e28cca702d371779ad5965b0aeb07ade.ppt

- Количество слайдов: 15

Private Equity in Turkey 5 th International Venture Capital Forum, Athens, June 16, 2004 Evren Ünver Director

Private Equity in Turkey 5 th International Venture Capital Forum, Athens, June 16, 2004 Evren Ünver Director

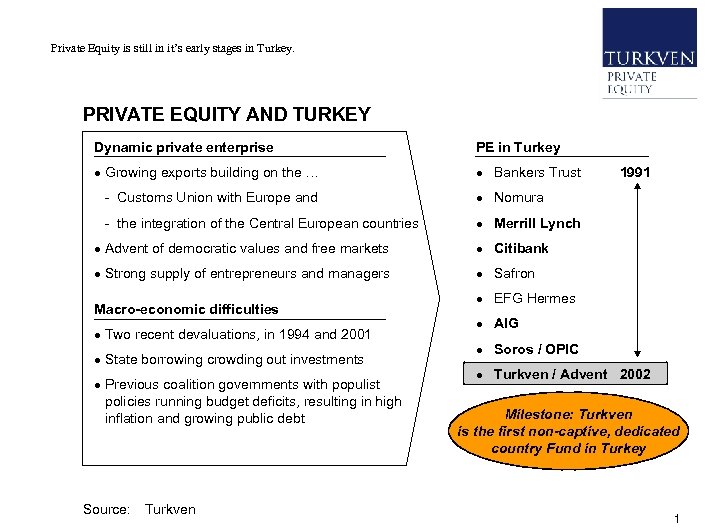

• Private Equity is still in it’s early stages in Turkey. PRIVATE EQUITY AND TURKEY Dynamic private enterprise PE in Turkey · Growing exports building on the … · Bankers Trust - Customs Union with Europe and · Nomura - the integration of the Central European countries 1991 · Merrill Lynch · Advent of democratic values and free markets · Citibank · Strong supply of entrepreneurs and managers · Safron Macro-economic difficulties · Two recent devaluations, in 1994 and 2001 · State borrowing crowding out investments · Previous coalition governments with populist policies running budget deficits, resulting in high inflation and growing public debt Source: Turkven · EFG Hermes · AIG · Soros / OPIC · Turkven / Advent 2002 Milestone: Turkven is the first non-captive, dedicated country Fund in Turkey 1

• Private Equity is still in it’s early stages in Turkey. PRIVATE EQUITY AND TURKEY Dynamic private enterprise PE in Turkey · Growing exports building on the … · Bankers Trust - Customs Union with Europe and · Nomura - the integration of the Central European countries 1991 · Merrill Lynch · Advent of democratic values and free markets · Citibank · Strong supply of entrepreneurs and managers · Safron Macro-economic difficulties · Two recent devaluations, in 1994 and 2001 · State borrowing crowding out investments · Previous coalition governments with populist policies running budget deficits, resulting in high inflation and growing public debt Source: Turkven · EFG Hermes · AIG · Soros / OPIC · Turkven / Advent 2002 Milestone: Turkven is the first non-captive, dedicated country Fund in Turkey 1

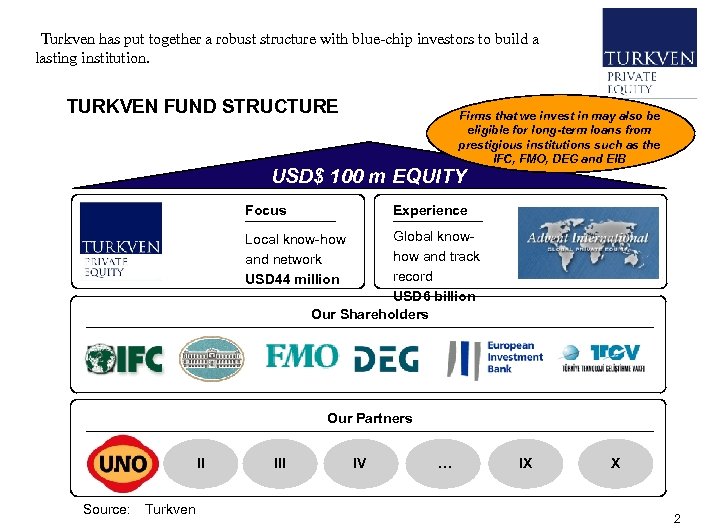

• Turkven has put together a robust structure with blue-chip investors to build a lasting institution. TURKVEN FUND STRUCTURE Firms that we invest in may also be eligible for long-term loans from prestigious institutions such as the IFC, FMO, DEG and EIB USD$ 100 m EQUITY Focus Experience Global knowhow and track record USD 6 billion Our Shareholders Local know-how and network USD 44 million Our Partners II Source: Turkven III IV … IX X 2

• Turkven has put together a robust structure with blue-chip investors to build a lasting institution. TURKVEN FUND STRUCTURE Firms that we invest in may also be eligible for long-term loans from prestigious institutions such as the IFC, FMO, DEG and EIB USD$ 100 m EQUITY Focus Experience Global knowhow and track record USD 6 billion Our Shareholders Local know-how and network USD 44 million Our Partners II Source: Turkven III IV … IX X 2

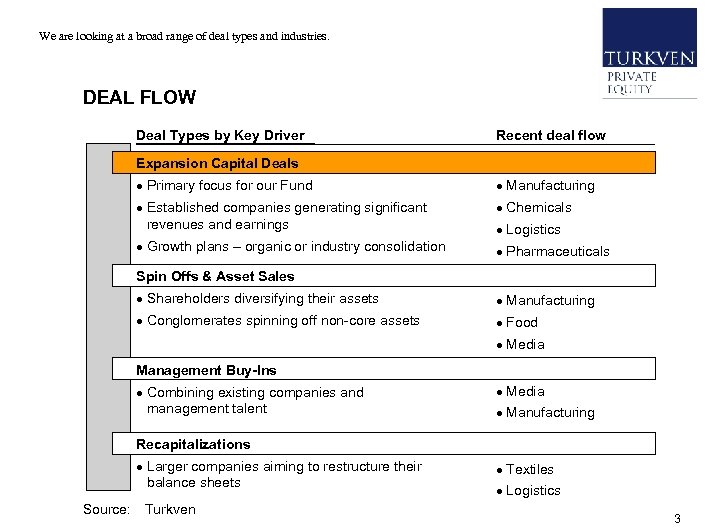

• We are looking at a broad range of deal types and industries. DEAL FLOW Deal Types by Key Driver Recent deal flow Expansion Capital Deals · Primary focus for our Fund · Manufacturing · Established companies generating significant revenues and earnings · Chemicals · Growth plans – organic or industry consolidation · Pharmaceuticals · Logistics Spin Offs & Asset Sales · Shareholders diversifying their assets · Manufacturing · Conglomerates spinning off non-core assets · Food · Media Management Buy-Ins · Combining existing companies and management talent · Media · Manufacturing Recapitalizations · Larger companies aiming to restructure their balance sheets Source: Turkven · Textiles · Logistics 3

• We are looking at a broad range of deal types and industries. DEAL FLOW Deal Types by Key Driver Recent deal flow Expansion Capital Deals · Primary focus for our Fund · Manufacturing · Established companies generating significant revenues and earnings · Chemicals · Growth plans – organic or industry consolidation · Pharmaceuticals · Logistics Spin Offs & Asset Sales · Shareholders diversifying their assets · Manufacturing · Conglomerates spinning off non-core assets · Food · Media Management Buy-Ins · Combining existing companies and management talent · Media · Manufacturing Recapitalizations · Larger companies aiming to restructure their balance sheets Source: Turkven · Textiles · Logistics 3

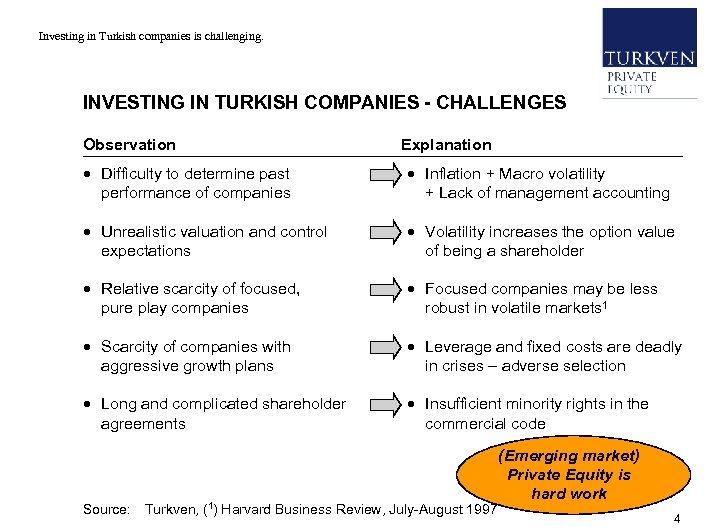

• Investing in Turkish companies is challenging. INVESTING IN TURKISH COMPANIES - CHALLENGES Observation Explanation · Difficulty to determine past performance of companies · Inflation + Macro volatility + Lack of management accounting · Unrealistic valuation and control expectations · Volatility increases the option value of being a shareholder · Relative scarcity of focused, pure play companies · Focused companies may be less robust in volatile markets 1 · Scarcity of companies with aggressive growth plans · Leverage and fixed costs are deadly in crises – adverse selection · Long and complicated shareholder agreements · Insufficient minority rights in the commercial code Source: Turkven, (1) Harvard Business Review, July-August 1997 (Emerging market) Private Equity is hard work 4

• Investing in Turkish companies is challenging. INVESTING IN TURKISH COMPANIES - CHALLENGES Observation Explanation · Difficulty to determine past performance of companies · Inflation + Macro volatility + Lack of management accounting · Unrealistic valuation and control expectations · Volatility increases the option value of being a shareholder · Relative scarcity of focused, pure play companies · Focused companies may be less robust in volatile markets 1 · Scarcity of companies with aggressive growth plans · Leverage and fixed costs are deadly in crises – adverse selection · Long and complicated shareholder agreements · Insufficient minority rights in the commercial code Source: Turkven, (1) Harvard Business Review, July-August 1997 (Emerging market) Private Equity is hard work 4

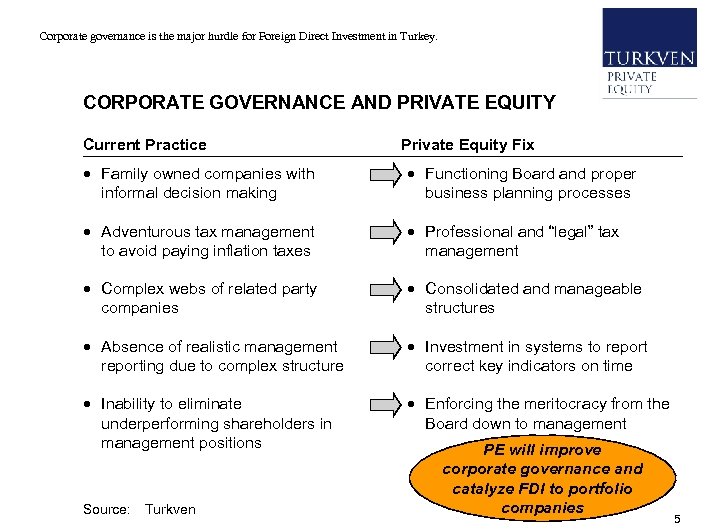

• Corporate governance is the major hurdle for Foreign Direct Investment in Turkey. CORPORATE GOVERNANCE AND PRIVATE EQUITY Current Practice Private Equity Fix · Family owned companies with informal decision making · Functioning Board and proper business planning processes · Adventurous tax management to avoid paying inflation taxes · Professional and “legal” tax management · Complex webs of related party companies · Consolidated and manageable structures · Absence of realistic management reporting due to complex structure · Investment in systems to report correct key indicators on time · Inability to eliminate underperforming shareholders in management positions · Enforcing the meritocracy from the Board down to management Source: Turkven PE will improve corporate governance and catalyze FDI to portfolio companies 5

• Corporate governance is the major hurdle for Foreign Direct Investment in Turkey. CORPORATE GOVERNANCE AND PRIVATE EQUITY Current Practice Private Equity Fix · Family owned companies with informal decision making · Functioning Board and proper business planning processes · Adventurous tax management to avoid paying inflation taxes · Professional and “legal” tax management · Complex webs of related party companies · Consolidated and manageable structures · Absence of realistic management reporting due to complex structure · Investment in systems to report correct key indicators on time · Inability to eliminate underperforming shareholders in management positions · Enforcing the meritocracy from the Board down to management Source: Turkven PE will improve corporate governance and catalyze FDI to portfolio companies 5

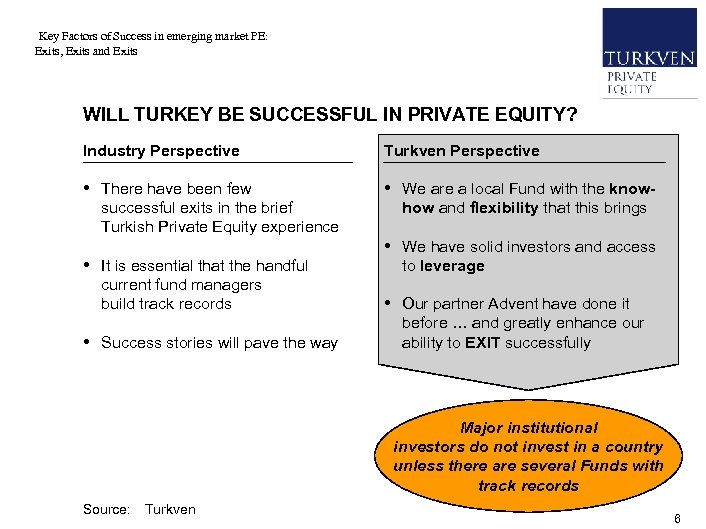

• Key Factors of Success in emerging market PE: Exits, Exits and Exits WILL TURKEY BE SUCCESSFUL IN PRIVATE EQUITY? Industry Perspective Turkven Perspective • There have been few • We are a local Fund with the know- successful exits in the brief Turkish Private Equity experience • It is essential that the handful current fund managers build track records • Success stories will pave the way how and flexibility that this brings • We have solid investors and access to leverage • Our partner Advent have done it before … and greatly enhance our ability to EXIT successfully Major institutional investors do not invest in a country unless there are several Funds with track records Source: Turkven 6

• Key Factors of Success in emerging market PE: Exits, Exits and Exits WILL TURKEY BE SUCCESSFUL IN PRIVATE EQUITY? Industry Perspective Turkven Perspective • There have been few • We are a local Fund with the know- successful exits in the brief Turkish Private Equity experience • It is essential that the handful current fund managers build track records • Success stories will pave the way how and flexibility that this brings • We have solid investors and access to leverage • Our partner Advent have done it before … and greatly enhance our ability to EXIT successfully Major institutional investors do not invest in a country unless there are several Funds with track records Source: Turkven 6

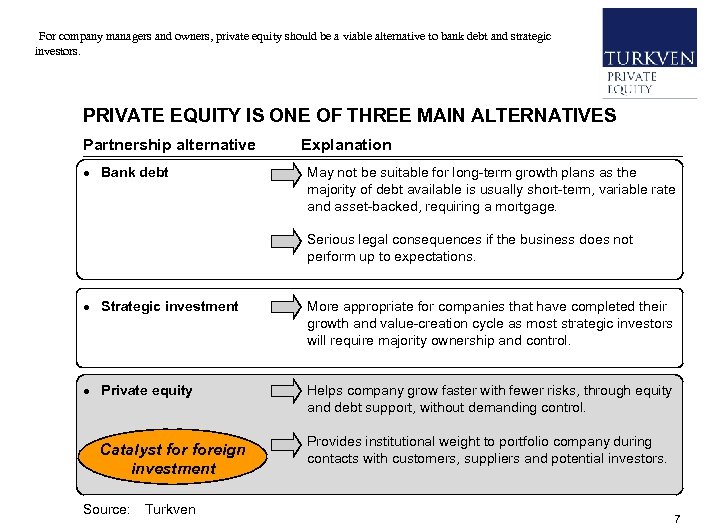

• For company managers and owners, private equity should be a viable alternative to bank debt and strategic investors. PRIVATE EQUITY IS ONE OF THREE MAIN ALTERNATIVES Partnership alternative · Bank debt Explanation May not be suitable for long-term growth plans as the majority of debt available is usually short-term, variable rate and asset-backed, requiring a mortgage. Serious legal consequences if the business does not perform up to expectations. · Strategic investment More appropriate for companies that have completed their growth and value-creation cycle as most strategic investors will require majority ownership and control. · Private equity Helps company grow faster with fewer risks, through equity and debt support, without demanding control. Catalyst foreign investment Source: Turkven Provides institutional weight to portfolio company during contacts with customers, suppliers and potential investors. 7

• For company managers and owners, private equity should be a viable alternative to bank debt and strategic investors. PRIVATE EQUITY IS ONE OF THREE MAIN ALTERNATIVES Partnership alternative · Bank debt Explanation May not be suitable for long-term growth plans as the majority of debt available is usually short-term, variable rate and asset-backed, requiring a mortgage. Serious legal consequences if the business does not perform up to expectations. · Strategic investment More appropriate for companies that have completed their growth and value-creation cycle as most strategic investors will require majority ownership and control. · Private equity Helps company grow faster with fewer risks, through equity and debt support, without demanding control. Catalyst foreign investment Source: Turkven Provides institutional weight to portfolio company during contacts with customers, suppliers and potential investors. 7

• We are meeting 15 new companies from all sectors every month, and select those with strategic exit potential. TARGET INDUSTRIES Industry • • • Comment • Logistics • Automotive Parts • Business Services • Food and Beverage • Durable Goods • Packaging • Chemicals • Construction Mat. • Media • . . . • Start-Ups • Pharma Source: Turkven Generic manufacturers with market share 3 PL services We like to invest USD 10 -20 million of equity per deal System manufacturers Services to blue-chip clients Strong brand distribution Component manufacturers High end food packaging Focused players with high market share Radio, Outdoor, Services. . . Only proven management teams We invest if we believe in STRATEGIC EXIT POTENTIAL within 4 years 8

• We are meeting 15 new companies from all sectors every month, and select those with strategic exit potential. TARGET INDUSTRIES Industry • • • Comment • Logistics • Automotive Parts • Business Services • Food and Beverage • Durable Goods • Packaging • Chemicals • Construction Mat. • Media • . . . • Start-Ups • Pharma Source: Turkven Generic manufacturers with market share 3 PL services We like to invest USD 10 -20 million of equity per deal System manufacturers Services to blue-chip clients Strong brand distribution Component manufacturers High end food packaging Focused players with high market share Radio, Outdoor, Services. . . Only proven management teams We invest if we believe in STRATEGIC EXIT POTENTIAL within 4 years 8

• Turkven aims to invest in 8 -10 companies over the next 4 years. TURKVEN INVESTMENT CRITERIA Criteria Explanation OPEN TO PARTNERSHIP • Shareholders and managers with a desire to partner with international firms MANAGEMENT • Successful and trustworthy management team • Shareholders open to institutionalisation SECTORAL STANDING • Strong market positioning with scale economies • Companies with USD$ 10 -100 million sales GROWTH POTENTIAL • Strong, sustainable sales and profitability growth potential Source: Turkven 9

• Turkven aims to invest in 8 -10 companies over the next 4 years. TURKVEN INVESTMENT CRITERIA Criteria Explanation OPEN TO PARTNERSHIP • Shareholders and managers with a desire to partner with international firms MANAGEMENT • Successful and trustworthy management team • Shareholders open to institutionalisation SECTORAL STANDING • Strong market positioning with scale economies • Companies with USD$ 10 -100 million sales GROWTH POTENTIAL • Strong, sustainable sales and profitability growth potential Source: Turkven 9

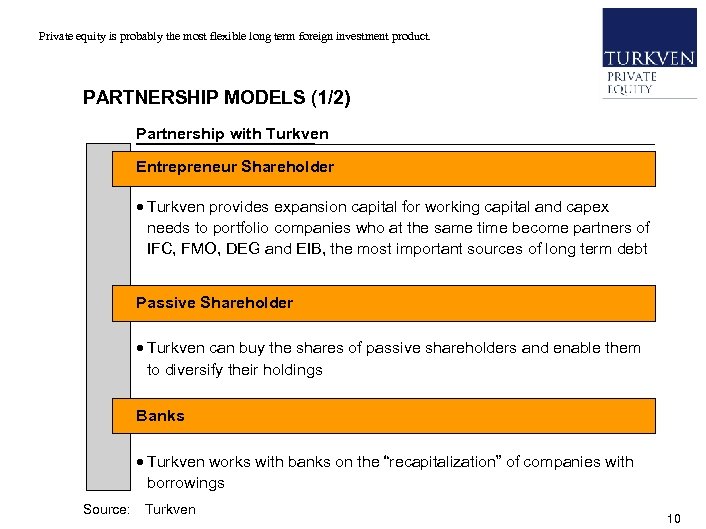

• Private equity is probably the most flexible long term foreign investment product. PARTNERSHIP MODELS (1/2) Partnership with Turkven Entrepreneur Shareholder · Turkven provides expansion capital for working capital and capex needs to portfolio companies who at the same time become partners of IFC, FMO, DEG and EIB, the most important sources of long term debt Passive Shareholder · Turkven can buy the shares of passive shareholders and enable them to diversify their holdings Banks · Turkven works with banks on the “recapitalization” of companies with borrowings Source: Turkven 10

• Private equity is probably the most flexible long term foreign investment product. PARTNERSHIP MODELS (1/2) Partnership with Turkven Entrepreneur Shareholder · Turkven provides expansion capital for working capital and capex needs to portfolio companies who at the same time become partners of IFC, FMO, DEG and EIB, the most important sources of long term debt Passive Shareholder · Turkven can buy the shares of passive shareholders and enable them to diversify their holdings Banks · Turkven works with banks on the “recapitalization” of companies with borrowings Source: Turkven 10

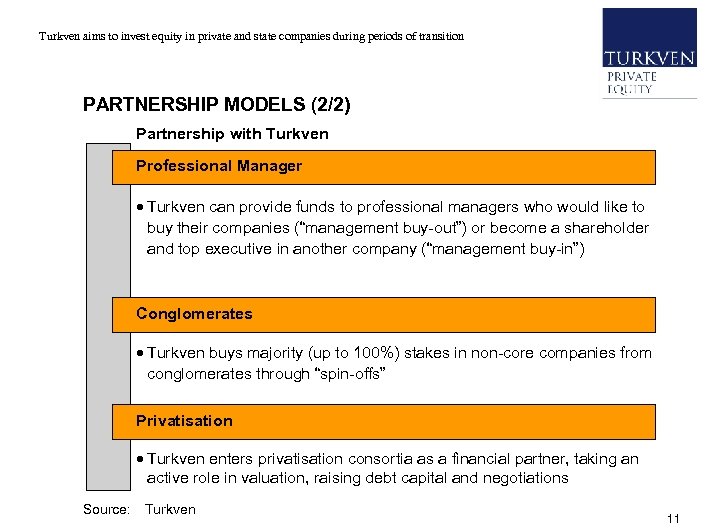

• Turkven aims to invest equity in private and state companies during periods of transition PARTNERSHIP MODELS (2/2) Partnership with Turkven Professional Manager · Turkven can provide funds to professional managers who would like to buy their companies (“management buy-out”) or become a shareholder and top executive in another company (“management buy-in”) Conglomerates · Turkven buys majority (up to 100%) stakes in non-core companies from conglomerates through “spin-offs” Privatisation · Turkven enters privatisation consortia as a financial partner, taking an active role in valuation, raising debt capital and negotiations Source: Turkven 11

• Turkven aims to invest equity in private and state companies during periods of transition PARTNERSHIP MODELS (2/2) Partnership with Turkven Professional Manager · Turkven can provide funds to professional managers who would like to buy their companies (“management buy-out”) or become a shareholder and top executive in another company (“management buy-in”) Conglomerates · Turkven buys majority (up to 100%) stakes in non-core companies from conglomerates through “spin-offs” Privatisation · Turkven enters privatisation consortia as a financial partner, taking an active role in valuation, raising debt capital and negotiations Source: Turkven 11

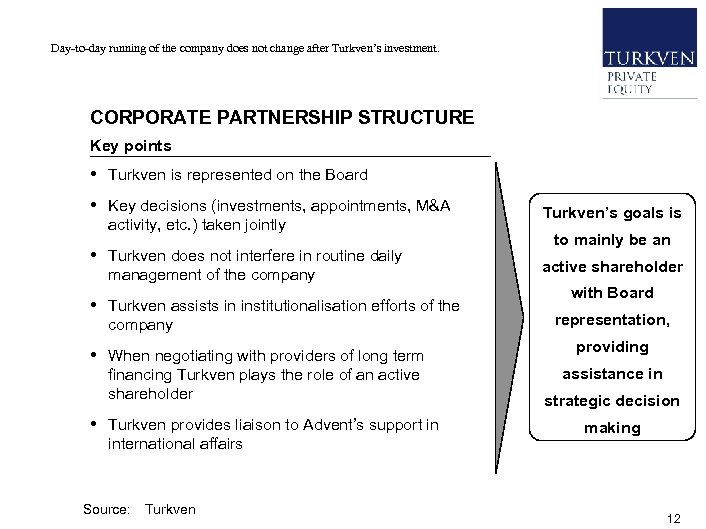

• Day-to-day running of the company does not change after Turkven’s investment. CORPORATE PARTNERSHIP STRUCTURE Key points • Turkven is represented on the Board • Key decisions (investments, appointments, M&A activity, etc. ) taken jointly • Turkven does not interfere in routine daily management of the company • Turkven assists in institutionalisation efforts of the company • When negotiating with providers of long term Turkven’s goals is to mainly be an active shareholder with Board representation, providing assistance in financing Turkven plays the role of an active shareholder strategic decision • Turkven provides liaison to Advent’s support in making international affairs Source: Turkven 12

• Day-to-day running of the company does not change after Turkven’s investment. CORPORATE PARTNERSHIP STRUCTURE Key points • Turkven is represented on the Board • Key decisions (investments, appointments, M&A activity, etc. ) taken jointly • Turkven does not interfere in routine daily management of the company • Turkven assists in institutionalisation efforts of the company • When negotiating with providers of long term Turkven’s goals is to mainly be an active shareholder with Board representation, providing assistance in financing Turkven plays the role of an active shareholder strategic decision • Turkven provides liaison to Advent’s support in making international affairs Source: Turkven 12

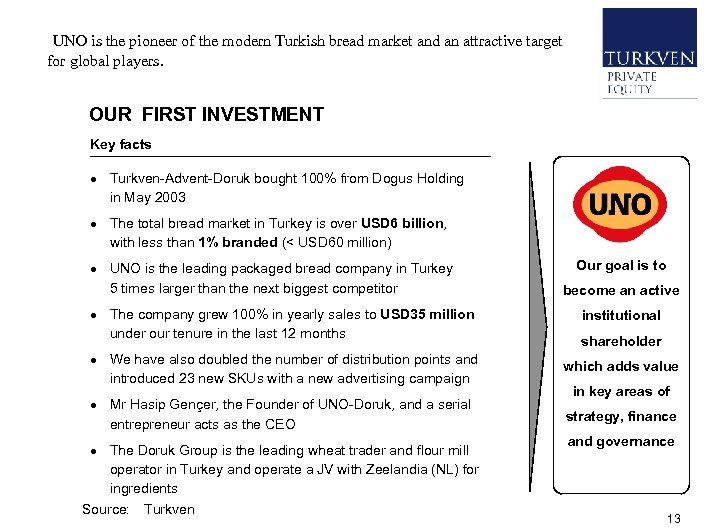

• UNO is the pioneer of the modern Turkish bread market and an attractive target for global players. OUR FIRST INVESTMENT Key facts · Turkven-Advent-Doruk bought 100% from Dogus Holding in May 2003 · The total bread market in Turkey is over USD 6 billion, with less than 1% branded (< USD 60 million) · UNO is the leading packaged bread company in Turkey 5 times larger than the next biggest competitor · The company grew 100% in yearly sales to USD 35 million under our tenure in the last 12 months Our goal is to become an active institutional shareholder · We have also doubled the number of distribution points and introduced 23 new SKUs with a new advertising campaign which adds value · Mr Hasip Gençer, the Founder of UNO-Doruk, and a serial entrepreneur acts as the CEO strategy, finance · The Doruk Group is the leading wheat trader and flour mill operator in Turkey and operate a JV with Zeelandia (NL) for ingredients Source: Turkven in key areas of and governance 13

• UNO is the pioneer of the modern Turkish bread market and an attractive target for global players. OUR FIRST INVESTMENT Key facts · Turkven-Advent-Doruk bought 100% from Dogus Holding in May 2003 · The total bread market in Turkey is over USD 6 billion, with less than 1% branded (< USD 60 million) · UNO is the leading packaged bread company in Turkey 5 times larger than the next biggest competitor · The company grew 100% in yearly sales to USD 35 million under our tenure in the last 12 months Our goal is to become an active institutional shareholder · We have also doubled the number of distribution points and introduced 23 new SKUs with a new advertising campaign which adds value · Mr Hasip Gençer, the Founder of UNO-Doruk, and a serial entrepreneur acts as the CEO strategy, finance · The Doruk Group is the leading wheat trader and flour mill operator in Turkey and operate a JV with Zeelandia (NL) for ingredients Source: Turkven in key areas of and governance 13

Abdi Ipekci Caddesi 23/5, Orjin Han, 80200 Nisantasi, Istanbul Tel: +90 (212) 291 56 30 - Fax: +90 (212) 291 56 36 www. turkven. com www. adventinternational. com 14

Abdi Ipekci Caddesi 23/5, Orjin Han, 80200 Nisantasi, Istanbul Tel: +90 (212) 291 56 30 - Fax: +90 (212) 291 56 36 www. turkven. com www. adventinternational. com 14