e17a967816c76d46394cf2ca80148664.ppt

- Количество слайдов: 20

Progress in BOJ’s XBRL Pilot Project Nov. 2004 Yoshiaki Wada Bank Examination and Surveillance Department Bank of Japan 1 © 2004 Bank of Japan

1.The role of the BOJ within Japanese Financial Systems and the progress in the XBRL pilot project • BOJ’s branch network • Range of FSIs covered by BOJ examination / monitoring, and the participants in the pilot project • Project history • The BOJ way to provide and receive different types information and apply them to FSI supervision of 22 © 2004 Bank of Japan

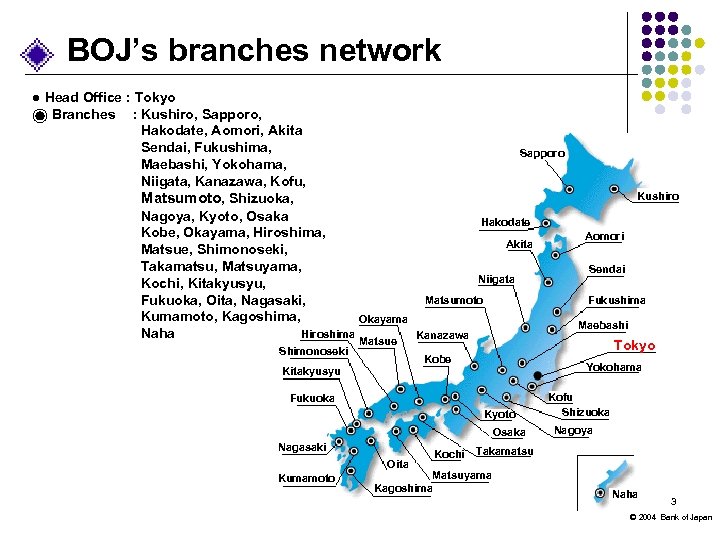

BOJ’s branches network ● Head Office : Tokyo Branches : Kushiro, Sapporo, Hakodate, Aomori, Akita Sendai, Fukushima, Maebashi, Yokohama, Niigata, Kanazawa, Kofu, Matsumoto, Shizuoka, Nagoya, Kyoto, Osaka Kobe, Okayama, Hiroshima, Matsue, Shimonoseki, Takamatsu, Matsuyama, Kochi, Kitakyusyu, Fukuoka, Oita, Nagasaki, Kumamoto, Kagoshima, Okayama Naha Hiroshima Shimonoseki Matsue Sapporo Kushiro Hakodate Akita Niigata Matsumoto Maebashi Kanazawa Tokyo Yokohama Fukuoka Kyoto Osaka Nagasaki Oita Kumamoto Kochi Sendai Fukushima Kobe Kitakyusyu Aomori Kofu Shizuoka Nagoya Takamatsu Matsuyama Kagoshima Naha 3 © 2004 Bank of Japan

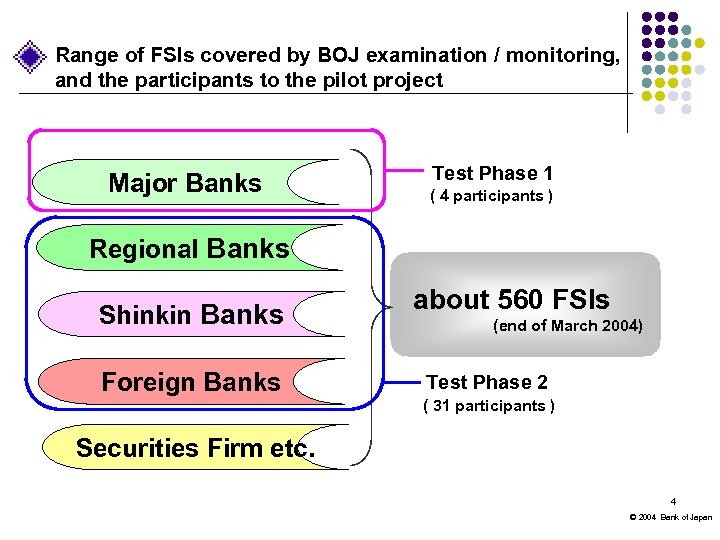

Range of FSIs covered by BOJ examination / monitoring, and the participants to the pilot project Major Banks Test Phase 1 ( 4 participants ) Regional Banks Shinkin Banks Foreign Banks about 560 FSIs (end of March 2004) Test Phase 2 ( 31 participants ) Securities Firm etc. 4 © 2004 Bank of Japan

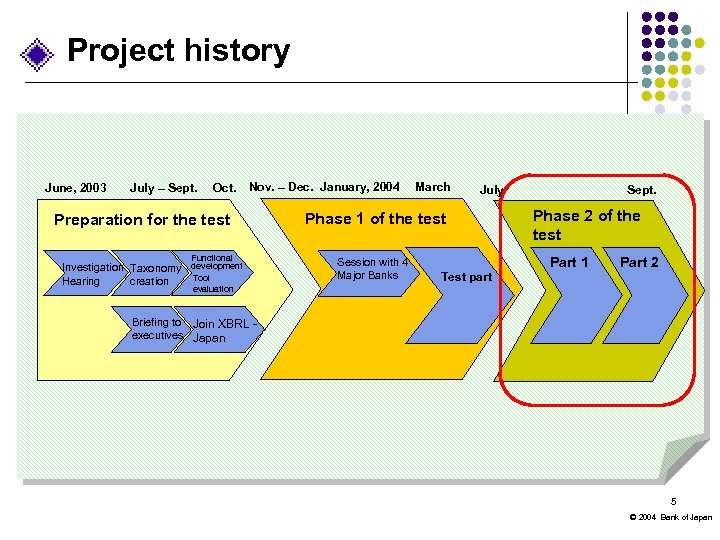

Project history Nov. – Dec. January, 2004 March June, 2003 July – Sept. Oct. Preparation for the test Functional Investigation Taxonomy development Tool Hearing creation July Phase 1 of the test Session with 4 Major Banks Test part Sept. Phase 2 of the test Part 1 Part 2 evaluation Briefing to Join XBRL executives Japan 5 © 2004 Bank of Japan

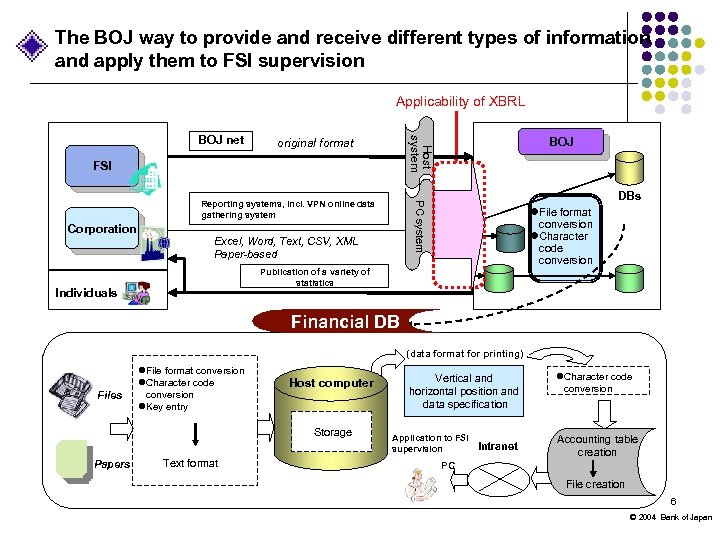

The BOJ way to provide and receive different types of information and apply them to FSI supervision Applicability of XBRL Host system BOJ net original format FSI Corporation DBs PC system Reporting systems, incl. VPN online data gathering system BOJ Excel, Word, Text, CSV, XML Paper-based l. File format conversion l. Character code conversion Publication of a variety of statistics Individuals Financial DB (data format for printing) Files l. File format conversion l. Character code conversion l. Key entry Host computer Storage Papers Text format Vertical and horizontal position and data specification Application to FSI supervision Intranet l. Character code conversion Accounting table creation PC File creation 6 © 2004 Bank of Japan

2.Understanding the pilot project • Project overview • Concept of BOJ’s VPN system • Taxonomy structure 7 7 © 2004 Bank of Japan

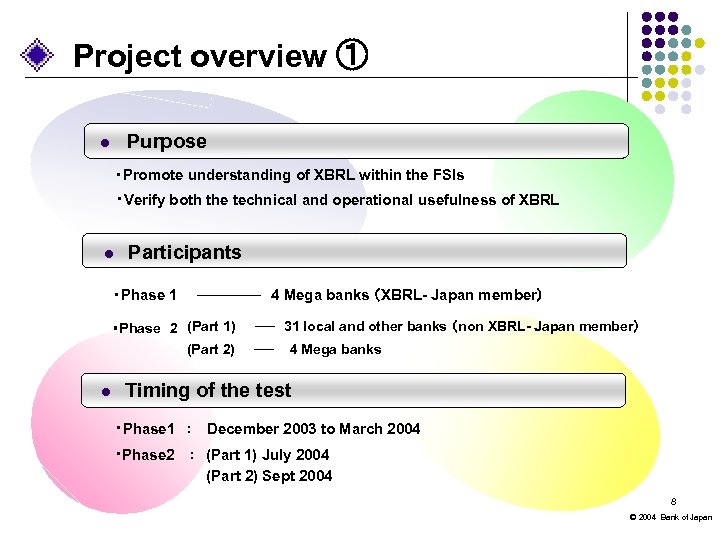

Project overview ① Purpose l ・Promote understanding of XBRL within the FSIs ・Verify both the technical and operational usefulness of XBRL l Participants ・Phase 1 ────── 4 Mega banks (XBRL- Japan member) ・Phase 2 (Part 1) (Part 2) l Timing ── 31 local and other banks (non XBRL- Japan member) ── 4 Mega banks of the test ・Phase 1 : December 2003 to March 2004 ・Phase 2 : (Part 1) July 2004 (Part 2) Sept 2004 8 © 2004 Bank of Japan

Wanted! XBRL Data Communication Test – Participant Invitation (Scope of Test) - Create an XBRL data file and transmit to the Bank of Japan (Date of Execution /Recruitment Period) - July / 17 -25 th June (Number and Type of Participants) - 20 BOJ Partner FSIs (Application) -Yoshiaki Wada, Bank Examination and Surveillance Department, BOJ 9 © 2004 Bank of Japan

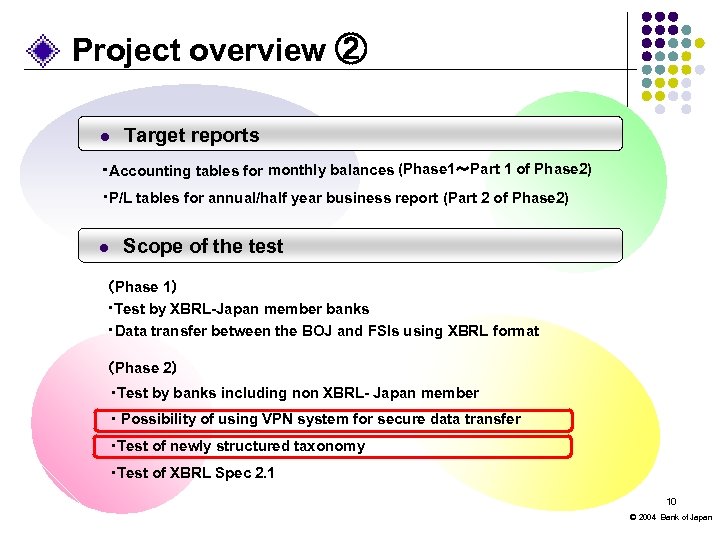

Project overview ② l Target reports monthly balances (Phase 1~Part 1 of Phase 2) ・Accounting tables for ・P/L tables for annual/half year business report (Part 2 of Phase 2) l Scope of the test (Phase 1) ・Test by XBRL-Japan member banks ・Data transfer between the BOJ and FSIs using XBRL format (Phase 2) ・Test by banks including non XBRL- Japan member ・ Possibility of using VPN system for secure data transfer ・Test of newly structured taxonomy ・Test of XBRL Spec 2. 1 10 © 2004 Bank of Japan

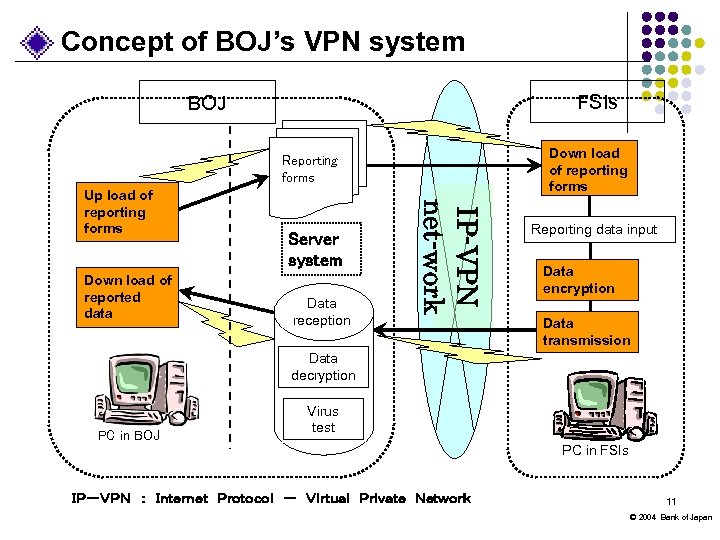

Concept of BOJ’s VPN system FSIs BOJ Down load of reporting forms Reporting forms Down load of reported data Server system Data reception IP-VPN net-work Up load of reporting forms Reporting data input Data encryption Data transmission Data decryption PC in BOJ Virus test PC in FSIs IP-VPN : Internet Protocol - Virtual Private Network 11 © 2004 Bank of Japan

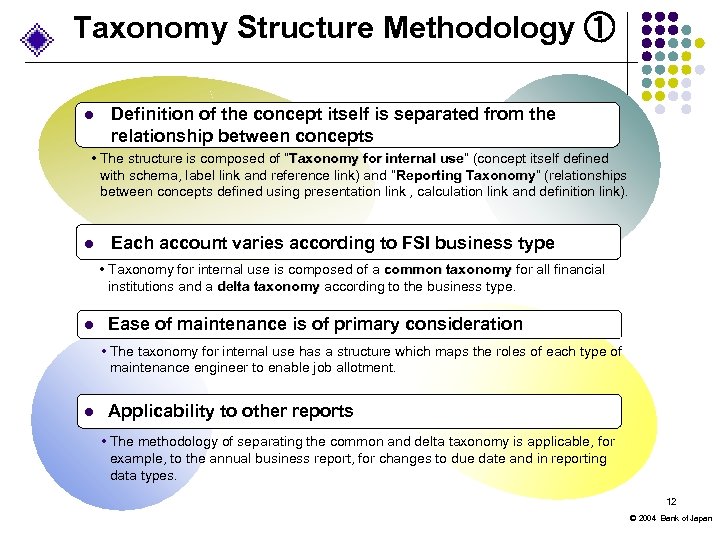

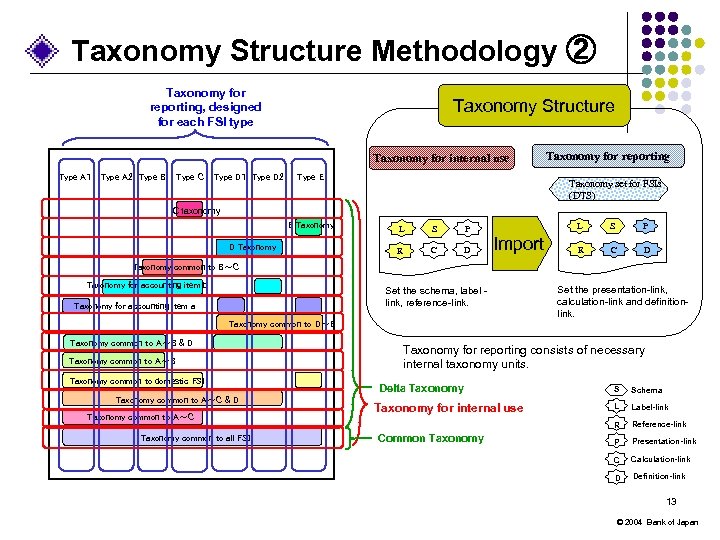

Taxonomy Structure Methodology ① l Definition of the concept itself is separated from the relationship between concepts • The structure is composed of “Taxonomy for internal use” (concept itself defined use with schema, label link and reference link) and “Reporting Taxonomy” (relationships Taxonomy between concepts defined using presentation link , calculation link and definition link). l Each account varies according to FSI business type • Taxonomy for internal use is composed of a common taxonomy for all financial institutions and a delta taxonomy according to the business type. l Ease of maintenance is of primary consideration • The taxonomy for internal use has a structure which maps the roles of each type of maintenance engineer to enable job allotment. l Applicability to other reports • The methodology of separating the common and delta taxonomy is applicable, for example, to the annual business report, for changes to due date and in reporting data types. 12 © 2004 Bank of Japan

Taxonomy Structure Methodology ② Taxonomy for reporting, designed for each FSI type Taxonomy Structure Taxonomy for internal use Type A1 Type A 2 Type B Type C Type D1 Type D 2 Type E Taxonomy for reporting Taxonomy set for FSIs (DTS) C taxonomy E Taxonomy D Taxonomy L S P R C D L Import S P R C D Taxonomy common to B~C Taxonomy for accounting item b Set the schema, label link, reference-link. Taxonomy for accounting item a Taxonomy common to D~E Taxonomy common to A~B & D Taxonomy common to A~B Taxonomy common to domestic FSI Taxonomy common to A~C & D Taxonomy common to A~C Taxonomy common to all FSI Set the presentation-link, calculation-link and definitionlink. Taxonomy for reporting consists of necessary internal taxonomy units. Delta Taxonomy Common Taxonomy Schema L Label-link R Taxonomy for internal use S Reference-link P Presentation-link C Calculation-link D Definition-link 13 © 2004 Bank of Japan

3.Test summary • Test results and summary of Phase 2 • Evaluation of Phase 2 by test participant FSIs 13 14 © 2004 Bank of Japan

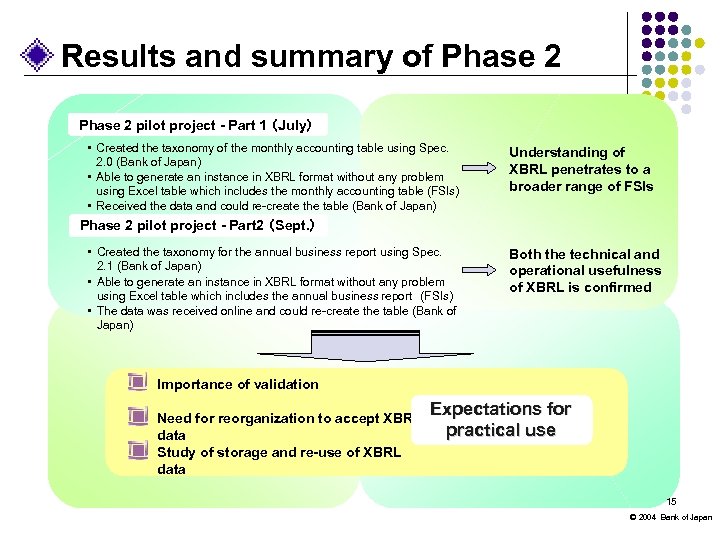

Results and summary of Phase 2 pilot project - Part 1 (July) • Created the taxonomy of the monthly accounting table using Spec. 2. 0 (Bank of Japan) • Able to generate an instance in XBRL format without any problem using Excel table which includes the monthly accounting table (FSIs) • Received the data and could re-create the table (Bank of Japan) Understanding of XBRL penetrates to a broader range of FSIs Phase 2 pilot project - Part 2 (Sept. ) • Created the taxonomy for the annual business report using Spec. 2. 1 (Bank of Japan) • Able to generate an instance in XBRL format without any problem using Excel table which includes the annual business report (FSIs) • The data was received online and could re-create the table (Bank of Japan) Both the technical and operational usefulness of XBRL is confirmed Importance of validation Need for reorganization to accept XBRL data Study of storage and re-use of XBRL data Expectations for practical use 15 © 2004 Bank of Japan

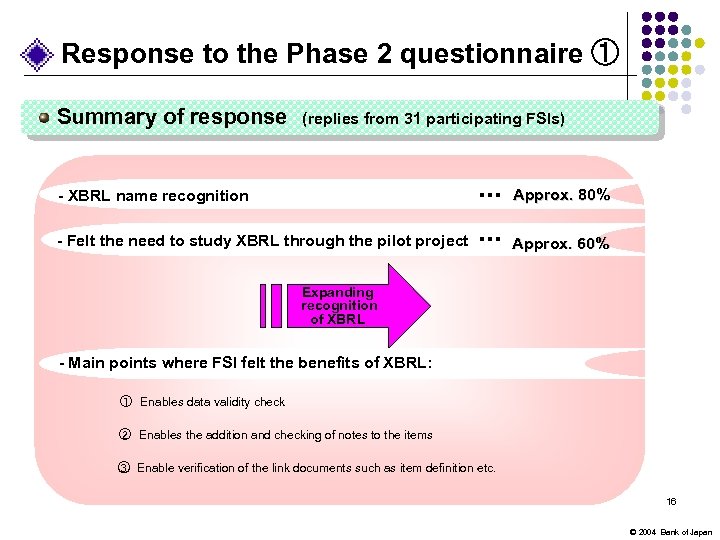

Response to the Phase 2 questionnaire ① Summary of response (replies from 31 participating FSIs) - XBRL name recognition ・・・ Approx. 80% - Felt the need to study XBRL through the pilot project ・・・ Approx. 60% Expanding recognition of XBRL - Main points where FSI felt the benefits of XBRL: ① Enables data validity check ② Enables the addition and checking of notes to the items ③ Enable verification of the link documents such as item definition etc. 16 © 2004 Bank of Japan

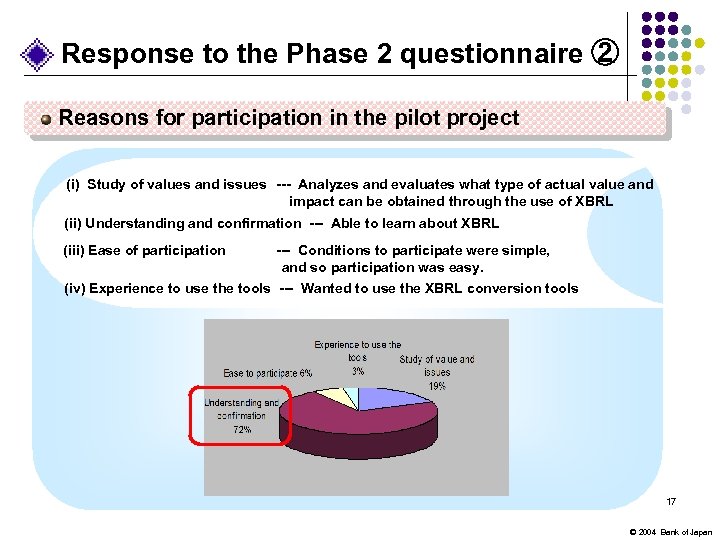

Response to the Phase 2 questionnaire ② Reasons for participation in the pilot project (i) Study of values and issues --- Analyzes and evaluates what type of actual value and impact can be obtained through the use of XBRL (ii) Understanding and confirmation --- Able to learn about XBRL (iii) Ease of participation --- Conditions to participate were simple, and so participation was easy. (iv) Experience to use the tools --- Wanted to use the XBRL conversion tools 17 © 2004 Bank of Japan

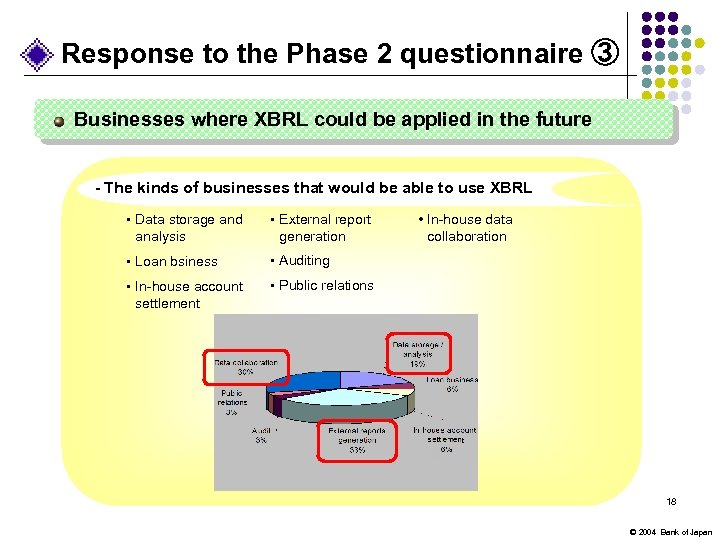

Response to the Phase 2 questionnaire ③ Businesses where XBRL could be applied in the future - The kinds of businesses that would be able to use XBRL • Data storage and analysis • External report generation • Loan bsiness • Auditing • In-house account • In-house data collaboration • Public relations settlement t 18 © 2004 Bank of Japan

And now for the last word --- 19 18 © 2004 Bank of Japan

Thank you for listening. 20 19 © 2004 Bank of Japan

e17a967816c76d46394cf2ca80148664.ppt