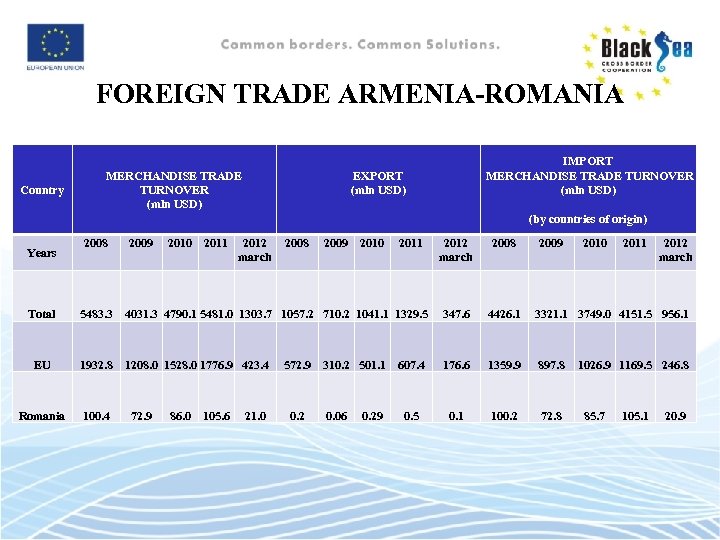

FOREIGN TRADE ARMENIA-ROMANIA Country MERCHANDISE TRADE TURNOVER (mln USD) IMPORT MERCHANDISE TRADE TURNOVER (mln USD) EXPORT (mln USD) (by countries of origin) Years 2008 2009 2010 2011 2012 march Total 5483. 3 4031. 3 4790. 1 5481. 0 1303. 7 1057. 2 710. 2 1041. 1 1329. 5 347. 6 4426. 1 3321. 1 3749. 0 4151. 5 956. 1 EU 1932. 8 1208. 0 1528. 0 1776. 9 423. 4 607. 4 176. 6 1359. 9 897. 8 Romania 100. 4 0. 5 0. 1 100. 2 72. 8 72. 9 86. 0 105. 6 21. 0 572. 9 0. 2 310. 2 501. 1 0. 06 0. 29 1026. 9 1169. 5 246. 8 85. 7 105. 1 20. 9

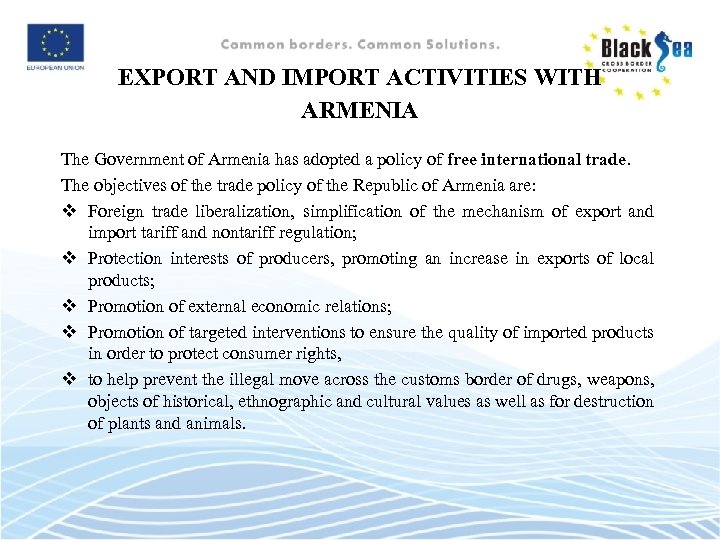

EXPORT AND IMPORT ACTIVITIES WITH ARMENIA The Government of Armenia has adopted a policy of free international trade. The objectives of the trade policy of the Republic of Armenia are: v Foreign trade liberalization, simplification of the mechanism of export and import tariff and nontariff regulation; v Protection interests of producers, promoting an increase in exports of local products; v Promotion of external economic relations; v Promotion of targeted interventions to ensure the quality of imported products in order to protect consumer rights, v to help prevent the illegal move across the customs border of drugs, weapons, objects of historical, ethnographic and cultural values as well as for destruction of plants and animals.

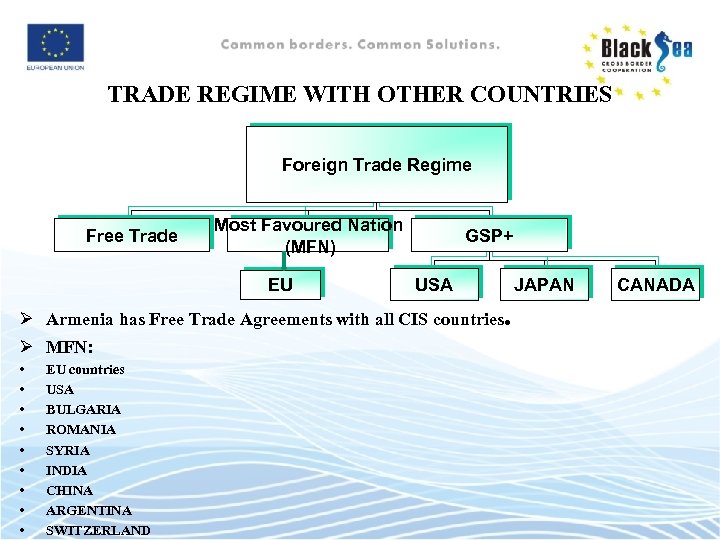

TRADE REGIME WITH OTHER COUNTRIES Foreign Trade Regime Free Trade Most Favoured Nation (MFN) EU GSP+ USA Ø Armenia has Free Trade Agreements with all CIS countries. Ø MFN: • • • EU countries USA BULGARIA ROMANIA SYRIA INDIA CHINA ARGENTINA SWITZERLAND JAPAN CANADA

EXPORT/IMPORT PROCEDURE Ø In accordance with Decree “On the lists of documents and information required for implementation of customs control and their procedure submission to custom services" adopted by the Government of the Republic of Armenia as of 21 November, 2003 № 1779 -N. Ø There is no need to be registered at the Customs (Decree adopted by the Government of the RA as of 1 st January, 2012)

EXPORT AND IMPORT ACTIVITIES WITH ARMENIA Customs clearance v Customs clearance of goods and vehicles moving across the customs border of the Republic of Armenia is exercised in compliance with 15 regimes established by the Customs Code of the Republic of Armenia. v The selection of the Customs regime is made by a declarant (physical person or company), which implements import/export transaction. v In order to perform a custom clearance of goods imported by companies and individual entrepreneurs, the declarant must submit the following documents: v customs declaration, v invoice or contract of sale of goods, v cargo customs notification (waybill).

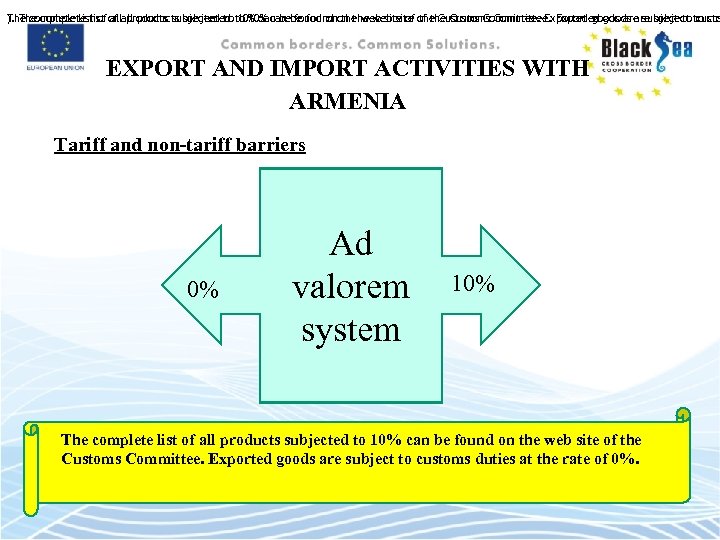

The complete list of all products subjected to 10% can be found on the web site of the Customs Committee. Exported goods are subject to custo ). The complete list of all products subjected to 10% can be found on the web site of the Customs Committee. Exported goods are subject to cus EXPORT AND IMPORT ACTIVITIES WITH ARMENIA Tariff and non-tariff barriers 0% Ad valorem system 10% The complete list of all products subjected to 10% can be found on the web site of the Customs Committee. Exported goods are subject to customs duties at the rate of 0%.

Taxation- clearing, VAT v The Value Added Tax (VAT) levied on value of goods imported to Armenia by the “Import for Free Turnover” customs regime. VAT on goods imported to the domestic territory of Armenia shall be calculated and charged by customs authorities at the border of the Republic of Armenia, except: v Goods imported by organizations and individual entrepreneurs, included in a statutory list, the import customs duty rate that is set to 0% and are not subject to excise tax; v Goods supplied by foreign states, international intergovernmental organizations, international, foreign and public (including charities), religious and other organizations of the Republic of Armenia of a similar nature, individual philanthropists in programs of humanitarian aid and charity programs; v Goods exported from the Republic of Armenia. v For goods imported to Armenia are liable to VAT at the time of importation, is calculated on the total sum of the customs value of the goods, customs duty and excise tax. The current VAT rate is 20%. v For goods importing to Armenia calculation and collection of VAT by customs authorities justified with customs declarations and payment documents filled in for custom clearance.

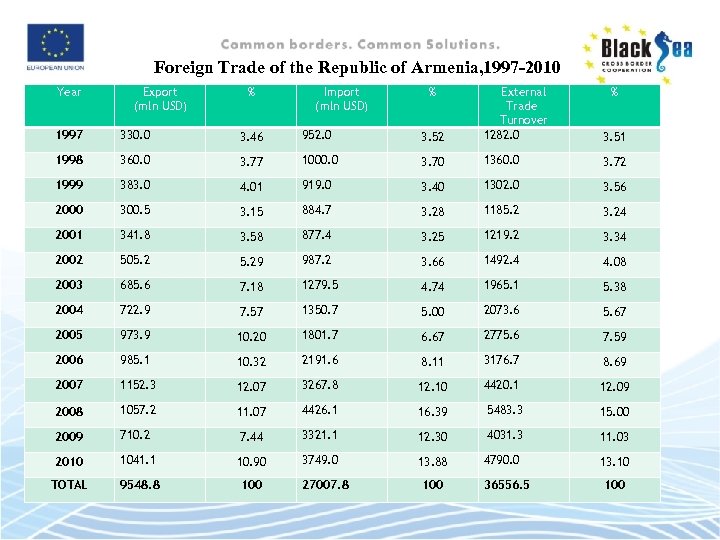

Foreign Trade of the Republic of Armenia, 1997 -2010 Year Export (mln USD) % Import (mln USD) 1997 330. 0 3. 46 952. 0 3. 52 External Trade Turnover 1282. 0 1998 360. 0 3. 77 1000. 0 3. 70 1360. 0 3. 72 1999 383. 0 4. 01 919. 0 3. 40 1302. 0 3. 56 2000 300. 5 3. 15 884. 7 3. 28 1185. 2 3. 24 2001 341. 8 3. 58 877. 4 3. 25 1219. 2 3. 34 2002 505. 29 987. 2 3. 66 1492. 4 4. 08 2003 685. 6 7. 18 1279. 5 4. 74 1965. 1 5. 38 2004 722. 9 7. 57 1350. 7 5. 00 2073. 6 5. 67 2005 973. 9 10. 20 1801. 7 6. 67 2775. 6 7. 59 2006 985. 1 10. 32 2191. 6 8. 11 3176. 7 8. 69 2007 1152. 3 12. 07 3267. 8 12. 10 4420. 1 12. 09 2008 1057. 2 11. 07 4426. 1 16. 39 5483. 3 15. 00 2009 710. 2 7. 44 3321. 1 12. 30 4031. 3 11. 03 2010 1041. 1 10. 90 3749. 0 13. 88 4790. 0 13. 10 TOTAL 9548. 8 100 27007. 8 % 100 36556. 5 % 3. 51 100

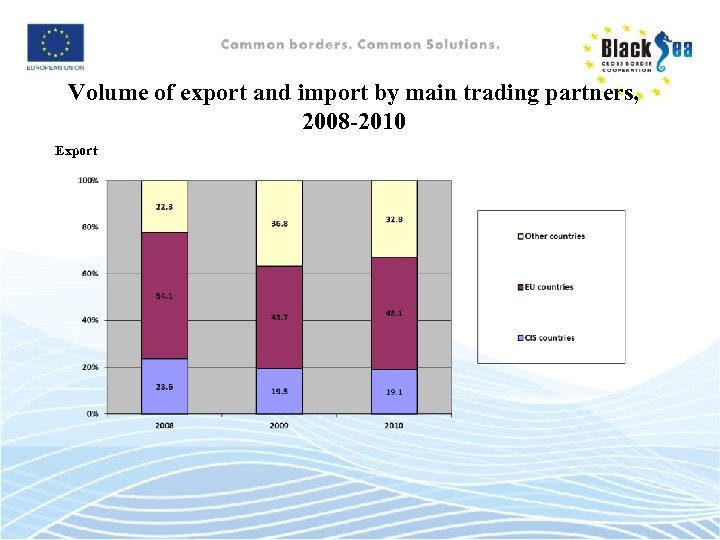

Volume of export and import by main trading partners, 2008 -2010 Export

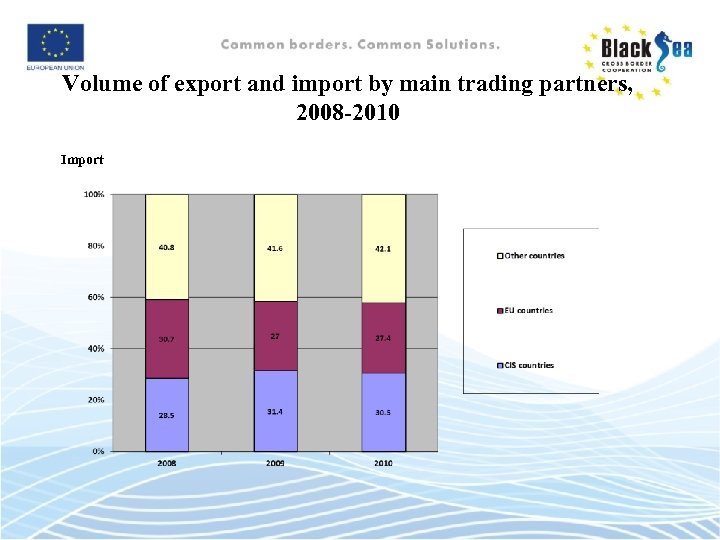

Volume of export and import by main trading partners, 2008 -2010 Import

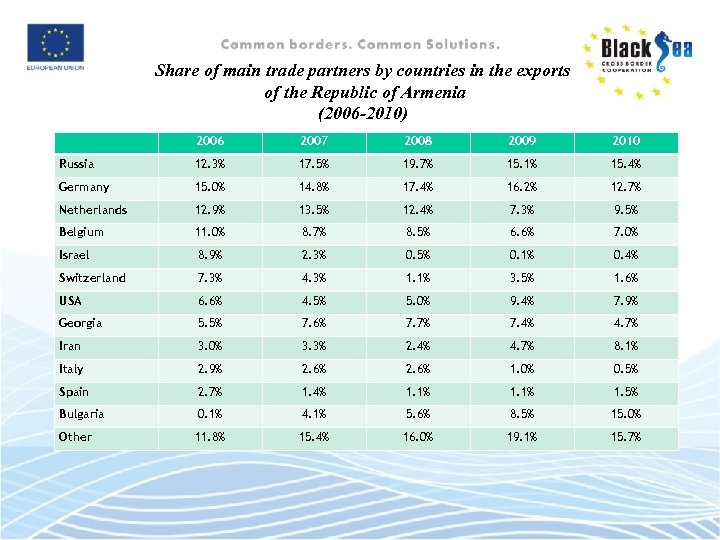

Share of main trade partners by countries in the exports of the Republic of Armenia (2006 -2010) 2006 2007 2008 2009 2010 Russia 12. 3% 17. 5% 19. 7% 15. 1% 15. 4% Germany 15. 0% 14. 8% 17. 4% 16. 2% 12. 7% Netherlands 12. 9% 13. 5% 12. 4% 7. 3% 9. 5% Belgium 11. 0% 8. 7% 8. 5% 6. 6% 7. 0% Israel 8. 9% 2. 3% 0. 5% 0. 1% 0. 4% Switzerland 7. 3% 4. 3% 1. 1% 3. 5% 1. 6% USA 6. 6% 4. 5% 5. 0% 9. 4% 7. 9% Georgia 5. 5% 7. 6% 7. 7% 7. 4% 4. 7% Iran 3. 0% 3. 3% 2. 4% 4. 7% 8. 1% Italy 2. 9% 2. 6% 1. 0% 0. 5% Spain 2. 7% 1. 4% 1. 1% 1. 5% Bulgaria 0. 1% 4. 1% 5. 6% 8. 5% 15. 0% Other 11. 8% 15. 4% 16. 0% 19. 1% 15. 7%

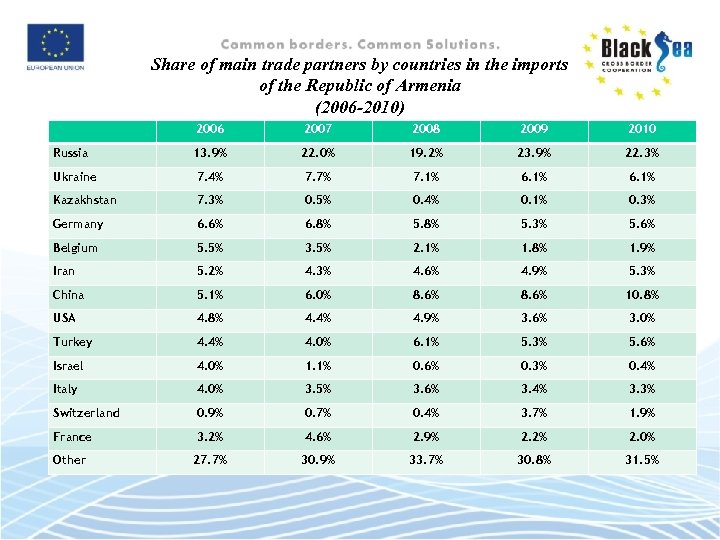

Share of main trade partners by countries in the imports of the Republic of Armenia (2006 -2010) 2006 2007 2008 2009 2010 Russia 13. 9% 22. 0% 19. 2% 23. 9% 22. 3% Ukraine 7. 4% 7. 7% 7. 1% 6. 1% Kazakhstan 7. 3% 0. 5% 0. 4% 0. 1% 0. 3% Germany 6. 6% 6. 8% 5. 3% 5. 6% Belgium 5. 5% 3. 5% 2. 1% 1. 8% 1. 9% Iran 5. 2% 4. 3% 4. 6% 4. 9% 5. 3% China 5. 1% 6. 0% 8. 6% 10. 8% USA 4. 8% 4. 4% 4. 9% 3. 6% 3. 0% Turkey 4. 4% 4. 0% 6. 1% 5. 3% 5. 6% Israel 4. 0% 1. 1% 0. 6% 0. 3% 0. 4% Italy 4. 0% 3. 5% 3. 6% 3. 4% 3. 3% Switzerland 0. 9% 0. 7% 0. 4% 3. 7% 1. 9% France 3. 2% 4. 6% 2. 9% 2. 2% 2. 0% Other 27. 7% 30. 9% 33. 7% 30. 8% 31. 5%

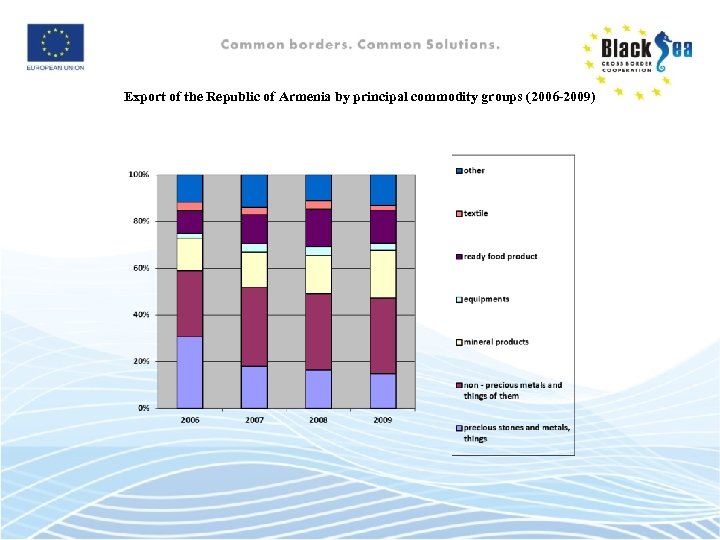

Export of the Republic of Armenia by principal commodity groups (2006 -2009)

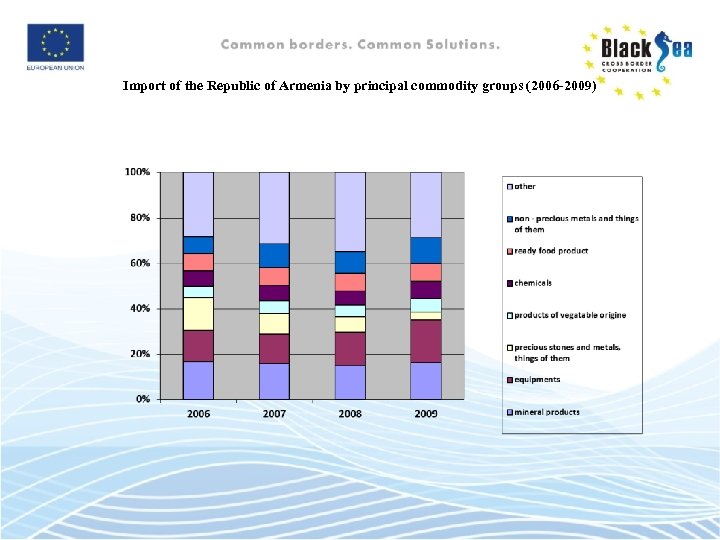

Import of the Republic of Armenia by principal commodity groups (2006 -2009)

Taxation- clearing, VAT Customs Valuation Armenia is a member of the World Customs Organization and uses the transaction value method of customs valuation. To determine the customs value is taken as the basis of transaction price (in fact, the amount paid or the amount to be paid for the goods). Customs value of goods determined in accordance with the Customs Code of the Republic of Armenia, which meet the standards of the Agreement on customs valuation of goods WTO (GATT Article VII).

Payment terms Customs formalities should take 10 days. Payments must be paid within 3 days after the customs formalities, however not later than 10 days after filling the transfer list. Customs charges may be paid through bank branches located in the customs office. In case of late payments of the customs duties exceeding the stipulated periods a penalty shall be levied from the payer in the amount of 0. 2 % of the overdue payment of the customs duties for every day of the delay. Customs user fees are mandatory payments levied on behalf of the State Budget pursuant to the procedure and in the amounts stipulated by Customs Code.

Origin rule The Chamber of Commerce and Industry of RA is the authorized body responsible for issuing Certificates of the country of origin of goods. The mentioned process is regulated by a number of normative documents. The process of certification is carried out on the basis of business organization's application and embraces the following two parts: expertise and issue of the certificate of origin. The Expertise is conducted by the Certification Department of the Chamber of Commerce and Industry by "Armexpertiza" LLC and the Certificate of Origin is issued on the basis of the Examination Act. At the moment, it is possible to present all required documents for acquiring certificate of origin also by the e-mail: havastagir@armcci. am.

SOURCES OF FINANCING BUSINESS ACTIVITIES IN ARMENIA As of June 30 2011, the Armenian financial market numbered 21 commercial banks (with 418 branch offices. As at June 30 2011, other players of the Armenian financial market included: v 31 credit organizations (with 60 branch offices) v 9 insurance companies and 4 insurance brokerage firms v 119 pawnshops v 236 exchange offices v 1 legal entity currency dealers v 10 money transferring companies ('Hay. Post' CJSC, 'Armenian Express' CJSC, 'Depi Toun' LTD) and 6 organization dealing with processing and clearing of payment instruments and payment documents ('Armenian Card' CJSC) v 8 investment companies, NASDAQ OMX Armenia and Armenian Central depositary v 15 reporting issuers www. banks. am, www. cba. am, www. finport. am Note: For your reference, USD or EUR equivalent of amounts indicated in AMD may be calculated using the official exchange rate established by the RA Central Bank (www. cba. am)

Private sources, including bank loans All banking transactions are possible in Armenia: Ø opening a bank account, Ø banking transfers, Ø currency exchange, Ø collection of liquid assets, Ø letters of credit, Ø bank guarantees, Ø credit card services, check books.

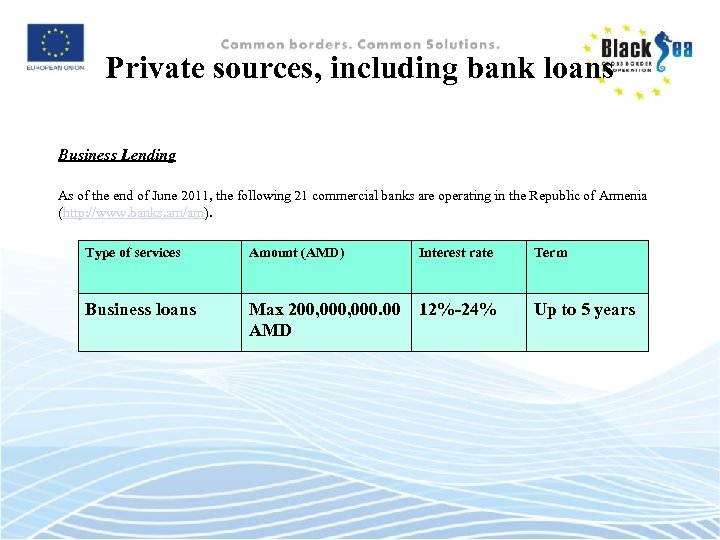

Private sources, including bank loans Business Lending As of the end of June 2011, the following 21 commercial banks are operating in the Republic of Armenia (http: //www. banks. am/am). Type of services Amount (AMD) Interest rate Business loans Max 200, 000. 00 12%-24% AMD Term Up to 5 years

ENTREPRENEURIAL CULTURE Historically, Armenia has always been notable for its craftsmen and artisans, and, since Armenia has had to develop new sectors of its economy since the dissolution of the Soviet Union, skilled labor has made a resurgence with the creation of precious stone processing, jewelry-making, and information and communication technology. Armenian women and men have long expressed their creativity through exquisite wood carving, fine metal work, and complex, high-quality needle laces, knitting, crochet, and embroidered textiles intended for household use, everyday clothing, and traditional costumes. Many designs link artisans to family regions where crafts were often village-based. Armenians consider knowledge of needle art techniques a heritage of critical importance for successive generations of women.

Enhancing the competence through innovation, especially technological innovation and new business schemes v Using intellectual potential, capabilities and achievements of scientific-technical complex of the Republic of Armenia, as well as introduction into the economy of scientific and technological activities considered by the Government of the Republic of Armenia as one of the main directions of economic development. At the same time the most important task is promotion of high performance knowledge-based economy to enhance the competitiveness of domestic products at world markets.

Local products and services of cross border interest Ø Ø Ø Ø Information Technologies Food & Drinks Jewelry and Diamonds Tourism Mining Textiles & Clothing Fine Chemicals & Pharmaceuticals Electronics & Precision Engineering

Thank you for your attention! The Fund “SME Development National Center of Armenia” VIOLETA VIRABYAN Web site: www. smednc. am E-mail: vvirabyan@smednc. am

c1fff0effa669f6a29bce07aa0509d39.ppt