1e9df9012781871990615cdf4c62ca7a.ppt

- Количество слайдов: 63

Profiling & Expectations of respondents for AMP Universal Realty 1 Page 1 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Profiling & Expectations of respondents for AMP Universal Realty 1 Page 1 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

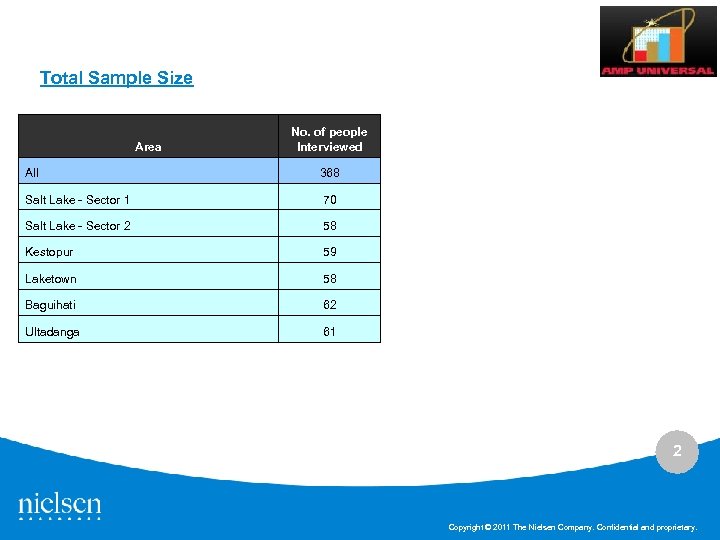

Total Sample Size Area No. of people Interviewed All 368 Salt Lake - Sector 1 70 Salt Lake - Sector 2 58 Kestopur 59 Laketown 58 Baguihati 62 Ultadanga 61 2 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Total Sample Size Area No. of people Interviewed All 368 Salt Lake - Sector 1 70 Salt Lake - Sector 2 58 Kestopur 59 Laketown 58 Baguihati 62 Ultadanga 61 2 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Current Shopping Behaviour 3 Page 3 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Current Shopping Behaviour 3 Page 3 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

If we look at the outlet preference, we can see that majority of the population are favorably disposed to shopping from both formats i. e. Malls & Traditional markets. The preference is lower in Laketown & Ultadanga. Thus signifying the opportunity for the client arcade to attract the customers from the catchment areas. (Figures in % of sample) 4 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

If we look at the outlet preference, we can see that majority of the population are favorably disposed to shopping from both formats i. e. Malls & Traditional markets. The preference is lower in Laketown & Ultadanga. Thus signifying the opportunity for the client arcade to attract the customers from the catchment areas. (Figures in % of sample) 4 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

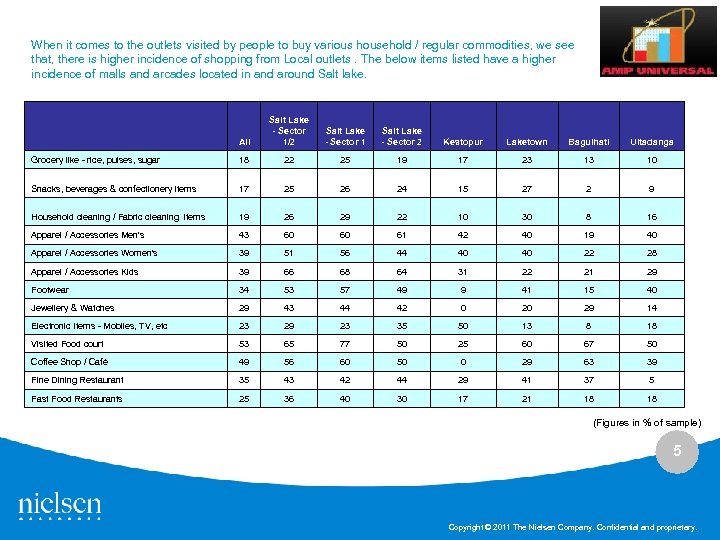

When it comes to the outlets visited by people to buy various household / regular commodities, we see that, there is higher incidence of shopping from Local outlets. The below items listed have a higher incidence of malls and arcades located in and around Salt lake. All Salt Lake - Sector 1/2 Grocery like - rice, pulses, sugar 18 22 25 19 17 23 13 10 Snacks, beverages & confectionery items 17 25 26 24 15 27 2 9 Household cleaning / Fabric cleaning items 19 26 29 22 10 30 8 16 Apparel / Accessories Men's 43 60 60 61 42 40 19 40 Apparel / Accessories Women's 39 51 56 44 40 40 22 28 Apparel / Accessories Kids 39 66 68 64 31 22 21 29 Footwear 34 53 57 49 9 41 15 40 Jewellery & Watches 29 43 44 42 0 20 29 14 Electronic Items - Mobiles, TV, etc 23 29 23 35 50 13 8 18 Visited Food court 53 65 77 50 25 60 67 50 Coffee Shop / Café 49 56 60 50 0 29 63 39 Fine Dining Restaurant 35 43 42 44 29 41 37 5 Fast Food Restaurants 25 36 40 30 17 21 18 18 Salt Lake - Sector 1 Salt Lake - Sector 2 Kestopur Laketown Baguihati Ultadanga (Figures in % of sample) 5 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

When it comes to the outlets visited by people to buy various household / regular commodities, we see that, there is higher incidence of shopping from Local outlets. The below items listed have a higher incidence of malls and arcades located in and around Salt lake. All Salt Lake - Sector 1/2 Grocery like - rice, pulses, sugar 18 22 25 19 17 23 13 10 Snacks, beverages & confectionery items 17 25 26 24 15 27 2 9 Household cleaning / Fabric cleaning items 19 26 29 22 10 30 8 16 Apparel / Accessories Men's 43 60 60 61 42 40 19 40 Apparel / Accessories Women's 39 51 56 44 40 40 22 28 Apparel / Accessories Kids 39 66 68 64 31 22 21 29 Footwear 34 53 57 49 9 41 15 40 Jewellery & Watches 29 43 44 42 0 20 29 14 Electronic Items - Mobiles, TV, etc 23 29 23 35 50 13 8 18 Visited Food court 53 65 77 50 25 60 67 50 Coffee Shop / Café 49 56 60 50 0 29 63 39 Fine Dining Restaurant 35 43 42 44 29 41 37 5 Fast Food Restaurants 25 36 40 30 17 21 18 18 Salt Lake - Sector 1 Salt Lake - Sector 2 Kestopur Laketown Baguihati Ultadanga (Figures in % of sample) 5 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

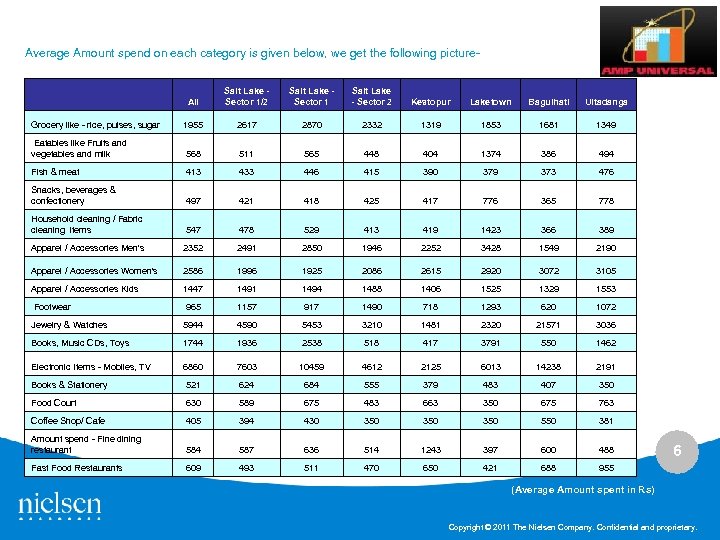

Average Amount spend on each category is given below, we get the following picture- All Salt Lake - Sector 1/2 Salt Lake - Sector 1 Salt Lake - Sector 2 Kestopur Laketown Baguihati Ultadanga Grocery like - rice, pulses, sugar 1955 2617 2870 2332 1319 1853 1681 1349 Eatables like Fruits and vegetables and milk 568 511 565 448 404 1374 386 494 Fish & meat 413 433 446 415 390 379 373 476 Snacks, beverages & confectionery 497 421 418 425 417 776 365 778 Household cleaning / Fabric cleaning items 547 478 529 413 419 1423 366 389 Apparel / Accessories Men's 2352 2491 2850 1946 2252 3428 1549 2190 Apparel / Accessories Women's 2586 1996 1925 2086 2615 2920 3072 3105 Apparel / Accessories Kids 1447 1491 1494 1488 1406 1525 1329 1553 Footwear 965 1157 917 1490 718 1293 620 1072 Jewelry & Watches 5944 4590 5453 3210 1481 2320 21571 3036 Books, Music CDs, Toys 1744 1936 2538 518 417 3791 550 1462 Electronic Items - Mobiles, TV 6860 7603 10459 4612 2125 6013 14238 2191 Books & Stationery 521 624 684 555 379 483 407 350 Food Court 630 589 675 483 663 350 675 763 Coffee Shop/ Cafe 405 394 430 350 350 550 381 Amount spend - Fine dining restaurant 584 587 636 514 1243 397 600 488 Fast Food Restaurants 609 493 511 470 650 421 688 955 6 (Average Amount spent in Rs) Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Average Amount spend on each category is given below, we get the following picture- All Salt Lake - Sector 1/2 Salt Lake - Sector 1 Salt Lake - Sector 2 Kestopur Laketown Baguihati Ultadanga Grocery like - rice, pulses, sugar 1955 2617 2870 2332 1319 1853 1681 1349 Eatables like Fruits and vegetables and milk 568 511 565 448 404 1374 386 494 Fish & meat 413 433 446 415 390 379 373 476 Snacks, beverages & confectionery 497 421 418 425 417 776 365 778 Household cleaning / Fabric cleaning items 547 478 529 413 419 1423 366 389 Apparel / Accessories Men's 2352 2491 2850 1946 2252 3428 1549 2190 Apparel / Accessories Women's 2586 1996 1925 2086 2615 2920 3072 3105 Apparel / Accessories Kids 1447 1491 1494 1488 1406 1525 1329 1553 Footwear 965 1157 917 1490 718 1293 620 1072 Jewelry & Watches 5944 4590 5453 3210 1481 2320 21571 3036 Books, Music CDs, Toys 1744 1936 2538 518 417 3791 550 1462 Electronic Items - Mobiles, TV 6860 7603 10459 4612 2125 6013 14238 2191 Books & Stationery 521 624 684 555 379 483 407 350 Food Court 630 589 675 483 663 350 675 763 Coffee Shop/ Cafe 405 394 430 350 350 550 381 Amount spend - Fine dining restaurant 584 587 636 514 1243 397 600 488 Fast Food Restaurants 609 493 511 470 650 421 688 955 6 (Average Amount spent in Rs) Copyright © 2011 The Nielsen Company. Confidential and proprietary.

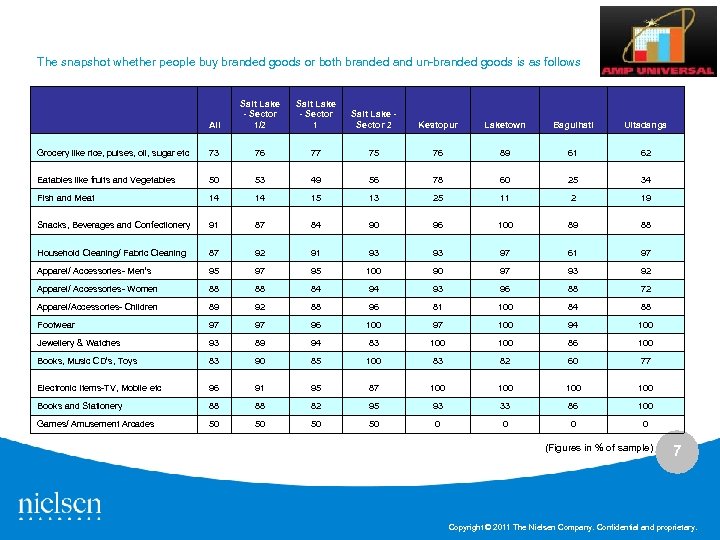

The snapshot whether people buy branded goods or both branded and un-branded goods is as follows All Salt Lake - Sector 1/2 Salt Lake - Sector 1 Salt Lake - Sector 2 Kestopur Laketown Baguihati Ultadanga Grocery like rice, pulses, oil, sugar etc 73 76 77 75 76 89 61 62 Eatables like fruits and Vegetables 50 53 49 56 78 60 25 34 Fish and Meat 14 14 15 13 25 11 2 19 Snacks, Beverages and Confectionery 91 87 84 90 96 100 89 88 Household Cleaning/ Fabric Cleaning 87 92 91 93 93 97 61 97 Apparel/ Accessories- Men’s 95 97 95 100 90 97 93 92 Apparel/ Accessories- Women 88 88 84 94 93 96 88 72 Apparel/Accessories- Children 89 92 88 96 81 100 84 88 Footwear 97 97 96 100 97 100 94 100 Jewellery & Watches 93 89 94 83 100 86 100 Books, Music CD’s, Toys 83 90 85 100 83 82 60 77 Electronic Items-TV, Mobile etc 96 91 95 87 100 100 Books and Stationery 88 88 82 95 93 33 86 100 Games/ Amusement Arcades 50 50 0 0 (Figures in % of sample) 7 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

The snapshot whether people buy branded goods or both branded and un-branded goods is as follows All Salt Lake - Sector 1/2 Salt Lake - Sector 1 Salt Lake - Sector 2 Kestopur Laketown Baguihati Ultadanga Grocery like rice, pulses, oil, sugar etc 73 76 77 75 76 89 61 62 Eatables like fruits and Vegetables 50 53 49 56 78 60 25 34 Fish and Meat 14 14 15 13 25 11 2 19 Snacks, Beverages and Confectionery 91 87 84 90 96 100 89 88 Household Cleaning/ Fabric Cleaning 87 92 91 93 93 97 61 97 Apparel/ Accessories- Men’s 95 97 95 100 90 97 93 92 Apparel/ Accessories- Women 88 88 84 94 93 96 88 72 Apparel/Accessories- Children 89 92 88 96 81 100 84 88 Footwear 97 97 96 100 97 100 94 100 Jewellery & Watches 93 89 94 83 100 86 100 Books, Music CD’s, Toys 83 90 85 100 83 82 60 77 Electronic Items-TV, Mobile etc 96 91 95 87 100 100 Books and Stationery 88 88 82 95 93 33 86 100 Games/ Amusement Arcades 50 50 0 0 (Figures in % of sample) 7 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Current Shopping Visit Dynamics 8 Page 8 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Current Shopping Visit Dynamics 8 Page 8 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

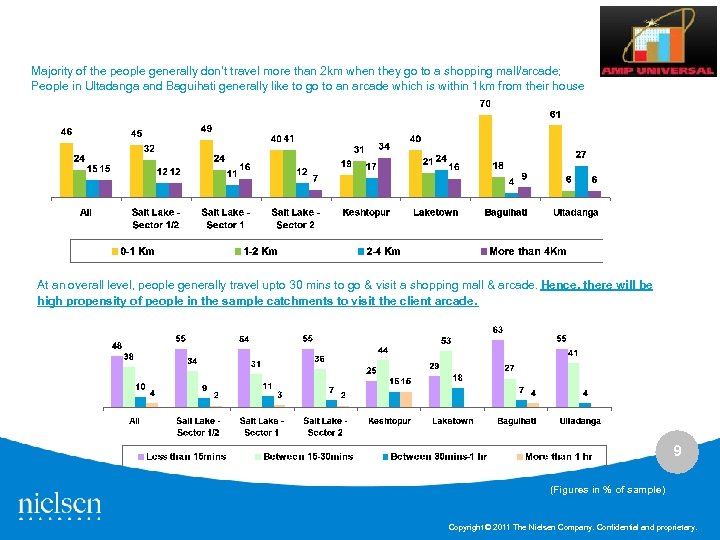

Majority of the people generally don’t travel more than 2 km when they go to a shopping mall/arcade; People in Ultadanga and Baguihati generally like to go to an arcade which is within 1 km from their house At an overall level, people generally travel upto 30 mins to go & visit a shopping mall & arcade. Hence, there will be high propensity of people in the sample catchments to visit the client arcade. 9 (Figures in % of sample) Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Majority of the people generally don’t travel more than 2 km when they go to a shopping mall/arcade; People in Ultadanga and Baguihati generally like to go to an arcade which is within 1 km from their house At an overall level, people generally travel upto 30 mins to go & visit a shopping mall & arcade. Hence, there will be high propensity of people in the sample catchments to visit the client arcade. 9 (Figures in % of sample) Copyright © 2011 The Nielsen Company. Confidential and proprietary.

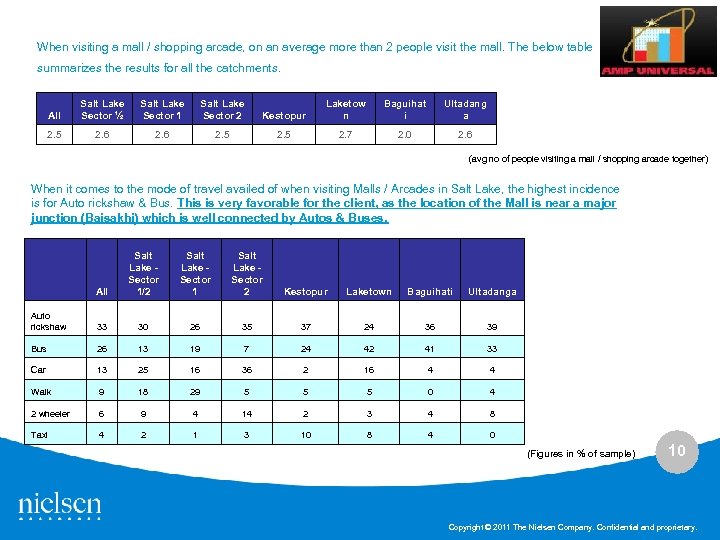

When visiting a mall / shopping arcade, on an average more than 2 people visit the mall. The below table summarizes the results for all the catchments. All Salt Lake Sector ½ Salt Lake Sector 1 Salt Lake Sector 2 Kestopur Laketow n Baguihat i Ultadang a 2. 5 2. 6 2. 5 2. 7 2. 0 2. 6 (avg no of people visiting a mall / shopping arcade together) When it comes to the mode of travel availed of when visiting Malls / Arcades in Salt Lake, the highest incidence is for Auto rickshaw & Bus. This is very favorable for the client, as the location of the Mall is near a major junction (Baisakhi) which is well connected by Autos & Buses. All Salt Lake - Sector 1/2 Salt Lake - Sector 1 Salt Lake - Sector 2 Kestopur Laketown Baguihati Ultadanga Auto rickshaw 33 30 26 35 37 24 36 39 Bus 26 13 19 7 24 42 41 33 Car 13 25 16 36 2 16 4 4 Walk 9 18 29 5 5 5 0 4 2 wheeler 6 9 4 14 2 3 4 8 Taxi 4 2 1 3 10 8 4 0 (Figures in % of sample) 10 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

When visiting a mall / shopping arcade, on an average more than 2 people visit the mall. The below table summarizes the results for all the catchments. All Salt Lake Sector ½ Salt Lake Sector 1 Salt Lake Sector 2 Kestopur Laketow n Baguihat i Ultadang a 2. 5 2. 6 2. 5 2. 7 2. 0 2. 6 (avg no of people visiting a mall / shopping arcade together) When it comes to the mode of travel availed of when visiting Malls / Arcades in Salt Lake, the highest incidence is for Auto rickshaw & Bus. This is very favorable for the client, as the location of the Mall is near a major junction (Baisakhi) which is well connected by Autos & Buses. All Salt Lake - Sector 1/2 Salt Lake - Sector 1 Salt Lake - Sector 2 Kestopur Laketown Baguihati Ultadanga Auto rickshaw 33 30 26 35 37 24 36 39 Bus 26 13 19 7 24 42 41 33 Car 13 25 16 36 2 16 4 4 Walk 9 18 29 5 5 5 0 4 2 wheeler 6 9 4 14 2 3 4 8 Taxi 4 2 1 3 10 8 4 0 (Figures in % of sample) 10 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Shopping Arcade Visit Dynamics 11 Page 11 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Shopping Arcade Visit Dynamics 11 Page 11 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

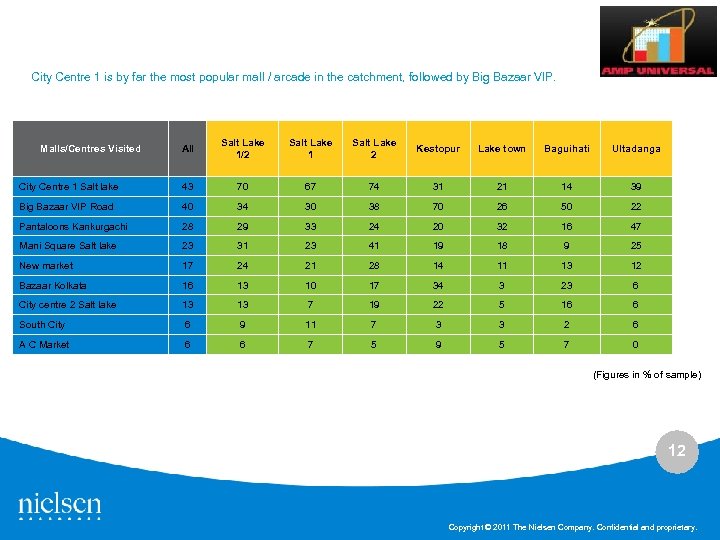

City Centre 1 is by far the most popular mall / arcade in the catchment, followed by Big Bazaar VIP. All Salt Lake 1/2 Salt Lake 1 Salt Lake 2 Kestopur Lake town Baguihati Ultadanga City Centre 1 Salt lake 43 70 67 74 31 21 14 39 Big Bazaar VIP Road 40 34 30 38 70 26 50 22 Pantaloons Kankurgachi 28 29 33 24 20 32 16 47 Mani Square Salt lake 23 31 23 41 19 18 9 25 New market 17 24 21 28 14 11 13 12 Bazaar Kolkata 16 13 10 17 34 3 23 6 City centre 2 Salt lake 13 13 7 19 22 5 16 6 South City 6 9 11 7 3 3 2 6 A C Market 6 6 7 5 9 5 7 0 Malls/Centres Visited (Figures in % of sample) 12 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

City Centre 1 is by far the most popular mall / arcade in the catchment, followed by Big Bazaar VIP. All Salt Lake 1/2 Salt Lake 1 Salt Lake 2 Kestopur Lake town Baguihati Ultadanga City Centre 1 Salt lake 43 70 67 74 31 21 14 39 Big Bazaar VIP Road 40 34 30 38 70 26 50 22 Pantaloons Kankurgachi 28 29 33 24 20 32 16 47 Mani Square Salt lake 23 31 23 41 19 18 9 25 New market 17 24 21 28 14 11 13 12 Bazaar Kolkata 16 13 10 17 34 3 23 6 City centre 2 Salt lake 13 13 7 19 22 5 16 6 South City 6 9 11 7 3 3 2 6 A C Market 6 6 7 5 9 5 7 0 Malls/Centres Visited (Figures in % of sample) 12 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

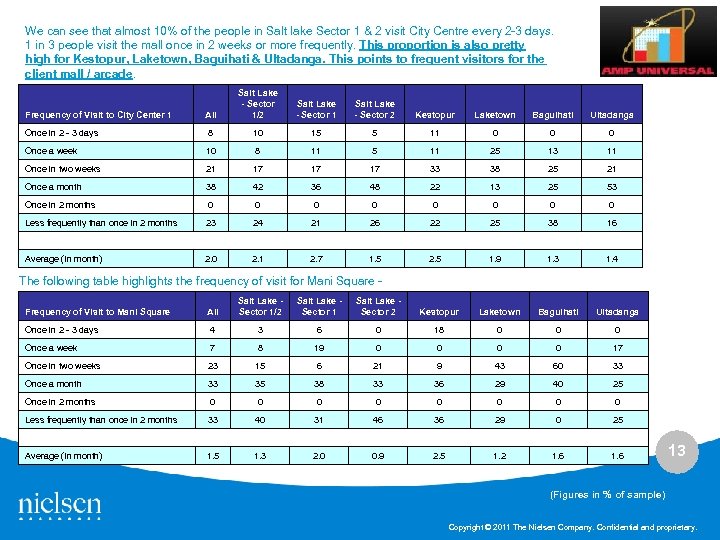

We can see that almost 10% of the people in Salt lake Sector 1 & 2 visit City Centre every 2 -3 days. 1 in 3 people visit the mall once in 2 weeks or more frequently. This proportion is also pretty high for Kestopur, Laketown, Baguihati & Ultadanga. This points to frequent visitors for the client mall / arcade. All Salt Lake - Sector 1/2 Salt Lake - Sector 1 Salt Lake - Sector 2 Kestopur Laketown Baguihati Ultadanga Once in 2 - 3 days 8 10 15 5 11 0 0 0 Once a week 10 8 11 5 11 25 13 11 Once in two weeks 21 17 17 17 33 38 25 21 Once a month 38 42 36 48 22 13 25 53 Once in 2 months 0 0 0 0 Less frequently than once in 2 months 23 24 21 26 22 25 38 16 2. 0 2. 1 2. 7 1. 5 2. 5 1. 9 1. 3 1. 4 Frequency of Visit to City Center 1 Average (In month) The following table highlights the frequency of visit for Mani Square - All Salt Lake - Sector 1/2 Salt Lake - Sector 1 Salt Lake - Sector 2 Kestopur Laketown Baguihati Ultadanga Once in 2 - 3 days 4 3 6 0 18 0 0 0 Once a week 7 8 19 0 0 17 Once in two weeks 23 15 6 21 9 43 60 33 Once a month 33 35 38 33 36 29 40 25 Once in 2 months 0 0 0 0 Less frequently than once in 2 months 33 40 31 46 36 29 0 25 1. 5 1. 3 2. 0 0. 9 2. 5 1. 2 1. 6 Frequency of Visit to Mani Square Average (In month) 13 (Figures in % of sample) Copyright © 2011 The Nielsen Company. Confidential and proprietary.

We can see that almost 10% of the people in Salt lake Sector 1 & 2 visit City Centre every 2 -3 days. 1 in 3 people visit the mall once in 2 weeks or more frequently. This proportion is also pretty high for Kestopur, Laketown, Baguihati & Ultadanga. This points to frequent visitors for the client mall / arcade. All Salt Lake - Sector 1/2 Salt Lake - Sector 1 Salt Lake - Sector 2 Kestopur Laketown Baguihati Ultadanga Once in 2 - 3 days 8 10 15 5 11 0 0 0 Once a week 10 8 11 5 11 25 13 11 Once in two weeks 21 17 17 17 33 38 25 21 Once a month 38 42 36 48 22 13 25 53 Once in 2 months 0 0 0 0 Less frequently than once in 2 months 23 24 21 26 22 25 38 16 2. 0 2. 1 2. 7 1. 5 2. 5 1. 9 1. 3 1. 4 Frequency of Visit to City Center 1 Average (In month) The following table highlights the frequency of visit for Mani Square - All Salt Lake - Sector 1/2 Salt Lake - Sector 1 Salt Lake - Sector 2 Kestopur Laketown Baguihati Ultadanga Once in 2 - 3 days 4 3 6 0 18 0 0 0 Once a week 7 8 19 0 0 17 Once in two weeks 23 15 6 21 9 43 60 33 Once a month 33 35 38 33 36 29 40 25 Once in 2 months 0 0 0 0 Less frequently than once in 2 months 33 40 31 46 36 29 0 25 1. 5 1. 3 2. 0 0. 9 2. 5 1. 2 1. 6 Frequency of Visit to Mani Square Average (In month) 13 (Figures in % of sample) Copyright © 2011 The Nielsen Company. Confidential and proprietary.

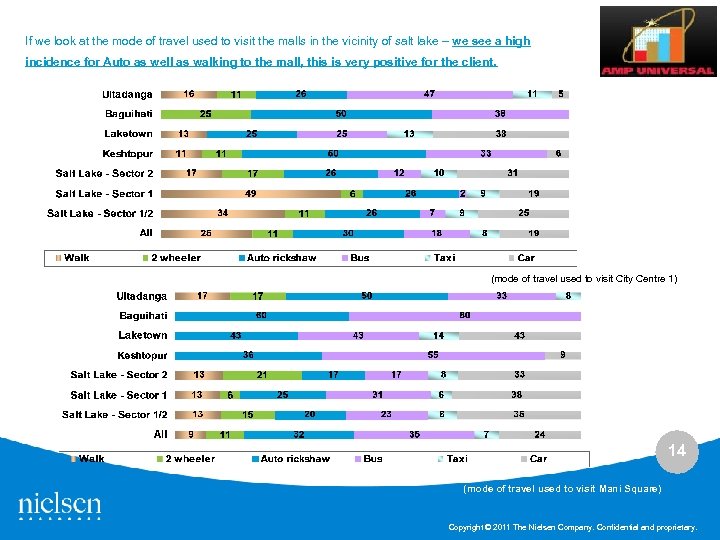

If we look at the mode of travel used to visit the malls in the vicinity of salt lake – we see a high incidence for Auto as well as walking to the mall, this is very positive for the client. (mode of travel used to visit City Centre 1) 14 (mode of travel used to visit Mani Square) Copyright © 2011 The Nielsen Company. Confidential and proprietary.

If we look at the mode of travel used to visit the malls in the vicinity of salt lake – we see a high incidence for Auto as well as walking to the mall, this is very positive for the client. (mode of travel used to visit City Centre 1) 14 (mode of travel used to visit Mani Square) Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Dining Out Dynamics 15 Page 15 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Dining Out Dynamics 15 Page 15 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

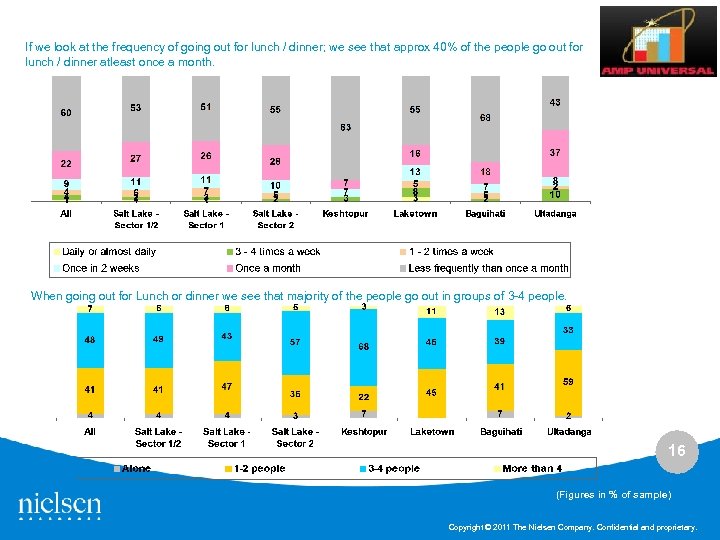

If we look at the frequency of going out for lunch / dinner; we see that approx 40% of the people go out for lunch / dinner atleast once a month. When going out for Lunch or dinner we see that majority of the people go out in groups of 3 -4 people. 16 (Figures in % of sample) Copyright © 2011 The Nielsen Company. Confidential and proprietary.

If we look at the frequency of going out for lunch / dinner; we see that approx 40% of the people go out for lunch / dinner atleast once a month. When going out for Lunch or dinner we see that majority of the people go out in groups of 3 -4 people. 16 (Figures in % of sample) Copyright © 2011 The Nielsen Company. Confidential and proprietary.

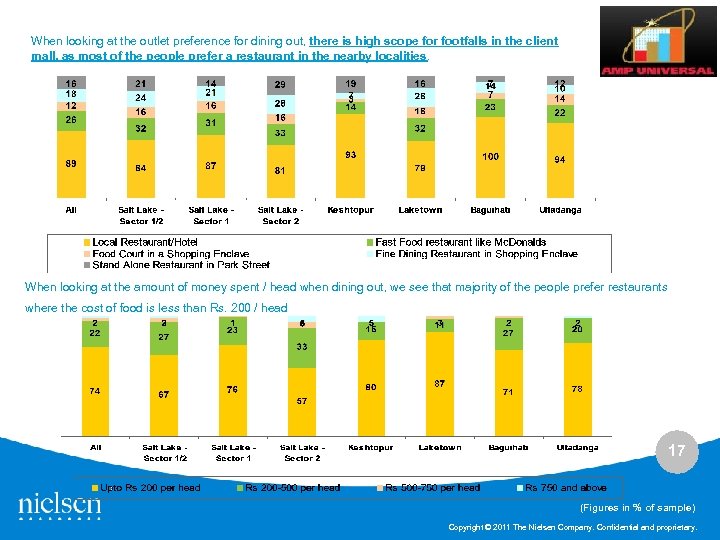

When looking at the outlet preference for dining out, there is high scope for footfalls in the client mall, as most of the people prefer a restaurant in the nearby localities. When looking at the amount of money spent / head when dining out, we see that majority of the people prefer restaurants where the cost of food is less than Rs. 200 / head 17 (Figures in % of sample) Copyright © 2011 The Nielsen Company. Confidential and proprietary.

When looking at the outlet preference for dining out, there is high scope for footfalls in the client mall, as most of the people prefer a restaurant in the nearby localities. When looking at the amount of money spent / head when dining out, we see that majority of the people prefer restaurants where the cost of food is less than Rs. 200 / head 17 (Figures in % of sample) Copyright © 2011 The Nielsen Company. Confidential and proprietary.

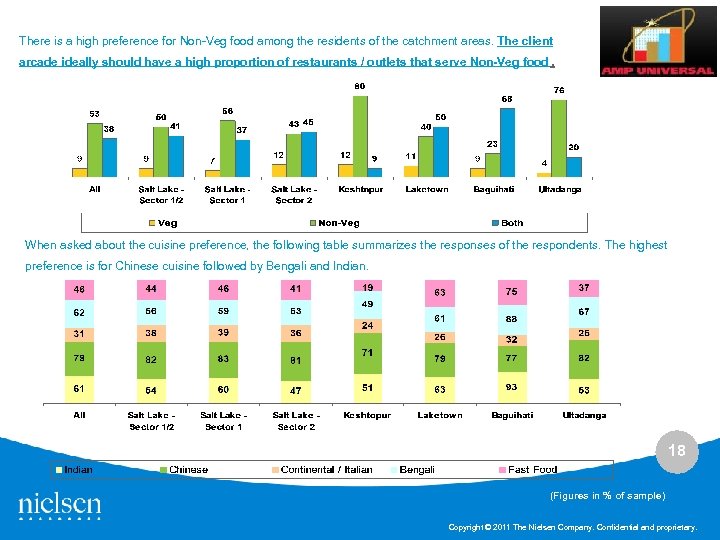

There is a high preference for Non-Veg food among the residents of the catchment areas. The client arcade ideally should have a high proportion of restaurants / outlets that serve Non-Veg food. When asked about the cuisine preference, the following table summarizes the responses of the respondents. The highest preference is for Chinese cuisine followed by Bengali and Indian. 18 (Figures in % of sample) Copyright © 2011 The Nielsen Company. Confidential and proprietary.

There is a high preference for Non-Veg food among the residents of the catchment areas. The client arcade ideally should have a high proportion of restaurants / outlets that serve Non-Veg food. When asked about the cuisine preference, the following table summarizes the responses of the respondents. The highest preference is for Chinese cuisine followed by Bengali and Indian. 18 (Figures in % of sample) Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Concept Evaluation 19 Page 19 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Concept Evaluation 19 Page 19 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

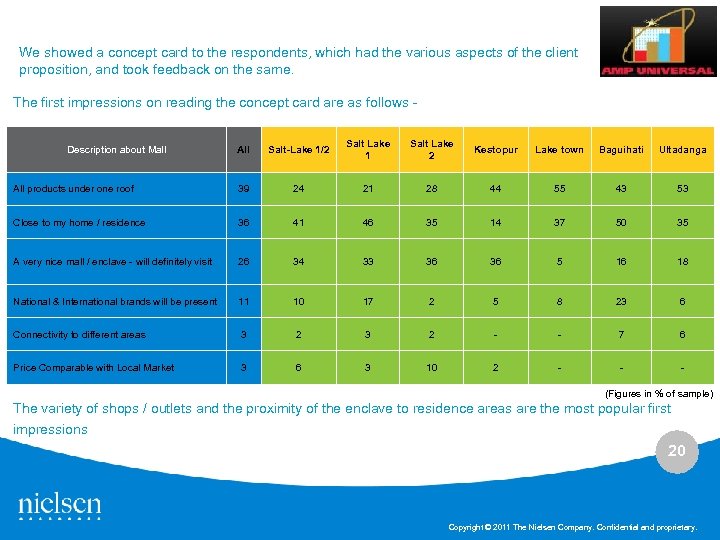

We showed a concept card to the respondents, which had the various aspects of the client proposition, and took feedback on the same. The first impressions on reading the concept card are as follows - All Salt-Lake 1/2 Salt Lake 1 Salt Lake 2 Kestopur Lake town Baguihati Ultadanga All products under one roof 39 24 21 28 44 55 43 53 Close to my home / residence 36 41 46 35 14 37 50 35 A very nice mall / enclave - will definitely visit 26 34 33 36 36 5 16 18 National & International brands will be present 11 10 17 2 5 8 23 6 Connectivity to different areas 3 2 - - 7 6 Price Comparable with Local Market 3 6 3 10 2 - - - Description about Mall (Figures in % of sample) The variety of shops / outlets and the proximity of the enclave to residence areas are the most popular first impressions 20 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

We showed a concept card to the respondents, which had the various aspects of the client proposition, and took feedback on the same. The first impressions on reading the concept card are as follows - All Salt-Lake 1/2 Salt Lake 1 Salt Lake 2 Kestopur Lake town Baguihati Ultadanga All products under one roof 39 24 21 28 44 55 43 53 Close to my home / residence 36 41 46 35 14 37 50 35 A very nice mall / enclave - will definitely visit 26 34 33 36 36 5 16 18 National & International brands will be present 11 10 17 2 5 8 23 6 Connectivity to different areas 3 2 - - 7 6 Price Comparable with Local Market 3 6 3 10 2 - - - Description about Mall (Figures in % of sample) The variety of shops / outlets and the proximity of the enclave to residence areas are the most popular first impressions 20 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

The facts liked about the mall are - Features Liked All Salt-Lake 1/2 Salt-Lake 1 Salt-Lake 2 Kestopur Lake town Baguihati Ultadanga National and international brands will be available 35 31 39 22 15 42 50 45 Items under one roof 22 25 20 31 31 16 23 10 Will have parking facilities 20 21 24 17 22 21 13 20 Close to my Residence 12 17 16 19 15 0 5 12 Structure & look of the mall is nice 12 11 9 14 5 16 16 16 (Figures in % of sample) The factors with the highest likeability are – National & International brands will be available, and availability of all items under one roof There are no dislikes at an overall level; however 23% of the people from Laketown feel that the mall is far from their house 21 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

The facts liked about the mall are - Features Liked All Salt-Lake 1/2 Salt-Lake 1 Salt-Lake 2 Kestopur Lake town Baguihati Ultadanga National and international brands will be available 35 31 39 22 15 42 50 45 Items under one roof 22 25 20 31 31 16 23 10 Will have parking facilities 20 21 24 17 22 21 13 20 Close to my Residence 12 17 16 19 15 0 5 12 Structure & look of the mall is nice 12 11 9 14 5 16 16 16 (Figures in % of sample) The factors with the highest likeability are – National & International brands will be available, and availability of all items under one roof There are no dislikes at an overall level; however 23% of the people from Laketown feel that the mall is far from their house 21 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

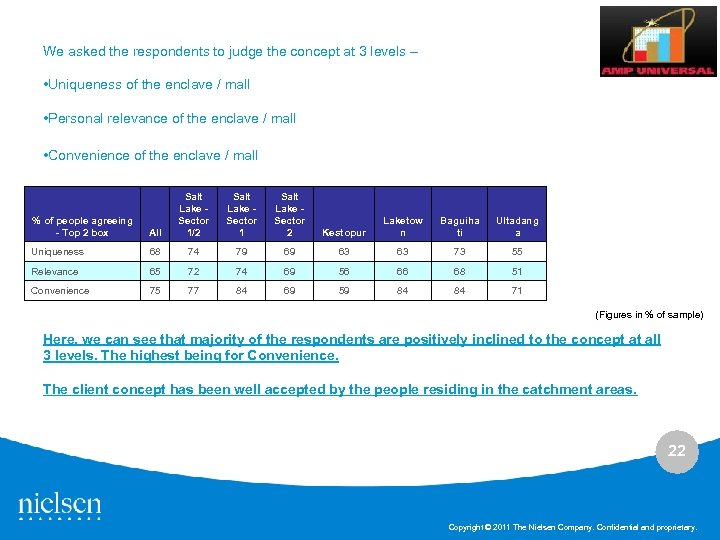

We asked the respondents to judge the concept at 3 levels – • Uniqueness of the enclave / mall • Personal relevance of the enclave / mall • Convenience of the enclave / mall % of people agreeing - Top 2 box All Salt Lake - Sector 1/2 Salt Lake - Sector 1 Salt Lake - Sector 2 Kestopur Laketow n Baguiha ti Ultadang a Uniqueness 68 74 79 69 63 63 73 55 Relevance 65 72 74 69 56 66 68 51 Convenience 75 77 84 69 59 84 84 71 (Figures in % of sample) Here, we can see that majority of the respondents are positively inclined to the concept at all 3 levels. The highest being for Convenience. The client concept has been well accepted by the people residing in the catchment areas. 22 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

We asked the respondents to judge the concept at 3 levels – • Uniqueness of the enclave / mall • Personal relevance of the enclave / mall • Convenience of the enclave / mall % of people agreeing - Top 2 box All Salt Lake - Sector 1/2 Salt Lake - Sector 1 Salt Lake - Sector 2 Kestopur Laketow n Baguiha ti Ultadang a Uniqueness 68 74 79 69 63 63 73 55 Relevance 65 72 74 69 56 66 68 51 Convenience 75 77 84 69 59 84 84 71 (Figures in % of sample) Here, we can see that majority of the respondents are positively inclined to the concept at all 3 levels. The highest being for Convenience. The client concept has been well accepted by the people residing in the catchment areas. 22 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

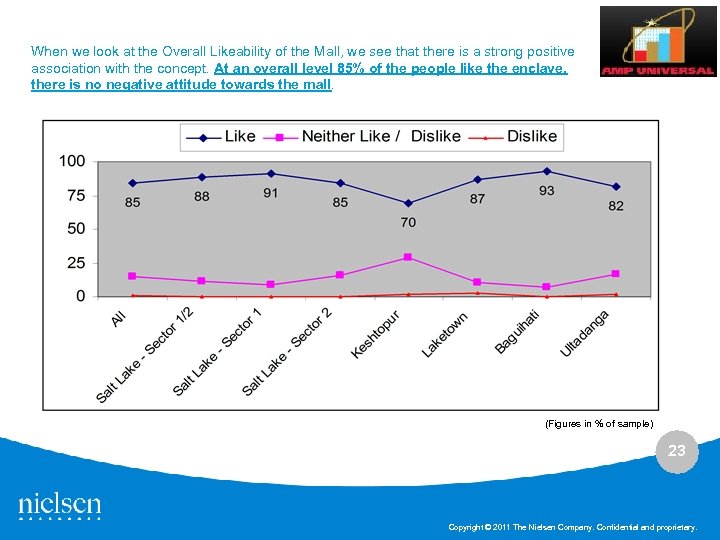

When we look at the Overall Likeability of the Mall, we see that there is a strong positive association with the concept. At an overall level 85% of the people like the enclave, there is no negative attitude towards the mall. (Figures in % of sample) 23 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

When we look at the Overall Likeability of the Mall, we see that there is a strong positive association with the concept. At an overall level 85% of the people like the enclave, there is no negative attitude towards the mall. (Figures in % of sample) 23 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

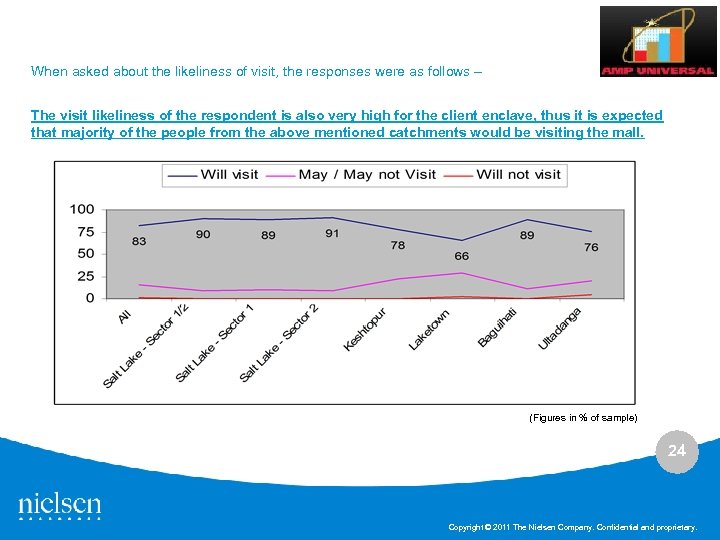

When asked about the likeliness of visit, the responses were as follows – The visit likeliness of the respondent is also very high for the client enclave, thus it is expected that majority of the people from the above mentioned catchments would be visiting the mall. (Figures in % of sample) 24 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

When asked about the likeliness of visit, the responses were as follows – The visit likeliness of the respondent is also very high for the client enclave, thus it is expected that majority of the people from the above mentioned catchments would be visiting the mall. (Figures in % of sample) 24 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

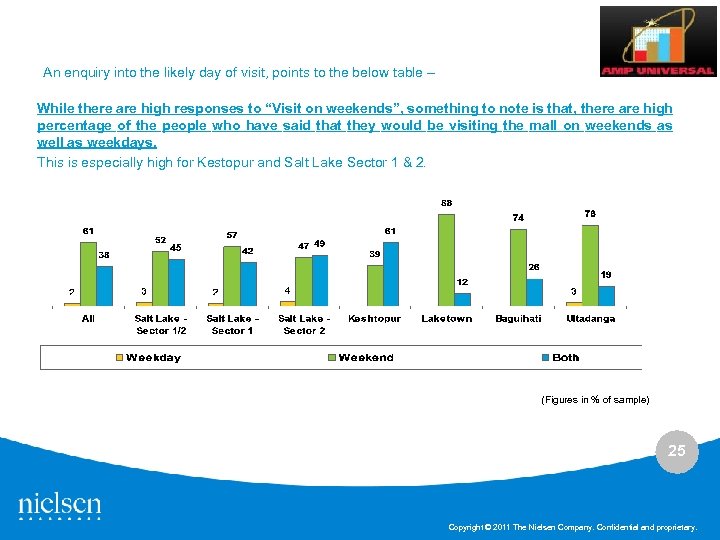

An enquiry into the likely day of visit, points to the below table – While there are high responses to “Visit on weekends”, something to note is that, there are high percentage of the people who have said that they would be visiting the mall on weekends as well as weekdays. This is especially high for Kestopur and Salt Lake Sector 1 & 2. (Figures in % of sample) 25 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

An enquiry into the likely day of visit, points to the below table – While there are high responses to “Visit on weekends”, something to note is that, there are high percentage of the people who have said that they would be visiting the mall on weekends as well as weekdays. This is especially high for Kestopur and Salt Lake Sector 1 & 2. (Figures in % of sample) 25 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

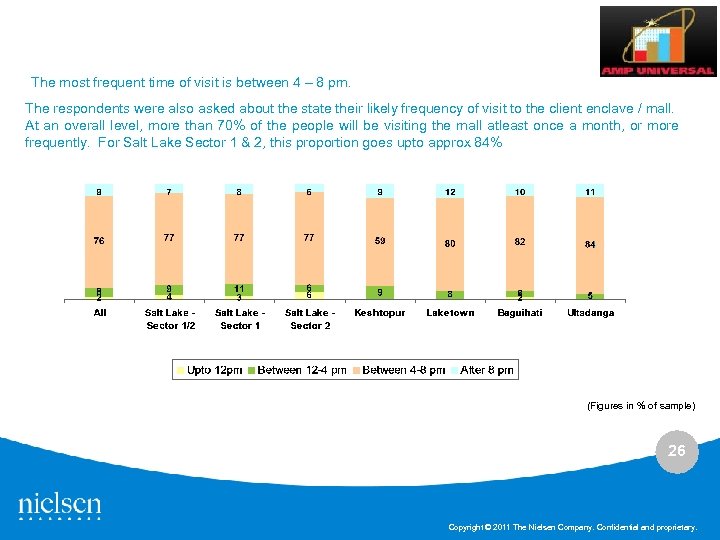

The most frequent time of visit is between 4 – 8 pm. The respondents were also asked about the state their likely frequency of visit to the client enclave / mall. At an overall level, more than 70% of the people will be visiting the mall atleast once a month, or more frequently. For Salt Lake Sector 1 & 2, this proportion goes upto approx 84% (Figures in % of sample) 26 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

The most frequent time of visit is between 4 – 8 pm. The respondents were also asked about the state their likely frequency of visit to the client enclave / mall. At an overall level, more than 70% of the people will be visiting the mall atleast once a month, or more frequently. For Salt Lake Sector 1 & 2, this proportion goes upto approx 84% (Figures in % of sample) 26 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

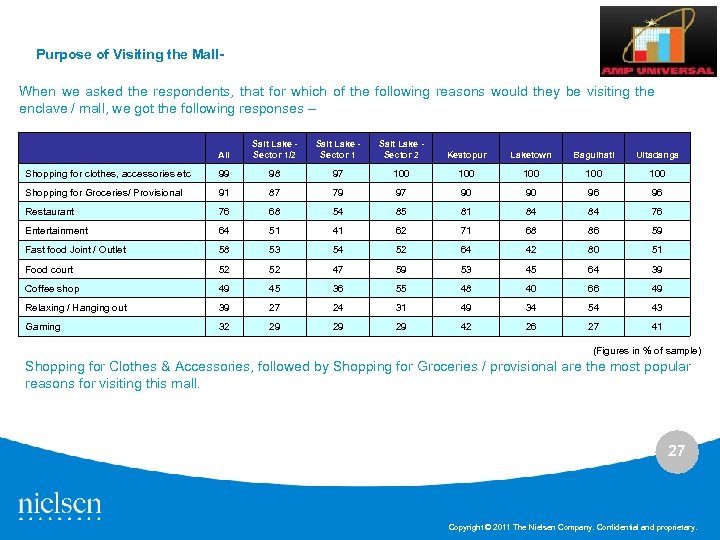

Purpose of Visiting the Mall. When we asked the respondents, that for which of the following reasons would they be visiting the enclave / mall, we got the following responses – All Salt Lake - Sector 1/2 Salt Lake - Sector 1 Salt Lake - Sector 2 Kestopur Laketown Baguihati Ultadanga Shopping for clothes, accessories etc 99 98 97 100 100 100 Shopping for Groceries/ Provisional 91 87 79 97 90 90 96 96 Restaurant 76 68 54 85 81 84 84 76 Entertainment 64 51 41 62 71 68 86 59 Fast food Joint / Outlet 58 53 54 52 64 42 80 51 Food court 52 52 47 59 53 45 64 39 Coffee shop 49 45 36 55 48 40 66 49 Relaxing / Hanging out 39 27 24 31 49 34 54 43 Gaming 32 29 29 29 42 26 27 41 (Figures in % of sample) Shopping for Clothes & Accessories, followed by Shopping for Groceries / provisional are the most popular reasons for visiting this mall. 27 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Purpose of Visiting the Mall. When we asked the respondents, that for which of the following reasons would they be visiting the enclave / mall, we got the following responses – All Salt Lake - Sector 1/2 Salt Lake - Sector 1 Salt Lake - Sector 2 Kestopur Laketown Baguihati Ultadanga Shopping for clothes, accessories etc 99 98 97 100 100 100 Shopping for Groceries/ Provisional 91 87 79 97 90 90 96 96 Restaurant 76 68 54 85 81 84 84 76 Entertainment 64 51 41 62 71 68 86 59 Fast food Joint / Outlet 58 53 54 52 64 42 80 51 Food court 52 52 47 59 53 45 64 39 Coffee shop 49 45 36 55 48 40 66 49 Relaxing / Hanging out 39 27 24 31 49 34 54 43 Gaming 32 29 29 29 42 26 27 41 (Figures in % of sample) Shopping for Clothes & Accessories, followed by Shopping for Groceries / provisional are the most popular reasons for visiting this mall. 27 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

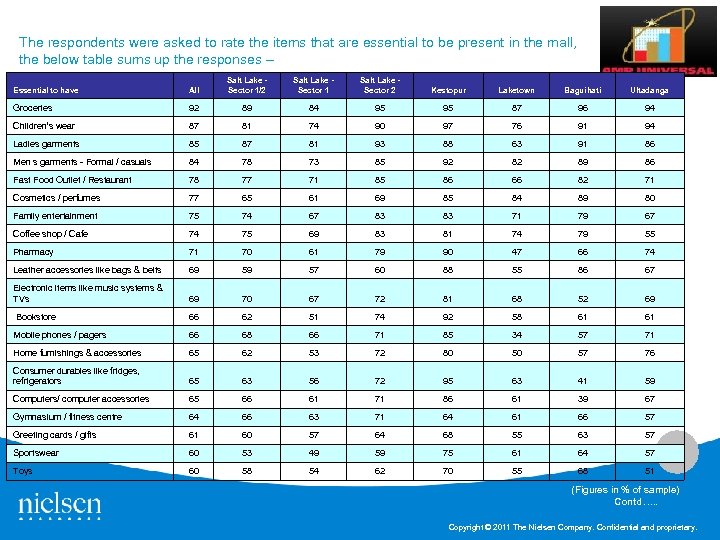

The respondents were asked to rate the items that are essential to be present in the mall, the below table sums up the responses – Essential to have All Salt Lake - Sector 1/2 Salt Lake - Sector 1 Salt Lake - Sector 2 Kestopur Laketown Baguihati Ultadanga Groceries 92 89 84 95 95 87 96 94 Children’s wear 87 81 74 90 97 76 91 94 Ladies garments 85 87 81 93 88 63 91 86 Men s garments - Formal / casuals 84 78 73 85 92 82 89 86 Fast Food Outlet / Restaurant 78 77 71 85 86 66 82 71 Cosmetics / perfumes 77 65 61 69 85 84 89 80 Family entertainment 75 74 67 83 83 71 79 67 Coffee shop / Cafe 74 75 69 83 81 74 79 55 Pharmacy 71 70 61 79 90 47 66 74 Leather accessories like bags & belts 69 59 57 60 88 55 86 67 Electronic items like music systems & TVs 69 70 67 72 81 68 52 69 Bookstore 66 62 51 74 92 58 61 61 Mobile phones / pagers 66 68 66 71 85 34 57 71 Home furnishings & accessories 65 62 53 72 80 50 57 76 Consumer durables like fridges, refrigerators 65 63 56 72 95 63 41 59 Computers/ computer accessories 65 66 61 71 86 61 39 67 Gymnasium / fitness centre 64 66 63 71 64 61 66 57 Greeting cards / gifts 61 60 57 64 68 55 63 57 Sportswear 60 53 49 59 75 61 64 57 Toys 60 58 54 62 70 55 68 51 28 (Figures in % of sample) Contd…. . Copyright © 2011 The Nielsen Company. Confidential and proprietary.

The respondents were asked to rate the items that are essential to be present in the mall, the below table sums up the responses – Essential to have All Salt Lake - Sector 1/2 Salt Lake - Sector 1 Salt Lake - Sector 2 Kestopur Laketown Baguihati Ultadanga Groceries 92 89 84 95 95 87 96 94 Children’s wear 87 81 74 90 97 76 91 94 Ladies garments 85 87 81 93 88 63 91 86 Men s garments - Formal / casuals 84 78 73 85 92 82 89 86 Fast Food Outlet / Restaurant 78 77 71 85 86 66 82 71 Cosmetics / perfumes 77 65 61 69 85 84 89 80 Family entertainment 75 74 67 83 83 71 79 67 Coffee shop / Cafe 74 75 69 83 81 74 79 55 Pharmacy 71 70 61 79 90 47 66 74 Leather accessories like bags & belts 69 59 57 60 88 55 86 67 Electronic items like music systems & TVs 69 70 67 72 81 68 52 69 Bookstore 66 62 51 74 92 58 61 61 Mobile phones / pagers 66 68 66 71 85 34 57 71 Home furnishings & accessories 65 62 53 72 80 50 57 76 Consumer durables like fridges, refrigerators 65 63 56 72 95 63 41 59 Computers/ computer accessories 65 66 61 71 86 61 39 67 Gymnasium / fitness centre 64 66 63 71 64 61 66 57 Greeting cards / gifts 61 60 57 64 68 55 63 57 Sportswear 60 53 49 59 75 61 64 57 Toys 60 58 54 62 70 55 68 51 28 (Figures in % of sample) Contd…. . Copyright © 2011 The Nielsen Company. Confidential and proprietary.

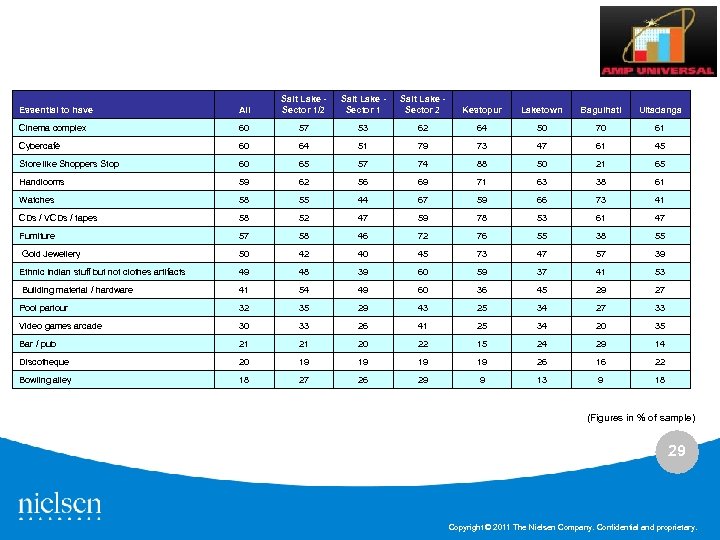

Essential to have All Salt Lake - Sector 1/2 Salt Lake - Sector 1 Salt Lake - Sector 2 Kestopur Laketown Baguihati Ultadanga Cinema complex 60 57 53 62 64 50 70 61 Cybercafé 60 64 51 79 73 47 61 45 Store like Shoppers Stop 60 65 57 74 88 50 21 65 Handlooms 59 62 56 69 71 63 38 61 Watches 58 55 44 67 59 66 73 41 CDs / VCDs / tapes 58 52 47 59 78 53 61 47 Furniture 57 58 46 72 76 55 38 55 Gold Jewellery 50 42 40 45 73 47 57 39 Ethnic Indian stuff but not clothes artifacts 49 48 39 60 59 37 41 53 Building material / hardware 41 54 49 60 36 45 29 27 Pool parlour 32 35 29 43 25 34 27 33 Video games arcade 30 33 26 41 25 34 20 35 Bar / pub 21 21 20 22 15 24 29 14 Discotheque 20 19 19 26 16 22 Bowling alley 18 27 26 29 9 13 9 18 (Figures in % of sample) 29 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Essential to have All Salt Lake - Sector 1/2 Salt Lake - Sector 1 Salt Lake - Sector 2 Kestopur Laketown Baguihati Ultadanga Cinema complex 60 57 53 62 64 50 70 61 Cybercafé 60 64 51 79 73 47 61 45 Store like Shoppers Stop 60 65 57 74 88 50 21 65 Handlooms 59 62 56 69 71 63 38 61 Watches 58 55 44 67 59 66 73 41 CDs / VCDs / tapes 58 52 47 59 78 53 61 47 Furniture 57 58 46 72 76 55 38 55 Gold Jewellery 50 42 40 45 73 47 57 39 Ethnic Indian stuff but not clothes artifacts 49 48 39 60 59 37 41 53 Building material / hardware 41 54 49 60 36 45 29 27 Pool parlour 32 35 29 43 25 34 27 33 Video games arcade 30 33 26 41 25 34 20 35 Bar / pub 21 21 20 22 15 24 29 14 Discotheque 20 19 19 26 16 22 Bowling alley 18 27 26 29 9 13 9 18 (Figures in % of sample) 29 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

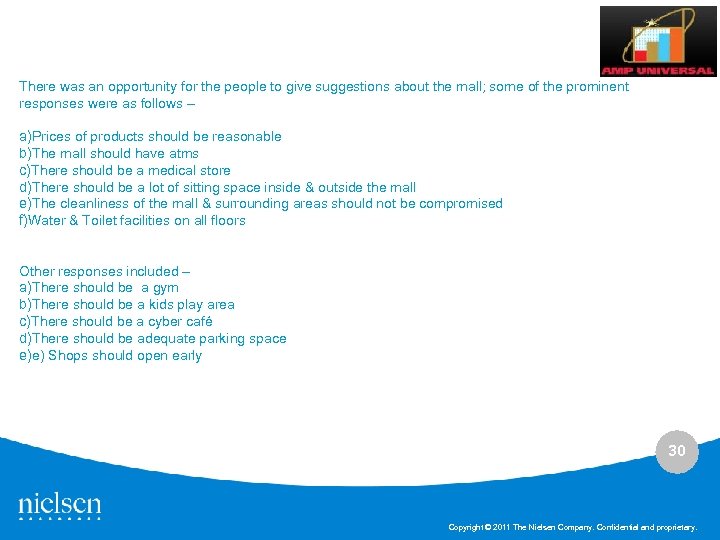

There was an opportunity for the people to give suggestions about the mall; some of the prominent responses were as follows – a)Prices of products should be reasonable b)The mall should have atms c)There should be a medical store d)There should be a lot of sitting space inside & outside the mall e)The cleanliness of the mall & surrounding areas should not be compromised f)Water & Toilet facilities on all floors Other responses included – a)There should be a gym b)There should be a kids play area c)There should be a cyber café d)There should be adequate parking space e)e) Shops should open early 30 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

There was an opportunity for the people to give suggestions about the mall; some of the prominent responses were as follows – a)Prices of products should be reasonable b)The mall should have atms c)There should be a medical store d)There should be a lot of sitting space inside & outside the mall e)The cleanliness of the mall & surrounding areas should not be compromised f)Water & Toilet facilities on all floors Other responses included – a)There should be a gym b)There should be a kids play area c)There should be a cyber café d)There should be adequate parking space e)e) Shops should open early 30 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

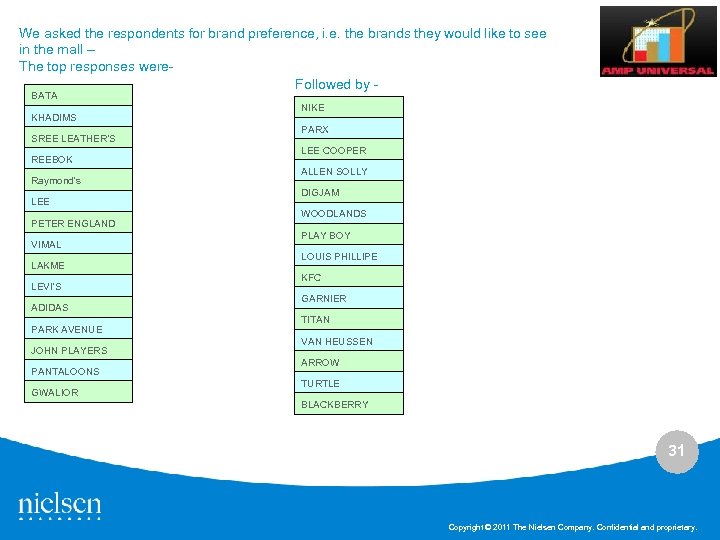

We asked the respondents for brand preference, i. e. the brands they would like to see in the mall – The top responses were- Followed by - BATA KHADIMS SREE LEATHER’S REEBOK Raymond's LEE PETER ENGLAND VIMAL LAKME LEVI'S ADIDAS PARK AVENUE JOHN PLAYERS PANTALOONS GWALIOR NIKE PARX LEE COOPER ALLEN SOLLY DIGJAM WOODLANDS PLAY BOY LOUIS PHILLIPE KFC GARNIER TITAN VAN HEUSSEN ARROW TURTLE BLACKBERRY 31 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

We asked the respondents for brand preference, i. e. the brands they would like to see in the mall – The top responses were- Followed by - BATA KHADIMS SREE LEATHER’S REEBOK Raymond's LEE PETER ENGLAND VIMAL LAKME LEVI'S ADIDAS PARK AVENUE JOHN PLAYERS PANTALOONS GWALIOR NIKE PARX LEE COOPER ALLEN SOLLY DIGJAM WOODLANDS PLAY BOY LOUIS PHILLIPE KFC GARNIER TITAN VAN HEUSSEN ARROW TURTLE BLACKBERRY 31 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

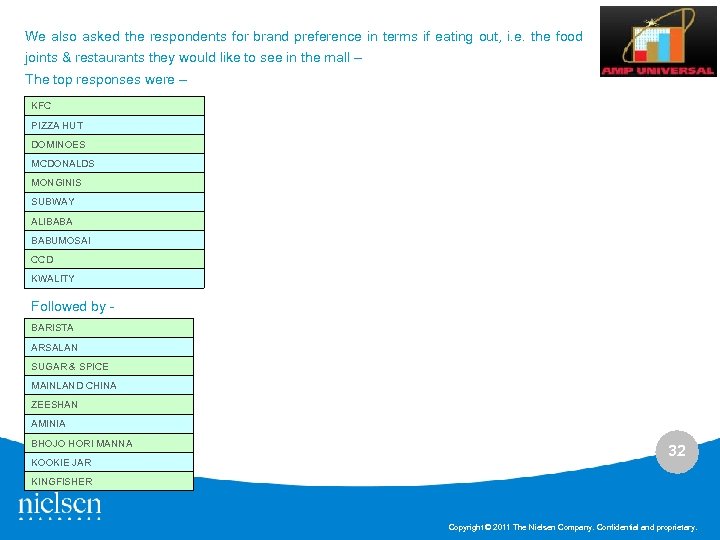

We also asked the respondents for brand preference in terms if eating out, i. e. the food joints & restaurants they would like to see in the mall – The top responses were – KFC PIZZA HUT DOMINOES MCDONALDS MONGINIS SUBWAY ALIBABA BABUMOSAI CCD KWALITY Followed by - BARISTA ARSALAN SUGAR & SPICE MAINLAND CHINA ZEESHAN AMINIA BHOJO HORI MANNA KOOKIE JAR 32 KINGFISHER Copyright © 2011 The Nielsen Company. Confidential and proprietary.

We also asked the respondents for brand preference in terms if eating out, i. e. the food joints & restaurants they would like to see in the mall – The top responses were – KFC PIZZA HUT DOMINOES MCDONALDS MONGINIS SUBWAY ALIBABA BABUMOSAI CCD KWALITY Followed by - BARISTA ARSALAN SUGAR & SPICE MAINLAND CHINA ZEESHAN AMINIA BHOJO HORI MANNA KOOKIE JAR 32 KINGFISHER Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Profiling & Expectations of Salt Lake – Sector V respondents 33 Page 33 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Profiling & Expectations of Salt Lake – Sector V respondents 33 Page 33 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

General Profiling 34 Page 34 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

General Profiling 34 Page 34 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

We met employees from…. Among others… Page 35 35 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

We met employees from…. Among others… Page 35 35 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

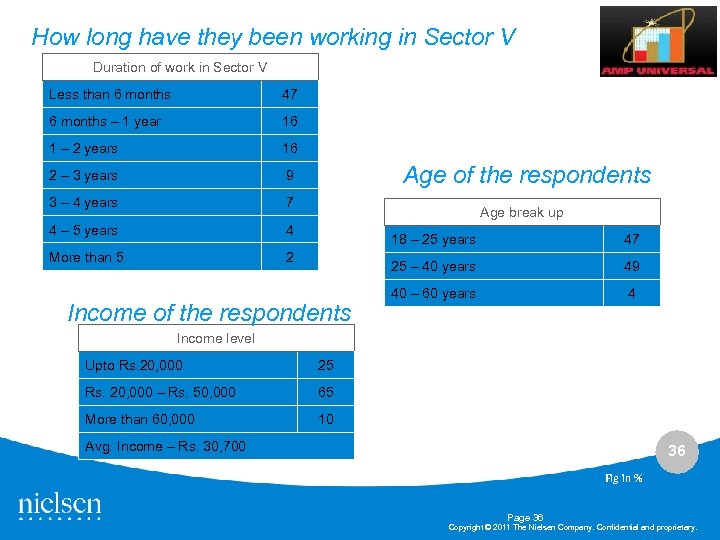

How long have they been working in Sector V Duration of work in Sector V Less than 6 months 47 6 months – 1 year 16 1 – 2 years 16 2 – 3 years 9 3 – 4 years 7 4 – 5 years 4 More than 5 2 Age of the respondents Age break up 18 – 25 years 25 – 40 years Income of the respondents 47 49 40 – 60 years 4 Income level Upto Rs. 20, 000 25 Rs. 20, 000 – Rs. 50, 000 65 More than 60, 000 10 Avg. Income – Rs. 30, 700 36 Fig in % Page 36 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

How long have they been working in Sector V Duration of work in Sector V Less than 6 months 47 6 months – 1 year 16 1 – 2 years 16 2 – 3 years 9 3 – 4 years 7 4 – 5 years 4 More than 5 2 Age of the respondents Age break up 18 – 25 years 25 – 40 years Income of the respondents 47 49 40 – 60 years 4 Income level Upto Rs. 20, 000 25 Rs. 20, 000 – Rs. 50, 000 65 More than 60, 000 10 Avg. Income – Rs. 30, 700 36 Fig in % Page 36 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Food Habits 37 Page 37 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Food Habits 37 Page 37 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

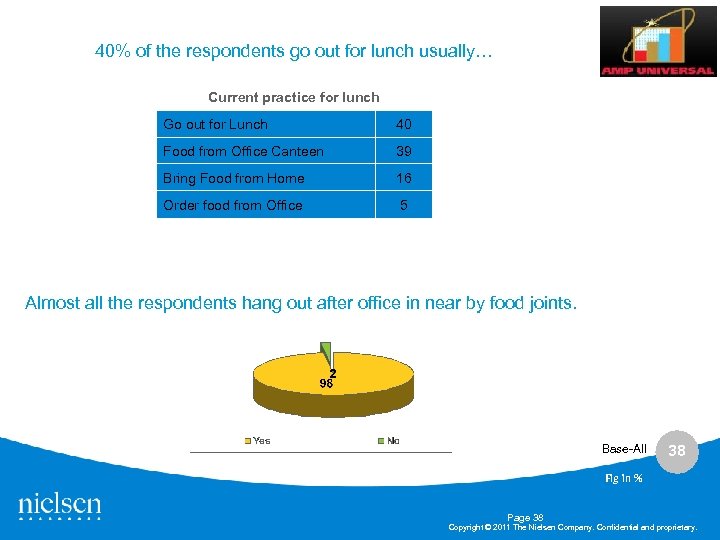

40% of the respondents go out for lunch usually… Current practice for lunch Go out for Lunch 40 Food from Office Canteen 39 Bring Food from Home 16 Order food from Office 5 Almost all the respondents hang out after office in near by food joints. Base-All 38 Fig in % Page 38 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

40% of the respondents go out for lunch usually… Current practice for lunch Go out for Lunch 40 Food from Office Canteen 39 Bring Food from Home 16 Order food from Office 5 Almost all the respondents hang out after office in near by food joints. Base-All 38 Fig in % Page 38 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

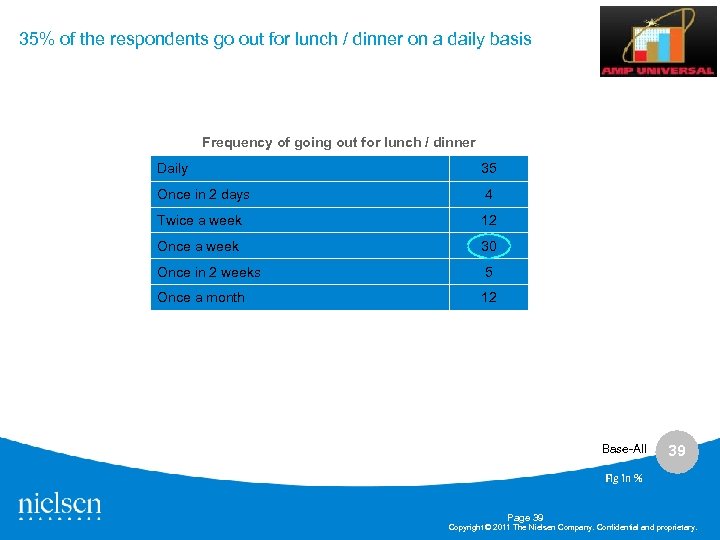

35% of the respondents go out for lunch / dinner on a daily basis Frequency of going out for lunch / dinner Daily 35 Once in 2 days 4 Twice a week 12 Once a week 30 Once in 2 weeks 5 Once a month 12 Base-All 39 Fig in % Page 39 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

35% of the respondents go out for lunch / dinner on a daily basis Frequency of going out for lunch / dinner Daily 35 Once in 2 days 4 Twice a week 12 Once a week 30 Once in 2 weeks 5 Once a month 12 Base-All 39 Fig in % Page 39 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

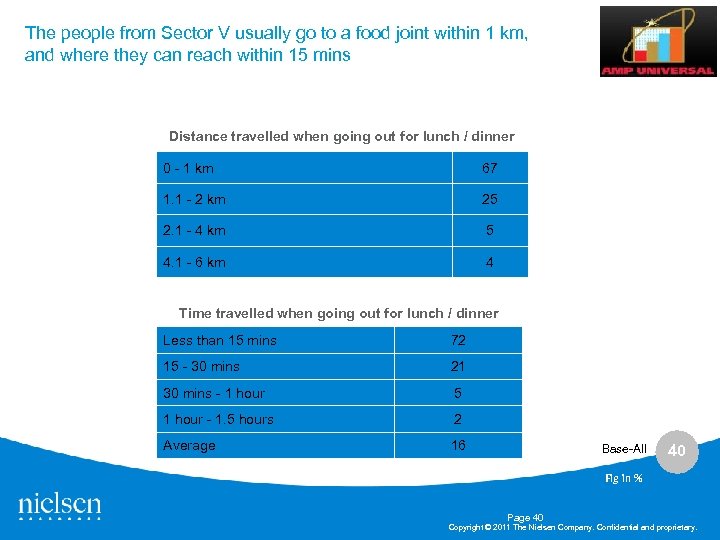

The people from Sector V usually go to a food joint within 1 km, and where they can reach within 15 mins Distance travelled when going out for lunch / dinner 0 - 1 km 67 1. 1 - 2 km 25 2. 1 - 4 km 5 4. 1 - 6 km 4 Time travelled when going out for lunch / dinner Less than 15 mins 72 15 - 30 mins 21 30 mins - 1 hour 5 1 hour - 1. 5 hours 2 Average 16 Base-All 40 Fig in % Page 40 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

The people from Sector V usually go to a food joint within 1 km, and where they can reach within 15 mins Distance travelled when going out for lunch / dinner 0 - 1 km 67 1. 1 - 2 km 25 2. 1 - 4 km 5 4. 1 - 6 km 4 Time travelled when going out for lunch / dinner Less than 15 mins 72 15 - 30 mins 21 30 mins - 1 hour 5 1 hour - 1. 5 hours 2 Average 16 Base-All 40 Fig in % Page 40 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

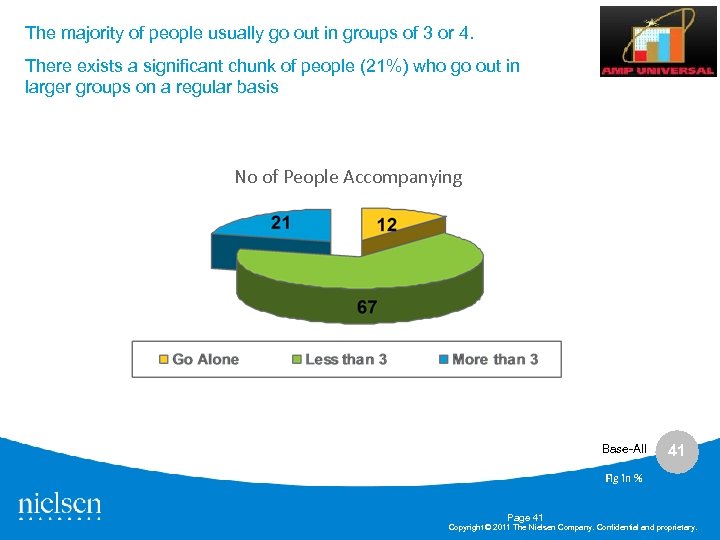

The majority of people usually go out in groups of 3 or 4. There exists a significant chunk of people (21%) who go out in larger groups on a regular basis No of People Accompanying Base-All 41 Fig in % Page 41 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

The majority of people usually go out in groups of 3 or 4. There exists a significant chunk of people (21%) who go out in larger groups on a regular basis No of People Accompanying Base-All 41 Fig in % Page 41 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

More than half the people walk to their destination Mode of travel used Walk 58 Auto rickshaw 16 2 wheeler 11 Car 7 Taxi 5 Bus 4 Almost 90% of the people go to a local restaurant / hotel in Sector V Destination for lunch / dinner Local Restaurant/hotel in sector 5 88 Stand alone restaurant in Sector 5 4 Food court of any mall / building 5 Stand alone restaurant in areas like Park Street 2 Base-All 42 Fig in % Page 42 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

More than half the people walk to their destination Mode of travel used Walk 58 Auto rickshaw 16 2 wheeler 11 Car 7 Taxi 5 Bus 4 Almost 90% of the people go to a local restaurant / hotel in Sector V Destination for lunch / dinner Local Restaurant/hotel in sector 5 88 Stand alone restaurant in Sector 5 4 Food court of any mall / building 5 Stand alone restaurant in areas like Park Street 2 Base-All 42 Fig in % Page 42 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

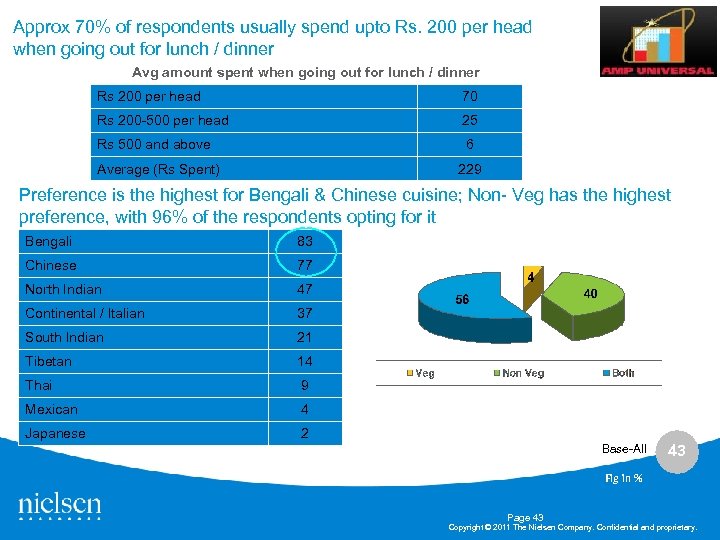

Approx 70% of respondents usually spend upto Rs. 200 per head when going out for lunch / dinner Avg amount spent when going out for lunch / dinner Rs 200 per head 70 Rs 200 -500 per head 25 Rs 500 and above 6 Average (Rs Spent) 229 Preference is the highest for Bengali & Chinese cuisine; Non- Veg has the highest preference, with 96% of the respondents opting for it Bengali 83 Chinese 77 North Indian 47 Continental / Italian 37 South Indian 21 Tibetan 14 Thai 9 Mexican 4 Japanese 2 Base-All 43 Fig in % Page 43 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Approx 70% of respondents usually spend upto Rs. 200 per head when going out for lunch / dinner Avg amount spent when going out for lunch / dinner Rs 200 per head 70 Rs 200 -500 per head 25 Rs 500 and above 6 Average (Rs Spent) 229 Preference is the highest for Bengali & Chinese cuisine; Non- Veg has the highest preference, with 96% of the respondents opting for it Bengali 83 Chinese 77 North Indian 47 Continental / Italian 37 South Indian 21 Tibetan 14 Thai 9 Mexican 4 Japanese 2 Base-All 43 Fig in % Page 43 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Concept Evaluation 44 Page 44 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Concept Evaluation 44 Page 44 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

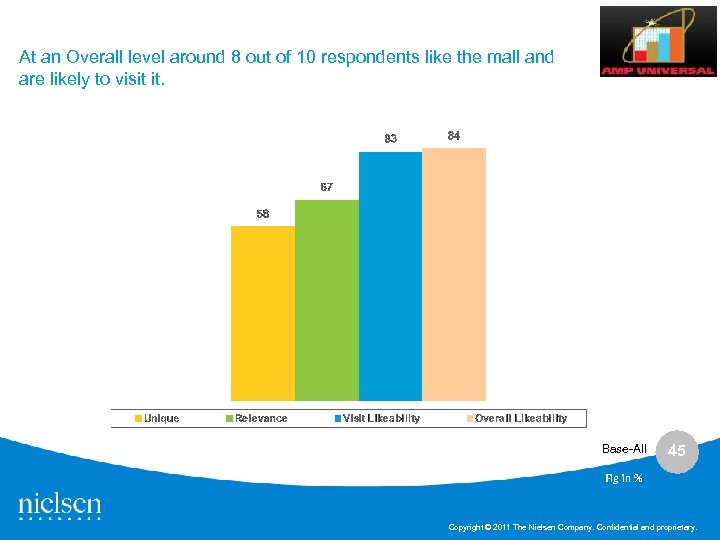

At an Overall level around 8 out of 10 respondents like the mall and are likely to visit it. Base-All 45 Fig in % Copyright © 2011 The Nielsen Company. Confidential and proprietary.

At an Overall level around 8 out of 10 respondents like the mall and are likely to visit it. Base-All 45 Fig in % Copyright © 2011 The Nielsen Company. Confidential and proprietary.

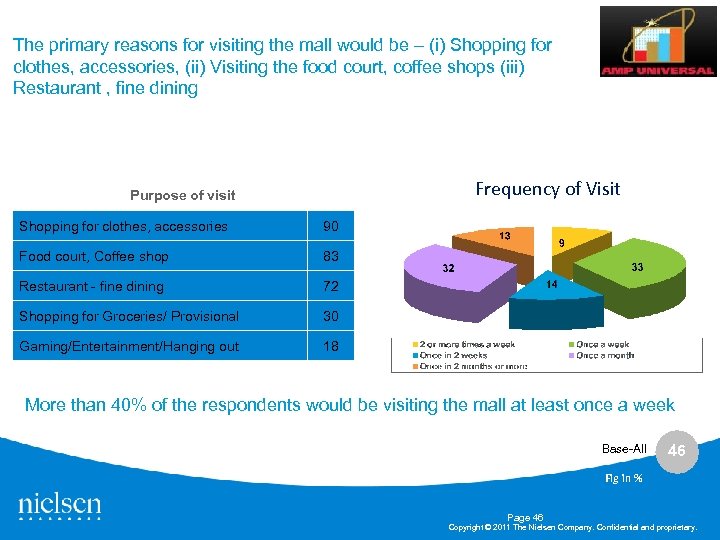

The primary reasons for visiting the mall would be – (i) Shopping for clothes, accessories, (ii) Visiting the food court, coffee shops (iii) Restaurant , fine dining Frequency of Visit Purpose of visit Shopping for clothes, accessories 90 Food court, Coffee shop 83 Restaurant - fine dining 72 Shopping for Groceries/ Provisional 30 Gaming/Entertainment/Hanging out 18 More than 40% of the respondents would be visiting the mall at least once a week Base-All 46 Fig in % Page 46 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

The primary reasons for visiting the mall would be – (i) Shopping for clothes, accessories, (ii) Visiting the food court, coffee shops (iii) Restaurant , fine dining Frequency of Visit Purpose of visit Shopping for clothes, accessories 90 Food court, Coffee shop 83 Restaurant - fine dining 72 Shopping for Groceries/ Provisional 30 Gaming/Entertainment/Hanging out 18 More than 40% of the respondents would be visiting the mall at least once a week Base-All 46 Fig in % Page 46 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

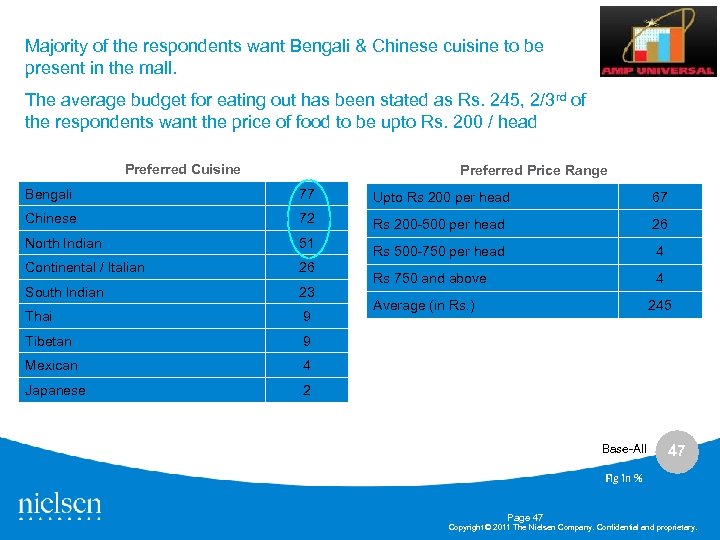

Majority of the respondents want Bengali & Chinese cuisine to be present in the mall. The average budget for eating out has been stated as Rs. 245, 2/3 rd of the respondents want the price of food to be upto Rs. 200 / head Preferred Cuisine Preferred Price Range Bengali 77 Upto Rs 200 per head 67 Chinese 72 Rs 200 -500 per head 26 North Indian 51 Rs 500 -750 per head 4 Continental / Italian 26 South Indian 23 Rs 750 and above 4 Thai 9 Tibetan 9 Mexican 4 Japanese 2 Average (in Rs. ) 245 Base-All 47 Fig in % Page 47 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Majority of the respondents want Bengali & Chinese cuisine to be present in the mall. The average budget for eating out has been stated as Rs. 245, 2/3 rd of the respondents want the price of food to be upto Rs. 200 / head Preferred Cuisine Preferred Price Range Bengali 77 Upto Rs 200 per head 67 Chinese 72 Rs 200 -500 per head 26 North Indian 51 Rs 500 -750 per head 4 Continental / Italian 26 South Indian 23 Rs 750 and above 4 Thai 9 Tibetan 9 Mexican 4 Japanese 2 Average (in Rs. ) 245 Base-All 47 Fig in % Page 47 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Reebok & KFC are the most desired brands for the respondents. Most Desired Brands Most Desired Joints REEBOK 46 KFC 77 PANTALOONS 23 DOMINOS 35 ADIDAS 16 MCDONALDS 32 JOHN PLAYERS 16 PIZZA HUT 23 LEE 14 MAINLAND CHINA 7 BATA 14 ALI-BABA 5 PETER ENGLAND 12 ARSALAN 5 LEVI'S 11 CCD 5 VAN HEUSEN 11 BARISTA 5 KODAK 11 MONGINIS 4 RAYMOND 11 SUBWAY 4 NIKE 11 BHOJOHORI MANNA 4 ARROW 9 KOOKIE JAR 2 48 Fig in % Base-All Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Reebok & KFC are the most desired brands for the respondents. Most Desired Brands Most Desired Joints REEBOK 46 KFC 77 PANTALOONS 23 DOMINOS 35 ADIDAS 16 MCDONALDS 32 JOHN PLAYERS 16 PIZZA HUT 23 LEE 14 MAINLAND CHINA 7 BATA 14 ALI-BABA 5 PETER ENGLAND 12 ARSALAN 5 LEVI'S 11 CCD 5 VAN HEUSEN 11 BARISTA 5 KODAK 11 MONGINIS 4 RAYMOND 11 SUBWAY 4 NIKE 11 BHOJOHORI MANNA 4 ARROW 9 KOOKIE JAR 2 48 Fig in % Base-All Copyright © 2011 The Nielsen Company. Confidential and proprietary.

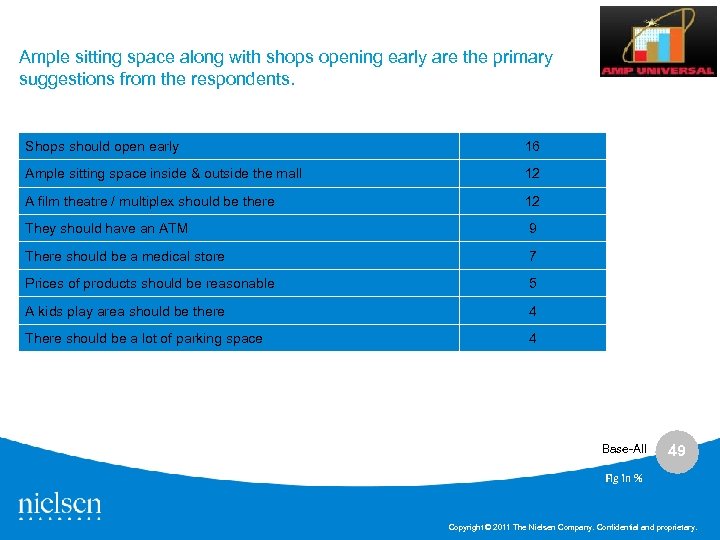

Ample sitting space along with shops opening early are the primary suggestions from the respondents. Shops should open early 16 Ample sitting space inside & outside the mall 12 A film theatre / multiplex should be there 12 They should have an ATM 9 There should be a medical store 7 Prices of products should be reasonable 5 A kids play area should be there 4 There should be a lot of parking space 4 Base-All 49 Fig in % Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Ample sitting space along with shops opening early are the primary suggestions from the respondents. Shops should open early 16 Ample sitting space inside & outside the mall 12 A film theatre / multiplex should be there 12 They should have an ATM 9 There should be a medical store 7 Prices of products should be reasonable 5 A kids play area should be there 4 There should be a lot of parking space 4 Base-All 49 Fig in % Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Population Enumeration 50 Page 50 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Population Enumeration 50 Page 50 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

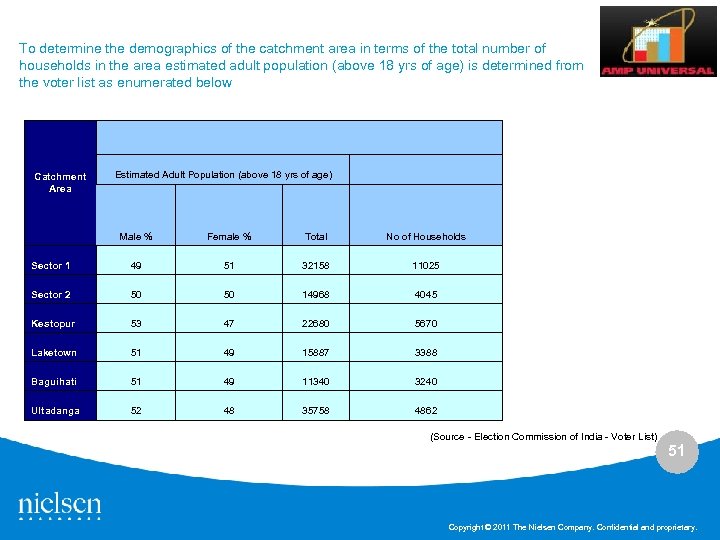

To determine the demographics of the catchment area in terms of the total number of households in the area estimated adult population (above 18 yrs of age) is determined from the voter list as enumerated below Catchment Area Estimated Adult Population (above 18 yrs of age) Male % Female % Total No of Households Sector 1 49 51 32158 11025 Sector 2 50 50 14968 4045 Kestopur 53 47 22680 5670 Laketown 51 49 15887 3388 Baguihati 51 49 11340 3240 Ultadanga 52 48 35758 4862 (Source - Election Commission of India - Voter List) 51 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

To determine the demographics of the catchment area in terms of the total number of households in the area estimated adult population (above 18 yrs of age) is determined from the voter list as enumerated below Catchment Area Estimated Adult Population (above 18 yrs of age) Male % Female % Total No of Households Sector 1 49 51 32158 11025 Sector 2 50 50 14968 4045 Kestopur 53 47 22680 5670 Laketown 51 49 15887 3388 Baguihati 51 49 11340 3240 Ultadanga 52 48 35758 4862 (Source - Election Commission of India - Voter List) 51 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

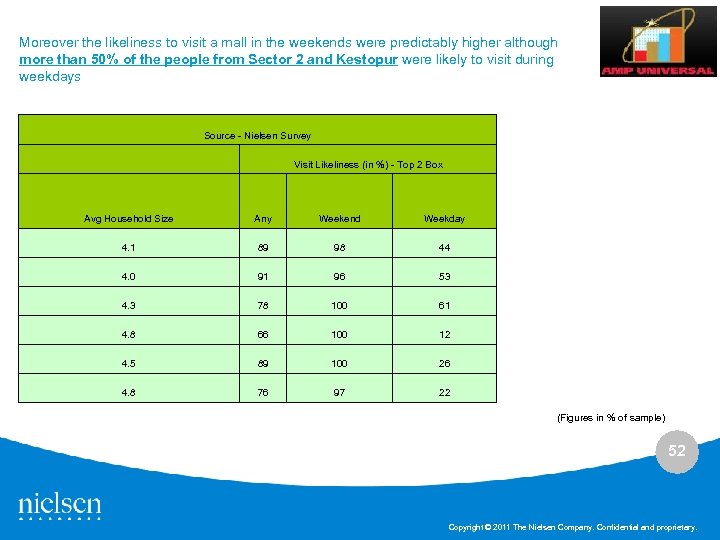

Moreover the likeliness to visit a mall in the weekends were predictably higher although more than 50% of the people from Sector 2 and Kestopur were likely to visit during weekdays Source - Nielsen Survey Visit Likeliness (in %) - Top 2 Box Avg Household Size Any Weekend Weekday 4. 1 89 98 44 4. 0 91 96 53 4. 3 78 100 61 4. 8 66 100 12 4. 5 89 100 26 4. 8 76 97 22 (Figures in % of sample) 52 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Moreover the likeliness to visit a mall in the weekends were predictably higher although more than 50% of the people from Sector 2 and Kestopur were likely to visit during weekdays Source - Nielsen Survey Visit Likeliness (in %) - Top 2 Box Avg Household Size Any Weekend Weekday 4. 1 89 98 44 4. 0 91 96 53 4. 3 78 100 61 4. 8 66 100 12 4. 5 89 100 26 4. 8 76 97 22 (Figures in % of sample) 52 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

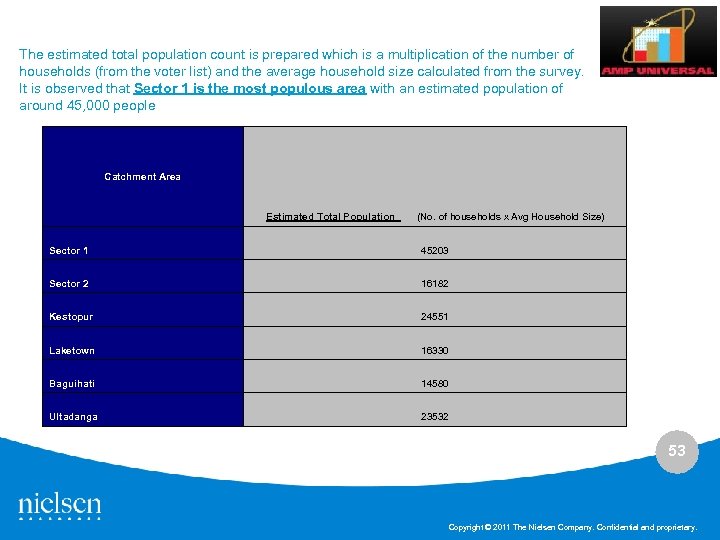

The estimated total population count is prepared which is a multiplication of the number of households (from the voter list) and the average household size calculated from the survey. It is observed that Sector 1 is the most populous area with an estimated population of around 45, 000 people Catchment Area Estimated Total Population (No. of households x Avg Household Size) Sector 1 45203 Sector 2 16182 Kestopur 24551 Laketown 16330 Baguihati 14580 Ultadanga 23532 53 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

The estimated total population count is prepared which is a multiplication of the number of households (from the voter list) and the average household size calculated from the survey. It is observed that Sector 1 is the most populous area with an estimated population of around 45, 000 people Catchment Area Estimated Total Population (No. of households x Avg Household Size) Sector 1 45203 Sector 2 16182 Kestopur 24551 Laketown 16330 Baguihati 14580 Ultadanga 23532 53 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

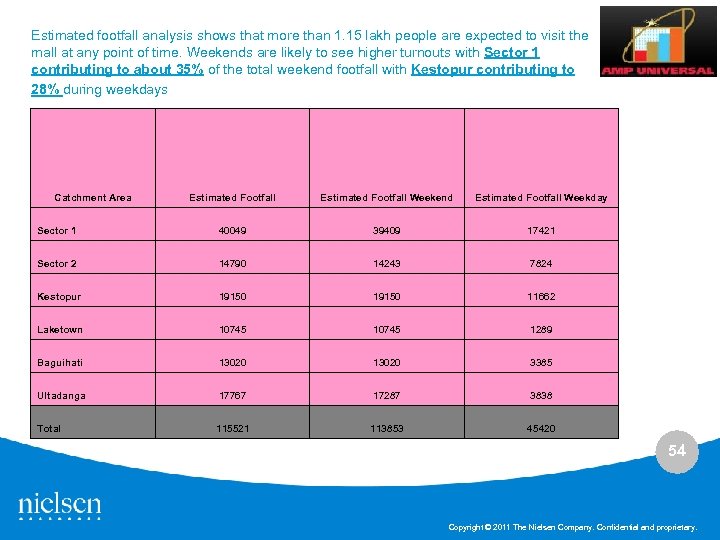

Estimated footfall analysis shows that more than 1. 15 lakh people are expected to visit the mall at any point of time. Weekends are likely to see higher turnouts with Sector 1 contributing to about 35% of the total weekend footfall with Kestopur contributing to 28% during weekdays Catchment Area Estimated Footfall Weekend Estimated Footfall Weekday Sector 1 40049 39409 17421 Sector 2 14790 14243 7824 Kestopur 19150 11662 Laketown 10745 1289 Baguihati 13020 3385 Ultadanga 17767 17287 3838 Total 115521 113853 45420 54 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Estimated footfall analysis shows that more than 1. 15 lakh people are expected to visit the mall at any point of time. Weekends are likely to see higher turnouts with Sector 1 contributing to about 35% of the total weekend footfall with Kestopur contributing to 28% during weekdays Catchment Area Estimated Footfall Weekend Estimated Footfall Weekday Sector 1 40049 39409 17421 Sector 2 14790 14243 7824 Kestopur 19150 11662 Laketown 10745 1289 Baguihati 13020 3385 Ultadanga 17767 17287 3838 Total 115521 113853 45420 54 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Location Drawing To have a better understanding of the catchment area lacational maps have been provided with (ref from Google Maps) keeping the mall “AMP VAISAAKKHI” as the base point. The maps give us a clear representation of the sub areas within the catchment areas from where the survey was carried out. The locational maps have been provided for the following areas: - 1. Sector 1 Salt lake 2. Sector 2 Salt Lake 3. Kestopur 4. Baguihati 5. Laketown 6. Ultadanga 55 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Location Drawing To have a better understanding of the catchment area lacational maps have been provided with (ref from Google Maps) keeping the mall “AMP VAISAAKKHI” as the base point. The maps give us a clear representation of the sub areas within the catchment areas from where the survey was carried out. The locational maps have been provided for the following areas: - 1. Sector 1 Salt lake 2. Sector 2 Salt Lake 3. Kestopur 4. Baguihati 5. Laketown 6. Ultadanga 55 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

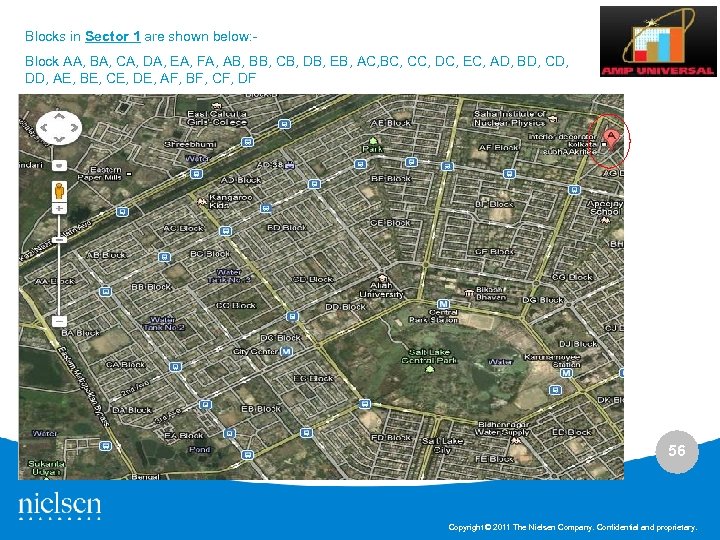

Blocks in Sector 1 are shown below: - Block AA, BA, CA, DA, EA, FA, AB, BB, CB, DB, EB, AC, BC, CC, DC, EC, AD, BD, CD, DD, AE, BE, CE, DE, AF, BF, CF, DF 56 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Blocks in Sector 1 are shown below: - Block AA, BA, CA, DA, EA, FA, AB, BB, CB, DB, EB, AC, BC, CC, DC, EC, AD, BD, CD, DD, AE, BE, CE, DE, AF, BF, CF, DF 56 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Blocks in Sector 2 are shown below: Block AG, BG, CG , DG, AH, BH, AJ, BJ, CJ, DJ, AK, BK, CK, DK, AL, BL, CL, DL, ED, EE 57 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Blocks in Sector 2 are shown below: Block AG, BG, CG , DG, AH, BH, AJ, BJ, CJ, DJ, AK, BK, CK, DK, AL, BL, CL, DL, ED, EE 57 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

The areas under Kestopur are displayed in the map given below: Ghosh Para, Majher Para, Hana Para, Rabindra Pally, Adarsha Pally, Prafulla Kanan, Narayantola, Chirantani Park 58 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

The areas under Kestopur are displayed in the map given below: Ghosh Para, Majher Para, Hana Para, Rabindra Pally, Adarsha Pally, Prafulla Kanan, Narayantola, Chirantani Park 58 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

The areas under Baguihati are displayed in the map given below: Deshbandu Nagar, Aswani Nagar, Zarda Bagan, Narayantola West 59 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

The areas under Baguihati are displayed in the map given below: Deshbandu Nagar, Aswani Nagar, Zarda Bagan, Narayantola West 59 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

The areas under Laketown are displayed in the map given below: Laketown Block B, Block C , Sreebhumi and Tank no-1, 2, 3, 4, 5 in Dum Park area Laketown Block B, C and Sreebhumi Tank No 1 -5 in Dum Park Area 60 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

The areas under Laketown are displayed in the map given below: Laketown Block B, Block C , Sreebhumi and Tank no-1, 2, 3, 4, 5 in Dum Park area Laketown Block B, C and Sreebhumi Tank No 1 -5 in Dum Park Area 60 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

The areas under Ultadanga are displayed in the map given below: Ultadanga, Murari Pukur and Bagmari Murari Pukur Bagmari 61 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

The areas under Ultadanga are displayed in the map given below: Ultadanga, Murari Pukur and Bagmari Murari Pukur Bagmari 61 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

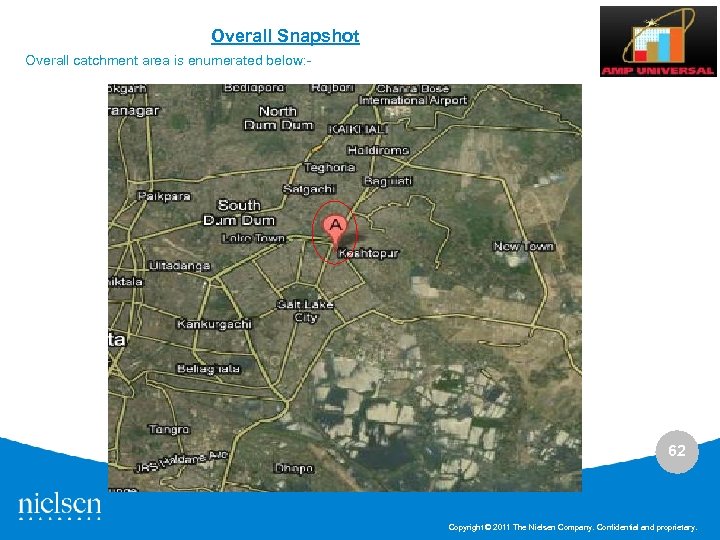

Overall Snapshot Overall catchment area is enumerated below: - 62 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Overall Snapshot Overall catchment area is enumerated below: - 62 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Thank you… 63 Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Thank you… 63 Copyright © 2011 The Nielsen Company. Confidential and proprietary.