d722c47a2dc2e0a1707f62156b30568c.ppt

- Количество слайдов: 33

Private Pay Funding Options for Senior Care

Private Pay Funding Options for Senior Care

Founded in 2007, Life Care Funding specializes in converting the death benefit of an in-force life insurance policy into a Long Term Care Benefit plan to cover the costs of Homecare, Assisted Living, Skilled Nursing Home Care and Hospice.

Founded in 2007, Life Care Funding specializes in converting the death benefit of an in-force life insurance policy into a Long Term Care Benefit plan to cover the costs of Homecare, Assisted Living, Skilled Nursing Home Care and Hospice.

The Problem

The Problem

“In the coming decades, many Americans will not have a way to pay for long-term care services. As the population is aging, the need for longterm care services is exploding. into an FDIC insured bank account ü Value of policy is deposited However, as the need for services increases, government funding will not ü Automatic payments are made directly to a provider of long term care be able to keep up, undermining a critical component of the nation’s ü Monthly payments can be adjusted to address changing care needs health care delivery system. ” –The Long Term Care Funding Crisis ü Funeral benefit equal to lesser of $5, 000 or 5% of face value Milliman Consulting ü Conversion complies with state life settlement regulations

“In the coming decades, many Americans will not have a way to pay for long-term care services. As the population is aging, the need for longterm care services is exploding. into an FDIC insured bank account ü Value of policy is deposited However, as the need for services increases, government funding will not ü Automatic payments are made directly to a provider of long term care be able to keep up, undermining a critical component of the nation’s ü Monthly payments can be adjusted to address changing care needs health care delivery system. ” –The Long Term Care Funding Crisis ü Funeral benefit equal to lesser of $5, 000 or 5% of face value Milliman Consulting ü Conversion complies with state life settlement regulations

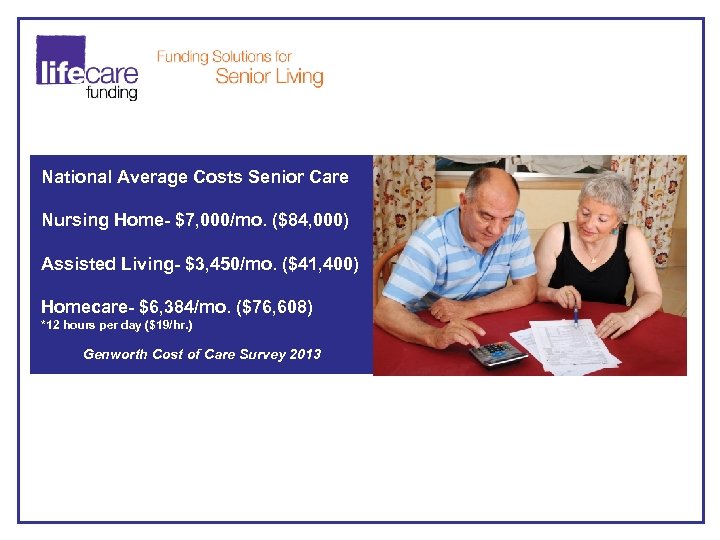

National Average Costs Senior Care Nursing Home- $7, 000/mo. ($84, 000) Assisted Living- $3, 450/mo. ($41, 400) Homecare- $6, 384/mo. ($76, 608) *12 hours per day ($19/hr. ) Genworth Cost of Care Survey 2013

National Average Costs Senior Care Nursing Home- $7, 000/mo. ($84, 000) Assisted Living- $3, 450/mo. ($41, 400) Homecare- $6, 384/mo. ($76, 608) *12 hours per day ($19/hr. ) Genworth Cost of Care Survey 2013

Alarming Statistics • 10, 000 Baby Boomers turn 65 every day • ü Value of policy is deposited into an FDIC insured bank account 70% of them will need some form of long term care (40% in a nursing home) ü Automatic payments are made directly to a provider of long term care • 60% of people incorrectly think Medicare will cover Assisted Living or residence in a ü Monthly payments can be adjusted to address changing care needs Nursing Home ü Funeral benefit equal to lesser of $5, 000 or 5% of face value • 92% incorrectly estimate the costs of Assisted Living and Nursing Home Care ü Conversion complies with state life settlement regulations • 75% exhaust all savings inside one year

Alarming Statistics • 10, 000 Baby Boomers turn 65 every day • ü Value of policy is deposited into an FDIC insured bank account 70% of them will need some form of long term care (40% in a nursing home) ü Automatic payments are made directly to a provider of long term care • 60% of people incorrectly think Medicare will cover Assisted Living or residence in a ü Monthly payments can be adjusted to address changing care needs Nursing Home ü Funeral benefit equal to lesser of $5, 000 or 5% of face value • 92% incorrectly estimate the costs of Assisted Living and Nursing Home Care ü Conversion complies with state life settlement regulations • 75% exhaust all savings inside one year

Medicaid Eligibility • Medical necessity • Income/Asset levels below poverty line • Asset transfer rules and violations • Medicaid qualified spend-down • 5 year look back period • People don’t want to go on Medicaid

Medicaid Eligibility • Medical necessity • Income/Asset levels below poverty line • Asset transfer rules and violations • Medicaid qualified spend-down • 5 year look back period • People don’t want to go on Medicaid

The Liabilities

The Liabilities

Alarming Liabilities • OBRA ’ 93 / DRA (Mandates to recover $) • Filial Responsibility Laws (28 states) • Health Care & Retirement Corporation of America v. Pittas (Pa. Super. Ct. ) • Larry Grill et al v. Lincoln National Life Insurance Company (California Central District Court) Families and Advisors are being held liable for poor financial planning and punitive court cases are mounting

Alarming Liabilities • OBRA ’ 93 / DRA (Mandates to recover $) • Filial Responsibility Laws (28 states) • Health Care & Retirement Corporation of America v. Pittas (Pa. Super. Ct. ) • Larry Grill et al v. Lincoln National Life Insurance Company (California Central District Court) Families and Advisors are being held liable for poor financial planning and punitive court cases are mounting

Pennsylvania Man Appeals to Court to Avoid Paying Mom's $93, 000 Nursing Home Bill May 23, 2012 By Susanna Kim GOOD MORNING AMERICA As the only remaining family member left in the U. S. , John Pittas was left to foot the $92, 943. 41 bill after his mother's Medicaid application was not approved in time. The Health Care & Retirement Corp. of America, which owns Liberty Nursing & Rehabilitation Center, sued Pittas in May 2008 for the money and a trial court sided with the nursing home in 2011. The restaurant owner said he was "in shock" and "devastated" at the ruling

Pennsylvania Man Appeals to Court to Avoid Paying Mom's $93, 000 Nursing Home Bill May 23, 2012 By Susanna Kim GOOD MORNING AMERICA As the only remaining family member left in the U. S. , John Pittas was left to foot the $92, 943. 41 bill after his mother's Medicaid application was not approved in time. The Health Care & Retirement Corp. of America, which owns Liberty Nursing & Rehabilitation Center, sued Pittas in May 2008 for the money and a trial court sided with the nursing home in 2011. The restaurant owner said he was "in shock" and "devastated" at the ruling

The Politics

The Politics

Commission on Long Term Care appointed by Congress in 2013 to study and make recommendations about the rapidly escalating crisis facing Americans and their ability to pay for long term care. "We know that 70 percent of people over the age 65 will need some form of long-term services and support, " said Dr. Bruce Chernof, the commission’s chairman. “Although government programs provide a significant portion of long-term care, none offer the full range of services people need”, said Kirsten Colello, a health and aging policy specialist at the Congressional Research Service. "The question is whether most Americans can afford to pay for Long Term Care. " According to G. William Hoagland of the Bipartisan Policy Center, "Medicare and Medicaid have become the major source of long-term care, and cannot continue at the current pace. ”

Commission on Long Term Care appointed by Congress in 2013 to study and make recommendations about the rapidly escalating crisis facing Americans and their ability to pay for long term care. "We know that 70 percent of people over the age 65 will need some form of long-term services and support, " said Dr. Bruce Chernof, the commission’s chairman. “Although government programs provide a significant portion of long-term care, none offer the full range of services people need”, said Kirsten Colello, a health and aging policy specialist at the Congressional Research Service. "The question is whether most Americans can afford to pay for Long Term Care. " According to G. William Hoagland of the Bipartisan Policy Center, "Medicare and Medicaid have become the major source of long-term care, and cannot continue at the current pace. ”

In 2010, the National Conference of Insurance Legislators unanimously passed the Life Insurance Consumer Disclosure Model Law. Conversion of a life insurance policy into a Long Term Care Benefit Plan is one of the mandated options in the Model Law. Multiple states have introduced Life Policy Conversion Consumer Disclosure Laws Granting Medicaid Departments authority to educate citizens they have right to convert life policies to pay for any form of care they select. : CA, FL, GA, KY, LA, MD, ME, NJ, NY, PA, TX, and WA

In 2010, the National Conference of Insurance Legislators unanimously passed the Life Insurance Consumer Disclosure Model Law. Conversion of a life insurance policy into a Long Term Care Benefit Plan is one of the mandated options in the Model Law. Multiple states have introduced Life Policy Conversion Consumer Disclosure Laws Granting Medicaid Departments authority to educate citizens they have right to convert life policies to pay for any form of care they select. : CA, FL, GA, KY, LA, MD, ME, NJ, NY, PA, TX, and WA

Private Pay Options has attracted positive attention from the press and policymakers “…Life Care Funding puts the money in an FDIC insured account used to send monthly payments directly to a long term care provider…You can switch from one provider to another as your needs change; but you can’t use the money for a vacation (or blow it at a casino). ” 10/9/2013 “But a few state law makers who have introduced laws to publicize the [Benefit Plan] option have pointed out that it beats surrendering a policy to access government benefits while also giving families more control over how to spend the money. ” 8/30/2013 “Texas enacted a law earlier this month that gives state Medicaid officials the authority to tell people applying for help they can sell long-held life-insurance policies to a third party to pay for custodial health care of their choice. ” 6/27/2013

Private Pay Options has attracted positive attention from the press and policymakers “…Life Care Funding puts the money in an FDIC insured account used to send monthly payments directly to a long term care provider…You can switch from one provider to another as your needs change; but you can’t use the money for a vacation (or blow it at a casino). ” 10/9/2013 “But a few state law makers who have introduced laws to publicize the [Benefit Plan] option have pointed out that it beats surrendering a policy to access government benefits while also giving families more control over how to spend the money. ” 8/30/2013 “Texas enacted a law earlier this month that gives state Medicaid officials the authority to tell people applying for help they can sell long-held life-insurance policies to a third party to pay for custodial health care of their choice. ” 6/27/2013

The Solution

The Solution

Private Pay Funding • VA Aide and Attendance • Reverse Mortgage • Loans • Life Settlements • LTCi • Long Term Care Benefit Plan

Private Pay Funding • VA Aide and Attendance • Reverse Mortgage • Loans • Life Settlements • LTCi • Long Term Care Benefit Plan

Veteran’s Aide & Attendance A monthly benefit for low income veterans (and their spouses) age 65 or older who served at least one day during a wartime period. The VA benefit is a tax-free supplemental income pension benefit intended to assist the costs of skilled nursing care for a disabled veteran. A single veteran can receive upwards of $1, 700/mo. and with a spouse upwards of $2, 000/mo. The Veteran’s Administration has proposed a significant rule change that would include a three year look back period (similar to Medicaid look back rules) for all applicants that is expected to be in effect before the end of 2015.

Veteran’s Aide & Attendance A monthly benefit for low income veterans (and their spouses) age 65 or older who served at least one day during a wartime period. The VA benefit is a tax-free supplemental income pension benefit intended to assist the costs of skilled nursing care for a disabled veteran. A single veteran can receive upwards of $1, 700/mo. and with a spouse upwards of $2, 000/mo. The Veteran’s Administration has proposed a significant rule change that would include a three year look back period (similar to Medicaid look back rules) for all applicants that is expected to be in effect before the end of 2015.

Reverse Mortgage A reverse mortgage is a loan that enables senior homeowners, age 62 and older, to convert part of their home equity (primary residence only) into tax-free income without having to sell their home, give up title to it, or make monthly mortgage payments. You don’t need to repay the loan as long as you or another borrower continues to live in the house and keep the taxes paid and insurance in force. The loan only becomes due when the last borrower (s) permanently leaves the home at which time the reverse mortgage principal, interest charges, closing costs and service fees are typically paid back from the sale of the house.

Reverse Mortgage A reverse mortgage is a loan that enables senior homeowners, age 62 and older, to convert part of their home equity (primary residence only) into tax-free income without having to sell their home, give up title to it, or make monthly mortgage payments. You don’t need to repay the loan as long as you or another borrower continues to live in the house and keep the taxes paid and insurance in force. The loan only becomes due when the last borrower (s) permanently leaves the home at which time the reverse mortgage principal, interest charges, closing costs and service fees are typically paid back from the sale of the house.

Senior Living Loans that can be secured specifically to pay for long term care services for a maximum term of three years. These loans are unsecured by collateral and instead are guaranteed by family members (one or more). Interest rates are similar to a credit card.

Senior Living Loans that can be secured specifically to pay for long term care services for a maximum term of three years. These loans are unsecured by collateral and instead are guaranteed by family members (one or more). Interest rates are similar to a credit card.

Long Term Care Insurance Long-term care insurance is designed to cover a wide range of longterm care services such as homecare, assisted living, nursing homes, or hospice. Generally, the younger and healthier you are when you buy long-term care insurance, the lower your premiums will be. Waiting too long can decrease the likelihood of being accepted and increase the cost of coverage.

Long Term Care Insurance Long-term care insurance is designed to cover a wide range of longterm care services such as homecare, assisted living, nursing homes, or hospice. Generally, the younger and healthier you are when you buy long-term care insurance, the lower your premiums will be. Waiting too long can decrease the likelihood of being accepted and increase the cost of coverage.

Life Settlements A life or viatical settlement is the sale of an existing life insurance policy to a third party for more than its cash surrender value, but less than its net death benefit Most states regulate life and viatical settlement transactions, and many of the specific regulations in place are intended to protect individuals that are selling their insurance policies. For example, in most states, the seller of an insurance policy through a life settlement cancel the transaction by returning the purchase price within fifteen days of receipt. More than forty states have regulations in place regarding the sale of life insurance policies to third parties.

Life Settlements A life or viatical settlement is the sale of an existing life insurance policy to a third party for more than its cash surrender value, but less than its net death benefit Most states regulate life and viatical settlement transactions, and many of the specific regulations in place are intended to protect individuals that are selling their insurance policies. For example, in most states, the seller of an insurance policy through a life settlement cancel the transaction by returning the purchase price within fifteen days of receipt. More than forty states have regulations in place regarding the sale of life insurance policies to third parties.

Single Premium Income Annuity (SPIA) An immediate annuity is a contract with an insurance company under which the consumer pays a certain amount of money to the company and the company sends the consumer a monthly check for the rest of his or her life. In most states the purchase of an annuity is not considered to be a transfer for purposes of eligibility for Medicaid, but is instead the purchase of an investment. It transforms otherwise countable assets into a non-countable income stream as long as the income is in the name of the community spouse. Under the DRA, the state must be named the remainder beneficiary up to the amount of Medicaid paid on the annuitant's behalf.

Single Premium Income Annuity (SPIA) An immediate annuity is a contract with an insurance company under which the consumer pays a certain amount of money to the company and the company sends the consumer a monthly check for the rest of his or her life. In most states the purchase of an annuity is not considered to be a transfer for purposes of eligibility for Medicaid, but is instead the purchase of an investment. It transforms otherwise countable assets into a non-countable income stream as long as the income is in the name of the community spouse. Under the DRA, the state must be named the remainder beneficiary up to the amount of Medicaid paid on the annuitant's behalf.

Long Term Care Benefit Plan A Long Term Care Benefit Plan is the conversion of an in-force life insurance policy into an irrevocable, FDIC-insured Benefit Account. An unneeded life insurance policy is sold for a percentage of the death benefit (the range can be between 20 -60 percent) and the funds are immediately available to pay for Senior Care. Once enrolled in the benefit plan, tax-advantaged monthly payments are made directly from the account to cover any form of senior care: home care, assisted living, nursing home, memory care, and hospice.

Long Term Care Benefit Plan A Long Term Care Benefit Plan is the conversion of an in-force life insurance policy into an irrevocable, FDIC-insured Benefit Account. An unneeded life insurance policy is sold for a percentage of the death benefit (the range can be between 20 -60 percent) and the funds are immediately available to pay for Senior Care. Once enrolled in the benefit plan, tax-advantaged monthly payments are made directly from the account to cover any form of senior care: home care, assisted living, nursing home, memory care, and hospice.

Private Pay allows for choice and dignity Home Health Care Private Duty Home Health Care Assisted Living Skilled Nursing and Hospice Memory or Behavioral Care

Private Pay allows for choice and dignity Home Health Care Private Duty Home Health Care Assisted Living Skilled Nursing and Hospice Memory or Behavioral Care

Accepted by all Long Term Care Providers in the U. S.

Accepted by all Long Term Care Providers in the U. S.

Conclusion

Conclusion

Problem • Families confronting Long Term Care unprepared, uninformed and are looking for comprehensive advice and access to options • Seniors want to remain financially independent and in control of care decisions • Seniors don’t want to be a burden on their family or become a ward of the state Solution • Numerous options to remain private pay are available • Advisors and care providers need to be familiar with these options so families are able to make well informed decisions

Problem • Families confronting Long Term Care unprepared, uninformed and are looking for comprehensive advice and access to options • Seniors want to remain financially independent and in control of care decisions • Seniors don’t want to be a burden on their family or become a ward of the state Solution • Numerous options to remain private pay are available • Advisors and care providers need to be familiar with these options so families are able to make well informed decisions

Who Benefits and How? • Consumer: Use assets they already own that will provide private pay dollars to their preferred form of senior housing and care while preserving financial independence, choice and dignity. • Provider: Long term care service provider receives private pay funding for services (1/3 higher than CMS rate) over a guaranteed timeframe without disruption from cutbacks in Medicare/Medicaid reimbursements. • Medicaid and Tax Payers: Private pay delays entry onto Medicaid generating considerable savings to stressed Medicaid budgets and tax payers.

Who Benefits and How? • Consumer: Use assets they already own that will provide private pay dollars to their preferred form of senior housing and care while preserving financial independence, choice and dignity. • Provider: Long term care service provider receives private pay funding for services (1/3 higher than CMS rate) over a guaranteed timeframe without disruption from cutbacks in Medicare/Medicaid reimbursements. • Medicaid and Tax Payers: Private pay delays entry onto Medicaid generating considerable savings to stressed Medicaid budgets and tax payers.

Life Care Funding Phone: 888 -670 -7773 info@lifecarefunding. com www. lifecarefunding. com

Life Care Funding Phone: 888 -670 -7773 info@lifecarefunding. com www. lifecarefunding. com

Chris Orestis, CEO of Life Care Funding, a former Washington, DC lobbyist, is an 18 year veteran of both the insurance and long-term care industries. A nationally known senior care advocate; he is the author of the Amazon best-seller book “Help on the Way”, a legislative expert, featured speaker, columnist and contributor to a number of insurance and long term care industry publications. Chris is a frequent guest about senior issues on national radio programs and has also been featured in the Wall Street Journal, New York Times, USA Today, Woman’s World Magazine, Fox Business News, Kiplinger's, and PBS. His blog on senior living issues can be found at www. lifecarefunding. com. He can be reached at 888 -670 -7773 x 6623 corestis@lifecarefunding. com.

Chris Orestis, CEO of Life Care Funding, a former Washington, DC lobbyist, is an 18 year veteran of both the insurance and long-term care industries. A nationally known senior care advocate; he is the author of the Amazon best-seller book “Help on the Way”, a legislative expert, featured speaker, columnist and contributor to a number of insurance and long term care industry publications. Chris is a frequent guest about senior issues on national radio programs and has also been featured in the Wall Street Journal, New York Times, USA Today, Woman’s World Magazine, Fox Business News, Kiplinger's, and PBS. His blog on senior living issues can be found at www. lifecarefunding. com. He can be reached at 888 -670 -7773 x 6623 corestis@lifecarefunding. com.