c7eea67bfe41aacd7683ea69144c215b.ppt

- Количество слайдов: 61

PRIVATE LABELS IN EUROPE PROMOSOLUTION INTERNATIONAL SEMINAR 2004 NICOSIA CYPRUS – March 17/04 By Jean-Pierre BONVALLET International Business Development Representative PLMA (Private Label Manufacturers Association)

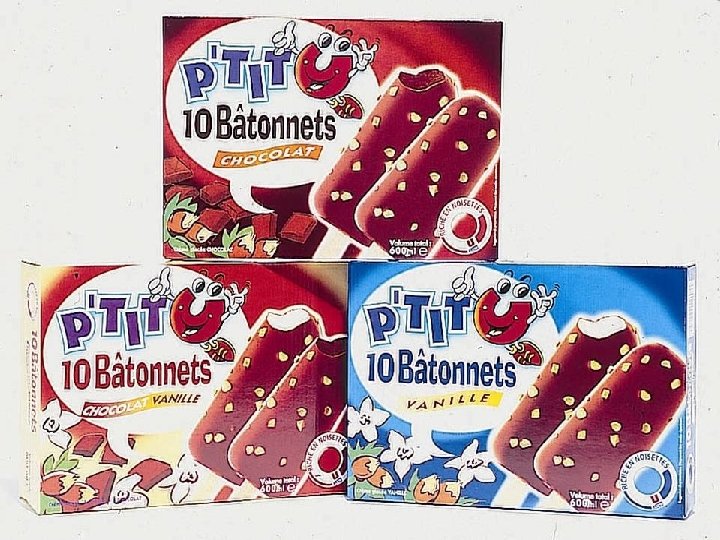

PRIVATE LABEL, PRIVATE BRAND RETAILER’S BRAND are brands owned and used by a retailer (vs a manufacturer) – Name of the retailer CARREFOUR, TESCO – Or a kind of "guarantee name" MARQUE REPERE, PRESIDENT CHOICE – Fantasy name eventually different for each range or for "wide family « PATURAGES, KANOË, REFLETS DE FRANCE

PRIVATE LABEL WORLDWIDE GOES TOGETHER WITH MODERN TRADE DEVELOPMENT n First PL in UK SAINSBURY 1869 n First in France CASINO 1901 Modern phase CARREFOUR, PRODUITS LIBRES 1976

New ACNielsen Study Private Label now accounts for 15% of the total sales in 80 major categories accross 36 countries in Europe, North America, South America and Asia.

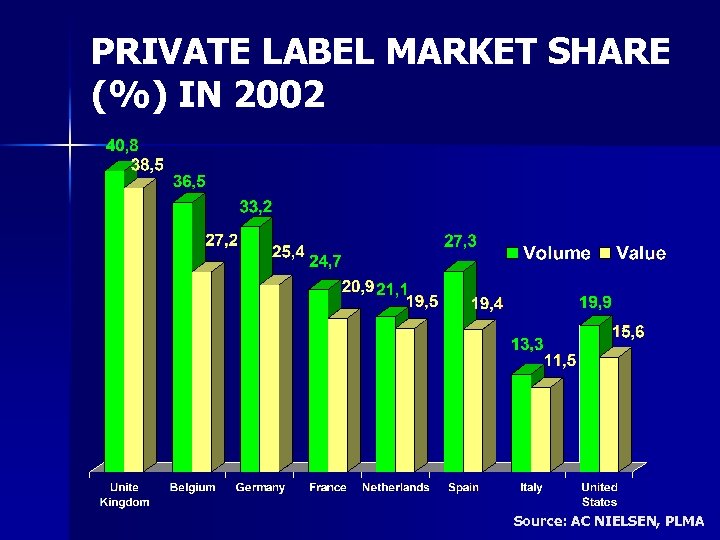

PRIVATE LABEL MARKET SHARE (%) IN 2002 Source: AC NIELSEN, PLMA

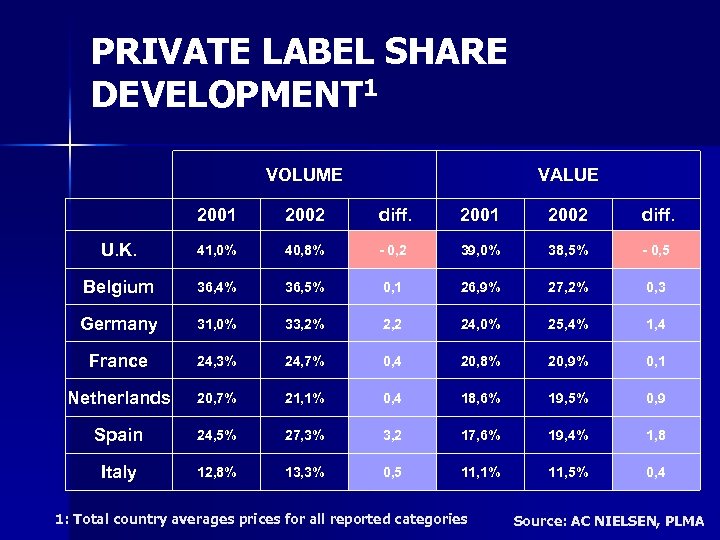

PRIVATE LABEL SHARE DEVELOPMENT 1 VOLUME VALUE 2001 2002 diff. U. K. 41, 0% 40, 8% - 0, 2 39, 0% 38, 5% - 0, 5 Belgium 36, 4% 36, 5% 0, 1 26, 9% 27, 2% 0, 3 Germany 31, 0% 33, 2% 2, 2 24, 0% 25, 4% 1, 4 France 24, 3% 24, 7% 0, 4 20, 8% 20, 9% 0, 1 Netherlands 20, 7% 21, 1% 0, 4 18, 6% 19, 5% 0, 9 Spain 24, 5% 27, 3% 3, 2 17, 6% 19, 4% 1, 8 Italy 12, 8% 13, 3% 0, 5 11, 1% 11, 5% 0, 4 1: Total country averages prices for all reported categories Source: AC NIELSEN, PLMA

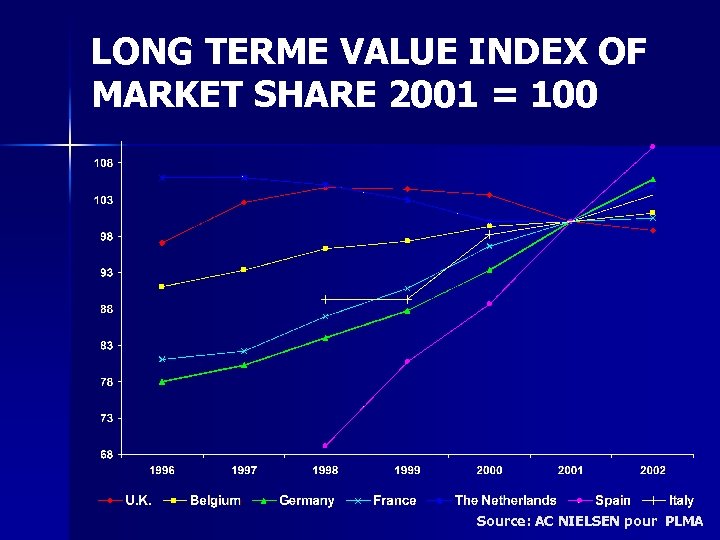

LONG TERME VALUE INDEX OF MARKET SHARE 2001 = 100 Source: AC NIELSEN pour PLMA

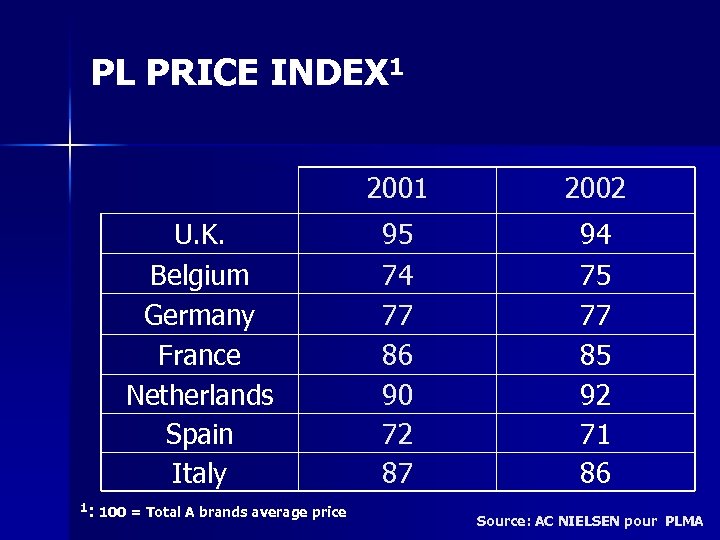

PL PRICE INDEX 1 2001 U. K. Belgium Germany France Netherlands Spain Italy 1: 100 = Total A brands average price 2002 95 74 77 86 90 72 87 94 75 77 85 92 71 86 Source: AC NIELSEN pour PLMA

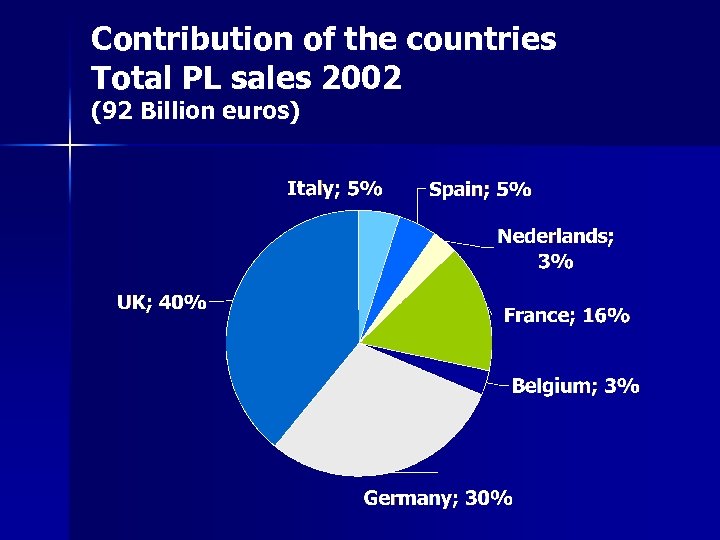

Contribution of the countries Total PL sales 2002 (92 Billion euros)

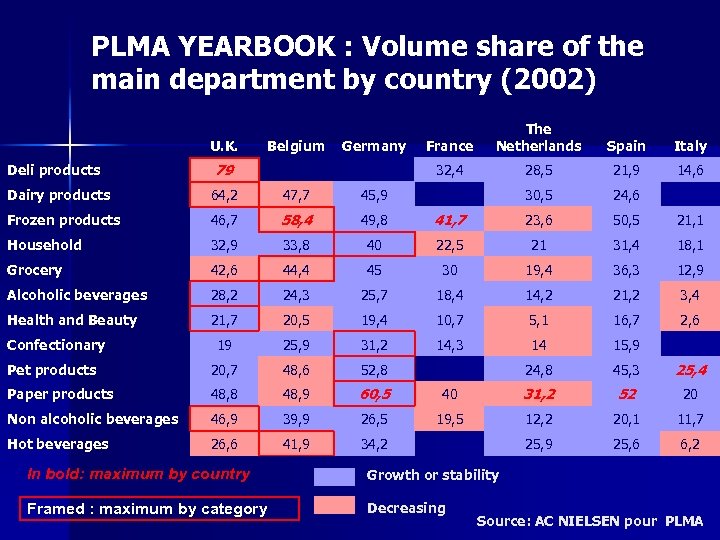

PLMA YEARBOOK : Volume share of the main department by country (2002) U. K. Deli products Germany 79 France Spain Italy 32, 4 Belgium The Netherlands 28, 5 21, 9 14, 6 30, 5 24, 6 Dairy products 64, 2 47, 7 45, 9 Frozen products 46, 7 58, 4 49, 8 41, 7 23, 6 50, 5 21, 1 Household 32, 9 33, 8 40 22, 5 21 31, 4 18, 1 Grocery 42, 6 44, 4 45 30 19, 4 36, 3 12, 9 Alcoholic beverages 28, 2 24, 3 25, 7 18, 4 14, 2 21, 2 3, 4 Health and Beauty 21, 7 20, 5 19, 4 10, 7 5, 1 16, 7 2, 6 19 25, 9 31, 2 14, 3 14 15, 9 Pet products 20, 7 48, 6 52, 8 24, 8 45, 3 25, 4 Paper products 48, 8 48, 9 60, 5 40 31, 2 52 20 Non alcoholic beverages 46, 9 39, 9 26, 5 19, 5 12, 2 20, 1 11, 7 Hot beverages 26, 6 41, 9 34, 2 25, 9 25, 6 6, 2 Confectionary In bold: maximum by country Growth or stability Framed : maximum by category Decreasing Source: AC NIELSEN pour PLMA

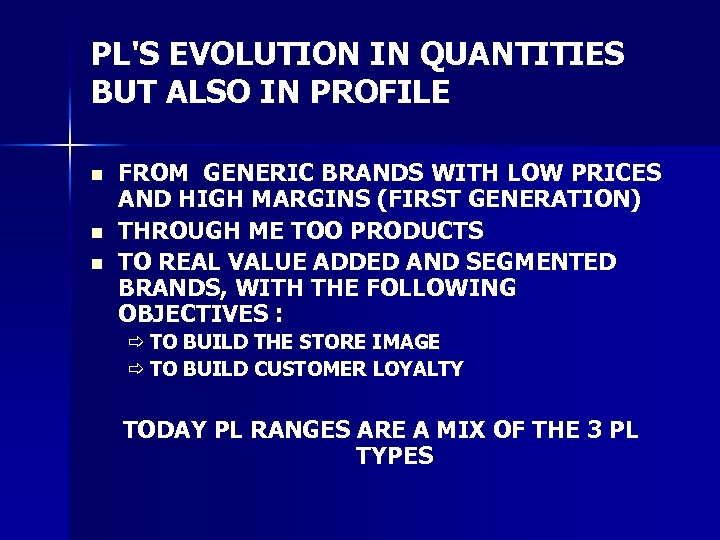

PL'S EVOLUTION IN QUANTITIES BUT ALSO IN PROFILE n n n FROM GENERIC BRANDS WITH LOW PRICES AND HIGH MARGINS (FIRST GENERATION) THROUGH ME TOO PRODUCTS TO REAL VALUE ADDED AND SEGMENTED BRANDS, WITH THE FOLLOWING OBJECTIVES : ð TO BUILD THE STORE IMAGE ð TO BUILD CUSTOMER LOYALTY TODAY PL RANGES ARE A MIX OF THE 3 PL TYPES

Private Label strategies • Store name brands • Exclusive Brands • Multiple exclusive brands • Department brand strategy

AS WELL AS THE “A” BRANDS THE PL IN EUROPE ARE SEGMENTED ACCORDING THE MAJOR CONSUMER TRENDS n By consumers profiles: Babies – young mothers – older persons… n According major consumers expectations: – Health – Well being - Freshness - BIO – Ethical growing concerns – Research of variety and pleasure: Regional, Ethnic or Exotic Foods – Practicity (easy to handle and preserve) – Ratio price / quality

Common characteristics • Brand promotion • High quality standards • In-store awareness • Shelf positioning • Defined role for A-brand

REASONS OF SUCCESS ARE A “TRIPLE WIN” SITUATION FOR : CONSUMERS RETAILERS MANUFACTURERS (PRODUCERS)

CONSUMER ADVANTAGES n PRODUCTS AS GOOD OR EVEN BETTER OR MORE INNOVATIVE THAN “A” BRANDS – Quick feed back of consumers reactions – Lower marketing costs n BETTER PRICES: ECONOMY TO PREMIUM PL – - 25 TO - 5 % n MORE SECURITY and TRUST – Next door SUPERMARKET is known whereas a far away B or C producer is not: specially important for Fresh food products and personal care… n SIMPLER CHOICE compared to the jungle of the brands – Many products under one hat

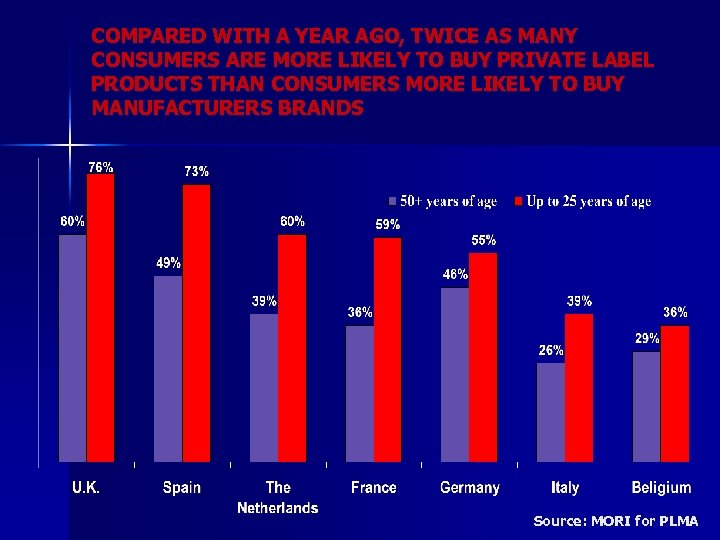

COMPARED WITH A YEAR AGO, TWICE AS MANY CONSUMERS ARE MORE LIKELY TO BUY PRIVATE LABEL PRODUCTS THAN CONSUMERS MORE LIKELY TO BUY MANUFACTURERS BRANDS Source: MORI for PLMA

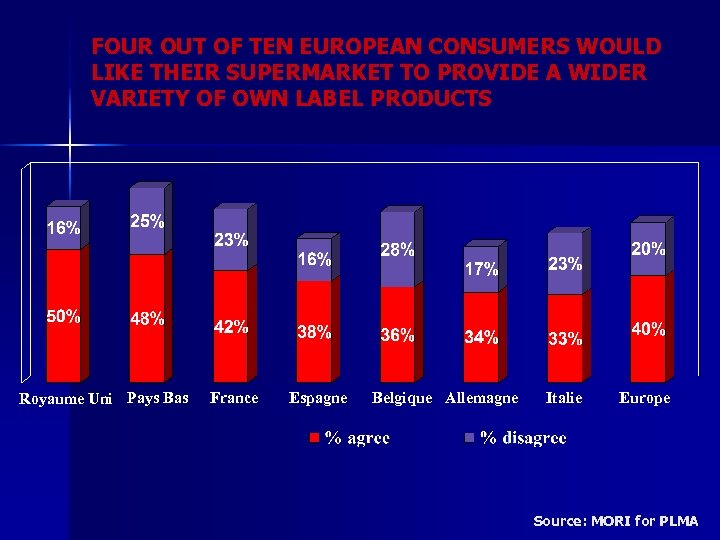

FOUR OUT OF TEN EUROPEAN CONSUMERS WOULD LIKE THEIR SUPERMARKET TO PROVIDE A WIDER VARIETY OF OWN LABEL PRODUCTS Royaume Uni Pays Bas France Espagne Belgique Allemagne Italie Europe Source: MORI for PLMA

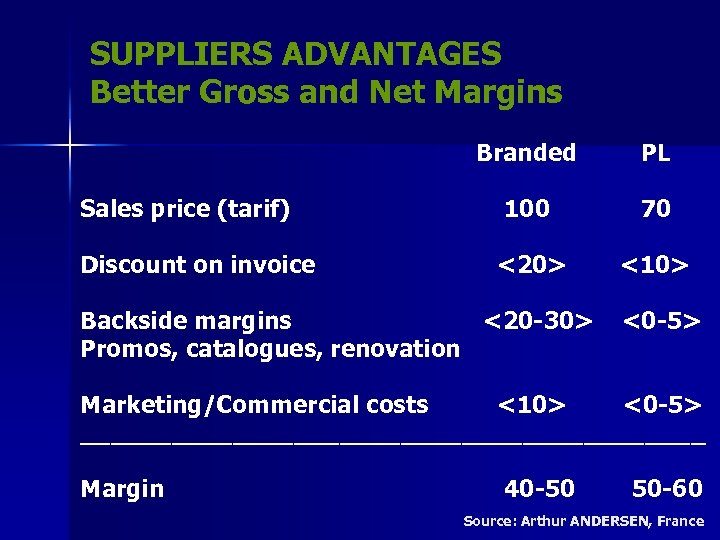

SUPPLIERS ADVANTAGES Better Gross and Net Margins Branded PL Sales price (tarif) 100 70 Discount on invoice <20> <10> Backside margins <20 -30> Promos, catalogues, renovation <0 -5> Marketing/Commercial costs <10> <0 -5> _____________________ Margin 40 -50 50 -60 Source: Arthur ANDERSEN, France

OPPORTUNITIES FOR THE SUPPLIERS n n n Better shelf placement and brand visibility Reduction of sales and marketing costs (publicity, promotion, referencing, sales forces, logistics…): better margins Increase of turn-over = better return on investments and “scale” economies (raw material, packaging, equipments. . . )

OPPORTUNITIES FOR THE SUPPLIERS n n n The producers focus on his core know-how (Rand D, quality) An alternative to high cost of developing ones own brand Innovation safer and quicker due to consumer feed back via the retailer Co-operation spirit with retailer A start to develop one’s own label or brand A key to export

WHY HAVE FOOD RETAILERS DEVELOPED OWN LABEL? n n n Cost savings: product development, packaging, advertising & promotion thanks to the mass buying are borne by the retailer mainly Higher profitability - % margins and better competitivity Pricing free of manufacturer pressures and of state price regulations Control within retail system: store image, inventory control, range / quality Develop freely various ranges (budget, heart of market, added value…) Increased customer loyalty differentiated away from competitors

Future outlook • Greater concentration in retail trade • Greater importance of value-added Private Label • Greater international distribution • Greater retail segmentation

RETAIL SIDE EVOLUTION OF STRUCTURES IN RETAIL BUSINESS An extraordinary concentration of purchases in the hands of a few very big buyers ð Concentration of sales in hypermarkets and supermarkets (big size formats) ð Pan-European and even global groups ð Strong link between globalization and Private Label

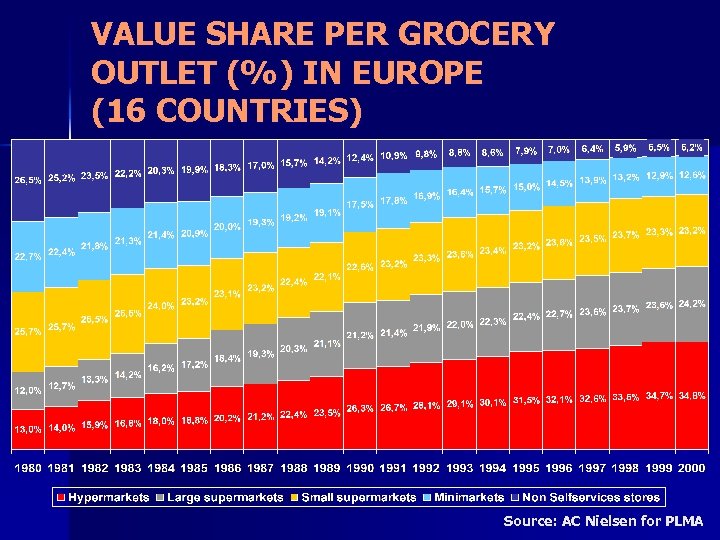

VALUE SHARE PER GROCERY OUTLET (%) IN EUROPE (16 COUNTRIES) Source: AC Nielsen for PLMA

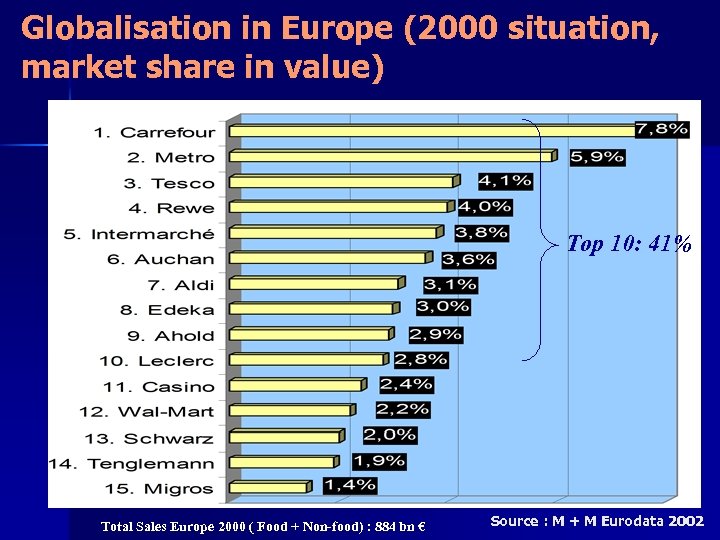

Globalisation in Europe (2000 situation, market share in value) Top 10: 41% Total Sales Europe 2000 ( Food + Non-food) : 884 bn € Source : M + M Eurodata 2002

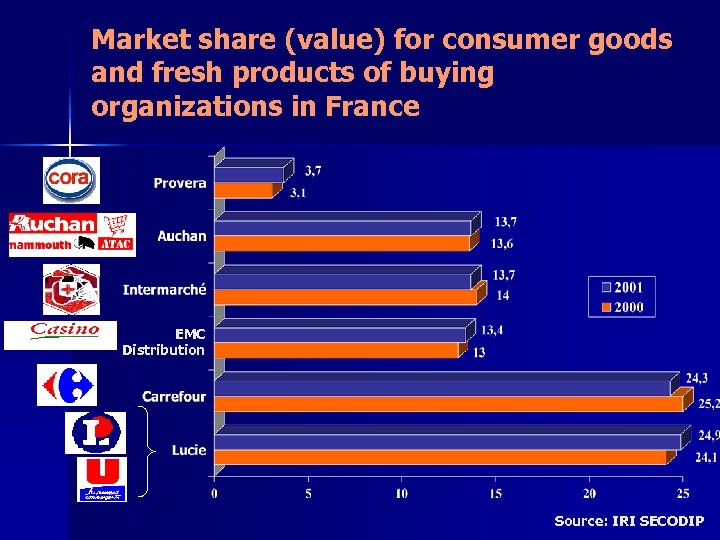

Market share (value) for consumer goods and fresh products of buying organizations in France EMC Distribution Source: IRI SECODIP

Greater importance of valueadded Private Label • Trader Joe

Greater international distribution • Wal-Mart

Greater retail segmentation • Whole Foods

Worldwide Globalization leaded by Europe and USA Source: Jean-Pierre BONVALLET, PLMA

FUTURE GROWTH ? CONFIRMATION : RESULTS OF THE SURVEY RETAILER TRENDS 2002 ONLY FOR PLMA n n n Nearly 90 % of retailers in the survey say that their companies plan to expand their private label programmes in the near future More than 90 % say that quality will be very important in establishing their future private label lines 75 % expect their companies will develop more value-added lines 75 % believe that packaging will be very important in establishing the identity of their private label lines in the near future More than 50 % feel that : – Their private label manufacturers have improved their willingness to work with retailers and are doing a better job of product development and quality control – Say that they will need more sources from other parts of the world – Believe that the greatest problem facing private label is a lack of innovation Source: PLMA Retail Survey 2002

ASSOCIATION-AT-A-GLANCE PLMA’s Head Office New York PLMA International Council Amsterdam Business Development Office Paris PLMA International Council Hong Kong in Asia Singapore PLMA Representative Offices London Hanover Madrid Tokyo Buenos Aires Sydney Paris

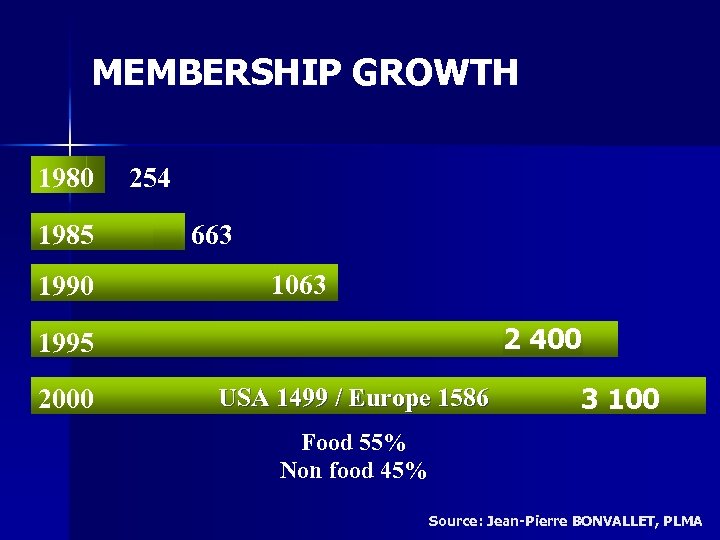

MEMBERSHIP GROWTH 1980 1985 1990 254 663 1063 2 400 1995 2000 USA 1499 / Europe 1586 3 100 Food 55% Non food 45% Source: Jean-Pierre BONVALLET, PLMA

PLMA ACTIVITIES n Trade Shows : USA, Chicago – since 24 years, november International Trade Show, Amsterdam – since 19 years, may Special Events : Paris (20 – 21. 03), Londres, Francfort, … n n n Studies, Conferences and Seminars with LSA Research and Publications Press and Public Relations PLMA Global: Online Trade Show Executive Education Programme (USA, The Netherlands and soon in France )

INTERNATIONAL SHOW PROFILE 2003 n n n 23 670 m² net booth (47 340 m² gross) 2 508 exhibit stands 1 289 companies coming from 65 countries / v 35 in 1998 including 25 national and regional pavilions / v 13 in 1998 Exhibitors by General Classification n Food 1 110 Perishables 235 Non Food 1 163 Source: Jean-Pierre BONVALLET, PLMA

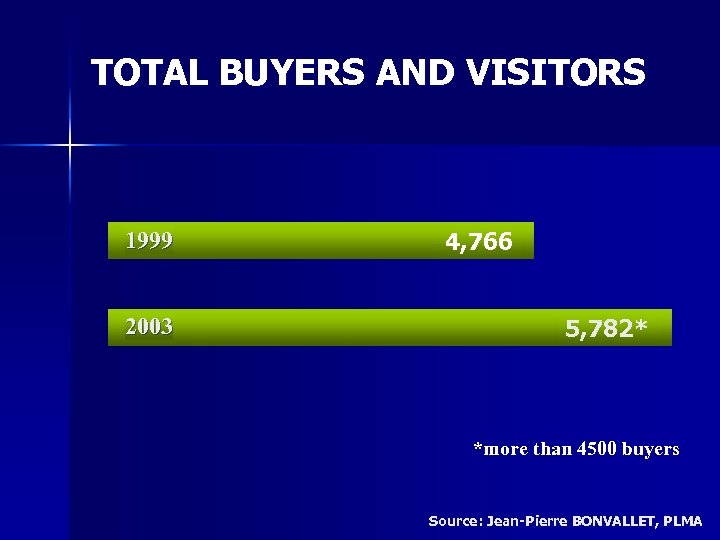

TOTAL BUYERS AND VISITORS 1999 2003 4, 766 5, 782* *more than 4500 buyers Source: Jean-Pierre BONVALLET, PLMA

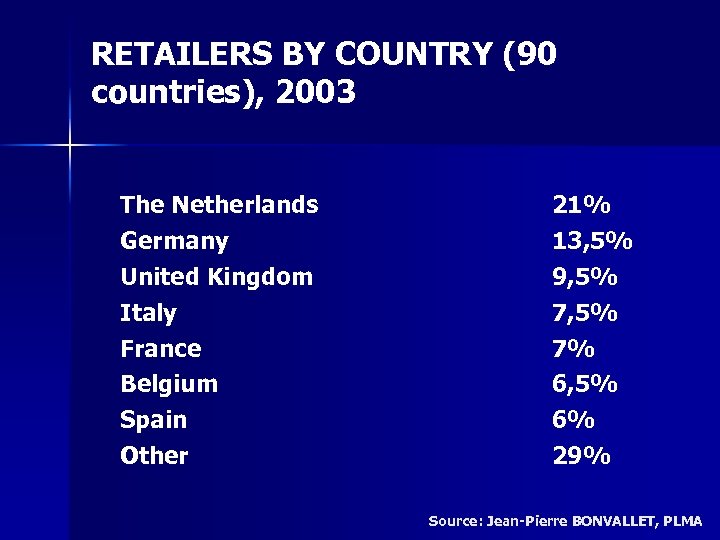

RETAILERS BY COUNTRY (90 countries), 2003 The Netherlands Germany United Kingdom Italy France Belgium Spain Other 21% 13, 5% 9, 5% 7% 6, 5% 6% 29% Source: Jean-Pierre BONVALLET, PLMA

AMSTERDAM 2004 SHOW SCHEDULE Monday 24 May Pre-Show Seminars Pre-Show Opening New Exhibitors 13. 00 -16. 00 -18. 00 Tuesday 25 May Show Floor Open 9. 00 -18. 30 New Products Expo Wednesday 26 May Show Floor Open 9. 00 -16. 30

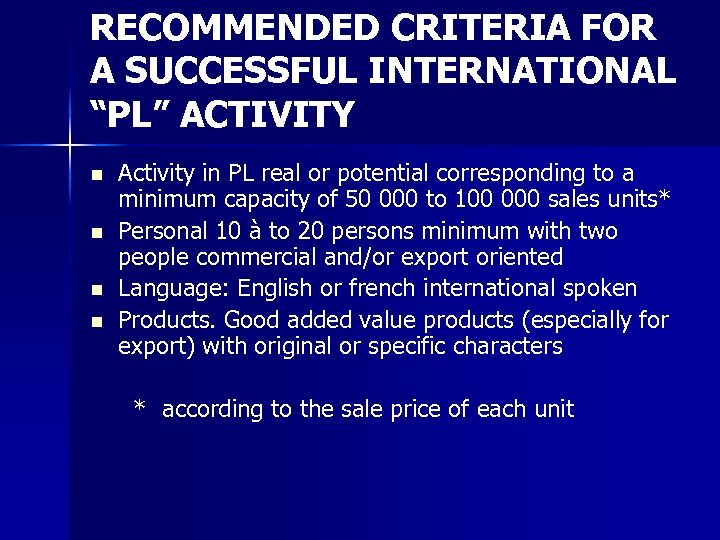

RECOMMENDED CRITERIA FOR A SUCCESSFUL INTERNATIONAL “PL” ACTIVITY n n Activity in PL real or potential corresponding to a minimum capacity of 50 000 to 100 000 sales units* Personal 10 à to 20 persons minimum with two people commercial and/or export oriented Language: English or french international spoken Products. Good added value products (especially for export) with original or specific characters * according to the sale price of each unit

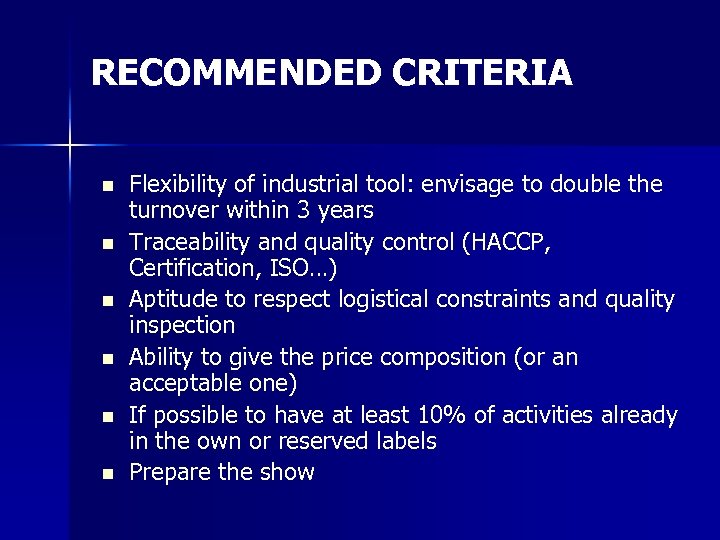

RECOMMENDED CRITERIA n n n Flexibility of industrial tool: envisage to double the turnover within 3 years Traceability and quality control (HACCP, Certification, ISO…) Aptitude to respect logistical constraints and quality inspection Ability to give the price composition (or an acceptable one) If possible to have at least 10% of activities already in the own or reserved labels Prepare the show

AS A GENERAL CONCLUSION PRIVATE LABEL MARKET IS: n A growing market n A profitable market n A “niche” market for small/medium size companies WHY DON’T YOU JOIN US AND TAKE ADVANTAGE OF IT?

Thank you for your attention

c7eea67bfe41aacd7683ea69144c215b.ppt