0ba275c1611545d8de436b59b597a245.ppt

- Количество слайдов: 28

Process Improvements: How to begin to transform your collections organization Ted London, Vice President, CGI © CGI GROUP INC. All rights reserved May 5, 2010

Agenda • Background • Getting started: Operational review • Sample Process Improvement Success Stories • Questions Confidential

Realities of today’s environment Tight state budgets Catch-22 for revenue generating projects • Government needs revenues • Government does not have the dollar it takes to increase revenue by ten Goal: Brings dollars (or $100) in extra revenues without any impact on the general Confidential

…but despite these challenges • Government will continue to be expected to do more with less • Significant accomplishments can be made through Process Improvements • True Transformation is Possible Confidential

Agenda • Background • Getting started: Operational review • Sample Process Improvement Success Stories • Questions Confidential

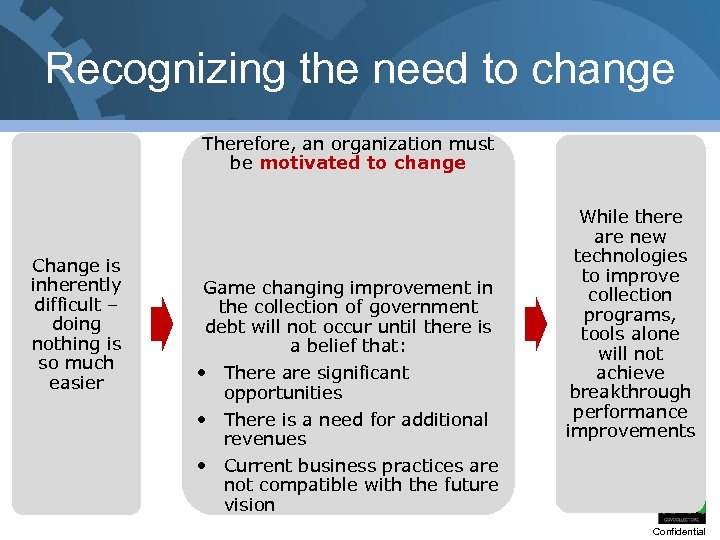

Recognizing the need to change Therefore, an organization must be motivated to change Change is inherently difficult – doing nothing is so much easier Game changing improvement in the collection of government debt will not occur until there is a belief that: • There are significant opportunities • There is a need for additional revenues • Current business practices are not compatible with the future vision While there are new technologies to improve collection programs, tools alone will not achieve breakthrough performance improvements Confidential

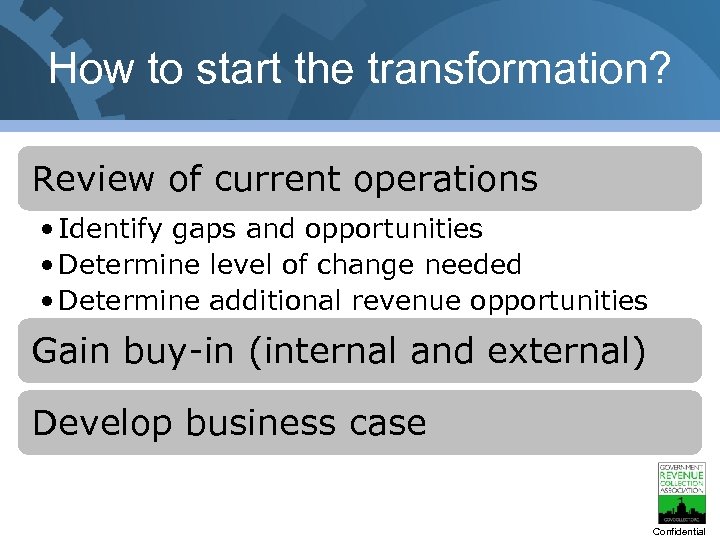

How to start the transformation? Review of current operations • Identify gaps and opportunities • Determine level of change needed • Determine additional revenue opportunities Gain buy-in (internal and external) Develop business case Confidential

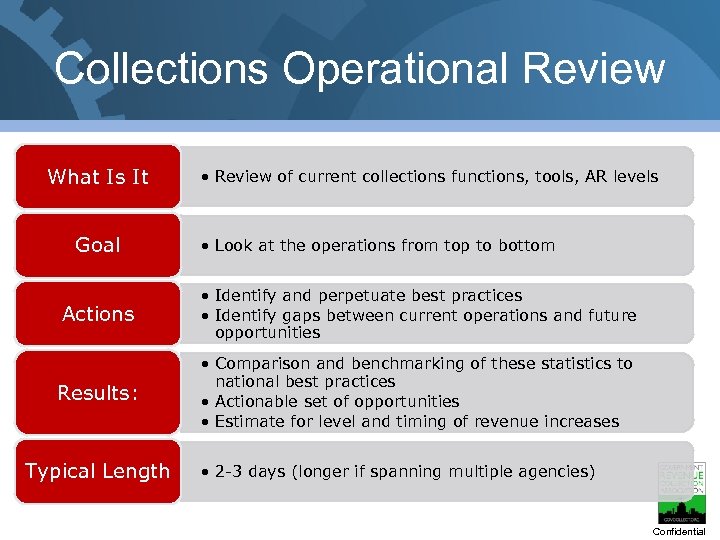

Collections Operational Review What Is It Goal • Review of current collections functions, tools, AR levels • Look at the operations from top to bottom Actions • Identify and perpetuate best practices • Identify gaps between current operations and future opportunities Results: • Comparison and benchmarking of these statistics to national best practices • Actionable set of opportunities • Estimate for level and timing of revenue increases Typical Length • 2 -3 days (longer if spanning multiple agencies) Confidential

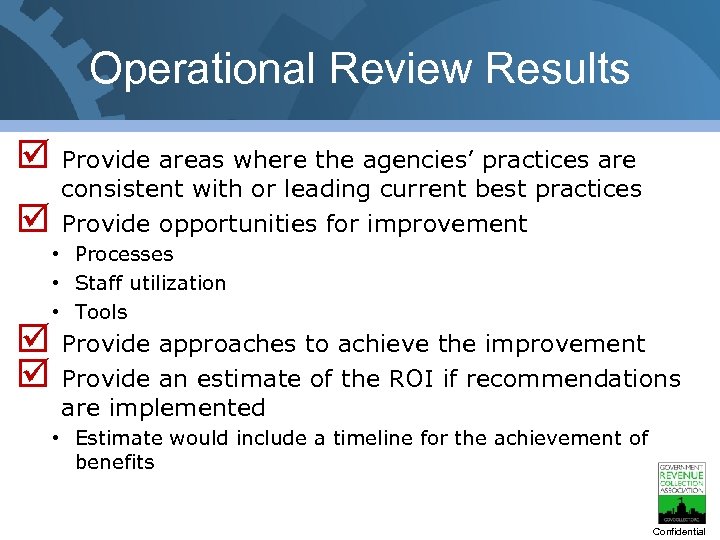

Operational Review Results Provide areas where the agencies’ practices are consistent with or leading current best practices Provide opportunities for improvement • Processes • Staff utilization • Tools Provide approaches to achieve the improvement Provide an estimate of the ROI if recommendations are implemented • Estimate would include a timeline for the achievement of benefits Confidential

Operational Review Benefits Insights • Provides additional details of what the State is doing as compared to other States New ideas • Provides a fresh perspective on opportunities (some of which the department could implement on their own) Business Case • Provides estimates which could assist with the development of a business case Confidential

Agenda • Background • Getting started: Operational review • Sample Process Improvement Success Stories • Questions Confidential

CGI’s approach to process improvements Right Account Right Resource Right Time Right Tools Right Results Confidential

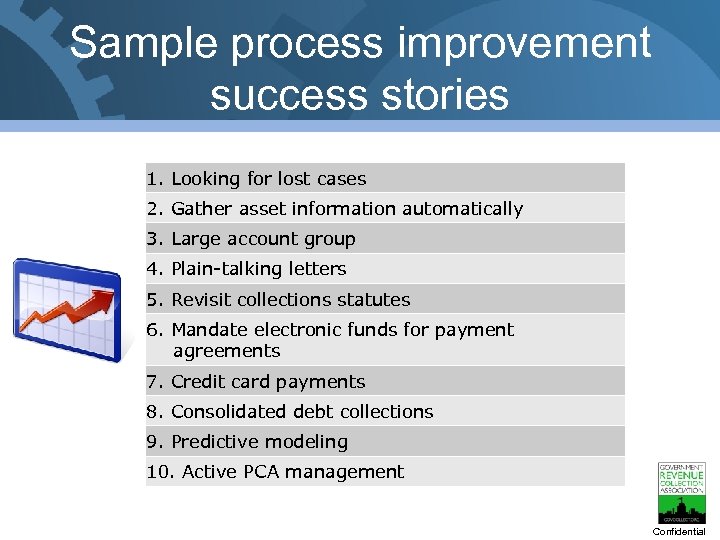

Sample process improvement success stories 1. Looking for lost cases 2. Gather asset information automatically 3. Large account group 4. Plain-talking letters 5. Revisit collections statutes 6. Mandate electronic funds for payment agreements 7. Credit card payments 8. Consolidated debt collections 9. Predictive modeling 10. Active PCA management Confidential

1. Looking for lost cases • Many collections workflow processes grow over time • While cases are worked diligently up-front, productive cases can be under-worked later • Through analysis these “lost” cases can be identified • Sometimes payment can be made simply by calling the right individual at the right time Confidential

2. Gather asset information automatically • Government typically has many ways to gather asset information for free • Other agencies • Data supplied to government • Historically, gathering asset information has been manual • Agencies are now capturing asset information directly from remittance equipment • Through automated asset gathering and advanced workflow, cases can be automatically prioritized based on available asset information Confidential

3. Large account group Work large dollar accounts more timely Give agents additional time to perform skip trace activities on large dollar accounts Assign fewer cases to these collectors who can therefore focus on them Often working with attorneys and CPA’s Assigning the right individuals to this group is key Confidential

4. Plain-talking letters • Letters often written by attorneys – And can only be understood by attorneys • Experience has shown letters need to be: – Simple – Straightforward – Focus the debtor on what is owed, how to pay, and what are the consequences of non-payment • Significant increase in collections through plain-talking Confidential

5. Revisit collections statutes Often statutes make collections needlessly difficult (or more expensive) • No access to data that is available • Certified letters • Multiple steps before involuntary actions Given the state of the economy – this is the year to ask • Financial Institution Records Match • New Employee Registry • Additional authority for involuntary collections Confidential

6. Mandate electronic funds for payment agreements • A number of governments have found that EFT can dramatically reduce the default rate • Private sector typically only takes EFT Benefits P Allows departments to increase their “wallet-share” P Can be a customer service benefit P Frees staff to work other cases California and Minnesota reduced defaults from the 40 -50% range to the 3 -5% range Confidential

7. Credit card payments Allows payment when the taxpayer does not have liquid assets Vendors will work with Government so the taxpayer pays the credit cards fees Brings in money quickly and efficiently Moves the collection risk from the Government to the credit card company Confidential

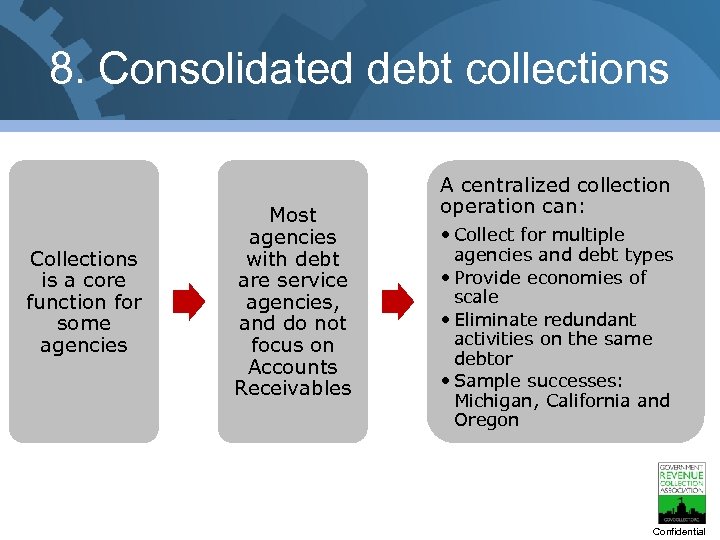

8. Consolidated debt collections Collections is a core function for some agencies Most agencies with debt are service agencies, and do not focus on Accounts Receivables A centralized collection operation can: • Collect for multiple agencies and debt types • Provide economies of scale • Eliminate redundant activities on the same debtor • Sample successes: Michigan, California and Oregon Confidential

9. Predictive modeling Move from “Treating all taxpayers the same” to “Treating all similar taxpayers the same” Use yield instead of strictly dollar amount Order cases for phone call based on risk score Alter rates paid to PCA’s based on risk score Assign to staff based on risk score Confidential

10. Active PCA management Find appropriate usage of PCA’s Review portfolio for best timing for PCA assignment Use primary and secondary placements Alter assignments based on scorecards – Encourages healthily competition – Change percentage of cases going to each PCA each month/quarter Monitor PCA’s closely and have authority to terminate the contract easily if performance warrants Confidential

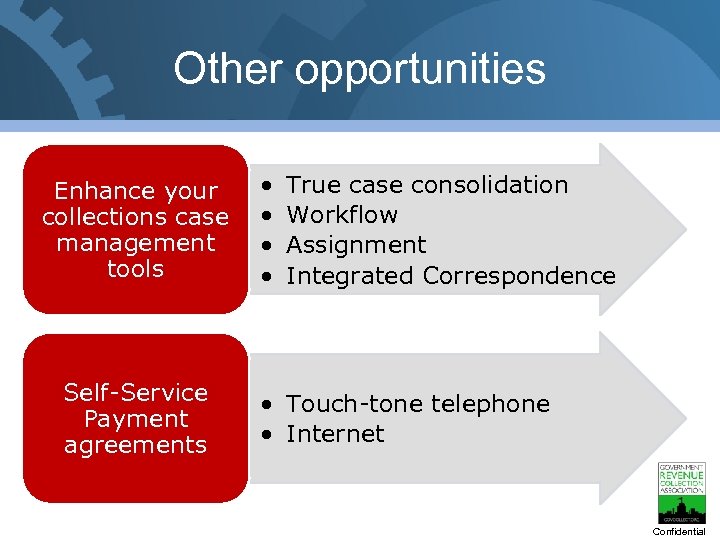

Other opportunities Enhance your collections case management tools Self-Service Payment agreements • • True case consolidation Workflow Assignment Integrated Correspondence • Touch-tone telephone • Internet Confidential

Agenda • Background • Getting started: Operational review • Sample Process Improvement Success Stories • Questions Confidential

Contact Information About the Presenter § 17 Years with CGI exclusively working with State, Federal and Local tax and collections agencies § Leader of CGI’s Global Tax and Revenue and Collections Practice § Experience with more than 20 different revenue agencies § Experience with enhancing collections, audit and tax accounting systems and business processes § Oversees estimation and measurement for CGI’s benefits funded tax projects ISO 9001 Certified Ted London Vice President Tax, Revenue and Collections Center of Excellence (916) 284 -7277 Ted. London@cgi. com www. cgi. com/tax 26 Confidential

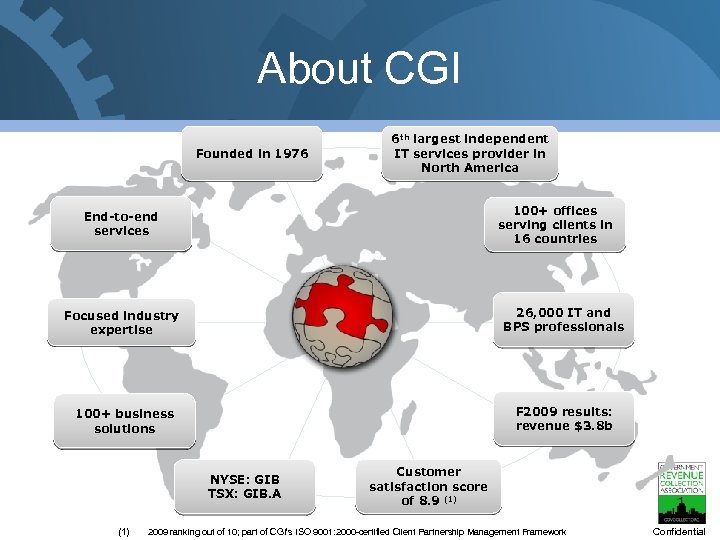

About CGI Founded in 1976 6 th largest independent IT services provider in North America 100+ offices serving clients in 16 countries End-to-end services Focused industry expertise 26, 000 IT and BPS professionals 100+ business solutions F 2009 results: revenue $3. 8 b NYSE: GIB TSX: GIB. A (1) Customer satisfaction score of 8. 9 (1) 2009 ranking out of 10; part of CGI’s ISO 9001: 2000 -certified Client Partnership Management Framework Confidential

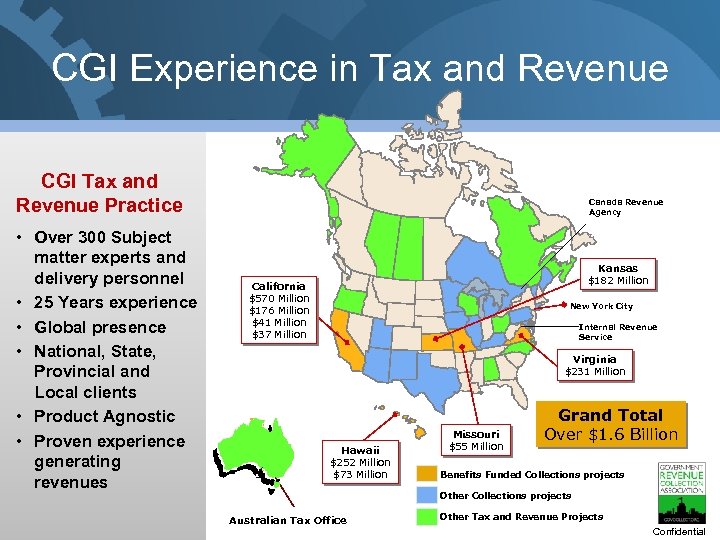

CGI Experience in Tax and Revenue CGI Tax and Revenue Practice • Over 300 Subject matter experts and delivery personnel • 25 Years experience • Global presence • National, State, Provincial and Local clients • Product Agnostic • Proven experience generating revenues Canada Revenue Agency Kansas $182 Million California $570 Million $176 Million $41 Million $37 Million New York City Internal Revenue Service Virginia $231 Million Hawaii $252 Million $73 Million Missouri $55 Million Grand Total Over $1. 6 Billion Benefits Funded Collections projects Other Collections projects Australian Tax Office Other Tax and Revenue Projects Confidential

0ba275c1611545d8de436b59b597a245.ppt