fb1c38d62f2d405c90f80a3bc68b0ce5.ppt

- Количество слайдов: 44

Privatization in Eastern Europe and the EU Enlargement Dr. Evgeni Peev University of Vienna April 2008

Privatization in Eastern Europe and the EU Enlargement Dr. Evgeni Peev University of Vienna April 2008

Issues: Transition in Central and Eastern Europe (CEE) Privatization Policy in CEE Effects of Privatization on the EU Enlargement

Issues: Transition in Central and Eastern Europe (CEE) Privatization Policy in CEE Effects of Privatization on the EU Enlargement

Table of Contents 1. Transition from Totalitarian Socialism to Market Economy in Central and Eastern Europe (CEE) 1. 1. Why Privatization is So Important to the EU Enlargement Process? 1. 2. What Does Privatization Mean in Poland in the United Kingdom? 1. 3. The State Ownership 2. Privatisation policy in Central and Eastern Europe (CEE) 2. 1. Why to Privatize? 2. 2. How to Privatize? Privatization Methods 2. 3. Why to Privatize to Foreigners? 3. Effects of Privatization 3. 1. Which Are The Effects on Firm’ Performance? 3. 2. Which Are The Effects on Corporate Governance and Economic Growth? 3. 3. Which Are The Effects on Convergence of CEE and The EU Enlargement?

Table of Contents 1. Transition from Totalitarian Socialism to Market Economy in Central and Eastern Europe (CEE) 1. 1. Why Privatization is So Important to the EU Enlargement Process? 1. 2. What Does Privatization Mean in Poland in the United Kingdom? 1. 3. The State Ownership 2. Privatisation policy in Central and Eastern Europe (CEE) 2. 1. Why to Privatize? 2. 2. How to Privatize? Privatization Methods 2. 3. Why to Privatize to Foreigners? 3. Effects of Privatization 3. 1. Which Are The Effects on Firm’ Performance? 3. 2. Which Are The Effects on Corporate Governance and Economic Growth? 3. 3. Which Are The Effects on Convergence of CEE and The EU Enlargement?

1. Transition from Totalitarian Socialism to Market Economy in Central and Eastern Europe (CEE) 1. 1. Why Privatization is So Important to the EU Enlargement Process? EU Enlargement in CEE: 2004 Hungary, Poland, Czech Republic, Slovak Republic, Slovenia, Estonia, Latvia, Lithuania 2007 Bulgaria, Romania

1. Transition from Totalitarian Socialism to Market Economy in Central and Eastern Europe (CEE) 1. 1. Why Privatization is So Important to the EU Enlargement Process? EU Enlargement in CEE: 2004 Hungary, Poland, Czech Republic, Slovak Republic, Slovenia, Estonia, Latvia, Lithuania 2007 Bulgaria, Romania

1. 1. Why Privatization is So Important to the EU Enlargement Process? Privatization – a key part of reforms to a functioning market economy ‘Conventional wisdom’ to reforms in transition countries (World Bank, 1991; 1996; EBRD, 1995) (1) privatisation and deregulation, (2)macro stabilization by low inflation and fiscal deficits, (3) liberalization through opening of economy to the rest of the world, and a domestic prices control release.

1. 1. Why Privatization is So Important to the EU Enlargement Process? Privatization – a key part of reforms to a functioning market economy ‘Conventional wisdom’ to reforms in transition countries (World Bank, 1991; 1996; EBRD, 1995) (1) privatisation and deregulation, (2)macro stabilization by low inflation and fiscal deficits, (3) liberalization through opening of economy to the rest of the world, and a domestic prices control release.

1. 1. Why Privatization is So Important to the EU Enlargement Process? A functioning market economy - precondition to become member of the EU Privatization is a major path to establish: Competitive enterprise sector in CEE Competitive financial sector in CEE Micro-convergence between ownership and control strictures, corporate governance and financial structures in CEE and Old EU Member states

1. 1. Why Privatization is So Important to the EU Enlargement Process? A functioning market economy - precondition to become member of the EU Privatization is a major path to establish: Competitive enterprise sector in CEE Competitive financial sector in CEE Micro-convergence between ownership and control strictures, corporate governance and financial structures in CEE and Old EU Member states

1. 2. What Does Privatization Mean in Poland in the United Kingdom? What is privatization? Privatization is the deliberate sale by a government of state-owned enterprises (SOEs) or assets to private economic agents Privatization is a political process with economic consequences. M. Thatcher adopted the label “privatization, ” which was originally coined by Peter Drucker and which replaced the term “denationalization” (Yergin and Stanislaw 1998, p. 114).

1. 2. What Does Privatization Mean in Poland in the United Kingdom? What is privatization? Privatization is the deliberate sale by a government of state-owned enterprises (SOEs) or assets to private economic agents Privatization is a political process with economic consequences. M. Thatcher adopted the label “privatization, ” which was originally coined by Peter Drucker and which replaced the term “denationalization” (Yergin and Stanislaw 1998, p. 114).

1. 2. What Does Privatization Mean in Poland in the United Kingdom? The objectives set for the British privatization program by the Conservatives since 1979 are the same as those described by many governments in CEE countries (e. g. Poland). These goals as described in Price Waterhouse (1989 a, b), are to: (1) raise revenue for the state, (2) promote economic efficiency, (3) reduce government interference in the economy, (4) promote wider share ownership, (5) provide the opportunity to introduce competition (6) subject SOEs to market discipline. (7) develop the national capital market. These goals can be conflicting.

1. 2. What Does Privatization Mean in Poland in the United Kingdom? The objectives set for the British privatization program by the Conservatives since 1979 are the same as those described by many governments in CEE countries (e. g. Poland). These goals as described in Price Waterhouse (1989 a, b), are to: (1) raise revenue for the state, (2) promote economic efficiency, (3) reduce government interference in the economy, (4) promote wider share ownership, (5) provide the opportunity to introduce competition (6) subject SOEs to market discipline. (7) develop the national capital market. These goals can be conflicting.

1. 3. The State Ownership Why do state-owned firms must be transformed during post-communist transition? • Model of socialist and capitalist systems • State ownership in capitalist economies • State ownership in socialist economies • Soft-budget constraint syndrome

1. 3. The State Ownership Why do state-owned firms must be transformed during post-communist transition? • Model of socialist and capitalist systems • State ownership in capitalist economies • State ownership in socialist economies • Soft-budget constraint syndrome

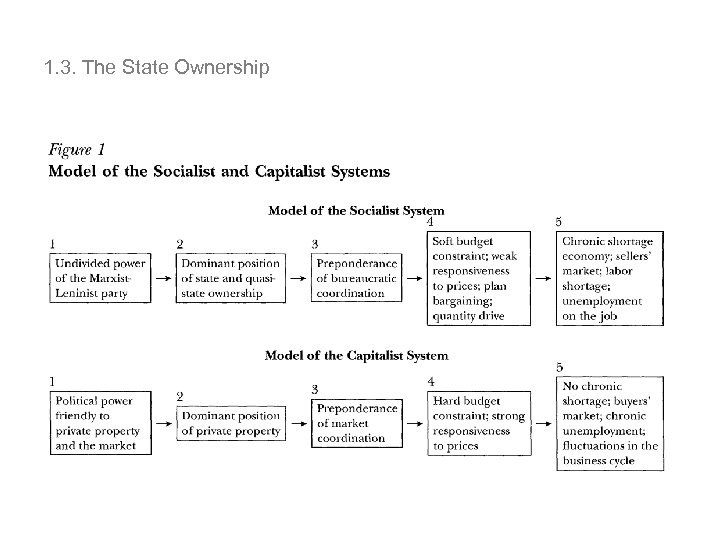

1. 3. The State Ownership

1. 3. The State Ownership

1. 3. The State Ownership State ownership in market economies Triple agency problems of state-owned firms: Principal-agent structure Firm’ Managers – Owner-government Government – Politicians (Members of Parliament) Politicians – Population (Voters) Agency problems of private corporations: Principal-agent structure Managers - shareholders

1. 3. The State Ownership State ownership in market economies Triple agency problems of state-owned firms: Principal-agent structure Firm’ Managers – Owner-government Government – Politicians (Members of Parliament) Politicians – Population (Voters) Agency problems of private corporations: Principal-agent structure Managers - shareholders

1. 3. The State Ownership State ownership in planned economies Communist party- state Prevailing state-owned firms and state-owned banks State-firms political connections State – the main regulator of economic transactions Soft budget constraint

1. 3. The State Ownership State ownership in planned economies Communist party- state Prevailing state-owned firms and state-owned banks State-firms political connections State – the main regulator of economic transactions Soft budget constraint

1. 3. The State Ownership Soft-budget constraint syndrome ( Kornai, Maskin, and Roland, 2003) The contention that softness of the budget constraint was a cause of inefficiency of socialist economies has gained wide acceptance. SBC syndrome An organization (e. g. state-owned firm) has a budget constraint (call this a BCorganization): it must cover its expenditures out of its initial endowment and revenue. If it fails to do so, deficit arises. BC organization faces HBC as long as it does not receive support from other organizations to cover its deficit. The SBC occurs if one or more supporting organizations (S-organizations) are ready to cover all or part of the deficit.

1. 3. The State Ownership Soft-budget constraint syndrome ( Kornai, Maskin, and Roland, 2003) The contention that softness of the budget constraint was a cause of inefficiency of socialist economies has gained wide acceptance. SBC syndrome An organization (e. g. state-owned firm) has a budget constraint (call this a BCorganization): it must cover its expenditures out of its initial endowment and revenue. If it fails to do so, deficit arises. BC organization faces HBC as long as it does not receive support from other organizations to cover its deficit. The SBC occurs if one or more supporting organizations (S-organizations) are ready to cover all or part of the deficit.

1. 3. The State Ownership Means of softening Fiscal means – budget subsidies, tax concessions (reduction, postponement of tax obligations), tolerance of tax arrears Soft credit – soft loans by state-owned banks, excess trade credit Indirect methods of support – administrative restrictions on import, deterrent tariff barrier to ease pressure from foreign competitors

1. 3. The State Ownership Means of softening Fiscal means – budget subsidies, tax concessions (reduction, postponement of tax obligations), tolerance of tax arrears Soft credit – soft loans by state-owned banks, excess trade credit Indirect methods of support – administrative restrictions on import, deterrent tariff barrier to ease pressure from foreign competitors

1. 3. The State Ownership Primary consequences of the SBC: A key measure of the SBC is the degree to which firms are permitted to fail – overall frequency of bankruptcy and liquidation (1) Distortions of the survival and exit of firms (2) Distortions of the profit-maximization motives of managers of state -owned firms (3) Distortions of the motives for innovation (4) Winning the favor of potential S-organizations (i. e. rent-seeking) becomes more important than market-oriented behavior. (5) Overinvestment by loss-makers and underinvestment by profitmakers

1. 3. The State Ownership Primary consequences of the SBC: A key measure of the SBC is the degree to which firms are permitted to fail – overall frequency of bankruptcy and liquidation (1) Distortions of the survival and exit of firms (2) Distortions of the profit-maximization motives of managers of state -owned firms (3) Distortions of the motives for innovation (4) Winning the favor of potential S-organizations (i. e. rent-seeking) becomes more important than market-oriented behavior. (5) Overinvestment by loss-makers and underinvestment by profitmakers

1. 3. The State Ownership Which crucial elements of the institutional environment of the capitalist economy generate HBC? Well functioning markets for liquidated assets Competition across enterprises Decentralization of credit Hardening the budget constraint means creating institutional conditions in which the government can credibly commit not to refinance enterprises. According to the conventional wisdom how to transform the enterprise sector in post-communist transition - privatization is the major tool for hardening of budget constraint.

1. 3. The State Ownership Which crucial elements of the institutional environment of the capitalist economy generate HBC? Well functioning markets for liquidated assets Competition across enterprises Decentralization of credit Hardening the budget constraint means creating institutional conditions in which the government can credibly commit not to refinance enterprises. According to the conventional wisdom how to transform the enterprise sector in post-communist transition - privatization is the major tool for hardening of budget constraint.

2. Privatisation policy in Central and Eastern Europe (CEE) 2. 1. Why to Privatize? 2. 2. How to Privatize? Privatization Methods 2. 3. Why to Privatize to Foreigners?

2. Privatisation policy in Central and Eastern Europe (CEE) 2. 1. Why to Privatize? 2. 2. How to Privatize? Privatization Methods 2. 3. Why to Privatize to Foreigners?

2. 1. Why to Privatize? Privatization is a response to the failings of state ownership. (1) The impact of privatization depends on the degree of market failure. Privatization has the greatest positive impact in competitive markets. In contrast, the justification for privatization is less compelling in markets for public goods and natural monopolies where competitive considerations are weaker (2) Contracting ability impacts the efficiency of state and private ownership. Governments have other objectives than profit or shareholder-wealth maximization – various social goals such as maximizing social welfare, keeping employment, etc. The owners of public firms (the nation’s citizens) are less able to write complete contracts with their managers because of diffuse ownership, making it difficult to tie the managers’ incentives to the returns from their decisions. (3) Ownership structure affects the ease with which government can intervene in firm operations. Governments can intervene in the operations of any firm, either public or private. The government’s transaction costs of intervening in production arrangements are greater when firms are privately owned.

2. 1. Why to Privatize? Privatization is a response to the failings of state ownership. (1) The impact of privatization depends on the degree of market failure. Privatization has the greatest positive impact in competitive markets. In contrast, the justification for privatization is less compelling in markets for public goods and natural monopolies where competitive considerations are weaker (2) Contracting ability impacts the efficiency of state and private ownership. Governments have other objectives than profit or shareholder-wealth maximization – various social goals such as maximizing social welfare, keeping employment, etc. The owners of public firms (the nation’s citizens) are less able to write complete contracts with their managers because of diffuse ownership, making it difficult to tie the managers’ incentives to the returns from their decisions. (3) Ownership structure affects the ease with which government can intervene in firm operations. Governments can intervene in the operations of any firm, either public or private. The government’s transaction costs of intervening in production arrangements are greater when firms are privately owned.

2. 1. Why to Privatize? (4) Less-prosperous state-owned firms being allowed to rely on the government for funding, leading to “soft” budget constraints. The state is unlikely to allow a large SOE to face bankruptcy. Thus the discipline enforced on private firms by capital markets and the threat of financial distress is less important for state-owned firms. (5) Privatization can impact efficiency through its effect on government fiscal conditions. Government may raise huge amounts of money by selling SOEs. Such sales have helped reduce the fiscal deficit in many countries. (6) Privatization can help develop product and security markets and institutions. One important motivation for privatization is to help develop factor and product markets, as well as security markets. Many of theoretical arguments for privatization are based on the premise that the harmful effects of state intervention have a greater impact under state ownership than under state regulation, not that the harmful effects can be eliminated through privatization.

2. 1. Why to Privatize? (4) Less-prosperous state-owned firms being allowed to rely on the government for funding, leading to “soft” budget constraints. The state is unlikely to allow a large SOE to face bankruptcy. Thus the discipline enforced on private firms by capital markets and the threat of financial distress is less important for state-owned firms. (5) Privatization can impact efficiency through its effect on government fiscal conditions. Government may raise huge amounts of money by selling SOEs. Such sales have helped reduce the fiscal deficit in many countries. (6) Privatization can help develop product and security markets and institutions. One important motivation for privatization is to help develop factor and product markets, as well as security markets. Many of theoretical arguments for privatization are based on the premise that the harmful effects of state intervention have a greater impact under state ownership than under state regulation, not that the harmful effects can be eliminated through privatization.

2. 2. How to Privatize? Privatization Methods Factors that influence the privatization methods: (1) the history of the asset’s ownership, (2) the financial and competitive position of the SOE, (3) the government’s ideological view of markets and regulation, (4) the past, present, and potential future regulatory structure in the country, (5) the need to pay off important interest groups in the privatization, (6) the government’s ability to credibly commit itself to respect investors’ property rights after divestiture, (7) the capital market conditions and existing institutional framework for corporate governance in the country, (8) the sophistication of potential investors, (9) the government’s willingness to let foreigners own divested assets.

2. 2. How to Privatize? Privatization Methods Factors that influence the privatization methods: (1) the history of the asset’s ownership, (2) the financial and competitive position of the SOE, (3) the government’s ideological view of markets and regulation, (4) the past, present, and potential future regulatory structure in the country, (5) the need to pay off important interest groups in the privatization, (6) the government’s ability to credibly commit itself to respect investors’ property rights after divestiture, (7) the capital market conditions and existing institutional framework for corporate governance in the country, (8) the sophistication of potential investors, (9) the government’s willingness to let foreigners own divested assets.

2. 2. How to Privatize? Privatization Methods • Privatization methods in CEE Different privatization methods have created different profitable investment opportunities for the penetration of foreign firms. Studies present various major types of privatization methods like: (i) employee ownership programmes and management buy-outs (insiders privatisation); (ii) voucher (mass) privatization; (iii) sales to local and foreign strategic investors; (iv) privatization initial public offerings (PIPOs); (v) restitution (return of assets to either the original owners or theirs).

2. 2. How to Privatize? Privatization Methods • Privatization methods in CEE Different privatization methods have created different profitable investment opportunities for the penetration of foreign firms. Studies present various major types of privatization methods like: (i) employee ownership programmes and management buy-outs (insiders privatisation); (ii) voucher (mass) privatization; (iii) sales to local and foreign strategic investors; (iv) privatization initial public offerings (PIPOs); (v) restitution (return of assets to either the original owners or theirs).

2. 2. How to Privatize? Privatization Methods Mass or voucher privatization. Eligible citizens can use vouchers that are distributed free or at nominal cost to bid for stakes in SOEs or other assets. This method has been used only in the transition economies of CEE. Problems: establishment of irresponsible quasishareholders and transfer of state assets to few political “cronies” without entrepreneurial and managerial skills, lack of finance resources. Privatization through sale of state property. Government trades its ownership claim for an explicit cash payment through direct sales (or asset sales) of state-owned enterprises (or some parts thereof) to an individual, an existing corporation, or a group of investors. Privatization initial public offerings (PIPOs). Some or a government’s entire stake in an SOE is sold to investors through a public share offering. PIPOs are structured to raise money and to respond to some of the political factors mentioned earlier. Privatization through restitution. This method is appropriate when land or other easily identifiable property that was expropriated in years past can be returned to either the original owners or to theirs. The major difficulty with this method is that the records needed to prove ownership are often inadequate or conflicting.

2. 2. How to Privatize? Privatization Methods Mass or voucher privatization. Eligible citizens can use vouchers that are distributed free or at nominal cost to bid for stakes in SOEs or other assets. This method has been used only in the transition economies of CEE. Problems: establishment of irresponsible quasishareholders and transfer of state assets to few political “cronies” without entrepreneurial and managerial skills, lack of finance resources. Privatization through sale of state property. Government trades its ownership claim for an explicit cash payment through direct sales (or asset sales) of state-owned enterprises (or some parts thereof) to an individual, an existing corporation, or a group of investors. Privatization initial public offerings (PIPOs). Some or a government’s entire stake in an SOE is sold to investors through a public share offering. PIPOs are structured to raise money and to respond to some of the political factors mentioned earlier. Privatization through restitution. This method is appropriate when land or other easily identifiable property that was expropriated in years past can be returned to either the original owners or to theirs. The major difficulty with this method is that the records needed to prove ownership are often inadequate or conflicting.

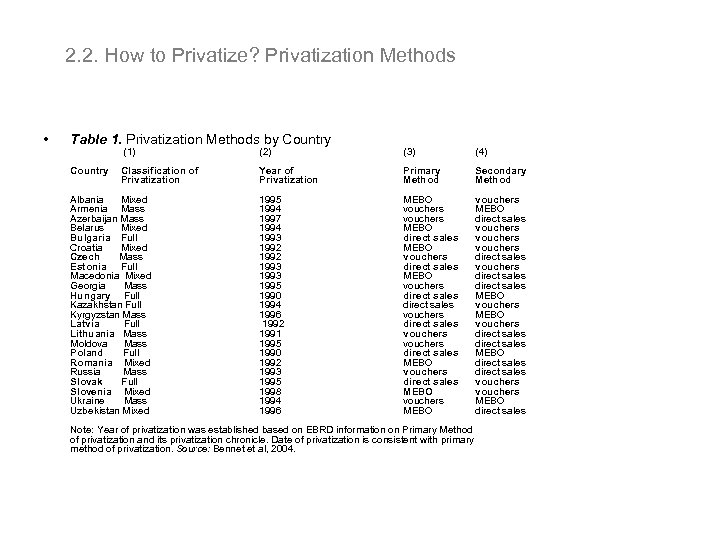

2. 2. How to Privatize? Privatization Methods • Table 1. Privatization Methods by Country (1) (2) (3) (4) Country Classification of Privatization Year of Privatization Primary Method Secondary Method Albania Mixed Armenia Mass Azerbaijan Mass Belarus Mixed Bulgaria Full Croatia Mixed Czech Mass Estonia Full Macedonia Mixed Georgia Mass Hungary Full Kazakhstan Full Kyrgyzstan Mass Latvia Full Lithuania Mass Moldova Mass Poland Full Romania Mixed Russia Mass Slovak Full Slovenia Mixed Ukraine Mass Uzbekistan Mixed 1995 1994 1997 1994 1993 1992 1993 1995 1990 1994 1996 1992 1991 1995 1990 1992 1993 1995 1998 1994 1996 MEBO vouchers MEBO direct sales MEBO vouchers direct sales vouchers direct sales MEBO vouchers MEBO direct sales vouchers direct sales MEBO vouchers direct sales MEBO direct sales vouchers MEBO direct sales Note: Year of privatization was established based on EBRD information on Primary Method of privatization and its privatization chronicle. Date of privatization is consistent with primary method of privatization. Source: Bennet et al, 2004.

2. 2. How to Privatize? Privatization Methods • Table 1. Privatization Methods by Country (1) (2) (3) (4) Country Classification of Privatization Year of Privatization Primary Method Secondary Method Albania Mixed Armenia Mass Azerbaijan Mass Belarus Mixed Bulgaria Full Croatia Mixed Czech Mass Estonia Full Macedonia Mixed Georgia Mass Hungary Full Kazakhstan Full Kyrgyzstan Mass Latvia Full Lithuania Mass Moldova Mass Poland Full Romania Mixed Russia Mass Slovak Full Slovenia Mixed Ukraine Mass Uzbekistan Mixed 1995 1994 1997 1994 1993 1992 1993 1995 1990 1994 1996 1992 1991 1995 1990 1992 1993 1995 1998 1994 1996 MEBO vouchers MEBO direct sales MEBO vouchers direct sales vouchers direct sales MEBO vouchers MEBO direct sales vouchers direct sales MEBO vouchers direct sales MEBO direct sales vouchers MEBO direct sales Note: Year of privatization was established based on EBRD information on Primary Method of privatization and its privatization chronicle. Date of privatization is consistent with primary method of privatization. Source: Bennet et al, 2004.

2. 3. Why to Privatize to Foreigners? The potential beneficial effects of FDI in transition economies were seen in various directions. First, foreign firms have access to investment finance, managerial and technical know-how, new markets and can reply to the need for restructuring and improving the long-term performance of former socialist state-owned firms. Second, domestic savings in transition economies cannot absorb the huge amount of privatized equity and government may sell stateowned firms to foreign investors as strategic owners. Third, the penetration of FDI into local markets can generate positive spill-over effects to domestic firms through technology transfer.

2. 3. Why to Privatize to Foreigners? The potential beneficial effects of FDI in transition economies were seen in various directions. First, foreign firms have access to investment finance, managerial and technical know-how, new markets and can reply to the need for restructuring and improving the long-term performance of former socialist state-owned firms. Second, domestic savings in transition economies cannot absorb the huge amount of privatized equity and government may sell stateowned firms to foreign investors as strategic owners. Third, the penetration of FDI into local markets can generate positive spill-over effects to domestic firms through technology transfer.

2. 3. Why to Privatize to Foreigners? Fourth, FDI can impose more efficient corporate governance in privatized firms than insiders, who frequently impede restructuring (Blanchard, 1997). Fifth, foreign investors can lead to hardening budget constraints and “depolitization” through cutting the link between the government and firms. Sixth, FDI can make a major contribution to economic growth and development in post-communist countries.

2. 3. Why to Privatize to Foreigners? Fourth, FDI can impose more efficient corporate governance in privatized firms than insiders, who frequently impede restructuring (Blanchard, 1997). Fifth, foreign investors can lead to hardening budget constraints and “depolitization” through cutting the link between the government and firms. Sixth, FDI can make a major contribution to economic growth and development in post-communist countries.

3. Effects of Privatization 3. 1. Which Are the Effects on Firm’s Performance? 3. 2. Which Are the Effects on Economic Growth? 3. 3. Which Are the Effects on Convergence of CEE and the EU Enlargement?

3. Effects of Privatization 3. 1. Which Are the Effects on Firm’s Performance? 3. 2. Which Are the Effects on Economic Growth? 3. 3. Which Are the Effects on Convergence of CEE and the EU Enlargement?

3. 1. Which Are the Effects on Firm’ Performance? There are many methodological problems with research on privatization: Data availability and consistency. Sample selection bias governments’ desire to make privatization “look good” by privatizing the healthiest firms first. Accounting information the problems include determining the correct measure of operating performance, selecting an appropriate benchmark with which to compare performance, and determining the appropriate statistical tests to use Studies of post performance rarely examine the welfare effects on consumers. Most important, few studies control for the possible use of market power by the privatized firms; that is, performance improvements could be due to greater exploitation of monopoly power, which has harmful effects on allocative efficiency, rather than productive efficiency.

3. 1. Which Are the Effects on Firm’ Performance? There are many methodological problems with research on privatization: Data availability and consistency. Sample selection bias governments’ desire to make privatization “look good” by privatizing the healthiest firms first. Accounting information the problems include determining the correct measure of operating performance, selecting an appropriate benchmark with which to compare performance, and determining the appropriate statistical tests to use Studies of post performance rarely examine the welfare effects on consumers. Most important, few studies control for the possible use of market power by the privatized firms; that is, performance improvements could be due to greater exploitation of monopoly power, which has harmful effects on allocative efficiency, rather than productive efficiency.

3. 1. Which Are the Effects on Firm’ Performance? Summary of Results (Megginson and Netter, 2000): 1) Private ownership is associated with better firm level performance than is continued state ownership. (2) Concentrated private ownership is asso ciated with greater improvement than is diffuse ownership. (3) Foreign ownership is associated with greater post privatization performance improve ment than is purely domestic ownership. (4) Majority ownership by outside (non employee) investors is associated with significantly greater improvement than is any form of insider control. (5) Firm level restructuring is associated with significant post privatization performance improvements, and this is a key advantage of outsider control— firms controlled by non employee investors are much more likely to restructure.

3. 1. Which Are the Effects on Firm’ Performance? Summary of Results (Megginson and Netter, 2000): 1) Private ownership is associated with better firm level performance than is continued state ownership. (2) Concentrated private ownership is asso ciated with greater improvement than is diffuse ownership. (3) Foreign ownership is associated with greater post privatization performance improve ment than is purely domestic ownership. (4) Majority ownership by outside (non employee) investors is associated with significantly greater improvement than is any form of insider control. (5) Firm level restructuring is associated with significant post privatization performance improvements, and this is a key advantage of outsider control— firms controlled by non employee investors are much more likely to restructure.

3. 1. Which Are the Effects on Firm’ Performance? Summary of Results (Megginson and Netter, 2000): (6) Most studies document that performance improves more when new managers are brought in to run a firm after it is privatized than when the original managers are retained. (7) The role of investment funds in promoting efficiency improvements in privatized Czech firms is ambiguous. (8) The impact of privatization on employment is also ambiguous, primarily because employment falls for virtually all firms in transition economies after reforms are initiated. (9) There is little evidence that governments have been able to impose hard budget constraints on firms that remain state owned after reforms begin.

3. 1. Which Are the Effects on Firm’ Performance? Summary of Results (Megginson and Netter, 2000): (6) Most studies document that performance improves more when new managers are brought in to run a firm after it is privatized than when the original managers are retained. (7) The role of investment funds in promoting efficiency improvements in privatized Czech firms is ambiguous. (8) The impact of privatization on employment is also ambiguous, primarily because employment falls for virtually all firms in transition economies after reforms are initiated. (9) There is little evidence that governments have been able to impose hard budget constraints on firms that remain state owned after reforms begin.

3. 1. Which Are the Effects on Firm’ Performance? Summary of Results (Djankov and Murrell, 2002) (1) Privatization is strongly associated with more enterprise restructuring. (2) State ownership within traditional state firms is less effective than all other ownership types, except for worker owners who have a negative effect. (3) Privatization to outsiders is associated with 50% more restructuring than privatization to insiders (managers and workers). (4) Investment funds, foreigners, and other blockholders produce more than ten times as much restructuring as diffuse individual ownership.

3. 1. Which Are the Effects on Firm’ Performance? Summary of Results (Djankov and Murrell, 2002) (1) Privatization is strongly associated with more enterprise restructuring. (2) State ownership within traditional state firms is less effective than all other ownership types, except for worker owners who have a negative effect. (3) Privatization to outsiders is associated with 50% more restructuring than privatization to insiders (managers and workers). (4) Investment funds, foreigners, and other blockholders produce more than ten times as much restructuring as diffuse individual ownership.

3. 2. Which Are The Effects on Corporate Governance and Economic Growth? Privatization and growth (Sachs, Zinnes, and Eilat (2000): (1) Change in ownership is not enough to improve macroeconomic performance. (2) The gains from privatization come from change in ownership combined with other reforms such as institutions to address incentive and contracting issues, hardened budget constraints, removal of barriers to entry, and an effective legal and regulatory framework.

3. 2. Which Are The Effects on Corporate Governance and Economic Growth? Privatization and growth (Sachs, Zinnes, and Eilat (2000): (1) Change in ownership is not enough to improve macroeconomic performance. (2) The gains from privatization come from change in ownership combined with other reforms such as institutions to address incentive and contracting issues, hardened budget constraints, removal of barriers to entry, and an effective legal and regulatory framework.

3. 3. Which Are The Effects on Convergence of CEE and The EU Enlargement? Convergence of financial institutions Convergence of ownership structures Functional convergence

3. 3. Which Are The Effects on Convergence of CEE and The EU Enlargement? Convergence of financial institutions Convergence of ownership structures Functional convergence

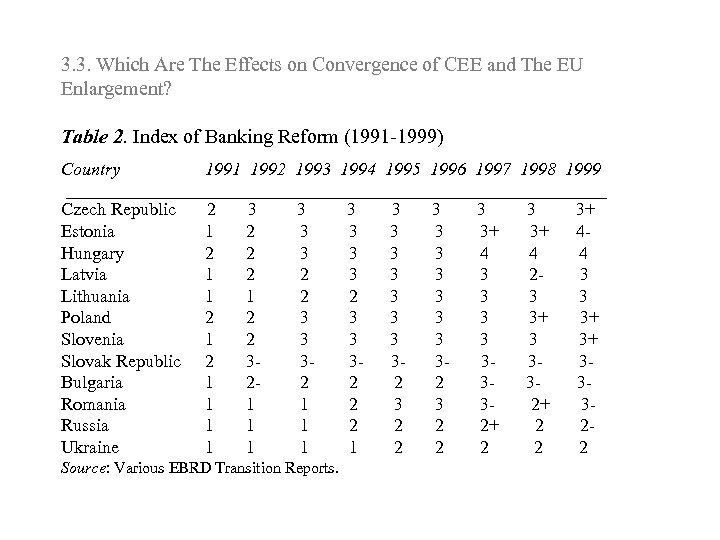

3. 3. Which Are The Effects on Convergence of CEE and The EU Enlargement? Table 2. Index of Banking Reform (1991 1999) Country 1991 1992 1993 1994 1995 1996 1997 1998 1999 Czech Republic Estonia Hungary Latvia Lithuania Poland Slovenia Slovak Republic Bulgaria Romania Russia Ukraine 2 1 2 1 1 1 1 3 2 2 2 1 2 2 3 2 1 1 1 3 3 3 2 2 3 3 3 2 1 1 1 Source: Various EBRD Transition Reports. 3 3 2 3 3 3 2 2 2 1 3 3 3 3 2 3 2 2 3 3+ 4 3 3 3 3 2+ 2 3 3+ 4 2 3 3+ 3 3 3 2+ 2 2 3+ 4 4 3 3 3+ 3+ 3 3 3 2 2

3. 3. Which Are The Effects on Convergence of CEE and The EU Enlargement? Table 2. Index of Banking Reform (1991 1999) Country 1991 1992 1993 1994 1995 1996 1997 1998 1999 Czech Republic Estonia Hungary Latvia Lithuania Poland Slovenia Slovak Republic Bulgaria Romania Russia Ukraine 2 1 2 1 1 1 1 3 2 2 2 1 2 2 3 2 1 1 1 3 3 3 2 2 3 3 3 2 1 1 1 Source: Various EBRD Transition Reports. 3 3 2 3 3 3 2 2 2 1 3 3 3 3 2 3 2 2 3 3+ 4 3 3 3 3 2+ 2 3 3+ 4 2 3 3+ 3 3 3 2+ 2 2 3+ 4 4 3 3 3+ 3+ 3 3 3 2 2

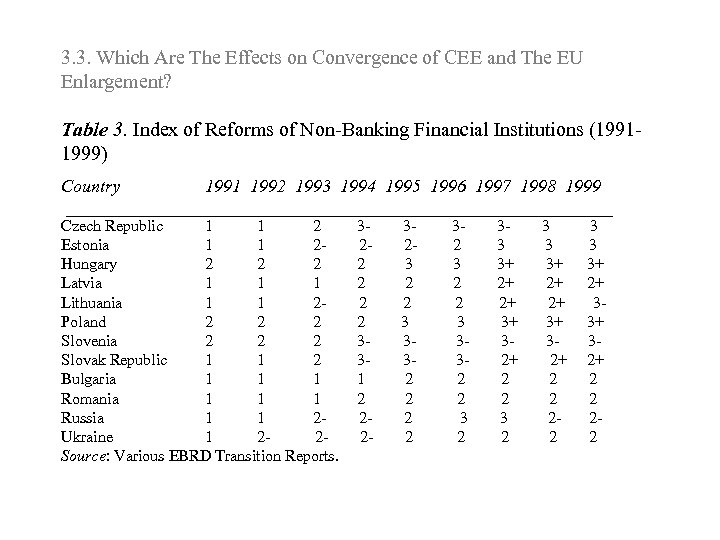

3. 3. Which Are The Effects on Convergence of CEE and The EU Enlargement? Table 3. Index of Reforms of Non Banking Financial Institutions (1991 1999) Country 1991 1992 1993 1994 1995 1996 1997 1998 1999 Czech Republic 1 1 2 Estonia 1 1 2 Hungary 2 2 2 Latvia 1 1 1 Lithuania 1 1 2 Poland 2 2 2 Slovenia 2 2 2 Slovak Republic 1 1 2 Bulgaria 1 1 1 Romania 1 1 1 Russia 1 1 2 Ukraine 1 2 2 Source: Various EBRD Transition Reports. 3 2 2 2 3 3 1 2 2 2 3 2 2 3 3 3 2 2 3 2 3 3 3+ 2+ 2+ 3+ 3 2+ 2 2 3 3 3+ 2+ 3 3+ 3 2+ 2 2

3. 3. Which Are The Effects on Convergence of CEE and The EU Enlargement? Table 3. Index of Reforms of Non Banking Financial Institutions (1991 1999) Country 1991 1992 1993 1994 1995 1996 1997 1998 1999 Czech Republic 1 1 2 Estonia 1 1 2 Hungary 2 2 2 Latvia 1 1 1 Lithuania 1 1 2 Poland 2 2 2 Slovenia 2 2 2 Slovak Republic 1 1 2 Bulgaria 1 1 1 Romania 1 1 1 Russia 1 1 2 Ukraine 1 2 2 Source: Various EBRD Transition Reports. 3 2 2 2 3 3 1 2 2 2 3 2 2 3 3 3 2 2 3 2 3 3 3+ 2+ 2+ 3+ 3 2+ 2 2 3 3 3+ 2+ 3 3+ 3 2+ 2 2

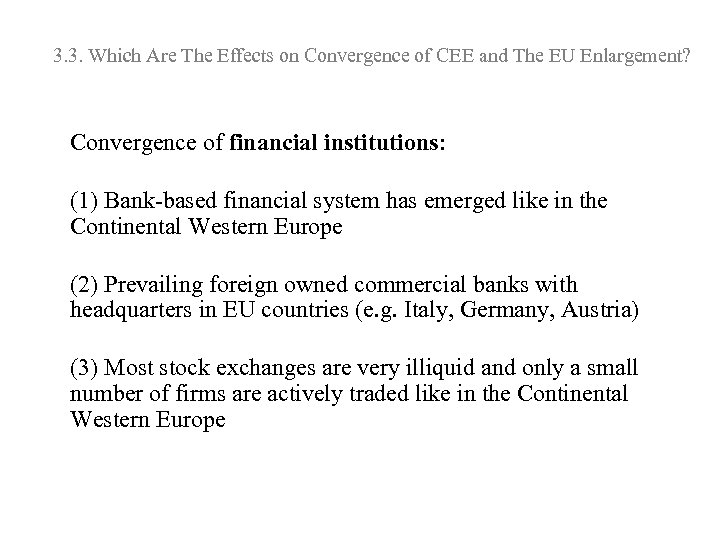

3. 3. Which Are The Effects on Convergence of CEE and The EU Enlargement? Convergence of financial institutions: (1) Bank based financial system has emerged like in the Continental Western Europe (2) Prevailing foreign owned commercial banks with headquarters in EU countries (e. g. Italy, Germany, Austria) (3) Most stock exchanges are very illiquid and only a small number of firms are actively traded like in the Continental Western Europe

3. 3. Which Are The Effects on Convergence of CEE and The EU Enlargement? Convergence of financial institutions: (1) Bank based financial system has emerged like in the Continental Western Europe (2) Prevailing foreign owned commercial banks with headquarters in EU countries (e. g. Italy, Germany, Austria) (3) Most stock exchanges are very illiquid and only a small number of firms are actively traded like in the Continental Western Europe

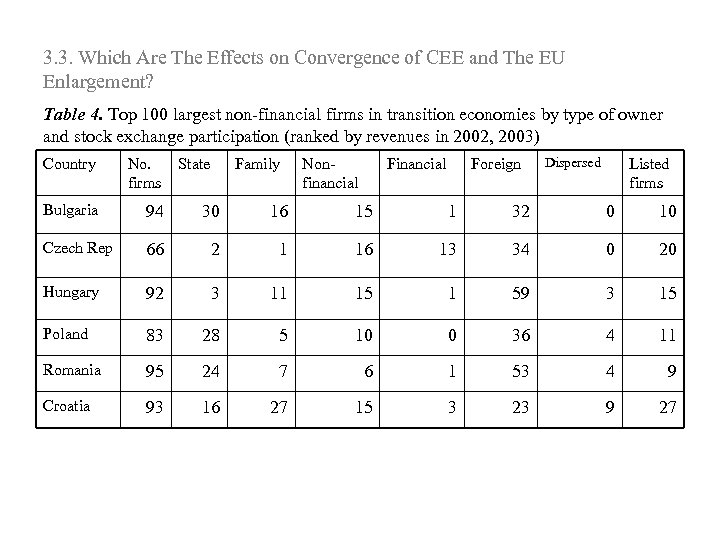

3. 3. Which Are The Effects on Convergence of CEE and The EU Enlargement? Table 4. Top 100 largest non financial firms in transition economies by type of owner and stock exchange participation (ranked by revenues in 2002, 2003) State Family Non financial Foreign Dispersed Country No. firms Listed firms Bulgaria 94 30 16 15 1 32 0 10 Czech Rep 66 2 1 16 13 34 0 20 Hungary 92 3 11 15 1 59 3 15 Poland 83 28 5 10 0 36 4 11 Romania 95 24 7 6 1 53 4 9 Croatia 93 16 27 15 3 23 9 27

3. 3. Which Are The Effects on Convergence of CEE and The EU Enlargement? Table 4. Top 100 largest non financial firms in transition economies by type of owner and stock exchange participation (ranked by revenues in 2002, 2003) State Family Non financial Foreign Dispersed Country No. firms Listed firms Bulgaria 94 30 16 15 1 32 0 10 Czech Rep 66 2 1 16 13 34 0 20 Hungary 92 3 11 15 1 59 3 15 Poland 83 28 5 10 0 36 4 11 Romania 95 24 7 6 1 53 4 9 Croatia 93 16 27 15 3 23 9 27

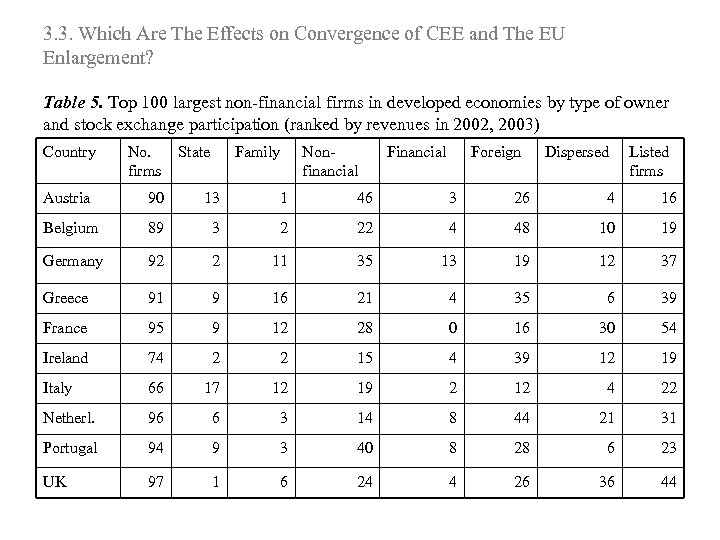

3. 3. Which Are The Effects on Convergence of CEE and The EU Enlargement? Table 5. Top 100 largest non financial firms in developed economies by type of owner and stock exchange participation (ranked by revenues in 2002, 2003) Country No. firms State Family Non financial Foreign Dispersed Listed firms Austria 90 13 1 46 3 26 4 16 Belgium 89 3 2 22 4 48 10 19 Germany 92 2 11 35 13 19 12 37 Greece 91 9 16 21 4 35 6 39 France 95 9 12 28 0 16 30 54 Ireland 74 2 2 15 4 39 12 19 Italy 66 17 12 19 2 12 4 22 Netherl. 96 6 3 14 8 44 21 31 Portugal 94 9 3 40 8 28 6 23 UK 97 1 6 24 4 26 36 44

3. 3. Which Are The Effects on Convergence of CEE and The EU Enlargement? Table 5. Top 100 largest non financial firms in developed economies by type of owner and stock exchange participation (ranked by revenues in 2002, 2003) Country No. firms State Family Non financial Foreign Dispersed Listed firms Austria 90 13 1 46 3 26 4 16 Belgium 89 3 2 22 4 48 10 19 Germany 92 2 11 35 13 19 12 37 Greece 91 9 16 21 4 35 6 39 France 95 9 12 28 0 16 30 54 Ireland 74 2 2 15 4 39 12 19 Italy 66 17 12 19 2 12 4 22 Netherl. 96 6 3 14 8 44 21 31 Portugal 94 9 3 40 8 28 6 23 UK 97 1 6 24 4 26 36 44

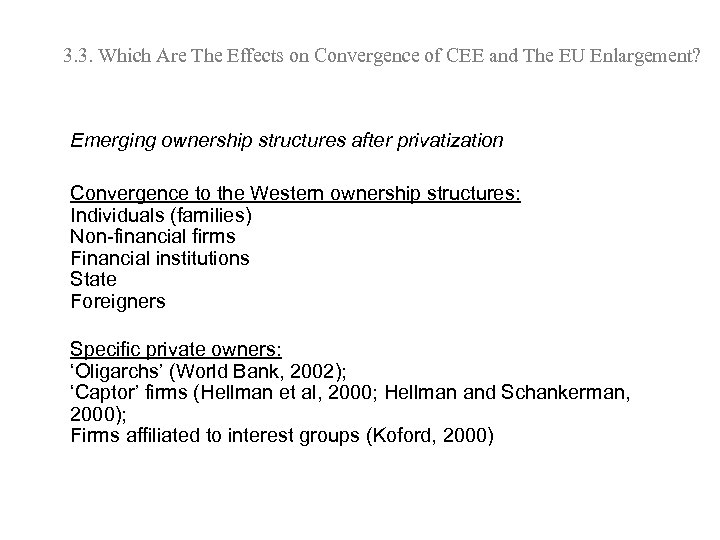

3. 3. Which Are The Effects on Convergence of CEE and The EU Enlargement? Emerging ownership structures after privatization Convergence to the Western ownership structures: Individuals (families) Non-financial firms Financial institutions State Foreigners Specific private owners: ‘Oligarchs’ (World Bank, 2002); ‘Captor’ firms (Hellman et al, 2000; Hellman and Schankerman, 2000); Firms affiliated to interest groups (Koford, 2000)

3. 3. Which Are The Effects on Convergence of CEE and The EU Enlargement? Emerging ownership structures after privatization Convergence to the Western ownership structures: Individuals (families) Non-financial firms Financial institutions State Foreigners Specific private owners: ‘Oligarchs’ (World Bank, 2002); ‘Captor’ firms (Hellman et al, 2000; Hellman and Schankerman, 2000); Firms affiliated to interest groups (Koford, 2000)

3. 3. Which Are The Effects on Convergence of CEE and The EU Enlargement? Convergence of ownership structures: (1) Ownership structures of non-financial firms measured by the share of the direct largest owner have become concentrated like in the Continental Western Europe. (2) The private owners are prevailing. (3) Major corporate governance conflict is between controlling shareholder and minority shareholders like in the Continental Western Europe.

3. 3. Which Are The Effects on Convergence of CEE and The EU Enlargement? Convergence of ownership structures: (1) Ownership structures of non-financial firms measured by the share of the direct largest owner have become concentrated like in the Continental Western Europe. (2) The private owners are prevailing. (3) Major corporate governance conflict is between controlling shareholder and minority shareholders like in the Continental Western Europe.

3. 3. Which Are The Effects on Convergence of CEE and The EU Enlargement? Functional convergence Recent study presents an empirical evidence. Ownership Structures and Investment Performance in Central and Eastern Europe (Mueller and Peev, 2007)

3. 3. Which Are The Effects on Convergence of CEE and The EU Enlargement? Functional convergence Recent study presents an empirical evidence. Ownership Structures and Investment Performance in Central and Eastern Europe (Mueller and Peev, 2007)

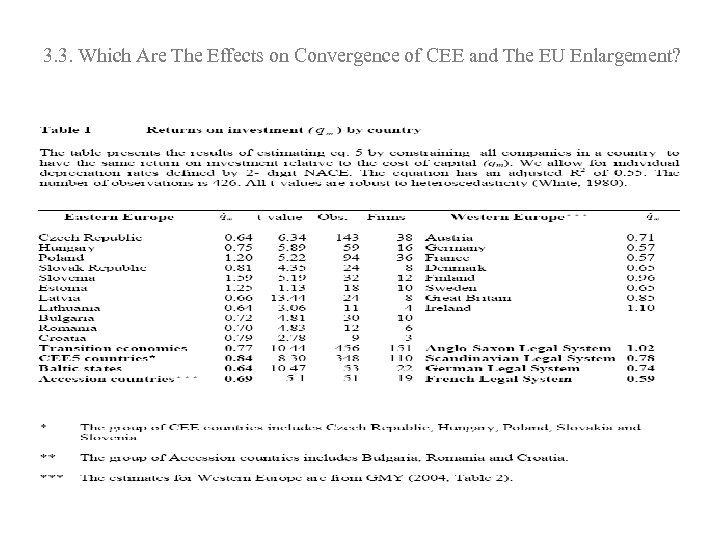

3. 3. Which Are The Effects on Convergence of CEE and The EU Enlargement?

3. 3. Which Are The Effects on Convergence of CEE and The EU Enlargement?

3. 3. Which Are The Effects on Convergence of CEE and The EU Enlargement? Mueller and Peev (2007) found that: (1) The investment performance (qm) of the average public nonfinancial firm in CEE is fairly similar to the corresponding estimates for countries with Germanic and Scandinavian legal systems. (2) The investment performance of CEE companies was better than that of the average firm in EU countries with French origin legal systems (e. g. France, Greece, Italy, Portugal, Spain), but worse than in the Anglo-Saxon countries. (3) Thus, this paper provides evidence for a functional convergence of public non-financial companies in CEE countries to those in the West.

3. 3. Which Are The Effects on Convergence of CEE and The EU Enlargement? Mueller and Peev (2007) found that: (1) The investment performance (qm) of the average public nonfinancial firm in CEE is fairly similar to the corresponding estimates for countries with Germanic and Scandinavian legal systems. (2) The investment performance of CEE companies was better than that of the average firm in EU countries with French origin legal systems (e. g. France, Greece, Italy, Portugal, Spain), but worse than in the Anglo-Saxon countries. (3) Thus, this paper provides evidence for a functional convergence of public non-financial companies in CEE countries to those in the West.

Conclusion Convergence of ownership and financial structures of CEE countries to the structures in the Continental Western Europe Convergence in performance (functional convergence)

Conclusion Convergence of ownership and financial structures of CEE countries to the structures in the Continental Western Europe Convergence in performance (functional convergence)

Selected Readings: • Kornai, Janos, Eric Maskin, and Gerard Roland, Understanding the Soft Budget Constraint, Journal of Economic Literature, Vol. 41, No. 4, Dec. , 2003, 1095 -1136. • Megginson, W. & Netter, J. M. "From State to Market: A Survey of Empirical Studies on Privatization. " Journal of Economic Literature, 39, (2001), pp. 321 -389. • Mueller Dennis and Evgeni Peev, Corporate Governance and Investment in Central and Eastern Europe, Journal of Comparative Economics, 2007, 35, pp. 414 -437.

Selected Readings: • Kornai, Janos, Eric Maskin, and Gerard Roland, Understanding the Soft Budget Constraint, Journal of Economic Literature, Vol. 41, No. 4, Dec. , 2003, 1095 -1136. • Megginson, W. & Netter, J. M. "From State to Market: A Survey of Empirical Studies on Privatization. " Journal of Economic Literature, 39, (2001), pp. 321 -389. • Mueller Dennis and Evgeni Peev, Corporate Governance and Investment in Central and Eastern Europe, Journal of Comparative Economics, 2007, 35, pp. 414 -437.