9a16cc15838f81998488e7d55a8ba91f.ppt

- Количество слайдов: 11

Privatization 2016 - Opportunities for Investors March 2016 Igor Bilous Chairman of the State Property Fund of Ukraine 1

Privatization 2016 - Opportunities for Investors March 2016 Igor Bilous Chairman of the State Property Fund of Ukraine 1

IMPORTANCE OF PRIVATIZATION 1 • WE UNDERSTAND: PRIVATE OWNER IS MORE EFFECTIVE THAN STATE. 2 • WE MAKE ALL PROCEDURES AS SIMPLE AS POSSIBLE. 3 • FULL TRANSPARENCY, NO REGULATIONS, NO RESTRICTIONS. 2

IMPORTANCE OF PRIVATIZATION 1 • WE UNDERSTAND: PRIVATE OWNER IS MORE EFFECTIVE THAN STATE. 2 • WE MAKE ALL PROCEDURES AS SIMPLE AS POSSIBLE. 3 • FULL TRANSPARENCY, NO REGULATIONS, NO RESTRICTIONS. 2

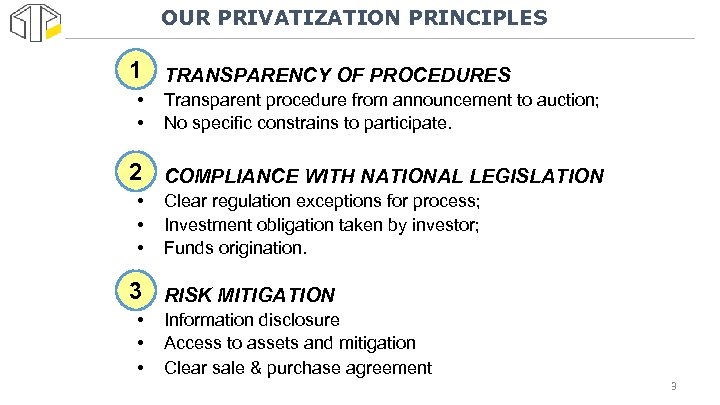

OUR PRIVATIZATION PRINCIPLES 1 TRANSPARENCY OF PROCEDURES • • • Transparent procedure from announcement to auction; No specific constrains to participate. 2 COMPLIANCE WITH NATIONAL LEGISLATION • • Clear regulation exceptions for process; Investment obligation taken by investor; Funds origination. 3 RISK MITIGATION • • Information disclosure Access to assets and mitigation Clear sale & purchase agreement 3

OUR PRIVATIZATION PRINCIPLES 1 TRANSPARENCY OF PROCEDURES • • • Transparent procedure from announcement to auction; No specific constrains to participate. 2 COMPLIANCE WITH NATIONAL LEGISLATION • • Clear regulation exceptions for process; Investment obligation taken by investor; Funds origination. 3 RISK MITIGATION • • Information disclosure Access to assets and mitigation Clear sale & purchase agreement 3

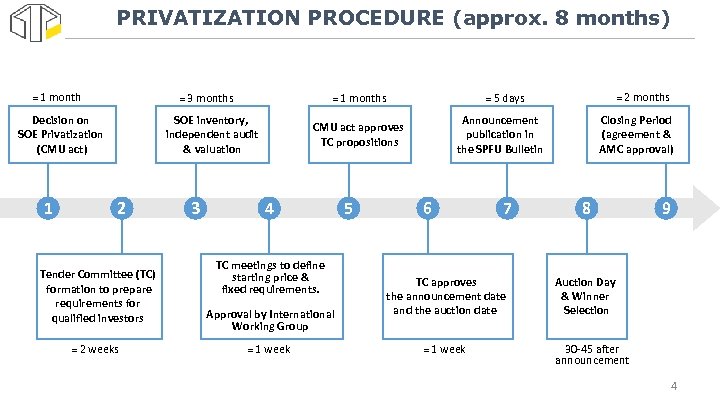

PRIVATIZATION PROCEDURE (approx. 8 months) ≈ 1 month ≈ 3 months Decision on SOE Privatization (CMU act) 1 SOE inventory, independent audit & valuation 2 Tender Committee (TC) formation to prepare requirements for qualified investors ≈ 2 weeks 3 Announcement publication in the SPFU Bulletin CMU act approves TC propositions 4 TC meetings to define starting price & fixed requirements. Approval by International Working Group ≈ 1 week 5 ≈ 2 months ≈ 5 days ≈ 1 months 6 7 TC approves the announcement date and the auction date ≈ 1 week Closing Period (agreement & AMC approval) 8 9 Auction Day & Winner Selection 30 -45 after announcement 4

PRIVATIZATION PROCEDURE (approx. 8 months) ≈ 1 month ≈ 3 months Decision on SOE Privatization (CMU act) 1 SOE inventory, independent audit & valuation 2 Tender Committee (TC) formation to prepare requirements for qualified investors ≈ 2 weeks 3 Announcement publication in the SPFU Bulletin CMU act approves TC propositions 4 TC meetings to define starting price & fixed requirements. Approval by International Working Group ≈ 1 week 5 ≈ 2 months ≈ 5 days ≈ 1 months 6 7 TC approves the announcement date and the auction date ≈ 1 week Closing Period (agreement & AMC approval) 8 9 Auction Day & Winner Selection 30 -45 after announcement 4

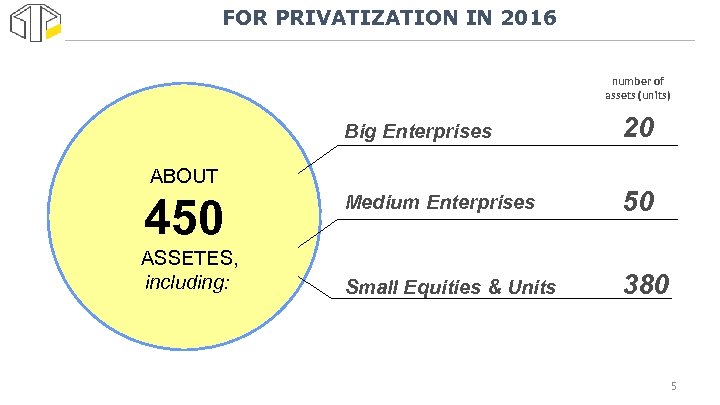

FOR PRIVATIZATION IN 2016 number of assets (units) Big Enterprises 20 Medium Enterprises 50 Small Equities & Units 380 ABOUT 450 ASSETES, including: 5

FOR PRIVATIZATION IN 2016 number of assets (units) Big Enterprises 20 Medium Enterprises 50 Small Equities & Units 380 ABOUT 450 ASSETES, including: 5

“Odesa Portside Plant” Privatization OPP – the leading CEE nitrogen fertilizer producer Advisory Group: Key Workstreams: • Lead Advisor • Valuation & Modeling • Communication with bidders • Coordination of work with OPP on the ground • Assistance in analysis and marketing • Financial and Tax DD • Preparation of Virtual Data Room • Preparation of Reports Assistance: • Legal VDR & VDD • Input in Terms & Conditions of Privatization • Assistance in DD • Financial Assistance for Privatization on International Standards Partners to Winner: • Possible financial cooperation for the plant development (with the buyer of OPP) 6

“Odesa Portside Plant” Privatization OPP – the leading CEE nitrogen fertilizer producer Advisory Group: Key Workstreams: • Lead Advisor • Valuation & Modeling • Communication with bidders • Coordination of work with OPP on the ground • Assistance in analysis and marketing • Financial and Tax DD • Preparation of Virtual Data Room • Preparation of Reports Assistance: • Legal VDR & VDD • Input in Terms & Conditions of Privatization • Assistance in DD • Financial Assistance for Privatization on International Standards Partners to Winner: • Possible financial cooperation for the plant development (with the buyer of OPP) 6

“Energy DISCOs” Privatization Regional Energy Distribution Companies with controlling state stake (51 -100%) Advisor: Kharkivoblenergo Mykolayivoblenergo Key Workstreams: • Pre-privatization advice • Review of Contracts and Obligations • VDD and Data Room • Energy Privatization Communication Strategy • Financial & Legal Privatization Advisory Zaporizhyaoblenergo Termopiloblenergo Assistance: Cherkasyoblenergo Khmelnitskoblenergo • Financial Assistance for Privatization on International Standards 7

“Energy DISCOs” Privatization Regional Energy Distribution Companies with controlling state stake (51 -100%) Advisor: Kharkivoblenergo Mykolayivoblenergo Key Workstreams: • Pre-privatization advice • Review of Contracts and Obligations • VDD and Data Room • Energy Privatization Communication Strategy • Financial & Legal Privatization Advisory Zaporizhyaoblenergo Termopiloblenergo Assistance: Cherkasyoblenergo Khmelnitskoblenergo • Financial Assistance for Privatization on International Standards 7

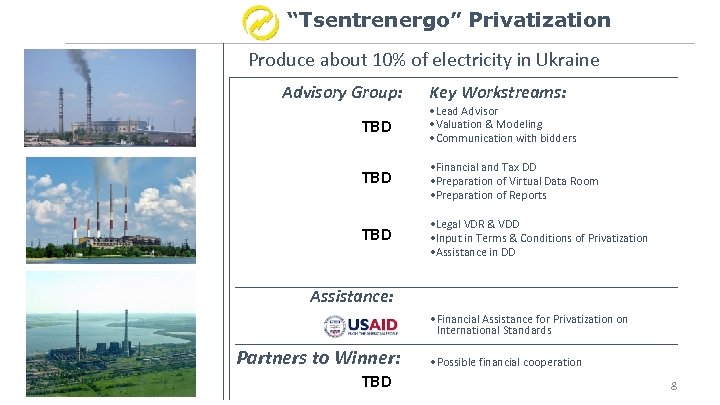

“Tsentrenergo” Privatization Produce about 10% of electricity in Ukraine Advisory Group: Key Workstreams: TBD • Lead Advisor • Valuation & Modeling • Communication with bidders TBD • Financial and Tax DD • Preparation of Virtual Data Room • Preparation of Reports TBD • Legal VDR & VDD • Input in Terms & Conditions of Privatization • Assistance in DD Assistance: • Financial Assistance for Privatization on International Standards Partners to Winner: TBD • Possible financial cooperation 8

“Tsentrenergo” Privatization Produce about 10% of electricity in Ukraine Advisory Group: Key Workstreams: TBD • Lead Advisor • Valuation & Modeling • Communication with bidders TBD • Financial and Tax DD • Preparation of Virtual Data Room • Preparation of Reports TBD • Legal VDR & VDD • Input in Terms & Conditions of Privatization • Assistance in DD Assistance: • Financial Assistance for Privatization on International Standards Partners to Winner: TBD • Possible financial cooperation 8

WHO CAN PARTICIPATE IN PRIVATIZATION FOREIGN LEGAL ENTITIES AND INDIVIDUALS ARE WELCOMED TO THE PROCESS OF PRIVATIZATION EXCEPT: -1 State business entities or their subsidiaries of any legal form -2 Persons incorporated in off-shore zones or listed in FATF list -3 Legal entities or individuals on any sanction list -4 Companies that are controlled by the persons specified -5 Ukrainian entities with 25%+ state-owned stake 9

WHO CAN PARTICIPATE IN PRIVATIZATION FOREIGN LEGAL ENTITIES AND INDIVIDUALS ARE WELCOMED TO THE PROCESS OF PRIVATIZATION EXCEPT: -1 State business entities or their subsidiaries of any legal form -2 Persons incorporated in off-shore zones or listed in FATF list -3 Legal entities or individuals on any sanction list -4 Companies that are controlled by the persons specified -5 Ukrainian entities with 25%+ state-owned stake 9

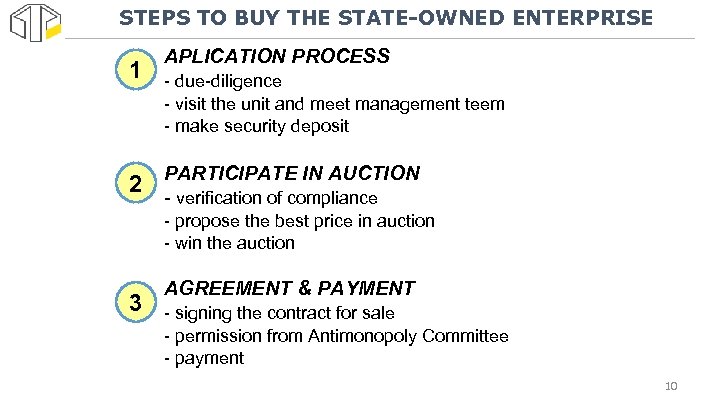

STEPS TO BUY THE STATE-OWNED ENTERPRISE • APLICATION PROCESS 1 - due-diligence - visit the unit and meet management teem - make security deposit • 2 PARTICIPATE IN AUCTION - verification of compliance - propose the best price in auction - win the auction • AGREEMENT & PAYMENT 3 - signing the contract for sale - permission from Antimonopoly Committee - payment 10

STEPS TO BUY THE STATE-OWNED ENTERPRISE • APLICATION PROCESS 1 - due-diligence - visit the unit and meet management teem - make security deposit • 2 PARTICIPATE IN AUCTION - verification of compliance - propose the best price in auction - win the auction • AGREEMENT & PAYMENT 3 - signing the contract for sale - permission from Antimonopoly Committee - payment 10

Thank you for your attention! Contact details: igor. bilous@spfu. gov. ua +38 (044) 200 -33 -93 11

Thank you for your attention! Contact details: igor. bilous@spfu. gov. ua +38 (044) 200 -33 -93 11