9eb66ae41b6ee748f0435f56669b4113.ppt

- Количество слайдов: 17

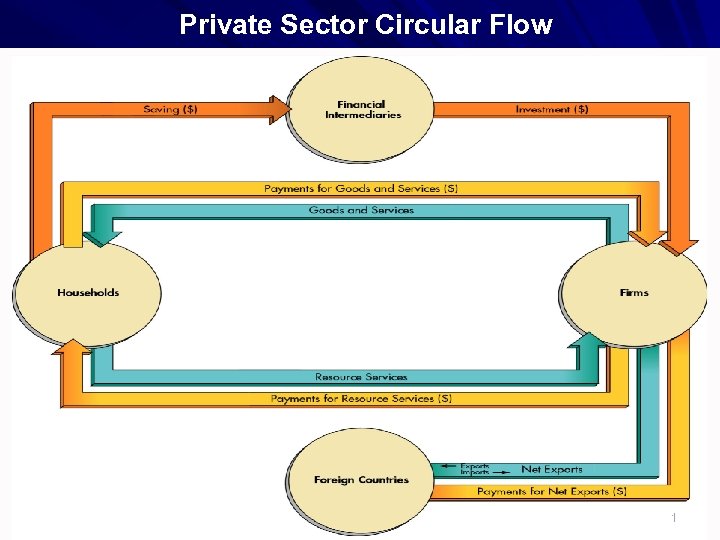

Private Sector Circular Flow 1

Private Sector Circular Flow 1

Private and Public Sectors Private sector: households, businesses, & the international sector. Household spending “consumption”. Business spending on capital goods and inventories “investment”. Sales of goods and services to foreigners “exports. ” Purchases from foreigners “imports. ” Public sector: government activities. 2

Private and Public Sectors Private sector: households, businesses, & the international sector. Household spending “consumption”. Business spending on capital goods and inventories “investment”. Sales of goods and services to foreigners “exports. ” Purchases from foreigners “imports. ” Public sector: government activities. 2

Wisdom of Adam Smith: The Invisible Hand at Work Private sector responds to consumer Consumer sovereignty It is not from the benevolence of the butcher, the brewer, or the baker that we seek our dinner, but from their regard to their own interest. 3

Wisdom of Adam Smith: The Invisible Hand at Work Private sector responds to consumer Consumer sovereignty It is not from the benevolence of the butcher, the brewer, or the baker that we seek our dinner, but from their regard to their own interest. 3

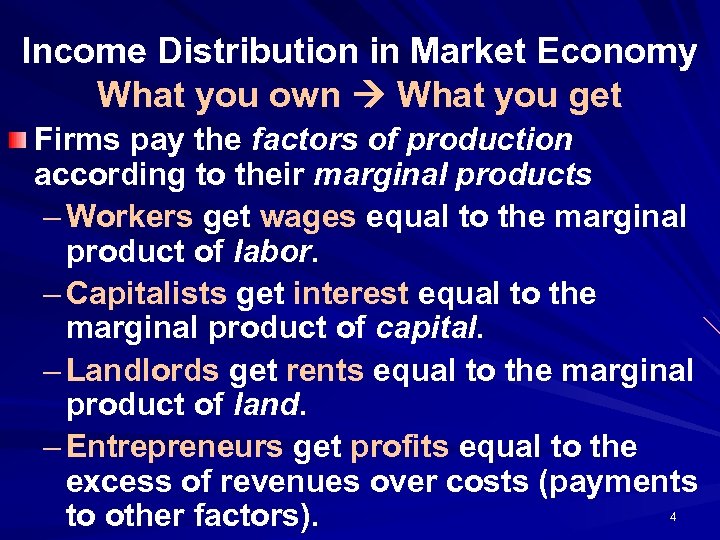

Income Distribution in Market Economy What you own What you get Firms pay the factors of production according to their marginal products – Workers get wages equal to the marginal product of labor. – Capitalists get interest equal to the marginal product of capital. – Landlords get rents equal to the marginal product of land. – Entrepreneurs get profits equal to the excess of revenues over costs (payments to other factors). 4

Income Distribution in Market Economy What you own What you get Firms pay the factors of production according to their marginal products – Workers get wages equal to the marginal product of labor. – Capitalists get interest equal to the marginal product of capital. – Landlords get rents equal to the marginal product of land. – Entrepreneurs get profits equal to the excess of revenues over costs (payments to other factors). 4

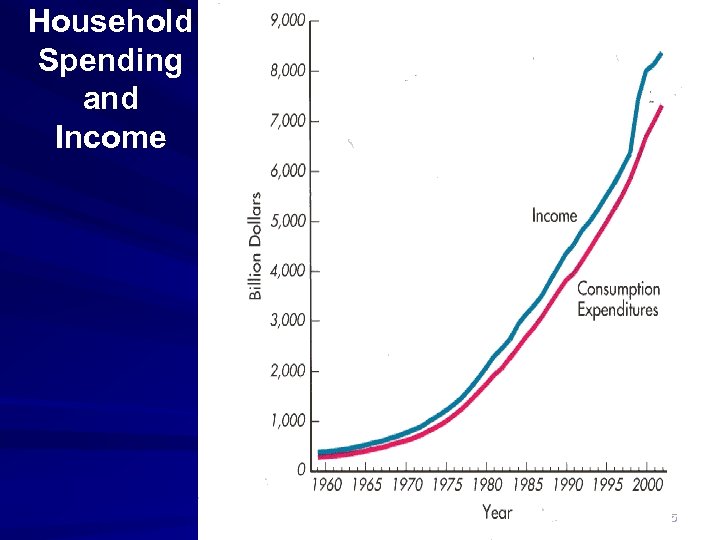

Household Spending and Income 5

Household Spending and Income 5

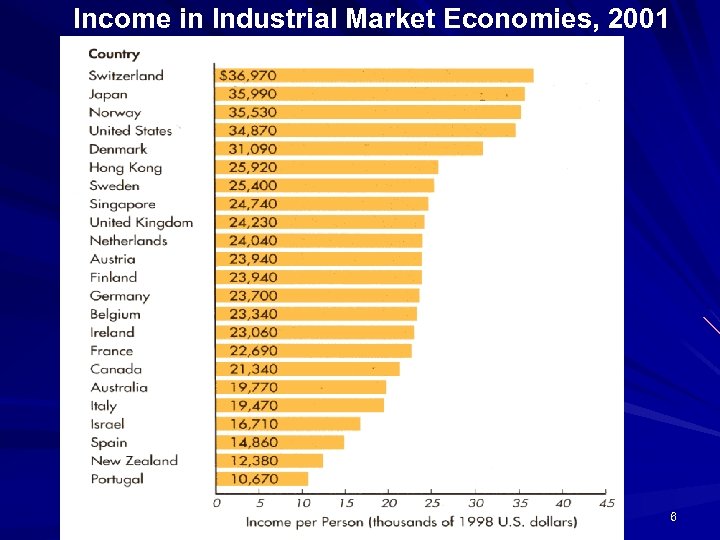

Income in Industrial Market Economies, 2001 6

Income in Industrial Market Economies, 2001 6

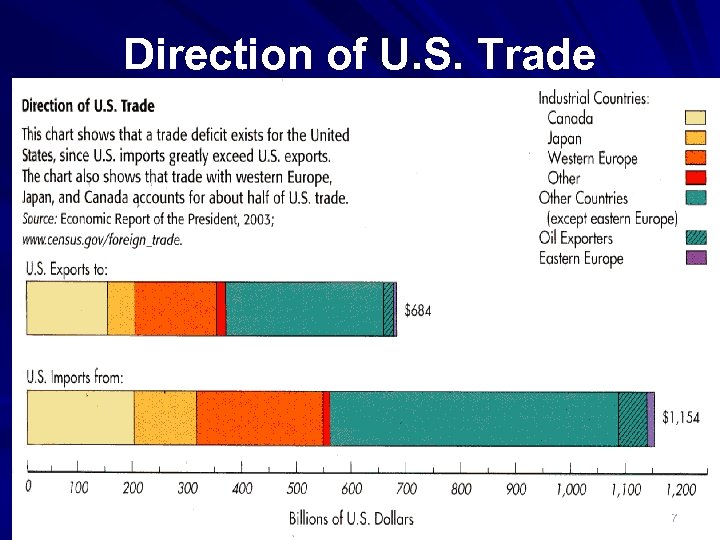

Direction of U. S. Trade 7

Direction of U. S. Trade 7

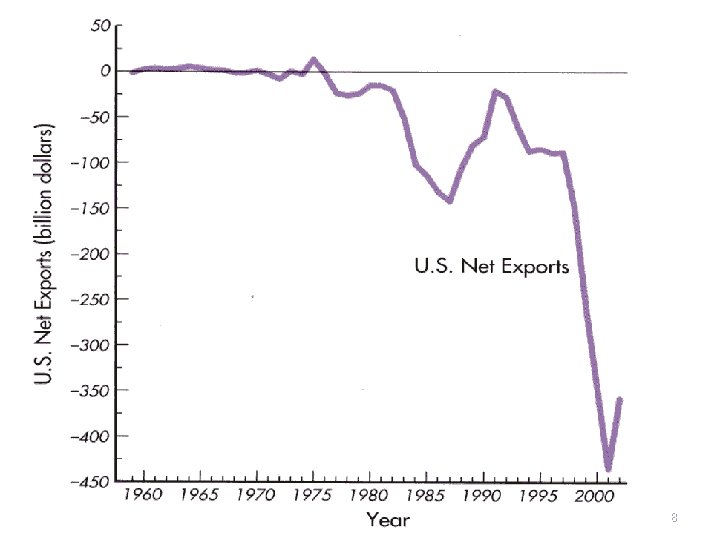

U. S. Net Exports 8

U. S. Net Exports 8

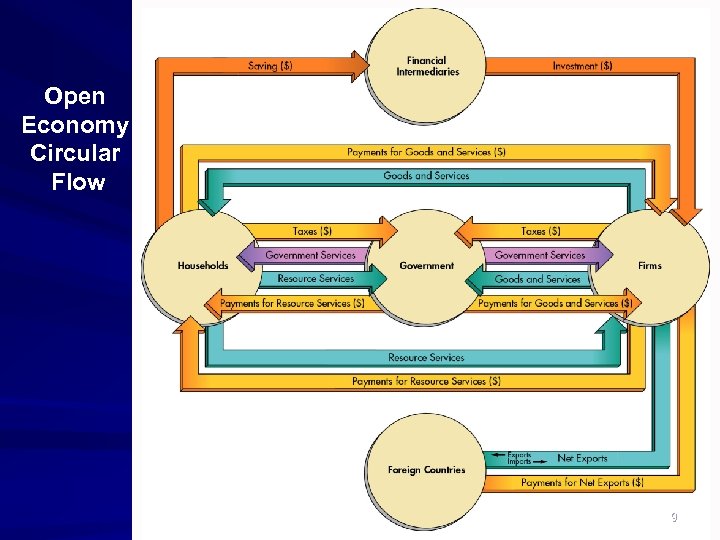

Open Economy Circular Flow 9

Open Economy Circular Flow 9

The Government’s Role Correct for: l l l Imperfect Information Externalities Public Goods Lack of Competition Business Cycles 10

The Government’s Role Correct for: l l l Imperfect Information Externalities Public Goods Lack of Competition Business Cycles 10

Externalities: External Benefits Someone outside a transaction benefits from the transaction. . . and doesn’t pay – Less than the socially optimal amount will be produced and bought. – Examples: Mowing your lawn, painting your house, getting educated. 11

Externalities: External Benefits Someone outside a transaction benefits from the transaction. . . and doesn’t pay – Less than the socially optimal amount will be produced and bought. – Examples: Mowing your lawn, painting your house, getting educated. 11

Externalities: External Costs Someone outside a transaction incurs costs because of it. . . but isn’t paid – If buyers don’t bear all the costs of their purchase, they buy too much. – If producers don’t bear all the costs of production, they produce too much. – Examples: A nightclub next door to your house, pollution by a manufacturer. 12

Externalities: External Costs Someone outside a transaction incurs costs because of it. . . but isn’t paid – If buyers don’t bear all the costs of their purchase, they buy too much. – If producers don’t bear all the costs of production, they produce too much. – Examples: A nightclub next door to your house, pollution by a manufacturer. 12

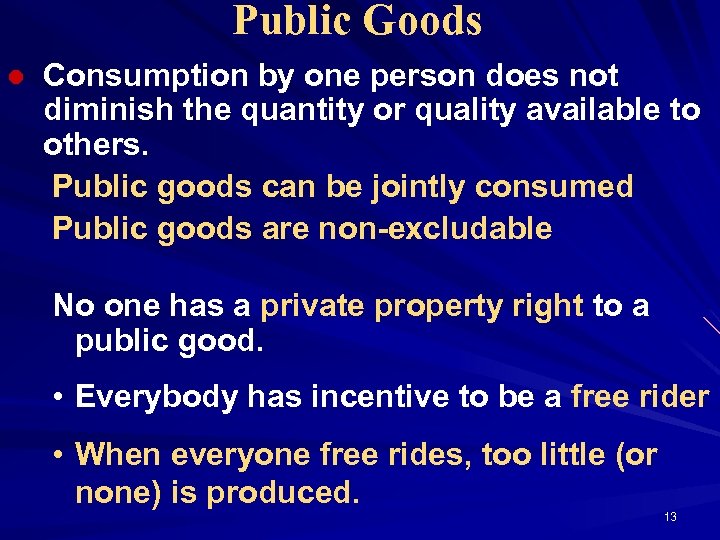

Public Goods l Consumption by one person does not diminish the quantity or quality available to others. Public goods can be jointly consumed Public goods are non-excludable No one has a private property right to a public good. • Everybody has incentive to be a free rider • When everyone free rides, too little (or none) is produced. 13

Public Goods l Consumption by one person does not diminish the quantity or quality available to others. Public goods can be jointly consumed Public goods are non-excludable No one has a private property right to a public good. • Everybody has incentive to be a free rider • When everyone free rides, too little (or none) is produced. 13

Microeconomic Policy Government provides public goods to avoid the free rider problem in the private production of certain goods. Government taxes or subsidizes activities that create externalities. Government ensures competitive markets where possible and regulates noncompetitive industries in the public interest. But there’s problem of regulatory capture. 14

Microeconomic Policy Government provides public goods to avoid the free rider problem in the private production of certain goods. Government taxes or subsidizes activities that create externalities. Government ensures competitive markets where possible and regulates noncompetitive industries in the public interest. But there’s problem of regulatory capture. 14

Macroeconomic Policy Monetary Policy – Policies that influence money and credit (money supply and interest rates). – In the U. S. , the Federal Reserve Board (“the Fed”) is responsible for this. Fiscal Policy – Policies that control government spending and taxation. – In the U. S. federal government, Congress enacts these policies and the President signs them into law. 15

Macroeconomic Policy Monetary Policy – Policies that influence money and credit (money supply and interest rates). – In the U. S. , the Federal Reserve Board (“the Fed”) is responsible for this. Fiscal Policy – Policies that control government spending and taxation. – In the U. S. federal government, Congress enacts these policies and the President signs them into law. 15

Federal, State, and Local Government Expenditures for Goods and Services 16

Federal, State, and Local Government Expenditures for Goods and Services 16

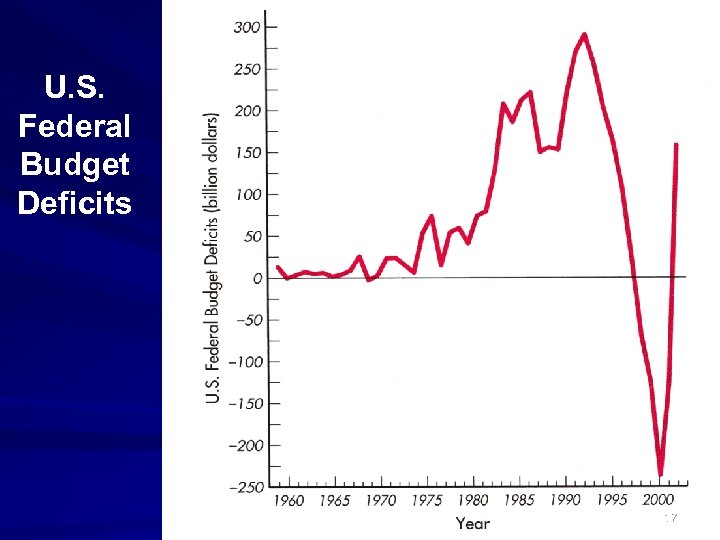

U. S. Federal Budget Deficits 17

U. S. Federal Budget Deficits 17