161c443af8eed8b02edc40eeb37693f2.ppt

- Количество слайдов: 55

PROFESSIONAL PRACTICE IN THE UK professional practice A PERSONAL VIEW in the uk BY GEOFF BRITTON PERSONAL VIEW A BY GEOFF BRITTON

PROFESSIONAL PRACTICE IN THE UK professional practice A PERSONAL VIEW in the uk BY GEOFF BRITTON PERSONAL VIEW A BY GEOFF BRITTON

PRESENTATION SUMMARY § EUROPE AND THE UK § THE UK ACCOUNTANCY PROFESSION § ACCA WITHIN THE UK ACCOUNTANCY PROFESSION § GBAC – § CLIENT RELATIONSHIP OVERVIEWS GOVERNANCE HISTORY & GEOGRAPHY STAFF – PRESENT STRUCTURE TYPICAL BUDGETS TRAINING INFORMATION TECHNOLOGY RELATIONSHIP WITH OTHER ORGANISATIONS FUTURE

PRESENTATION SUMMARY § EUROPE AND THE UK § THE UK ACCOUNTANCY PROFESSION § ACCA WITHIN THE UK ACCOUNTANCY PROFESSION § GBAC – § CLIENT RELATIONSHIP OVERVIEWS GOVERNANCE HISTORY & GEOGRAPHY STAFF – PRESENT STRUCTURE TYPICAL BUDGETS TRAINING INFORMATION TECHNOLOGY RELATIONSHIP WITH OTHER ORGANISATIONS FUTURE

EUROPE AND THE UK

EUROPE AND THE UK

THE BRITISH ECONOMY POPULATION • ENGLAND • WALES 2. 9 m • SCOTLAND 5. 1 m • NORTHERN IRELAND 1. 7 m • ISLE OF MAN 75, 000 • JERSEY 91, 000 • GUERNSEY 65, 000 50. 7 m

THE BRITISH ECONOMY POPULATION • ENGLAND • WALES 2. 9 m • SCOTLAND 5. 1 m • NORTHERN IRELAND 1. 7 m • ISLE OF MAN 75, 000 • JERSEY 91, 000 • GUERNSEY 65, 000 50. 7 m

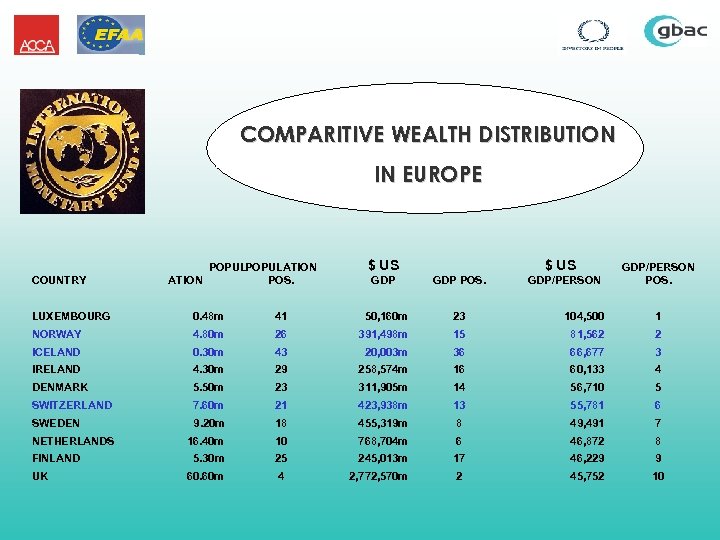

COMPARITIVE WEALTH DISTRIBUTION IN EUROPE COUNTRY POPULATION POS. $ US GDP POS. GDP/PERSON POS. LUXEMBOURG 0. 48 m 41 50, 160 m 23 104, 500 1 NORWAY 4. 80 m 26 391, 498 m 15 81, 562 2 ICELAND 0. 30 m 43 20, 003 m 36 66, 677 3 IRELAND 4. 30 m 29 258, 574 m 16 60, 133 4 DENMARK 5. 50 m 23 311, 905 m 14 56, 710 5 SWITZERLAND 7. 60 m 21 423, 938 m 13 55, 781 6 SWEDEN 9. 20 m 18 455, 319 m 8 49, 491 7 16. 40 m 10 768, 704 m 6 46, 872 8 5. 30 m 25 245, 013 m 17 46, 229 9 60. 60 m 4 2, 772, 570 m 2 45, 752 10 NETHERLANDS FINLAND UK

COMPARITIVE WEALTH DISTRIBUTION IN EUROPE COUNTRY POPULATION POS. $ US GDP POS. GDP/PERSON POS. LUXEMBOURG 0. 48 m 41 50, 160 m 23 104, 500 1 NORWAY 4. 80 m 26 391, 498 m 15 81, 562 2 ICELAND 0. 30 m 43 20, 003 m 36 66, 677 3 IRELAND 4. 30 m 29 258, 574 m 16 60, 133 4 DENMARK 5. 50 m 23 311, 905 m 14 56, 710 5 SWITZERLAND 7. 60 m 21 423, 938 m 13 55, 781 6 SWEDEN 9. 20 m 18 455, 319 m 8 49, 491 7 16. 40 m 10 768, 704 m 6 46, 872 8 5. 30 m 25 245, 013 m 17 46, 229 9 60. 60 m 4 2, 772, 570 m 2 45, 752 10 NETHERLANDS FINLAND UK

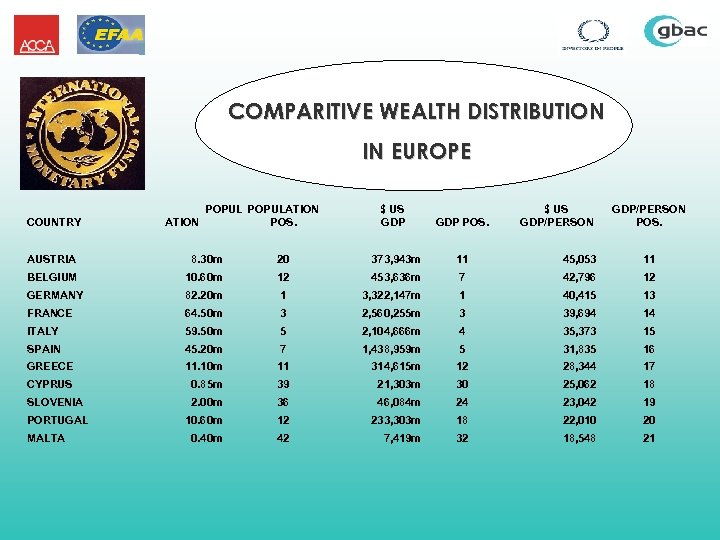

COMPARITIVE WEALTH DISTRIBUTION IN EUROPE COUNTRY ATION POPULATION POS. $ US GDP/PERSON POS. AUSTRIA 8. 30 m 20 373, 943 m 11 45, 053 11 BELGIUM 10. 60 m 12 453, 636 m 7 42, 796 12 GERMANY 82. 20 m 1 3, 322, 147 m 1 40, 415 13 FRANCE 64. 50 m 3 2, 560, 255 m 3 39, 694 14 ITALY 59. 50 m 5 2, 104, 666 m 4 35, 373 15 SPAIN 45. 20 m 7 1, 438, 959 m 5 31, 835 16 GREECE 11. 10 m 11 314, 615 m 12 28, 344 17 CYPRUS 0. 85 m 39 21, 303 m 30 25, 062 18 SLOVENIA 2. 00 m 36 46, 084 m 24 23, 042 19 PORTUGAL 10. 60 m 12 233, 303 m 18 22, 010 20 0. 40 m 42 7, 419 m 32 18, 548 21 MALTA

COMPARITIVE WEALTH DISTRIBUTION IN EUROPE COUNTRY ATION POPULATION POS. $ US GDP/PERSON POS. AUSTRIA 8. 30 m 20 373, 943 m 11 45, 053 11 BELGIUM 10. 60 m 12 453, 636 m 7 42, 796 12 GERMANY 82. 20 m 1 3, 322, 147 m 1 40, 415 13 FRANCE 64. 50 m 3 2, 560, 255 m 3 39, 694 14 ITALY 59. 50 m 5 2, 104, 666 m 4 35, 373 15 SPAIN 45. 20 m 7 1, 438, 959 m 5 31, 835 16 GREECE 11. 10 m 11 314, 615 m 12 28, 344 17 CYPRUS 0. 85 m 39 21, 303 m 30 25, 062 18 SLOVENIA 2. 00 m 36 46, 084 m 24 23, 042 19 PORTUGAL 10. 60 m 12 233, 303 m 18 22, 010 20 0. 40 m 42 7, 419 m 32 18, 548 21 MALTA

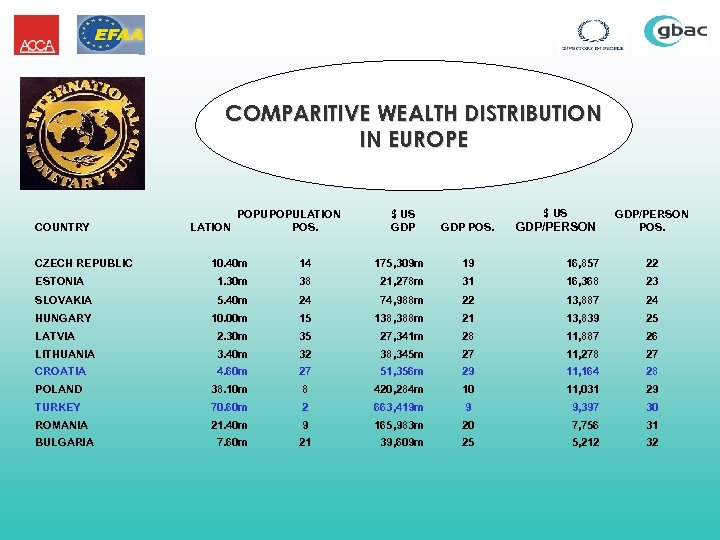

COMPARITIVE WEALTH DISTRIBUTION IN EUROPE COUNTRY CZECH REPUBLIC LATION POPULATION POS. $ US GDP POS. GDP/PERSON POS. 10. 40 m 14 175, 309 m 19 16, 857 22 ESTONIA 1. 30 m 38 21, 278 m 31 16, 368 23 SLOVAKIA 5. 40 m 24 74, 988 m 22 13, 887 24 HUNGARY 10. 00 m 15 138, 388 m 21 13, 839 25 LATVIA 2. 30 m 35 27, 341 m 28 11, 887 26 LITHUANIA 3. 40 m 32 38, 345 m 27 11, 278 27 CROATIA 4. 60 m 27 51, 356 m 29 11, 164 28 POLAND 38. 10 m 8 420, 284 m 10 11, 031 29 TURKEY 70. 60 m 2 663, 419 m 9 9, 397 30 ROMANIA 21. 40 m 9 165, 983 m 20 7, 756 31 BULGARIA 7. 60 m 21 39, 609 m 25 5, 212 32

COMPARITIVE WEALTH DISTRIBUTION IN EUROPE COUNTRY CZECH REPUBLIC LATION POPULATION POS. $ US GDP POS. GDP/PERSON POS. 10. 40 m 14 175, 309 m 19 16, 857 22 ESTONIA 1. 30 m 38 21, 278 m 31 16, 368 23 SLOVAKIA 5. 40 m 24 74, 988 m 22 13, 887 24 HUNGARY 10. 00 m 15 138, 388 m 21 13, 839 25 LATVIA 2. 30 m 35 27, 341 m 28 11, 887 26 LITHUANIA 3. 40 m 32 38, 345 m 27 11, 278 27 CROATIA 4. 60 m 27 51, 356 m 29 11, 164 28 POLAND 38. 10 m 8 420, 284 m 10 11, 031 29 TURKEY 70. 60 m 2 663, 419 m 9 9, 397 30 ROMANIA 21. 40 m 9 165, 983 m 20 7, 756 31 BULGARIA 7. 60 m 21 39, 609 m 25 5, 212 32

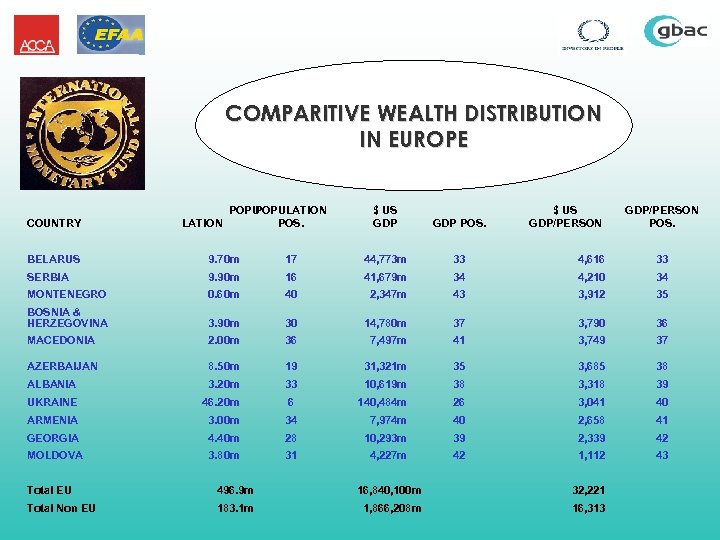

COMPARITIVE WEALTH DISTRIBUTION IN EUROPE COUNTRY LATION POPULATION POS. $ US GDP/PERSON POS. BELARUS 9. 70 m 17 44, 773 m 33 4, 616 33 SERBIA 9. 90 m 16 41, 679 m 34 4, 210 34 MONTENEGRO 0. 60 m 40 2, 347 m 43 3, 912 35 BOSNIA & HERZEGOVINA 3. 90 m 30 14, 780 m 37 3, 790 36 MACEDONIA 2. 00 m 36 7, 497 m 41 3, 749 37 AZERBAIJAN 8. 50 m 19 31, 321 m 35 3, 685 38 ALBANIA 3. 20 m 33 10, 619 m 38 3, 318 39 UKRAINE 46. 20 m 6 140, 484 m 26 3, 041 40 ARMENIA 3. 00 m 34 7, 974 m 40 2, 658 41 GEORGIA 4. 40 m 28 10, 293 m 39 2, 339 42 MOLDOVA 3. 80 m 31 4, 227 m 42 1, 112 43 Total EU 496. 9 m 16, 840, 100 m 32, 221 Total Non EU 183. 1 m 1, 866, 208 m 16, 313

COMPARITIVE WEALTH DISTRIBUTION IN EUROPE COUNTRY LATION POPULATION POS. $ US GDP/PERSON POS. BELARUS 9. 70 m 17 44, 773 m 33 4, 616 33 SERBIA 9. 90 m 16 41, 679 m 34 4, 210 34 MONTENEGRO 0. 60 m 40 2, 347 m 43 3, 912 35 BOSNIA & HERZEGOVINA 3. 90 m 30 14, 780 m 37 3, 790 36 MACEDONIA 2. 00 m 36 7, 497 m 41 3, 749 37 AZERBAIJAN 8. 50 m 19 31, 321 m 35 3, 685 38 ALBANIA 3. 20 m 33 10, 619 m 38 3, 318 39 UKRAINE 46. 20 m 6 140, 484 m 26 3, 041 40 ARMENIA 3. 00 m 34 7, 974 m 40 2, 658 41 GEORGIA 4. 40 m 28 10, 293 m 39 2, 339 42 MOLDOVA 3. 80 m 31 4, 227 m 42 1, 112 43 Total EU 496. 9 m 16, 840, 100 m 32, 221 Total Non EU 183. 1 m 1, 866, 208 m 16, 313

UK ACCOUNTANCY PROFESSION

UK ACCOUNTANCY PROFESSION

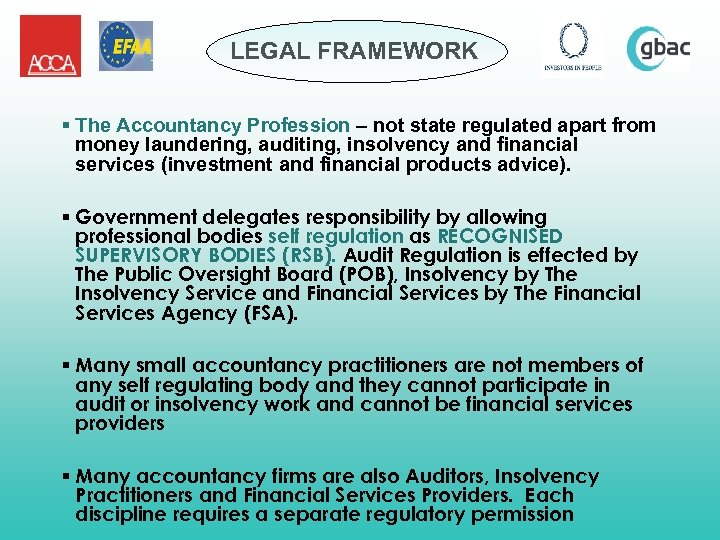

LEGAL FRAMEWORK § The Accountancy Profession – not state regulated apart from money laundering, auditing, insolvency and financial services (investment and financial products advice). § Government delegates responsibility by allowing professional bodies self regulation as RECOGNISED SUPERVISORY BODIES (RSB). Audit Regulation is effected by The Public Oversight Board (POB), Insolvency by The Insolvency Service and Financial Services by The Financial Services Agency (FSA). § Many small accountancy practitioners are not members of any self regulating body and they cannot participate in audit or insolvency work and cannot be financial services providers § Many accountancy firms are also Auditors, Insolvency Practitioners and Financial Services Providers. Each discipline requires a separate regulatory permission

LEGAL FRAMEWORK § The Accountancy Profession – not state regulated apart from money laundering, auditing, insolvency and financial services (investment and financial products advice). § Government delegates responsibility by allowing professional bodies self regulation as RECOGNISED SUPERVISORY BODIES (RSB). Audit Regulation is effected by The Public Oversight Board (POB), Insolvency by The Insolvency Service and Financial Services by The Financial Services Agency (FSA). § Many small accountancy practitioners are not members of any self regulating body and they cannot participate in audit or insolvency work and cannot be financial services providers § Many accountancy firms are also Auditors, Insolvency Practitioners and Financial Services Providers. Each discipline requires a separate regulatory permission

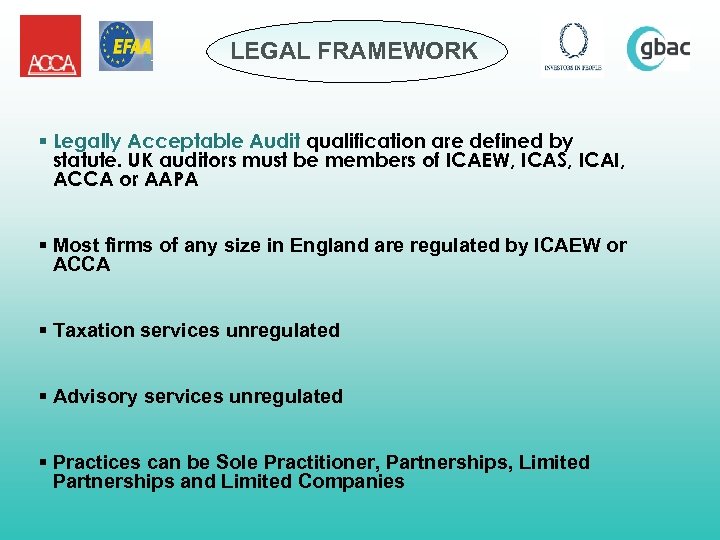

LEGAL FRAMEWORK § Legally Acceptable Audit qualification are defined by statute. UK auditors must be members of ICAEW, ICAS, ICAI, ACCA or AAPA § Most firms of any size in England are regulated by ICAEW or ACCA § Taxation services unregulated § Advisory services unregulated § Practices can be Sole Practitioner, Partnerships, Limited Partnerships and Limited Companies

LEGAL FRAMEWORK § Legally Acceptable Audit qualification are defined by statute. UK auditors must be members of ICAEW, ICAS, ICAI, ACCA or AAPA § Most firms of any size in England are regulated by ICAEW or ACCA § Taxation services unregulated § Advisory services unregulated § Practices can be Sole Practitioner, Partnerships, Limited Partnerships and Limited Companies

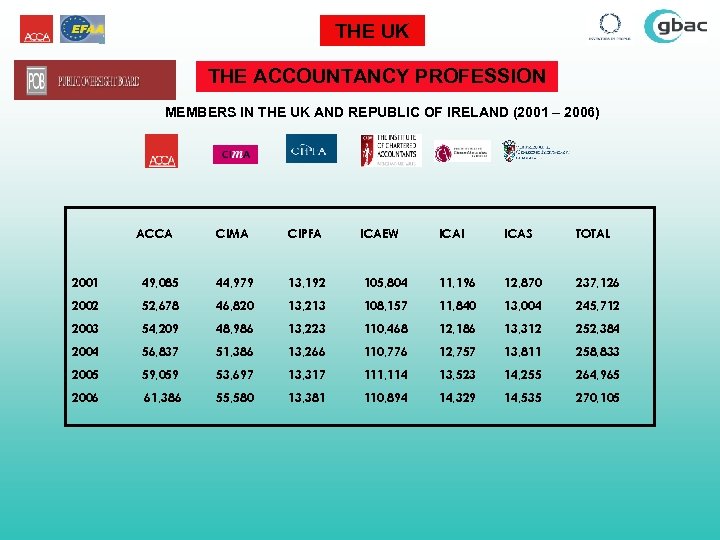

THE UK THE ACCOUNTANCY PROFESSION MEMBERS IN THE UK AND REPUBLIC OF IRELAND (2001 – 2006) ACCA CIMA CIPFA ICAEW ICAI ICAS TOTAL 2001 49, 085 44, 979 13, 192 105, 804 11, 196 12, 870 237, 126 2002 52, 678 46, 820 13, 213 108, 157 11, 840 13, 004 245, 712 2003 54, 209 48, 986 13, 223 110, 468 12, 186 13, 312 252, 384 2004 56, 837 51, 386 13, 266 110, 776 12, 757 13, 811 258, 833 2005 59, 059 53, 697 13, 317 111, 114 13, 523 14, 255 264, 965 2006 61, 386 55, 580 13, 381 110, 894 14, 329 14, 535 270, 105

THE UK THE ACCOUNTANCY PROFESSION MEMBERS IN THE UK AND REPUBLIC OF IRELAND (2001 – 2006) ACCA CIMA CIPFA ICAEW ICAI ICAS TOTAL 2001 49, 085 44, 979 13, 192 105, 804 11, 196 12, 870 237, 126 2002 52, 678 46, 820 13, 213 108, 157 11, 840 13, 004 245, 712 2003 54, 209 48, 986 13, 223 110, 468 12, 186 13, 312 252, 384 2004 56, 837 51, 386 13, 266 110, 776 12, 757 13, 811 258, 833 2005 59, 059 53, 697 13, 317 111, 114 13, 523 14, 255 264, 965 2006 61, 386 55, 580 13, 381 110, 894 14, 329 14, 535 270, 105

THE UK THE ACCOUNTANCY PROFESSION MEMBERS WORLDWIDE (2001 – 2006) ACCA CIMA CIPFA ICAEW ICAI ICAS TOTAL 2001 86, 929 57, 616 13, 471 121, 356 12, 515 15, 042 306, 929 2002 95, 416 59, 782 13, 521 123, 719 13, 039 15, 166 320, 643 2003 98, 293 62, 361 13, 510 125, 643 13, 551 15, 749 329, 107 2004 104, 613 65, 053 13, 499 126, 597 14, 193 15, 931 339, 886 2005 109, 588 67, 670 13, 565 127, 826 14, 973 16, 388 350, 010 2006 115, 345 70, 016 13, 661 128, 416 15, 791 16, 710 359, 939

THE UK THE ACCOUNTANCY PROFESSION MEMBERS WORLDWIDE (2001 – 2006) ACCA CIMA CIPFA ICAEW ICAI ICAS TOTAL 2001 86, 929 57, 616 13, 471 121, 356 12, 515 15, 042 306, 929 2002 95, 416 59, 782 13, 521 123, 719 13, 039 15, 166 320, 643 2003 98, 293 62, 361 13, 510 125, 643 13, 551 15, 749 329, 107 2004 104, 613 65, 053 13, 499 126, 597 14, 193 15, 931 339, 886 2005 109, 588 67, 670 13, 565 127, 826 14, 973 16, 388 350, 010 2006 115, 345 70, 016 13, 661 128, 416 15, 791 16, 710 359, 939

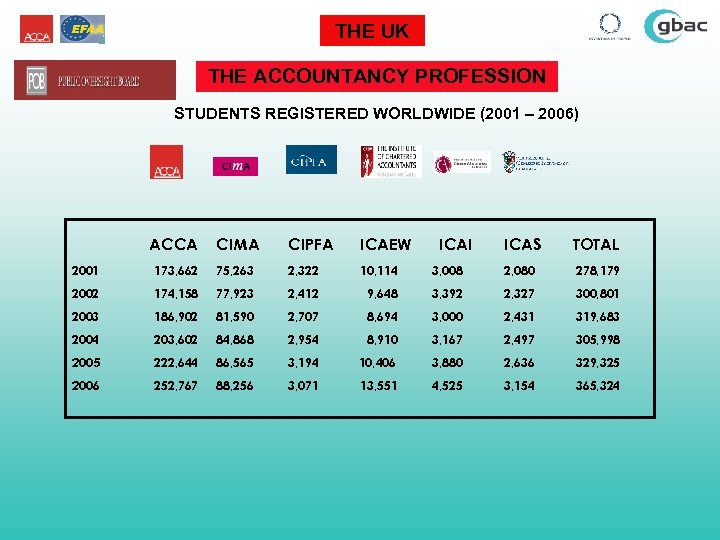

THE UK THE ACCOUNTANCY PROFESSION STUDENTS REGISTERED WORLDWIDE (2001 – 2006) ACCA CIMA CIPFA ICAEW 2001 173, 662 75, 263 2, 322 10, 114 2002 174, 158 77, 923 2, 412 2003 186, 902 81, 590 2004 203, 602 2005 2006 ICAI ICAS TOTAL 3, 008 2, 080 278, 179 9, 648 3, 392 2, 327 300, 801 2, 707 8, 694 3, 000 2, 431 319, 683 84, 868 2, 954 8, 910 3, 167 2, 497 305, 998 222, 644 86, 565 3, 194 10, 406 3, 880 2, 636 329, 325 252, 767 88, 256 3, 071 13, 551 4, 525 3, 154 365, 324

THE UK THE ACCOUNTANCY PROFESSION STUDENTS REGISTERED WORLDWIDE (2001 – 2006) ACCA CIMA CIPFA ICAEW 2001 173, 662 75, 263 2, 322 10, 114 2002 174, 158 77, 923 2, 412 2003 186, 902 81, 590 2004 203, 602 2005 2006 ICAI ICAS TOTAL 3, 008 2, 080 278, 179 9, 648 3, 392 2, 327 300, 801 2, 707 8, 694 3, 000 2, 431 319, 683 84, 868 2, 954 8, 910 3, 167 2, 497 305, 998 222, 644 86, 565 3, 194 10, 406 3, 880 2, 636 329, 325 252, 767 88, 256 3, 071 13, 551 4, 525 3, 154 365, 324

THE UK THE ACCOUNTANCY PROFESSION SECTORAL EMPLOYMENT OF MEMBERS WORLDWIDE 2006 ACCA CIMA Public Practice 31, 143 1, 400 Industry & Commerce 63, 439 49, 011 Public Sector 11, 534 Other Total Retired GRAND TOTAL CIPFA - ICAEW ICAI ICAS 57, 787 5, 211 4, 678 1, 229 44, 945 9, 316 6, 851 12, 602 9, 152 2, 568 - 668 4, 613 2, 100 273 6, 420 473 1, 336 110, 729 65, 113 10, 654 111, 720 15, 000 13, 533 4, 613 5, 601 3, 005 16, 694 789 3, 174 115, 342 70, 714 13, 659 128, 414 15, 789 16, 707

THE UK THE ACCOUNTANCY PROFESSION SECTORAL EMPLOYMENT OF MEMBERS WORLDWIDE 2006 ACCA CIMA Public Practice 31, 143 1, 400 Industry & Commerce 63, 439 49, 011 Public Sector 11, 534 Other Total Retired GRAND TOTAL CIPFA - ICAEW ICAI ICAS 57, 787 5, 211 4, 678 1, 229 44, 945 9, 316 6, 851 12, 602 9, 152 2, 568 - 668 4, 613 2, 100 273 6, 420 473 1, 336 110, 729 65, 113 10, 654 111, 720 15, 000 13, 533 4, 613 5, 601 3, 005 16, 694 789 3, 174 115, 342 70, 714 13, 659 128, 414 15, 789 16, 707

ACCA PRACTICE FRAMEWORK • ACCA is responsible to the Public Oversight Board in respect of Audit and to the Department for Business Enterprise and Regulatory Reform in respect of Insolvency work. It takes upon itself the task of regular visits to Practitioners wishing to be ACCA approved employers and for those wishing to attain the quality checked seal in respect of general accountancy work. • ACCA Members in Practice must hold a valid Practising Certificate and in addition those carrying out audit work must also hold an Auditing Certificate, submit to regular monitoring visits (approximately every 5 years) and hold professional indemnity insurance.

ACCA PRACTICE FRAMEWORK • ACCA is responsible to the Public Oversight Board in respect of Audit and to the Department for Business Enterprise and Regulatory Reform in respect of Insolvency work. It takes upon itself the task of regular visits to Practitioners wishing to be ACCA approved employers and for those wishing to attain the quality checked seal in respect of general accountancy work. • ACCA Members in Practice must hold a valid Practising Certificate and in addition those carrying out audit work must also hold an Auditing Certificate, submit to regular monitoring visits (approximately every 5 years) and hold professional indemnity insurance.

ACCA PRACTICE FRAMEWORK • Strong codes regarding ethical standards are strictly enforced but formal complaint is usually needed in order to start the disciplinary process. This complaint can be made by any person including monitoring officers of the Association. The disciplinary committees are entirely independent of ACCA and the judging panels are made up of lawyers and lay people as well as accountants. The Chairman is never an accountant and usually from a legal background. • All staff working for any accountancy practice are individually required to comply with money laundering regulations. • Control of all Accountancy and Auditing Practices monitored by RSB’s must be controlled by qualified personnel but minority shareholdings are allowed to be in the hands of others.

ACCA PRACTICE FRAMEWORK • Strong codes regarding ethical standards are strictly enforced but formal complaint is usually needed in order to start the disciplinary process. This complaint can be made by any person including monitoring officers of the Association. The disciplinary committees are entirely independent of ACCA and the judging panels are made up of lawyers and lay people as well as accountants. The Chairman is never an accountant and usually from a legal background. • All staff working for any accountancy practice are individually required to comply with money laundering regulations. • Control of all Accountancy and Auditing Practices monitored by RSB’s must be controlled by qualified personnel but minority shareholdings are allowed to be in the hands of others.

GOVERNANCE

GOVERNANCE

ACCA § Letter of Engagement guarantees ACCA standards § Statutory audit regulation – 5 year inspections § Availability of practice assurance § Approved employer status – internationally accepted standards helps recruitment

ACCA § Letter of Engagement guarantees ACCA standards § Statutory audit regulation – 5 year inspections § Availability of practice assurance § Approved employer status – internationally accepted standards helps recruitment

CONTRACT OF EMPLOYMENT • Employer Details • Full Name/Date of Birth of Employee • Job Title • Start Date • Remuneration • Hours of Work • Holiday Entitlement • Training Rules • Standards of Conduct • Confidentiality & Non Disclosure to Others • Restrictions After Leaving • IT Policy • Sickness – Statutory Entitlement • Working Parents • Pensions • Trade Unions • Retirement • Employment Termination Requirements • Grievance • Disciplinary • Changes in Circumstances • Outside Interests • GBAC Property • Money Laundering

CONTRACT OF EMPLOYMENT • Employer Details • Full Name/Date of Birth of Employee • Job Title • Start Date • Remuneration • Hours of Work • Holiday Entitlement • Training Rules • Standards of Conduct • Confidentiality & Non Disclosure to Others • Restrictions After Leaving • IT Policy • Sickness – Statutory Entitlement • Working Parents • Pensions • Trade Unions • Retirement • Employment Termination Requirements • Grievance • Disciplinary • Changes in Circumstances • Outside Interests • GBAC Property • Money Laundering

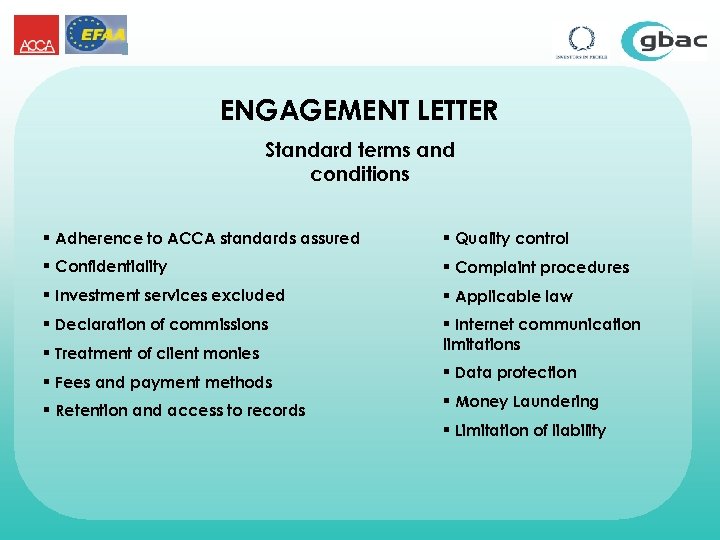

ENGAGEMENT LETTER Standard terms and conditions § Adherence to ACCA standards assured § Quality control § Confidentiality § Complaint procedures § Investment services excluded § Applicable law § Declaration of commissions § Internet communication limitations § Treatment of client monies § Fees and payment methods § Retention and access to records § Data protection § Money Laundering § Limitation of liability

ENGAGEMENT LETTER Standard terms and conditions § Adherence to ACCA standards assured § Quality control § Confidentiality § Complaint procedures § Investment services excluded § Applicable law § Declaration of commissions § Internet communication limitations § Treatment of client monies § Fees and payment methods § Retention and access to records § Data protection § Money Laundering § Limitation of liability

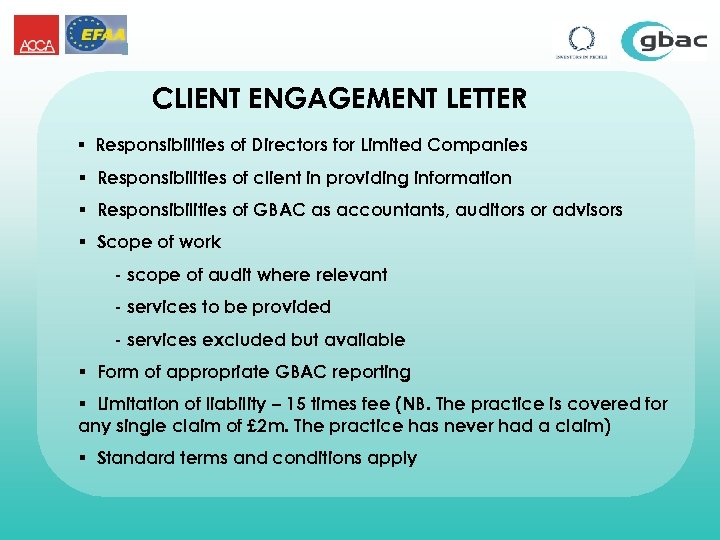

CLIENT ENGAGEMENT LETTER § Responsibilities of Directors for Limited Companies § Responsibilities of client in providing information § Responsibilities of GBAC as accountants, auditors or advisors § Scope of work - scope of audit where relevant - services to be provided - services excluded but available § Form of appropriate GBAC reporting § Limitation of liability – 15 times fee (NB. The practice is covered for any single claim of £ 2 m. The practice has never had a claim) § Standard terms and conditions apply

CLIENT ENGAGEMENT LETTER § Responsibilities of Directors for Limited Companies § Responsibilities of client in providing information § Responsibilities of GBAC as accountants, auditors or advisors § Scope of work - scope of audit where relevant - services to be provided - services excluded but available § Form of appropriate GBAC reporting § Limitation of liability – 15 times fee (NB. The practice is covered for any single claim of £ 2 m. The practice has never had a claim) § Standard terms and conditions apply

INVESTORS IN PEOPLE § Voluntary registration § Regular quality inspections § Best practice must be adopted § Enables good staff relations and quality recruitment

INVESTORS IN PEOPLE § Voluntary registration § Regular quality inspections § Best practice must be adopted § Enables good staff relations and quality recruitment

CORPORATE SOCIAL RESPONSIBILITY § Low environmental impact profession § Free advice for social projects and enterprises § Endeavour to recycle all waste § Committed to being energy efficient § Flexible working § Car sharing to reduce travel pollution

CORPORATE SOCIAL RESPONSIBILITY § Low environmental impact profession § Free advice for social projects and enterprises § Endeavour to recycle all waste § Committed to being energy efficient § Flexible working § Car sharing to reduce travel pollution

HISTORY & GEOGRAPHY

HISTORY & GEOGRAPHY

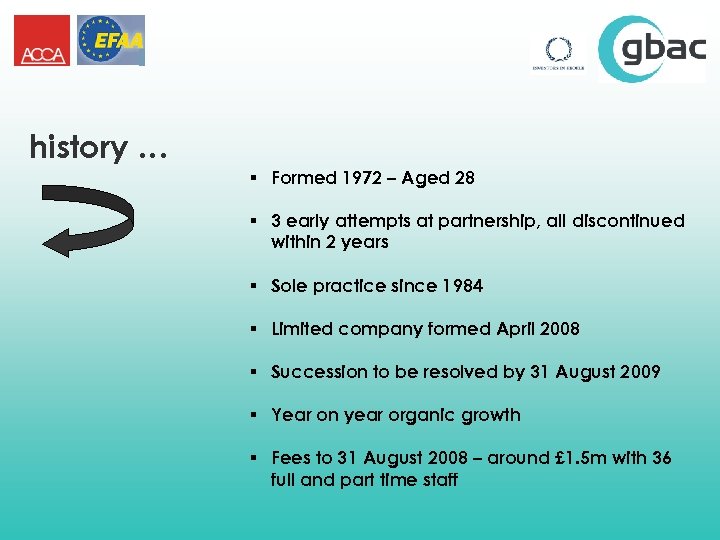

history … § Formed 1972 – Aged 28 § 3 early attempts at partnership, all discontinued within 2 years § Sole practice since 1984 § Limited company formed April 2008 § Succession to be resolved by 31 August 2009 § Year on year organic growth § Fees to 31 August 2008 – around £ 1. 5 m with 36 full and part time staff

history … § Formed 1972 – Aged 28 § 3 early attempts at partnership, all discontinued within 2 years § Sole practice since 1984 § Limited company formed April 2008 § Succession to be resolved by 31 August 2009 § Year on year organic growth § Fees to 31 August 2008 – around £ 1. 5 m with 36 full and part time staff

THE BRITISH ISLES BARNSLEY

THE BRITISH ISLES BARNSLEY

STAFF

STAFF

PRESENT STRUCTURE

PRESENT STRUCTURE

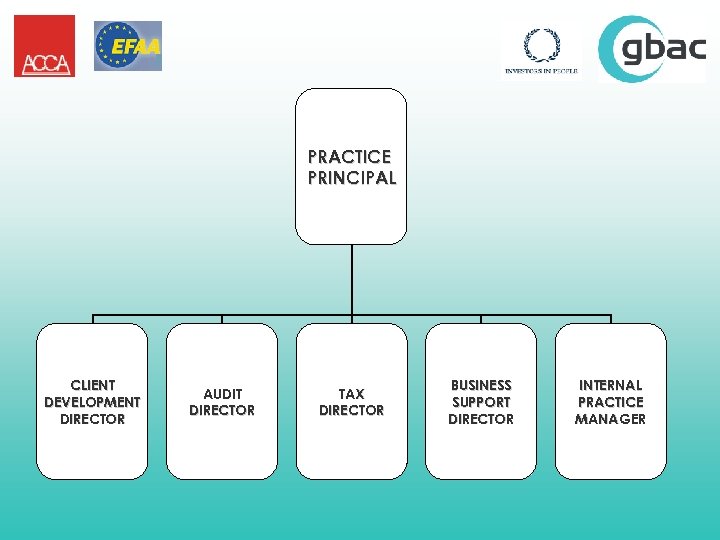

PRACTICE PRINCIPAL CLIENT DEVELOPMENT DIRECTOR AUDIT DIRECTOR TAX DIRECTOR BUSINESS SUPPORT DIRECTOR INTERNAL PRACTICE MANAGER

PRACTICE PRINCIPAL CLIENT DEVELOPMENT DIRECTOR AUDIT DIRECTOR TAX DIRECTOR BUSINESS SUPPORT DIRECTOR INTERNAL PRACTICE MANAGER

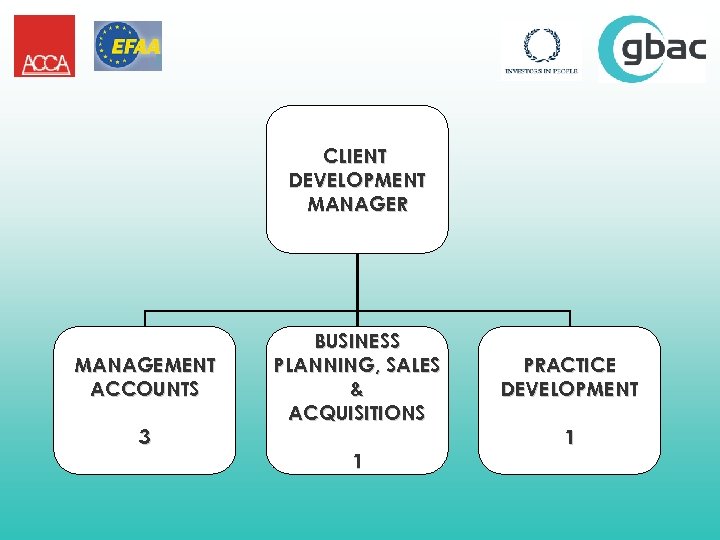

CLIENT DEVELOPMENT MANAGER MANAGEMENT ACCOUNTS 3 BUSINESS PLANNING, SALES & ACQUISITIONS 1 PRACTICE DEVELOPMENT 1

CLIENT DEVELOPMENT MANAGER MANAGEMENT ACCOUNTS 3 BUSINESS PLANNING, SALES & ACQUISITIONS 1 PRACTICE DEVELOPMENT 1

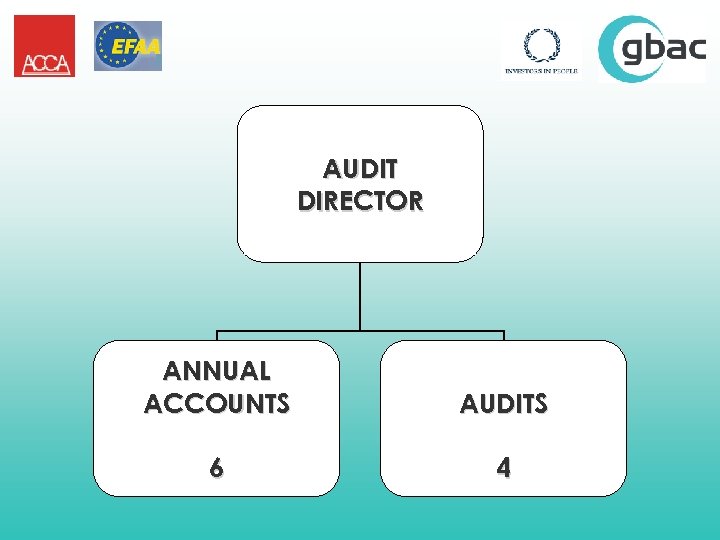

AUDIT DIRECTOR ANNUAL ACCOUNTS AUDITS 6 4

AUDIT DIRECTOR ANNUAL ACCOUNTS AUDITS 6 4

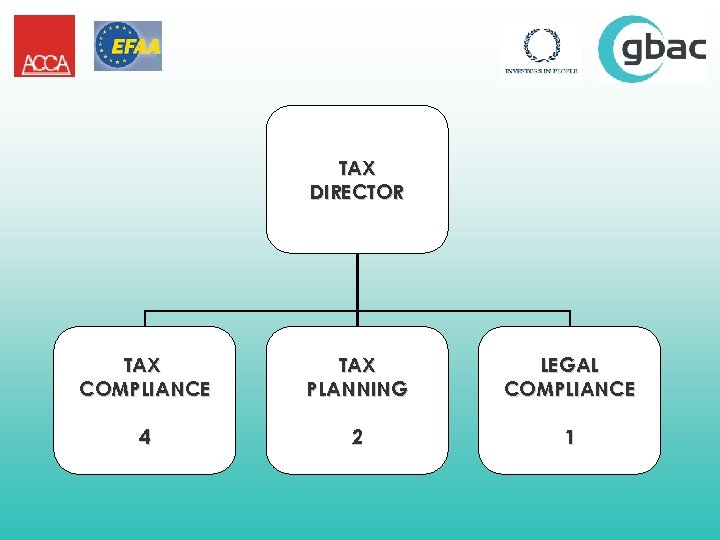

TAX DIRECTOR TAX COMPLIANCE TAX PLANNING LEGAL COMPLIANCE 4 2 1

TAX DIRECTOR TAX COMPLIANCE TAX PLANNING LEGAL COMPLIANCE 4 2 1

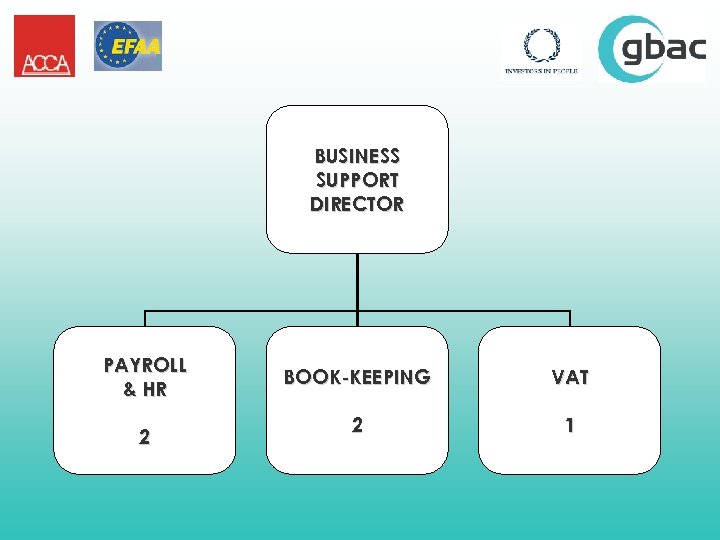

BUSINESS SUPPORT DIRECTOR PAYROLL & HR 2 BOOK-KEEPING VAT 2 1

BUSINESS SUPPORT DIRECTOR PAYROLL & HR 2 BOOK-KEEPING VAT 2 1

INTERNAL PRACTICE MANAGER IT & SYSTEMS 1 RECEPTION & GENERAL SUPPORT STAFF 3 PRACTICE RECORDS BUDGET MONITORING CASH FLOW 1 PERSONNEL ISSUES

INTERNAL PRACTICE MANAGER IT & SYSTEMS 1 RECEPTION & GENERAL SUPPORT STAFF 3 PRACTICE RECORDS BUDGET MONITORING CASH FLOW 1 PERSONNEL ISSUES

typical staff budgets …

typical staff budgets …

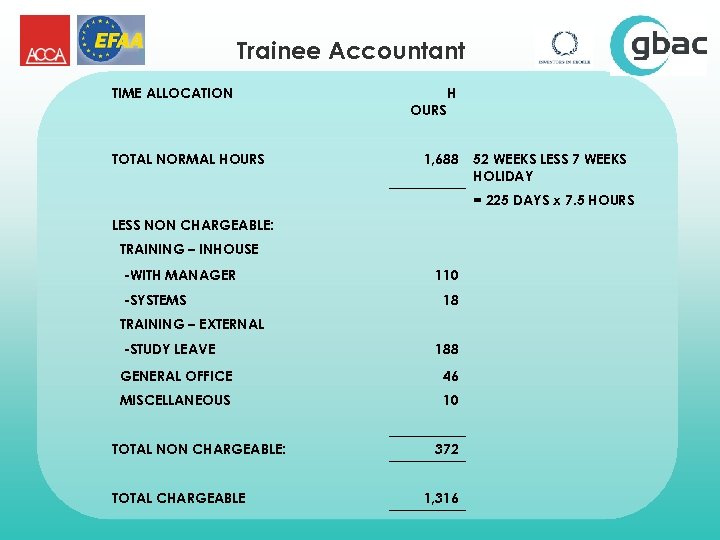

Trainee Accountant TIME ALLOCATION TOTAL NORMAL HOURS H 1, 688 52 WEEKS LESS 7 WEEKS HOLIDAY = 225 DAYS x 7. 5 HOURS LESS NON CHARGEABLE: TRAINING – INHOUSE -WITH MANAGER -SYSTEMS 110 18 TRAINING – EXTERNAL -STUDY LEAVE 188 GENERAL OFFICE 46 MISCELLANEOUS 10 TOTAL NON CHARGEABLE: TOTAL CHARGEABLE 372 1, 316

Trainee Accountant TIME ALLOCATION TOTAL NORMAL HOURS H 1, 688 52 WEEKS LESS 7 WEEKS HOLIDAY = 225 DAYS x 7. 5 HOURS LESS NON CHARGEABLE: TRAINING – INHOUSE -WITH MANAGER -SYSTEMS 110 18 TRAINING – EXTERNAL -STUDY LEAVE 188 GENERAL OFFICE 46 MISCELLANEOUS 10 TOTAL NON CHARGEABLE: TOTAL CHARGEABLE 372 1, 316

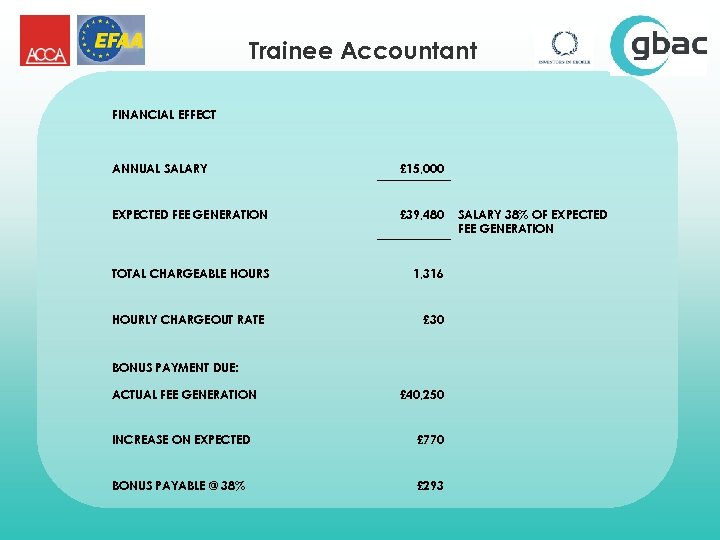

Trainee Accountant FINANCIAL EFFECT ANNUAL SALARY £ 15, 000 EXPECTED FEE GENERATION £ 39, 480 TOTAL CHARGEABLE HOURS 1, 316 HOURLY CHARGEOUT RATE £ 30 BONUS PAYMENT DUE: ACTUAL FEE GENERATION £ 40, 250 INCREASE ON EXPECTED £ 770 BONUS PAYABLE @ 38% £ 293 SALARY 38% OF EXPECTED FEE GENERATION

Trainee Accountant FINANCIAL EFFECT ANNUAL SALARY £ 15, 000 EXPECTED FEE GENERATION £ 39, 480 TOTAL CHARGEABLE HOURS 1, 316 HOURLY CHARGEOUT RATE £ 30 BONUS PAYMENT DUE: ACTUAL FEE GENERATION £ 40, 250 INCREASE ON EXPECTED £ 770 BONUS PAYABLE @ 38% £ 293 SALARY 38% OF EXPECTED FEE GENERATION

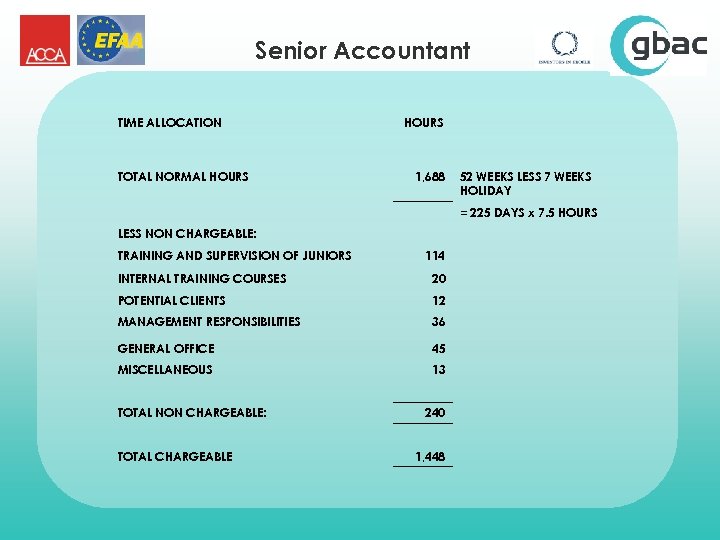

Senior Accountant TIME ALLOCATION TOTAL NORMAL HOURS 1, 688 52 WEEKS LESS 7 WEEKS HOLIDAY = 225 DAYS x 7. 5 HOURS LESS NON CHARGEABLE: TRAINING AND SUPERVISION OF JUNIORS 114 INTERNAL TRAINING COURSES 20 POTENTIAL CLIENTS 12 MANAGEMENT RESPONSIBILITIES 36 GENERAL OFFICE 45 MISCELLANEOUS 13 TOTAL NON CHARGEABLE: TOTAL CHARGEABLE 240 1, 448

Senior Accountant TIME ALLOCATION TOTAL NORMAL HOURS 1, 688 52 WEEKS LESS 7 WEEKS HOLIDAY = 225 DAYS x 7. 5 HOURS LESS NON CHARGEABLE: TRAINING AND SUPERVISION OF JUNIORS 114 INTERNAL TRAINING COURSES 20 POTENTIAL CLIENTS 12 MANAGEMENT RESPONSIBILITIES 36 GENERAL OFFICE 45 MISCELLANEOUS 13 TOTAL NON CHARGEABLE: TOTAL CHARGEABLE 240 1, 448

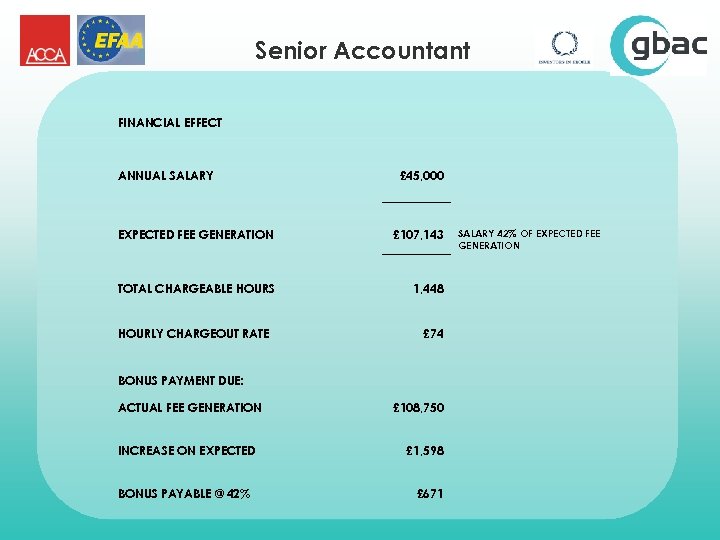

Senior Accountant FINANCIAL EFFECT ANNUAL SALARY £ 45, 000 EXPECTED FEE GENERATION £ 107, 143 TOTAL CHARGEABLE HOURS 1, 448 HOURLY CHARGEOUT RATE £ 74 BONUS PAYMENT DUE: ACTUAL FEE GENERATION INCREASE ON EXPECTED BONUS PAYABLE @ 42% £ 108, 750 £ 1, 598 £ 671 SALARY 42% OF EXPECTED FEE GENERATION

Senior Accountant FINANCIAL EFFECT ANNUAL SALARY £ 45, 000 EXPECTED FEE GENERATION £ 107, 143 TOTAL CHARGEABLE HOURS 1, 448 HOURLY CHARGEOUT RATE £ 74 BONUS PAYMENT DUE: ACTUAL FEE GENERATION INCREASE ON EXPECTED BONUS PAYABLE @ 42% £ 108, 750 £ 1, 598 £ 671 SALARY 42% OF EXPECTED FEE GENERATION

TRAINING

TRAINING

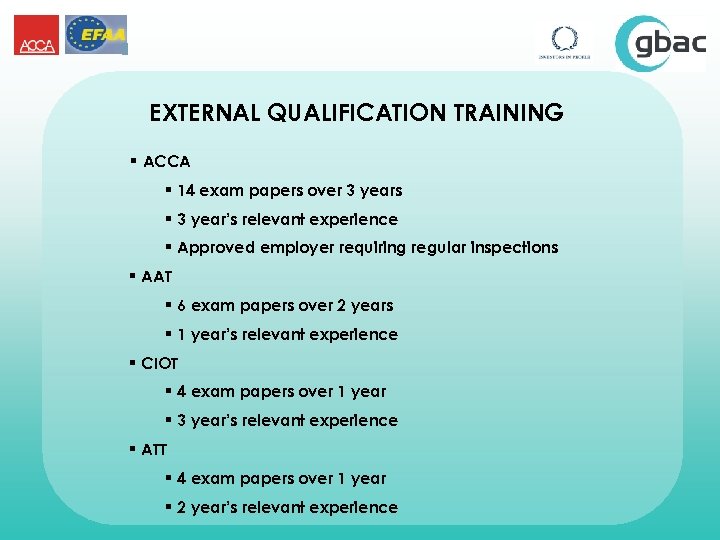

EXTERNAL QUALIFICATION TRAINING § ACCA § 14 exam papers over 3 years § 3 year’s relevant experience § Approved employer requiring regular inspections § AAT § 6 exam papers over 2 years § 1 year’s relevant experience § CIOT § 4 exam papers over 1 year § 3 year’s relevant experience § ATT § 4 exam papers over 1 year § 2 year’s relevant experience

EXTERNAL QUALIFICATION TRAINING § ACCA § 14 exam papers over 3 years § 3 year’s relevant experience § Approved employer requiring regular inspections § AAT § 6 exam papers over 2 years § 1 year’s relevant experience § CIOT § 4 exam papers over 1 year § 3 year’s relevant experience § ATT § 4 exam papers over 1 year § 2 year’s relevant experience

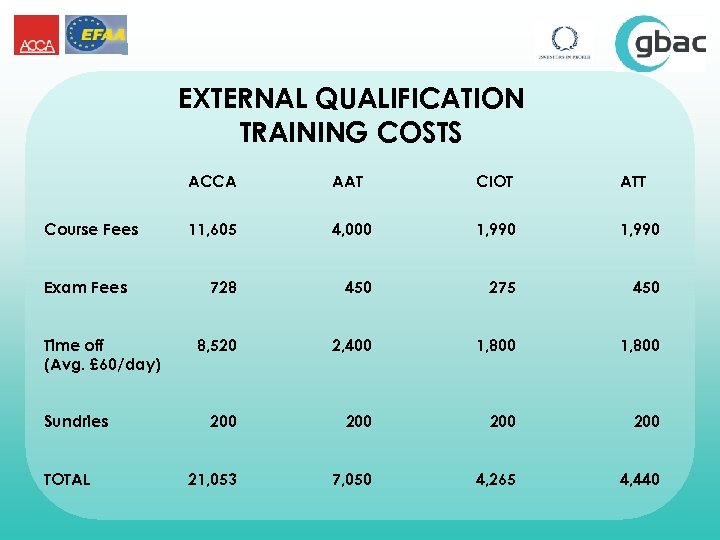

EXTERNAL QUALIFICATION TRAINING COSTS ACCA Course Fees Exam Fees Time off (Avg. £ 60/day) Sundries TOTAL AAT CIOT ATT 11, 605 4, 000 1, 990 728 450 275 450 8, 520 2, 400 1, 800 200 200 21, 053 7, 050 4, 265 4, 440

EXTERNAL QUALIFICATION TRAINING COSTS ACCA Course Fees Exam Fees Time off (Avg. £ 60/day) Sundries TOTAL AAT CIOT ATT 11, 605 4, 000 1, 990 728 450 275 450 8, 520 2, 400 1, 800 200 200 21, 053 7, 050 4, 265 4, 440

INHOUSE CPD TRAINING § 8 sessions per year – 3 hours § 50: 50 GBAC : Staff Time § Updates on all relevant subjects § Courses in 2007 § HMRC Construction Industry Scheme § Personal Tax § Audit & Accounts x 2 § Finance Act & Corporate Tax x 2 § Company Law § Money Laundering • Annual Cost circa £ 8, 000 (less government contribution of around £ 3, 000)

INHOUSE CPD TRAINING § 8 sessions per year – 3 hours § 50: 50 GBAC : Staff Time § Updates on all relevant subjects § Courses in 2007 § HMRC Construction Industry Scheme § Personal Tax § Audit & Accounts x 2 § Finance Act & Corporate Tax x 2 § Company Law § Money Laundering • Annual Cost circa £ 8, 000 (less government contribution of around £ 3, 000)

IT § Integrated system § Client records § Email and telephone § Practice financial records § Timesheets § Audit files, Accounts production, Tax § Remote access § Move towards § Paperless office § Client access

IT § Integrated system § Client records § Email and telephone § Practice financial records § Timesheets § Audit files, Accounts production, Tax § Remote access § Move towards § Paperless office § Client access

RELATIONS WITH AUTHORITIES § Substantial recent changes within the UK Government's Treasury function have merged the departments dealing with direct taxation. VAT, Income Taxes and Capital Taxes are now dealt with by a unified department known as HM Revenue and Customs. § Moreover the local nature of tax offices has shifted toward larger and more specialist units dealing with more specific taxation matters. § Local offices meant local connections and the personal nature of relationships with the profession has almost disappeared. § Our relationship with the authorities continues to be good but we are very mindful that we do the best deal for our client and we hope that this attitude earns respect rather than resentment.

RELATIONS WITH AUTHORITIES § Substantial recent changes within the UK Government's Treasury function have merged the departments dealing with direct taxation. VAT, Income Taxes and Capital Taxes are now dealt with by a unified department known as HM Revenue and Customs. § Moreover the local nature of tax offices has shifted toward larger and more specialist units dealing with more specific taxation matters. § Local offices meant local connections and the personal nature of relationships with the profession has almost disappeared. § Our relationship with the authorities continues to be good but we are very mindful that we do the best deal for our client and we hope that this attitude earns respect rather than resentment.

RELATIONSHIP WITH OTHER INSTITUTIONS • Relationships based upon perceived view of integrity and ability • Mutual recommendations are very important • Best deal for client always gains respect and not resentment • Do not always accept state interpretation of legislation • Wide range of specialist consultants • Never afraid to say we don’t know – but we will always find out.

RELATIONSHIP WITH OTHER INSTITUTIONS • Relationships based upon perceived view of integrity and ability • Mutual recommendations are very important • Best deal for client always gains respect and not resentment • Do not always accept state interpretation of legislation • Wide range of specialist consultants • Never afraid to say we don’t know – but we will always find out.

FUTURE

FUTURE

COMPETITION, THREATS AND OPPORTUNITIES Threats Ø Competition from other accountants - Smaller unregulated firms - smaller clients - Larger firms - bigger clients (Similar offering to our own) Ø Expectation management of staff and clients Ø Staff instability / stagnation Ø Market perception of sole practitioner Ø Practice Principal replacement Ø Client age profile Opportunites Endless…

COMPETITION, THREATS AND OPPORTUNITIES Threats Ø Competition from other accountants - Smaller unregulated firms - smaller clients - Larger firms - bigger clients (Similar offering to our own) Ø Expectation management of staff and clients Ø Staff instability / stagnation Ø Market perception of sole practitioner Ø Practice Principal replacement Ø Client age profile Opportunites Endless…

§ Optimistic view of future growth § Business plan envisages doubling of turnover next 5 years with creation of a new office in Leeds § Planning consents already obtained for extension to freehold office in Barnsley § Main focus of expansion on business advice, acquisitions and business sales § Increased emphasis on trainee recruitment § Plans to transfer practice to a Limited Company giving the facility to offer share options future …

§ Optimistic view of future growth § Business plan envisages doubling of turnover next 5 years with creation of a new office in Leeds § Planning consents already obtained for extension to freehold office in Barnsley § Main focus of expansion on business advice, acquisitions and business sales § Increased emphasis on trainee recruitment § Plans to transfer practice to a Limited Company giving the facility to offer share options future …

FEE GROWTH • Referrals – Clients – Banks and professional advisors • “The other side of the deal” • Growth from existing clients • Marketing not undertaken to date • WE KNOW WE MUST CHANGE!!!

FEE GROWTH • Referrals – Clients – Banks and professional advisors • “The other side of the deal” • Growth from existing clients • Marketing not undertaken to date • WE KNOW WE MUST CHANGE!!!

THANK YOU

THANK YOU