cc234559331d89d3fee955e5decad4e6.ppt

- Количество слайдов: 14

Private Sector Operations The Af. DB as a Development and Business Partner July 20, 2011

Af. DB’s Position on Private sector development • PSD is an institutional priority for the Af. DB • It is a key component of the Bank’s Vision and Strategic Plan

The Af. DB’s private sector development efforts, are anchored on three interrelated activities: • Understanding the business environment through diagnostics and strategy development • Assisting African governments to improve the enabling environment for the private sector • Creating catalytic and demonstration effects by assisting entrepreneurs with specific transactions

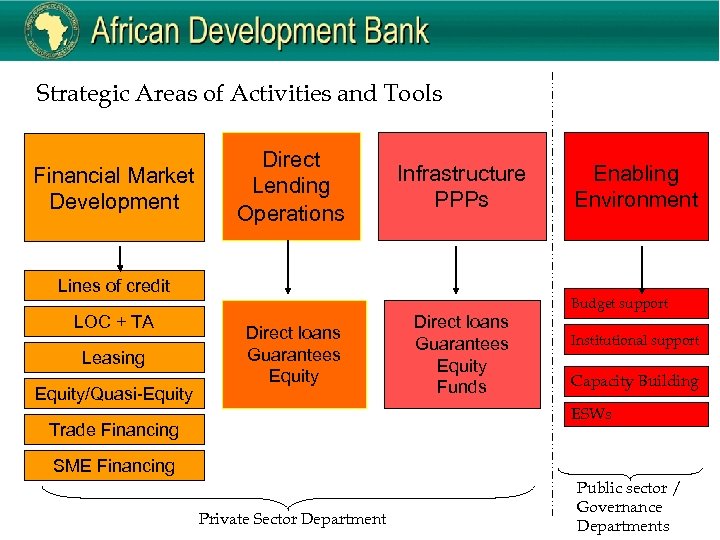

Strategic Areas of Activities and Tools Financial Market Development Direct Lending Operations Infrastructure PPPs Lines of credit LOC + TA Leasing Equity/Quasi-Equity Enabling Environment Budget support Direct loans Guarantees Equity Funds Institutional support Capacity Building ESWs Trade Financing SME Financing Private Sector Department Public sector / Governance Departments

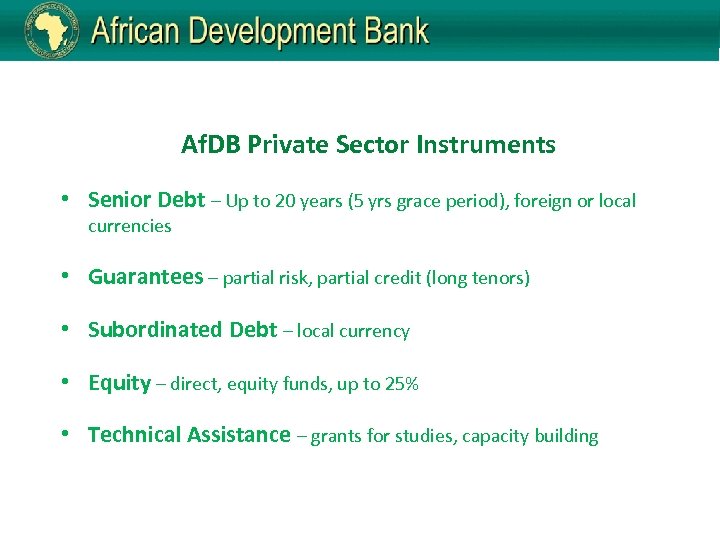

Af. DB Private Sector Instruments • Senior Debt – Up to 20 years (5 yrs grace period), foreign or local currencies • Guarantees – partial risk, partial credit (long tenors) • Subordinated Debt – local currency • Equity – direct, equity funds, up to 25% • Technical Assistance – grants for studies, capacity building

Strategic Priorities • Improving the Investment Climate - To encourage domestic and foreign investment. • Supporting Private Enterprises – Promoting entrepreneurship will create sustainable growth. • Strengthening Financial Systems – A sound financial system and a vibrant banking sector are essential. • Building Competitive Infrastructure – Participation of the private sector in infrastructure through PPPs. • Promoting Regional Integration and Trade – To assist African countries to become globally competitive.

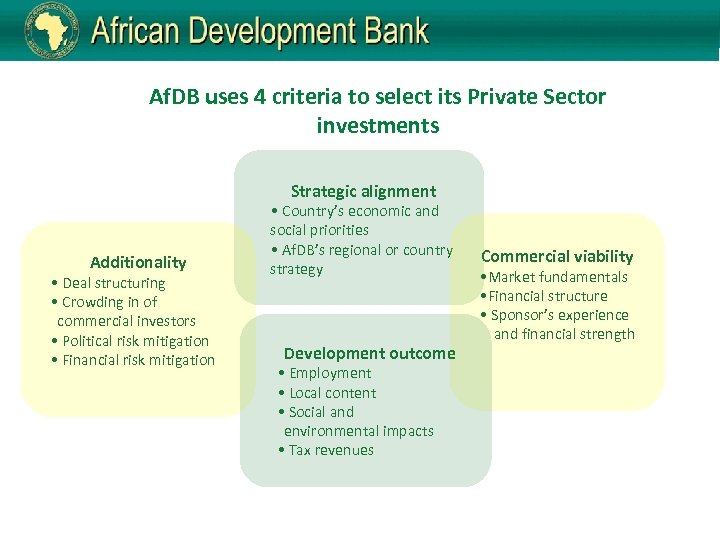

Af. DB uses 4 criteria to select its Private Sector investments Strategic alignment Additionality • Deal structuring • Crowding in of commercial investors • Political risk mitigation • Financial risk mitigation • Country’s economic and social priorities • Af. DB’s regional or country strategy Development outcome • Employment • Local content • Social and environmental impacts • Tax revenues Commercial viability • Market fundamentals • Financial structure • Sponsor’s experience and financial strength

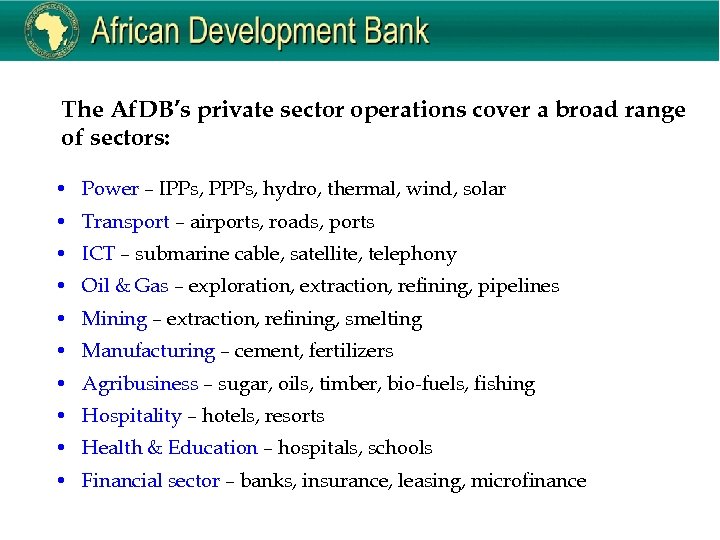

The Af. DB’s private sector operations cover a broad range of sectors: • Power – IPPs, PPPs, hydro, thermal, wind, solar • Transport – airports, roads, ports • ICT – submarine cable, satellite, telephony • Oil & Gas – exploration, extraction, refining, pipelines • Mining – extraction, refining, smelting • Manufacturing – cement, fertilizers • Agribusiness – sugar, oils, timber, bio-fuels, fishing • Hospitality – hotels, resorts • Health & Education – hospitals, schools • Financial sector – banks, insurance, leasing, microfinance

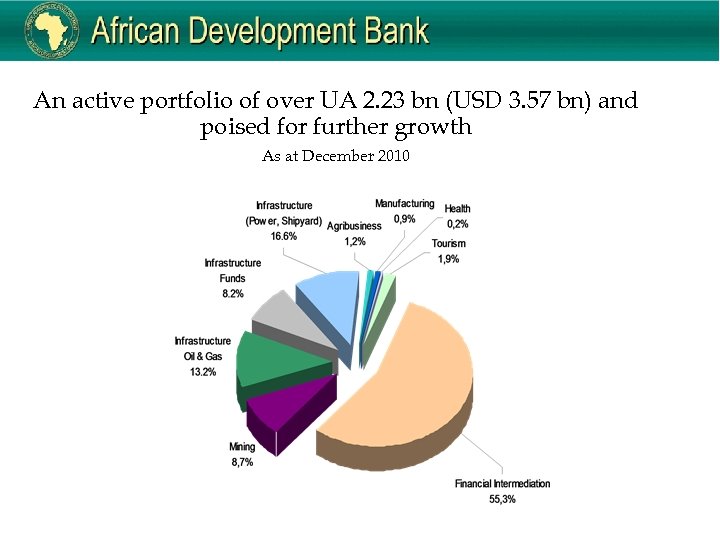

An active portfolio of over UA 2. 23 bn (USD 3. 57 bn) and poised for further growth As at December 2010

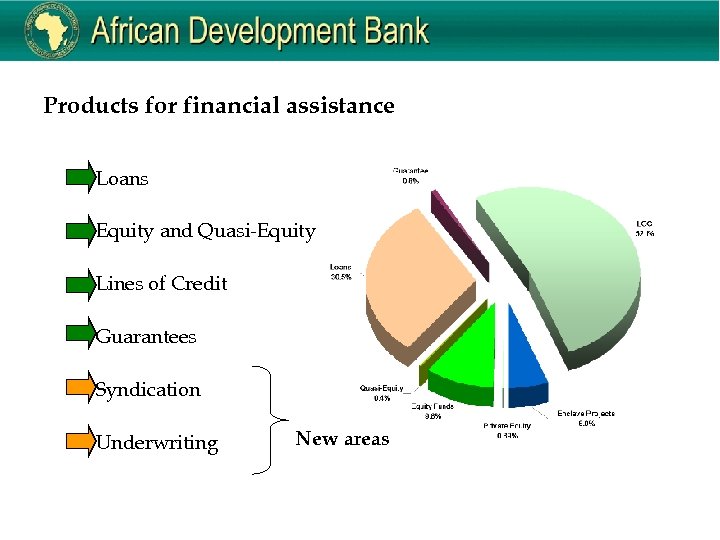

Products for financial assistance Loans Equity and Quasi-Equity Lines of Credit Guarantees Syndication Underwriting New areas

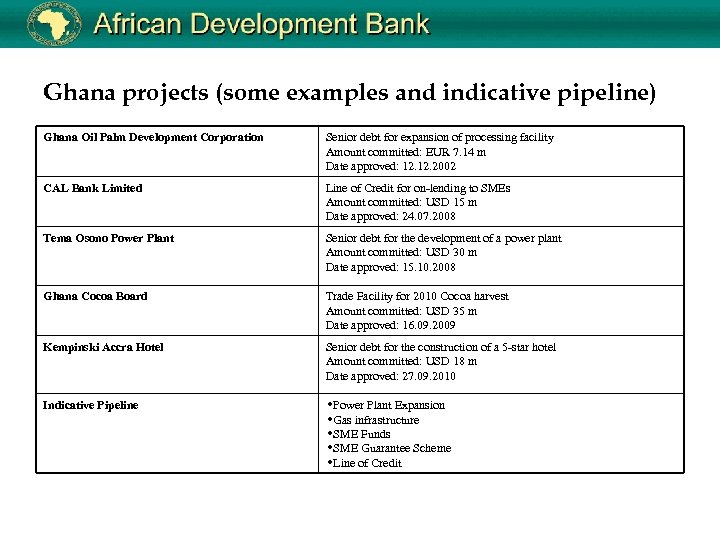

Ghana projects (some examples and indicative pipeline) Ghana Oil Palm Development Corporation Senior debt for expansion of processing facility Amount committed: EUR 7. 14 m Date approved: 12. 2002 CAL Bank Limited Line of Credit for on-lending to SMEs Amount committed: USD 15 m Date approved: 24. 07. 2008 Tema Osono Power Plant Senior debt for the development of a power plant Amount committed: USD 30 m Date approved: 15. 10. 2008 Ghana Cocoa Board Trade Facility for 2010 Cocoa harvest Amount committed: USD 35 m Date approved: 16. 09. 2009 Kempinski Accra Hotel Senior debt for the construction of a 5 -star hotel Amount committed: USD 18 m Date approved: 27. 09. 2010 Indicative Pipeline • Power Plant Expansion • Gas infrastructure • SME Funds • SME Guarantee Scheme • Line of Credit

Future Orientations ( Policy Orientations in Support of Private Sector Development): • Improving Business Environments and Strengthening RMCs’ International Competitiveness – Reforming policies and building critical institutions – Infrastructure development and infrastructure services delivery – Financial Intermediaries and Capital Markets – Economic Diversification – Transformation of the production base • Broadening Participation and Inclusion in Private Sector led economic growth – Promoting Entrepreneurship and Entrepreneurs in Africa – Micro, Small and Medium Enterprises (MSMEs). – Empowering Women to Participate • Embedding Social and Environmental Responsibility in Private Sector Development

Future Orientations (Transactions): • Financial Services Diversification (leasing, microfinance) • Syndications • Private infrastructure projects/Public-Private Partnerships (PPPs) • Renewable energy (wind, solar, hydro) • Assistance to SMEs

Thank you

cc234559331d89d3fee955e5decad4e6.ppt