bed584f07455f7745b30db8d3c965202.ppt

- Количество слайдов: 39

Product Development Strategy Graham Cardwell Head of Product Marketing

Product Development Strategy Graham Cardwell Head of Product Marketing

It is a matter of life and death, a road either to safety or to ruin. Hence it is a subject of inquiry which can on no account be neglected. Laying Plans - Sun Tzu

It is a matter of life and death, a road either to safety or to ruin. Hence it is a subject of inquiry which can on no account be neglected. Laying Plans - Sun Tzu

Line 500 v 5 • • Reporting – Integration with Analyst Financials Usability – Installer • Ease of use to be improved, this is to include less dialogs, ensure typical installation is as simple as possible and ensure upgrading keeps existing information – Client enhancements (menu management, form controls) – Help enhancements · Enhanced design in several areas of the help system. · Dynamically loading Contents list, giving much faster response times to the user. · New layout and additional cross-references for topics in 'Working With' section, providing easier navigation to help on key areas of functionality. · Descriptions of licensable projects and system key help added as pop-ups where mentioned in 'Working With' section. – XML Interfaces - enabling EDI to work with XML files

Line 500 v 5 • • Reporting – Integration with Analyst Financials Usability – Installer • Ease of use to be improved, this is to include less dialogs, ensure typical installation is as simple as possible and ensure upgrading keeps existing information – Client enhancements (menu management, form controls) – Help enhancements · Enhanced design in several areas of the help system. · Dynamically loading Contents list, giving much faster response times to the user. · New layout and additional cross-references for topics in 'Working With' section, providing easier navigation to help on key areas of functionality. · Descriptions of licensable projects and system key help added as pop-ups where mentioned in 'Working With' section. – XML Interfaces - enabling EDI to work with XML files

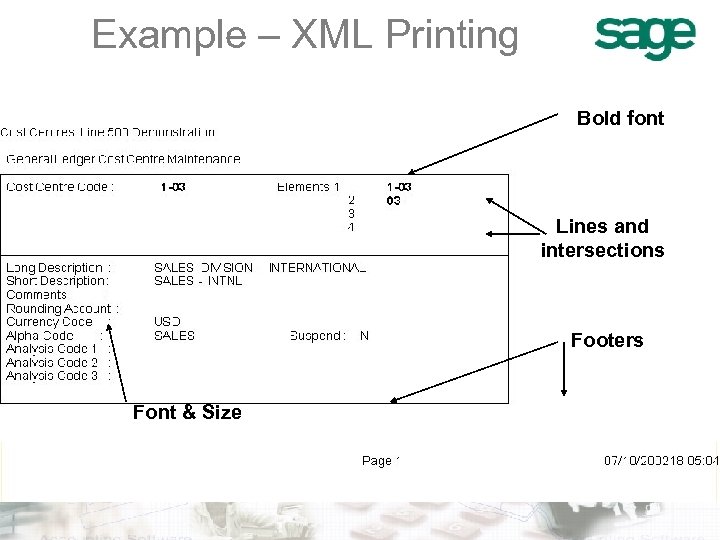

Example – XML Printing Bold font Lines and intersections Footers Font & Size

Example – XML Printing Bold font Lines and intersections Footers Font & Size

Line 500 V 5 – Infrastructure – IBM i. Series – Linux Port • Port Sage Line 500 V 5. 0 product to the IBM i. Series platform. • The product will run on Su. Se Linux 7. 3 and will be powered by an IBM UDB V 5 Release 1 database. – Intel – Linux Port • Port Sage Line 500 V 5. 0 product for Oracle 9 i and Informix IDS Version 9. 30 to Su. Se Linux 7. 3. Informix is the priority.

Line 500 V 5 – Infrastructure – IBM i. Series – Linux Port • Port Sage Line 500 V 5. 0 product to the IBM i. Series platform. • The product will run on Su. Se Linux 7. 3 and will be powered by an IBM UDB V 5 Release 1 database. – Intel – Linux Port • Port Sage Line 500 V 5. 0 product for Oracle 9 i and Informix IDS Version 9. 30 to Su. Se Linux 7. 3. Informix is the priority.

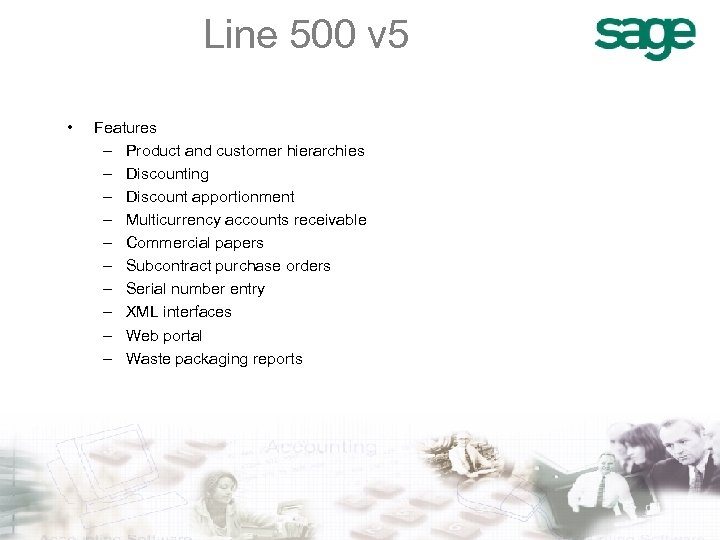

Line 500 v 5 • Features – Product and customer hierarchies – Discounting – Discount apportionment – Multicurrency accounts receivable – Commercial papers – Subcontract purchase orders – Serial number entry – XML interfaces – Web portal – Waste packaging reports

Line 500 v 5 • Features – Product and customer hierarchies – Discounting – Discount apportionment – Multicurrency accounts receivable – Commercial papers – Subcontract purchase orders – Serial number entry – XML interfaces – Web portal – Waste packaging reports

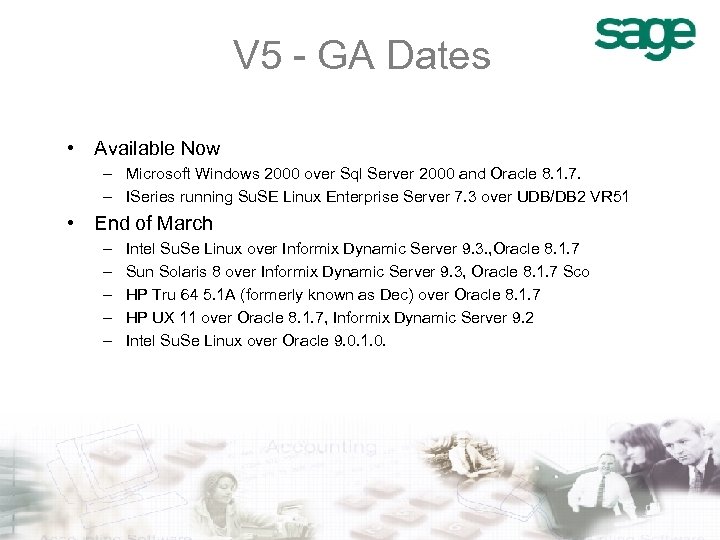

V 5 - GA Dates • Available Now – Microsoft Windows 2000 over Sql Server 2000 and Oracle 8. 1. 7. – ISeries running Su. SE Linux Enterprise Server 7. 3 over UDB/DB 2 VR 51 • End of March – – – Intel Su. Se Linux over Informix Dynamic Server 9. 3. , Oracle 8. 1. 7 Sun Solaris 8 over Informix Dynamic Server 9. 3, Oracle 8. 1. 7 Sco HP Tru 64 5. 1 A (formerly known as Dec) over Oracle 8. 1. 7 HP UX 11 over Oracle 8. 1. 7, Informix Dynamic Server 9. 2 Intel Su. Se Linux over Oracle 9. 0. 1. 0.

V 5 - GA Dates • Available Now – Microsoft Windows 2000 over Sql Server 2000 and Oracle 8. 1. 7. – ISeries running Su. SE Linux Enterprise Server 7. 3 over UDB/DB 2 VR 51 • End of March – – – Intel Su. Se Linux over Informix Dynamic Server 9. 3. , Oracle 8. 1. 7 Sun Solaris 8 over Informix Dynamic Server 9. 3, Oracle 8. 1. 7 Sco HP Tru 64 5. 1 A (formerly known as Dec) over Oracle 8. 1. 7 HP UX 11 over Oracle 8. 1. 7, Informix Dynamic Server 9. 2 Intel Su. Se Linux over Oracle 9. 0. 1. 0.

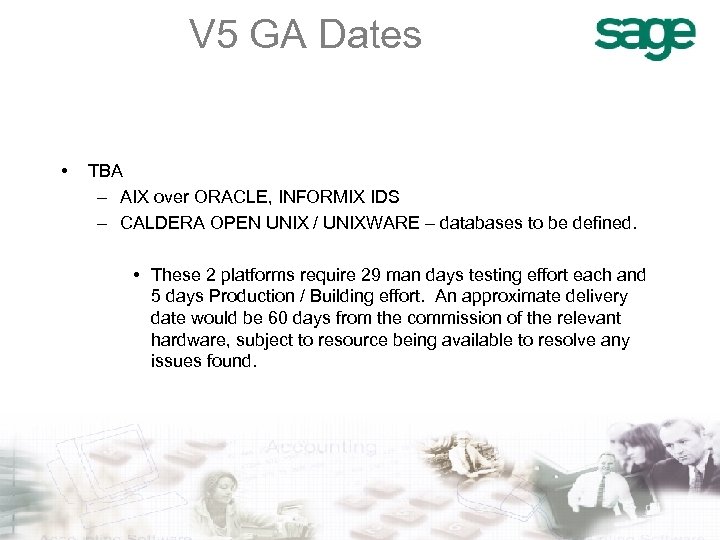

V 5 GA Dates • TBA – AIX over ORACLE, INFORMIX IDS – CALDERA OPEN UNIX / UNIXWARE – databases to be defined. • These 2 platforms require 29 man days testing effort each and 5 days Production / Building effort. An approximate delivery date would be 60 days from the commission of the relevant hardware, subject to resource being available to resolve any issues found.

V 5 GA Dates • TBA – AIX over ORACLE, INFORMIX IDS – CALDERA OPEN UNIX / UNIXWARE – databases to be defined. • These 2 platforms require 29 man days testing effort each and 5 days Production / Building effort. An approximate delivery date would be 60 days from the commission of the relevant hardware, subject to resource being available to resolve any issues found.

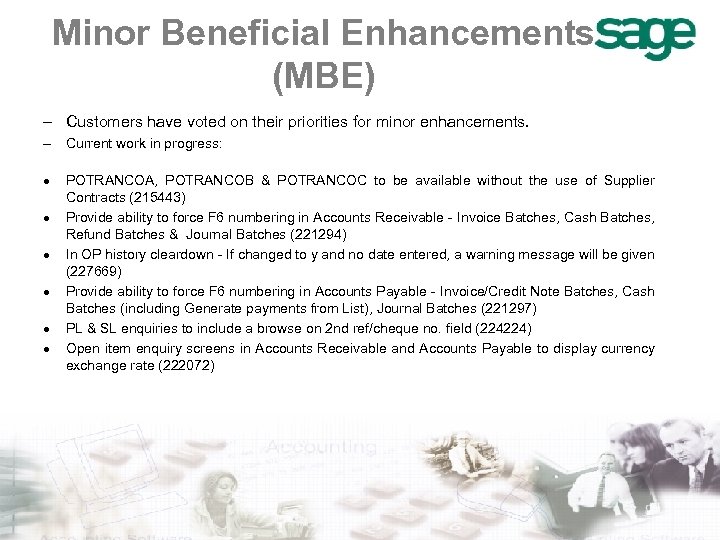

Minor Beneficial Enhancements (MBE) – Customers have voted on their priorities for minor enhancements. – Current work in progress: · · · POTRANCOA, POTRANCOB & POTRANCOC to be available without the use of Supplier Contracts (215443) Provide ability to force F 6 numbering in Accounts Receivable - Invoice Batches, Cash Batches, Refund Batches & Journal Batches (221294) In OP history cleardown - If changed to y and no date entered, a warning message will be given (227669) Provide ability to force F 6 numbering in Accounts Payable - Invoice/Credit Note Batches, Cash Batches (including Generate payments from List), Journal Batches (221297) PL & SL enquiries to include a browse on 2 nd ref/cheque no. field (224224) Open item enquiry screens in Accounts Receivable and Accounts Payable to display currency exchange rate (222072)

Minor Beneficial Enhancements (MBE) – Customers have voted on their priorities for minor enhancements. – Current work in progress: · · · POTRANCOA, POTRANCOB & POTRANCOC to be available without the use of Supplier Contracts (215443) Provide ability to force F 6 numbering in Accounts Receivable - Invoice Batches, Cash Batches, Refund Batches & Journal Batches (221294) In OP history cleardown - If changed to y and no date entered, a warning message will be given (227669) Provide ability to force F 6 numbering in Accounts Payable - Invoice/Credit Note Batches, Cash Batches (including Generate payments from List), Journal Batches (221297) PL & SL enquiries to include a browse on 2 nd ref/cheque no. field (224224) Open item enquiry screens in Accounts Receivable and Accounts Payable to display currency exchange rate (222072)

Minor Beneficial Enhancements (MBE) – Customers have voted on their priorities for minor enhancements. – Current work in progress: · · · Inter-Warehouse transfers to allow transfer of items with different UOM's (217388) In General Ledger Transaction Enquiry, hold period date selection values and only clear on exit from option. - (219573) Print currency code & description on Accounts Receivable statements (220470) Allow entry of negative value in Production Issues (220580) Payroll log to record details of what causes payroll parameters to trip (224192) Print order quantity on order status report if POQTYKEEP = YES (229721)

Minor Beneficial Enhancements (MBE) – Customers have voted on their priorities for minor enhancements. – Current work in progress: · · · Inter-Warehouse transfers to allow transfer of items with different UOM's (217388) In General Ledger Transaction Enquiry, hold period date selection values and only clear on exit from option. - (219573) Print currency code & description on Accounts Receivable statements (220470) Allow entry of negative value in Production Issues (220580) Payroll log to record details of what causes payroll parameters to trip (224192) Print order quantity on order status report if POQTYKEEP = YES (229721)

The Future

The Future

Roadmap Strategy - What do we need to Address • • Infrastructure UI Platforms Features – Core – Verticalisation • CRM

Roadmap Strategy - What do we need to Address • • Infrastructure UI Platforms Features – Core – Verticalisation • CRM

Roadmap Strategy - How do we deliver • Organic – Main Development – CPD • Jointly funded development that WILL go into future product release – MBE • Acquisition – Core, competitive • OEM – Speed to market

Roadmap Strategy - How do we deliver • Organic – Main Development – CPD • Jointly funded development that WILL go into future product release – MBE • Acquisition – Core, competitive • OEM – Speed to market

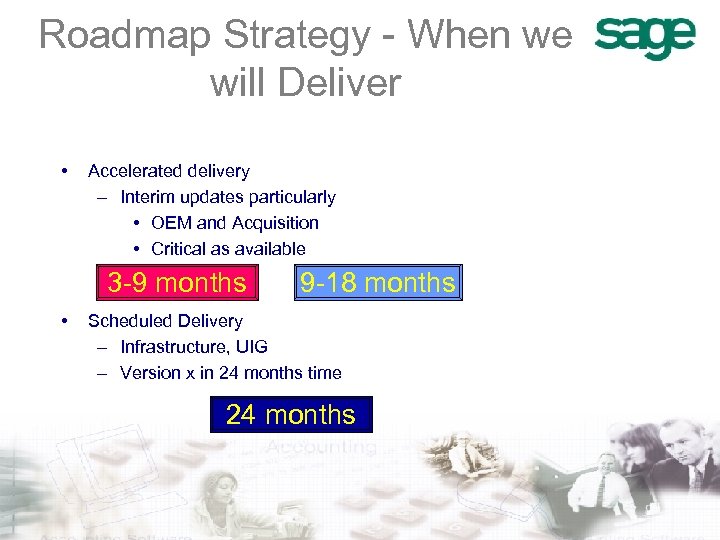

Roadmap Strategy - When we will Deliver • Accelerated delivery – Interim updates particularly • OEM and Acquisition • Critical as available 3 -9 months • 9 -18 months Scheduled Delivery – Infrastructure, UIG – Version x in 24 months time 24 months

Roadmap Strategy - When we will Deliver • Accelerated delivery – Interim updates particularly • OEM and Acquisition • Critical as available 3 -9 months • 9 -18 months Scheduled Delivery – Infrastructure, UIG – Version x in 24 months time 24 months

Roadmap - Infrastucture • Need to be friendly to Integration – While ERP solutions were designed to consolidate data management - ‘one version of the truth’. Business are now as badly ‘integrated’ as ever before – The main challenge/opportunity for organisations ‘getting their house in order’ is to make use of new technologies and standards - enabling integration beyond organisational boundaries • • • New Applications Framework - Build API’s an integration framework Generic Browser – Addressing usability concerns Multiple Server Architecture

Roadmap - Infrastucture • Need to be friendly to Integration – While ERP solutions were designed to consolidate data management - ‘one version of the truth’. Business are now as badly ‘integrated’ as ever before – The main challenge/opportunity for organisations ‘getting their house in order’ is to make use of new technologies and standards - enabling integration beyond organisational boundaries • • • New Applications Framework - Build API’s an integration framework Generic Browser – Addressing usability concerns Multiple Server Architecture

Multi Server Architecture (MSA) • • • MSA is the method of providing increased user counts on the Microsoft Windows platform – A ‘scale out’ solution as opposed to ‘scale up’ – Easily increase processing power on demand – Simply swap out hardware for upgrades or maintenance Sage Line 500 V 5 infrastructure is ‘MSA ready’, but MSA operation not supported General release of MSA will incorporate early adopter feedback and provide system and user management tools

Multi Server Architecture (MSA) • • • MSA is the method of providing increased user counts on the Microsoft Windows platform – A ‘scale out’ solution as opposed to ‘scale up’ – Easily increase processing power on demand – Simply swap out hardware for upgrades or maintenance Sage Line 500 V 5 infrastructure is ‘MSA ready’, but MSA operation not supported General release of MSA will incorporate early adopter feedback and provide system and user management tools

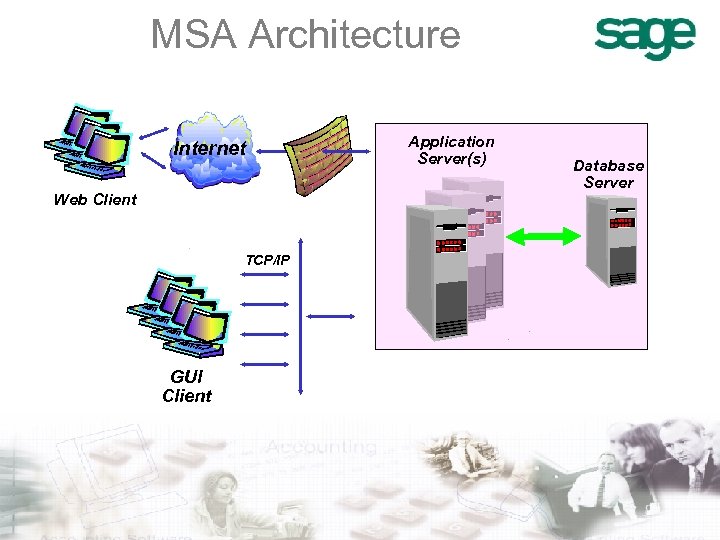

MSA Architecture Internet Web Client TCP/IP GUI Client Application Server(s) Database Server

MSA Architecture Internet Web Client TCP/IP GUI Client Application Server(s) Database Server

Roadmap - User Interface • Concentrate on inspecting and navigating data. Drill down, search and find capabilities • Can’t re build UI fully until infrastructure work completed. • Enhanced Web Client coupled with portal

Roadmap - User Interface • Concentrate on inspecting and navigating data. Drill down, search and find capabilities • Can’t re build UI fully until infrastructure work completed. • Enhanced Web Client coupled with portal

Roadmap - Platforms • Properly architected application server environment – Improve performance on RDBMS – Removal of Cisam platform facilitates • Platforms – – Ms SQL Oracle Informix IDS DB 2

Roadmap - Platforms • Properly architected application server environment – Improve performance on RDBMS – Removal of Cisam platform facilitates • Platforms – – Ms SQL Oracle Informix IDS DB 2

Roadmap - Core • • e. Fax and e. Forms solutions Reporting – Inquiries – Formatted Reports deliver templates Migration Utility Payroll – 2003/4 updates – e. Filing returns HR Solution Alerts Workflow

Roadmap - Core • • e. Fax and e. Forms solutions Reporting – Inquiries – Formatted Reports deliver templates Migration Utility Payroll – 2003/4 updates – e. Filing returns HR Solution Alerts Workflow

Roadmap Core • • • German Accreditation – Traceability – Enabling Ease of Auditing – Vat Extensions – Archiving US Sales Tax support Reallocation of AP/AR Items (e. g. bounced cheques) UK & International Payments (new European Banking Rules) Corporate Charge Cards

Roadmap Core • • • German Accreditation – Traceability – Enabling Ease of Auditing – Vat Extensions – Archiving US Sales Tax support Reallocation of AP/AR Items (e. g. bounced cheques) UK & International Payments (new European Banking Rules) Corporate Charge Cards

Roadmap Core - Reporting • • Positive market feedback and successful early reseller installations – Sage Winnersh implementing for internal Finance use Opportunity now is to widen the scope of Analyst Financials Optional report packs based on organisation roles – Financial; Distribution; Inventory; Manufacturing; Projects – Report packs will comprise a minimum of four management reports, developed, and supported by Sage – Licensed by Sage in addition to the core Analyst Financials license Actively marketing through conferences, newsletters and mailers

Roadmap Core - Reporting • • Positive market feedback and successful early reseller installations – Sage Winnersh implementing for internal Finance use Opportunity now is to widen the scope of Analyst Financials Optional report packs based on organisation roles – Financial; Distribution; Inventory; Manufacturing; Projects – Report packs will comprise a minimum of four management reports, developed, and supported by Sage – Licensed by Sage in addition to the core Analyst Financials license Actively marketing through conferences, newsletters and mailers

Roadmap Core - e. Commerce • • 57% MB expect to increase purchases via the internet next year 69% of all UK MB purchase goods and services over the internet up from 46% in 2001 • Most popular products – Printers &Peripherals 60% – PC Networking Software 57% – Computing/electronic products 55% – Publications (Books) 50% e. Commerce 48%-75% will use secure on line transactions. B 2 b will become dominant 57% by 2006 Need to address Web Sales

Roadmap Core - e. Commerce • • 57% MB expect to increase purchases via the internet next year 69% of all UK MB purchase goods and services over the internet up from 46% in 2001 • Most popular products – Printers &Peripherals 60% – PC Networking Software 57% – Computing/electronic products 55% – Publications (Books) 50% e. Commerce 48%-75% will use secure on line transactions. B 2 b will become dominant 57% by 2006 Need to address Web Sales

Roadmap Core - e. Commerce • Transaction Mail Enablement – EDI/XML already there and most of the message sets needed • Sales Quotations in development – Line 50 enabled now – 30 -40% of your customers and suppliers use a Sage Solution

Roadmap Core - e. Commerce • Transaction Mail Enablement – EDI/XML already there and most of the message sets needed • Sales Quotations in development – Line 50 enabled now – 30 -40% of your customers and suppliers use a Sage Solution

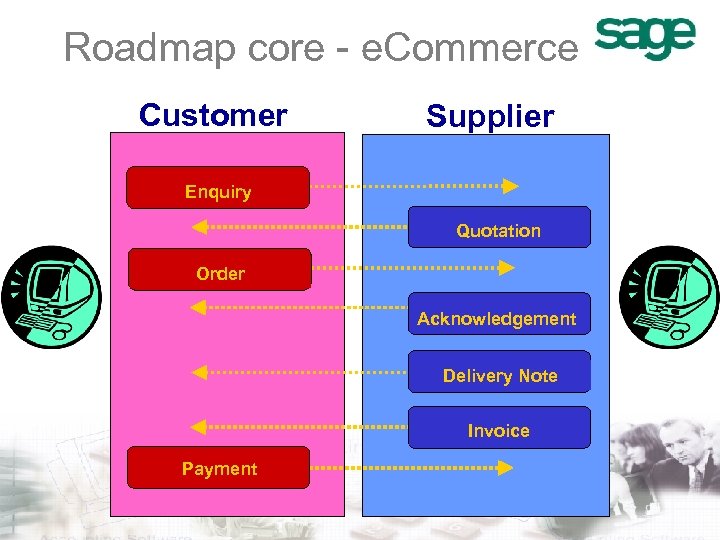

Roadmap core - e. Commerce Customer Supplier Enquiry Quotation Order Acknowledgement Delivery Note Invoice Payment

Roadmap core - e. Commerce Customer Supplier Enquiry Quotation Order Acknowledgement Delivery Note Invoice Payment

Roadmap - Manufacturing • • Play to strengths – 30% SME in Manufacturing, Sage via 50/100 200 and 500 large encumbent base with upgrade potential and the biggest vertical market. – Upgrade pull for line 50/100 customers Extend solution adding advanced planning and scheduling systems.

Roadmap - Manufacturing • • Play to strengths – 30% SME in Manufacturing, Sage via 50/100 200 and 500 large encumbent base with upgrade potential and the biggest vertical market. – Upgrade pull for line 50/100 customers Extend solution adding advanced planning and scheduling systems.

Roadmap Manufacturing • Additional Modules – Production Backflush – Engineering Change – Works order and MRP extensions – Features Module (1) • Additional reporting and enquiry – Contract Estimating & MTO – Automatic WO & PO issues – Vendor Returns – Features Module (2)

Roadmap Manufacturing • Additional Modules – Production Backflush – Engineering Change – Works order and MRP extensions – Features Module (1) • Additional reporting and enquiry – Contract Estimating & MTO – Automatic WO & PO issues – Vendor Returns – Features Module (2)

Roadmap Construction • Modules written based on multisoft product shares same label names etc. • Construction pack • Modules (Contract Costing, CIS Subcontractors Ledger, Contract Sales Ledger, estimating) • Financial pack • Commercials pack • Payroll • Health & Safety Compliance

Roadmap Construction • Modules written based on multisoft product shares same label names etc. • Construction pack • Modules (Contract Costing, CIS Subcontractors Ledger, Contract Sales Ledger, estimating) • Financial pack • Commercials pack • Payroll • Health & Safety Compliance

Roadmap Services • Project Billing now live and running in sites • Enhancements – Reconciliation's – Enquiries – Speed entry of Codes – Short code support – Projects in Purchase Accrual – Edi

Roadmap Services • Project Billing now live and running in sites • Enhancements – Reconciliation's – Enquiries – Speed entry of Codes – Short code support – Projects in Purchase Accrual – Edi

Roadmap - CRM • • • Completes product footprint in an integrated environment To be effective, a CRM system must integrate seamlessly with the company's data warehouse and with all corporate applications such as ERP and e-commerce applications CRM's value is greatly diminished if it is not integrated with back-office systems z e-CRM is the final step in the evolution towards a truly extended enterprise which few companies have achieved to date z SME companies have largely escaped CRM angst • Application integration Server, Back office viewer

Roadmap - CRM • • • Completes product footprint in an integrated environment To be effective, a CRM system must integrate seamlessly with the company's data warehouse and with all corporate applications such as ERP and e-commerce applications CRM's value is greatly diminished if it is not integrated with back-office systems z e-CRM is the final step in the evolution towards a truly extended enterprise which few companies have achieved to date z SME companies have largely escaped CRM angst • Application integration Server, Back office viewer

Conclusions • • • We will have a new architecture - need to be friendly to integration We will deliver a new UI - both browser and forms themselves and we will deliver a solution not a piecemeal toolkit that customer needs to build themselves We will extend core functionality We will deliver a properly architected application server environment - a true relational model We will exploit vertical market opportunities We will provide an integrated CRM solution We will deliver an e. Commerce solution We will exploit OEM opportunities We will Acquire solutions where appropriate

Conclusions • • • We will have a new architecture - need to be friendly to integration We will deliver a new UI - both browser and forms themselves and we will deliver a solution not a piecemeal toolkit that customer needs to build themselves We will extend core functionality We will deliver a properly architected application server environment - a true relational model We will exploit vertical market opportunities We will provide an integrated CRM solution We will deliver an e. Commerce solution We will exploit OEM opportunities We will Acquire solutions where appropriate

Product Development Strategy

Product Development Strategy