d357b684b46c7c97308ab3dc3a80e15d.ppt

- Количество слайдов: 41

PROGRAMME § 09: 15 Tom Kovacic Madame Tussauds § 10: 00 Andre Fucci Lavazza Coffee § 10: 45 Break § 11: 00 Sheelagh Wylie Xanadu § 11: 45 Video § 12: 00 Close

PROGRAMME § 09: 15 Tom Kovacic Madame Tussauds § 10: 00 Andre Fucci Lavazza Coffee § 10: 45 Break § 11: 00 Sheelagh Wylie Xanadu § 11: 45 Video § 12: 00 Close

Tom Kovacic Madame Tussauds

Tom Kovacic Madame Tussauds

know wants to

know wants to

know wants to

know wants to

know wants to

know wants to

know wants to

know wants to

know wants to

know wants to

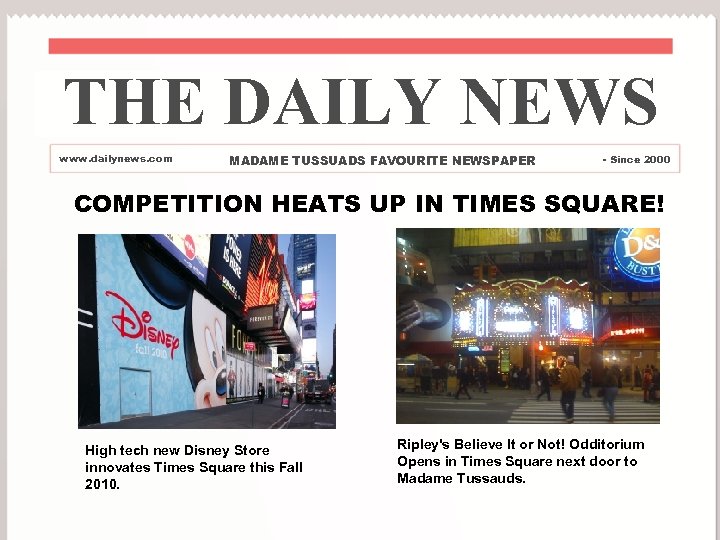

THE DAILY NEWS www. dailynews. com MADAME TUSSUADS FAVOURITE NEWSPAPER - Since 2000 COMPETITION HEATS UP IN TIMES SQUARE! High tech new Disney Store innovates Times Square this Fall 2010. Ripley's Believe It or Not! Odditorium Opens in Times Square next door to Madame Tussauds.

THE DAILY NEWS www. dailynews. com MADAME TUSSUADS FAVOURITE NEWSPAPER - Since 2000 COMPETITION HEATS UP IN TIMES SQUARE! High tech new Disney Store innovates Times Square this Fall 2010. Ripley's Believe It or Not! Odditorium Opens in Times Square next door to Madame Tussauds.

• Promotions - incentive • Partnerships - reach • Targeted Ads - segmenting • Online and Social Marketing - Facebook • Press - It’s free! And POWERFUL

• Promotions - incentive • Partnerships - reach • Targeted Ads - segmenting • Online and Social Marketing - Facebook • Press - It’s free! And POWERFUL

• CUSTOMER SERVICE + HOSPITALITY • MOMENT OF TRUTH TRAINING

• CUSTOMER SERVICE + HOSPITALITY • MOMENT OF TRUTH TRAINING

When we meet or go beyond visitor expectations: • the visitors become part of our marketing team • the visitors will recommend us and return

When we meet or go beyond visitor expectations: • the visitors become part of our marketing team • the visitors will recommend us and return

know wants to

know wants to

know wants to

know wants to

Andre Fucci Lavazza Coffee

Andre Fucci Lavazza Coffee

EST Congress Lavazza Away From Home North America Andre Fucci, New York 21 st march 2009

EST Congress Lavazza Away From Home North America Andre Fucci, New York 21 st march 2009

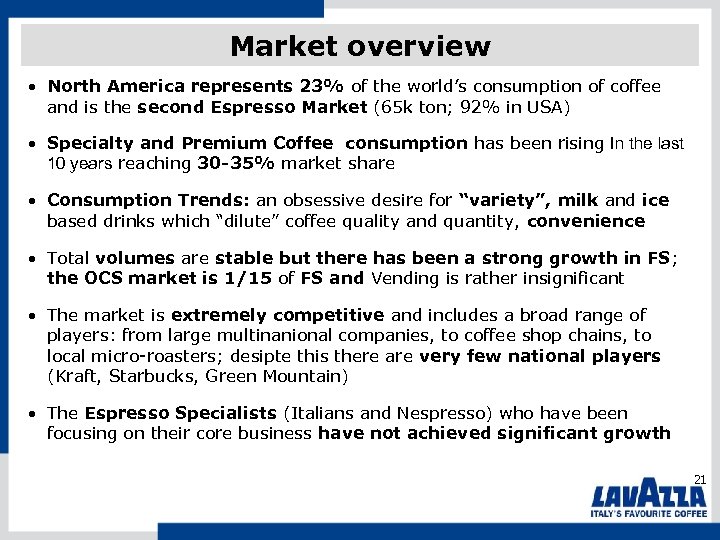

Market overview • North America represents 23% of the world’s consumption of coffee and is the second Espresso Market (65 k ton; 92% in USA) • Specialty and Premium Coffee consumption has been rising In the last 10 years reaching 30 -35% market share • Consumption Trends: an obsessive desire for “variety”, milk and ice based drinks which “dilute” coffee quality and quantity, convenience • Total volumes are stable but there has been a strong growth in FS; the OCS market is 1/15 of FS and Vending is rather insignificant • The market is extremely competitive and includes a broad range of players: from large multinanional companies, to coffee shop chains, to local micro-roasters; desipte this there are very few national players (Kraft, Starbucks, Green Mountain) • The Espresso Specialists (Italians and Nespresso) who have been focusing on their core business have not achieved significant growth 21

Market overview • North America represents 23% of the world’s consumption of coffee and is the second Espresso Market (65 k ton; 92% in USA) • Specialty and Premium Coffee consumption has been rising In the last 10 years reaching 30 -35% market share • Consumption Trends: an obsessive desire for “variety”, milk and ice based drinks which “dilute” coffee quality and quantity, convenience • Total volumes are stable but there has been a strong growth in FS; the OCS market is 1/15 of FS and Vending is rather insignificant • The market is extremely competitive and includes a broad range of players: from large multinanional companies, to coffee shop chains, to local micro-roasters; desipte this there are very few national players (Kraft, Starbucks, Green Mountain) • The Espresso Specialists (Italians and Nespresso) who have been focusing on their core business have not achieved significant growth 21

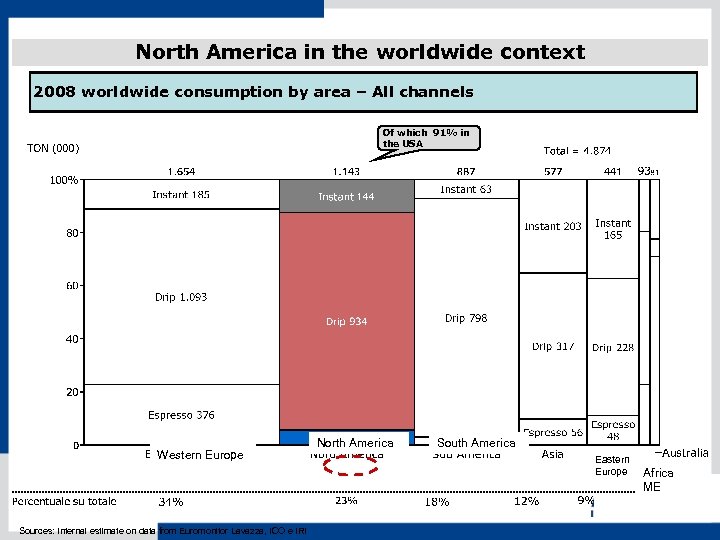

North America in the worldwide context 2008 worldwide consumption by area – All channels Of which 91% in the USA Western Europe Sources: Internal estimate on data from Euromonitor Lavazza, ICO e IRI North America South America Eastern Europe Africa ME 22

North America in the worldwide context 2008 worldwide consumption by area – All channels Of which 91% in the USA Western Europe Sources: Internal estimate on data from Euromonitor Lavazza, ICO e IRI North America South America Eastern Europe Africa ME 22

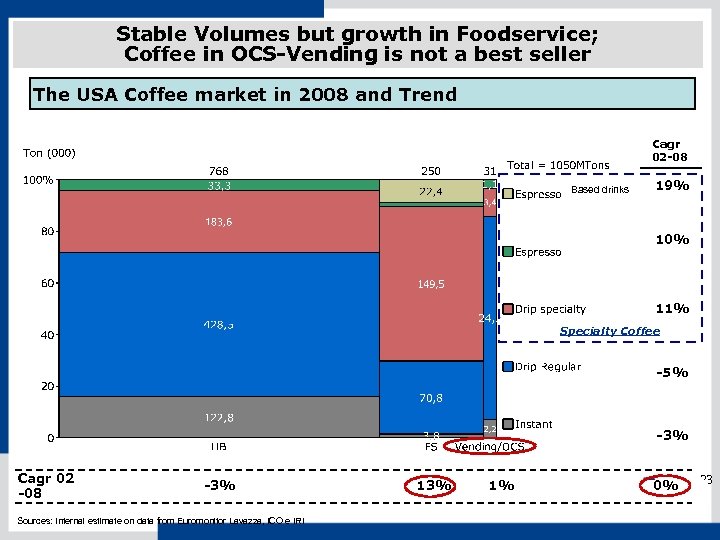

Stable Volumes but growth in Foodservice; Coffee in OCS-Vending is not a best seller The USA Coffee market in 2008 and Trend Cagr 02 -08 Based drinks 19% 10% 11% Specialty Coffee -5% -3% Cagr 02 -08 -3% Sources: Internal estimate on data from Euromonitor Lavazza, ICO e IRI 13% 1% 0% 23

Stable Volumes but growth in Foodservice; Coffee in OCS-Vending is not a best seller The USA Coffee market in 2008 and Trend Cagr 02 -08 Based drinks 19% 10% 11% Specialty Coffee -5% -3% Cagr 02 -08 -3% Sources: Internal estimate on data from Euromonitor Lavazza, ICO e IRI 13% 1% 0% 23

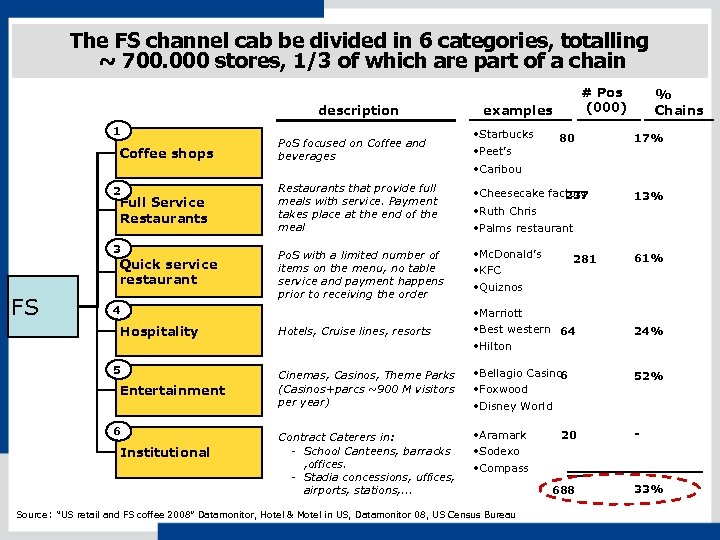

The FS channel cab be divided in 6 categories, totalling ~ 700. 000 stores, 1/3 of which are part of a chain description 1 Coffee shops 2 Full Service Restaurants 3 Quick service restaurant FS Po. S focused on Coffee and beverages 5 Entertainment 6 Institutional examples • Starbucks • Peet’s 80 % Chains 17% • Caribou Restaurants that provide full meals with service. Payment takes place at the end of the meal • Cheesecake factory 237 • Ruth Chris • Palms restaurant 13% Po. S with a limited number of items on the menu, no table service and payment happens prior to receiving the order • Mc. Donald’s • KFC • Quiznos 61% Hotels, Cruise lines, resorts • Marriott • Best western 64 • Hilton Cinemas, Casinos, Theme Parks (Casinos+parcs ~900 M visitors per year) • Bellagio Casino 6 • Foxwood • Disney World 52% Contract Caterers in: - School Canteens, barracks , offices. - Stadia concessions, uffices, airports, stations, . . . • Aramark • Sodexo • Compass - 4 Hospitality # Pos (000) Source: “US retail and FS coffee 2008” Datamonitor, Hotel & Motel in US, Datamonitor 08, US Census Bureau 281 20 688 24% 33% 24

The FS channel cab be divided in 6 categories, totalling ~ 700. 000 stores, 1/3 of which are part of a chain description 1 Coffee shops 2 Full Service Restaurants 3 Quick service restaurant FS Po. S focused on Coffee and beverages 5 Entertainment 6 Institutional examples • Starbucks • Peet’s 80 % Chains 17% • Caribou Restaurants that provide full meals with service. Payment takes place at the end of the meal • Cheesecake factory 237 • Ruth Chris • Palms restaurant 13% Po. S with a limited number of items on the menu, no table service and payment happens prior to receiving the order • Mc. Donald’s • KFC • Quiznos 61% Hotels, Cruise lines, resorts • Marriott • Best western 64 • Hilton Cinemas, Casinos, Theme Parks (Casinos+parcs ~900 M visitors per year) • Bellagio Casino 6 • Foxwood • Disney World 52% Contract Caterers in: - School Canteens, barracks , offices. - Stadia concessions, uffices, airports, stations, . . . • Aramark • Sodexo • Compass - 4 Hospitality # Pos (000) Source: “US retail and FS coffee 2008” Datamonitor, Hotel & Motel in US, Datamonitor 08, US Census Bureau 281 20 688 24% 33% 24

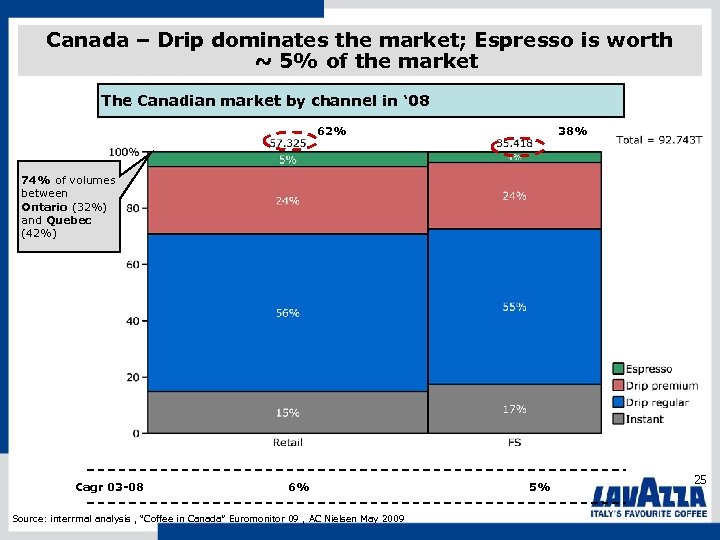

Canada – Drip dominates the market; Espresso is worth ~ 5% of the market The Canadian market by channel in ‘ 08 62% 38% 74% of volumes between Ontario (32%) and Quebec (42%) Cagr 03 -08 6% Source: interrmal analysis , “Coffee in Canada” Euromonitor 09 , AC Nielsen May 2009 5% 25

Canada – Drip dominates the market; Espresso is worth ~ 5% of the market The Canadian market by channel in ‘ 08 62% 38% 74% of volumes between Ontario (32%) and Quebec (42%) Cagr 03 -08 6% Source: interrmal analysis , “Coffee in Canada” Euromonitor 09 , AC Nielsen May 2009 5% 25

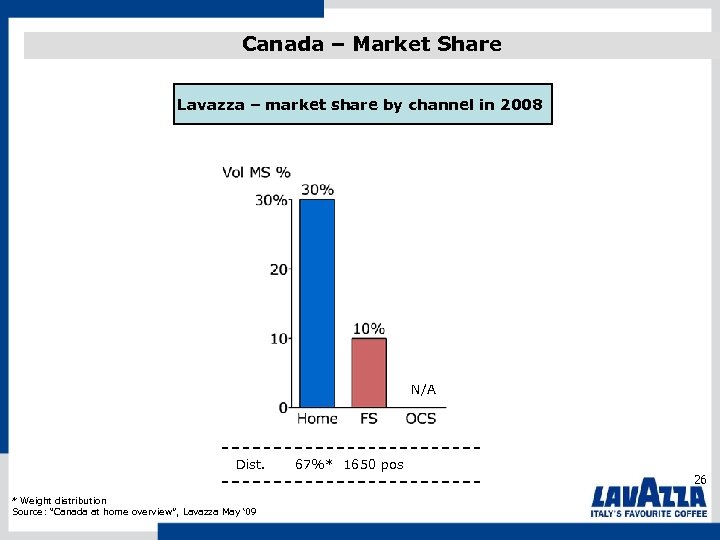

Canada – Market Share Lavazza – market share by channel in 2008 N/A Dist. 67%* 1650 pos 26 * Weight distribution Source: “Canada at home overview”, Lavazza May ‘ 09

Canada – Market Share Lavazza – market share by channel in 2008 N/A Dist. 67%* 1650 pos 26 * Weight distribution Source: “Canada at home overview”, Lavazza May ‘ 09

Lavazza North America: Foodservice chip accounts Over 3, 500 top ranked white tablecloth restaurants, hotels and cafes PRESTIGIOUS US-CANADA ACCOUNTS:

Lavazza North America: Foodservice chip accounts Over 3, 500 top ranked white tablecloth restaurants, hotels and cafes PRESTIGIOUS US-CANADA ACCOUNTS:

Lavazza North America: Foodservice chip accounts

Lavazza North America: Foodservice chip accounts

Lavazza and Regal Entertainment Group is the largest motion picture exhibitor in the world • Operates the largest and most geographically diverse theatre circuit in the United States: • • • 552 theatres (6, 801 screens) in 39 states 242 million attendees Head Office in Knoxville TN Annual Revenue $ 2. 6 billion Founded 1989 28, 000 employees

Lavazza and Regal Entertainment Group is the largest motion picture exhibitor in the world • Operates the largest and most geographically diverse theatre circuit in the United States: • • • 552 theatres (6, 801 screens) in 39 states 242 million attendees Head Office in Knoxville TN Annual Revenue $ 2. 6 billion Founded 1989 28, 000 employees

Distribution - Lavazza and Regal Cinemas Ø Coffee program: BLUE Colibri Ø SUPPLY Capsules and powders through National Distributors (Vistar, Core-Mark Int. , Clark Products) Ø Equipment installation by a National third party Network and TRAINING by Lavazza Staff Ø TECHNICAL SERVICE 1 -800 number ØDesign AD HOC Coffee Menu and POS Materials

Distribution - Lavazza and Regal Cinemas Ø Coffee program: BLUE Colibri Ø SUPPLY Capsules and powders through National Distributors (Vistar, Core-Mark Int. , Clark Products) Ø Equipment installation by a National third party Network and TRAINING by Lavazza Staff Ø TECHNICAL SERVICE 1 -800 number ØDesign AD HOC Coffee Menu and POS Materials

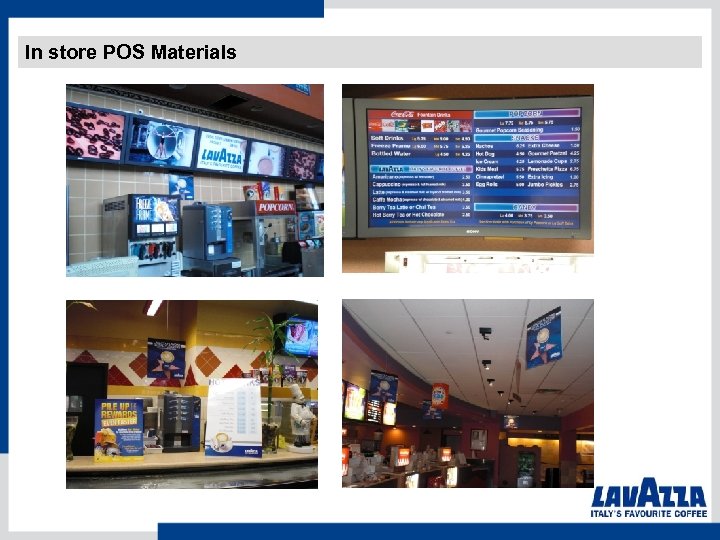

POS materials Ø AD HOC POS Materials Menu , Danglers, Cups

POS materials Ø AD HOC POS Materials Menu , Danglers, Cups

The Test • Equipment: BLUE Colibri • Number of Locations: 15 Theatres • Duration of the test: 12 weeks (10. 15. 08 – 1. 15. 09) • Parameters of the test: Ø Unit sales per 1000 patrons: higher than 3 Ø Drink preference/volume review Ø Consumer comments (positive or negative) & overall customer satisfaction Ø Cannibalization on other beverages (if any) Ø Lavazza product performance vs. existing coffee program • Sales during the test period: 400 capsules/cinema/month

The Test • Equipment: BLUE Colibri • Number of Locations: 15 Theatres • Duration of the test: 12 weeks (10. 15. 08 – 1. 15. 09) • Parameters of the test: Ø Unit sales per 1000 patrons: higher than 3 Ø Drink preference/volume review Ø Consumer comments (positive or negative) & overall customer satisfaction Ø Cannibalization on other beverages (if any) Ø Lavazza product performance vs. existing coffee program • Sales during the test period: 400 capsules/cinema/month

Lavazza in 504 locations

Lavazza in 504 locations

In store POS Materials

In store POS Materials

Lavazza and Hilton Hotels (USA & CANADA) Lavazza branded premium in-room coffee program: • 550+ locations; circa 90, 000 rooms • Single serve pod used with a Cuisinart Hilton proprietary brewer • Estimated volume for 2009: 140, 000 kilos or 15. 3 million pods • The pods are offered to hotel guests free of charge and sold by Sara Lee to Hilton for circa $0. 175/pod • Customized Lavazza POS material: ceramics coffee mugs, paper cups and stirrers • Revenue: $2, 375, 000

Lavazza and Hilton Hotels (USA & CANADA) Lavazza branded premium in-room coffee program: • 550+ locations; circa 90, 000 rooms • Single serve pod used with a Cuisinart Hilton proprietary brewer • Estimated volume for 2009: 140, 000 kilos or 15. 3 million pods • The pods are offered to hotel guests free of charge and sold by Sara Lee to Hilton for circa $0. 175/pod • Customized Lavazza POS material: ceramics coffee mugs, paper cups and stirrers • Revenue: $2, 375, 000

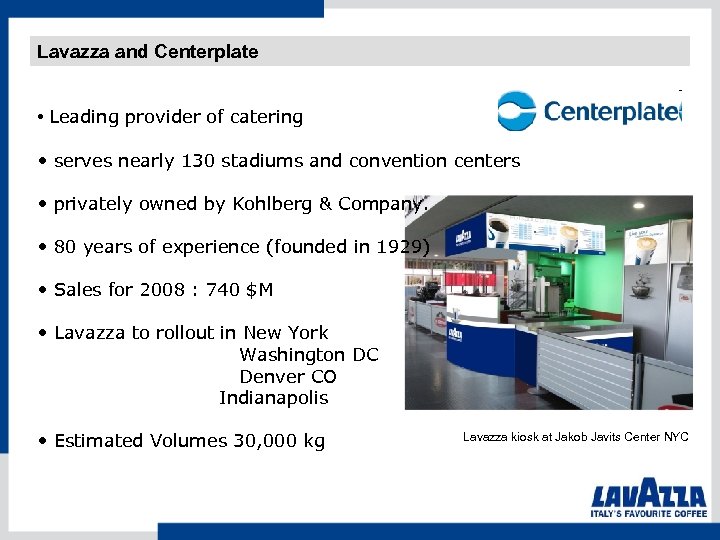

Lavazza and Centerplate • Leading provider of catering • serves nearly 130 stadiums and convention centers • privately owned by Kohlberg & Company. • 80 years of experience (founded in 1929) • Sales for 2008 : 740 $M • Lavazza to rollout in New York Washington DC Denver CO Indianapolis • Estimated Volumes 30, 000 kg Lavazza kiosk at Jakob Javits Center NYC

Lavazza and Centerplate • Leading provider of catering • serves nearly 130 stadiums and convention centers • privately owned by Kohlberg & Company. • 80 years of experience (founded in 1929) • Sales for 2008 : 740 $M • Lavazza to rollout in New York Washington DC Denver CO Indianapolis • Estimated Volumes 30, 000 kg Lavazza kiosk at Jakob Javits Center NYC

Lavazza success factors • Authenticity • Heritage • Brand Equity • Quality – Premium market • Innovation • Service • Distribution • People

Lavazza success factors • Authenticity • Heritage • Brand Equity • Quality – Premium market • Innovation • Service • Distribution • People

QUESTIONS

QUESTIONS

Sheelagh Wylie Xanadu

Sheelagh Wylie Xanadu

QUESTIONS

QUESTIONS