e1b385f8e67e22b2e966cd440177e9f4.ppt

- Количество слайдов: 30

Programmed Withdrawals * Augusto Iglesias P. Prim. América Consultores Warsaw, Poland May 2009 *Presented at FIAP Annual Conference

Programmed Withdrawals * Augusto Iglesias P. Prim. América Consultores Warsaw, Poland May 2009 *Presented at FIAP Annual Conference

Objective of the presentation I will try to convince you that to have PW as a pension alternative in mandatory funded pension programs does make sense in most (although not in all) real world situations.

Objective of the presentation I will try to convince you that to have PW as a pension alternative in mandatory funded pension programs does make sense in most (although not in all) real world situations.

Agenda 1. Preliminary remarks 2. Pension modes 3. Programmed withdrawals: 3. 1 Supply side 3. 2 Demand side 3. 3 Intermediation of PW´s 4. Policy conclusions

Agenda 1. Preliminary remarks 2. Pension modes 3. Programmed withdrawals: 3. 1 Supply side 3. 2 Demand side 3. 3 Intermediation of PW´s 4. Policy conclusions

1. Preliminary remarks • Should a mandate exist to transform the stock of pension savings into a flow of future pensions? : ü Individual preferences may collide with the objectives of a mandatory pension program (since there is a strong demand for lump sum payments). ü But, in some circumstances, “transformation costs” of pensions savings into a flow of pensions could be too high compared with the level of the pension to be financed. ü And -at retirement- some individuals could finance the “target replacement rate” with other sources of retirement income. A: In most (but not in all) cases mandatory pension savings should be used to buy a flow of pensions

1. Preliminary remarks • Should a mandate exist to transform the stock of pension savings into a flow of future pensions? : ü Individual preferences may collide with the objectives of a mandatory pension program (since there is a strong demand for lump sum payments). ü But, in some circumstances, “transformation costs” of pensions savings into a flow of pensions could be too high compared with the level of the pension to be financed. ü And -at retirement- some individuals could finance the “target replacement rate” with other sources of retirement income. A: In most (but not in all) cases mandatory pension savings should be used to buy a flow of pensions

2. Pension modes (in a funded mandatory pension program)

2. Pension modes (in a funded mandatory pension program)

2. Pension modes • Two main pension modes: üProgrammed withdrawals (PW´s): “Flow of regular payments (in most cases monthly) to a pensioner (or his/her beneficiaries), each one of them financed with the balance in the respective individual personal pension savings account”. üAnnuities: “A contract sold by an insurance company designed to provide payments to the holder (and eventually its beneficiaries) at specified intervals for life after retirement. Fixed annuities guarantee a certain payment amount; variable annuities do not”. • But there are many different types of PW´s and annuities: ü PW´s: Adjusted on a regular basis by longevity and investment returns; fixed amounts until the fund is depleted; payments for a pre-defined number of periods; etc. ü Annuities: Fixed (nominal or real); variable; with guaranteed periods of payments; group or population longevity risk; etc. ü Some PW´s and annuities may look like very similar products.

2. Pension modes • Two main pension modes: üProgrammed withdrawals (PW´s): “Flow of regular payments (in most cases monthly) to a pensioner (or his/her beneficiaries), each one of them financed with the balance in the respective individual personal pension savings account”. üAnnuities: “A contract sold by an insurance company designed to provide payments to the holder (and eventually its beneficiaries) at specified intervals for life after retirement. Fixed annuities guarantee a certain payment amount; variable annuities do not”. • But there are many different types of PW´s and annuities: ü PW´s: Adjusted on a regular basis by longevity and investment returns; fixed amounts until the fund is depleted; payments for a pre-defined number of periods; etc. ü Annuities: Fixed (nominal or real); variable; with guaranteed periods of payments; group or population longevity risk; etc. ü Some PW´s and annuities may look like very similar products.

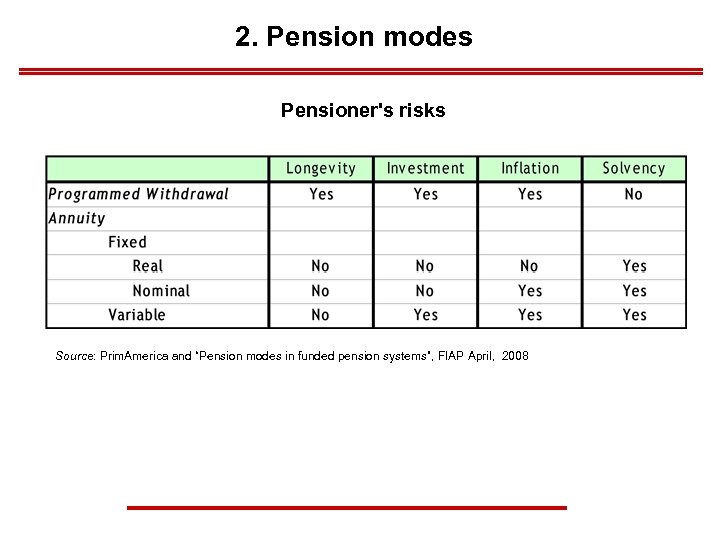

2. Pension modes Pensioner's risks Source: Prim. America and “Pension modes in funded pension systems”, FIAP April, 2008

2. Pension modes Pensioner's risks Source: Prim. America and “Pension modes in funded pension systems”, FIAP April, 2008

2. Pension modes • So, the main differences between both pension modes seems to be due to: ü Longevity risk : PW pensioners run the risk of outliving their pension savings (even if expectations on future returns of those savings are met) while annuitants do not. Can be mitigated with government guarantees. ü Solvency risk: Annuitants face the risk of bankruptcy of the provider of annuities. Since annuities contracts can go on for long periods of time, this risk is relevant. Can be mitigated with regulation and government guarantees. If pension savings assets are segregated from the PW management company, PW will not face “solvency risk”. (There are some annuities which offer protection against “investment risk” while PW´s do not offer this kind of protection- , but this is not an “intrinsic” component of this kind of pension mode)

2. Pension modes • So, the main differences between both pension modes seems to be due to: ü Longevity risk : PW pensioners run the risk of outliving their pension savings (even if expectations on future returns of those savings are met) while annuitants do not. Can be mitigated with government guarantees. ü Solvency risk: Annuitants face the risk of bankruptcy of the provider of annuities. Since annuities contracts can go on for long periods of time, this risk is relevant. Can be mitigated with regulation and government guarantees. If pension savings assets are segregated from the PW management company, PW will not face “solvency risk”. (There are some annuities which offer protection against “investment risk” while PW´s do not offer this kind of protection- , but this is not an “intrinsic” component of this kind of pension mode)

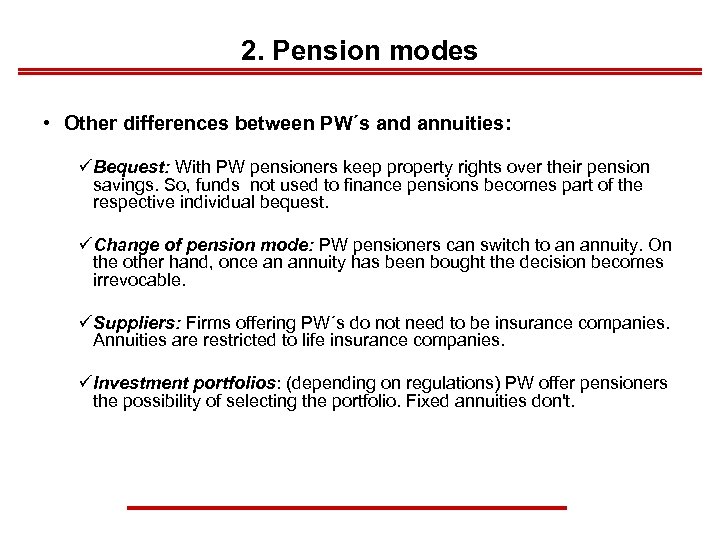

2. Pension modes • Other differences between PW´s and annuities: ü Bequest: With PW pensioners keep property rights over their pension savings. So, funds not used to finance pensions becomes part of the respective individual bequest. ü Change of pension mode: PW pensioners can switch to an annuity. On the other hand, once an annuity has been bought the decision becomes irrevocable. ü Suppliers: Firms offering PW´s do not need to be insurance companies. Annuities are restricted to life insurance companies. ü Investment portfolios: (depending on regulations) PW offer pensioners the possibility of selecting the portfolio. Fixed annuities don't.

2. Pension modes • Other differences between PW´s and annuities: ü Bequest: With PW pensioners keep property rights over their pension savings. So, funds not used to finance pensions becomes part of the respective individual bequest. ü Change of pension mode: PW pensioners can switch to an annuity. On the other hand, once an annuity has been bought the decision becomes irrevocable. ü Suppliers: Firms offering PW´s do not need to be insurance companies. Annuities are restricted to life insurance companies. ü Investment portfolios: (depending on regulations) PW offer pensioners the possibility of selecting the portfolio. Fixed annuities don't.

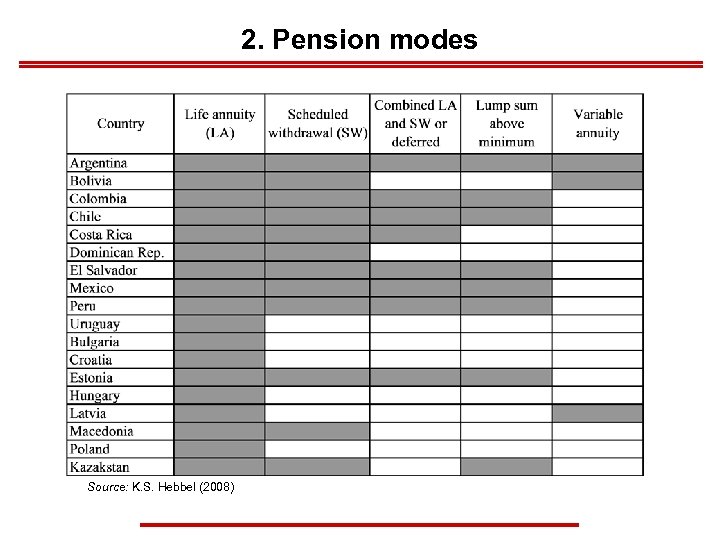

2. Pension modes Source: K. S. Hebbel (2008)

2. Pension modes Source: K. S. Hebbel (2008)

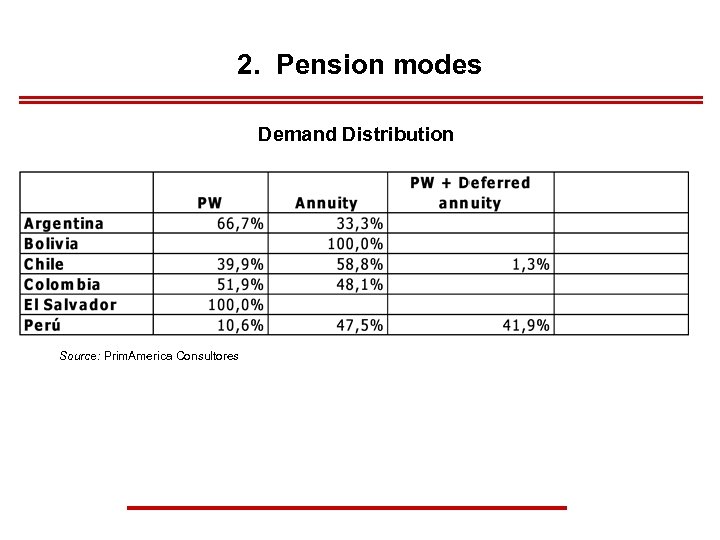

2. Pension modes Demand Distribution Source: Prim. America Consultores

2. Pension modes Demand Distribution Source: Prim. America Consultores

3. Programmed withdrawals

3. Programmed withdrawals

3. 1 Supply side • Estimation of PW´s: If the objective of regulation is that the PW should last for life, then the monthly pension will be estimated by dividing the balance in the respective individuals personal pension account by the “necessary capital” to finance one unit of pension (a year and for life) and by 12: - Pension n = (capitaln / cnun )/ 12 : ü Capitaln = Personal account balance in year n ü Cnun = Necessary capital per unit of pension in year n ü Pensionn = Monthly pension • “Necessary capital” per unit of pension: is the capital necessary to finance an annuity which will pay $1 since some date and for all of the pensioner's life (and of his/her beneficiaries if pensions are “joint pensions”). So, it's an estimate of the “present value” of future payments, for life, of one unit of a pension. It depends on i) Interest rate; ii) Probability of being alive in each one of future years (pensioner and his/her beneficiaries).

3. 1 Supply side • Estimation of PW´s: If the objective of regulation is that the PW should last for life, then the monthly pension will be estimated by dividing the balance in the respective individuals personal pension account by the “necessary capital” to finance one unit of pension (a year and for life) and by 12: - Pension n = (capitaln / cnun )/ 12 : ü Capitaln = Personal account balance in year n ü Cnun = Necessary capital per unit of pension in year n ü Pensionn = Monthly pension • “Necessary capital” per unit of pension: is the capital necessary to finance an annuity which will pay $1 since some date and for all of the pensioner's life (and of his/her beneficiaries if pensions are “joint pensions”). So, it's an estimate of the “present value” of future payments, for life, of one unit of a pension. It depends on i) Interest rate; ii) Probability of being alive in each one of future years (pensioner and his/her beneficiaries).

3. 1 Supply side • Interest rate (used to estimate the PW): ü Should be a good estimate of the future investment return of pension savings. ü The greater the IR used, the greater the estimated PW. So, the comparison between PW and annuities depend (in part) on the IR used to estimate PW vs. the IR implicit in annuities. ü Differences between IR used to estimate the PW and the actual rate of return of pension savings will have an impact on actual pensions vs. those originally estimated. ü Critical regulatory issues: how to estimate the IR to be used? ; IR should be constant, or should be changed every time the PW is re-estimated? ; should all PW providers use the same IR? ; should the IR depend on the pension savings investment portfolio characteristics? .

3. 1 Supply side • Interest rate (used to estimate the PW): ü Should be a good estimate of the future investment return of pension savings. ü The greater the IR used, the greater the estimated PW. So, the comparison between PW and annuities depend (in part) on the IR used to estimate PW vs. the IR implicit in annuities. ü Differences between IR used to estimate the PW and the actual rate of return of pension savings will have an impact on actual pensions vs. those originally estimated. ü Critical regulatory issues: how to estimate the IR to be used? ; IR should be constant, or should be changed every time the PW is re-estimated? ; should all PW providers use the same IR? ; should the IR depend on the pension savings investment portfolio characteristics? .

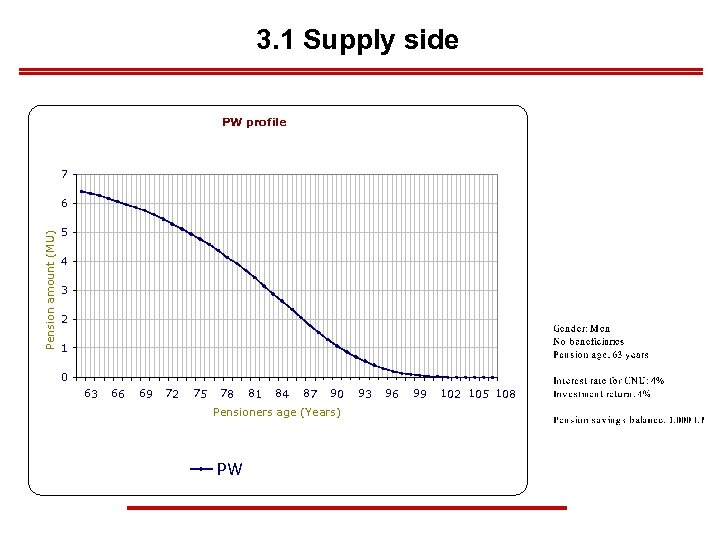

3. 1 Supply side • PW´s amounts depend also on the balance of pension savings; on investments returns; on life expectancies and life expectancies tables; on the number, age and gender of beneficiaries. Since all of these magnitudes can change, usually PW´s are re- estimated periodically. • Under most likely circumstances, the time profile of PW payments will be decreasing. This is because, year to year, life expectancies will decrease in less than a full year (but pension savings would have been used to pay for a full year of pensions). Compensating effects: ü Positive difference between the actual rate of return of the pension fund and the “discount rate” used to estimate the PW. ü Lower number of beneficiaries.

3. 1 Supply side • PW´s amounts depend also on the balance of pension savings; on investments returns; on life expectancies and life expectancies tables; on the number, age and gender of beneficiaries. Since all of these magnitudes can change, usually PW´s are re- estimated periodically. • Under most likely circumstances, the time profile of PW payments will be decreasing. This is because, year to year, life expectancies will decrease in less than a full year (but pension savings would have been used to pay for a full year of pensions). Compensating effects: ü Positive difference between the actual rate of return of the pension fund and the “discount rate” used to estimate the PW. ü Lower number of beneficiaries.

3. 1 Supply side PW profile 7 Pension amount (MU) 6 5 4 3 2 1 0 63 66 69 72 75 78 81 84 87 90 Pensioners age (Years) PW 93 96 99 102 105 108

3. 1 Supply side PW profile 7 Pension amount (MU) 6 5 4 3 2 1 0 63 66 69 72 75 78 81 84 87 90 Pensioners age (Years) PW 93 96 99 102 105 108

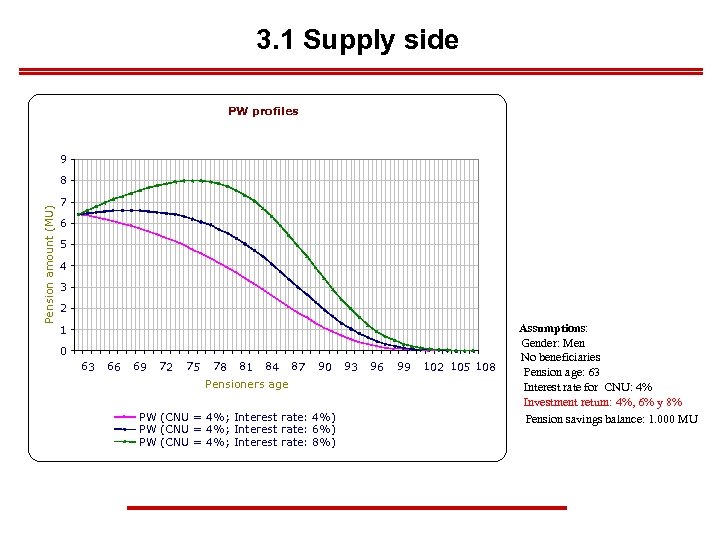

3. 1 Supply side PW profiles 9 Pension amount (MU) 8 7 6 5 4 3 2 1 0 63 66 69 72 75 78 81 84 87 90 Pensioners age PW (CNU = 4%; Interest rate: 4%) PW (CNU = 4%; Interest rate: 6%) PW (CNU = 4%; Interest rate: 8%) 93 96 99 102 105 108 Assumptions: Gender: Men No beneficiaries Pension age: 63 Interest rate for CNU: 4% Investment return: 4%, 6% y 8% Pension savings balance: 1. 000 MU

3. 1 Supply side PW profiles 9 Pension amount (MU) 8 7 6 5 4 3 2 1 0 63 66 69 72 75 78 81 84 87 90 Pensioners age PW (CNU = 4%; Interest rate: 4%) PW (CNU = 4%; Interest rate: 6%) PW (CNU = 4%; Interest rate: 8%) 93 96 99 102 105 108 Assumptions: Gender: Men No beneficiaries Pension age: 63 Interest rate for CNU: 4% Investment return: 4%, 6% y 8% Pension savings balance: 1. 000 MU

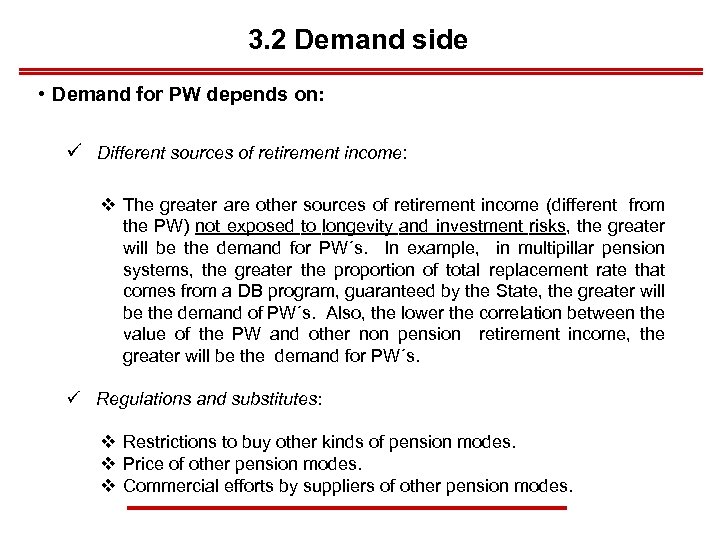

3. 2 Demand side • Demand for PW depends on: ü Different sources of retirement income: v The greater are other sources of retirement income (different from the PW) not exposed to longevity and investment risks, the greater will be the demand for PW´s. In example, in multipillar pension systems, the greater the proportion of total replacement rate that comes from a DB program, guaranteed by the State, the greater will be the demand of PW´s. Also, the lower the correlation between the value of the PW and other non pension retirement income, the greater will be the demand for PW´s. ü Regulations and substitutes: v Restrictions to buy other kinds of pension modes. v Price of other pension modes. v Commercial efforts by suppliers of other pension modes.

3. 2 Demand side • Demand for PW depends on: ü Different sources of retirement income: v The greater are other sources of retirement income (different from the PW) not exposed to longevity and investment risks, the greater will be the demand for PW´s. In example, in multipillar pension systems, the greater the proportion of total replacement rate that comes from a DB program, guaranteed by the State, the greater will be the demand of PW´s. Also, the lower the correlation between the value of the PW and other non pension retirement income, the greater will be the demand for PW´s. ü Regulations and substitutes: v Restrictions to buy other kinds of pension modes. v Price of other pension modes. v Commercial efforts by suppliers of other pension modes.

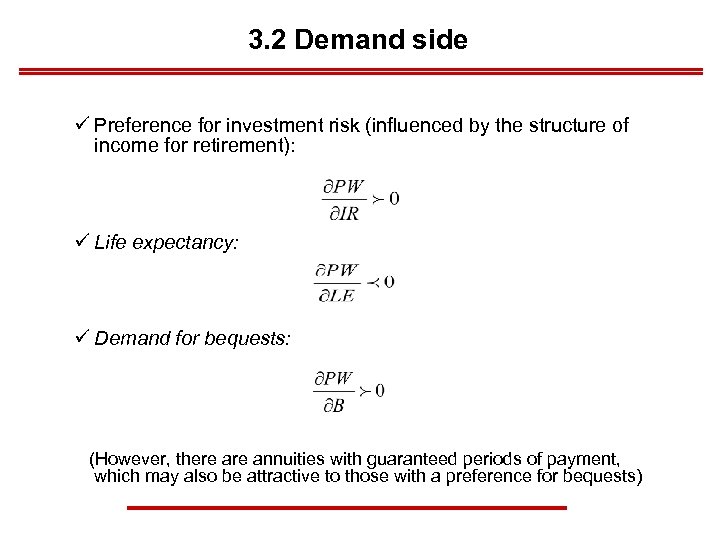

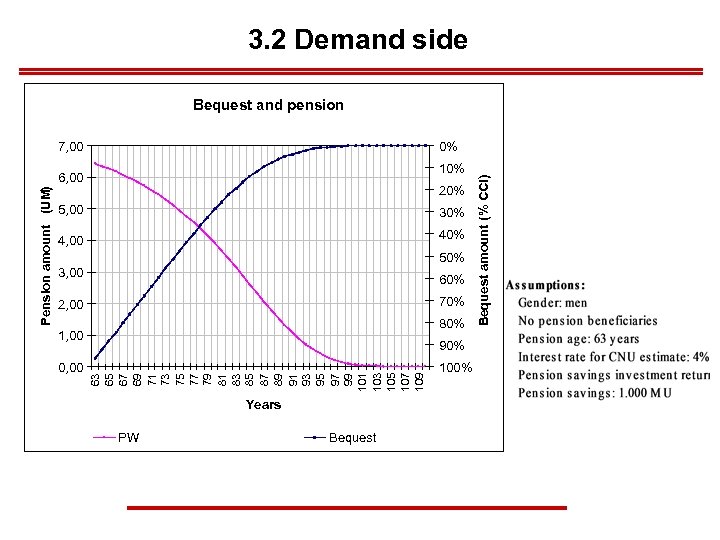

3. 2 Demand side ü Preference for investment risk (influenced by the structure of income for retirement): ü Life expectancy: ü Demand for bequests: (However, there annuities with guaranteed periods of payment, which may also be attractive to those with a preference for bequests)

3. 2 Demand side ü Preference for investment risk (influenced by the structure of income for retirement): ü Life expectancy: ü Demand for bequests: (However, there annuities with guaranteed periods of payment, which may also be attractive to those with a preference for bequests)

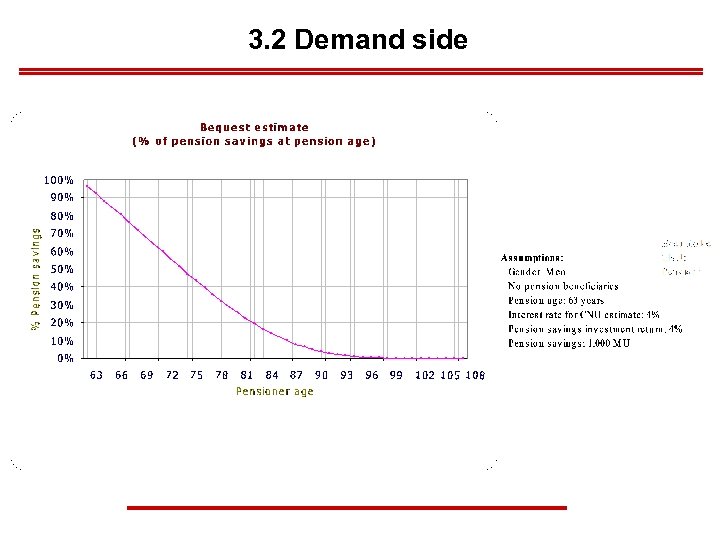

3. 2 Demand side

3. 2 Demand side

3. 2 Demand side Bequest and pension 0% 10% 20% 5, 00 30% 4, 00 50% 3, 00 60% 70% 2, 00 80% 1, 00 0, 00 90% 63 65 67 69 71 73 75 77 79 81 83 85 87 89 91 93 95 97 99 101 103 105 107 109 Pension amount (UM) 6, 00 Years PW Bequest 100% Bequest amount (% CCI) 7, 00

3. 2 Demand side Bequest and pension 0% 10% 20% 5, 00 30% 4, 00 50% 3, 00 60% 70% 2, 00 80% 1, 00 0, 00 90% 63 65 67 69 71 73 75 77 79 81 83 85 87 89 91 93 95 97 99 101 103 105 107 109 Pension amount (UM) 6, 00 Years PW Bequest 100% Bequest amount (% CCI) 7, 00

3. 2 Demand side • What kind of pensioners have actually chosen PW? (chilean experience): ü Pensioners with low level of pension savings: v Some of them could not buy an annuity. v Others were willing to take the investment and longevity risks since they were covered by a minimum pension guarantee. ü Pensioners with very high level of pension savings and/or high wealth: v They have other sources of retirement income uncorrelated with the value of PW´s. ü Pensioners with low life expectancy and with demand for bequests (poorer individuals and those in bad health conditions).

3. 2 Demand side • What kind of pensioners have actually chosen PW? (chilean experience): ü Pensioners with low level of pension savings: v Some of them could not buy an annuity. v Others were willing to take the investment and longevity risks since they were covered by a minimum pension guarantee. ü Pensioners with very high level of pension savings and/or high wealth: v They have other sources of retirement income uncorrelated with the value of PW´s. ü Pensioners with low life expectancy and with demand for bequests (poorer individuals and those in bad health conditions).

3. 3 Intermediation of PW´s • No intense competition between providers of annuities and providers of PW´s has been actually observed: ü In some cases pension fund managers are not authorized to charge for the PW´s they sell. In other cases they have decided not to charge. ü Incentives for pension fund managers to sell PW´s depend on the size of the potential market (relative to the size of the market for active accounts management). • No intense competition between PW providers has been observed. Usually only pension fund managers have been authorized to offer PW´s (no clear reason for this). • Chile introduced an electronic mechanism for “blind quotations” of PW´s and annuities (providers do not know the identity of the individual they are presenting their respective offers to). This has helped to reduce information costs about pension alternatives and has increased competition.

3. 3 Intermediation of PW´s • No intense competition between providers of annuities and providers of PW´s has been actually observed: ü In some cases pension fund managers are not authorized to charge for the PW´s they sell. In other cases they have decided not to charge. ü Incentives for pension fund managers to sell PW´s depend on the size of the potential market (relative to the size of the market for active accounts management). • No intense competition between PW providers has been observed. Usually only pension fund managers have been authorized to offer PW´s (no clear reason for this). • Chile introduced an electronic mechanism for “blind quotations” of PW´s and annuities (providers do not know the identity of the individual they are presenting their respective offers to). This has helped to reduce information costs about pension alternatives and has increased competition.

4. Policy Conclusions

4. Policy Conclusions

4. Policy conclusions • Should PW´s be authorized at all? : ü PW seem to be at odds with a mandatory pension system objectives. ü Pensioners do not seem to be well prepared to manage both investment and longevity risks. • On the other hand, in some cases PW will contribute only a small fraction to total retirement income: ü When the relative size of the mandatory funded pension programs (compared with the other pension programs which are part of the pension system) is small. ü When individuals have other (non pension) sources of retirement income. ( It is also relevant to see if those other sources of retirement income are or not uncorrelated with the value of PW’s)

4. Policy conclusions • Should PW´s be authorized at all? : ü PW seem to be at odds with a mandatory pension system objectives. ü Pensioners do not seem to be well prepared to manage both investment and longevity risks. • On the other hand, in some cases PW will contribute only a small fraction to total retirement income: ü When the relative size of the mandatory funded pension programs (compared with the other pension programs which are part of the pension system) is small. ü When individuals have other (non pension) sources of retirement income. ( It is also relevant to see if those other sources of retirement income are or not uncorrelated with the value of PW’s)

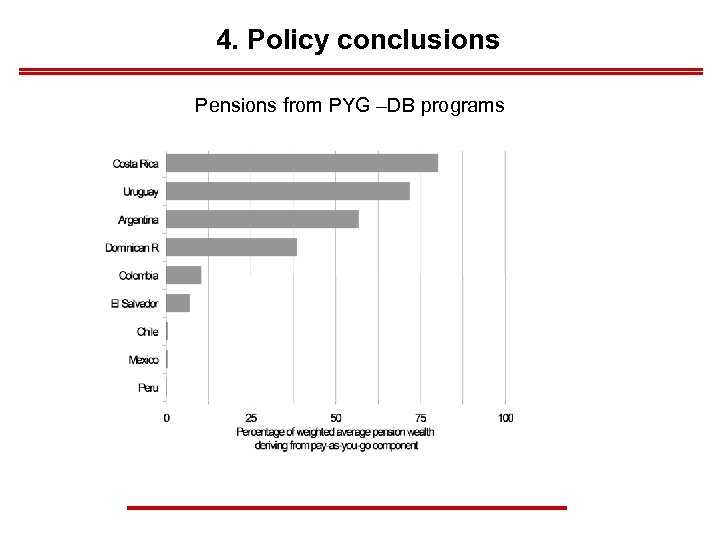

4. Policy conclusions Pensions from PYG –DB programs

4. Policy conclusions Pensions from PYG –DB programs

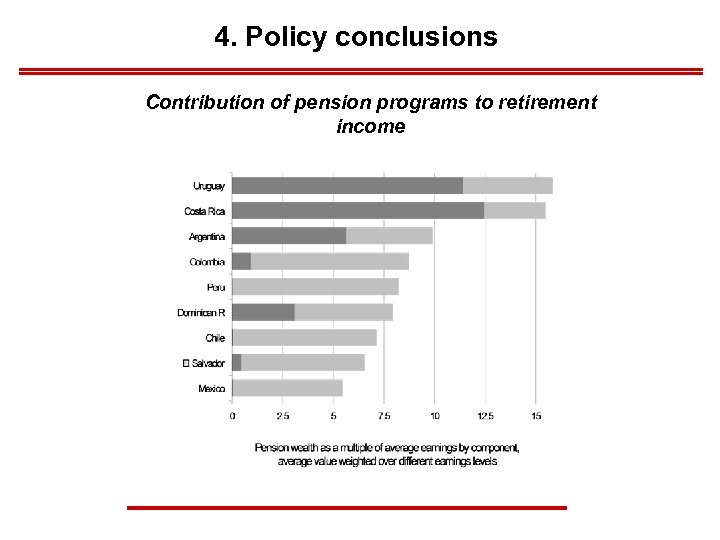

4. Policy conclusions Contribution of pension programs to retirement income

4. Policy conclusions Contribution of pension programs to retirement income

4. Policy conclusions • Moreover, to authorize only annuities has problems of its own: ü Low income individuals and those in poor health have lower life expectancies. Does the pension system want to re-distribute against them? ü The mandate to annuitize may come at a bad time (after a period of low returns; or in a period with high annuity prices). ü It's not easy and it takes a time to create efficient markets for annuities. ü The obligations of companies offering annuities will be very long term. So, solvency problems are relevant. Efficient regulation and supervision of providers is necessary. ü Annuities may be an expensive product to buy (particularly for individuals with low pension savings).

4. Policy conclusions • Moreover, to authorize only annuities has problems of its own: ü Low income individuals and those in poor health have lower life expectancies. Does the pension system want to re-distribute against them? ü The mandate to annuitize may come at a bad time (after a period of low returns; or in a period with high annuity prices). ü It's not easy and it takes a time to create efficient markets for annuities. ü The obligations of companies offering annuities will be very long term. So, solvency problems are relevant. Efficient regulation and supervision of providers is necessary. ü Annuities may be an expensive product to buy (particularly for individuals with low pension savings).

4. Policy conclusions • So, particularly when mandatory pension savings finance only part of retirement income (and the other sources are uncorrelated with PW’s), PW´s should be an authorized pension mode. üBut there are important ‘micro design” issues to be solved: PW formula; investments regulations during retirement. • Annuities should always be offered as an alternative to PW´s, and PW´s pensioners should be authorized to switch to annuities at any time, and to combine PW´s and annuities. • Eventually, buying a PW could be restricted to those who give proof that they have protected some target replacement rate starting at some (late) age (say 75) (but easier to say than to implement…. ). One alternative is to authorize PW only in combination with deferred annuities.

4. Policy conclusions • So, particularly when mandatory pension savings finance only part of retirement income (and the other sources are uncorrelated with PW’s), PW´s should be an authorized pension mode. üBut there are important ‘micro design” issues to be solved: PW formula; investments regulations during retirement. • Annuities should always be offered as an alternative to PW´s, and PW´s pensioners should be authorized to switch to annuities at any time, and to combine PW´s and annuities. • Eventually, buying a PW could be restricted to those who give proof that they have protected some target replacement rate starting at some (late) age (say 75) (but easier to say than to implement…. ). One alternative is to authorize PW only in combination with deferred annuities.

Programmed Withdrawals Augusto Iglesias P. Prim. América Consultores

Programmed Withdrawals Augusto Iglesias P. Prim. América Consultores