10ab01433d982424f12ece5832e33276.ppt

- Количество слайдов: 15

Product Market Competition, Insider Trading Regulation, and Optimal Managerial Contracts Chyi-Mei Chen Chien-Shan Han

Product Market Competition, Insider Trading Regulation, and Optimal Managerial Contracts Chyi-Mei Chen Chien-Shan Han

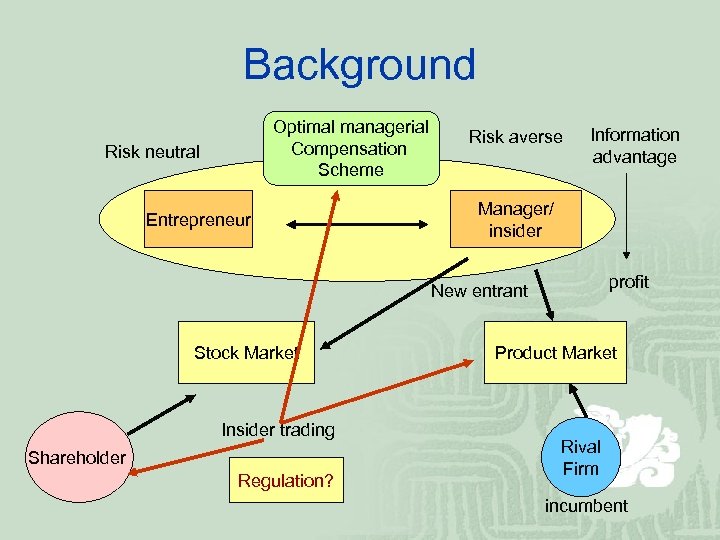

Background Optimal managerial Compensation Scheme Risk neutral Entrepreneur Risk averse Information advantage Manager/ insider profit New entrant Stock Market Insider trading Shareholder Regulation? Product Market Rival Firm incumbent

Background Optimal managerial Compensation Scheme Risk neutral Entrepreneur Risk averse Information advantage Manager/ insider profit New entrant Stock Market Insider trading Shareholder Regulation? Product Market Rival Firm incumbent

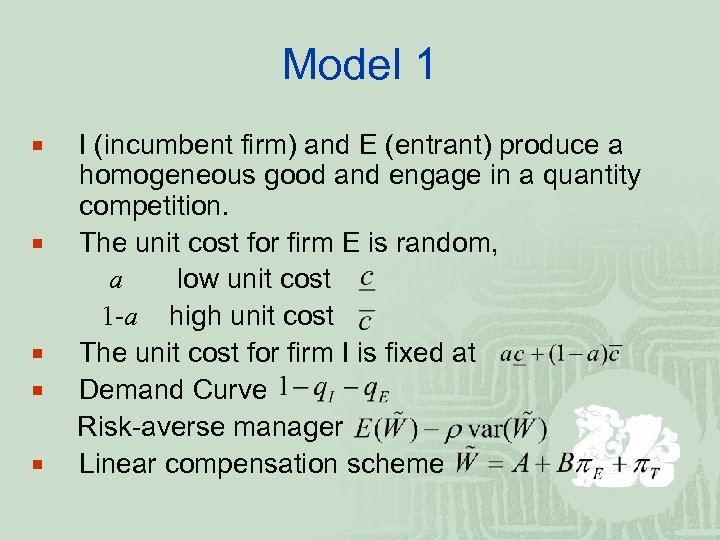

Model 1 ¡ ¡ ¡ I (incumbent firm) and E (entrant) produce a homogeneous good and engage in a quantity competition. The unit cost for firm E is random, a low unit cost 1 -a high unit cost The unit cost for firm I is fixed at Demand Curve Risk-averse manager Linear compensation scheme

Model 1 ¡ ¡ ¡ I (incumbent firm) and E (entrant) produce a homogeneous good and engage in a quantity competition. The unit cost for firm E is random, a low unit cost 1 -a high unit cost The unit cost for firm I is fixed at Demand Curve Risk-averse manager Linear compensation scheme

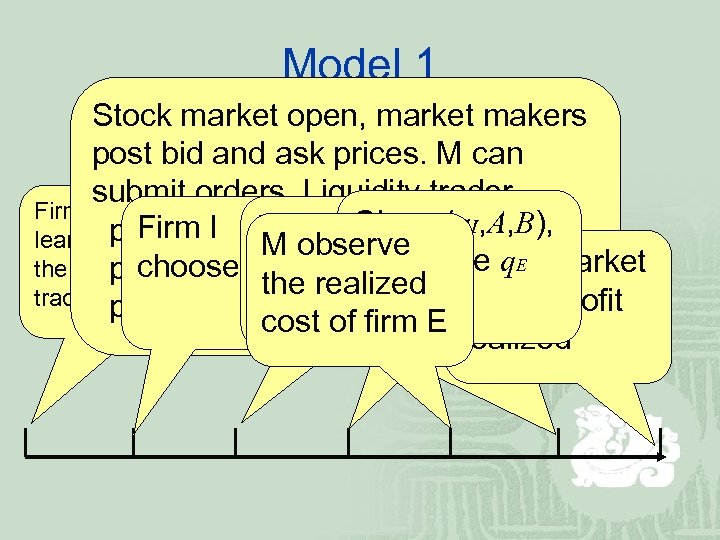

Model 1 Stock market open, market makers post bid and ask prices. M can submit orders. Liquidity trader Firms and managers Firm I prob b Firm El. Givena(q. I, A, B), share learn about whether Mbuy offer observe M choose q. E there are choose q. I sell l share Stock market insider prob s scheme (A, B) trading prob 1 -b-s the realized close, profit restrictions no of firm E trade cost realized

Model 1 Stock market open, market makers post bid and ask prices. M can submit orders. Liquidity trader Firms and managers Firm I prob b Firm El. Givena(q. I, A, B), share learn about whether Mbuy offer observe M choose q. E there are choose q. I sell l share Stock market insider prob s scheme (A, B) trading prob 1 -b-s the realized close, profit restrictions no of firm E trade cost realized

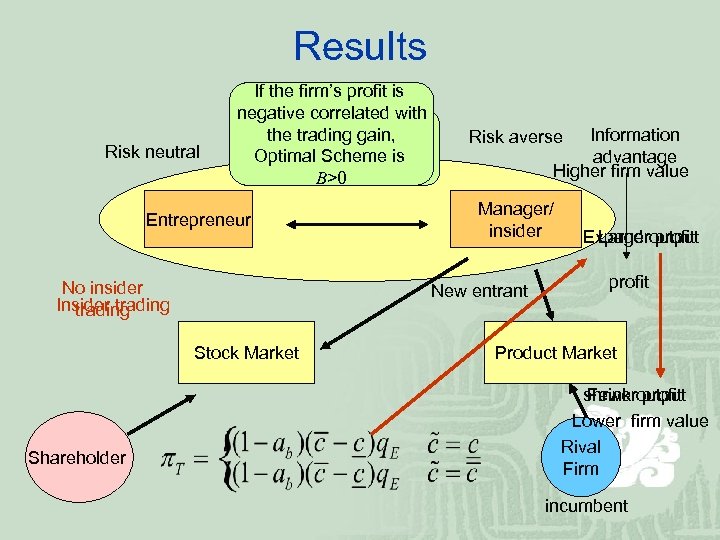

Results Risk neutral If the firm’s profit is negative correlated with the trading gain, is Optimal Scheme is B=0 B>0 Entrepreneur No insider Insider trading Manager/ insider New entrant Stock Market Shareholder Information advantage Higher firm value Risk averse Expand output Larger profit Product Market shrink output Fewer profit Lower firm value Rival Firm incumbent

Results Risk neutral If the firm’s profit is negative correlated with the trading gain, is Optimal Scheme is B=0 B>0 Entrepreneur No insider Insider trading Manager/ insider New entrant Stock Market Shareholder Information advantage Higher firm value Risk averse Expand output Larger profit Product Market shrink output Fewer profit Lower firm value Rival Firm incumbent

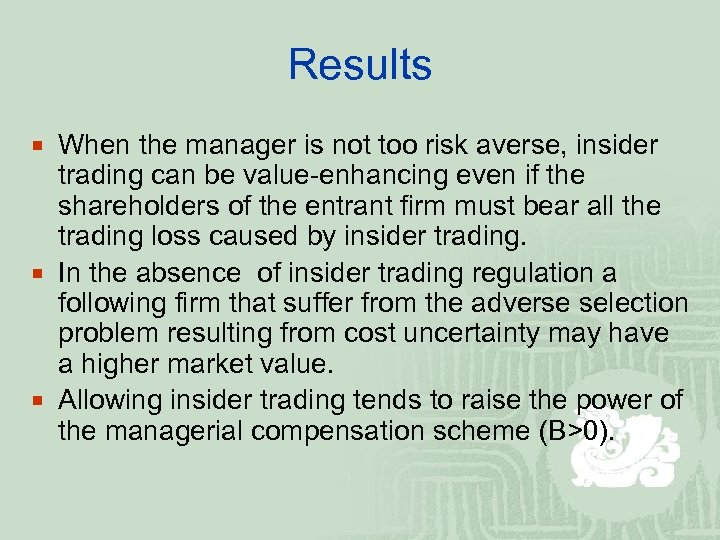

Results ¡ When the manager is not too risk averse, insider trading can be value-enhancing even if the shareholders of the entrant firm must bear all the trading loss caused by insider trading. ¡ In the absence of insider trading regulation a following firm that suffer from the adverse selection problem resulting from cost uncertainty may have a higher market value. ¡ Allowing insider trading tends to raise the power of the managerial compensation scheme (B>0).

Results ¡ When the manager is not too risk averse, insider trading can be value-enhancing even if the shareholders of the entrant firm must bear all the trading loss caused by insider trading. ¡ In the absence of insider trading regulation a following firm that suffer from the adverse selection problem resulting from cost uncertainty may have a higher market value. ¡ Allowing insider trading tends to raise the power of the managerial compensation scheme (B>0).

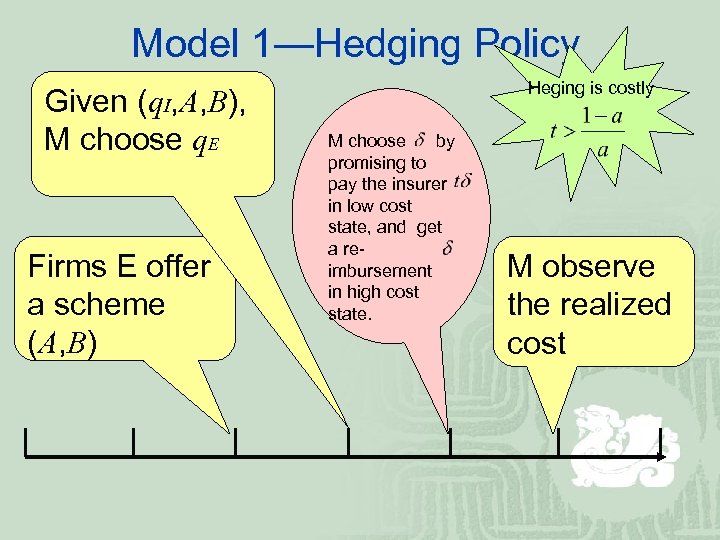

Model 1—Hedging Policy Given (q. I, A, B), M choose q. E Firms E offer a scheme (A, B) Heging is costly M choose by promising to pay the insurer in low cost state, and get a reimbursement in high cost state. M observe the realized cost

Model 1—Hedging Policy Given (q. I, A, B), M choose q. E Firms E offer a scheme (A, B) Heging is costly M choose by promising to pay the insurer in low cost state, and get a reimbursement in high cost state. M observe the realized cost

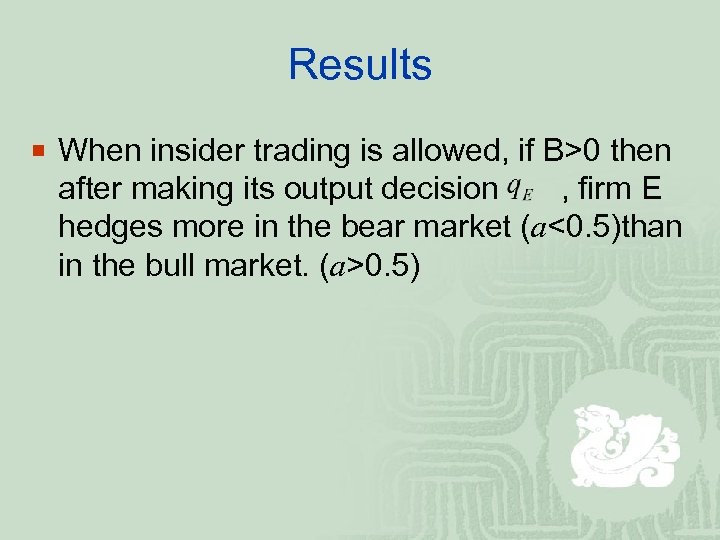

Results ¡ When insider trading is allowed, if B>0 then after making its output decision , firm E hedges more in the bear market (a<0. 5)than in the bull market. (a>0. 5)

Results ¡ When insider trading is allowed, if B>0 then after making its output decision , firm E hedges more in the bear market (a<0. 5)than in the bull market. (a>0. 5)

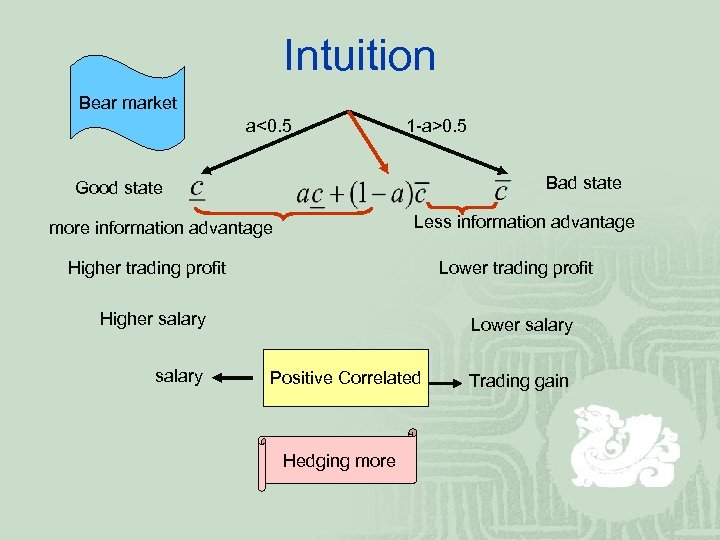

Intuition Bear market a<0. 5 1 -a>0. 5 Bad state Good state Less information advantage more information advantage Higher trading profit Lower trading profit Higher salary Lower salary Positive Correlated Hedging more Trading gain

Intuition Bear market a<0. 5 1 -a>0. 5 Bad state Good state Less information advantage more information advantage Higher trading profit Lower trading profit Higher salary Lower salary Positive Correlated Hedging more Trading gain

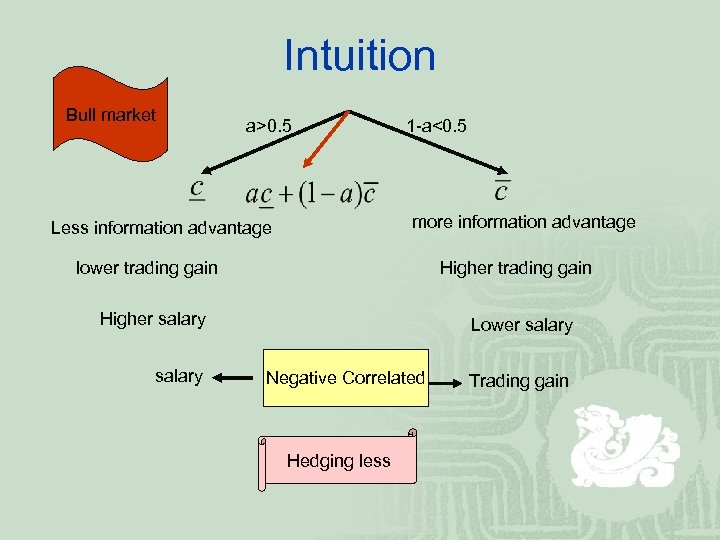

Intuition Bull market a>0. 5 1 -a<0. 5 more information advantage Less information advantage lower trading gain Higher salary Lower salary Negative Correlated Hedging less Trading gain

Intuition Bull market a>0. 5 1 -a<0. 5 more information advantage Less information advantage lower trading gain Higher salary Lower salary Negative Correlated Hedging less Trading gain

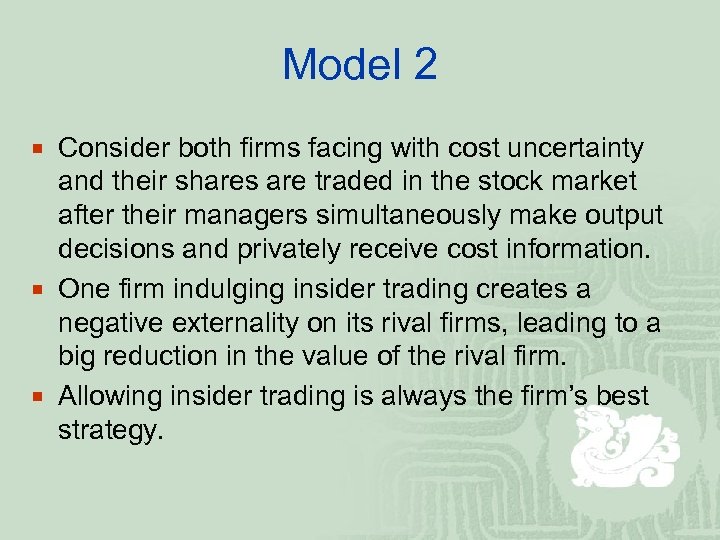

Model 2 ¡ Consider both firms facing with cost uncertainty and their shares are traded in the stock market after their managers simultaneously make output decisions and privately receive cost information. ¡ One firm indulging insider trading creates a negative externality on its rival firms, leading to a big reduction in the value of the rival firm. ¡ Allowing insider trading is always the firm’s best strategy.

Model 2 ¡ Consider both firms facing with cost uncertainty and their shares are traded in the stock market after their managers simultaneously make output decisions and privately receive cost information. ¡ One firm indulging insider trading creates a negative externality on its rival firms, leading to a big reduction in the value of the rival firm. ¡ Allowing insider trading is always the firm’s best strategy.

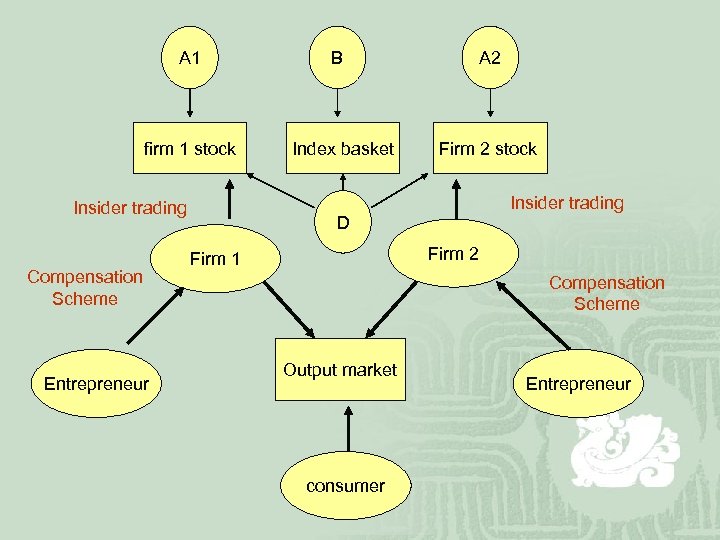

A 1 firm 1 stock Insider trading Compensation Scheme Entrepreneur B Index basket A 2 Firm 2 stock Insider trading D Firm 2 Firm 1 Compensation Scheme Output market consumer Entrepreneur

A 1 firm 1 stock Insider trading Compensation Scheme Entrepreneur B Index basket A 2 Firm 2 stock Insider trading D Firm 2 Firm 1 Compensation Scheme Output market consumer Entrepreneur

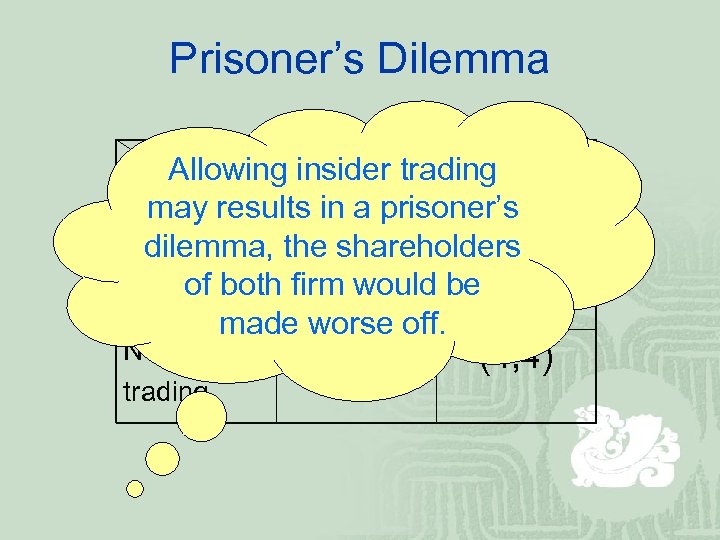

Prisoner’s Dilemma Firm 2 insider No insider Allowing. Insider trading Firm 1 results in a prisoner’s trading may dilemma, the shareholders Insider (2, 2) of both firm would be(5, 1) trading made worse off. No insider trading (1, 5) (4, 4)

Prisoner’s Dilemma Firm 2 insider No insider Allowing. Insider trading Firm 1 results in a prisoner’s trading may dilemma, the shareholders Insider (2, 2) of both firm would be(5, 1) trading made worse off. No insider trading (1, 5) (4, 4)

Implications ¡ This provides a rationale for insider trading regulation. ¡ The value of index Trading ¡ Reasons: Insiders possessing security-specific private information loses much of their information advantage if they are forced to trade the basket, which implies insider’s incentive to over-expand output is mitigated, the firm value is enhanced

Implications ¡ This provides a rationale for insider trading regulation. ¡ The value of index Trading ¡ Reasons: Insiders possessing security-specific private information loses much of their information advantage if they are forced to trade the basket, which implies insider’s incentive to over-expand output is mitigated, the firm value is enhanced

Thank you for listening The End

Thank you for listening The End