84ab079d93d4fb3c77b16c5b9b2c0025.ppt

- Количество слайдов: 24

Program logo here Program Executive Office Command, Control, Communications, Computers and Intelligence (PEO C 4 I) Bringing Commonality to Navy Afloat Networks: Consolidated Afloat Networks and Enterprise Services (CANES) http//www. peoc 4 i. navy. mil/CANES 16 Oct 2008 CDR Phil Turner PEO C 4 I/PMW 160 Statement A: Approved for public release; distribution is unlimited (16 Oct) Information Dominance Anytime, Anywhere… PEOC 4 I. NAVY. MIL

Program logo here Program Executive Office Command, Control, Communications, Computers and Intelligence (PEO C 4 I) Bringing Commonality to Navy Afloat Networks: Consolidated Afloat Networks and Enterprise Services (CANES) http//www. peoc 4 i. navy. mil/CANES 16 Oct 2008 CDR Phil Turner PEO C 4 I/PMW 160 Statement A: Approved for public release; distribution is unlimited (16 Oct) Information Dominance Anytime, Anywhere… PEOC 4 I. NAVY. MIL

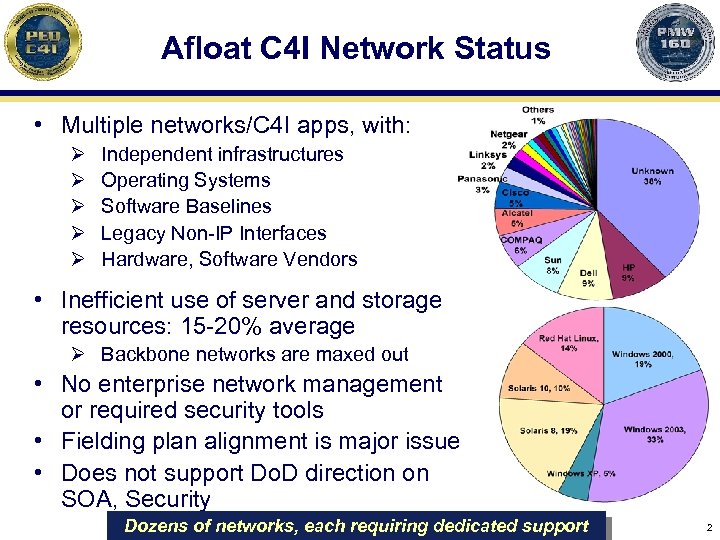

Afloat C 4 I Network Status • Multiple networks/C 4 I apps, with: Ø Ø Ø Independent infrastructures Operating Systems Software Baselines Legacy Non-IP Interfaces Hardware, Software Vendors • Inefficient use of server and storage resources: 15 -20% average Ø Backbone networks are maxed out • No enterprise network management or required security tools • Fielding plan alignment is major issue • Does not support Do. D direction on SOA, Security Dozens of networks, each requiring dedicated support 2

Afloat C 4 I Network Status • Multiple networks/C 4 I apps, with: Ø Ø Ø Independent infrastructures Operating Systems Software Baselines Legacy Non-IP Interfaces Hardware, Software Vendors • Inefficient use of server and storage resources: 15 -20% average Ø Backbone networks are maxed out • No enterprise network management or required security tools • Fielding plan alignment is major issue • Does not support Do. D direction on SOA, Security Dozens of networks, each requiring dedicated support 2

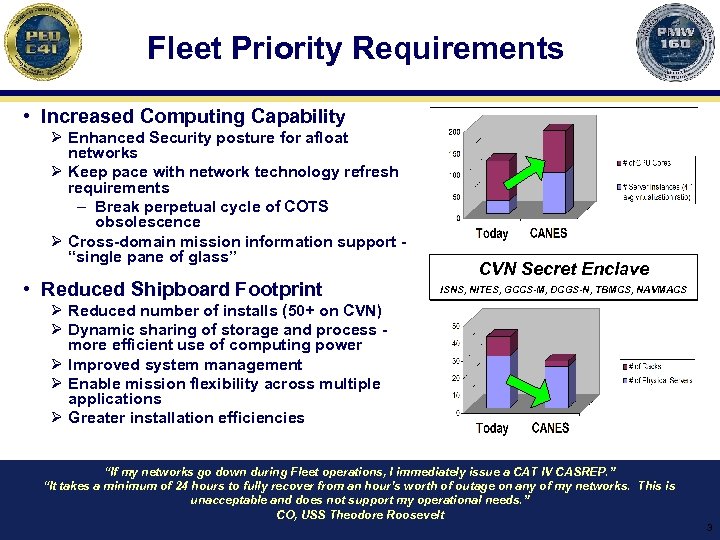

Fleet Priority Requirements • Increased Computing Capability Ø Enhanced Security posture for afloat networks Ø Keep pace with network technology refresh requirements – Break perpetual cycle of COTS obsolescence Ø Cross-domain mission information support “single pane of glass” • Reduced Shipboard Footprint CVN Secret Enclave ISNS, NITES, GCCS-M, DCGS-N, TBMCS, NAVMACS Ø Reduced number of installs (50+ on CVN) Ø Dynamic sharing of storage and process more efficient use of computing power Ø Improved system management Ø Enable mission flexibility across multiple applications Ø Greater installation efficiencies “If my networks go down during Fleet operations, I immediately issue a CAT IV CASREP. ” “It takes a minimum of 24 hours to fully recover from an hour’s worth of outage on any of my networks. This is unacceptable and does not support my operational needs. ” CO, USS Theodore Roosevelt 3

Fleet Priority Requirements • Increased Computing Capability Ø Enhanced Security posture for afloat networks Ø Keep pace with network technology refresh requirements – Break perpetual cycle of COTS obsolescence Ø Cross-domain mission information support “single pane of glass” • Reduced Shipboard Footprint CVN Secret Enclave ISNS, NITES, GCCS-M, DCGS-N, TBMCS, NAVMACS Ø Reduced number of installs (50+ on CVN) Ø Dynamic sharing of storage and process more efficient use of computing power Ø Improved system management Ø Enable mission flexibility across multiple applications Ø Greater installation efficiencies “If my networks go down during Fleet operations, I immediately issue a CAT IV CASREP. ” “It takes a minimum of 24 hours to fully recover from an hour’s worth of outage on any of my networks. This is unacceptable and does not support my operational needs. ” CO, USS Theodore Roosevelt 3

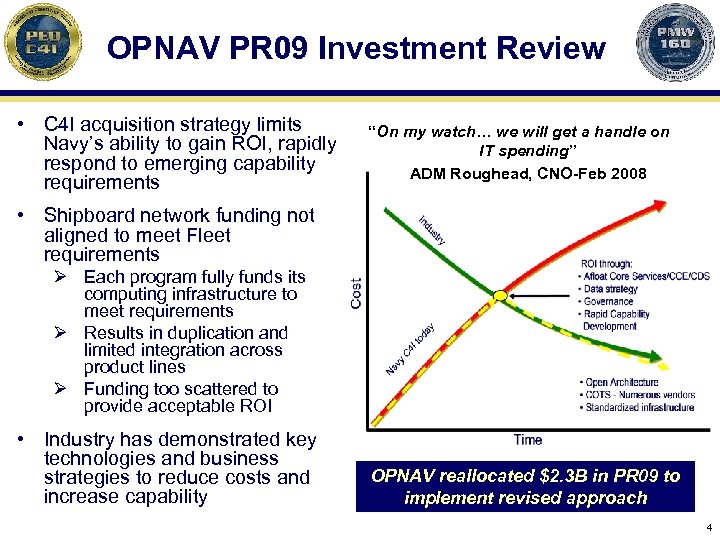

OPNAV PR 09 Investment Review • C 4 I acquisition strategy limits Navy’s ability to gain ROI, rapidly respond to emerging capability requirements “On my watch… we will get a handle on IT spending” ADM Roughead, CNO-Feb 2008 • Shipboard network funding not aligned to meet Fleet requirements Ø Each program fully funds its computing infrastructure to meet requirements Ø Results in duplication and limited integration across product lines Ø Funding too scattered to provide acceptable ROI • Industry has demonstrated key technologies and business strategies to reduce costs and increase capability OPNAV reallocated $2. 3 B in PR 09 to implement revised approach 4

OPNAV PR 09 Investment Review • C 4 I acquisition strategy limits Navy’s ability to gain ROI, rapidly respond to emerging capability requirements “On my watch… we will get a handle on IT spending” ADM Roughead, CNO-Feb 2008 • Shipboard network funding not aligned to meet Fleet requirements Ø Each program fully funds its computing infrastructure to meet requirements Ø Results in duplication and limited integration across product lines Ø Funding too scattered to provide acceptable ROI • Industry has demonstrated key technologies and business strategies to reduce costs and increase capability OPNAV reallocated $2. 3 B in PR 09 to implement revised approach 4

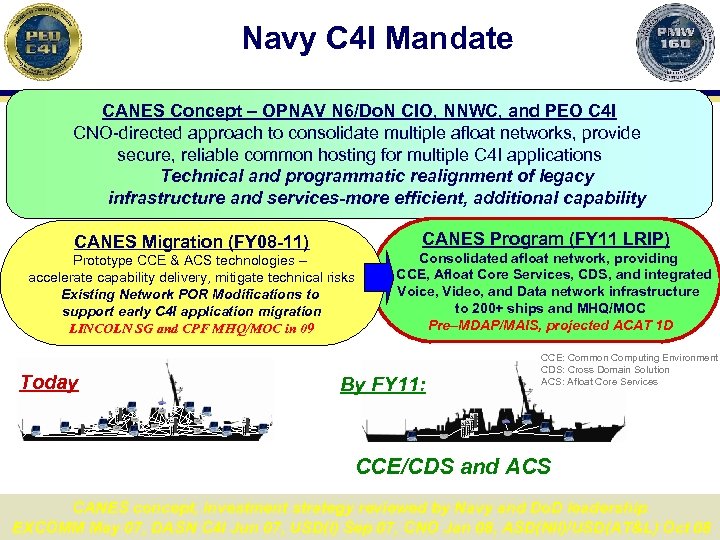

Navy C 4 I Mandate CANES Concept – OPNAV N 6/Do. N CIO, NNWC, and PEO C 4 I CNO-directed approach to consolidate multiple afloat networks, provide secure, reliable common hosting for multiple C 4 I applications Technical and programmatic realignment of legacy infrastructure and services-more efficient, additional capability CANES Program (FY 11 LRIP) CANES Migration (FY 08 -11) Prototype CCE & ACS technologies – accelerate capability delivery, mitigate technical risks Existing Network POR Modifications to support early C 4 I application migration LINCOLN SG and CPF MHQ/MOC in 09 Today Consolidated afloat network, providing CCE, Afloat Core Services, CDS, and integrated Voice, Video, and Data network infrastructure to 200+ ships and MHQ/MOC Pre–MDAP/MAIS, projected ACAT 1 D By FY 11: CCE: Common Computing Environment CDS: Cross Domain Solution ACS: Afloat Core Services CCE/CDS and ACS CANES concept, investment strategy reviewed by Navy and Do. D leadership 5 EXCOMM May 07, DASN C 4 I Jun 07, USD(I) Sep 07, CNO Jan 08, ASD(NII)/USD(AT&L) Oct 08

Navy C 4 I Mandate CANES Concept – OPNAV N 6/Do. N CIO, NNWC, and PEO C 4 I CNO-directed approach to consolidate multiple afloat networks, provide secure, reliable common hosting for multiple C 4 I applications Technical and programmatic realignment of legacy infrastructure and services-more efficient, additional capability CANES Program (FY 11 LRIP) CANES Migration (FY 08 -11) Prototype CCE & ACS technologies – accelerate capability delivery, mitigate technical risks Existing Network POR Modifications to support early C 4 I application migration LINCOLN SG and CPF MHQ/MOC in 09 Today Consolidated afloat network, providing CCE, Afloat Core Services, CDS, and integrated Voice, Video, and Data network infrastructure to 200+ ships and MHQ/MOC Pre–MDAP/MAIS, projected ACAT 1 D By FY 11: CCE: Common Computing Environment CDS: Cross Domain Solution ACS: Afloat Core Services CCE/CDS and ACS CANES concept, investment strategy reviewed by Navy and Do. D leadership 5 EXCOMM May 07, DASN C 4 I Jun 07, USD(I) Sep 07, CNO Jan 08, ASD(NII)/USD(AT&L) Oct 08

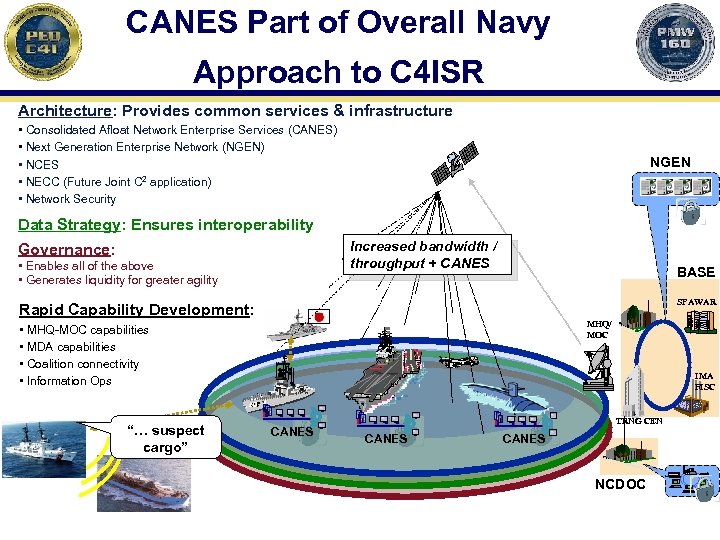

CANES Part of Overall Navy Approach to C 4 ISR Architecture: Provides common services & infrastructure • Consolidated Afloat Network Enterprise Services (CANES) • Next Generation Enterprise Network (NGEN) • NCES • NECC (Future Joint C 2 application) • Network Security NGEN Data Strategy: Ensures interoperability Increased bandwidth / throughput + CANES Governance: • Enables all of the above • Generates liquidity for greater agility BASE SPAWAR Rapid Capability Development: MHQ/ MOC • MHQ-MOC capabilities • MDA capabilities • Coalition connectivity • Information Ops “… suspect cargo” IMA FISC CANES TRNG CEN CANES NCDOC

CANES Part of Overall Navy Approach to C 4 ISR Architecture: Provides common services & infrastructure • Consolidated Afloat Network Enterprise Services (CANES) • Next Generation Enterprise Network (NGEN) • NCES • NECC (Future Joint C 2 application) • Network Security NGEN Data Strategy: Ensures interoperability Increased bandwidth / throughput + CANES Governance: • Enables all of the above • Generates liquidity for greater agility BASE SPAWAR Rapid Capability Development: MHQ/ MOC • MHQ-MOC capabilities • MDA capabilities • Coalition connectivity • Information Ops “… suspect cargo” IMA FISC CANES TRNG CEN CANES NCDOC

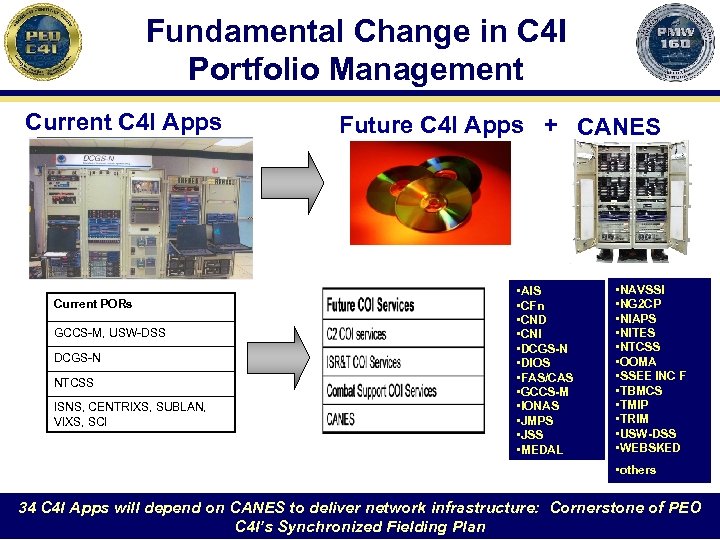

Fundamental Change in C 4 I Portfolio Management Current C 4 I Apps Current PORs GCCS-M, USW-DSS DCGS-N NTCSS ISNS, CENTRIXS, SUBLAN, VIXS, SCI Future C 4 I Apps + CANES • AIS • CFn • CND • CNI • DCGS-N • DIOS • FAS/CAS • GCCS-M • IONAS • JMPS • JSS • MEDAL • NAVSSI • NG 2 CP • NIAPS • NITES • NTCSS • OOMA • SSEE INC F • TBMCS • TMIP • TRIM • USW-DSS • WEBSKED • others 34 C 4 I Apps will depend on CANES to deliver network infrastructure: Cornerstone of PEO C 4 I’s Synchronized Fielding Plan

Fundamental Change in C 4 I Portfolio Management Current C 4 I Apps Current PORs GCCS-M, USW-DSS DCGS-N NTCSS ISNS, CENTRIXS, SUBLAN, VIXS, SCI Future C 4 I Apps + CANES • AIS • CFn • CND • CNI • DCGS-N • DIOS • FAS/CAS • GCCS-M • IONAS • JMPS • JSS • MEDAL • NAVSSI • NG 2 CP • NIAPS • NITES • NTCSS • OOMA • SSEE INC F • TBMCS • TMIP • TRIM • USW-DSS • WEBSKED • others 34 C 4 I Apps will depend on CANES to deliver network infrastructure: Cornerstone of PEO C 4 I’s Synchronized Fielding Plan

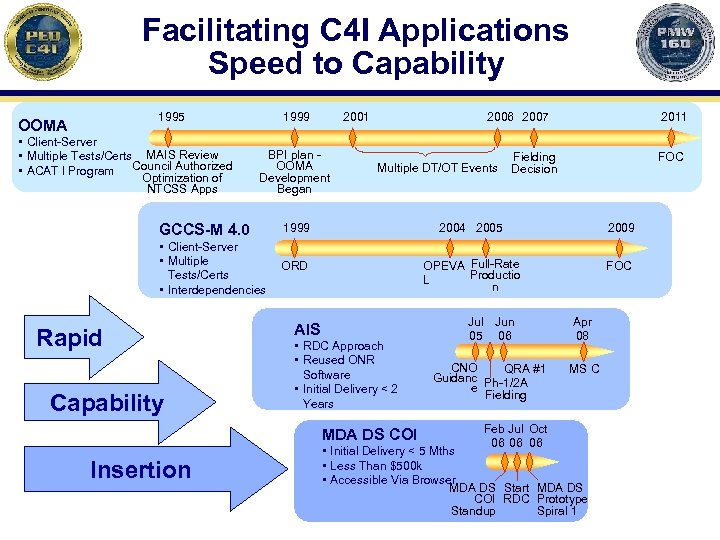

Facilitating C 4 I Applications Speed to Capability 1995 OOMA • Client-Server • Multiple Tests/Certs MAIS Review • ACAT I Program Council Authorized Optimization of NTCSS Apps 1999 2001 BPI plan OOMA Development Began 2006 2007 Multiple DT/OT Events 2011 FOC Fielding Decision GCCS-M 4. 0 1999 2004 2005 2009 • Client-Server • Multiple Tests/Certs • Interdependencies ORD OPEVA Full-Rate Productio L n FOC Rapid Capability AIS • RDC Approach • Reused ONR Software • Initial Delivery < 2 Years MDA DS COI Insertion Jul Jun 05 06 Apr 08 CNO QRA #1 Guidanc Ph-1/2 A e Fielding MS C Feb Jul Oct 06 06 06 • Initial Delivery < 5 Mths • Less Than $500 k • Accessible Via Browser MDA DS Start MDA DS COI RDC Prototype Standup Spiral 1

Facilitating C 4 I Applications Speed to Capability 1995 OOMA • Client-Server • Multiple Tests/Certs MAIS Review • ACAT I Program Council Authorized Optimization of NTCSS Apps 1999 2001 BPI plan OOMA Development Began 2006 2007 Multiple DT/OT Events 2011 FOC Fielding Decision GCCS-M 4. 0 1999 2004 2005 2009 • Client-Server • Multiple Tests/Certs • Interdependencies ORD OPEVA Full-Rate Productio L n FOC Rapid Capability AIS • RDC Approach • Reused ONR Software • Initial Delivery < 2 Years MDA DS COI Insertion Jul Jun 05 06 Apr 08 CNO QRA #1 Guidanc Ph-1/2 A e Fielding MS C Feb Jul Oct 06 06 06 • Initial Delivery < 5 Mths • Less Than $500 k • Accessible Via Browser MDA DS Start MDA DS COI RDC Prototype Standup Spiral 1

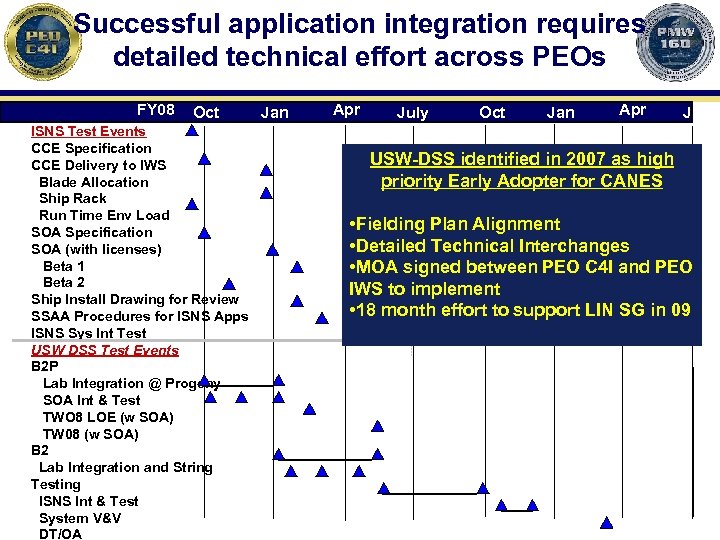

Successful application integration requires detailed technical effort across PEOs FY 08 Oct ISNS Test Events CCE Specification CCE Delivery to IWS Blade Allocation Ship Rack Run Time Env Load SOA Specification SOA (with licenses) Beta 1 Beta 2 Ship Install Drawing for Review SSAA Procedures for ISNS Apps ISNS Sys Int Test USW DSS Test Events B 2 P Lab Integration @ Progeny SOA Int & Test TWO 8 LOE (w SOA) TW 08 (w SOA) B 2 Lab Integration and String Testing ISNS Int & Test System V&V DT/OA Jan Apr July Oct Jan Apr July USW-DSS identified in 2007 as high priority Early Adopter for CANES • Fielding Plan Alignment • Detailed Technical Interchanges • MOA signed between PEO C 4 I and PEO IWS to implement • 18 month effort to support LIN SG in 09

Successful application integration requires detailed technical effort across PEOs FY 08 Oct ISNS Test Events CCE Specification CCE Delivery to IWS Blade Allocation Ship Rack Run Time Env Load SOA Specification SOA (with licenses) Beta 1 Beta 2 Ship Install Drawing for Review SSAA Procedures for ISNS Apps ISNS Sys Int Test USW DSS Test Events B 2 P Lab Integration @ Progeny SOA Int & Test TWO 8 LOE (w SOA) TW 08 (w SOA) B 2 Lab Integration and String Testing ISNS Int & Test System V&V DT/OA Jan Apr July Oct Jan Apr July USW-DSS identified in 2007 as high priority Early Adopter for CANES • Fielding Plan Alignment • Detailed Technical Interchanges • MOA signed between PEO C 4 I and PEO IWS to implement • 18 month effort to support LIN SG in 09

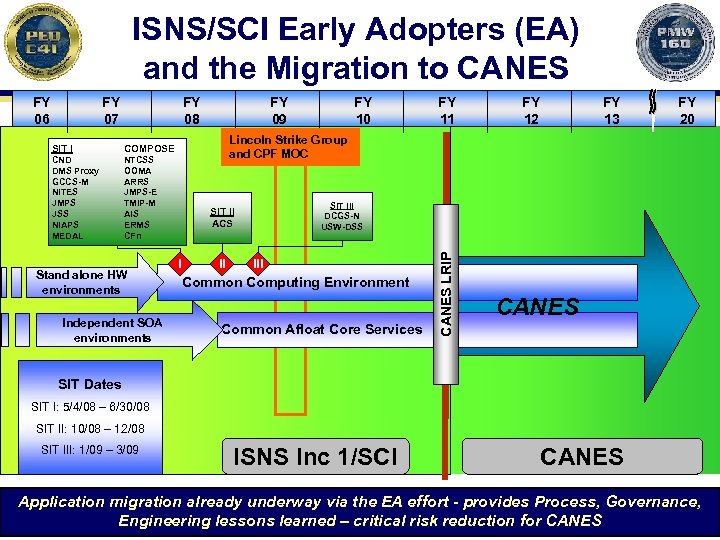

ISNS/SCI Early Adopters (EA) and the Migration to CANES FY 07 FY 08 SIT I NTCSS OOMA ARRS JMPS-E TMIP-M AIS ERMS CFn Stand alone HW environments Independent SOA environments FY 10 FY 11 FY 12 FY 13 FY 20 Lincoln Strike Group and CPF MOC COMPOSE CND DMS Proxy GCCS-M NITES JMPS JSS NIAPS MEDAL FY 09 SIT III DCGS-N USW-DSS SIT II ACS I II III Common Computing Environment Common Afloat Core Services CANES LRIP FY 06 CANES SIT Dates SIT I: 5/4/08 – 6/30/08 SIT II: 10/08 – 12/08 SIT III: 1/09 – 3/09 ISNS Inc 1/SCI CANES Application migration already underway via the EA effort - provides Process, Governance, Engineering lessons learned – critical risk reduction for CANES

ISNS/SCI Early Adopters (EA) and the Migration to CANES FY 07 FY 08 SIT I NTCSS OOMA ARRS JMPS-E TMIP-M AIS ERMS CFn Stand alone HW environments Independent SOA environments FY 10 FY 11 FY 12 FY 13 FY 20 Lincoln Strike Group and CPF MOC COMPOSE CND DMS Proxy GCCS-M NITES JMPS JSS NIAPS MEDAL FY 09 SIT III DCGS-N USW-DSS SIT II ACS I II III Common Computing Environment Common Afloat Core Services CANES LRIP FY 06 CANES SIT Dates SIT I: 5/4/08 – 6/30/08 SIT II: 10/08 – 12/08 SIT III: 1/09 – 3/09 ISNS Inc 1/SCI CANES Application migration already underway via the EA effort - provides Process, Governance, Engineering lessons learned – critical risk reduction for CANES

C 4 ISR Acquisition Landscape • Pending Do. DI 5000. 02 release Ø Ø Keep programs prior to MS B longer Competitive Prototyping Greater interaction with industry Earlier review of programs (MDD, MS A) • OSD and OSD concern over technical readiness and cost control issues • Perceived SOA technical risks • POM 10, budget pressures, transition

C 4 ISR Acquisition Landscape • Pending Do. DI 5000. 02 release Ø Ø Keep programs prior to MS B longer Competitive Prototyping Greater interaction with industry Earlier review of programs (MDD, MS A) • OSD and OSD concern over technical readiness and cost control issues • Perceived SOA technical risks • POM 10, budget pressures, transition

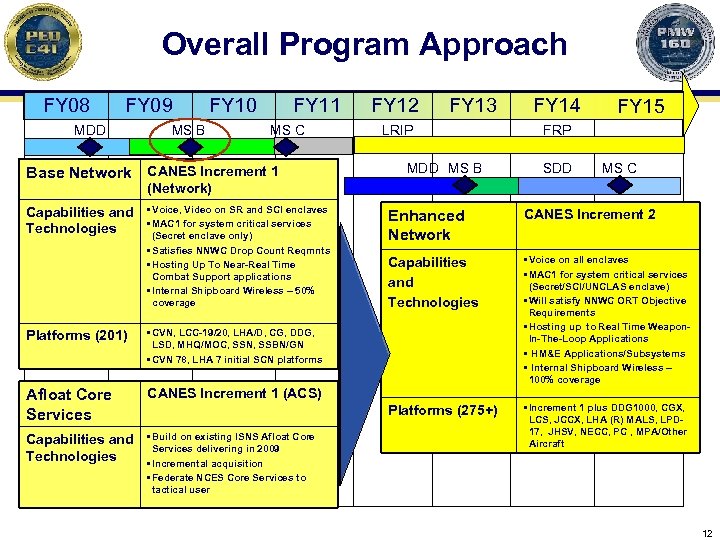

Overall Program Approach FY 08 FY 09 MDD FY 10 MS B FY 11 MS C Base Network CANES Increment 1 FY 12 FY 13 LRIP MDD MS B FY 14 FY 15 FRP SDD MS C (Network) Capabilities and Technologies • Voice, Video on SR and SCI enclaves • MAC 1 for system critical services (Secret enclave only) • Satisfies NNWC Drop Count Reqmnts • Hosting Up To Near-Real Time Combat Support applications • Internal Shipboard Wireless – 50% coverage • Build on existing ISNS Afloat Core Services delivering in 2009 • Incremental acquisition • Federate NCES Core Services to tactical user • Voice on all enclaves • MAC 1 for system critical services (Secret/SCI/UNCLAS enclave) • Will satisfy NNWC ORT Objective Requirements • Hosting up to Real Time Weapon. In-The-Loop Applications • HM&E Applications/Subsystems • Internal Shipboard Wireless – 100% coverage • Increment 1 plus DDG 1000, CGX, LCS, JCCX, LHA (R) MALS, LPD 17, JHSV, NECC, PC , MPA/Other Aircraft CANES Increment 1 (ACS) Capabilities and Technologies • CVN, LCC-19/20, LHA/D, CG, DDG, LSD, MHQ/MOC, SSN, SSBN/GN • CVN 78, LHA 7 initial SCN platforms Afloat Core Services CANES Increment 2 Platforms (275+) Platforms (201) Enhanced Network 12

Overall Program Approach FY 08 FY 09 MDD FY 10 MS B FY 11 MS C Base Network CANES Increment 1 FY 12 FY 13 LRIP MDD MS B FY 14 FY 15 FRP SDD MS C (Network) Capabilities and Technologies • Voice, Video on SR and SCI enclaves • MAC 1 for system critical services (Secret enclave only) • Satisfies NNWC Drop Count Reqmnts • Hosting Up To Near-Real Time Combat Support applications • Internal Shipboard Wireless – 50% coverage • Build on existing ISNS Afloat Core Services delivering in 2009 • Incremental acquisition • Federate NCES Core Services to tactical user • Voice on all enclaves • MAC 1 for system critical services (Secret/SCI/UNCLAS enclave) • Will satisfy NNWC ORT Objective Requirements • Hosting up to Real Time Weapon. In-The-Loop Applications • HM&E Applications/Subsystems • Internal Shipboard Wireless – 100% coverage • Increment 1 plus DDG 1000, CGX, LCS, JCCX, LHA (R) MALS, LPD 17, JHSV, NECC, PC , MPA/Other Aircraft CANES Increment 1 (ACS) Capabilities and Technologies • CVN, LCC-19/20, LHA/D, CG, DDG, LSD, MHQ/MOC, SSN, SSBN/GN • CVN 78, LHA 7 initial SCN platforms Afloat Core Services CANES Increment 2 Platforms (275+) Platforms (201) Enhanced Network 12

Acquisition Roadmap • • • ISNS Increment 2 ADM (Pre acq activities) PEO C 4 I Acquisition Coordination Team (ACT) DASN C 4 I, PMW 160 ACT ASD (NII) MDAP/MAIS list released Gate 3 Review with CNO/VCNO CANES Program Element established USD(PA&E) Ao. A guidance approved USD (AT&L) MDAP list released USD/ASD Directors CANES Program Review (SES Level) CANES OSD Stakeholder Focused Issue Group (FIG) #1 CANES FIG #2 CANES Acquisition OIPT with OSD Senior Leadership • Gate 4/5 Review with ASN (RDA) • Material Development Decision with USD (AT&L) Nov 06 Mar 07 Sep 07 Dec 07 Jan 08 May 08 Mar 08 May 08 Aug 08 Sep 08 Oct 08 7 Nov 08 13

Acquisition Roadmap • • • ISNS Increment 2 ADM (Pre acq activities) PEO C 4 I Acquisition Coordination Team (ACT) DASN C 4 I, PMW 160 ACT ASD (NII) MDAP/MAIS list released Gate 3 Review with CNO/VCNO CANES Program Element established USD(PA&E) Ao. A guidance approved USD (AT&L) MDAP list released USD/ASD Directors CANES Program Review (SES Level) CANES OSD Stakeholder Focused Issue Group (FIG) #1 CANES FIG #2 CANES Acquisition OIPT with OSD Senior Leadership • Gate 4/5 Review with ASN (RDA) • Material Development Decision with USD (AT&L) Nov 06 Mar 07 Sep 07 Dec 07 Jan 08 May 08 Mar 08 May 08 Aug 08 Sep 08 Oct 08 7 Nov 08 13

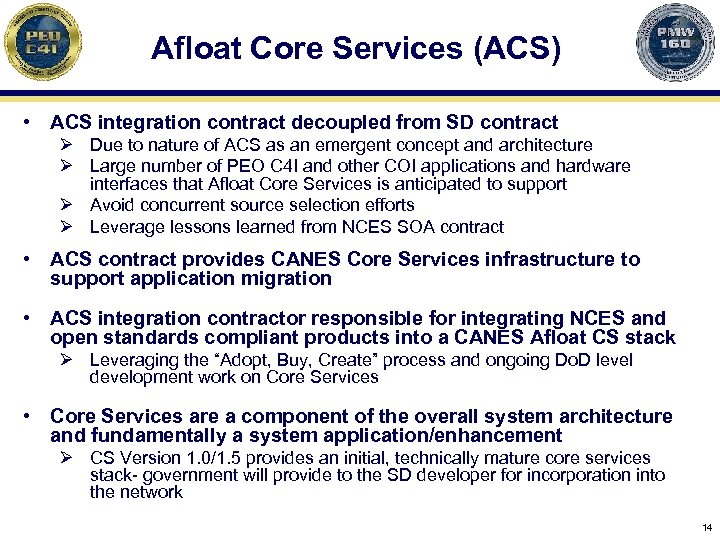

Afloat Core Services (ACS) • ACS integration contract decoupled from SD contract Ø Due to nature of ACS as an emergent concept and architecture Ø Large number of PEO C 4 I and other COI applications and hardware interfaces that Afloat Core Services is anticipated to support Ø Avoid concurrent source selection efforts Ø Leverage lessons learned from NCES SOA contract • ACS contract provides CANES Core Services infrastructure to support application migration • ACS integration contractor responsible for integrating NCES and open standards compliant products into a CANES Afloat CS stack Ø Leveraging the “Adopt, Buy, Create” process and ongoing Do. D level development work on Core Services • Core Services are a component of the overall system architecture and fundamentally a system application/enhancement Ø CS Version 1. 0/1. 5 provides an initial, technically mature core services stack- government will provide to the SD developer for incorporation into the network 14

Afloat Core Services (ACS) • ACS integration contract decoupled from SD contract Ø Due to nature of ACS as an emergent concept and architecture Ø Large number of PEO C 4 I and other COI applications and hardware interfaces that Afloat Core Services is anticipated to support Ø Avoid concurrent source selection efforts Ø Leverage lessons learned from NCES SOA contract • ACS contract provides CANES Core Services infrastructure to support application migration • ACS integration contractor responsible for integrating NCES and open standards compliant products into a CANES Afloat CS stack Ø Leveraging the “Adopt, Buy, Create” process and ongoing Do. D level development work on Core Services • Core Services are a component of the overall system architecture and fundamentally a system application/enhancement Ø CS Version 1. 0/1. 5 provides an initial, technically mature core services stack- government will provide to the SD developer for incorporation into the network 14

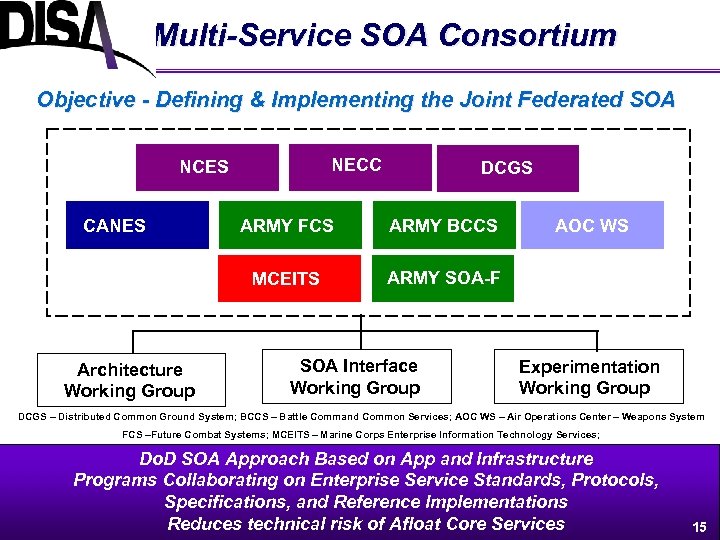

Multi-Service SOA Consortium Objective - Defining & Implementing the Joint Federated SOA NECC NCES DCGS Architecture Working Group ARMY FCS ARMY BCCS MCEITS CANES ARMY SOA-F SOA Interface Working Group AOC WS Experimentation Working Group DCGS – Distributed Common Ground System; BCCS – Battle Command Common Services; AOC WS – Air Operations Center – Weapons System FCS –Future Combat Systems; MCEITS – Marine Corps Enterprise Information Technology Services; Do. D SOA Approach Based on App and Infrastructure Programs Collaborating on Enterprise Service Standards, Protocols, Specifications, and Reference Implementations Reduces technical risk of Afloat Core Services 15

Multi-Service SOA Consortium Objective - Defining & Implementing the Joint Federated SOA NECC NCES DCGS Architecture Working Group ARMY FCS ARMY BCCS MCEITS CANES ARMY SOA-F SOA Interface Working Group AOC WS Experimentation Working Group DCGS – Distributed Common Ground System; BCCS – Battle Command Common Services; AOC WS – Air Operations Center – Weapons System FCS –Future Combat Systems; MCEITS – Marine Corps Enterprise Information Technology Services; Do. D SOA Approach Based on App and Infrastructure Programs Collaborating on Enterprise Service Standards, Protocols, Specifications, and Reference Implementations Reduces technical risk of Afloat Core Services 15

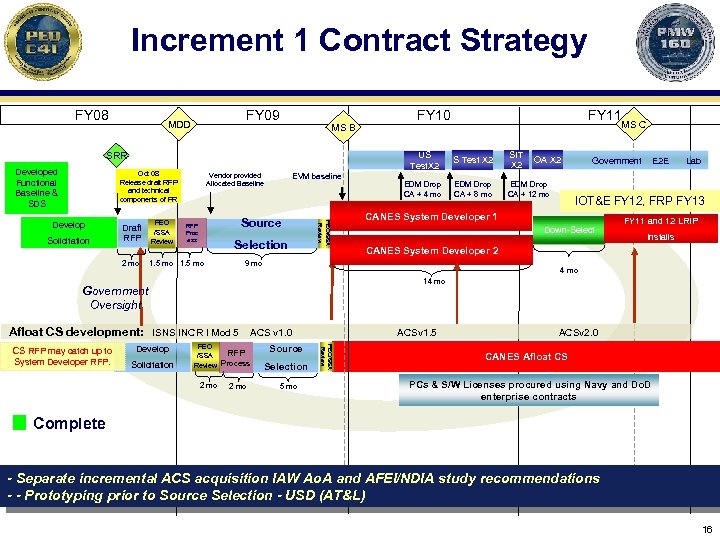

Increment 1 Contract Strategy FY 08 FY 09 MDD MS B Oct 08 Release draft RFP and technical components of PR Solicitation Draft RFP 2 mo PEO /SSA Review Vendor provided Allocated Baseline EVM baseline Source RFP Proc ess Selection 1. 5 mo PEO/SSA Review Develop EDM Drop CA + 4 mo EDM Drop CA + 8 mo EDM Drop CA + 12 mo OA X 2 Government E 2 E Lab IOT&E FY 12, FRP FY 13 CANES System Developer 1 Down-Select FY 11 and 12 LRIP Installs CANES System Developer 2 4 mo PEO RFP /SSA Review Process 2 mo Source Selection 5 mo ACSv 1. 5 PEO/SSA Review Solicitation SIT X 2 14 mo Afloat CS development: ISNS INCR I Mod 5 ACS v 1. 0 CS RFP may catch up to System Developer RFP. S Test X 2 9 mo Government Oversight Develop MS C US Test. X 2 SRR Developed Functional Baseline & SDS FY 11 FY 10 ACSv 2. 0 CANES Afloat CS PCs & S/W Licenses procured using Navy and Do. D enterprise contracts Complete - Separate incremental ACS acquisition IAW Ao. A and AFEI/NDIA study recommendations - - Prototyping prior to Source Selection - USD (AT&L) 16

Increment 1 Contract Strategy FY 08 FY 09 MDD MS B Oct 08 Release draft RFP and technical components of PR Solicitation Draft RFP 2 mo PEO /SSA Review Vendor provided Allocated Baseline EVM baseline Source RFP Proc ess Selection 1. 5 mo PEO/SSA Review Develop EDM Drop CA + 4 mo EDM Drop CA + 8 mo EDM Drop CA + 12 mo OA X 2 Government E 2 E Lab IOT&E FY 12, FRP FY 13 CANES System Developer 1 Down-Select FY 11 and 12 LRIP Installs CANES System Developer 2 4 mo PEO RFP /SSA Review Process 2 mo Source Selection 5 mo ACSv 1. 5 PEO/SSA Review Solicitation SIT X 2 14 mo Afloat CS development: ISNS INCR I Mod 5 ACS v 1. 0 CS RFP may catch up to System Developer RFP. S Test X 2 9 mo Government Oversight Develop MS C US Test. X 2 SRR Developed Functional Baseline & SDS FY 11 FY 10 ACSv 2. 0 CANES Afloat CS PCs & S/W Licenses procured using Navy and Do. D enterprise contracts Complete - Separate incremental ACS acquisition IAW Ao. A and AFEI/NDIA study recommendations - - Prototyping prior to Source Selection - USD (AT&L) 16

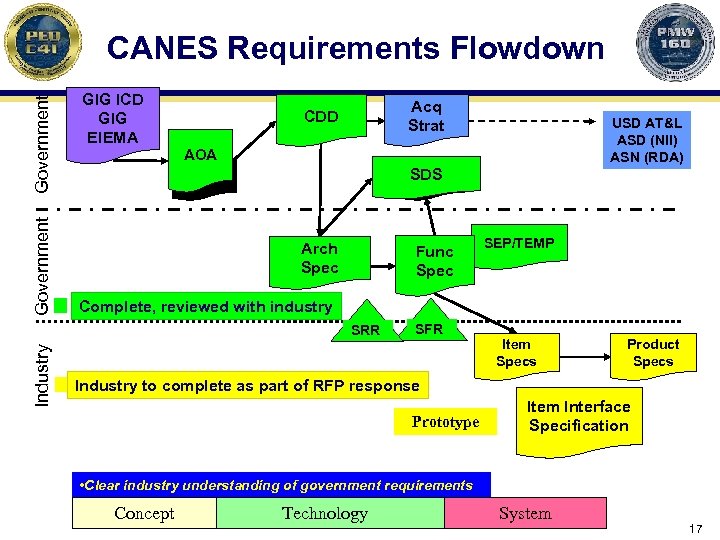

Government CANES Requirements Flowdown GIG ICD GIG EIEMA Acq Strat CDD AOA SDS Arch Spec Func Spec SEP/TEMP Complete, reviewed with industry SRR Industry USD AT&L ASD (NII) ASN (RDA) SFR Item Specs Product Specs Industry to complete as part of RFP response Prototype Item Interface Specification • Clear industry understanding of government requirements Concept Technology System 17

Government CANES Requirements Flowdown GIG ICD GIG EIEMA Acq Strat CDD AOA SDS Arch Spec Func Spec SEP/TEMP Complete, reviewed with industry SRR Industry USD AT&L ASD (NII) ASN (RDA) SFR Item Specs Product Specs Industry to complete as part of RFP response Prototype Item Interface Specification • Clear industry understanding of government requirements Concept Technology System 17

Questions/Backup “The CANES system achieves an open, agile, flexible and affordable network architecture that will move us forward. CANES embraces cross domain solutions that enable enhanced movement of data. It is a revolutionary change in our information technology infrastructure and it is absolutely vital for us to excel in 21 st century warfare” ADM Roughead’s CNO testimony to Senate Armed Services Committee on 2009 Budget Priorities 28 Feb 08 18

Questions/Backup “The CANES system achieves an open, agile, flexible and affordable network architecture that will move us forward. CANES embraces cross domain solutions that enable enhanced movement of data. It is a revolutionary change in our information technology infrastructure and it is absolutely vital for us to excel in 21 st century warfare” ADM Roughead’s CNO testimony to Senate Armed Services Committee on 2009 Budget Priorities 28 Feb 08 18

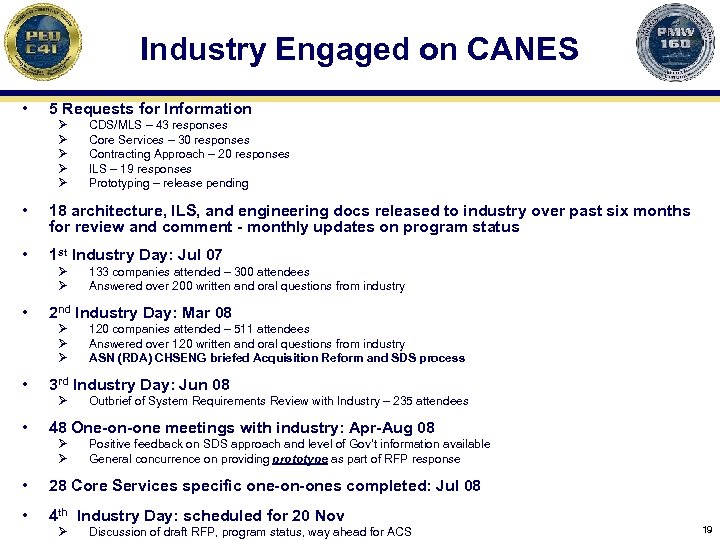

Industry Engaged on CANES • 5 Requests for Information Ø Ø Ø CDS/MLS – 43 responses Core Services – 30 responses Contracting Approach – 20 responses ILS – 19 responses Prototyping – release pending • 18 architecture, ILS, and engineering docs released to industry over past six months for review and comment - monthly updates on program status • 1 st Industry Day: Jul 07 Ø Ø • 2 nd Industry Day: Mar 08 Ø Ø Ø • 120 companies attended – 511 attendees Answered over 120 written and oral questions from industry ASN (RDA) CHSENG briefed Acquisition Reform and SDS process 3 rd Industry Day: Jun 08 Ø • 133 companies attended – 300 attendees Answered over 200 written and oral questions from industry Outbrief of System Requirements Review with Industry – 235 attendees 48 One-on-one meetings with industry: Apr-Aug 08 Ø Ø Positive feedback on SDS approach and level of Gov’t information available General concurrence on providing prototype as part of RFP response • 28 Core Services specific one-on-ones completed: Jul 08 • 4 th Industry Day: scheduled for 20 Nov Ø Discussion of draft RFP, program status, way ahead for ACS 19

Industry Engaged on CANES • 5 Requests for Information Ø Ø Ø CDS/MLS – 43 responses Core Services – 30 responses Contracting Approach – 20 responses ILS – 19 responses Prototyping – release pending • 18 architecture, ILS, and engineering docs released to industry over past six months for review and comment - monthly updates on program status • 1 st Industry Day: Jul 07 Ø Ø • 2 nd Industry Day: Mar 08 Ø Ø Ø • 120 companies attended – 511 attendees Answered over 120 written and oral questions from industry ASN (RDA) CHSENG briefed Acquisition Reform and SDS process 3 rd Industry Day: Jun 08 Ø • 133 companies attended – 300 attendees Answered over 200 written and oral questions from industry Outbrief of System Requirements Review with Industry – 235 attendees 48 One-on-one meetings with industry: Apr-Aug 08 Ø Ø Positive feedback on SDS approach and level of Gov’t information available General concurrence on providing prototype as part of RFP response • 28 Core Services specific one-on-ones completed: Jul 08 • 4 th Industry Day: scheduled for 20 Nov Ø Discussion of draft RFP, program status, way ahead for ACS 19

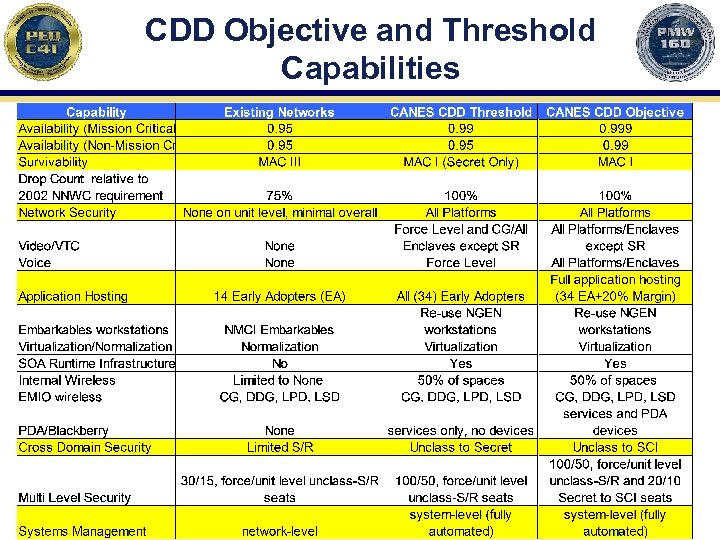

CDD Objective and Threshold Capabilities

CDD Objective and Threshold Capabilities

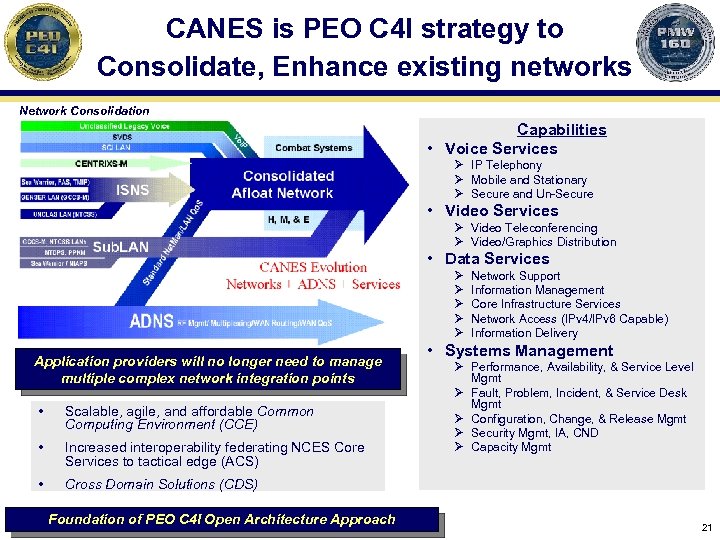

CANES is PEO C 4 I strategy to Consolidate, Enhance existing networks Network Consolidation Capabilities • Voice Services Ø IP Telephony Ø Mobile and Stationary Ø Secure and Un-Secure • Video Services Ø Video Teleconferencing Ø Video/Graphics Distribution • Data Services Ø Ø Ø Application providers will no longer need to manage multiple complex network integration points • Scalable, agile, and affordable Common Computing Environment (CCE) • Increased interoperability federating NCES Core Services to tactical edge (ACS) • Network Support Information Management Core Infrastructure Services Network Access (IPv 4/IPv 6 Capable) Information Delivery • Systems Management Ø Performance, Availability, & Service Level Mgmt Ø Fault, Problem, Incident, & Service Desk Mgmt Ø Configuration, Change, & Release Mgmt Ø Security Mgmt, IA, CND Ø Capacity Mgmt Cross Domain Solutions (CDS) Foundation of PEO C 4 I Open Architecture Approach 21

CANES is PEO C 4 I strategy to Consolidate, Enhance existing networks Network Consolidation Capabilities • Voice Services Ø IP Telephony Ø Mobile and Stationary Ø Secure and Un-Secure • Video Services Ø Video Teleconferencing Ø Video/Graphics Distribution • Data Services Ø Ø Ø Application providers will no longer need to manage multiple complex network integration points • Scalable, agile, and affordable Common Computing Environment (CCE) • Increased interoperability federating NCES Core Services to tactical edge (ACS) • Network Support Information Management Core Infrastructure Services Network Access (IPv 4/IPv 6 Capable) Information Delivery • Systems Management Ø Performance, Availability, & Service Level Mgmt Ø Fault, Problem, Incident, & Service Desk Mgmt Ø Configuration, Change, & Release Mgmt Ø Security Mgmt, IA, CND Ø Capacity Mgmt Cross Domain Solutions (CDS) Foundation of PEO C 4 I Open Architecture Approach 21

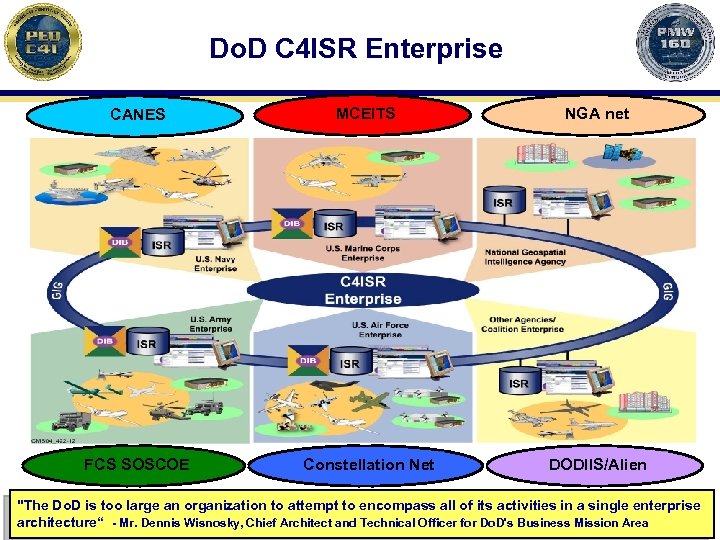

Do. D C 4 ISR Enterprise CANES MCEITS NGA net FCS SOSCOE Constellation Net DODIIS/Alien "The Do. D is too large an organization to attempt to encompass all of its activities in a single enterprise architecture“ - Mr. Dennis Wisnosky, Chief Architect and Technical Officer for Do. D's Business Mission Area

Do. D C 4 ISR Enterprise CANES MCEITS NGA net FCS SOSCOE Constellation Net DODIIS/Alien "The Do. D is too large an organization to attempt to encompass all of its activities in a single enterprise architecture“ - Mr. Dennis Wisnosky, Chief Architect and Technical Officer for Do. D's Business Mission Area

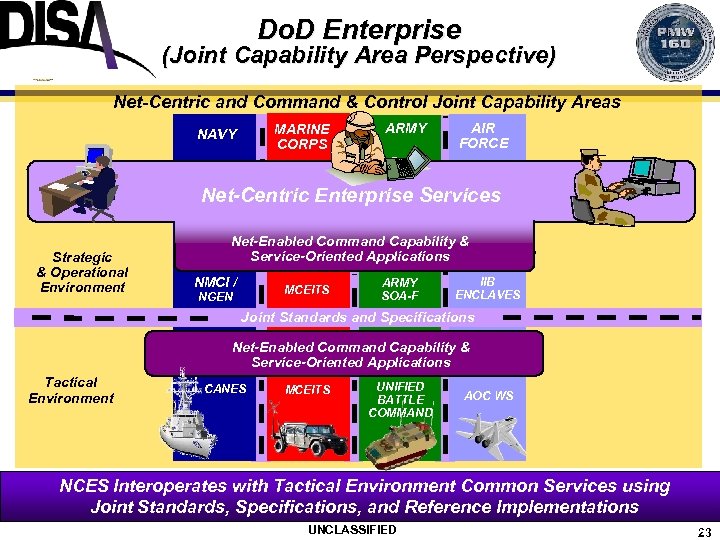

Do. D Enterprise (Joint Capability Area Perspective) Net-Centric and Command & Control Joint Capability Areas MARINE CORPS NAVY ARMY AIR FORCE Net-Centric Enterprise Services Strategic & Operational Environment Net-Enabled Command Capability & Service-Oriented Applications NMCI / MCEITS NGEN ARMY SOA-F IIB ENCLAVES Joint Standards and Specifications Net-Enabled Command Capability & Service-Oriented Applications Tactical Environment CANES MCEITS UNIFIED BATTLE COMMAND AOC WS NCES Interoperates with Tactical Environment Common Services using Joint Standards, Specifications, and Reference Implementations UNCLASSIFIED 23 23

Do. D Enterprise (Joint Capability Area Perspective) Net-Centric and Command & Control Joint Capability Areas MARINE CORPS NAVY ARMY AIR FORCE Net-Centric Enterprise Services Strategic & Operational Environment Net-Enabled Command Capability & Service-Oriented Applications NMCI / MCEITS NGEN ARMY SOA-F IIB ENCLAVES Joint Standards and Specifications Net-Enabled Command Capability & Service-Oriented Applications Tactical Environment CANES MCEITS UNIFIED BATTLE COMMAND AOC WS NCES Interoperates with Tactical Environment Common Services using Joint Standards, Specifications, and Reference Implementations UNCLASSIFIED 23 23

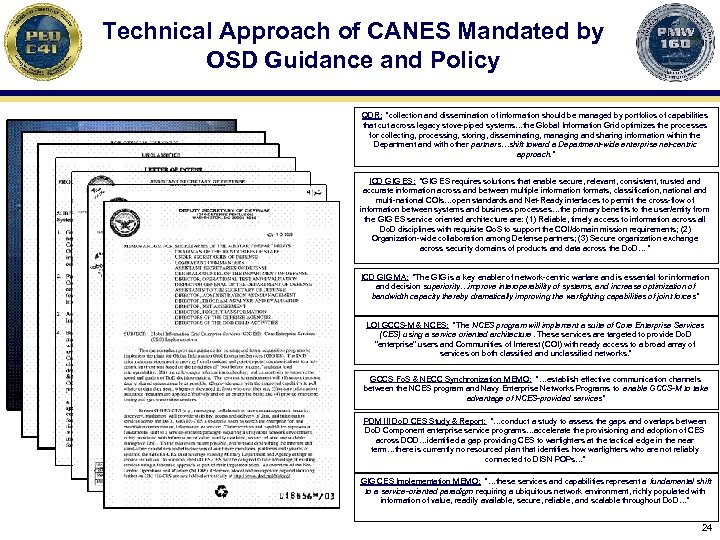

Technical Approach of CANES Mandated by OSD Guidance and Policy QDR: “collection and dissemination of information should be managed by portfolios of capabilities that cut across legacy stove-piped systems…the Global Information Grid optimizes the processes for collecting, processing, storing, disseminating, managing and sharing information within the Department and with other partners…shift toward a Department-wide enterprise net-centric approach. ” ICD GIG ES: “GIG ES requires solutions that enable secure, relevant, consistent, trusted and accurate information across and between multiple information formats, classification, national and multi-national COIs…open standards and Net-Ready interfaces to permit the cross-flow of information between systems and business processes…the primary benefits to the user/entity from the GIG ES service oriented architecture are: (1) Reliable, timely access to information across all Do. D disciplines with requisite Qo. S to support the COI/domain mission requirements; (2) Organization-wide collaboration among Defense partners; (3) Secure organization exchange across security domains of products and data across the Do. D… “ ICD GIG MA: “The GIG is a key enabler of network-centric warfare and is essential for information and decision superiority…improve interoperability of systems, and increase optimization of bandwidth capacity thereby dramatically improving the warfighting capabilities of joint forces” LOI GCCS-M & NCES: “The NCES program will implement a suite of Core Enterprise Services (CES) using a service oriented architecture. These services are targeted to provide Do. D "enterprise" users and Communities of Interest (COI) with ready access to a broad array of services on both classified and unclassified networks. ” GCCS Fo. S & NECC Synchronization MEMO: “…establish effective communication channels between the NCES program and Navy Enterprise Networks Programs to enable GCCS-M to take advantage of NCES-provided services ” PDM III Do. D CES Study & Report: “…conduct a study to assess the gaps and overlaps between Do. D Component enterprise service programs…accelerate the provisioning and adoption of CES across DOD…identified a gap providing CES to warfighters at the tactical edge in the near term…there is currently no resourced plan that identifies how warfighters who are not reliably connected to DISN POPs…” GIG CES Implementation MEMO: “…these services and capabilities represent a fundamental shift to a service-oriented paradigm requiring a ubiquitous network environment, richly populated with information of value, readily available, secure, reliable, and scalable throughout Do. D…” 24

Technical Approach of CANES Mandated by OSD Guidance and Policy QDR: “collection and dissemination of information should be managed by portfolios of capabilities that cut across legacy stove-piped systems…the Global Information Grid optimizes the processes for collecting, processing, storing, disseminating, managing and sharing information within the Department and with other partners…shift toward a Department-wide enterprise net-centric approach. ” ICD GIG ES: “GIG ES requires solutions that enable secure, relevant, consistent, trusted and accurate information across and between multiple information formats, classification, national and multi-national COIs…open standards and Net-Ready interfaces to permit the cross-flow of information between systems and business processes…the primary benefits to the user/entity from the GIG ES service oriented architecture are: (1) Reliable, timely access to information across all Do. D disciplines with requisite Qo. S to support the COI/domain mission requirements; (2) Organization-wide collaboration among Defense partners; (3) Secure organization exchange across security domains of products and data across the Do. D… “ ICD GIG MA: “The GIG is a key enabler of network-centric warfare and is essential for information and decision superiority…improve interoperability of systems, and increase optimization of bandwidth capacity thereby dramatically improving the warfighting capabilities of joint forces” LOI GCCS-M & NCES: “The NCES program will implement a suite of Core Enterprise Services (CES) using a service oriented architecture. These services are targeted to provide Do. D "enterprise" users and Communities of Interest (COI) with ready access to a broad array of services on both classified and unclassified networks. ” GCCS Fo. S & NECC Synchronization MEMO: “…establish effective communication channels between the NCES program and Navy Enterprise Networks Programs to enable GCCS-M to take advantage of NCES-provided services ” PDM III Do. D CES Study & Report: “…conduct a study to assess the gaps and overlaps between Do. D Component enterprise service programs…accelerate the provisioning and adoption of CES across DOD…identified a gap providing CES to warfighters at the tactical edge in the near term…there is currently no resourced plan that identifies how warfighters who are not reliably connected to DISN POPs…” GIG CES Implementation MEMO: “…these services and capabilities represent a fundamental shift to a service-oriented paradigm requiring a ubiquitous network environment, richly populated with information of value, readily available, secure, reliable, and scalable throughout Do. D…” 24