fdeb055423fb3a329b8221da88cbd5df.ppt

- Количество слайдов: 34

Private Equity Raoul Hughes

> The Observer 18 March 2007 – “Barbarians back at the Gate” > Financial Times 16 March 2007 – “Unions demand G 8 motion on Private Equity” > The Observer 11 March 2007 – “Concern grows about tax avoidance and windfall profits” > The Independent 9 February 2007 – “Rodeo capitalism of Private Equity” > The Guardian 26 January 2007 – “Buy it, Strip it, Flip it” > Daily Mail 21 February 2007 – “Private Equity under Siege” | 2 |

> Financial Times 2 April 2007 – “FT probe finds many private equity deals add staff” > Daily Telegraph 28 February 2007 – “Private Equity firms are a success story” > The Independent 25 February 2007 – “Blair lands economic boom of Private Equity” > The Guardian 23 February 2007 – “EU Commissioner praises Private Equity firms as economic saviours” | 3 |

Who am I > BSc (Hons) Business Administration at Bath in 1987 > Joined a London Investment Bank > 17 years in Venture Capital/Private Equity Industry > Partner and CFO Bridgepoint > Fellow Society of Turnaround Professionals | 4 |

Introduction > Statistics > Private Equity Business Model – Management Company – Investees > Couple of Examples of Recent Bridgepoint deals > Recruitment | 5 |

Bridgepoint In a few words… > A major international private equity group > A key Investment Manager for institutional investors around the world > A long-established buyer and seller of businesses across Europe In a few figures… > 50 investment professionals led by 19 partners > Buy Companies valued between € 100 million and € 1 billion > € 8 billion of committed capital raised to date > 150 deals in last 10 years worth over € 18 billion > Current portfolio of businesses with over 70, 000 employees > € 5 billion returned to investors since 2000 | 6 |

Private Equity in the UK > 20% of Private Sector employees work for businesses owned at some point by Private Equity > 1. 2 m people are currently employed in businesses backed by Private Equity > Over the five years to 2005/06 Private Equity-backed companies increased their staff levels by an average of 9% per annum (versus FTSE 100 and FTSE Mid-250 companies at 1% and 2% respectively) > Over the same period Private Equity-backed companies’ sales rose by 9% compared to FTSE 100 companies (7%) and FTSE Mid-250 companies (5%) > Private Equity-backed companies boost the UK economy – estimated that Private Equitybacked companies have generated sales of £ 424 bn, exports of £ 48 bn and contributed over £ 26 bn in taxes > Industry makes important contribution to UK financial services sector – financial & professional services firms earn an estimated £ 3. 3 bn in annual revenues from the private equity community (7% of total UK financial services industry turnover) Source: BVCA | 7 |

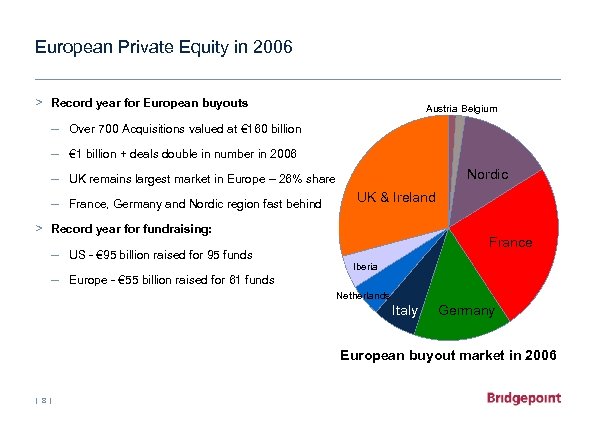

European Private Equity in 2006 > Record year for European buyouts Austria Belgium – Over 700 Acquisitions valued at € 160 billion – € 1 billion + deals double in number in 2006 Nordic – UK remains largest market in Europe – 26% share – France, Germany and Nordic region fast behind UK & Ireland > Record year for fundraising: – US - € 95 billion raised for 95 funds – Europe - € 55 billion raised for 61 funds France Iberia Netherlands Italy Germany European buyout market in 2006 | 8 |

Global Private Equity statistics Buyouts > Private Equity groups announced deals with a global value of more than $700 bn in 2006 > This was double the record set in 2005 and 20 times bigger than in 1996 Fundraising > 2006 – 684 new funds raised $432 bn globally – a 38% increase on 2005 > 2007 – global funds raised forecast to reach $500 bn Source: Thomson Financial & Private Equity International | 9 |

Introduction > Statistics > Private Equity Business Model – Management Company – Investees > Couple of Examples of Recent Bridgepoint deals > Recruitment | 10 |

Private Equity Business Model: Management Company > Form of Investment Manager > Raise Capital from Institutional Investors > Pension Funds, Endorsements, General Wealth Managers, Banks etc. > Annual Management Fee > Share in profits over hurdle return | 11 |

Private Equity Business Model: Management Company cont. > Funds have limited life > Money only used once > Drawdown when we buy a business > Return the Capital to our Investors on disposal > Target materially higher returns than quoted Markets > Return of 2. 5 – 3. 0 x money > IRR 25 – 30% per annum > Justifies why rational Investors will pay higher fees | 12 |

Introduction > Statistics > Private Equity Business Model – Management Company – Investees > Couple of Examples of Recent Bridgepoint deals > Recruitment | 13 |

Private Equity Investment Model: Investee Company > Coverage > Management > Focus / Accountability > Leverage | 14 |

Private Equity Investment Model: Coverage > Research > Market Breadth > What we do > Ability to identify opportunities | 15 |

Private Equity Investment Model: Management > We reward management teams through equity participation > Ownership mentality > Enables us to recruit better management than Company size would dictate > Capability and willingness affect change in teams | 16 |

Private Equity Investment Model: Focus > We sit on board of Investee Company > Owner at table > Wasted time on regulation, compliance or Investor relations > Focus on agreed common goals | 17 |

Private Equity Investment Model: Leverage > We buy businesses using third party Leverage > Able due to our approach and exit intentions to borrow significantly more than quoted or family owned businesses. | 18 |

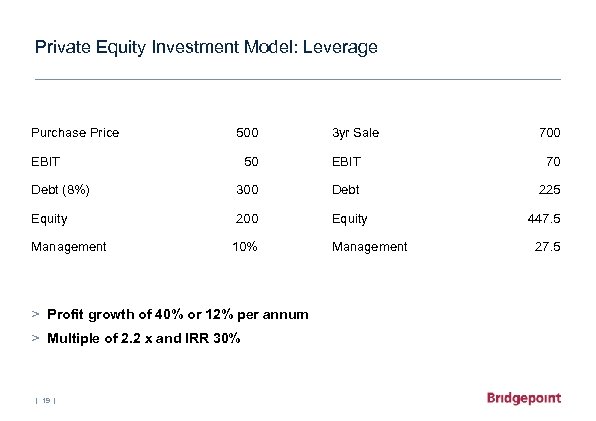

Private Equity Investment Model: Leverage Purchase Price 500 EBIT 3 yr Sale 700 50 EBIT 70 Debt (8%) 300 Debt 225 Equity 200 Equity Management 10% > Profit growth of 40% or 12% per annum > Multiple of 2. 2 x and IRR 30% | 19 | Management 447. 5 27. 5

Introduction > Statistics > Private Equity Business Model – Management Company – Investees > Couple of Examples of Recent Bridgepoint deals > Recruitment | 20 |

A typical Bridgepoint deal > Take a look at ERM | 21 |

A typical Bridgepoint deal > Take a look at ERM | 22 |

A typical Bridgepoint deal > Take a look at ERM – World’s largest specialist environmental consultancy business, operating in 39 countries with 2, 500 employees and over 100 offices – Senior management understood to be world class – Market growth of 5 -8% underpinned by legislative changes and increased public awareness of environmental responsibility – Highly profitable (20% net margins), cash generative and growing at 10 -15% p. a. – A branded people business worth € 400 m – € 500 m – Had just completed a five year transition restructuring the group to become a joined-up business | 23 |

What was the opportunity? > Market leader in a sector with strong regulatory and legislative drivers > Back a first rate and proven management team > Take a business which had been internally focused on becoming an integrated company and re-direct this energy into the market > Start utilising information from a new MIS to drive the business | 24 |

How did we win it? > We work in sector teams in London and have an on-going long range target list > ERM was identified as an interesting market leading business in 2004 > We met management in advance of the sale process and commissioned diligence on what we believed would be key issues | 25 |

What happened? > By the time the auction process kicked off we were already ahead > We got on with management > We had several official and unofficial lines of communication – helped differentiate the reality from the rumours > 5 people, 4 months, 100% of time and huge emotional energy | 26 |

A typical Bridgepoint deal: buy and build Building and Realising Value | 27 |

A typical Bridgepoint deal: buy and build Building and Realising Value | 28 |

A typical Bridgepoint deal: buy and build Building and Realising Value > Purchase of Chrysalis Plc television division – Unloved under-managed disparate group of TV production business in the UK, Holland New Zealand (!) within a plc which wanted to focus on radio – We saw opportunity to – Put in heavy hitting FTSE 100 team to get the business to work more collectively, applying stronger commercial acumen – Support management and business as a buy and build platform – Take advantage of positive market outlook – regulatory changes beneficial to independent producers, especially those with multiple genres – Take business to market leading position and create a “strategic must-have” asset for exit | 29 |

A typical Bridgepoint deal: buy and build Building and Realising Value – We bought business in 2003 for £ 45 m and re-branded as ALL 3 Media – We completed 3 material bolt-on acquisitions in 2004 and 2005 – Management materially improved businesses ‘ability to target broadcasters’ needs rather than push production companies’ internal projects – Created an umbrella structure allowing producers to produce and the commercial directors to negotiate and facilitate new business – The business grew from No. 3/4 in the UK market to No. 1 and EBITDA grew from c. £ 6 m to a run rate of over £ 30 m | 30 |

Issues and Outcome Building and Realising Value Exit – Despite initially thinking about an IPO, we opted to focus on PE and trade for deliverability – The vendor due diligence cost c. £ 2 m and was over 1, 500 pages – We sold to Permira who wanted to continue the acquisition path with management – On exit the business had grown to become the market leading independent producer and this delivered superior returns to our investors | 31 |

Introduction > Statistics > Private Equity Business Model – Management Company – Investees > Couple of Examples of Recent Bridgepoint deals > Recruitment | 32 |

Joining Private Equity Industry > Small Industry > Competition for place is fierce, quality of candidates exceptional > 5 new people to Investment Team at Junior level > We are completely different to an Investment Bank or Consultancy – Less structured, more responsibility, hands-on > Principal decisions | 33 |

Joining Private Equity Industry cont. Career Progression > Your first 3 -4 years would be hard work, but hugely rewarding > As part of a small team you will “touch and feel” the companies we are assessing > It’s not just about the maths – winning or losing the deals is almost always due to “soft issue” judgement calls – your opinion will be sought > You need to decide if the culture is for you – but for those who join, very few ever leave Rewards > High energy, stimulating work environment surrounded by ‘can do’ people > 1 st class introduction to private equity in Europe > You also get paid… | 34 |

fdeb055423fb3a329b8221da88cbd5df.ppt