ed17d1858d1fc83051e33d9fa04b99a6.ppt

- Количество слайдов: 40

Private equity as an asset class in the region: a multi-focal approach Prof. Luc Nijs Founder & Chairman Horizon Ltd Istanbul April 27 -28, 2009 Buy-outs & growth capital in the Balkans and emerging markets 2009

Private equity as an asset class in the region: a multi-focal approach Prof. Luc Nijs Founder & Chairman Horizon Ltd Istanbul April 27 -28, 2009 Buy-outs & growth capital in the Balkans and emerging markets 2009

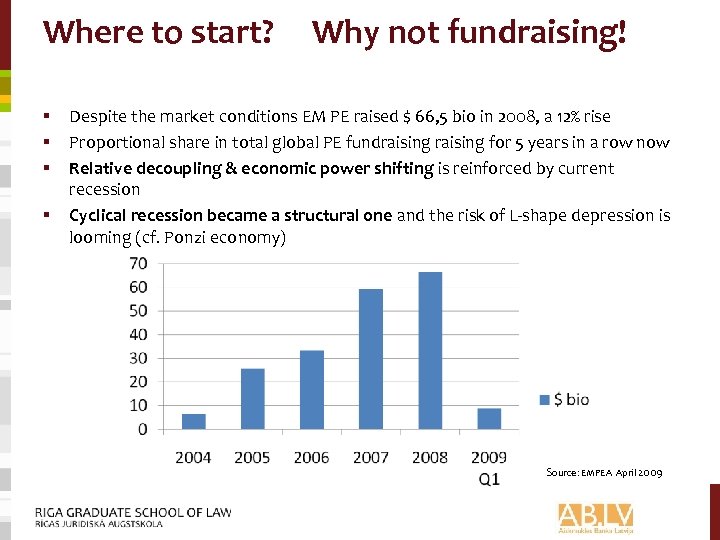

Where to start? § § Why not fundraising! Despite the market conditions EM PE raised $ 66, 5 bio in 2008, a 12% rise Proportional share in total global PE fundraising for 5 years in a row now Relative decoupling & economic power shifting is reinforced by current recession Cyclical recession became a structural one and the risk of L-shape depression is looming (cf. Ponzi economy) Source: EMPEA April 2009

Where to start? § § Why not fundraising! Despite the market conditions EM PE raised $ 66, 5 bio in 2008, a 12% rise Proportional share in total global PE fundraising for 5 years in a row now Relative decoupling & economic power shifting is reinforced by current recession Cyclical recession became a structural one and the risk of L-shape depression is looming (cf. Ponzi economy) Source: EMPEA April 2009

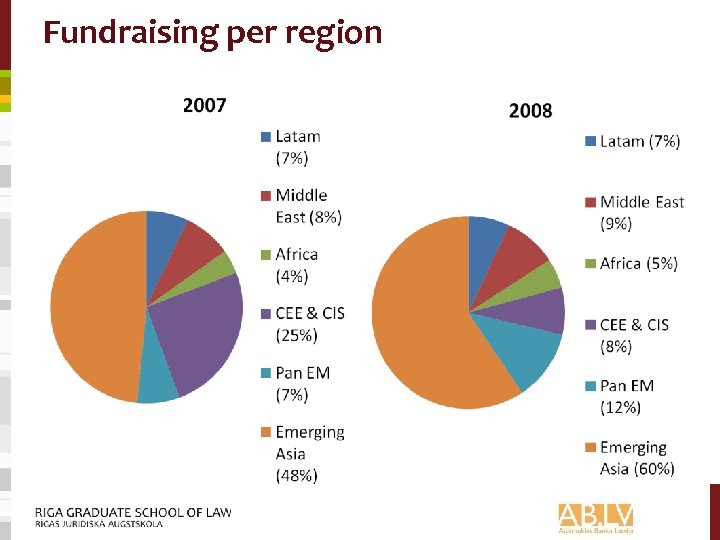

Fundraising per region

Fundraising per region

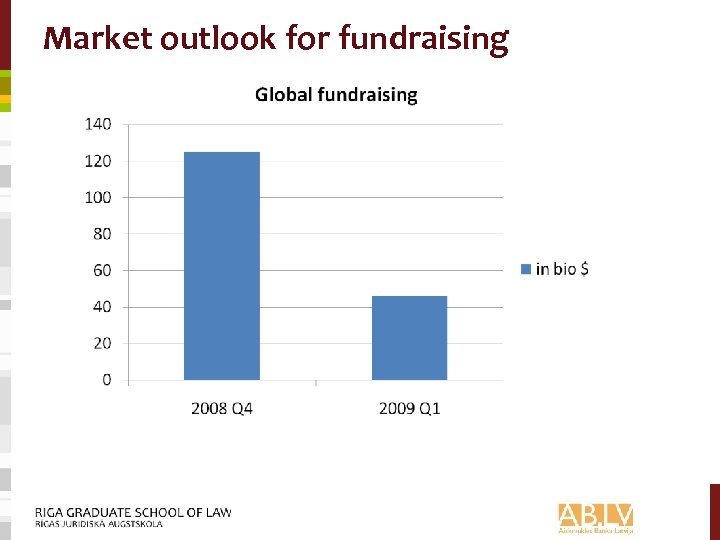

Market outlook for fundraising

Market outlook for fundraising

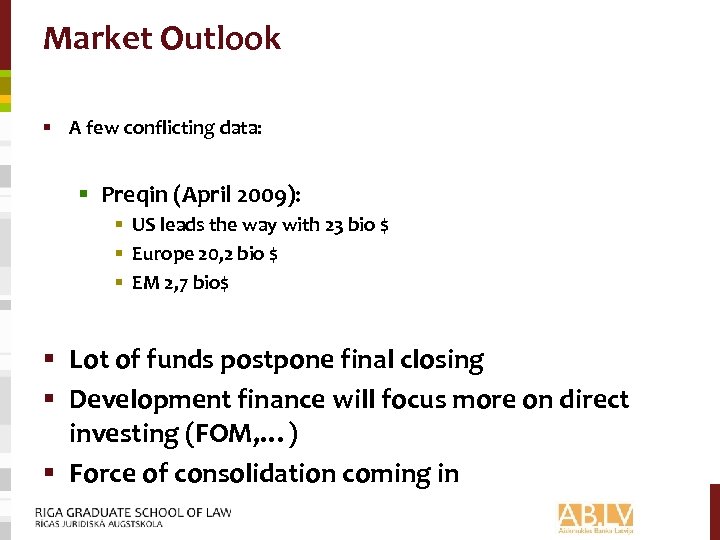

Market Outlook § A few conflicting data: § Preqin (April 2009): § US leads the way with 23 bio $ § Europe 20, 2 bio $ § EM 2, 7 bio$ § Lot of funds postpone final closing § Development finance will focus more on direct investing (FOM, …) § Force of consolidation coming in

Market Outlook § A few conflicting data: § Preqin (April 2009): § US leads the way with 23 bio $ § Europe 20, 2 bio $ § EM 2, 7 bio$ § Lot of funds postpone final closing § Development finance will focus more on direct investing (FOM, …) § Force of consolidation coming in

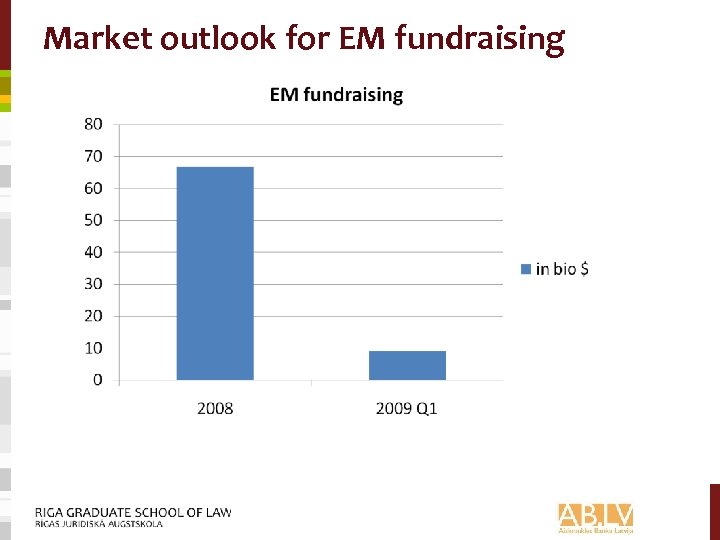

Market outlook for EM fundraising

Market outlook for EM fundraising

Market Outlook § Argumentation for EM proposition: § Resilient growth § Less use of leverage § Wider CEE massively impacted § 20% of investors refer to increase EM risk

Market Outlook § Argumentation for EM proposition: § Resilient growth § Less use of leverage § Wider CEE massively impacted § 20% of investors refer to increase EM risk

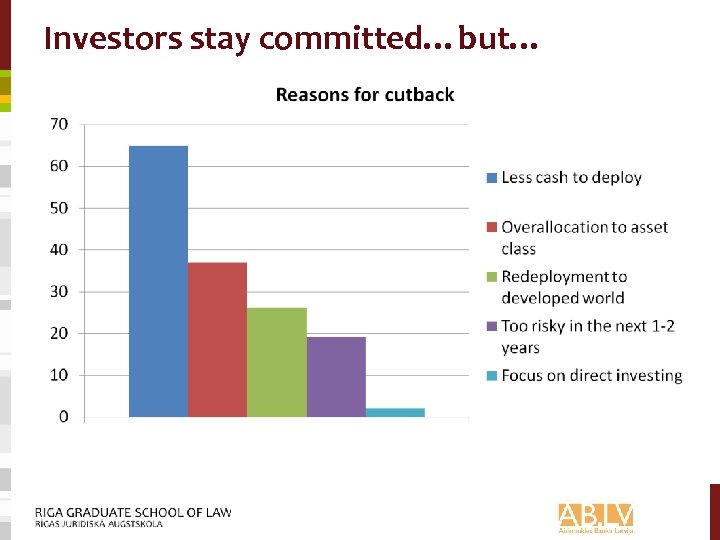

Investors stay committed…but…

Investors stay committed…but…

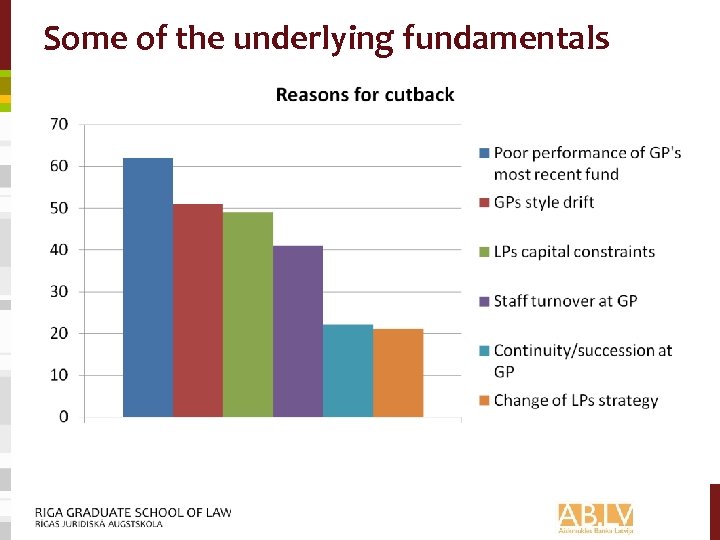

Some of the underlying fundamentals

Some of the underlying fundamentals

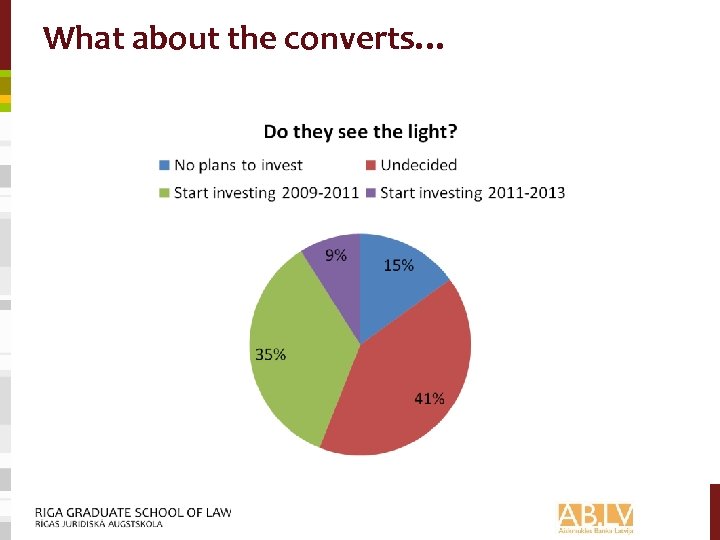

What about the converts…

What about the converts…

Market Outlook § Argumentation for refusal of EM proposition: § (Short-term) EM risk § Lack of experience in EMs § Only few quality GPs available in EMs § Quantitative easing and systemic risk?

Market Outlook § Argumentation for refusal of EM proposition: § (Short-term) EM risk § Lack of experience in EMs § Only few quality GPs available in EMs § Quantitative easing and systemic risk?

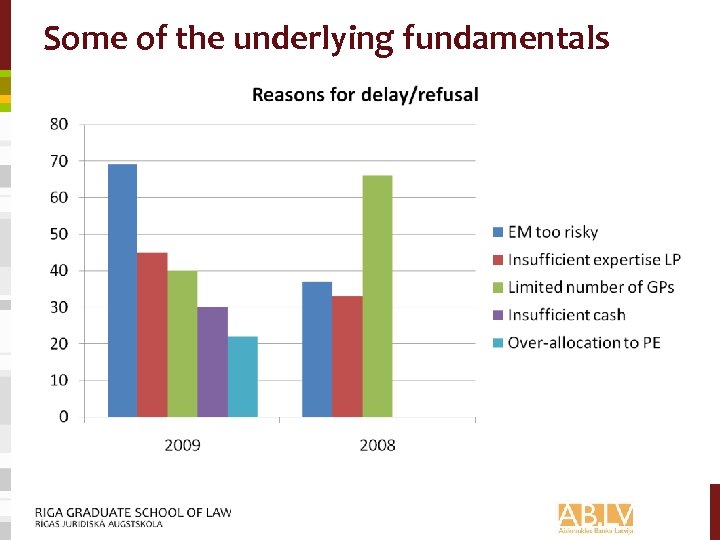

Some of the underlying fundamentals

Some of the underlying fundamentals

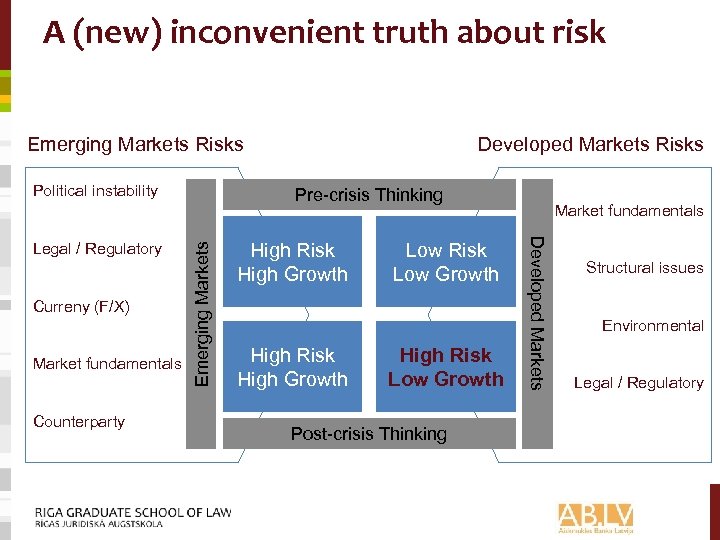

A (new) inconvenient truth about risk Emerging Markets Risks Political instability Market fundamentals Counterparty Emerging Markets Curreny (F/X) Pre-crisis Thinking High Risk High Growth Low Risk Low Growth High Risk Low Growth Post-crisis Thinking Market fundamentals Developed Markets Legal / Regulatory Developed Markets Risks Structural issues Environmental Legal / Regulatory

A (new) inconvenient truth about risk Emerging Markets Risks Political instability Market fundamentals Counterparty Emerging Markets Curreny (F/X) Pre-crisis Thinking High Risk High Growth Low Risk Low Growth High Risk Low Growth Post-crisis Thinking Market fundamentals Developed Markets Legal / Regulatory Developed Markets Risks Structural issues Environmental Legal / Regulatory

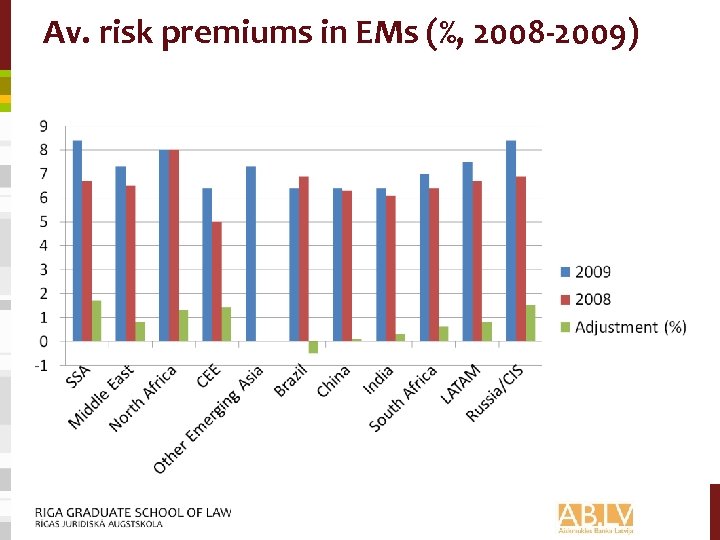

Av. risk premiums in EMs (%, 2008 -2009)

Av. risk premiums in EMs (%, 2008 -2009)

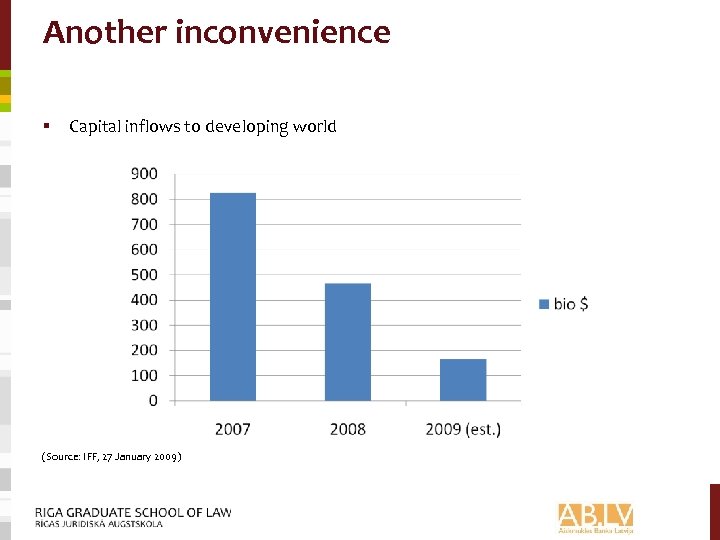

Another inconvenience § Capital inflows to developing world (Source: IFF, 27 January 2009)

Another inconvenience § Capital inflows to developing world (Source: IFF, 27 January 2009)

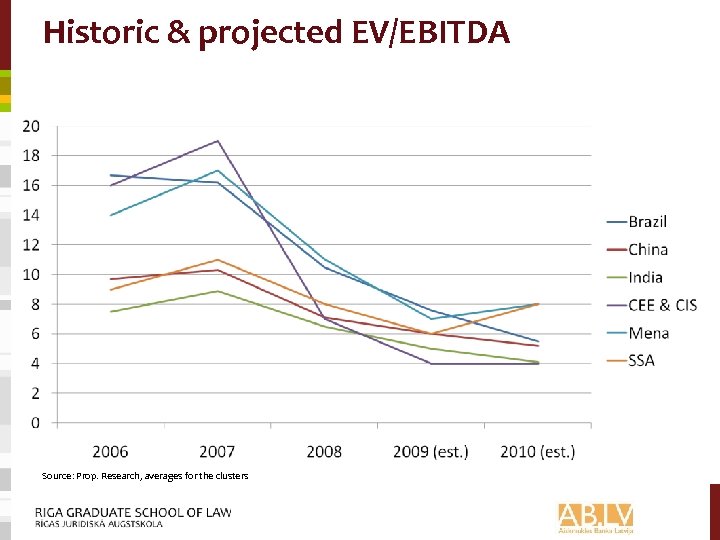

Historic & projected EV/EBITDA Source: Prop. Research, averages for the clusters

Historic & projected EV/EBITDA Source: Prop. Research, averages for the clusters

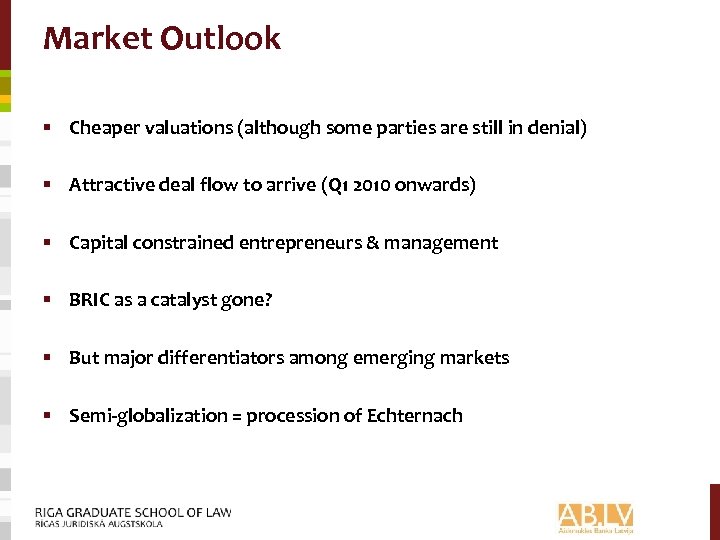

Market Outlook § Cheaper valuations (although some parties are still in denial) § Attractive deal flow to arrive (Q 1 2010 onwards) § Capital constrained entrepreneurs & management § BRIC as a catalyst gone? § But major differentiators among emerging markets § Semi-globalization = procession of Echternach

Market Outlook § Cheaper valuations (although some parties are still in denial) § Attractive deal flow to arrive (Q 1 2010 onwards) § Capital constrained entrepreneurs & management § BRIC as a catalyst gone? § But major differentiators among emerging markets § Semi-globalization = procession of Echternach

Market Outlook But major differentiators among emerging markets § CEE & CIS: § Sovereign risk & currency management § Debt-financed growth model is broke § Euro and Nordic currency infrastructure has eroded fundamentals § Mid/Long term catch-up dynamics still in place § South-East Europe & Turkey still attractive § Russia has a significant implied X-factor at present time § MENA: § Undeniable impact on economy § SWFs are diverting capital flows back home § Mid/Long term outlook still positive § Valuations in region still need recalibration to new reality

Market Outlook But major differentiators among emerging markets § CEE & CIS: § Sovereign risk & currency management § Debt-financed growth model is broke § Euro and Nordic currency infrastructure has eroded fundamentals § Mid/Long term catch-up dynamics still in place § South-East Europe & Turkey still attractive § Russia has a significant implied X-factor at present time § MENA: § Undeniable impact on economy § SWFs are diverting capital flows back home § Mid/Long term outlook still positive § Valuations in region still need recalibration to new reality

Market Outlook But major differentiators among emerging markets § Mena: § Still growth but impact of the credit situation trickling down § Commodity play § Sector focus § Sub-Saharan Africa: § Limited effect of credit situation § Tremendous improvement in investment environment § Good risk-adjusted returns § GDP growth & overall economic development decoupled from commodity play

Market Outlook But major differentiators among emerging markets § Mena: § Still growth but impact of the credit situation trickling down § Commodity play § Sector focus § Sub-Saharan Africa: § Limited effect of credit situation § Tremendous improvement in investment environment § Good risk-adjusted returns § GDP growth & overall economic development decoupled from commodity play

Market Outlook But major differentiators among emerging markets § Asia: § China as a manufacturing hub § Semi-globalization shows § Global gross capital formation (cross-border at risk) § Unrealistic valuations in India at present § Volume of investments dropped 38, 5 % in 2008 to $ 10, 7 bio and are expected to drop to $ 5 bio this year § 3/4 th of PE investments were done in listed entities § Can they become our customers of last resort? § Social unrest might destabilize the vulnerable progress made § South Korea, Singapore, Malaysia etc weak on their feet for the time to come

Market Outlook But major differentiators among emerging markets § Asia: § China as a manufacturing hub § Semi-globalization shows § Global gross capital formation (cross-border at risk) § Unrealistic valuations in India at present § Volume of investments dropped 38, 5 % in 2008 to $ 10, 7 bio and are expected to drop to $ 5 bio this year § 3/4 th of PE investments were done in listed entities § Can they become our customers of last resort? § Social unrest might destabilize the vulnerable progress made § South Korea, Singapore, Malaysia etc weak on their feet for the time to come

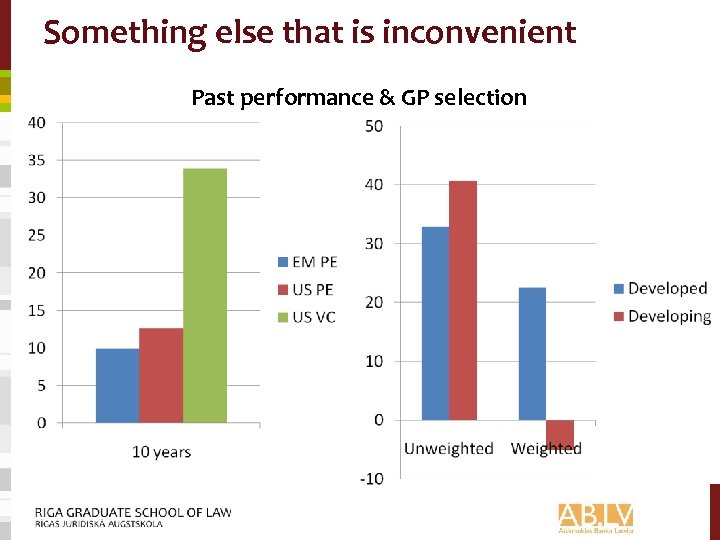

Something else that is inconvenient Past performance & GP selection

Something else that is inconvenient Past performance & GP selection

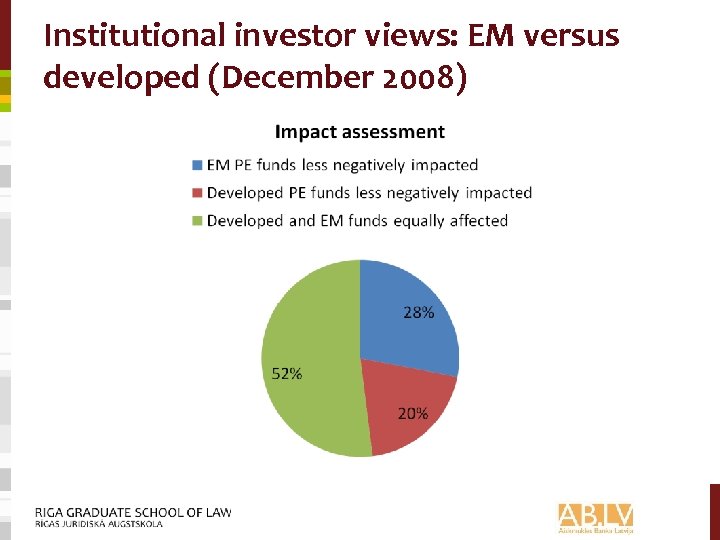

Institutional investor views: EM versus developed (December 2008)

Institutional investor views: EM versus developed (December 2008)

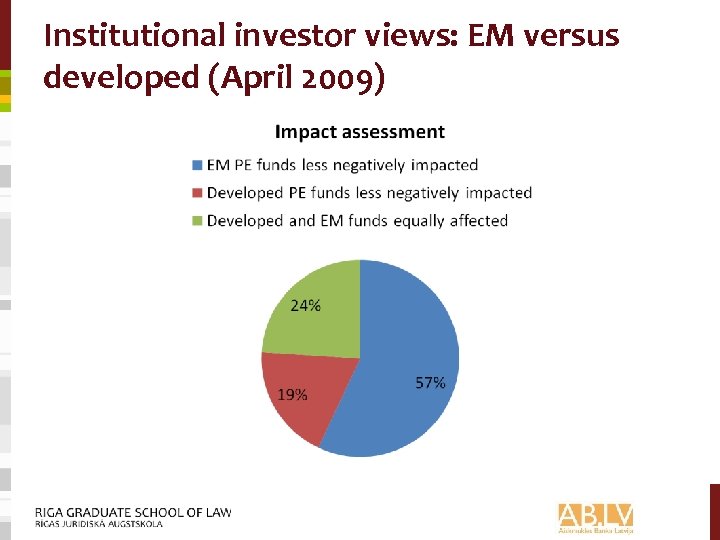

Institutional investor views: EM versus developed (April 2009)

Institutional investor views: EM versus developed (April 2009)

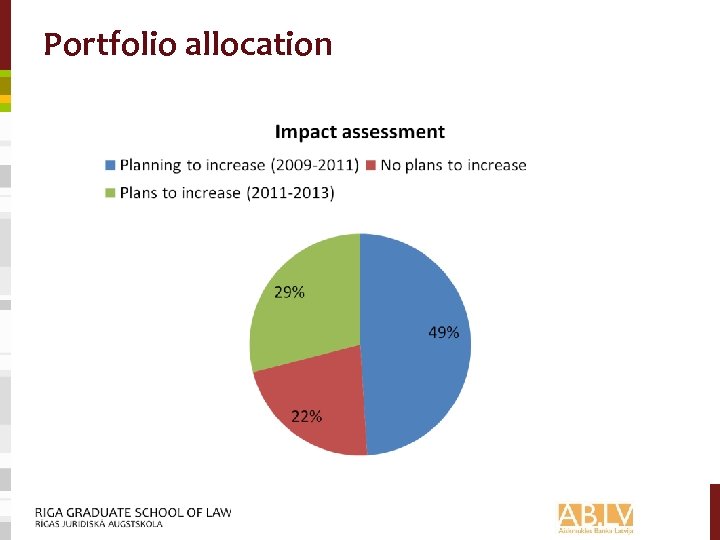

Portfolio allocation

Portfolio allocation

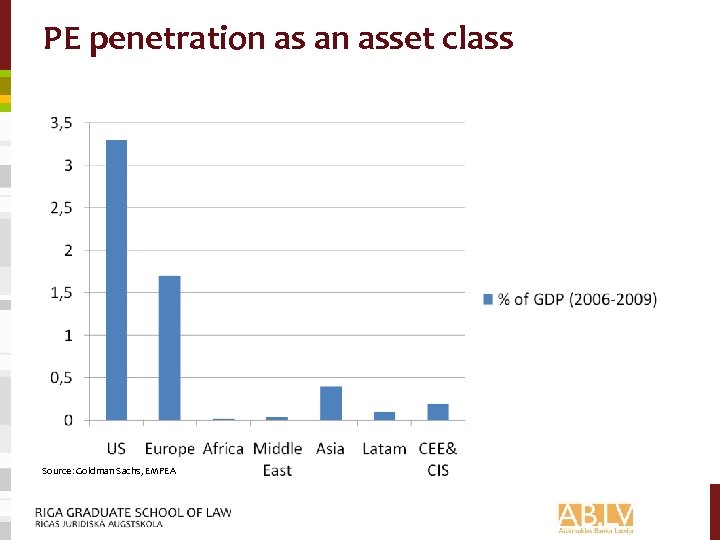

PE penetration as an asset class Source: Goldman Sachs, EMPEA

PE penetration as an asset class Source: Goldman Sachs, EMPEA

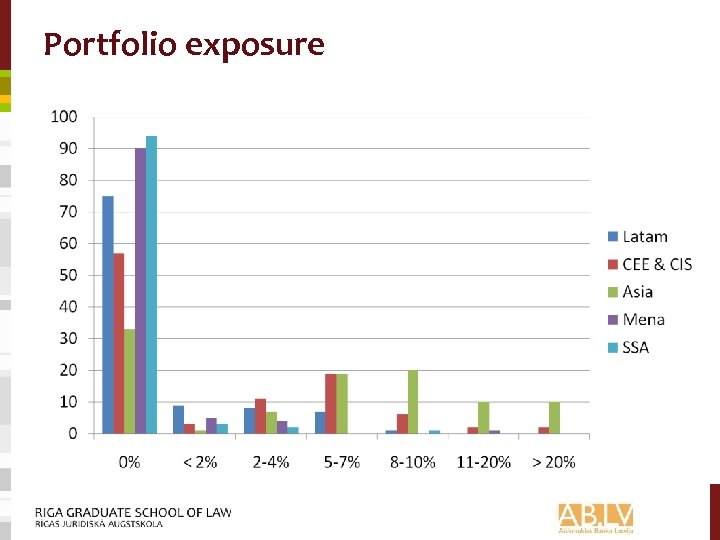

Portfolio exposure

Portfolio exposure

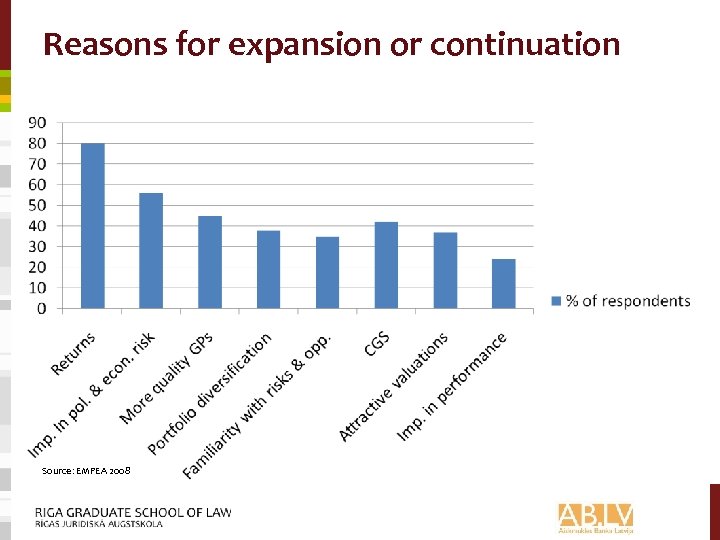

Reasons for expansion or continuation Source: EMPEA 2008

Reasons for expansion or continuation Source: EMPEA 2008

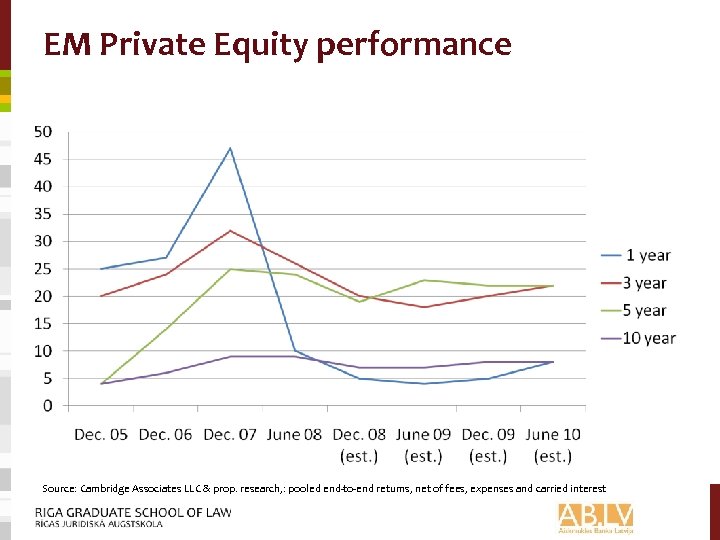

EM Private Equity performance Source: Cambridge Associates LLC & prop. research, : pooled end-to-end returns, net of fees, expenses and carried interest

EM Private Equity performance Source: Cambridge Associates LLC & prop. research, : pooled end-to-end returns, net of fees, expenses and carried interest

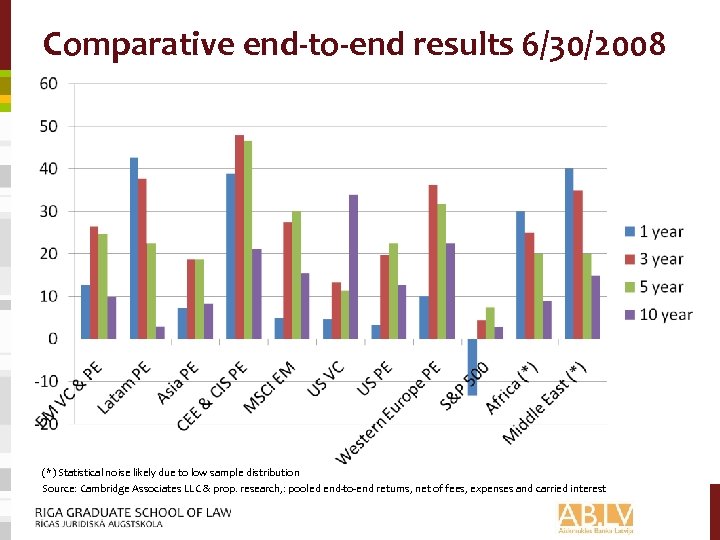

Comparative end-to-end results 6/30/2008 (*) Statistical noise likely due to low sample distribution Source: Cambridge Associates LLC & prop. research, : pooled end-to-end returns, net of fees, expenses and carried interest

Comparative end-to-end results 6/30/2008 (*) Statistical noise likely due to low sample distribution Source: Cambridge Associates LLC & prop. research, : pooled end-to-end returns, net of fees, expenses and carried interest

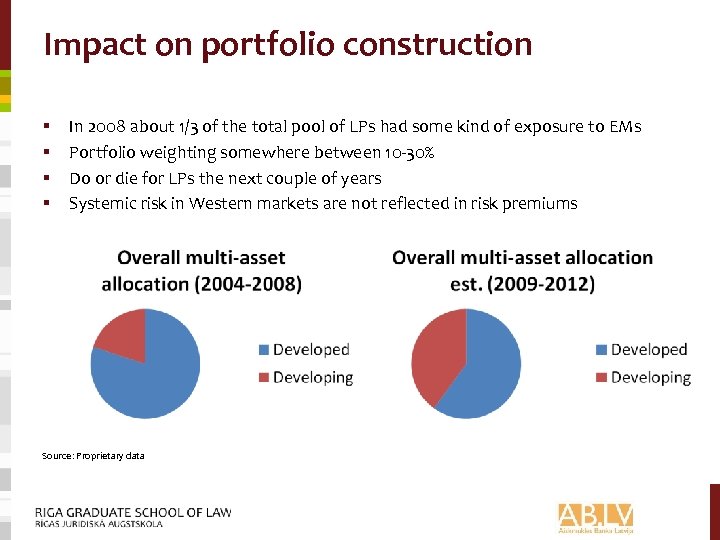

Impact on portfolio construction § § In 2008 about 1/3 of the total pool of LPs had some kind of exposure to EMs Portfolio weighting somewhere between 10 -30% Do or die for LPs the next couple of years Systemic risk in Western markets are not reflected in risk premiums Source: Proprietary data

Impact on portfolio construction § § In 2008 about 1/3 of the total pool of LPs had some kind of exposure to EMs Portfolio weighting somewhere between 10 -30% Do or die for LPs the next couple of years Systemic risk in Western markets are not reflected in risk premiums Source: Proprietary data

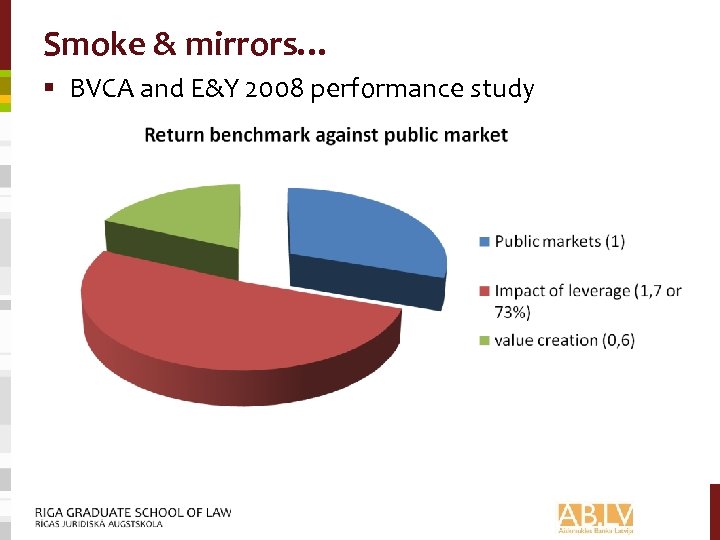

Smoke & mirrors… § BVCA and E&Y 2008 performance study

Smoke & mirrors… § BVCA and E&Y 2008 performance study

A disaster waiting to happen

A disaster waiting to happen

So now what… § If PE is an activist shareholders’ position than why have these funds been managed as investment vehicles § Demonstrate inept to manage companies § Focus on financial engineering § Models have to change § Fund structure § Terms & conditions § Exit modeling § Valuation and transparency

So now what… § If PE is an activist shareholders’ position than why have these funds been managed as investment vehicles § Demonstrate inept to manage companies § Focus on financial engineering § Models have to change § Fund structure § Terms & conditions § Exit modeling § Valuation and transparency

So now what…life after leverage § Value creation/operational side § Impact of average /holding periods § Massive room for improvement of private capital formation § Put capital to work § But do they have the right ‘human capital in place’?

So now what…life after leverage § Value creation/operational side § Impact of average /holding periods § Massive room for improvement of private capital formation § Put capital to work § But do they have the right ‘human capital in place’?

The 7 deadly sins of banking (Mike Mayo) § 5 April 2009 -more bad weather to come § § § § Greedy loan growth Gluttony of real estate Lust for high yields Sloth-like risk management Pride of low capital Envy of exotic fees Anger of regulators § Each reflects a way that banks tried to compensate for lower natural rates of growth by taking more risk

The 7 deadly sins of banking (Mike Mayo) § 5 April 2009 -more bad weather to come § § § § Greedy loan growth Gluttony of real estate Lust for high yields Sloth-like risk management Pride of low capital Envy of exotic fees Anger of regulators § Each reflects a way that banks tried to compensate for lower natural rates of growth by taking more risk

The 7 deadly sins of banking (Mike Mayo) § Zombie banks versus complete recapitalization of system § Relaxation of mark-to-market rules will impact balance sheets but the upswing will be largely out powered by the later downswing § A potential artificial accounting-induced capital injection that does not change the economics

The 7 deadly sins of banking (Mike Mayo) § Zombie banks versus complete recapitalization of system § Relaxation of mark-to-market rules will impact balance sheets but the upswing will be largely out powered by the later downswing § A potential artificial accounting-induced capital injection that does not change the economics

Is this time going to be different for EMs? § During previous booms and busts the developed and developing world evolved in a parallel fashion § This time there is a (partly) contra-cyclical pattern § Political & regulatory impact § Global versus local teams: the best of both § Business model rethinking & paradigm shift § EM debt usage less or more prudent

Is this time going to be different for EMs? § During previous booms and busts the developed and developing world evolved in a parallel fashion § This time there is a (partly) contra-cyclical pattern § Political & regulatory impact § Global versus local teams: the best of both § Business model rethinking & paradigm shift § EM debt usage less or more prudent

Let gravity have its way

Let gravity have its way

Darwinian tsunami & paradigm shifting Where are you?

Darwinian tsunami & paradigm shifting Where are you?

Contact Riga Graduate School of Law & Finance Chair Strelnieku iela 4 k-2 Riga LV-1010 LATVIA luc. nijs@rgsl. edu. lv Tel. +37167039230

Contact Riga Graduate School of Law & Finance Chair Strelnieku iela 4 k-2 Riga LV-1010 LATVIA luc. nijs@rgsl. edu. lv Tel. +37167039230