a270c83faae2ebdc6a3f010058861f52.ppt

- Количество слайдов: 41

• • Problem Identification Policy Formation Policy Analysis Policy Choice Policy Legitimation Policy Implementation Policy Evaluation Policy Formulation, etc.

Policy Choices & Policy Analysis “Policy analysis is the effort to think carefully about policy problems and potential solutions” Ex ante analysis: Ex post analysis:

Policy is like sausage Within democratic systems public policy emerges from a complex mix of: – – – Electioneering and voting Organizing and mobilizing groups Lobbying Assessing public opinion The interacting of all of the above

Cost-Benefit Analysis Emphasizing the importance of opportunity costs in achieving public benefits and the principle that benefits must be considered relative to costs. 6 important stages in cost-benefit analysis

1. Problem and Objective Identification: Goals and Values 2. Identification of Potential Solutions 3. Data Collection and Analysis

4. Estimation of Costs and Benefits – Monetization – Human v. Monetary Costs and Benefits – Intangibles – Discounted Value (money now v. money later) – Risk Assessment

5. Decision Criteria – Democratic: fair, politically acceptable – Benefits outweigh costs – Competitive – Scientific – Pareto Principle – Kaldor-Hicks 6. Policy Recommendation

How do we estimate costs & benefits? • Identify relevant impacts – Geographic targets – Spillover/externalities – Persons and Preferences • Do our political institutions articulate all the relevant preferences? • Children, vulnerable populations, future generations – Reprise of Standing Issues • Who has standing regarding this issue (citizenship, constituency, political representation) • If part of the problem is a debate over standing, CB may not be an appropriate method of analysis.

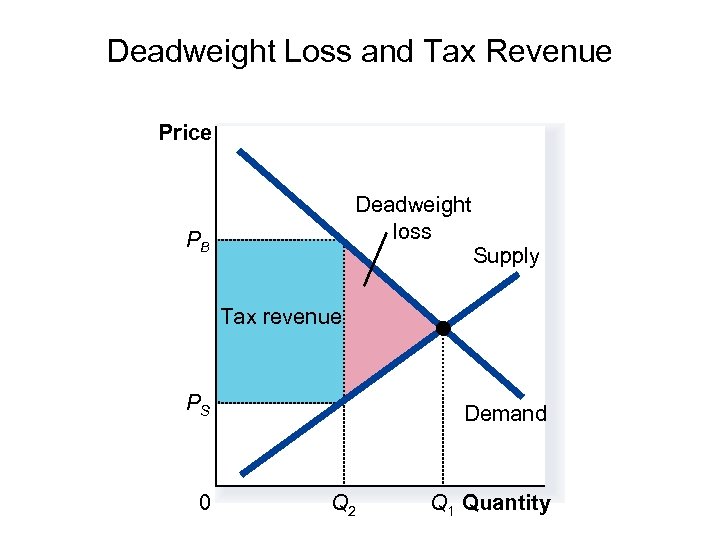

Monetizing Impacts – Valuing Inputs • • Opportunity costs (could have done something else) OC are offset when social surplus is created Measuring social surplus is not easy For example, Chapter 4 discussed the deadweight loss of an excise tax that raised the price of a good. Yes, the government received revenue, but the consumers had to pay more and because of the new inefficiency, government revenue did not offset consumer costs. But if there are other spillover effects, i. e. tax on alcohol reduces car accidents, then we can include those benefits. • The government hiring of workers, a cost, but need to subtract the consumer surplus enjoyed by those hired

• Valuing Outcomes – Willingness to pay – Benefits equal the net revenue generated plus any social surplus – Social surplus depends on efficiencies of the market – Government Day Care: direct benefit of those in program, indirect benefit of shifting supply schedule to the right. – Secondary markets need to be considered • Stocking lake with game fish example • Sales of bait and equipment go up, but golfing goes down

• Estimating the demand for nonmarket goods – Hedonic Price Models • Public safety; quality schools increase housing value, but how do we put a price on a specific public good? • Statistical techniques; control variables – Opinion Surveys • Ask people how much they value a good • Difficult to describe goods accurately • Hypothetical not really forcing respondent to make an economic choice – Activity Surveys • Survey respondents on their behavior • Regional park example: examine travel, time, distance costs to estimate value.

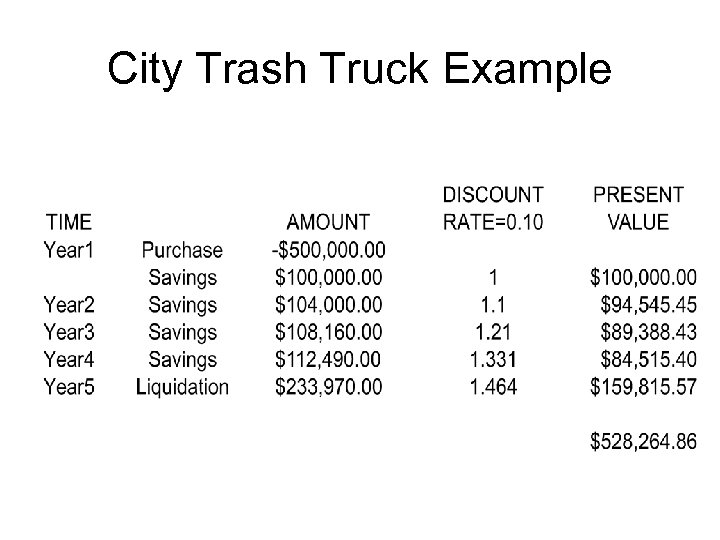

Discounting for Time & Risk • The concept of Present Value – Most of us would be unwilling to loan someone $1000 today for a promise of repayment for $1000 next month. Why? – Formula: (Bt-Ct)/(1+d)t – How do we calculate d? In an efficient market the market interest rate is an appropriate estimate. – In the next example, we take current costs, adjust for predicted inflation, and adjust for our calculated discount rate over time (1+interest rate)t [In this case 0. 10]

City Trash Truck Example

Expected Value • Expected Value adds another level of complexity. – The value of improving the levies in New Orleans depends on the probability of a hurricane and the expected damage – Need a Risk Assessment: Past occurrences, past damage, estimate probablities – Dam Example: 1 major flood every 20 years, avoiding damage = $25 million. What if no flood happens. – (. 33)($25 million) + (. 67)(-$5 million) = $4. 9 million

Choosing among Policies • Cost-Benefit Ratio – Pick the policy that has the best cost ratio – A million dollar project produces a net benefit of 10 million, but another costs $10 million and produces $20 million in net benefits. – This take into account risk and physical and budgetary constraints – Book recommends against it because calculation of the ratio is easily manipulated

Choosing among Policies • Kaldor-Hicks – Requires only that policies have the potential to produce Pareto improvements; it does not require that people actually be compensated for the costs that they bear. – Sometimes we expect different people to bear costs under different policies so that over the broad range of public activities few, if any, people will actually bear net costs. • Feasibility – disaggregate benefit/cost by interest groups

Applying the cost-benefit analysis: Is it appropriate to talk in terms of cost/benefit when dealing with all policies? What about child abuse policy? How do we handle the meaning or definition of child abuse and weigh in the rights of parents and maintain due process?

• the most economic efficient method to deal with child abuse is probably not to do anything - but beyond that due process and being sensitive to others rights gets in the way of solving the problem of child abuse. • the most efficient way of dealing with criminals is not to give them a trial or hearing - but most of us would not want to live in a society that did not provide some type of trial for those accused of a crime. • Protection of due process creates a social surplus which is hard to monitize.

• Some problems are not easily applied to economic models, market incentives, or cost/benefit analysis. • Very few firms take on the problems of housing, education, and medically caring for the old, abating drug abuse, or dealing with crime.

• Fairness is often a major goal/value when we are trying to solve a social problem and fairness can conflict with goals of efficiency or cost/benefit analysis. • Multigoal Analysis is likely needed for these types of issues

• Although “Cost/Benefit Analysis” sounds efficient and objective it is often applied very subjectively and strategically • The process is likely to be affected by: – The role of values – Agenda setting – Subjective perceptions – Competition for limited resources

Taxing Alcohol to Saves lives • Who bears the cost? • Who bears the benefits? • How will consumers respond to a tax increase? • Demand schedule q = ap-b • Where q=quantity demand; p=price; b=elasticity; Literature review suggests elasticity=-0. 5

• 1988 a beer costs $0. 63, 54 billion sold in a year. • What if we impose a $0. 19 tax increase? • Plug in the numbers to calculate a for current quantity and price and then calculate new quantity for new (higher price) = 47. 347 billion drinks • This brings in almost $9 billion in gov. revenue • But adds a consumer cost of $9 billion + deadweight loss (calculated to be $0. 586 billion)

Deadweight Loss and Tax Revenue Price Deadweight loss PB Supply Tax revenue PS 0 Demand Q 2 Q 1 Quantity

Reductions in Fatalities, Injuries, property damage • Reduction varies by age, why? • Estimates based on state data (autopsies, blood alcohol levels in all highway fatalities) • Found 30% increase in price would result in 40% reduction in the deaths of those 16 -21 years of age • Also need to include Health and Productivity gains

Monetizing these benefits What is the Value of a Life? : • EPA has lowered the Value of Life. 11 percent lower than 5 years ago. Each person is worth 6. 9 million dollars. • How do economists value life? riskier job should be paid more. Survey questions about risk. "how much someone is willing to pay to reduce their risk" • Estimates range from $600, 000 to $8 million (in 1986) • Why do we do this? to compare apples to apples. A policy could save 10, 000 lives but costs 10 billion dollars, is it a good policy. We need a value of life.

Monetizing these benefits Uninformed demand: assumes that people do not consider the accident, health and productivity costs of drinking Informed demand: people take into consideration these costs and adjust for them, willingly, with lower wages, higher insurance premiums, paying for damages, etc. Best Guess: some people are informed, others are not (10% young people are informed; 90% of older people)

Findings • With a conservative estimate of human life $1 million • Assuming everyone is informed (don’t include death of drinkers or property damage or health and productivity benefits) • There are still net benefits of the alcohol tax (barely) • Benefits change depending on size of tax (and assumptions made).

The Strategic Petroleum Reserve Example • Shows how Cost Benefit analysis is done in a political/bureaucratic setting • Background – Oil dependency is an old issue – 1959 US regulated imports and domestic production to prevent direct vulnerability to changes in world oil markets

• But this policy of regulation became ineffective because of changes domestically and internationally. • Oil prices fell because corporations preferred higher rates of current production because countries began to assert sovereign control over their resources • This led to increased use (and therefore reliance) of oil around the world • Nixon’s price controls on oil slowed the production of domestic oil

• Therefore, we saw great use and need of oil at the same time domestic production capacity was at its maximum • This led to policy experts to recommend stockpiling oil reserves in case of a shortage that could effect the economy. • By 1973 there were several proposal for US stockpiling • In October 1973 Egypt attacked Israeli positions along the Suez Canal. When US began to supply arms to Israel, OAPEC embargoed oil shipments to the US and lowered production.

• Not a perfect policy plan – Overly optimistic about cost of storage – Unrealistic expectations about need and time • Purchasing oil before storage facilities were ready – Lots of red tape: SPR office; Federal Energy Administration; Newly created Department of Energy; EPA; Army Corps of Engineers; Energy Research and Development Administration – Plan was accelerated by Carter’s energy advisor

• Besides some of the implementation problems, was it a good policy? • Measuring the Impact of a Stockpiling Program – Expenditure effects – Market effects • Small but steady oil purchases should only modestly inflate prices • Sell large sums during disruptions should greatly lower prices – Political effects • Large stockpile may deter embargoes – Collateral effects • May discourage private stockpiling

Quantifying Costs & Benefits • How expensive will it be to store oil? – Cost of storage – Cost of oil at the time • How big is the social surplus of selling stored oil during a disruption? – Depends on level of dependence – And on how oil markets influence secondary markets

Role of Policy Analysis in SPR • FEA plan in 1976 included a costeffectiveness analysis in support of a 500 million barrel reserve • Really this was a compromise between FEA and OMB • 1977 Carter’s advisor roles out the billion barrel plan (with no analysis to support it) • Proposal has wide support from Congress and President

• OMB not convinced. 1978 organizes a study of the plan. Office of Contingency Planning in the Policy and Evaluation Office of the DOE, the Special Studies Division for Natural Resources, Energy, and Science in the OMB, and the Council of Economic Advisors (CEA) were all involved. • Some dispute over assumptions for the model to estimate costs and benefits • Even though the DOE made concessions on the assumptions, the analysis basically supported the idea of a billion barrel policy

• Still not enough, 1979 OMB pressured DOE to participate in another joint study on the policy. • DOE committed 20 staff months of professional time and $80, 000 for consultants for the study. • Report suggested a policy of 2. 1 billion barrels was desirable. • 1980 Separate agency, Office of Oil, saw flaws in the study and asked an economist at MIT to look into it using a better methodology (Dynamic programming formulation-DPF).

• Over a range of scenarios and assumptions DPF found that anywhere from 800 million to 4. 4 billion barrels was the ideal policy. • OMB was still not satisfied, argued that DPF was to complicated. • But, by November of 1980 it was clear that the OMB was not going to oppose the policy. • So why was the OMB so resistant to the policy and why did it finally allow the policy to proceed?

Postscript • In 1991, an SPR draw down of 17 million barrels was initiated to moderate prices during the 1 st Gulf War. • Chapter says SPR has the capacity to hold 700 million barrels; it actually held 610 in mid-2003 • The Energy Policy Act of 2005 directed the Secretary of Energy to fill the SPR to its authorized one billion barrel capacity • As of today (10/28/2008) 701. 8 million

a270c83faae2ebdc6a3f010058861f52.ppt